Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Unilife Corp | d866731dex993.htm |

| EX-99.1 - EX-99.1 - Unilife Corp | d866731dex991.htm |

| 8-K - FORM 8-K - Unilife Corp | d866731d8k.htm |

2

nd

Quarter of Fiscal 2015 Earnings Call

Confidential-Unilife Corporation

February 9, 2015

Exhibit 99.2 |

Confidential-Unilife Corporation

2

This

presentation contains forward looking statements under the safe harbor provisions of

the US securities laws. These forward-looking

statements

are

based

on

management’s

beliefs

and

assumptions

and

on

information

currently

available

to

our management. Our management believes that these forward-looking

statements are reasonable as and when made. However you should not place

undue reliance on any such forward looking statements as these are subject to risks and

uncertainties.

Please

refer

to

our

press

releases

and

our

SEC

filings

for

more

information

regarding

the

use

of

forward

looking statements.

Cautionary Note Regarding Forward-Looking Statements

|

Confidential-Unilife Corporation

Investor Highlights

Continuing our Strong Momentum

3

Our large market

opportunity is proven and

expanding

Our ability to win uniquely is

well-demonstrated and

gaining strength

Our execution to support

existing customer programs

is strong and remains firmly

on track

Our attractive model is

validated and supported

by our improving revenue

performance |

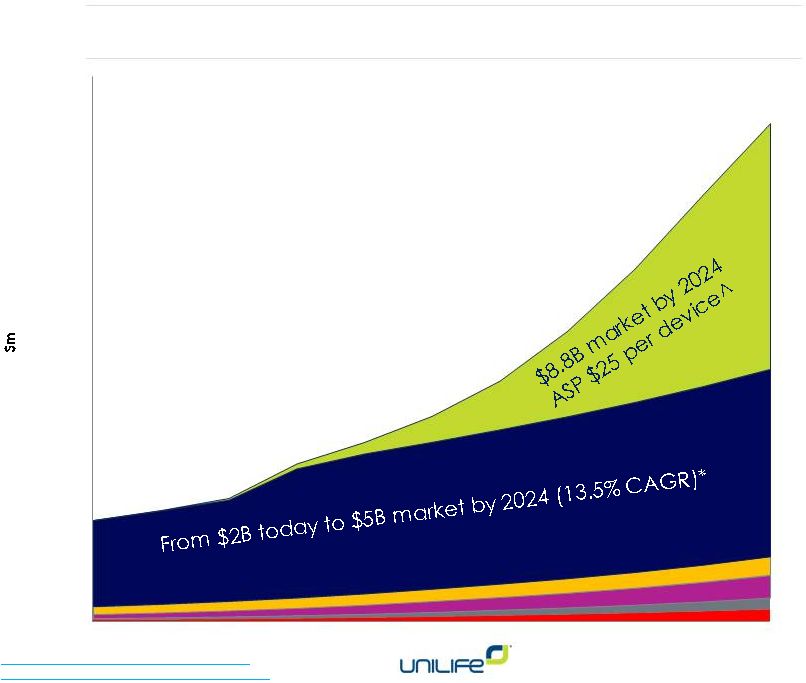

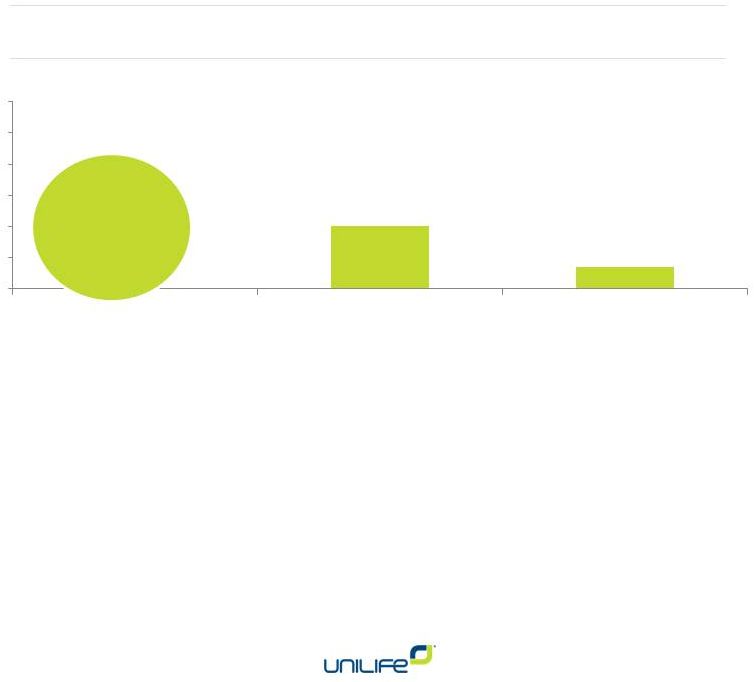

Projected growth

from $4B (2015) -

$15B (2025)**

CAGR 14%

Wearable

injectors

^

(wearable disposal

self-injectors)

Prefilled

syringes*

Auto-injectors

Reconstitution

Ocular delivery

Novel delivery

^

Roots

Resarch.

Wearable

Bolus

Injectors.

2014.

VisionGain

Medical

Device

Leader

Series

2014-2024.

** Compilation of Unilife estimates and market research reports

4

Large, Growing Markets

$-

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

$18,000

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025 |

Our

Demonstrated Ability to Win Uniquely 5

5

Compelling Technologies

Platform Specific Solutions

Comprehensive Portfolio

Robust Supply Chain with Continuity of Supply

Addressing unmet needs

Adding value for patients,

prescribers and payers

Mitigating customer risk

Customizable to needs of specific

drugs in broad portfolio

Preferred one-stop partner for

economies of scope

Addressing immediate and long-

term needs

Initial due diligence streamlines

path to incremental agreements

Flexible supply chain for

components and materials

Alternative sources of production

and supply

Maximize efficiencies and minimize

risk

Create distinctive brand identity for

each drug

Integration with standard

equipment and processes |

An

Attractive Business Model 6

•

Unifill Finesse for

Lovenox

•

10-Years

•

$50MM

in upfront payments

•

Min. 150MM units^

•

Unifill platform for 20

generic injectables

•

15-Years

•

$40MM

in upfront / milestone payments

•

Min. 175MM units^

•

Unilife sole provider

for all applicable

wearable drugs

•

5-10 biologics*

•

15-Years minimum

•

With biologics R&D

division MedImmune

•

Long-term agreement

(duration not disclosed)

•

Several target biologics

6

+ for innovative, differentiated delivery systems. Supply agreements in negotiation.

Avg. 5MM units p.a. wearable drug* with device ASP $25 Supply Agreements for

Prefilled Syringes Supply Agreements for Wearable Injectors

^ Minimum annual volumes per year following initial ramp program

* Unilife estimates based on industry averages and internal estimates

Cornerstone Supply Agreements Signed To-Date

Model validated and supported by growing financial performance

o

Can generate a flow of incremental programs and supply agreements

Capacity

to

generate

recurring,

predictable

revenue

for

10

–

15

years

Low sales and marketing costs supports attractive blended

operating margins of 40% or more over time |

Commercial Pipeline to Generate Incremental Growth

7

•

In-depth product-specific

discussions with customer

•

Multiple current and

prospective customers

•

Multiple potential drug

candidates per customer

•

May take 1 -

3 years to

begin an active program

•

Device customization and

other activities to prepare

for commercial launch

•

Signed customer agreements

•

Many programs confidential

•

Upfront or milestone based

revenue from programs

•

Programs may span 1 –

3 years

•

May be more than one

program per customer

•

Supply agreements signed

prior to commercial launch

•

10-15 yr. duration common

•

Potential for multiple supply

agreements per customer

Many active

target

opportunities

across multitude

of pharma

companies and

therapy areas

Snapshot as of Jan 1, 2015

Up 33% from last quarter

20

7

0

10

20

30

40

50

60

Commercial Pipeline

Active Programs

Supply Agreements |

Business Execution

8

•

Commercial shipments commenced

°

1

st

1 million units prior to middle FY16

°

2

nd

line operational

°

3

rd

line nearing completion

•

Shipments to accelerate FY15 -

FY16

Case Study One: Unifill platform of prefilled syringes |

9

Several customer

programs underway

Shipped over 80,000 devices

or drug containers in H1 FY15

Scaling up capacity

High-volume line with 5MM

unit annual capacity

Flextronics validation

Begin shipping devices

for human drug trials

during first half FY16

Business Execution

Case Study Two: Platform of Wearable Injectors |

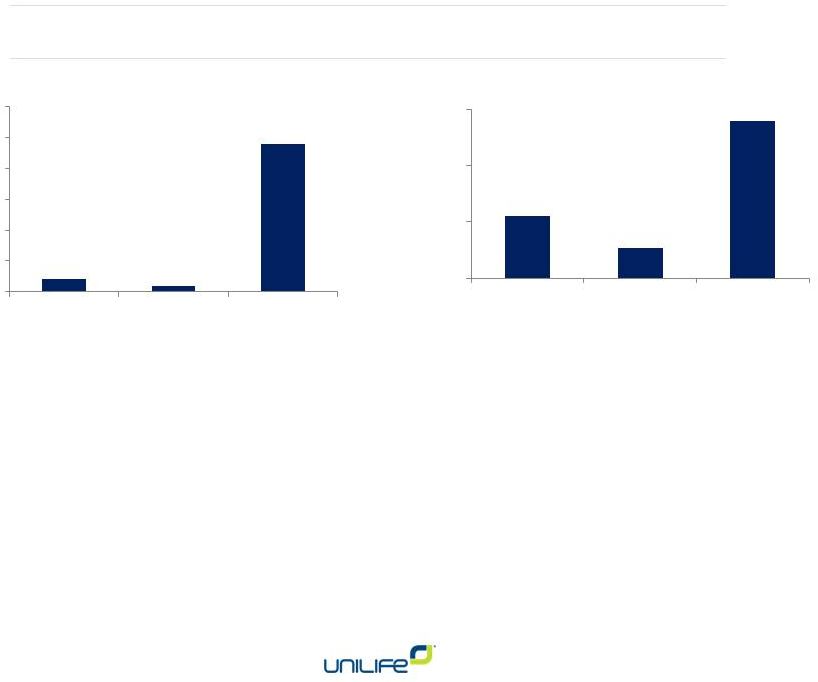

Business Execution

Now 180-plus patents issued worldwide. Over 200 more pending.

R&D investment to improve existing technologies and create new

device categories

Case Study Three: R&D Programs

10

New Patent

Applications

Granted Patents

FY 2012

FY 2013

FY 2014

0

50

100

150

200

250

Patent

return

on

investment

is

increasing

for

each

dollar

of

R&D

spent |

Financial Results

Three Months Ended

2014

2013

Revenues

$5.4MM

$3.6MM

Research & development

$11.3

MM

$7.8MM

Selling, general & administrative

$9.5MM

$6.7MM

Net loss per share

$0.18

$0.17

Adjusted net loss*

$12.5MM

$8.3MM

Adjusted

net

loss

per

share

-

diluted

$0.12

$0.08

* Adjusted net loss excludes non-cash share-based compensation

expense, depreciation and amortization, interest expense and change

in fair value of financial statements. ^ Excluding non-cash items

•

Compared to prior quarter (Q1, FY 2015):

o

Increased revenue by $4MM

o

Decreased adjusted net loss by $3.4MM (21%)

•

Deferred revenue increased by $3.9MM since 6/30/2014

•

Current cash of $10.8MM

o

Does not include net proceeds of $44.7MM from Feb 2015

offering 11 |

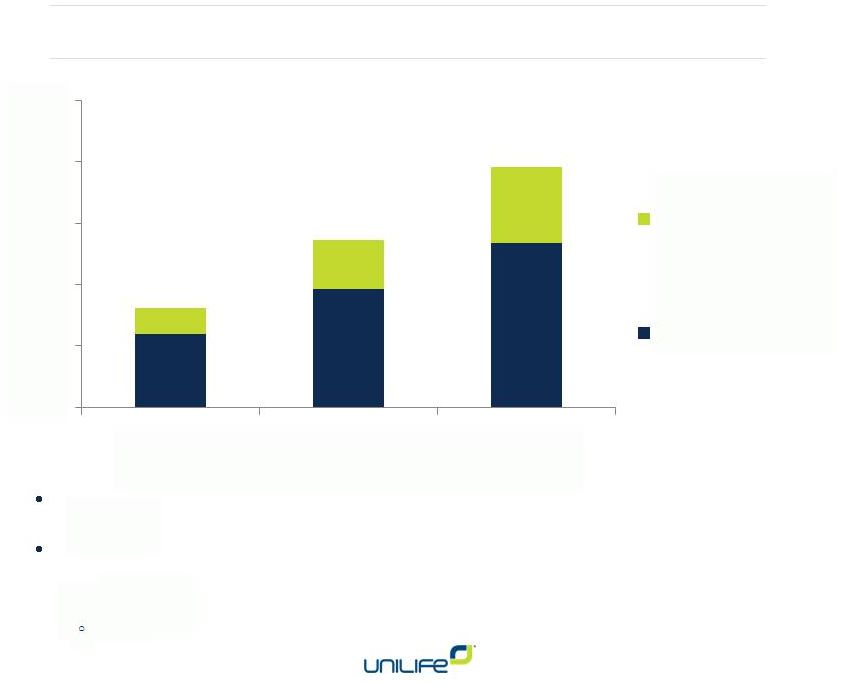

Increasing Cash Receipts and Revenue

12

Cash Receipts

Revenue

$MM

$MM

12

•

$8MM in cash receipts from

customers during the first half FY 2015

o

On schedule to generate an additional $20MM during second half FY 2015

•

Additional $45

million from U.S. offering of common stock added in February 2015 to $10 million on balance sheet as of December 31

•

Sufficient cash on hand and to be generated from customer

programs and device sales to support operating activities through to

at least the end of fiscal 2016

o

Additional agreements may further extend cash runway.

$-

$5.00

$10.00

$15.00

$20.00

$25.00

$30.00

FY 2012

FY 2013

FY 2014

$-

$5.00

$10.00

$15.00

FY 2012

FY 2013

FY 2014 |

Summary

13

Existing Agreements

•

Continued scale-up to commercial launch

•

Commencement of new programs with additional molecules

•

Expected human drug studies with some target molecules

Incremental Agreements

•

Multiple new agreements: commercial supply agreements with AbbVie and others

Other Commercial and Operational Highlights

•

Increase in the total number of active programs

•

Development of additional Unilife products / platforms

Financial Highlights

•

Substantial increase in year on year revenue for the current quarter

•

Increasing revenue from product sales, customization programs and milestone-based

fees •

Potential for significant fees from customers seeking exclusivity access

|

Confidential-Unilife Corporation

Questions

14 |

Confidential-Unilife Corporation

Final Comments |