Attached files

| file | filename |

|---|---|

| EX-21 - LIST OF SUBSIDIARIES - FASTENAL CO | fast1231201410-kexhibit21.htm |

| EX-32 - CERTIFICATIONS UNDER SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 - FASTENAL CO | fast1231201410-kexhibit32.htm |

| EX-31 - CERTIFICATIONS UNDER SECTION 302 OF THE SARBANES-OXELY ACT OF 2002 - FASTENAL CO | fast1231201410-kexhibit31.htm |

| EX-23 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - FASTENAL CO | fast1231201410-kexhibit23.htm |

| EXCEL - IDEA: XBRL DOCUMENT - FASTENAL CO | Financial_Report.xls |

| 10-K - 10-K - FASTENAL CO | fast1231201410-k.htm |

2014 ANNUAL REPORT 2014 ANNUAL REPO RT ANNUAL REPORT 2014 9704582 2014 Annual Report | 1.15TB | Printed in the USA The Oil City, Pennsylvania Fastenal store team, led by General Manager Bradly Arnink

2014 ANNUAL REPORT 2014 ANNUAL REPORT 6.6 % 18,417 EMPLOYEE SAFETY COACHING, TRAINING, & INSPECTION EVENTS 79,000+ SALES GROWTH TO CUSTOMERS WITH VENDING 20.6% VENDING MACHINES INSTALLED 46,855 D A IL Y 2,637 MICHAEL J. DOLAN Self-Employed Business Consultant, Former Executive Vice President and Chief Operating Officer, The Smead Manufacturing Company GARY A. POLIPNICK Executive Vice President - Sales SCOTT A. SATTERLEE President of North America Surface Transportation, C.H. Robinson Worldwide, Inc. (logistics and distribution company) JAMES C. JANSEN Executive Vice President - Operations LELAND J. HEIN President and Chief Executive Officer NICHOLAS J. LUNDQUIST Executive Vice President - Operations KENNETH R. NANCE Executive Vice President - Sales RITA J. HEISE Self-Employed Business Consultant, Former Corporate Vice President and Chief Information Officer of Cargill LELAND J. HEIN SHERYL A. LISOWSKI Controller and Chief Accounting Officer MICHAEL M. GOSTOMSKI Chief Executive Officer, Winona Heating & Ventilating Company (mechanical and roofing contractor) DANIEL L. FLORNESS Executive Vice President and Chief Financial Officer HUGH L. MILLER President and Chief Executive Officer, RTP Company (thermoplastics materials manufacturer) REYNE K. WISECUP REYNE K. WISECUP Executive Vice President - Human Resources DARREN R. JACKSON Chief Executive Officer, Advance Auto Parts (auto parts company) ASHOK SINGH Executive Vice President - Information Technology WILLARD D. OBERTON Chairman of the Board Former Chief Executive Officer and President, Fastenal Company STEVEN A. RUCINSKI Executive Vice President - Sales MICHAEL J. ANCIUS Director of Strategic Planning, Financing, and Taxation, Kwik Trip, Inc. (retail convenience store operator) The Fastenal story began in 1967 when Bob Kierlin and four friends opened our very first store, a 1,000-square-foot fastener shop in Winona, MN. It was a humble beginning, but we eventually forged our identity as a supplier that earns loyalty and opportunities by exceeding customers’ expectations for service – an approach later summed up with four words: Growth Through Customer Service®. Guided by this motto, we’ve grown from that original store to one of the world’s most efficient distributors of industrial and construction supplies. Below is a snapshot of our business today, including some of our key performance metrics for 2014. 22COU NT RIE S W ITH FASTENAL STORES 494 MILLION$3.7 NET NET EARNINGS SALES BILLION DIRECTOR S EXECUTIVE OFFICER S 1-3 4-5 6 7 Letter to Shareholders 10-Year Selected Financial Data & Financial Highlights Stock and Financial Data Stock Performance Highlights 8 9 INSIDE We Support Our Stores Form 10-K Directors Executive Officers Corporate Information BACK COVER TERRY M. OWEN Executive Vice President - E-Business JOHN L. SODERBERG Executive Vice President - Sales Operations & Support ANNUAL MEETING FORM 10-K LEGAL COUNSEL HOME OFFICE TRANSFER AGENT INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The annual meeting of shareholders will be held at 10:00 a.m., central time, April 21, 2015, at our home offices located at 2001 Theurer Boulevard, Winona, Minnesota. A copy of our 2014 Annual Report on Form 10-K to the Securities and Exchange Commission is available without charge to shareholders upon written request to internal audit at the address of our home office listed on this page. Copies of our latest press releases, unaudited supplemental company information, and monthly sales information are available at: http://investor.fastenal.com. Faegre Baker Daniels LLP Minneapolis, Minnesota Streater & Murphy, PA Winona, Minnesota Fastenal Company 2001 Theurer Boulevard Winona, Minnesota 55987-0978 Phone: (507) 454-5374 Fax: (507) 453-8049 Wells Fargo Bank, N.A. Minneapolis, Minnesota KPMG LLP Minneapolis, Minnesota CORPOR ATE INFORM ATIO N TABLE OF CONTENTS 121 747 MILES DELIVERED POUNDS DELIVERED MILLION MILLION FASTENAL AT A GLANCE INVENTORY VALUE NO. OF ORDERS PROCESSED 35,118,182 MILLION $869 NO. OF FASTENAL SCHOOL OF BUSINESS COURSE COMPLETIONS 288,098 30 ,0 00 A C T IV E B IN S T O C K S

2014 ANNUAL REPORT 1 LETTER TO SHAREHOLDERS One of the keys to Fastenal’s success over the years has been our ability to operate profitable local stores in not only larger metro markets but also in small towns and rural communities. This may seem like a minor achievement, but it has truly set us apart in our industry, enabling us to get closer to our customers, provide superior service, and, in turn, achieve exceptional growth. The word ‘local’ isn’t spelled out in our motto of Growth Through Customer Service®, but it’s implicit. While others embraced e-commerce as their primary distribution model, adapting their businesses to direct-ship orders via remote warehouses, we’ve never stopped working to develop our local store network, bringing our people and products closer and closer to our customers. This approach has served us well for many years, and we believe it gives us an important structural advantage moving forward. In response to customers’ demand for ever-faster fulfillment, major internet retailers are racing to provide a same-day service option, opening local branches to transcend the 24 to 48 hour (or longer) lead times built into traditional e-commerce transactions. A similar race is shaping up in the industrial world, where same- day service isn’t just a convenience but in many cases the key to keeping a production line running or fixing a critical piece of equipment. With far more store locations – and, by extension, more vending machines and ‘keep-fill’ programs in place at customer sites – than any of our competitors, we are well positioned to be the best same-day supplier of industrial and construction products in North America, and potentially the world. This will continue to be a strategic focus for our company, driving many of the initiatives and areas of the business we’ll discuss later in this letter. But first, let’s focus on our 2014 financial performance. Overall, 2014 was a positive year for Fastenal. Following a sluggish start in January and February, we achieved double-digit daily sales growth in March, achieved 15.0% daily sales growth in August (a threshold we surpassed in November and again in December), and finished the year with sales of $3.73 billion, a 12.2% increase over sales of $3.33 billion in 2013. Our return to solid double-digit growth was preceded by an initiative, launched in mid-2013, to increase labor hours in our stores, add district and regional sales leadership personnel, and ultimately generate more ‘sales energy’ within the organization. As part of this ongoing growth initiative, we plan to increase our store labor hours company-wide by an additional 10 to 15% in 2015, with a focus on adding part-time personnel to maximize scheduling flexibility and selling energy within our stores. One point worth noting – at Fastenal, we don’t really ‘hire part-time help.’ Our goal is to find, hire and train ‘future full-time employees.’ Recruiting and hiring great people is hard work. Finding truly service-minded people makes it even harder, and being a growth- centered company adds to the number of people we need to find. To satisfy these needs, we like to find full-time students looking for an opportunity, with a focus on individuals who meet three specific criteria: 1) they’re interested in pursuing a career in sales or business, 2) they display the potential to someday assume a leadership role in the company, and 3) they’re willing to relocate somewhere within the area in the future. As they complete their education, these individuals fill a critical short-term need – freeing up time in the store for our more seasoned personnel to sell and serve. Our end of the bargain is to provide these ‘future full-time employees’ with an opportunity. Our pre-tax earnings in 2014 were $787 million, or 10.4% above our 2013 pre-tax earnings of $713 million. On an after-tax basis, our net earnings grew from $449 million in 2013 to $494 million in 2014, an increase of 10.1%. As a percentage of sales, our pre-tax earnings were 21.1% in 2014 versus 21.5% in 2013. The decline relates to a decrease in gross profit (50.8% in 2014 versus 51.7% in 2013), which was partially offset by a decline in operating and administrative expenses (29.8% in 2014 versus 30.3% in 2013). Some of the headwinds we faced in terms of gross profit stem from the growth of our average store size in conjunction with our ‘Pathway to Profit’ initiative. Simply put, as our stores grow larger, they tend to have larger customers that merit more favorable pricing terms. That said, any slippage in gross profit margin due to increased store size should be counterbalanced by the lower relative operating costs typically associated with our larger stores. In recent years this has been the case, but in 2014 the improvement in our operating and administrative expenses, as a percentage of net sales, was not sufficient to provide that counterbalance. This was due to our push to add personnel and labor hours in our stores while also adding district and regional leadership to better serve our stores (after all, that’s what leaders do – provide service). Unfortunately, it was also due to rising miscellaneous expenses. For much of 2014, we frankly didn’t live up to our company’s high standards for frugality and resourcefulness. The good news is that we did a much better job of expense control in the fourth quarter, and we’ll be working very hard to maintain that discipline in the year ahead. A summary of our financial performance in 2014 really boils down to three thoughts. First, the gross profit decline negatively impacted our business and created some challenges in our ability to grow earnings – this stood out in the first six to nine months of the year. Second, under the ‘Pathway to Profit’ we believe our ability to manage our operating and administrative expenses long-term will provide more than just an ‘offset’ to the gross profit decline and will allow us to grow net earnings faster than our net sales – this stood

2014 ANNUAL REPORT fasteners through our FMI® (‘keep-fill’) program. The product and supply process are different, but the same basic value-add applies: we stock needed product locally, visit the customer regularly, and maintain a lean flow of inventory to their points of use, driving cost savings and productivity. As with our vending program, it’s a level of service only Fastenal can provide on a national, and increasingly global scale, and it’s a vital part of our same-day service advantage. This brings us to another very important growth driver for our company – our national accounts programs, which provide a combination of corporate support and local service for larger, multi-site customers. In 2014, customers tied to a national agreement represented 43% of total company revenues and more than 50% of our sales growth. In our opinion, the keys to this success are: 1) our dedicated national account sales team, 2) the high-level support provided by our specialists in the areas of safety, metalworking, engineering, and other important areas for customers, 3) our on-site inventory management programs (FAST Solutions® and FMI®), and 4) the ‘glue’ that holds it all together, our local stores and their ability to service our national account customers everywhere they operate – from metro areas, to rural towns, to global factories. Another very important type of contract customer is supported by our government sales team. The word ‘government’ may conjure images of Washington D.C., but while we do service several federal agencies, the vast majority of our government business is at the state and local level, with customers ranging from state departments of transportation and municipalities, to higher education and local K-12 schools. This is yet another area where our local presence gives us an important advantage. An example of our local presence would be the state of Kansas. While our national competitors have branches in Wichita, Topeka, and maybe one or two other locations, we’re able to service customers locally at 36 stores statewide – all staffed by people who live in the community and pay local taxes (an important factor for many government customers). When you consider this scenario is playing out in states, cities, and towns across the country, it’s not surprising that our annual net sales to state and local government customers increased 25% in 2014, and that we now have contracts with 44 states, up from just five such contracts five years ago. In the opening statement, we made a distinction between the competition’s focus on e-commerce versus our focus on local stores, but of course it’s not an ‘either/or’ situation – to be the best, you have to excel in both areas. In 2014, our e-commerce and information technology teams did a nice job of leveraging our local presence to provide faster (in many cases, same- day) fulfillment via Fastenal.com and the custom e-commerce solutions we provide for our customers. A great example is our new web interface, which presents customers with not only the exact item they’re searching for but also closely-related alternatives that are in stock at the local Fastenal store and our nearest distribution center – pointing the customer to the fastest solution. This ability to view local inventory isn’t unique, but it’s out in the last three months of the year. (Remember, this is a comment about long-term trends, not a static quarter by quarter prediction.) Third, if we grow our business and manage our expenses, a distribution business like ours can have incredible cash flow characteristics. This stood out in 2014 as noted in the ‘Cash Flow Summary’ information, most notably our ‘free cash flow’ on page four of this annual report. Earlier we framed Fastenal’s same-day service advantage in terms of being able to react to unplanned customer needs – for example, an unforeseen stock outage or some broken equipment – but in fact, most of our customers’ needs are very predictable and repetitive, and in these cases ‘same-day service’ describes our ability to proactively plan and manage the flow of supplies from our suppliers, to our distribution centers, to our stores, and finally to our customers’ sites. One of the most efficient ways we do this is through our FAST Solutions® (industrial vending) programs. In 2014, we signed agreements for 16,342 new vending devices and ended the year with a total of 46,855 devices in place at customer locations. Today, we vend more than $40 million worth of product each month, but this only tells part of the story. In December 2014, our net sales to customers with vending devices (this includes both vended and non-vended items) represented around 39% of our total net sales (versus approximately 37% in the same period in 2013), and total sales to vending customers grew approximately 20% in 2014. These latter two numbers reflect a couple of important concepts: 1) vending is not really a discrete area of our business but rather an extension of our stores, enabling our local teams to get even closer to the customer; and 2) vending supports a very broad range of customers – from manufacturers to contractors, from Fortune 500 companies to small businesses. With an expanded technology lineup, streamlined systems for machine setup and replenishment, and a new incentive program motivating our sales people to sign and install more devices, we’ll continue to move aggressively in an effort to extend our industry lead in vending in the year ahead. While our industrial vending solutions generally support the non- fastener side of our business, we provide a similar service for 2

2014 ANNUAL REPORT all the numbers and charts published in this report is something much more human, and that is a desire among our people to exceed customer expectations, to solve problems, to offer new and better solutions – in a word, to serve. This applies not only to our store personnel but to all of the teams supporting our stores: distribution, transportation, manufacturing, quality, information technology, vending support, sales specialists, human resources, accounting, maintenance, product development, purchasing, marketing, and everyone else who works behind the scenes to keep the ‘Big Blue Machine’ rolling. As leaders of the company, we can never forget the power of Fastenal people, and that our job boils down to two simple directives: 1) make sure that everybody who joins Fastenal understands our common goal, and 2) find ways to bring out and maximize the potential of everyone in the organization. If we can continue to do this, we’re confident that we’ll continue to achieve Growth Through Customer Service® for many years to come. Last year, we closed this letter by laying out five reasons we were optimistic for 2014. This year, we’ll reiterate the same list with an eye toward 2015: • We have a small percentage of the industrial market worldwide. • We continue to generate cash flow to support growth. • We continue to make wise investments to support future growth. • We feel strongly that the highest level of service comes when we are face to face with our customers. • We believe in our people and their ability to make the best decisions for Fastenal and for their customers. Thank you to every employee for everything you do, and thank you to our shareholders for your continued support. We do not take it for granted. a lot more meaningful when ‘local’ means a short drive across town rather than a long haul to a distant metro area. In the year ahead, we’ll continue working to harness our brick-and- mortar footprint to maximize speed, service, and value for our e-commerce customers. No matter how the product ends up in the customer’s hands – via the local store, an on-site FAST Solutions® or FMI® program, or an e-commerce transaction – it first has to move through our distribution system. In 2014, we continued to invest aggressively in our distribution infrastructure to support long-term growth. Major projects included the installation of automated storage and retrieval technology in our Jessup, Pennsylvania distribution center (which services stores in the northeast U.S.); the addition of 180,000 square feet to our master distribution center in Indianapolis, Indiana; a brand-new facility in Kitchener, Ontario (Canada) that includes 100,000 square feet of warehouse space and features automated storage and retrieval technology (along with new regional sales offices and a training facility); and finally, a new 46,000 square-foot facility in Apodaca, Nuevo Leon (Mexico) to support our international growth. These investments in infrastructure and technology are essential, but the single most important investment we can make is in our people. For the past 15 years, one of the primary ways we’ve invested in the ‘Blue Team’ is by offering training and career development through the Fastenal School of Business (FSB). In 2014, our FSB team focused on not just what they have to offer our employees, but how they promote and present these learning opportunities to the field. This included a major redesign of our online training portal, making it far easier for employees to access all of the available training courses and resources we offer. Thanks in part to this initiative, our employees completed 8,689 instructor-led courses and 279,409 online courses in 2014, shattering our previous records for course participation. That’s a total of 288,098 opportunities to gain a better understanding of the industries we serve, the products we sell, and the resources available to serve our customers. Every year, the scope of our business becomes larger – with more stores, departments, products, and solutions – yet the number of pages allotted for this letter remains the same. There’s simply no way to sum up all of the good things our team accomplished in 2014, so we’ll leave you with this: behind ??????????? Chairman of the Board ???????? President and CEO ? “These investments in infrastructure and technology are essential, but the single most important investment we can make is in our people.”

2014 ANNUAL REPORT Operating Results 2014 Percent Change 2013 2012 2011 2010 2009 2008 2007 2006 2005 Net sales $ 3,733,507 12.2% $3,326,106 $3,133,577 $2,766,859 $2,269,471 $1,930,330 $2,340,425 $2,061,819 $1,809,337 $1,523,333 Gross profit $ 1,897,402 10.3% 1,719,445 1,614,524 1,434,172 1,174,836 983,435 1,236,092 1,047,574 907,675 758,103 % of net sales 50.8% 51.7% 51.5% 51.8% 51.8% 50.9% 52.8% 50.8% 50.2% 49.8% Earnings before income taxes $ 787,434 10.4% 713,468 674,155 575,081 430,640 297,490 451,167 377,899 321,029 269,056 % of net sales 21.1% 21.5% 21.5% 20.8% 19.0% 15.4% 19.3% 18.3% 17.7% 17.7% Net earnings $ 494,150 10.1% 448,636 420,536 357,929 265,356 184,357 279,705 232,622 199,038 166,814 % of net sales 13.2% 13.5% 13.4% 12.9% 11.7% 9.6% 12.0% 11.3% 11.0% 11.0% Basic net earnings per share $ 1.67 10.6% 1.51 1.42 1.21 0.90 0.62 0.94 0.77 0.66 0.55 Basic weighted average shares outstanding 296,490 -0.1% 296,754 296,089 295,054 294,861 296,716 297,662 301,109 302,068 302,540 Diluted net earnings per share $ 1.66 9.9% 1.51 1.42 1.21 0.90 0.62 0.94 0.77 0.66 0.55 Diluted weighted average shares outstanding1 297,313 -0.1% 297,684 297,151 295,869 294,861 296,716 297,662 301,109 302,329 303,015 Dividends and Common Stock Purchase Summary 2014 Percent Change 2013 2012 2011 2010 2009 2008 2007 2006 2005 Dividends paid $ 296,581 24.9% $237,456 $367,306 $191,741 $182,814 $106,943 $117,474 $66,216 $ 60,548 $ 46,935 % of net earnings 60.0% 52.9% 87.3% 53.6% 68.9% 58.0% 42.0% 28.5% 30.4% 28.1% Dividends paid per share $ 1.00 25.0% 0.80 1.24 0.65 0.62 0.36 0.395 0.22 0.20 0.155 Purchases of common stock $ 52,942 483.1% 9,080 - - - 41,104 25,958 87,311 17,294 18,739 % of net earnings 10.7% 2.0% - - - 22.3% 9.3% 37.5% 8.7% 11.2% Common stock shares purchased 1,200 500.0% 200 - - - 2,200 1,180 4,172 948 1,400 Average price paid per share $ 44.12 -2.8% 45.40 - - - 18.69 22.00 20.93 18.25 13.38 Cash Flow Summary 2014 Percent Change 2013 2012 2011 2010 2009 2008 2007 2006 2005 Net cash provided by operating activities $ 499,392 20.0% $416,120 $396,292 $268,489 $240,488 $306,070 $259,898 $227,895 $97,875 $121,912 % of net earnings 101.1% 92.8% 94.2% 75.0% 90.6% 166.0% 92.9% 98.0% 49.2% 73.1% Less capital expenditures, net $ (183,655) -8.9% (201,550) (133,882) (116,489) (69,138) (47,675) (86,923) (49,830) (73,335) (60,455) Acquisitions and other $ (5,577) 3,746.2% (145) (133) 212 (10,329) (5,133) (72) (265) (231) (164) Free cash flow $ 310,160 44.6% 214,425 262,277 152,212 161,021 253,262 172,903 177,800 24,309 61,293 % of net earnings 62.8% 47.8% 62.4% 42.5% 60.7% 137.4% 61.8% 76.4% 12.2% 36.7% Financial Position at Year End 2014 Percent Change 2013 2012 2011 2010 2009 2008 2007 2006 2005 Operational working capital (accounts receivable, net and inventories) $ 1,331,301 11.1% $1,198,399 $1,087,542 $984,746 $827,502 $722,574 $809,187 $740,923 $665,529 $545,117 Net working capital (current assets less current liabilities) $ 1,207,912 3.4% 1,168,629 1,082,482 1,048,320 923,513 862,855 827,410 742,980 663,880 557,470 Fixed capital (property and equipment, net) $ 763,889 16.7% 654,850 516,427 435,601 363,419 335,004 324,182 276,627 264,030 224,448 Total assets $ 2,359,102 13.6% 2,075,784 1,815,832 1,684,948 1,468,283 1,327,358 1,304,149 1,163,061 1,039,016 890,035 Total stockholders' equity $ 1,915,217 8.0% 1,772,697 1,560,360 1,458,976 1,282,512 1,190,843 1,142,259 1,010,161 992,093 783,549 All information contained in this Annual Report reflects the 2-for-1 stock splits in 2011 and 2005. 1 Reflects impact of stock options issued by the Company that were in-the-money and outstanding during the period. (Amounts in Thousands Except Per Share Information) 10-YEAR SELECTED FINANCIAL DA TA 4

2014 ANNUAL REPORT 200 5 200 6 200 7 200 8 200 9 201 0 201 1 201 2 201 3 201 4 200 5 200 6 200 7 200 8 200 9 201 0 201 1 201 2 201 3 201 4 200 5 200 6 200 7 200 8 200 9 201 0 201 1 201 2 201 3 201 4 200 5 200 6 200 7 200 8 200 9 201 0 201 1 201 2 201 3 201 4 Operating Results 2014 Percent Change 2013 2012 2011 2010 2009 2008 2007 2006 2005 Net sales $ 3,733,507 12.2% $3,326,106 $3,133,577 $2,766,859 $2,269,471 $1,930,330 $2,340,425 $2,061,819 $1,809,337 $1,523,333 Gross profit $ 1,897,402 10.3% 1,719,445 1,614,524 1,434,172 1,174,836 983,435 1,236,092 1,047,574 907,675 758,103 % of net sales 50.8% 51.7% 51.5% 51.8% 51.8% 50.9% 52.8% 50.8% 50.2% 49.8% Earnings before income taxes $ 787,434 10.4% 713,468 674,155 575,081 430,640 297,490 451,167 377,899 321,029 269,056 % of net sales 21.1% 21.5% 21.5% 20.8% 19.0% 15.4% 19.3% 18.3% 17.7% 17.7% Net earnings $ 494,150 10.1% 448,636 420,536 357,929 265,356 184,357 279,705 232,622 199,038 166,814 % of net sales 13.2% 13.5% 13.4% 12.9% 11.7% 9.6% 12.0% 11.3% 11.0% 11.0% Basic net earnings per share $ 1.67 10.6% 1.51 1.42 1.21 0.90 0.62 0.94 0.77 0.66 0.55 Basic weighted average shares outstanding 296,490 -0.1% 296,754 296,089 295,054 294,861 296,716 297,662 301,109 302,068 302,540 Diluted net earnings per share $ 1.66 9.9% 1.51 1.42 1.21 0.90 0.62 0.94 0.77 0.66 0.55 Diluted weighted average shares outstanding1 297,313 -0.1% 297,684 297,151 295,869 294,861 296,716 297,662 301,109 302,329 303,015 Dividends and Common Stock Purchase Summary 2014 Percent Change 2013 2012 2011 2010 2009 2008 2007 2006 2005 Dividends paid $ 296,581 24.9% $237,456 $367,306 $191,741 $182,814 $106,943 $117,474 $66,216 $ 60,548 $ 46,935 % of net earnings 60.0% 52.9% 87.3% 53.6% 68.9% 58.0% 42.0% 28.5% 30.4% 28.1% Dividends paid per share $ 1.00 25.0% 0.80 1.24 0.65 0.62 0.36 0.395 0.22 0.20 0.155 Purchases of common stock $ 52,942 483.1% 9,080 - - - 41,104 25,958 87,311 17,294 18,739 % of net earnings 10.7% 2.0% - - - 22.3% 9.3% 37.5% 8.7% 11.2% Common stock shares purchased 1,200 500.0% 200 - - - 2,200 1,180 4,172 948 1,400 Average price paid per share $ 44.12 -2.8% 45.40 - - - 18.69 22.00 20.93 18.25 13.38 Cash Flow Summary 2014 Percent Change 2013 2012 2011 2010 2009 2008 2007 2006 2005 Net cash provided by operating activities $ 499,392 20.0% $416,120 $396,292 $268,489 $240,488 $306,070 $259,898 $227,895 $97,875 $121,912 % of net earnings 101.1% 92.8% 94.2% 75.0% 90.6% 166.0% 92.9% 98.0% 49.2% 73.1% Less capital expenditures, net $ (183,655) -8.9% (201,550) (133,882) (116,489) (69,138) (47,675) (86,923) (49,830) (73,335) (60,455) Acquisitions and other $ (5,577) 3,746.2% (145) (133) 212 (10,329) (5,133) (72) (265) (231) (164) Free cash flow $ 310,160 44.6% 214,425 262,277 152,212 161,021 253,262 172,903 177,800 24,309 61,293 % of net earnings 62.8% 47.8% 62.4% 42.5% 60.7% 137.4% 61.8% 76.4% 12.2% 36.7% Financial Position at Year End 2014 Percent Change 2013 2012 2011 2010 2009 2008 2007 2006 2005 Operational working capital (accounts receivable, net and inventories) $ 1,331,301 11.1% $1,198,399 $1,087,542 $984,746 $827,502 $722,574 $809,187 $740,923 $665,529 $545,117 Net working capital (current assets less current liabilities) $ 1,207,912 3.4% 1,168,629 1,082,482 1,048,320 923,513 862,855 827,410 742,980 663,880 557,470 Fixed capital (property and equipment, net) $ 763,889 16.7% 654,850 516,427 435,601 363,419 335,004 324,182 276,627 264,030 224,448 Total assets $ 2,359,102 13.6% 2,075,784 1,815,832 1,684,948 1,468,283 1,327,358 1,304,149 1,163,061 1,039,016 890,035 Total stockholders' equity $ 1,915,217 8.0% 1,772,697 1,560,360 1,458,976 1,282,512 1,190,843 1,142,259 1,010,161 992,093 783,549 All information contained in this Annual Report reflects the 2-for-1 stock splits in 2011 and 2005. 1 Reflects impact of stock options issued by the Company that were in-the-money and outstanding during the period. FINANCIAL HIGHLIGHTS NET SALES (in thousands) $3,733,50 7 GROSS PROFIT (in thousands) NET EARNINGS (in thousands) EARNINGS BEFORE INCOME TAXES (in thousands) $1,897,40 2 $494,15 0 $787,43 4 5

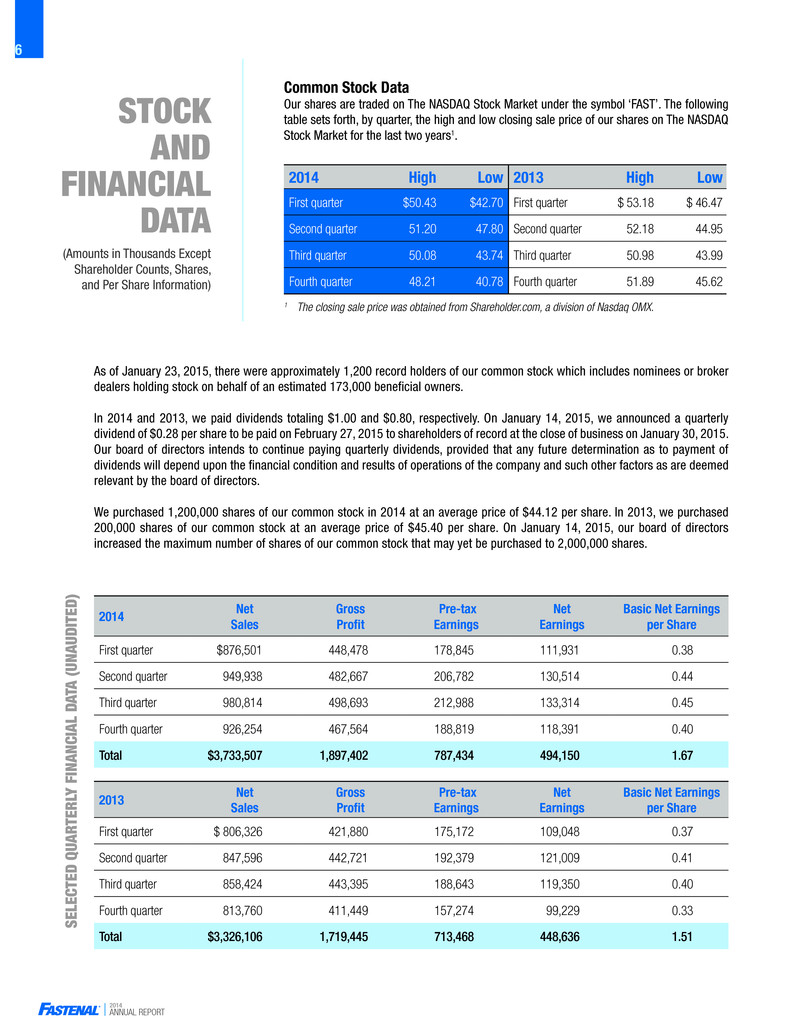

2014 ANNUAL REPORT 2014 High Low 2013 High Low First quarter $50.43 $42.70 First quarter $ 53.18 $ 46.47 Second quarter 51.20 47.80 Second quarter 52.18 44.95 Third quarter 50.08 43.74 Third quarter 50.98 43.99 Fourth quarter 48.21 40.78 Fourth quarter 51.89 45.62 As of January 23, 2015, there were approximately 1,200 record holders of our common stock which includes nominees or broker dealers holding stock on behalf of an estimated 173,000 beneficial owners. In 2014 and 2013, we paid dividends totaling $1.00 and $0.80, respectively. On January 14, 2015, we announced a quarterly dividend of $0.28 per share to be paid on February 27, 2015 to shareholders of record at the close of business on January 30, 2015. Our board of directors intends to continue paying quarterly dividends, provided that any future determination as to payment of dividends will depend upon the financial condition and results of operations of the company and such other factors as are deemed relevant by the board of directors. We purchased 1,200,000 shares of our common stock in 2014 at an average price of $44.12 per share. In 2013, we purchased 200,000 shares of our common stock at an average price of $45.40 per share. On January 14, 2015, our board of directors increased the maximum number of shares of our common stock that may yet be purchased to 2,000,000 shares. Common Stock Data Our shares are traded on The NASDAQ Stock Market under the symbol ‘FAST’. The following table sets forth, by quarter, the high and low closing sale price of our shares on The NASDAQ Stock Market for the last two years1. 2014 Net Sales Gross Profit Pre-tax Earnings Net Earnings Basic Net Earnings per Share First quarter $876,501 448,478 178,845 111,931 0.38 Second quarter 949,938 482,667 206,782 130,514 0.44 Third quarter 980,814 498,693 212,988 133,314 0.45 Fourth quarter 926,254 467,564 188,819 118,391 0.40 Total $3,733,507 1,897,402 787,434 494,150 1.67 2013 Net Sales Gross Profit Pre-tax Earnings Net Earnings Basic Net Earnings per Share First quarter $ 806,326 421,880 175,172 109,048 0.37 Second quarter 847,596 442,721 192,379 121,009 0.41 Third quarter 858,424 443,395 188,643 119,350 0.40 Fourth quarter 813,760 411,449 157,274 99,229 0.33 Total $3,326,106 1,719,445 713,468 448,636 1.51 1 The closing sale price was obtained from Shareholder.com, a division of Nasdaq OMX. STOCK AND FINANCIAL DATA (Amounts in Thousands Except Shareholder Counts, Shares, and Per Share Information) SELECTED Q UA RTER LY FINANCIAL DA TA (UN AUDITED ) 6

2014 ANNUAL REPORT Invested $9,000 on August 20, 1987 Value on December 31, 2014: $4,565,760 Stock Split ??????????????? On August 20, 1987 (date of our initial public offering), 1,000 shares of our stock sold for $9,000. Approximately 27 years later, on December 31, 2014, those 1,000 shares, having split seven times, were 96,000 shares worth $4,565,760, for a gain of approximately 25.9% compounded annually. (In addition, the holder of these shares would have received $561,504 in dividends since August 20, 1987.) ????? On December 31, 2004, 1,000 shares of our stock sold for $61,560. Ten years later on December 31, 2014, those 1,000 shares, having split two times, were 4,000 shares worth $190,240, for a gain of approximately 11.9% compounded annually. (In addition, the holder of these shares would have received $22,560 in dividends since December 2004.) ????? On December 31, 2009, 1,000 shares of our stock sold for $41,640. Five years later, on December 31, 2014, those 1,000 shares, having split once, were 2,000 shares worth $95,120 for a gain of approximately 18.0% compounded annually. (In addition, the holder of these shares would have received $8,620 in dividends since December 2009.) 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2014 $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 STOCK PERFORMANCE HIGHLIGHTS1,2 HISTORICAL STOCK PERFORMANC E 2014 MERCHANDISING COMPETITION Top Bob Kierlin (BK) Store Winners 2nd Kirksville, MS 1st Scottsboro, AL 3rd Macon, MS DIVIDENDS AND STOCK DILUTIO N We have paid dividends in every year since 1991. Since going public in 1987, we have maintained a consistent focus on avoiding, if feasible, the potentially dilutive impact of our activities on our shareholders. To this end, we have grown our organization with our internal cash flow, have supported the Fastenal Company and Subsidiaries 401(k) and Employee Stock Ownership Plan with stock purchased in the open market, and since creating a stock option program in 2003, have periodically purchased common stock in the open market to offset the potential impact of our stock option grants. We have purchased approximately 11.3 million shares since 2003, and have granted our employees options to purchase approximately 11.0 million shares. Of the stock option grants, approximately 3.7 million have been exercised, approximately 2.6 million have been forfeited, and approximately 4.7 million currently remain outstanding. (Note – these amounts have been adjusted to reflect the impact of stock splits.) 1 The share data represents past performance, which is no guarantee of future results. 2 The information above is presented in whole amounts versus thousands or millions as is prevalent in the remainder of this document. ?

2014 ANNUAL REPORT WE SUPPORT OUR STORES PEOPLE PRODUCTS & SUPPLY SOLUTIONS FINANCE DISTRIBUTION SYSTEMS AND EMPOWER OUR LEADERS TO GROW Our stores are at the center of our business model, but if you dig a little deeper you’ll find that at the heart of it all is a core belief in people – that each of us has the capacity to accomplish extraordinary things, if given the opportunity. In an effort to unlock this vast human potential, we invest aggressively in employee training and development. We reward individual initiative and promote almost exclusively from within. We foster a highly decentralized culture that encourages our people to make local decisions, and to run their business like they own it. The result is a highly motivated, entrepreneurial team that’s empowered to think creatively, develop their talents, and grow with the company. 8 Fastenal goes to market through a chain of nearly 2,700 strategically located stores – each supported by a spectrum of company resources. That includes well-trained people in the store backed by numerous teams of specialists and experts in the field; an ever-evolving mix of products & supply solutions to meet customer needs in increasingly frictionless ways; an extremely efficient distribution network anchored by our regional hubs and company-owned transportation fleet; and innovative systems that streamline our operations and ultimately our service. This model positions our store teams to provide tremendous value to the customer, charge a fair price for that value, and generate the healthy operating income (the finance piece) we need to reinvest in all of the above – continually improving our service and, in turn, growing our business. WHY OUR MODEL WORKS

2014 ANNUAL REPORT 2014 ANNUAL REPORT 6.6 % 18,417 EMPLOYEE SAFETY COACHING, TRAINING, & INSPECTION EVENTS 79,000+ SALES GROWTH TO CUSTOMERS WITH VENDING 20.6% VENDING MACHINES INSTALLED 46,855 D A IL Y 2,637 MICHAEL J. DOLAN Self-Employed Business Consultant, Former Executive Vice President and Chief Operating Officer, The Smead Manufacturing Company GARY A. POLIPNICK Executive Vice President - Sales SCOTT A. SATTERLEE President of North America Surface Transportation, C.H. Robinson Worldwide, Inc. (logistics and distribution company) JAMES C. JANSEN Executive Vice President - Operations LELAND J. HEIN President and Chief Executive Officer NICHOLAS J. LUNDQUIST Executive Vice President - Operations KENNETH R. NANCE Executive Vice President - Sales RITA J. HEISE Self-Employed Business Consultant, Former Corporate Vice President and Chief Information Officer of Cargill LELAND J. HEIN SHERYL A. LISOWSKI Controller and Chief Accounting Officer MICHAEL M. GOSTOMSKI Chief Executive Officer, Winona Heating & Ventilating Company (mechanical and roofing contractor) DANIEL L. FLORNESS Executive Vice President and Chief Financial Officer HUGH L. MILLER President and Chief Executive Officer, RTP Company (thermoplastics materials manufacturer) REYNE K. WISECUP REYNE K. WISECUP Executive Vice President - Human Resources DARREN R. JACKSON Chief Executive Officer, Advance Auto Parts (auto parts company) ASHOK SINGH Executive Vice President - Information Technology WILLARD D. OBERTON Chairman of the Board Former Chief Executive Officer and President, Fastenal Company STEVEN A. RUCINSKI Executive Vice President - Sales MICHAEL J. ANCIUS Director of Strategic Planning, Financing, and Taxation, Kwik Trip, Inc. (retail convenience store operator) The Fastenal story began in 1967 when Bob Kierlin and four friends opened our very first store, a 1,000-square-foot fastener shop in Winona, MN. It was a humble beginning, but we eventually forged our identity as a supplier that earns loyalty and opportunities by exceeding customers’ expectations for service – an approach later summed up with four words: Growth Through Customer Service®. Guided by this motto, we’ve grown from that original store to one of the world’s most efficient distributors of industrial and construction supplies. Below is a snapshot of our business today, including some of our key performance metrics for 2014. 22COU NT RIE S W ITH FASTENAL STORES 494 MILLION$3.7 NET NET EARNINGS SALES BILLION DIRECTOR S EXECUTIVE OFFICER S 1-3 4-5 6 7 Letter to Shareholders 10-Year Selected Financial Data & Financial Highlights Stock and Financial Data Stock Performance Highlights 8 9 INSIDE We Support Our Stores Form 10-K Directors Executive Officers Corporate Information BACK COVER TERRY M. OWEN Executive Vice President - E-Business JOHN L. SODERBERG Executive Vice President - Sales Operations & Support ANNUAL MEETING FORM 10-K LEGAL COUNSEL HOME OFFICE TRANSFER AGENT INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The annual meeting of shareholders will be held at 10:00 a.m., central time, April 21, 2015, at our home offices located at 2001 Theurer Boulevard, Winona, Minnesota. A copy of our 2014 Annual Report on Form 10-K to the Securities and Exchange Commission is available without charge to shareholders upon written request to internal audit at the address of our home office listed on this page. Copies of our latest press releases, unaudited supplemental company information, and monthly sales information are available at: http://investor.fastenal.com. Faegre Baker Daniels LLP Minneapolis, Minnesota Streater & Murphy, PA Winona, Minnesota Fastenal Company 2001 Theurer Boulevard Winona, Minnesota 55987-0978 Phone: (507) 454-5374 Fax: (507) 453-8049 Wells Fargo Bank, N.A. Minneapolis, Minnesota KPMG LLP Minneapolis, Minnesota CORPOR ATE INFORM ATIO N TABLE OF CONTENTS 121 747 MILES DELIVERED POUNDS DELIVERED MILLION MILLION FASTENAL AT A GLANCE INVENTORY VALUE NO. OF ORDERS PROCESSED 35,118,182 MILLION $869 NO. OF FASTENAL SCHOOL OF BUSINESS COURSE COMPLETIONS 288,098 30 ,0 00 A C T IV E B IN S T O C K S

2014 ANNUAL REPORT 2014 ANNUAL REPO RT ANNUAL REPORT 2014 9704582 2014 Annual Report | 1.15TB | Printed in the USA The Oil City, Pennsylvania Fastenal store team, led by General Manager Bradly Arnink