Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STAAR SURGICAL CO | v402808_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - STAAR SURGICAL CO | v402808_ex99-1.htm |

Exhibit 99.2

1 NASDAQ: STAA Q4 2014 Results – Investor Presentation February 25, 2015

Forward - Looking Statements All statements in this press release that are not statements of historical fact are forward - looking statements, including statements about any of the following: any projections of earnings, revenue, sales, profit margins, cash, effective tax rate or any other financial items; the plans, strategies, and o bje ctives of management for future operations or prospects for achieving such plans ; statements regarding new or improved products, including but not limited to, expectations for success of new, existing or improved products in the U.S. or international markets or government approval of new or improved products (including the Toric ICL in the U.S.) ; t he nature, timing and likelihood of resolving issues cited in the FDA’s Warning Letter or 2015 Form FDA - 403; future economic conditions or size of market opportunities; expected costs of quality system remediation; statements of belief, including as to achieving 2014 growth plans or metrics; expected regulatory activities and approvals, product laun che s, and any statements of assumptions underlying any of the foregoing. Important additional factors that could cause actual results to differ materially from those indicated by such forward - looking statements are set forth in the company’s Annual Report on Form 10 - K for the year ended January 3, 2014, under the caption “Risk Factors,” and also in the compa ny’s Quarterly Report on Form 10 - Q for the quarter ended July 4, 2014, under the caption “Risk Factors,” both of which are on file with the Securities and Exchange Commission and available i n t he “Investor Information” section of the company’s website under the heading “SEC Filings . These statements are based on expectations and assumptions as of the date of this press release and are subject to numerous r isk s and uncertainties, which could cause actual results to differ materially from those described in the forward - looking statements. The risks and uncertainties include the following : our limited capital resources and limited access to financing; the negative effect of unstable global economic conditions on sales of products, especially products suc h a s the ICL used in non - reimbursed elective procedures; the challenge of managing our foreign subsidiaries; backlog or supply delays as we fully integrate our manufactur ing facility consolidation; the risk of unfavorable changes in currency exchange rate; the discretion of regulatory agencies to approve or reject new or improved products, or to re quire additional actions before approval (including but not limited to FDA requirements regarding the TICL and/or actions related to the FDA Warning Letter); unexpect ed costs or delays that could reduce or eliminate the expected benefits of our consolidation plans; the risk that research and development efforts will not be successful or ma y b e delayed in delivering for launch; the purchasing patterns of our distributors carrying inventory in the market; the willingness of surgeons and patients to adopt a new or imp rov ed product and procedure; patterns of Visian ICL use that have typically limited our penetration of the refractive procedure market, negative media coverage in different regions regarding refractive procedures, and a general decline in the demand for refractive surgery particularly in the U.S. and the Asia Pacific region, which STAAR believes has r esu lted from both concerns about the safety and effectiveness of laser procedures and current economic conditions. The Visian Toric ICL and the Visian ICL with CentraFLOW a re not yet approved for sale in the United States . In addition, to supplement the GAAP numbers, this presentation includes supplemental non - GAAP financial information, which STAAR believes investors will find helpful in understanding its operating performance. “Adjusted Net Income” excludes the following items that are included in “Net Income (L oss)” as calculated in accordance with U.S. generally accepted accounting principles (“GAAP”): manufacturing consolidation expenses, gain or loss on foreign currency tran sactions, Spain distribution transition cost, the fair value adjustment of outstanding warrants issued in 2007, stock - based compensation expenses and FDA Panel/Remediation expenses. A table reconciling the GAAP information to the non - GAAP information is included in our financial release which can be found in our Form 8 - K filed on October 30, 2014 and also available on our website . 2

Agenda Revenue Overview Barry G. Caldwell Chief Executive Officer Q4 & YTD Key Financial Results Steve Brown Chief Financial Officer Regulatory & Closing Remarks Barry G. Caldwell Chief Executive Officer 3 Q&A Session Your Questions

Q4 & 2014 Sales Overview • 2014 Fiscal Year • Total sales increased 4% as reported to $75 million • 6% increase on constant currency basis • ICLs flat, IOLs increased 1% / 5% in CC • Other product lower margin sales increased 68% • Q4 • Total sales at $16.6 million as compared to $18.9 million Q4 2013 • ICL sales $9 million vs. $11.5 million • IOL sales were $5.5 million/$5.8 million in CC vs. $6.6 million 4

Challenges Impacting Q4 Sales • Voluntary hold on ICL shipments • Approximately 2,000 ICLs not shipped • The timing of a 2,500 ICL lens order from our Korean distributor received in January • Foreign Currency Q4 • Five fewer shipping days vs. Q4 2013 5

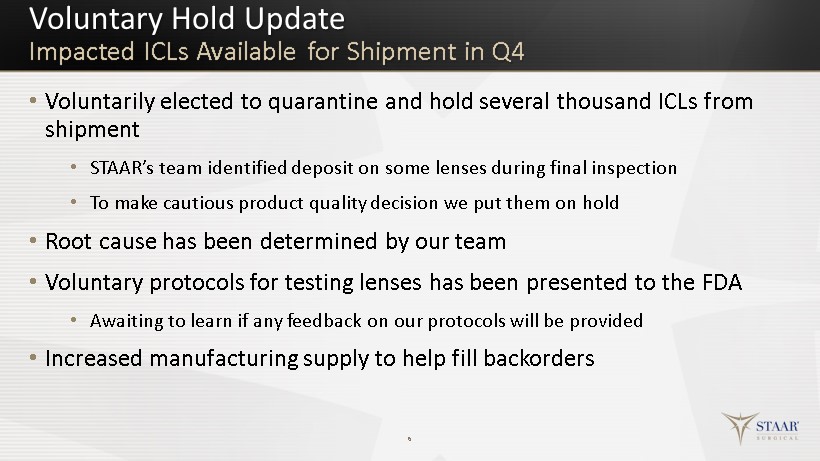

Voluntary Hold Update Impacted ICLs Available for Shipment in Q4 • Voluntarily elected to quarantine and hold several thousand ICLs from shipment • STAAR’s team identified deposit on some lenses during final inspection • To make cautious product quality decision we put them on hold • Root cause has been determined by our team • Voluntary protocols for testing lenses has been presented to the FDA • Awaiting to learn if any feedback on our protocols will be provided • Increased manufacturing supply to help fill backorders 6

Korean Refractive Market 2H Headwind in 2014 • Q3 negative media coverage of LASIK complications • Woo Jeon DTC Campaign started in December • Cable Television commercials • Movie Theater commercials • Bus Wraps • Journal and Magazine ads • Standing Banners for ICL Centers • The rate of decline in ICL procedures has improved 7

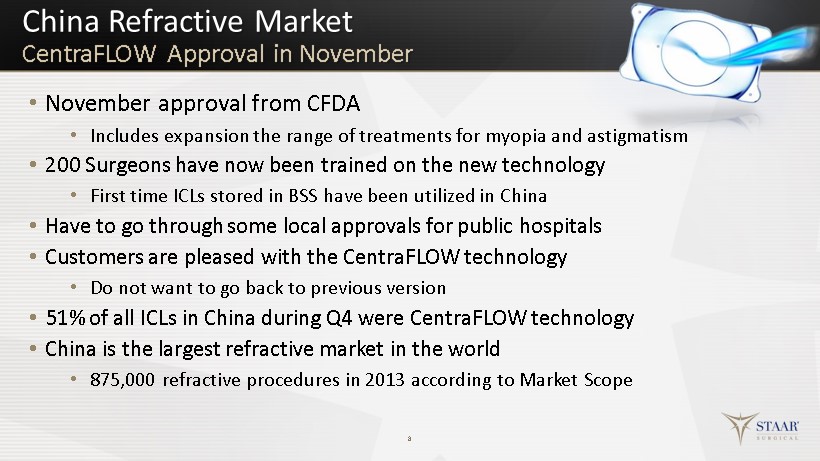

China Refractive Market CentraFLOW Approval in November • November approval from CFDA • Includes expansion the range of treatments for myopia and astigmatism • 200 Surgeons have now been trained on the new technology • First time ICLs stored in BSS have been utilized in China • Have to go through some local approvals for public hospitals • Customers are pleased with the CentraFLOW technology • Do not want to go back to previous version • 51% of all ICLs in China during Q4 were CentraFLOW technology • China is the largest refractive market in the world • 875,000 refractive procedures in 2013 according to Market Scope 8

Financial Results Topics to Discuss • GAAP and Non - GAAP P&L • Gross Margin • Operating Expenses • Tax Benefit • Cash 9

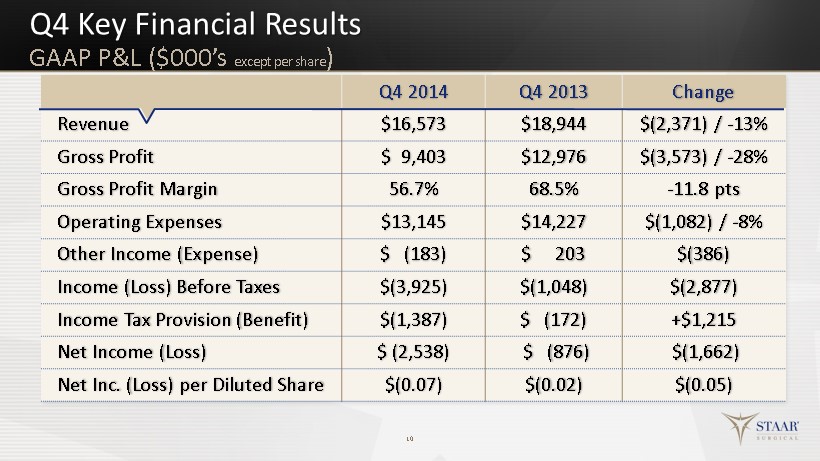

Q4 Key Financial Results 10 Q4 2014 Q4 2013 Change Revenue $16,573 $18,944 $(2,371) / - 13% Gross Profit $ 9,403 $12,976 $(3,573) / - 28% Gross Profit Margin 56.7% 68.5% - 11.8 pts Operating Expenses $13,145 $14,227 $(1,082) / - 8% Other Income (Expense) $ (183) $ 203 $(386) Income (Loss) Before Taxes $(3,925) $ (1,048) $(2,877) Income Tax Provision (Benefit) $(1,387) $ ( 172) +$ 1,215 Net Income (Loss) $ ( 2,538) $ (876) $(1,662) Net Inc. (Loss) per Diluted Share $(0.07) $(0.02) $(0.05) GAAP P&L ($000’s except per share )

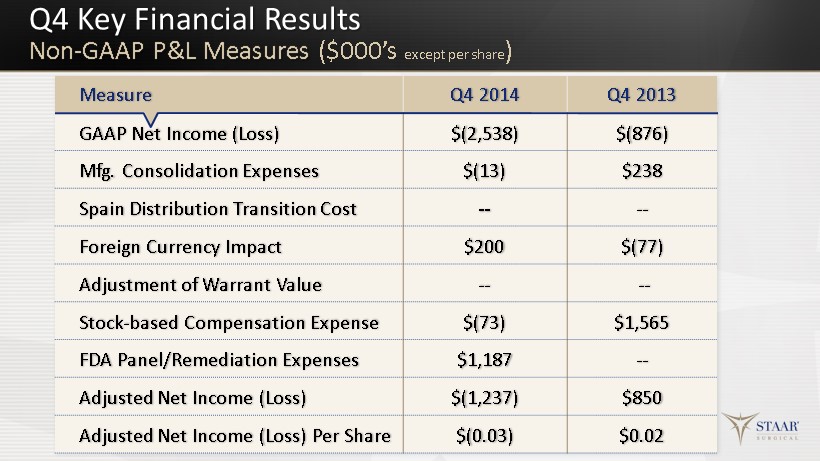

Q4 Key Financial Results Non - GAAP P&L Measures ($ 000’s except per share ) 11 Measure Q4 2014 Q4 2013 GAAP Net Income (Loss) $(2,538) $(876) Mfg. Consolidation Expenses $(13) $238 Spain Distribution Transition Cost -- -- Foreign Currency Impact $200 $(77) Adjustment of Warrant Value -- -- Stock - based Compensation Expense $(73) $1,565 FDA Panel/Remediation Expenses $ 1,187 -- Adjusted Net Income (Loss) $(1,237) $850 Adjusted Net Income (Loss) Per Share $(0.03) $0.02

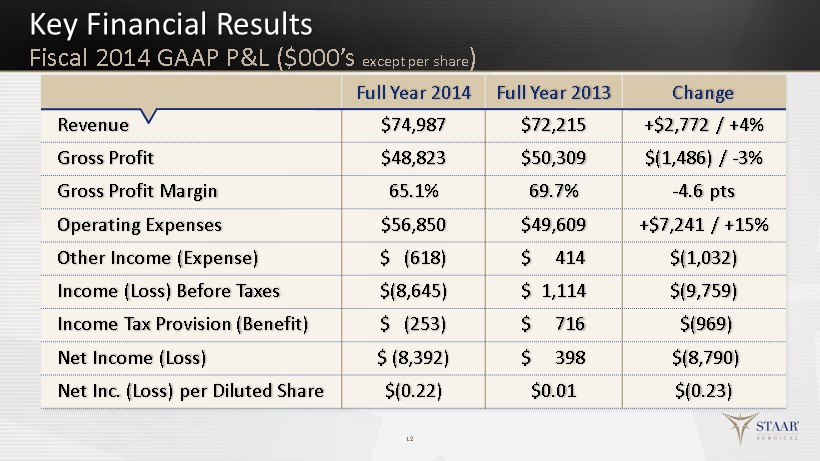

Key Financial Results 12 Full Year 2014 Full Year 2013 Change Revenue $74,987 $72,215 +$2,772 / +4% Gross Profit $48,823 $50,309 $(1,486) / - 3% Gross Profit Margin 65.1% 69.7% - 4.6 pts Operating Expenses $56,850 $49,609 +$7,241 / +15% Other Income (Expense) $ (618) $ 414 $(1,032) Income (Loss) Before Taxes $(8,645) $ 1,114 $(9,759) Income Tax Provision (Benefit) $ (253) $ 716 $(969) Net Income (Loss) $ ( 8,392) $ 398 $(8,790) Net Inc. (Loss) per Diluted Share $(0.22) $0.01 $(0.23) Fiscal 2014 GAAP P&L ($ 000’s except per share )

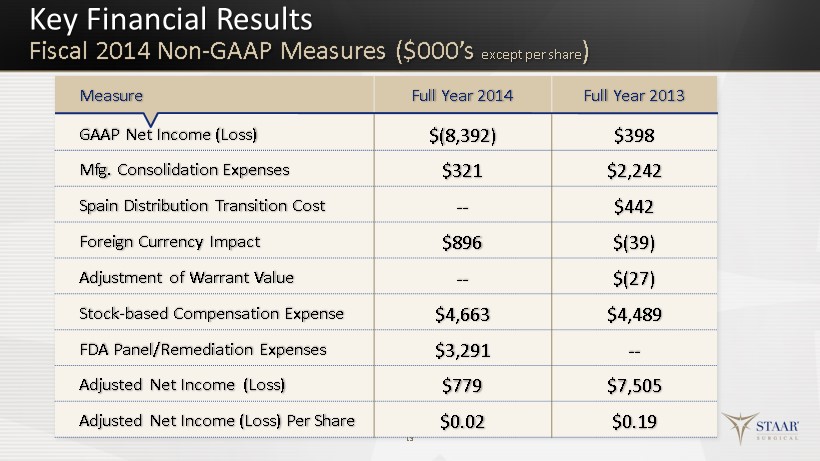

Key Financial Results Fiscal 2014 Non - GAAP Measures ($000’s except per share ) 13 Measure Full Year 2014 Full Year 2013 GAAP Net Income (Loss) $(8,392) $398 Mfg. Consolidation Expenses $321 $2,242 Spain Distribution Transition Cost -- $442 Foreign Currency Impact $896 $( 39) Adjustment of Warrant Value -- $ (27) Stock - based Compensation Expense $4,663 $4,489 FDA Panel/Remediation Expenses $3,291 -- Adjusted Net Income (Loss) $779 $7,505 Adjusted Net Income (Loss) Per Share $0.02 $0.19

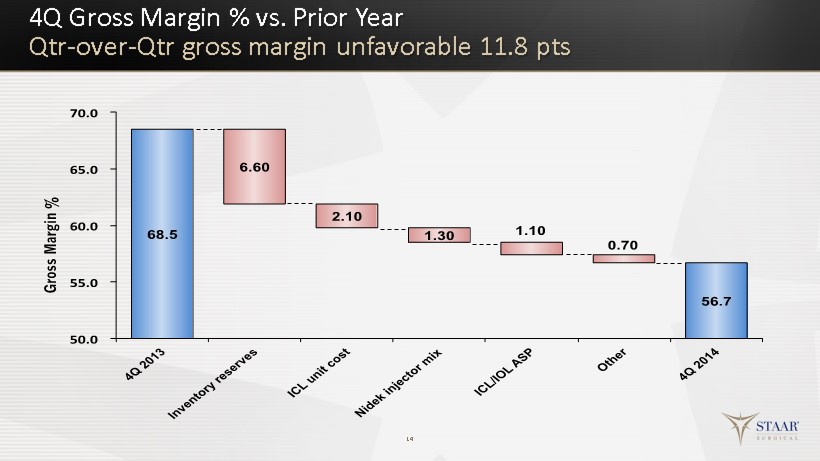

4Q Gross Margin % vs. Prior Year Qtr - over - Qtr gross margin unfavorable 11.8 pts 14

Q4 Operating Expenses • Decreased by $1.1M (8%) to $13.1M vs. prior year • Selling and Marketing decreased by $ 1.7M • $470k lower stock - based compensation • $790k reduction from ESCRS Conference timing • General and Administrative decreased by $350k • Lower stock - based compensation • Research and Development increased by $1.3M • $1.2M from remediation activities related to the Warning Letter and inspections • Full year 2014 remediation, panel and inspections costs of $3.3M 15

Other Financial Items • Taxes • $1.4M income tax benefit in Q4 • Swiss tax authority ruling in connection with manufacturing consolidation • Cash • $13M at January 2, 2015 • Used $3.5M in cash for operating activities in Q4 • Used $1.5M in cash for purchase of PP&E in Q4 • Used $800k in cash for increased inventory 16

Regulatory Update FDA Warning Letter of 2014 & Observations on 2015 FDA - 483 • Continued to work to resolve observations in the May Warning Letter • Two FDA inspections began in mid - November & ended February 4 – One was follow up on inspection on the Warning Letter – Second was a post approval inspection on transfer of ICL manufacturing to U.S. • Inspections concluded with 10 observations focused primarily on improved procedures, processes & documentation around: – D esign change and design transfer to specifications – Improvement in Good Documentation Practices – Broader environmental monitoring • Our response to the observations will go to the Agency by tomorrow • We are committed to a successful resolution & continue to work toward this goal 17

• Q4 had it’s headwinds and challenges, but we are making progress • We are committed to the continuous improvement in our quality system and addressing the FDA observations • China and our other focus markets continue to represent a growth opportunity with current and enhanced technology • STAAR’s product innovation leadership with the ICL remains intact with significant room for growth ahead – Continued Adoption of ICL with CentraFLOW technology – On - going innovation like the V5 preloaded and V6a ICL for patients approaching presbyopia 18 STAAR Surgical Company Opportunities

Thank You YOUR QUESTIONS PLEASE 19

20 NASDAQ: STAA Q4 2014 Results – Investor Presentation February 25, 2015