Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HANCOCK WHITNEY CORP | d856360d8k.htm |

Exhibit 99.1

For Immediate Release

January 22, 2015

For More Information

Trisha Voltz Carlson

SVP, Investor Relations Manager

504.299.5208

trisha.carlson@hancockbank.com

Hancock reports fourth quarter 2014 financial results

Continuing to replace declines in purchase accounting income with quality, core results;

full year 2014 core income and E.P.S. up over 30% compared to 2013

GULFPORT, Miss. (January 22, 2015) — Hancock Holding Company (Nasdaq: HBHC) today announced its financial results for the fourth quarter of 2014. Net income for the fourth quarter of 2014 was $40.1 million, or $.48 per diluted common share, compared to $46.6 million, or $.56 in the third quarter of 2014 and $34.7 million, or $.41 in the fourth quarter of 2013.

Operating income for the fourth quarter of 2014 was $46.4 million, or $.56 per diluted common share, compared to $49.1 million, or $.59, in the third quarter of 2014. Operating income was $45.8 million, or $.55, in the fourth quarter of 2013. We define our operating income as net income excluding tax-effected securities transactions gains or losses and nonoperating expense items. Nonoperating expenses totaled $9.7 million and $3.9 million (pre-tax), in the fourth and third quarters of 2014, respectively, and $17.1 million (pre-tax) in the fourth quarter of 2013. Management believes that operating income is one useful measure of our financial performance that helps investors compare the company’s fundamental operational performance from period to period. The financial tables include a reconciliation of net income to operating income.

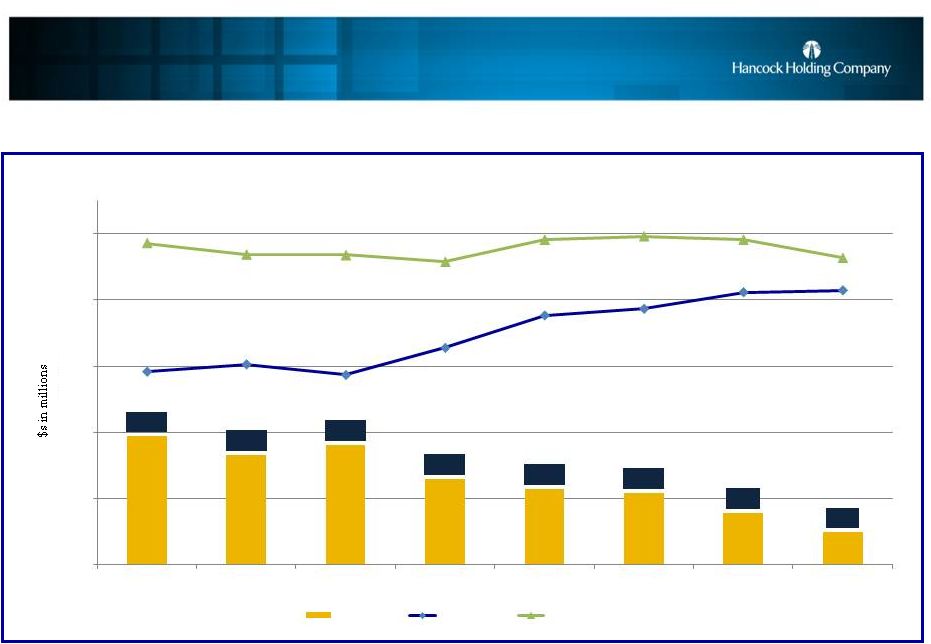

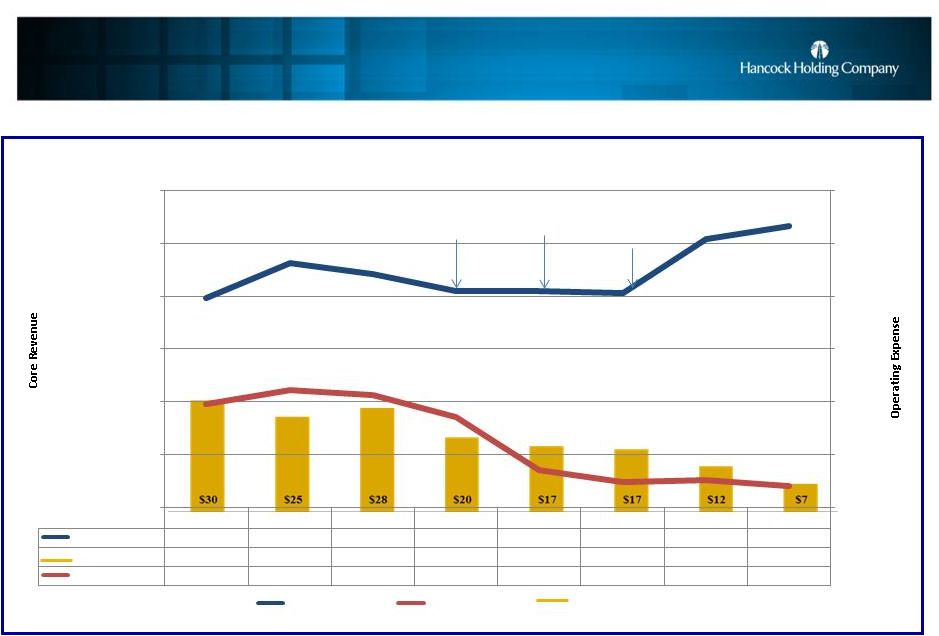

Over the past several quarters we have disclosed our focus on strategic initiatives that are designed to replace declining levels of purchase accounting income from acquisitions with improvement in core income, which the company defines as operating income excluding tax-effected purchase accounting adjustments. Over time, this strategic focus should improve the company’s core income. Management believes that consistent reporting of core income helps investors understand the success management has had in executing its strategic initiatives. Our core income for the fourth quarter of 2014 was $41.5 million or $.50 per diluted common share, up from $41.2 million or $.49 in the third quarter of 2014 and $32.8 million, or $.39, in the fourth quarter of 2013. The financial tables include a reconciliation of net income to core income.

1

Hancock reports fourth quarter 2014 financial results

January 22, 2015

“The strategic initiatives we announced almost two years ago continue to generate results,” said Hancock’s President and Chief Executive Officer John M. Hairston. “During 2014 we reported a $50 million decline in pre-tax purchase accounting income that we more than replaced through successfully reducing and controlling expenses, and investing in revenue-generating initiatives. While operating results may look somewhat flat year over year, a comparison of our core results for 2014 to 2013 tells quite a different story. Core income increased $38 million, or 31%, E.P.S. grew $.47 per share, or up 33%, loans increased $1.6 billion, or 13%, deposits grew $1.2 billion, up 8%, the core margin for the year remained stable, credit metrics improved, capital remained solid, and our operating efficiency improved over 300 basis points. The management team is extremely proud of these results, and expects 2015 to reflect similar progress towards achieving our goals.”

Highlights of the company’s fourth quarter of 2014 results:

| • | Net loan growth of $547 million, or 16% linked-quarter annualized |

| • | Net deposit growth of $836 million, or 21% linked-quarter annualized |

| • | An increase of $1.2 million in core revenue and a $1.1 million decline in operating expense offset half of the $4.7 million decline in purchase accounting income |

| • | Over the past 2 quarters growth in core revenue and declines in operating expense offset approximately 90% of the decline in purchase accounting items |

| • | Solid capital levels with a tangible common equity (TCE) ratio of 8.59%, after using approximately $38 million of capital during the quarter to repurchase stock |

| • | Return on average assets (ROA) (operating) 0.92%; core ROA 0.82% |

| • | Total assets grew $761 million and totaled approximately $21 billion at year-end 2014 |

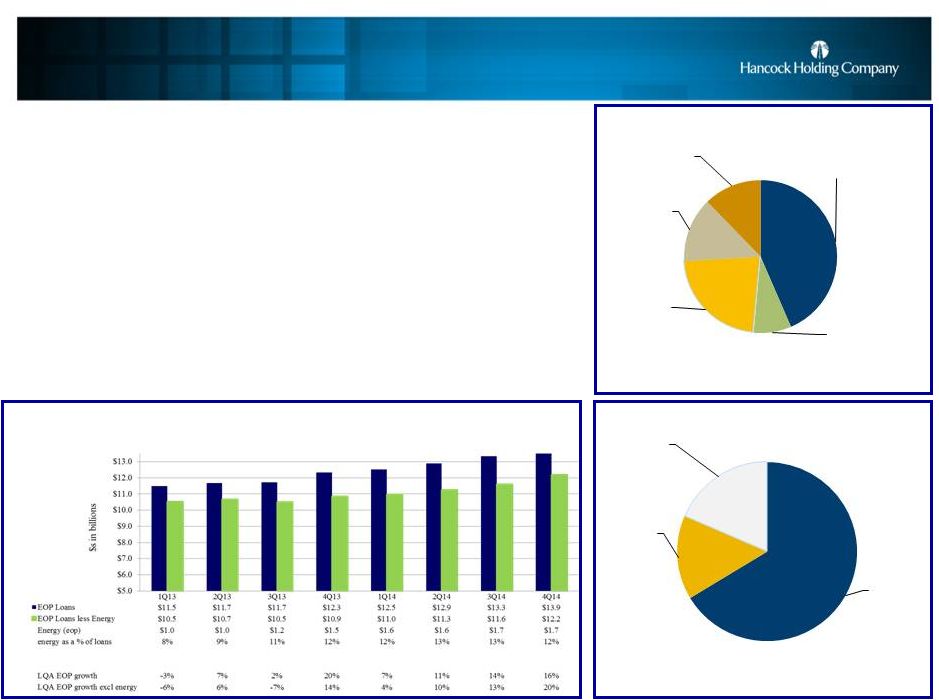

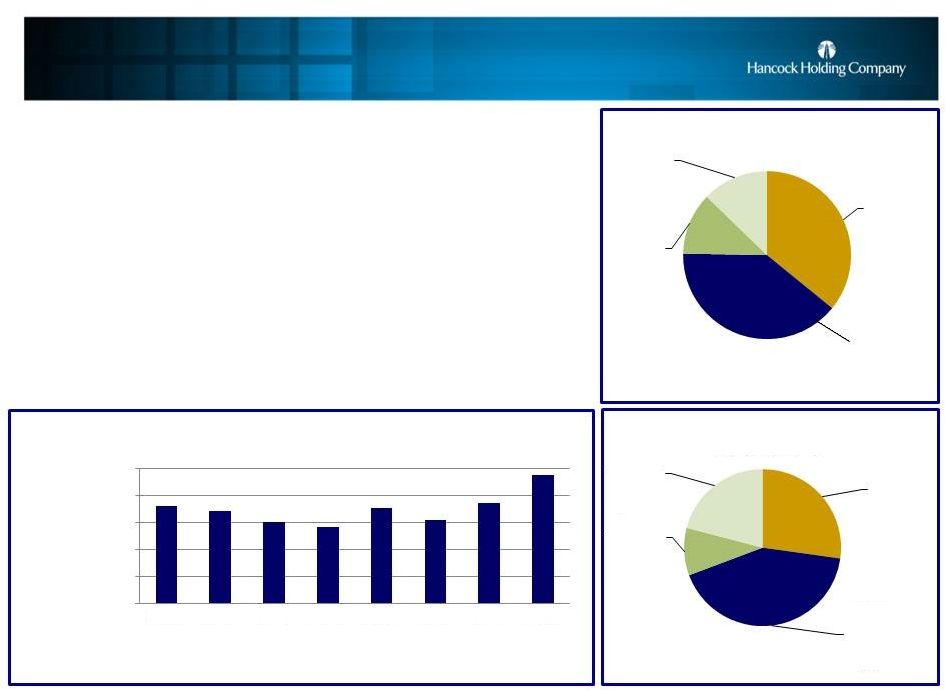

Loans

Total loans at December 31, 2014 were $13.9 billion, up $547 million from September 30, 2014.

All markets across the franchise reported growth during the quarter, with south Louisiana, Houston and central Florida generating approximately two-thirds of the quarter’s net loan growth. During the fourth quarter, approximately two-thirds of the average net loan growth came from commercial lending lines of business, with minimal growth in the energy sector over the past several months.

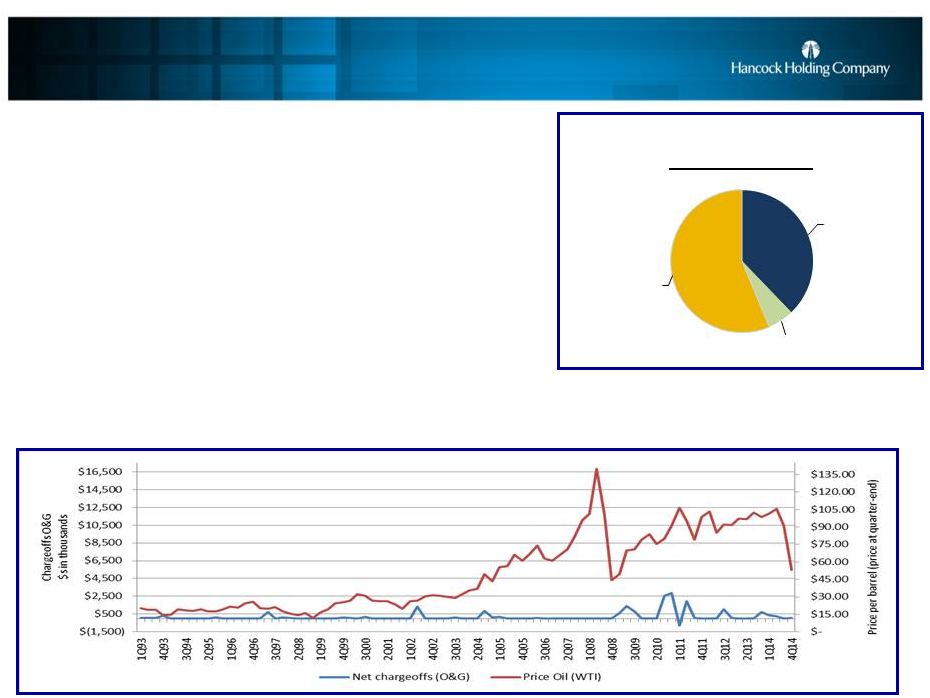

At December 31, 2014, loans in the energy segment totaled $1.7 billion, or 12% of total loans. The portfolio is comprised of credits to both the E&P industry and support industries. Additional details of the energy portfolio are included in the presentation slides posted on our Investor Relations website.

“We have been in the energy lending business for more than 60 years with relationships that go back generations,” said Hairston. “The potential impact of the recent precipitous drop in oil prices on our future results will depend on the severity and duration of this cycle. We are disciplined in our underwriting, and while we could see some pressure in risk ratings, based on what we know today we expect no significant loss in our energy portfolio and believe our current reserves are sufficient to cover any losses in the portfolio.”

2

Hancock reports fourth quarter 2014 financial results

January 22, 2015

Average loans totaled $13.6 billion for the fourth quarter of 2014, up $476 million, or 4%, from the third quarter of 2014.

Deposits

Total deposits at December 31, 2014 were $16.6 billion, up $836 million, or 5%, from September 30, 2014. Average deposits for the fourth quarter of 2014 were $15.9 billion, up $521 million, or 3%, from the third quarter of 2014. Initiatives were put in place recently with a focus on growing deposits in order to fund the Company’s loan growth. Previously the loan growth had been funded primarily through runoff in the securities portfolio.

Noninterest-bearing demand deposits (DDAs) totaled $5.9 billion at December 31, 2014, up $79 million, or 1%, compared to September 30, 2014. DDAs comprised 36% of total period-end deposits at December 31, 2014.

Interest-bearing transaction and savings deposits totaled $6.5 billion at the end of the fourth quarter of 2014, up $206 million, or 3%, from September 30, 2014. Time deposits (CDs) of $2.1 billion grew $103 million, or 5%, while interest-bearing public fund deposits increased $448 million, or 29%, to $2.0 billion at December 31, 2014. A portion of the public fund balances are seasonal, and we expect to see runoff in those deposits in the first quarter of 2015.

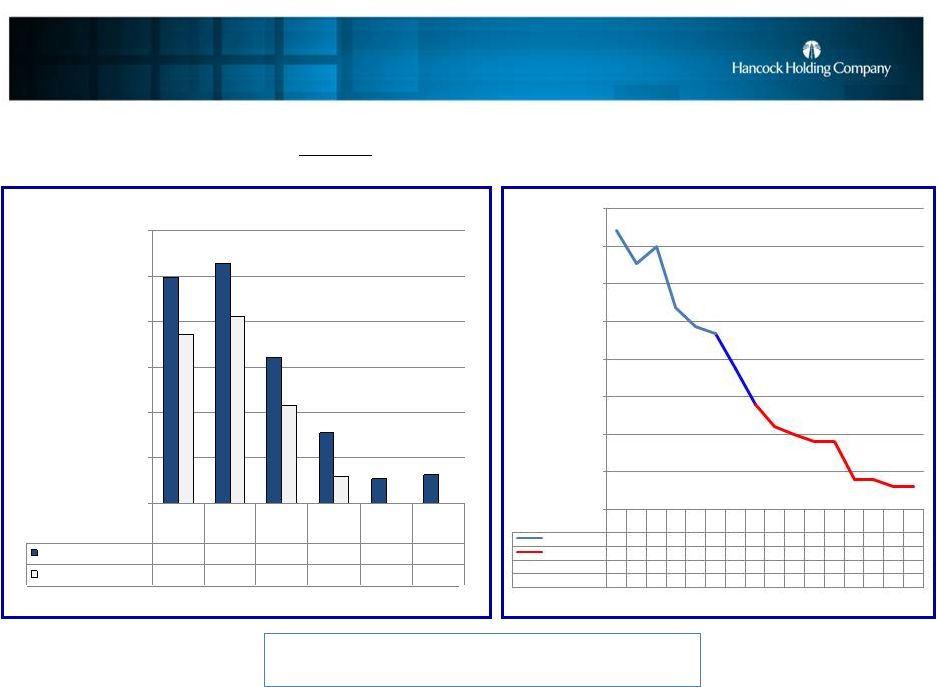

Asset Quality

Nonperforming assets (NPAs) totaled $148 million at December 31, 2014, up less than $1 million from September 30, 2014. During the fourth quarter of 2014, total nonperforming loans declined $2.6 million while foreclosed and surplus real estate (ORE) and other foreclosed assets increased $3.5 million. The increase in ORE was mainly additions of existing branch property. Nonperforming assets as a percent of total loans, ORE and other foreclosed assets was 1.06% at December 31, 2014, down 4 bps from September 30, 2014.

The total allowance for loan losses was $128.8 million at December 31, 2014, up $3.2 million from September 30, 2014. The ratio of the allowance for loan losses to period-end loans was .93% at December 31, 2014, virtually unchanged from September 30, 2014. The allowance maintained on the non-FDIC acquired portion of the loan portfolio increased $7.2 million linked-quarter, totaling $98.2 million, and the impaired reserve on the FDIC acquired loan portfolio declined $4.0 million linked-quarter.

During the quarter, management reviewed all energy credits $1 million and greater, and also stress tested the entire energy portfolio. Based on current conditions no additional reserve build was required for the energy portfolio at December 31, 2014. Should pricing pressures on oil continue, we could see some downward pressure on risk ratings that could lead to additional provision expense in future quarters. However, this will depend on the severity and duration of this cycle. Management believes that even if downgrades occur, they will not result in significant losses.

3

Hancock reports fourth quarter 2014 financial results

January 22, 2015

Net charge-offs from the noncovered loan portfolio were $2.6 million, or 0.08% of average total loans on an annualized basis in the fourth quarter of 2014, down from $6.4 million, or 0.19% of average total loans in the third quarter of 2014.

During the fourth quarter of 2014, Hancock recorded a total provision for loan losses of $9.7 million, up slightly from the third quarter of 2014 and primarily related to the noncovered portion of the allowance.

The non-single family portion of the FDIC loss share agreement related to the Peoples First acquisition in December 2009 expired at year-end 2014. Approximately $197 million of single family loans remain covered under a FDIC loss share agreement until December 31, 2019.

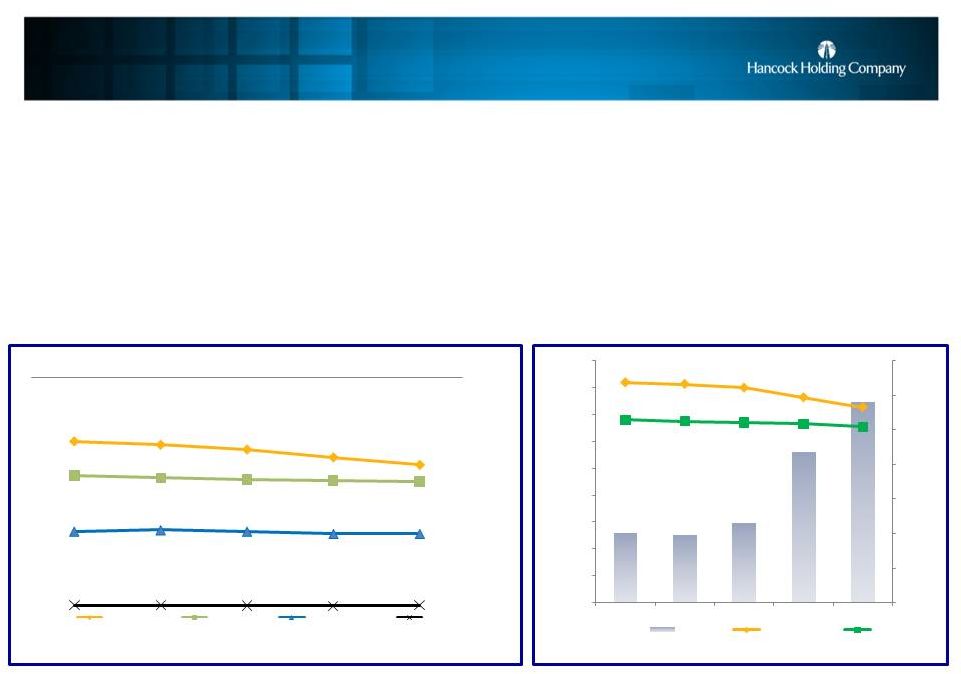

Net Interest Income and Net Interest Margin

Net interest income (TE) for the fourth quarter of 2014 was $163.6 million, down $2.6 million from the third quarter of 2014. The impact of purchase accounting items (PAAs) on net interest income was $16.0 million, down $5.5 million linked-quarter. Excluding the impact from purchase accounting items, core net interest income increased $2.8 million linked-quarter, replacing more than half of the runoff in PAAs. Average earning assets were $17.9 billion for the fourth quarter of 2014, up $587 million, or 3%, from the third quarter of 2014.

The reported net interest margin (TE) was 3.63% for the fourth quarter of 2014, down 18 bps from the third quarter of 2014. The core net interest margin (reported net interest income (TE) excluding total net purchase accounting adjustments, annualized, as a percent of average earning assets) declined 5 bps to 3.27% during the fourth quarter of 2014. Declines in the core loan yield (-3 bps) and an increase in the cost of funds (+2 bps) were the main drivers of the margin compression. An improved earning asset mix and increased loan volumes were drivers of the increase in core net interest income.

Noninterest Income

Noninterest income, including securities transactions, totaled $57.0 million for the fourth quarter of 2014, down $1.0 million, or 2%, from the third quarter of 2014. Included in the total is a reduction of $2.1 million related to the amortization of the FDIC indemnification asset, compared to a reduction of $2.8 million in the third quarter of 2014. Excluding the impact of this item, core noninterest income decreased by approximately $1.6 million linked-quarter.

Branch closures and sales led to some customer attrition and reductions in service charges and card fees during 2014. Service charges on deposits totaled $19.0 million for the fourth quarter of 2014, down $1.0 million, or 5%, from the third quarter of 2014. Bank card and ATM fees totaled $11.2 million, down $0.4 million, or 4%, from the third quarter of 2014.

4

Hancock reports fourth quarter 2014 financial results

January 22, 2015

Trust fees totaled $11.6 million, virtually unchanged linked-quarter. Investment and annuity income and insurance fees totaled $6.6 million, down $0.9 million, or 12%, linked-quarter.

Fees from secondary mortgage operations totaled $2.0 million for the fourth quarter of 2014, down $0.3 million, or 14%, linked-quarter.

Other noninterest income totaled $8.7 million, up $0.9 million, or 12%, from the third quarter of 2014.

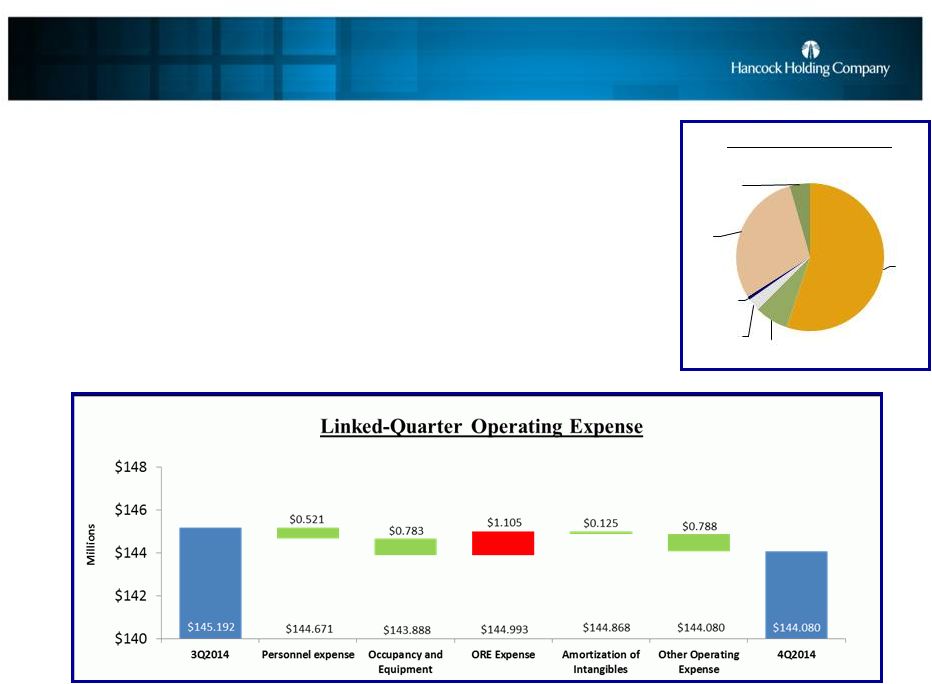

Noninterest Expense & Taxes

Noninterest expense for the fourth quarter of 2014 totaled $153.7 million and included $9.7 million of nonoperating expenses. The nonoperating expenses were mainly incurred in connection with the Company’s ongoing expense and efficiency initiative, although a portion of these costs were amounts paid to recently separated executives. Excluding these costs, operating expense totaled $144.1 million in the fourth quarter of 2014, down $1.1 million, or less than 1%, linked-quarter. (The details of the changes in the noninterest expense categories noted below exclude the impact of nonoperating items.)

Total personnel expense was $79.5 million in the fourth quarter of 2014, down $0.5 million, or less than 1%, from the third quarter of 2014. Occupancy and equipment expense totaled $14.6 million in the fourth quarter of 2014, down $0.7 million, or 5%, from the third quarter of 2014.

ORE expense totaled $1.0 million for the fourth quarter of 2014, reflecting a more normalized level of quarterly expense. Net gains on ORE dispositions exceeded ORE expense in the third quarter of 2014 by $104,000.

Other operating expense totaled $42.6 million in the fourth quarter of 2014, down $0.8 million, or 2%, from the third quarter of 2014.

The effective income tax rate for the fourth quarter of 2014 was 26%, unchanged from the third quarter of 2014. Management expects the effective income tax rate to approximate 27-29% in 2015. The effective income tax rate continues to be less than the statutory rate of 35% due primarily to tax-exempt income and tax credits.

Capital

Common shareholders’ equity at December 31, 2014 totaled $2.5 billion. The tangible common equity (TCE) ratio was 8.59%, down 51 bps from September 30, 2014. The decline in the TCE ratio reflects organic growth in the balance sheet, the repurchase of common shares during the quarter and a decrease in other comprehensive income (OCI) primarily related to the year-end revaluation of the pension liability. Assets totaled $21 billion at December 31, 2014, up $761 million from September 30, 2014.

5

Hancock reports fourth quarter 2014 financial results

January 22, 2015

In July of 2014, the Board of Directors authorized a new common stock repurchase program for up to 5%, or approximately 4 million shares, of the Company’s common stock. During the fourth quarter, the Company repurchased 1,224,279 shares of its common stock at an average price of $30.75. To-date the Company has repurchased 37% of the total buyback authorization. Shares may be repurchased in the open market or in privately negotiated transactions from time to time, depending upon market conditions and other factors, and in accordance with applicable regulations of the Securities and Exchange Commission. The repurchase authorization will expire December 31, 2015. Additional capital ratios are included in the financial tables.

Conference Call and Slide Presentation

Management will host a conference call for analysts and investors at 9:00 a.m. Central Time on Friday, January 23, 2015 to review the results. A live listen-only webcast of the call will be available under the Investor Relations section of Hancock’s website at www.hancockbank.com. Additional financial tables and a slide presentation related to fourth quarter results are also posted as part of the webcast link. To participate in the Q&A portion of the call, dial (877) 564-1219 or (973) 638-3429. An audio archive of the conference call will be available under the Investor Relations section of our website. A replay of the call will also be available through January 30, 2015 by dialing (855) 859-2056 or (404) 537-3406, passcode 60107247.

About Hancock Holding Company

Hancock Holding Company is a financial services company with regional business headquarters and locations throughout a growing Gulf South corridor. The company’s banking subsidiary provides a comprehensive network of full-service financial choices through Hancock Bank locations in Mississippi, Alabama, and Florida and Whitney Bank offices in Louisiana and Texas, including traditional and online banking; commercial and small business banking; energy banking; private banking; trust and investment services; certain insurance services; mortgage services; and consumer financing. More information and online banking are available at www.hancockbank.com and www.whitneybank.com.

Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of section 27A of the Securities Act of 1933, as amended, and section 21E of the Securities Exchange Act of 1934, as amended, and we intend such forward-looking statements to be covered by the safe harbor provisions therein and are including this statement for purposes of invoking these safe-harbor provisions. Forward-looking statements provide projections of results of operations or of financial condition or state other forward-looking information, such as expectations about future conditions and descriptions of plans and strategies for the future.

Forward-looking statements that we may make include, but may not be limited to, comments with respect to future levels of economic activity in our markets, including the impact of volatility of oil and gas prices on our energy portfolio and associated loan loss reserves and the downstream impact on businesses that support the energy sector, especially in the Gulf Coast region, loan growth expectations, deposit trends, credit quality trends, net interest margin trends, future expense levels, success of revenue-generating initiatives, projected tax rates, future profitability, improvements in expense to revenue (efficiency) ratio, purchase accounting impacts such as accretion levels, the impact of the branch rationalization process, details of the common stock buyback, possible repurchases of shares under stock buyback programs, and the financial impact of regulatory requirements. Hancock’s ability to accurately project results, predict the effects of future plans or strategies, or predict market or economic developments is inherently limited. Although Hancock believes that the expectations reflected in its forward-looking statements are based on reasonable assumptions, actual results and performance could differ materially from those set forth in the forward-looking statements. Factors that could cause actual results to differ from those expressed in Hancock’s forward-looking statements include, but are not limited to, those risk factors outlined in Hancock’s public filings with the Securities and Exchange Commission, which are available at the SEC’s internet site (http://www.sec.gov).

6

Hancock reports fourth quarter 2014 financial results

January 22, 2015

You are cautioned not to place undue reliance on these forward-looking statements. Hancock does not intend, and undertakes no obligation, to update or revise any forward-looking statements, whether as a result of differences in actual results, changes in assumptions or changes in other factors affecting such statements, except as required by law.

7

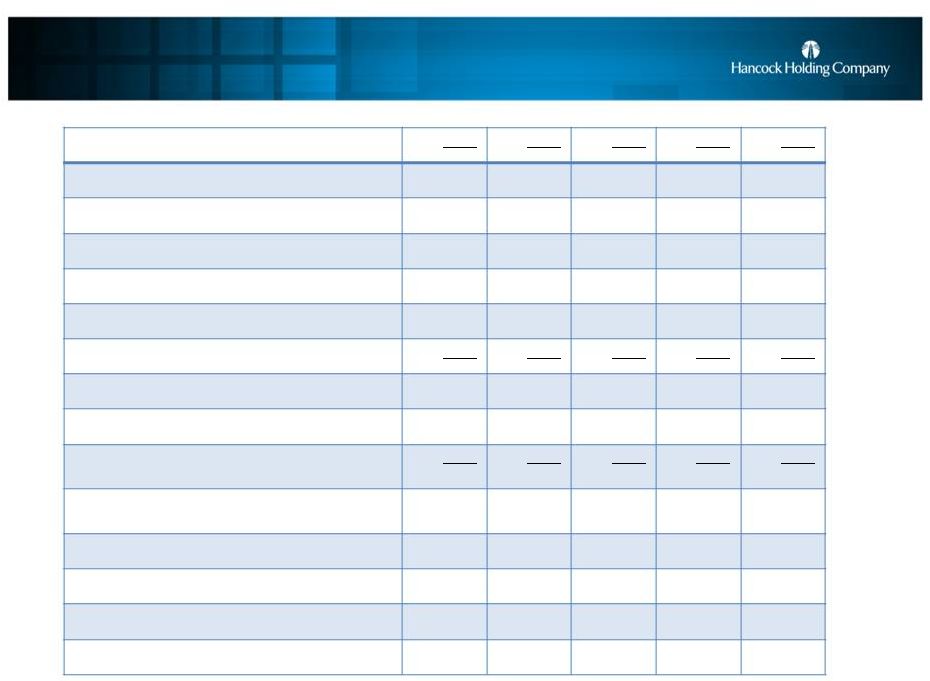

HANCOCK HOLDING COMPANY

FINANCIAL HIGHLIGHTS

(Unaudited)

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||

| (amounts in thousands, except per share data) |

12/31/2014 | 9/30/2014 | 12/31/2013 | 12/31/2014 | 12/31/2013 | |||||||||||||||

| INCOME STATEMENT DATA |

||||||||||||||||||||

| Net interest income |

$ | 160,813 | $ | 163,541 | $ | 166,007 | $ | 654,694 | $ | 680,731 | ||||||||||

| Net interest income (TE) (a) |

163,581 | 166,230 | 168,466 | 665,341 | 691,141 | |||||||||||||||

| Provision for loan losses |

9,718 | 9,468 | 7,331 | 33,840 | 32,734 | |||||||||||||||

| Noninterest income excluding securities transactions |

56,961 | 57,941 | 58,894 | 227,999 | 246,038 | |||||||||||||||

| Securities transactions gains |

— | — | 105 | — | 105 | |||||||||||||||

| Noninterest expense (excluding nonoperating expense items) |

144,080 | 145,192 | 157,097 | 580,980 | 640,271 | |||||||||||||||

| Nonoperating expense items |

9,667 | 3,887 | 17,116 | 25,686 | 38,003 | |||||||||||||||

| Net income |

40,092 | 46,553 | 34,716 | 175,722 | 163,356 | |||||||||||||||

| Operating income (b) |

46,376 | 49,079 | 45,773 | 194,145 | 187,990 | |||||||||||||||

| Core income (c) |

41,537 | 41,176 | 32,847 | 159,191 | 121,100 | |||||||||||||||

| PERIOD-END BALANCE SHEET DATA |

||||||||||||||||||||

| Loans |

$ | 13,895,276 | $ | 13,348,574 | $ | 12,324,817 | $ | 13,895,276 | $ | 12,324,817 | ||||||||||

| Investment securities |

3,826,454 | 3,913,370 | 4,033,124 | 3,826,454 | 4,033,124 | |||||||||||||||

| Earning assets |

18,544,930 | 17,748,600 | 16,651,295 | 18,544,930 | 16,651,295 | |||||||||||||||

| Total assets |

20,747,266 | 19,985,950 | 19,009,251 | 20,747,266 | 19,009,251 | |||||||||||||||

| Noninterest-bearing deposits |

5,945,208 | 5,866,255 | 5,530,253 | 5,945,208 | 5,530,253 | |||||||||||||||

| Total deposits |

16,572,831 | 15,736,694 | 15,360,516 | 16,572,831 | 15,360,516 | |||||||||||||||

| Common shareholders’ equity |

2,472,402 | 2,509,342 | 2,425,069 | 2,472,402 | 2,425,069 | |||||||||||||||

| AVERAGE BALANCE SHEET DATA |

||||||||||||||||||||

| Loans |

$ | 13,578,223 | $ | 13,102,108 | $ | 11,903,603 | $ | 12,938,869 | $ | 11,700,218 | ||||||||||

| Investment securities (d) |

3,836,123 | 3,780,089 | 4,070,657 | 3,816,724 | 4,140,051 | |||||||||||||||

| Earning assets |

17,911,143 | 17,324,444 | 16,376,587 | 17,195,492 | 16,443,868 | |||||||||||||||

| Total assets |

20,090,372 | 19,549,947 | 18,739,091 | 19,436,827 | 18,929,018 | |||||||||||||||

| Noninterest-bearing deposits |

5,849,356 | 5,707,523 | 5,483,918 | 5,641,792 | 5,393,955 | |||||||||||||||

| Total deposits |

15,892,507 | 15,371,209 | 14,915,677 | 15,399,993 | 15,117,236 | |||||||||||||||

| Common shareholders’ equity |

2,509,509 | 2,489,948 | 2,355,768 | 2,474,948 | 2,386,564 | |||||||||||||||

| COMMON SHARE DATA |

||||||||||||||||||||

| Earnings per share - diluted |

$ | 0.48 | $ | 0.56 | $ | 0.41 | $ | 2.10 | $ | 1.93 | ||||||||||

| Operating earnings per share - diluted (b) |

0.56 | 0.59 | 0.55 | 2.32 | 2.22 | |||||||||||||||

| Core earnings per share - diluted (c) |

0.50 | 0.49 | 0.39 | 1.90 | 1.43 | |||||||||||||||

| Cash dividends per share |

$ | 0.24 | $ | 0.24 | $ | 0.24 | $ | 0.96 | $ | 0.96 | ||||||||||

| Book value per share (period-end) |

$ | 30.74 | $ | 30.76 | $ | 29.49 | $ | 30.74 | $ | 29.49 | ||||||||||

| Tangible book value per share (period-end) |

21.37 | 21.44 | 19.94 | 21.37 | 19.94 | |||||||||||||||

| Weighted average number of shares - diluted |

81,530 | 81,942 | 82,220 | 82,034 | 83,167 | |||||||||||||||

| Period-end number of shares |

80,426 | 81,567 | 82,237 | 80,426 | 82,237 | |||||||||||||||

| Market data |

||||||||||||||||||||

| High sales price |

$ | 35.67 | $ | 36.47 | $ | 37.12 | $ | 38.50 | $ | 37.12 | ||||||||||

| Low sales price |

28.68 | 31.25 | 30.09 | 28.68 | 25.00 | |||||||||||||||

| Period-end closing price |

30.70 | 32.05 | 36.68 | 30.70 | 36.68 | |||||||||||||||

| Trading volume |

36,396 | 25,553 | 27,816 | 120,635 | 122,496 | |||||||||||||||

| PERFORMANCE RATIOS |

||||||||||||||||||||

| Return on average assets |

0.79 | % | 0.94 | % | 0.74 | % | 0.90 | % | 0.86 | % | ||||||||||

| Return on average assets (operating) (b) |

0.92 | % | 1.00 | % | 0.97 | % | 1.00 | % | 0.99 | % | ||||||||||

| Return on average common equity |

6.34 | % | 7.42 | % | 5.85 | % | 7.10 | % | 6.84 | % | ||||||||||

| Return on average common equity (operating) (b) |

7.33 | % | 7.82 | % | 7.71 | % | 7.84 | % | 7.88 | % | ||||||||||

| Return on average tangible common equity |

9.08 | % | 10.70 | % | 8.79 | % | 10.30 | % | 10.30 | % | ||||||||||

| Return on average tangible common equity (operating) (b) |

10.50 | % | 11.28 | % | 11.59 | % | 11.37 | % | 11.85 | % | ||||||||||

| Tangible common equity ratio (e) |

8.59 | % | 9.10 | % | 9.00 | % | 8.59 | % | 9.00 | % | ||||||||||

| Net interest margin (TE) (a) |

3.63 | % | 3.81 | % | 4.09 | % | 3.87 | % | 4.20 | % | ||||||||||

| Average loan/deposit ratio |

85.44 | % | 85.24 | % | 79.93 | % | 84.02 | % | 77.56 | % | ||||||||||

| Efficiency ratio (f) |

62.41 | % | 61.84 | % | 65.94 | % | 62.03 | % | 65.17 | % | ||||||||||

| Allowance for loan losses as a percent of period-end loans |

0.93 | % | 0.94 | % | 1.08 | % | 0.93 | % | 1.08 | % | ||||||||||

| Annualized net noncovered charge-offs to average loans |

0.08 | % | 0.19 | % | 0.17 | % | 0.13 | % | 0.21 | % | ||||||||||

| Allowance for loan losses to non-performing loans + accruing loans 90 days past due |

137.96 | % | 128.44 | % | 111.97 | % | 137.96 | % | 111.97 | % | ||||||||||

| Noninterest income excluding securities transactions as a percent of total revenue (TE) (a) |

25.83 | % | 25.85 | % | 25.90 | % | 25.52 | % | 26.25 | % | ||||||||||

| FTE Total Headcount |

3,794 | 3,787 | 3,978 | 3,794 | 3,978 | |||||||||||||||

| (a) | Tax-equivalent (TE) amounts are calculated using a federal income tax rate of 35%. |

| (b) | Net income less tax-effected securities transactions and nonoperating expense items. Management believes that operating income provides a useful measure of financial performance that helps investors compare the Company’s fundamental operations over time. |

| (c) | Operating income excluding tax-effected purchase accounting adjustments. Management believes that reporting on core income provides a useful measure of financial performance that helps investors determine whether management is successfully executing its strategic initiatives. |

| (d) | Average securities does not include unrealized holding gains/losses on available for sale securities. |

| (e) | The tangible common equity ratio is common shareholders’ equity less intangible assets divided by total assets less intangible assets. |

| (f) | The efficiency ratio is noninterest expense to total net interest (TE) and noninterest income, excluding amortization of purchased intangibles, nonoperating expense items, and securities transactions. |

8

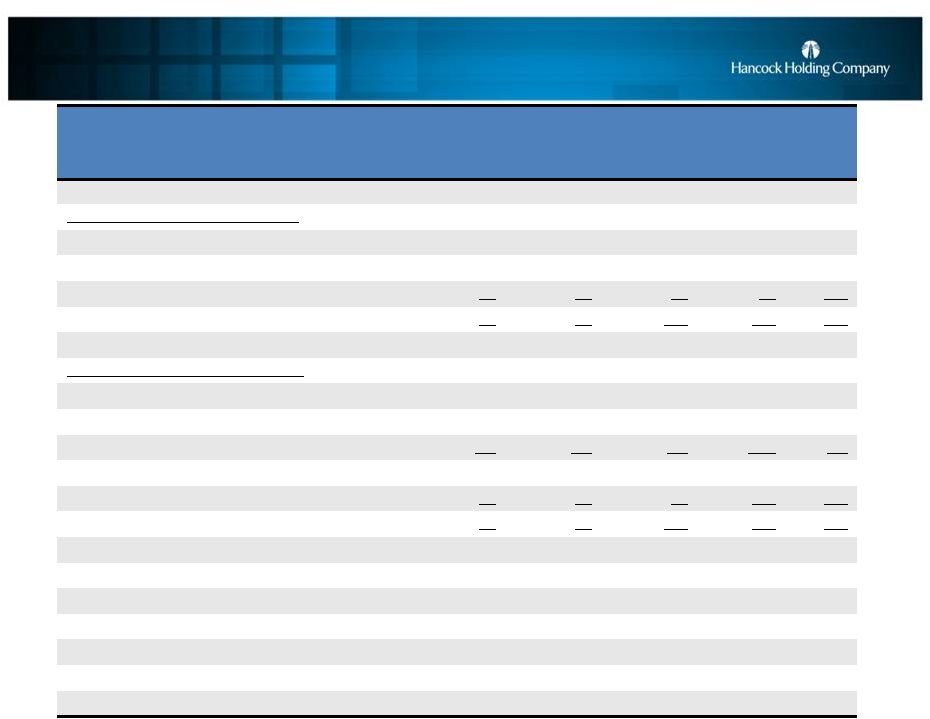

HANCOCK HOLDING COMPANY

QUARTERLY HIGHLIGHTS

(Unaudited)

| Three Months Ended | ||||||||||||||||||||

| (amounts in thousands, except per share data) |

12/31/2014 | 9/30/2014 | 6/30/2014 | 3/31/2014 | 12/31/2013 | |||||||||||||||

| INCOME STATEMENT DATA |

||||||||||||||||||||

| Net interest income |

$ | 160,813 | $ | 163,541 | $ | 164,778 | $ | 165,562 | $ | 166,007 | ||||||||||

| Net interest income (TE) (a) |

163,581 | 166,230 | 167,332 | 168,198 | 168,466 | |||||||||||||||

| Provision for loan losses |

9,718 | 9,468 | 6,691 | 7,963 | 7,331 | |||||||||||||||

| Noninterest income excluding securities transactions |

56,961 | 57,941 | 56,398 | 56,699 | 58,894 | |||||||||||||||

| Securities transactions gains |

— | — | — | — | 105 | |||||||||||||||

| Noninterest expense (excluding nonoperating expense items) |

144,080 | 145,192 | 144,727 | 146,982 | 157,097 | |||||||||||||||

| Nonoperating expense items |

9,667 | 3,887 | 12,131 | — | 17,116 | |||||||||||||||

| Net income |

40,092 | 46,553 | 39,962 | 49,115 | 34,716 | |||||||||||||||

| Operating income (b) |

46,376 | 49,079 | 49,575 | 49,115 | 45,773 | |||||||||||||||

| Core income (c) |

41,537 | 41,176 | 38,736 | 37,742 | 32,847 | |||||||||||||||

| PERIOD-END BALANCE SHEET DATA |

||||||||||||||||||||

| Loans |

$ | 13,895,276 | $ | 13,348,574 | $ | 12,884,056 | $ | 12,527,937 | $ | 12,324,817 | ||||||||||

| Investment securities |

3,826,454 | 3,913,370 | 3,677,229 | 3,797,883 | 4,033,124 | |||||||||||||||

| Earning assets |

18,544,930 | 17,748,600 | 17,023,990 | 16,622,104 | 16,651,295 | |||||||||||||||

| Total assets |

20,747,266 | 19,985,950 | 19,349,431 | 19,004,170 | 19,009,251 | |||||||||||||||

| Noninterest-bearing deposits |

5,945,208 | 5,866,255 | 5,723,663 | 5,613,872 | 5,530,253 | |||||||||||||||

| Total deposits |

16,572,831 | 15,736,694 | 15,245,227 | 15,274,774 | 15,360,516 | |||||||||||||||

| Common shareholders’ equity |

2,472,402 | 2,509,342 | 2,492,582 | 2,462,534 | 2,425,069 | |||||||||||||||

| AVERAGE BALANCE SHEET DATA |

||||||||||||||||||||

| Loans |

$ | 13,578,223 | $ | 13,102,108 | $ | 12,680,861 | $ | 12,379,316 | $ | 11,903,603 | ||||||||||

| Investment securities (d) |

3,836,123 | 3,780,089 | 3,716,563 | 3,935,616 | 4,070,657 | |||||||||||||||

| Earning assets |

17,911,143 | 17,324,444 | 16,791,744 | 16,740,353 | 16,376,587 | |||||||||||||||

| Total assets |

20,090,372 | 19,549,947 | 19,039,264 | 19,055,107 | 18,739,091 | |||||||||||||||

| Noninterest-bearing deposits |

5,849,356 | 5,707,523 | 5,505,735 | 5,499,993 | 5,483,918 | |||||||||||||||

| Total deposits |

15,892,507 | 15,371,209 | 15,060,581 | 15,269,143 | 14,915,677 | |||||||||||||||

| Common shareholders’ equity |

2,509,509 | 2,489,948 | 2,463,385 | 2,435,980 | 2,355,768 | |||||||||||||||

| COMMON SHARE DATA |

||||||||||||||||||||

| Earnings per share - diluted |

$ | 0.48 | $ | 0.56 | $ | 0.48 | $ | 0.58 | $ | 0.41 | ||||||||||

| Operating earnings per share - diluted (b) |

0.56 | 0.59 | 0.59 | 0.58 | 0.55 | |||||||||||||||

| Core earnings per share - diluted (c) |

0.50 | 0.49 | 0.46 | 0.45 | 0.39 | |||||||||||||||

| Cash dividends per share |

$ | 0.24 | $ | 0.24 | $ | 0.24 | $ | 0.24 | $ | 0.24 | ||||||||||

| Book value per share (period-end) |

$ | 30.74 | $ | 30.76 | $ | 30.45 | $ | 29.93 | $ | 29.49 | ||||||||||

| Tangible book value per share (period-end) |

21.37 | 21.44 | 21.08 | 20.47 | 19.94 | |||||||||||||||

| Weighted average number of shares - diluted |

81,530 | 81,942 | 82,174 | 82,534 | 82,220 | |||||||||||||||

| Period-end number of shares |

80,426 | 81,567 | 81,860 | 82,282 | 82,237 | |||||||||||||||

| Market data |

||||||||||||||||||||

| High sales price |

$ | 35.67 | $ | 36.47 | $ | 37.86 | $ | 38.50 | $ | 37.12 | ||||||||||

| Low sales price |

28.68 | 31.25 | 32.02 | 32.66 | 30.09 | |||||||||||||||

| Period-end closing price |

30.70 | 32.05 | 35.32 | 36.65 | 36.68 | |||||||||||||||

| Trading volume |

36,396 | 25,553 | 27,432 | 31,328 | 27,816 | |||||||||||||||

| PERFORMANCE RATIOS |

||||||||||||||||||||

| Return on average assets |

0.79 | % | 0.94 | % | 0.84 | % | 1.05 | % | 0.74 | % | ||||||||||

| Return on average assets (operating) (b) |

0.92 | % | 1.00 | % | 1.04 | % | 1.05 | % | 0.97 | % | ||||||||||

| Return on average common equity |

6.34 | % | 7.42 | % | 6.51 | % | 8.18 | % | 5.85 | % | ||||||||||

| Return on average common equity (operating) (b) |

7.33 | % | 7.82 | % | 8.07 | % | 8.18 | % | 7.71 | % | ||||||||||

| Return on average tangible common equity |

9.08 | % | 10.70 | % | 9.47 | % | 12.04 | % | 8.79 | % | ||||||||||

| Return on average tangible common equity (operating) (b) |

10.50 | % | 11.28 | % | 11.75 | % | 12.04 | % | 11.59 | % | ||||||||||

| Tangible common equity ratio (e) |

8.59 | % | 9.10 | % | 9.29 | % | 9.24 | % | 9.00 | % | ||||||||||

| Net interest margin (TE) (a) |

3.63 | % | 3.81 | % | 3.99 | % | 4.06 | % | 4.09 | % | ||||||||||

| Average loan/deposit ratio |

85.44 | % | 85.24 | % | 84.20 | % | 81.20 | % | 79.93 | % | ||||||||||

| Efficiency ratio (f) |

62.41 | % | 61.84 | % | 61.67 | % | 62.23 | % | 65.94 | % | ||||||||||

| Allowance for loan losses as a percent of period-end loans |

0.93 | % | 0.94 | % | 1.00 | % | 1.02 | % | 1.08 | % | ||||||||||

| Annualized net noncovered charge-offs to average loans |

0.08 | % | 0.19 | % | 0.13 | % | 0.13 | % | 0.17 | % | ||||||||||

| Allowance for loan losses to non-performing loans + accruing loans 90 days past due |

137.96 | % | 128.44 | % | 126.26 | % | 112.64 | % | 111.97 | % | ||||||||||

| Noninterest income excluding securities transactions as a percent of total revenue (TE) (a) |

25.83 | % | 25.85 | % | 25.21 | % | 25.21 | % | 25.90 | % | ||||||||||

| FTE headcount |

3,794 | 3,787 | 3,901 | 3,974 | 3,978 | |||||||||||||||

| (a) | Tax-equivalent (TE) amounts are calculated using a federal income tax rate of 35%. |

| (b) | Net income less tax-effected securities transactions and nonoperating expense items. Management believes that operating income provides a useful measure of financial performance that helps investors compare the Company’s fundamental operations over time. |

| (c) | Operating income excluding tax-effected purchase accounting adjustments. Management believes that reporting on core income provides a useful measure of financial performance that helps investors determine whether management is successfully executing its strategic initiatives. |

| (d) | Average securities does not include unrealized holding gains/losses on available for sale securities. |

| (e) | The tangible common equity ratio is common shareholders’ equity less intangible assets divided by total assets less intangible assets. |

| (f) | The efficiency ratio is noninterest expense to total net interest (TE) and noninterest income, excluding amortization of purchased intangibles, nonoperating expense items, and securities transactions. |

9

HANCOCK HOLDING COMPANY

INCOME STATEMENT

(Unaudited)

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||

| (dollars in thousands, except per share data) |

12/31/2014 | 9/30/2014 | 12/31/2013 | 12/31/2014 | 12/31/2013 | |||||||||||||||

| NET INCOME |

||||||||||||||||||||

| Interest income |

$ | 170,971 | $ | 172,701 | $ | 175,650 | $ | 692,813 | $ | 722,210 | ||||||||||

| Interest income (TE) |

173,739 | 175,390 | 178,109 | 703,460 | 732,620 | |||||||||||||||

| Interest expense |

10,158 | 9,160 | 9,643 | 38,119 | 41,479 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income (TE) |

163,581 | 166,230 | 168,466 | 665,341 | 691,141 | |||||||||||||||

| Provision for loan losses |

9,718 | 9,468 | 7,331 | 33,840 | 32,734 | |||||||||||||||

| Noninterest income excluding securities transactions |

56,961 | 57,941 | 58,894 | 227,999 | 246,038 | |||||||||||||||

| Securities transactions gains |

— | — | 105 | — | 105 | |||||||||||||||

| Noninterest expense |

153,747 | 149,079 | 174,213 | 606,666 | 678,274 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income taxes |

54,309 | 62,935 | 43,462 | 242,187 | 215,866 | |||||||||||||||

| Income tax expense |

14,217 | 16,382 | 8,746 | 66,465 | 52,510 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 40,092 | $ | 46,553 | $ | 34,716 | $ | 175,722 | $ | 163,356 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| ADJUSTMENTS FROM NET TO OPERATING INCOME |

||||||||||||||||||||

| Securities transactions gains |

— | — | 105 | — | 105 | |||||||||||||||

| Nonoperating expense items |

||||||||||||||||||||

| Impact of insurance business lines divestiture |

— | — | — | (9,101 | ) | — | ||||||||||||||

| FDIC settlement |

— | — | — | 10,268 | — | |||||||||||||||

| Expense and efficiency initiatives and other items |

9,667 | 3,887 | 17,116 | 21,058 | 38,003 | |||||||||||||||

| Early debt redemption |

— | — | — | 3,461 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total nonoperating expense items |

9,667 | 3,887 | 17,116 | 25,686 | 38,003 | |||||||||||||||

| Taxes on adjustments at marginal tax rate |

3,383 | 1,361 | 5,954 | 7,263 | 13,264 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total adjustments (net of taxes) |

6,284 | 2,526 | 11,057 | 18,423 | 24,634 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income (g) |

$ | 46,376 | $ | 49,079 | $ | 45,773 | $ | 194,145 | $ | 187,990 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Purchase accounting adjustments (net of taxes) |

4,839 | 7,903 | 12,926 | 34,954 | 66,890 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Core income (h) |

$ | 41,537 | $ | 41,176 | $ | 32,847 | $ | 159,191 | $ | 121,100 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NONINTEREST INCOME AND NONINTEREST EXPENSE |

||||||||||||||||||||

| Service charges on deposit accounts |

$ | 19,025 | $ | 20,000 | $ | 19,605 | $ | 77,006 | $ | 79,000 | ||||||||||

| Trust fees |

11,559 | 11,530 | 10,214 | 44,826 | 38,186 | |||||||||||||||

| Bank card and ATM fees |

11,225 | 11,641 | 11,261 | 45,031 | 45,939 | |||||||||||||||

| Investment & annuity fees |

4,736 | 5,506 | 4,619 | 20,291 | 19,574 | |||||||||||||||

| Secondary mortgage market operations |

2,000 | 2,313 | 1,554 | 8,036 | 12,543 | |||||||||||||||

| Insurance fees |

1,862 | 1,979 | 3,304 | 9,473 | 15,804 | |||||||||||||||

| Amortization of FDIC loss share receivable |

(2,113 | ) | (2,760 | ) | (1,649 | ) | (12,102 | ) | (2,239 | ) | ||||||||||

| Other income |

8,667 | 7,732 | 9,986 | 35,438 | 37,231 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Noninterest income excluding securities transactions |

56,961 | 57,941 | 58,894 | 227,999 | 246,038 | |||||||||||||||

| Securities transactions gains |

— | — | 105 | — | 105 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total noninterest income including securities transactions |

$ | 56,961 | $ | 57,941 | $ | 58,999 | $ | 227,999 | $ | 246,143 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Personnel expense |

$ | 79,522 | $ | 80,043 | $ | 84,912 | $ | 320,502 | $ | 347,267 | ||||||||||

| Occupancy expense (net) |

10,571 | 10,798 | 11,613 | 43,476 | 48,847 | |||||||||||||||

| Equipment expense |

3,986 | 4,542 | 4,679 | 16,861 | 19,885 | |||||||||||||||

| Other real estate owned expense (net) |

1,001 | (104 | ) | 1,535 | 2,758 | 8,036 | ||||||||||||||

| Other operating expense |

42,555 | 43,343 | 47,180 | 170,586 | 186,766 | |||||||||||||||

| Amortization of intangibles |

6,445 | 6,570 | 7,178 | 26,797 | 29,470 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expense |

144,080 | 145,192 | 157,097 | 580,980 | 640,271 | |||||||||||||||

| Nonoperating expense items |

9,667 | 3,887 | 17,116 | 25,686 | 38,003 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total noninterest expense |

$ | 153,747 | $ | 149,079 | $ | 174,213 | $ | 606,666 | $ | 678,274 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| COMMON SHARE DATA |

||||||||||||||||||||

| Earnings per share: |

||||||||||||||||||||

| Basic |

$ | 0.48 | $ | 0.56 | $ | 0.41 | $ | 2.10 | $ | 1.93 | ||||||||||

| Diluted |

0.48 | 0.56 | 0.41 | 2.10 | 1.93 | |||||||||||||||

| Operating earnings per share: |

||||||||||||||||||||

| Basic |

$ | 0.56 | $ | 0.59 | $ | 0.55 | $ | 2.32 | $ | 2.22 | ||||||||||

| Diluted |

0.56 | 0.59 | 0.55 | 2.32 | 2.22 | |||||||||||||||

| Core earnings per share: |

||||||||||||||||||||

| Basic |

$ | 0.50 | $ | 0.49 | $ | 0.39 | 1.90 | $ | 1.43 | |||||||||||

| Diluted |

0.50 | 0.49 | 0.39 | 1.90 | 1.43 | |||||||||||||||

| (g) | Net income less tax-effected securities transactions and nonoperating expense items. Management believes that operating income provides a useful measure of financial performance that helps investors compare the Company’s fundamental operations over time. |

| (h) | Operating income excluding tax-effected purchase accounting adjustments. Management believes that reporting on core income provides a useful measure of financial performance that helps investors determine whether management is successfully executing its strategic initiatives. |

10

HANCOCK HOLDING COMPANY

INCOME STATEMENT

(Unaudited)

| Three months ended | ||||||||||||||||||||

| (dollars in thousands) |

12/31/2014 | 9/30/2014 | 6/30/2014 | 3/31/2014 | 12/31/2013 | |||||||||||||||

| Interest income |

$ | 170,971 | $ | 172,701 | $ | 174,001 | $ | 175,140 | $ | 175,650 | ||||||||||

| Interest income (TE) |

173,739 | 175,390 | 176,555 | 177,776 | 178,109 | |||||||||||||||

| Interest expense |

10,158 | 9,160 | 9,223 | 9,578 | 9,643 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income (TE) |

163,581 | 166,230 | 167,332 | 168,198 | 168,466 | |||||||||||||||

| Provision for loan losses |

9,718 | 9,468 | 6,691 | 7,963 | 7,331 | |||||||||||||||

| Noninterest income excluding securities transactions |

56,961 | 57,941 | 56,398 | 56,699 | 58,894 | |||||||||||||||

| Securities transactions gains |

— | — | — | — | 105 | |||||||||||||||

| Noninterest expense |

153,747 | 149,079 | 156,858 | 146,982 | 174,213 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income taxes |

54,309 | 62,935 | 57,627 | 67,316 | 43,462 | |||||||||||||||

| Income tax expense |

14,217 | 16,382 | 17,665 | 18,201 | 8,746 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 40,092 | $ | 46,553 | $ | 39,962 | $ | 49,115 | $ | 34,716 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| ADJUSTMENTS FROM NET TO OPERATING INCOME |

||||||||||||||||||||

| Securities transactions gains |

— | — | — | — | 105 | |||||||||||||||

| Total nonoperating expense items |

9,667 | 3,887 | 12,131 | — | 17,116 | |||||||||||||||

| Taxes on adjustments at marginal tax rate |

3,383 | 1,361 | 2,518 | — | 5,954 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjustments (net of taxes) |

6,284 | 2,526 | 9,613 | — | 11,057 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income (g) |

$ | 46,376 | $ | 49,079 | $ | 49,575 | $ | 49,115 | $ | 45,773 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Core income (h) |

$ | 41,537 | $ | 41,176 | $ | 38,736 | $ | 37,742 | $ | 32,847 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NONINTEREST INCOME AND NONINTEREST EXPENSE |

||||||||||||||||||||

| Service charges on deposit accounts |

$ | 19,025 | $ | 20,000 | $ | 19,269 | $ | 18,712 | $ | 19,605 | ||||||||||

| Trust fees |

11,559 | 11,530 | 11,499 | 10,238 | 10,214 | |||||||||||||||

| Bank card and ATM fees |

11,225 | 11,641 | 11,596 | 10,569 | 11,261 | |||||||||||||||

| Investment & annuity fees |

4,736 | 5,506 | 5,097 | 4,952 | 4,619 | |||||||||||||||

| Secondary mortgage market operations |

2,000 | 2,313 | 1,758 | 1,965 | 1,554 | |||||||||||||||

| Insurance fees |

1,862 | 1,979 | 1,888 | 3,744 | 3,304 | |||||||||||||||

| Amortization of FDIC loss share receivable |

(2,113 | ) | (2,760 | ) | (3,321 | ) | (3,908 | ) | (1,649 | ) | ||||||||||

| Other income |

8,667 | 7,732 | 8,612 | 10,427 | 9,986 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Noninterest income excluding securities transactions |

56,961 | 57,941 | 56,398 | 56,699 | 58,894 | |||||||||||||||

| Securities transactions gains |

— | — | — | — | 105 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total noninterest income including securities transactions |

$ | 56,961 | $ | 57,941 | $ | 56,398 | $ | 56,699 | $ | 58,999 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Personnel expense |

$ | 79,522 | $ | 80,043 | $ | 79,506 | $ | 81,432 | $ | 84,912 | ||||||||||

| Occupancy expense (net) |

10,571 | 10,798 | 10,840 | 11,266 | 11,613 | |||||||||||||||

| Equipment expense |

3,986 | 4,542 | 4,059 | 4,274 | 4,679 | |||||||||||||||

| Other real estate owned expense (net) |

1,001 | (104 | ) | 84 | 1,777 | 1,535 | ||||||||||||||

| Other operating expense |

42,555 | 43,343 | 43,494 | 41,195 | 47,180 | |||||||||||||||

| Amortization of intangibles |

6,445 | 6,570 | 6,744 | 7,038 | 7,178 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expense |

144,080 | 145,192 | 144,727 | 146,982 | 157,097 | |||||||||||||||

| Nonoperating expense items |

9,667 | 3,887 | 12,131 | — | 17,116 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total noninterest expense |

$ | 153,747 | $ | 149,079 | $ | 156,858 | $ | 146,982 | $ | 174,213 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (g) | Net income less tax-effected securities transactions and nonoperating expense items. Management believes that operating income provides a useful measure of financial performance that helps investors compare the Company’s fundamental operations over time. |

| (h) | Operating income excluding tax-effected purchase accounting adjustments. Management believes that reporting on core income provides a useful measure of financial performance that helps investors determine whether management is successfully executing its strategic initiatives. |

11

HANCOCK HOLDING COMPANY

PERIOD-END BALANCE SHEET

(Unaudited)

| Three Months Ended | ||||||||||||||||||||

| (dollars in thousands) |

12/31/2014 | 9/30/2014 | 6/30/2014 | 3/31/2014 | 12/31/2013 | |||||||||||||||

| ASSETS |

||||||||||||||||||||

| Commercial non-real estate loans |

$ | 6,044,060 | $ | 5,587,137 | $ | 5,393,691 | $ | 5,198,029 | $ | 5,064,224 | ||||||||||

| Construction and land development loans |

1,106,761 | 1,095,902 | 1,040,656 | 978,798 | 915,541 | |||||||||||||||

| Commercial real estate loans |

3,144,048 | 3,100,834 | 3,056,263 | 3,069,316 | 3,042,841 | |||||||||||||||

| Residential mortgage loans |

1,894,181 | 1,858,490 | 1,771,271 | 1,720,307 | 1,720,614 | |||||||||||||||

| Consumer loans |

1,706,226 | 1,706,211 | 1,622,175 | 1,561,487 | 1,581,597 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans |

13,895,276 | 13,348,574 | 12,884,056 | 12,527,937 | 12,324,817 | |||||||||||||||

| Loans held for sale |

20,252 | 15,098 | 22,017 | 15,911 | 24,515 | |||||||||||||||

| Securities |

3,826,454 | 3,913,370 | 3,677,229 | 3,797,883 | 4,033,124 | |||||||||||||||

| Short-term investments |

802,948 | 471,558 | 440,688 | 280,373 | 268,839 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earning assets |

18,544,930 | 17,748,600 | 17,023,990 | 16,622,104 | 16,651,295 | |||||||||||||||

| Allowance for loan losses |

(128,762 | ) | (125,572 | ) | (128,672 | ) | (128,248 | ) | (133,626 | ) | ||||||||||

| Goodwill |

621,193 | 621,193 | 621,193 | 625,675 | 625,675 | |||||||||||||||

| Other intangible assets, net |

132,810 | 139,256 | 145,825 | 152,734 | 159,773 | |||||||||||||||

| Other assets |

1,577,095 | 1,602,473 | 1,687,095 | 1,731,905 | 1,706,134 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 20,747,266 | $ | 19,985,950 | $ | 19,349,431 | $ | 19,004,170 | $ | 19,009,251 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| LIABILITIES |

||||||||||||||||||||

| Noninterest-bearing deposits |

$ | 5,945,208 | $ | 5,866,255 | $ | 5,723,663 | $ | 5,613,872 | $ | 5,530,253 | ||||||||||

| Interest-bearing transaction and savings deposits |

6,531,628 | 6,325,671 | 6,079,837 | 6,118,150 | 6,162,959 | |||||||||||||||

| Interest-bearing public fund deposits |

1,982,616 | 1,534,678 | 1,484,188 | 1,451,430 | 1,571,532 | |||||||||||||||

| Time deposits |

2,113,379 | 2,010,090 | 1,957,539 | 2,091,322 | 2,095,772 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total interest-bearing deposits |

10,627,623 | 9,870,439 | 9,521,564 | 9,660,902 | 9,830,263 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total deposits |

16,572,831 | 15,736,694 | 15,245,227 | 15,274,774 | 15,360,516 | |||||||||||||||

| Short-term borrowings |

1,151,573 | 1,171,809 | 1,063,664 | 712,634 | 657,960 | |||||||||||||||

| Long-term debt |

374,371 | 376,452 | 374,991 | 380,001 | 385,826 | |||||||||||||||

| Other liabilities |

176,089 | 191,653 | 172,967 | 174,227 | 179,880 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities |

18,274,864 | 17,476,608 | 16,856,849 | 16,541,636 | 16,584,182 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| COMMON SHAREHOLDERS’ EQUITY |

||||||||||||||||||||

| Common stock and capital surplus |

1,798,980 | 1,832,529 | 1,838,931 | 1,837,461 | 1,832,282 | |||||||||||||||

| Retained earnings |

723,497 | 703,506 | 676,942 | 657,062 | 628,166 | |||||||||||||||

| Accumulated other comprehensive income |

(50,075 | ) | (26,693 | ) | (23,291 | ) | (31,989 | ) | (35,379 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total common shareholders’ equity |

2,472,402 | 2,509,342 | 2,492,582 | 2,462,534 | 2,425,069 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities & shareholders’ equity |

$ | 20,747,266 | $ | 19,985,950 | $ | 19,349,431 | $ | 19,004,170 | $ | 19,009,251 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| CAPITAL RATIOS |

||||||||||||||||||||

| Tangible common equity |

$ | 1,718,343 | $ | 1,748,828 | $ | 1,725,489 | $ | 1,684,037 | $ | 1,639,524 | ||||||||||

| Tier 1 capital (i) |

1,777,280 | 1,784,588 | 1,758,178 | 1,725,947 | 1,685,058 | |||||||||||||||

| Common equity (period-end) as a percent of total assets (period-end) |

11.92 | % | 12.56 | % | 12.88 | % | 12.96 | % | 12.76 | % | ||||||||||

| Tangible common equity ratio |

8.59 | % | 9.10 | % | 9.29 | % | 9.24 | % | 9.00 | % | ||||||||||

| Leverage (Tier 1) ratio (i) |

9.17 | % | 9.48 | % | 9.61 | % | 9.43 | % | 9.34 | % | ||||||||||

| Tier 1 risk-based capital ratio (i) |

11.22 | % | 11.59 | % | 11.83 | % | 11.90 | % | 11.76 | % | ||||||||||

| Total risk-based capital ratio (i) |

12.29 | % | 12.66 | % | 12.96 | % | 13.20 | % | 13.11 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (i) | Estimated for most recent period-end. |

12

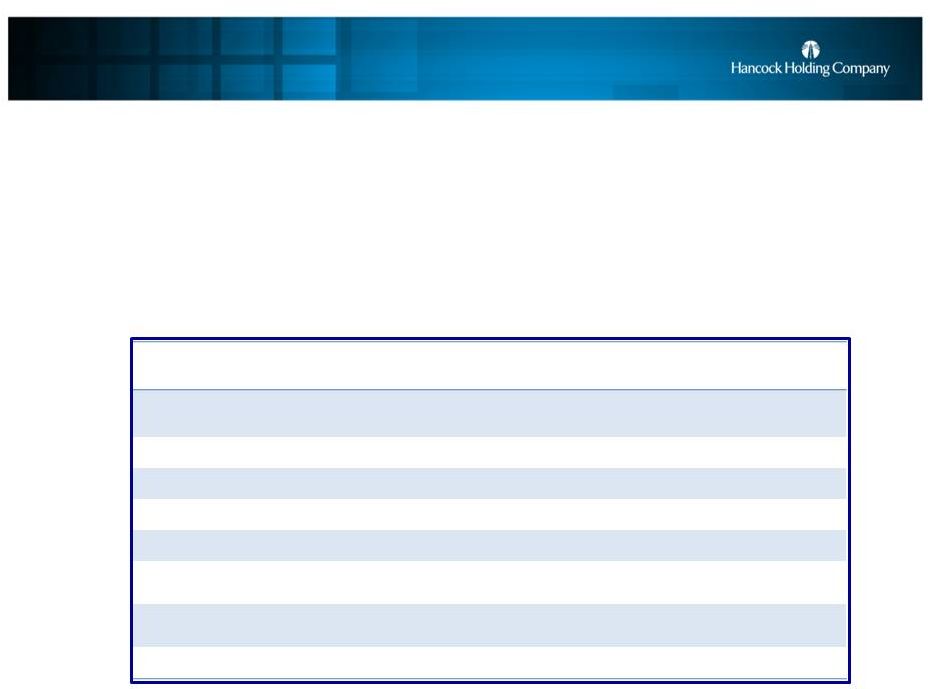

HANCOCK HOLDING COMPANY

AVERAGE BALANCE SHEET

(Unaudited)

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||

| (dollars in thousands) |

12/31/2014 | 9/30/2014 | 12/31/2013 | 12/31/2014 | 12/31/2013 | |||||||||||||||

| ASSETS |

||||||||||||||||||||

| Commercial non-real estate loans |

$ | 5,727,003 | $ | 5,485,982 | $ | 4,782,476 | $ | 5,401,992 | $ | 4,612,208 | ||||||||||

| Construction and land development loans |

1,159,378 | 1,070,763 | 931,214 | 1,047,753 | 965,237 | |||||||||||||||

| Commercial real estate loans |

3,057,022 | 3,070,821 | 2,915,323 | 3,058,355 | 2,899,317 | |||||||||||||||

| Residential mortgage loans |

1,886,230 | 1,814,186 | 1,701,144 | 1,791,859 | 1,638,103 | |||||||||||||||

| Consumer loans |

1,748,590 | 1,660,356 | 1,573,446 | 1,638,910 | 1,585,353 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans |

13,578,223 | 13,102,108 | 11,903,603 | 12,938,869 | 11,700,218 | |||||||||||||||

| Loans held for sale |

15,424 | 16,885 | 18,776 | 16,540 | 24,986 | |||||||||||||||

| Securities (j) |

3,836,123 | 3,780,089 | 4,070,657 | 3,816,724 | 4,140,051 | |||||||||||||||

| Short-term investments |

481,373 | 425,362 | 383,551 | 423,359 | 578,613 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earning assets |

17,911,143 | 17,324,444 | 16,376,587 | 17,195,492 | 16,443,868 | |||||||||||||||

| Allowance for loan losses |

(127,356 | ) | (129,734 | ) | (138,708 | ) | (129,642 | ) | (137,897 | ) | ||||||||||

| Goodwill and other intangible assets |

757,123 | 763,652 | 788,990 | 768,047 | 799,996 | |||||||||||||||

| Other assets |

1,549,462 | 1,591,585 | 1,712,222 | 1,602,930 | 1,823,051 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 20,090,372 | $ | 19,549,947 | $ | 18,739,091 | $ | 19,436,827 | $ | 18,929,018 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

||||||||||||||||||||

| Noninterest-bearing deposits |

$ | 5,849,356 | $ | 5,707,523 | $ | 5,483,918 | $ | 5,641,792 | $ | 5,393,955 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Interest-bearing transaction and savings deposits |

6,380,347 | 6,160,911 | 5,981,110 | 6,173,683 | 5,962,114 | |||||||||||||||

| Interest-bearing public fund deposits |

1,598,482 | 1,547,513 | 1,253,199 | 1,530,972 | 1,410,679 | |||||||||||||||

| Time deposits |

2,064,322 | 1,955,262 | 2,197,450 | 2,053,546 | 2,350,488 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total interest-bearing deposits |

10,043,151 | 9,663,686 | 9,431,759 | 9,758,201 | 9,723,281 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total deposits |

15,892,507 | 15,371,209 | 14,915,677 | 15,399,993 | 15,117,236 | |||||||||||||||

| Short-term borrowings |

1,135,255 | 1,139,694 | 848,934 | 1,005,680 | 806,082 | |||||||||||||||

| Long-term debt |

376,819 | 375,914 | 381,561 | 379,692 | 389,153 | |||||||||||||||

| Other liabilities |

176,282 | 173,182 | 237,151 | 176,514 | 229,983 | |||||||||||||||

| Common shareholders’ equity |

2,509,509 | 2,489,948 | 2,355,768 | 2,474,948 | 2,386,564 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities & shareholders’ equity |

$ | 20,090,372 | $ | 19,549,947 | $ | 18,739,091 | $ | 19,436,827 | $ | 18,929,018 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (j) | Average securities does not include unrealized holding gains/losses on available for sale securities. |

13

HANCOCK HOLDING COMPANY

AVERAGE BALANCE AND NET INTEREST MARGIN SUMMARY

(Unaudited)

| Three Months Ended | ||||||||||||||||||||||||||||||||||||

| 12/31/2014 | 9/30/2014 | 12/31/2013 | ||||||||||||||||||||||||||||||||||

| (dollars in millions) |

Volume | Interest | Rate | Volume | Interest | Rate | Volume | Interest | Rate | |||||||||||||||||||||||||||

| AVERAGE EARNING ASSETS |

||||||||||||||||||||||||||||||||||||

| Commercial & real estate loans (TE) |

$ | 9,943.4 | $ | 105.8 | 4.23 | % | $ | 9,627.6 | $ | 108.2 | 4.46 | % | $ | 8,629.0 | $ | 104.1 | 4.79 | % | ||||||||||||||||||

| Residential mortgage loans |

1,886.2 | 20.3 | 4.31 | % | 1,814.2 | 20.0 | 4.41 | % | 1,701.1 | 23.5 | 5.52 | % | ||||||||||||||||||||||||

| Consumer loans |

1,748.6 | 23.9 | 5.43 | % | 1,660.4 | 24.0 | 5.74 | % | 1,573.4 | 24.4 | 6.15 | % | ||||||||||||||||||||||||

| Loan fees & late charges |

— | 0.6 | 0.00 | % | — | 0.4 | 0.00 | % | — | 1.0 | 0.00 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total loans (TE) |

13,578.2 | 150.6 | 4.41 | % | 13,102.2 | 152.6 | 4.63 | % | 11,903.5 | 153.0 | 5.10 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Loans held for sale |

15.4 | 0.2 | 4.27 | % | 16.9 | 0.1 | 4.66 | % | 18.8 | 0.2 | 3.47 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| US Treasury and government agency securities |

300.0 | 1.1 | 1.52 | % | 184.8 | 0.7 | 1.47 | % | 100.2 | 0.6 | 2.20 | % | ||||||||||||||||||||||||

| CMOs and mortgage backed securities |

3,324.5 | 19.1 | 2.30 | % | 3,379.2 | 19.2 | 2.27 | % | 3,725.4 | 21.6 | 2.33 | % | ||||||||||||||||||||||||

| Municipals (TE) |

199.3 | 2.3 | 4.63 | % | 203.7 | 2.4 | 4.62 | % | 235.8 | 2.4 | 4.14 | % | ||||||||||||||||||||||||

| Other securities |

12.3 | 0.1 | 2.24 | % | 12.3 | 0.1 | 2.21 | % | 9.3 | 0.1 | 2.49 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total securities (TE) (j) |

3,836.1 | 22.6 | 2.36 | % | 3,780.0 | 22.4 | 2.36 | % | 4,070.7 | 24.7 | 2.43 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total short-term investments |

481.4 | 0.3 | 0.23 | % | 425.3 | 0.3 | 0.23 | % | 383.6 | 0.2 | 0.23 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Average earning assets yield (TE) |

$ | 17,911.1 | 173.7 | 3.86 | % | $ | 17,324.4 | 175.4 | 4.02 | % | $ | 16,376.6 | 178.1 | 4.32 | % | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| INTEREST-BEARING LIABILITIES |

||||||||||||||||||||||||||||||||||||

| Interest-bearing transaction and savings deposits |

$ | 6,380.3 | 2.1 | 0.13 | % | $ | 6,160.9 | 1.6 | 0.11 | % | $ | 5,981.1 | 1.4 | 0.09 | % | |||||||||||||||||||||

| Time deposits |

2,064.3 | 3.5 | 0.68 | % | 1,955.3 | 3.1 | 0.64 | % | 2,197.5 | 3.3 | 0.60 | % | ||||||||||||||||||||||||

| Public funds |

1,598.5 | 1.1 | 0.28 | % | 1,547.5 | 1.1 | 0.27 | % | 1,253.2 | 0.7 | 0.21 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total interest-bearing deposits |

10,043.1 | 6.7 | 0.27 | % | 9,663.7 | 5.8 | 0.24 | % | 9,431.8 | 5.4 | 0.23 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Short-term borrowings |

1,135.3 | 0.3 | 0.09 | % | 1,139.7 | 0.2 | 0.08 | % | 848.9 | 1.1 | 0.51 | % | ||||||||||||||||||||||||

| Long-term debt |

376.8 | 3.1 | 3.28 | % | 375.9 | 3.2 | 3.27 | % | 381.6 | 3.2 | 3.29 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total borrowings |

1,512.1 | 3.4 | 0.88 | % | 1,515.6 | 3.4 | 0.87 | % | 1,230.5 | 4.3 | 1.37 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total interest-bearing liabilities cost |

11,555.2 | 10.1 | 0.35 | % | 11,179.3 | 9.2 | 0.33 | % | 10,662.3 | 9.7 | 0.36 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net interest-free funding sources |

6,355.9 | 6,145.1 | 5,714.3 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total cost of funds |

17,911.1 | 10.1 | 0.23 | % | 17,324.4 | 9.2 | 0.21 | % | 16,376.6 | 9.7 | 0.23 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net Interest Spread (TE) |

$ | 163.6 | 3.51 | % | $ | 166.2 | 3.69 | % | $ | 168.5 | 3.96 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net Interest Margin (TE) |

$ | 17,911.1 | $ | 163.6 | 3.63 | % | $ | 17,324.4 | $ | 166.2 | 3.81 | % | $ | 16,376.6 | $ | 168.5 | 4.09 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| (j) | Average securities does not include unrealized holding gains/losses on available for sale securities. |

14

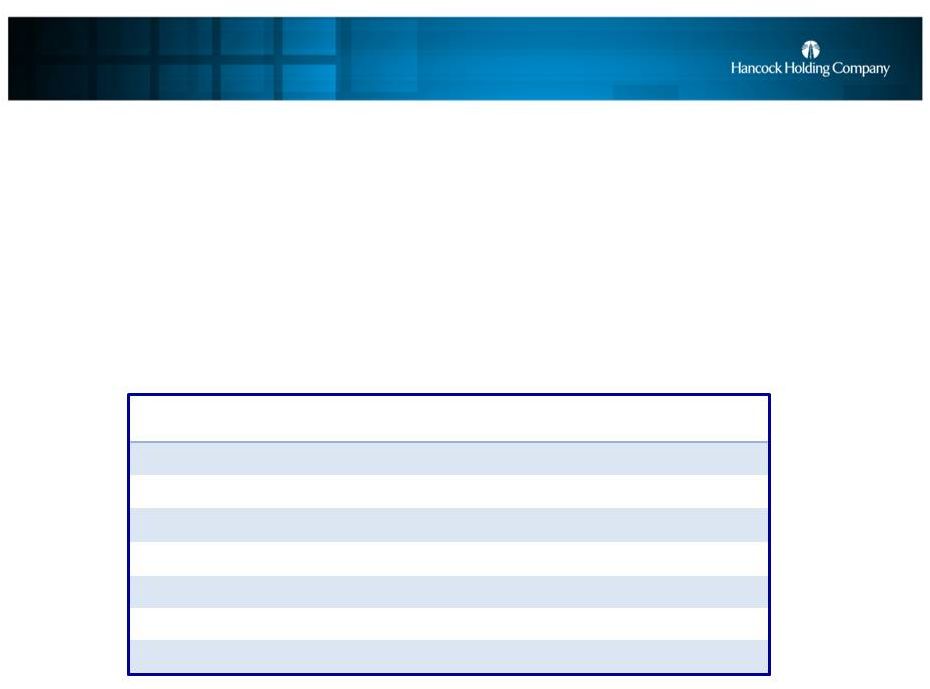

HANCOCK HOLDING COMPANY

AVERAGE BALANCE AND NET INTEREST MARGIN SUMMARY

(Unaudited)

| Twelve Months Ended | ||||||||||||||||||||||||

| 12/31/2014 | 12/31/2013 | |||||||||||||||||||||||

| (dollars in millions) |

Volume | Interest | Rate | Volume | Interest | Rate | ||||||||||||||||||

| AVERAGE EARNING ASSETS |

||||||||||||||||||||||||

| Commercial & real estate loans (TE) |

$ | 9,508.1 | $ | 430.2 | 4.52 | % | $ | 8,476.8 | $ | 430.3 | 5.08 | % | ||||||||||||

| Residential mortgage loans |

1,791.9 | 82.7 | 4.61 | % | 1,638.1 | 101.8 | 6.21 | % | ||||||||||||||||

| Consumer loans |

1,638.9 | 94.7 | 5.78 | % | 1,585.4 | 103.1 | 6.50 | % | ||||||||||||||||

| Loan fees & late charges |

— | 2.4 | 0.00 | % | — | 3.5 | 0.00 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total loans (TE) |

12,938.9 | 610.0 | 4.71 | % | 11,700.2 | 638.7 | 5.45 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Loans held for sale |

16.5 | 0.7 | 4.28 | % | 25.0 | 0.9 | 3.60 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| US Treasury and government agency securities |

145.2 | 2.3 | 1.62 | % | 28.1 | 0.1 | 2.16 | % | ||||||||||||||||

| CMOs and mortgage backed securities |

3,450.9 | 79.6 | 2.31 | % | 3,870.1 | 81.9 | 2.12 | % | ||||||||||||||||

| Municipals (TE) |

206.4 | 9.5 | 4.61 | % | 233.3 | 10.3 | 4.43 | % | ||||||||||||||||

| Other securities |

14.2 | 0.3 | 2.22 | % | 8.5 | 0.2 | 2.44 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total securities (TE) (j) |

3,816.7 | 91.7 | 2.40 | % | 4,140.1 | 92.5 | 2.23 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total short-term investments |

423.4 | 1.0 | 0.23 | % | 578.6 | 1.4 | 0.24 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Average earning assets yield (TE) |

$ | 17,195.5 | 703.4 | 4.09 | % | $ | 16,443.9 | 732.6 | 4.45 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| INTEREST-BEARING LIABILITIES |

||||||||||||||||||||||||

| Interest-bearing transaction and savings deposits |

$ | 6,173.7 | 6.7 | 0.11 | % | $ | 5,962.1 | 6.0 | 0.10 | % | ||||||||||||||

| Time deposits |

2,053.5 | 12.8 | 0.62 | % | 2,350.5 | 14.9 | 0.63 | % | ||||||||||||||||

| Public funds |

1,531.0 | 3.7 | 0.24 | % | 1,410.7 | 3.3 | 0.23 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total interest-bearing deposits |

9,758.2 | 23.2 | 0.24 | % | 9,723.3 | 24.2 | 0.25 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Short-term borrowings |

1,005.7 | 2.4 | 0.23 | % | 806.1 | 4.5 | 0.56 | % | ||||||||||||||||

| Long-term debt |

379.7 | 12.5 | 3.30 | % | 389.2 | 12.8 | 3.28 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total borrowings |

1,385.4 | 14.9 | 1.08 | % | 1,195.3 | 17.3 | 1.45 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total interest-bearing liabilities cost |

11,143.6 | 38.1 | 0.34 | % | 10,918.5 | 41.5 | 0.38 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net interest-free funding sources |

6,051.9 | 5,525.4 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total cost of funds |

17,195.5 | 38.1 | 0.22 | % | 16,443.9 | 41.5 | 0.25 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net Interest Spread (TE) |

$ | 665.3 | 3.75 | % | $ | 691.1 | 4.07 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net Interest Margin (TE) |

$ | 17,195.5 | $ | 665.3 | 3.87 | % | $ | 16,443.9 | $ | 691.1 | 4.20 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (j) | Average securities does not include unrealized holding gains/losses on available for sale securities. |

15

HANCOCK HOLDING COMPANY

ASSET QUALITY INFORMATION

(Unaudited)

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||

| (dollars in thousands) |

12/31/2014 | 9/30/2014 | 12/31/2013 | 12/31/2014 | 12/31/2013 | |||||||||||||||

| Nonaccrual loans (k) |

$ | 79,537 | $ | 83,154 | $ | 99,711 | $ | 79,537 | $ | 99,711 | ||||||||||

| Restructured loans - still accruing |

8,971 | 7,944 | 9,247 | 8,971 | 9,247 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total nonperforming loans |

88,508 | 91,098 | 108,958 | 88,508 | 108,958 | |||||||||||||||

| ORE and foreclosed assets |

59,569 | 56,081 | 76,979 | 59,569 | 76,979 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total nonperforming assets |

$ | 148,077 | $ | 147,179 | $ | 185,937 | $ | 148,077 | $ | 185,937 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Nonperforming assets as a percent of loans, ORE and foreclosed assets |

1.06 | % | 1.10 | % | 1.50 | % | 1.06 | % | 1.50 | % | ||||||||||

| Accruing loans 90 days past due |

$ | 4,825 | $ | 6,667 | $ | 10,387 | $ | 4,825 | $ | 10,387 | ||||||||||

| Accruing loans 90 days past due as a percent of loans |

0.03 | % | 0.05 | % | 0.08 | % | 0.03 | % | 0.08 | % | ||||||||||

| Nonperforming assets + accruing loans 90 days past due to loans, ORE and foreclosed assets |

1.10 | % | 1.15 | % | 1.58 | % | 1.10 | % | 1.58 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| ALLOWANCE FOR LOAN LOSSES |

||||||||||||||||||||

| Beginning Balance |

$ | 125,572 | $ | 128,672 | $ | 138,223 | $ | 133,626 | $ | 136,171 | ||||||||||

| Net provision for loan losses - covered loans |

(160 | ) | (391 | ) | (532 | ) | (926 | ) | 7,455 | |||||||||||

| Provision for loan losses - noncovered loans |

9,878 | 9,859 | 7,863 | 34,766 | 25,279 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net provision for loan losses |

9,718 | 9,468 | 7,331 | 33,840 | 32,734 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (Decrease) increase in FDIC loss share receivable |

(4,514 | ) | (6,695 | ) | (10,111 | ) | (19,084 | ) | (8,615 | ) | ||||||||||

| Net charge-offs - covered |

(624 | ) | (566 | ) | (3,399 | ) | 2,501 | 2,355 | ||||||||||||

| Charge-offs - noncovered |

8,229 | 8,482 | 11,515 | 31,502 | 42,899 | |||||||||||||||

| Recoveries - noncovered |

(5,591 | ) | (2,043 | ) | (6,299 | ) | (14,383 | ) | (18,590 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net charge-offs |

2,014 | 5,873 | 1,817 | 19,620 | 26,664 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ending Balance |

$ | 128,762 | $ | 125,572 | $ | 133,626 | $ | 128,762 | $ | 133,626 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Allowance for loan losses as a percent of period-end loans |

0.93 | % | 0.94 | % | 1.08 | % | 0.93 | % | 1.08 | % | ||||||||||

| Allowance for loan losses to nonperforming loans + accruing loans 90 days past due |

137.96 | % | 128.44 | % | 111.97 | % | 137.96 | % | 111.97 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET CHARGE-OFF INFORMATION |

||||||||||||||||||||

| Net charge-offs - noncovered: |

||||||||||||||||||||

| Commercial & real estate loans |

$ | 1,446 | $ | 2,451 | $ | 2,183 | $ | 6,437 | $ | 11,684 | ||||||||||

| Residential mortgage loans |

349 | 558 | (197 | ) | 1,641 | 361 | ||||||||||||||

| Consumer loans |

843 | 3,430 | 3,230 | 9,041 | 12,264 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total net charge-offs - noncovered |

$ | 2,638 | $ | 6,439 | $ | 5,216 | $ | 17,119 | $ | 24,309 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net charge-offs - noncovered to average loans: |

||||||||||||||||||||

| Commercial & real estate loans |

0.06 | % | 0.10 | % | 0.10 | % | 0.07 | % | 0.14 | % | ||||||||||

| Residential mortgage loans |

0.07 | % | 0.12 | % | (0.05 | )% | 0.09 | % | 0.02 | % | ||||||||||

| Consumer loans |

0.19 | % | 0.82 | % | 0.81 | % | 0.55 | % | 0.77 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total net charge-offs - noncovered to average loans |

0.08 | % | 0.19 | % | 0.17 | % | 0.13 | % | 0.21 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (k) | Nonaccrual loans and accruing loans past due 90 days or more do not include acquired credit-impaired loans which were written down to fair value upon acquisition and accrete interest income over the remaining life of the loan. Included in nonaccrual loans are $7.0 million, $9.9 million, and $15.7 million at 12/31/14, 9/30/14 and 12/31/13, respectively, in nonaccruing restructured loans. |

16

HANCOCK HOLDING COMPANY

ASSET QUALITY INFORMATION

(Unaudited)

| Three months ended | ||||||||||||||||||||

| (dollars in thousands) |

12/31/2014 | 9/30/2014 | 6/30/2014 | 3/31/2014 | 12/31/2013 | |||||||||||||||

| Nonaccrual loans |

$ | 79,537 | $ | 83,154 | $ | 89,901 | $ | 101,400 | $ | 99,711 | ||||||||||

| Restructured loans - still accruing |