Attached files

FORM 10-K

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________ | |

Commission file number 1-13175

VALERO ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

Delaware | 74-1828067 |

(State or other jurisdiction of | (I.R.S. Employer |

incorporation or organization) | Identification No.) |

One Valero Way | |||

San Antonio, Texas | 78249 | ||

(Address of principal executive offices) | (Zip Code) | ||

Registrant’s telephone number, including area code: (210) 345-2000 | |||

Securities registered pursuant to Section 12(b) of the Act: Common stock, $0.01 par value per share listed on the New York Stock Exchange.

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The aggregate market value of the voting and non-voting common stock held by non-affiliates was approximately $31.3 billion based on the last sales price quoted as of June 30, 2015 on the New York Stock Exchange, the last business day of the registrant’s most recently completed second fiscal quarter.

As of January 29, 2016, 470,392,665 shares of the registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

We intend to file with the Securities and Exchange Commission a definitive Proxy Statement for our Annual Meeting of Stockholders scheduled for May 12, 2016, at which directors will be elected. Portions of the 2016 Proxy Statement are incorporated by reference in Part III of this Form 10-K and are deemed to be a part of this report.

CROSS-REFERENCE SHEET

The following table indicates the headings in the 2016 Proxy Statement where certain information required in Part III of this Form 10-K may be found.

Form 10-K Item No. and Caption | Heading in 2016 Proxy Statement | ||

10. | Directors, Executive Officers and Corporate Governance | Information Regarding the Board of Directors, Independent Directors, Audit Committee, Proposal No. 1 Election of Directors, Information Concerning Nominees and Other Directors, Identification of Executive Officers, Section 16(a) Beneficial Ownership Reporting Compliance, and Governance Documents and Codes of Ethics | |

11. | Executive Compensation | Compensation Committee, Compensation Discussion and Analysis, Director Compensation, Executive Compensation, and Certain Relationships and Related Transactions | |

12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | Beneficial Ownership of Valero Securities and Equity Compensation Plan Information | |

13. | Certain Relationships and Related Transactions, and Director Independence | Certain Relationships and Related Transactions and Independent Directors | |

14. | Principal Accountant Fees and Services | KPMG LLP Fees and Audit Committee Pre-Approval Policy | |

Copies of all documents incorporated by reference, other than exhibits to such documents, will be provided without charge to each person who receives a copy of this Form 10-K upon written request to Valero Energy Corporation, Attn: Secretary, P.O. Box 696000, San Antonio, Texas 78269-6000.

i

CONTENTS

PAGE | ||

ii

The terms “Valero,” “we,” “our,” and “us,” as used in this report, may refer to Valero Energy Corporation, to one or more of our consolidated subsidiaries, or to all of them taken as a whole. In this Form 10-K, we make certain forward-looking statements, including statements regarding our plans, strategies, objectives, expectations, intentions, and resources under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. You should read our forward-looking statements together with our disclosures beginning on page 24 of this report under the heading: “CAUTIONARY STATEMENT FOR THE PURPOSE OF SAFE HARBOR PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995.”

PART I

ITEMS 1. and 2. BUSINESS AND PROPERTIES

Overview. We are a Fortune 500 company based in San Antonio, Texas. Our corporate offices are at One Valero Way, San Antonio, Texas, 78249, and our telephone number is (210) 345-2000. Our common stock trades on the New York Stock Exchange (NYSE) under the symbol “VLO.” We were incorporated in Delaware in 1981 under the name Valero Refining and Marketing Company. We changed our name to Valero Energy Corporation on August 1, 1997. On January 31, 2016, we had 10,103 employees.

Our 15 petroleum refineries are located in the United States (U.S.), Canada, and the United Kingdom (U.K.). Our refineries can produce conventional gasolines, premium gasolines, gasoline meeting the specifications of the California Air Resources Board (CARB), diesel, low-sulfur diesel, ultra-low-sulfur diesel, CARB diesel, other distillates, jet fuel, asphalt, petrochemicals, lubricants, and other refined products. We market branded and unbranded refined products on a wholesale basis in the U.S., Canada, the Caribbean, the U.K., and Ireland through an extensive bulk and rack marketing network and through approximately 7,500 outlets that carry our brand names. We also own 11 ethanol plants in the central plains region of the U.S. that primarily produce ethanol, which we market on a wholesale basis through a bulk marketing network.

Available Information. Our website address is www.valero.com. Information on our website is not part of this annual report on Form 10-K. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K filed with (or furnished to) the U.S. Securities and Exchange Commission (SEC) are available on our website (under “Investors”) free of charge, soon after we file or furnish such material. In this same location, we also post our corporate governance guidelines, codes of ethics, and the charters of the committees of our board of directors. These documents are available in print to any stockholder that makes a written request to Valero Energy Corporation, Attn: Secretary, P.O. Box 696000, San Antonio, Texas 78269-6000.

SEGMENTS

We have two reportable segments: refining and ethanol. Our refining segment includes refining and marketing operations in the U.S., Canada, the U.K., Aruba, and Ireland. Our ethanol segment includes ethanol and marketing operations in the U.S. Financial information about our segments is presented in Note 17 of Notes to Consolidated Financial Statements and is incorporated herein by reference.

We formerly had a third reportable segment: retail. In 2013, we completed the separation of our retail business by creating an independent public company named CST Brands, Inc. (CST). The separation of our retail business is discussed in Note 3 of Notes to Consolidated Financial Statements and that discussion is incorporated herein by reference.

1

VALERO’S OPERATIONS

REFINING

On December 31, 2015, our refining operations included 15 petroleum refineries in the U.S., Canada, and the U.K., with a combined total throughput capacity of approximately 3.0 million barrels per day (BPD). The following table presents the locations of these refineries and their approximate feedstock throughput capacities as of December 31, 2015.

Refinery | Location | Throughput Capacity (a) (BPD) | |||

U.S. Gulf Coast: | |||||

Corpus Christi (b) | Texas | 370,000 | |||

Port Arthur | Texas | 375,000 | |||

St. Charles | Louisiana | 305,000 | |||

Texas City | Texas | 260,000 | |||

Houston | Texas | 175,000 | |||

Meraux | Louisiana | 135,000 | |||

Three Rivers | Texas | 100,000 | |||

1,720,000 | |||||

U.S. Mid-Continent: | |||||

Memphis | Tennessee | 195,000 | |||

McKee | Texas | 200,000 | |||

Ardmore | Oklahoma | 90,000 | |||

485,000 | |||||

North Atlantic: | |||||

Pembroke | Wales, U.K. | 270,000 | |||

Quebec City | Quebec, Canada | 235,000 | |||

505,000 | |||||

U.S. West Coast: | |||||

Benicia | California | 170,000 | |||

Wilmington | California | 135,000 | |||

305,000 | |||||

Total | 3,015,000 | ||||

(a) | “Throughput capacity” represents estimated capacity for processing crude oil, inter-mediates, and other feedstocks. Total estimated crude oil capacity is approximately 2.5 million BPD. |

(b) | Represents the combined capacities of two refineries – the Corpus Christi East and Corpus Christi West Refineries. |

2

Total Refining System

The following table presents the percentages of principal charges and yields (on a combined basis) for all of our refineries for the year ended December 31, 2015. Our total combined throughput volumes averaged approximately 2.8 million BPD for the year ended December 31, 2015.

Combined Total Refining System Charges and Yields | |||

Charges: | |||

sour crude oil | 31 | % | |

sweet crude oil | 43 | % | |

residual fuel oil | 10 | % | |

other feedstocks | 5 | % | |

blendstocks | 11 | % | |

Yields: | |||

gasolines and blendstocks | 48 | % | |

distillates | 38 | % | |

petrochemicals | 3 | % | |

other products (includes gas oils, No. 6 fuel oil, petroleum coke, and asphalt) | 11 | % | |

U.S. Gulf Coast

The following table presents the percentages of principal charges and yields (on a combined basis) for the eight refineries in this region for the year ended December 31, 2015. Total throughput volumes for the U.S. Gulf Coast refining region averaged approximately 1.6 million BPD for the year ended December 31, 2015.

Combined U.S. Gulf Coast Region Charges and Yields | |||

Charges: | |||

sour crude oil | 40 | % | |

sweet crude oil | 25 | % | |

residual fuel oil | 16 | % | |

other feedstocks | 7 | % | |

blendstocks | 12 | % | |

Yields: | |||

gasolines and blendstocks | 46 | % | |

distillates | 38 | % | |

petrochemicals | 4 | % | |

other products (includes gas oil, No. 6 fuel oil, petroleum coke, and asphalt) | 12 | % | |

Corpus Christi East and West Refineries. Our Corpus Christi East and West Refineries are located on the Texas Gulf Coast along the Corpus Christi Ship Channel. The East Refinery processes sour crude oil, and the West Refinery processes sweet crude oil, sour crude oil, and residual fuel oil. In 2015, we completed construction and placed into service a new 70,000 BPD crude distillation unit in the West Refinery. The feedstocks are delivered by tanker or barge via deepwater docking facilities along the Corpus Christi Ship Channel, and West Texas or South Texas crude oil is delivered via pipelines. The refineries’ physical locations allow for the transfer of various feedstocks and blending components between them. The refineries produce gasoline, aromatics, jet fuel, diesel, and asphalt. Truck racks service local markets for gasoline, diesel, jet

3

fuels, liquefied petroleum gases, and asphalt. These and other finished products are also distributed by ship or barge across docks and third-party pipelines.

Port Arthur Refinery. Our Port Arthur Refinery is located on the Texas Gulf Coast approximately 90 miles east of Houston. The refinery processes heavy sour crude oils and other feedstocks into gasoline, diesel, and jet fuel. In 2015, we completed a 15,000 BPD hydrocracker expansion project at this refinery. The refinery receives crude oil by rail, marine docks, and pipelines. Finished products are distributed into the Colonial, Explorer, and other pipelines and across the refinery docks into ships or barges.

St. Charles Refinery. Our St. Charles Refinery is located approximately 15 miles west of New Orleans along the Mississippi River. The refinery processes sour crude oils and other feedstocks into gasoline and diesel. The refinery receives crude oil over docks and has access to the Louisiana Offshore Oil Port. Finished products can be shipped over these docks or through the Parkway or Bengal pipelines, which ultimately provide access to the Plantation or Colonial pipeline networks.

Texas City Refinery. Our Texas City Refinery is located southeast of Houston on the Texas City Ship Channel. The refinery processes crude oils into gasoline, diesel, and jet fuel. The refinery receives its feedstocks by pipeline and by ship or barge via deepwater docking facilities along the Texas City Ship Channel. The refinery uses ships and barges, as well as the Colonial, Explorer, and other pipelines for distribution of its products.

Houston Refinery. Our Houston Refinery is located on the Houston Ship Channel. It processes a mix of crude and intermediate oils into gasoline, jet fuel, and diesel. The refinery receives its feedstocks by tankers or barges at deepwater docking facilities along the Houston Ship Channel and by various interconnecting pipelines with our Texas City Refinery. The majority of its finished products are delivered to local, mid-continent U.S., and northeastern U.S. markets through various pipelines, including the Colonial and Explorer pipelines.

Meraux Refinery. Our Meraux Refinery is located approximately 25 miles southeast of New Orleans along the Mississippi River. The refinery processes sour and sweet crude oils into gasoline, diesel, jet fuel, and high sulfur fuel oil. The refinery receives crude oil at its dock and has access to the Louisiana Offshore Oil Port. Finished products can be shipped from the refinery’s dock or through the Colonial pipeline. The refinery is located about 40 miles from our St. Charles Refinery, allowing for integration of feedstocks and refined product blending.

Three Rivers Refinery. Our Three Rivers Refinery is located in South Texas between Corpus Christi and San Antonio. It processes sweet and sour crude oils into gasoline, distillates, and aromatics. The refinery has access to crude oil from sources outside the U.S. delivered to the Texas Gulf Coast at Corpus Christi as well as crude oil from local sources through third-party pipelines and trucks. The refinery distributes its refined products primarily through third-party pipelines.

4

U.S. Mid-Continent

The following table presents the percentages of principal charges and yields (on a combined basis) for the three refineries in this region for the year ended December 31, 2015. Total throughput volumes for the U.S. Mid-Continent refining region averaged approximately 447,000 BPD for the year ended December 31, 2015.

Combined U.S. Mid-Continent Region Charges and Yields | |||

Charges: | |||

sour crude oil | 6 | % | |

sweet crude oil | 85 | % | |

other feedstocks | 1 | % | |

blendstocks | 8 | % | |

Yields: | |||

gasolines and blendstocks | 54 | % | |

distillates | 36 | % | |

petrochemicals | 4 | % | |

other products (includes gas oil, No. 6 fuel oil, and asphalt) | 6 | % | |

Memphis Refinery. Our Memphis Refinery is located in Tennessee along the Mississippi River. It processes primarily sweet crude oils. Most of its production is gasoline, diesel, and jet fuels. Crude oil is supplied to the refinery via the Capline pipeline and can also be received, along with other feedstocks, via barge. Most of the refinery’s products are distributed via truck rack and barges.

McKee Refinery. Our McKee Refinery is located in the Texas Panhandle. It processes primarily sweet crude oils into gasoline, diesel, jet fuels, and asphalt. The refinery has access to local and Permian Basin crude oil sources via third-party pipelines. In 2015, we completed the final phases of a multi-year project, which increased the refinery’s crude oil processing capacity by approximately 20,000 BPD. The refinery distributes its products primarily via third-party pipelines to markets in Texas, New Mexico, Arizona, Colorado, and Oklahoma.

Ardmore Refinery. Our Ardmore Refinery is located in Oklahoma, approximately 100 miles south of Oklahoma City. It processes medium sour and sweet crude oils into gasoline, diesel, and asphalt. The refinery receives local crude oil and feedstock supply via third-party pipelines. Refined products are transported to market via rail, trucks, and the Magellan pipeline system.

5

North Atlantic

The following table presents the percentages of principal charges and yields (on a combined basis) for the two refineries in this region for the year ended December 31, 2015. Total throughput volumes for the North Atlantic refining region averaged approximately 494,000 BPD for the year ended December 31, 2015.

Combined North Atlantic Region Charges and Yields | |||

Charges: | |||

sour crude oil | 3 | % | |

sweet crude oil | 84 | % | |

residual fuel oil | 5 | % | |

other feedstocks | 1 | % | |

blendstocks | 7 | % | |

Yields: | |||

gasolines and blendstocks | 44 | % | |

distillates | 44 | % | |

petrochemicals | 1 | % | |

other products (includes gas oil, No. 6 fuel oil, and other products) | 11 | % | |

Pembroke Refinery. Our Pembroke Refinery is located in the County of Pembrokeshire in southwest Wales, U.K. The refinery processes primarily sweet crude oils into gasoline, diesel, jet fuel, heating oil, and low-sulfur fuel oil. The refinery receives all of its feedstocks and delivers the majority of its products by ship and barge via deepwater docking facilities along the Milford Haven Waterway, with its remaining products being delivered by our Mainline pipeline system and by trucks.

Quebec City Refinery. Our Quebec City Refinery is located in Lévis, Canada (near Quebec City). It processes sweet crude oils into gasoline, diesel, jet fuel, heating oil, and low-sulfur fuel oil. The refinery receives crude oil by ship at its deepwater dock on the St. Lawrence River or by pipeline/ship from western Canada. The refinery transports its products through our pipeline from Quebec City to our terminal in Montreal and to various other terminals throughout eastern Canada by rail, ships, trucks, and third-party pipelines.

6

U.S. West Coast

The following table presents the percentages of principal charges and yields (on a combined basis) for the two refineries in this region for the year ended December 31, 2015. Total throughput volumes for the U.S. West Coast refining region averaged approximately 266,000 BPD for the year ended December 31, 2015.

Combined U.S. West Coast Region Charges and Yields | |||

Charges: | |||

sour crude oil | 70 | % | |

sweet crude oil | 5 | % | |

other feedstocks | 11 | % | |

blendstocks | 14 | % | |

Yields: | |||

gasolines and blendstocks | 60 | % | |

distillates | 25 | % | |

other products (includes gas oil, No. 6 fuel oil, petroleum coke, and asphalt) | 15 | % | |

Benicia Refinery. Our Benicia Refinery is located northeast of San Francisco on the Carquinez Straits of San Francisco Bay. It processes sour crude oils into gasoline, diesel, jet fuel, and asphalt. Gasoline production is primarily CARBOB gasoline, which meets CARB specifications when blended with ethanol. The refinery receives crude oil feedstocks via a marine dock and crude oil pipelines connected to a southern California crude oil delivery system. Most of the refinery’s products are distributed via pipeline and truck rack into northern California markets.

Wilmington Refinery. Our Wilmington Refinery is located near Los Angeles, California. The refinery processes a blend of heavy and high-sulfur crude oils. The refinery produces CARBOB gasoline, diesel, CARB diesel, jet fuel, and asphalt. The refinery is connected by pipeline to marine terminals and associated dock facilities that can move and store crude oil and other feedstocks. Refined products are distributed via pipeline systems to various third-party terminals in southern California, Nevada, and Arizona.

7

Feedstock Supply

Approximately 59 percent of our current crude oil feedstock requirements are purchased through term contracts while the remaining requirements are generally purchased on the spot market. Our term supply agreements include arrangements to purchase feedstocks at market-related prices directly or indirectly from various national oil companies as well as international and U.S. oil companies. The contracts generally permit the parties to amend the contracts (or terminate them), effective as of the next scheduled renewal date, by giving the other party proper notice within a prescribed period of time (e.g., 60 days, 6 months) before expiration of the current term. The majority of the crude oil purchased under our term contracts is purchased at the producer’s official stated price (i.e., the “market” price established by the seller for all purchasers) and not at a negotiated price specific to us.

Refining Segment Sales

Overview

Our refining segment includes sales of refined products in both the wholesale rack and bulk markets. These sales include refined products that are manufactured in our refining operations as well as refined products purchased or received on exchange from third parties. Most of our refineries have access to marine transportation facilities and interconnect with common-carrier pipeline systems, allowing us to sell products in the U.S., Canada, the U.K., and other countries.

Wholesale Marketing

We market branded and unbranded refined products on a wholesale basis through an extensive rack marketing network. The principal purchasers of our refined products from terminal truck racks are wholesalers, distributors, retailers, and truck-delivered end users throughout the U.S., Canada, the U.K., and Ireland.

The majority of our rack volume is sold through unbranded channels. The remainder is sold to distributors and dealers that are members of the Valero-brand family that operate approximately 5,700 branded sites in the U.S. and the Caribbean, approximately 1,000 branded sites in the U.K. and Ireland, and approximately 800 branded sites in Canada. These sites are independently owned and are supplied by us under multi-year contracts. For wholesale branded sites, we promote the Valero®, Beacon®, Diamond Shamrock®, and Shamrock® brands in the U.S. and the Caribbean, the Texaco® brand in the U.K. and Ireland, and we license the Ultramar® brand in Canada.

Bulk Sales and Trading

We sell a significant portion of our gasoline and distillate production through bulk sales channels in U.S. and international markets. Our bulk sales are made to various oil companies and traders as well as certain bulk end-users such as railroads, airlines, and utilities. Our bulk sales are transported primarily by pipeline, barges, and tankers to major tank farms and trading hubs.

We also enter into refined product exchange and purchase agreements. These agreements help minimize transportation costs, optimize refinery utilization, balance refined product availability, broaden geographic distribution, and provide access to markets not connected to our refined-product pipeline systems. Exchange agreements provide for the delivery of refined products by us to unaffiliated companies at our and third-parties’ terminals in exchange for delivery of a similar amount of refined products to us by these unaffiliated companies at specified locations. Purchase agreements involve our purchase of refined products from third parties with delivery occurring at specified locations.

8

Specialty Products

We sell a variety of other products produced at our refineries, which we refer to collectively as “Specialty Products.” Our Specialty Products include asphalt, lube oils, natural gas liquids (NGLs), petroleum coke, petrochemicals, and sulfur.

• | We produce asphalt at five of our refineries. Our asphalt products are sold for use in road construction, road repair, and roofing applications through a network of refinery and terminal loading racks. |

• | We produce naphthenic oils at one of our refineries suitable for a wide variety of lubricant and process applications. |

• | NGLs produced at our refineries include butane, isobutane, and propane. These products can be used for gasoline blending, home heating, and petrochemical plant feedstocks. |

• | We are a significant producer of petroleum coke, supplying primarily power generation customers and cement manufacturers. Petroleum coke is used largely as a substitute for coal. |

• | We produce and market a number of commodity petrochemicals including aromatics (benzene, toluene, and xylene) and two grades of propylene. Aromatics and propylenes are sold to customers in the chemical industry for further processing into such products as paints, plastics, and adhesives. |

• | We are a large producer of sulfur with sales primarily to customers serving the agricultural sector. Sulfur is used in manufacturing fertilizer. |

Logistics and Transportation

We own several transportation and logistics assets (crude oil pipelines, refined product pipelines, terminals, tanks, marine docks, truck rack bays, rail cars, and rail facilities) that support our refining and ethanol operations. In addition, through subsidiaries, we own the 2.0 percent general partner interest in Valero Energy Partners LP (VLP) and a 65.7 percent limited partner interest in VLP. VLP is a midstream master limited partnership. Its common units, representing limited partner interests, are traded on the NYSE under the symbol “VLP.” Its assets support the operations of our Ardmore, Corpus Christi, Houston, McKee, Memphis, Port Arthur, St. Charles, and Three Rivers Refineries. VLP is discussed more fully in Note 4 of Notes to Consolidated Financial Statements.

9

ETHANOL

We own 11 ethanol plants with a combined ethanol production capacity of about 1.4 billion gallons per year. Our ethanol plants are dry mill facilities1 that process corn to produce ethanol and distillers grains.2 We source our corn supply from local farmers and commercial elevators. Our facilities receive corn primarily by rail and truck. We publish on our website a corn bid for local farmers and cooperative dealers to use to facilitate corn supply transactions.

After processing, our ethanol is held in storage tanks on-site pending loading to rail cars, trucks and barges. We sell our ethanol (i) to large customers–primarily refiners and gasoline blenders–under term and spot contracts, and (ii) in bulk markets such as New York, Chicago, the U.S. Gulf Coast, Florida, and the U.S. West Coast. We ship our dry distillers grains (DDG) by truck or rail primarily to animal feed customers in the U.S. and Mexico, with some sales into the Far East. We also sell modified distillers grains locally at our plant sites.

The following table presents the locations of our ethanol plants, their approximate ethanol and DDG production capacities, and their approximate corn processing capacities.

State | City | Ethanol Production Capacity (in gallons per year) | Production of DDG (in tons per year) | Corn Processed (in bushels per year) | ||||

Indiana | Linden | 130 million | 385,000 | 46 million | ||||

Mount Vernon | 100 million | 320,000 | 37 million | |||||

Iowa | Albert City | 130 million | 385,000 | 46 million | ||||

Charles City | 135 million | 400,000 | 48 million | |||||

Fort Dodge | 135 million | 400,000 | 48 million | |||||

Hartley | 135 million | 400,000 | 48 million | |||||

Minnesota | Welcome | 135 million | 400,000 | 48 million | ||||

Nebraska | Albion | 130 million | 385,000 | 46 million | ||||

Ohio | Bloomingburg | 130 million | 385,000 | 46 million | ||||

South Dakota | Aurora | 135 million | 400,000 | 48 million | ||||

Wisconsin | Jefferson | 105 million | 335,000 | 39 million | ||||

total | 1,400 million | 4,195,000 | 500 million | |||||

The combined production of denatured ethanol from our plants in 2015 averaged 3.8 million gallons per day.

________________________

1 | Ethanol is commercially produced using either the wet mill or dry mill process. Wet milling involves separating the grain kernel into its component parts (germ, fiber, protein, and starch) prior to fermentation. In the dry mill process, the entire grain kernel is ground into flour. The starch in the flour is converted to ethanol during the fermentation process, creating carbon dioxide and distillers grains. |

2 | During fermentation, nearly all of the starch in the grain is converted into ethanol and carbon dioxide, while the remaining nutrients (proteins, fats, minerals, and vitamins) are concentrated to yield modified distillers grains, or, after further drying, dried distillers grains. Distillers grains generally are an economical partial replacement for corn and soybeans in feeds for cattle, swine, and poultry. |

10

ENVIRONMENTAL MATTERS

We incorporate by reference into this Item the environmental disclosures contained in the following sections of this report:

• | Item 1A, “Risk Factors”—Compliance with and changes in environmental laws, including proposed climate change laws and regulations, could adversely affect our performance, |

• | Item 1A, “Risk Factors”—We may incur additional costs as a result of our use of rail cars for the transportation of crude oil and the products that we manufacture, |

• | Item 3, “Legal Proceedings” under the caption “Environmental Enforcement Matters,” and |

• | Item 8, “Financial Statements and Supplementary Data” in Note 9 of Notes to Consolidated Financial Statements under the caption “Environmental Liabilities,” and Note 11 of Notes to Consolidated Financial Statements under the caption “Environmental Matters.” |

Capital Expenditures Attributable to Compliance with Environmental Regulations. In 2015, our capital expenditures attributable to compliance with environmental regulations were $140 million, and they are currently estimated to be $83 million for 2016 and $95 million for 2017. The estimates for 2016 and 2017 do not include amounts related to capital investments at our facilities that management has deemed to be strategic investments. These amounts could materially change as a result of governmental and regulatory actions.

PROPERTIES

Our principal properties are described above under the caption “Valero’s Operations,” and that information is incorporated herein by reference. We believe that our properties and facilities are generally adequate for our operations and that our facilities are maintained in a good state of repair. As of December 31, 2015, we were the lessee under a number of cancelable and noncancelable leases for certain properties. Our leases are discussed more fully in Notes 10 and 11 of Notes to Consolidated Financial Statements. Financial information about our properties is presented in Note 7 of Notes to Consolidated Financial Statements and is incorporated herein by reference.

Our patents relating to our refining operations are not material to us as a whole. The trademarks and tradenames under which we conduct our branded wholesale business–including Valero®, Diamond Shamrock®, Shamrock®, Ultramar®, Beacon®, Texaco®–and other trademarks employed in the marketing of petroleum products are integral to our wholesale marketing operations.

11

ITEM 1A. RISK FACTORS

You should carefully consider the following risk factors in addition to the other information included in this report. Each of these risk factors could adversely affect our business, operating results, and/or financial condition, as well as adversely affect the value of an investment in our common stock.

Our financial results are affected by volatile refining margins, which are dependent upon factors beyond our control, including the price of crude oil and the market price at which we can sell refined products.

Our financial results are primarily affected by the relationship, or margin, between refined product prices and the prices for crude oil and other feedstocks. Historically, refining margins have been volatile, and we believe they will continue to be volatile in the future. Our cost to acquire feedstocks and the price at which we can ultimately sell refined products depend upon several factors beyond our control, including regional and global supply of and demand for crude oil, gasoline, diesel, and other feedstocks and refined products. These in turn depend on, among other things, the availability and quantity of imports, the production levels of U.S. and international suppliers, levels of refined product inventories, productivity and growth (or the lack thereof) of U.S. and global economies, U.S. relationships with foreign governments, political affairs, and the extent of governmental regulation.

Some of these factors can vary by region and may change quickly, adding to market volatility, while others may have longer-term effects. The longer-term effects of these and other factors on refining and marketing margins are uncertain. We do not produce crude oil and must purchase all of the crude oil we refine. We may purchase our crude oil and other refinery feedstocks long before we refine them and sell the refined products. Price level changes during the period between purchasing feedstocks and selling the refined products from these feedstocks could have a significant effect on our financial results. A decline in market prices may negatively impact the carrying value of our inventories.

Economic turmoil and political unrest or hostilities, including the threat of future terrorist attacks, could affect the economies of the U.S. and other countries. Lower levels of economic activity could result in declines in energy consumption, including declines in the demand for and consumption of our refined products, which could cause our revenues and margins to decline and limit our future growth prospects.

Refining margins are also significantly impacted by additional refinery conversion capacity through the expansion of existing refineries or the construction of new refineries. Worldwide refining capacity expansions may result in refining production capability exceeding refined product demand, which would have an adverse effect on refining margins.

A significant portion of our profitability is derived from the ability to purchase and process crude oil feedstocks that historically have been cheaper than benchmark crude oils, such as Louisiana Light Sweet (LLS) and Brent crude oils. These crude oil feedstock differentials vary significantly depending on overall economic conditions and trends and conditions within the markets for crude oil and refined products, and they could decline in the future, which would have a negative impact on our results of operations.

Compliance with and changes in environmental laws, including proposed climate change laws and regulations, could adversely affect our performance.

The principal environmental risks associated with our operations are emissions into the air and releases into the soil, surface water, or groundwater. Our operations are subject to extensive environmental laws and regulations, including those relating to the discharge of materials into the environment, waste management, pollution prevention measures, greenhouse gas (GHG) emissions, and characteristics and composition of fuels, including gasoline and diesel. Certain of these laws and regulations could impose obligations to conduct

12

assessment or remediation efforts at our facilities as well as at formerly owned properties or third-party sites where we have taken wastes for disposal or where our wastes have migrated. Environmental laws and regulations also may impose liability on us for the conduct of third parties, or for actions that complied with applicable requirements when taken, regardless of negligence or fault. If we violate or fail to comply with these laws and regulations, we could be fined or otherwise sanctioned.

Because environmental laws and regulations are becoming more stringent and new environmental laws and regulations are continuously being enacted or proposed, such as those relating to GHG emissions and climate change, the level of expenditures required for environmental matters could increase in the future. Current and future legislative action and regulatory initiatives could result in changes to operating permits, material changes in operations, increased capital expenditures and operating costs, increased costs of the goods we sell, and decreased demand for our products that cannot be assessed with certainty at this time. We may be required to make expenditures to modify operations or install pollution control equipment that could materially and adversely affect our business, financial condition, results of operations, and liquidity.

For example, the U.S. Environmental Protection Agency (EPA) has, in recent years, adopted final rules making more stringent the National Ambient Air Quality Standards (NAAQS) for ozone, sulfur dioxide, and nitrogen dioxide, and the U.S. EPA is considering further revisions to the NAAQS. Emerging rules and permitting requirements implementing these revised standards may require us to install more stringent controls at our facilities, which may result in increased capital expenditures. Governmental regulations regarding GHG emissions–including so-called “cap-and-trade” programs targeted at reducing carbon dioxide emissions–and low carbon fuel standards could result in increased compliance costs, additional operating restrictions or permitting delays for our business, and an increase in the cost of, and reduction in demand for, the products we produce, which could have a material adverse effect on our financial position, results of operations, and liquidity.

In addition, in 2015, the U.S., Canada, and the U.K. participated in the United Nations Conference on Climate Change, which led to the creation of the Paris Agreement. The Paris Agreement will be open for signing on April 22, 2016, and will require countries to review and “represent a progression” in their intended nationally determined contributions (which set GHG emission reduction goals) every five years beginning in 2020. Restrictions on emissions of methane or carbon dioxide that have been or may be imposed in various U.S. states or at the U.S. federal level or in other countries could adversely affect the oil and gas industry.

Finally, some scientists have concluded that increasing concentrations of GHG emissions in the Earth’s atmosphere may produce climate changes that have significant physical effects, such as increased frequency and severity of storms, droughts, and floods and other climatic events. If any such effects were to occur, it is uncertain if they would have an adverse effect on our financial condition and operations.

Disruption of our ability to obtain crude oil could adversely affect our operations.

A significant portion of our feedstock requirements is satisfied through supplies originating in the Middle East, Africa, Asia, North America, and South America. We are, therefore, subject to the political, geographic, and economic risks attendant to doing business with suppliers located in, and supplies originating from, these areas. If one or more of our supply contracts were terminated, or if political events disrupt our traditional crude oil supply, we believe that adequate alternative supplies of crude oil would be available, but it is possible that we would be unable to find alternative sources of supply. If we are unable to obtain adequate crude oil volumes or are able to obtain such volumes only at unfavorable prices, our results of operations could be materially adversely affected, including reduced sales volumes of refined products or reduced margins as a result of higher crude oil costs.

13

In addition, the U.S. government can prevent or restrict us from doing business in or with other countries. These restrictions, and those of other governments, could limit our ability to gain access to business opportunities in various countries. Actions by both the U.S. and other countries have affected our operations in the past and will continue to do so in the future.

We are subject to interruptions and increased costs as a result of our reliance on third-party transportation of crude oil and the products that we manufacture.

We generally use the services of third parties to transport feedstocks to our facilities and to transport the products we manufacture to market. If we experience prolonged interruptions of supply or increases in costs to deliver our products to market, or if the ability of the pipelines, vessels, or railroads to transport feedstocks or products is disrupted because of weather events, accidents, derailment, collision, fire, explosion, governmental regulations, or third-party actions, it could have a material adverse effect on our financial position, results of operations, and liquidity.

We may incur additional costs as a result of our use of rail cars for the transportation of crude oil and the products that we manufacture.

We currently use rail cars for the transportation of some feedstocks to certain of our facilities and for the transportation of some of the products we manufacture to their markets. We own and lease rail cars for our operations. Rail transportation is subject to a variety of federal, state, and local regulations. New laws and regulations and changes in existing laws and regulations are continuously being enacted or proposed that could result in increased expenditures for compliance. For example, in May 2014, the U.S. Department of Transportation (DOT) issued an order requiring rail carriers to provide certain notifications to state agencies along routes used by trains over a certain length carrying crude oil. In addition, in November 2014, the U.S. DOT issued a final rule regarding safety training standards under the Rail Safety Improvement Act of 2008. The rule required each railroad or contractor to develop and submit a training program to perform regular oversight and annual written reviews. In May 2015, the Pipeline and Hazardous Materials Safety Administration and the Federal Railroad Administration issued new final rules for enhanced tank car standards and operational controls for high-hazard flammable trains. Although we do not believe recently adopted rules will have a material impact on our financial position, results of operations, and liquidity, further changes in law, regulations or industry standards could require us to incur additional costs to the extent they are applicable to us.

Competitors that produce their own supply of feedstocks, own their own retail sites, have greater financial resources, or provide alternative energy sources may have a competitive advantage.

The refining and marketing industry is highly competitive with respect to both feedstock supply and refined product markets. We compete with many companies for available supplies of crude oil and other feedstocks and for sites for our refined products. We do not produce any of our crude oil feedstocks and, following the separation of our retail business, we do not have a company-owned retail network. Many of our competitors, however, obtain a significant portion of their feedstocks from company-owned production and some have extensive retail sites. Such competitors are at times able to offset losses from refining operations with profits from producing or retailing operations, and may be better positioned to withstand periods of depressed refining margins or feedstock shortages.

Some of our competitors also have materially greater financial and other resources than we have. Such competitors have a greater ability to bear the economic risks inherent in all phases of our industry. In addition, we compete with other industries that provide alternative means to satisfy the energy and fuel requirements of our industrial, commercial, and individual consumers.

14

Uncertainty and illiquidity in credit and capital markets can impair our ability to obtain credit and financing on acceptable terms, and can adversely affect the financial strength of our business partners.

Our ability to obtain credit and capital depends in large measure on capital markets and liquidity factors that we do not control. Our ability to access credit and capital markets may be restricted at a time when we would like, or need, to access those markets, which could have an impact on our flexibility to react to changing economic and business conditions. In addition, the cost and availability of debt and equity financing may be adversely impacted by unstable or illiquid market conditions. Protracted uncertainty and illiquidity in these markets also could have an adverse impact on our lenders, commodity hedging counterparties, or our customers, causing them to fail to meet their obligations to us. In addition, decreased returns on pension fund assets may also materially increase our pension funding requirements.

Our access to credit and capital markets also depends on the credit ratings assigned to our debt by independent credit rating agencies. We currently maintain investment-grade ratings by Standard & Poor’s Ratings Services (S&P), Moody’s Investors Service (Moody’s), and Fitch Ratings (Fitch) on our senior unsecured debt. Ratings from credit agencies are not recommendations to buy, sell, or hold our securities. Each rating should be evaluated independently of any other rating. We cannot provide assurance that any of our current ratings will remain in effect for any given period of time or that a rating will not be lowered or withdrawn entirely by a rating agency if, in its judgment, circumstances so warrant. Specifically, if ratings agencies were to downgrade our long-term rating, particularly below investment grade, our borrowing costs would increase, which could adversely affect our ability to attract potential investors and our funding sources could decrease. In addition, we may not be able to obtain favorable credit terms from our suppliers or they may require us to provide collateral, letters of credit, or other forms of security, which would increase our operating costs. As a result, a downgrade below investment grade in our credit ratings could have a material adverse impact on our financial position, results of operations, and liquidity.

From time to time, our cash needs may exceed our internally generated cash flow, and our business could be materially and adversely affected if we were unable to obtain necessary funds from financing activities. From time to time, we may need to supplement our cash generated from operations with proceeds from financing activities. We have existing revolving credit facilities, committed letter of credit facilities, and an accounts receivable sales facility to provide us with available financing to meet our ongoing cash needs. In addition, we rely on the counterparties to our derivative instruments to fund their obligations under such arrangements. Uncertainty and illiquidity in financial markets may materially impact the ability of the participating financial institutions and other counterparties to fund their commitments to us under our various financing facilities or our derivative instruments, which could have a material adverse effect on our financial position, results of operations, and liquidity.

A significant interruption in one or more of our refineries could adversely affect our business.

Our refineries are our principal operating assets. As a result, our operations could be subject to significant interruption if one or more of our refineries were to experience a major accident or mechanical failure, be damaged by severe weather or other natural or man-made disaster, such as an act of terrorism, or otherwise be forced to shut down. If any refinery were to experience an interruption in operations, earnings from the refinery could be materially adversely affected (to the extent not recoverable through insurance) because of lost production and repair costs. Significant interruptions in our refining system could also lead to increased volatility in prices for crude oil feedstocks and refined products, and could increase instability in the financial and insurance markets, making it more difficult for us to access capital and to obtain insurance coverage that we consider adequate.

15

A significant interruption related to our information technology systems could adversely affect our business.

Our information technology systems and network infrastructure may be subject to unauthorized access or attack, which could result in a loss of sensitive business information, systems interruption, or the disruption of our business operations. There can be no assurance that our infrastructure protection technologies and disaster recovery plans can prevent a technology systems breach or systems failure, which could have a material adverse effect on our financial position or results of operations.

Our business may be negatively affected by work stoppages, slowdowns or strikes by our employees, as well as new labor legislation issued by regulators.

Workers at some of our refineries are covered by collective bargaining agreements. To the extent we are in negotiations for labor agreements expiring in the future, there is no assurance an agreement will be reached without a strike, work stoppage, or other labor action. Any prolonged strike, work stoppage, or other labor action could have an adverse effect on our financial condition or results of operations. In addition, future federal or state labor legislation could result in labor shortages and higher costs, especially during critical maintenance periods.

We are subject to operational risks and our insurance may not be sufficient to cover all potential losses arising from operating hazards. Failure by one or more insurers to honor its coverage commitments for an insured event could materially and adversely affect our financial position, results of operations, and liquidity.

Our operations are subject to various hazards common to the industry, including explosions, fires, toxic emissions, maritime hazards, and natural catastrophes. As protection against these hazards, we maintain insurance coverage against some, but not all, potential losses and liabilities. We may not be able to maintain or obtain insurance of the type and amount we desire at reasonable rates. As a result of market conditions, premiums and deductibles for certain of our insurance policies could increase substantially. In some instances, certain insurance could become unavailable or available only for reduced amounts of coverage. For example, coverage for hurricane damage is very limited, and coverage for terrorism risks includes very broad exclusions. If we were to incur a significant liability for which we were not fully insured, it could have a material adverse effect on our financial position, results of operations, and liquidity.

Our insurance program includes a number of insurance carriers. Significant disruptions in financial markets could lead to a deterioration in the financial condition of many financial institutions, including insurance companies. We can make no assurances that we will be able to obtain the full amount of our insurance coverage for insured events.

Large capital projects can take many years to complete, and market conditions could deteriorate over time, negatively impacting project returns.

We may engage in capital projects based on the forecasted project economics and level of return on the capital to be employed in the project. Large-scale projects take many years to complete, and market conditions can change from our forecast. As a result, we may be unable to fully realize our expected returns, which could negatively impact our financial condition, results of operations, and cash flows.

Compliance with and changes in tax laws could adversely affect our performance.

We are subject to extensive tax liabilities imposed by multiple jurisdictions, including income taxes, indirect taxes (excise/duty, sales/use, gross receipts, and value-added taxes), payroll taxes, franchise taxes, withholding taxes, and ad valorem taxes. New tax laws and regulations and changes in existing tax laws and regulations are continuously being enacted or proposed that could result in increased expenditures for tax

16

liabilities in the future. Many of these liabilities are subject to periodic audits by the respective taxing authority. Subsequent changes to our tax liabilities as a result of these audits may subject us to interest and penalties.

We may incur losses and incur additional costs as a result of our forward-contract activities and derivative transactions.

We currently use commodity derivative instruments, and we expect to continue their use in the future. If the instruments we use to hedge our exposure to various types of risk are not effective, we may incur losses. In addition, we may be required to incur additional costs in connection with future regulation of derivative instruments to the extent it is applicable to us.

One of our subsidiaries acts as the general partner of a publicly traded master limited partnership, VLP, which may involve a greater exposure to legal liability than our historic business operations.

One of our subsidiaries acts as the general partner of VLP, a publicly traded master limited partnership. Our control of the general partner of VLP may increase the possibility of claims of breach of fiduciary duties, including claims of conflicts of interest, related to VLP. Liability resulting from such claims could have a material adverse effect on our financial position, results of operations, and liquidity.

If our spin-off of CST (the “Spin-off”), or certain internal transactions undertaken in anticipation of the Spin-off, were determined to be taxable for U.S. federal income tax purposes, then we and certain of our stockholders could be subject to significant tax liability.

We received a private letter ruling from the Internal Revenue Service (IRS) substantially to the effect that, for U.S. federal income tax purposes, the Spin-off, except for cash received in lieu of fractional shares, qualified as tax-free under sections 355 and 361 of the U.S. Internal Revenue Code of 1986, as amended (Code), and that certain internal transactions undertaken in anticipation of the Spin-off qualified for favorable treatment. The IRS did not rule, however, on whether the Spin-off satisfied certain requirements necessary to obtain tax-free treatment under section 355 of the Code. Instead, the private letter ruling was based on representations by us that those requirements were satisfied, and any inaccuracy in those representations could invalidate the private letter ruling. In connection with the private letter ruling, we also obtained an opinion from a nationally recognized accounting firm, substantially to the effect that, for U.S. federal income tax purposes, the Spin-off qualified under sections 355 and 361 of the Code. The opinion relied on, among other things, the continuing validity of the private letter ruling and various assumptions and representations as to factual matters made by CST and us which, if inaccurate or incomplete in any material respect, would jeopardize the conclusions reached by such counsel in its opinion. The opinion is not binding on the IRS or the courts, and there can be no assurance that the IRS or the courts would not challenge the conclusions stated in the opinion or that any such challenge would not prevail. Furthermore, notwithstanding the private letter ruling, the IRS could determine on audit that the Spin-off or the internal transactions undertaken in anticipation of the Spin-off should be treated as taxable transactions if it determines that any of the facts, assumptions, representations, or undertakings we or CST have made or provided to the IRS are incorrect or incomplete, or that the Spin-off or the internal transactions should be taxable for other reasons, including as a result of a significant change in stock or asset ownership after the Spin-off.

If the Spin-off ultimately were determined to be taxable, each holder of our common stock who received shares of CST common stock in the Spin-off generally would be treated as receiving a spin-off of property in an amount equal to the fair market value of the shares of CST common stock received by such holder. Any such spin-off would be a dividend to the extent of our current earnings and profits as of the end of 2013, and any accumulated earnings and profits. Any amount that exceeded our relevant earnings and profits would be treated first as a non-taxable return of capital to the extent of such holder’s tax basis in our shares of common stock with any remaining amount generally being taxed as a capital gain. In addition, we would

17

recognize gain in an amount equal to the excess of the fair market value of shares of CST common stock distributed to our holders on the Spin-off date over our tax basis in such shares of CST common stock. Moreover, we could incur significant U.S. federal income tax liabilities if it ultimately were determined that certain internal transactions undertaken in anticipation of the Spin-off were taxable.

Under the terms of the tax matters agreement we entered into with CST in connection with the Spin-off, we generally are responsible for any taxes imposed on us and our subsidiaries in the event that the Spin-off and/or certain related internal transactions were to fail to qualify for tax-free treatment. However, if the Spin-off and/or such internal transactions were to fail to qualify for tax-free treatment because of actions or failures to act by CST or its subsidiaries, CST would be responsible for all such taxes. If we were to become liable for taxes under the tax matters agreement, that liability could have a material adverse effect on us. The Spin-off is more fully described in Note 3 of Notes to Consolidated Financial Statements.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 3. LEGAL PROCEEDINGS

Litigation

We incorporate by reference into this Item our disclosures made in Part II, Item 8 of this report included in Note 11 of Notes to Consolidated Financial Statements under the caption “Litigation Matters.”

Environmental Enforcement Matters

While it is not possible to predict the outcome of the following environmental proceedings, if any one or more of them were decided against us, we believe that there would be no material effect on our financial position, results of operations, or liquidity. We are reporting these proceedings to comply with SEC regulations, which require us to disclose certain information about proceedings arising under federal, state, or local provisions regulating the discharge of materials into the environment or protecting the environment if we reasonably believe that such proceedings will result in monetary sanctions of $100,000 or more.

People of the State of Illinois, ex rel. v. The Premcor Refining Group Inc., et al., Third Judicial Circuit Court, Madison County (Case No. 03-CH-00459, filed May 29, 2003) (Hartford Refinery and terminal). The Illinois EPA has issued several Notices of Violation (NOVs) alleging violations of air and waste regulations at Premcor’s Hartford, Illinois terminal and closed refinery. We are negotiating the terms of a consent order for corrective action.

Bay Area Air Quality Management District (BAAQMD) (Benicia Refinery). We currently have multiple outstanding Violation Notices (VNs) issued by the BAAQMD. These VNs are for various alleged air regulation and air permit violations at our Benicia Refinery and asphalt plant. In the fourth quarter of 2015, we entered into an agreement with BAAQMD to resolve various VNs and continue to work with the BAAQMD to resolve the remaining VNs.

South Coast Air Quality Management District (SCAQMD) (Wilmington Refinery). We currently have multiple NOVs issued by the SCAQMD. These NOVs are for alleged reporting violations and excess emissions at our Wilmington Refinery. In the fourth quarter of 2015, we entered into an agreement to resolve various NOVs, and we continue to work with the SCAQMD to resolve the remaining NOVs.

18

Texas Commission on Environmental Quality (TCEQ) (Port Arthur Refinery). In our annual report on Form 10-K for the year ended December 31, 2014, we reported that we had received two proposed Agreed Orders from the TCEQ resolving multiple violations that occurred at our Port Arthur Refinery between May 2007 and April 2013. We continue to work with the TCEQ to finalize these Agreed Orders.

Quebec Ministry of Environment (QME) (Quebec City Refinery). In the fourth quarter of 2015, the QME issued a NOV for alleged excess emissions at our Quebec City Refinery. We are currently working with the QME to resolve the NOV.

ITEM 4. MINE SAFETY DISCLOSURES

None.

19

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock trades on the NYSE under the symbol “VLO.”

As of January 31, 2016, there were 5,911 holders of record of our common stock.

The following table shows the high and low sales prices of and dividends declared on our common stock for each quarter of 2015 and 2014.

Sales Prices of the Common Stock | Dividends Per Common Share | |||||||||||

Quarter Ended | High | Low | ||||||||||

2015: | ||||||||||||

December 31 | $ | 73.88 | $ | 58.98 | $ | 0.500 | ||||||

September 30 | 71.50 | 51.68 | 0.400 | |||||||||

June 30 | 64.28 | 56.09 | 0.400 | |||||||||

March 31 | 64.49 | 43.45 | 0.400 | |||||||||

2014: | ||||||||||||

December 31 | 52.10 | 42.53 | 0.275 | |||||||||

September 30 | 54.61 | 45.73 | 0.275 | |||||||||

June 30 | 59.69 | 50.03 | 0.250 | |||||||||

March 31 | 55.96 | 45.90 | 0.250 | |||||||||

On January 21, 2016, our board of directors declared a quarterly cash dividend of $0.60 per common share payable March 3, 2016 to holders of record at the close of business on February 9, 2016.

Dividends are considered quarterly by the board of directors and may be paid only when approved by the board.

20

The following table discloses purchases of shares of our common stock made by us or on our behalf during the fourth quarter of 2015.

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Not Purchased as Part of Publicly Announced Plans or Programs (a) | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs (b) | ||||||||||

October 2015 | 1,658,771 | $ | 62.12 | 842,059 | 816,712 | $2.0 billion | |||||||||

November 2015 | 2,412,467 | $ | 71.08 | 212,878 | 2,199,589 | $1.8 billion | |||||||||

December 2015 | 7,008,414 | $ | 70.31 | 980 | 7,007,434 | $1.3 billion | |||||||||

Total | 11,079,652 | $ | 69.25 | 1,055,917 | 10,023,735 | $1.3 billion | |||||||||

(a) | The shares reported in this column represent purchases settled in the fourth quarter of 2015 relating to (i) our purchases of shares in open-market transactions to meet our obligations under stock-based compensation plans, and (ii) our purchases of shares from our employees and non-employee directors in connection with the exercise of stock options, the vesting of restricted stock, and other stock compensation transactions in accordance with the terms of our stock-based compensation plans. |

(b) | On July 13, 2015, we announced that our board of directors approved our purchase of $2.5 billion of our outstanding common stock (with no expiration date), which was in addition to the remaining amount available under our $3 billion program previously authorized. During the third quarter of 2015, we completed our purchases under the $3 billion program. As of December 31, 2015, we had $1.3 billion remaining available for purchase under the $2.5 billion program. |

21

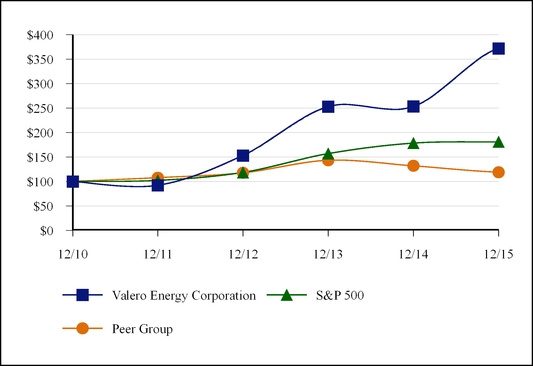

The following performance graph is not “soliciting material,” is not deemed filed with the SEC, and is not to be incorporated by reference into any of Valero’s filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, as amended, respectively.

This performance graph and the related textual information are based on historical data and are not indicative of future performance. The following line graph compares the cumulative total return1 on an investment in our common stock against the cumulative total return of the S&P 500 Composite Index and an index of peer companies (that we selected) for the five-year period commencing December 31, 2010 and ending December 31, 2015. Our peer group comprises the following 11 companies: Alon USA Energy, Inc.; BP plc; CVR Energy, Inc.; Delek US Holdings, Inc.; HollyFrontier Corporation; Marathon Petroleum Corporation; PBF Energy Inc.; Phillips 66; Royal Dutch Shell plc; Tesoro Corporation; and Western Refining, Inc.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN1

Among Valero Energy Corporation, the S&P 500 Index,

and Peer Group

As of December 31, | |||||||||||||||||||||||

2010 | 2011 | 2012 | 2013 | 2014 | 2015 | ||||||||||||||||||

Valero Common Stock | $ | 100.00 | $ | 92.15 | $ | 153.13 | $ | 252.67 | $ | 253.28 | $ | 371.80 | |||||||||||

S&P 500 | 100.00 | 102.11 | 118.45 | 156.82 | 178.29 | 180.75 | |||||||||||||||||

Peer Group | 100.00 | 107.70 | 117.64 | 143.16 | 131.88 | 118.95 | |||||||||||||||||

____________________________________

1 | Assumes that an investment in Valero common stock and each index was $100 on December 31, 2010. “Cumulative total return” is based on share price appreciation plus reinvestment of dividends from December 31, 2010 through December 31, 2015. |

22

ITEM 6. SELECTED FINANCIAL DATA

The selected financial data for the five-year period ended December 31, 2015 was derived from our audited financial statements. The following table should be read together with Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and with the historical financial statements and accompanying notes included in Item 8, “Financial Statements and Supplementary Data.”

The following summaries are in millions of dollars, except for per share amounts:

Year Ended December 31, | |||||||||||||||||||

2015 (a) | 2014 | 2013 (b) | 2012 | 2011 (c) | |||||||||||||||

Operating revenues | $ | 87,804 | $ | 130,844 | $ | 138,074 | $ | 138,393 | $ | 120,607 | |||||||||

Income from continuing operations | 4,101 | 3,775 | 2,722 | 3,114 | 2,336 | ||||||||||||||

Earnings per common share from continuing operations – assuming dilution | 7.99 | 6.97 | 4.96 | 5.61 | 4.11 | ||||||||||||||

Dividends per common share | 1.70 | 1.05 | 0.85 | 0.65 | 0.30 | ||||||||||||||

Total assets | 44,343 | 45,550 | 47,260 | 44,477 | 42,783 | ||||||||||||||

Debt and capital lease obligations, less current portion | 7,250 | 5,780 | 6,261 | 6,463 | 6,732 | ||||||||||||||

_________________________________________________

(a) | Includes a noncash lower of cost or market inventory valuation adjustment of $790 million, as described in Note 6 of Notes to Consolidated Financial Statements. |

(b) | Includes the operations of our retail business prior to its separation from us on May 1, 2013, as further described in Note 3 of Notes to Consolidated Financial Statements. |

(c) | We acquired the Meraux Refinery on October 1, 2011 and the Pembroke Refinery on August 1, 2011. The information presented for 2011 includes the results of operations from these acquisitions commencing on their respective acquisition dates. |

23

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following review of our results of operations and financial condition should be read in conjunction with Item 1A, “Risk Factors,” and Item 8, “Financial Statements and Supplementary Data,” included in this report.

CAUTIONARY STATEMENT FOR THE PURPOSE OF SAFE HARBOR PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This report, including without limitation our disclosures below under the heading “OVERVIEW AND OUTLOOK,” includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. You can identify our forward-looking statements by the words “anticipate,” “believe,” “expect,” “plan,” “intend,” “estimate,” “project,” “projection,” “predict,” “budget,” “forecast,” “goal,” “guidance,” “target,” “could,” “should,” “may,” and similar expressions.

These forward-looking statements include, among other things, statements regarding:

• | future refining margins, including gasoline and distillate margins; |

• | future ethanol margins; |

• | expectations regarding feedstock costs, including crude oil differentials, and operating expenses; |

• | anticipated levels of crude oil and refined product inventories; |

• | our anticipated level of capital investments, including deferred costs for refinery turnarounds and catalyst, capital expenditures for environmental and other purposes, and joint venture investments, and the effect of those capital investments on our results of operations; |

• | anticipated trends in the supply of and demand for crude oil and other feedstocks and refined products in the regions where we operate, as well as globally; |

• | expectations regarding environmental, tax, and other regulatory initiatives; and |

• | the effect of general economic and other conditions on refining and ethanol industry fundamentals. |

We based our forward-looking statements on our current expectations, estimates, and projections about ourselves and our industry. We caution that these statements are not guarantees of future performance and involve risks, uncertainties, and assumptions that we cannot predict. In addition, we based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Accordingly, our actual results may differ materially from the future performance that we have expressed or forecast in the forward-looking statements. Differences between actual results and any future performance suggested in these forward-looking statements could result from a variety of factors, including the following:

• | acts of terrorism aimed at either our facilities or other facilities that could impair our ability to produce or transport refined products or receive feedstocks; |

• | political and economic conditions in nations that produce crude oil or consume refined products; |

• | demand for, and supplies of, refined products such as gasoline, diesel, jet fuel, petrochemicals, and ethanol; |

• | demand for, and supplies of, crude oil and other feedstocks; |

• | the ability of the members of the Organization of Petroleum Exporting Countries to agree on and to maintain crude oil price and production controls; |

• | the level of consumer demand, including seasonal fluctuations; |

• | refinery overcapacity or undercapacity; |

• | our ability to successfully integrate any acquired businesses into our operations; |

24

• | the actions taken by competitors, including both pricing and adjustments to refining capacity in response to market conditions; |

• | the level of competitors’ imports into markets that we supply; |

• | accidents, unscheduled shutdowns, or other catastrophes affecting our refineries, machinery, pipelines, equipment, and information systems, or those of our suppliers or customers; |

• | changes in the cost or availability of transportation for feedstocks and refined products; |

• | the price, availability, and acceptance of alternative fuels and alternative-fuel vehicles; |

• | the levels of government subsidies for alternative fuels; |

• | the volatility in the market price of biofuel credits (primarily Renewable Identification Numbers (RINs) needed to comply with the U.S. federal Renewable Fuel Standard) and GHG emission credits needed to comply with the requirements of various GHG emission programs; |

• | delay of, cancellation of, or failure to implement planned capital projects and realize the various assumptions and benefits projected for such projects or cost overruns in constructing such planned capital projects; |

• | earthquakes, hurricanes, tornadoes, and irregular weather, which can unforeseeably affect the price or availability of natural gas, crude oil, grain and other feedstocks, and refined products and ethanol; |

• | rulings, judgments, or settlements in litigation or other legal or regulatory matters, including unexpected environmental remediation costs, in excess of any reserves or insurance coverage; |

• | legislative or regulatory action, including the introduction or enactment of legislation or rulemakings by governmental authorities, including tax and environmental regulations, such as those implemented under the California Global Warming Solutions Act (also known as AB 32), Quebec’s Regulation respecting the cap-and-trade system for greenhouse gas emission allowances (the Quebec cap-and-trade system), and the U.S. EPA’s regulation of GHGs, which may adversely affect our business or operations; |

• | changes in the credit ratings assigned to our debt securities and trade credit; |

• | changes in currency exchange rates, including the value of the Canadian dollar, the pound sterling, and the euro relative to the U.S. dollar; |

• | overall economic conditions, including the stability and liquidity of financial markets; and |

• | other factors generally described in the “Risk Factors” section included in Item 1A, “Risk Factors” in this report. |

Any one of these factors, or a combination of these factors, could materially affect our future results of operations and whether any forward-looking statements ultimately prove to be accurate. Our forward-looking statements are not guarantees of future performance, and actual results and future performance may differ materially from those suggested in any forward-looking statements. We do not intend to update these statements unless we are required by the securities laws to do so.

All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing. We undertake no obligation to publicly release any revisions to any such forward-looking statements that may be made to reflect events or circumstances after the date of this report or to reflect the occurrence of unanticipated events.

25

OVERVIEW AND OUTLOOK

Overview

For the year ended December 31, 2015, we reported net income attributable to Valero stockholders from continuing operations of $4.0 billion, or $7.99 per share (assuming dilution), compared to $3.7 billion, or $6.97 per share (assuming dilution), for the year ended December 31, 2014. Included in our 2015 results was a noncash charge for a lower of cost or market inventory valuation adjustment recorded in December 2015 of $790 million ($624 million after taxes, or $1.25 per share (assuming dilution)), of which $740 million was attributable to our refining segment and $50 million was attributable to our ethanol segment. This matter is more fully described in Note 6 of Notes to Consolidated Financial Statements. Included in our 2014 results was a last-in, first-out (LIFO) inventory gain of $233 million ($151 million after taxes, or $0.29 per share (assuming dilution)) primarily related to our refining segment.

Our operating income increased $456 million from 2014 to 2015 as outlined by business segment in the following table (in millions):

Year Ended December 31, | ||||||||||||

2015 | 2014 | Change | ||||||||||

Operating income (loss) by business segment: | ||||||||||||

Refining | $ | 6,973 | $ | 5,884 | $ | 1,089 | ||||||

Ethanol | 142 | 786 | (644 | ) | ||||||||

Corporate | (757 | ) | (768 | ) | 11 | |||||||

Total | $ | 6,358 | $ | 5,902 | $ | 456 | ||||||