Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DOVER Corp | a201501278-k.htm |

| EX-99.1 - EXHIBIT 99.1 - DOVER Corp | a201501278-kexhibit991.htm |

Earnings Conference Call Fourth Quarter 2014 January 27, 2015 – 9:00am CT

2 Forward looking statements and non-GAAP measures We want to remind everyone that our comments may contain forward-looking statements that are inherently subject to uncertainties and risks. We caution everyone to be guided in their analysis of Dover Corporation by referring to the documents we file from time to time with the SEC, including our Form 10-K for 2013, for a list of factors that could cause our results to differ from those anticipated in any such forward-looking statements. We would also direct your attention to our website, www.dovercorporation.com, where considerably more information can be found. This document contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or Dover’s earnings release and investor supplement for the fourth quarter and full year 2014. 2

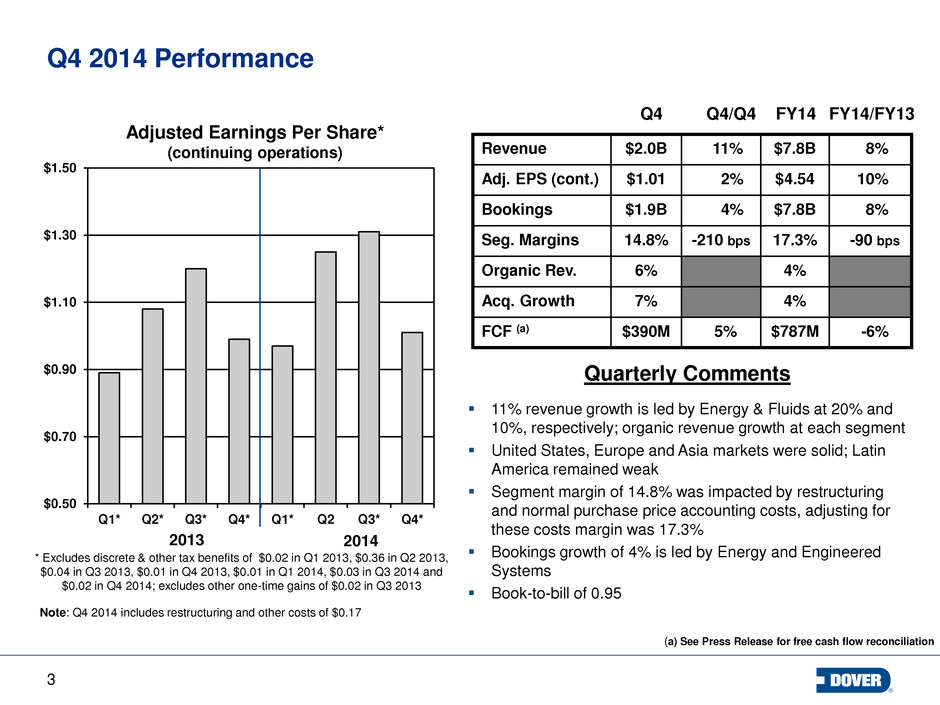

3 $0.50 $0.70 $0.90 $1.10 $1.30 $1.50 Q1* Q2* Q3* Q4* Q1* Q2 Q3* Q4* Q4 2014 Performance Adjusted Earnings Per Share* (continuing operations) Q4 Q4/Q4 * Excludes discrete & other tax benefits of $0.02 in Q1 2013, $0.36 in Q2 2013, $0.04 in Q3 2013, $0.01 in Q4 2013, $0.01 in Q1 2014, $0.03 in Q3 2014 and $0.02 in Q4 2014; excludes other one-time gains of $0.02 in Q3 2013 (a) See Press Release for free cash flow reconciliation 3 Quarterly Comments 2013 2014 11% revenue growth is led by Energy & Fluids at 20% and 10%, respectively; organic revenue growth at each segment United States, Europe and Asia markets were solid; Latin America remained weak Segment margin of 14.8% was impacted by restructuring and normal purchase price accounting costs, adjusting for these costs margin was 17.3% Bookings growth of 4% is led by Energy and Engineered Systems Book-to-bill of 0.95 Revenue $2.0B 11% $7.8B 8% Adj. EPS (cont.) $1.01 2% $4.54 10% Bookings $1.9B 4% $7.8B 8% Seg. Margins 14.8% -210 bps 17.3% -90 bps Organic Rev. 6% 4% Acq. Growth 7% 4% FCF (a) $390M 5% $787M -6% FY14 FY14/FY13 Note: Q4 2014 includes restructuring and other costs of $0.17

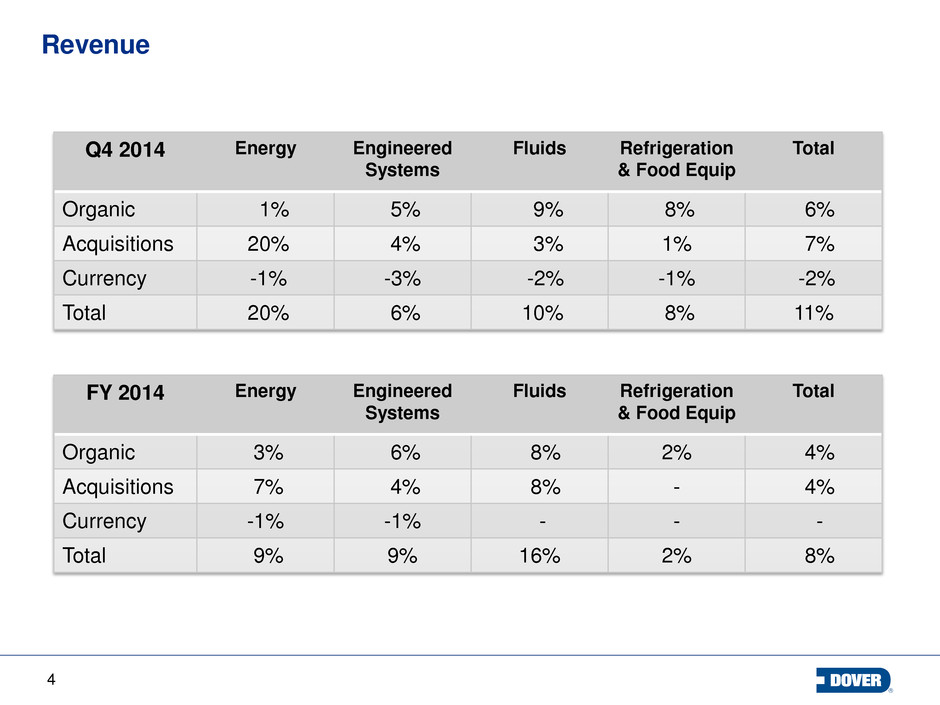

4 Revenue Q4 2014 Energy Engineered Systems Fluids Refrigeration & Food Equip Total Organic 1% 5% 9% 8% 6% Acquisitions 20% 4% 3% 1% 7% Currency -1% -3% -2% -1% -2% Total 20% 6% 10% 8% 11% FY 2014 Energy Engineered Systems Fluids Refrigeration & Food Equip Total Organic 3% 6% 8% 2% 4% Acquisitions 7% 4% 8% - 4% Currency -1% -1% - - - Total 9% 9% 16% 2% 8%

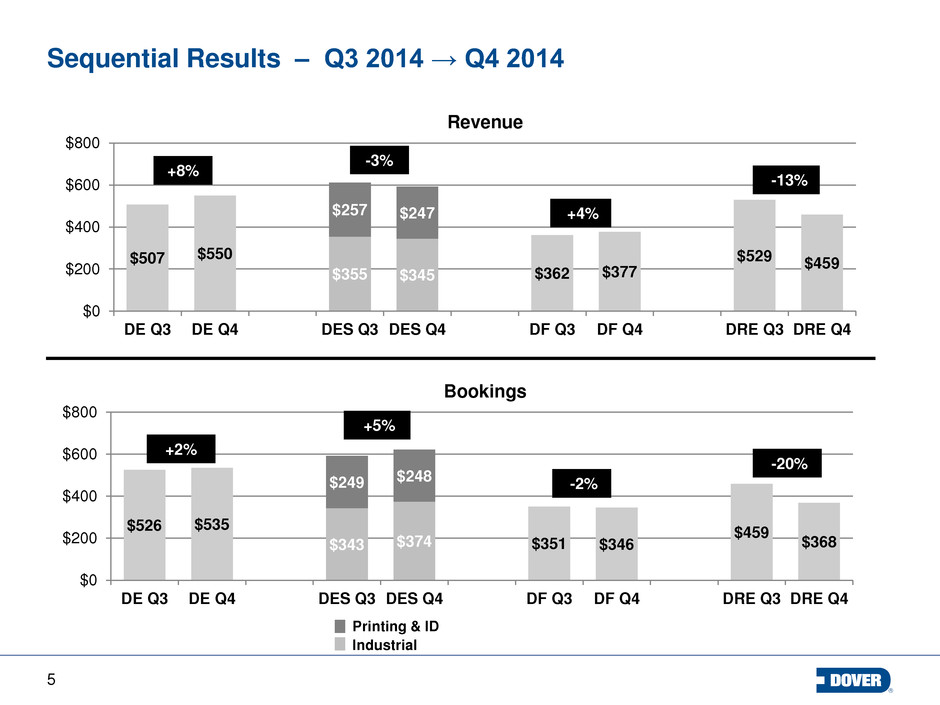

5 Printing & ID Industrial $343 $374 $526 $535 $249 $248 $351 $346 $459 $368 $0 $200 $400 $600 $800 DE Q3 DE Q4 DES Q3 DES Q4 DF Q3 DF Q4 DRE Q3 DRE Q4 Sequential Results – Q3 2014 → Q4 2014 5 $355 $345 $507 $550 $257 $247 $362 $377 $529 $459 $0 $200 $400 $600 $800 DE Q3 DE Q4 DES Q3 DES Q4 DF Q3 DF Q4 DRE Q3 DRE Q4 Revenue +8% -20% -13% -2% +4% +5% -3% +2% Bookings

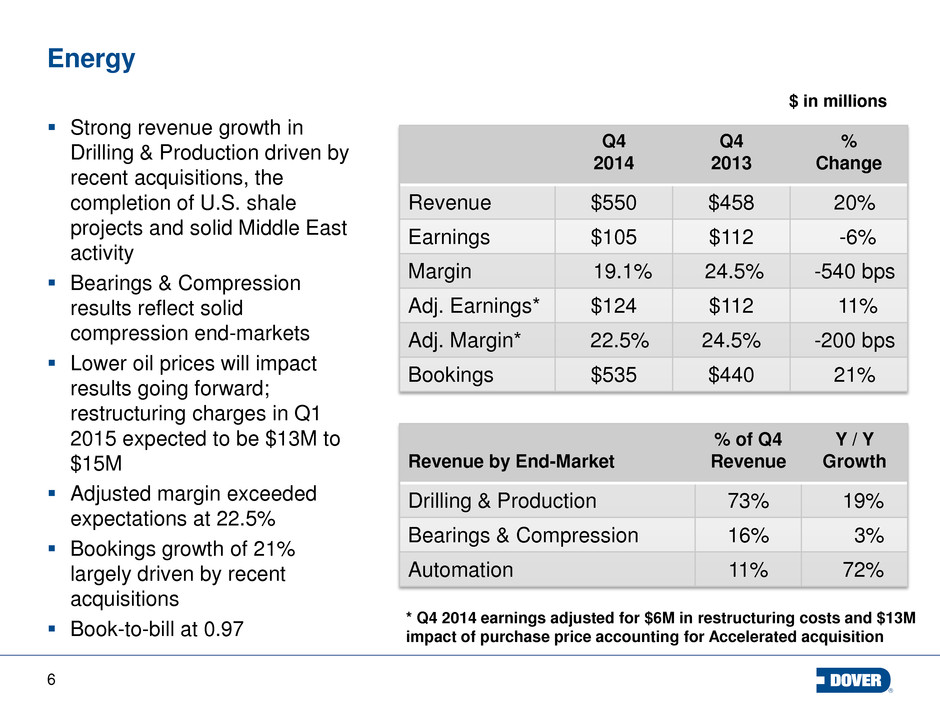

6 Energy Strong revenue growth in Drilling & Production driven by recent acquisitions, the completion of U.S. shale projects and solid Middle East activity Bearings & Compression results reflect solid compression end-markets Lower oil prices will impact results going forward; restructuring charges in Q1 2015 expected to be $13M to $15M Adjusted margin exceeded expectations at 22.5% Bookings growth of 21% largely driven by recent acquisitions Book-to-bill at 0.97 6 Q4 2014 Q4 2013 % Change Revenue $550 $458 20% Earnings $105 $112 -6% Margin 19.1% 24.5% -540 bps Adj. Earnings* $124 $112 11% Adj. Margin* 22.5% 24.5% -200 bps Bookings $535 $440 21% Revenue by End-Market % of Q4 Revenue Y / Y Growth Drilling & Production 73% 19% Bearings & Compression 16% 3% Automation 11% 72% $ in millions * Q4 2014 earnings adjusted for $6M in restructuring costs and $13M impact of purchase price accounting for Accelerated acquisition

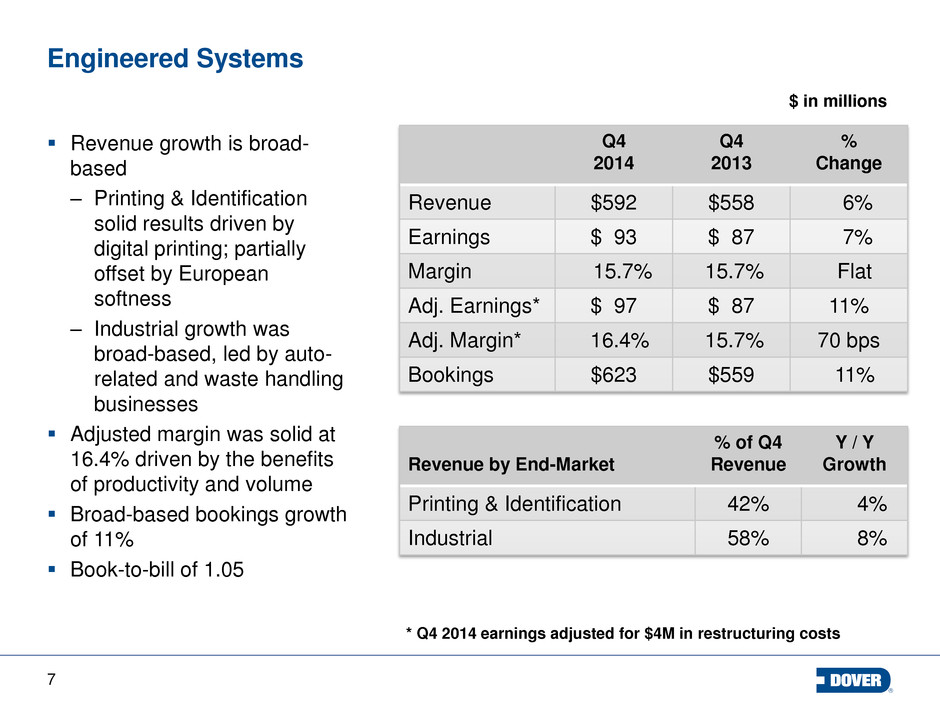

7 Engineered Systems Revenue growth is broad- based – Printing & Identification solid results driven by digital printing; partially offset by European softness – Industrial growth was broad-based, led by auto- related and waste handling businesses Adjusted margin was solid at 16.4% driven by the benefits of productivity and volume Broad-based bookings growth of 11% Book-to-bill of 1.05 7 Q4 2014 Q4 2013 % Change Revenue $592 $558 6% Earnings $ 93 $ 87 7% Margin 15.7% 15.7% Flat Adj. Earnings* $ 97 $ 87 11% Adj. Margin* 16.4% 15.7% 70 bps Bookings $623 $559 11% Revenue by End-Market % of Q4 Revenue Y / Y Growth Printing & Identification 42% 4% Industrial 58% 8% $ in millions * Q4 2014 earnings adjusted for $4M in restructuring costs

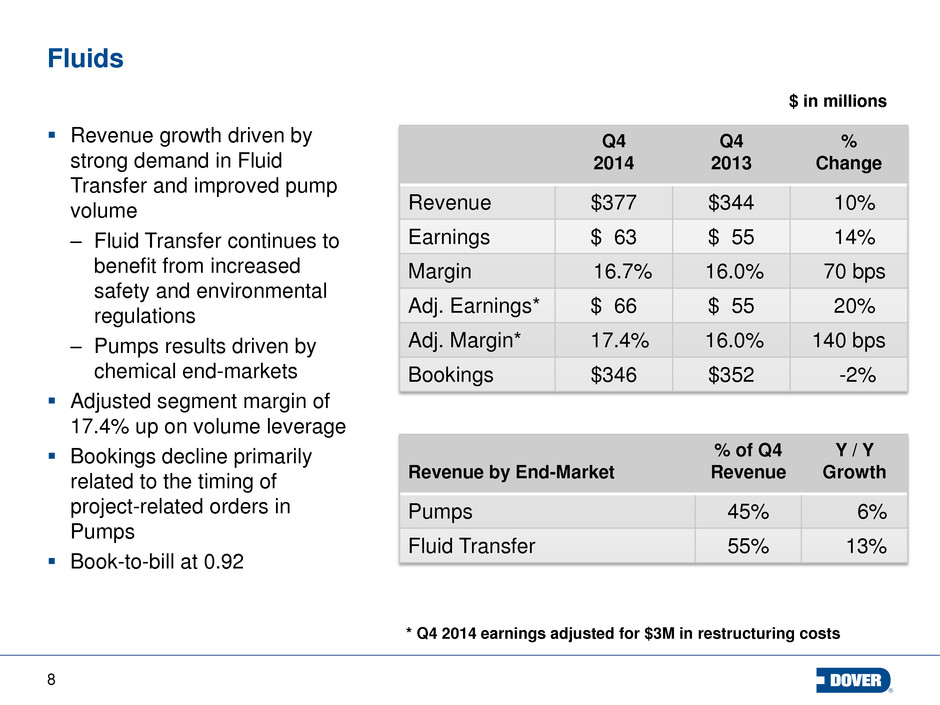

8 Fluids Revenue growth driven by strong demand in Fluid Transfer and improved pump volume – Fluid Transfer continues to benefit from increased safety and environmental regulations – Pumps results driven by chemical end-markets Adjusted segment margin of 17.4% up on volume leverage Bookings decline primarily related to the timing of project-related orders in Pumps Book-to-bill at 0.92 8 Q4 2014 Q4 2013 % Change Revenue $377 $344 10% Earnings $ 63 $ 55 14% Margin 16.7% 16.0% 70 bps Adj. Earnings* $ 66 $ 55 20% Adj. Margin* 17.4% 16.0% 140 bps Bookings $346 $352 -2% Revenue by End-Market % of Q4 Revenue Y / Y Growth Pumps 45% 6% Fluid Transfer 55% 13% $ in millions * Q4 2014 earnings adjusted for $3M in restructuring costs

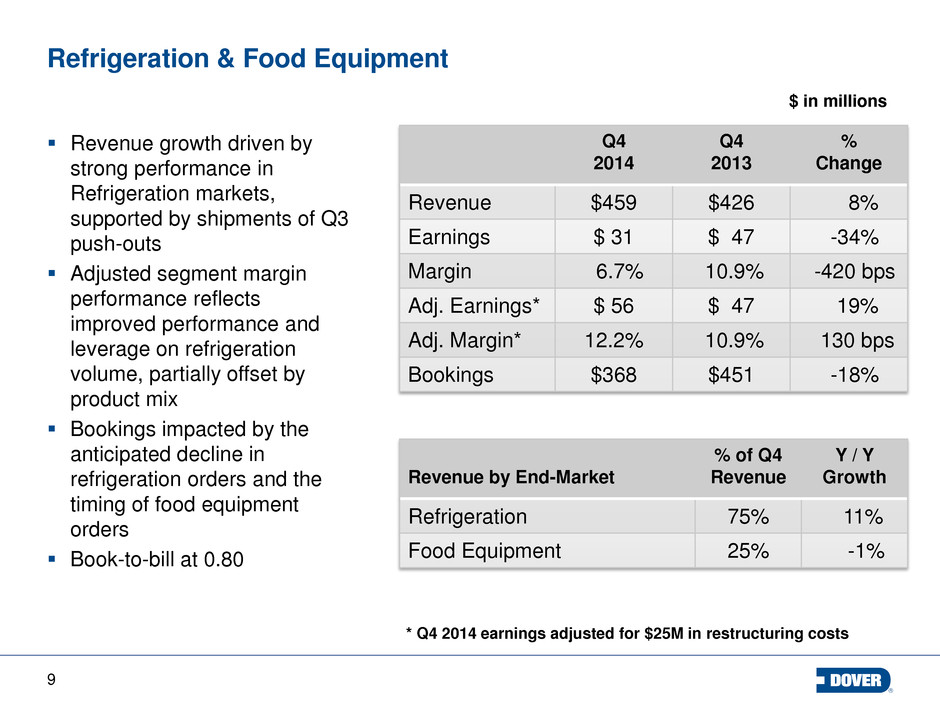

9 Refrigeration & Food Equipment Revenue growth driven by strong performance in Refrigeration markets, supported by shipments of Q3 push-outs Adjusted segment margin performance reflects improved performance and leverage on refrigeration volume, partially offset by product mix Bookings impacted by the anticipated decline in refrigeration orders and the timing of food equipment orders Book-to-bill at 0.80 9 Q4 2014 Q4 2013 % Change Revenue $459 $426 8% Earnings $ 31 $ 47 -34% Margin 6.7% 10.9% -420 bps Adj. Earnings* $ 56 $ 47 19% Adj. Margin* 12.2% 10.9% 130 bps Bookings $368 $451 -18% Revenue by End-Market % of Q4 Revenue Y / Y Growth Refrigeration 75% 11% Food Equipment 25% -1% $ in millions * Q4 2014 earnings adjusted for $25M in restructuring costs

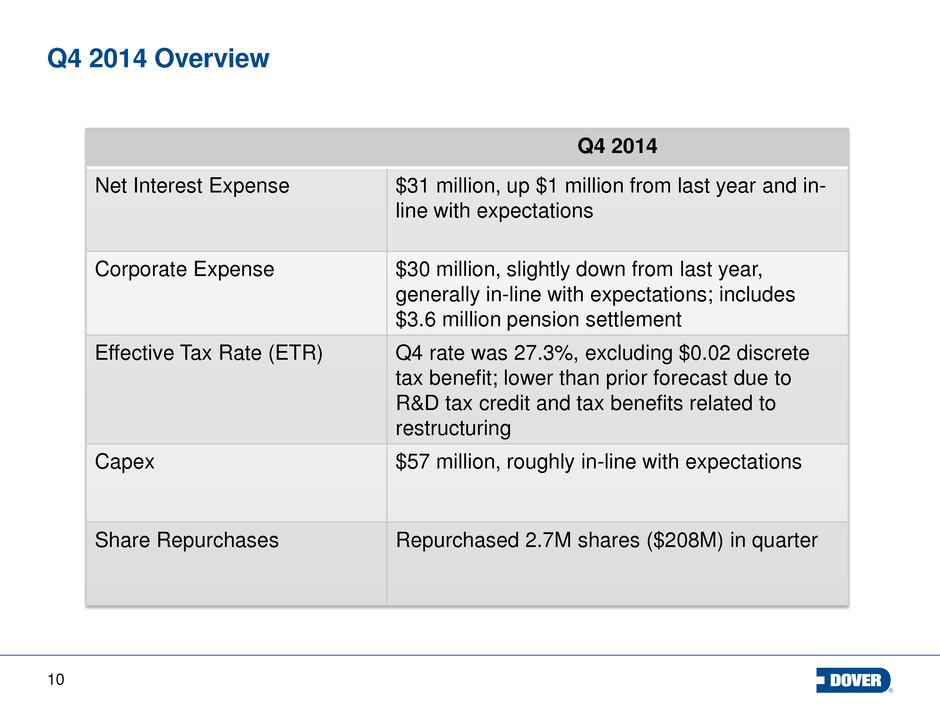

10 Q4 2014 Overview 10 Q4 2014 Net Interest Expense $31 million, up $1 million from last year and in- line with expectations Corporate Expense $30 million, slightly down from last year, generally in-line with expectations; includes $3.6 million pension settlement Effective Tax Rate (ETR) Q4 rate was 27.3%, excluding $0.02 discrete tax benefit; lower than prior forecast due to R&D tax credit and tax benefits related to restructuring Capex $57 million, roughly in-line with expectations Share Repurchases Repurchased 2.7M shares ($208M) in quarter

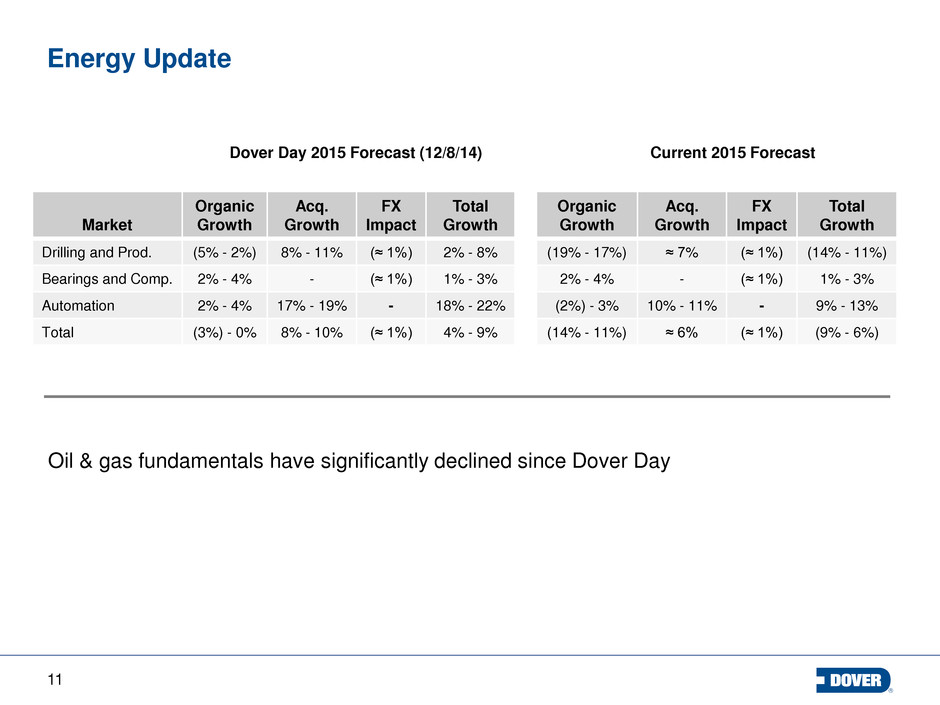

11 Energy Update Oil & gas fundamentals have significantly declined since Dover Day Market Organic Growth Acq. Growth FX Impact Total Growth Organic Growth Acq. Growth FX Impact Total Growth Drilling and Prod. (5% - 2%) 8% - 11% (≈ 1%) 2% - 8% (19% - 17%) ≈ 7% (≈ 1%) (14% - 11%) Bearings and Comp. 2% - 4% - (≈ 1%) 1% - 3% 2% - 4% - (≈ 1%) 1% - 3% Automation 2% - 4% 17% - 19% - 18% - 22% (2%) - 3% 10% - 11% - 9% - 13% Total (3%) - 0% 8% - 10% (≈ 1%) 4% - 9% (14% - 11%) ≈ 6% (≈ 1%) (9% - 6%) Dover Day 2015 Forecast (12/8/14) Current 2015 Forecast

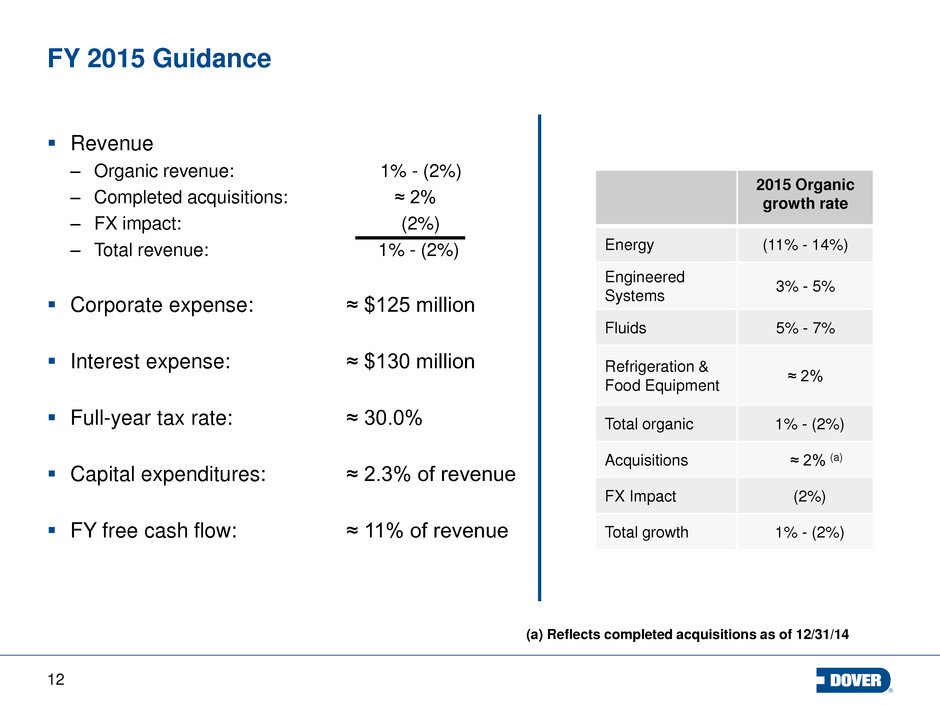

12 FY 2015 Guidance Revenue – Organic revenue: 1% - (2%) – Completed acquisitions: ≈ 2% – FX impact: (2%) – Total revenue: 1% - (2%) Corporate expense: ≈ $125 million Interest expense: ≈ $130 million Full-year tax rate: ≈ 30.0% Capital expenditures: ≈ 2.3% of revenue FY free cash flow: ≈ 11% of revenue 2015 Organic growth rate Energy (11% - 14%) Engineered Systems 3% - 5% Fluids 5% - 7% Refrigeration & Food Equipment ≈ 2% Total organic 1% - (2%) Acquisitions ≈ 2% (a) FX Impact (2%) Total growth 1% - (2%) (a) Reflects completed acquisitions as of 12/31/14

13 2015 EPS Guidance – Continuing Ops 2014 EPS – Continuing Ops (GAAP) $ 4.61 – Less 2014 tax items(1): (0.07) 2014 Adjusted EPS $ 4.54 – Net restructuring and one-time items(2): 0.09 - 0.10 – Performance including restructuring benefits: (0.06) - 0.10 – Acquisitions(3): (0.03 - 0.01) – Shares(4): 0.27 - 0.29 – Interest / Corp. / Tax rate / Other (net): (0.11 - 0.07) 2014 EPS – Continuing Ops $4.70 - $4.95 (1) $0.01 in Q1 2014 , $0.03 in Q3 2014 and $0.02 in Q4 2014 (3) Deals completed as of December 31, 2014, principally Accelerated (4) Based on 2015 estimated repurchases of $600M (2) Includes restructuring charges of $0.16 in Q4 2014 and $0.07 - $0.08 in Q1 2015, and pension settlement costs of $0.01 in Q4 2014

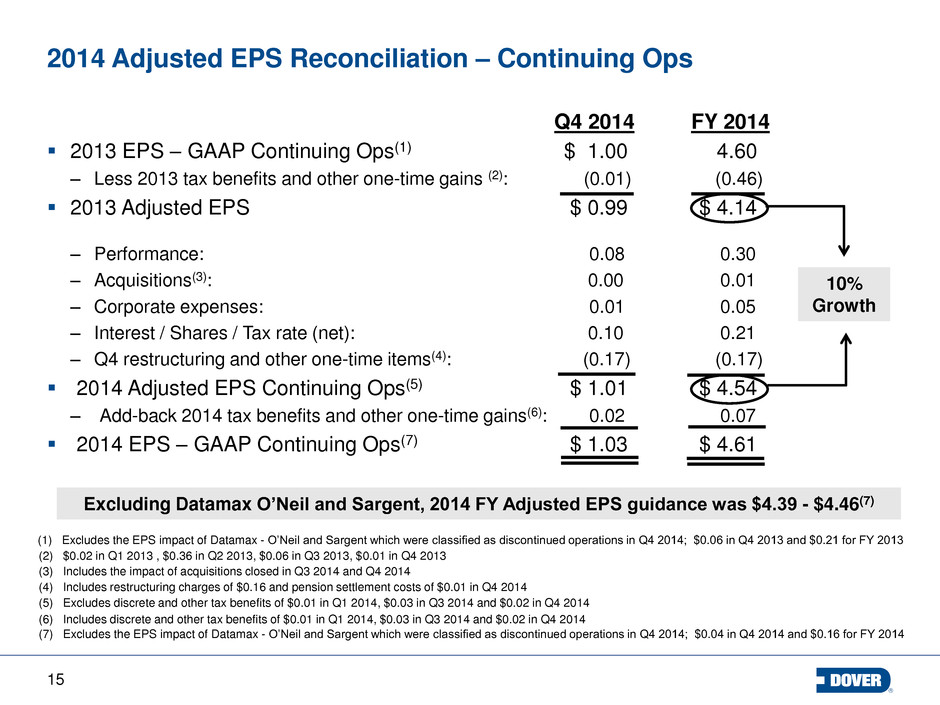

15 2013 EPS – GAAP Continuing Ops(1) $ 1.00 4.60 – Less 2013 tax benefits and other one-time gains (2): (0.01) (0.46) 2013 Adjusted EPS $ 0.99 $ 4.14 – Performance: 0.08 0.30 – Acquisitions(3): 0.00 0.01 – Corporate expenses: 0.01 0.05 – Interest / Shares / Tax rate (net): 0.10 0.21 – Q4 restructuring and other one-time items(4): (0.17) (0.17) 2014 Adjusted EPS Continuing Ops(5) $ 1.01 $ 4.54 – Add-back 2014 tax benefits and other one-time gains(6): 0.02 0.07 2014 EPS – GAAP Continuing Ops(7) $ 1.03 $ 4.61 2014 Adjusted EPS Reconciliation – Continuing Ops (1) Excludes the EPS impact of Datamax - O’Neil and Sargent which were classified as discontinued operations in Q4 2014; $0.06 in Q4 2013 and $0.21 for FY 2013 (2) $0.02 in Q1 2013 , $0.36 in Q2 2013, $0.06 in Q3 2013, $0.01 in Q4 2013 (3) Includes the impact of acquisitions closed in Q3 2014 and Q4 2014 (4) Includes restructuring charges of $0.16 and pension settlement costs of $0.01 in Q4 2014 FY 2014 Q4 2014 (7) Excludes the EPS impact of Datamax - O’Neil and Sargent which were classified as discontinued operations in Q4 2014; $0.04 in Q4 2014 and $0.16 for FY 2014 10% Growth Excluding Datamax O’Neil and Sargent, 2014 FY Adjusted EPS guidance was $4.39 - $4.46(7) (6) Includes discrete and other tax benefits of $0.01 in Q1 2014, $0.03 in Q3 2014 and $0.02 in Q4 2014 (5) Excludes discrete and other tax benefits of $0.01 in Q1 2014, $0.03 in Q3 2014 and $0.02 in Q4 2014