Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MITEL NETWORKS CORP | d884497d8k.htm |

| EX-99.1 - EX-99.1 - MITEL NETWORKS CORP | d884497dex991.htm |

Mitel

Networks to acquire Mavenir Systems March 2, 2015

Exhibit 99.2 |

| ©2014 Mitel. Proprietary and Confidential.

Safe Harbor Statement

2 |

| ©2014 Mitel. Proprietary and Confidential.

Safe Harbor Statement (cont’d)

3

Forward Looking Statements

Some of the statements in this presentation are forward-looking statements (or forward-looking

information) within the meaning of applicable U.S. and Canadian securities laws. These include

statements using the words believe, target, outlook, may, will, should, could, estimate, continue, expect, intend,

plan, predict, potential, project and anticipate, and similar statements which do not describe the

present or provide information about the past. There is no guarantee that the expected events

or expected results will actually occur. Such statements reflect the current views of management of Mitel and are

subject to a number of risks and uncertainties. These statements are based on many assumptions and

factors, including general economic and market conditions, industry conditions, operational and

other factors. Any changes in these assumptions or other factors could cause actual results to differ

materially from current expectations. All forward-looking statements attributable to Mitel, or

persons acting on its behalf, and are expressly qualified in their entirety by the cautionary

statements set forth in this paragraph. Undue reliance should not be placed on such statements. In addition, material risks that

could cause actual results to differ from forward-looking statements include: the inherent

uncertainty associated with financial or other projections; the integration of Mavenir and the

ability to recognize the anticipated benefits from the acquisition of Mavenir; the ability to obtain required regulatory

approvals for the exchange offer and merger, the timing of obtaining such approvals and the risk that

such approvals may result in the imposition of conditions that could adversely affect the

expected benefits of the acquisition of Mavenir; the risk that the conditions to the exchange offer or merger are

not satisfied on a timely basis or at all and the failure of the exchange offer or merger to close for

any other reason; risks relating to the value of the Mitel common shares to be issued in

connection with the exchange offer and merger; the anticipated size of the markets and continued demand for Mitel and

Mavenir products and the impact of competitive products and pricing that could result from the

announcement of the acquisition of Mavenir; access to available financing on a timely basis and

on reasonable terms, including the refinancing of Mitel’s debt to fund the cash portion of the consideration in

connection with the exchange offer and merger; Mitel's ability to achieve or sustain profitability in

the future since its acquisition of Aastra; fluctuations in quarterly and annual revenues and

operating results; fluctuations in foreign exchange rates; current and ongoing global economic instability, political

unrest and related sanctions, particularly in connection with the Ukraine and the Middle East; intense

competition; reliance on channel partners for a significant component of sales; dependence upon

a small number of outside contract manufacturers to manufacture products; and, Mitel’s ability to

implement and achieve its business strategies successfully. Additional risks are described under the

heading "Risk Factors" in Mitel's Annual Report on Form 10-K for the year ended

December 31, 2014, filed with the SEC on February 26, 2015, and in Mavenir’s Annual Report on Form 10-K for the year

ended December 31, 2014 to be filed with the SEC. Forward-looking statements speak only as of the

date they are made. Except as required by law, Mitel does not have any intention or obligation

to update or to publicly announce the results of any revisions to any of the forward-looking statements to reflect

actual results, future events or developments, changes in assumptions or changes in other factors

affecting the forward-looking statements. |

| ©2014 Mitel. Proprietary and Confidential.

Transaction Overview

4

Under the terms of the agreement, Mitel Networks will acquire Mavenir

Systems for $560 million purchase price

Consideration

$17.94 per share to

MVNR shareholders;

$11.08 per share in cash

and 0.675x Mitel shares

per share of Mavenir

Cash consideration

funded with ~$50mm in

cash from the balance

sheet and new debt

Pro Forma Ownership

MVNR shareholders will

own ~16% of MITL

Closing Details

Anticipated to close in

second quarter 2015

Leadership

•

Pardeep Kohli will join Mitel as President, Mavenir, Mobile Division of

Mitel Key Pro Forma Financials

Revenue: $1.2bn

EBITDA: $164mn

Synergies: ~$20mm run rate

Pro Forma Net Debt /

Adjusted CY14 EBITDA: 3.2x |

| ©2014 Mitel. Proprietary and Confidential.

Mavenir Overview

5

•

Wireless pure-play networking solutions provider

•

Leading provider of mobile voice, messaging and video solutions

•

Capitalizing on two key network trends

•

4G All-IP

•

Virtualized, scalable software

•

Customer relationships with 15 of the top 20 mobile global operators

•

4 of top 5 in the Europe

•

3 of the top 4 in US

•

Positioned well to drive growth from transition to 4G/VoLTE

•

Strong financial profile

•

CY-2014 Revenues: $129.8 million, up 28.1% vs. CY13

•

~1100 employees

•

Growing number of carrier footprint wins |

| ©2014 Mitel. Proprietary and Confidential.

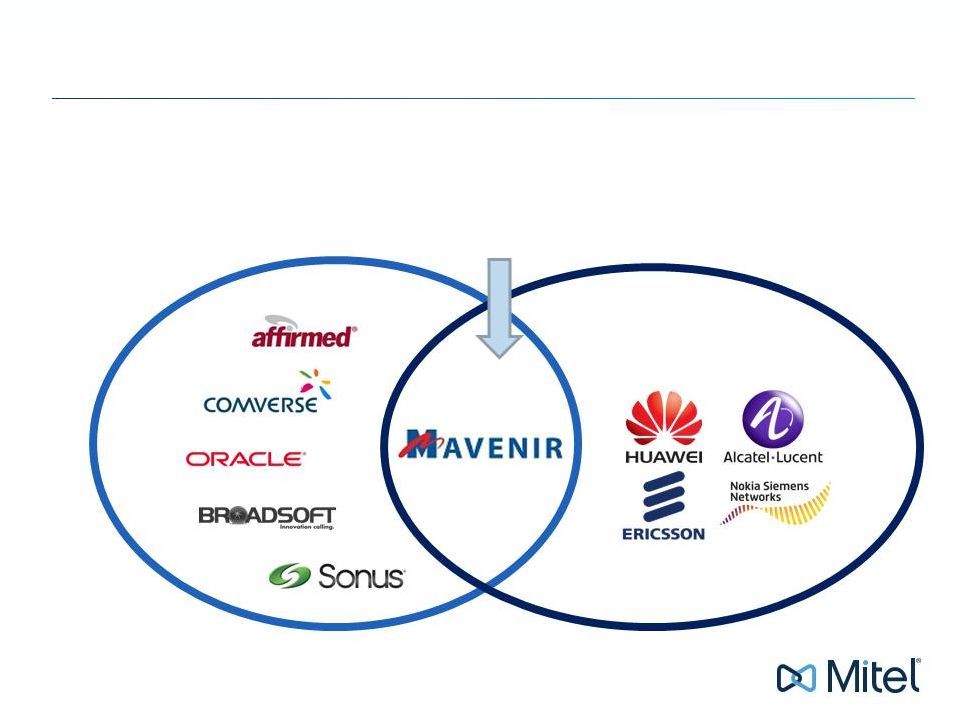

Mavenir –

A Leader in Mobility

Point S/W-based

Solutions

Complete S/W Portfolio

6

End to End (proprietary

H/W) |

| ©2014 Mitel. Proprietary and Confidential.

Customer Highlights

7

VoLTE/WiFi

17

RCS

17

CORE

23

2G/3G/4G

130+

Based on Mavenir 2Q2014 data

Growing Roster of Blue Chip 4G Customers

•

4 of top 5 operators in the Europe; 3 of top 4 operators in US

Diversified 4G Customer Base

•

Geographically diverse, as well across product lines

Strong 2G/3G Customer Base

•

15 of top 20 operators globally |

| ©2014 Mitel. Proprietary and Confidential.

Strong/Diverse Customer Base

130+ Customers Globally with over 2B Subscribers

Growing Roster of Tier One Customers for Next Generation 4G Solutions

8 |

| ©2014 Mitel. Proprietary and Confidential.

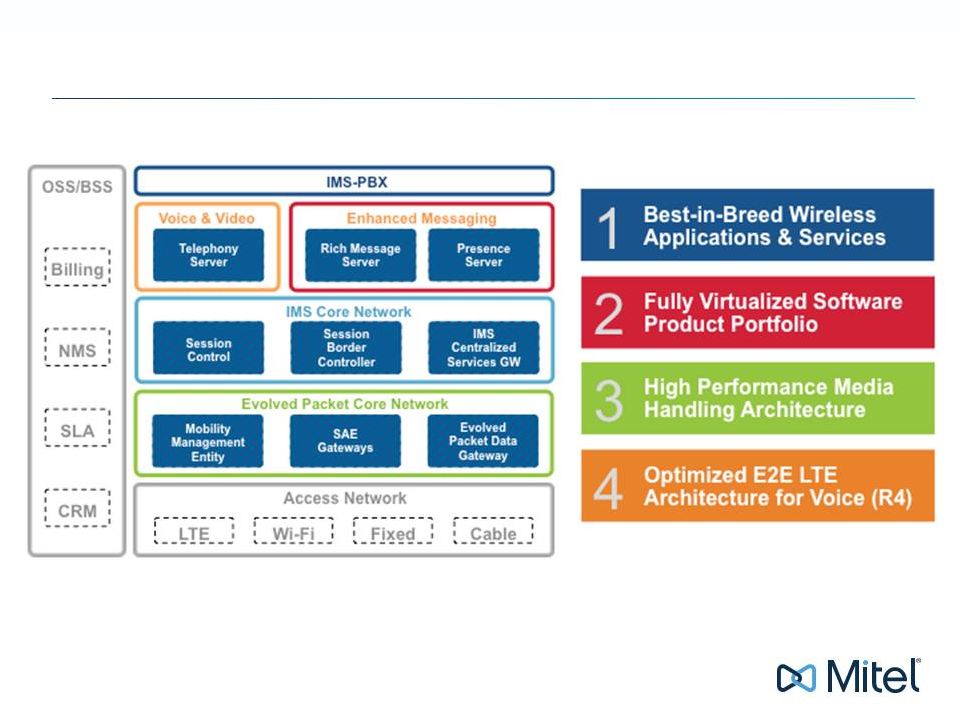

Mavenir’s 4G Solutions Addressing the Opportunity

9 |

| ©2014 Mitel. Proprietary and Confidential.

The New Mitel

Next Generation Fixed, Mobile & Cloud Communications Experts

10

Enterprise

Mobile

Experts in Business &

Consumer IP

Communications

Positioned to lead the

Mobilization of Unified

Communications

Telco Cloud Front-Runner

•

Virtualized SW Portfolio

•

NFV/SDN Architectures

Market Scale & Diversity

•

2500+ Channel Partners

•

15 of Top 20 Mobile Operators

Global Leadership

•

#1 Business Cloud Communications

•

#1 Eur / #3 US Total PBX/IP PBX

•

A Leader in VoLTE/RCS |

| ©2014

Mitel.

Proprietary

and

Confidential.

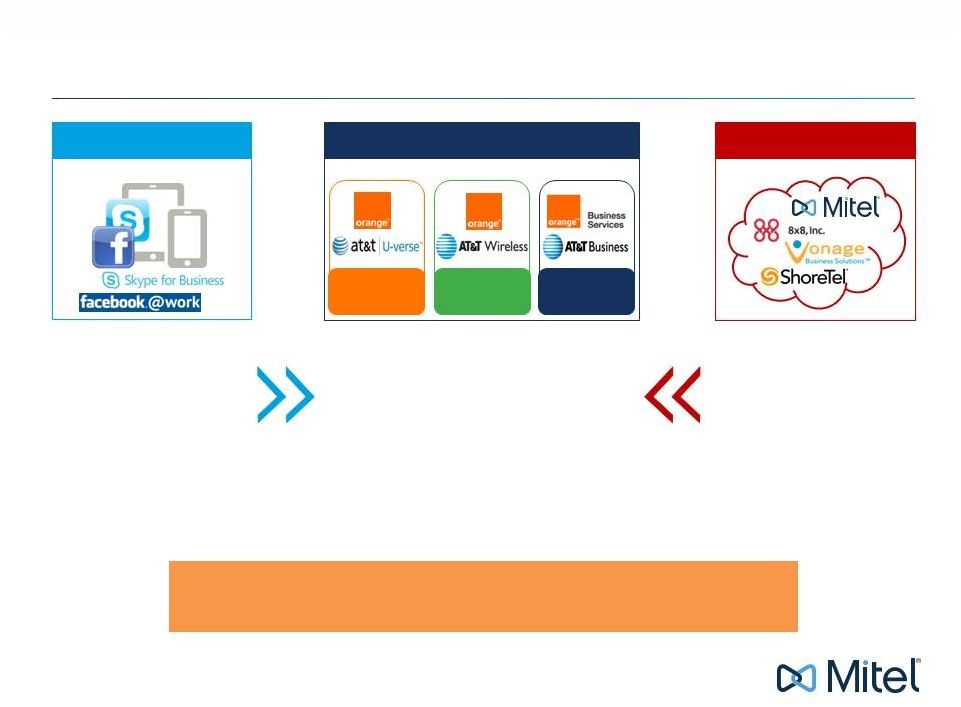

Market Dynamics Driving Change

11

Commoditization

Price Pressure

Segmentation

New Service Providers Challenging Traditional Operators’

Business & Operating Model

Operators

Rich services driving usage

Expansion into enterprise

Mobile apps supporting BYOD

Pricing driving residential share

OTT

Cloud Telephony

Service ubiquity constraints

Economy of scale challenges

Wireline

Wireless

Business |

| ©2014

Mitel.

Proprietary

and

Confidential.

Capitalizing on Two Major Trends

12

Convergence

Wireline

Wireless

Business

CONVERGENCE

Operators

Org Realignment

Wireless and Business

Units Consolidation

Adjacency

Expansion, Mergers,

Technology Rationalization

Cloud

Virtualization, NFV, SDN,

Telco Cloud

Service

Ubiquity

Network

Consolidation

New Business

Models

Operators are Transforming

Cloud |

| ©2014 Mitel. Proprietary and Confidential.

Convergence Creating Market Opportunity

13

Mobile

Infrastructure

Hosted

Business Services

Cloud

Seats

Premise

Equipment

Consumer

Business

Operator

Enterprise

#2 VoLTE/RCS

#1 EMEA/#3 N.A.

PBX/IP PBX

#1 Business Cloud

Communications

UC

Mobility

GREATER THAN SUM OF ALL PARTS

RELATIONSHIP

VALUE

TECHNOLOGY

Valuable Business Features

Enterprise relationships

Converged IP Network

Incumbent at operators

Mass Market Scale

Cloud Infrastructure |

| ©2014

Mitel.

Proprietary

and

Confidential.

Mobilization of Unified Communications

Collaboration

Cloud/Hosted

Contact Center

Voice/Video

SERVICES

DELIVERY

Mobilization of Unified Communications Across Industry

Verticals and Access Technologies

Mobile

14 |

| ©2014

Mitel.

Proprietary

and

Confidential.

Speed

up to

15x

faster

Services

more

revenue

Savings

less

cost

Spectrum

up to

10x

better

Why 4G LTE is a Necessity

15 |

| ©2014 Mitel. Proprietary and Confidential.

4G LTE Progress

Operators globally

1000+

Source: GSMA, February 2015

2014

–

59.6

million

VoLTE

subscriptions

2019 –

1.2 billion VoLTE subscriptions

Source: ABI June 2014

16

<5%

Connections on

LTE

801

invested in LTE

445

launched |

| ©2014 Mitel. Proprietary and Confidential.

Mitel

•

Growth

–

Creates three growth pillars with

combined $300m revenue growing at

>20% YoY

–

Cloud + Contact Center + Mobility

–

Supply Operators directly in addition

to Enterprises

•

TAM

–

$14b increase by 2018

•

Portfolio

–

Accelerates Mobile UC evolution

–

Introduces highly scalable mobile

platform

Mavenir

•

Scale

–

Grows and diversifies revenue

sources ($1B+)

–

Growth in Sales and Operations to

support increased business

–

Expanded global presence via Mitel

channel partners

•

Portfolio

–

Introduces feature rich business

services

–

Accelerates in-flight Mobile UC and

differentiated end-to-end SIP

Trunking offer

–

Gains access to robust vertically

integrated Enterprise solutions

Transaction Benefits

17 |

| ©2014 Mitel. Proprietary and Confidential.

Source: Company filings and Wall Street research.

(1)

TAM growth includes new Business Services in 2015, which grows from $1.1bn in 2015

to $3.1bn in 2018 at a CAGR of 42%.

Voice

Expertise

Operational

Expertise

•

Differentiated and broadest business

IP-voice portfolio in the industry for all

business size segments with broad regional

strength

•

Continually expanding margins and increasing

profitability; history of successful synergy

attainment

•

Management successfully integrated and realized

synergy from multiple acquisitions

Execution

on Growing

Market

Mitel Skill Set

Premise

Cloud

•

Stable and profitable business

•

Provides strong cash flow to support high growth

Cloud and Carrier Mobility growth

•

Hardware to software transition

•

$6.8bn TAM in 2014 growing at 1-2% CAGR to

$7.6bn in 2018

•

Revenues growing at 24% and exceed 10% of

quarterly revenue

•

Positioned to benefit from fast growing market

•

Public and private cloud

•

$5.0bn TAM in 2014 growing at 14.7% CAGR to

$8.7bn in 2018

Mobile

Opportunities

•

Mavenir provides key strategic carrier

relationships

•

Key personnel with expertise in mobile

infrastructure

•

Strong technology and patents

•

Large and rapidly growing market: $2.6bn TAM in

2014 growing at 54.5% CAGR to $14bn 2018

(1)

•

Mitel undergoing successful business transition to

Cloud and Contact Center, two rapidly growing

markets

•

Cloud and Contact Center to make up 16% of Mitel

revenue in 2015; Contact Center outpacing market

growth by 3x

•

Proven ability to grow faster than market

Leveraging Mitel’s Core Skill Sets

18 |

| ©2014 Mitel. Proprietary and Confidential.

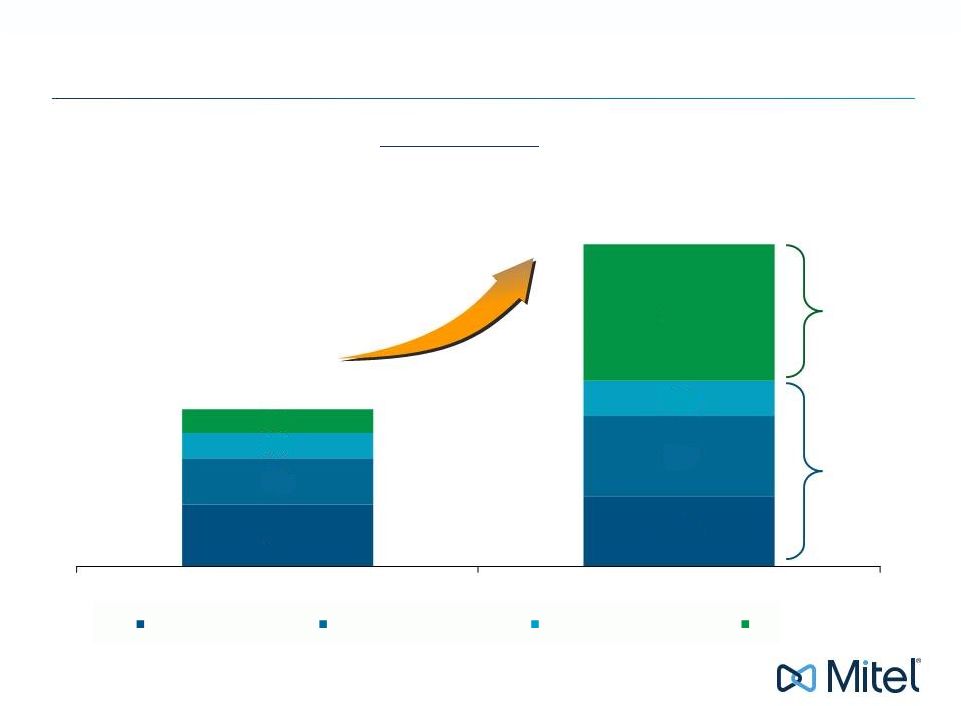

Expand Market Through Combination

19

Source: IDC.

Additional

TAM from

Mavenir

Mitel

Existing

TAM

($bn)

TAM Expansion

19.6% Pro Forma

‘14 –

’18 CAGR

6.8

7.6

5.0

8.7

2.7

3.9

2.6

14.8

$17.1

$35.0

2014

2018

Premise Based IP PBX

Hosted/Cloud Voice and UC

Contact Center Applications

Mobility

2.7

2.6 |

| ©2014 Mitel. Proprietary and Confidential.

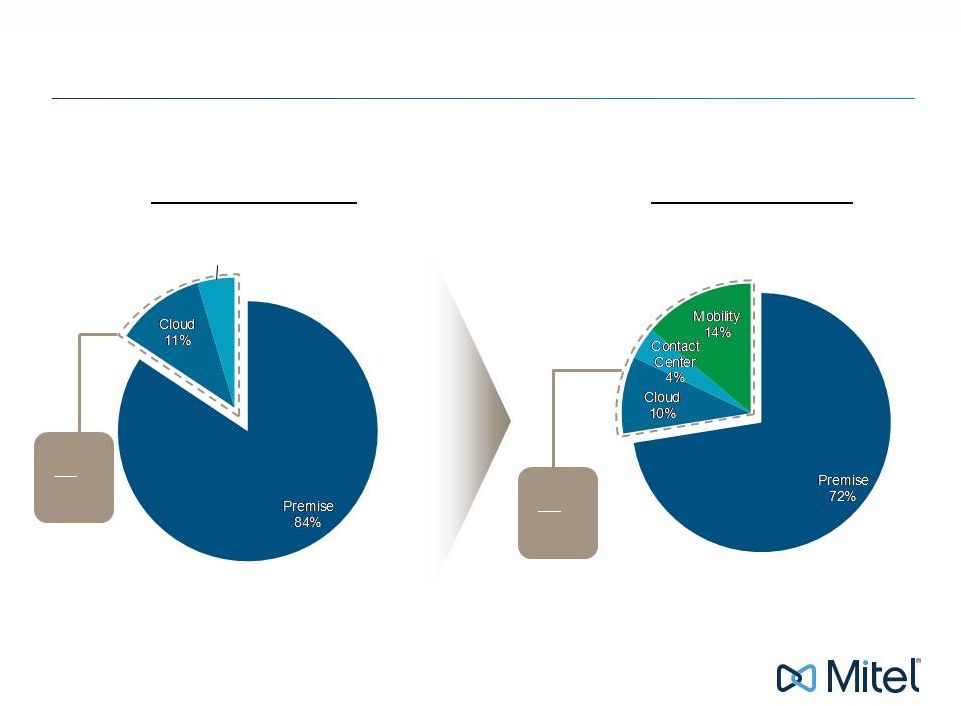

Represent

16%

of

Revenue in

2015

Represent

28%

of

Revenue in

2015

Source: Mitel and Mavenir management estimates.

2015 Before

2015 After

Premise Growth Rate: (4%)

Cloud + Contact Center

Growth Rate

>20%

Premise Growth Rate: (4%)

Cloud + Contact Center + Mobility

Growth Rate

>20%

Mitel’s Three Strategic Growth Pillars

Mobile/Cloud/Contact Centre Represent ~30% Rev Mix in 2015

20

Contact Center

5% |

| ©2014 Mitel. Proprietary and Confidential.

Mitel / Mavenir Portfolios

Mobile

2G / 3G / 4G / Wi-Fi

MMTEL & 3GPP Services

Converged IP Core

Mavenir

Mitel

•

Highly Scalable Mobile Platform

•

Converged IP Core Network

•

Wireless & Fixed Network Services

•

Feature Rich Business Services

•

Leading Cloud Telephony Services

•

Broad Industry Vertical Solutions

21 |

| ©2014 Mitel. Proprietary and Confidential.

Mitel + Mavenir Portfolios

Mobile / Cloud / Fixed

2G / 3G / 4G / Wi-Fi

MMTEL & 3GPP Services

Converged IP Core

Mitel

•

Highly Scalable Converged Mobile & Fixed Platform

•

Broad Range of Fixed/Cloud Mobile Business Services

•

Suite of Converged IP Core Networking Solutions

•

Broad Industry Vertical Solutions

22 |

2014 Proforma P&L

23

Represents Non-GAAP financials

Revenue

$1,104M

$130M

$1,234M

Gross Profit

1

$590M

$73M

$663M

Gross Margin %

53%

56%

54%

Operating Expenses

1

$457M

$79M

$536M

Operating Profit

1

$133M

($6M)

$127M

Operating Margin %

12%

(5%)

10%

EBITDA

1

$167M

($3M)

$164M

EBITDA Margin %

15%

(2%)

13%

| ©2014 Mitel. Proprietary and Confidential.

1 |

| ©2014 Mitel. Proprietary and Confidential.

Preliminary Thoughts on Synergies

•

Early estimates $20M, by mid CY17, with $26M est. one time costs

•

Approx. 200 outsourced R&D staff in India…bring in house

$3-4M

•

Leverage low cost R&D centre in India

$3-4M

•

Duplicate public company costs

$3-4M

•

Facilities/Marketing

programs/Sales/IT/G&A

$3-4M

•

R&D cost avoidance re: mobile PBX (leverage Mitel’s Telepo

solution)

$3-5M

•

Attractive revenue synergies seen in combined

company TBD

•

Leveraging scale/balance sheet of larger entity

•

Cross

selling

Mitel

cloud

solutions

via

existing

Mavenir

carrier

relationships

•

Cross selling Mavenir solutions into existing Mitel carrier relationships

24 |

| ©2014 Mitel. Proprietary and Confidential.

Acquisition Drives Improved Target Model

25

1

2

Prior Target Model Mitel (2017)

Post –Mavenir Target Model

Mitel {2017}

1

Gross Margin

55% -

56%

57% -

59%

R&D

2

9% -

10%

11% -

12%

SG&A

2

30% -

32%

30% -

31%

Adjusted EBITDA

17% -

19%

18% -

20%

Effective Tax Rate

18% -

20%

18% -

20%

1

Target model assumes integration and synergies complete, exiting 2017 Excludes

stock-based compensation, amortization of acquired intangibles, and special charges and restructuring costs |

| ©2014 Mitel. Proprietary and Confidential.

Big Picture -

Strategy

Rapid growth with

27% year/year

Results outpacing

market growth by

3x

Robust

Ecosystem

Rapidly

Expand

in

the

contact center

Solid revenue

Excellent

improvement in

gross margin

Hardware to

software transition

Large installed

base

Maximize

value

in the premise

Fastest growing

Public and

private

Revenues

exceeded 10% of

total quarterly

revenue

Accelerate

in the cloud

Rapidly growing

end market (55%

CAGR)

Convergence of

fixed and mobile

technologies

BYOD movement

Expand

into

mobile

26 |

| ©2014 Mitel. Proprietary and Confidential.

Key Transaction Takeaways

•

An offensive and defensive strategy

•

Enhanced shareholder value creation

•

Growth

•

Comfortable leverage/rapidly de-levers

•

Modestly

dilutive

in

2

half

of

CY15/accretive

in

2016

•

Materially expanded TAM opportunity/rapid growth market

•

Cloud + Contact Center + Mobile builds a $300+ million revenue base growing at

>20% year-over-year

•

High visibility with 15 of top 20 mobile global operators, including top 4 in the

US Mitel -

the Next Generation Fixed, Mobile & Cloud Communications Experts

27

nd |

|