Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BEL FUSE INC /NJ | bel8-k.htm |

| EX-99.1 - PRESS RELEASE - BEL FUSE INC /NJ | ex99-1.htm |

Exhibit 99.1

January 13, 2015 Needham Growth Conference

Safe Harbor Statement Confidential Bel Fuse, Inc. * Except for historical information contained in this presentation, the matters discussed in this presentation (including the statements regarding the impact of the Company's expertise and products on customer purchasing decisions, anticipated growth in revenues, the accretive nature and projected cost savings associated with the Power Solutions and CS acquisitions and potential future growth for the Company's shareholders) are forward-looking statements that involve risks and uncertainties. Actual results could differ materially from Bel's projections. Among the factors that could cause actual results to differ materially from such statements are: the market concerns facing our customers; the continuing viability of sectors that rely on our products; the effects of business and economic conditions; difficulties associated with integrating recently acquired companies; capacity and supply constraints or difficulties; product development, commercialization or technological difficulties; the regulatory and trade environment; risks associated with foreign currencies; uncertainties associated with legal proceedings; the market's acceptance of the Company's new products and competitive responses to those new products; and the risk factors detailed from time to time in the Company's SEC reports. In light of the risks and uncertainties, there can be no assurance that any forward-looking statement will in fact prove to be correct. We undertake no obligation to update or revise any forward looking statements. POWER | PROTECT | CONNECT

Bel Attendees Confidential Bel Fuse, Inc. * POWER | PROTECT | CONNECT Presenter Background Daniel Bernstein*President & CEO President of Bel since 1992 and CEO since May 2001On the Board of Directors since 1986Held a variety of positions with Bel, including Vice President, Treasurer and Managing Director of the Company’s Macau subsidiaryMBA from Baruch College Colin Dunn*VP, Finance & Secretary Vice President of Finance since 1992 and Secretary since May 2003Finance Manager since 1991, after previously serving as a Director of Bel Fuse Ltd. and Bel Fuse Macau LDAVice President of Finance and Operations - Kentek Information Systems from 1985-1991MBA degree from Yale University Dennis AckermanVP, Operations President of Bel Power Solutions since 2014Vice President of Operations since 2001Served in a variety of operational, sales and purchasing roles after joining Bel in 1986MBA degree from Fairleigh Dickinson University Avi Eden Bel Director Independent consultant for Business Development Matters, including mergers and acquisitionsRetired Vice Chairman and Executive Vice President of Vishay Intertechnology Inc. 1996-2003.

Investment Highlights Confidential Bel Fuse, Inc. * Demonstrated history of stable revenue growth and EBITDA Demonstrated history of stable revenue growth and EBITDA Strong track record of cash flow generation Strong track record of cash flow generation Consistent performance driven by:Diverse group of customersStable end marketsSuccessful integration of acquisitionsStable management team Consistent performance driven by:Diverse group of customersStable end marketsSuccessful integration of acquisitionsStable management team POWER | PROTECT | CONNECT

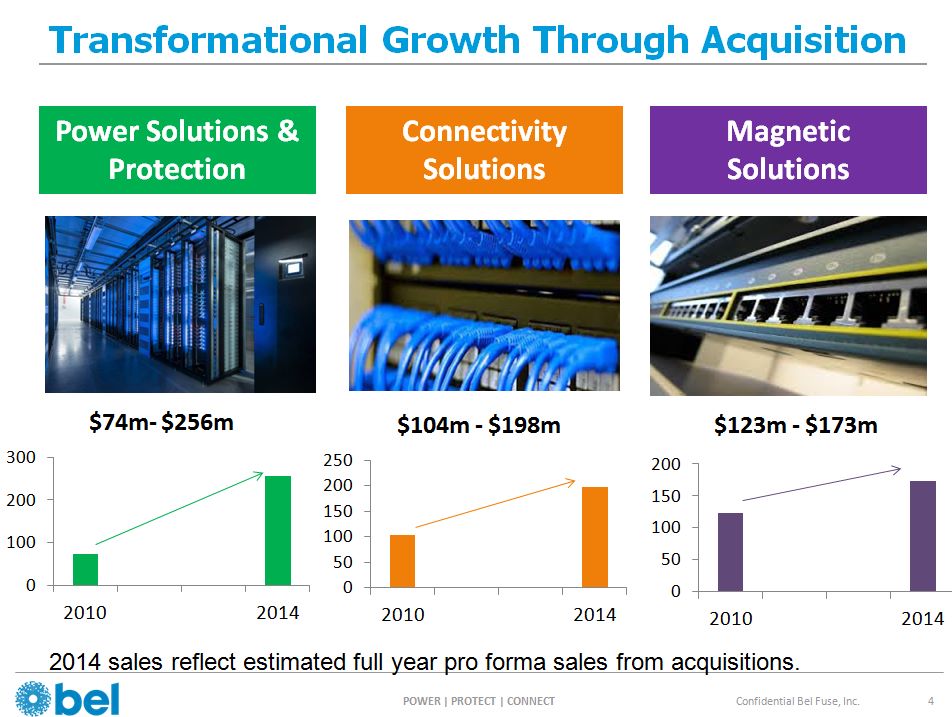

Transformational Growth Through Acquisition Confidential Bel Fuse, Inc. * POWER | PROTECT | CONNECT 2014 sales reflect estimated full year pro forma sales from acquisitions.

Pursue Highly Strategic Acquisitions Confidential Bel Fuse, Inc. * POWER | PROTECT | CONNECT Proven, disciplined approach to acquiring companies -Accretive to earnings (EPS) -Leverage our fixed costs -Expand our global footprint -Focus on products and markets that we know Acquisition Rationale and understand 8 successful acquisitions in the last five years. Four were divestitures from billion dollar conglomerates.

Growth through Acquisition Confidential Bel Fuse, Inc. * Acquired Company Year Products Revenue Purchase Emerson Network Power Connectivity Solutions* 2014 Connectivity $78M $98M ABB/Power-One Power Solutions* 2014 Power $194M $117M TE’s Coil Wound Magnetics Business* 2013 Magnetics $75M $22.4M Array Connector 2013 Connectivity $10M $10M GigaCom Interconnect 2012 Connectivity $2M $2.7M Fibreco Limited 2012 Connectivity $7M $13.7M Powerbox Italia S.R.I. 2012 Power $4M $3M Cinch Connectors* 2010 Connectivity $52M $37.5M Galaxy Power 2005 Power $18M $18M Insilco Passive Components Group* 2003 Magnetics $70M $35M APC UK 2003 Power $5M $5.5M E-Power/Current Concepts 2001 Power $3M $6.2M Lucent Transformers + Inductor Group* 1998 Magnetics $35M $30M POWER | PROTECT | CONNECT

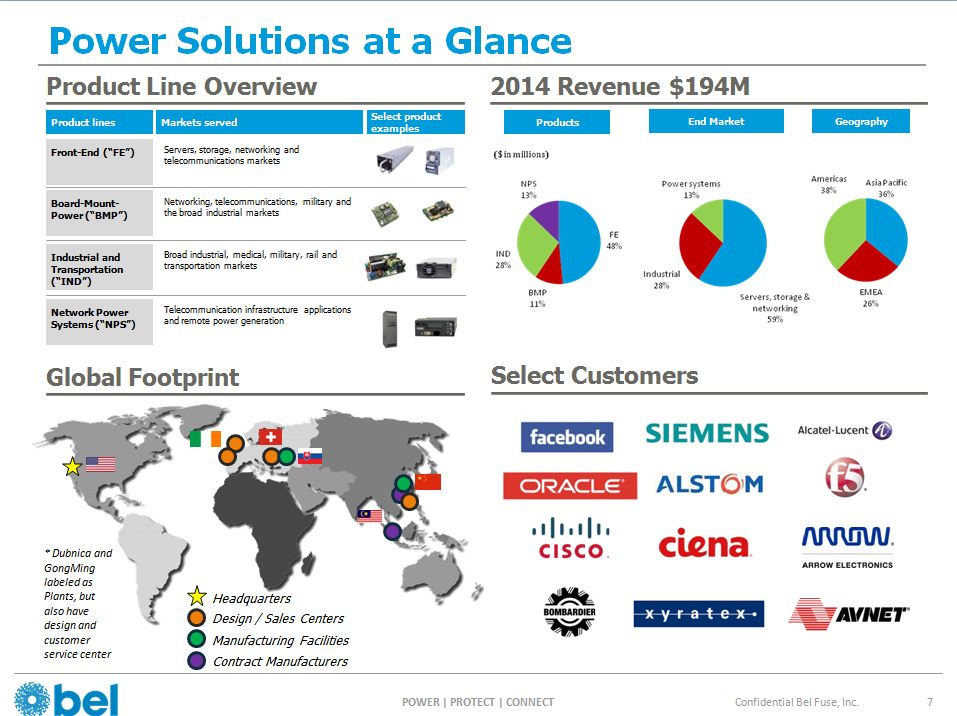

Power Solutions at a Glance Product Line Overview Select Customers * Dubnica and GongMing labeled as Plants, but also have design and customer service center Headquarters Global Footprint Design / Sales Centers Manufacturing Facilities Contract Manufacturers 2014 Revenue $194M Product lines Markets served Select product examples Front-End (“FE”) Board-Mount-Power (“BMP”) Industrial and Transportation (“IND”) Network Power Systems (“NPS”) Servers, storage, networking and telecommunications markets Networking, telecommunications, military and the broad industrial markets Broad industrial, medical, military, rail and transportation markets Telecommunication infrastructure applications and remote power generation Confidential Bel Fuse, Inc. * POWER | PROTECT | CONNECT Products End Market Geography

Connectivity Solutions at a Glance Product Line Overview Select Customers Global Footprint 2014 Revenue $78M Product lines Markets served Select product examples RF Coax Connectors & Cables Microwave Components Harsh Environment Optical with Expanded Beam Aerospace , Broadcast, Military, Telecommunications Military, Space, Laboratory Testing Broadcast, Military, Oil & Gas Headquarters Sales Centers Manufacturing Facilities Confidential Bel Fuse, Inc. * POWER | PROTECT | CONNECT Products End Market Geography

Leverage our Fixed Cost Confidential Bel Fuse, Inc. * Restructure management $5.8MUtilized existing Bel management and existing middle level management to restructure senior leadership. Restructure management $5.8MUtilized existing Bel management and existing middle level management to restructure senior leadership. Eliminate redundancies $2.7MReduced headcounts in areas where Bel, with a combination of the two acquisitions, overlapped in certain functions such as web site development, marketing, sales, product management, and logistics. Eliminate redundancies $2.7MReduced headcounts in areas where Bel, with a combination of the two acquisitions, overlapped in certain functions such as web site development, marketing, sales, product management, and logistics. Combine facilities (estimated to be $1.5M by 2016)Closed Singapore and Russia office of Power-OneClosing Gothenburg Sweden office of GigacomCombining Fibreco UK into Connectivity Solutions UK facilityCombining Bel Pleasanton, CA location with Bel Power San Jose, CA facilityPlan to combine Cinch Lombard, IL facility with Bannockburn, IL facility Combine facilities (estimated to be $1.5M by 2016)Closed Singapore and Russia office of Power-OneClosing Gothenburg Sweden office of GigacomCombining Fibreco UK into Connectivity Solutions UK facilityCombining Bel Pleasanton, CA location with Bel Power San Jose, CA facilityPlan to combine Cinch Lombard, IL facility with Bannockburn, IL facility POWER | PROTECT | CONNECT

Corporate Constraints Lifted Confidential Bel Fuse, Inc. * Meetings and Programs15% -20% of direct staff time was spent on reporting to corporate, while top management spend 40% - 60% of their time reporting to corporateManagement processes such as weekly staff meetings, PACE, S&OP, GDP programs consumed a lot of resources and added little value Meetings and Programs15% -20% of direct staff time was spent on reporting to corporate, while top management spend 40% - 60% of their time reporting to corporateManagement processes such as weekly staff meetings, PACE, S&OP, GDP programs consumed a lot of resources and added little value Customer TermsContract limitations with large OEM customers, due to risk averse nature of the companyNo flexibility for payment terms beyond 30 days.Terms & Conditions – Mandatory limitations of liabilities Customer TermsContract limitations with large OEM customers, due to risk averse nature of the companyNo flexibility for payment terms beyond 30 days.Terms & Conditions – Mandatory limitations of liabilities Unrealistic Company GoalsGross profit and operating targets needed to be maintainedQuarterly revenue targets resulted in uneven production schedules and increased overtime and logistics costsArbitrary headcount controls (revenue drops by 5%, headcount needs to drop by 5%) Unrealistic Company GoalsGross profit and operating targets needed to be maintainedQuarterly revenue targets resulted in uneven production schedules and increased overtime and logistics costsArbitrary headcount controls (revenue drops by 5%, headcount needs to drop by 5%) POWER | PROTECT | CONNECT

Going Forward Category Bel Power-One Connectivity Solutions Combined Revenue $356M $194M $78M $628M* Employees 5,500 2,000 525 8,025 R&D Centers 16 3 4 23 Manufacturing Sites 13 2 5 20 Facilities 1.86M sq ft 377K sq ft 215K sq ft 2.45M sq ft Confidential Bel Fuse, Inc. * POWER | PROTECT | CONNECT * If Bel owned for 12 months

Going Forward Americas35% Annual Revenue • 10 Manufacturing Sites• 10 Design Centers Asia44% Annual Revenue• 5 Manufacturing Sites• 5 Design Centers Europe20% Annual Revenue• 5 Manufacturing Sites• 8 Design Centers Confidential Bel Fuse, Inc. * POWER | PROTECT | CONNECT

Market Segmentation Revenue By Region Confidential Bel Fuse, Inc. * POWER | PROTECT | CONNECT

Diverse End-Markets and Blue Chip Customer Base Confidential Bel Fuse, Inc. * POWER | PROTECT | CONNECT

Broad, Industry Leading Product Portfolio Integrated Connector Modules Transformers Magnetics Front Ends & Board-Mount Power Industrial Circuit Protection Magnetic Solutions $174 million Power Solutions & Protection$256 million Connectivity Solutions$198 million RF Connectors /Microwave Components Passive Connectors Connectors & Cable Assemblies Confidential Bel Fuse, Inc. * POWER | PROTECT | CONNECT

Power Solutions & Protection Technology Leaders in efficiency and power density for Front-End and Board-Mount Power products for networking, cloud and open compute applicationsWorld-Class offering and well-recognized brand Melcher™ in Industrial and transportation marketsComplete Portfolio of Electronic Circuit Protection Products Reengage with key customersNew standard products AC/DC, DC/DC, and Circuit ProtectionExpanded offering for railway applicationsPartnership with EchelonNew products for hybrid electric vehicles Growth Drivers LTM Revenue: $256M | Percent of Total Revenue: 41% Overview Servers, Storage & NetworkingIndustrial and TransportationLighting Confidential Bel Fuse, Inc. * POWER | PROTECT | CONNECT : Brands

Connectivity Solutions World-Class RF and Microwave Connector supplierMarket leader for Expanded Beam and Fiber ConnectivityLargest supplier of Boeing approved Circular Connectors (BACC) for the aerospace industry Emerson acquisition creates critical mass in expanded beam and fiber optic connectorsCross-Licensing with Radiall for innovative solutions in commercial aerospaceGreater strength in distribution channels and better penetration across existing accounts Growth Drivers LTM Revenue: $198 mm | Percent of Total Revenue: 32% Overview Computer, Network & CommunicationIndustrial & MedicalMilitary & Aerospace Confidential Bel Fuse, Inc. * POWER | PROTECT | CONNECT Brands

Magnetic Solutions Largest offering of Integrated Connector Module products (MagJack®)Broad offering of Magnetics for industrial, consumer and commercial applicationsLargest selection of IC reference designs Higher bandwidth and greater complexity requirementsContinued expansion of SMD inductor and switching magneticsInternet Protocol (IP) traffic growing at nearly 20% CAGRContinued growth from end users picking up IC reference designsVolume production of press-fit MagJack® connectors Growth Drivers LTM Revenue: $174 mm | Percent of Total Revenue: 27% Overview Computer, Network & CommunicationIndustrial & MedicalConsumer Confidential Bel Fuse, Inc. * POWER | PROTECT | CONNECT Brands

Case Study #1 Confidential Bel Fuse, Inc. * POWER | PROTECT | CONNECT

Case Study #1 Confidential Bel Fuse, Inc. * Dura-Con (4) * Bel content $50K per aircraft depending on configuration FQIS (7) Omega (5,500) POWER | PROTECT | CONNECT

Case Study #2 POWER | PROTECT | CONNECT Confidential Bel Fuse, Inc. *

Case Study #2 10Gig ICMs Internal Board level components include - Fuses - DC/DC isolated board mount converters - DC/DC point-of-load converters Multiport 1Gig ICMs AC/DC Front-End Power * Bel content $496/unit, depending on configuration Cisco Nexus 7000 Switch POWER | PROTECT | CONNECT Confidential Bel Fuse, Inc. *

Financial Overview POWER | PROTECT | CONNECT Confidential Bel Fuse, Inc. *

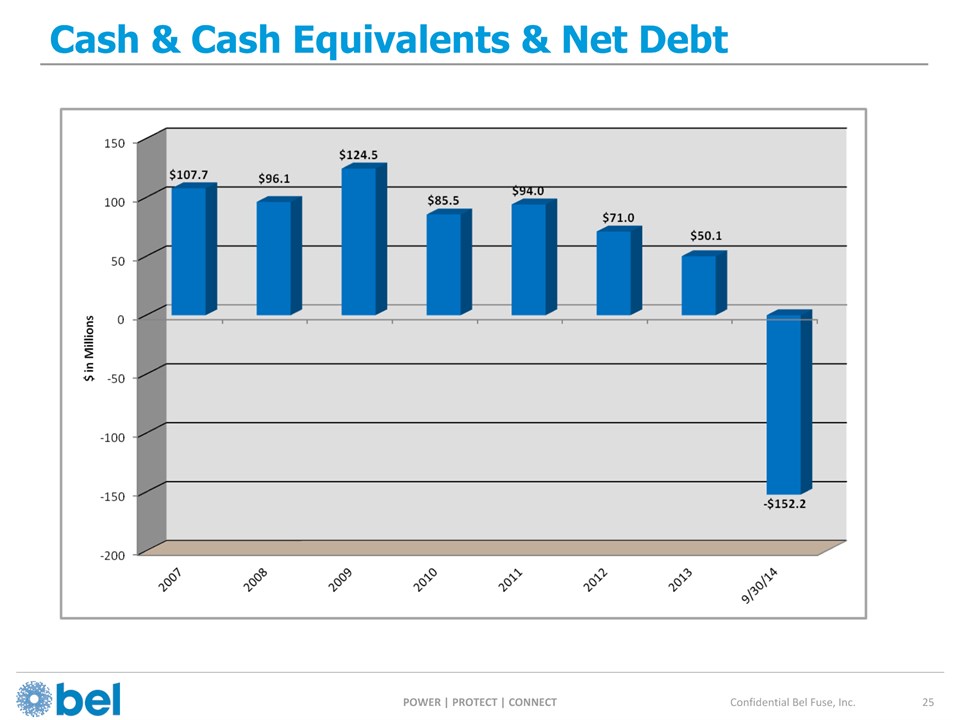

Balance Sheet Highlights Confidential Bel Fuse, Inc. * POWER | PROTECT | CONNECT 12/31/13 9/30/14 Cash & Cash Equivalents $62.1 mm $83.1 mm Working Capital $137.2 mm $193.4 mm Total Assets $308.1 mm $643.5 mm Total Debt $12.0 mm $235.3 mm Stockholders’ Equity $228.7 mm $229.3 mm Book Value per Share $19.86 $19.30

Cash & Cash Equivalents & Net Debt Confidential Bel Fuse, Inc. * POWER | PROTECT | CONNECT

Debt Balance Loan 9/30/14Balance Payment Schedule Principal Interest Total Debt Payments Term LoansRevolver $212,31223,000 Balance 20142015 $2,68813,438 $3,8616,777 $6,54920,215 Total DebtCash $235,31283,140 201620172018 16,12518,81324,188 6,3345,8105,165 22,45924,62229,352 Net Debt $152,172 2019 160,060 2,401 162,463 LiquidityCashRevolver Availability $83,14027,000 Total DebtPayments $235,312 $30,347 $265,659 Total Liquidity $110,140 Confidential Bel Fuse, Inc. * POWER | PROTECT | CONNECT * If Bel owned for 12 months

Pro Forma Historical Capex Confidential Bel Fuse, Inc. * POWER | PROTECT | CONNECT In Thousands

Adjusted EBITDA Confidential Bel Fuse, Inc. * POWER | PROTECT | CONNECT FY2012 and FY2013 Proforma Adjusted EBITDA per the June 2014 Lender PresentationFY2014 preliminary Proforma Adjusted EBITDA per the Credit Agreement In Millions

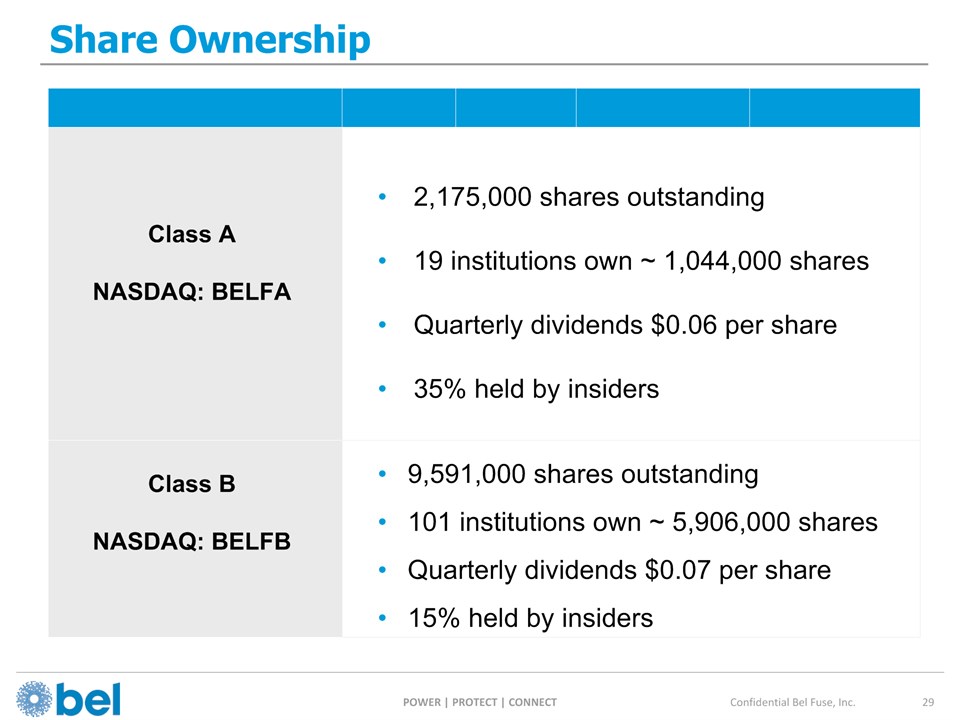

Share Ownership Confidential Bel Fuse, Inc. * POWER | PROTECT | CONNECT Class ANASDAQ: BELFA Class BNASDAQ: BELFB 2,175,000 shares outstanding19 institutions own ~ 1,044,000 sharesQuarterly dividends $0.06 per share35% held by insiders 9,591,000 shares outstanding101 institutions own ~ 5,906,000 sharesQuarterly dividends $0.07 per share15% held by insiders