Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - Spectrum Brands Holdings, Inc. | d858241dex311.htm |

| EX-31.2 - EX-31.2 - Spectrum Brands Holdings, Inc. | d858241dex312.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO .

Commission file number: 1-4219

Harbinger Group Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 74-1339132 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

450 Park Avenue, 29th Floor, New York NY 10022

(Address of principal executive offices, including zip code)

Registrant’s Telephone Number, Including Area Code: (212) 906-8555

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.01 par value | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known, seasoned issuer, as defined in Rule 405 of the Securities Act: Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act: Yes ¨ No x

Indicate by check mark whether the Issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a small reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the common stock held by non-affiliates of the registrant, computed by reference to the closing price as of the last business day of the registrant’s most recently completed second fiscal quarter, March 31, 2014, was approximately $708.7 million. For the sole purpose of making this calculation, the term “non-affiliate” has been interpreted to exclude directors and executive officers and other affiliates of the registrant. Exclusion of shares held by any person should not be construed as a conclusion by the registrant, or an admission by any such person, that such person is an “affiliate” of the Company, as defined by applicable securities laws.

As of January 19, 2015, the registrant had outstanding 201,516,318 shares of common stock, $0.01 par value.

Documents Incorporated By Reference: None.

Table of Contents

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (this “Form 10-K/A”) to the Annual Report on Form 10-K of the Company for Fiscal 2014, filed with the Securities and Exchange Commission (the “SEC”) on November 21, 2014 (the “Original 10-K”) is being filed solely for the purpose of including the information required by Part III of Form 10-K.

As required by Rule 12b-15, in connection with this Form 10-K/A, the Company’s Principal Executive Officer and Chief Financial Officer are providing Rule 13a-14(a) certifications as included herein.

Except as described above, this Form 10-K/A does not modify or update disclosure in, or exhibits to, the Original 10-K. Furthermore, this Form 10-K/A does not change any previously reported financial results, nor does it reflect events occurring after the date of the Original 10-K. Information not affected by this Form 10-K/A remains unchanged and reflects the disclosures made at the time the Original 10-K was filed.

| Page | ||||||

| 1 | ||||||

| Item 10. |

1 | |||||

| Item 11. |

9 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

31 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

34 | ||||

| Item 14. |

36 | |||||

| 37 | ||||||

| Item 15. |

37 | |||||

i

Table of Contents

Unless otherwise indicated or the context requires otherwise, references herein to the “Company,” “HGI,” “we,” “us” or “our” refers to Harbinger Group Inc. and, where applicable, its consolidated subsidiaries; “Compass” refers to our oil and gas business, which we conduct through Compass Production GP, LLC (“Compass GP”) and Compass Production Partners, LP (“Compass Limited Partnership”) and their subsidiaries; “FGL” refers to Fidelity & Guaranty Life (formerly, Harbinger F&G, LLC) and, where applicable, its consolidated subsidiaries; “FIAM” refers to Five Island Asset Management, LLC (formerly, HGI Asset Management, LLC), which holds our interest in CorAmerica Capital, LLC (“CorAmerica”), FIAM Capital Management, LLC (“Five Island”) and Energy & Infrastructure Capital, LLC (“EIC”), and “Asset Managers” refers collectively to the business conducted by CorAmerica, FIAM, Five Island, EIC and Salus (each referred to individually as an “Asset Manager”); “Fiscal 2012” refers to the fiscal year ended September 30, 2012; “Fiscal 2013” refers to the fiscal year ended September 30, 2013; “Fiscal 2014” refers to the fiscal year ended September 30, 2014; “Fiscal 2015” refers to the fiscal year ending September 30, 2015; “Front Street” refers to Front Street Re (Delaware) Ltd. and, where applicable, its consolidated subsidiaries; “Front Street Cayman” refers to Front Street Re (Cayman) Ltd.; “Harbinger Capital” refers to Harbinger Capital Partners LLC; “HCP Stockholders” refers, collectively, to Harbinger Capital Partners Master Fund I, Ltd. (the “Master Fund”), Harbinger Capital Partners Special Situations Fund, L.P. (the “Special Situations Fund”) and Global Opportunities Breakaway Ltd. (the “Global Fund”); “HGI Energy” refers to HGI Energy Holdings, LLC, which holds our interests in Compass; “HGI Funding” refers to HGI Funding, LLC, and where applicable, its consolidated subsidiaries; “Salus” refers to Salus Capital Partners, LLC; “Spectrum Brands” refers to Spectrum Brands Holdings, Inc. and, where applicable, its consolidated subsidiaries; and “Zap.Com” refers to Zap.Com Corporation.

| Item 10. | Directors, Executive Officers and Corporate Governance |

BOARD OF DIRECTORS

In accordance with our Bylaws (“Bylaws”), as of the date of this report, our board of directors (our “Board”) consists of seven members. In accordance with our Certificate of Incorporation (our “Charter”), our Board is divided into three classes (designated as Class I, Class II, and Class III, respectively). The three classes are currently comprised of the following directors:

Class II Directors – Terms Expiring 2015

David M. Maura, age 42, has served as Managing Director and Executive Vice President of Investments of HGI effective as of October 2011 and as a director of HGI since May 2011. Mr. Maura has also served as the Chairman of Spectrum Brands, a subsidiary of HGI, since July 2011 and as the interim Chairman of the board of directors of Spectrum Brands and as one of its directors since June 2010. Prior to becoming Managing Director and Executive Vice President of Investments at HGI, Mr. Maura was a Vice President and Director of Investments of Harbinger Capital, a significant stockholder of HGI. Prior to joining Harbinger Capital in 2006, Mr. Maura was a Managing Director and Senior Research Analyst at First Albany Capital, where he focused on distressed debt and special situations, primarily in the consumer products and retail sectors. Prior to First Albany, Mr. Maura was a Director and Senior High Yield Research Analyst in Global High Yield Research at Merrill Lynch & Co. Mr. Maura was a Vice President and Senior Analyst in the High Yield Group at Wachovia Securities, where he covered various consumer product, service and retail companies. Mr. Maura began his career at ZPR Investment Management as a Financial Analyst. During the past five years, Mr. Maura has served on the board of directors of Russell Hobbs, Inc. (formerly Salton, Inc.), Applica Incorporated, and Ferrous Resources Ltd. Mr. Maura received a B.S. in Business Administration from Stetson University and is a CFA charterholder.

Joseph S. Steinberg, age 70, has served as Chairman of the Board of HGI since December 2014 and as a director of HGI since July 2014. Mr. Steinberg is Chairman of the board of directors of Leucadia National Corporation (“Leucadia”), which is a significant stockholder of HGI. He has served as a director of Leucadia since December 1978 and as President from January 1979 until March 1, 2013, when he became the Chairman of the Leucadia board of directors. Mr. Steinberg has served as Chairman of the board of directors of HomeFed Corporation since 1999 and as a HomeFed director since 1998. Mr. Steinberg also serves on the board of directors of Crimson Wine Group, Ltd. Mr. Steinberg has served as a director of Jefferies Group, LLC since April 2008. Mr. Steinberg previously served as a director of Mueller Industries, Inc. from September 2011 to September 2012. Mr. Steinberg has managerial and investing experience in a broad range of businesses through his many years as President and a director of Leucadia and its affiliates.

1

Table of Contents

Class III Directors – Terms Expiring 2016

Omar M. Asali, age 44, has served as President of HGI effective as of October 2011, as Acting President since June 2011, and as a director of HGI since May 2011. Mr. Asali is responsible for overseeing the day-to-day activities of HGI, including M&A activity and overall business strategy for HGI and HGI’s underlying subsidiaries. Mr. Asali has been directly involved in all of HGI’s acquisitions across all sectors, and he is actively involved in HGI’s management and investment activities. Mr. Asali is also the Vice Chairman of the board of Spectrum Brands, Chairman of the board of HGI Asset Management Holdings, LLC, a director of FGL, Front Street Cayman, Zap.Com and Compass GP, each of which is a subsidiary of HGI, and a member of the investment committee of HGI’s Asset Managers. Prior to becoming President of HGI, Mr. Asali was a Managing Director and Head of Global Strategy of Harbinger Capital, a significant stockholder of HGI. Prior to joining Harbinger Capital in 2009, Mr. Asali was the co-head of Goldman Sachs Hedge Fund Strategies (“Goldman Sachs HFS”) where he helped manage approximately $25 billion of capital allocated to external managers. Mr. Asali also served as co-chair of the Investment Committee at Goldman Sachs HFS. Before joining Goldman Sachs HFS in 2003, Mr. Asali worked in Goldman Sachs’ Investment Banking Division, providing M&A and strategic advisory services to clients in the High Technology Group. Mr. Asali previously worked at Capital Guidance, a boutique private equity firm. Mr. Asali began his career working for a public accounting firm. Mr. Asali received an MBA from Columbia Business School and a B.S. in Accounting from Virginia Tech.

Frank Ianna, age 65, has served as a director of HGI since April 2013. Mr. Ianna has served as director of Sprint Corporation since 2009. Mr. Ianna served as a director of Clearwire Corporation from November 2008 until June 2011 and as a director of Tellabs, Inc. from 2004 until 2013. Mr. Ianna served on the board of trustees of the Stevens Institute of Technology between 1997 and 2007 and as chairman of its subsidiary, Castle Point Holdings, Inc., between 2006 and 2007. Mr. Ianna has also served as a director of a number of private companies and non-profit organizations. Mr. Ianna retired from AT&T, Inc. in 2003 after a 31-year career serving in various executive positions, most recently as President of AT&T Network Services. Mr. Ianna serves as a consultant for McCreight & Company, a consulting company based in Connecticut. Mr. Ianna received his undergraduate degree from the Stevens Institute in Electrical Engineering in 1971 (BEEE), and his Master’s Degree from MIT in 1972 (MSEE) and completed the Program for Management Development (PMD), an Executive Education Program of the Harvard Business School in 1985.

Gerald Luterman, age 71, has served as a director of HGI since April 2013. Mr. Luterman has been a director of Florida Community Bank since January 2010. Mr. Luterman also serves as a director of a number of private companies and non-profit organizations. Mr. Luterman also served as Interim Chief Financial Officer of NRG Energy, Inc. (“NRG”) from November 2009 through May 2010. Mr. Luterman was Executive Vice President and Chief Financial Officer of KeySpan Corporation from August 1999 to September 2007. Mr. Luterman has more than 30 years of experience in senior financial positions with companies including American Express Company, Booz Allen & Hamilton, Inc., Emerson Electric Company and Arrow Electronics. Mr. Luterman also served as a director of NRG from April 2009 to 2014, IKON Office Solutions, Inc. from November 2003 until August 2008 and U.S. Shipping Partners L.P. from May 2006 until November 2009. Mr. Luterman previously qualified as a Canadian Chartered Accountant and graduated from McGill University in Montreal, earning a Bachelor of Commerce Degree in Economics in 1965 and a MBA from Harvard Business School in 1967.

Class I Directors – Terms Expiring 2017

Eugene I. Davis, age 59, has served as a director of HGI since February 2014. Mr. Davis has been the Chairman and Chief Executive Officer of Pirinate Consulting Group LLC (“Pirinate”), a privately held consulting firm, since 1999. Pirinate specializes in turnaround management, merger and acquisition consulting and strategic planning advisory services for public and private business entities. Previously, Mr. Davis served as President, Vice Chairman and Director of Emerson Radio Corporation and Chief Executive Officer and Vice Chairman of Sport Supply Group, Inc. Mr. Davis currently serves as director of the following public companies: Spectrum Brands, a subsidiary of HGI, WMI Holdings Corp. and U.S. Concrete, Inc. During the past five years, Mr. Davis has also been a director of Ambassadors International, Inc., American Commercial Lines Inc., Delta Airlines, Dex One Corp., Foamex International Inc., Footstar, Inc., Granite Broadcasting Corporation, GSI Group, Inc., Ion Media Networks, Inc., JGWPT Holdings Inc., Knology, Inc., Media General, Inc., Mosaid Technologies, Inc., Ogelbay Norton Company, Orchid Cellmark, Inc., PRG-Schultz International Inc., Roomstore, Inc., Rural/Metro Corp., SeraCare Life Sciences, Inc., Silicon Graphics International, Smurfit-Stone Container Corporation, Solutia Inc., Spansion, Inc., Tipperary Corporation, Trump Entertainment Resorts, Inc., Viskase, Inc. and YRC Worldwide, Inc. Mr. Davis holds a Bachelor of Arts in International Politics from Columbia University, Columbia College, a Masters in International Affairs, International Law and Organization from Columbia University’s School of International Affairs and a Juris Doctor from Columbia University’s School of Law.

2

Table of Contents

Andrew Whittaker, age 53, has served as a director of HGI since July 2014. Mr. Whittaker has been the Vice Chairman of Leucadia, a significant stockholder of HGI, since 2014 and has been Vice Chairman of Jefferies Group LLC, a subsidiary of Leucadia, since 2002. Mr. Whittaker has served as member of the board of directors of Jefferies Finance LLC since 2004. Mr. Whittaker has been a member of the Jefferies Executive Committee for the past 19 years. He was formerly the Co-Head of Investment Banking at Jefferies Group LLC. Mr. Whittaker has over 27 years of investment banking experience in a broad range of industries. Mr. Whittaker received an MBA from Harvard Business School and a BA from Dartmouth College.

3

Table of Contents

EXECUTIVE OFFICERS

The following sets forth certain information with respect to the executive officers of the Company as of January 26, 2015. All officers of the Company serve at the discretion of the Company’s Board.

| Name |

Position | |

| Omar M. Asali* | Director and President | |

| Thomas A. Williams | Executive Vice President and Chief Financial Officer | |

| David M. Maura* | Director and Executive Vice President of Investments | |

| Michael Sena | Senior Vice President and Chief Accounting Officer | |

| * | For information regarding Messrs. Asali and Maura, see “Board of Directors” above. |

Thomas A. Williams, age 55, has been the Executive Vice President and Chief Financial Officer of HGI since March 2012. Mr. Williams has also been the Executive Vice President and Chief Financial Officer of Zap.Com, a subsidiary of HGI, since March 2012 and has served as a director of Zap.Com since December 2014. Mr. Williams is also a director of Front Street Cayman, a director of FS Holdco II Ltd., a director of HGI Asset Management Holdings, LLC and a director and member of the audit committee of FGL, each of which is a subsidiary of HGI. Prior to joining HGI, Mr. Williams was President, Chief Executive Officer and a director of RDA Holding Co. and its subsidiary Reader’s Digest Association, Inc. (together, “RDA”) from April 2011 until September 2011. Previously, Mr. Williams was RDA’s Chief Financial Officer from February 2009 until April 2011 where his primary focus was on developing business restructuring plans for the company. RDA filed for bankruptcy protection in August 2009 and February 2013. Prior to joining RDA, Mr. Williams served as Executive Vice President and Chief Financial Officer for Affinion Group Holdings, Inc., a portfolio company of Apollo Management, L.P., from January 2007 until February 2009 where his primary focus was on growing enterprise value, finance, accounting, treasury, tax, investor relations and compliance with the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”). Previously, Mr. Williams spent more than 21 years with AT&T, Inc., where he held a progression of senior financial and officer positions including Chief Financial Officer, AT&T Networks; Chief Financial Officer, AT&T Global Network Technology Services; Chief Financial Officer, AT&T Laboratories; and AT&T Chief Process Officer. Mr. Williams started at AT&T with Bell Laboratories in June 1985. Prior to his tenure at AT&T, Mr. Williams was International Controller of McLean Industries Inc. from 1984 to 1985, Industry Analyst of Interpool Ltd. from 1982 to 1984 and Commodity Trading Associate with Bache Halsey Stuart Shields, Inc. from 1981 to 1982. Mr. Williams received a BA in Economics from the University of South Florida.

Michael Sena, age 41, has been the Senior Vice President and Chief Accounting Officer of HGI since October 2014 and had previously served as the Vice President and Chief Accounting Officer from November 2012 to October 2014. Mr. Sena is also the Vice President and Chief Accounting Officer of Zap.Com, a subsidiary of HGI, and has served as a director of Zap.Com since December 2014. From January 2009 until November 2012, Mr. Sena held various accounting and financial reporting positions with the Reader’s Digest Association, Inc., last serving as Vice President and North American Controller. Before joining the Reader’s Digest Association, Inc., Mr. Sena served as Director of Reporting and Business Processes for Barr Pharmaceuticals from July 2007 until January 2009. Prior to that, Mr. Sena held various positions with PricewaterhouseCoopers. Mr. Sena is a Certified Public Accountant and holds a B.S. in Accounting from Syracuse University.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 (as amended, the “Exchange Act”) requires our directors, executive officers, and the persons who beneficially own more than 10% of the common stock, par value $0.01 per share, of the Company (the “Common Stock”) and securities convertible into shares of Common Stock (together with the Common Stock, “Subject Shares”), to file with the SEC initial reports of ownership and reports of changes in ownership of Subject Shares. Directors, officers and greater than 10% beneficial owners of the Subject Shares are required by the SEC’s regulations to furnish us with copies of all forms they file with the SEC pursuant to Section 16(a) of the Exchange Act. Based solely on the reports filed with the SEC, we believe that these persons have complied with all applicable filing requirements during Fiscal 2014, except that Mr. Michael Kuritzkes (HGI’s former General Counsel), Mr. Philip A. Falcone and the funds affiliated with Harbinger Capital each filed one Statement of Changes in Beneficial Ownership on Form 4, each of which reported one transaction, later than the time prescribed by the SEC.

4

Table of Contents

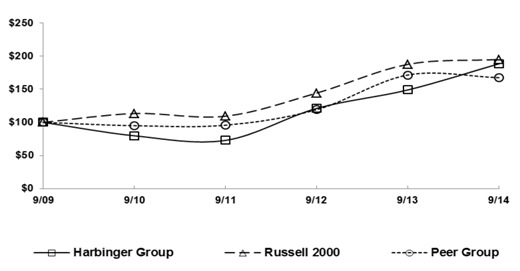

PERFORMANCE GRAPH

Set forth below is a line-graph presentation comparing the cumulative stockholder return on our Common Stock against cumulative total returns of the following: (a) the Russell 2000 and (b) a peer group of companies consisting of Leucadia, Carlisle Companies Inc., Apollo Global Management, LLC and Standex International Corp. The performance graph shows the total return on an investment of $100 for the period beginning September 30, 2009 and ending September 30, 2014. The Company believes that the peer group of companies provides a reasonable basis for comparing total stockholder returns. The stockholder return shown on the graph below is not necessarily indicative of future performance, and we will not make or endorse any predictions as to future stockholder returns. The graph and related data were furnished by Research Data Group, Inc.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Harbinger Group, the Russell 2000 Index, and a Peer Group

| * | $100 invested on September 30, 2009 in stock or index, including reinvestment of dividends. Fiscal year ending September 30. |

5

Table of Contents

CORPORATE GOVERNANCE

In accordance with the New York Stock Exchange Listed Company Manual (the “NYSE Rules”), a majority of our Board is comprised of independent directors and we have an Audit Committee (the “Audit Committee”), a Compensation Committee (the “Compensation Committee”) and a Nominating and Corporate Governance Committee (the “NCG Committee”), each of which have written charters addressing each such committee’s purpose and responsibilities and are comprised entirely of independent directors.

Director Independence

Our Board has determined that Messrs. Davis, Ianna, Luterman, Steinberg and Whittaker, our non-management directors, qualify as independent directors under our Corporate Governance Guidelines and the NYSE Rules. Under our Corporate Governance Guidelines and the NYSE Rules, no director qualifies as independent unless our Board affirmatively determines that the director has no material relationship with HGI. Based upon information requested from and provided by each director concerning their background, employment and affiliations, our Board has determined that each of the independent directors named above has no material relationship with HGI, nor has any such person entered into any material transactions or arrangements with HGI or its subsidiaries, and is therefore independent under the NYSE Rules. In making such determination, our Board considered a variety of factors, including certain ordinary course of business transactions from time to time between us and certain entities affiliated with non-management directors, and determined that our non-management directors qualify as independent directors under our Corporate Governance Guidelines and the NYSE Rules.

Corporate Governance Guidelines and Code of Ethics and Business Conduct

Our Board has adopted Corporate Governance Guidelines to assist it in the exercise of its responsibilities. These guidelines reflect our Board’s commitment to monitor the effectiveness of policy and decision making both at our Board and management level, with a view to enhancing stockholder value over the long term. The Corporate Governance Guidelines address, among other things, our Board and Board committee composition and responsibilities, director qualifications standards and selection of the Chairman of our Board and our Chief Executive Officer.

Our Board has adopted a Code of Business Conduct and Ethics for Directors, Officers and Employees and a Code of Ethics for Chief Executive and Senior Financial Officers to provide guidance to all of our directors, officers and employees, including our principal executive officer, principal accounting officer or controller or persons performing similar functions. Our Board has adopted a corporate governance policy prohibiting HGI’s directors and executive officers from (i) hedging the economic risk associated with the ownership of HGI’s Common Stock, or (ii) pledging our Common Stock, after the date the policy was adopted, unless first pre-approved by HGI’s legal department. Our Board has also adopted an equity retention policy for the Company’s senior management.

Meetings of Independent Directors

We generally hold executive sessions at each Board and committee meeting. The Chairman of the Audit Committee presides over executive sessions of the entire Board and the chairman of each committee presides over the executive session of that committee.

Board Leadership Structure and Role in Risk Oversight

Mr. Steinberg serves as the Chairman of our Board and was appointed to this role in December 2014, following the resignation of Mr. Falcone as Chairman and Chief Executive Officer. Mr. Asali currently serves as a member of our Board and our President and is responsible for overseeing the day-to-day activities of the Company, including M&A activity and overall business strategy for the Company and its subsidiaries.

Our management is responsible for understanding and managing the risks that we face in our business, and our Board is responsible for overseeing management’s overall approach to risk management. Our Board receives, reviews and discusses reports on the operations of our businesses from members of management and members of management of our subsidiaries as appropriate. Our Board also fulfills its oversight role through the operations of our NCG Committee, Audit Committee and Compensation Committee. As appropriate, these committees of the Board provide periodic reports to our Board on their activities. Our Audit Committee is responsible for oversight of corporate finance and financial reporting-related risks, including those related to our accounting, auditing and financial reporting practices. Our Compensation Committee is responsible for the oversight of our compensation policies and practices, including conducting annual risk assessments of our compensation policies and practices. Our

6

Table of Contents

NCG Committee is responsible for assisting our Board with the oversight of risks and reviewing and making recommendations to our Board regarding our overall corporate governance, including board and committee composition, board nominees, size and structure and director independence, our corporate governance profile and ratings, and our political participation and contributions.

Governance Documents Availability

We have posted our Corporate Governance Guidelines, Code of Business Conduct and Ethics for Directors, Officers and Employees, Code of Ethics for Chief Executive and Senior Financial Officers, Audit Committee Charter, Compensation Committee Charter and NCG Committee Charter on our website under the heading “Corporate Governance” at www.harbingergroupinc.com. We intend to disclose any amendments to, and, if applicable, any waivers of, these governance documents on that section of our website. These governance documents are also available in print without charge to any stockholder of record that makes a written request to HGI. Inquiries must be directed to the Investor Relations Department at Harbinger Group Inc., 450 Park Avenue, 29th floor, New York, New York 10022.

INFORMATION ABOUT COMMITTEES OF THE BOARD OF DIRECTORS

Our Audit Committee, Compensation Committee and NCG Committee were our Board’s standing committees during Fiscal 2014. Our Board held 25 meetings during Fiscal 2014. In addition, a special committee of the independent directors of our Board operated on an ad hoc basis, holding 8 meetings during Fiscal 2014.

Audit Committee

Currently, our Audit Committee is composed of Messrs. Luterman (Chairman), Davis and Ianna. Messrs. Ianna and Luterman were appointed as members of our Board and our Audit Committee on April 8, 2013. Mr. Davis was appointed as a member of our Board and our Audit Committee on February 25, 2014 and April 28, 2014, respectively.

Our Board determined that all 3 members of our Audit Committee qualify as independent under applicable SEC rules (including SEC rule 10A-3), NYSE Rules and the Company’s Corporate Governance Guidelines. Messrs. Luterman, Ianna and Davis also qualify as “audit committee financial experts” as defined by Item 407(d)(5)(ii) of Regulation S-K. Our Audit Committee held 4 meetings during Fiscal 2014.

Our Audit Committee has been delegated the authority to, among other things, (i) appoint and replace the independent auditor; (ii) determine the compensation and oversight of the independent auditor; (iii) pre-approve all auditing services and permitted non-audit services, including the fees and terms thereof, to be performed for the Company by its independent auditor; (iv) provide oversight with respect to the Company’s internal control and procedures; and (v) prepare any reports required by law to be prepared by the Audit Committee. Our Audit Committee operates under, and has the responsibility and authority set forth in, the written charter adopted by our Board, which can be viewed on our website, www.harbingergroupinc.com, under the heading “Corporate Governance.”

Compensation Committee

Currently, our Compensation Committee is composed of Messrs. Davis (Chairman), Ianna, Luterman and Steinberg. Messrs. Ianna and Luterman were appointed as members of our Compensation Committee on April 8, 2013. Mr. Davis was appointed as a member of our Compensation Committee on April 28, 2014. Mr. Steinberg was appointed as a member of our Board and our Compensation Committee on July 1, 2014.

Our Board determined that all members of our Compensation Committee qualify as independent under applicable SEC rules, NYSE Rules and the Company’s Corporate Governance Guidelines. Our Compensation Committee held 24 meetings during Fiscal 2014. Our Compensation Committee has been delegated the authority to, among other things, (i) review and recommend to our Board corporate goals and objectives relevant to our executive officer compensation and recommend to our Board the compensation level of our executive officers; (ii) make recommendations to our Board with respect to executive officer compensation and benefits, including incentive-compensation and equity-based plans for executive officers; (iii) review and recommend to our Board any employment agreements or severance or termination arrangements to be made with any of our executive officers; and (iv) review and discuss with management our compensation discussion and analysis disclosure and compensation committee reports in order to comply with our public reporting requirements. Our Compensation Committee operates under, and has the responsibility and authority set forth in, the written charter adopted by our Board, which can be viewed on our website, www.harbingergroupinc.com, under the heading “Corporate Governance.”

7

Table of Contents

NCG Committee

Currently, our NCG Committee is composed of Messrs. Frank Ianna (Chairman), Eugene I. Davis, Gerald Luterman and Joseph S. Steinberg. Messrs. Ianna, Davis, Luterman and Steinberg were appointed as members of the NCG Committee on September 27, 2013, November 21, 2013, April 28, 2014 and November 20, 2014, respectively.

Our Board determined that all members of our NCG Committee qualify as independent under applicable SEC rules, NYSE Rules and the Company’s Corporate Governance Guidelines. Our NCG Committee held 6 meetings during Fiscal 2014.

Our NCG Committee has been delegated the authority to, among other things, (i) develop and recommend to our Board for approval the criteria for Board membership and identify individuals qualified to become members of our Board; (ii) as directed by our Board from time to time, either select or recommend to our Board for selection director nominees for the next annual meeting of shareholders or to fill vacancies on our Board; (iii) assist the Board in determining whether individual directors have material relationships with our Company that may interfere with their independence; and (iv) develop, review and assess at least annually the adequacy of the Company’s corporate governance principles and guidelines, the Board’s and management’s review of the Company’s risk oversight process, and make recommendations to the Board as the NCG Committee deems appropriate. The NCG Committee operates under, and has the responsibility and authority set forth in, the written charter adopted by our Board, which can be viewed on our website, www.harbingergroupinc.com, under the heading “Corporate Governance.”

8

Table of Contents

| Item 11. | Executive Compensation |

COMPENSATION DISCUSSION AND ANALYSIS

This section provides an overview and analysis of our compensation program and policies, the material compensation decisions made under those programs and policies, and the material factors considered in making those decisions. The discussion below is intended to help you understand the detailed information provided in our executive compensation tables and put that information into context within our overall compensation program. The series of tables following this Compensation Discussion and Analysis provides more detailed information concerning compensation earned or paid in Fiscal 2014, Fiscal 2013 and Fiscal 2012 for the following individuals (each a “named executive officer” as of September 30, 2014):

| • | Omar M. Asali, a Director and our President; |

| • | Thomas A. Williams, our Executive Vice President and Chief Financial Officer; |

| • | David M. Maura, a Director and our Managing Director and Executive Vice President of Investments; and |

| • | Michael Sena, our Senior Vice President and Chief Accounting Officer. |

In addition, Philip A. Falcone, who served as the Chairman of our Board and our Chief Executive Officer was one of our “named executive officers” during Fiscal 2014. On November 25, 2014, Mr. Falcone resigned from his positions with the Company, effective as of December 1, 2014.

Executive Summary

Highlights for Fiscal 2014

During Fiscal 2014, we made significant progress in our business strategy to reduce our cost of capital, increase our investor base and grow and diversify our businesses. Some of the most significant of these steps include the following:

| • | FGL completed its initial public offering and its shares began trading on the New York Stock Exchange under the ticker symbol “FGL” and Front Street Cayman, a wholly-owned indirect subsidiary of HGI, closed a reinsurance treaty with Bankers Life Insurance Company. |

| • | HGI expanded its footprint in asset management by launching EIC, an investment manager specializing in direct lending to companies in the global energy and infrastructure sectors, and acquiring a controlling interest in CorAmerica, a commercial real estate investment firm. In addition, Salus originated $597.3 million of new asset-based loan commitments. Salus, together with its affiliated co-lenders FGL and Front Street, had $811.6 million of loans outstanding as of September 30, 2014. |

| • | Spectrum Brands continued to execute on its business strategy, including, completing the $35.8 million acquisition of The Liquid Fence Company, Inc., a producer of animal repellents. |

| • | HGI simplified its capital structure by exercising its option to convert all but one of its issued and outstanding shares of preferred stock into Common Stock of the Company in May 2014. In addition, in May 2014, HGI completed an offer to exchange $320.6 million of its outstanding Senior Secured Notes due 2019 for $350.0 million aggregate principal amount of Unsecured Senior Notes due 2022. HGI also solicited the holders of its Senior Secured Notes to amend the indenture governing the Senior Secured Notes to provide HGI with, among other things, greater flexibility to repurchase or redeem its outstanding Common Stock. |

| • | HGI opportunistically purchased its Common Stock through its Board-authorized stock repurchase program of $100.0 million. Under its repurchase programs, HGI repurchased 5,197,000 shares of our outstanding Common Stock during Fiscal 2014, for an aggregate purchase price of $65.6 million, or an average of $12.62 per share. |

| • | Diluted net loss attributable to the Company’s common and participating preferred stockholders decreased $10.3 million to $83.9 million, or $0.51 diluted per common share attributable to controlling interest ($0.51 basic) in Fiscal 2014, compared to diluted net loss attributable to common and participating preferred stockholders of $94.2 million, or $0.67 diluted per common share attributable to controlling interest ($0.67 basic), in Fiscal 2013. |

9

Table of Contents

| • | HGI recorded total revenues of $6.0 billion, the highest level of annual revenue recorded by HGI and an increase of $419.6 million, or 7.6%, from Fiscal 2013, driven by increases in all operating segments as compared to Fiscal 2013. |

| • | HGI’s consolidated operating income of $569.5 million decreased $167.9 million, or (22.8)%, as compared to the $737.4 million reported in Fiscal 2013, driven primarily by lower operating income in Insurance, as a portfolio repositioning undertaken in the year ago period resulted in higher realized investment gains in Fiscal 2013, which were not expected to recur in Fiscal 2014. |

The foregoing is a highlight summary of certain of HGI’s performance measures as of the end of Fiscal 2014. For a more complete understanding and evaluation of the business of the Company and its subsidiaries, you are encouraged to read the Company’s other reports filed with the SEC.

Summary of Sound Governance Features of our Compensation Programs

Our compensation programs, practices and policies are reviewed and re-evaluated periodically, and are subject to change from time to time. Our executive compensation philosophy is focused on pay for performance and is designed to reflect appropriate governance practices aligned with the needs of our business. Listed below are some of the Company’s more significant practices and policies that were in effect during Fiscal 2014, which were adopted to drive performance and to align our executives’ interests with those of our stockholders.

What We Did For Fiscal 2014

| • | Pay for Performance Philosophy: Our executive compensation programs are designed to pay for performance, with a significant portion of executive compensation not guaranteed. Target compensation is established for our executive officers at the beginning of the performance period by our Compensation Committee. Our named executive officers had an opportunity to earn actual compensation that varied from target, based on achievement against pre-established performance targets. Variable compensation rewards performance and contribution to both short-term and long-term corporate financial performance. For Fiscal 2014, variable pay represented 97.6%, 97.6%, 93.5%, 97.4% and 82.8% of total compensation for Messrs. Falcone, Asali, Williams, Maura and Sena, respectively, each of whom participated in our Fiscal 2014 bonus program. |

| • | Independent Executive Compensation Consultants: The Compensation Committee worked with Hodak Value Advisors (“Hodak”), its independent executive compensation consultant firm throughout Fiscal 2014, and from time to time with another independent compensation consulting firm, and separate outside counsel, as it determined appropriate. |

| • | Mitigation of Undue Risk: Our compensation plans have provisions to mitigate undue risk, including bonus plan mechanisms that defer significant portions of awards, partially subject to forfeiture (see “Clawback Policy” and “Malus Provision” below), and relate future target performance to past performance in a manner that closely ties awards to sustainable performance over time. |

| • | Post-employment Restrictive Covenants: Our employment agreements provide for post-employment non-competition, non-solicitation and non-disparagement provisions. |

| • | Clawback Policy: Our equity awards allow the Company to recover payouts in the event that recoupment is required by applicable law (including pursuant to Sarbanes-Oxley and the Dodd-Frank Wall Street Reform and Consumer Protection Act) or a participant receives for any reason any amount in excess of what should have been received (including, without limitation, by reason of a financial restatement, mistake in calculations or other administrative error). |

| • | Malus Provision: Our annual bonus program provides for an automatic deferral of payouts in excess of two times the target bonus pool, with cash deferrals subject to reduction if the Company does not meet certain specified performance criteria in subsequent years. |

10

Table of Contents

| • | Negative Discretion and Other Reductions: Our Compensation Committee reserves the right to exercise negative discretion to reduce awards under the annual bonus plan. For Fiscal 2014, senior management recommended the use of negative discretion and other offsets, as described further below, to reduce the corporate bonus pool by $28.66 million to $60.56 million. The Compensation Committee reviewed and accepted this recommendation. |

| • | Award Caps: Amounts that can be earned by any individual under the annual bonus program are capped at $20 million per year (“Award Cap”). |

| • | Equity Retention: We maintain an equity retention policy for senior management, requiring each member of senior management to retain ownership of at least 25% of his or her covered shares, net of taxes and transaction costs, until the earlier of (i) the date of such senior management member’s termination of employment with the Company or (ii) the date such person is no longer a member of senior management. |

What We Did Not Do for Fiscal 2014

| • | No 280G or Section 409A Excise Tax Gross-Ups: We do not provide “gross-ups” for any taxes imposed with respect to Section 280G (change of control) or Section 409A (nonqualified deferred compensation) of the Internal Revenue Code. |

| • | No Pensions or Supplemental Pensions: Our named executive officers are not provided with pension or supplemental executive retirement plans. |

| • | No Single-Trigger Equity Acceleration: In Fiscal 2014, we did not provide our named executive officers “single-trigger” equity vesting upon a change of control of the Company. |

| • | No Repricing of Underwater Stock Options without Stockholder Approval: We do not lower the exercise price of any outstanding stock options, unless stockholders approve this. |

| • | No Discounted Stock Options: The exercise price of our stock options is not less than 100% of the fair market value of our Common Stock on the date of grant. |

| • | No Unauthorized Hedging or Pledging: The Board has adopted a corporate governance policy prohibiting our directors and executive officers from (i) hedging the economic risk associated with the ownership of our Common Stock and (ii) pledging our Common Stock, after the date the policy was adopted, unless first pre-approved by the Company’s legal department. |

Compensation Philosophy and General Objectives

Our executive compensation philosophy is focused on pay for performance and is designed to reflect appropriate governance practices aligned with the needs of our business. We grant target levels of compensation that are designed to attract and retain employees who are able to meaningfully contribute to our success. Our Compensation Committee considers several factors in designing target levels of compensation, including, but not limited to, historical levels of pay for each executive, actual turnover in the executive ranks, market data on the compensation of executive officers at similar companies, and its judgment about retention risk with regards to each executive relative to their importance to the Company. In reviewing market data, our Compensation Committee has reviewed the total compensation for each executive officer relative to executives in the same or similar positions in an appropriate market comparison group, which includes seventeen business development or private equity companies, adjusting the total compensation observed at these peers for their size relative to the Company. The seventeen companies are American Capital, Ltd., Apollo Global Mgmt., Blackstone Group LP, Capital Southwest Corp, Carlyle Group, Compass Diversified Holdings, Harris & Harris Group, Hercules Tech Growth Cap, Icahn Enterprises, KKR, Kohlberg Capital Corp, Leucadia, Loews Corp, Main Street Capital Corp, MCG Capital Corp, Safeguard Scientifics Inc. and Triangle Capital Corp. While median, size-adjusted total compensation is initially presumed to be competitive market pay, the Compensation Committee does not attempt to target a specific percentile within a peer group or otherwise rely exclusively on that data to determine named executive officer compensation. The Compensation Committee does not use market data to target specific components of total compensation, such as salary or bonuses, and instead determines the target total level of compensation necessary to be competitive for each executive in the relevant market for that executive’s talent.

The Company’s mix of fixed versus variable compensation, within the target total level of pay, is driven by the Company’s emphasis on pay for performance. The Company uses variable compensation, including performance-based equity grants, as well as management’s accumulated equity holdings, both vested and unvested, to enhance alignment of our named executive officers’ and stockholders’ interests.

11

Table of Contents

Components of Executive Compensation

Our compensation program has four basic elements: salary, initial equity grants, incentive compensation and other benefits. Salary and benefits are designed to aid in the retention of our employees. Initial equity grants are generally, though not necessarily, awarded upon hiring or promotion, and may consist of restricted stock or stock options with a vesting period. Incentive compensation generally consists of bonuses for individual and company performance, and may be awarded as cash or equity. Equity awards will typically be vested over a period of years to enhance both retention and alignment of interests.

We believe that the various components of our executive compensation program are effective in attracting and retaining our employees and providing a strong alignment of their interests with those of our stockholders. Although each element of compensation described below is considered separately, our Compensation Committee makes its determinations regarding each individual component of the compensation program in the context of the aggregate effect on total compensation for each named executive officer.

The principal elements of compensation for our named executive officers in Fiscal 2014 were:

| • | base salary; |

| • | variable compensation potential consisting of cash and equity payouts; and |

| • | limited benefits. |

In addition, as described further under the heading “Initial Long Term Equity Grant” below, in Fiscal 2014, our Compensation Committee and Board, and subsequently our stockholders, approved a one-time issuance to Mr. Falcone of warrants to purchase 3,000,000 shares of our Common Stock at an exercise price of $13.125 per share, which was 105% of the fair market value per share on the date of grant.

How We Determine Each Element of Compensation

Role of Our Compensation Committee and Compensation Consultants

Our Compensation Committee is responsible for our executive compensation program design and administration, including a regular review of our compensation programs and evaluation of management performance and awards consistent with our bonus plan. In approving the compensation program and awards for Fiscal 2014, our Compensation Committee considered a number of factors including, but not limited to, the responsibilities of the position, the executives’ experience and contributions, the competitive marketplace for executive talent and corporate performance.

Throughout Fiscal 2014, our Compensation Committee has been advised by Hodak, its independent executive compensation firm, and from time to time by another independent executive compensation firm, and separate outside counsel. Throughout Fiscal 2014, our Compensation Committee, with the assistance of its advisors, reviewed the Company’s compensation program, including target levels of compensation for current and new employees, bonus plans or equity awards, and other compensation policies affecting executive officers and directors. Our Compensation Committee held 24 meetings during Fiscal 2014.

In light of new SEC rules and new NYSE Rules, our Compensation Committee considered the independence of each of our compensation consultants, including assessment of the following factors: (i) other services provided to the Company by the consultant; (ii) fees paid as a percentage of the consulting firm’s total revenue; (iii) policies or procedures maintained by the consulting firm that are designed to prevent a conflict of interest; (iv) any business or personal relationships between the individual consultants involved in the engagement and any member of our Compensation Committee; (v) any Company stock owned by the individual consultants involved in the engagement; and (vi) any business or personal relationships between our executive officers and the consulting firm or the individual consultants involved in the engagement. Our Compensation Committee has concluded that no conflict of interest exists that would prevent our consultants from independently representing our Compensation Committee.

12

Table of Contents

Base Salary

The base salary of our named executive officers is intended to provide a level of fixed compensation that contributes to the attraction or retention of our executive officers. For Fiscal 2014, our Compensation Committee determined that, at $500,000 per year for each of Messrs. Falcone, Asali, Williams and Maura and $250,000 per year for Mr. Sena, the salaries represented an appropriate level of fixed compensation relative to each such named executive officer’s respective target total compensation, which varies by position in accordance with each such executive officer’s job responsibilities and contributions to our Company.

During Fiscal 2014, the Company entered into revised employment agreements with each of Messrs. Asali, Williams and Maura, and during Fiscal 2013 the Company entered into an employment agreement with Mr. Sena. These employment agreements provide for a fixed base salary and other compensation and were approved by our Compensation Committee. During Fiscal 2014, the Compensation Committee set Mr. Falcone’s salary at $500,000, consistent with other senior executives of the Company.

Annual Bonus Plan

For Fiscal 2014, Messrs. Falcone, Asali, Williams, Maura and Sena, and other key employees of the Company, were eligible to participate in the bonus plan established by the Compensation Committee (the “2014 Bonus Plan”). As described further herein, Mr. Falcone was paid $1 million of his 2014 bonus at the same time as bonuses were paid generally to other 2014 Bonus Plan participants. Subsequently, in connection with Mr. Falcone’s resignation of his positions with the Company, the Company and Mr. Falcone entered into a Separation and General Release Agreement, dated November 25, 2014 (the “Falcone Separation Agreement”), that, among other things, provided Mr. Falcone with a cash payment described under the headings “Compensation and Benefits – Summary Compensation Table,” “Company Significant Events after Fiscal 2014 – Equity Grants Pursuant to the 2014 Bonus Plan” and “Falcone Separation Agreement.”

The 2014 Bonus Plan is designed to (i) offer target variable compensation that provide competitive levels of total pay to executives if they achieve target results and (ii) reward and encourage value creation by executives. It provides for annual bonuses comprised of two components. The first component is an individual bonus (the “individual bonus”) based on the achievement of personal performance goals. The second component is a corporate bonus (the “corporate bonus”) based on the achievement of corporate performance measured in terms of the change in the Company’s “Net Asset Value” (as defined below) from the beginning of the Company’s fiscal year to the end of the Company’s fiscal year end (“NAV Return”), in excess of a threshold NAV Return, which for Fiscal 2014 was set at $151.1 million (the “Fiscal 2014 Threshold NAV Return”), representing a 7% increase in the Compensation Committee’s approved Net Asset Value per share at the beginning of Fiscal 2014. Please see the discussion below for additional details for the calculation of the NAV Return.

Corporate Bonus

As stated above, for Fiscal 2014, a portion of the annual bonus (namely, the corporate bonus), was based on the Company’s NAV Return. The Company believes that NAV Return is a good proxy for creation of value for the Company and its stockholders because it encourages, among other things, the generation of cash flow by the Company’s subsidiaries and transactions resulting in appreciation of the assets of the Company and its subsidiaries. Corporate bonuses are awarded annually with a portion immediately vested and a portion subject to vesting over a number of years. A portion of the unvested amounts are subject to forfeiture if the NAV Return thresholds are not satisfied in the following years. Our Compensation Committee believes that paying a corporate bonus consistently based on NAV Return, subject to vesting over a number of years, encourages a long-term focus on value creation for the benefit of our stockholders. If in Fiscal 2014, the Company had not produced a NAV Return greater than $151.1 million, no corporate bonuses would have been earned.

For Fiscal 2014, NAV Return was based on the amount calculated as the product of (i) the percentage increase in the Net Asset Value per share of the Company from the beginning of Fiscal 2014 to the end of Fiscal 2014 multiplied by (ii) the Net Asset Value at the beginning of Fiscal 2014. The 2014 Bonus Plan provides that 12% of the excess, if any, of the NAV Return for Fiscal 2014 over the Fiscal 2014 Threshold NAV Return is to be allocated to fund the corporate bonus pool for bonuses to all named executive officers and other key employees. This amount was then reduced (as discussed in greater detail below) by our Compensation Committee pursuant to its exercise of its negative discretion.

For the purpose of the foregoing calculation, the Company’s “Net Asset Value” is generally calculated by (i) starting with the value of the Company’s “Net Asset Value,” as such term is defined in the Company’s Certificate of Designation of Series A Participating

13

Table of Contents

Convertible Preferred Stock of the Company dated as of May 12, 2011 (the “Preferred Stock Certificate”), (ii) then subtracting from such amount the Company’s deferred tax liabilities, (iii) then adding to such amount the Company’s capital contributions to fund start-up businesses, which is subject to a $20 million cap, (iv) then adding to such amount the Company’s deferred financing costs, (v) then adding to such amount the value of the Company’s assets that have not been appraised, which is subject to a $50 million cap, (vi) then eliminating the effect of any increase in legacy liabilities associated with our predecessor entity, Zapata Corporation and its subsidiaries, (vii) then adding to such amount expenses incurred in connection with completing any acquisitions by the Company within the past twelve months, and (viii) excluding any accretion on Preferred Stock (calculated in the manner contained in the Preferred Stock Certificate). The Company then makes adjustments to eliminate the effects of any conversion of Preferred Stock into Common Stock.

Our Company achieved a NAV Return of $894.61 million during Fiscal 2014. Accordingly, pursuant to the 2014 Bonus Plan, 12% of the portion of the Fiscal 2014 NAV Return that is in excess of $151.1 million or $89.22 million, was allocated to fund the corporate bonus pool for bonuses to all named executive officers and other key employees. The overall bonus pool was preliminarily divided among all plan participants based on their individual target bonuses as a proportion to the sum of target bonuses. Our Compensation Committee, and our Board, following the recommendation of our senior management, determined the overall bonus pool and the allocation of awards to all plan participants relative to their respective contributions.

For Fiscal 2014, senior management recommended and the Compensation Committee agreed to reduce the corporate bonus pool by $28.66 million to $60.56 million to reflect the use of negative discretion and the offset of board fees and compensatory payments (cash and equity) made by certain of the Company’s subsidiaries or affiliates to certain of the Company’s officers for their service to such subsidiaries or affiliates. For more details regarding such board fees and compensatory payments, see the heading titled “HGI Subsidiary and Affiliate Fees” below.

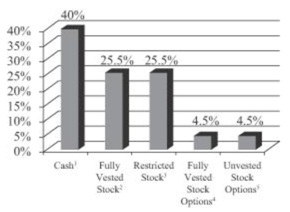

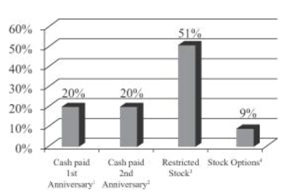

Pursuant to the 2014 Bonus Plan, awards were paid out in a mix of cash (40%) and equity (60%). The 2014 Bonus Plan was designed such that all awards for Fiscal 2014 greater than two times the target bonus for each plan participant were deferred to subsequent years, in each case, in the proportions as set forth in the charts below. Deferred cash payments may be reduced in subsequent years, if the NAV Return in such years is below a threshold return.

The corporate bonus earned, after reductions taken for compensation payments made by our subsidiaries and affiliates as described below in “HGI Subsidiary and Affiliate Fees”, was distributed to participants as follows:

14

Table of Contents

Individual Bonus

As stated above, for Fiscal 2014, a portion of the annual bonus (namely, the individual bonus), was based on individual performance achievement against certain pre-established goals. For Messrs. Falcone, Asali and Maura, for Fiscal 2014, 85% of their target annual bonus was the corporate bonus (based on NAV Return) and 15% was the individual bonus based on performance of individual goals. For Mr. Williams, for Fiscal 2014, 60% of his target annual bonus consisted of a corporate bonus and 40% was an individual bonus. For Mr. Sena, for Fiscal 2014, 50% of his target annual bonus consisted of a corporate bonus and 50% was an individual bonus. The performance goals for the individual bonus were determined by our Compensation Committee on an individual basis. Participants earned between 0 and 200% of their individual target bonus based on achievement of the individual performance goals, and the individual bonuses could be earned even if NAV Return during Fiscal 2014 did not exceed the Fiscal 2014 Threshold NAV Return. Each of the named executive officers earned 200% of their individual target bonuses based on achievement of their individual performance goals during Fiscal 2014.

For Fiscal 2014, our Compensation Committee established only objective performance goals for Mr. Falcone’s individual bonus, which were (i) identify companies that are undervalued or fairly valued with attractive financial or strategic characteristics and provide recommendations for Board approval, (ii) receipt of $117 million of dividends and other sources of cash and (iii) the Company will remain in compliance with all corporate governance policies. For Fiscal 2014, Mr. Falcone’s total target bonus was $2.5 million, which was comprised of his individual and corporate bonus. Our Compensation Committee determined that Mr. Falcone achieved or exceeded each of his individual performance measures. A portion of the amount was paid shortly following the Compensation Committee’s determination of his award. In addition, Mr. Falcone was paid a cash payment in connection with the Falcone Separation Agreement. See “Compensation and Benefits – Summary Compensation Table,” “Company Significant Events after Fiscal 2014 – Equity Grants Pursuant to the 2014 Bonus Plan” and “Falcone Separation Agreement.”

For Fiscal 2014, our Compensation Committee established only objective performance goals for Mr. Asali’s individual bonus, which were (i) receipt of $117 million of dividends and other sources of cash, (ii) improve the financial flexibility of our Company through an initial public offering of our insurance subsidiary FGL and (iii) the Company’s compliance with all existing or new debt covenants. For Fiscal 2014, Mr. Asali’s total target bonus was $2.5 million, which was comprised of his individual and corporate bonus. Our Compensation Committee determined that Mr. Asali achieved or exceeded each of his individual performance measures. Accordingly, for Fiscal 2014, our Compensation Committee awarded Mr. Asali an individual bonus and corporate bonus in excess of his target amounts, which were comprised of immediately vested and deferred cash and equity. See “Compensation and Benefits – Summary Compensation Table” and “Company Significant Events after Fiscal 2014 – Equity Grants Pursuant to the 2014 Bonus Plan” for details regarding the amount of Mr. Asali’s individual bonus and corporate bonus and its allocation among immediately vested and deferred cash and equity.

For Fiscal 2014, our Compensation Committee established only objective performance goals for Mr. Williams’ individual bonus, which were (i) receipt of $117 million of dividends and other sources of cash, (ii) improve the financial flexibility of our Company through an initial public offering of our insurance subsidiary FGL, (iii) the Company’s compliance with all existing or new debt covenants and (iv) timely and accurate completion of all external financial reporting by the Company. For Fiscal 2014, Mr. Williams’s total target bonus was $1 million, which was comprised of his individual and corporate bonus. Our Compensation Committee determined that Mr. Williams achieved or exceeded each of his individual performance measures. Accordingly, for Fiscal 2014, our Compensation Committee awarded Mr. Williams an individual bonus and corporate bonus in excess of his target amounts, which were comprised of immediately vested and deferred cash and equity. See “Compensation and Benefits – Summary Compensation Table” and “Company Significant Events after Fiscal 2014.”

For Fiscal 2014, our Compensation Committee established only objective performance goals for Mr. Maura’s individual bonus, which were (i) Spectrum Brands’ achievement of $710 million of adjusted EBITDA (as defined below), (ii) Spectrum Brands’ achievement of $340 million of adjusted free cash flow and (iii) receipt of $36 million of dividends by the Company from Spectrum Brands. For the purposes of Mr. Maura’s performance measure, “adjusted EBITDA” was defined as reported operating income plus certain defined add-backs for depreciation, amortization, acquisition, integration and restructuring related charges. For Fiscal 2014,

15

Table of Contents

Mr. Maura’s total target bonus was $2 million, which was comprised of his individual and corporate bonus. Our Compensation Committee determined that Mr. Maura achieved or exceeded each of his individual performance measures. Accordingly, for Fiscal 2014, our Compensation Committee awarded Mr. Maura an individual bonus and corporate bonus in excess of his target amounts, which were comprised of immediately vested and deferred cash and equity. See “Compensation and Benefits – Summary Compensation Table” and “Company Significant Events after Fiscal 2014 – Equity Grants Pursuant to the 2014 Bonus Plan” for details regarding the amount of Mr. Maura’s individual bonus and corporate bonus and its allocation among immediately vested and deferred cash and equity.

For Fiscal 2014, our Compensation Committee established both objective and subjective performance goals for Mr. Sena’s individual bonus, which were (i) preparing debt and equity offering memorandums and debt and equity registrations as directed by the Company’s Chief Financial Officer, (ii) timely and successful completion of all external auditor reviews and audits of the Company, (iii) timely and accurate completion of all financial reporting by the Company and (iv) foster growth and teamwork and meet all project priorities as agreed to with the Company’s Chief Financial Officer. For Fiscal 2014, Mr. Sena’s total target bonus was $200,000, which was comprised of his individual and corporate bonus. Our Compensation Committee determined that Mr. Sena achieved or exceeded each of his individual performance measures. Accordingly, for Fiscal 2014, our Compensation Committee awarded Mr. Sena an individual bonus and corporate bonus in excess of his target amounts, which were comprised of immediately vested and deferred cash and equity. See “Compensation and Benefits – Summary Compensation Table” and “Company Significant Events after Fiscal 2014 – Equity Grants Pursuant to the 2014 Bonus Plan” for details regarding the amount of Mr. Sena’s individual bonus and corporate bonus and its allocation among immediately vested and deferred cash and equity.

The maximum bonus payment to any individual under our Bonus Plan with respect to any year is subject to the $20 million Award Cap. For Fiscal 2014, this cap limited the total bonus awarded to Mr. Falcone and Mr. Asali in contrast to the amount they would have otherwise earned for Fiscal 2014.

Cash amounts payable pursuant to the 2014 Bonus Plan are included in the column titled “Non-Equity Incentive Plan Compensation” in the Summary Compensation Table for Fiscal 2014 (although no amounts are actually payable until after the end of Fiscal 2014). However, in the case of equity awards, the SEC disclosure rules require that the Summary Compensation Table and the Grants of Plan-Based Awards Table include for each fiscal year the aggregate fair value, as of the grant date, of equity awards granted only during the applicable fiscal year. The equity awards that were earned by our named executive officers pursuant to the 2014 Bonus Plan in respect of Fiscal 2014 performance were granted on November 25, 2014. As these equity awards will be granted after the end of Fiscal 2014, they are not included in the Summary Compensation Table and Grants of Plan-Based Awards Table in this report, but in accordance with SEC rules will be included in next year’s table for our named executive officers in Fiscal 2014. Notwithstanding the foregoing, we do disclose these awards in this report under “Company Significant Events after Fiscal 2014 – Equity Grants Pursuant to the 2014 Bonus Plan.”

Initial Long Term Equity Grant

Our practice is to grant service-based equity to named executive officers when our Compensation Committee or Board determines that it would be to the advantage and in the best interests of the Company and its stockholders to grant such equity as an inducement to enter into or remain in the employ of the Company and as an incentive for increased efforts during such employment.

During Fiscal 2014, our Compensation Committee and our Board, and subsequently our stockholders, approved the Harbinger Group Inc. 2014 Warrant Plan (the “2014 Warrant Plan”), which provided for the issuance to our then Chief Executive Officer, Mr. Falcone, of warrants to purchase 3,000,000 shares of our Common Stock at an exercise price per share of $13.125, which was the per share exercise price equal to 105% of the fair market value of our Common Stock on the date of grant. In determining whether to recommend approval of the 2014 Warrant Plan to the Board, our Compensation Committee considered a variety of factors, including that: (i) our Chief Executive Officer had historically not been paid compensation from the Company for his services to the Company and its subsidiaries; (ii) the warrants to be granted pursuant to the 2014 Warrant Plan have an exercise price above the market price of the underlying Common Stock on the grant date of the warrants, thereby linking any appreciation in the value of the warrants to an increase in the market price of the underlying Common Stock; and (iii) the issuance or exercise of the warrants to be granted under the 2014 Warrant Plan do not have a significant effect on the Company’s ability to use its net operating loss carryforwards.

The warrant is scheduled to expire on March 10, 2019 and vests in five equal tranches over the five-year term of the warrant, with twenty percent (20%) vesting on May 30, 2014 and an additional twenty percent (20%) vesting on each of March 10, 2015, 2016, 2017 and 2018. As described further herein, in connection with the Falcone Separation Agreement, the warrant was amended to provide for its continued vesting in accordance with its vesting schedule as if Mr. Falcone remained employed with the Company through each applicable vesting dates.

16

Table of Contents

Benefits

During Fiscal 2014, we provided our named executive officers with standard medical, dental, vision, disability and life insurance benefits available to employees generally.

We limit the use of perquisites as a method of compensation and provide executive officers with only those perquisites that we believe are reasonable and consistent with our overall compensation program to better enable us to attract and retain superior employees for key positions. In this regard, our named executive officers are eligible to participate in a flexible perquisite account under our FlexNet Program, which permits them to be reimbursed for certain eligible personal expenses, up to a per year cap of $50,000 for Messrs. Falcone, Asali, Williams and Maura and $10,000 for Mr. Sena. Eligible expenses include, but are not limited to, reimbursement for tax preparation, legal services, education programs, health and wellness programs, technology and personal computers, wills and estate planning services and transportation services. Participants are responsible for payment of taxes on FlexNet payments. Reimbursements, at participants’ elections, can be net of taxes and/or include an estimated tax payment, subject to the annual maximum reimbursement cap. Further, we may provide from time to time in our discretion reimbursement for other employment related expenses. The perquisites provided to the named executive officers are quantified in the Summary Compensation Table below.

We sponsor a 401(k) Retirement Savings Plan (the “401(k) Plan”) in which eligible participants may defer a fixed amount or a percentage of their eligible compensation, subject to limitations. In Fiscal 2014 we made discretionary matching contributions of up to 5% of eligible compensation.

HGI Subsidiary and Affiliate Fees

As discussed above, during Fiscal 2014, Messrs. Falcone, Asali, Williams and Maura and certain of our other employees provided services as directors and officer to certain of our subsidiaries and affiliates and were compensated, in the form of cash and equity, by such entities. Specifically, during Fiscal 2014, (i) Mr. Falcone received from HC2 Holdings, Inc., an NYSE listed company, $14,000 in cash and equity, which was valued by our Compensation Committee at $2,520,000; (ii) Mr. Asali received from Spectrum Brands and FGL, each an NYSE listed company, an aggregate of $75,000 in cash and equity, which was valued by our Compensation Committee at $210,000; (iii) Mr. Williams received from Spectrum Brands and FGL, an aggregate of $15,000 in cash and equity, which was valued by our Compensation Committee at $75,000; and (iv) Mr. Maura received from Spectrum Brands, equity, which was valued by our Compensation Committee at $210,000. Our Compensation Committee offset such amounts against compensation Messrs. Falcone, Asali, Williams and Maura and certain of our other employees would have otherwise received from the Company. The foregoing does not reflect offsets that were also applied in respect of any compensation received by Messrs. Falcone, Asali, Williams and Maura from HGI subsidiaries and affiliates after Fiscal 2014.

Risk Review

Our Compensation Committee has reviewed, analyzed and discussed the incentives created by our executive compensation program. Our Compensation Committee does not believe that any aspect of our executive compensation encourages the named executive officers to take unnecessary or excessive risks.

Our compensation program has provisions to mitigate undue risk, including bonus plan mechanisms that defer significant portions of awards, which are partially subject to forfeiture if the performance that merited the award is not sustained. Furthermore, a significant portion of the deferred awards consist of unvested equity, and the vested portion is subject to the Company’s stock ownership guidelines. We believe that the additional alignment created by this exposure to the Company’s stock price serves to moderate an appetite for undue risk. We also relate future target performance to past actual performance in a manner that closely ties awards to performance over multiple years, which we believe reduces the incentive for short-term decisions or actions that increase current performance at the expense of future growth.

17

Table of Contents

Compensation in Connection with Termination of Employment and Change-In-Control

In determining our employees’ compensation packages, our Compensation Committee recognizes that an appropriate incentive in attracting talent is to provide reasonable protection against loss of income in the event the employment relationship terminates without fault of the employee. Thus, compensation practices in connection with termination of employment generally have been designed to achieve our goal of attracting highly qualified executive talent. Messrs. Asali, Williams, Maura and Sena have employment agreements which provide for termination compensation in the form of payment of bonuses and salary and benefit continuation ranging from six to twenty-four months following involuntary termination of employment. During Fiscal 2014, our compensation programs did not provide for any “golden parachute” tax gross-ups to any named executive officer. During Fiscal 2014, we also did not provide any of our named executive officers any “single-trigger” payments due to the occurrence of a change of control of the Company.

As described herein, in connection with Mr. Falcone’s resignation, on November 25, 2014, the Company and Mr. Falcone entered into the Falcone Separation Agreement as detailed in the section titled “Company Significant Events after Fiscal 2014 – Falcone Separation Agreement.”

You can find additional information regarding our practices in providing compensation in connection with termination of employment to our named executive officers under the heading “Payments Upon Termination and Change of Control” below.

Impact of Tax Considerations

With respect to taxes, Section 162(m) of the Internal Revenue Code imposes a $1 million limit on the deduction that a company may claim in any tax year with respect to compensation paid to each of its Chief Executive Officer and three other named executive officers (other than the Chief Financial Officer), unless certain conditions are satisfied. Certain types of performance-based compensation are generally exempted from the $1 million limit. Performance-based compensation can include income from stock options, performance-based restricted stock, and certain formula driven compensation that meets the requirements of Section 162(m). One of the factors that we may consider in structuring the compensation for our named executive officers is the deductibility of such compensation under Section 162(m), to the extent applicable. However, this is not the driving or most influential factor. Our Compensation Committee may approve non-deductible compensation arrangements after taking into account several factors, including our ability to utilize deductions based on projected taxable income, and specifically reserves the right to do so.

Advisory Vote on Executive Compensation

Our Compensation Committee and our Board considered the results of our stockholder vote regarding the non-binding resolution on executive compensation presented at the 2014 Annual Meeting, where 91.16% of votes cast approved the compensation program described in the Company’s proxy statement for the 2014 Annual Meeting. Our Compensation Committee and our Board have continued to maintain a generally similar compensation philosophy.