Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CommScope Holding Company, Inc. | d859489d8k.htm |

| EX-2.1 - EX-2.1 - CommScope Holding Company, Inc. | d859489dex21.htm |

| EX-99.1 - EX-99.1 - CommScope Holding Company, Inc. | d859489dex991.htm |

| EX-10.1 - EX-10.1 - CommScope Holding Company, Inc. | d859489dex101.htm |

1

Acquisition of TE Connectivity’s Telecom,

Enterprise and Wireless Businesses

Eddie Edwards •

President and Chief Executive Officer

Mark Olson •

Executive Vice President and Chief Financial Officer

January 28, 2015

Exhibit 99.2 |

2

Caution Regarding Forward Looking Statements

Safe Harbor

Non-GAAP Financial Measures

CommScope management believes that presenting certain non-GAAP financial

measures provides meaningful information to investors in understanding operating results and

may enhance investors' ability to analyze financial and business

trends. Non-GAAP measures, including EBITDA, Adjusted EBITDA, Adjusted

EPS and Adjusted Free Cash Flow, are not a substitute for GAAP measures and

should be considered together with the GAAP financial measures. As calculated, our non-GAAP measures may not be

comparable to other similarly titled measures of other companies. In

addition, CommScope management believes that these non-GAAP financial measures allow investors to

compare period to period more easily by excluding items that could have a

disproportionately negative or positive impact on results in any particular period. GAAP to non-

GAAP reconciliations are included in the Appendix to this presentation.

This communication contains forward-looking statements (including within the meaning of the

Private Securities Litigation Reform Act of 1995) concerning CommScope, the proposed

acquisition by CommScope of the Telecom, Enterprise and Wireless businesses of TE Connectivity and other matters. These statements

may discuss goals, intentions and expectations as to future plans, trends, events, results of

operations or financial condition, or otherwise, based on current beliefs of the management of

CommScope and TE Connectivity as well as assumptions made by, and information currently available to, such management. Forward-looking

statements may be accompanied by words such as "aim," "anticipate," "believe,"

"plan," "could," "would," "should," "estimate," "expect," "forecast," "future," "guidance,"

"intend," "may," "will," "possible," "potential,"

"predict," "project" or similar words, phrases or expressions. These forward-looking statements are subject to various risks

and uncertainties, many of which are outside the control of CommScope and TE Connectivity. Therefore,

you should not place undue reliance on such statements. Factors that could cause actual results

to differ materially from those in the forward-looking statements include failure to obtain applicable regulatory approvals in a

timely manner, on terms acceptable to CommScope or TE Connectivity or at all; failure to satisfy

other closing conditions to the proposed transactions; the risk that CommScope will be required

to pay the reverse break-up fee under the Stock and Asset Purchase Agreement; the risk that the TE Connectivity businesses will not be

integrated successfully into CommScope or that CommScope will not realize estimated cost savings,

synergies and growth or that such benefits may take longer to realize than expected; failure by

CommScope to realize anticipated benefits of the acquisition; risks relating to unanticipated costs of integration; risks from relying on

TE Connectivity for various critical transaction services for an extended period; reductions in

customer spending and/or a slowdown in customer payments; failure to manage potential conflicts

of interest between or among customers; unanticipated changes relating to competitive factors in the telecommunications industry; ability to

hire and retain key personnel; the potential impact of announcement or consummation of the proposed

acquisition on relationships with third parties, including customers, employees and

competitors; ability to attract new customers and retain existing customers in the manner anticipated; changes in legislation or

governmental regulations affecting the CommScope and the TE Connectivity businesses to be acquired;

international, national or local economic, social or political conditions that could adversely

affect CommScope, the TE Connectivity businesses to be acquired or their customers; conditions in the credit markets that could

impact the costs associated with financing the acquisition; risks associated with assumptions made in

connection with the critical accounting estimates, including segment presentation, and legal

proceedings of CommScope and/or the TE Connectivity businesses to be acquired; and the international operations of CommScope

and/or the TE Connectivity businesses to be acquired, which are subject to the risks of currency

fluctuations and foreign exchange controls. The foregoing list of factors is not exhaustive.

You should carefully consider the foregoing factors and the other risks and uncertainties that affect the businesses of CommScope and/or the

TE Connectivity businesses to be acquired, including those described in each of CommScope's and TE

Connectivity's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current

Reports on Form 8-K and other documents filed from time to time with the Securities and Exchange Commission. Except as required under

applicable law, the parties do not assume any obligation to update these forward-looking

statements. |

3

Summary Overview

Enables CommScope to broaden its position as a leading communications infrastructure

provider 1 Excluding purchase accounting, transition costs and other special or

one-time items Compelling

Financial Impact

•

Estimated run rate synergies of $150m three years following the close of the

transaction •

Estimated $50m of synergies in first full year following the closing

•

Expected to be more than 20% accretive to Adjusted EPS by the end of the first

full year after closing

on

a

pro

forma

basis

(1)

•

LTM 9/30/14 pro forma revenue of $5.8b

•

LTM

9/30/14

pro

forma

Adjusted

EBITDA

(1)(2)

of

$1.2b

•

20%

LTM

9/30/14

pro

forma

Adjusted

EBITDA

margin

(1)(2)

Approvals

and

Closing

•

Approved by boards of directors of both companies

•

Subject to customary closing conditions and regulatory approvals, including

antitrust approval •

Expected to close by the end of 2015

Strong Strategic

Rationale

•

Creates a company that is very well positioned to capitalize on the global,

secular growth in bandwidth demand across both wired and wireless

networks •

More balanced revenue base across Wireless, Broadband Connectivity and Enterprise

with a strong pro forma free cash flow profile

•

Enhances our ability to serve customers globally

Structure and

Consideration

•

Purchase price: $3.0b cash (~10x FY2014 Adjusted EBITDA)

•

Transaction

financed

through

use

of

cash

on

hand

and

up

to

$3.0b

of

incremental

debt

•

Fully committed financing in place from J.P. Morgan, B of A Merrill Lynch,

Deutsche Bank and Wells Fargo

2 See Appendix of this presentation for a reconciliation of Total Operating Income (as

reported) to Non-GAAP Adjusted EBITDA and Cash flow generated from operating activities (as reported) to

Non-GAAP adjusted Free Cash Flow for each of CommScope and TE Connectivity’s

Telecom, Enterprise and Wireless businesses |

4

Compelling Strategic and Financial Rationale

Aligns with CommScope’s Growth Plan

1

3

2

4

1 Estimated run rate synergies of $150m expected to be achieved in three years

following the close of the transaction TE Connectivity’s

Telecom, Enterprise

& Wireless

Businesses

Product & geographic

diversification

Enhanced product portfolio

More balanced revenue base across

Wireless, Broadband Connectivity and

Enterprise

Meaningfully expands footprint and

strengthens global competitive position

Expands platform for

innovative solutions

Significantly accretive

Estimated

run

rate

synergies

of

$150m

(1)

Pro forma company with $5.8b revenue,

$1.2b

Adjusted

EBITDA

(1)(2)

in

LTM

9/30/14

Highly complementary

transaction

Broadens position across multiple product

lines and geographies

Technology, solutions & talent to provide

greater value & a broader range of services

Compelling financial profile

and meaningful synergy

opportunities

Leading fiber technology

Addition of ~7,000 patents and patent

applications worldwide

2 See Appendix of this presentation for a reconciliation of Total Operating Income (as

reported) to Non-GAAP Adjusted EBITDA and Cash flow generated from operating activities (as reported) to

Non-GAAP adjusted Free Cash Flow for each of CommScope and TE Connectivity’s

Telecom, Enterprise and Wireless businesses |

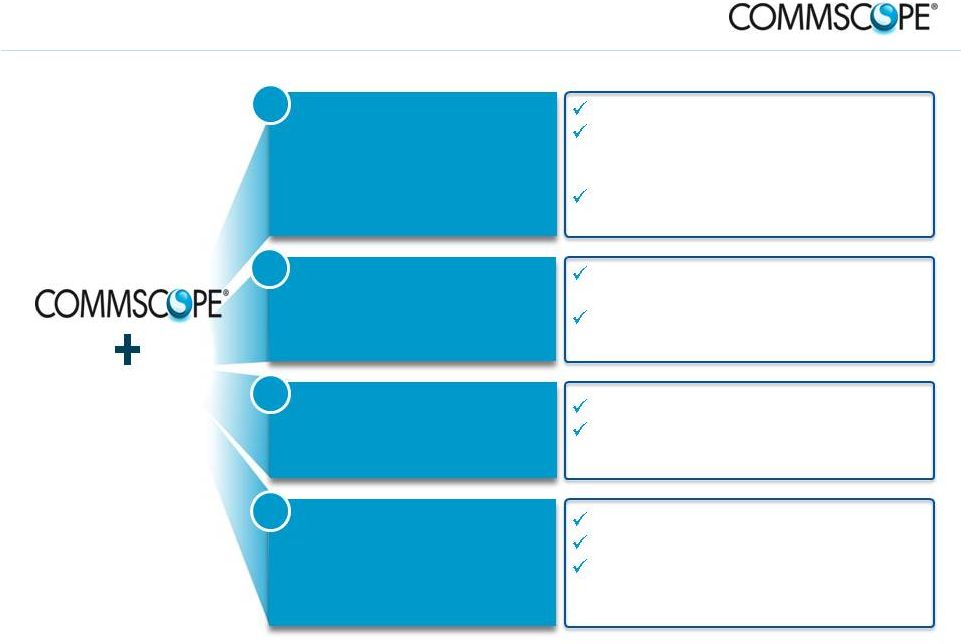

5

Robust Long-Term Growth Profile

Robust growth dependent on next-generation communications infrastructure

Big Four global trends driving demand for communications infrastructure

Mobile Data

Consumer IP Traffic

Business IP Traffic

Wireless

Broadband

Social Media

Cloud Service

Mobile Broadband Data

Social Media

Cloud Service

Big Data

Source: Cisco VNI report; Cisco Visual Networking Index, June 2014

(PB per month, Global, Business and Consumer)

(PB per month, Global)

(PB per month, Global)

1,480

2,582

4,337

6,981

10,788

15,838

2013

2014

2015

2016

2017

2018

40,905

50,375

61,439

74,361

89,689

107,958

2013

2014

2015

2016

2017

2018

10,263

12,100

14,300

16,899

20,016

23,595

2013

2014

2015

2016

2017

2018 |

6

#1

in cables for hybrid

fiber coaxial (HFC)

networks –

for broadband

service providers

CommScope Today

Wireless

Enterprise

Broadband

CommScope is a leading global provider of essential communications

infrastructure Global Position

#1

in

merchant

Radio

Frequency network

connectivity solutions and

small cell DAS solutions –

for carriers, OEMs and

enterprises

#1

in

enterprise

connectivity solutions for

data centers and

commercial buildings

Segment

Revenue

(1)

% of Total

Adj. EBITDA

(1)(2)

Adj. EBITDA

(1)(2)

Margin

End

Customers

1 Segment revenue excludes $3.1mm of inter-segment eliminations. Revenue and

Adjusted EBITDA based on LTM September 30, 2014 2 See Appendix of this

presentation for a reconciliation of Total Operating Income (as reported) to Non-GAAP Adjusted EBITDA and Cash flow generated from operating activities (as reported) to Non-GAAP adjusted Free

Cash Flow for each of CommScope and TE Connectivity’s Telecom, Enterprise and

Wireless businesses. See CommScope’s Q314 results and investor materials for additional details.

$2,519m

65%

$843m

22%

$489m

13%

$658m

26%

$168m

20%

$34m

7%

Carriers

OEMs

Enterprises

Enterprises

(Primarily through channel

partners)

Cable MSOs |

7

Overview of TE Connectivity’s Telecom,

Enterprise and Wireless Businesses

Telecom

Enterprise

Wireless

A leader in fiber optic connectivity in wireline and wireless networks

Bandwidth demand

New technologies and

business models

Regulatory change

$1,137m

$220m

19%

•

FTTx Solutions

•

Central office connectivity and

equipment

•

Closures, cabinets and

terminals

•

Patch panels and frames

Bandwidth demand

Intelligent buildings

Data centers

In-building cellular/DAS

•

Fiber and central office LAN

solutions

•

Data Center solutions

•

Outlets, patch cords & panels

•

Raceways and cable assemblies

Bandwidth demand

Mobile broadband

densification

In-building cellular/DAS

•

Distributed Antenna Systems

(DAS)

$627m

$66m

11%

$164m

$13m

8%

Note: Financials based on LTM September 30, 2014

1 Adjusted EBITDA excludes restructuring costs, transition costs, purchase accounting

and other special items. 2 Total revenue excludes a discontinued business

Solutions

Segment Revenue

Adj. EBITDA

(1)(3)

Adj. EBITDA margin

Growth Drivers

Total Revenue: $1,928m

(2)

; Adj. EBITDA: $299m; Adj. EBITDA margin: 15.5%

(1)(3)

3 See Appendix of this presentation for a reconciliation of Total Operating Income (as

reported) to Non-GAAP Adjusted EBITDA and Cash flow generated from operating activities (as reported)

to Non-GAAP adjusted Free Cash Flow for each of CommScope and TE

Connectivity’s Telecom, Enterprise and Wireless businesses |

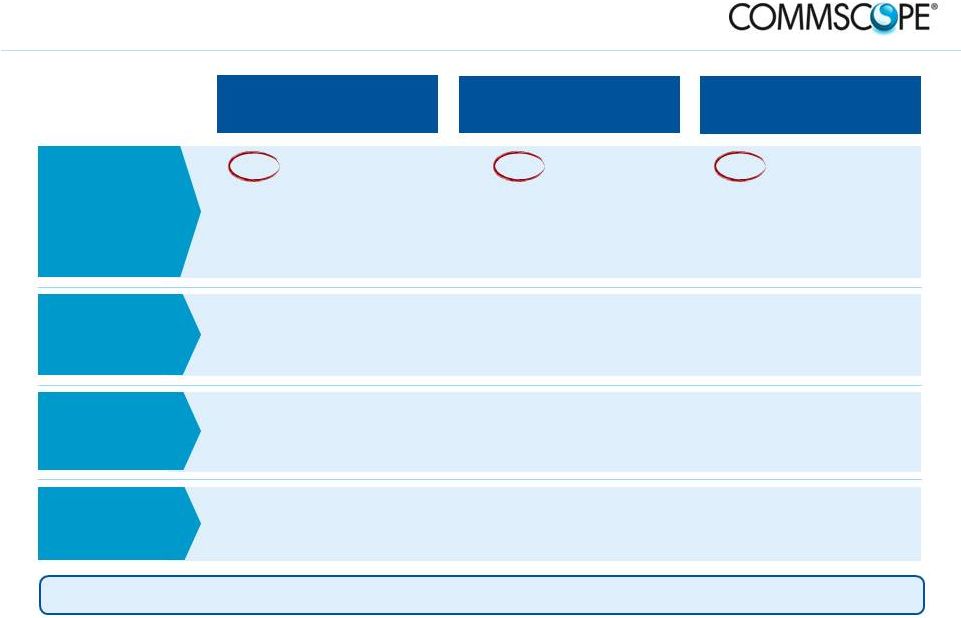

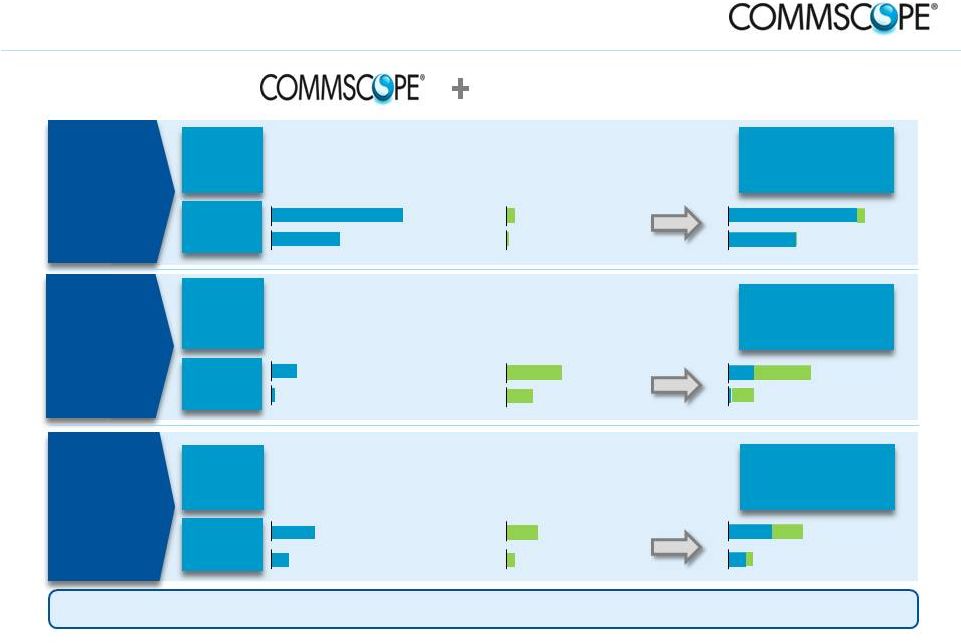

8

Complementary Transaction

Business

Description

•

Global cell site solutions

•

Global metro cell solutions

•

Global small cell DAS

•

Backhaul solutions

•

Differentiated small cell /

DAS technology

•

Primarily North America

•

HFC (coaxial and fiber) solutions

•

Multiple-system operators

(MSOs)

•

Primarily North America

•

Broad connectivity portfolio

•

FTTx deployments

•

Hyper scale data centers

•

Solid EMEA & APAC presence

•

Structured cabling

•

Intelligent building solutions

•

Data centers –

DCIM & DCOD

•

Network intelligence

•

Fiber connectivity

•

Data center connectivity

•

Strong EMEA & APAC presence

Pro Forma

CommScope

(1)

Revenue

Adj.

EBITDA

Note: Financials based on LTM September 30, 2014. Revenue excludes $3.1mm of

inter-segment eliminations for CommScope. 1 Excludes synergies. Excluding

purchase accounting, transition costs and other special or one-time items 2

See Appendix of this presentation for a reconciliation of Total Operating Income (as reported) to Non-GAAP Adjusted EBITDA and Cash flow generated from operating activities (as reported) to Non-GAAP adjusted Free

Complementary transaction that broadens position across all segments

Business

Description

Revenue

Adj.

EBITDA

(2)

Business

Description

Revenue

Adj.

EBITDA

(2)

Enhanced product

portfolio

A leading fiber

technology and

strengthened global

presence

A leading fiber

technology and

strengthened global

presence

TE Connectivity’s

Telecom, Enterprise

& Wireless

Businesses

$2,519m

$164m

$658m

$13m

$2,683m

$671m

$489m

$1,137m

$34m

$220m

$1,626m

$254m

$843m

$627m

$168m

$66m

$1,470m

$234m

Cash Flow for each of CommScope and TE Connectivity’s Telecom, Enterprise and

Wireless businesses

Wireless

Broadband

Connectivity

Enterprise

(2) |

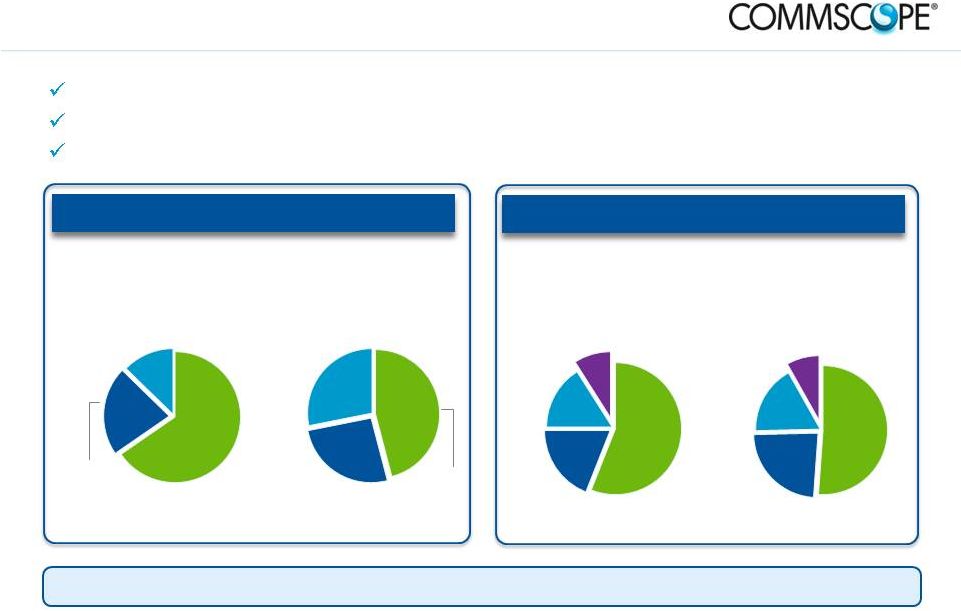

9

Further Diversifies CommScope’s Business

1 Actual segment reporting will be determined following the completion of the

acquisition 2 Based on LTM September 30, 2014 revenue

Expansion

into

adjacent

Wireline

Telecom

Networks

/

Fiber

To

The

X

(FTTx)

market

More balanced revenue base across Wireless, Broadband Connectivity and

Enterprise Broadens customer base

CommScope

Today

(2)

Pro Forma

CommScope

(2)

Broadband

13%

Broadband

Connectivity

28%

Wireless

65%

Enterprise

22%

Wireless

46%

Enterprise

26%

CommScope

Today

(2)

Pro Forma

CommScope

(2)

US

56%

EMEA

19%

APAC

16%

Other

Americas

9%

US

51%

EMEA

24%

APAC

16%

Other

Americas

9%

Geographic Diversification

Expected

to

create

leading

positions

across

diverse

and

growing

segments

and

geographies

Product

Sales

Diversification

(1) |

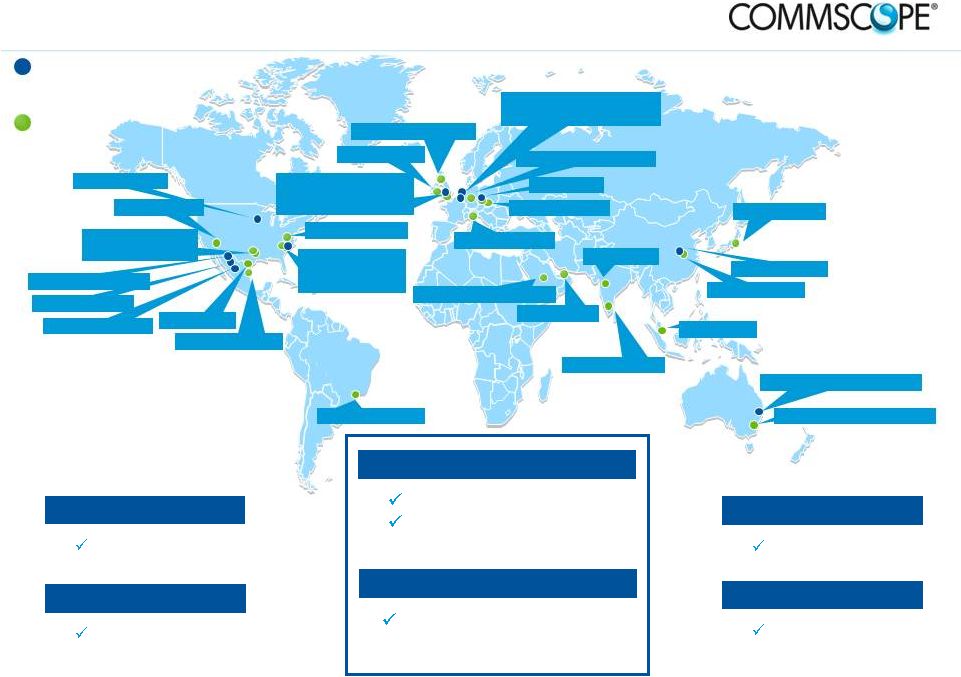

10

Global Leadership and Scale

Mission, TX

Reynosa, Mexico

Euless, TX

Richardson, TX

Sorocaba, Brazil

Catawba, NC

Claremont, NC

Greensboro, NC

Forest, VA

Chennai, India

Singapore

Campbellfield, Australia

Goa, India

Suzhou, China

Tokyo, Japan

Dubai, UAE

Riyadh, Saudi Arabia

Lochgelly, Scotland

Bray, Ireland

Denbigshire, England

Yorkshire, England

Guildford, England

Veenendaal, Netherlands

Kessel-Lo, Belgium

Buchdorf, Germany

Brno, CZ

Pardubice, CZ

Agraté, Italy

Regional Expertise

Cost-effective Footprint

Minimizes time to market

Enhances flexibility

Optimizes low-cost region mix,

technology and proximity to

customers

Patents

nearly 10,000

Employees

> 20,000

R&D Spend

> $200 million annually

Manufacturing Facilities

> 30 worldwide

TE Connectivity’s Telecom,

Enterprise & Wireless

Businesses

Berkeley Vale, Australia

Juarez, Mexico

Wuxi, China

Shakopee, MN

Santa Teresa, NM

Delicias, Mexico

McCarran, NV

CommScope

Note: Map includes manufacturing and distribution locations pro forma for the

acquisition |

11

Significant and Achievable

Cost Synergy Potential

CommScope has strong track record of effective cost

management and integration of acquisitions

Estimated Run Rate Synergies

$150 million

(Three Years Following Closing)

Corporate-Wide Focus on Integration and

Synergy

Detailed three-year roadmap across all

functional areas:

o

Operations

o

Material savings

o

Plant rationalization

o

Sales, marketing and customer service

o

General and administrative

o

Research and development

o

Information technology

Understand, integrate and innovate

Drive cost reduction and margin expansion

$50

$120

$150

($m)

Year 1

Year 2

Year 3 |

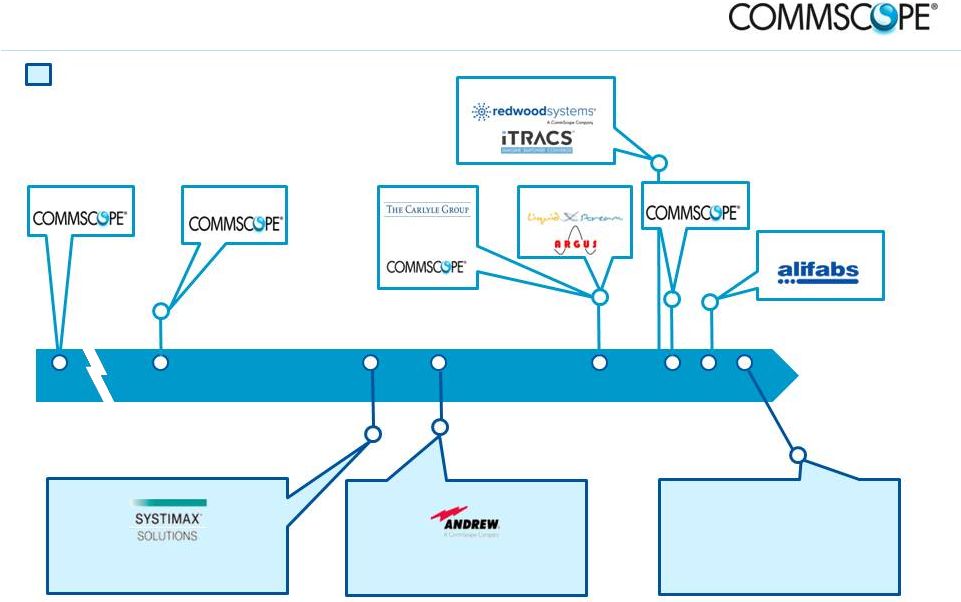

12

Demonstrated Record of Value Enhancing

Transactions and Successful Integrations

1976

1997

2011

2013

Acquired

Acquired

Founded

IPO

Acquired

(1)

Established Enterprise business

Revenue at time of acquisition: $542m

Current EBITDA margin > 20%

Acquired

Established Wireless business

Revenue at time of acquisition: $2.2b

Significant margin improvement

acquired

Acquired

Announced acquisition

Revenue: $1.9b

Estimated run-rate synergies: $150m

TE Connectivity’s Telecom, Enterprise &

Wireless Businesses

Transformative acquisitions

IPO

2014

2004

2007

2015

1 Business acquired from Avaya Connectivity Solutions

|

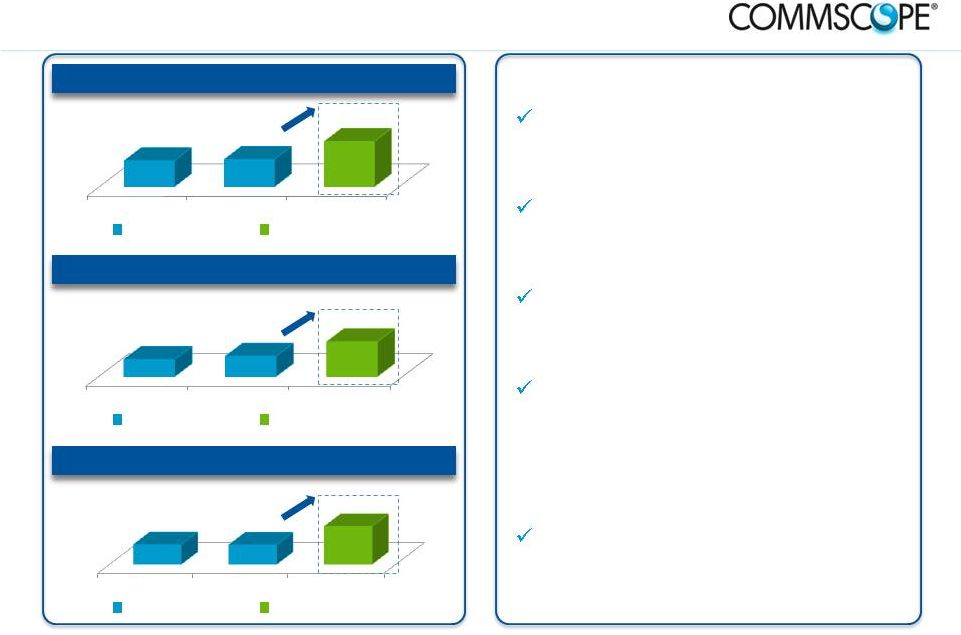

13

Enhanced Pro Forma Financial Profile

Business mix and geographic reach

provide platform for revenue growth

Incremental operating efficiencies drive

margin improvement opportunity

Synergies drive further value creation

opportunity

Expected to be in excess of 20%

accretive to Adjusted EPS by the end of

the first full year after closing on a pro

forma basis

(2)

Strong cash flow profile supports debt

reduction and continued investment in

business

Revenue

Adjusted EBITDA

Adjusted Free Cash Flow

(3)

Note: See Appendix of this presentation for a reconciliation of Total Operating Income

(as reported) to Non-GAAP Adjusted EBITDA and Cash flow generated from operating activities (as reported) to Non-GAAP adjusted Free Cash Flow for each of

CommScope and TE Connectivity’s Telecom, Enterprise and Wireless businesses

1 PF 2014 combines CommScope and TE Connectivity’s Telecom, Enterprise and Wireless

businesses results based on LTM September 30, 2014 and excludes synergies 2

Excludes purchase accounting, transition costs and other special or one-time items

3 PF 2014 adjusted Free Cash Flow excludes synergies, transaction or incremental synergy

costs, and incremental cash paid for interest related to new debt from the transaction.

(1)

(1)(2)

(1)

($m)

($m)

($m)

Standalone CommScope

Transaction Pro Forma

Standalone CommScope

Transaction Pro Forma

Standalone CommScope

Transaction Pro Forma

2012

2013

PF 2014

$571

$675

$1,159

2012

2013

PF 2014

$3,322

$3,480

5,787

2012

2013

PF 2014

$258

$254

496

$

$ |

14

Transaction Positions CommScope for

Significant Future Growth & Value Creation

Strong Global

Position

•

Leader across Wireless, Broadband Connectivity and Enterprise

•

Leadership position driven by technology, scale, product portfolio

and operational excellence

Operational

Excellence

•

Culture of continuous improvements and cost reductions

•

Strong track record of integration and synergy realization

•

Manufacturing model optimizes low-cost regions, technology and

proximity to customers

•

Products

•

Customers

•

Geographies

Diversified Business

Model

•

Fundamental demand for bandwidth is driving growth for

CommScope solutions

•

Next-generation broadband networks = Wireless and FTTx

Attractive Industry

Growth Trends

Compelling Financial

Profile

•

Robust cash flow characteristics across economic cycles

•

Proven track record of effective cost management and

deleveraging

•

Continued ability to re-invest in business

Enables CommScope to broaden its position as a leading communications infrastructure

provider |

15

Appendix

CommScope management believes that presenting certain non-GAAP financial

measures provides meaningful information to investors in understanding

operating results and may enhance investors' ability to analyze financial and business trends. Non-GAAP measures, including

EBITDA, Adjusted EBITDA, Adjusted EPS and Adjusted Free Cash Flow, are not a

substitute for GAAP measures and should be considered together with the GAAP

financial measures. As calculated, our non-GAAP measures may not be comparable to other similarly titled measures of

other companies. In addition, CommScope management believes that these

non-GAAP financial measures allow investors to compare period to period

more easily by excluding items that could have a disproportionately negative or positive impact on results in any particular period. GAAP to

non-GAAP reconciliations are included in the Appendix to this

presentation. |

16

Reconciliation of GAAP to Adjusted Measures

CommScope

FYE 12/31 ($mm)

2012

2013

LTM Q3 2014

Net sales

3,321.9

$

3,480.1

$

3,848.3

$

Operating income, as reported

238.2

$

329.7

$

561.4

$

Amortization of purchased intangibles

175.7

174.9

177.4

Restructuring costs, net

23.0

22.1

17.3

Equity-based compensation

7.5

16.1

19.2

Asset impairments

40.9

45.5

18.0

Transaction costs

6.3

27.2

26.5

Purchase accounting adjustments

-

2.5

(11.4)

Adjustment of prior year warranty matter

8.9

2.1

2.1

Gain on sale of product line or subsidiary

(1.5)

-

-

Prior year customs matter

2.0

-

-

Non-GAAP adjusted operating income

501.1

$

620.1

$

810.4

$

Non-GAAP adjusted operating margin %

15.1%

17.8%

21.1%

Depreciation

69.5

55.2

49.9

Non-GAAP adjusted EBITDA

570.6

$

675.3

$

860.3

$

TE Connectivity Acquisition

(1)

FYE 09/30 ($mm)

2012

2013

2014

Revenues, as reported

1,957.1

$

1,890.0

$

1,938.7

$

Less: Exited business

(74.8)

(34.6)

(10.9)

Revenues, as adjusted

1,882.3

$

1,855.4

$

1,927.8

$

Operating income, as reported

149.4

$

98.5

$

182.0

$

Amortization of purchased intangibles

31.1

31.1

30.7

Restructuring costs, net

24.9

90.4

39.2

Equity-based compensation

6.9

6.9

7.0

Exited business

(7.9)

7.5

4.8

Non-GAAP adjusted operating income

204.5

$

234.4

$

263.7

$

Non-GAAP adjusted operating margin %

10.9%

12.6%

13.7%

Depreciation

47.5

40.0

35.4

Non-GAAP adjusted EBITDA

252.0

$

274.4

$

299.1

$

1 TE Connectivity’s Telecom, Enterprise and Wireless businesses |

17

Reconciliation of GAAP to Adjusted Measures

CommScope

FYE 12/31 ($mm)

2012

2013

LTM Q3 2014

Cash flow generated from operating activities, as reported

286.1

$

237.7

$

248.1

$

Less: Additions to property, plant and equipment

(28.0)

(36.8)

(33.9)

Adjustments:

Debt redemption premium

-

33.0

126.9

Fee paid to terminate management agreement

-

20.2

20.2

Non-GAAP adjusted free cash flow

258.1

$

254.1

$

361.3

$

2 Excludes impact of restructuring and other special items

1 TE Connectivity’s Telecom, Enterprise and Wireless businesses

TE Connectivity Acquisition

(1)

FYE 09/30 ($mm)

2012

2013

2014

Cash flow generated from operating activities, as reported

(2)

215.9

$

194.7

$

173.3

$

Less: Additions to property, plant and equipment

(29.0)

(35.5)

(39.1)

Non-GAAP adjusted free cash flow

186.9

$

159.2

$

134.2

$ |