Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VALERO ENERGY CORP/TX | d878186d8k.htm |

Investor

Presentation February 2015

Exhibit 99.01 |

Statements

contained in this presentation that state the company’s or management’s

expectations or predictions of the future are forward– looking statements intended

to be covered by the safe harbor provisions of the Securities Act of 1933 and the

Securities Exchange Act of 1934. The words “believe,”

“expect,”

“should,”

“estimates,”

“intend,”

and other similar expressions identify forward–looking

statements. It is important to note that actual results could differ

materially from those projected in such forward–looking statements.

For more information concerning factors that could cause actual

results to differ from those expressed or forecasted, see Valero’s

annual reports on Form 10-K and quarterly reports on Form 10-Q, filed

with the Securities and Exchange Commission, and available on

Valero’s website at www.valero.com.

2

Safe Harbor Statement |

3

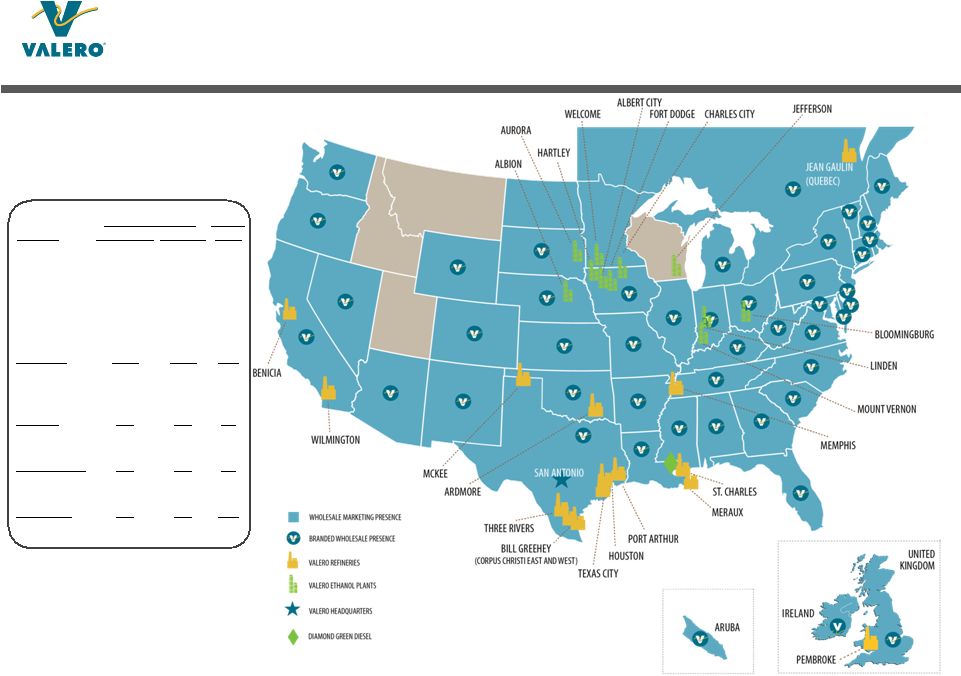

Who We Are

World’s Largest Independent Refiner

•

15 refineries, 2.9 million barrels per day (BPD) of high-complexity throughput

capacity •

Greater

than

70%

of

refining

capacity

located

in

U.S.

Gulf

Coast

and

Mid-Continent

•

Approximately 10,000 employees

Large Logistics Infrastructure with Focus on Growth

•

General partner and majority owner of Valero Energy Partners LP (NYSE: VLP), a

growth-oriented, fee-based master limited partnership (MLP)

•

Significant inventory of logistics assets within Valero

Wholesale Fuels Marketer

•

Approximately 7,400 marketing sites in U.S., Canada, United Kingdom, and Ireland

•

Brands include Valero, Ultramar, Texaco, Shamrock, Diamond Shamrock, and Beacon

One of North America’s Largest Renewable Fuels Producers

•

11 corn ethanol plants, 1.3 billion gallons per year (85,000 BPD) production capacity

•

Operator

and

50%

owner

of

Diamond

Green

Diesel

joint

venture

–

10,500

BPD

renewable diesel production capacity |

4

Assets Concentrated in

Advantaged Locations

Refinery

Capacities (MBPD)

Nelson

Index

Throughput

Crude Oil

Corpus Christi

325

205

19.9

Houston

175

90

15.4

Meraux

135

125

9.7

Port Arthur

375

335

12.4

St. Charles

290

215

16.0

Texas City

260

225

11.1

Three Rivers

100

89

13.2

Gulf Coast

1,660

1,284

14.0

Ardmore

90

86

12.1

McKee

180

168

9.5

Memphis

195

180

7.9

Mid-Con

465

434

9.3

Pembroke

270

210

10.1

Quebec City

235

230

7.7

North Atlantic

505

440

8.9

Benicia

170

145

16.1

Wilmington

135

85

15.9

West Coast

305

230

16.0

Total or Avg.

2,935

2,388

12.4 |

Strategy to

Enhance Stockholder Returns Operations

Excellence

Capital Returns to

Stockholders

Disciplined Capital

Investments

Unlocking Asset

Value

•

Demonstrate commitment to safe and reliable operations

•

Continuously improve our top-tier operating performance

•

Optimize margins with refining system’s feedstock and product

markets flexibility

•

Disciplined capital allocation

•

Seek to increase cash returns through dividend growth

•

Use stock buybacks to reduce shares outstanding and concentrate

future value per share

•

Rigor in capital projects and M&A selection and execution

•

Invest to grow logistics assets and reduce feedstock costs

•

Evaluate investments to upgrade natural gas and natural gas liquids

•

Opportunistically invest in ethanol to maintain high returns

•

Grow Valero Energy Partners LP and realize value for Valero

•

Execute accelerated dropdown strategy and evaluate other

potential MLP-able earnings streams

•

Previously unlocked value in retail business via 2013 spinoff to

stockholders

5 |

6

Key Market Trends

U.S. and Canadian crude oil, natural gas, and natural gas liquids

(NGLs) production growth is providing cost advantages to

North American refiners

-

Lower crude prices may temporarily constrain production growth rate

Location-advantaged refiners in U.S. Gulf Coast, Mid-Continent,

and Canada benefit from resource advantages and/or export

opportunities

Global refined products demand growth is expected to continue

-

Expect lower prices to consumers will drive product demand growth

|

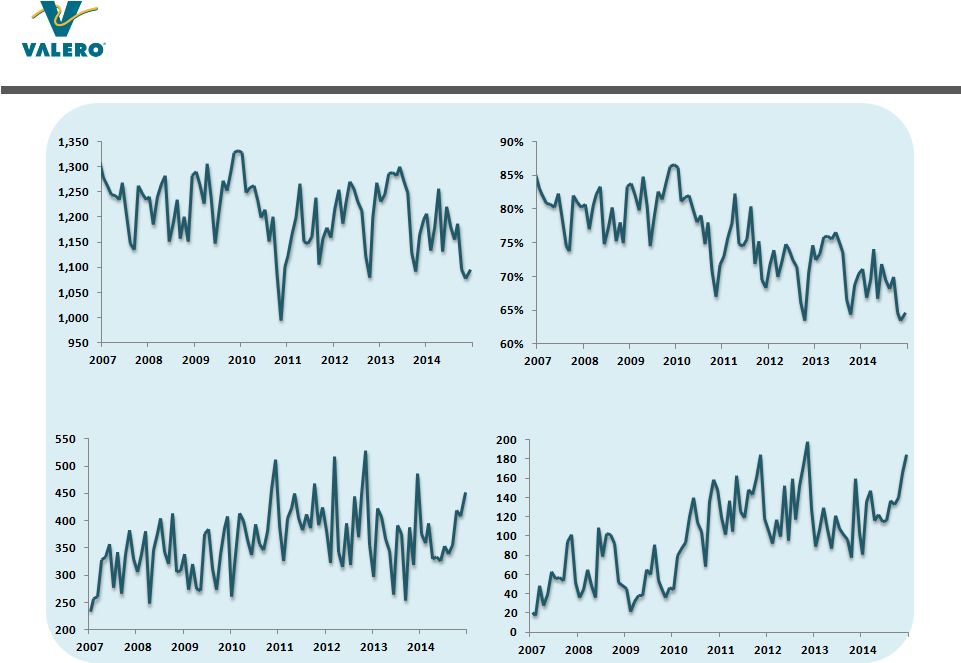

Production

Growth Provides Resource Advantage to North American Refiners

Source: DOE (for 2014, data through November)

Source: DOE (for 2014, data through November)

7 |

8

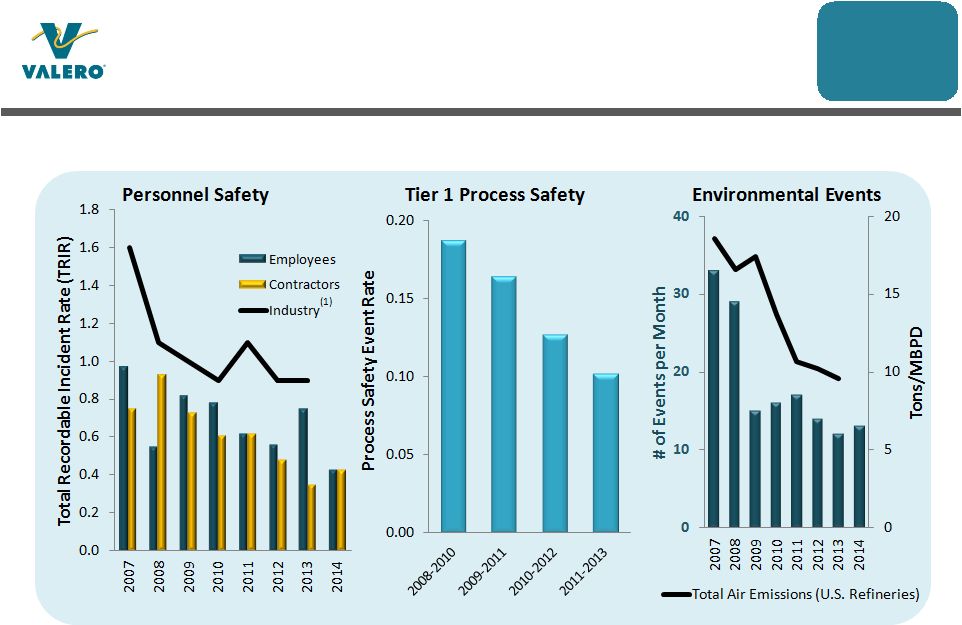

Persistent Focus Drives Results in Safety,

Environmental, and Regulatory Compliance

(1)Source: U.S. Bureau of Labor Statistics.

All 2014 values are estimates.

Statistics are for Refining only.

Operations

Excellence |

9

Top-Tier Operating Performance through

Continuous Improvements

Source:

Solomon

Associates

and

Valero

Energy,

includes

Pembroke

and

Meraux

2012

2010

2008

•

Reliability drives safe and

profitable operations

Seven of our refineries are first

quartile in mechanical availability

•

Initiated new reliability programs

beginning mid-2000s

•

Significant gains made in

operations benchmarks since

2008

•

Personnel committed to

excellence |

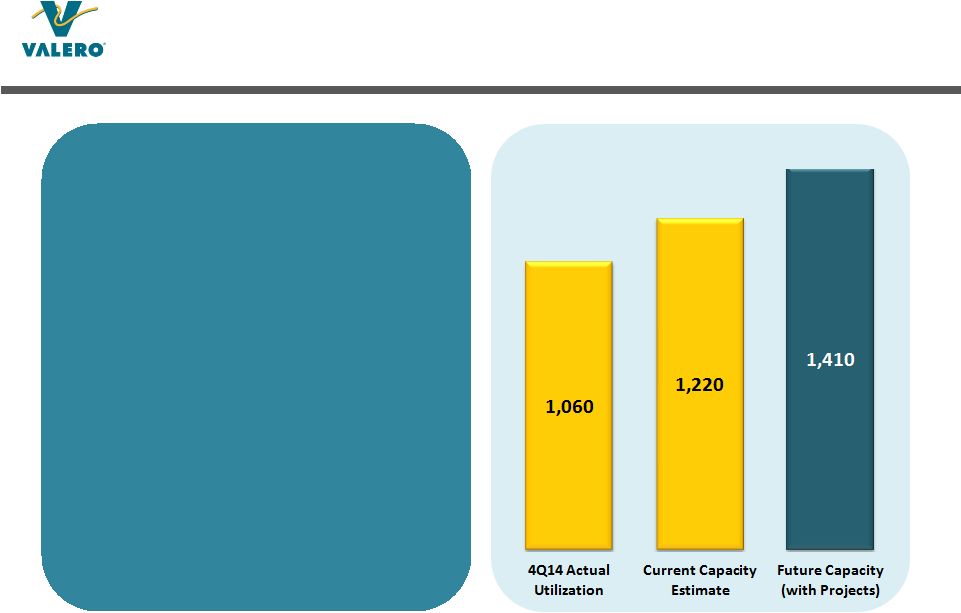

Sustained

high availability and favorable margin environment enable higher capacity utilization

rates 10

Reliability Programs and Commercial

Optimization Drive Higher Utilization Rates

System-wide

mechanical

availability near

1

st

Quartile

since

2011 |

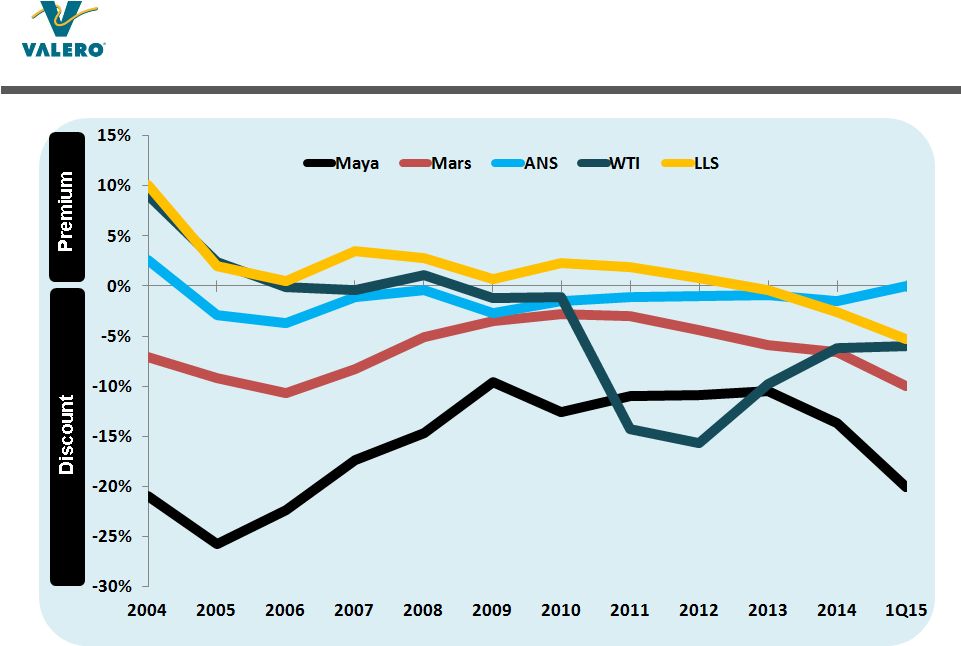

11

Optimizing Margins with Feedstock Flexibility

in Our Complex Refinery System

•

Capability to adjust

feedstocks and optimize

margins as crude price

environment shifts among

grades: light, medium,

heavy, sweet, sour

•

Focus on optimization

activities

•

Expect additional light crude

flexibility with completion

of topper units in progress

Range of Flexibility in Valero’s Gulf Coast

Region Quarterly Feedstock Mix 2010-2014 |

•

Approximately half of benefits visible in

margin capture rate increase of >4%

and balance of benefits in 100 MBPD

throughput volume increase from

feedstocks and new gas plant

•

Benefits visible in U.S. Gulf Coast

region reported results improvement

from 4Q12 to 3Q14

(1)

•

120 MBPD of combined new capacity

successfully started end of 2012 and

mid-2013

•

Designed to produce high-quality

distillates from low-quality feedstocks

and natural gas

Port Arthur and St. Charles Hydrocrackers

Performing Better Than Expected

12

(1) See Appendix for details and assumptions

•

Realized annual EBITDA estimated at

$800 million for trailing 4-quarters

3Q14

•

Compares to $780 million implied by

disclosed guidance model

(1) |

Disciplined

Capital Allocation Framework Emphasizes Stockholders

Dividend Growth

•

Focus on sustainability

•

Increase competition

for cash flow versus

reinvestments (growth

capex and acquisitions)

Sustaining Capex

•

Estimate $1.5 billion or

lower annual “stay-in-

business”

spend

•

Key to safe and

reliable operations

Debt and Cash

•

Maintain investment

grade credit rating

•

Target 20% to 30%

debt-to-cap ratio

(1)

Stock Buybacks

•

Flexibility to return

cash, reduce share

count, and manage

capital employed

•

Increase competition

versus reinvestments

Growth Capex

•

Prioritize higher-value,

higher-growth, faster-

payback opportunities

that enhance future

returns

Acquisitions

•

Evaluate accretion

versus stock buybacks

•

Enhance future

returns

“Non-Discretionary”

“Discretionary”

13

Capital

Returns to

Stockholders

(1) Debt-to-cap ratio based on total debt reduced by $2 billion cash balance,

excluding VLP debt and equity |

14

Increasing Focus on Dividends and Stock

Buybacks

•

Increased dividend by 45% in

1Q15 versus 4Q14

•

Regular dividend increases over

last three years

•

Accelerated stock buybacks in

2013 and 2014

•

Approximately $1.5 billion of

stock repurchase authorization at

end of 4Q14

Targeting >50% total payout ratio of

earnings in 2015 via dividends and

stock buybacks

*2015 through Feb 20 |

15

Advancing Growth Investments While

Managing Capital Spending Lower

(1) Excludes estimated placeholder for methanol project of $150 million in 2015 and $300

million in 2016 as evaluation remains in progress Disciplined

Capital

Investment

(1)

•

Focus on logistics growth after 2015 spending to complete crude toppers

•

Expect nearly all logistics growth investments to be eligible for dropdown into VLP

|

Pipelines

•

Completed tie-in to pipeline in Childress, TX and secured incremental

40 to 50 MBPD Midland-priced crude as substitute for Cushing-priced

crude primarily at the McKee refinery

•

Expect Diamond Pipeline to supply Memphis refinery via Cushing and

start up in 1H17 or earlier

Tanks, Docks, and Vessels

•

Tanks and vessels to supply crude to Quebec City refinery post-Enbridge

Line 9B reversal expected in 2Q15

•

Corpus Christi dock commissioned in 3Q14; completion of tanks for

crude exports expected in 1Q15

16

Logistics Investments Enhance Valero’s

Feedstock Flexibility and Export Capability

Rail

•

Purchased 5,320 CPC-1232 railcars; received 4,078 through Jan 2015

•

Expect new railcars to serve long-term needs in ethanol and asphalt

•

Crude unloading facilities at Quebec City, St. Charles, and Port

Arthur

•

Benicia crude unloading facility undergoing permitting process |

Crude Topper

Investments Very Attractive 17

Estimate $500 million annual EBITDA for combined projects in 2014 price environment

•

160 MBPD new topping capacity

designed to process up to 50 API

domestic sweet crude

Lowers feedstock cost by

generating 55 MBPD low sulfur

resid

Increases net throughput

capacity by 105 MBPD

•

Expect startup in 1H16

•

Expect 50% IRR on 2014 prices,

>25% IRR with Brent and LLS even

•

Corpus Christi: Estimated $350 MM

capex for 70 MBPD capacity

•

Houston: Estimated $400 MM

capex for 90 MBPD capacity

Incremental Volume

(MBPD)

Feeds

Eagle Ford crude

160

Low sulfur atmos resid

(55)

Products

LPG

3.3

Propylene

1.3

BTX

0.4

Naphtha (at export prices)

40

Gasoline

12

Jet

39

Diesel

13

Resid

(3)

Combined Projects Estimates

Total investment

(1)

$750 MM

Annual EBITDA contribution

(2)

$500 MM

Unlevered IRR on total spend

(2)

50%

See Appendix for assumptions.

(1)

Excluding interest and overhead allocation

(2)

Estimates based on 2014 full year average prices; EBITDA = operating income before

deduction for depreciation and amortization expense |

Key Natural

Gas and NGLs Upgrading Investments

18

Hydrocracker

Expansions

Evaluating

Methanol Plant at

St. Charles

Evaluating Houston

Alkylation Unit

•

1.6

–

1.7

million

tonnes

per

year

production

(36

–

38

MBPD)

•

Leverages existing assets to reduce capital requirement

compared to grassroots facility

•

Continuing to evaluate capital costs and project economics

•

Expect investment decision in 2Q15; startup in 2018 if approved

•

12.5 MBPD capacity

•

Upgrades low-cost NGLs to premium-priced alkylate

•

Continuing to evaluate capital costs and project economics

•

Expect investment decision in 2015; startup in 2017 if approved

•

Increase distillate yield partially from hydrogen via natural gas

•

Completed Meraux’s 20 MBPD capacity expansion in 4Q14;

expect approximately $90 million annual EBITDA contribution

at 2014

(1)

prices on total investment of approx. $260 million

•

30 MBPD total capacity addition at St. Charles and Port Arthur

in progress; expect startup in 2H15

(1) 2014 full year average prices; see project details in Appendix

|

19

Ethanol Investments Have Performed Well

Note: See Appendix for reconciliation of EBITDA to GAAP results.

Outstanding

Cash

Generation

Excellent

Acquisitions

Competitive

Advantages

•

11 plants acquired between

2Q09 and 1Q14 for $794MM,

less than 35% of replacement

value

•

1.3 billion gallons total

annual production

•

Scale and location in corn

belt

•

Operational best practices

transferred from refining

•

Low capital investment

•

$2.2 billion cumulative

EBITDA generated since

acquisitions

•

$161 million cumulative

capex excluding acquisition

costs |

20

Our Sponsored MLP

Valero Energy Partners (NYSE: VLP)

Growth-oriented

logistics MLP with

100% fee-based

revenues

•

Valero owns entire 2% general partner interest, all incentive

distribution rights, and 68.6% LP interest

•

High-quality assets integrated with Valero’s refining system

•

Primary vehicle to grow Valero’s midstream investments

•

Provides access to lower cost capital

Unlocking

Asset Value |

21

Estimated EBITDA from Inventory of Eligible MLP

Assets Total Approximately $900 Million

(1) Includes assets that have other joint venture or minority interests.

Pipelines

(1)

•

Over 1,200 miles of active pipelines

•

Expect start-up of 440-mile Diamond Pipeline from Cushing to Memphis refinery in

1H17

Racks, Terminals, and Storage

(1)

•

Over 72 million barrels of active shell capacity for crude and products

•

139 truck rack bays

Rail

•

Three crude unloading facilities with estimated total capacity of 150 MBPD

•

Purchased CPC-1232 railcars expected to serve long-term needs in ethanol and

asphalt

Marine

(1)

•

51 docks

•

Two Panamax class vessels

Fuels Distribution

•

Evaluating qualifying volumes and commercial structure as potential drop-down

candidate

Expect $1 billion of drop-down transactions to VLP in 2015 |

22

We Believe Valero Is an Excellent Investment

•

Majority of capacity located in U.S. Gulf Coast and Mid-

Continent with access to cost-advantaged crude, natural gas,

NGLs, and corn

•

Proven operations excellence

•

Excellent investment and operations in ethanol

•

Emphasis on capital allocation to stockholders

•

Disciplined capital investment that prioritizes higher-value,

higher-growth, faster-payback opportunities to capture

benefits of advantaged resources

•

Unlocking value through growth in MLP-able assets and

dropdowns to VLP

•

Focus on valuation multiple expansion |

23

Appendix

Topic

Pages

Valero 2014 Highlights and 2015 Goals

24-25

Valero Energy Partners LP and CST Brands Spinoff

26-28

Capital Spending and Key Investment Details

29-38

Other Valero Operations Highlights

39-44

Macro Outlook and Key Margin Drivers

45-51

Global Demand and Refining Capacity

52-56

U.S. Fundamentals and DOE Data

58-68

International Fundamentals

69-70

Non-GAAP Reconciliations

71

IR Contact Information

72 |

24

Key 2014 Highlights

Operations Excellence

•

Achieved record annual system refinery capacity utilization of approximately 96% in 2014

•

Increased average consumption of price-advantaged North American light sweet crudes in

2014 by approximately 200 MBPD compared to 2013

•

Reduced Quebec refinery’s crude costs by $3/bbl versus Brent from premium of

approximately $2/bbl in 2013 to discount of approximately $1/bbl in 2014

•

Secured attractively priced term-supply of WTI Midland for Mid-Continent

refineries •

Increased gasoline and diesel exports by 49 MBPD, or approximately 18%, in 2014 versus

2013 •

Launched Top Tier gasoline in wholesale marketing system

•

Achieved record $835 million annual Ethanol segment EBITDA

Capital Returns to Stockholders

•

Increased cash returned to stockholders through dividends and buybacks by $460 million in

2014, or 33%, versus 2013 Disciplined Capital Investments

•

Completed and started up Meraux hydrocracker conversion project in 4Q14

•

Secured capital efficient Diamond Pipeline option and supply to Memphis refinery with crude

from Cushing •

Started

up

90

MBPD

of

total

crude

rail

unloading

capacity

at

St.

Charles

and

Port

Arthur

•

Acquired

idled

ethanol

plant

in

Mt.

Vernon,

Indiana

at

less

than

15%

of

replacement

cost

and

restarted

facility

within

five months

Unlocking Asset Value

•

Grew VLP via first drop-down acquisition of $154 million purchase price on July 1,

2014 Other

•

Diamond

Green

Diesel

JV

benefitted

by

approximately

$126

million

on

retroactive

reinstatement

of

Blenders

Tax

Credit |

25

Key 2015 Goals

Operations Excellence

•

Start up Montreal crude terminal with the Enbridge Line 9B reversal and lower Quebec

refinery’s crude costs versus Brent compared to 2014

•

Grow product export market share and increase branded wholesale fuels volume

Capital Returns to Stockholders

•

Increase total payout ratio of earnings over 2014’s 50% payout level

Disciplined Capital Investments

•

Complete Houston and Corpus Christi toppers on time and on budget

•

Make

final

investment

decisions

on

methanol

plant

at

St.

Charles

refinery

and

alkylation

unit

a

t Houston

refinery;

if

approved,

share

strategic

rationale

with

investors

•

Complete 25 MBPD McKee CDU capacity expansion

•

Complete 30 MBPD total hydrocracker capacity expansions at Port Arthur and St. Charles

•

Gain permit approval to construct Benicia crude rail unloading facility

Unlocking Asset Value

•

Grow the size of identified MLP-able EBITDA available for drop-downs to VLP

•

Execute $1 billion of drop-down transactions to VLP |

Approximately

$900 Million of Estimated MLP Eligible EBITDA at Valero

Fuels distribution would provide incremental EBITDA if selected

26 |

27

VLP Nearing the “High Splits”

•

4Q14 distribution at $0.266 per unit

•

VLP

expected

to

reach

50%

split

in

2015,

payable

in

2016,

based

on

accelerated

drop-down

strategy |

Unlocked Value

via Retail Spinoff in 2013 28

CST Brands, Inc. (NYSE: CST) has traded

at approximately double the earnings

valuation of VLO

VLO received nearly $1 billion in cash net

of tax liability and working capital

benefit to CST

Liquidated our 20% retained interest in

CST common stock, or 15 million shares,

in November 2013

CST Brands is now Valero’s largest

wholesale customer |

Allocating

Significant Growth Capital to Logistics

29

•

Railcars spending declines as receipt of railcars order concludes

•

Future spending focuses on pipelines |

30

Refining & Renewables Capital Focused on

Capturing Benefits of Key Long-Term Trends

•

Advantaged crude processing optimizes feedstock flexibility, mainly for light crudes

•

Hydrocracking increases production of high-margin distillates

•

Petchems, methanol, and hydrocracking upgrade natural gas or NGLs to higher-value

liquids |

McKee Diesel

Recovery Improvement and CDU Expansion Startup Expected in 2H15

31

Incremental Volume

(MBPD)

Feeds

WTI

25

Products

LPG

0.4

Benzene concentrate

0.3

Gasoline

12

Jet

-

Diesel

12

Resid

0.6

Project Estimates

Total investment

$140 MM

Annual EBITDA contribution

(1)

$100 MM

Unlevered IRR on total spend

(1)

45%

Investment Highlights

•

Adding 25 MBPD crude unit capacity

and parallel light ends processing

train

•

Expect to improve yields and

volume gain by recovering diesel

from FCC and HCU feeds

•

Expect to increase diesel and

gasoline production on price-

advantaged crude

•

Expect to reduce energy

consumption via heat integration

Status

•

Diesel recovery and benefits started

in mid-2014; expect crude

expansion start-up in 2H15

(1)

Estimates based on 2014 full year average prices; EBITDA = operating income before

deduction for depreciation and amortization expense |

Meraux

Hydrocracker Conversion Completed December 2014

32

Incremental Volume

(MBPD)

Feeds

Purchased hydrogen

(MMSCFD)

13

Products (MBPD)

Gasoline

5

Jet

-

Diesel

19

HSVGO

2

Unconverted gasoil

(23)

Fuel oil

-

Project Estimates

Total investment

$260 MM

Annual EBITDA contribution

(1)

$90 MM

Unlevered IRR on total spend

(1)

25%

(1)

Estimates based on 2014 full year average prices; EBITDA = operating income before

deduction for depreciation and amortization expense

Investment Highlights

•

Converted hydrotreater into high-

pressure hydrocracker and

repurposed old FCC gas plant for

additional LPG recovery

•

Expect to upgrade 23 MBPD gasoil

and low-cost hydrogen (via natural

gas) mainly into high quality diesel

•

Expect to increase refinery distillate

yield versus gasoline (Gas/Diesel

ratio drops from 0.72 to 0.59)

•

Expect to increase refinery liquid

volume yield by 1.8%

•

Avoided compliance capex on FCC

Status

•

Project started up in Dec 2014 and is

operating well |

Estimates

Incremental Volume (MBPD)

Feeds

Eagle Ford crude

70

Low sulfur atmos resid

(24)

Products

LPG

2.5

Propylene

0.9

BTX

0.4

Naphtha

16

Gasoline

7

Jet

16

Diesel

9

Resid

(3)

Houston and Corpus Christi Crude Topping

Units Expected Online in 1

st

Half of 2016

33

Project Estimates

Total investment

$350 MM

Annual EBITDA contribution

(1)

$260 MM

Unlevered IRR on total spend

(1)

55%

Estimates

Incremental Volume (MBPD)

Feeds

Eagle Ford crude

90

Low sulfur atmos resid

(29)

Distillate

(2)

Butane

(2)

Hydrogen (MMSCFD)

3

Products

LPG

0.8

Propylene

0.4

Naphtha

24

Gasoline

5

Jet

23

Diesel

4

Slurry

0.2

Project Estimates

Total investment

$400 MM

Annual EBITDA contribution

(1)

$240 MM

Unlevered IRR on total spend

(1)

45%

Corpus Christi

Houston

(1)

Estimates based on 2014 full year average prices; EBITDA = operating income before deduction

for depreciation and amortization expense |

Diamond

Pipeline 34

Project Estimates

Total investment

(1)

$484 MM

Cumulative spend through 2014

Zero

Annual EBITDA contribution

(2)

$46 MM

Unlevered IRR on total spend

at least 12%

(1)

Includes additional Valero cost for pipeline connection at Memphis refinery

(2)

EBITDA = Operating income before deduction for depreciation and amortization expense

Investment Highlights

•

Increases Memphis refinery’s crude

supply flexibility via connection to

Cushing and economic crudes

•

Provides direct control over crude

blend quality

•

Grows Valero’s inventory of assets

eligible for VLP dropdown in capital-

efficient manner

•

Valero holds option until January

2016 to acquire 50% interest in

pipeline

•

Expect completion in 1H17 or earlier |

Estimated Key

Price Sensitivities on Project Economics

35

Change

in

Estimated

EBITDA

(1)

Relative

to

2014

(2)

Prices

($millions/year)

McKee Diesel

Recovery & CDU

Expansion

Meraux HCU

Expansion

Corpus

Christi

Topper

Houston

Topper

ICE Brent, +$1/bbl

none

$0.8

$0.4

none

ICE Brent –

WTI, +$1/bbl

$5.5

none

None

none

ICE Brent –

LLS, +$1/bbl

N/A

none

$25.6

$32.9

Group 3 CBOB –

ICE Brent, +$1/bbl

$2.0

N/A

N/A

N/A

Group 3 ULSD –

ICE Brent, +$1/bbl

$5.5

N/A

N/A

N/A

USGC CBOB –

ICE Brent, +$1/bbl

N/A

$1.7

$2.4

$2.4

USGC ULSD –

ICE Brent, +$1/bbl

N/A

$6.8

$9.0

$9.9

Natural gas (Houston Ship Channel), +$1/mmBtu

-$0.7

-$1.9

-$4.3

-$3.2

Naphtha –

ICE Brent, +$1/bbl

N/A

none

$5.8

$8.8

LSVGO –

ICE Brent, + $1/bbl

N/A

-$7.3

$3.1

$5.2

Total investment IRR, +10% cost

-6%

N/A

-5%

-4%

(1)

Operating income before deduction for depreciation and amortization expense

(2)

2014 full year average

Note: Margin drivers shown are not inclusive of all feedstocks and products in economic

models. Estimated economic sensitivities can not be accurately interpolated or extrapolated solely

from the estimated key price sensitivities shown above. 1 |

Project Price

Set Assumptions 36

Driver ($/bbl)

2014 Average

ICE Brent

99.49

ICE Brent –

WTI

6.35

ICE Brent –

LLS

2.75

USGC CBOB –

ICE Brent

3.52

G3 CBOB –

WTI

12.27

USGC ULSD –

ICE Brent

14.25

G3 ULSD –

WTI

23.88

Natural gas (Houston Ship Channel, $/mmBtu)

4.34

Naphtha –

ICE Brent

-0.67

LSVGO –

ICE Brent

8.86 |

37

Port Arthur and St. Charles Hydrocrackers

Performance Details

Benefits Realized in Reported Results

Trailing 4 Quarters

$mm, except /bbl amounts

4Q12

3Q14

Increase

Gulf Coast Capture Rate

58.8%

63.2%

4.4%

x Gulf Coast Indicator/bbl, trailing 4Q 3Q14

$19

= Extra margin captured/bbl

$0.83

x Gulf Coast volume, trailing 4Q 3Q14 MPBD

1,586

x Annualized Days

365

= Benefit from higher Capture Rate

$483

Gulf Coast Throughput Volume MBPD

1,488

1,586

98

x Gulf Coast Indicator/bbl, trailing 4Q 3Q14

$19

x Gulf Coast Capture Rate, trailing 4Q 3Q14

63%

x Annualized Days

365

= Benefit from higher Volume

$429

Total Benefit from Hydrocracker Projects

$912

Less: estimated operating costs before depreciation and amort. exp.

-110

= EBITDA (estimated)

$802

Key Assumptions

•

Market

prices

for

trailing

4

quarters

as

of

3Q14

applied

to

guidance

model

disclosed

by

Valero

in

February

2012

to

estimate

$780

million

in

EBITDA

•

Gulf Coast capture rate increase based on average of trailing 4 quarters reported margin per

barrel (excluding cost of RINs allocated in results at $0.30/bbl for 4Q12 and $0.40/bbl

for 4Q13 averages) divided by Gulf Coast indicator margin •

Gulf Coast LPGs pricing based on propane

•

Many factors can influence our reported margins including, but not limited to, charges,

yields, pricing, timing and ratability, secondary costs, other allocations, hedging,

and GAAP inventory costing methods •

EBITDA = operating income before deduction for depreciation and amortization expense

|

Gated

Investment Management Process •

Development costs increase as project progresses through the phases

•

NPV and IRR of future cash flows per price forecasts and operating plans evaluated

•

“Target”

IRR hurdle rate ranges, which can change depending on the project and

market conditions:

Refining growth projects, target >=50% in Phase 1 to >=30% in Phase 3

Cost savings projects, target >=12% in Phase 3

Logistics projects, target pre-tax >=12% in Phase 3 + refinery benefits

38 |

39

Valero’s Light Crude Processing Capacity in

North America

MBPD

(1) Not incentivized in 4Q14 to maximize North American light crude consumption versus

alternative grades.

McKee Crude Unit Expansion

•

25 MBPD additional capacity

expected in 2H15

•

Distillate recovery improvements

Houston Crude Topper

•

90 MBPD capacity expected 1H16

•

Displaces 30 MBPD intermediate

feedstock purchases

Corpus Christi Crude Topper

•

70 MBPD capacity expected 1H16

•

Displaces 25 MBPD intermediate

feedstock purchases

(1) |

40

Valero Continues to Process Cost-Advantaged

U.S. and Canadian Crude

Note: Non-U.S. and Canadian crude runs exclude Valero’s Pembroke

Refinery. Cost-advantaged crudes exclude imports and historically discounted medium sour crudes, such as Mars/ASCI domestic;

heavy sour crudes, such as Maya; and high-acid crudes, such as Pazflor.

|

41

Valero Leads Peers in Total Location-

Advantaged Crude Capacity

Source: Company 10-k reports. Crude distillation capacity based on geographic

location. Access to lower cost North American crude benefits refiners in

Mid-Continent, Gulf Coast, and Canada; product export opportunities for Gulf Coast

and Canada |

42

Expect Quebec City Refinery to Have Cost-Advantaged

Access to 100% North American Crude Slate in 2015

Shifted to cost-advantaged crudes via rail and foreign flagged ships from USGC, with

additional savings expected from deliveries on Enbridge Line 9B beginning in 2Q15

|

43

U.S. Natural Gas Provides Opex and

Feedstock Cost Advantages

Note: Estimated per barrel cost of 864,000 mmBtu/day of natural gas consumption at 92%

refinery throughput capacity utilization, or 2.7 MMBPD. $1.3 billion

higher pre-tax

annual costs

$2.8 billion

higher pre-tax

annual costs

Valero’s refining operations consume approximately 864,000 mmBtu/day of

natural

gas, split almost equally between operating expense and cost of goods sold

Significant annual pre-tax cost savings compared to refiners in Europe or Asia

|

44

Valero’s Capacity for Additional

Product Exports

Opportunities to expand U.S. Gulf

Coast export capability for gasoline

to 308 MBPD and diesel to 472

MBPD

Export markets pull volume from

U.S., enabling high refinery

utilization and improved margins

Supported by global refined

products demand growth

Logistics investments also support

segregation |

Long-Term

Macro Market Expectations Global Outlook

U.S. Economy and

Petroleum Demand

North American

Resource

Advantage

International Export

Markets

•

Economic activity and total petroleum demand increases

•

Transportation fuels demand grows

•

Refining capacity growth slows after 2015; utilization stabilizes then

expected to increase

•

Refinery rationalization pressure continues in Europe, Japan, and Australia

•

Economic growth strengthens over next five years, which stimulates refined

product demand

•

Diesel and jet fuel demand continues to strengthen

•

Gasoline demand continues to recover moderately

•

Natural gas production growth still attractive and development continues

•

Crude production is economic; growth continues, but may be tempered

with lower prices

•

North American refiners maintain competitive advantage

•

Broad lifting of crude export ban not expected for several years, if ever

•

U.S. continues to be an advantaged net exporter of products

•

Atlantic Basin market continues to grow, with increasing demand from

Latin America and Africa

•

U.S. Gulf Coast is strategically positioned with globally competitive assets

45 |

46

U.S. and Canadian Production Growth Provides

Crude Cost Advantage to North American Refiners

Source: EIA, Consultants, company announcements and Valero estimates; 2014 U.S. Crude imports

as of Nov 2014 Production growth

reduces imports

Largest growth from U.S.

shale crude and heavy

Canadian crude |

Estimated

Crude Oil Transportation Costs to USEC

Rail $12 to

$15/bbl

to St. James

Rail $12/bbl

to Cushing

Rail $9/bbl

Cushing

to Houston

Pipe $2 to

$4/bbl

Midland

to Houston

Pipe $4/bbl

CC to Houston

$1 to $2/bbl

Houston to

St. James

$1 to $2 /bbl

to West Coast

Rail $13 to $15/bbl

USGC to USEC

U.S. Ship $5 to $7/bbl

USGC to Canada

Foreign Ship $2/bbl

Alberta to Bakken

$1 to $2/bbl

Rail $9/bbl

U.S. Ship

$4 to

$5/bbl

Alberta

to Eastern Canada

Rail $11 to $12/bbl

Bakken

47 |

48

Crude Oil Differentials Versus ICE Brent

Source: Argus; 1Q15 through Feb 6. LLS prices are roll adjusted.

|

49

Valero’s Regional Refinery Indicator Margins

Source: Argus; 1Q15 through Feb 6 |

•

Gulf Coast Indicator: (GC Colonial 85 CBOB A grade-

LLS) x 60% + (GC ULSD 10ppm

Colonial Pipeline prompt -

LLS) x 40% + (LLS -

Maya Formula Pricing) x 40% + (LLS -

Mars Month 1) x 40%

•

Midcontinent Indicator: [(Group 3 CBOB prompt -

WTI Month 1) x 60% + (Group 3

ULSD 10ppm prompt -

WTI Month 1) x 40%] x 60% + [(GC Colonial 85 CBOB A grade

prompt -

LLS) x 60% + (GC ULSD 10ppm Colonial Pipeline -

LLS) x 40%] x 40%

•

West Coast Indicator: (San Fran CARBOB Gasoline Month 1 -

ANS USWC Month 1) x

60% + (San Fran EPA 10 ppm Diesel pipeline -

ANS USWC Month 1) x 40% + 10%

(ANS –

West Coast High Sulfur Vacuum Gasoil cargo prompt)

•

North Atlantic Indicator: (NYH Conv 87 Gasoline Prompt –

ICE Brent) x 50% + (NYH

ULSD 15 ppm cargo prompt –

ICE Brent) x 50%

•

LLS prices are Month 1, adjusted for complex roll

•

Prior to 2010, GC Colonial 85 CBOB is substituted for GC 87 Conventional

•

Prior to 4Q13, Group 3 Conventional 87 gasoline substituted for Group 3 CBOB

50

Valero’s Regional Indicator Margins Defined |

Low Cost U.S.

Natural Gas Provides Competitive Advantage

51

Sources:

Argusand

Bloomberg.

Japan

LNG

through

Nov

30,

2014;

U.S.

and

Europe

through

Feb

12,2015.

Natural

gas

price

converted

to

barrels

using

factor

of

6.05x

•

U.S. natural gas is significantly discounted to Brent on an energy equivalent basis

•

Prices expected to remain low and disconnected from global oil and gas markets

for foreseeable future |

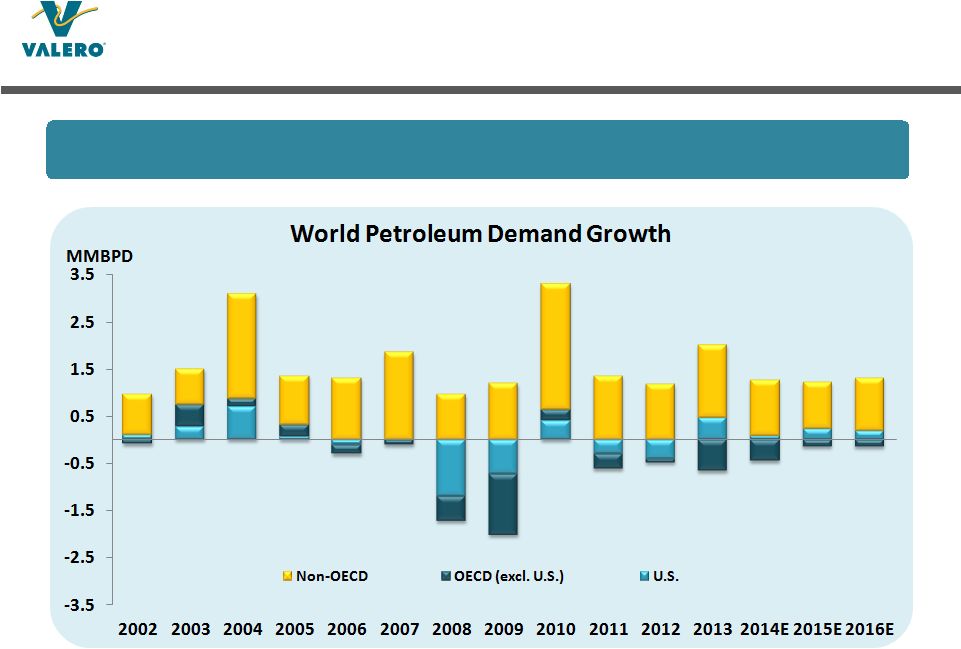

52

Global Petroleum Demand Projected to Grow

Source: Consultant (EIA and IEA) and Valero estimates. Consultant annual estimates

generally updated 6 to 12 months after year end. Emerging markets in Latin

America, Middle East, Africa, and Asia lead demand growth

|

53

U.S. Refining Capacity Is Globally Competitive and

Continues to Take Market Share

Source: EIA and IEA (U.S. data through November 2014, Europe data through December

2014) Less-competitive capacity

Source: EIA (2014 data through November)

Net imports

Net

exports

•

U.S. flipped from importer to exporter on lower local product demand and higher refinery

utilization, particularly in PADDS 2, 3, and 4, driven by structural cost advantages

for crude oil and natural gas

•

Gulf Coast refineries have gained export market share in the Atlantic Basin

|

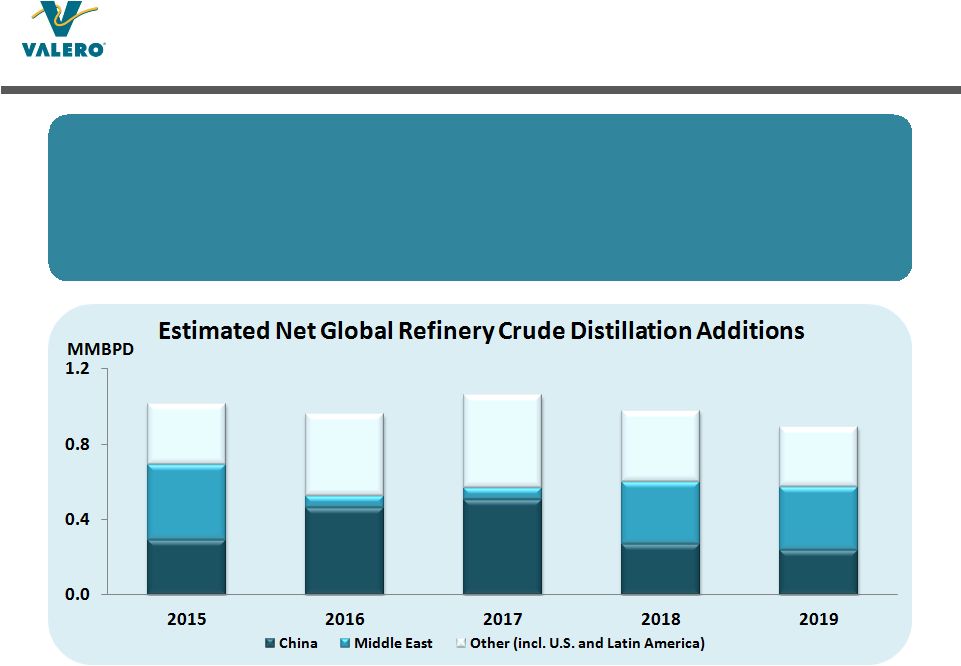

54

World Refinery Capacity Growth

Source:

Consultantand

Valero

estimates;

Net

Global

Refinery

Additions

=

New

Capacity

+

Restarts

–

Announced

Closures

•

New capacity additions expected in Asia and Middle East

•

Announced new capacity in Brazil, Mexico, and Colombia likely to

be smaller and start later than

planned

•

Expansions in Ecuador, Peru, Algeria, and Egypt unlikely due to cost and geopolitical

pressures •

Capacity rationalization expected to continue in Europe, Australia, and Japan

|

55

Capacity Rationalization in Atlantic Basin

Sources: Industry and Consultant reports and Valero estimates

•

Marginal refiners in U.S. East Coast, Caribbean and Western Europe are shutting capacity

•

Demand growth, poor reliability, and low utilization in Latin American refineries provide

opportunities for competitive refineries to export products and meet supply needs

|

*Partial

closure of refinery captured in capacity. Note: This data represents refineries currently closed, ownership may choose to restart or sell listed refinery.

Sources:

Industry

and

Consultant

reports,

Valero

estimates,

and

direct

and

public

disclosure

by

each

owner.

Location

Owner

CDU Capacity

Closed (MBPD)

Year

Closed

Location

Owner

CDU Capacity

Closed (MBPD)

Year

Closed

Perth Amboy, NJ

Chevron

80

2008

Coryton, U.K.

Petroplus

175

2012

Bakersfield,CA

Big West

65

2008

Petit Couronne, France

Petroplus

160

2012

Ingolstadt, Germany*

Bayernoil

102

2008

Rome, Italy

Total/Erg

88

2012

Yabucoa, Puerto Rico

Shell

76

2008

Fawley, U.K.*

ExxonMobil

80

2012

Westville, NJ

Sunoco

145

2009

Paramo, Czech Republic

Unipetrol

20

2012

Bloomfield, NM

Western

17

2009

St. Croix, U.S.V.I

Hovensa

350

2012

North Pole, AK*

Flint Hills

85

2009

Aruba

Valero

235

2012

Teesside, UK

Petroplus

117

2009

Lisichansk, Ukraine

TNK-BP

175

2012

Gonfreville, France*

Total

90

2009

Clyde, Australia

Shell

75

2012

Dunkirk, France

Total

140

2009

Port Reading, NJ

Hess

N/A

2013

Toyama, Japan

Nihonkai Oil

57

2009

Dartmouth, Canada

Imperial Oil

88

2013

Yorktown, VA

Western

65

2010

Harburg, Germany

Shell

107

2013

Montreal, Canada

Shell

130

2010

Porto Marghera, Italy

ENI

80

2013

Reichstett, France

Petroplus

85

2010

Sakaide, Japan

Cosmo Oil

140

2013

Wilhemshaven, Germany

ConocoPhillips

260

2010

North Pole, AK

Flint Hills

80

2014

Sodegaura, Japan*

Fuji Oil

50

2010

Mantova, Italy

MOL

69

2014

Oita, Japan*

JX Holdings

24

2010

Stanlow, U.K.*

Essar

101

2014

Mizushima, Japan*

JX Holdings

110

2010

Milford Haven, UK

Murphy

130

2014

Negishi, Japan*

JX Holdings

70

2010

Yokkaichi, Japan*

Cosmo Oil

43

2014

Kashima, Japan*

JX Holdings

18

2010

Tokuyama, Japan

Idemitsu Kosan

114

2014

Marcus Hook, PA

Sunoco

175

2011

Kurnell, Australia

Caltex

135

2014

St. Croix, U.S.V.I,*

Hovensa

150

2011

Kawasaki, Japan *

Tonen-General

67

2014

Arpechim, Romania

OMV Petrom

70

2011

Wakayama, Japan*

Tonen-General

38

2014

Cremona, Italy

Tamoil

94

2011

Muroran, Japan

JX Holdings

180

2014

Ogimachi, Japan

Toa Oil Company

120

2011

Chiba, Japan*

Kyokuto Petroleum

23

2014

Funshun, China

Funshun Petrochem.

70

2011

Kaohsiung, Taiwan

Chinese Petroleum Corp.

200

2015

Paramount, CA

Alon

90

2012

Bulwer Island, Australia

BP

102

2015

North Pole, AK*

Flint Hills

48

2012

Lindsey, U.K.*

Total

110

2016

Berre L’Etang, France

LyondellBasell

105

2012

56

Global Refining Capacity Rationalization |

Location

Owner

CDU Capacity (MBPD)

Lytton, Australia

Caltex

109

Nishihara, Japan

Petrobras/Sumitomo

95

Inchon, Korea

SK Energy

270

Whitegate, Ireland

Phillips 66

71

Barbers Point, HI

Chevron

54

Pasadena, TX

Petrobras

100

Bahia Blanca, Argentina

Petrobras

31

Gothenburg, Sweden

Shell

80

Port Dickson, Malaysia

Shell

156

Livorno

ENI

106

Taranto

ENI

120

Mazeikiai, Lithuania

PKN

190

Okinawa, Japan

Petrobras/Nansei Sekiyu

100

Falconara, Italy

API

80

Hamburg, Germany

Tamoil

78

Collombey, Switzerland

Tamoil

72

Chiba, Japan

Cosmo Oil

240

Chiba, Japan

TonenGeneral

152

57

Global Refining Capacity For Sale or Under

Strategic Review

Sources: Direct and public disclosure by each owner |

58

U.S. Crude Fundamentals

Source: DOE weekly data through February 6, 2015 |

59

U.S. Gasoline Fundamentals

USGC Brent Gasoline Crack (per bbl)

U.S. Gasoline Demand (mmbpd)

Source: Argus; 2015 weekly data through Feb 6

Source: 2014 DOE monthly data through Nov 2014; 2015 weekly data through Feb 6

Source: 2014 DOE monthly data through Nov 2014; 2015 weekly data through Feb 6

U.S. Net Imports of Gasoline and Blendstocks (mbpd)

Source: 2014 DOE monthly data through Nov 2014

U.S. Gasoline Days of Supply |

60

U.S. Distillate Fundamentals

USGC Brent ULSD Crack (per bbl)

U.S. Distillate Demand (mmbpd)

Source: Argus; 2015 weekly data through Feb 6

Source: 2014 DOE monthly data through Nov 2014; 2015 weekly data through Feb 6

Source: 2014 DOE monthly data through Nov 2014; 2015 weekly data through Feb 6

Source: 2014 DOE monthly data through Nov 2014; 2015 weekly data through Feb 6

U.S. Distillate Days of Supply

U.S. Distillate Net Imports (mbpd) |

61

U.S. Transport Indicators

Source: U.S. DOE PSM / U.S. DOT FHA

Most recent data includes Nov 2014 |

62

U.S. Transport Indicators: Trucking |

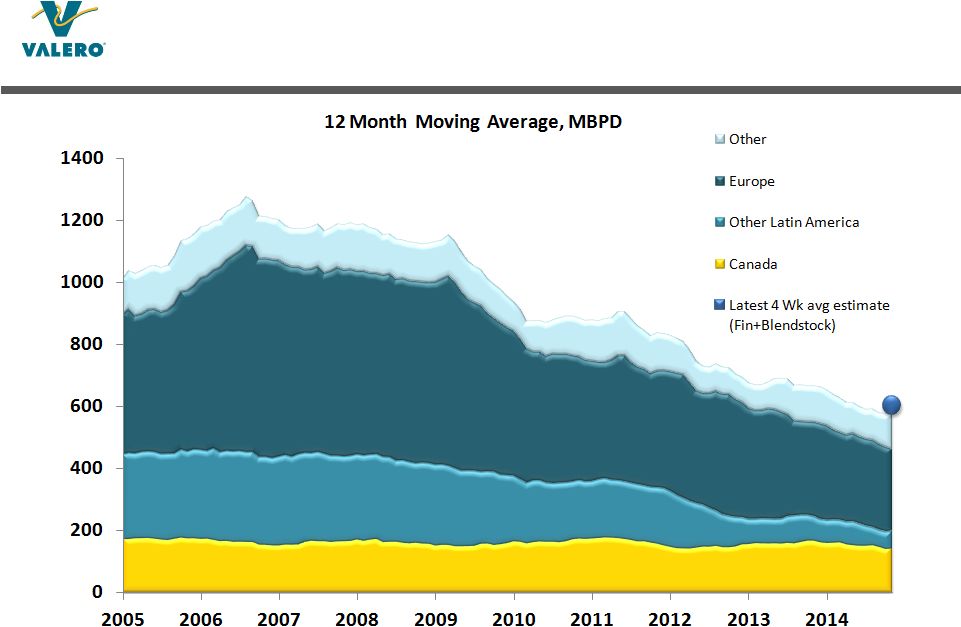

Note:

Gasoline represents all finished gasoline plus all blendstocks (including ethanol, MTBE, and other oxygenates)

Source: DOE Petroleum Supply Monthly data as of November 2014.

4 Week Average estimate from Weekly Petroleum Statistics Report and Valero estimates.

63

Increase in U.S. Gasoline Exports |

Decrease in

U.S. Gasoline Imports Note: Gasoline represents all finished gasoline plus all

blendstocks (including ethanol, MTBE, and other oxygenates) Source:

DOE

Petroleum

Supply

Monthly

data

as

of

November

2014.

4

Week

Average

estimate

fromWeekly

Petroleum

Statistics

Report

and

Valero

estimates.

64 |

Source: DOE

Petroleum Supply Monthly with data as of November 2014. 4 Week Average estimate from Weekly Petroleum Statistics Report

65

Increase in U.S. Diesel Exports

12 Month Moving Average, MBPD |

66

U.S. Is Net Refined Products Exporter

U.S. Demand for Refined Products and Net Trade

MMBPD

U.S. Petroleum Demand Excluding Ethanol and Non-Refinery NGL’s

(Refined Product Demand)

Net Imports

Net

Exports

Implied Total Production of

U.S. Refined Products

Note:

Implied

production

=

Petroleum

demand

excluding

ethanol

and

non-refinery

NGLs

minus

product

netimports.

Source:

EIA,

Consultant

and

Valero

estimates;

data

through

Nov

2014

Implied Production of U.S. Refined

Products for Domestic Use

Valero’s share of U.S. exports has averaged 20% to 25% over the past few years

|

MBPD

67

U.S. Shifted to Net Exporter

Note: Gasoline represents all finished gasoline plus all blendstocks (including ethanol,

MTBE, and other oxygenates) Source: DOE Petroleum Supply Monthly data as of Nov

2014 •

Net refined products exports increased from 335 MBPD in 2010 to 2,450 MBPD in 2014

•

Diesel net exports averaged 917 MBPD in 2014 (Jan-Nov)

•

Gasoline net exports averaged 50 MBPD in 2014 (Jan –

Nov)

•

Gasoline and blendstocks have shifted to net exports |

Source:

DOE

Petroleum

Supply

Monthly

dataas

of

Nov2014;

Latin

America

includes

Southand

Central

America

plus

Mexico.

U. S. Product Exports By Destination

U. S. Product Exports By Source

MMBPD

12 Month Moving Average

68

U.S. Growing Market Share by Exports

•

Refined products demand is growing in developing countries and Atlantic Basin

(capacity closures)

•

U.S. Gulf Coast (PADD III) is the largest source of exported products

|

69

Mexico Statistics

Diesel Gross Imports (MBPD)

Source: PEMEX, latest data Dec 2014

Gasoline Gross Imports (MBPD)

Crude Unit Throughput (MBPD)

Crude Unit Utilization |

70

Decrease in Venezuelan Exports to the U.S.

Source: EIA, November 2014 |

71

Reconciliation of Operating Income to EBITDA

Ethanol (millions)

2Q09 –

4Q09

2010

2011

2012

2013

2014

Cumulative

Operating income

$165

$209

$396

$(47)

$491

$786

$2,000

+ Depreciation and

amortization expense

$18

$36

$39

$42

$45

$49

$229

= EBITDA

$183

$245

$435

$(5)

$536

$835

$2,229 |

Investor

Relations Contacts 72

For more information, please contact:

John Locke

Executive Director, Investor Relations

210-345-3077

john.locke@valero.com

Karen Ngo

Manager, Investor Relations

210-345-4574

karen.ngo@valero.com |