Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - Sow Good Inc. | blackridge_8k.htm |

| EX-99.2 - PRESS RELEASE - Sow Good Inc. | blackridge_8k-ex9902.htm |

Exhibit 99.1

EnerCom The Oil and Services Conference OTCQB: ANFC Focused Growth in the Williston Basin February 18, 2015

Forward Looking Statements www.blackridgeoil.com 2 Statements made by representatives of Black Ridge Oil & Gas, Inc . (“Black Ridge” or the “Company”) during the course of this presentation that are not historical facts are “forward-looking statements” within the meaning of federal securities laws . These statements are based on certain assumptions and expectations made by the Company which reflect management’s experience, estimates and perception of historical trends, current conditions, anticipated future developments and other factors believed to be appropriate . No assurances can be given that such assumptions and expectations will occur as anticipated and actual results may differ materially from those implied or anticipated in the forward looking statements . Such statements are subject to a number of risks and uncertainties, many of which are beyond the control of the Company, and which include risks relating to the global financial crisis, our ability to obtain additional capital needed to implement our business plan, declines in prices and demand for gas, oil and natural gas liquids, loss of key personnel, lack of business diversification, reliance on strategic third-party relationships, ability to obtain rights to explore and develop oil and gas reserves, the rate of in - fill drilling on our leased acreage, financial performance and results, our indebtedness under our line of credit, our ability to replace reserves and efficiently develop our current reserves, our ability to make acquisitions on economically acceptable terms, our ability to effectively utilize hedging, our ability to become listed on a national exchange, and other important factors . Black Ridge undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information or future events .

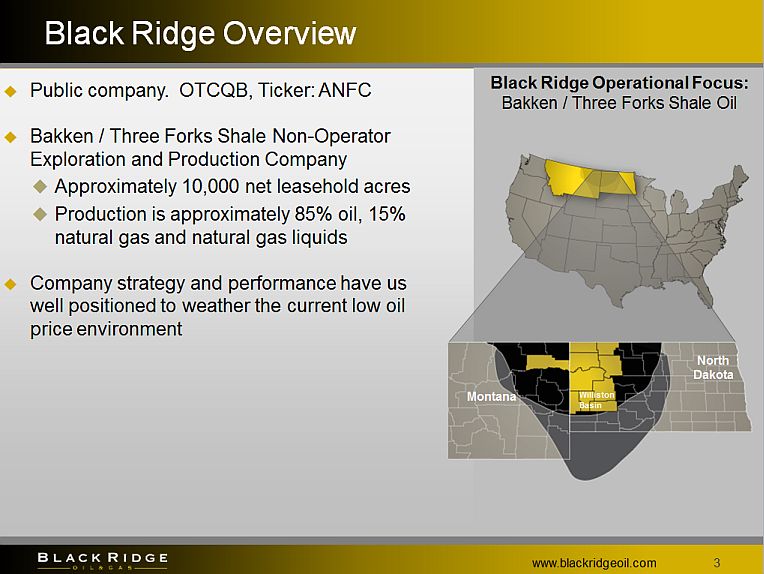

Black Ridge Overview www.blackridgeoil.com 3 Public company. OTCQB, Ticker: ANFC Bakken / Three Forks Shale Non - Operator Exploration and Production Company Approximately 10,000 net leasehold acres Production is approximately 85% oil, 15% natural gas and natural gas liquids Company strategy and performance have us well positioned to weather the current low oil price environment Black Ridge Operational Focus: Bakken / Three Forks Shale Oil North Dakota Montana Williston Basin

Why The Non - Operator Business Model? www.blackridgeoil.com 4 Ability to selectively invest in the highest return projects, without the need to control a drilling unit Knowledge and data from over 300 gross wells to make capital allocation decisions Low cost structure Fragmented nature of non - operator leaseholds will continue to provide growth opportunity as the play matures Flexible capex decision - making: option to participate in all well proposals from operating partners

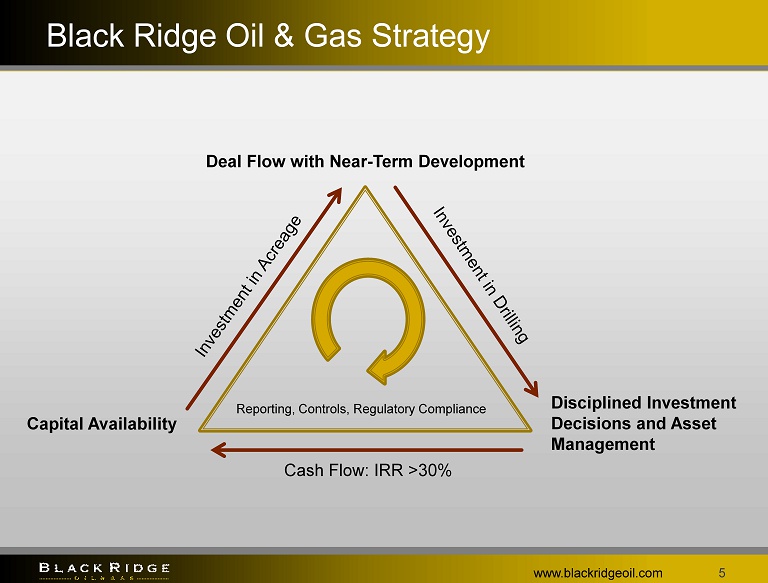

Black Ridge Oil & Gas Strategy www.blackridgeoil.com 5 Deal Flow with Near - Term Development Disciplined Investment D ecisions and Asset Management Capital Availability Reporting, Controls, Regulatory C ompliance Cash Flow: IRR >30%

14 29 118 86 88 192 304 222 242 283 308 358 525 715 761 - 200 400 600 800 1,000 1,200 Actual Guidance www.blackridgeoil.com 6 Production Ramping Up in High Return Areas Black Ridge Oil & Gas’ Net Production BOE/d 4Q 2014 guidance updated to approximately 1,190 BOE/d from previous guidance of 950 – 1,100 BOE/d

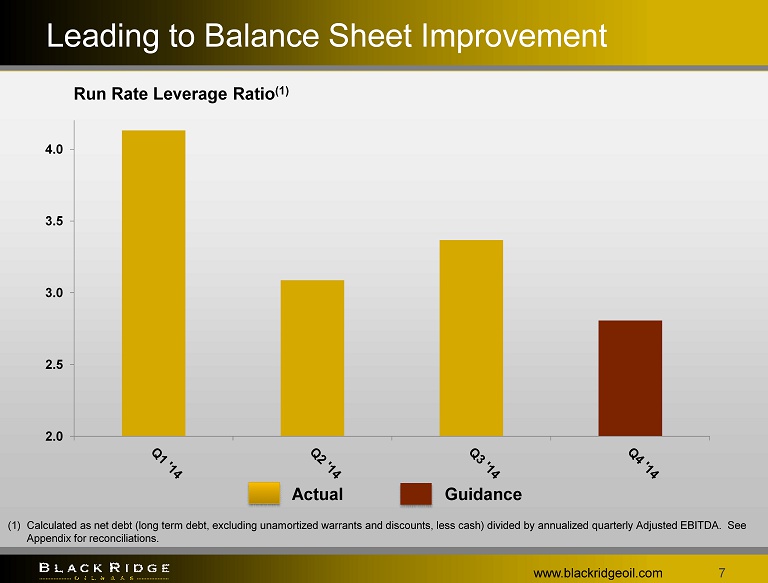

Leading to Balance Sheet Improvement www.blackridgeoil.com 7 Run Rate Leverage Ratio (1) (1) Calculated as net debt (long term debt, excluding unamortized warrants and discounts, less cash) divided by annualized quarte rly Adjusted EBITDA. See Appendix for reconciliations. 2.0 2.5 3.0 3.5 4.0 Actual Guidance

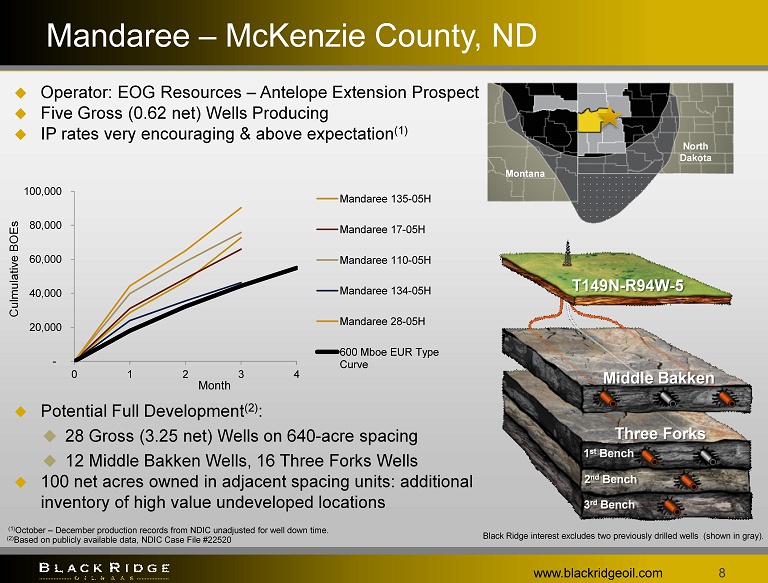

Mandaree – McKenzie County, ND Operator: EOG Resources – Antelope Extension Prospect Five Gross (0.62 net) Wells Producing IP rates very encouraging & above expectation (1) Potential Full Development (2) : 28 Gross (3.25 net) Wells on 640 - acre spacing 12 Middle Bakken Wells, 16 Three Forks Wells 100 net acres owned in adjacent spacing units: additional inventory of high value undeveloped locations www.blackridgeoil.com 8 (2) Based on publicly available data, NDIC Case File #22520 1 st Bench 2 nd Bench 3 rd Bench Middle Bakken Three Forks (1) October – December production records from NDIC unadjusted for well down time. Montana North Dakota Black Ridge interest excludes two previously drilled wells (shown in gray). T149N - R94W - 5 - 20,000 40,000 60,000 80,000 100,000 0 1 2 3 4 Mandaree 135 - 05H Mandaree 17 - 05H Mandaree 110 - 05H Mandaree 134 - 05H Mandaree 28 - 05H 600 Mboe EUR Type Curve Month Culmulative BOEs

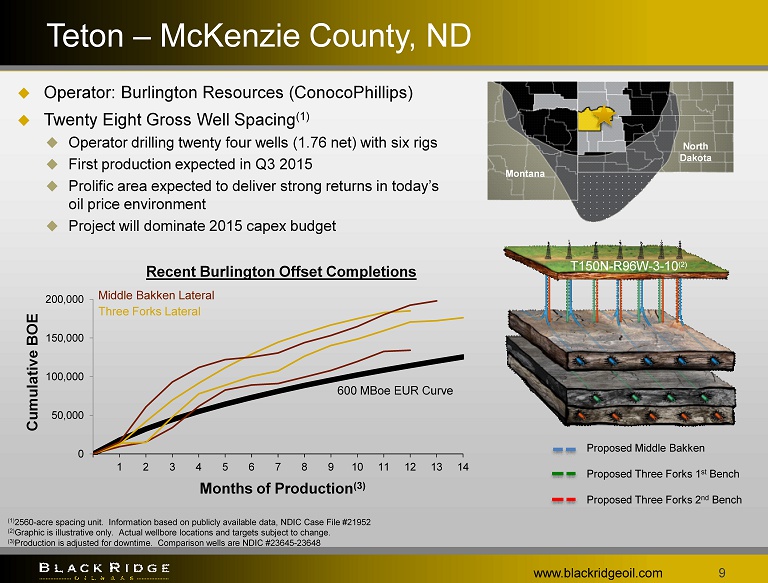

0 50,000 100,000 150,000 200,000 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Teton – McKenzie County, ND Operator: Burlington Resources (ConocoPhillips) Twenty Eight Gross Well Spacing (1) Operator drilling twenty four wells (1.76 net) with six rigs First production expected in Q3 2015 Prolific area expected to deliver strong returns in today’s oil price environment Project will dominate 2015 capex budget www.blackridgeoil.com 9 ( 1) 2560 - acre spacing unit. Information based on publicly available data, NDIC Case File #21952 (2) Graphic is illustrative only. Actual wellbore locations and targets subject to change. (3) Production is adjusted for downtime. Comparison wells are NDIC #23645 - 23648 Montana North Dakota Proposed Middle Bakken Proposed Three Forks 2 nd Bench Proposed Three Forks 1 st Bench T150N - R96W - 3 - 10 (2) Cumulative BOE Three Forks Lateral Months of Production (3) Middle Bakken Lateral 600 MBoe EUR Curve Recent Burlington Offset Completions

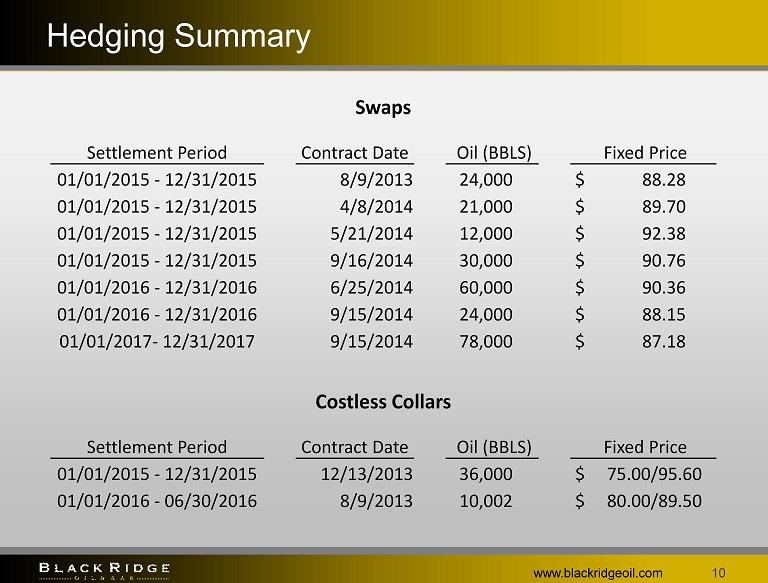

Hedging Summary 10 www.blackridgeoil.com Swaps Settlement Period Contract Date Oil (BBLS) Fixed Price 01/01/2015 - 12/31/2015 8/9/2013 24,000 $ 88.28 01/01/2015 - 12/31/2015 4/8/2014 21,000 $ 89.70 01/01/2015 - 12/31/2015 5/21/2014 12,000 $ 92.38 01/01/2015 - 12/31/2015 9/16/2014 30,000 $ 90.76 01/01/2016 - 12/31/2016 6/25/2014 60,000 $ 90.36 01/01/2016 - 12/31/2016 9/15/2014 24,000 $ 88.15 01/01/2017 - 12/31/2017 9/15/2014 78,000 $ 87.18 Costless Collars Settlement Period Contract Date Oil (BBLS) Fixed Price 01/01/2015 - 12/31/2015 12/13/2013 36,000 $ 75.00/95.60 01/01/2016 - 06/30/2016 8/9/2013 10,002 $ 80.00/89.50

2015 Plan www.blackridgeoil.com 11 Company strategy, management execution has Black Ridge Oil & Gas on solid ground to weather current commodity price environment 4Q 2014 production guidance raised to approximately 1,190 BOE/d 4Q 2014 run rate leverage ratio < 3X $12.4 Million undrawn availability at year - end 2014 under Cadence facility Strong projects adding to reserve base Updated 2015 plan will be released soon Cost reductions, focus on returns will likely result in capex < $20 Million, compared to $32 Million capex of 2014 2015 production growth funded from operating cash flow and availability from senior secured reserve based lending facility with Cadence Bank Position company to thrive as cost reductions are implemented and commodity price environment improves

For More Information www.blackridgeoil.com 12 Ken DeCubellis Chief Executive Officer ken.decubellis@blackridgeoil.com 952 - 426 - 1241 Stay Up to Date on Black Ridge Oil & Gas www.blackridgeoil.com

www.blackridgeoil.com 13 Appendix

Reconciliation of Net Income to Adjusted EBITDA www.blackridgeoil.com 14 Black Ridge Oil & Gas, Inc. Adjusted EBITDA by Quarter March 31, June 30, September 30, 2014 2014 2014 Net income (loss) (381,560)$ (543,360)$ 1,190,716$ Add Back: Interest expense, net, excluding amortization of warrant based financing costs 929,378 1,136,603 1,280,674 Income tax provision (284,023) (305,715) 700,587 Depreciation, depletion and amortization 1,594,857 2,139,733 2,283,917 Accretion of abandonment liability 4,505 5,148 5,833 Share based compensation 297,762 301,241 302,961 Unrealized loss (gain) on derivatives 214,035 881,124 (2,147,798) Adjusted EBITDA 2,374,954$ 3,614,774$ 3,616,890$ Three Months Ended

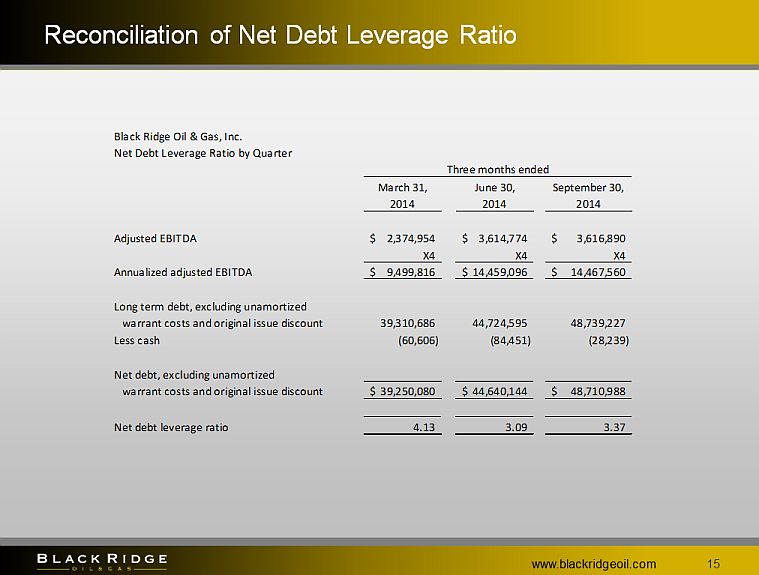

Reconciliation of Net Debt Leverage Ratio www.blackridgeoil.com 15 Black Ridge Oil & Gas, Inc. Net Debt Leverage Ratio by Quarter March 31, June 30, September 30, 2014 2014 2014 Adjusted EBITDA 2,374,954$ 3,614,774$ 3,616,890$ X4 X4 X4 Annualized adjusted EBITDA 9,499,816$ 14,459,096$ 14,467,560$ Long term debt, excluding unamortized of warrant costs and original issue discount 39,310,686 44,724,595 48,739,227 Less cash (60,606) (84,451) (28,239) Net debt, excluding unamortized of warrant costs and original issue discount 39,250,080$ 44,640,144$ 48,710,988$ Net debt leverage ratio 4.13 3.09 3.37 Three months ended