Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ARMSTRONG WORLD INDUSTRIES INC | d875284dex991.htm |

| EX-99.2 - EX-99.2 - ARMSTRONG WORLD INDUSTRIES INC | d875284dex992.htm |

| EX-99.4 - EX-99.4 - ARMSTRONG WORLD INDUSTRIES INC | d875284dex994.htm |

| 8-K - FORM 8-K - ARMSTRONG WORLD INDUSTRIES INC | d875284d8k.htm |

Earnings Call

Presentation

4

th

Quarter 2014

February 23, 2015

Exhibit 99.3 |

2

Our disclosures in this presentation, including without limitation, those relating

to future financial results guidance and the separation of our flooring

business from our building products business, and in our other public

documents and comments contain forward-looking statements within the meaning of the Private

Securities Litigation Reform Act. Those statements provide our future

expectations or forecasts and can be identified

by

our

use

of

words

such

as

"anticipate,"

"estimate,"

"expect,"

"project,"

"intend,"

"plan,"

"believe,"

"outlook,"

"target,"

"predict,"

"may,"

"will,"

"would,"

"could,"

"should,"

"seek,"

and

other

words

or

phrases

of

similar meaning in connection with any discussion of future operating or financial

performance or the separation of our businesses. Forward-looking

statements, by their nature, address matters that are uncertain and involve

risks because they relate to events and depend on circumstances that may or may not

occur in the future. As a result, our actual results may differ

materially from our expected results and from those expressed in our

forward-looking

statements.

A

more

detailed

discussion

of

the

risks

and

uncertainties

that

may

affect

our

ability

to

achieve

the

projected

performance

is

included

in

the

“Risk

Factors”

and

“Management’s

Discussion

and

Analysis”

sections of our reports on Forms 10-K and 10-Q filed with the SEC.

Forward-looking statements speak only as of the date they are

made. We undertake no obligation to update any forward-looking statements

beyond what is required under applicable securities law.

In

addition,

we

will

be

referring

to

non-GAAP

financial

measures

within

the

meaning

of

SEC

Regulation

G.

A

reconciliation of the differences between these measures with the most directly

comparable financial measures calculated in accordance with GAAP are

included within this presentation and available on the Investor

Relations

page

of

our

website

at

www.armstrong.com.

The guidance in this presentation is only effective as of the date given, February

23, 2015, and will not be updated or affirmed unless and until we publicly

announce updated or affirmed guidance. Safe Harbor Statement

|

3

All

figures

throughout

the

presentation

are

in

$

millions

unless

otherwise

noted.

Figures

may

not

add

due

to

rounding.

•

When reporting our financial results within this presentation, we make several

adjustments. Management uses the non-GAAP measures below in managing the

business and believes the adjustments provide meaningful comparisons of

operating performance between periods. As reported results will be

footnoted throughout the presentation. Basis of Presentation

Explanation •

We report in comparable dollars to remove

the effects of currency translation on the

P&L. The budgeted exchange rate for 2014

is used for all currency translations in 2014

and prior years. Guidance is presented using

the 2015 budgeted exchange rate for the

year.

•

We remove the impact of discrete expenses

and income. Examples include plant

closures, restructuring actions, and other

large unusual items. We also remove the

non-cash

impact

of

our

U.S.

Pension

Plan.

•

Taxes for normalized Net Income and EPS

are calculated using a constant 39% for 2015

guidance, and 2014 and 2013 results, which

are based on the expected full year historical

tax rate.

What Items Are Adjusted

Comparable

Dollars

Other

Adjustments

Net Sales

Yes

No

Gross Profit

Yes

Yes

SG&A Expense

Yes

Yes

Equity Earnings

Yes

Yes

Operating Income

Yes

Yes

Net Income

Yes

Yes

Cash Flow

No

No

Return on Capital

Yes

Yes

EBITDA

Yes

Yes |

4

•

Flooring business separation

announcement

•

Review of fourth quarter

and full year 2014 results

•

2015 Outlook

Agenda |

5

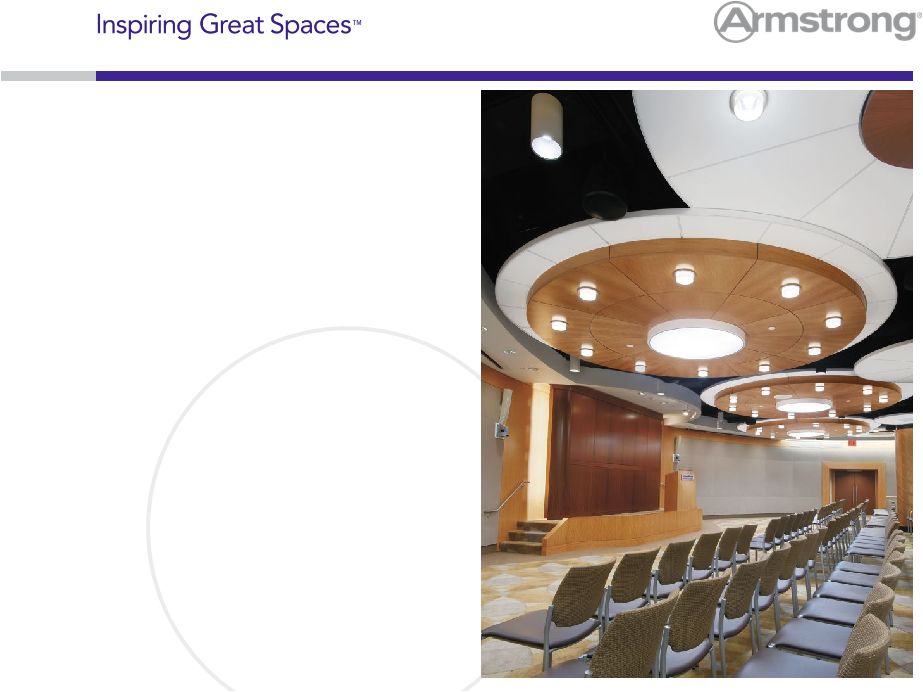

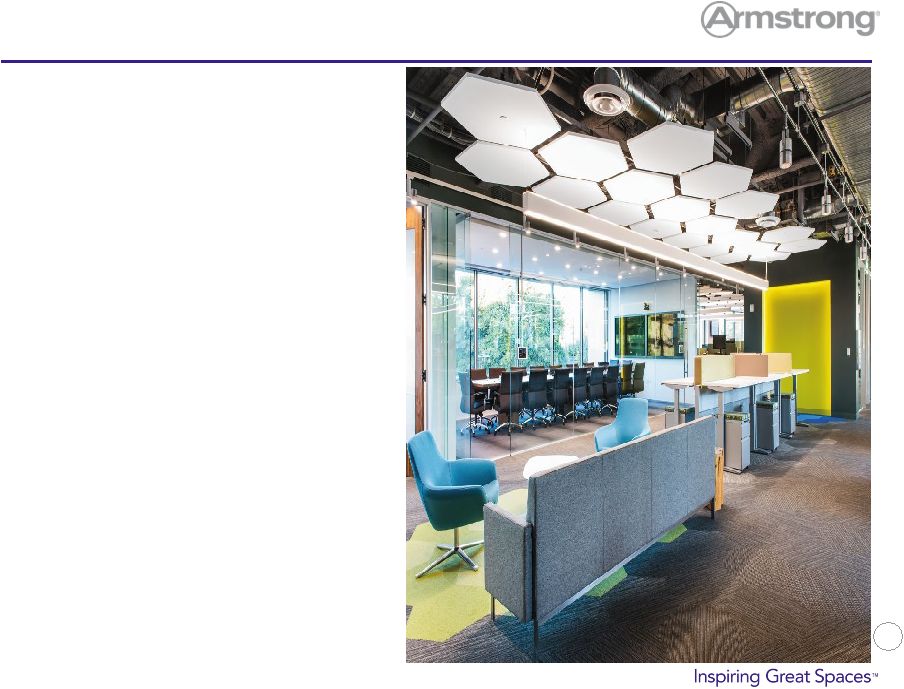

Creating Two Independent Industry Leaders

[Armstrong World Industries]

•

Global commercial suspended ceiling solutions provider

•

#1 market position in all major geographies

•

Poised to deliver margin expansion driven by recovery in

North American commercial

•

Recently completed investments in expanded sales and

manufacturing capabilities

•

Attractive opportunities for enhanced growth and margins,

including emerging markets

•

23 year WAVE JV delivered $68M of cash dividends and

$65M of equity earnings in 2014

Vic Grizzle

Chief Executive Officer

Key Statistics (2014 Year End)

$1.3B (95/5)

Revenue

(% Commercial vs. Residential)

$330M

*

Adjusted EBITDA

~3,400

Team Members

Worldwide

22

Manufacturing Facilities

in

8

Countries

†

100+

Countries Have Armstrong

Ceilings

[Armstrong Flooring ]

•

Dedicated hard surface flooring products designer and

manufacturer

•

Substantial margin expansion, driven by mix and

operating leverage

•

Positioned to benefit from expected recovery in North

American commercial

•

Significant growth opportunity in Asia

•

Well-positioned for both residential and non-residential

cyclical recoveries

Don Maier

Chief Executive Officer

Key Statistics (2014 Year End)

$1.2B (35/65)

Revenue

(% Commercial vs. Residential)

$114M

*

Adjusted EBITDA

~3,600

Team Members

Worldwide

17

Manufacturing Facilities

in 3

Countries

8,000,000+

Annual Visitors to

Global Websites

*

Does not include unallocated corporate expense of $60 million

†Including the WAVE JV |

6

•

Final approval of Armstrong’s Board of Directors

•

Receipt of opinion of counsel regarding the tax-free nature of the

separation •

Effectiveness of a Form S-1 filing with the Securities and Exchange

Commission

Principal

Closing

Conditions

Separation Details

•

Expected tax-free spin-off of AFP to current AWI shareholders

•

Expected completion in the first quarter of 2016, subject to customary

conditions

Structure and

Timing

•

Separation Management Office (SMO) to lead transition planning

•

Expect to enter into intercompany agreements for certain shared services

Transition

Management |

7

Enhanced Opportunities To Create Value

Two Companies With Distinct Operating Models, Market Dynamics, Capital

Needs and Distribution Channels, With Minimal Overlap and Synergies

Strategic

•

Increases flexibility to

pursue domestic and

international growth

opportunities

•

Sharpens focus on distinct

strategic priorities and

distribution channels

•

Closer alignment of

compensation/incentives to

performance

Operational

•

Little overlap, no significant

synergies from operating as

combined entity

•

Enhances ability to address

unique customer needs

•

Greater opportunity to build

stronger and more intimate

customer relationships

Financial

•

Optimized capital

structures to match

different risk and cash

flow profiles

•

Direct access to capital

markets to fund growth

agendas

•

Allows investors to better

assess each business on

its own merits |

8

Outlook

Positioning both businesses to succeed as independent companies

Both businesses more profitable in 2016

[Armstrong World

Industries] •

Volumes grow for the first time since 2008

•

Another solid year in the Americas

•

Profit growth in Europe, but challenges from

Russia and the Ruble

•

Growth continues in the Pacific Rim

[Armstrong Flooring

•

North America commercial up low single digits, Residential new and R&R both

up •

UK and Middle East improve, offset by soft Euro-zone and challenging

Russia •

China up except for high-end office, India strong, Australia mixed

•

Overall emerging markets challenged

Economic

Conditions

•

2015 is a year of investment in North America

•

Especially in the residential sector

•

Recapture volumes, reinvigorate products and

set the stage for 2016

•

LVT and Somerset investments come on-line in

2015 |

9

Financial Review

Financial Review |

10

European Flooring Exit –

2014 Guidance Impact

•

European Flooring Business

•

Announced decision to exit European flooring business in Q4 2014

•

Treated as discontinued operation starting in Q4 2014 and removed from historical

presentation within continuing operations

•

Results had previously been included in the Resilient segment

Q4 2014

FY 2014

October sales guidance

$610 -

$650 million

$2,680 -

$2,720 million

October EBITDA guidance

$55 -

$75 million

$355 -

$375 million

Estimated European Flooring sales

$50 million

$210 million

Estimated European Flooring EBITDA

($5) million

($10) million

Implied Guidance ranges excluding European Flooring

Sales

$560 -

$600M

$2,470 -

$2,510

EBITDA

$60 -

$80M

$365 -

$385 |

11

Key Metrics –

Fourth Quarter 2014

2014

2013

Variance

Net Sales

(1)

$595

$610

(2.5%)

Operating

Income

(2)

47

44

7.3%

% of Sales

8.0%

7.2%

80 bps

EBITDA

78

72

8.3%

% of Sales

13.2%

11.8%

140 bps

Earnings

Per

Share

(3)

$0.38

$0.35

6.9%

Free Cash Flow

49

(7)

768%

Net Debt

857

954

(97)

ROIC

(4)

7.7%

9.8%

(210 bps)

(1)

As reported Net Sales: $587 million in 2014 and $615 million in 2013

(2)

As reported Operating Income: $36 million in 2014 and $43 million in 2013

(3)

As reported EPS: $0.19 in 2014 and $0.42 in 2013

(4)

Unadjusted |

12

Fourth Quarter 2014 vs. PY–

Adjusted EBITDA to Reported Net Income

2014

2013

V

EBITDA–

Adjusted

$78

$72

$6

Depreciation and Amortization

(31)

(28)

(3)

Operating

Income

–

Adjusted

$47

$44

$3

Non-cash impact of U.S. pension

-

(1)

1

Foreign Exchange Movements

(1)

-

(1)

Impairment

10

-

10

Cost Reduction Initiatives

2

2

-

Operating

Income

–

As

Reported

$36

$43

($7)

Interest/Other (Expense)

(12)

(12)

-

EBT

$24

$31

($7)

Tax (Expense)

(13)

(8)

(5)

Net Income

$11

$23

($12) |

13

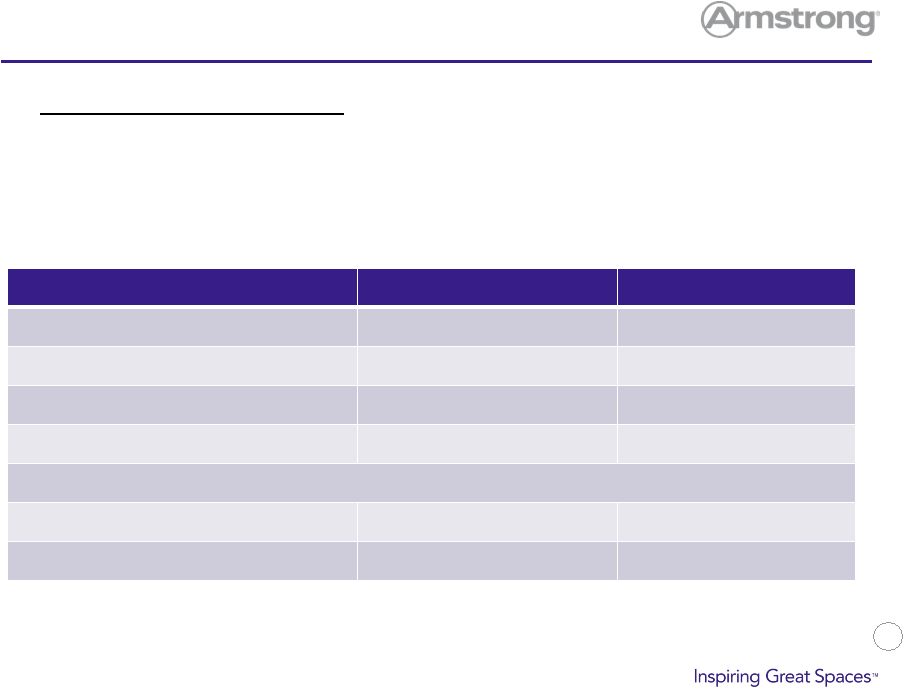

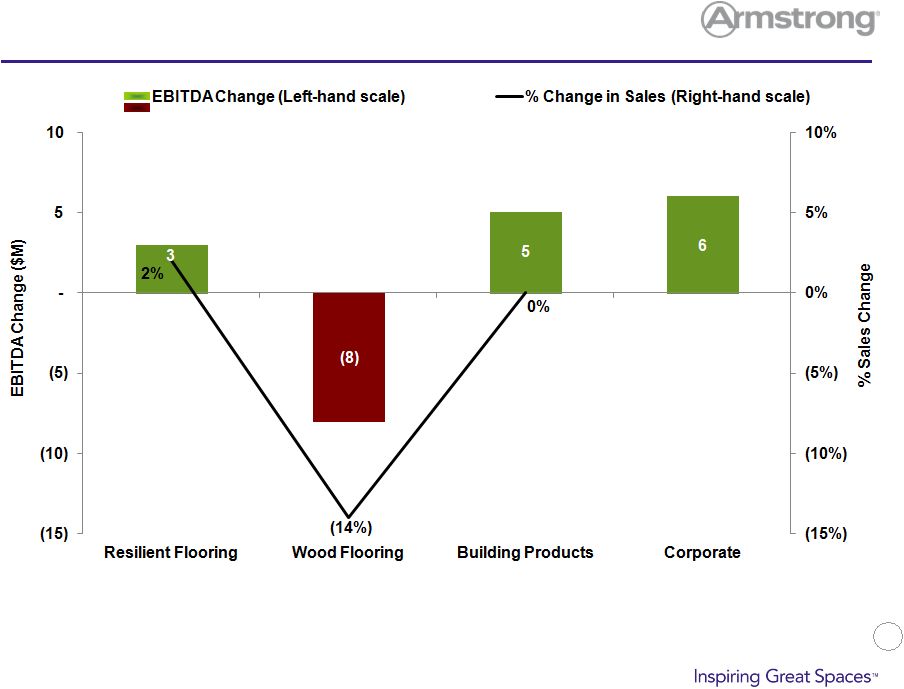

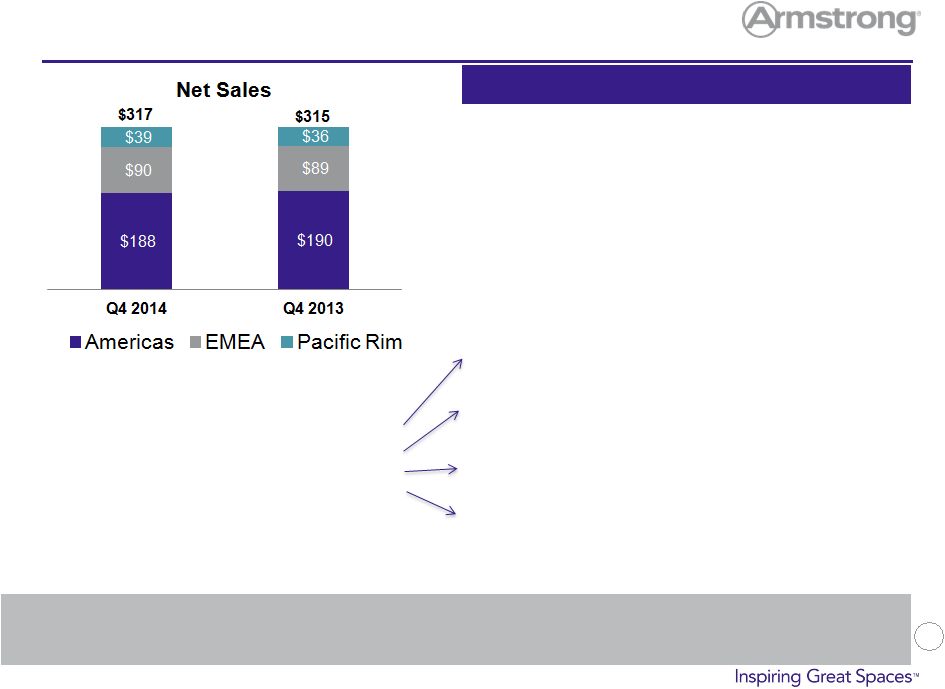

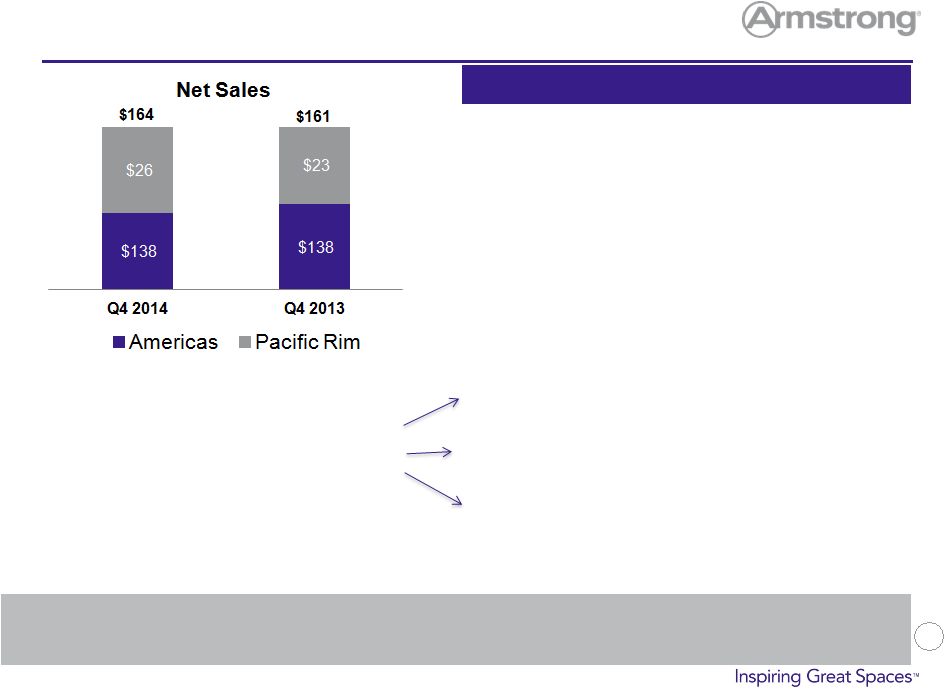

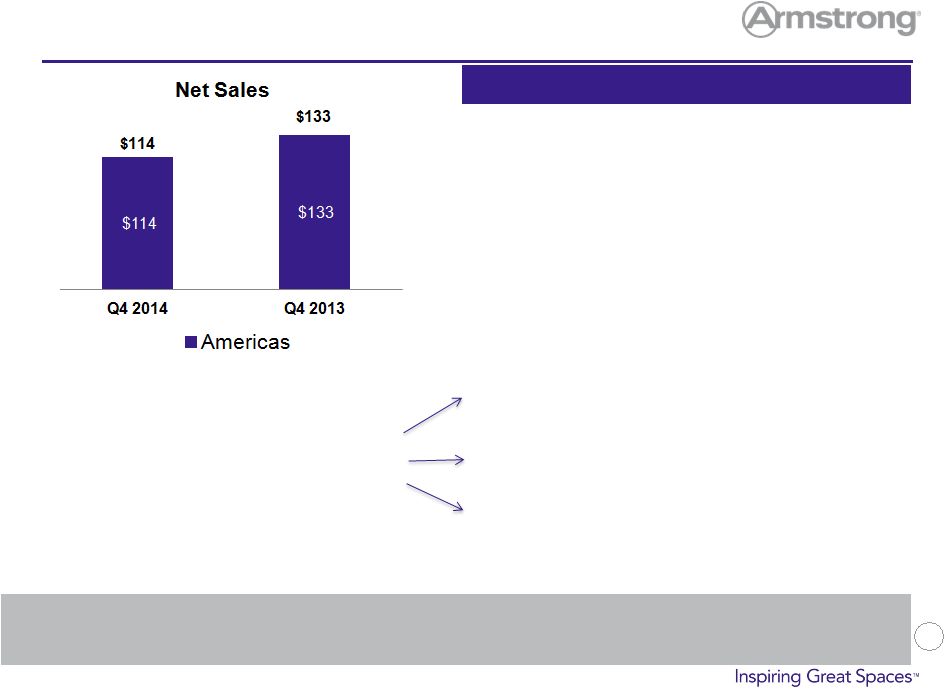

Fourth Quarter Sales and EBITDA by Segment –

2014 vs. Prior Year |

14

•

Sales increased slightly over a strong base period

(sales were up over 9% in the fourth quarter of 2013).

Price and mix both improved and were only partially

offset by lower volumes, primarily in the Americas.

•

Soft year-on-year retail activity driven by Lowes load-in

in 2013

•

Reflects impact of price increases announced earlier in

year and continued strong mix performance.

•

Driven by lower volumes in the Americas.

•

Strong productivity in the Americas more than offset

increased costs associated with Russia plant

construction and higher input costs.

•

Lower SG&A spending in the Americas and Pacific Rim

Building Products Fourth Quarter Results

Margin improvement demonstrates strong operating leverage as adjusted EBITDA

improved 7% despite volume declines and higher plant construction and input

costs Key Highlights

Q4 2013 Adjusted EBITDA

$ 68M

Price & Mix

8

Volume

(9)

Manufacturing & Input Costs

4

SG&A

2

Q4 2014 Adjusted EBITDA

$ 73M |

15

•

Sales increased slightly as strength in the Pacific Rim

offset lower volumes in the Americas. Mix

improvements in the Americas offset the lower

volumes.

•

With commercialization of the two plants in China

completed, volumes in China were up over 30%.

•

Driven by positive mix performance in the Americas

and Pacific Rim.

•

Double digit volume growth in the Pacific Rim was

more than offset by lower volumes in the Americas.

•

Strong productivity offset input cost inflation

Resilient Fourth Quarter Results

Improved results in the Pacific Rim and strong global productivity drove margin

improvement

Key Highlights

Q4 2013 Adjusted EBITDA

$ 18M

Price & Mix

1

Volume

(1)

Manufacturing & Input Costs

3

Q4 2014 Adjusted EBITDA

$ 21M |

16

•

Sales declined 15% despite improvements in price and

mix as pricing actions by competitors resulted in lower

volumes.

•

The comparison was impacted by a strong base period

(sales were up over 20% in the fourth quarter of 2013).

•

Reflects impact of price increases announced earlier in

the year as a result of higher lumber costs and

continued mix improvements.

•

Lower volumes driven by share loss at opening price

points.

•

Continued increases year on year in lumber costs.

Wood Fourth Quarter Results

Despite improved price and mix performance, sales and margins decline due to

lower volumes and continued elevated lumber pricing

Key Highlights

Q4 2013 Adjusted EBITDA

$ 4M

Price & Mix

9

Volume

(10)

Manufacturing & Input Costs

(6)

SG&A

(1)

Q4 2014 Adjusted EBITDA

$ (4M) |

17

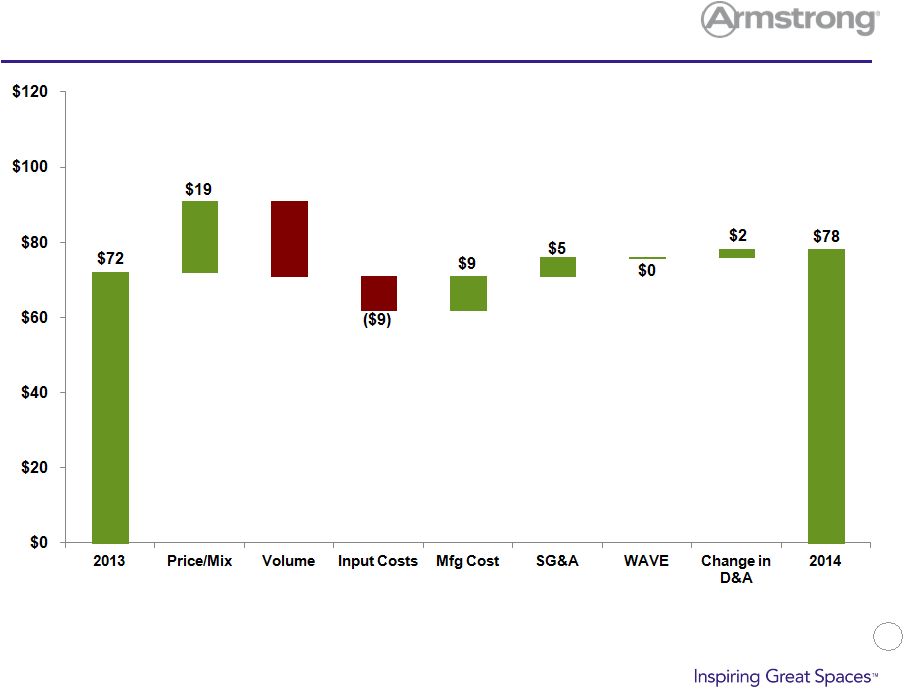

EBITDA Bridge –

Fourth Quarter 2014 vs. Prior Year

($20) |

18

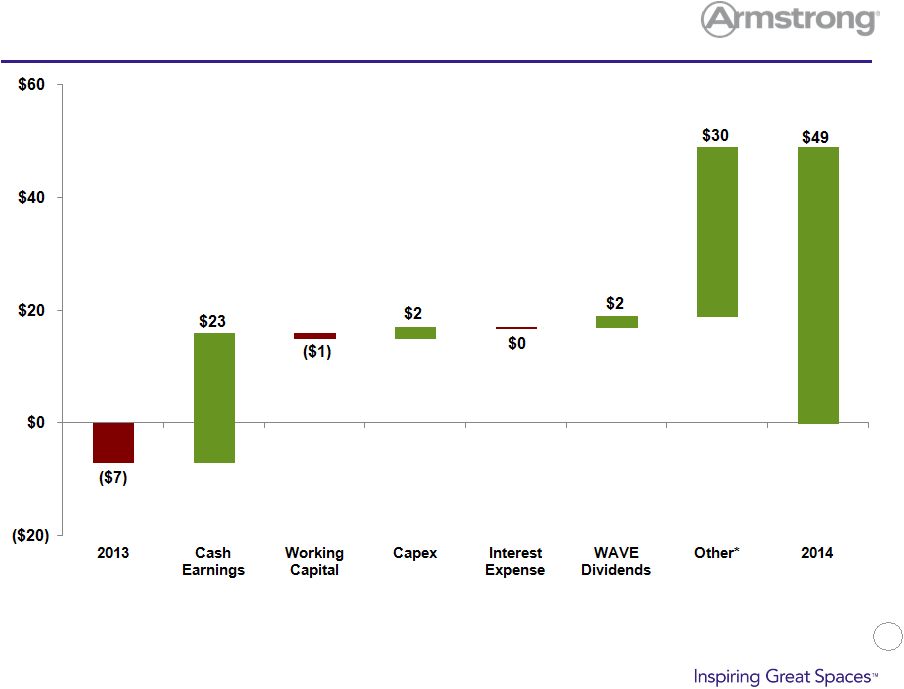

Free

Cash

Flow

–

Fourth

Quarter

2014

vs.

Prior

Year

* Includes $24 million associated with the closing of intercompany loan hedges

|

19

Key Metrics –

Full Year 2014

2014

2013

Variance

Net

Sales

(1)

$2,515

$2,508

0.3%

Operating

Income

(2)

266

269

(1.3%)

% of Sales

10.6%

10.7%

(10 bps)

EBITDA

384

372

3.2%

% of Sales

15.3%

14.8%

50 bps

Earnings

Per

Share

(3)

$2.32

$2.11

10.1%

Free Cash Flow

64

68

(6.3%)

(1)

As

reported

Net

Sales:

$2,515

million

in

2014

and

$2,527

million

in

2013

(2)

As reported Operating Income: $239 million in 2014 and $266 million in 2013

(3)

As reported EPS: $1.83 in 2014 and $2.17 in 2013 |

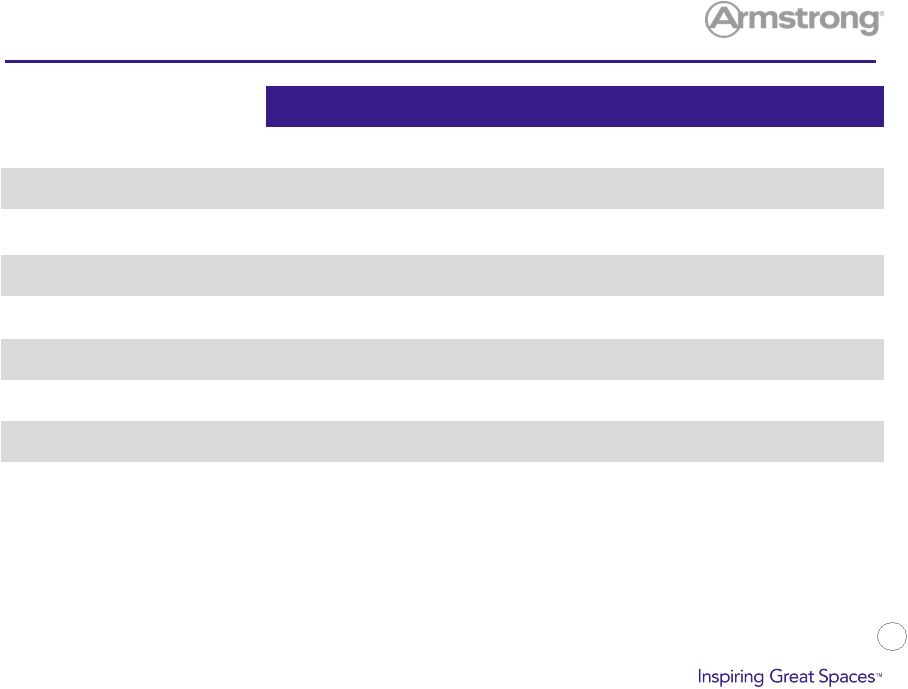

20

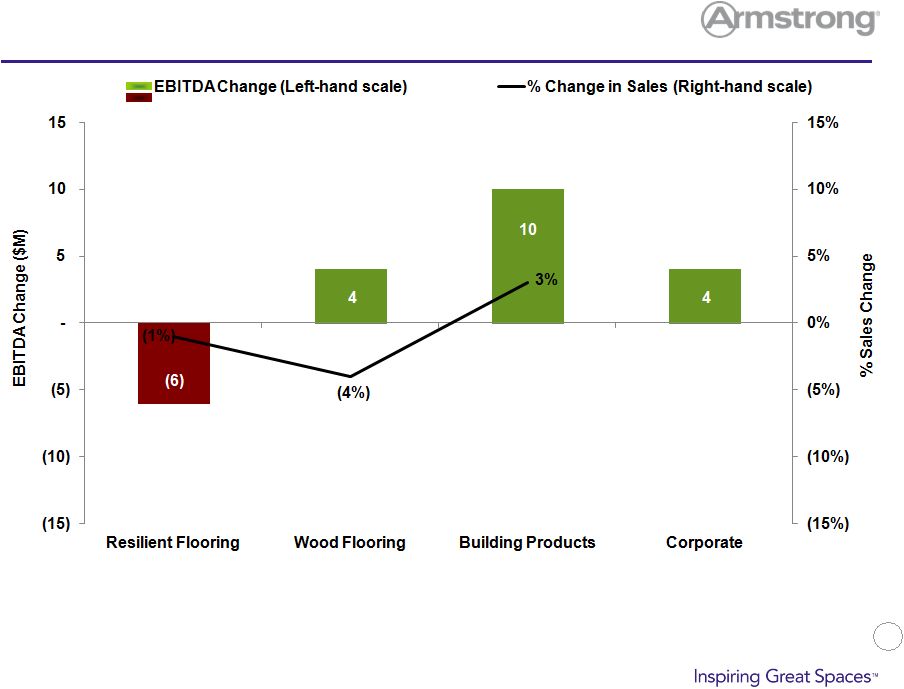

Full Year Sales and EBITDA by Segment –

2014 vs. Prior Year |

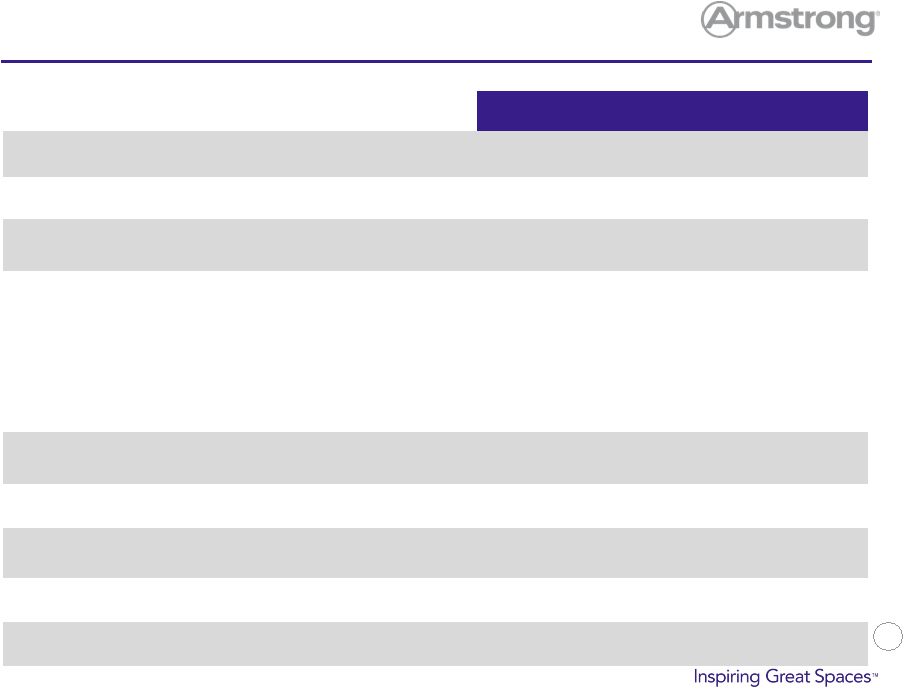

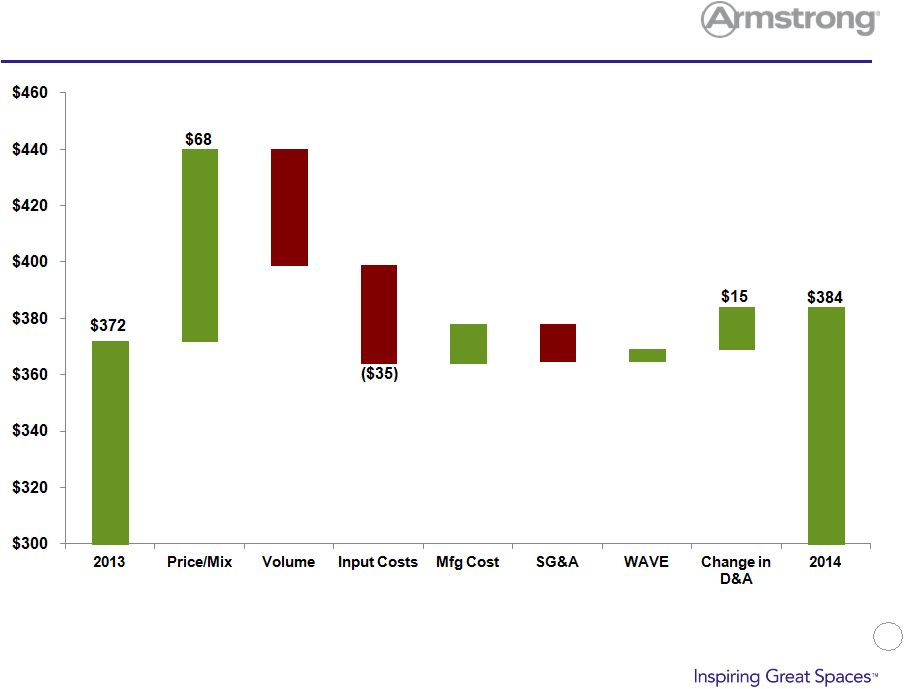

21

EBITDA Bridge –

Full Year 2014 vs. Prior Year

($13)

($41)

$4

$14 |

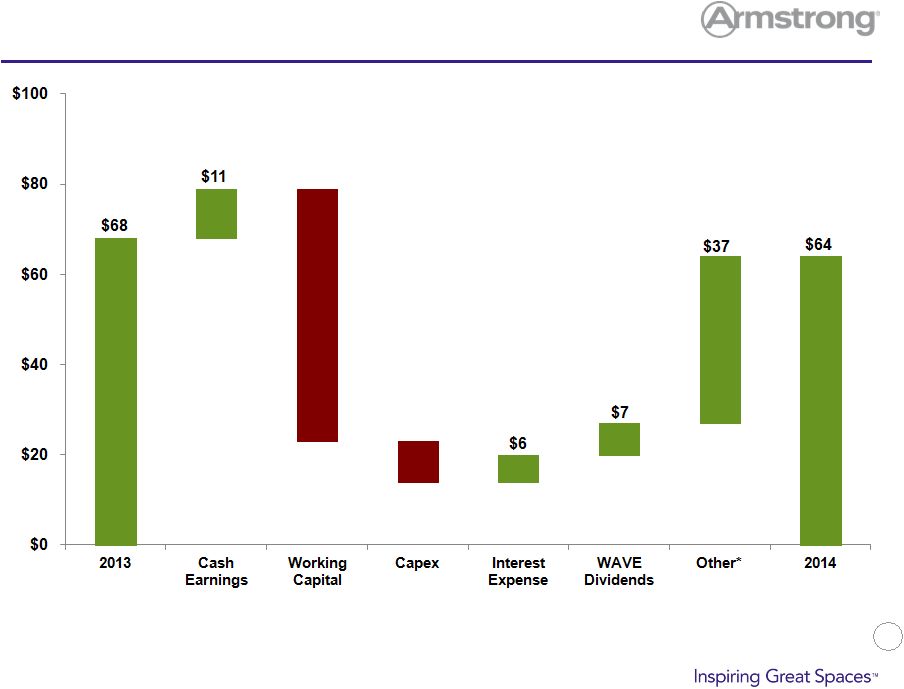

22

Free

Cash

Flow

–

Full

Year

2014

vs.

Prior

Year

($56)

($9)

* Includes $29 million associated with the closing of intercompany loan hedges

|

23

2015 Estimate Range

(1)

2014

(2)

Variance

Net Sales

(3)

2,525

to

2,625

2,515

0%

to

4%

Operating Income

(4)

230

to

270

271

(15%)

to

(1%)

EBITDA

350

to

390

389

(10%)

to

0%

Earnings Per Share

(5)

$2.05

to

$2.45

$2.38

(14%)

to

3%

(1)

Guidance is presented using 2015 budgeted foreign exchange rates

(2)

2014 results are presented using 2015 budgeted foreign exchange rates

(3)

2015 and 2014 net sales include the impact of foreign exchange

(4)

As reported Operating Income: $175 -

$215 million in 2015 and $239 million 2014

(5)

As reported earnings per share: $1.25 -

$1.60

in 2015 and $1.83 in 2014

Key Metrics –

Guidance 2015 |

24

2015 Financial Outlook

Sales

(1)

$1,300-$1,350 million; EBITDA $335-$360 million

Sales

(1)

$1,225-$1,275 million; EBITDA $80-$100 million

EBITDA ($65) –

($70)

$45 -

$55 million; Adjusted long-term ETR of ~39%

(2)

$125 -

$150 million

Non-cash:

$22 -

$28 million US pension expense

Cash:

$20 -

$40 million transaction costs

ABP Segment

AFP

Segment

Cash Taxes/ETR

Capital Spending

Exclusions from EBITDA

(1)

Net sales include foreign exchange impact

(2)

As reported ETR of 47% for 2015

Corporate Segment |

25

Appendix |

26

Full Year 2014 vs. Prior Year –

Adjusted EBITDA to Reported Net Income

2014

2013

V

EBITDA–

Adjusted

$384

$372

$12

Depreciation and Amortization

(118)

(103)

(15)

Operating

Income

–

Adjusted

$266

$269

($3)

Non-cash impact of U.S. pension

1

(2)

3

Foreign Exchange Movements

(1)

(2)

1

Impairments

13

-

13

Cost Reduction Initiatives

14

7

7

Operating

Income

–

As

Reported

$239

$266

($27)

Interest/Other (Expense)

(54)

(67)

13

EBT

$185

$199

($14)

Tax (Expense)

(83)

(72)

(11)

Net Income

$102

$127

($25) |

27

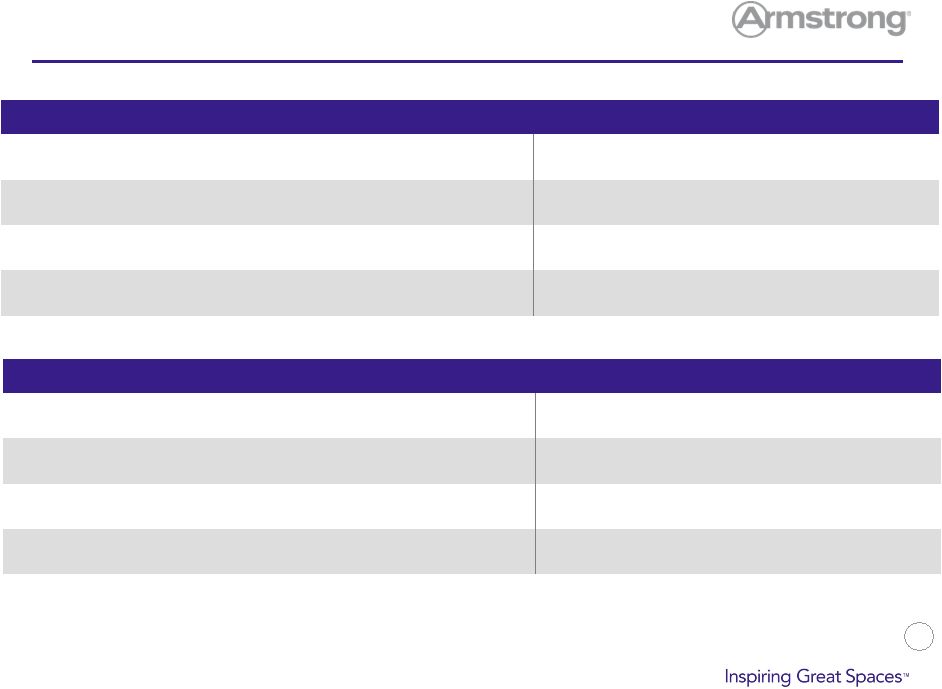

Consolidated Results

Fourth Quarter

2014

Reported

Comparability

(1)

Adjustments

FX

(2)

Adj

2014

Adjusted

2013

Reported

Comparability

(1)

Adjustments

FX

(2)

Adj

2013

Adjusted

Net Sales

587

-

8

595

615

-

(5)

610

Operating

Income

36

12

(1)

47

43

1

-

44

EPS

$0.19

$0.20

($0.01)

$0.38

$0.42

($0.07)

-

$0.35

Full Year

2014

Reported

Comparability

(1)

Adjustments

FX

(2)

Adj

2014

Adjusted

2013

Reported

Comparability

(1)

Adjustments

FX

(2)

Adj

2013

Adjusted

Net Sales

2,515

-

-

2,515

2,527

-

(19)

2,508

Operating

Income

239

28

(1)

266

266

5

(2)

269

EPS

$1.83

$0.50

($0.01)

$2.32

$2.17

($0.04)

($0.02)

$2.11

(1)

See earnings press release and 10-K for additional detail on comparability

adjustments (2)

Eliminates impact of foreign exchange movements |

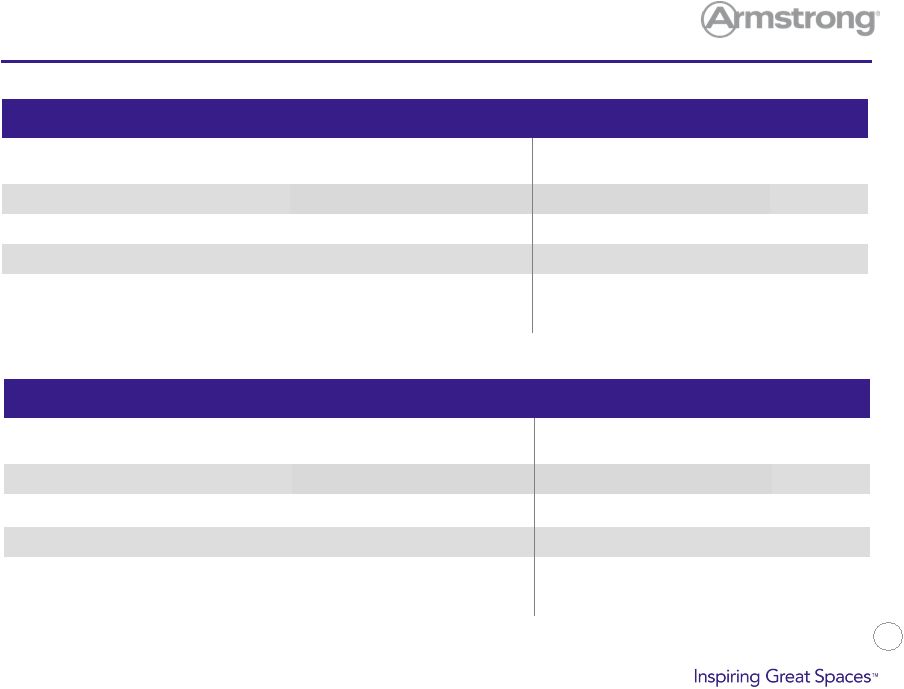

28

Segment Operating Income (Loss)

Fourth Quarter

2014

Reported

Comparability

(1)

Adjustments

2014

Adjusted

2013

Reported

Comparability

(1)

Adjustments

2013

Adjusted

Building Products

55

-

55

52

1

53

Resilient Flooring

16

(1)

15

10

1

11

Wood Flooring

(19)

12

(7)

0

-

0

Unallocated Corporate

(Expense) Income

(16)

-

(16)

(19)

(1)

(20)

Full Year

2014

Reported

Comparability

(1)

Adjustments

2014

Adjusted

2013

Reported

Comparability

(1)

Adjustments

2013

Adjusted

Building Products

265

(2)

263

263

-

263

Resilient Flooring

61

5

66

70

3

73

Wood Flooring

(2)

(15)

23

8

6

-

6

Unallocated Corporate

(Expense) Income

(72)

1

(71)

(73)

-

(73)

(1)

Eliminates impact of foreign exchange movements and non-recurring items; see

earnings press release and 10-K for additional detail. (2)

Includes a $1 million gain in the second quarter of 2014 related

to a refund of previously paid duties on imports of engineered wood flooring

|

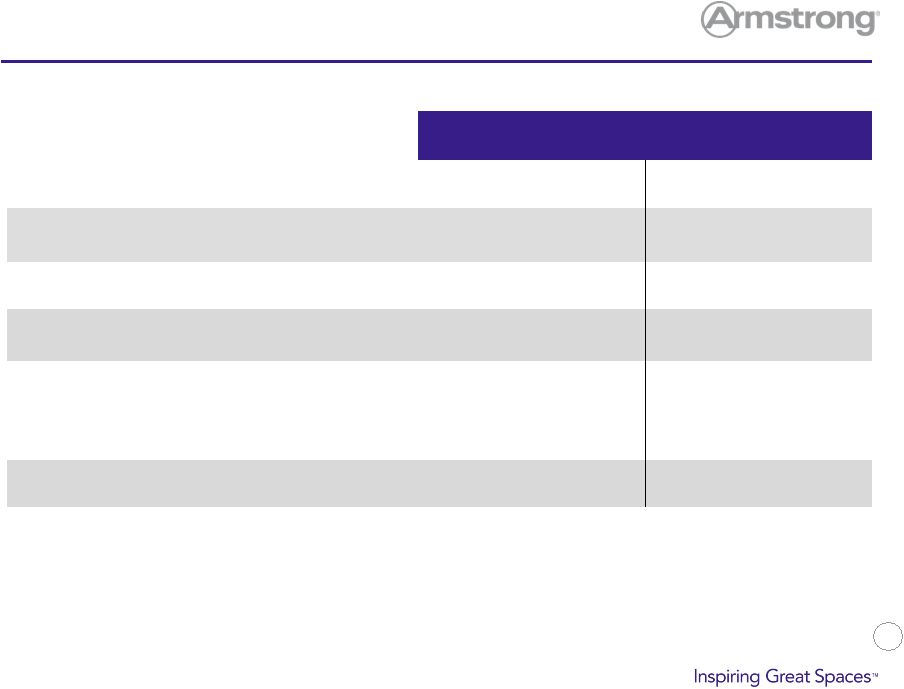

29

Cash Flow

Fourth Quarter

Full Year

($ millions)

2014

2013

2014

2013

Net cash from operations

$98

$52

$209

$214

Net cash (used for) investing

(52)

(59)

(149)

(146)

Add back (subtract) adjustments to reconcile to

free cash flow

Net cash effect from deconsolidation of

European Flooring business

4

-

4

-

Other

(1)

-

-

-

Free Cash Flow

$49

($7)

$64

$68

Cash flow includes cash flows attributable to the European flooring business

|