Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - NORTHSTAR REALTY FINANCE CORP. | a2202279zex-32_2.htm |

| EX-32.1 - EX-32.1 - NORTHSTAR REALTY FINANCE CORP. | a2202279zex-32_1.htm |

| EX-31.2 - EX-31.2 - NORTHSTAR REALTY FINANCE CORP. | a2202279zex-31_2.htm |

| EX-21.1 - EX-21.1 - NORTHSTAR REALTY FINANCE CORP. | a2202279zex-21_1.htm |

| EX-23.1 - EX-23.1 - NORTHSTAR REALTY FINANCE CORP. | a2202279zex-23_1.htm |

| EX-31.1 - EX-31.1 - NORTHSTAR REALTY FINANCE CORP. | a2202279zex-31_1.htm |

| EX-12.1 - EX-12.1 - NORTHSTAR REALTY FINANCE CORP. | a2202279zex-12_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2010 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number: 001-32330

NorthStar Realty Finance Corp.

(Exact Name of Registrant as Specified in its Charter)

| Maryland (State or other Jurisdiction of Incorporation or Organization) |

11-3707493 (I.R.S. Employer Identification No.) |

|

399 Park Avenue, 18th Floor New York, New York (Address of Principal Executive Offices) |

10022 (Zip Code) |

(212) 547-2600

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Class | Name of Each Exchange on Which Registered | |

|---|---|---|

| Common Stock, $0.01 par value | New York Stock Exchange | |

| 8.75% Series A Cumulative Redeemable | ||

| Preferred Stock, $0.01 par value | New York Stock Exchange | |

| 8.25% Series B Cumulative Redeemable | ||

| Preferred Stock, $0.01 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of "large accelerated filer", "accelerate filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the registrant's voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2010, was $205,907,287. As of February 24, 2011, the registrant had issued and outstanding 77,175,882 shares of common stock, par value $0.01 per share.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement for the registrant's 2011 Annual Meeting of Stockholders (the "2011 Proxy Statement"), to be filed within 120 days after the end of the registrant's fiscal year ending December 31, 2010, are incorporated by reference into this Annual Report on Form 10-K in response to Part III, Items 10, 11, 12, 13 and 14.

2

This Annual Report on Form 10-K contains certain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements relate to, among other things, the operating performance of our investments and financing needs. Forward-looking statements are generally identifiable by use of forward-looking terminology such as "may," "will," "should," "potential," "intend," "expect," "seek," "anticipate," "estimate," "believe," "could," "project," "predict," "continue" or other similar words or expressions. Forward-looking statements are not guarantees of performance and are based on certain assumptions, discuss future expectations, describe plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Our ability to predict results or the actual effect of plans or strategies is inherently uncertain, particularly given the economic environment. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements. These forward-looking statements involve risks, uncertainties and other factors that may cause our actual results in future periods to differ materially from those forward looking statements. We are under no duty to update any of the forward-looking statements after the date of this report to conform these statements to actual results.

Factors that could have a material adverse effect on our operations and future prospects are set forth in "Risk Factors" in this Annual Report on Form 10-K beginning on page 15. The factors set forth in the Risk Factors section could cause our actual results to differ significantly from those contained in any forward-looking statement contained in this report.

3

Our Company

We are a real estate finance company that has focused primarily on originating, investing in and managing commercial real estate debt, commercial real estate securities and net lease properties. We have invested in those areas of commercial real estate that enabled us to leverage our real estate investment expertise, utilize our broad capital markets knowledge, and capitalize on our ability to employ innovative financing structures. We believe that our three principal business lines are complementary to each other due to their overlapping sources of investment opportunities, common reliance on real estate fundamentals and ability to apply similar asset management skills to maximize value and to protect capital. We conduct our operations so as to qualify as a real estate investment trust, or a REIT, for federal income tax purposes. In this Annual Report, "we" or the "Company" means NorthStar Realty Finance Corp. and its consolidated subsidiaries, unless the context otherwise requires.

The U.S. economy is continuing to experience high unemployment and low economic growth compared to historical periods. These conditions were precipitated by the collapse of the U.S. residential real estate sector in 2007, and continue to have a negative impact on commercial real estate fundamentals. During 2010, liquidity began to return to commercial real estate debt and equity markets despite these poor economic conditions; however, many investors remain cautious in providing capital to legacy commercial real estate finance companies, like us, until the economic outlook becomes more clear. Our priorities are to actively manage portfolio credit to preserve capital, generate and recycle liquidity from existing assets, reduce leverage by purchasing our issued debt at discounts to par, make opportunistic investments and to access new investment capital through channels other than the listed public capital markets, such as the non-traded REIT market.

Since 2008, most of our new investment activities have been funded using proceeds from repayments and sales of investments within our portfolio. During 2010, we began raising equity capital in the non-traded REIT sector. We sponsor and are the advisor of NorthStar Real Estate Income Trust, Inc. ("NSREIT"), a registered and non-listed REIT that is currently raising capital via a continuous offering. We also have filed a registration statement on Form S-11for NorthStar Senior Care Trust, Inc., a non-listed REIT that intends to invest in loans and real estate focused on the healthcare sector. We earn fees for managing these REITs and expect that a portion of our new investment activities will be conducted on behalf of these sponsored companies.

The following describes the major commercial asset classes in which we have invested and which we continue to actively manage to maximize value and to preserve our capital. Beginning in the second half of 2007 and continuing throughout 2010, we significantly reduced new investment activity in our company, which was generally limited to a level supported by recycled capital from repayments and asset sales.

For financial information regarding our reportable segments, see Note 20, Segment Reporting, in our accompanying Consolidated Financial Statements for the year ended December 31, 2010.

Real Estate Debt

Overview

Our real estate debt business has historically focused on originating, structuring and acquiring senior and subordinate debt investments secured primarily by commercial and multifamily properties, including first lien mortgage loans, which are also referred to as senior mortgage loans, junior participations in first lien mortgage loans, which are often referred to as B-Notes, second lien mortgage

4

loans, mezzanine loans and preferred equity interests in borrowers who own such properties. We generally hold these instruments for investment, but we sometimes syndicate or sell portions of loans to maximize risk adjusted returns, manage credit exposure and generate liquidity.

We have built a franchise with a reputation for providing capital to high quality real estate investors who want a responsive and flexible balance sheet lender. Given that we are a lender who does not generally seek to sell or syndicate the full amount of the loans we originate, we are able to maintain flexibility in how we structure loans that meet the unique needs of our borrowers. Typical commercial mortgage-backed securities, or CMBS, and other conduit securitization lenders generally could not provide these types of loans because of constraints within their funding structures and because they usually originated loans with the intent to sell them to third parties and relinquish control. Additionally, our centralized investment organization has enabled senior management to review potential new loans early in the origination process which, unlike many large institutional lenders with several levels of approval required to commit to a loan, allowed us to respond quickly and provided a high degree of certainty to our borrowers that we would close a loan on terms substantially similar to those initially proposed. We believe that this level of service has enhanced our reputation in the marketplace. In addition, we believe the early and active role of senior management in our investment process has been key to maximizing recoveries of invested capital from our investments and ability to be responsive to changing market conditions. As of December 31, 2010, our average funded loan size was $18.9 million and we managed 143 separate commercial real estate loans with a carrying value of $1.8 billion.

The collateral underlying our real estate debt investments consists largely of income-producing real estate assets, properties that require some capital investment to increase cash flows, or assets undergoing repositionings or conversions, and may involve vertical construction or unimproved land. We seek to make real estate debt investments that offer the most attractive risk-adjusted returns and evaluate the risk based upon our underwriting criteria, sponsorship and the pricing of comparable investments. We have accessed the asset-backed markets to match-fund our real estate debt investments with non-recourse, term debt liabilities which were structured as collateralized debt obligations ("CDOs"). These CDO transactions are flexible financing structures that have typically permitted us to re-invest proceeds from asset repayments for a five-year period after issuance with no repayment of the term debt, subject to certain criteria; thereafter, the CDO is repaid when the underlying assets pay off. In addition to these CDO financings, we have utilized secured term financings and credit facilities to finance real estate debt investments.

Targeted Investments

Our real estate debt investments typically have many of the following characteristics: (i) terms of two to ten years inclusive of any extension options; (ii) collateral in the form of a first mortgage or a subordinate interest in a first mortgage on real property, a pledge of ownership interests in a real estate owning entity or a preferred equity investment in a real estate owning entity; (iii) investment amounts of $5 million to $100 million; (iv) floating interest rates priced at a spread over LIBOR or fixed interest rates; (v) an interest rate cap or other hedge to protect against interest rate volatility; and (vi) an intercreditor agreement that outlines our rights relative to other investors in the capital structure of the transaction and that typically provides us with a right to cure any defaults to the lender of those tranches senior to us and, under certain circumstances, to purchase senior tranches.

Investment Process for Real Estate Debt

We have employed a standardized investment and underwriting process that focuses on a number of factors in order to ensure each investment is being evaluated appropriately, including: (i) macroeconomic conditions that may influence operating performance; (ii) fundamental analysis of the underlying real estate collateral, including tenant rosters, lease terms, zoning, operating costs and

5

the asset's overall competitive position in its market; (iii) real estate market factors that may influence the economic performance of the collateral; (iv) the operating expertise and financial strength of the sponsor or borrower; (v) real estate and leasing market conditions affecting the asset; (vi) the cash flow in place and projected to be in place over the term of the loan; (vii) the appropriateness of estimated costs associated with rehabilitation or new construction; (viii) a valuation of the property, our investment basis relative to its value and the ability to liquidate an investment through a sale or refinancing of the underlying asset; (ix) review of third-party reports including appraisals, engineering and environmental reports; (x) physical inspections of properties and markets; and (xi) the overall legal structure of the investment and the lenders' rights.

We may originate and structure debt investments directly with borrowers or may acquire loans from third parties. In the past we emphasized direct origination of our debt investments because this allows us a greater degree of control in loan structuring and in potential future loan modification or restructuring negotiations, provides us the opportunity to create subordinate interests in the loan, if desired, that meet our risk-return objectives, allows us to maintain a more direct relationship with our borrowers and provides an opportunity for us to earn origination and other fees. We believe that the continued lack of available debt capital for commercial real estate and sub-par economic conditions may present opportunities to obtain attractive terms from both new directly-originated loans and from pre-existing loans acquired from third-party originators, who may be motivated to sell due to liquidity needs or who are exiting the business.

At December 31, 2010 we held the following real estate debt investments (dollars in thousands):

December 31, 2010

|

Principal Balances |

Carrying Value(1)(2) |

Allocation by Investment Type |

Average Fixed Rate |

Average Spread Over LIBOR(3) |

Average Spread Over Prime |

Number of Investments |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Whole loans, floating rate—LIBOR |

$ | 1,533,352 | $ | 1,042,194 | 56.5 | % | — | % | 2.79 | % | — | % | 71 | ||||||||||

Whole loans—floating rate—prime |

106,279 | 17,417 | 0.9 | % | — | — | 3.32 | % | 3 | ||||||||||||||

Whole loans, fixed rate |

211,565 | 107,419 | 5.8 | % | 5.76 | % | — | — | 27 | ||||||||||||||

Subordinate mortgage interests, floating rate |

220,444 | 143,153 | 7.8 | % | — | 3.06 | % | — | 10 | ||||||||||||||

Subordinate mortgage interests, fixed rate |

74,443 | 46,805 | 2.5 | % | 7.62 | % | — | — | 3 | ||||||||||||||

Mezzanine loans, floating rate |

387,183 | 305,901 | 16.6 | % | — | 2.76 | % | — | 16 | ||||||||||||||

Mezzanine loan, fixed rate |

153,027 | 140,956 | 7.7 | % | 5.65 | % | — | — | 7 | ||||||||||||||

Preferred—Float |

17,444 | 17,444 | 0.9 | % | — | 4.00 | % | — | 1 | ||||||||||||||

Other loans—floating |

11,460 | 11,460 | 0.6 | % | — | 2.50 | % | — | 2 | ||||||||||||||

Other loans—fixed |

12,152 | 12,152 | 0.7 | % | 6.44 | % | — | — | 3 | ||||||||||||||

Total/Weighted average |

$ | 2,727,349 | $ | 1,844,901 | 100.0 | % | 6.05 | % | 2.82 | % | 3.32 | % | 143 | ||||||||||

- (1)

- Approximately $1.7 billion of these investments serve as collateral for the Company's CDO financings, $44.0 million is financed under a borrowing facility and the remainder is unleveraged. The Company has future funding commitments, which are subject to certain conditions that borrowers must meet to qualify for such fundings, totaling $48.5 million related to these investments. The Company expects that a minimum of $45.5 million of these future fundings will be funded within the Company's existing CDO financings and require no additional capital from the Company. Assuming that all loans that have future fundings meet the terms to qualify for such

6

funding, the Company's equity requirement on future funding requirements would be approximately $3.0 million.

- (2)

- Includes

$18.7 million in real estate debt investments, held for sale.

- (3)

- Approximately $525.2 million of the Company's real estate debt investments have a weighted-average LIBOR rate floor of 2.08%

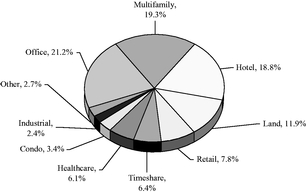

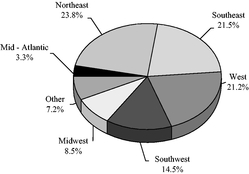

The following charts display our loan portfolio by collateral type and by geographic location:

| Loan Portfolio by Collateral Type | Loans by Geographic Location | |

|

|

Real Estate Securities

Overview

Our real estate securities business has historically invested in, created and managed portfolios of commercial real estate debt securities, which we have financed by raising third-party capital in transactions structured as CDOs. These securities include CMBS, debt obligations of REITs and term debt transactions backed primarily by commercial real estate securities, or CRE CDOs. Substantially all of our securities investments have explicit credit ratings assigned by at least one of the three leading nationally-recognized statistical rating agencies (Moody's Investors Service, Standard & Poor's Ratings Services, Inc. and Fitch Ratings, generally referred to as rating agencies), and were typically rated investment grade at the time of purchase. In addition to these securities, our CDOs may also invest in bank loans to REITs and real estate operating companies, real estate whole loans, or subordinate debt investments such as B-Notes and mezzanine loans.

We seek to mitigate credit risk through credit analysis, subordination and diversification. The CMBS we invest in are generally junior in right of payment of interest and principal to one or more senior classes, but benefit from the support of one or more subordinate classes of securities or other form of credit support within a securitization transaction. The senior unsecured REIT debt securities we invest in carry similar credit ratings and reflect comparable credit risk. Credit risk refers to each individual borrower's ability to make required interest and principal payments on the scheduled due dates. While the expected yield on our securities investments is sensitive to the performance of the underlying assets, the more subordinated securities, in the case of CMBS, and the issuer's underlying equity, in the case of REIT securities, are designed to bear the first risk of default and loss. In addition to diversification by issuer and security within our CDOs, the underlying real estate portfolios represented by each such security are further diversified by number of properties, property type, geographic location, and tenant composition. We further seek to minimize credit risk by monitoring the real estate securities portfolios of our term debt issuances and the underlying credit quality of their holdings.

7

The average rating of our securities investments was B/B2 as of December 31, 2010. In addition, our securities portfolio had an average investment size of approximately $3.4 million as of December 31, 2010.

Our Real Estate Securities Investments

The various types of securities backed by real estate assets that we invest in, including CMBS, fixed income securities issued by REITs and real estate term debt transactions, are described in more detail below.

CMBS. CMBS, or commercial mortgage-backed securities, are securities backed by obligations (including certificates of participation in obligations) that are principally secured by mortgages on real property or interests therein having a multifamily or commercial use and located in the United States. Underlying property types include regional malls, neighborhood shopping centers, office buildings, industrial or warehouse properties, hotels, apartment buildings, self-storage, and healthcare facilities. Loan collateral is held in a trust that issues securities in the form of fixed and floating-rate notes secured by the cash flows from the underlying loans. The securities issued by the trust have varying levels of priority in the allocation of cash flows from the pooled loans and are rated by one or more of the rating agencies. These ratings reflect the risk characteristics of each class of CMBS and range from "AAA" to "C". Any losses realized on defaulted loans are first absorbed by any non-rated classes, with losses then allocated in reverse sequential order to the most junior, lowest-rated bond classes. Typically, all principal received on the loans is allocated first to the most senior outstanding class of bonds and then to the next class in order of seniority.

REIT Fixed Income Securities: Substantially all of our long-term investments in REIT fixed income securities consist of non-amortizing senior unsecured notes issued by equity REITs. REITs own a variety of property types with a large number of companies focused on the office, retail, multifamily, industrial, healthcare and hotel sectors. REIT senior unsecured notes typically incorporate protective financial covenants and have credit ratings issued by one or more rating agencies. We may also invest in junior unsecured debt, preferred equity or common equity of REITs.

Commercial Real Estate CDOs: Commercial real estate term CDOs (also referred to as CRE CDO's) are debt obligations typically collateralized by a combination of CMBS and REIT unsecured debt. CRE CDOs may also include real estate whole loans, B-notes and other asset-backed securities as part of their underlying collateral. These assets are held within a special-purpose vehicle that issues rated liabilities and equity in private securities offerings. We have used the CRE CDO markets to finance a majority of our real estate loans and securities investments.

Underwriting Process for Real Estate Securities

Our underwriting process for real estate securities is focused on evaluating both the real estate risk of the underlying assets and the structural protections available to the particular class of securities in which we are investing. We believe that even when a security such as a CMBS or a REIT bond is backed by a diverse pool of properties, risk cannot be evaluated purely by statistical or quantitative means. Properties backing loans with identical debt service coverage ratios or loan-to-value ratios can have very different risk characteristics depending on their age, location, lease structure and physical condition. Our underwriting process seeks to identify those factors that may lead to an increase or decrease in credit quality over time.

8

When evaluating a CMBS pool backed by a large number of loans, we combine real estate analysis on individual loans with stress testing of the portfolio under various sets of default and loss assumptions. First, we identify a sample of loans in the pool which are subject to individual analysis. This sample typically includes the largest 10 to 15 loans in the pool, as well as loans selected for higher risk characteristics such as low debt service coverage ratios, properties located in weaker markets, or properties that exhibit greater cash flow volatility such as hotels. We also may review a random sample of small to medium sized loans in the pool. The loans in the sample are typically analyzed based on available information including underwriter reports, servicer reports and third- party information providers, as well as any additional market or property level information that we are able to obtain including information that may be available from our other business lines. Each loan in the sample is assigned a risk rating, which affects the default assumption for that loan in our stress test. A loan with the highest risk rating is assumed to default and suffer a loss whereas loans with better risk ratings are assigned a lower probability of default. The stress tests we run allow us to determine whether the bond class in which we are investing would suffer a loss under the stressed assumptions.

REIT securities are evaluated based on the quality, type and location of the property portfolio, the capital structure and financial ratios of the company, and management's track record, operating expertise and strategy. We also evaluate the REIT's debt covenants. Our investment decisions are based on the REIT's ability to withstand financial stress, as well as more subjective criteria related to the quality of management and of the property portfolio.

At December 31, 2010, we held the following real estate securities investments:

December 31, 2010

|

Carrying Value |

Estimated Fair Value |

||||||

|---|---|---|---|---|---|---|---|---|

CMBS |

$ | 2,040,582 | $ | 1,392,099 | ||||

Third party CDO notes |

174,537 | 37,213 | ||||||

REIT debt |

222,112 | 236,958 | ||||||

Trust preferred securities |

34,917 | 24,784 | ||||||

Total |

$ | 2,472,148 | $ | 1,691,054 | ||||

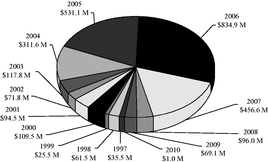

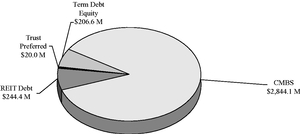

The following charts display our CMBS assets under management by vintage and our on-balance sheet securities assets under management by asset type based on par values.

| CMBS AUM by Vintage | Securities AUM | |

|

|

Core Net Lease

Overview

Our core net lease strategy has historically involved investing primarily in office, industrial and retail properties across the United States that are net leased long term to corporate tenants. Net lease properties are typically leased to a single tenant who agrees to pay basic rent, plus all taxes, insurance,

9

capital and operating expenses arising from the use of the leased property. We may also invest in properties that are leased to tenants for which we are responsible for some of the operating expenses and capital costs. At the end of the lease term, the tenant typically has a right to renew the lease at market rates or to vacate the property with no further ongoing obligation. Accordingly, we target properties that are located in primary or secondary markets with strong demand fundamentals, and that have a property design and location that make them suitable and attractive for alternative tenants.

We believe that the majority of net lease investors who acquire office, industrial and retail properties are primarily focused on assets leased to investment-grade tenants with lease terms of 15 years or longer. In our experience, there is a more limited universe of investors with the real estate and capital markets expertise necessary to underwrite net lease assets with valuations that are more closely linked to real estate fundamentals than to tenant credit.

During 2009 and 2010, we made no new net lease investments because our increased cost of capital relative to prior years continues to make investing in net lease assets uneconomical. Our primary focus in this area during 2010 was to actively manage our existing asset base by focusing on leasing vacant space and working toward tenant renewals. Weak economic conditions are currently causing difficulties in leasing vacant space and in obtaining attractive lease rates from prospective tenants. Based on current capital markets and economic conditions we do not expect new net lease investing to be a material part of our business in the near future.

Healthcare Net Lease

We own and manage a portfolio of healthcare net lease assets, a majority of which are assisted living facilities with the remainder comprised of skilled nursing facilities, a medical campus and a medical office building. We initially entered the healthcare net lease business in 2006 through a joint venture, and in 2009 acquired our partner's interest and hired a senior management team that was formerly employed by our partner who also managed the assets. Our management team has significant experience investing in a wide variety of healthcare properties, ranging from low-acuity assisted living facilities to higher-acuity skilled nursing facilities. We have historically sought out opportunities to acquire individual assets or portfolios of assets from local or regionally-focused owner/operators with established track records and in markets where barriers to entry exist. The assets typically have been purchased from and leased back to private operators under long-term net leases. We believe that our management team that is focused on this sector provides us a competitive advantage because of its extensive relationships in the industry and its knowledge of and experience in operating, owning and lending to healthcare-related assets.

Underwriting Process and Financing for Net Lease Investments

Our core net lease investments were underwritten utilizing our skills in evaluating real estate market and property fundamentals, real estate residual values and tenant credit. At inception and throughout the life of our ownership we conduct detailed tenant credit analyses to assess, among other things, the potential for credit deterioration and lease default risk. This analysis is also employed to measure the adequacy of landlord protection mechanisms incorporated into the underlying lease. Our underwriting process included sub-market and property-level due diligence in order to understand downside investment risks, including quantifying the costs associated with tenant defaults and releasing scenarios. We also evaluated stress scenarios to understand refinancing risk.

Our healthcare net lease investments were underwritten utilizing a comprehensive analysis of the profitability of a targeted business or facility, its cash flow, occupancy, patient and payer mix, financial trends in revenues and expenses, barriers to competition, the need in the market for the type of healthcare services provided by the business or the facility, the strength of the location and the

10

underlying value of the business or the facility, as well as the financial strength and experience of the management team of the business or the facility.

Our core and healthcare net lease investments are principally financed with non-recourse first mortgages having terms approximately matching the term of the underlying leases.

Our Net Lease Investments

At December 31, 2010, we held the following net lease investments (dollars in thousands):

Type of Property

|

Number of Properties |

Carrying Value |

Percentage of Aggregate Carrying Value |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Healthcare |

100 | $ | 581,655 | 59.7 | % | ||||||

Office |

14 | 248,981 | 25.5 | ||||||||

Retail |

11 | 51,402 | 5.3 | ||||||||

Investment in unconsolidated joint venture-office/flex(1) |

3 | 23,191 | 2.4 | ||||||||

Office/Flex |

1 | 29,531 | 3.0 | ||||||||

Distribution center |

1 | 23,127 | 2.4 | ||||||||

Retail/Office |

1 | 3,366 | 0.3 | ||||||||

Real estate owned |

4 | 13,141 | 1.4 | ||||||||

Total(2) |

135 | $ | 974,394 | 100.0 | % | ||||||

- (1)

- Our

investment in the unconsolidated net lease joint venture is $6.2 million.

- (2)

- Includes $13.1 million of operating real estate reclassified to assets of properties held for sale at December 31, 2010.

NRF Capital Markets

NRF Capital Markets, LLC, or NRF Capital Markets, is our wholly-owned subsidiary wholesale broker-dealer located in Denver, CO. NRF Capital Markets was formed in 2009 to distribute equity of our sponsored REITs in the non-traded REIT sector, and is currently raising equity capital for NSREIT. We expect that NRF Capital Markets will in the future assist us in accessing diverse sources of capital for companies that may be sponsored and managed by us, such as for NSREIT and NorthStar Senior Care Trust, Inc.

During 2010, we filed a registration statement on Form S-11for NorthStar Senior Care Trust, Inc., a REIT which will target healthcare property and debt investments. We intend to raise equity for this company in the non-traded REIT market and to use our expertise in the healthcare sector to make investments.

Business Strategy

Our long-term primary objectives are to make real estate-related investments that increase our franchise value, produce attractive risk-adjusted returns and generate predictable cash flow for distribution to our stockholders. The recent global economic recession has required us to focus on preserving capital and managing liquidity. Although the capital markets for commercial real estate performed well during 2010 and banks began to originate new loans for securitization, as a legacy commercial mortgage finance company with assets primarily originated prior to 2008, we cannot currently raise large amounts of corporate equity capital at attractive levels. We are observing continued weak performance levels in our asset base due to poor economic and employment conditions and expect that investors will wait until economic conditions have strengthened before investing more

11

significantly in legacy finance REITs. We believe that we have created a franchise that derives a competitive advantage from the combination of our real estate, credit underwriting and capital markets expertise, which enables us to manage credit risk across our business lines as well as to structure and finance our assets efficiently. We hope that our reputation in the marketplace will enable us to be early in raising corporate capital when market conditions improve. We will also seek to conduct certain new investment activities, where possible, in managed vehicles using equity capital raised primarily from sources other than from our balance sheet, such as in the non-traded REIT sector. During 2010, we began raising capital for non-traded REITs sponsored by us, and believe that our fixed income investment strategy and expertise is unique in that market. If we are successful in raising capital for these managed vehicles, we believe that these structures could provide a higher return on our invested equity capital due to the management and incentive fees that may be generated, and would broaden our sources of capital so that we would be less reliant on the public equity markets to grow our business.

We believe that our complementary core businesses provide us with the following synergies that enhance our competitive position:

Sourcing Investments. CMBS, purchased real estate debt and net leased properties are often sourced from the same originators. In addition, we can offer a single source of financing by purchasing or originating a rated senior interest for our real estate securities portfolio and an unrated junior interest for our real estate debt portfolio.

Credit Analysis. Real estate debt interests are usually marketed to investors prior to the issuance of CMBS backed by rated senior interests secured by the same property. By participating in both sectors, we can utilize our underwriting resources more efficiently and enhance our ability to underwrite the securitized debt.

Flexible Asset-Backed and Secured Term Financing. We believe our experience and reputation as an issuer and manager in the asset-backed debt markets, our credit track record and our relationships with major money-center banks should provide us preferential access to match-funded financing for our real estate securities, real estate debt and net lease investments. Match funded debt capital is currently very difficult to obtain. The asset-backed markets for commercial real estate remain closed for most types of real estate loans and banks and life companies are currently working to deleverage their balance sheets and therefore are not making significant new lending commitments. Our current strategy has been to use our existing flexible financing structures to leverage new investments, or to acquire new investments that generate attractive returns without leverage.

Capital Allocation. Through our participation in these three principal businesses and the fixed income markets generally, we benefit from market information that enables us to make more informed decisions with regard to the relative valuation of financial assets and capital allocation.

Our investment and portfolio management processes are centralized and overseen by our senior management team. We have formal guidelines which require senior management approval for all new investments, and Board approval is required for investments exceeding size and concentration limits. Senior management also reviews and approves portfolio management strategies including loan modification and workout situations.

Financing Strategy

We seek to access a wide range of secured and unsecured debt and public and private equity capital sources to fund our investment activities and asset growth. Since our IPO in 2004, we have completed preferred and common equity offerings raising approximately $1.0 billion of aggregate net proceeds. Additionally, during 2007 and 2008 we issued $252.5 million of unsecured exchangeable

12

senior notes. We have also raised $286.3 million of long-term, subordinated debt capital that is equity-like in nature due to its 30-year term and relatively few covenants.

In the past, we have sought to access diverse short and long-term funding sources that enable us to deliver attractive risk-adjusted returns to our shareholders while match-funding our investments to minimize interest rate and maturity risk. This means we financed assets with debt having like-kind interest rate benchmarks (fixed or floating) and similar maturities. Our real estate debt and securities businesses typically used warehouse and secured credit facilities with major financial institutions to initially fund investments until a sufficient pool of assets was accumulated to efficiently execute a CRE CDO transaction.

In a CDO financing, rated bonds are issued and backed by pools of securities or loan collateral originated or acquired by us. The bonds are non-recourse and the interest income from the collateral is used to service the interest cost on the rated bonds. After a reinvestment period, which is typically five years, principal from collateral payoffs is used to amortize the notes, so there is no maturity risk. We typically have sold all of the investment-grade rated CDO bonds, and retain the non-investment grade classes as our "equity" interest in the financing. CDO financings provided low cost financing because the most senior bond classes were rated "AAA/Aaa" by the rating agencies at the time of issuance.

Net lease investments are generally match-funded with non-recourse first mortgage debt representing approximately 75% to 80% of the total value of the investment. We seek to match the term of the financing with the remaining lease term.

During 2010, the CMBS new issue market began to recover, with approximately $10 billion of issuance. Many experts expect at least $30-$40 billion of new CMBS issuance for 2011. These levels are well below the over $200 billion issued in each of 2006 and 2007, but are comparable to the $26-$77 billion of annual issuance experienced between 1996 and 2003. There have not yet been any new CRE CDO financings, but the corporate collateralized loan (CLO) market, which has a similar structure to CRE CDOs, is issuing new financings. We believe the real estate securitization markets are in the early stages of recovery, and will again provide attractive match-funded debt capital. We believe that our credit track record and reputation with bank lenders and the securitization markets could enable us to be an early user of this capital if it becomes available for independent finance companies like us.

Hedging Strategy

We use derivatives primarily to manage interest rate risk exposure. These derivatives are typically in the form of interest rate swap agreements and the primary objective is to minimize the interest rate risks associated with our investing and financing activities. The counterparties to these arrangements are major financial institutions with which we may also have other financial relationships.

Creating an effective strategy for dealing with interest rate movements is complex and no strategy can completely insulate us from risks associated with such fluctuations. There can be no assurance that our hedging activities will have the intended impact on our results. A more detailed discussion of our hedging policy is provided in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources."

Portfolio Management

We actively monitor collateral and property-level performance of our asset base through our portfolio management group which is closely supervised by our senior executive team. All major portfolio management strategies and tactics are developed using the extensive experience of our senior executives and a majority of our employees are dedicated to portfolio management activities.

13

For commercial real estate loans, we typically have a contractual right to regularly receive updated information from our borrowers such as budgets, operating statements, rent rolls, major tenant lease signings, renewals, expirations and modifications. We also monitor for changes in property management, borrower's and sponsor's financial condition, timing and funding of distributions from reserves and capital accounts or future funding draws, real estate market conditions, sales of comparable and competitive properties, occupancy and asking rents at competitive properties and financial performance of major tenants. When a borrower cannot comply with its requirements according to the loan terms, we generally have a range of strategies to choose from, including foreclosing on the collateral in order to sell it, extending the final maturity date in return for a paydown and/or a fee, changing the interest rate or making any other modification to the loan terms which we believe maximizes long-term value and preserves capital.

We closely monitor our securities investments by using sophisticated third- party applications that are designed to screen for performance issues in the loan collateral underlying the securities. We also utilize our capital markets expertise to seek opportunities to sell securities investments which we believe the market is valuing too highly relative to the underlying risk.

We closely monitor our net lease assets to ensure, among other things, the tenants are complying with the terms of their respective leases, and seek to enter into renewal discussions with tenants well in advance of lease expirations. We also physically inspect these assets regularly so that we can ensure that the tenants are maintaining the assets as required.

Poor economic conditions have negatively impacted commercial real estate cash flows and valuations. During 2010, debt and equity capital began returning to the real estate markets, especially in supply-constrained urban areas such as New York City, Washington, DC and Boston, MA, and to asset types expected to benefit most immediately from an economic recovery, such as hotels and apartments. Although investors and lenders appear more confident in a few select markets, many of our assets are continuing to experience stress and have not benefited from the early signs of recovery in real estate. We expect a broader improvement in real estate conditions during 2011, but also anticipate that credit management will remain challenging.

As of March 2011, we will be added to Standard and Poor's Select Service list as an approved special servicer. This designation provides us with the ability to provide asset management services to CMBS securitizations rated by S&P relating to troubled or defaulted mortgages underlying the securitization.

Regulation

We are subject, in certain instances, to supervision and regulation by state and federal governmental authorities and may be subject to various laws and judicial and administrative decisions imposing various requirements and restrictions, which, among other things: (1) regulate credit granting activities; (2) establish maximum interest rates, finance charges and other fees we can charge our customers; (3) require disclosures to customers; (4) govern secured transactions; and (5) set collection, foreclosure, repossession and claims-handling procedures and other trade practices. Although most states do not regulate commercial finance, certain states impose limitations on interest rates and other charges and on certain collection practices and creditor remedies and require licensing of lenders and financiers and adequate disclosure of certain contract terms. We are also required to comply with certain provisions of the Equal Credit Opportunity Act that are applicable to commercial real estate loans.

We believe that we are not, and intend to conduct our operations so as not to become regulated as an investment company under the Investment Company Act of 1940, as amended, or the Investment Company Act. We have been, and intend to continue to rely on current interpretations of the staff of the Securities and Exchange Commission, or the SEC, in an effort to continue to qualify for an

14

exemption from registration under the Investment Company Act. For more information on the exemptions that we utilize, see "Item 1A—Risk Factors—Maintenance of our Investment Company Act exemption imposes limits on our operations."

Certain of our subsidiaries may apply to be registered investment advisors under the Investment Advisors Act of 1940, or the Investment Advisors Act, and, as such, may also be supervised by the SEC. The Investment Advisors Act requires registered investment advisors to comply with numerous obligations, including record-keeping requirements, operational procedures and disclosure obligations. Such subsidiaries may also be registered with various states and thus, subject to the oversight and regulation of such states' regulatory agencies. The regulatory environment in which investment advisors operate changes frequently and regulations have increased significantly in recent years. We may be adversely affected as a result of new or revised legislation or regulations or by changes in the interpretation or enforcement of existing laws and regulations.

We have elected and expect to continue to make an election to be taxed as a REIT under Section 856 through 860 of the Internal Revenue Code of 1986, as amended, or the Code. As a REIT, we must currently distribute, at a minimum, an amount equal to 90% of our taxable income. In addition, we must distribute 100% of our taxable income to avoid paying corporate federal income taxes. REITs are also subject to a number of organizational and operational requirements in order to elect and maintain REIT status. These requirements include specific share ownership tests and assets and gross income composition tests. If we fail to qualify as a REIT in any taxable year, we will be subject to federal income tax (including any applicable alternative minimum tax) on our taxable income at regular corporate tax rates. Even if we qualify for taxation as a REIT, we may be subject to state and local income taxes and to federal income tax and excise tax on our undistributed income.

On April 20, 2010, NRF Capital Markets became registered with the SEC and a member of the Financial Industry Regulatory Authority, or FINRA. Much of the regulation of broker-dealers has been delegated to self-regulatory organizations, or SROs, principally FINRA, that adopt and amend rules, subject to approval by the SEC, which govern their members and conduct periodic examinations of member firms' operations. The SEC, SROs and state securities commissions may conduct administrative proceedings that can result in censure, fine, suspension or expulsion of a broker-dealer, its officers or employees. Such administrative proceedings, whether or not resulting in adverse findings, can require substantial expenditures and can have an adverse impact on the reputation of a broker-dealer.

As a registered broker-dealer, NRF Capital Markets is required by federal law to be a member of the Securities Investor Protection Corporation, or SIPC. When the SIPC fund falls below a certain amount, members are required to pay annual assessments to replenish the reserves. In anticipation of inadequate SIPC fund levels during the current economic environment, our broker-dealer subsidiary will be required to pay 0.25% of net operating revenues as a special assessment. As of December 31, 2010, we have incurred an immaterial amount of special assessment charges. The SIPC fund provides protection for securities held in customer accounts up to $500,000 per customer, with a limitation of $100,000 on claims for cash balances.

In addition, as a registered broker-dealer and member of FINRA, NRF Capital Markets is subject to the SEC's Uniform Net Capital Rule 15c3-1, which is designed to measure the general financial integrity and liquidity of a broker-dealer and requires the maintenance of minimum net capital. Net capital is defined as the net worth of a broker-dealer subject to certain adjustments. In computing net capital, various adjustments are made to net worth that exclude assets not readily convertible into cash. Additionally, the regulations require that certain assets, such as a broker-dealer's position in securities, be valued in a conservative manner so as to avoid over-inflation of the broker-dealer's net capital.

The U.S. Government, Federal Reserve, U.S. Treasury, Federal Deposit Insurance Corporation, Securities and Exchange Commission and other governmental and regulatory bodies have taken or are

15

considering taking actions in response to the recent financial crisis. We are unable to predict whether or when such actions may occur or what impact, if any, such actions could have on our business, results of operations and financial condition. In July 2010, the Dodd Frank Wall Street Reform and Consumer Protection Act, or Dodd-Frank, was passed by the U.S. Congress and signed into law. Certain aspects of Dodd-Frank provide strengthened regulations for business activities we are engaged in. For example, Dodd-Frank contains laws affecting the securitization of mortgages with requirements for risk retention by originators and/or sponsors of mortgage securitization and laws affecting credit rating agencies. We are unable to predict at this time how this legislation, as well as other laws that may be adopted in the future, will impact the environment for financing and investing for CMBS and/or mortgage loans, the securitization industry, interest rate swaps and other derivatives as much of the Dodd-Frank's implementation will likely require numerous implementing regulations and other rulemaking by government regulators. However, at minimum, we believe that Dodd-Frank and the regulations to be promulgated thereunder are likely to increase the economic and compliance costs for participants in the mortgage and securitization industries, including us.

In the judgment of management, existing statutes and regulations have not had a material adverse effect on our business. However, it is not possible to forecast the nature of future legislation, regulations, judicial decisions, orders or interpretations, nor their impact upon our future business, financial condition, results of operations or prospects.

Competition

We have in the past been subject to significant competition in seeking real estate investments. Historically, we have competed with many third parties engaged in real estate investment activities including other REITs, specialty finance companies, savings and loan associations, banks, mortgage bankers, insurance companies, mutual funds, private institutional funds, hedge funds, private opportunity funds, investment banking firms, CMBS lenders, governmental bodies and other entities. In addition, there are other REITs with asset investment objectives similar to ours and others may be organized in the future, and in 2009 three commercial finance REITs with strategies similar to ours went public. Some of these competitors, including larger REITs and the recently-public REITs with no legacy asset issues, have substantially greater financial resources than we do and generally may be able to accept more risk. They may also enjoy significant competitive advantages that result from, among other things, a lower cost of capital and enhanced operating efficiencies.

Additionally, future competition from new market entrants may limit the number of suitable investment opportunities offered to us. It may also result in higher prices, lower yields and a narrower spread of yields over our borrowing costs, making it more difficult for us to acquire new investments on attractive terms.

Employees

As of December 31, 2010, NorthStar had 91 employees. Management believes that a major strength of NorthStar is the quality and dedication of our people. We strive to maintain a work environment that fosters professionalism, excellence, diversity and cooperation among our employees.

Corporate Governance and Internet Address

We emphasize the importance of professional business conduct and ethics through our corporate governance initiatives. Our Board of Directors consists of a majority of independent directors; the audit, nominating and corporate governance, and compensation committees of our Board of Directors are composed exclusively of independent directors. We have adopted corporate governance guidelines and a code of business conduct and ethics, which delineate our standards for our officers, directors and employees.

16

Our internet address is www.nrfc.com. The information on our website is not incorporated by reference in this Annual Report on Form 10-K. We make available, free of charge through a link on our site, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to such reports, if any, as filed with the SEC, as soon as reasonably practicable after such filing. Our site also contains our code of business conduct and ethics, code of ethics for senior financial officers, corporate governance guidelines, and the charters of our audit committee, nominating and corporate governance committee and compensation committee of our Board of Directors. Within the time period required by the rules of the SEC and the New York Stock Exchange, or NYSE, we will post on our website any amendment to our code of business conduct and ethics and our code of ethics for senior financial officers as defined in the code.

Our business is subject to a number of risks that are substantial and inherent in our business. This section describes some of the more important risks that we face, any of which could have a material adverse effect on our business, financial condition, results of operations and future prospects. The risk factors set forth in this section could cause our actual results to differ significantly from those contained in this Annual Report on Form 10-K. In connection with the forward-looking statements that appear in this Annual Report on Form 10-K, you should carefully review the factors discussed below and the cautionary statements referred to under "Forward-Looking Statements."

Risks Related to Our Businesses

The commercial real estate finance industry has been and may continue to be adversely affected by conditions in the global financial markets and economic conditions in the U.S. generally.

The U.S. economy is continuing to experience high unemployment and low economic growth compared to historical periods. These conditions were precipitated by the collapse of the U.S. residential real estate sector in 2007, and continue to have a negative impact on commercial real estate fundamentals. During 2010, liquidity began to return to commercial real estate debt and equity markets despite these poor economic conditions; however, many investors remain cautious in providing capital to legacy commercial real estate finance companies, like us, until the economic outlook becomes clearer. Although we are hopeful that the financial markets will continue to improve, a worsening of these conditions would likely exacerbate any adverse effects the market environment may have on us, on others in the commercial real estate finance industry and on commercial real estate generally.

Liquidity is essential to our businesses and we rely on outside sources of capital that have been severely impacted by the recent economic recession.

We require significant outside capital to fund our businesses. A primary source of liquidity for us has been the equity and debt capital markets, including issuances of common equity, preferred equity, trust preferred securities and convertible senior notes. When the subprime residential lending and single family housing market collapse quickly spread broadly into the capital markets, our business was adversely affected, including due to the lack of access to capital and prohibitively high costs of obtaining capital. Since 2008, most of our new investment activities have been funded using proceeds from repayments and sales of investments within our portfolio. Although investor interest in real estate improved during 2010, we do not know whether any sources of capital will be available to us in the future on terms that are acceptable to us, if at all. If we cannot obtain sufficient capital on acceptable terms, our business and our ability to operate will be severely impacted. For information about our available sources of funds, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources" and the notes to the consolidated financial statements in this Annual Report on Form 10-K.

17

We also depend on external sources of capital because the Internal Revenue Code of 1986, as amended, requires that a REIT distribute 90% of its taxable income to its shareholders, including taxable income where we do not receive corresponding cash. We intend to distribute all or substantially all of our REIT taxable income in order to comply with the REIT distribution requirements of the Code.

Our exchangeable senior notes are recourse obligations to us.

As of December 31, 2010, the amount outstanding under our exchangeable senior notes was $128.9 million. These amounts are full recourse obligations of the company. If we are not able to extend, refinance or repurchase the indebtedness, we may not have the ability to repay these amounts when they come due. Our inability to repay any of our exchangeable senior notes could cause the acceleration of the indebtedness, which would have a material adverse effect on our business.

Our exchangeable senior notes contain cross- acceleration provisions.

Our indentures governing our exchangeable senior notes contain cross-acceleration provisions whereby a default under one agreement could result in a default and acceleration of indebtedness under other agreements. If a cross-acceleration were to occur, we may not be able to pay our debts or access capital from external sources in order to refinance our debts. If some or all of our debt obligations default and it causes a default under other indebtedness, our business, financial condition and results of operations could be materially and adversely affected.

Our CDOs have certain coverage tests that are required to be met in order for payments to be made to our subordinate bonds and equity notes. Failing coverage tests could significantly impact our cash flow and overall liquidity position.

Our CDOs generally require that the underlying collateral and cash flow generated by the collateral to be in excess of ratios stipulated in the related indentures. These ratios are called overcollateralization, or OC, and interest coverage, or IC, tests and are used primarily to determine whether and to what extent principal and interest proceeds on the underlying collateral debt securities and other assets may be used to pay principal of, and interest on, the subordinate classes of bonds in the CDOs. Uncured defaults on commercial real estate loans and rating agency downgrades on commercial real estate securities are the primary causes for decreases in the OC and IC ratios. In the event these tests are not met, cash that would normally be distributed to us would be used to amortize the senior notes until the financing is back in compliance with the tests. Additionally, we may elect to buy assets out of our CDOs in order to preserve cash flow, which could have a significant impact on our liquidity. As of December 31, 2010 we were in compliance with all of the OC and IC tests in our CDOs, except for N-Star Real Estate CDO II and the CSE RE 2006-A CDO. Nonetheless, we expect that weak economic conditions, lack of capital for "legacy" commercial real estate and credit ratings downgrades of real estate securities will make complying with OC and IC tests more difficult in the future. Our failure to satisfy the coverage tests could adversely affect our operating results, liquidity and cash flows.

The reinvestment period for certain of our CDOs will expire in 2011.

The reinvestment periods, which allow us to reinvest principal payments on the underlying assets into qualifying replacement collateral, for our N-Star Real Estate CDO VI and N-Star Real Estate CDO VII, will each expire in June 2011. The CDO notes have a stated maturity in June 2041 and June 2051, respectively, although the actual life of the notes are expected to be substantially shorter. The reinvestment periods have already expired for our N-Star Real Estate CDO I and N-Star Real Estate CDO II, in 2003 and 2004, respectively, and for our N-Star Real Estate CDO III, N-Star REL CDO IV and N-Star Real Estate CDO V, in 2010. Since we will be unable to reinvest principal in these

18

CDOs, principal repayments will pay down the senior-most notes, which will de-lever the CDO and negatively impact our return on equity. Additionally, our ability to reinvest has been important in maintaining OC and IC ratios. Following the conclusion of the reinvestment period in a CDO, our ability to maintain the OC and IC ratios will be negatively impacted.

We retain the subordinate classes of bonds and equity notes in the CDOs that we have issued, which entails certain risks, including that subordinate classes of bonds and equity notes in the CDOs receive distributions only if the CDO generates enough income to pay all of the other bond classes.

The subordinate classes of bonds and equity notes that we retain in the CDOs that we have issued represent leveraged investments in the underlying assets. Various classes of securities participate in the income stream in CDOs and distributions on subordinate classes of bonds and equity notes are generally made only after payment of interest on, and principal of, the senior bond classes. Although generally there is no interest or principal due on the equity notes, distributions may be made to holders of the subordinate classes of bonds and equity notes on each payment date after all of the other required payments are made on each payment date. There will be little or no income available to the subordinate classes of bonds and equity notes if there are defaults by the obligors under the underlying collateral and those defaults exceed a certain amount. In that event, the value of our investment in the CDO could decrease quickly and substantially. There can be no assurance that after making required payments on the senior bond classes there will be any remaining funds available to pay us. Accordingly, our subordinate classes of bonds and equity notes may not be paid in full and we may be subject to a loss of all of our interest in the event that payments are not made on the underlying assets or losses are incurred with respect to the underlying assets, which could have a material adverse effect on us.

A payment default on bonds underlying one of our CDOs could have a compounding effect on our other CDOs.

Certain of our CDOs have invested in bonds issued by other CDOs that we created and manage. Such investments expose us to increased risk, as potential defaults in any particular CDO would also affect other CDOs that own bonds in the CDO that experiences defaults. Defaults across certain of our CDOs could, therefore, have a material impact on the cash flow of other CDOs that we own that may not have otherwise had such an impact.

We are unable to complete additional CDOs due to the collapse of the credit markets.

We historically accessed the asset-backed markets to match-fund our real estate debt investments with non-recourse, term debt liabilities which were structured as CDOs. When the subprime residential lending and single family housing market collapse quickly spread broadly into the capital markets in 2007, the resulting investor concerns surrounding the real estate markets and the asset-backed markets generally, among other things, left no liquidity available through the issuance of new CDOs. Although the general economic condition began to improve during 2010, there has been no successful CDO financing since the collapse of the credit markets in 2007. Issuing CDOs was a critical part of our overall business plan and we currently believe that CDOs will not be available for the foreseeable future, if ever.

The documentation governing our CDOs is complex.

The operation of each of our CDOs is governed by an indenture, collateral management agreement and other documentation. The documents are complex and collectively describe the conditions upon which we can sell assets and reinvest principal proceeds and set forth covenants and other provisions to which we and the CDOs are subject. As described above, our ability to sell certain assets and reinvest proceeds is instrumental in maintaining the IC and OC ratios. In certain circumstances the performance of the underlying CDO collateral has raised ambiguities in both our and

19

other CDO documentation. Although we have as a general matter been able to reach agreement with our CDO trustees as to how the CDO documentation should be interpreted, it is possible that we and our CDO trustees may not be able to reach agreement on important CDO documentation provisions in the future. To the extent we and our CDO trustees are unable to resolve any differences in CDO documentation interpretation, or third parties do not agree with conclusions that are reached by us and/or the CDO trustees, our ability to manage the underlying collateral, and thus maintain the IC and OC ratios and otherwise optimize the performance of the CDOs, may be adversely affected.

Continued disruptions in the financial markets and difficult economic conditions could adversely affect the values of investments we made.

Weakened U.S. macroeconomic conditions combined with the recent turmoil in the capital markets, and constrained equity and debt capital available for investment in commercial real estate, have resulted in fewer buyers seeking to acquire commercial properties compared to historic levels. Additionally, these buyers are requiring greater returns and are ascribing lower valuations for commercial real estate properties. Furthermore, difficult economic conditions have, and may in the future, negatively impact commercial real estate fundamentals, which could have adverse effects on the collateral securing our commercial real estate loans.

Adverse economic conditions could significantly reduce the amount of income we earn on our commercial real estate loans.

Adverse economic conditions have caused us to experience an increase in the number of commercial real estate loans that could result in loan delinquencies, foreclosures and nonperforming assets and a decrease in the value of the property or other collateral which secures our commercial real estate loans, all of which could adversely affect our results of operations. Loan defaults result in a decrease in interest income and may require the establishment of, or an increase in, loan loss reserves. The decrease in interest income resulting from a loan default or defaults may be for a prolonged period of time as we seek to recover, primarily through legal proceedings, the outstanding principal balance, accrued interest and default interest due on a defaulted commercial real estate loan, plus the legal costs incurred in pursuing our legal remedies. Legal proceedings, which may include foreclosure actions and bankruptcy proceedings, are expensive and time consuming. The decrease in interest income, and the costs involved in pursuing our legal remedies will reduce the amount of cash available to meet our expenses and adversely impact our liquidity and operating results.

Loan restructurings may reduce our net interest income.

As a result of the adverse economic conditions and difficult conditions that we experienced in the commercial real estate market, we continue to restructure loans. In order to preserve long-term value, we are often required to lower the interest rate on our loans in connection with a restructuring, which ultimately reduces our net interest income. Although the commercial mortgage-backed securities markets are beginning to recover, we expect loan restructurings where we reduce interest rates to continue, which will have an adverse impact on our net interest margin.

Our borrowers were unable to achieve their business plans due to the difficult economic environment and strain on commercial real estate, which has caused stress in our commercial real estate loan portfolio.

Many of our commercial real estate loans were made to borrowers who had business plans to improve occupancy and cash flows that have not been accomplished due to the economic recession. The economic recession created a number of obstacles to borrowers attempting to achieve their business plans, including lower occupancy rates and lower lease rates across all property types, which continues to be exacerbated by high unemployment and overall financial uncertainty. If borrowers are

20

unable to achieve their business plans, the related commercial real estate loans could go into default and severely impact our operating results and cash flows.

Many of our commercial real estate loans are funded with interest reserves and our borrowers may be unable to replenish those interest reserves once they run out.

Given the transitional nature of many of our commercial real estate loans, we required borrowers to pre-fund reserves to cover interest and operating expenses until the property cash flows were projected to increase sufficiently to cover debt service costs. We also generally required the borrower to replenish reserves if they became deficient due to underperformance or if the borrower wanted to exercise extension options under the loan. Despite low interest rates, revenues on the properties underlying commercial real estate loans decreased in the recent economic environment, which made it more difficult for borrowers to meet their payment obligations to us. In fact, many of our borrowers only met their obligations to us because of the reserves we set up at the outset of our loans. We expect that in the future many of the reserves will run out and some of our borrowers will have difficulty servicing our debt and will not have sufficient capital to replenish reserves, which could have a significant impact on our operating results and cash flow.

Our mortgage loans, mezzanine loans, participation interests in mortgage and mezzanine loans, real estate securities and preferred equity investments have been and may continue to be adversely affected by widening credit spreads.

Our investments in commercial real estate loans and real estate securities are subject to changes in credit spreads. When credit spreads widen, which was the case in 2008 and early 2009, the economic value of existing loans decreases. Although credit spreads decreased in 2010, if a lender were to originate a loan today, such loan would likely still carry a greater credit spread than that attributable to many of the loans that we originated. Even though a loan may be performing in accordance with its loan agreement and the underlying collateral has not changed, the economic value of the loan may be negatively impacted by the incremental interest foregone from the widened credit spread. Although credit spreads tightened in 2010 and into early 2011, the economic value of our commercial real estate loan portfolio and our real estate securities portfolio has been significantly impacted by credit spread widening.

Loan repayments are unlikely in the current market environment.

In the past, a source of liquidity for us was the voluntary repayment of loans. Because the CMBS market has just recently begun to recover and traditional commercial real estate lenders severely curtailed their lending between mid-2007 and 2009, resulting in a severe shortage of debt capital for real estate investors and those needing to refinance maturing loans, real estate owners are having difficulty refinancing their assets at maturity. If borrowers are not able to refinance loans at their maturity, the loans could go into default and the liquidity that we would receive from such repayments will not be available. Furthermore, without a functioning commercial real estate finance market, borrowers that are performing on their loans will almost certainly extend such loans if they have that right, which will further delay our ability to access liquidity through repayments.

Higher loan loss reserves are expected if economic conditions do not improve significantly.

If the U.S. economy does not improve significantly, we will likely continue to experience significant loan loss provisions, defaults and asset impairment charges in 2011. Borrowers may also be less able to pay principal and interest on loans if the economy does not continue to strengthen and they continue to experience financial stress. Declines in real property values also increased loan-to-value ratios on our loans and, therefore, weakened our collateral coverage and increased the likelihood of higher loan loss

21

provisions. A continuing period of increased defaults and foreclosures would adversely affect our interest income, financial condition, business prospects and our cash flows.

Loan loss reserves are difficult to estimate in a turbulent economic environment.

Our loan loss reserves are evaluated on a quarterly basis. Our determination of loan loss reserves requires us to make certain estimates and judgments, which have been, and may continue to be, difficult to determine in turbulent economic conditions. While the overall economy has seen some signs of growth, our estimates and judgments are based on a number of factors, including projected cash flows from the collateral securing our commercial real estate loans, loan structure, including the availability of reserves and recourse guarantees, likelihood of repayment in full at the maturity of a loan, potential for refinancing and expected market discount rates for varying property types, which remain uncertain. Our estimates and judgments may not be correct and, therefore, our results of operations and financial condition could be severely impacted.