Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BRADY CORP | form8-kearningsreleasex131.htm |

| EX-99.2 - ADDITIONAL ANNOUNCEMENT - BRADY CORP | exhibit992-hsirkinpressrel.htm |

| EX-99.1 - SECOND QUARTER FISCAL 2015 PRESS RELEASE - BRADY CORP | exhibit991-financials.htm |

February 19, 2015 Brady Corporation F’15 Q2 Financial Results

2 Forward-Looking Statements In this presentation, statements that are not reported financial results or other historic information are “forward-looking statements.” These forward-looking statements relate to, among other things, the Company's future financial position, business strategy, targets, projected sales, costs, earnings, capital expenditures, debt levels and cash flows, and plans and objectives of management for future operations. The use of words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “project” or “plan” or similar terminology are generally intended to identify forward-looking statements. These forward-looking statements by their nature address matters that are, to different degrees, uncertain and are subject to risks, assumptions, and other factors, some of which are beyond Brady's control, that could cause actual results to differ materially from those expressed or implied by such forward- looking statements. For Brady, uncertainties arise from: implementation of the healthcare strategy; implementation of the Workplace Safety strategy; future competition; risks associated with restructuring plans; future financial performance of major markets Brady serves, which include, without limitation, telecommunications, hard disk drive, manufacturing, electrical, construction, laboratory, education, governmental, public utility, computer, healthcare and transportation; technology changes and potential security violations to the Company's information technology system; fluctuations in currency rates versus the U.S. dollar; risks associated with international operations; difficulties associated with exports; Brady's ability to develop and successfully market new products; risks associated with identifying, completing, and integrating acquisitions; changes in the supply of, or price for, parts and components; increased price pressure from suppliers and customers; Brady's ability to retain significant contracts and customers; risk associated with loss of key talent; risks associated with divestitures and businesses held for sale; risks associated with obtaining governmental approvals and maintaining regulatory compliance; risk associated with product liability claims; environmental, health and safety compliance costs and liabilities; potential write-offs of Brady's substantial intangible assets; risks associated with our ownership structure; unforeseen tax consequences; Brady's ability to maintain compliance with its debt covenants; increase in our level of debt; and numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive, and regulatory nature contained from time to time in Brady's U.S. Securities and Exchange Commission filings, including, but not limited to, those factors listed in the “Risk Factors” section within Item 1A of Part I of Brady’s Form 10-K for the year ended July 31, 2014. These uncertainties may cause Brady's actual future results to be materially different than those expressed in its forward-looking statements. Brady does not undertake to update its forward-looking statements except as required by law.

3 Summary Comments Significant 2nd Quarter Events: • Organic sales growth of 1.4%. • Non-GAAP earnings per share* growth of 16%. • Facility consolidation costs moderating with completion anticipated by the end of fiscal 2015. F’15 Priorities: • Facility Consolidations – Complete this process to optimize customer service, operational performance & financial results. • Operational Excellence – Deliver the best possible end-to-end customer experience. • Emerging Technologies – Invest in emerging technologies. • Innovation Development Process – Develop and deliver the highest-value new products in a timely manner. • Focused Market Sales Expansion – Drive sales growth in selected vertical markets. • One Digital Platform – Drive towards a single platform to sell more products to more customers. * Net Earnings from Continuing Operations, Excluding Certain Items and Net Earnings from Continuing Operations Per Class A Diluted Nonvoting Share Excluding Certain Items, are non-GAAP measures. See appendix.

4 Q2 F’15 Financial Summary • Sales down 2.9% to $282.6M vs. $291.2M in Q2 of F’14. – Organic sales growth of 1.4% while foreign currency decreased sales by 4.3%. • Gross profit margin of 48.9% in Q2 of F’15, consistent with Q2 of F’14 and up 50 basis points from Q1 of F’15. • SG&A expense of $107.6M (38.1% of sales) in Q2 of F’15 vs. $111.4M (38.3% of sales) in Q2 of F’14. • Net earnings from continuing operations grew 10.1% to $11.6M in Q2 of F’15 vs. $10.5M in Q2 of F’14. – Non-GAAP Net Earnings from Continuing Operations* grew 12.5% to $15.0M in Q2 of F’15 vs. $13.4M in Q2 of F’14. • Net earnings from continuing operations per Class A Diluted Nonvoting Share growth of 15.0% to $0.23 in Q2 of F’15 vs. $0.20 in Q2 of F’14. – Non-GAAP Net Earnings from Continuing Operations per Class A Diluted Nonvoting Share* growth of 16.0% to $0.29 in Q2 of F’15 vs. $0.25 in Q2 of F’14. * Net Earnings from Continuing Operations, Excluding Certain Items and Net Earnings from Continuing Operations Per Class A Diluted Nonvoting Share Excluding Certain Items, are non-GAAP measures. See appendix.

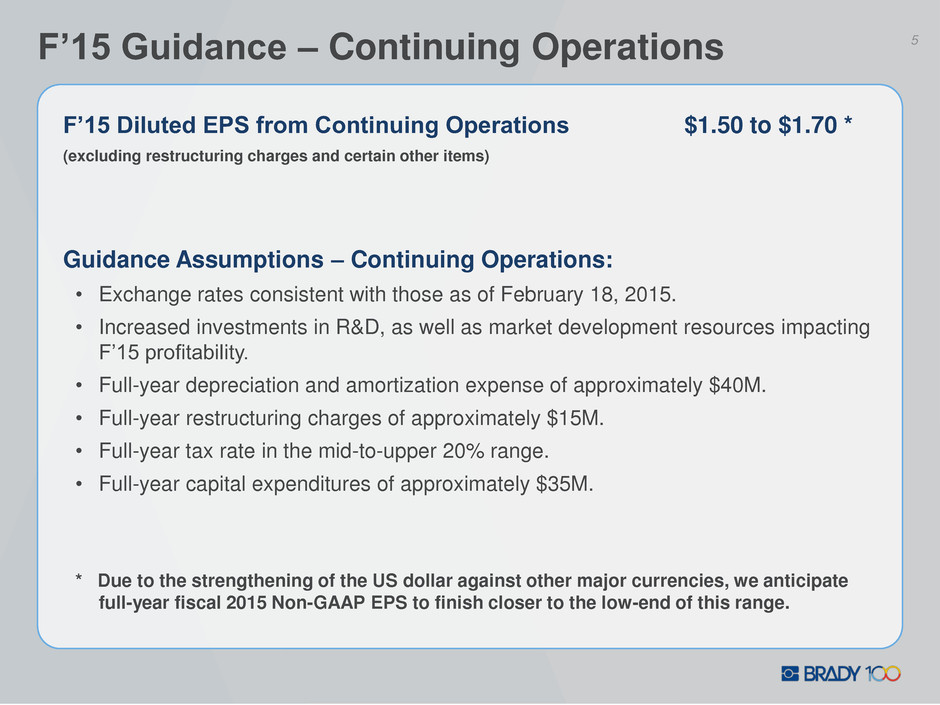

5 F’15 Guidance – Continuing Operations F’15 Diluted EPS from Continuing Operations $1.50 to $1.70 * (excluding restructuring charges and certain other items) Guidance Assumptions – Continuing Operations: • Exchange rates consistent with those as of February 18, 2015. • Increased investments in R&D, as well as market development resources impacting F’15 profitability. • Full-year depreciation and amortization expense of approximately $40M. • Full-year restructuring charges of approximately $15M. • Full-year tax rate in the mid-to-upper 20% range. • Full-year capital expenditures of approximately $35M. * Due to the strengthening of the US dollar against other major currencies, we anticipate full-year fiscal 2015 Non-GAAP EPS to finish closer to the low-end of this range.

6 Sales Overview • 1.4% organic sales growth: • ID Solutions – Organic sales growth of 1.9%. • Workplace Safety – Organic sales growth of 0.6%. • 4.3% decrease due to currency translation. Q2 F’15 SALES: • Organic growth trends continue in both the IDS and WPS platforms. • The strengthening of the U.S. dollar is having a significant impact on reported sales. Q2 F’15 SALES COMMENTARY: $200 $225 $250 $275 $300 $325 Q3 F'12 0.9% Q4 F'12 1.9% Q1 F'13 (0.8%) Q2 F'13 (1.8%) Q3 F'13 (4.8%) Q4 F'13 (2.1%) Q1 F'14 (2.1%) Q2 F'14 (1.1%) Q3 F'14 2.5% Q4 F'14 1.1% Q1 F'15 2.4% Q2 F'15 1.4%Organic Sales Growth SALES (millions of USD)

Gross Profit Margin & SG&A Expense 7 • GPM of 48.9% in Q2 of F’15 compared to 48.9% in Q2 of F’14 and 48.4% in Q1 of F’15. • Costs related to facility consolidation activities beginning to moderate. We expect these activities to be completed by July 31, 2015. GROSS PROFIT MARGIN: • SG&A expense was down $3.8M to $107.6M in Q2 of F’15 compared to $111.4M in Q2 of F’14. • SG&A expense was down vs. the prior year due to lower amortization expense and cost containment in general and administrative expenses. • Savings in G&A were partially reinvested in sales personnel in IDS and digital and catalog advertising in WPS. SG&A EXPENSE: $151 $148 $150 $142 $159 $158 $158 $143 $155 $154 $150 $138 56% 55% 55% 52% 53% 51% 51% 49% 50% 49% 48% 49% 25% 30% 35% 40% 45% 50% 55% 60% $100 $150 $200 Q3 F'12 Q4 F'12 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 GROSS PROFIT & GPM% (millions of USD) $98 $100 $99 $110 $112 $107 $113 $111 $117 $111 $109 $108 36% 37% 36% 40% 37% 34% 37% 38% 38% 35% 35% 38% 20% 25% 30% 35% 40% 45% $50 $100 $150 $200 Q3 F'12 Q4 F'12 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 SG&A and SG&A% as of SALES (millions of USD)

8 Net Earnings & EPS From Continuing Operations–Non-GAAP* * Non-GAAP Net Earnings from Continuing Operations and Non-GAAP Net Earnings from Continuing Operations Per Class A Diluted Nonvoting Share are non-GAAP measures. See appendix. • Q2 F’15 Non-GAAP net earnings from continuing operations* were up 12.5% to $15.0M compared to $13.4M in Q2 of F’14. • Year-on-year earnings growth driven by organic sales growth and cost containment in SG&A expenses. • Lower income tax rate in Q2 of F’15 providing benefit. Q2 F’15 – Non-GAAP Earnings* • Q2 F’15 Non-GAAP diluted EPS from continuing operations* grew 16.0% to $0.29 compared to $0.25 in Q2 of F’14. Q2 F’15 – Non-GAAP EPS* $0.56 $0.57 $0.51 $0.38 $0.55 $0.55 $0.43 $0.25 $0.43 $0.41 $0.36 $0.29 $0.00 $0.20 $0.40 $0.60 Q3 F'12 Q4 F'12 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 NET EARNINGS FROM CONTINUING OPERATIONS PER CLASS A DILUTED NONVOTING SHARE, EXCLUDING CERTAIN ITEMS* $29 $30 $26 $20 $29 $29 $23 $13 $22 $21 $18 $15 $0 $10 $20 $30 $40 Q3 F'12 Q4 F'12 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 NET EARNINGS FROM CONTINUING OPERATIONS, EXCLUDING CERTAIN ITEMS* (millions of USD)

9 Cash Generation • Cash flow from operating activities of $5.3M in Q2 of F’15. • Returned $10.3M to our shareholders in the form of dividends. CASH FLOWS IN Q2 OF F’15:

Net Debt & EBITDA 10 0.1 1.4 1.3 1.2 1.2 1.3 1.5 1.2 1.2 1.2 0.0x 0.5x 1.0x 1.5x Q3 F'12 Q4 F'12 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 NET DEBT / TTM EBITDA* • January 31, 2015 Cash = $93.3M, Debt = $277.1M (net debt = $183.8M), and TTM EBITDA (continuing operations) = $147.3M. • Net Debt/EBITDA* = 1.2:1. • Balance sheet continues to improve and provides flexibility for future cash uses. STRONG BALANCE SHEET: * EBITDA is a non-GAAP measure. See appendix for the reconciliation of net income to EBITDA. $10 $297 $261 $222 $210 $209 $221 $181 $174 $184 $0 $50 $100 $150 $200 $250 $300 Q3 F'12 Q4 F'12 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 NET DEBT (millions of USD)

Q2 F’15 vs. Q2 F’14 PERFORMANCE (millions of USD) 11 Identification Solutions • Revenues down 1.4%: • Organic = +1.9% • Fx = -(3.3)% • Organic sales growth strongest in Wire ID and Safety & Facility ID product categories. • Increased product demand and a commitment to maintain quality and service levels to our customers has resulted in the need to carry additional costs while consolidating manufacturing sites. • Facility consolidation activities still providing cost challenges, but nearing completion. Q2 F’15 SUMMARY: • Expect low single-digit organic sales growth for the remainder of F’15. • Expect segment profit as a % of sales to approximate 20% in fiscal 2015. OUTLOOK: Q2 F’15 Q2 F’14 Change Sales $ 192.1 $ 194.7 - 1.4 % Segment Profit 35.7 37.5 - 4.8% Segment Profit % 18.6% 19.3% - 0.7 pts 24% 23% 24% 19% 22% 20% 21% 19% 0% 5% 10% 15% 20% 25% $0 $50 $100 $150 $200 $250 $300 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 SALES & SEGMENT PROFIT % (millions of USD)

Q2 F’15 vs. Q2 F’14 PERFORMANCE (millions of USD) 12 Workplace Safety • Revenues down 6.1%: • Organic = +0.6%. • Fx = -(6.7)%. • Third consecutive quarter of organic growth driven by increased catalog advertising spend, selected price increases, and sales over the internet. • Strengthening of the US dollar had a more significant impact on this business as approximately half of WPS revenues are generated in Western Europe. • Segment profit of 14.1% is below the prior year due to increased catalog advertising and digital spending. Q2 F’15 SUMMARY: • Low single digit organic sales growth anticipated for the full-year ending July 31, 2015. • Anticipate segment profit as a % of sales to improve in the second half of the fiscal year and get back the rate we experienced in the last quarter of F’14. OUTLOOK: Q2 F’15 Q2 F’14 Change Sales $ 90.6 $ 96.5 - 6.1% Segment Profit 12.8 14.7 - 12.9% Segment Profit % 14.1% 15.2% - 1.1 pts 22% 21% 19% 15% 14% 18% 16% 14% 0% 5% 10% 15% 20% 25% $0 $50 $100 $150 $200 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 SALES & SEGMENT PROFIT % (millions of USD)

13 Investor Relations Brady Contact: Ann Thornton Investor Relations 414-438-6887 Ann_Thornton@Bradycorp.com See our web site at www.investor.bradycorp.com

Appendix 14

COMPARABLE INCOME STATEMENTS (millions of USD) 15 Comparable Income Statements

(‘000s of USD) 16 Debt Structure

Brady is presenting EBITDA because it is used by many of our investors and lenders, and is presented as a convenience to them. EBITDA represents net earnings before interest expense, income taxes, depreciation, amortization and impairment charges. EBITDA is not a calculation based on generally accepted accounting principles ("GAAP"). The amounts included in the EBITDA calculation, however, are derived from amounts included in the Consolidated Statements of Earnings data. EBITDA should not be considered as an alternative to net earnings or operating income as an indicator of the Company's operating performance, or as an alternative to net cash provided by operating activities as a measure of liquidity. The EBITDA measure presented may not always be comparable to similarly titled measures reported by other companies due to differences in the components of the calculation. EBITDA - Total Company (‘000s of USD) 17 EBITDA Reconciliation – Total Company

Brady is presenting EBITDA from Continuing Operations because it is used by many of our investors and lenders, and is presented as a convenience to them. EBITDA from Continuing Operations represents earnings from continuing operations before interest expense, income taxes, depreciation, amortization and impairment charges. EBITDA from Continuing Operations is not a calculation based on generally accepted accounting principles ("GAAP"). The amounts included in the EBITDA from Continuing Operations calculation, however, are derived from amounts included in the Consolidated Statements of Earnings data. EBITDA from Continuing Operations should not be considered as an alternative to net earnings or operating income as an indicator of the Company's operating performance, or as an alternative to net cash provided by operating activities as a measure of liquidity. The EBITDA from Continuing Operations measure presented may not always be comparable to similarly titled measures reported by other companies due to differences in the components of the calculation. EBITDA - Continuing Operations (‘000s of USD) 18 EBITDA Reconciliation – Continuing Operations

Brady is presenting the Non-GAAP measure "Net Earnings from Continuing Operations Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this Non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our sustainable results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of Net Earnings from Continuing Operations to Net Earnings from Continuing Operations Excluding Certain Items: Reconciliation of Non-GAAP Net Earnings from Continuing Operations (‘000s of USD) 19 Non-GAAP Earnings from Continuing Operations

Brady is presenting the Non-GAAP measure "Net Earnings from Continuing Operations Per Diluted Class A Nonvoting Common Share Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this Non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our sustainable results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of Net Earnings from Continuing Operations Per Diluted Class A Nonvoting Common Share to Net Earnings from Continuing Operations Per Diluted Class A Nonvoting Common Share Excluding Certain Items: Reconciliation of Non-GAAP Net Earnings from Continuing Operations per Diluted Class A Nonvoting Share 20 Non-GAAP EPS from Continuing Operations