Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TOTAL SYSTEM SERVICES INC | d860037d8k.htm |

| EX-99.1 - EX-99.1 - TOTAL SYSTEM SERVICES INC | d860037dex991.htm |

2014

Fourth Quarter and YTD Results January 27, 2015

Exhibit 99.2

©2015 Total System Services, Inc.® Proprietary. All rights reserved worldwide. |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

Forward-Looking Statements

2

This presentation and comments made by management contain forward-

looking

statements

including,

among

others,

statements

regarding

the

expected future operating results of TSYS. These statements are

based on

management’s current expectations and assumptions and are subject to

risks, uncertainties and changes in circumstances. Forward-looking

statements include all statements that are not historical facts and can be

identified by the use of forward-looking terminology such as the words

“believe,”

“expect,”

“anticipate,”

“intend,”

“plan,”

“potential”, “estimate”

or

similar expressions. Actual results may differ materially from those set

forth in the forward-looking statements due to a variety of

factors. More information about these risks, uncertainties and factors

may be found in TSYS’

filings with the Securities and Exchange Commission, including its

2013 Annual Report on Form 10-K. TSYS does not assume any obligation

to update any forward-looking statements as a result of new information,

future developments or otherwise. |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

Use of Non-GAAP Financial Measures

3

This slide presentation contains certain non-GAAP financial measures

determined by methods other than in accordance with generally accepted

accounting principles. Such non-GAAP financial measures include the

following: revenues before reimbursable items; operating margin excluding

reimbursable items; revenues measured on a constant currency basis; free

cash flow; EBITDA, adjusted EBITDA, adjusted earnings per share,

adjusted

segment operating income and adjusted segment operating margin. The most

comparable GAAP measures to these measures are revenues; operating

margin; revenues; cash flows from operating activities; net income; net income;

earnings per share, operating income and operating margin, respectively.

Management uses these non-GAAP financial measures to assess the

performance of TSYS’

core business. TSYS believes that these non-GAAP

financial measures provide meaningful additional information about TSYS to

assist investors in evaluating TSYS’

operating results. These non-GAAP

financial measures should not be considered as a substitute for operating

results determined in accordance with GAAP and may not be comparable to

other similarly titled measures of other companies. The computations of the

non-GAAP financial measures used in this slide presentation are set forth in

the Appendix to this slide presentation. |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

Troy Woods

President & Chief Executive Officer |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

Paul Todd

Chief Financial Officer |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

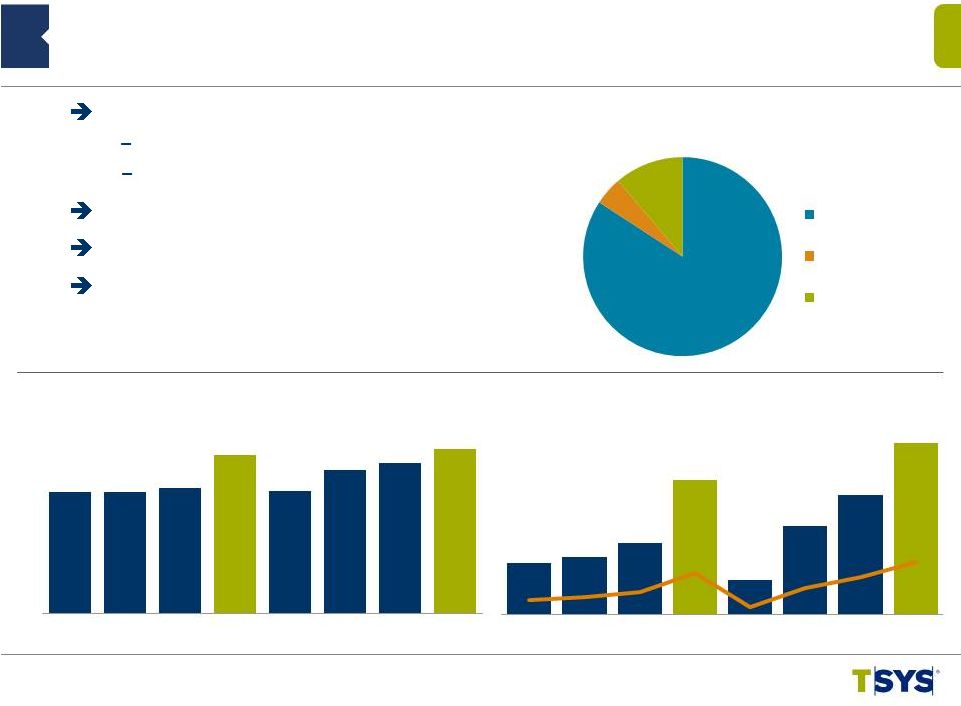

4Q 2014 North America Segment Highlights

6

($ in millions)

(*) Revenues Before Reimbursable Items

($ in millions)

0.8%

4.4%

4.5%

6.8%

Adjusted Segment Operating Income

Operating Margin

(1)

Includes Credit, Debit,

Retail, Prepaid & Loyalty

(2)

Includes Healthcare

9.1%

Historical High Revenue

Second Straight Quarter of Double Digit

Growth

Largest Quarter and Year of Operating Income

8.7%

10.9%

14.5%

Segment Revenue by Line of Business*

Consumer (1)

Commercial (2)

Other

$68.7

$81.3

$84.4

$87.1

$74.6

$84.6

$92.7

$99.6

33.4%

37.9%

38.9%

39.0%

33.2%

36.3%

38.5%

39.0%

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

$205.6

$214.5

$217.3

$223.3

$224.4

$233.2

$241.0

$255.5

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

Segment

Revenue*

YOY Growth %

3%

75%

22%

* |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

4Q 2014 North America Segment Highlights

7

(*) Growth

Excluding

Prepaid,

Government

Services

and

Single

Use

Accounts

(in millions)

(in millions)

5.2%

6.3%

16.2%

16.5%

16.9%

11.2%

11.6%

13.4%

7.8%

11.5%

17.6%

13.4%

15.6%

17.2%

17.1%

Six Straight Quarters of Double Digit Growth in Traditional Accounts on File*

Largest Quarter and Year of Transaction Volume

Same Client Transactions up 13.0%

18.5%

19.1%

20.7%

17.4%

18.1%

18.3%

14.1%

16.6%

19.8%

2,013.4

2,235.0

2,395.8

2,488.6

2,327.6

2,696.7

2,833.6

2,980.0

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

Transaction Volume

YOY Growth %

422.8

430.7

461.4

481.9

495.5

510.3

541.4

550.0

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

Accounts on File

YOY Growth % |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

Adjusted Segment Operating Income

5%

11%

4Q 2014 International Segment Highlights

8

($ in millions)

(*) Revenues Before Reimbursable Items

($ in millions)

(2.6%)

(4.0%)

0.7%

(0.9%)

3.1%

9.0%

8.6%

84%

0.5%

(4.6%)

Revenue $92.9M* –

Up 2.5%

Up 5.7% on Constant Currency

($2.9M) of Currency Impact

Processing Revenue Up in All Geographies

Margin Expansion Continues

Extended Relationship with Carrefour

(1.0%)

10.6%

1.8%

12.2%

4.4%

2.5%

5.7%

Reported

Constant

Currency

Segment Revenue by Region

QTD

Europe

MEA

Rest Of World

$76.4

$76.6

$77.9

$90.6

$76.8

$84.7

$87.4

$92.9

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

Segment

Revenue*

YOY Growth %

$6.9

$7.7

$9.5

$18.0

$4.6

$11.7

$16.0

$22.8

9.0%

10.0%

12.2%

19.9%

5.9%

13.9%

18.3%

24.6%

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

Operating

Margin

* |

4Q

2014 International Segment Highlights 9

(in millions)

(in millions)

3.7%

9.9%

12.1%

8.5%

14.2%

23.3%

26.7%

17.3%

8.9%

19.3%

Same Client Transactions Grew 11.8%

7.5%

13.4%

8.1%

9.3%

12.7%

11.3%

©2015 Total System Services, Inc.® Proprietary. All rights reserved worldwide. 434.0

492.4

525.5

555.6

517.9

558.1

574.3

618.1

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

Transaction Volume

YOY Growth%

55.7

58.0

59.2

59.1

60.7

62.3

64.1

66.6

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

Accounts on File

YOY Growth% |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

Revenues Decreased 2.4%*

-

Direct Up 2.6% with Continued Focus on Growth

Initiatives

-

Indirect Down (9.1)% But Exceeded Expectations

Industry Veteran Hired to Lead TSYS Merchant

Solutions

4Q 2014 Merchant Segment Highlights

10

(*) Revenues Before Reimbursable Items

($ in millions)

11.1%

15.6%

5.4%

4.3%

Adjusted Segment Operating Income

($ in millions)

41%

59%

(4.3%)

(4.1%)

1.2%

(2.4%)

Segment Revenue by Mix*

QTD

Direct

Indirect

$109.3

$113.0

$113.6

$110.4

$104.6

$108.3

$115.0

$107.7

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

Segment

Revenue*

YOY Growth %

$37.6

$41.3

$40.8

$36.0

$30.2

$32.9

$40.4

$31.4

34.4%

36.6%

35.9%

32.6%

28.8%

30.4%

35.1%

29.2%

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

Operating Margin* |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

11

4Q 2014 Merchant Segment Highlights

(*) Excludes Managed Accounts

Segment Revenue by LOB

YOY Growth %

($ in billions)

35.3%

40.6%

22.0%

11.1%

(12%)

45%

55%

26%

22%

(11%)

(12%)

(12%)

($ in millions)

4%

(14%)

9.3%

POS Transactions Increased 4.4%, Excluding Deconverted Accounts

SBS Sales Volume Up 10.6%

Continued Investment in Product and Service Offerings

8.2%

1%

(10%)

4%

(2%)

10.0%

10.6%

(9%)

3%

$52

$51

$51

$48

$45

$46

$50

$44

$57

$62

$63

$62

$59

$62

$65

$64

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

Indirect

Direct

$4.8

$5.3

$5.3

$5.2

$5.3

$5.8

$5.9

$5.7

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

SBS

Sales Volume

*

YOY Growth % |

Adjusted Segment Operating Income*

Operating Margin

Segment Revenue

YOY Growth %

4Q 2014 NetSpend Segment Highlights

12

($ in millions)

Revenue $119.2M –

Up 14.4%

Added 5k Distributing Locations and

Employers

Bringing the Total to Over 85k

Launched WalMart in Retail Channel

($ in millions)

(*NOTE: Periods prior to the acquisition by TSYS have been restated )

$28.0

$29.3

$34.6

$31.7

$28.7

$30.7

$36.1

$32.7

23.9%

27.9%

33.4%

30.5%

21.7%

26.3%

31.7%

27.5%

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

$117.3

$104.9

$103.7

$104.1

$132.6

$116.8

$114.0

$119.2

28.3%

22.9%

22.2%

16.1%

13.1%

11.4%

10.0%

14.4%

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

Segment Revenue by Channel

QTD

Partner

Retail

Direct

Paycard

10%

42%

34%

14%

©2015 Total System Services, Inc.® Proprietary. All rights reserved worldwide. * |

4Q

2014 NetSpend Segment Highlights 13

Gross Dollar Volume

YOY Growth %

Direct Deposit Active Cards

YOY Growth %

Direct Deposit Active Cards up 21.9%

Gross Dollar Volume (GDV) up 18.2%

Full Year 2014 Exceeded $20 Billion

(in thousands)

($ in millions)

66.7%

42.3%

23.8%

22.1%

42.8%

30.1%

22.4%

21.2%

17.6%

20.6%

21.9%

21.5%

22.1%

17.2%

16.6%

18.2%

$5,378.7

$3,947.9

$3,780.9

$3,967.6

$6,567.2

$4,628.0

$4,409.3

$4,691.5

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

1,707.9

1,361.4

1,261.1

1,321.1

2,070.3

1,600.7

1,520.7

1,610.2

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

©2015 Total System Services, Inc.® Proprietary. All rights reserved worldwide. |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

Consolidated Selected Financial Highlights

14

$635,104

$583,103

8.9%

Total Revenues

$2,446,877

$2,064,305

18.5%

569,301

525,259

8.4

Revenues Before Reimbursable Items

2,192,978

1,823,708

20.2

193,738

181,097

7.0

Adjusted EBITDA*

712,267

624,093

14.1

$0.58

$0.48

20.8

Adjusted EPS* from Continuing

Operations

$1.96

$1.73

13.2

(in

thousands,

except

per

share

data)

4

Qtr

2014

4

Qtr

2013

Percent

Change

YTD

2014

YTD

2013

Percent

Change

(*) Adjusted EBITDA and Adjusted EPS definitions are contained in Appendix

th

th |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

Revenues before

Reimbursable

Items

Adjusted

Operating Margin

Adjusted

Segment

Operating Income

North America

$99,620

$255,539

38.98%

International

22,849

92,895

24.60%

Merchant

31,399

107,677

29.16%

NetSpend

32,742

119,165

27.48%

Eliminations

--

(5,975)

Corporate administration excluding stock comp

(31,897)

--

Adjusted operating margin

$154,713

$569,301

27.18%

Amortization of acquisition intangibles

(24,166)

NetSpend M&A expenses

(3)

Stock-based compensation

(7,771)

Operating income (US GAAP)

$122,773

Segment Operating Margin and Consolidated

Adjusted Operating Margin

(in thousands)

15

Three Months Ended December 31, 2014 |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

Revenues before

Reimbursable

Items

Adjusted

Operating Margin

Adjusted

Segment

Operating Income

North America

$351,512

$954,082

36.84%

International

55,123

341,785

16.13%

Merchant

134,872

435,649

30.96%

NetSpend

128,285

482,686

26.58%

Eliminations

--

(21,224)

Corporate administration excluding stock comp

(107,175)

--

Adjusted operating margin

$562,617

$2,192,978

25.66%

Amortization of acquisition intangibles

(96,971)

NetSpend M&A expenses

(3,217)

Stock-based compensation

(30,790)

Operating income (US GAAP)

$431,639

Segment Operating Margin and Consolidated

Adjusted Operating Margin

(in thousands)

16

Twelve Months Ended December 31, 2014 |

Rollforward of Quarterly Cash Balance

$200

$500

$100

$0

$300

Operating

Activities

$171

Cap Ex

($68)

Debt Pmts

($21)

Dividends

($19)

Ending

Balance

$289

(in millions)

9/30/2014

12/31/2014

17

$400

Share

Repurchase

($50)

Beginning

Balance

$266

Other

($10)

©2015 Total System Services, Inc.® Proprietary. All rights reserved worldwide. |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

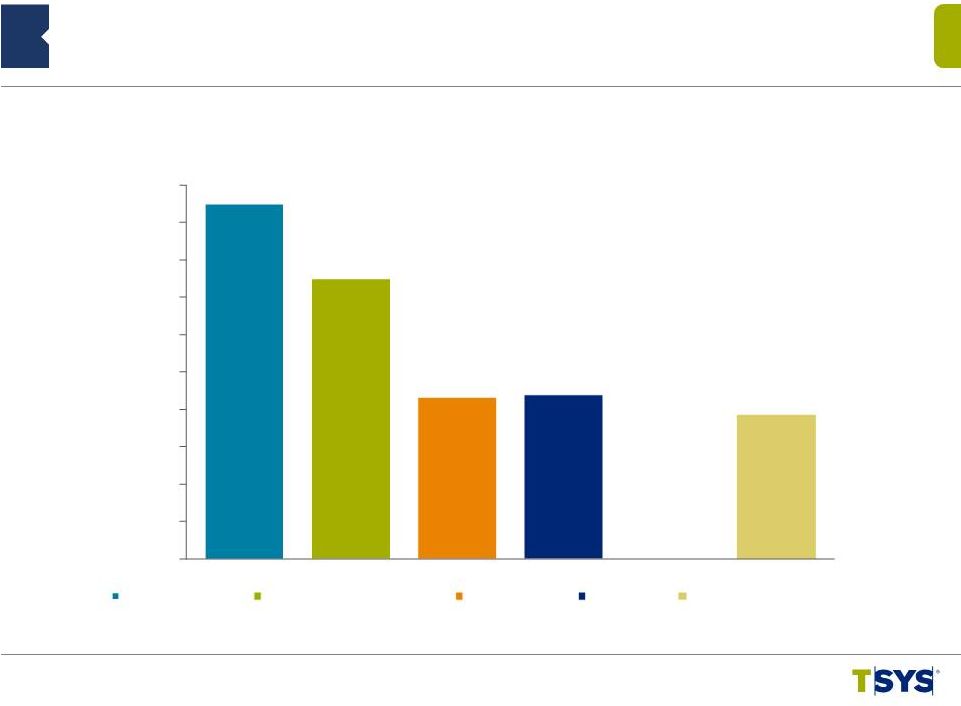

Cash Flow Strength:

2014 Consolidated Financial Highlights

18

(in millions)

$712

$561

$325

$329

$289

$0

$75

$150

$225

$300

$375

$450

$525

$600

$675

$750

Adjusted EBITDA

Cash flow from operations

Free cash flow

Net income

Ending cash |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

2015 Guidance*

Range

Range

Percent Change

Total Revenues

$2,620

to

$2,660

to

Revenues Before Reimbursable Items

$2,370

to

$2,410

8%

to

10%

Adjusted EPS attributable to TSYS common

shareholders from continuing operations

$2.17

to

$2.21

11%

to

13%

Average Basic Weighted Shares

186

(in millions, except per share data)

19

(*) See Appendix for guidance assumptions

7%

9% |

Q&A

©2015 Total System Services, Inc.® Proprietary. All rights reserved worldwide. |

Appendix

©2015 Total System Services, Inc.® Proprietary. All rights reserved worldwide. |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

Appendix: Non-GAAP Items –

Adjusted EBITDA

and Adjusted EPS

•

Adjusted EBITDA is net income excluding equity in income of equity investments,

nonoperating income/(expense), taxes, depreciation, amortization and

stock-based compensation expenses and NetSpend merger & acquisition expenses.

•

Adjusted EPS is adjusted earnings divided by weighted average shares outstanding

used for basic EPS calculations. Adjusted earnings is net income excluding

the after-tax impact of stock-based compensation expenses, amortization of acquisition intangibles, and NetSpend

merger & acquisition expenses.

•

Adjusted segment operating income is operating income at the segment level adjusted

for amortization of acquisition intangibles. •

Adjusted segment operating margin is adjusted segment operating income divided by

segment revenues before reimbursable items. •

The Company believes that these non-GAAP financial measures it presents are

useful to investors in evaluating the Company’s operating performance

for the following reasons: –

adjusted

EBITDA

and

adjusted

EPS

are

widely

used

by

investors

to

measure

a

company’s

operating

performance

without

regard

to

items,

such

as interest expense, income tax expense, depreciation and amortization, merger and

acquisition expenses and employee stock-based compensation

expense

that

can

vary

substantially

from

company

to

company

depending

upon

their

respective

financing

structures

and

accounting policies, the book values of their assets, their capital structures and

the methods by which their assets were acquired; and –

securities analysts use adjusted EBITDA and adjusted EPS as supplemental measures

to evaluate the overall operating performance of companies.

•

By comparing the Company’s adjusted EBITDA and adjusted EPS in different

historical periods, investors can evaluate the Company’s operating

results without the additional variations caused by employee stock-based compensation expense, which may not be comparable

from

period

to

period

due

to

changes

in

the

fair

market

value

of

the

Company’s

common

stock

(which

is

influenced

by

external

factors

like

the volatility of public markets and the financial performance of the

Company’s peers) and is not a key measure of the Company’s

operations.

•

The Company’s management uses the non-GAAP financial measures:

–

as measures of operating performance, because they exclude the impact of items not

directly resulting from the Company’s core operations; –

for planning purposes, including the preparation of the Company’s annual

operating budget; –

to allocate resources to enhance the financial performance of the Company’s

business; –

to evaluate the effectiveness of the Company’s business strategies; and

–

in communications with the Company’s board of directors concerning the

Company’s financial performance. 22 |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

Consumer Credit

270.0

228.9

18.0

270.0

263.9

2.3

Retail

28.4

27.8

2.2

28.4

28.4

0.1

Total Consumer

298.4

256.7

16.3

298.4

292.3

2.1

Commercial

41.6

39.9

4.2

41.6

41.5

0.1

Other

22.4

18.9

18.7

22.4

21.2

5.7

Subtotal

362.4

315.5

14.9

362.4

355.0

2.1

Prepaid*/

Stored Value

127.3

118.0

7.9

127.3

125.1

1.8

Government

Services

67.4

62.2

8.2

67.4

66.7

1.0

Commercial Card

Single Use

59.6

45.3

31.5

59.6

58.7

1.5

Total AOF

616.7

541.0

14.0

616.7

605.5

1.8

Appendix: Accounts on File Portfolio Summary

(in millions)

Dec

2014

Dec

2013

%

Change

Dec

2014

Sep

2014

%

Change

23

(* -

Prepaid does not include NetSpend accounts) |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

Appendix: Non-GAAP Reconciliation –

Revenues Before Reimbursable Items

Three Months

Ended Twelve Months Ended

Total Revenues

$635,104

$583,103

$2,446,877

$2,064,305

Reimbursable Items

65,803

57,844

253,899

240,597

Revenues Before Reimbursable Items

$569,301

$525,259

$2,192,978

$1,823,708

(in thousands)

24

12/31/14

12/31/13

12/31/14

12/31/13 |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

Appendix: Non-GAAP Reconciliation –

Adjusted

Segment Operating Income and Operating Margin

Three Months

Ended Twelve Months Ended

(in thousands)

25

12/31/14

12/31/13

12/31/14

12/31/13

Operating income

$122,773

$108,858

$431,639

$382,500

Add: Acquisition intangible amort

24,166

24,751

96,971

65,893

Add: Corporate admin and other

39,671

39,176

141,182

137,290

Total segment adjusted operating income

$186,610

$172,785

$669,792

$585,683

By segment: North America services (a)

$99,620

$87,110

$351,512

$321,619

International services (b)

$22,849

$17,986

$55,123

$42,068

Merchant services (c)

$31,399

$35,952

$134,872

$155,643

NetSpend (d)

$32,742

$31,737

$128,285

$66,353

Total revenues

$635,104

$583,103

$2,446,877

$2,064,305

Reimbursable items

(65,803)

(57,844)

(253,899)

(240,597)

Total segment revenues before reimbursable items

$569,301

$525,259

$2,192,978

$1,823,708

Intersegment revenues

5,975

3,121

21,224

12,549

By segment: North America services (e)

$255,539

$223,266

$954,082

$860,645

International services (f)

$92,895

$90,595

$341,785

$321,484

Merchant services (g)

$107,677

$110,375

$435,649

$446,278

NetSpend (h)

$119,165

$104,144

$482,686

$207,850

Adjusted segment operating margin:

North America services (a) / (e)

38.98%

39.02%

36.84%

37.37%

International services (b) / (f)

24.60%

19.85%

16.13%

13.09%

Merchant services (c) / (g)

29.16%

32.57%

30.96%

34.88%

NetSpend (d) / (h)

27.48%

30.47%

26.58%

31.92% |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

Twelve

Months Ended

12/31/14 12/31/13

Percentage

Change

Three

Months Ended

12/31/14 12/31/13

Percentage

Change

Appendix: Non-GAAP Reconciliation –

Constant Currency

(1) Reflects current period results on a non-GAAP basis as if foreign currency

rates did not change from the comparable prior year period. (2) Reflects the

impact of calculated changes in foreign currency rates from the comparable period.

(in thousands)

Consolidated:

Constant Currency (1)

$638,111

$583,103

9.4%

$2,431,947

$2,064,305

17.8%

Foreign Currency (2)

(3,007)

---

14,930

---

Total Revenues

$635,104

$583,103

8.9%

$2,446,877

$2,064,305

18.5%

International Services:

Constant Currency (1)

$101,655

$96,129

5.7%

$348,595

$341,549

2.1%

Foreign Currency (2)

(3,005)

---

14,764

---

Total Revenues

$98,650

$96,129

2.6%

$363,359

$341,549

6.4%

26 |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

Twelve

Months Ended

12/31/14 12/31/13

Percentage

Change

Three

Months Ended

12/31/14 12/31/13

Percentage

Change

Appendix: Non-GAAP Reconciliation –

Constant Currency

(1) Reflects current period results on a non-GAAP basis as if foreign currency

rates did not change from the comparable prior year period. (2) Reflects the

impact of calculated changes in foreign currency rates from the comparable period.

(in thousands)

27

Consolidated:

Constant Currency (1)

$572,166

$525,259

8.9%

$2,178,951

$1,823,708

19.5%

Foreign Currency (2)

(2,865)

---

14,027

---

Revenues before

reimbursable items

$569,301

$525,259

8.4%

$2,192,978

$1,823,708

20.2%

International Services:

Constant Currency (1)

$95,758

$90,595

5.7%

$327,923

$321,484

2.0%

Foreign Currency (2)

(2,863)

---

13,862

---

Revenues before

reimbursable items

$92,895

$90,595

2.5%

$341,785

$321,484

6.3% |

Appendix: Non-GAAP Reconciliation –

EBITDA and Adjusted EBITDA

(in thousands)

28

Three Months Ended

Twelve Months Ended

Dec

2014

Dec

2013

Dec

2014

Dec

2013

Net income :

As reported (GAAP) (a)

$81,242

$69,393

$329,406

$256,597

Adjusted for:

Add/(Deduct): Loss/(Income) from

discontinued operations

3,338

(751)

(48,655)

(2,055)

Deduct: Equity in Income of Equity

Investments

(5,751)

(3,691)

(17,583)

(13,047)

Add: Income Taxes

35,428

33,435

129,761

110,981

Add: Nonoperating expenses

8,516

10,472

38,711

30,024

Add: Depreciation and

amortization

63,191

61,268

246,620

199,026

EBITDA

$185,964

$170,126

$678,260

$581,526

Adjust for:

Add: Share-based compensation

7,771

9,345

30,790

28,933

Add: NetSpend M&A expenses

3

1,626

3,217

13,634

Adjusted EBITDA

$193,738

$181,097

$712,267

$624,093

©2015 Total System Services, Inc.® Proprietary. All rights reserved worldwide. |

©2015 Total

System Services, Inc.® Proprietary. All rights reserved worldwide.

Appendix: Non-GAAP Reconciliation –

Adjusted EPS

(in thousands)

29

Three Months Ended

Twelve Months Ended

Dec

2014

Dec

2013

Dec

2014

Dec

2013

Income from continuing operations available to

TSYS Common Shareholders:

As reported (GAAP) (a)

$83,198

$66,058

$275,216

$246,893

Adjusted for amounts attributable to TSYS

common shareholders (net of taxes):

Acquisition intangible amortization

17,747

16,609

65,127

43,743

Share-based compensation

5,777

6,405

20,944

19,830

NetSpend M&A expenses

3

1,318

3,115

15,251

Adjusted earnings (b)

$106,725

$90,390

$364,402

$325,717

Average common shares outstanding and

participating securities (c)

185,221

189,447

186,222

188,389

Basic EPS Available to TSYS Common

Shareholders (a) / (c)

$0.45

$0.35

$1.48

$1.31

Adjusted EPS Available to TSYS Common

Shareholders (b) / (c)

$0.58

$0.48

$1.96

$1.73 |

Appendix: Non-GAAP Reconciliation –

Free Cash Flow

Twelve Months

Ended

12/31/2014

Cash Flows from Operating Activities

$561,094

Less:

Purchase of Property and Equipment

(75,913)

Additions to Licensed Computer Software from Vendors

(29,638)

Additions to Internally Developed Computer Software

(41,502)

Additions to Contract Acquisition Costs

(88,871)

Free Cash Flow

$325,170

(in thousands)

30

©2016 Total System Services, Inc.® Proprietary. All rights reserved worldwide. |

Appendix: 2015 Guidance Assumptions

The guidance assumes:

•

•

•

•

•

•

31

©2015 Total System Services, Inc.® Proprietary. All rights reserved worldwide. There will be no significant

movements in the London Interbank Offered rate and TSYS will not make any

significant draws on the remaining balance of its credit facility;

There will be no significant movement in foreign currency exchange rates

related to TSYS’

business;

TSYS will not incur significant expenses associated with the conversion of

new large clients other than included in the 2015 estimate, additional

acquisitions,

or

any

significant

impairment

of

goodwill

or

other

intangibles;

There will be no deconversions of large clients during the year;

No share repurchases are included; and

The economy will not worsen. |

Appendix: Non-GAAP Reconciliation –

EBITDA and Adjusted EBITDA

Twelve Months

Ended

12/31/2014

Net Income

$329,406

Adjusted for:

Deduct: Discontinued operations

(48,655)

Deduct: Equity in Income of Equity Investments

(17,583)

Add: Income Taxes

129,760

Add: Nonoperating expense

38,711

Add: Depreciation and Amortization

246,620

EBITDA

$678,259

Adjust for: Share-based compensation

30,790

NetSpend M&A Operating Expenses*

3,217

Adjusted EBITDA

$712,266

(in thousands)

32

* Excludes share-based compensation

©2015 Total System Services, Inc.® Proprietary. All rights reserved worldwide. |