Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST FINANCIAL BANCORP /OH/ | a8kearningsrelease4q14.htm |

| EX-99.1 - EXHIBIT 99.1 - FIRST FINANCIAL BANCORP /OH/ | a8k4q14earningsreleaseex991.htm |

First Financial Bancorp Fourth Quarter 2014 Earnings Release Supplemental Information Exhibit 99.2

2 Certain statements contained in this release which are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Examples of forward-looking statements include, but are not limited to, projections of revenues, income or loss, earnings or loss per share, the payment or non- payment of dividends, capital structure and other financial items, statements of plans and objectives of First Financial or its management or board of directors and statements of future economic performances and statements of assumptions underlying such statements. Words such as ‘‘believes,’’ ‘‘anticipates,’’ “likely,” “expected,” ‘‘intends,’’ and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Management’s analysis contains forward-looking statements that are provided to assist in the understanding of anticipated future financial performance. However, such performance involves risks and uncertainties that may cause actual results to differ materially. These factors include, but are not limited to: economic, market, liquidity, credit, interest rate, operational and technological risks associated with the Company’s business; the effect of and changes in policies and laws or regulatory agencies (notably the recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act); management’s ability to effectively execute its business plan; mergers and acquisitions, including costs or difficulties related to the integration of acquired companies; the Company’s ability to comply with the terms of loss sharing agreements with the FDIC; the effect of changes in accounting policies and practices; and the costs and effects of litigation and of unexpected or adverse outcomes in such litigation. Please refer to the Company’s Annual Report on Form 10-K for the year ended December 31, 2013, as well as its other filings with the SEC, for a more detailed discussion of these risks, uncertainties and other factors that could cause actual results to differ from those discussed in the forward-looking statements. Such forward-looking statements are meaningful only on the date when such statements are made, and the Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such a statement is made to reflect the occurrence of unanticipated events. Forward Looking Statement Disclosure

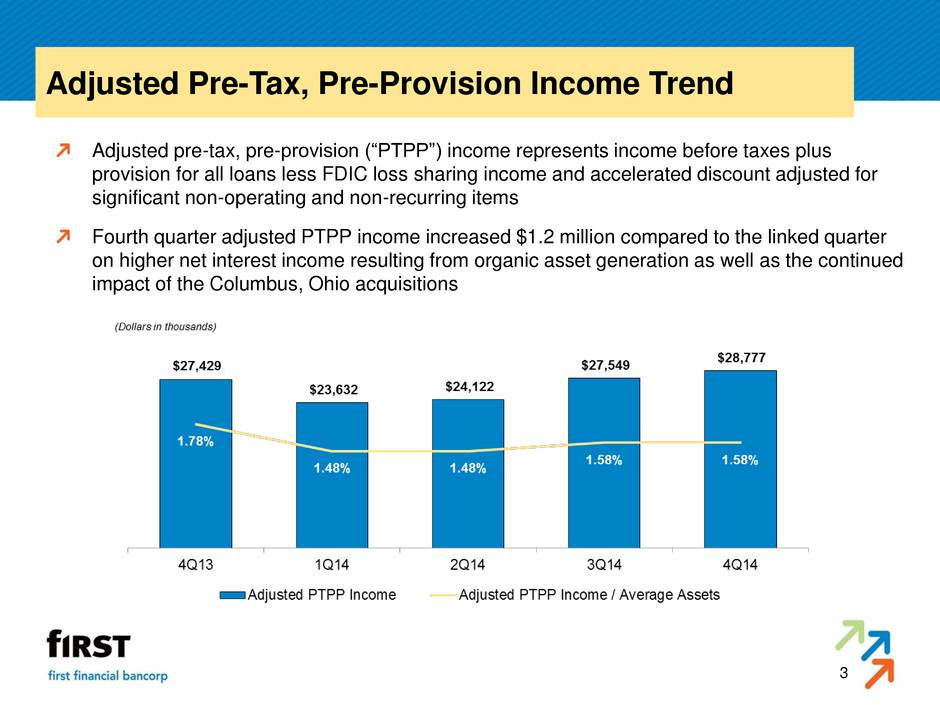

3 Adjusted Pre-Tax, Pre-Provision Income Trend Adjusted pre-tax, pre-provision (“PTPP”) income represents income before taxes plus provision for all loans less FDIC loss sharing income and accelerated discount adjusted for significant non-operating and non-recurring items Fourth quarter adjusted PTPP income increased $1.2 million compared to the linked quarter on higher net interest income resulting from organic asset generation as well as the continued impact of the Columbus, Ohio acquisitions

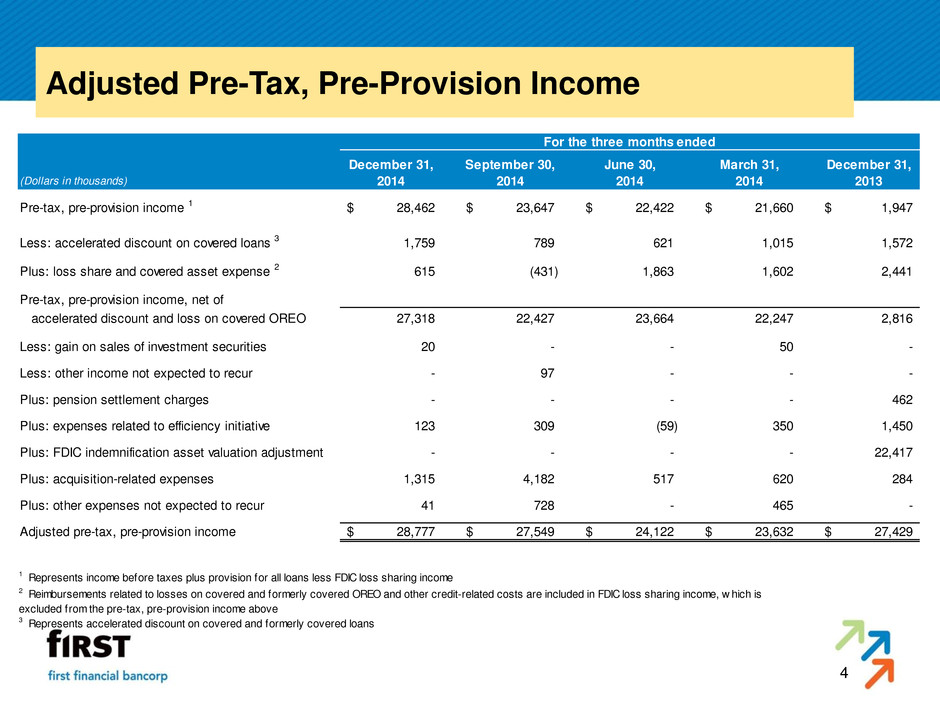

4 Adjusted Pre-Tax, Pre-Provision Income December 31, September 30, June 30, March 31, December 31, (Dollars in thousands) 2014 2014 2014 2014 2013 Pre-tax, pre-provision income 1 28,462$ 23,647$ 22,422$ 21,660$ 1,947$ Less: accelerated discount on covered loans 3 1,759 789 621 1,015 1,572 Plus: loss share and covered asset expense 2 615 (431) 1,863 1,602 2,441 Pre-tax, pre-provision income, net of accelerated discount and loss on covered OREO 27,318 22,427 23,664 22,247 2,816 Less: gain on sales of investment securities 20 - - 50 - Less: other income not expected to recur - 97 - - - Plus: pension settlement charges - - - - 462 Plus: expenses related to efficiency initiative 123 309 (59) 350 1,450 Plus: FDIC indemnification asset valuation adjustment - - - - 22,417 Plus: acquisition-related expenses 1,315 4,182 517 620 284 Plus: other expenses not expected to recur 41 728 - 465 - Adjusted pre-tax, pre-provision income 28,777$ 27,549$ 24,122$ 23,632$ 27,429$ 1 Represents income before taxes plus provision for all loans less FDIC loss sharing income 3 Represents accelerated discount on covered and formerly covered loans For the three months ended 2 Reimbursements related to losses on covered and formerly covered OREO and other credit-related costs are included in FDIC loss sharing income, w hich is excluded from the pre-tax, pre-provision income above

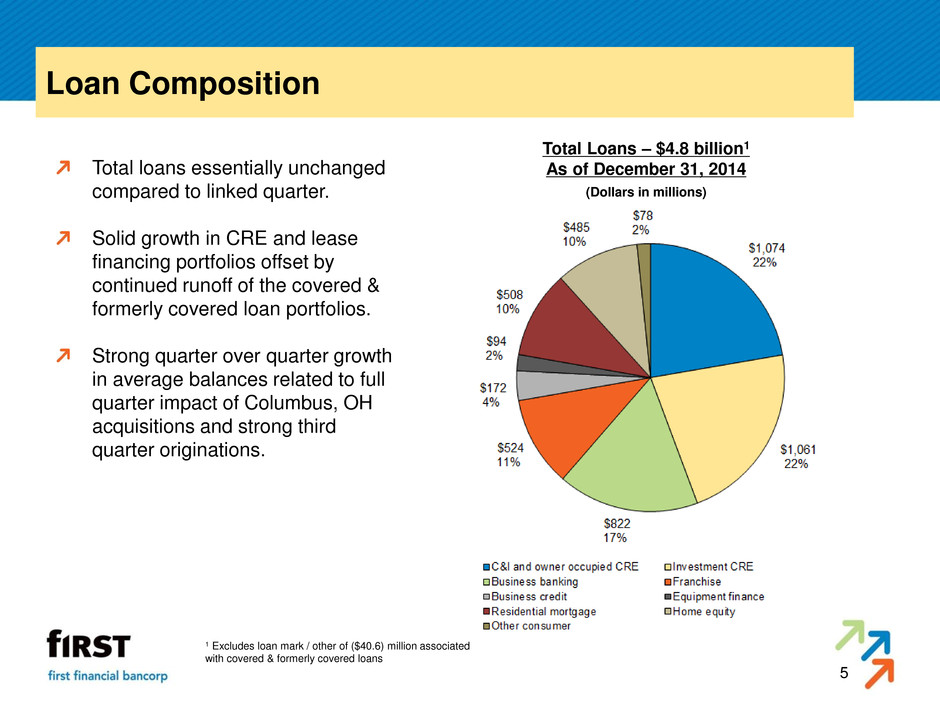

5 Loan Composition Total loans essentially unchanged compared to linked quarter. Solid growth in CRE and lease financing portfolios offset by continued runoff of the covered & formerly covered loan portfolios. Strong quarter over quarter growth in average balances related to full quarter impact of Columbus, OH acquisitions and strong third quarter originations. 1 Excludes loan mark / other of ($40.6) million associated with covered & formerly covered loans Total Loans – $4.8 billion1 As of December 31, 2014 (Dollars in millions)

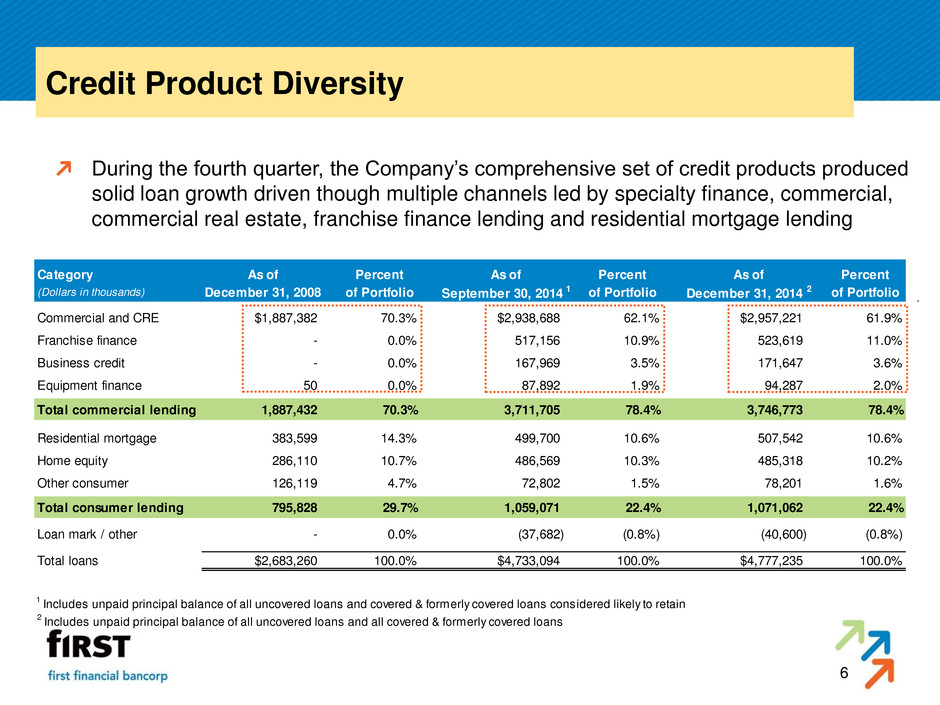

6 Credit Product Diversity During the fourth quarter, the Company’s comprehensive set of credit products produced solid loan growth driven though multiple channels led by specialty finance, commercial, commercial real estate, franchise finance lending and residential mortgage lending Category As of Percent As of Percent As of Percent (Dollars in thousands) December 31, 2008 of Portfolio September 30, 2014 1 of Portfolio December 31, 2014 2 of Portfolio Commercial and CRE $1,887,382 70.3% $2,938,688 62.1% $2,957,221 61.9% Franchise finance - 0.0% 517,156 10.9% 523,619 11.0% Business credit - 0.0% 167,969 3.5% 171,647 3.6% Equipment finance 50 0.0% 87,892 1.9% 94,287 2.0% Total commercial lending 1,887,432 70.3% 3,711,705 78.4% 3,746,773 78.4% Residential mortgage 383,599 14.3% 499,700 10.6% 507,542 10.6% Home equity 286,110 10.7% 486,569 10.3% 485,318 10.2% Other consumer 126,119 4.7% 72,802 1.5% 78,201 1.6% Total consumer lending 795,828 29.7% 1,059,071 22.4% 1,071,062 22.4% Loan mark / other - 0.0% (37,682) (0.8%) (40,600) (0.8%) Total loans $2,683,260 100.0% $4,733,094 100.0% $4,777,235 100.0% 1 Includes unpaid principal balance of all uncovered loans and covered & formerly covered loans considered likely to retain 2 Includes unpaid principal balance of all uncovered loans and all covered & formerly covered loans

First Financial Bancorp Fourth Quarter 2014 Earnings Release Supplemental Information