Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NORTHSTAR REALTY FINANCE CORP. | nrf8-kxregfdgreenstreetpre.htm |

Investor Presentation January 2015 399 Park Avenue, 18th Floor, New York, NY 10022 | 212.547.2600 | nrfc.com

1 Safe Harbor This presentation contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or Exchange Act, including statements about future results, projected yields, rates of return and performance, projected cash available for distribution, projected cash from any single source of investment or fee stream, projected expenses, expected and weighted average return on equity, market and industry trends, investment opportunities, business conditions and other matters, including, among other things: the resulting effects of becoming an externally managed company, including the payment of substantial fees to our manager, the allocation of investments by our manager among us and our manager's other managed companies, and various conflicts of interest in our relationship with NorthStar Asset Management Group Inc. (NSAM); our ability to realize anticipated benefits of the merger with Griffin-American Healthcare REIT II, Inc. (“Griffin- American”); the scalability of our investment platform; the performance of our real estate portfolio generally; the projected net operating income of our portfolio and associated cap rate, including the ability to achieve the growth, obtain the lease payments and step ups in contractual lease payments, and maintain dividend payments, at current or anticipated levels, or at all; the diversification of our portfolio; our potential inclusion in an established equity REIT index in the near future or at all, and, if included, our performance following such inclusion; our ability to close on our recent commitments to acquire real estate investments, including the recent commitment to acquire a €1.1 billion ($1.4 billion U.S. equivalent) pan- European office portfolio, on the terms contemplated or at all; our ability to engage in joint venture transactions on the terms contemplated or at all; the anticipated strength and growth of our business; our liquidity and financial flexibility, including the timing and amount of borrowings under our credit facilities and our ability to comply with the required affirmative and negative covenants, including the financial covenants; our ability to realize the benefits of our relationship with our strategic and joint venture partners, including strategic relationships and partners of NSAM; NSAM’s ability to source and consummate attractive investment opportunities on our behalf, both domestically and internationally; the equity and debt mix of our portfolio, including any concentration of European investments; whether we will realize any potential upside in our limited partnership interest in real estate private equity funds or any appreciation above our original cost basis of our real estate portfolio; performance of our investments relative to our expectations and the impact on our actual return on invested equity, as well as the cash generated from these investments and available for distribution; our ability to generate attractive risk-adjusted total returns; whether we will produce higher CAD per share in the coming quarters, or ever; our dividend yield; the size and timing of offerings or capital raises; the ability to opportunistically participate in commercial real estate re-financings; the ability to capitalize on attractive investment opportunities; our ability to realize the projections related to cash available for distribution and underlying assumptions; the projected returns on, and cash earned from, investments, including investments funded by drawings from our credit facilities and securities offerings and equity and debt capital. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “project,” “predict,” “hypothetical,” “continue,” “future” or other similar words or expressions. All forward-looking statements included in this presentation are based upon information available to NorthStar Realty Finance Corp. (the “Company”) on the date hereof and the Company is under no duty to update any of the forward-looking statements after the date of this presentation to conform these statements to actual results. The forward-looking statements involve a number of significant risks and uncertainties. Factors that could have a material adverse effect on the Company’s operations and future prospects are set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013 and Quarterly Report on Form 10-Q for the quarter ended June 30, 2014, including the section entitled “Risk Factors”. The factors set forth in the Risk Factors section and otherwise described in the Company’s filings with SEC could cause the Company’s actual results to differ significantly from those contained in any forward-looking statement contained in this presentation. The Company does not guarantee that the assumptions underlying such forward-looking statements are free from errors. Unless otherwise stated, historical financial information and per share and other data is as of September 30, 2014. This presentation is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities of the Company. The endnotes herein contain important information that is material to an understanding of this presentation and you should read this presentation only with and in context of the endnotes.

NorthStar Realty Finance: Not Your Typical REIT 2 NorthStar Realty Finance (NYSE: NRF, “NorthStar Realty”) is a diversified REIT with total assets of more than $17 billion(1) NorthStar Realty invests in a variety of property types in the United States and Europe The largest investment concentrations are in healthcare, hotel, manufactured housing communities, office (primarily European), net leased and multifamily properties(2) NorthStar Realty's highly experienced team has created shareholder value at different points in the real estate cycle by pursuing commercial real estate investments expected to generate the most attractive risk-adjusted returns Over 80% of total assets are now comprised of direct and indirect equity investments in real estate; FTSE NAREIT has reclassified NorthStar Realty as an “Equity Diversified” REIT effective December 19, 2014 Annualized total returns have exceeded 20% since the company's IPO in 2004; ~12% of annual outperformance versus the RMS

3 Portfolio Summary: Finding Value Wherever it Resides(1) NorthStar Realty's experienced management team constantly assesses the real estate and capital markets in pursuit of the most compelling risk-adjusted returns across different property types, geographies, and capital structures As a result, NorthStar Realty owns a diversified portfolio that has generated superior total returns for shareholders ($ in millions) Owned commercial real estate $ 14,430 Commercial real estate loans 1,216 Assets underlying deconsolidated CRE loan CDOs 1,422 Commercial real estate securities 811 Total assets $17,880

-10% 0% 10% 20% Commercial Mortgage REITs S&P 500 MSCI U.S. REIT Index (RMS) NRF 4 Compound Annual Total Return(3) NRF (IPO October 2004) through January 2, 2015 Impressive Total Returns... NorthStar Realty has significantly outperformed the average equity REIT (RMS) since its IPO in October 2004. The relative performance versus commercial mortgage REITs has been even more impressive An opportunistic investment style has been the hallmark of NorthStar Realty's strategy, and management's vision and execution have delivered impressive results for shareholders

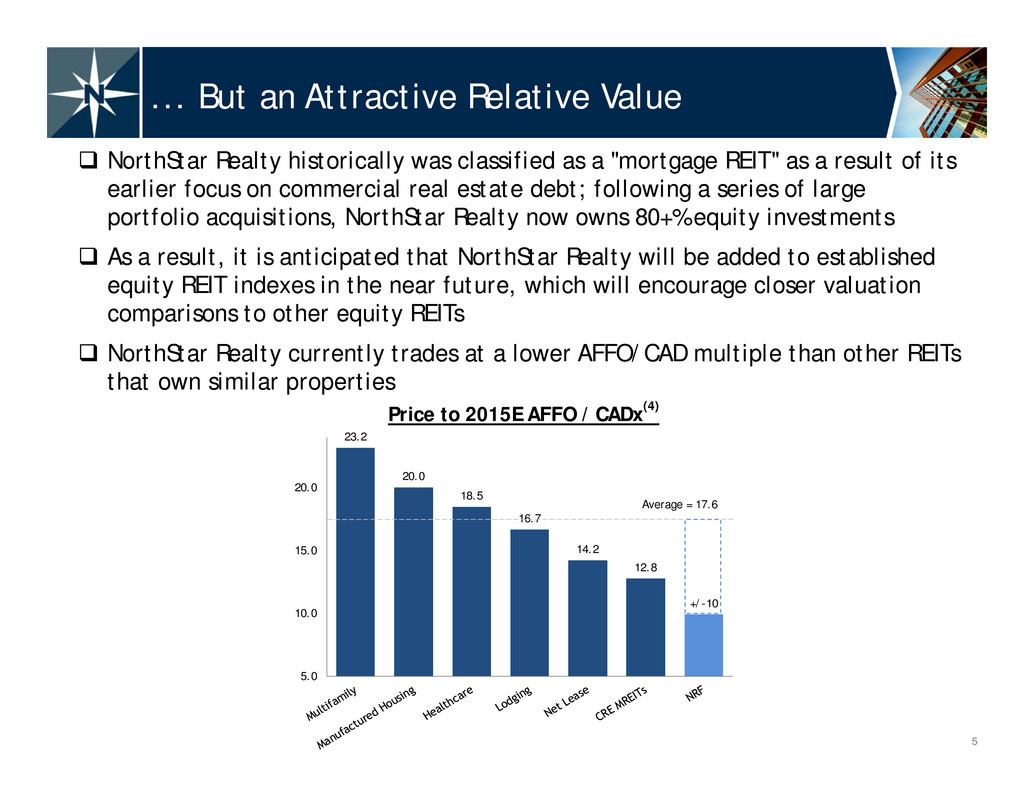

23.2 20.0 18.5 16.7 14.2 12.8 +/-10 5.0 10.0 15.0 20.0 5 ... But an Attractive Relative Value NorthStar Realty historically was classified as a "mortgage REIT" as a result of its earlier focus on commercial real estate debt; following a series of large portfolio acquisitions, NorthStar Realty now owns 80+% equity investments As a result, it is anticipated that NorthStar Realty will be added to established equity REIT indexes in the near future, which will encourage closer valuation comparisons to other equity REITs NorthStar Realty currently trades at a lower AFFO/CAD multiple than other REITs that own similar properties Price to 2015E AFFO / CADx(4) . Average = 17.6

6 A Deep Senior Management Team NorthStar Realty is led by a team of experienced commercial real estate veterans Management team has significant aligned interest in NorthStar Realty through NRF common stock ownership Years of Experience David T. Hamamoto 30 Albert Tylis 16 Daniel R. Gilbert 20 Debra A. Hess 28 Ronald J. Lieberman 19 Keith A. Feldman, CFA 16 Chief Financial Officer ▪ Newcastle Investment Corp. - Chief Financial Officer ▪ Fortress Investment Group - Managing Director ▪ Goldman, Sachs & Co. - Vice President, Manager of Financial Reporting Relevant Background Chairman and Chief Executive Officer Chief Investment and Operating Officer ▪ Hunton & Williams - Partner, Real Estate Capital Markets ▪ Skadden, Arps, Slate, Meagher and Flom - Associate, Corporate and SecuritiesExecutive Vice President and General Counsel Managing Director - Finance and Capital Markets Name Management Position ▪ NorthStar Capital - Co-Founder ▪ Goldman, Sachs & Co. - Co-Founder and Partner of Real Estate Principal Investments (Whitehall Funds) ▪ Bryan Cave / Robinson Silverman - Senior Attorney ▪ ASA Institute - Director of Corporate Finance and General Counsel ▪ NorthStar Capital - Head of Mezzanine Lending Business ▪ Merrill Lynch & Co. - Group Head in Global Principal Investment and Commercial Real Estate President ▪ Goldman, Sachs & Co. - Financial Reporting ▪ JPMorgan Chase & Co. - Finance

Years of Experience Daniel D. Raffe 25 Steven B. Kauff 27 Sujan S. Patel 14 Robert C. Gatenio 15 Mahbod Nia 15 Brett Klein 14 Robert S. Riggs 26 David S. Fallick 20 Ronald J. Jeanneault 23 Chief Executive Officer and President of NorthStar Healthcare Income, Inc. ▪ GE Business Property - Head of East and Midwest Real Estate Acquisitions ▪ Cushman & Wakefield - Managing Director, Real Estate Capital MarketsExecutive Vice President and Head of Portfolio Management ▪ NorthStar Capital - Structuring and Tax ▪ Arthur Anderson - Real Estate & Hospitality, Tax Consulting ▪ PricewaterhouseCoopers - Real Estate Industry, Tax Consulting Executive Vice President, Managing Director & Co-Head of European Operations Name Management Position Relevant Background ▪ Thayer Lodging - Acquisitions ▪ Morgan Stanley - Investment Banking DivisionManaging Director - Co-Head of Investments ▪ Goldman, Sachs & Co. - Commercial Real Estate Lending ▪ Goldman Sachs Asset Management - Fixed Income Portfolio ManagementManaging Director - Co-Head of Investments ▪ PanCap Investment Partners ▪ Goldman, Sachs & Co. - Senior Executive Director, Real Estate Group ▪ Citigroup, Inc. - Vice President, Real Estate Finance Head of European Investments ▪ NorthStar Capital - Mezzanine Lending Business ▪ Fitch Ratings - CMBSManaging Director - Head of Structured and Alternative Products ▪ Olympus Real Estate Partners - Partner ▪ GE Capital Realty Group - COO and EVP of Equity InvestingManaging Director - NorthStar Realty Asset Management ▪ Bank of America/Merrill Lynch - Managing Director, CMBS ▪ Standard & Poor’s - Managing Director and Co-Head, CMBSManaging Director and Co-Head of European Operations ▪ NorthStar Realty Finance Corp. - Executive Vice President and Head of Asset Management of the Healthcare Investment Division ▪ Sunrise Senior Living - Senior Vice President and Co-Head of Operations 7 The Investment and Asset Management Leaders NorthStar Realty is an active acquirer across a variety of property types and over the last 3 years has grown the real estate portfolio substantially The investment teams have unusually broad experience and is supported by a talented asset management team Europe represents an exciting growth opportunity for NorthStar Realty

James F. Flaherty III * Scott Rechler Jeffrey Fisher New York City Tri-State Office Real Estate * James F. Flaherty III provides additional services through a joint venture with NorthStar Asset Management Group Inc. where he is responsible for the directional strategy and implementation of the healthcare real estate business including the oversight of all healthcare investments. ▪ Chatham Lodging Trust - Chairman, CEO and President ▪ Innkeepers USA Trust - Former Chairman, CEO and PresidentHotel/Lodging Real Estate Name Business Sector Specialty Relevant Background ▪ Vice Chairman of the Board of NorthStar Healthcare Income, Inc. ▪ HCP, Inc. - Former Chairman and CEO ▪ Merrill Lynch & Co. - Former Head of Global Healthcare Group Healthcare Real Estate ▪ RXR Realty LLC - Chairman and CEO ▪ Reckson Associates Realty Corp. - Former Chairman and CEO 8 Affiliations with Proven Value Creators NorthStar Realty is managed day to day by NorthStar Asset Management Group Inc. (NYSE: NSAM), a global asset management firm An advantage to the externally advised structure is that it facilitates strategic relationships with real estate veterans who have created value for their shareholders

9 NorthStar Realty has over $17 billion in total assets Approximately $14 billion, or 81% of total assets is comprised of direct and indirect ownership of commercial real estate A Very Large Owner of Commercial Real Estate(5) Total Assets Owned commercial real estate

Portman Square House, London 10 NorthStar Realty recently announced an agreement to acquire a €1.1 billion pan- European office portfolio located in seven of Europe's top markets Real estate capital market conditions in Europe are far less liquid than in the United States, and NorthStar Realty expects to continue scouring the European market for investment opportunities €1.1 billion pan-European office portfolio: 186,299 square meters (2 million square feet); 8 year average age; 93% leased with 6 year WA remaining lease term with periodic rent reviews; Credit tenants and “Big Four” professional service firms such as BNP Paribas, Cushman & Wakefield, Chartis Europe, AIG, Barclays, Invesco UK, Ernst & Young and Deloitte represent ~66% of in-place rents; ~50% of portfolio, by rent, located in London and Paris Europe - An Exciting Growth Initiative Condor House, London Issy les Moulineaux, Paris

11 A key competitive advantage for NorthStar Realty is the broad experience of its investment team Market conditions change and investment opportunities ebb and flow, and the team is constantly in search of the most attractive risk-adjusted returns NorthStar Realty's penchant for finding value and investing across the real estate capital markets has resulted in some non-traditional investments with expected outsized risk adjusted total returns Real Estate Private Equity Fund Investments - NorthStar Realty acquired LP interests in institutional PE funds taking advantage of illiquid markets and as economic conditions improved during the current recovery, asset values have generated outsized returns Corporate Investments – NorthStar Realty has entered into a strategic investments with RXR Realty, a leading real estate owner, developer and investment management company focused on high- quality real estate investments in the New York Tri-State area; and Aerium Group, a €6 billion pan- European real estate investment manager specializing in commercial real estate properties Balance Sheet Loans – NorthStar Realty continues to utilize its strong loan origination platform in opportunistically originating, structuring, acquiring and managing senior and subordinate debt investments secured primarily by commercial real estate, including first mortgage loans, subordinate interests, mezzanine loans and preferred equity interests Repurchased N-Star CDO bonds – During the financial crisis, NorthStar Realty repurchased at significant discounts to principal amount certain bonds of its originally sponsored and managed CDOs. Many of these bonds have dramatically increased in price since these acquisitions. Staying Nimble, Finding Value leads to Some Unique Investments for an Equity REIT

12 Presentation Endnotes 1. Assets include assets underlying deconsolidated debt CDOs; the $4 billion acquisition of Griffin-American and the $1.1 billion hotel portfolio, both of which NorthStar Realty acquired subsequent to the end of the third quarter 2014; and is pro forma for a €1.1 billion ($1.4 billion USD equivalent) European office portfolio NorthStar Realty entered into an agreement to acquire subsequent to the end of the third quarter 2014. 2. Interests in real estate PE funds, an indirect real estate investment, represents a substantial portion of NorthStar Realty’s investment concentration. 3. Compounded Annual Total Return: Based on price performance including reinvestment of dividends. Commercial Mortgage REITs includes the average of companies that had their IPO prior to the recent financial crisis including ABR, NCT, RAS and STAR. 4. Price to 2015 AFFO/ CADx: Consensus estimate per SNL for all sectors except commercial mortgage REITs which represents I/B/E/S consensus estimate reported by FactSet. Prices based on January 2, 2015 market close. The most comparable reported earnings metric to NorthStar Realty’s reported CAD based on analyst consensus for 2015 estimates are used for presentation purposes and should not be considered as an alternative to NorthStar Realty’s reported CAD. In addition, our methodology for calculating CAD may differ from the methodologies used by other comparable companies, including other REITs, when calculating the same or similar supplemental financial measures and may not be comparable with these companies. For further information relating to NorthStar Realty’s calculation of CAD refer to NorthStar Realty’s form 10-Q. 5. Assets include assets underlying deconsolidated debt CDOs; the $4 billion acquisition of Griffin-American and the $1.1 billion hotel portfolio, both of which NorthStar Realty acquired subsequent to the end of the third quarter 2014; and is pro forma for a €1.1 billion ($1.4 billion USD equivalent) European office portfolio NorthStar Realty entered into an agreement to acquire subsequent to the end of the third quarter 2014.

13 399 Park Avenue, 18th Floor, New York, NY 10022 | 212.547.2600 | nrfc.com