Attached files

| file | filename |

|---|---|

| EX-10.1.22 - EX-10.1.22 - DIGITALGLOBE, INC. | dgi-20141231ex10122a0cc.htm |

| EX-10.1.23 - EX-10.1.23 - DIGITALGLOBE, INC. | dgi-20141231ex10123dace.htm |

| EX-21.1 - EX-21.1 - DIGITALGLOBE, INC. | dgi-20141231ex21141f6bf.htm |

| EX-10.1.24 - EX-10.1.24 - DIGITALGLOBE, INC. | dgi-20141231ex101242fe7.htm |

| EX-31.2 - EX-31.2 - DIGITALGLOBE, INC. | dgi-20141231ex3128daba7.htm |

| EX-23.1 - EX-23.1 - DIGITALGLOBE, INC. | dgi-20141231ex231b967c8.htm |

| EX-10.1.21 - EX-10.1.21 - DIGITALGLOBE, INC. | dgi-20141231ex101213d48.htm |

| EX-31.1 - EX-31.1 - DIGITALGLOBE, INC. | dgi-20141231ex311f53378.htm |

| EX-10.8.2 - EX-10.8.2 - DIGITALGLOBE, INC. | dgi-20141231ex10825c847.htm |

| EX-32.2 - EX-32.2 - DIGITALGLOBE, INC. | dgi-20141231ex3225fe05f.htm |

| EXCEL - IDEA: XBRL DOCUMENT - DIGITALGLOBE, INC. | Financial_Report.xls |

| 10-K - 10-K - DIGITALGLOBE, INC. | dgi-20141231x10k.htm |

| EX-10.8.1 - EX-10.8.1 - DIGITALGLOBE, INC. | dgi-20141231ex1081be47a.htm |

| EX-32.1 - EX-32.1 - DIGITALGLOBE, INC. | dgi-20141231ex321f7c5b9.htm |

SIXTH AMENDMENT TO LEASE

THIS SIXTH AMENDMENT TO LEASE (this “Amendment”) is entered into as of October 29, 2014 (the “Effective Date”), by and between HUB PROPERTIES TRUST, a Maryland real estate investment trust (“Landlord”), and DIGITALGLOBE, INC., a Delaware corporation (“Tenant”).

R E C I T A L S:

|

A. K/B Fund IV (“Original Landlord”) and Tenant entered into that certain Office Lease dated March 19, 2014 (the “Original Lease”) as amended by (i) that certain First Amendment to Office Lease dated September 10, 2004, (ii) that certain First [sic] Amendment to Lease dated April 18, 2005, (iii) that certain First [sic] Amendment to Lease dated October 14, 2011, (iv) that certain Fourth Amendment to Lease dated May 28, 2013, and (v) that certain Fifth Amendment to Lease dated May 28, 2013 (collectively, the “Lease”), pursuant to which Tenant leased from Landlord certain premises consisting of approximately 177,449 square feet of rentable area of office space and 7,817 square feet of rentable area of storage space in the building located at 1601 Dry Creek Drive, Longmont, Colorado (the “Building “). Although the Original Lease has not been amended by documents entitled “Second Amendment to Lease” or “Third Amendment to Lease”, the Original Lease has heretofore been amended a total of five (5) times. Therefore, the title of this Amendment is “Sixth Amendment to Lease.” |

|

B. Landlord has heretofore succeeded to all of the right, title and interest of Original Landlord as the landlord under the Lease. |

|

C. The term of the Lease is scheduled to expire on August 31, 2015. |

|

D. Tenant desires to extend the term of the Lease to August 31, 2020. |

|

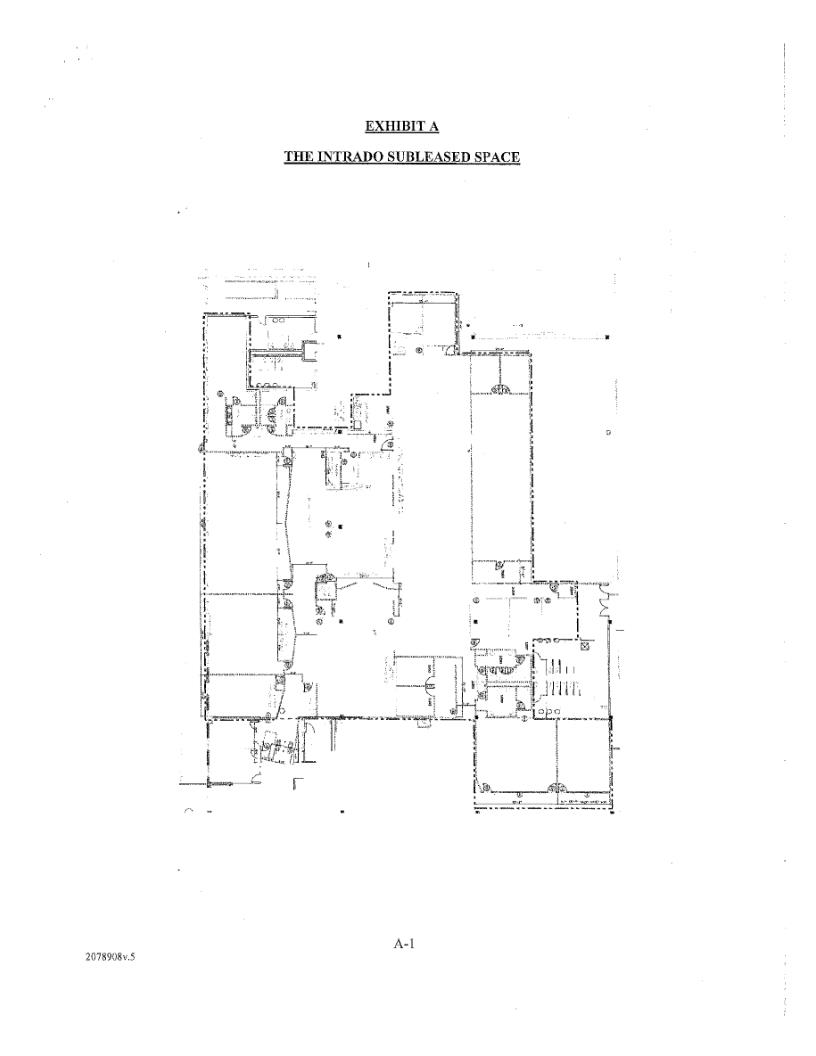

E. Tenant currently subleases 16,500 square feet of rentable area of office space located on the upper level space in the Southeast quadrant of the Premises (the “Intrado Subleased Space”) as depicted on Exhibit A attached hereto to Intrado Inc. (“Intrado”) pursuant to a Sublease Agreement dated November 3, 2006, as amended by that certain First Amendment to Sublease Agreement dated January 29, 2007 (the “Intrado Sublease”). |

|

F. Tenant desires to terminate the Lease with respect to the Intrado Subleased Space only effective as of August 31, 2015. |

|

G. Landlord and Tenant desire to amend the Lease on the terms and conditions hereinafter set forth. |

NOW, THEREFORE, in consideration of the mutual covenants contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Landlord and Tenant agree to amend the Lease as follows:

|

1. Extension of Term. The term of the Lease for the Premises (other than the Intrado Subleased Space) is hereby extended for a period of five (5) years commencing on |

September 1, 2015 (the “Extension Term Commencement Date”) and expiring on August 31, 2020, unless sooner terminated as is otherwise provided in the Lease (the “Extension Term”). All of the terms and provisions of the Lease shall continue to apply with respect to the Extension Term, except as specifically modified herein. Tenant acknowledges that Tenant has no further right or option to extend the term of the Lease, except as provided in Section 5 of this Amendment.

|

2. Expiration of Term with Respect to Intrado Subleased Space. Notwithstanding anything to the contrary contained herein, the term of the Lease with respect to the Intrado Subleased Space only shall expire on August 31, 2015. Tenant does hereby acknowledge and agree that such termination of the term of the Lease with respect to the Intrado Subleased Space shall not terminate the Lease with respect to the remainder of the Premises or release Tenant from its obligations under the Lease including, but not limited to, Tenant’s obligation to pay Base Rent, Additional Rent, and all other charges imposed on Tenant under the Lease accruing with respect to the Intrado Subleased Space on or before August 31, 2015. |

Tenant hereby represents and warrants that the following statements are true as of the date hereof and will be true on August 1, 2015:

(a)Tenant owns and holds the entire interest of Tenant under the Lease;

(b)There exist no subleases affecting the Intrado Subleased Space or any part thereof, other than the Intrado Sublease; and

(c)Tenant has not assigned or encumbered Tenant’s interest under the Lease or any part thereof.

Tenant agrees to defend, indemnify and save Landlord harmless from and against all loss, cost, damage and expense sustained by Landlord (including, without limitation, all expenses, costs and reasonable attorneys’ fees of Landlord in any action or defense undertaken by Landlord to protect itself from such loss or damage) resulting from any breach by Tenant of the covenants, representations and warranties made herein.

Effective on the Extension Term Commencement Date, the Intrado Subleased Space shall be subtracted from the Premises pursuant to the terms and conditions of this Amendment and the Premises shall be deemed to consist of 160,949 square feet of rentable area of office space and 7,817 square feet of rentable area of storage space.

|

3. Separation of Utilities. Landlord shall, promptly after August 31, 2015, cause the utility systems serving the Intrado Subleased Space to be separated from the utility systems serving the remainder of the Premises, so that Tenant and Intrado are billed separately for the utilities used at their respective premises. The costs and expenses to accomplish such utilities systems separation (the “Utility Systems Separation Costs”) shall be shared by Landlord and Tenant as follows. Landlord shall bear the first Fifteen Thousand Dollars ($15,000.00) of the Utility Systems Separation Costs. If and to the extent the Utility Systems Separation Costs exceed $15,000.00, Landlord and Tenant shall each bear fifty percent (50%) of such excess |

2

(provided that in no event shall Tenant be obligated to pay more than $17,500.00 of the Utility Systems Separation Costs). Tenant shall reimburse Landlord within forty-five (45) days after Landlord’s written demand therefor, for Tenant’s share of such excess Utility Systems Separation Costs. If Landlord requires access to the Premises to separate the utility systems as described above, Tenant shall grant Landlord and Landlord’s contractors such access to the Premises as Landlord shall deem necessary or desirable, and no such entry shall be deemed an eviction or partial eviction or entitle Tenant to abatement of rent or any other remedy. Tenant shall cooperate with the Landlord in the performance of any such work, including, without limitation, moving employees, furniture, equipment and other personal property as may be reasonably requested by Landlord to ensure the expeditious and safe completion of such work. Landlord hereby agrees that the separation of utilities contemplated by this Section 3 will not result in a diminution or impairment of the electric power provided to the Premises. Notwithstanding anything to the contrary contained in this Section 3, if Landlord can reasonably and accurately determine the amount of utilities used, respectively, in the Intrado Subleased Space and the remainder of the Premises without physically separating the utility systems, Landlord shall not so physically separate the utility systems unless Landlord pays the entire cost of such separation.

|

4. Rent. |

|

(a) Commencing on the Extension Term Commencement Date, Basic Annual Rent payable by Tenant for the Premises shall be as follows, and shall be payable at the same times and in the same manner as set forth in the Lease. |

Office Space:

|

Period |

|

Basic Annual Rent |

|

Basic |

|

Monthly |

|

|||

|

9/1/15 to 8/31/16 |

|

$ |

10.50 |

|

$ |

1,689,964.56 |

|

$ |

140,830.38 |

|

|

9/1/16 to 8/31/17 |

|

$ |

11.00 |

|

$ |

1,770,438.96 |

|

$ |

147,536.58 |

|

|

9/1/17 to 8/31/18 |

|

$ |

11.50 |

|

$ |

1,850,913.48 |

|

$ |

154,242.79 |

|

|

9/1/18 to 8/31/19 |

|

$ |

12.00 |

|

$ |

1,931,388.00 |

|

$ |

160,949.00 |

|

|

9/1/19 to 8/31/20 |

|

$ |

12.50 |

|

$ |

2,011,862.52 |

|

$ |

167,655.21 |

|

Storage Space:

|

Period |

|

Basic Annual Rent |

|

Basic |

|

Monthly |

|

|||

|

9/1/15 to 8/31/16 |

|

$ |

2.53 |

|

$ |

19,776.96 |

|

$ |

1,648.08 |

|

|

9/1/16 to 8/31/17 |

|

$ |

2.61 |

|

$ |

20,402.40 |

|

$ |

1,700.20 |

|

|

9/1/17 to 8/31/18 |

|

$ |

2.68 |

|

$ |

20,949.60 |

|

$ |

1,745.80 |

|

|

9/1/18 to 8/31/19 |

|

$ |

2.76 |

|

$ |

21,574.92 |

|

$ |

1,797.91 |

|

3

|

Period |

|

Basic Annual Rent per |

|

Basic |

|

Monthly |

|

|||

|

9/1/19 to 8/31/20 |

|

$ |

2.85 |

|

$ |

22,278.48 |

|

$ |

1,856.54 |

|

|

(b) Commencing on the Extension Term Commencement Date, Tenant's Proportionate Share of Operating Costs for Office Space shall be 29.112% (160,949/552,865) and Tenant's Total Proportionate Share shall be 30.526% (168,766/552,865). |

|

5. Extension Option. Landlord hereby grants to Tenant an option to extend the Term for two (2) periods of two (2) years each (each an “Extension Period”). The first Extension Period shall commence on September 1, 2020 (“First Extension Commencement Date”) and shall expire on August 30, 2022 (“First Extension Expiration Date”), unless sooner terminated in accordance with the terms and provisions of the Lease. The second Extension Period shall commence on September 1, 2022 (“Second Extension Commencement Date”) and shall expire on August 30, 2024, unless sooner terminated in accordance with the terms and provisions of the Lease. |

|

(a) Each of the Extension Periods shall be upon the same terms, covenants, and conditions as set forth in the Lease with respect to the current Term, except that Basic Annual Rent payable during each of the Extension Periods shall be equal to the Fair Market Rental Rate (as defined below) for lease terms commencing on or about the applicable Extension Commencement Date, as reasonably determined by Landlord. |

|

(b) If Tenant desires to exercise either option to extend, Tenant shall deliver a written notice (the “Extension Period Rental Rate Request”) to Landlord requesting that Landlord advise Tenant in writing of Landlord’s determination of the Fair Market Rental Rate for the applicable Extension Period. The Extension Period Rental Rate Request shall be delivered by Tenant no earlier than sixteen (16) months prior to the expiration of the current Term or the first Extension Period, as the case may be, and no later than fourteen (14) months prior to the end of the current Term or the first Extension Period, as the case may be, time being of the essence. Landlord shall, in response to such request by Tenant, notify Tenant in writing of the rental rate for the applicable Extension Period (the “Extension Period Rental Rate”), no later than thirteen (13) months prior to the expiration of the current Term on the First Extension Period, as the case may be. |

|

(c) If Tenant desires to extend the Term for the applicable Extension Period, at the applicable Extension Period Rental Rate, Tenant shall deliver written notice (“Extension Notice”) to Landlord to such effect no later than twelve (12) months prior to the expiration of the current Term or the first Extension Period, as the case may be, time being of the essence. If not so exercised, Tenant’s option to extend shall thereupon automatically expire. Once Tenant delivers the Extension Notice to the Landlord, as provided above, Tenant’s election to extend the Lease Term shall be irrevocable by Tenant. |

4

|

(d) Unless Landlord, in its sole and absolute discretion, otherwise agrees in writing, Tenant may only exercise its option to extend and an exercise thereof shall only be effective, if at the time of Tenant’s exercise of the option and on the applicable Extension Commencement Date, the Lease is in full force and effect and no uncured default by Tenant under the Lease shall then exist, and, inasmuch as the option is intended only for the original Tenant named in the Lease, Tenant has not assigned the Lease or sublet any portion of the Premises. |

|

(e) Upon the valid exercise by Tenant of an option to extend, Landlord and Tenant shall promptly enter into a written amendment to the Lease confirming the terms, conditions and provisions applicable to the applicable Extension Period, as determined in accordance with the provisions of this Section. |

|

(f) For purposes of the Lease, the term “Fair Market Rental Rate” shall mean a rate comprised of (i) the prevailing base rental rate per square foot of rentable area available in the Pertinent Market (as defined below), and taking into account tenant improvement allowances, other tenant inducements, operating cost stops and tax cost stops, and brokerage commissions, as determined by Landlord in good faith, and (ii) any escalation of any such base rental rate (based upon a fixed step and/or index) prevailing in the Pertinent Market, as determined by Landlord in good faith, taking into account (A) comparable leases (on the basis of factors such as, but not limited to, size and location of space and commencement date and term of lease), if any, recently executed for space in the Building, and (B) leases for comparable (on the basis of factors such as, but not limited to, size and location of space and commencement date and term of lease) improved space in office buildings in the Longmont, Colorado area which are comparable to the Building in reputation, quality, age, size, location and level and quality of services provided and which have reached economic stabilization (the foregoing factors not being exclusive in identifying comparable buildings) (the Building, together with such comparable buildings, if applicable, being herein referred to as the “Pertinent Market”). |

|

6. Termination Option. Provided that (a) Tenant has not sublet any portion of the Premises, unless all such sublettings shall expire or be terminated on or before the Early Termination Date (hereinafter defined), and (b) no uncured default then exists under the Lease, Tenant shall have a one (1) time option to terminate the Lease (the “Termination Option”) with respect to the Premises demised under the Lease as of the date of this Amendment only (the “Initial Premises”), effective on August 31, 2019 (the date when the Lease is terminated pursuant to this Section being referred to herein as the “Early Termination Date”). Tenant shall exercise the Termination Option by (i) delivering to Landlord written notice (the “Termination Notice”) of such election to terminate this Lease by no later than August 31, 2018, time being of the essence, and (ii) paying to Landlord the Termination Payment (hereinafter defined), concurrently with the Termination Notice, time being of the essence. If Tenant properly delivers the Termination Notice and pays the Termination Payment when due, then the Lease with respect to the Initial Premises only shall be deemed to have expired by lapse of time on the Early Termination Date. Tenant shall return the Initial Premises to Landlord on the Early Termination Date in accordance with the terms of the Lease, including, but not limited |

5

to, Section 5(c) of the Original Lease. If Tenant fails to pay the Termination Payment when due as stated above, the Termination Option shall, at Landlord’s option, be void. Upon Tenant’s delivering the Termination Notice, any and all rights of Tenant to extend the Term or to lease additional space in the Building, whether pursuant to a right of first offer, a right of first refusal, an expansion option, or otherwise, shall immediately be void and of no further force or effect. All obligations of either party to the other which accrue under the Lease on or before the Early Termination Date shall survive such termination. As used herein, “Termination Payment” shall mean the sum of (1) the unamortized balance of the Leasing Costs (hereinafter defined) as of the Early Termination Date had the Leasing Costs been loaned to Tenant as of the Extension Term Commencement Date at the interest rate of eight percent (8%) per annum and had such loaned amount been repaid in equal monthly installments commencing on the Extension Term Commencement Date in amounts sufficient to fully amortize such loaned amount and the imputed interest thereon on August 31, 2020, and (2) an amount equal to the monthly installments of Basic Annual Rent which would have been due for the period from September through November, 2019, but for Tenant’s exercise of the Termination Option. The term “Leasing Costs” shall mean the sum of (i) the total brokerage commission payable by Landlord in connection with this Amendment, and (ii) the amount paid by Landlord toward the cost of the Demising Work. Landlord and Tenant acknowledge that the Termination Payment is not a penalty, but is a reasonable estimate of the damages to be suffered by Landlord as a consequence of Tenant’s exercise of the Termination Option. Tenant acknowledges and agrees that Tenant’s exercise of the Termination Option will not terminate the Lease with respect to any space in the Building leased by Tenant after the Initial Premises.

|

7. Security Deposit. Notwithstanding anything to the contrary contained in the Lease, effective as of Extension Term Commencement Date, the current letter of credit held by Landlord as the Security Deposit pursuant to the Lease shall be terminated and released to Tenant. As of the Extension Term Commencement Date, Landlord waives any obligation of Tenant to post or maintain a Security Deposit or any other form of security under the Lease to secure Tenant’s obligations pursuant to the Lease. |

|

8. Termination of Certain Provisions. Effective as of the date of this Amendment, Addendum One to the Original Lease (entitled “Two Renewal Options at Market”) is deemed terminated, void and without further force or effect. |

|

9. Rents From Real Property. Landlord and Tenant agree that all rent paid to Landlord under the Lease shall qualify as “rents from real property” as defined in Internal Revenue Code Section 856(d) and as further defined in Treasury Regulation Section 1.856-4 (as amended from time to time). Should the requirements of the said Code Section or Regulation Section be amended so that any rent no longer qualifies as “rents from real property” for the purposes of the Code or the Regulation, the rent payable to Landlord shall be adjusted so that such rent will qualify as “rents from real property” under the Code and Regulation, provided that such adjustments required pursuant to the provisions of this Section 9 shall not increase the monetary obligations of Tenant. If any adjustment of rent is required under this Section 9, or if Landlord in good faith determines that its status as a real estate investment trust under the provisions of the Code or the Regulation will be jeopardized because of any provision of the Lease, Tenant shall, without charge therefor and within ten (10) business days after Landlord’s |

6

written request therefor, execute and deliver to Landlord such amendments to the Lease as may be reasonably required by Landlord to avoid such jeopardy, provided such amendments do not increase the monetary obligations of Tenant or in any other manner materially increase Tenant’s obligations or materially decrease Tenant’s rights under the Lease.

|

10. Electronic Signatures. The parties acknowledge and agree that they intend to conduct this transaction by electronic means and that this Amendment may be executed by electronic signature, which shall be considered as an original signature for all purposes and shall have the same force and effect as an original signature. Without limitation, in addition to electronically produced signatures, “electronic signature” shall include faxed versions of an original signature or electronically scanned and transmitted versions (e.g., via pdf) of an original signature. |

|

11. Brokers. Landlord and Tenant each represent and warrant to the other that the only brokers they have dealt with in connection with this Amendment are CRESA Partners-Denver, Inc. and CBRE, Inc., whose commission and fees shall be paid by Landlord pursuant to a separate written agreement. Landlord and Tenant each agree to defend, indemnify and hold the other harmless from and against all claims by any other broker for fees, commissions or other compensation to the extent such broker alleges to have been retained by the indemnifying party in connection with the execution of this Amendment. The provisions of this paragraph shall survive the expiration or sooner termination of the Lease. |

|

12. Limitation of Landlord’s Liability. The obligations of Landlord under the Lease as amended by this Amendment do not constitute personal obligations of the individual partners, members, directors, officers, shareholders, trustees or beneficiaries of Landlord, and Tenant shall not seek recourse against the partners, members, directors, officers, shareholders, trustees or beneficiaries of Landlord, or any of their personal assets for satisfaction of any liability with respect to the Lease as amended by this Amendment. In the event of any default by Landlord under the Lease as amended by this Amendment, Tenant’s sole and exclusive remedy shall be against Landlord’s interest in the Building and the real property on which it is located. The provisions of this paragraph are not designed to relieve Landlord from the performance of any of its obligations hereunder, but rather to limit Landlord’s liability in the case of the recovery of a judgment against it, as aforesaid, nor shall any of the provisions of this paragraph be deemed to limit or otherwise affect Tenant’s right to obtain injunctive relief or specific performance or availability of any other right or remedy which may be accorded Tenant by law or the Lease. In the event of sale or other transfer of Landlord’s right, title and interest in the Building, Landlord shall be released from all liability and obligations thereafter accruing under the Lease as amended by this Amendment; provided, that this paragraph shall inure to the benefit of any such purchaser or transferee. |

|

13. Miscellaneous. Except as modified herein, the Lease and all of the terms and provisions thereof shall remain unmodified and in full force and effect as originally written. In the event of any conflict or inconsistency between the provisions of the Lease and the provisions of this Amendment, the provisions of this Amendment shall control. All terms used herein but not defined herein which are defined in the Lease shall have the same meaning for purposes hereof as they do for purposes of the Lease. The Recitals set forth above in this Amendment are |

7

hereby incorporated by this reference. This Amendment shall be binding upon and shall inure to the benefit of the parties hereto and their respective beneficiaries, successors and assigns.

|

14. Counterparts. This Amendment may be executed in any number of counterparts and by each of the undersigned on separate counterparts, which counterparts taken together shall constitute one and the same instrument. |

[SIGNATURE PAGE FOLLOWS]

8

IN WITNESS WHEREOF, the undersigned have executed this Amendment as of the day and year first written above.

|

|

LANDLORD: |

||

|

|

|

||

|

|

HUB PROPERTIES TRUST, a Maryland real estate investment trust |

||

|

|

|

||

|

|

By: |

/s/ Eric Marx |

|

|

|

|

Name: |

Eric Marx |

|

|

|

Title: |

VP |

|

|

|

|

|

|

|

|

|

|

|

|

TENANT: |

||

|

|

|

||

|

|

DIGITALGLOBE, INC., a Delaware corporation |

||

|

|

|

|

|

|

|

By: |

/s/ Grover N Wray |

|

|

|

|

Name: |

Grover N Wray |

|

|

|

Title: |

SVP, HR/Real Estate |

9

1