Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Silver Bay Realty Trust Corp. | a8kq42014investorpresentat.htm |

SILVER BAY REALTY TRUST CORP. F o u r t h Q u a r t e r 2 0 1 4 I n v e s t o r P r e s e n t a t i o n

2 S A F E H A R B O R S T A T E M E N T F O R W A R D - L O O K I N G S T A T E M E N T S This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results. Factors that could cause actual results to differ include: adverse economic or real estate developments in Silver Bay’s markets; defaults on, early terminations of or non-renewal of leases by residents; difficulties in identifying properties to acquire and completing acquisitions; increased time and/or expense to gain possession and renovate properties; increased vacancy, resident turnover, or turnover costs; Silver Bay’s ability to control or reduce operating expenses, including repairs and maintenance expense and other costs such as real estate taxes, homeowners’ association fees, insurance and other costs outside the Company’s control; Silver Bay’s failure to successfully operate its properties; Silver Bay’s ability to obtain financing arrangements; Silver Bay’s failure to meet the conditions to draw under the revolving credit facility; delays or a failure to close on all or a portion of the portfolio of properties owned and operated by The American Home (the “Portfolio”); inability to obtain financing for the transaction, maintenance or capital improvement costs related to the Portfolio that exceed our assumptions, defaults among residents of the Portfolio that exceed our assumptions, poor operations of the Portfolio prior to the closing date and difficulties with successfully integrating the Portfolio into Silver Bay’s existing portfolio; the Company’s ability to hire and retain skilled managerial, investment, financial and operational personnel; the Company’s ability to perform under the covenants of its revolving credit facility and securitization loan; general volatility of the markets in which it participates; interest rates and the market value of Silver Bay’s assets; the impact of changes in governmental regulations, tax law and rates, and similar matters. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Silver Bay does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Silver Bay’s most recent filings with the Securities and Exchange Commission (“SEC”). All subsequent written and oral forward looking statements concerning Silver Bay or matters attributable to Silver Bay or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above.

3 S I L V E R B A Y R E A L T Y T R U S T C O R P . First publicly traded single-family residential REIT formed in 2012 Mission of bringing institutional excellence to the single- family rental market Capitalize on generational opportunity created by dislocations in U.S. housing market − Acquire single-family properties at significant discount to replacement cost − Focus on markets with strong demographic and macroeconomic indicators − Satisfy growing demand for high quality home rentals Diversified portfolio of more than 6,800(1) single-family properties in Arizona, California, Florida, Georgia, Nevada, North Carolina, Ohio and Texas Estimated portfolio value of $1.1 billion as of the fourth quarter of 2014 Completed a $313 million securitization transaction in 2014 Achieved 3% rental increases on renewals for 2014 On February 18th, 2015, Silver Bay entered into a definitive agreement to acquire The American Home Portfolio for approximately $263 million in cash, which will grow Silver Bay’s portfolio to more than 9,200 homes(2) (1) As of March 1, 2015, Silver Bay owned a portfolio of approximately 6,800 single-family properties. (2) Assumes closing on entire portfolio of The American Home. Silver Bay’s agreement with The American Home contemplates the potential for staged closings on certain properties or not closing on all properties for which certain defects are not cured. Ticker NYSE: SBY Indices MSCI U.S. REIT Index, Russell Small-Cap 2000 Index, and Russell Small Cap Completeness Index Board Board with broad public company and real estate experience Management Seasoned team with extensive public company and investing knowledge as well as single-family residential and real estate experience Objective Focused on the acquisition, renovation, leasing and management of single-family properties for rental income and long-term capital appreciation

4 STRATEGIC OVERVIEW

5 Internalized advisory management structure, which benefited Core FFO Completed $313 million securitization transaction with blended effective interest rate of LIBOR plus 192 basis points, which resulted in substantial reduction in cost of debt Recently internalized property management in Northern California and Dallas, bringing internally-managed homes to 80% of the portfolio SILVER BAY WELL POSITIONED FOR 2015 (1) NOI, Estimated NAV and Core FFO are non-GAAP financial measures. Non-GAAP reconciliations of these measures are included in the appendix. (2) Annualized dividend yield calculated by dividing annualized fourth quarter 2014 dividend of $0.06 by the closing share price on December 31, 2014 of $16.56. RECENT STRATEGIC ACCOMPLISHMENTS Achieved six consecutive quarters of revenue, NOI and Core FFO(1) growth Announced third dividend since formation increase in fourth quarter of 2014 to $0.06 per share, or 1.4% dividend yield(2) Experienced continued portfolio appreciation and reported Q4-2014 Estimated NAV(1) of $19.93 per share Maintained stabilized portfolio occupancy in the mid-90s STRONG FINANCIAL AND OPERATING RESULTS 2015 BUSINESS INITIATIVES Integrate the American Home Portfolio onto Silver Bay’s operating platform; successful integration will be one of the key drivers in achieving FFO expansion in 2015 Strive for operational excellence by further increasing operational efficiency and managing Silver Bay’s portfolio of single-family homes to the highest standards Further enhance business processes and realize additional cost efficiencies while maintaining high levels of resident satisfaction Optimize capital structure and portfolio and look for opportunities to further enhance capital structure including evaluating non-core assets Enhance revenue growth by achieving 3-3.5% rent increases

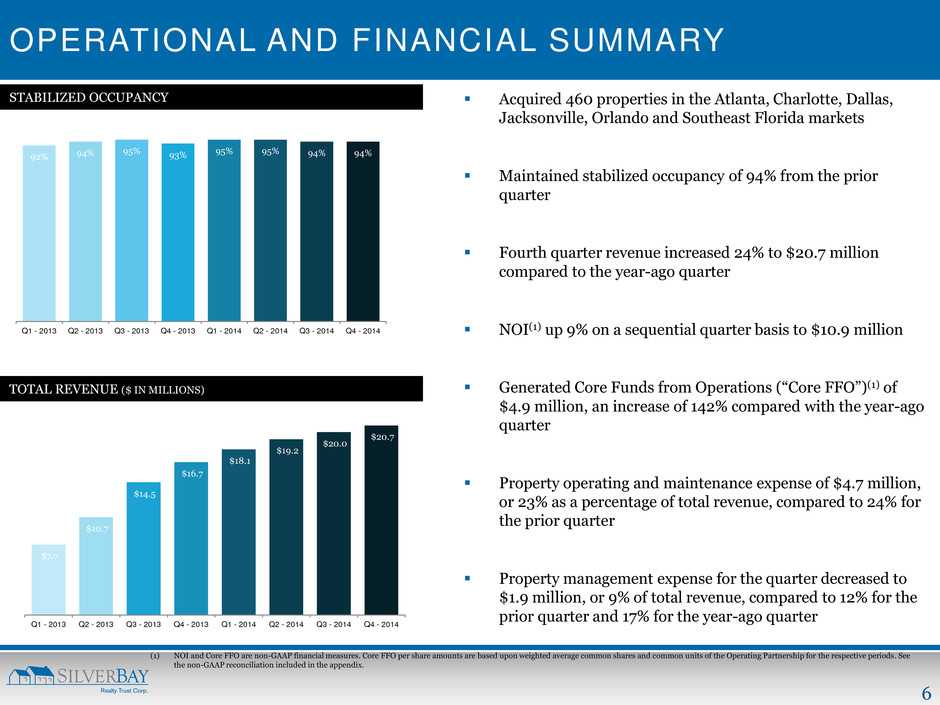

6 OPERATIONAL AND FINANCIAL SUMMARY Acquired 460 properties in the Atlanta, Charlotte, Dallas, Jacksonville, Orlando and Southeast Florida markets Maintained stabilized occupancy of 94% from the prior quarter Fourth quarter revenue increased 24% to $20.7 million compared to the year-ago quarter NOI(1) up 9% on a sequential quarter basis to $10.9 million Generated Core Funds from Operations (“Core FFO”)(1) of $4.9 million, an increase of 142% compared with the year-ago quarter Property operating and maintenance expense of $4.7 million, or 23% as a percentage of total revenue, compared to 24% for the prior quarter Property management expense for the quarter decreased to $1.9 million, or 9% of total revenue, compared to 12% for the prior quarter and 17% for the year-ago quarter (1) NOI and Core FFO are non-GAAP financial measures. Core FFO per share amounts are based upon weighted average common shares and common units of the Operating Partnership for the respective periods. See the non-GAAP reconciliation included in the appendix. 92% 94% 95% 93% 95% 95% 94% 94% Q1 - 2013 Q2 - 2013 Q3 - 2013 Q4 - 2013 Q1 - 2014 Q2 - 2014 Q3 - 2014 Q4 - 2014 $7.7 $10.7 $14.5 $16.7 $18.1 $19.2 $20.0 $20.7 Q1 - 2013 Q2 - 2013 Q3 - 2013 Q4 - 2013 Q1 - 2014 Q2 - 2014 Q3 - 2014 Q4 - 2014 TOTAL REVENUE ($ IN MILLIONS) STABILIZED OCCUPANCY

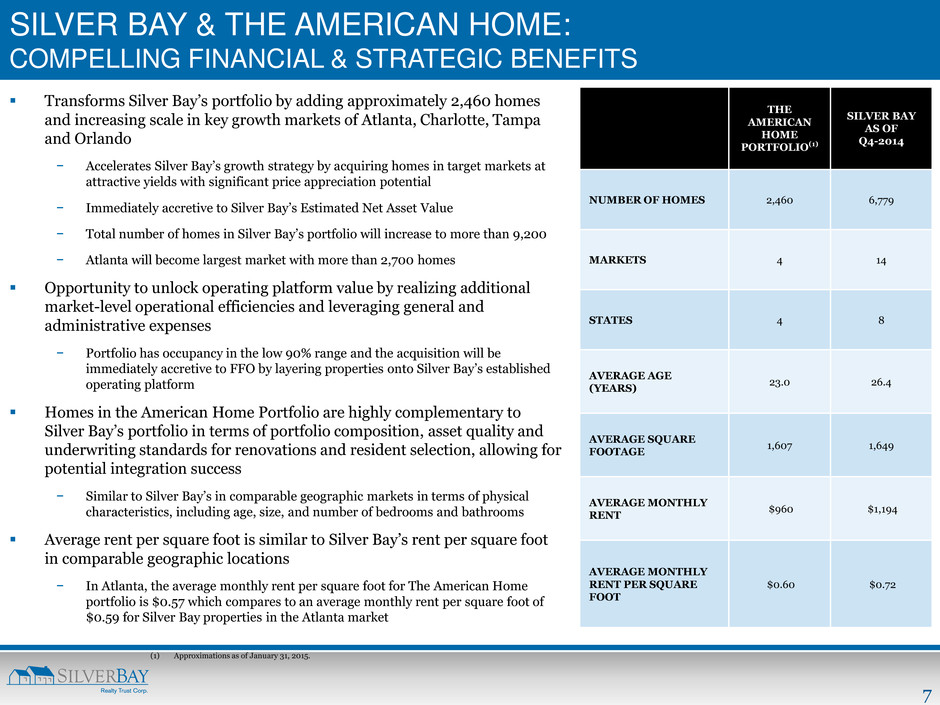

7 SILVER BAY & THE AMERICAN HOME: COMPELLING FINANCIAL & STRATEGIC BENEFITS Transforms Silver Bay’s portfolio by adding approximately 2,460 homes and increasing scale in key growth markets of Atlanta, Charlotte, Tampa and Orlando − Accelerates Silver Bay’s growth strategy by acquiring homes in target markets at attractive yields with significant price appreciation potential − Immediately accretive to Silver Bay’s Estimated Net Asset Value − Total number of homes in Silver Bay’s portfolio will increase to more than 9,200 − Atlanta will become largest market with more than 2,700 homes Opportunity to unlock operating platform value by realizing additional market-level operational efficiencies and leveraging general and administrative expenses − Portfolio has occupancy in the low 90% range and the acquisition will be immediately accretive to FFO by layering properties onto Silver Bay’s established operating platform Homes in the American Home Portfolio are highly complementary to Silver Bay’s portfolio in terms of portfolio composition, asset quality and underwriting standards for renovations and resident selection, allowing for potential integration success − Similar to Silver Bay’s in comparable geographic markets in terms of physical characteristics, including age, size, and number of bedrooms and bathrooms Average rent per square foot is similar to Silver Bay’s rent per square foot in comparable geographic locations − In Atlanta, the average monthly rent per square foot for The American Home portfolio is $0.57 which compares to an average monthly rent per square foot of $0.59 for Silver Bay properties in the Atlanta market THE AMERICAN HOME PORTFOLIO(1) SILVER BAY AS OF Q4-2014 NUMBER OF HOMES 2,460 6,779 MARKETS 4 14 STATES 4 8 AVERAGE AGE (YEARS) 23.0 26.4 AVERAGE SQUARE FOOTAGE 1,607 1,649 AVERAGE MONTHLY RENT $960 $1,194 AVERAGE MONTHLY RENT PER SQUARE FOOT $0.60 $0.72 (1) Approximations as of January 31, 2015.

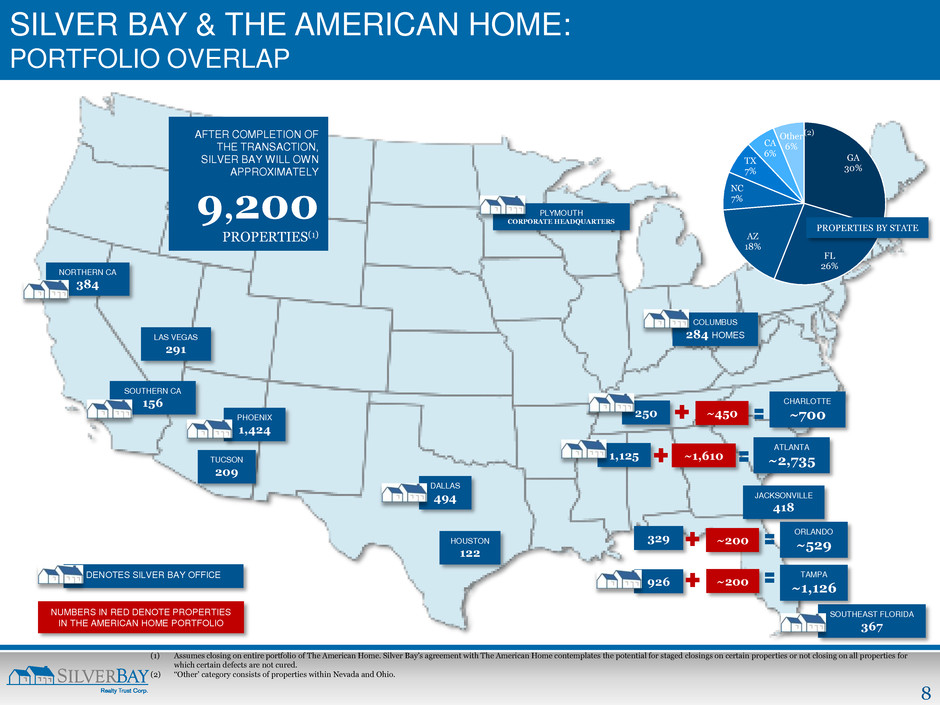

8 SILVER BAY & THE AMERICAN HOME: PORTFOLIO OVERLAP DENOTES SILVER BAY OFFICE NORTHERN CA 384 SOUTHERN CA 156 LAS VEGAS 291 PHOENIX 1,424 TUCSON 209 DALLAS 494 HOUSTON 122 SOUTHEAST FLORIDA 367 926 329 JACKSONVILLE 418 1,125 250 COLUMBUS 284 HOMES PLYMOUTH CORPORATE HEADQUARTERS ~1,610 ATLANTA ~2,735 ~450 CHARLOTTE ~700 ~200 TAMPA ~1,126 ~200 ORLANDO ~529 AFTER COMPLETION OF THE TRANSACTION, SILVER BAY WILL OWN APPROXIMATELY 9,200 PROPERTIES(1) NUMBERS IN RED DENOTE PROPERTIES IN THE AMERICAN HOME PORTFOLIO (1) Assumes closing on entire portfolio of The American Home. Silver Bay’s agreement with The American Home contemplates the potential for staged closings on certain properties or not closing on all properties for which certain defects are not cured. (2) ‘‘Other’ category consists of properties within Nevada and Ohio. GA 30% FL 26% AZ 18% NC 7% TX 7% CA 6% Other 6% PROPERTIES BY STATE (2)

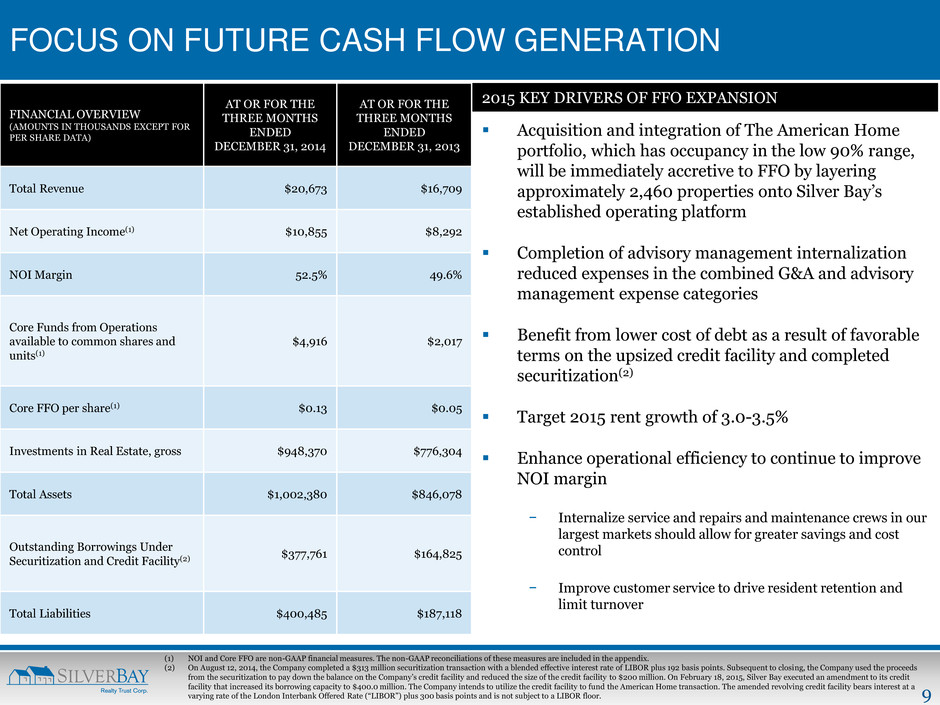

9 FOCUS ON FUTURE CASH FLOW GENERATION (1) NOI and Core FFO are non-GAAP financial measures. The non-GAAP reconciliations of these measures are included in the appendix. (2) On August 12, 2014, the Company completed a $313 million securitization transaction with a blended effective interest rate of LIBOR plus 192 basis points. Subsequent to closing, the Company used the proceeds from the securitization to pay down the balance on the Company’s credit facility and reduced the size of the credit facility to $200 million. On February 18, 2015, Silver Bay executed an amendment to its credit facility that increased its borrowing capacity to $400.0 million. The Company intends to utilize the credit facility to fund the American Home transaction. The amended revolving credit facility bears interest at a varying rate of the London Interbank Offered Rate (“LIBOR”) plus 300 basis points and is not subject to a LIBOR floor. Acquisition and integration of The American Home portfolio, which has occupancy in the low 90% range, will be immediately accretive to FFO by layering approximately 2,460 properties onto Silver Bay’s established operating platform Completion of advisory management internalization reduced expenses in the combined G&A and advisory management expense categories Benefit from lower cost of debt as a result of favorable terms on the upsized credit facility and completed securitization(2) Target 2015 rent growth of 3.0-3.5% Enhance operational efficiency to continue to improve NOI margin − Internalize service and repairs and maintenance crews in our largest markets should allow for greater savings and cost control − Improve customer service to drive resident retention and limit turnover FINANCIAL OVERVIEW (AMOUNTS IN THOUSANDS EXCEPT FOR PER SHARE DATA) AT OR FOR THE THREE MONTHS ENDED DECEMBER 31, 2014 AT OR FOR THE THREE MONTHS ENDED DECEMBER 31, 2013 Total Revenue $20,673 $16,709 Net Operating Income(1) $10,855 $8,292 NOI Margin 52.5% 49.6% Core Funds from Operations available to common shares and units(1) $4,916 $2,017 Core FFO per share(1) $0.13 $0.05 Investments in Real Estate, gross $948,370 $776,304 Total Assets $1,002,380 $846,078 Outstanding Borrowings Under Securitization and Credit Facility(2) $377,761 $164,825 Total Liabilities $400,485 $187,118 2015 KEY DRIVERS OF FFO EXPANSION

10 $850,000 $860,000 $870,000 $880,000 $890,000 $900,000 $910,000 $920,000 $930,000 $940,000 Q4 - 2013 Q1 - 2014 Q2 - 2014 Q3 - 2014 Q4 - 2014 T ho u sa n d s PORTFOLIO VALUE CREATION CAPTURING VALUE: Q4 - 2013 PORTFOLIO, ONE YEAR LATER ESTIMATED VALUE OF REAL ESTATE ASSETS OWNED AT Q4-2013 INCREASED 6% YEAR-OVER-YEAR(1) Achieving portfolio growth through disciplined acquisitions continues has been a top strategic priority Continued housing price appreciation in all Silver Bay markets Estimated portfolio value of $1.1 billion as of December 31, 2014 Completed 460 acquisitions in the fourth quarter at attractive yields in Atlanta, Charlotte, Dallas, Jacksonville, Orlando and Southeast Florida markets On February 18th, 2015, Silver Bay entered into a definitive agreement to acquire The American Home Portfolio for approximately $263 million in cash, which will grow Silver Bay’s portfolio to more than 9,200 homes(4) (1) Quarterly values based on 5,620 properties owned at both December 31, 2013 and December 31, 2014. (2) “MSA” means Metropolitan Statistical Areas, which is generally defined as one or more adjacent counties or county equivalents that have at least one urban core area of at least a 50,000-person population, plus adjacent territory that has a high degree of social and economic integration with the core as measured by commuting ties. MSA used for Northern California is Vallejo-Fairfield, which most closely approximates the geographic area in which we purchase homes in Northern California. This MSA is comprised of Solano County and the most populous cities in the MSA are Vallejo, Fairfield, Vacaville, Suisun and Benicia. MSA used for Southern California is Riverside-San Bernardino-Ontario. This MSA is comprised of Riverside and San Bernardino Counties and the most populous cities in the MSA are Riverside, San Bernardino, Fontana and Moreno. MSA used for Southeast FL is Fort Lauderdale-Pompano Beach-Deerfield Beach, FL. (3) Peak refers to highest historical home prices in a particular market prior to the start of the housing recovery. Trough refers to lowest home prices in a particular market since the peak. (4) Assumes closing on entire portfolio of The American Home. Silver Bay’s agreement with The American Home contemplates the potential for staged closings on certain properties or not closing on all properties for which certain defects are not cured. M S A H O M E P R I C E A P P R E C I A T I O N ( “ H P A ” )(2) S O U R C E : C O R E L O G I C A S O F D E C E M B E R 2 0 1 4 MARKET HPA (Peak to Trough)(3) HPA (Peak to Current) HPA (Prior 12 months) HPA (Prior 3 months) Phoenix, AZ -53% -30% 3% 0% Tucson, AZ -42% -32% 1% -1% Northern CA(2) -58% -33% 10% 1% Southern CA(2) -53% -31% 7% 0% Jacksonville, FL -40% -28% 3% -2% Orlando, FL -55% -37% 4% 0% Southeast FL(2) -53% -35% 5% 1% Tampa, FL -48% -34% 5% 0% Atlanta, GA -34% -9% 6% -1% Charlotte, NC -17% 3% 4% 0% Las Vegas, NV -60% -38% 6% 1% Columbus, OH -18% -3% 6% -2% Dallas, TX -14% 10% 9% 1% Houston, TX -13% 15% 10% 1% NATIONAL -32% -13% 5% 0%

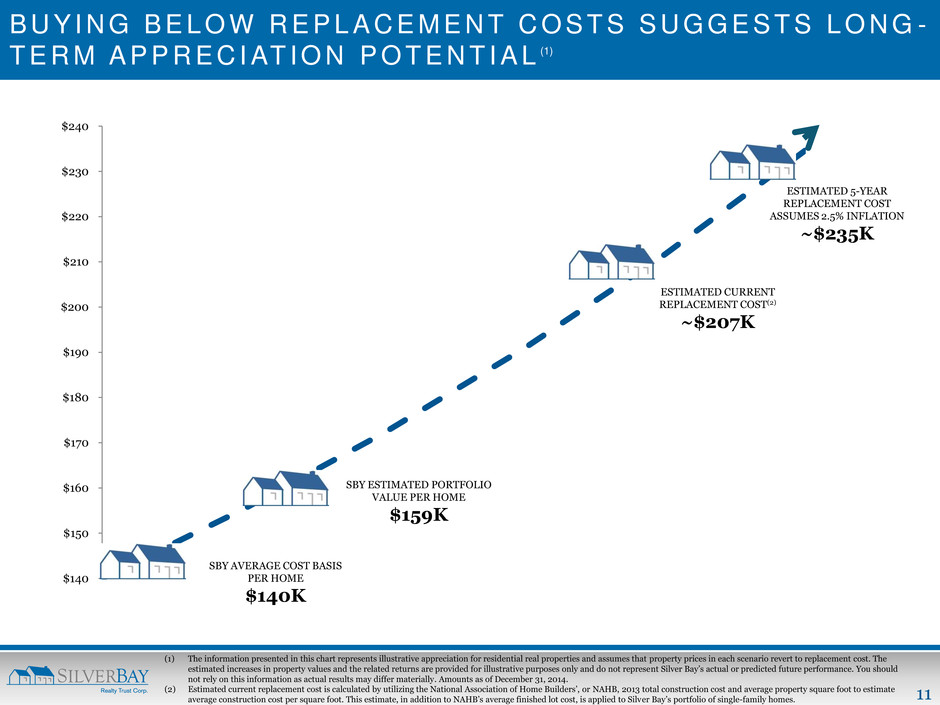

11 $140 $150 $160 $170 $180 $190 $200 $210 $220 $230 $240 B U Y I N G B E L O W R E P L A C E M E N T C O S T S S U G G E S T S L O N G - T E R M A P P R E C I AT I O N P O T E N T I A L (1) (1) The information presented in this chart represents illustrative appreciation for residential real properties and assumes that property prices in each scenario revert to replacement cost. The estimated increases in property values and the related returns are provided for illustrative purposes only and do not represent Silver Bay’s actual or predicted future performance. You should not rely on this information as actual results may differ materially. Amounts as of December 31, 2014. (2) Estimated current replacement cost is calculated by utilizing the National Association of Home Builders’, or NAHB, 2013 total construction cost and average property square foot to estimate average construction cost per square foot. This estimate, in addition to NAHB’s average finished lot cost, is applied to Silver Bay’s portfolio of single-family homes. SBY AVERAGE COST BASIS PER HOME $140K SBY ESTIMATED PORTFOLIO VALUE PER HOME $159K ESTIMATED CURRENT REPLACEMENT COST(2) ~$207K ESTIMATED 5-YEAR REPLACEMENT COST ASSUMES 2.5% INFLATION ~$235K

12 COMMITMENT TO DELIVERING STOCKHOLDER VALUE (1) NOI and Estimated NAV are non-GAAP financial measures. Estimated NAV per share amounts are based upon common shares outstanding plus common units as of December 31, 2014. Non-GAAP reconciliations of these measures are included in the appendix. Disciplined approach to acquisitions is paramount to delivering attractive total returns Acquiring homes at a discount and with compelling rental yields Portfolio of homes located in the most desirable demographic markets Seasoned management team and institutional-grade infrastructure with a significant focus on technology to drive efficiencies STRONG INDUSTRY FUNDAMENTALS POSITIONED TO DELIVER ATTRACTIVE RETURNS Large asset class with very small institutional presence Macroeconomic and demographic trends support long-term industry outlook Historically low net additions to housing stock with rising demand Historical correlation between home price appreciation and rental growth Current capacity for asset growth combined with gains in occupancy and NOI(1) margins to increase cash flow Internalized advisory management structure which resulted in increased Core FFO Completed securitization provides for reduced financing costs and capital structure optimization to increase ROE Commitment to increasing cash distributions to stockholders Compelling valuation based on Estimated NAV(1) of $19.93 per share as of December 31, 2014 SILVER BAY COMPETITIVE ADVANTAGE

13 O P E R AT I O N S O V E R V I E W

14 B U S I N E S S O B J E C T I V E S O B J E C T I V E S : Provide high quality rental homes with best-in-class customer service to create a long-term sustainable business Achieve attractive total return combining capital appreciation with rental cash flow yields ACQUISITIONS RENOVATIONS P R O P E R T Y MANAGEMENT A C H I E V E EFFICIENCIES Disciplined growth through rigorous asset selection Dedicated focus on properties exhibiting attractive total return profile Selection of high- quality homes in resident preferred locations High-quality up-front initial renovations to minimize future ongoing maintenance expenses Standardized fit and finish maximizes longevity and cost savings as well as resident satisfaction Rigorous resident screening process ensures quality residents with increased likelihood of long term tenancy Excellence in customer service to provide resident satisfaction and establish lasting relationships Expand operating platform and capture efficiencies of scale Establish brand as preferred manager within single-family rental community Leverage G&A, reduce per unit operating expenses and lower cost of capital

15 ACQUISITION STRATEGY AND ASSET SELECTION PROCESS TARGETED MSA EVALUATION NEIGHBORHOOD EVALUATION RIGOROUS PROPERTY DILIGENCE AND ASSESSMENT RENOVATION ASSESSMENT COMPREHENSIVE RENTAL AND RESIDENT EVALUATION Macroeconomic and demographic factors including population growth, unemployment and median income Analyze a variety of local market trends Supply of available assets at discount to replacement cost Physical visits to properties − Comprehensive on-site assessment for broker and bulk sourced properties − Drive-by inspection for auction sourced properties Review title Vintage and location; price vs. estimated replacement costs Property and home characteristics that are suitable for rental Proximity to key employment centers and other properties in portfolio, ease of transportation and commute, school districts, and low crime neighborhoods, etc. Renovation required vs. acquisition price Focus on attractive risk-adjusted net rental yields and minimizing future maintenance Assessment of rental rates and potential resident pool availability − Collaborative effort with local partners − Leverage public databases and exclusive relationships − Rental growth assumption not reflected in underwriting − Assumption to own property for indefinite period of time Comprehensive initial renovation assumption Annual repairs reflects full property life cycle Estimates of time to stabilize and vacancy cost

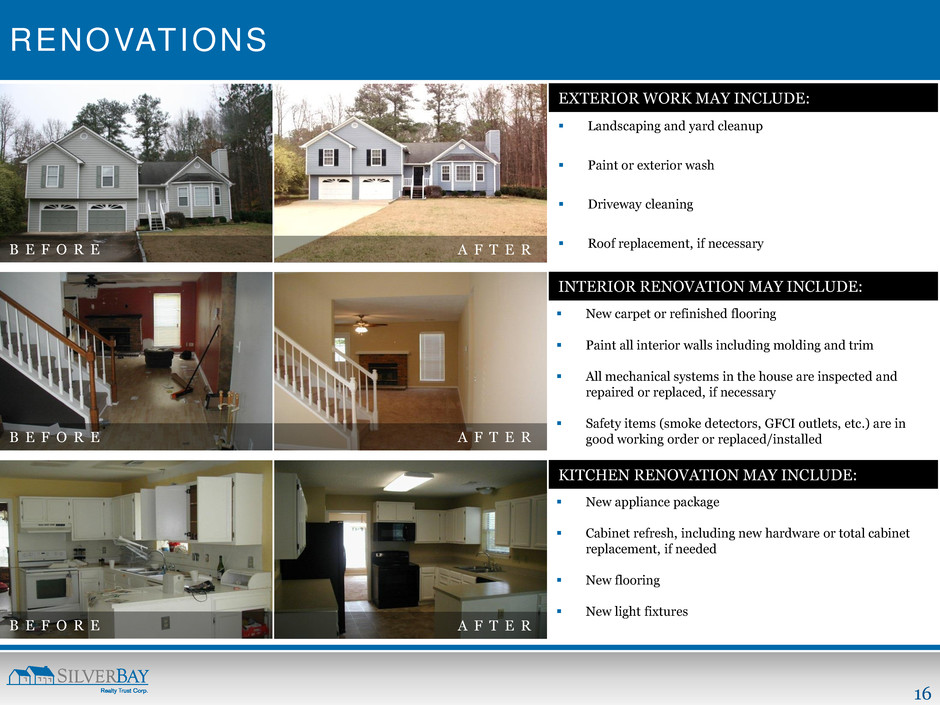

16 New appliance package Cabinet refresh, including new hardware or total cabinet replacement, if needed New flooring New light fixtures RENOVATIONS B E F O R E A F T E R Landscaping and yard cleanup Paint or exterior wash Driveway cleaning Roof replacement, if necessary New carpet or refinished flooring Paint all interior walls including molding and trim All mechanical systems in the house are inspected and repaired or replaced, if necessary Safety items (smoke detectors, GFCI outlets, etc.) are in good working order or replaced/installed B E F O R E A F T E R B E F O R E A F T E R KITCHEN RENOVATION MAY INCLUDE: INTERIOR RENOVATION MAY INCLUDE: EXTERIOR WORK MAY INCLUDE:

17 Local market knowledge and MLS broker relationships help drive leasing process Yard signage displayed once a property nears renovation completion to start driving traffic Web presence includes featured listing relationships with major online listing services Focus on establishing and growing Silver Bay’s brand through increased advertising presence Standardization of renovations and amenities aimed at attracting prospective residents to an institutional grade rental home Silver Bay Management website is updated on an ongoing basis and refined for ease of users Existing satisfied residents are encouraged to provide referrals RESIDENT CENTRIC PROPERTY MANAGEMENT(1) MARKETING LEASING Prospective residents are directed to a national call center (locally in third-party markets) to schedule showings for homes that best meet their needs Online rental application process for resident convenience and increased processing speed Resident screening process critical to reducing evictions, future turnover and associated costs and includes a review of a prospect’s credit, criminal background, residential history and verification of minimum income of 3x the monthly rent Managers submit renewal correspondence to quality residents at least 60 days prior to their lease expiration By keeping residents in our properties, we are able to maximize occupancy, minimize turnover, and drive cash flow generation (1) Representative of marketing and leasing processes for Silver Bay internal markets. Third-party partners are contracted to adhere to Silver Bay corporate guidelines, which may be modified to conform to local market conventions.

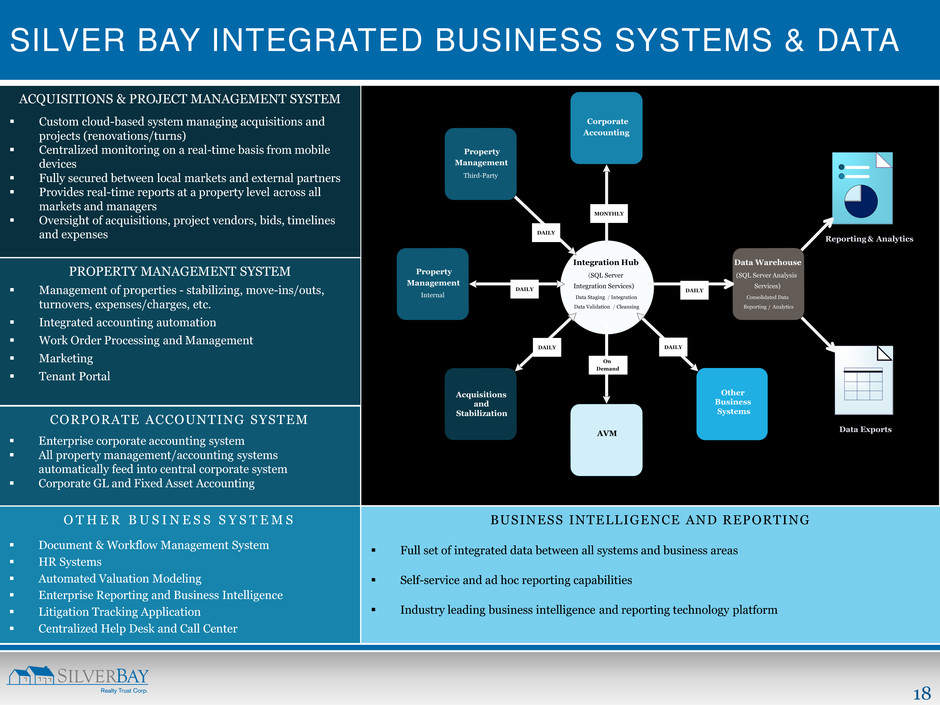

18 SILVER BAY INTEGRATED BUSINESS SYSTEMS & DATA ACQUISITIONS & PROJECT MANAGEMENT SYSTEM Custom cloud-based system managing acquisitions and projects (renovations/turns) Centralized monitoring on a real-time basis from mobile devices Fully secured between local markets and external partners Provides real-time reports at a property level across all markets and managers Oversight of acquisitions, project vendors, bids, timelines and expenses PROPERTY MANAGEMENT SYSTEM Management of properties - stabilizing, move-ins/outs, turnovers, expenses/charges, etc. Integrated accounting automation Work Order Processing and Management Marketing Tenant Portal O T H E R B U S I N E S S S Y S T E M S Document & Workflow Management System HR Systems Automated Valuation Modeling Enterprise Reporting and Business Intelligence Litigation Tracking Application Centralized Help Desk and Call Center CORPORATE ACCOUNTING SYSTEM Enterprise corporate accounting system All property management/accounting systems automatically feed into central corporate system Corporate GL and Fixed Asset Accounting BUSINESS INTELLIGENCE AND REPORTING Full set of integrated data between all systems and business areas Self-service and ad hoc reporting capabilities Industry leading business intelligence and reporting technology platform Yardi Acquisitions and Stabilization Other Business Systems Property Management Internal Corporate Accounting Integration Hub ( SQL Server Integration Services) Data Staging / Integration Data Validation / Cleansing Reporting & Analytics Data Exports Data Warehouse ( SQL Server Analysis Services) Consolidated Data Reporting / Analytics DAILY MONTHLY DAILY DAILY DAILY DAILY Yardi Property Management Third-Party AVM On Demand

19 SINGLE-FAMILY RENTAL INVESTMENT OPPORTUNITY

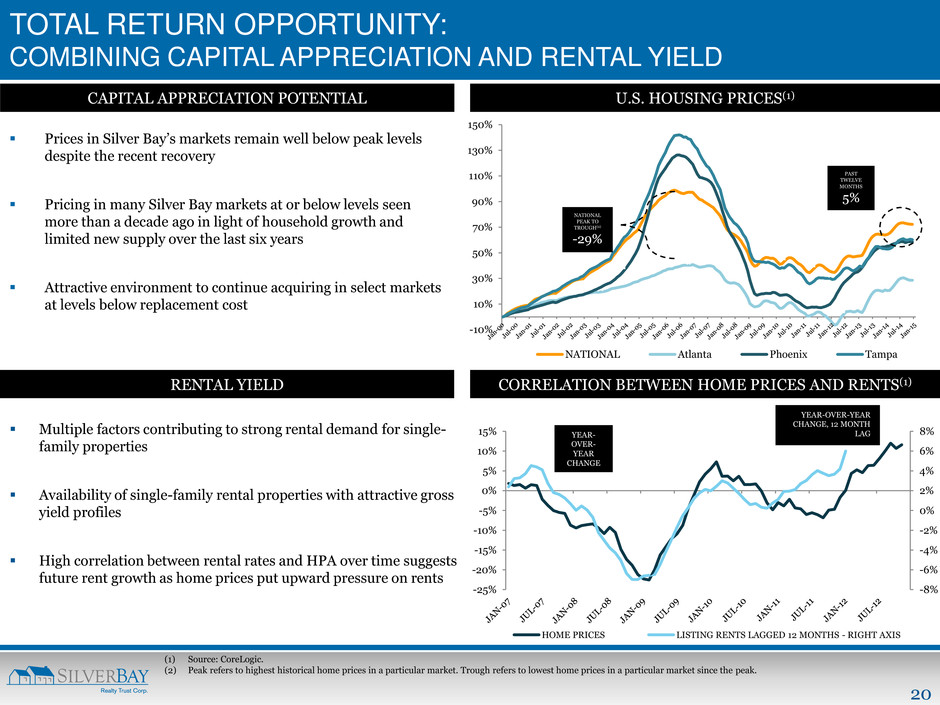

20 -10% 10% 30% 50% 70% 90% 110% 130% 150% NATIONAL Atlanta Phoenix Tampa -8% -6% -4% -2% 0% 2% 4% 6% 8% -25% -20% -15% -10% -5% 0% 5% 10% 15% HOME PRICES LISTING RENTS LAGGED 12 MONTHS - RIGHT AXIS TOTAL RETURN OPPORTUNITY: COMBINING CAPITAL APPRECIATION AND RENTAL YIELD Prices in Silver Bay’s markets remain well below peak levels despite the recent recovery Pricing in many Silver Bay markets at or below levels seen more than a decade ago in light of household growth and limited new supply over the last six years Attractive environment to continue acquiring in select markets at levels below replacement cost CAPITAL APPRECIATION POTENTIAL NATIONAL PEAK TO TROUGH(2) -29% PAST TWELVE MONTHS 5% (1) Source: CoreLogic. (2) Peak refers to highest historical home prices in a particular market. Trough refers to lowest home prices in a particular market since the peak. U.S. HOUSING PRICES(1) YEAR- OVER- YEAR CHANGE YEAR-OVER-YEAR CHANGE, 12 MONTH LAG CORRELATION BETWEEN HOME PRICES AND RENTS(1) Multiple factors contributing to strong rental demand for single- family properties Availability of single-family rental properties with attractive gross yield profiles High correlation between rental rates and HPA over time suggests future rent growth as home prices put upward pressure on rents RENTAL YIELD

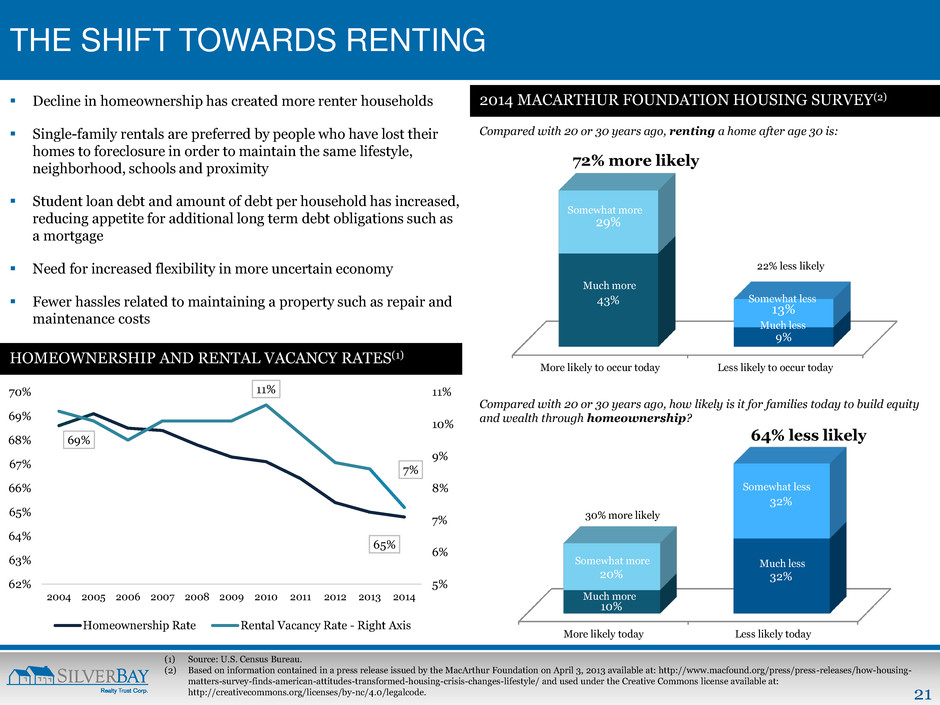

21 More likely today Less likely today 10% 32% 20% 32% More likely to occur today Less likely to occur today 43% 9% 29% 13% THE SHIFT TOWARDS RENTING 2014 MACARTHUR FOUNDATION HOUSING SURVEY(2) Compared with 20 or 30 years ago, renting a home after age 30 is: Compared with 20 or 30 years ago, how likely is it for families today to build equity and wealth through homeownership? Decline in homeownership has created more renter households Single-family rentals are preferred by people who have lost their homes to foreclosure in order to maintain the same lifestyle, neighborhood, schools and proximity Student loan debt and amount of debt per household has increased, reducing appetite for additional long term debt obligations such as a mortgage Need for increased flexibility in more uncertain economy Fewer hassles related to maintaining a property such as repair and maintenance costs HOMEOWNERSHIP AND RENTAL VACANCY RATES(1) (1) Source: U.S. Census Bureau. (2) Based on information contained in a press release issued by the MacArthur Foundation on April 3, 2013 available at: http://www.macfound.org/press/press-releases/how-housing- matters-survey-finds-american-attitudes-transformed-housing-crisis-changes-lifestyle/ and used under the Creative Commons license available at: http://creativecommons.org/licenses/by-nc/4.0/legalcode. Somewhat more Much more Much less Somewhat less Much more Much less 72% more likely 22% less likely 30% more likely 64% less likely 69% 65% 11% 7% 5% 6% 7% 8% 9% 10% 11% 62% 63% 64% 65% 66% 67% 68% 69% 70% 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Homeownership Rate Rental Vacancy Rate - Right Axis Somewhat more Somewhat less

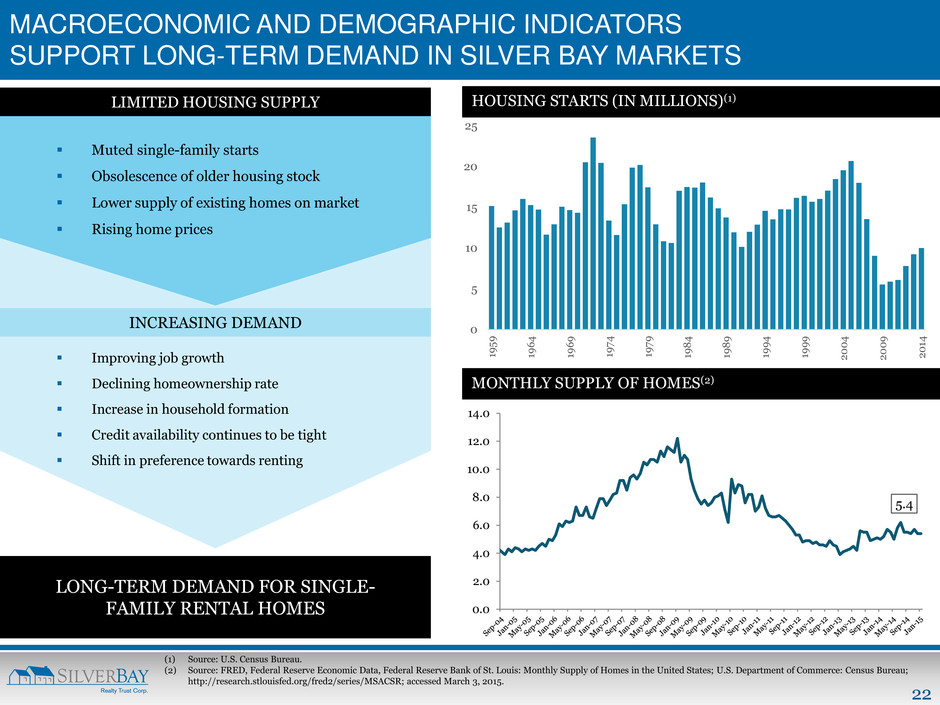

22 MACROECONOMIC AND DEMOGRAPHIC INDICATORS SUPPORT LONG-TERM DEMAND IN SILVER BAY MARKETS Muted single-family starts Obsolescence of older housing stock Lower supply of existing homes on market Rising home prices Improving job growth Declining homeownership rate Increase in household formation Credit availability continues to be tight Shift in preference towards renting LONG-TERM DEMAND FOR SINGLE- FAMILY RENTAL HOMES HOUSING STARTS (IN MILLIONS)(1) MONTHLY SUPPLY OF HOMES(2) (1) Source: U.S. Census Bureau. (2) Source: FRED, Federal Reserve Economic Data, Federal Reserve Bank of St. Louis: Monthly Supply of Homes in the United States; U.S. Department of Commerce: Census Bureau; http://research.stlouisfed.org/fred2/series/MSACSR; accessed March 3, 2015. LIMITED HOUSING SUPPLY INCREASING DEMAND 5.4 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 0 5 10 15 20 25 19 5 9 19 6 4 19 6 9 19 7 4 19 7 9 19 8 4 19 8 9 19 9 4 19 9 9 2 0 0 4 2 0 0 9 2 01 4

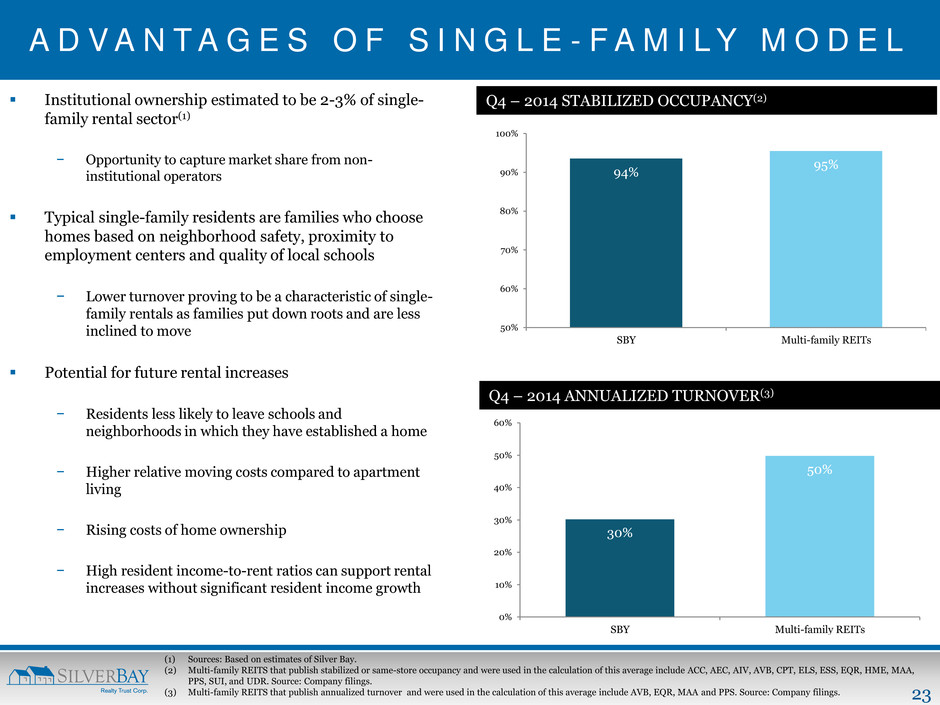

23 A D V A N T A G E S O F S I N G L E - F A M I L Y M O D E L Institutional ownership estimated to be 2-3% of single- family rental sector(1) − Opportunity to capture market share from non- institutional operators Typical single-family residents are families who choose homes based on neighborhood safety, proximity to employment centers and quality of local schools − Lower turnover proving to be a characteristic of single- family rentals as families put down roots and are less inclined to move Potential for future rental increases − Residents less likely to leave schools and neighborhoods in which they have established a home − Higher relative moving costs compared to apartment living − Rising costs of home ownership − High resident income-to-rent ratios can support rental increases without significant resident income growth Q4 – 2014 ANNUALIZED TURNOVER(3) 30% 50% 0% 10% 20% 30% 40% 50% 60% SBY Multi-family REITs Q4 – 2014 STABILIZED OCCUPANCY(2) 94% 95% 50% 60% 70% 80% 90% 100% SBY Multi-family REITs (1) Sources: Based on estimates of Silver Bay. (2) Multi-family REITS that publish stabilized or same-store occupancy and were used in the calculation of this average include ACC, AEC, AIV, AVB, CPT, ELS, ESS, EQR, HME, MAA, PPS, SUI, and UDR. Source: Company filings. (3) Multi-family REITS that publish annualized turnover and were used in the calculation of this average include AVB, EQR, MAA and PPS. Source: Company filings.

24 A P P E N D I X

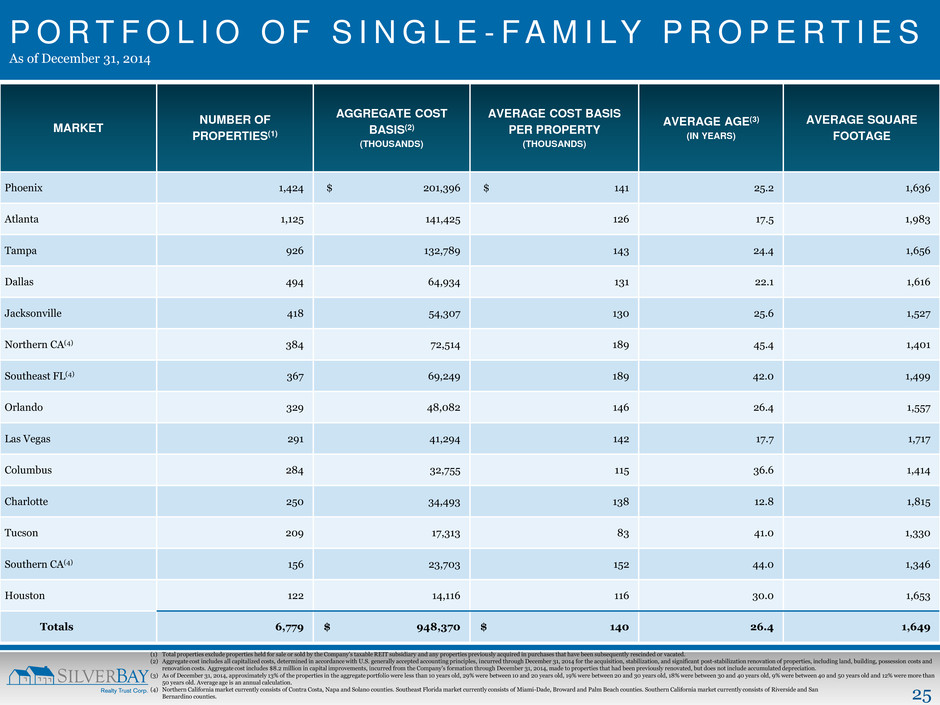

25 P O R T F O L I O O F S I N G L E - F A M I LY P R O P E R T I E S As of December 31, 2014 MARKET NUMBER OF PROPERTIES(1) AGGREGATE COST BASIS(2) (THOUSANDS) AVERAGE COST BASIS PER PROPERTY (THOUSANDS) AVERAGE AGE(3) (IN YEARS) AVERAGE SQUARE FOOTAGE Phoenix 1,424 $ 201,396 $ 141 25.2 1,636 Atlanta 1,125 141,425 126 17.5 1,983 Tampa 926 132,789 143 24.4 1,656 Dallas 494 64,934 131 22.1 1,616 Jacksonville 418 54,307 130 25.6 1,527 Northern CA(4) 384 72,514 189 45.4 1,401 Southeast FL(4) 367 69,249 189 42.0 1,499 Orlando 329 48,082 146 26.4 1,557 Las Vegas 291 41,294 142 17.7 1,717 Columbus 284 32,755 115 36.6 1,414 Charlotte 250 34,493 138 12.8 1,815 Tucson 209 17,313 83 41.0 1,330 Southern CA(4) 156 23,703 152 44.0 1,346 Houston 122 14,116 116 30.0 1,653 Totals 6,779 $ 948,370 $ 140 26.4 1,649 (1) Total properties exclude properties held for sale or sold by the Company’s taxable REIT subsidiary and any properties previously acquired in purchases that have been subsequently rescinded or vacated. (2) Aggregate cost includes all capitalized costs, determined in accordance with U.S. generally accepted accounting principles, incurred through December 31, 2014 for the acquisition, stabilization, and significant post-stabilization renovation of properties, including land, building, possession costs and renovation costs. Aggregate cost includes $8.2 million in capital improvements, incurred from the Company's formation through December 31, 2014, made to properties that had been previously renovated, but does not include accumulated depreciation. (3) As of December 31, 2014, approximately 13% of the properties in the aggregate portfolio were less than 10 years old, 29% were between 10 and 20 years old, 19% were between 20 and 30 years old, 18% were between 30 and 40 years old, 9% were between 40 and 50 years old and 12% were more than 50 years old. Average age is an annual calculation. (4) Northern California market currently consists of Contra Costa, Napa and Solano counties. Southeast Florida market currently consists of Miami-Dade, Broward and Palm Beach counties. Southern California market currently consists of Riverside and San Bernardino counties.

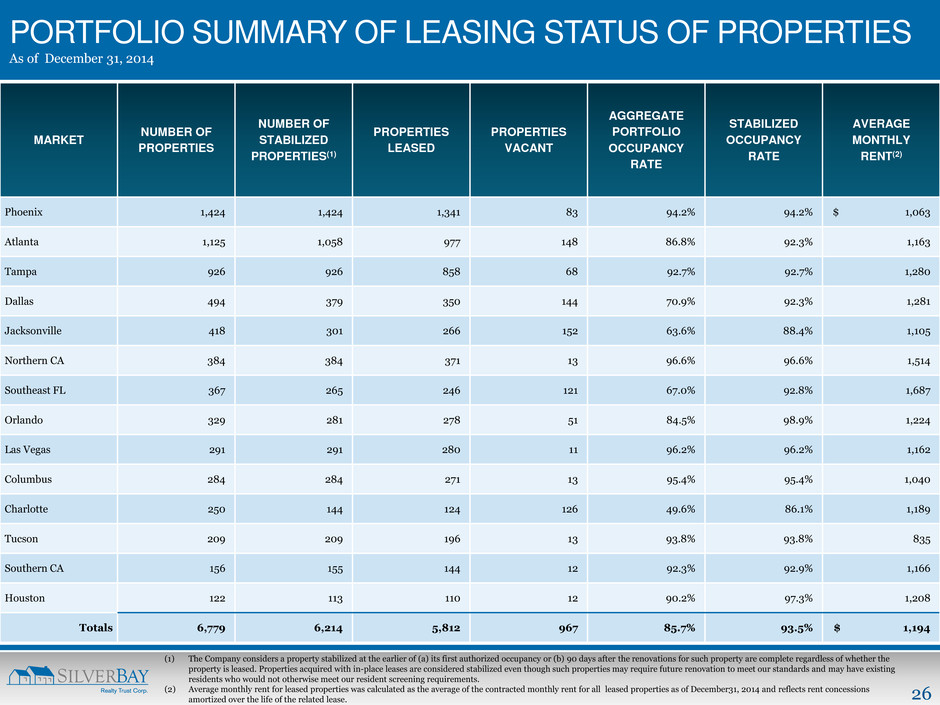

26 MARKET NUMBER OF PROPERTIES NUMBER OF STABILIZED PROPERTIES(1) PROPERTIES LEASED PROPERTIES VACANT AGGREGATE PORTFOLIO OCCUPANCY RATE STABILIZED OCCUPANCY RATE AVERAGE MONTHLY RENT(2) Phoenix 1,424 1,424 1,341 83 94.2% 94.2% $ 1,063 Atlanta 1,125 1,058 977 148 86.8% 92.3% 1,163 Tampa 926 926 858 68 92.7% 92.7% 1,280 Dallas 494 379 350 144 70.9% 92.3% 1,281 Jacksonville 418 301 266 152 63.6% 88.4% 1,105 Northern CA 384 384 371 13 96.6% 96.6% 1,514 Southeast FL 367 265 246 121 67.0% 92.8% 1,687 Orlando 329 281 278 51 84.5% 98.9% 1,224 Las Vegas 291 291 280 11 96.2% 96.2% 1,162 Columbus 284 284 271 13 95.4% 95.4% 1,040 Charlotte 250 144 124 126 49.6% 86.1% 1,189 Tucson 209 209 196 13 93.8% 93.8% 835 Southern CA 156 155 144 12 92.3% 92.9% 1,166 Houston 122 113 110 12 90.2% 97.3% 1,208 Totals 6,779 6,214 5,812 967 85.7% 93.5% $ 1,194 PORTFOLIO SUMMARY OF LEASING STATUS OF PROPERTIES As of December 31, 2014 (1) The Company considers a property stabilized at the earlier of (a) its first authorized occupancy or (b) 90 days after the renovations for such property are complete regardless of whether the property is leased. Properties acquired with in-place leases are considered stabilized even though such properties may require future renovation to meet our standards and may have existing residents who would not otherwise meet our resident screening requirements. (2) Average monthly rent for leased properties was calculated as the average of the contracted monthly rent for all leased properties as of December31, 2014 and reflects rent concessions amortized over the life of the related lease.

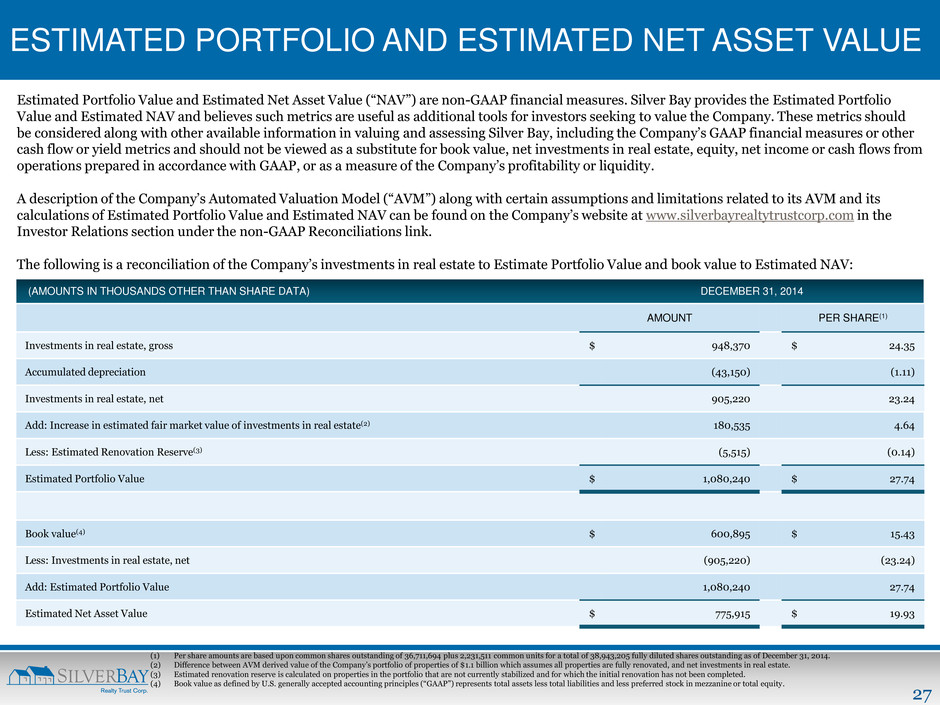

27 ESTIMATED PORTFOLIO AND ESTIMATED NET ASSET VALUE Estimated Portfolio Value and Estimated Net Asset Value (“NAV”) are non-GAAP financial measures. Silver Bay provides the Estimated Portfolio Value and Estimated NAV and believes such metrics are useful as additional tools for investors seeking to value the Company. These metrics should be considered along with other available information in valuing and assessing Silver Bay, including the Company’s GAAP financial measures or other cash flow or yield metrics and should not be viewed as a substitute for book value, net investments in real estate, equity, net income or cash flows from operations prepared in accordance with GAAP, or as a measure of the Company’s profitability or liquidity. A description of the Company’s Automated Valuation Model (“AVM”) along with certain assumptions and limitations related to its AVM and its calculations of Estimated Portfolio Value and Estimated NAV can be found on the Company’s website at www.silverbayrealtytrustcorp.com in the Investor Relations section under the non-GAAP Reconciliations link. The following is a reconciliation of the Company’s investments in real estate to Estimate Portfolio Value and book value to Estimated NAV: (1) Per share amounts are based upon common shares outstanding of 36,711,694 plus 2,231,511 common units for a total of 38,943,205 fully diluted shares outstanding as of December 31, 2014. (2) Difference between AVM derived value of the Company’s portfolio of properties of $1.1 billion which assumes all properties are fully renovated, and net investments in real estate. (3) Estimated renovation reserve is calculated on properties in the portfolio that are not currently stabilized and for which the initial renovation has not been completed. (4) Book value as defined by U.S. generally accepted accounting principles (“GAAP”) represents total assets less total liabilities and less preferred stock in mezzanine or total equity. (AMOUNTS IN THOUSANDS OTHER THAN SHARE DATA) DECEMBER 31, 2014 AMOUNT PER SHARE(1) Investments in real estate, gross $ 948,370 $ 24.35 Accumulated depreciation (43,150) (1.11) Investments in real estate, net 905,220 23.24 Add: Increase in estimated fair market value of investments in real estate(2) 180,535 4.64 Less: Estimated Renovation Reserve(3) (5,515) (0.14) Estimated Portfolio Value $ 1,080,240 $ 27.74 Book value(4) $ 600,895 $ 15.43 Less: Investments in real estate, net (905,220) (23.24) Add: Estimated Portfolio Value 1,080,240 27.74 Estimated Net Asset Value $ 775,915 $ 19.93

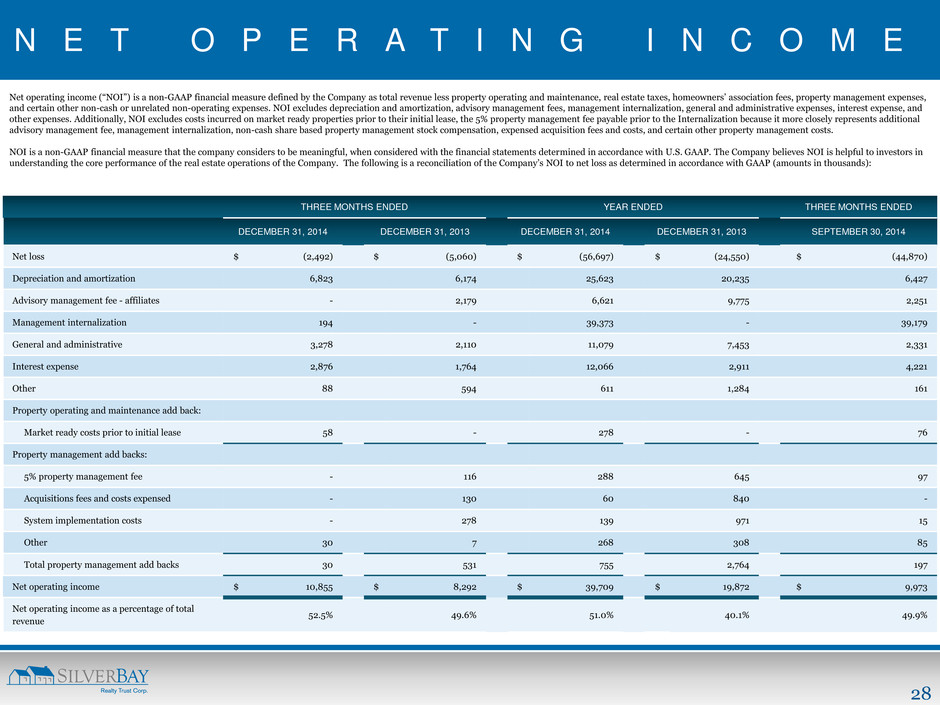

28 N E T O P E R A T I N G I N C O M E Net operating income (“NOI”) is a non-GAAP financial measure defined by the Company as total revenue less property operating and maintenance, real estate taxes, homeowners’ association fees, property management expenses, and certain other non-cash or unrelated non-operating expenses. NOI excludes depreciation and amortization, advisory management fees, management internalization, general and administrative expenses, interest expense, and other expenses. Additionally, NOI excludes costs incurred on market ready properties prior to their initial lease, the 5% property management fee payable prior to the Internalization because it more closely represents additional advisory management fee, management internalization, non-cash share based property management stock compensation, expensed acquisition fees and costs, and certain other property management costs. NOI is a non-GAAP financial measure that the company considers to be meaningful, when considered with the financial statements determined in accordance with U.S. GAAP. The Company believes NOI is helpful to investors in understanding the core performance of the real estate operations of the Company. The following is a reconciliation of the Company’s NOI to net loss as determined in accordance with GAAP (amounts in thousands): THREE MONTHS ENDED YEAR ENDED THREE MONTHS ENDED DECEMBER 31, 2014 DECEMBER 31, 2013 DECEMBER 31, 2014 DECEMBER 31, 2013 SEPTEMBER 30, 2014 Net loss $ (2,492) $ (5,060) $ (56,697) $ (24,550) $ (44,870) Depreciation and amortization 6,823 6,174 25,623 20,235 6,427 Advisory management fee - affiliates - 2,179 6,621 9,775 2,251 Management internalization 194 - 39,373 - 39,179 General and administrative 3,278 2,110 11,079 7,453 2,331 Interest expense 2,876 1,764 12,066 2,911 4,221 Other 88 594 611 1,284 161 Property operating and maintenance add back: Market ready costs prior to initial lease 58 - 278 - 76 Property management add backs: 5% property management fee - 116 288 645 97 Acquisitions fees and costs expensed - 130 60 840 - System implementation costs - 278 139 971 15 Other 30 7 268 308 85 Total property management add backs 30 531 755 2,764 197 Net operating income $ 10,855 $ 8,292 $ 39,709 $ 19,872 $ 9,973 Net operating income as a percentage of total revenue 52.5% 49.6% 51.0% 40.1% 49.9%

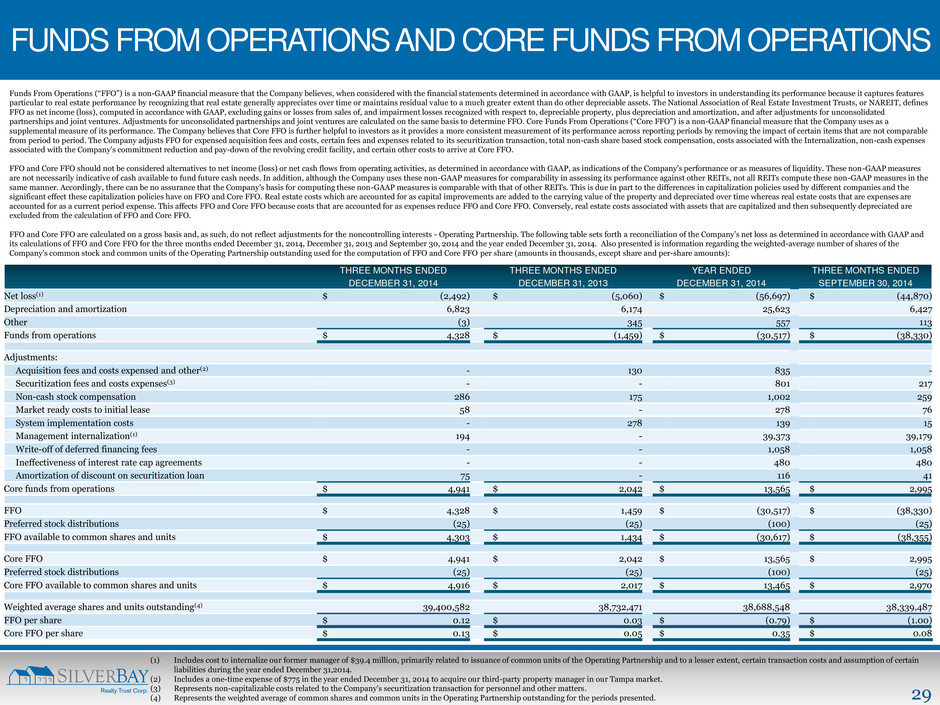

29 FUNDS FROM OPERATIONS AND CORE FUNDS FROM OPERATIONS Funds From Operations (“FFO”) is a non-GAAP financial measure that the Company believes, when considered with the financial statements determined in accordance with GAAP, is helpful to investors in understanding its performance because it captures features particular to real estate performance by recognizing that real estate generally appreciates over time or maintains residual value to a much greater extent than do other depreciable assets. The National Association of Real Estate Investment Trusts, or NAREIT, defines FFO as net income (loss), computed in accordance with GAAP, excluding gains or losses from sales of, and impairment losses recognized with respect to, depreciable property, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures are calculated on the same basis to determine FFO. Core Funds From Operations (“Core FFO”) is a non-GAAP financial measure that the Company uses as a supplemental measure of its performance. The Company believes that Core FFO is further helpful to investors as it provides a more consistent measurement of its performance across reporting periods by removing the impact of certain items that are not comparable from period to period. The Company adjusts FFO for expensed acquisition fees and costs, certain fees and expenses related to its securitization transaction, total non-cash share based stock compensation, costs associated with the Internalization, non-cash expenses associated with the Company's commitment reduction and pay-down of the revolving credit facility, and certain other costs to arrive at Core FFO. FFO and Core FFO should not be considered alternatives to net income (loss) or net cash flows from operating activities, as determined in accordance with GAAP, as indications of the Company's performance or as measures of liquidity. These non-GAAP measures are not necessarily indicative of cash available to fund future cash needs. In addition, although the Company uses these non-GAAP measures for comparability in assessing its performance against other REITs, not all REITs compute these non-GAAP measures in the same manner. Accordingly, there can be no assurance that the Company's basis for computing these non-GAAP measures is comparable with that of other REITs. This is due in part to the differences in capitalization policies used by different companies and the significant effect these capitalization policies have on FFO and Core FFO. Real estate costs which are accounted for as capital improvements are added to the carrying value of the property and depreciated over time whereas real estate costs that are expenses are accounted for as a current period expense. This affects FFO and Core FFO because costs that are accounted for as expenses reduce FFO and Core FFO. Conversely, real estate costs associated with assets that are capitalized and then subsequently depreciated are excluded from the calculation of FFO and Core FFO. FFO and Core FFO are calculated on a gross basis and, as such, do not reflect adjustments for the noncontrolling interests - Operating Partnership. The following table sets forth a reconciliation of the Company’s net loss as determined in accordance with GAAP and its calculations of FFO and Core FFO for the three months ended December 31, 2014, December 31, 2013 and September 30, 2014 and the year ended December 31, 2014. Also presented is information regarding the weighted-average number of shares of the Company's common stock and common units of the Operating Partnership outstanding used for the computation of FFO and Core FFO per share (amounts in thousands, except share and per-share amounts): THREE MONTHS ENDED DECEMBER 31, 2014 THREE MONTHS ENDED DECEMBER 31, 2013 YEAR ENDED DECEMBER 31, 2014 THREE MONTHS ENDED SEPTEMBER 30, 2014 Net loss(1) $ (2,492) $ (5,060) $ (56,697) $ (44,870) Depreciation and amortization 6,823 6,174 25,623 6,427 Other (3) 345 557 113 Funds from operations $ 4,328 $ (1,459) $ (30,517) $ (38,330) Adjustments: Acquisition fees and costs expensed and other(2) - 130 835 - Securitization fees and costs expenses(3) - - 801 217 Non-cash stock compensation 286 175 1,002 259 Market ready costs to initial lease 58 - 278 76 System implementation costs - 278 139 15 Management internalization(1) 194 - 39,373 39,179 Write-off of deferred financing fees - - 1,058 1,058 Ineffectiveness of interest rate cap agreements - - 480 480 Amortization of discount on securitization loan 75 - 116 41 Core funds from operations $ 4,941 $ 2,042 $ 13,565 $ 2,995 FFO $ 4,328 $ 1,459 $ (30,517) $ (38,330) Preferred stock distributions (25) (25) (100) (25) FFO available to common shares and units $ 4,303 $ 1,434 $ (30,617) $ (38,355) Core FFO $ 4,941 $ 2,042 $ 13,565 $ 2,995 Preferred stock distributions (25) (25) (100) (25) Core FFO available to common shares and units $ 4,916 $ 2,017 $ 13,465 $ 2,970 Weighted average shares and units outstanding(4) 39,400,582 38,732,471 38,688,548 38,339,487 FFO per share $ 0.12 $ 0.03 $ (0.79) $ (1.00) Core FFO per share $ 0.13 $ 0.05 $ 0.35 $ 0.08 (1) Includes cost to internalize our former manager of $39.4 million, primarily related to issuance of common units of the Operating Partnership and to a lesser extent, certain transaction costs and assumption of certain liabilities during the year ended December 31,2014. (2) Includes a one-time expense of $775 in the year ended December 31, 2014 to acquire our third-party property manager in our Tampa market. (3) Represents non-capitalizable costs related to the Company's securitization transaction for personnel and other matters. (4) Represents the weighted average of common shares and common units in the Operating Partnership outstanding for the periods presented.

30 3300 FERNBROOK LANE NORTH | SUITE 210 | PLYMOUTH | MN | 55447 P: 952.358.4400 | E: INVES TO RS@ SILVERBAYMGMT .C OM