Attached files

| file | filename |

|---|---|

| 8-K - SHENANDOAH TELECOMMUNICATIONS COMPANY 8-K 2-27-2015 - SHENANDOAH TELECOMMUNICATIONS CO/VA/ | form8k.htm |

February 27, 2015 4Q 2014 Earnings Conference Call Exhibit 99.1

* Safe Harbor Statement This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, regarding, among other things, our business strategy, our prospects and our financial position. These statements can be identified by the use of forward-looking terminology such as “believes,” “estimates,” “expects,” “intends,” “may,” “will,” “should,” “could,” or “anticipates” or the negative or other variation of these similar words, or by discussions of strategy or risks and uncertainties. These statements are based on current expectations of future events. If underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could vary materially from the Company’s expectations and projections. Important factors that could cause actual results to differ materially from such forward-looking statements include, without limitation, risks related to the following: Increasing competition in the communications industry; andA complex and uncertain regulatory environment.A further list and description of these risks, uncertainties and other factors can be found in the Company’s SEC filings which are available online at www.sec.gov, www.shentel.com or on request from the Company. The Company does not undertake to update any forward-looking statements as a result of new information or future events or developments.

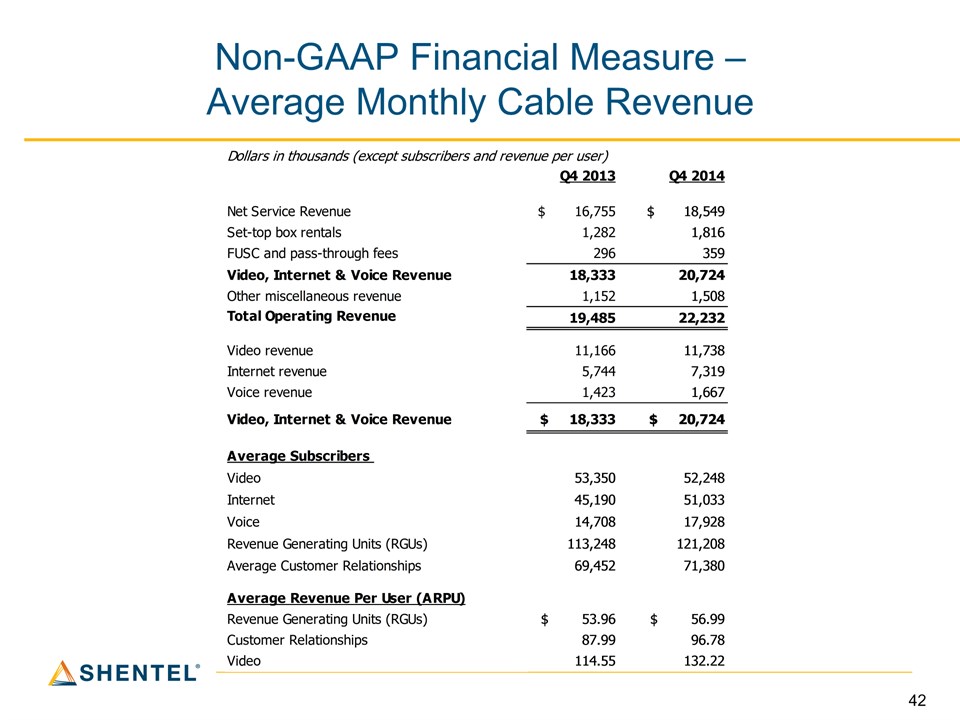

* Use of Non-GAAP Financial Measures Included in this presentation are certain non-GAAP financial measures that are not determined in accordance with US generally accepted accounting principles. These financial performance measures are not indicative of cash provided or used by operating activities and exclude the effects of certain operating, capital and financing costs and may differ from comparable information provided by other companies, and they should not be considered in isolation, as an alternative to, or more meaningful than measures of financial performance determined in accordance with US generally accepted accounting principles. These financial performance measures are commonly used in the industry and are presented because Shentel believes they provide relevant and useful information to investors. Shentel utilizes these financial performance measures to assess its ability to meet future capital expenditure and working capital requirements, to incur indebtedness if necessary, return investment to shareholders and to fund continued growth. Shentel also uses these financial performance measures to evaluate the performance of its businesses and for budget planning purposes.

* Chris FrenchPresident and CEO

* Q4’14 Highlights Net Income GrowthIncreased 29.6% over Q4’13 to $8.6 millionAdjusted OIBDA increased 17.8% to $34.2 millionRevenue Growth Revenue grew 6.2% over Q4’13 to $82.8 millionCustomer Growth 12/31/13 12/31/14 ChangeWireless 410,768 433,029 +22,261Cable (RGUs) 113,840 121,716 +7,876

* 2014 Financial Highlights Revenue ($ millions) Adjusted OIBDA ($ millions) 5.8% 11.4%

* 2014 Financial Highlights Net Income($ millions) Operating Income($ millions) 14.5% 11.7%

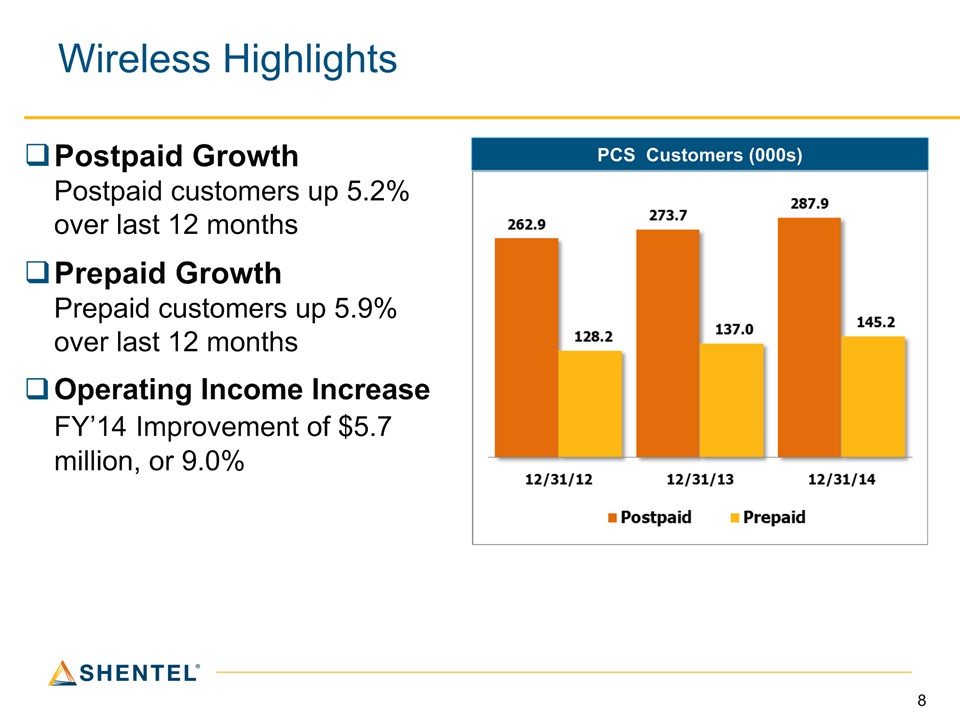

* Wireless Highlights PCS Customers (000s) Postpaid Growth Postpaid customers up 5.2% over last 12 monthsPrepaid GrowthPrepaid customers up 5.9% over last 12 monthsOperating Income IncreaseFY’14 Improvement of $5.7 million, or 9.0%

* Cable Highlights Revenue GrowthOperating revenues $22.2 million, growth of 14.1% over Q4’13Q4’14 Adjusted OIBDA $4.3 million, up 21.9% from Q4’13121,716 RGUs at 12/31/2014, up 6.9% over Q4’13 Cable OIBDA (in millions) Cable RGUs

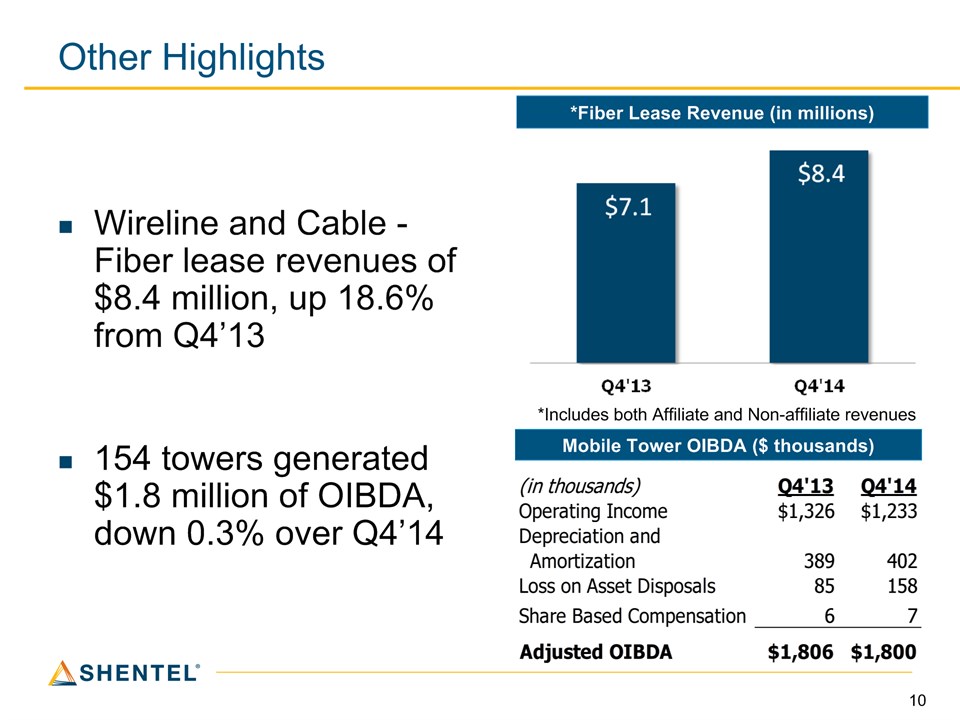

* Other Highlights Wireline and Cable -Fiber lease revenues of $8.4 million, up 18.6% from Q4’13154 towers generated $1.8 million of OIBDA, down 0.3% over Q4’14 *Fiber Lease Revenue (in millions) Mobile Tower OIBDA ($ thousands) *Includes both Affiliate and Non-affiliate revenues

* Annual Dividend Paid Every Year Since 1960 Dividend payment per share

* Adele SkolitsVP of Finance and CFO

* Adjusted EPS Adjusted EPS *See Appendix for reconciliation of net income to adjusted earnings per share. 15.2% 13.0%

* Profitability Adjusted OIBDA ($ thousands)

* Growth in Adjusted OIBDA ($ thousands) CAGR of 12% since 2010 Adjusted OIBDA ($ thousands)

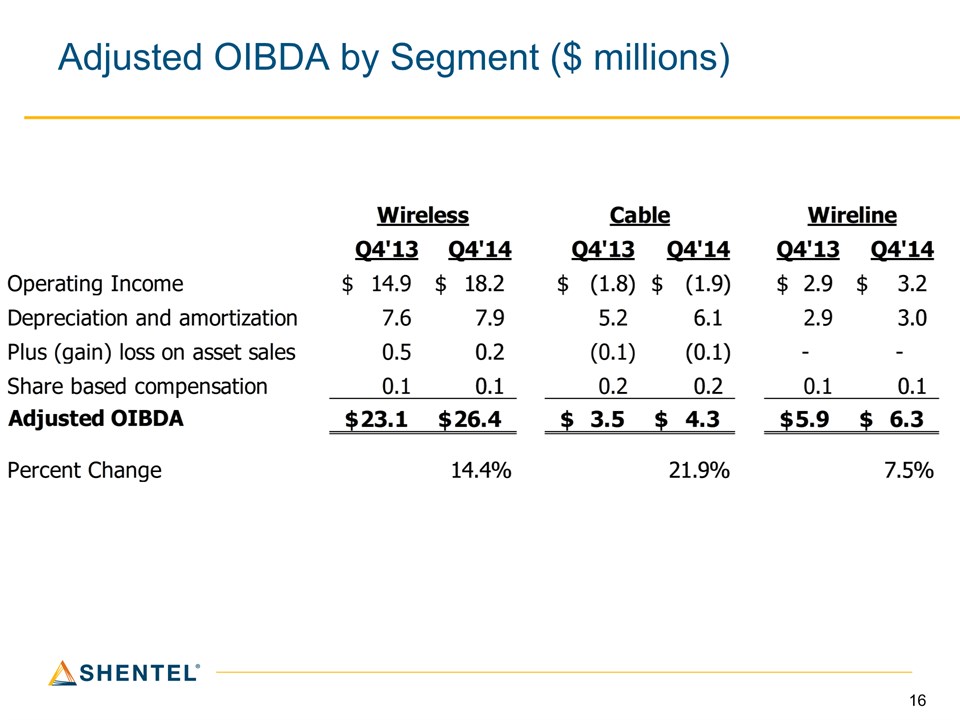

* Adjusted OIBDA by Segment ($ millions)

* Wireless Segment – Change in Adjusted OIBDA Q4’14 vs. Q4’13 ($ millions)

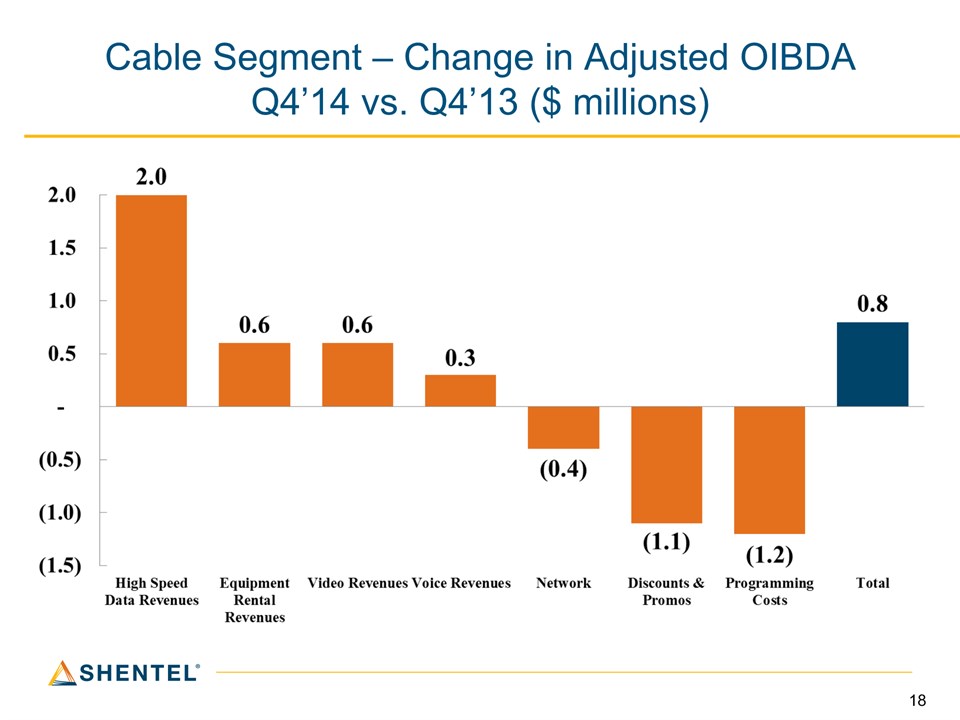

* Cable Segment – Change in Adjusted OIBDA Q4’14 vs. Q4’13 ($ millions)

* Wireline Segment – Change in Adjusted OIBDA Q4’14 vs. Q4’13 ($ millions)

* Earle MacKenzieEVP and COO

* Wireless Segment

* Postpaid Customer Growth PCS Postpaid Customers (000s)

* Postpaid Customer Additions Postpaid Additions – Year-to-Date Postpaid Additions – Q4 Net adds of 4,891 in Q4 2014 versus 6,054 in Q4 2013Q4 2014 churn of 1.92% up from 1.69% in Q4 2013Shentel-controlled channels produced 34% of gross adds in Q4 2014 and 48% in Q4 20132014 annual churn of 1.76% up from 1.75% in 2013

* Billed Revenue per Customer Down; Data Usage Increasing Gross Billed Service Revenue per Postpaid User – Data & Voice 1 1 – Before Service credits, bad debt, Sprint Nextel fees.

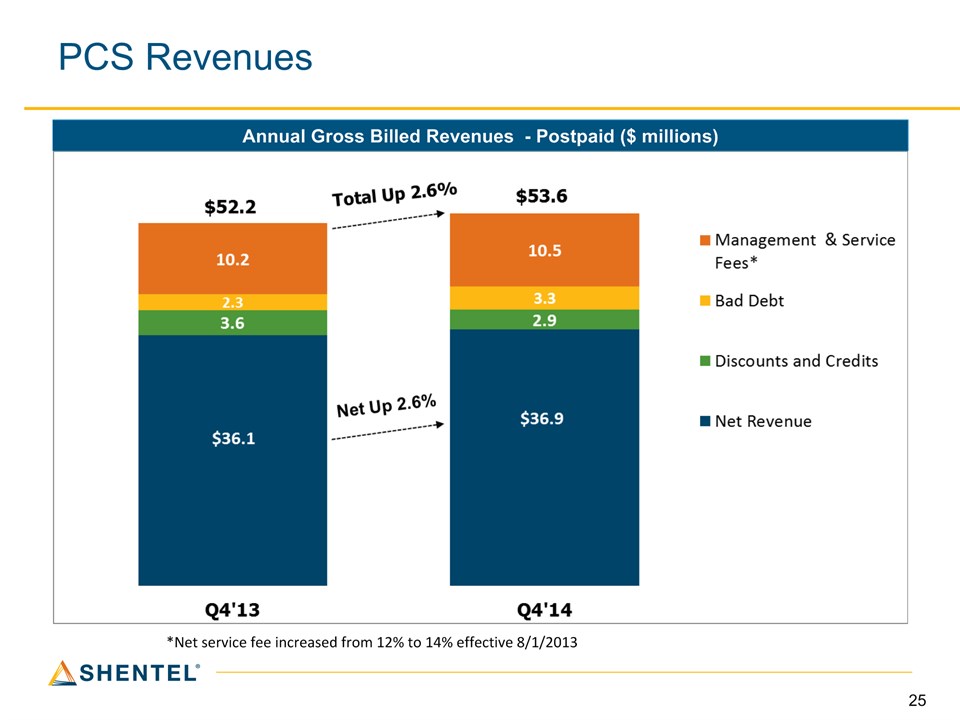

* PCS Revenues Annual Gross Billed Revenues - Postpaid ($ millions) * *Net service fee increased from 12% to 14% effective 8/1/2013

* PCS Prepaid Statistics Gross Additions (000s) Cumulative Customers (000s) *The loss of customers in Q2’14 related to more stringent governmental requirements for customers renewing their eligibility for the government subsidized Assurance program.

* PCS Prepaid Statistics Churn % Average Gross Billed Revenue

* Network Statistics 538 Cell Sites94% have a second LTE carrier at 800 MHz120 sites have three carriers, including a second carrier at 1900 MHzTraffic 77% of data traffic is on LTE, with 40% on 800 MHzData usage grew more than 2x in 2014LTE traffic grew more than 3x in 2014Average speeds of approximately 6 MbpsAverage customer uses over 3GB per month

* Cable Segment

* Cable - RGU Growth by Quarter Customers 69,538 70,670 69,889(2) 71,302 71,298 RGU's/Customer 1.64 1.65 1.66 1.69 1.71 Prior periods revised to reflect transfer of Shenandoah County, VA video activities to WirelineCollege students disconnect during summer

* Increasing Average Monthly Cable Revenue Average Monthly Revenue per RGU Average Monthly Revenue per Customer* *Average monthly revenue per video subscriber was $114.55 and $132.22 for Q4 2013 and Q4 2014, respectively.

* Key Operational Results – Cable* *Excludes cable operations in Shenandoah County, VA which are included in the Wireline segment.

* Wireline Segment

* Key Operational Results - Wireline Access line loss of 2.2% in past 12 monthsBroadband penetration in LEC area at 59.0%Total connections at 12/31/14 of 34.3 thousand5,692 video subscribers at 12/31/14 Access lines (000s) DSL Customers (000s)

* Wireline and Cable Fiber Sales ($ millions) Fiber Lease Revenue New External Fiber Lease Contracts* * Amounts shown represent the total contract value. Contract Terms range from 36 to 120 months. Revenues may be booked either in the Wireline or Cable segment depending on which assets are used to provide the service.

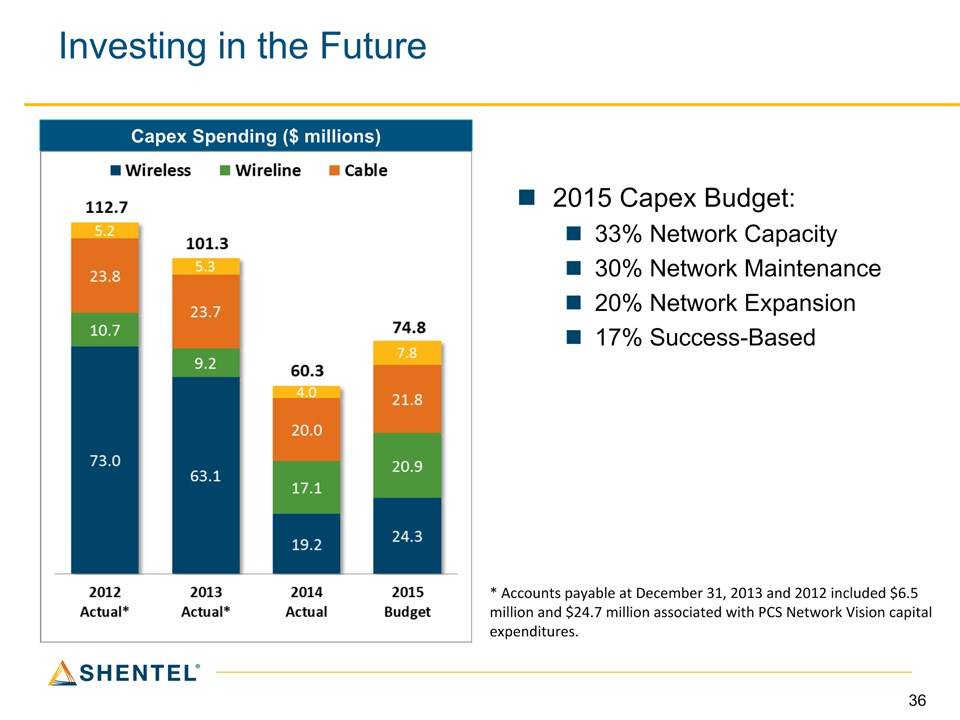

* Investing in the Future Capex Spending ($ millions) * Accounts payable at December 31, 2013 and 2012 included $6.5 million and $24.7 million associated with PCS Network Vision capital expenditures. 2015 Capex Budget:33% Network Capacity30% Network Maintenance20% Network Expansion17% Success-Based

* Q&A

* Appendix

* Non-GAAP Financial Measures – Billed Revenue per Prepaid & Postpaid Subscriber Calculation of Billed revenue per subscriber = Gross billed revenue / Average subscribers / 3 months

* Postpaid PCS Customers Top Picks Q4 2014 Top Service Plans – 72% of Gross Adds Top Devices – New Activations – All Channels 20GB Share Pack 22% Unlimited, My Way 18% Unlimited, Talk/Text 12% Sprint Simply Unlimited 12% Everything Data 1500 8% iPhone 43% Samsung Galaxy S 19% Samsung Galaxy Tablet 9% Smartphones made up 79% of the Postpaid base in Q4’14, up from 78% in Q3’14 and 75% in Q4’13.

* iPhone Statistics – Q4’14 43% of Q4 Gross Adds27% of iPhones were sold or upgraded in Shentel-controlled channels35.1% of 12/31/14 Postpaid customers had the iPhone, up from 33.2% at 9/30/14 and 28.9% at 12/31/13.iPhone Base – 12/31/1451% iPhone 5, 5C & 5S29% iPhone 4 & 4S20% iPhone 6, 6 Plus

* Non-GAAP Financial Measure – Average Monthly Cable Revenue

* Key Operational Results – Mobile Company Mobile Tower Revenue ($ millions) Towers and Leases

* Non-GAAP Financial Measure – Adjusted Earnings Per Share