Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Adeptus Health Inc. | Financial_Report.xls |

| EX-10.20 - EX-10.20 - Adeptus Health Inc. | adpt-20141231ex1020ebd80.htm |

| EX-31.1 - EX-31.1 - Adeptus Health Inc. | adpt-20141231ex3113a3331.htm |

| EX-23.1 - EX-23.1 - Adeptus Health Inc. | adpt-20141231ex2314f6100.htm |

| EX-32.1 - EX-32.1 - Adeptus Health Inc. | adpt-20141231ex32128a78e.htm |

| EX-10.21 - EX-10.21 - Adeptus Health Inc. | adpt-20141231ex1021cc1f1.htm |

| EX-31.2 - EX-31.2 - Adeptus Health Inc. | adpt-20141231ex31264b617.htm |

| EX-32.2 - EX-32.2 - Adeptus Health Inc. | adpt-20141231ex32261be5d.htm |

| EX-21.1 - EX-21.1 - Adeptus Health Inc. | adpt-20141231ex21134eec4.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

Or

|

◻ |

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-36520

ADEPTUS HEALTH INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

46-5037387 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer Identification No.) |

2941 Lake Vista Drive

Lewisville, TX 75067

(Address of principal executive offices) (Zip Code)

(972) 899-6666

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

(Title of Class) |

(Name of each exchange which registered) |

|

Class A Common Stock, $0.01 par value per share |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ◻ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes ◻ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ◻

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ◻

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

Large accelerated filer |

◻ |

Accelerated filer |

◻ |

|

Non-accelerated filer |

☒ (Do not check if a smaller reporting company) |

Smaller reporting company |

◻ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes ◻ No ☒

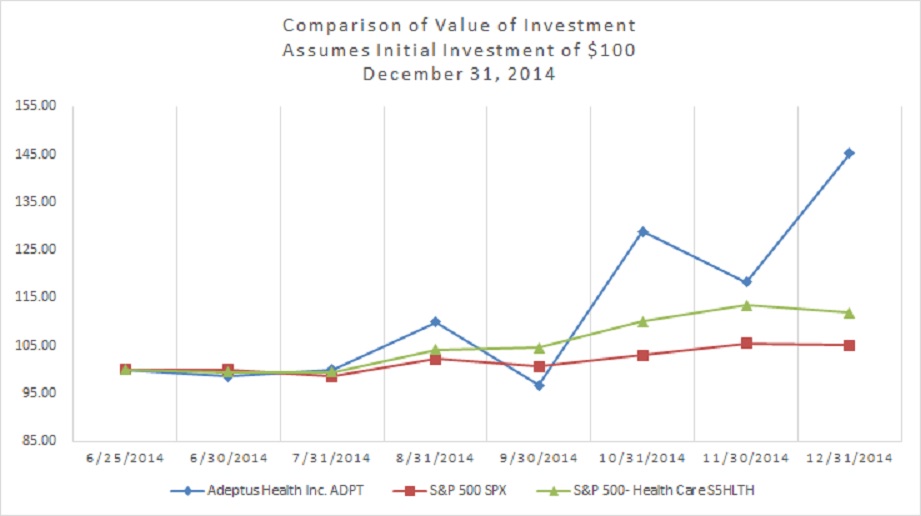

As of June 30, 2014, the aggregate market value of Class A common stock held by non-affiliates was approximately $143.0 million based upon a total of 5,635,000 shares of Class A common stock held by non-affiliates and a closing price of $25.37 per share for the Class A as reported on the New York Stock Exchange on such date.

As of February 15, 2015, 9,861,930 shares of Class A common stock, par value $0.01 per share, and 10,741,839 shares of Class B common stock, par value $0.01 per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Items 10, 11, 12, 13 and 14 of Part III of this Annual Report on Form 10-K incorporate information by reference from the registrant’s definitive proxy statement relating to its 2015 annual meeting of stockholders to be filed with the Securities and Exchange Commission within 120 days after the close of the registrant’s fiscal year.

ADEPTUS HEALTH INC. and SUBSIDIARIES

FORM 10-K

|

|

|

|

|

Page |

|

|

|

|

|

|

|

|

|

|

|

4 |

|

||

|

|

|

26 |

|

||

|

|

|

51 |

|

||

|

|

|

51 |

|

||

|

|

|

51 |

|

||

|

|

|

51 |

|

||

|

|

|

|

|

|

|

|

|

|

51 |

|

||

|

|

|

54 |

|

||

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

56 |

|

|

|

|

|

76 |

|

||

|

|

|

77 |

|

||

|

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

105 |

|

|

|

|

|

105 |

|

||

|

|

|

105 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

106 |

|

||

|

|

|

106 |

|

||

|

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

106 |

|

|

|

|

Certain Relationships and Related Transactions, and Director Independence |

|

106 |

|

|

|

|

|

106 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

107 |

|

||

|

|

|

|

|

|

|

|

|

|

|

108 |

|

|

|

|

|

|

|

|

|

|

|

|

|

109 |

|

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

In addition to historical information, this Annual Report on Form 10-K may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are subject to the “safe harbor” created by those sections. All statements, other than statements of historical facts included in this Annual Report on Form 10-K, including statements concerning our plans, objectives, goals, beliefs, business strategies, future events, business conditions, our results of operations, financial position and our business outlook, business trends and other information, may be forward-looking statements. Words such as “estimates,” “expects,” “contemplates,” “will,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “forecasts,” “may,” “should” and variations of such words or similar expressions are intended to identify forward-looking statements. The forward-looking statements are not historical facts, and are based upon our current expectations, beliefs, estimates and projections, and various assumptions, many of which, by their nature, are inherently uncertain and beyond our control. Our expectations, beliefs, estimates and projections are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs, estimates and projections will be achieved and actual results may vary materially from what is expressed in or indicated by the forward-looking statements.

There are a number of risks, uncertainties and other important factors, many of which are beyond our control, that could cause our actual results to differ materially from the forward-looking statements contained in this Annual Report on Form 10-K. Such risks, uncertainties and other important factors that could cause actual results to differ include, among others, the risks, uncertainties and factors set forth under “Risk Factors” in this Annual Report on Form 10-K, as such risk factors may be updated from time to time in our periodic filings with the SEC, and are accessible on the SEC’s website at www.sec.gov, and also include the following:

|

· |

Our ability to implement our growth strategy; |

|

· |

Our ability to maintain sufficient levels of cash flow to meet growth expectations; |

|

· |

Our ability to protect our brand; |

|

· |

Federal and state laws and regulations relating to our facilities, which could lead to the incurrence of significant penalties by us or require us to make significant changes to our operations; |

|

· |

Our ability to locate available facility sites on terms acceptable to us; |

|

· |

Competition from hospitals, clinics and other emergency care providers; |

|

· |

Our dependence on payments from third-party payors; |

|

· |

Our ability to source and procure new products and equipment to meet patient preferences; |

|

· |

Our reliance on Medical Properties Trust (“MPT”) and the MPT Master Funding and Development Agreements; |

|

· |

Disruptions in the global financial markets leading to difficulty in borrowing sufficient amounts of capital to finance the carrying costs of inventory, to pay for capital expenditures and operating costs; |

|

· |

Our ability or the ability of our healthcare system partners to negotiate favorable contracts or renew existing contracts with third-party payors on favorable terms; |

|

· |

Significant changes in our payor mix or case mix resulting from fluctuations in the types of cases treated at our facilities; |

3

|

· |

Significant changes in rules, regulations and systems governing Medicare and Medicaid reimbursements; |

|

· |

Material changes in IRS revenue rulings, case law or the interpretation of such rulings; |

|

· |

Shortages of, or quality control issues with, emergency care-related products, equipment and medical supplies that could result in a disruption of our operations; |

|

· |

The intense competition we face for patients, physician use of our facilities, strategic relationships and commercial payor contracts; |

|

· |

The fact that we are subject to significant malpractice and related legal claims; |

|

· |

The growth of patient receivables or the deterioration in the ability to collect on those accounts; |

|

· |

The impact on us of PPACA, which represents a significant change to the healthcare industry; |

|

· |

Ensuring our continued compliance with HIPAA, which could require us to expend significant resources and capital; and |

|

· |

The factors discussed in Part I, Item 1A. “Risk Factors” |

We caution you that the risks, uncertainties and other factors referenced above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. There can be no assurance that (i) we have correctly measured or identified all of the factors affecting our business or the extent of these factors’ likely impact, (ii) the available information with respect to these factors on which such analysis is based is complete or accurate, (iii) such analysis is correct or (iv) our strategy, which is based in part on this analysis, will be successful. All forward-looking statements in this report apply only as of the date of this report or as the date they were made and, except as required by applicable law, we undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise.

Unless the context otherwise indicates or requires, references in this Annual Report on Form 10-K to the “Company,” “we,” “us” and “our” refer to Adeptus Health Inc. and its consolidated subsidiaries after giving effect to the Reorganization Transactions (“Reorganization”) described herein and the initial public offering described herein and to Adeptus Health LLC and its consolidated subsidiaries prior to the Reorganization and initial public offering.

We own and operate First Choice Emergency Rooms, the largest network of independent freestanding emergency rooms in the United States. We have experienced rapid growth in recent periods, growing from 14 facilities at the end of 2012 to 26 facilities at the end of 2013, and to 55 facilities as of December 31, 2014. Our facilities are currently located in the Houston, Dallas/Fort Worth, San Antonio and Austin, Texas markets; Colorado Springs and Denver, Colorado; and Phoenix, Arizona. Each of our facilities opened in 2014 were newly constructed.

Since our founding in 2002, our mission has been to address the need within our local communities for immediate and convenient access to quality emergency care in a patient‑friendly, cost‑effective setting. We believe we are transforming the emergency care experience with a differentiated and convenient care delivery model which improves access, reduces wait times and provides high‑quality clinical and diagnostic services on‑site. Our facilities are

4

fully licensed and provide comprehensive, emergency care with an acuity mix that we believe is comparable to hospital‑based emergency rooms.

Emergency care is a significantly underserved market in the United States today and the current system is overburdened.

|

· |

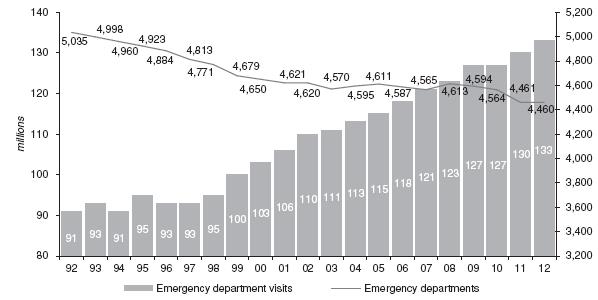

Demand has grown dramatically, with emergency room visits increasing 46.7%, from 90.8 million in 1992 to 133.2 million in 2012, while the number of emergency room departments decreased by 11.4% over the same period, from approximately 5,035 in 1992 to approximately 4,460 in 2012, according to the American Hospital Association. |

|

· |

In their 2014 National Report Card on America’s emergency care environment, the American College of Emergency Physicians assigned an overall grade of “D‑” for the category of access to emergency care, reflecting too few emergency departments to meet the needs of a growing, aging population and the projected increase in the number of insured individuals as a result of the Patient Protection and Affordable Care Act. |

We believe freestanding emergency rooms are an essential part of the solution, providing access to quality care and offering a significantly improved patient experience relative to traditional hospital emergency departments.

What We Do and Why We Are Different

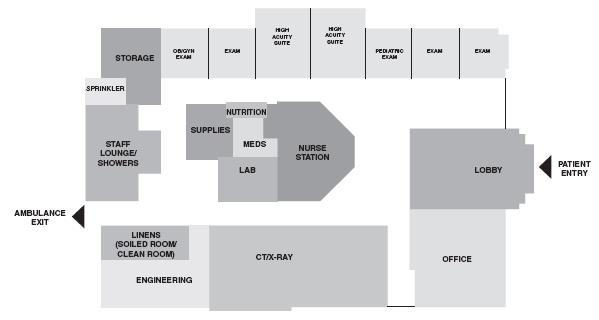

We focus on providing emergency care through our freestanding emergency rooms with the goal of improving the quality of care and enhancing the overall experience for patients and physicians. We have developed an innovative facility design and infrastructure specifically tailored to the emergency care delivery system that combines staff, equipment and physical layout to deliver high‑quality, cost‑effective care. We design, equip, staff and operate our facilities to deliver coordinated patient‑focused care. This approach limits the need to move patients and provides ease of access to all necessary medical services we provide, allowing us to enhance the overall experience of the patient. Our facility design also allows physicians and nursing staff to provide all levels of care required for our patients during their visit. Our philosophy is to center care around the patient, rather than expect the patient to adapt to our facilities and staff. We believe our focused approach increases patient, physician and staff satisfaction. Innovative characteristics of our emergency facilities include:

|

· |

24 / 7 Emergency Care. Freestanding emergency room facilities, which typically range from approximately 6,000 to 7,000 square feet and are located in a convenient, local community setting and open 24 hours a day, seven days a week with on‑site emergency staff, including a physician, at all times; |

|

· |

Board‑Certified Physicians. Staffed with experienced healthcare professionals capable of handling all emergency issues. As of December 31, 2014, we contracted with approximately 434 Board‑certified physicians with an average of 15 years of medical experience who have treated more than 400,000 patients at our facilities; |

|

· |

Streamlined. Streamlined check‑in process designed to have patients seen by a physician within minutes; |

|

· |

Focused Capability. Typically six to nine emergency exam rooms, which include two high‑acuity suites, one child‑friendly pediatric room and a specialized obstetrics/gynecology room; |

|

· |

Coordinated Care. Centralized nurses’ station that serves as a command center to coordinate care; |

|

· |

Full Radiology Suite. In‑house diagnostic imaging technology, including CT scanners, digital x‑rays and ultrasounds, with final reads from on‑call radiologists; and |

5

|

· |

On‑Site Laboratory. On‑site laboratories, which provide results within approximately 20 minutes and are certified by CLIA and accredited by COLA. |

We operate at the higher end of the acuity and emergency care spectrum. Our capabilities and offerings differ from other care models as outlined below:

Spectrum of Primary and Emergency Care Services

Market Opportunity

In their 2014 National Report Card on America’s emergency care environment, ACEP assigned an overall grade of “D‑” for the category of access to emergency care, reflecting too few emergency departments to meet the needs of a growing, aging population and the projected increase in the number of insured individuals as a result of PPACA. We believe freestanding emergency rooms are an essential part of the solution.

Freestanding emergency rooms remain the least penetrated alternate site provider segment in the U.S. healthcare sector. As of 2012, there were approximately 400 freestanding emergency rooms in the United States as compared to approximately 1,400 retail clinics, 6,000 ambulatory surgery centers and 9,300 urgent care centers. We believe this represents a significant opportunity to deliver quality care in the freestanding emergency room setting and transform this underpenetrated market. We have developed a highly scalable business model for establishing new freestanding emergency rooms that include attractive unit economics, sophisticated data analytics to support our site‑selection process, proven real estate development practices and innovative marketing programs. Using this model, we have grown to become more than three times the size of our next largest independent freestanding emergency room competitor and are expanding rapidly. We seek to transform the emergency care delivery model by offering high‑quality, efficient and consumer‑oriented healthcare in our local communities.

We also believe that we offer a dramatically improved patient experience relative to traditional hospital emergency departments by significantly reducing wait times and providing rapid access to Board‑certified physicians on‑site. We also provide convenient access to critical, high‑acuity care as compared with urgent care centers and are open 24 hours a day, seven days a week. Based on patient feedback collected by Press Ganey, First Choice Emergency Room received the prestigious Guardian of Excellence Award in 2013 and 2014 for exceeding the 95th percentile in patient satisfaction nationwide.

Industry Trends

The emergency room remains a critical access point for millions of Americans who experience sudden serious illness or injury in the United States each year. The availability of that care is under pressure and threatened by a wide range of factors, including shrinking capacity and an increasing demand for services. According to AHA, from 1992 to 2012, the number of emergency room visits increased by 46.7%, while the number of emergency departments decreased by 11.4%.

We believe freestanding emergency rooms are an essential part of the solution, providing access to high‑quality emergency care and offering a significantly improved patient experience relative to traditional hospital emergency departments.

6

The chart below sets forth the number of emergency departments and emergency department visits from 1992 to 2012 according to AHA:

The number of emergency room visits exceeded 130 million in 2012, or approximately 247 visits per minute, and care previously provided in inpatient settings is now increasingly being provided in emergency departments. Factors affecting access to emergency care include availability of emergency departments, capacity of emergency departments, and availability of staffing in emergency departments. As the largest operator of freestanding emergency rooms, we offer a solution that addresses the following trends currently affecting the healthcare services market:

Poor Access to Emergency Care Including a Shortage of Emergency Rooms

According to ACEP, between 1997 and 2007, emergency visit rates increased at two times the rate of growth of the U.S. population, causing a shortage of emergency rooms and persistent emergency department overcrowding with expanding wait times. This emergency room shortage is making it increasingly challenging to meet the rising demand for emergency care. According to ACEP’s National Report Card on America’s emergency care environment, only 4.2% of active physicians are emergency room physicians, yet they are responsible for 28% of all acute care visits and 11% of all outpatient care in the United States. The shortage of emergency rooms has created an acute need for more access and convenient emergency room care.

Emergence of Innovative Care Delivery Settings and Access Points

Healthcare industry trends, including the increasing demand for care, an aging population and the projected increase in the number of people now insured as a result of PPACA, combined with a shortage of access points, is driving the emergence of innovative care delivery models to meet patient needs for emergency care. Increasing demand for emergency care necessitates new healthcare access points such as freestanding emergency rooms for patients to receive timely and high‑quality care. The emergence of freestanding emergency rooms will fill a public need in underserved markets and provide connectivity across the patient care continuum from patient referrals to post‑emergency care. Freestanding emergency rooms remain the least penetrated alternate site segment with strong unit growth. This growth is expected to shift the delivery of healthcare services away from traditional inpatient hospitals to more effective and convenient solutions, such as freestanding emergency rooms and other alternate‑site settings such as urgent care centers and primary care access points.

7

Increasing Healthcare Consumerism

We believe patients will increasingly seek high‑quality and efficient care in cost‑effective settings. As self‑insured employers look to reduce their overall healthcare costs, they are rapidly shifting financial responsibility to patients through higher co‑payments and deductibles. These changes to health plan design, coupled with increased pricing transparency, are encouraging patients to take more control of their healthcare spending and seek out more cost‑effective and efficient options for their healthcare consumption. As consumers take on a larger share of their healthcare costs and spend more on healthcare services, they want a greater say in how and where they receive care, demanding higher quality care, increased convenience and more service for their dollars spent. This trend of increasing consumerism will benefit freestanding emergency room operators as they offer attractive and convenient neighborhood‑based, physician‑focused care at significantly reduced wait times. We believe that, given the choice, consumers will choose freestanding emergency rooms for both their convenience and high‑quality care and outcomes.

Opportunities Created by Healthcare Legislation

The expected increase in the number of people now insured as a result of PPACA may put additional pressure on an already overburdened emergency room system that lacks capacity and access points. This expected influx of newly insured patients creates opportunities for providers of emergency care with attractive and convenient locations capable of delivering high‑quality care. Additionally, we expect PPACA to create greater opportunities for cost‑effective providers of healthcare services as healthcare reform activities are expected to promote the transition from traditional fee‑for‑service payment models to more “at risk” or “capitated” models in which providers receive a flat fee per member per month from payors, regardless of the cost of care. These changes will be reflected through the creation of accountable care organizations or other payment model reforms. We believe this shift will create financial incentives to transition many types of medical procedures out of the hospital and into more convenient settings such as freestanding emergency rooms.

Our Value Proposition

Value Proposition for Patients

As healthcare has evolved, the consumer has taken greater control of healthcare expenditures and demands more convenient access to healthcare, better value and an improved overall patient experience. Our philosophy is to center care around the patient, rather than expect the patient to adapt to our facilities and staff. We offer patients an attractive value proposition:

|

· |

Access to Care. Our facilities are located in a convenient, local community setting and are open 24 hours a day, seven days a week with on‑site emergency staff, including a Board‑certified physician at all times. |

|

· |

Immediate Care. A streamlined check‑in process designed to have patients seen by a physician within minutes. |

|

· |

Physician Focus. Our physicians are focused on the patient, spending more time on patient care than on administrative tasks, providing high‑quality service, prompt diagnoses and the appropriate medical treatment. |

|

· |

Technology. Facilities equipped with full radiology suites, including CT scanners, digital x‑rays and ultrasounds, as well as on‑site laboratories certified by CLIA and accredited by COLA that provide test results within approximately 20 minutes. |

|

· |

Superior Experience. An overall enhanced patient experience. |

8

As a result, based on patient feedback collected by Press Ganey, First Choice Emergency Room received the prestigious Guardian of Excellence Award in 2013 and 2014 for exceeding the 95th percentile in patient satisfaction nationwide.

Value Proposition for Communities

Community providers, including physician’s offices and hospital emergency rooms, serve a critical and valuable purpose in delivering healthcare. However, the shortage of emergency rooms makes it increasingly challenging to meet the rising demand for emergency care. This has led to an overburdened emergency room network that is often poorly aligned with care consumption trends.

We seek to transform the emergency delivery model and fill a public need by offering high‑quality, efficient and consumer‑oriented healthcare in our local communities. We offer communities an attractive value proposition:

|

· |

Access to Care. Facilities located in convenient, local community settings. Approximately 60% of each facility’s patients come from a three‑mile radius, with approximately 80% coming from a five‑mile radius. |

|

· |

24 / 7. Access to Board‑certified physicians at all times, including outside normal business hours. |

|

· |

Partnership. Key partner for health systems seeking to enhance their local community presence through direct admissions relationships and new innovative partnerships. |

|

· |

Care Continuum. Connectivity across the patient‑care continuum from patient referrals to post‑emergency care. |

Value Proposition for Physicians

The evolving healthcare delivery environment, reflected by significant regulatory changes, increasing administrative burdens, shifting competitive provider landscape and a transition to new reimbursement models, is increasing pressure on physicians. We offer an attractive working environment:

|

· |

Team‑Based Care. Team‑based environment, supported by dedicated staff. |

|

· |

Patient Centric. Our model allows physicians to spend more time with each patient, which enables them to focus their attention on the patient in order to deliver high‑quality care. |

|

· |

Dedicated Support. Rapid delivery of lab and diagnostic results through on‑site capabilities. |

|

· |

Physician Friendly. Scheduling flexibility and a well‑defined compensation program. Payment of malpractice insurance coverage premiums for physicians practicing at our facilities. |

Value Proposition for Payors

We believe that our emergency room facilities reduce overall costs for payors by reducing unnecessary tests and patient admittances. According to the National Hospital Ambulatory Medical Care Survey, the national average emergency room inpatient admittance rate was approximately 11.6% in 2011, while our average inpatient admittance rate was approximately 3.8% for the year ended December 31, 2014. We believe our facilities provide comprehensive emergency care with an acuity mix that is comparable to hospital‑based emergency rooms.

Value Proposition for Hospitals

We have an attractive business model that provides communities direct access to emergency care, helping to relieve the overburdened hospital emergency room system. Our facilities provide high‑quality emergency care for a wide variety of conditions, including heart attacks, severe abdominal pain and respiratory distress similar to the care provided in traditional hospital emergency rooms. When hospital‑based services such as surgery or cardiac catheterization are needed, patients are stabilized at our facilities before being transferred to nearby hospitals via ambulance. Transfer agreements are in place with local hospitals that often facilitate direct admission.

9

Competitive Strengths

We believe the following strengths differentiate us from our competitors and will enable us to capitalize on favorable industry dynamics:

Leader in the Rapidly Expanding Freestanding Emergency Room Market

First Choice Emergency Room is the largest freestanding emergency room provider in the United States with 55 facilities as of December 31, 2014, of which 29 were opened in 2014. We are more than three times the size of our next largest independent freestanding emergency room competitor. We believe our innovative facility model enables us to offer our customers comprehensive emergency services with individualized attention and local convenience. We believe that our scale and scope, when combined with our comprehensive service offerings and tailored best practices, differentiate us from our local and regional competitors. Given our market positions in the highly fragmented and rapidly expanding markets in which we provide our services, we believe there continue to be opportunities to build more facilities in existing and new markets, which will result in further expanding our leadership in the freestanding emergency room market.

Superior Patient Experience

We strive to consistently offer a superior patient experience through both our medical staff and facility capabilities. Our emergency rooms are staffed with Board‑certified physicians and emergency‑trained registered nurses capable of handling all emergency room issues with a physician on‑site at all times. Each of our facilities is equipped with a full radiology suite, including CT scanners, digital x‑ray and ultrasound, as well as on‑site laboratories certified by CLIA and accredited by COLA. Our patients are typically face‑to‑face with a medical professional within minutes of arrival, and our patient satisfaction ratings exceed the vast majority of hospital emergency rooms nationally. Based on patient feedback collected by Press Ganey, we exceeded the 95th percentile in the nation for patient satisfaction and received the Guardian of Excellence Award in 2013 and 2014, the highest award bestowed by the organization.

Scalable Service Model Well‑Positioned for Growth

We maintain the highest standards of clinical excellence, led by our 434 contracted Board‑certified physicians who have an average of 15 years of medical experience. We have standardized, highly scalable clinical and operational infrastructure that we believe will support significant continued growth. Our highly trained staff is complemented by our managed care contracting and revenue cycle management expertise. Moreover, our innovative sales and marketing programs combine active outreach and awareness campaigns with patient‑centric marketing programs in order to most effectively reach our target populations. We endeavor to continue to develop multiple sites because we believe regional density creates value through leverage in managed care contracting and greater brand awareness.

Distinctive Real Estate Development Strategy Supports Attractive Unit Growth and Economics

We have built an internal team with significant experience in multi‑unit retail expansion strategy and execution. As a result, our approach to real estate planning is highly consumer‑centric with a discipline traditionally utilized by sophisticated retail businesses. Our proprietary site selection model is a key to the success of our business, allowing us to identify and fill critical voids in community healthcare delivery systems. When combined with our scalable operating structure and attractive new facility model, our real estate development strategy allows us to maximize performance and quickly grow our facility base. Our seasoned real estate planning and development team follows a proven and disciplined strategy that leverages advanced data analytics to identify opportunities to provide underserved communities with high‑quality emergency care.

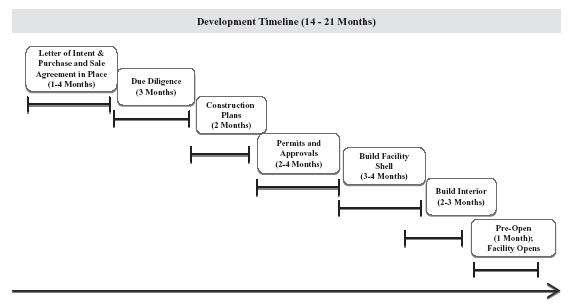

This development model has also proven commercially successful in highly competitive markets and is currently supporting growth outside of our home state of Texas. Our sophisticated selection guidelines and scalable procedures allow us to open a new facility within 14 to 21 months of site selection, enabling us to quickly capitalize on emerging opportunities. We have experienced rapid growth in recent periods, growing from 14 facilities at the end of 2012 to 26 facilities at the end of 2013, and to 55 facilities as of December 31, 2014. We have a robust pipeline under development designed to support the addition of a similar number of facilities in 2015. Moreover, we have access to a

10

variety of capital sources, including the Medical Properties Trust leasing facility, allowing us to fund the typical $5 million to $6 million build‑out cost of most facilities, inclusive of land acquisition costs. Given our expertise and the scale of our operations, we anticipate these new facilities will be profitable within their first year of operation, generating additional capital to continue capturing significant growth opportunities.

Ability to Attract and Retain High‑Quality Physicians and Clinicians

Through our differentiated recruiting and development programs, we are able to identify and target high‑quality physicians and clinicians to optimally match the needs of our facilities. Each of our facilities is staffed with Board‑certified physicians, who have an average of 15 years of medical experience. Compared to a traditional hospital setting, our physicians have a significantly reduced administrative workload, which allows them to spend more time focusing on patient care. Additionally, we offer our physicians extensive flexibility in managing their work schedules. Due to our customized staffing model, physicians can schedule their own work hours, practice at multiple sites, and take advantage of a wide variety of career development opportunities, including maintaining their own practice or affiliations with other healthcare facilities or hospitals. Consequently, our facilities offer a positive work environment that leads to high retention rates and strong customer and provider relationships. We believe these programs will allow us to continue to effectively recruit physicians and clinicians to support our robust pipeline of new facilities.

Management Team with Significant Public Company Experience

We have an experienced management team that leverages expertise across the healthcare, retail and hospitality sectors. The members of our executive management team with healthcare backgrounds have an average of 11 years of experience in that industry and have proven and extensive knowledge of healthcare operations and facility expansion. Additionally, our management has significant experience with high‑growth, multi‑state customer‑focused operations through involvement in the retail and hospitality sectors. The three most senior members of the executive team have substantial experience in leading publicly traded companies. Over their respective tenures, members of our team have been instrumental in establishing a successful, scalable operating model, consistently generating strong financial results and developing an effective site selection and build‑out process. They have also developed proven recruiting and staffing capabilities to identify, hire and retain high‑quality physicians. We believe the breadth of management’s background and the depth of its expertise will continue to drive our dynamic growth and continued success.

Growth Strategies

We believe we have significant growth potential in both new and existing markets because of our leading market position in the freestanding emergency room sector, high‑quality care delivery, strong unit economics, disciplined development strategy and significant management experience. We plan to pursue the following growth strategies:

Grow our Presence in Existing Markets

We believe there is a significant opportunity to expand in our existing markets including Dallas/Fort Worth, Houston, San Antonio and Austin, Texas as well as Colorado Springs and Denver, Colorado. Our scale, scope and leading market position, combined with our sophisticated, proven site selection and development processes provide us with competitive advantages to continue to expand our facility base in these markets. We endeavor to continue to develop multiple sites because we believe regional density creates value through leverage in managed care contracting and greater brand awareness. We anticipate that as we further build our brand and increase the visibility of our facilities in our existing markets these efforts will increase patient awareness, and drive patient volume and same‑store growth.

Build Strategic Alliances with Leading Health Systems

Development of our existing and new health system alliances is an important part of our continued growth. We expect to be a key partner for health systems seeking to enhance their local community presence through direct admissions relationships and new innovative partnerships. Our alliance with HCA in North Texas provides an example of one such innovative partnership, giving our patients direct access to HCA’s approximately 5,500 physicians and 11 hospitals in North Texas and approximately 3,300 physicians and 9 hospitals in the Houston area. In addition, we have a

11

relationship with the Concentra urgent care clinics in the Dallas/Fort Worth market, whereby we are able to refer workers’ compensation patients to Concentra when follow‑up, non‑emergent, care is needed. We also recently announced our expansion into Arizona through a joint venture with Dignity Health, one of the nation’s largest health systems, with the opening of a full-service healthcare hospital facility and includes plans for additional access to emergency medical care in Phoenix through freestanding emergency departments of the hospital. We believe our ability to alleviate hospital emergency room over‑crowding, while providing a new access point to patients, enhances our value proposition as a partner of choice for health systems.

Pursue a Disciplined Development Strategy in New States and Markets

We intend to continue expanding our facility base through new facility openings in new states and markets by leveraging our core capabilities in site selection, development and efficient facility openings. We view expansion as a core competency and see a significant opportunity to replicate the regional platform model established in Texas in new geographic markets. We entered the Colorado market in 2013. We also entered the Arizona market in 2015, through our partnership with Dignity Health, with a full‑service general hospital in the Phoenix area that has 16 inpatient rooms, two operating rooms, a nine‑room emergency department, a high‑complexity laboratory and a full radiology suite. We have experienced rapid growth in recent periods, growing from 14 facilities at the end of 2012 to 26 facilities at the end of 2013, and to 55 facilities as of December 31, 2014. We have a robust pipeline under development designed to support the addition of a similar number of facilities in 2015. As we expand into new markets, particularly in states with complex regulatory requirements, we believe there is a potential to implement different operating models, such as innovative hospital partnership models, including a hospital hub and freestanding emergency room satellite model.

Operations

Our operations consist primarily of our ownership and management of freestanding emergency care facilities. We provide patients prompt access to high‑quality, Board‑certified physicians and emergency trained registered nurses capable of handling all emergency issues and a wide array of treatments on‑site. We believe our acuity mix is comparable to hospital‑based emergency rooms. Our facilities provide the space and equipment necessary to enable our staff to provide quality emergency care. Each of our facilities is equipped with a full radiology suite, including CT scanners, digital x‑ray and ultrasound, as well as on‑site laboratories certified by CLIA and accredited by COLA. Every facility has transfer agreements in place with local hospitals for patients that need to be transferred to a hospital. In North Texas and the Houston area, we have entered into alliances with HCA to enhance the continuum of care for our patients by streamlining clinical protocols for transfers to hospitals and providing direct access to approximately 5,500 physicians and 11 hospitals in North Texas and approximately 3,300 physicians and 9 hospitals in the Houston area, for follow‑up care.

Facilities

As of December 31, 2014, we had 55 facilities in markets throughout Texas and Colorado. Our facilities are open 24 hours a day, seven days a week, and are designed to ensure that our patients receive high‑quality, rapid, comfortable and convenient emergency medical care. Each facility typically has six to nine emergency exam rooms. These include two high‑acuity suites, one “child‑friendly” pediatric room intended to create a comfortable environment for children, and a specialized obstetrics/gynecology room. All of our facilities have a centralized nurses’ station that acts as the command center providing easy access to our laboratory, radiology suite, supply rooms and secured narcotics area, in addition to being placed so that it maximizes the staff’s line of sight to our suites and exam rooms. If a patient needs to be transported to a hospital, our facilities have ambulance bays that that are located near the emergency suites, providing for rapid and efficient access for emergency medical services personnel.

12

Each facility is designed to be a calm and comfortable setting for patients. There is a lobby and check‑in desk where patients are greeted and welcomed into the facility. As patients are escorted back to their exam room, they see neutrally painted walls with carefully selected artwork, creating a comforting environment, seamless floors designed to minimize and prevent infection, and, in many facilities, a view of the CT scanner. Every pediatric room has a unique, hand‑painted mural and all exam rooms are equipped with flat‑screen televisions. Our facilities are also designed to be a comfortable environment for our clinicians. Our physicians have a private office where they can review notes or make follow‑up calls to patients. In addition, there is a dedicated employee break room and a special employee lounge complete with showers.

Each of our emergency rooms contains a laboratory that is certified by CLIA and accredited by COLA. CLIA defines our laboratories as “moderate complexity labs,” which can perform “waived” and automated tests. The CLIA‑waived tests that we most commonly perform include, but not are limited to, rapid strep, influenza, and respiratory syncytial virus and blood glucose levels. Additionally, there are moderate complexity automated tests that include chemistries, cardiac enzymes, complete blood counts, clotting studies, and a variety of other pertinent diagnostic assessments. All in‑house testing provides results within approximately 20 minutes and those results are immediately provided to the physician for a more efficient diagnostic process. Additional testing which would require pathologist review, such as cultures and sub‑specialty samples, are managed through our relationships with accredited third‑party laboratories. Each laboratory department is supervised by a facility medical director, who acts as the dedicated laboratory director, overseeing all policies, testing, and ongoing operations.

Our facilities are equipped with full radiology suites, including CT scanners, digital x‑rays and ultrasounds. Staffed around the clock with a licensed radiology technologist, our radiology suites are a critical component to the high‑quality care that we provide. Each radiology technologist has a minimum of two years of experience on both the CT and x‑ray modalities in a hospital setting. Our ultrasound machines are operated by certified on‑call ultrasound technologists that provide around‑the‑clock coverage for all of our facilities. All imaging studies are then interpreted off‑site by a contracted group of Board‑certified radiologists that are required to provide final reads within 30 minutes, 24 hours a day, seven days a week.

In addition to our carefully planned layout, laboratories and radiology suites, our facilities are also generally equipped with other features comparable to hospital emergency rooms. Our facilities are equipped with life‑safety code air systems with specialized ventilation and central oxygen with back‑up generators to ensure uninterrupted operations.

13

The below image depicts the typical layout of one of our facilities which range in size from approximately 6,000 to 7,000 square feet:

Staffing

We employ a base “1‑1‑1‑1” model for our staffing needs at each facility, meaning that we have a minimum of one Board‑certified physician, one emergency trained registered nurse, one radiology technologist and one front office staff member on‑site at all times. This is a fixed cost labor model as all facilities are open 24 hours a day, seven days a week. This base staffing can be augmented during periods of high‑patient volume. We operate using two 12‑hour shifts per day, beginning at 7:00 a.m. and 7:00 p.m. Each facility utilizes approximately 35 staff members, made up of four full‑time and five part‑time employees per function. Our full‑time employees work three 12‑hour shifts per week. Each of our facilities also has a facility administrator, who is also the nurse manager. The facility administrator is in charge of all operating aspects of the facility and the coordination of care to patients.

Our physicians are contracted through National Medical Professionals of Texas and National Medical Professionals of Colorado, affiliated professional limited liability companies owned by our Executive Medical Director that handles our physician‑staffing needs in each of the markets where we operate. We currently utilize over 434 accredited Board‑certified physicians. We provide physicians with a unique and attractive opportunity to practice emergency medicine in a work environment with a reduced administrative workload, scheduling flexibility and a covered cost of malpractice insurance, which allows our physicians to focus on providing high‑quality care. Our model allows physicians to spend more time with each patient and thus the ability to focus their attention on the patient in order to deliver quality care.

Our physician recruiters identify and source talent through a variety of methods, including networking, targeted job postings and employee referrals. Once a candidate has been identified, we invite them on‑site to tour our facility and meet with the facility medical director. If the candidate is a fit, a rigorous credentialing process is initiated that verifies the candidate’s education, training, state licensing, experience, current health status and clinical competence.

All of our physicians sign a physician services agreement, which sets forth their duties and responsibilities, assigns each physician to a home facility, outlines shift commitments and guarantees and contains a 90‑day notice of

14

termination provision for both parties. Each facility has a facility medical director, who is the physician responsible for providing clinical guidance and oversight, performing chart reviews, ensuring compliance with infection control protocols and acting as the laboratory director for the facility.

Patients

First Choice Emergency Rooms provide access to high‑quality emergency care in the neighborhoods near each site. Typically, approximately 60% of each facility’s patients come from a three‑mile radius, with approximately 80% coming from a five‑mile radius. Our facilities treat a wide array of emergency patient problems, such as heart attacks, severe abdominal pain and respiratory distress.

Patient satisfaction for First Choice Emergency Room care is among the highest in the nation. First Choice Emergency Room was named a Guardian of Excellence Award winner in 2013 and 2014 by Press Ganey. This award recognizes top‑performing facilities from among participating member hospital emergency rooms that are in the 95th percentile of performance in patient satisfaction nationwide, and is a healthcare industry symbol of achievement.

Illustrative Patient Experiences at First Choice Emergency Rooms

We believe we are transforming the emergency care experience with a differentiated care delivery model, as demonstrated by the below sampling of experiences our patients have had at First Choice Emergency Rooms:

|

· |

Cardiac Event. A man came to the nearby First Choice Emergency Room after experiencing chest pain and shortness of breath for over a day. Within minutes of his arrival he was given an electrocardiogram, which indicated a possible heart attack. While getting his chest x‑ray, his heart stopped beating. The clinical team administered CPR and the patient had a near immediate return of spontaneous circulation. The CT scan showed a large “saddle emboli” (a large blood clot straddling the blood vessels) in his heart and more in his pulmonary vasculature (blood vessels of the lungs). He was anti‑coagulated and transferred to the hospital catheterization laboratory. |

|

· |

Premature Delivery Complication. A 34‑week pregnant woman was rushed into a First Choice Emergency Room in active labor. The baby had already begun to crown and both mother and baby appeared to be in distress. Within four minutes of the patient’s arrival, the baby was delivered. The delivery was complicated by the umbilical cord being wrapped around the baby’s neck, a life‑threatening complication. Our physician properly handled the delivery and as a result both the mother and baby were healthy. |

|

· |

Respiratory Distress. A nearby family practice physician was experiencing shortness of breath and came into a First Choice Emergency Room. Within minutes, her shortness of breath became very severe. Our physician had to intubate (placing a breathing tube into the trachea to allow for mechanical ventilation) the patient to ensure adequate ventilation and oxygenation—a life‑saving measure. The patient was then transported to a nearby hospital to see a thoracic specialist. She has now recovered and regularly refers her patients, as well as her family, to First Choice Emergency Rooms for emergency care. |

|

· |

Accidental Poisoning. A one‑year‑old girl was brought to a First Choice Emergency Room after accidentally drinking toxic cleaning solution. During the three‑minute drive, the young girl elevated from having no symptoms to an almost complete inability to breathe. The First Choice Emergency Room staff immediately treated the patient and the child fully recovered. |

Licensing and Accreditation

All of our facilities are licensed pursuant to state‑specific licensing requirements. Our Texas facilities are licensed as “Freestanding Emergency Medical Care Facilities” by the Texas Department of State Health Services Regulatory Licensing Unit on a bi‑annual basis. Our facilities in Colorado are licensed as “Community Clinics with Emergency Centers” under the administration of the Colorado Department of Public Health and Environment, Health

15

Facilities and Emergency Medical Services Division on an annual basis. Our hospital facility in Arizona in partnership with Dignity Health is licensed as a “General Hospital” under the administration of the Arizona Department of Health Services.

First Choice Emergency Rooms are accredited as an Ambulatory System by the Joint Commission. An independent, not‑for‑profit organization, the Joint Commission is the nation’s oldest and largest standards‑setting and accrediting body in healthcare. Since 1975, the Joint Commission has developed state‑of‑the‑art standards for outpatient ambulatory care organizations. By demonstrating compliance with the Joint Commission’s national standards for healthcare quality and safety, First Choice Emergency Room has earned the Joint Commission’s Gold Seal of Approval. The accreditation award recognizes First Choice Emergency Room’s dedication to continuously comply with the Joint Commission’s state‑of‑the‑art standards.

Risk Management

We have various committees comprised of physicians and clinical personnel that discuss and set internal policies regarding various risk management issues including safety and environment of care, infection control, pharmacy and therapeutics, quality assessment and performance improvement, peer review and chart review. The policies we establish comply with relevant state, federal and regulatory and Joint Commission requirements.

Billing and Payment

We obtain patient service revenues by collecting fees from patients, insurance companies, and other third‑party payors for the professional and technical services provided in our facilities. All billing and coding is done by a centralized team. Claims are typically coded and filed within 72 hours of a patient visit. We manage the entire collections cycle up until the point that an account is written off and transferred to a third‑party collection service. Our general practice, where possible, is to collect estimated co‑payments at the facility. Claims are submitted electronically if the payor accepts electronic claims. We require claims submitted to third‑party payors be paid within timeframes that are generally consistent with industry standard practices, which vary based upon payor type.

We receive payment for patient services from a variety of third‑party payors, such as:

|

· |

health maintenance organizations, preferred provider organizations and private commercial insurance providers; and |

|

· |

out‑of‑pocket payments from patients. |

Charges for all services provided to insured patients are initially billed to and processed by the patients’ insurance provider. We have agreements with insurance companies that provide for payments at amounts different from our established rates. Differences between established rates and those set by insurance programs, as well as charity care, employee and prompt pay adjustments, are recorded as adjustments directly to patient service revenue. Estimated uncollectible amounts from insured patients are recorded as bad debt expense in the period the services are provided. Collection of payment for services provided to patients without insurance coverage is done at the time of service.

We write off as bad debt expense uncollectible accounts receivable arising from insured patient responsibility after all collection efforts have been exhausted and we have determined such accounts will not be collected. We believe that the collections process is another opportunity to differentiate ourselves in our patient’s minds. Our staff is trained to educate our patients on how the insurance company has determined the amount to pay on the claim.

Reimbursement

First Choice Emergency Rooms are full‑service emergency rooms. As such, we collect the emergency room benefits based on a patient’s specific insurance plan. Consistent with billing practices at all emergency rooms and in light of the fact our facilities are open 24 hours a day, seven days a week and staffed with Board‑certified physicians, we bill payors a facility fee, a professional services fee and other related fees.

16

Four major third‑party commercial payors accounted for approximately 84.8% of our patient service revenue for the year ended December 31, 2014. The remaining 13.3% of our patient service revenue comes from other smaller third‑ party commercial payors, self‑pay patients and workers’ compensation. Commercial third‑party payors include private health insurance as well as related payments from patients for deductibles and co‑payments. We enter into contracts with private health insurance and other health benefit groups by granting discounts to such organizations in return for the patient volume they provide. We do not currently bill Medicare or Medicaid for the care we provide.

Our contracts are structured as either case‑rate contracts or as discounts to billed charges. In a case rate contract, a set fee is assigned to visits based on acuity level. We also enter into contracts with payors based on a discount of our billed charges. There are contracted rates for both the professional component and the technical component, as well as a facility fee. Each portion of the claim is billed separately and paid based on the patient’s emergency room benefits.

Self‑pay consists of out‑of‑pocket payments for treatments by patients not otherwise covered by third‑party payors.

Real Estate Development Activities

General Strategy

We own and operate First Choice Emergency Rooms, the largest network of independent freestanding emergency rooms in the United States. We have experienced rapid growth in recent periods, growing from 14 facilities at the end of 2012 to 26 facilities at the end of 2013, and to 55 facilities as of December 31, 2014. We have a robust pipeline under development designed to support the addition of a similar number of facilities in 2015. We have built an internal eight person team with over 150 years of combined experience in multi‑unit retail expansion strategy.

This team has developed a highly scalable business model for establishing new freestanding emergency rooms that include attractive unit economics, sophisticated data analytics to support our site‑selection process, proven real estate development practices and innovative marketing programs. We have developed, and continue to refine, the databases, geographic information systems, and proprietary predictive models that enable us to evaluate the competitive landscape in a market as part of our site‑selection process. This allows us to quantify and qualify the potential for new emergency room facilities within a market, and create a plan for the number and location of emergency room facilities to be developed in a given market. Our proprietary site‑selection model specifically analyzes consumer preferences and habits, anticipated requirements for access to emergency care, and geographic alternatives to competing emergency care providers. The typical cost involved in opening a new freestanding facility is between $5.0 million and $6.0 million, with a typical opening timeline between 14 and 21 months, from the site‑selection phase to the opening of a new facility.

17

The image below depicts our typical development timeline, beginning with sites for which we have already entered into a letter of intent and/or purchase agreement:

Real Estate Financing Sources

We seek to finance each facility on a stand‑alone basis using various sources of financing, including cash generated by our operations, Senior Secured Credit Facility, MPT Agreements and other outside sources.

In June 2013, we entered into an initial MPT Agreement (the “Initial MPT Agreement”) to fund future facility development and construction and in July 2014 we entered into an additional MPT Agreement (the “Additional MPT Agreement” and, together with the Initial MPT Agreement, the “MPT Agreements”) to fund future facilities. The Additional MPT Agreement is separate from and in addition to our Initial MPT Agreement. The Additional MPT Agreement allows a maximum aggregate funding of $150.0 million, of which $89.4 million remained available as of December 31, 2014. All other material terms remain consistent with the Initial MPT Agreement. Under the terms of the MPT Agreements, MPT will acquire parcels of land selected by us, fund the ground‑up construction of new freestanding emergency room facilities and lease the facilities to us upon completion of construction. MPT is required to fund all hard and soft costs, including the project purchase price, closing costs and pursuit costs for the assets relating to the construction of up to 25 facilities with a maximum aggregate funding of $100.0 million. Each completed project will be leased for an initial term of 15 years, with three five‑year renewal options. The MPT Agreements have provided the funding for 19 facilities that opened in 2014, as well 22 facilities under different phases of development.

Marketing

The evolving healthcare environment has motivated consumers to take a much more active role in how and where they receive care. Therefore, our marketing strategies focus on educating local communities on the access and patient care available at First Choice Emergency Room as a key option within the continuum of care. We have a dedicated field marketing team to foster relevant relationships within the community as well as engaged physicians to support medical community outreach. We sponsor and host community activities, including school fundraisers, street parties and sporting events to deepen our local involvement and encourage tours of our facilities and to deliver first‑hand education of our capabilities. Additionally, we have targeted marketing campaigns for each site comprised of direct mail, television, radio, outdoor advertising, digital and social media.

18

As we open new facilities as part of our expansion strategy, our opportunity to strengthen the public’s awareness of our brand and unique services will also increase. For example, our increased penetration in the Dallas/Fort Worth and Houston markets has, and will continue to, enable us to gain both local and market‑wide awareness. We plan to continue these aggressive marketing plans to build community familiarity and acceptance of the services we provide.

Consumer research has helped us refine our innovative facility model to communicate emergency care and ensure an optimal patient experience. From the introductory message of a new facility, to the personalized follow‑up from the staff, the marketing programs highlight the convenient access and high‑ quality care that differentiates First Choice Emergency Rooms. These carefully designed efforts are not only structured to increase patient volume, but also to firmly establish the First Choice Emergency Room brand and experience as an integral part of each community we serve.

Competition

We compete with other emergency care providers on the basis of proximity to the facility, quality of patient care and awareness. In each of our markets we face competition from traditional and evolving medical providers, including other freestanding emergency rooms, both independent and hospital affiliated. Independent freestanding emergency room competitors include: Elite Care, ER Centers of America, Neighbors Emergency Center, PhysiciansER and Texas Emergency Care Center. Given our 24/7 operating hours and ability to handle high‑acuity needs, instead of competing with community medical practices and urgent care clinics, we believe we complement them. Many of our sites work closely with nearby urgent care facilities to ensure the most appropriate patient care for the community. In February 2013 we formed a relationship with the Concentra urgent care clinics in the Dallas/Fort Worth market, whereby we are able to refer workers’ compensation patients to Concentra when follow‑up, non‑emergent, care is needed. We are more than three times the size of our next largest independent freestanding emergency room competitor. While the competition is typically defined by the patient’s proximity to each site, we are gaining an advantage through our expanding scope and resultant brand awareness. In addition to our size, we believe the quality of our care, the clinical staff and the patient word‑of‑mouth will allow us to effectively compete with new entrants into the category.

Government Regulation

The healthcare industry is subject to extensive regulation by federal, state and local governments. Government regulation affects our business by controlling growth, requiring licensing or certification of facilities, regulating how facilities are used and controlling payment for services provided. Our ability to conduct our business and to operate profitably will depend in part upon obtaining and maintaining all necessary licenses and other approvals, and complying with applicable healthcare laws and regulations. See “Risk Factors—Risks Related To Healthcare Regulation.”

State Laws Regarding Prohibition of Corporate Practice of Medicine and Fee Splitting Arrangements

The laws and regulations relating to our operations vary from state to state and approximately 30 states prohibit general business corporations from practicing medicine or controlling physicians’ medical decisions. We believe that we and our physician practice management service relationships with professional entities are in substantial compliance with state laws prohibiting the corporate practice of medicine including Colorado, Arizona and Texas. However, regulatory authorities or other parties, including our affiliated physicians, may attempt to assert that, despite these arrangements, we are impermissibly engaged in the practice of medicine or that our contractual arrangements with affiliated physician groups constitute unlawful fee‑splitting. In this event, we could be subject to adverse judicial or administrative interpretations, to civil or criminal penalties, our contracts could be found legally invalid and unenforceable or we could be required to restructure our contractual arrangements with our affiliated physicians and physician groups.

Of note, the vast majority of our freestanding emergency room facilities are located in Texas. Texas has a fairly robust corporate practice of medicine doctrine. Texas prohibits corporations from employing physicians and receiving money for professional services rendered by the physicians. However, professional associations and professional limited liability companies may employ physicians so long as the owners of such entities are physicians licensed under Texas law. Similarly, there are certain organizations organized under the Texas Non‑Profit Corporation Act that receive

19

certification from the Texas State Board of Medical Examiners to allow ownership in physician organizations by non‑physicians. We believe that we are in compliance with the corporate practice of medicine restrictions in Texas, Colorado and Arizona. The physicians who provide services at our Texas facilities are employed by National Medical Professionals of Texas PLLC, a professional limited liability company owned and operated by our Executive Medical Director. National Medical Professionals of Texas PLLC makes certain payments to us for billing, collection, administrative and other services through a management services agreement. Other private individuals, the Texas Medical Board, the Texas Attorney General or other healthcare providers may attempt to assert that, despite these arrangements, we are impermissibly engaged in the practice of medicine or that our contractual arrangements with affiliated physician groups constitute unlawful fee‑splitting. In this event, we could be subject to adverse judicial or administrative interpretations, to civil or criminal penalties, our contracts could be found legally invalid and unenforceable or we could be required to restructure our contractual arrangements with our affiliated physicians and physician groups.

State Statutes and Regulations Regarding our Operations

Our operating freestanding emergency room facilities in Texas and Colorado, and our hospital facility in Arizona, are subject to many laws and regulations, particularly at the state and local government levels. These laws and regulations require our freestanding emergency rooms and hospital facility to meet various licensing, certification and other requirements. See “Risk Factors—Risks Related To Healthcare Regulation.”

New regulation of our facilities is also possible, which could force us to change our operational approach or lead to a finding by governmental actors that our facilities are out of legal compliance.

State Law Regulation of Construction, Acquisition or Expansion of Emergency Rooms

Thirty‑six states have certificate of need programs that require some level of prior approval for the construction of a new facility, acquisition or expansion of an existing facility, or the addition of new services for various healthcare facilities. One of the most common categories of healthcare services reviewed under certificate of need laws is hospital services, which may include the emergency services we provide at our freestanding emergency rooms. While the states where our facilities are currently operational (Texas, Colorado and Arizona) do not require a certificate of need, other states where we seek to expand our operations may require certificates of need under circumstances not currently applicable to our facilities. See “Risk Factors—Risks Related To Healthcare Regulation.”

In addition, additional state legislation restricting our ability to obtain licensure for new facilities may be enacted. Such licensure challenges may have a material impact on our growth projections and expansion plans.

Laws and Rules Regarding Billing

The majority of our services are paid for by private third‑party payors. These third‑party payors typically have differing and complex billing and documentation requirements that we must meet in order to receive payment for our services. See “Risk Factors—Risks Related To Healthcare Regulation.”

We must also comply with numerous other state and federal laws applicable to our documentation and the claims we submit for payment. Private third‑party payors carefully audit and monitor our compliance with these and other applicable rules. Our failure to comply with the billing and other rules applicable to us could result in non‑payment for services rendered or refunds of amounts previously paid for such services. In addition, non‑compliance with these rules may cause us to incur civil and criminal penalties, including fines, imprisonment and exclusion from government healthcare programs, under a number of state and federal laws. See “Risk Factors—Risks Related to Healthcare Regulation.”

Privacy and Security Laws

HIPAA required HHS to adopt standards to protect the privacy and security of certain health‑related information. The HIPAA privacy regulations contain detailed requirements concerning the use and disclosure of

20

individually identifiable health information and the grant of certain rights to patients with respect to such information by “covered entities.” As a provider of healthcare who conducts certain electronic transactions, each of our facilities is considered a covered entity under HIPAA. In addition to the privacy requirements, HIPAA covered entities must implement certain administrative, physical, and technical security standards to protect the integrity, confidentiality and availability of certain electronic health information received, maintained, or transmitted by covered entities or their business associates. We have taken actions in an effort to be in compliance with these privacy and security regulations and believe that we are in substantial compliance. Ongoing implementation and oversight of privacy security measures involves significant time, effort and expense. A security incident that bypasses our information security systems causing an information security breach, loss of protected health information or other data subject to privacy laws or a material disruption of our operational systems could result in a material adverse impact on our business, along with fines.

States may impose more protective privacy restrictions in laws related to health information and may afford individuals a private right of action with respect to the violation of such laws. We are subject to any federal or state privacy‑related laws that are more restrictive than the privacy regulations issued under HIPAA. In addition, states may also impose restrictions related to the confidentiality of personal information that is not considered “protected health information” under HIPAA. If we fail to comply with HIPAA or similar state laws, we could incur substantial monetary penalties. See “Risk Factors—Risks Related to Healthcare Regulation.”

Licensing, Certification, Accreditation and Related Laws and Guidelines

We and our affiliated physicians are subject to various federal, state and local licensing and certification laws and regulations and accreditation standards and other laws relating to, among other things, the adequacy of medical care, equipment, personnel, operating policies and procedures and state mandated services and service limitations. We are also subject to periodic inspection by governmental and other authorities to assure continued compliance with the various standards necessary for licensing and accreditations. We must be in compliance in order to maintain authorization to provide, or receive payment for, our services. Compliance with these requirements is complicated by the fact that they differ from jurisdiction to jurisdiction, and in some cases are not uniformly applied or interpreted even within the same jurisdiction. Failure to comply with these requirements can lead not only to delays in payment and refund requests, but in extreme cases can give rise to civil or criminal penalties.

In certain jurisdictions, changes in our ownership structure require pre‑ or post‑notification to governmental licensing and certification agencies, or agencies with which we have contracts. Relevant laws in some jurisdictions may also require re‑application or re‑enrollment and approval to maintain or renew our licensure, certification, contracts or other operating authority. Our changes in corporate structure and ownership involving changes in our beneficial ownership required us in some instances to give notice, re‑enroll or make other applications for authority to continue operating in various jurisdictions or to begin to receive payment from government payment programs. The extent of such notices and filings may vary in each jurisdiction in which we operate, although those regulatory entities requiring notification generally request factual information regarding the new corporate structure and new ownership composition of the operating entities that hold the applicable licensing and certification.

We have made consistent efforts to substantially comply with these requirements, yet the agencies that administer these programs or have awarded us contracts may find that we have failed to comply in some material respects. A finding of non‑compliance and any resulting payment delays, refund demands or other sanctions could have a material adverse effect on our business, financial condition or results of operations.