Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Intersect ENT, Inc. | d850341d8k.htm |

| EX-99.1 - EX-99.1 - Intersect ENT, Inc. | d850341dex991.htm |

| Exhibit 99.2

|

Lisa Earnhardt, President & CEO

NASDAQ: XENT

JANUARY 2015

|

|

Forward-Looking Statements

Certain statements in this presentation constitute “forward-looking statements” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and Securities Exchange Act of 1934, as amended (“Exchange Act”), including, without limitation, statements regarding our outlook for financial performance, sales force growth, clinical studies, approval of new products and indications and the receipt of reimbursement. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Securities Act and the Exchange Act and are making this statement for purposes of complying with those safe harbor provisions. These forward-looking statements reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations or strategies will be attained or achieved. Furthermore, actual results may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors that are beyond our control, including those risks and uncertainties discussed under “Risk Factors” in our S-1A filing dated July 18, 2014 and subsequent quarterly filings with the SEC. All information in this presentation is as of the date of this presentation, and we undertake no duty to update this information unless required by law. In addition, the preliminary revenue for the three months and year ended December 31, 2014 represent our estimates based on currently available information and have not been audited or reviewed by our independent registered public accounting firm. These estimates do not present all necessary information necessary for an understanding of our financial condition and may be adjusted when we complete our unaudited financial statements for the quarter and year periods ended December 31, 2014.

| 1 |

|

|

|

ADVANCING CLINICALLY-PROVEN THERAPIES for Ear, Nose and Throat (ENT)

Physicians and Patients

Focus on Chronic Sinusitis (CS)

29M

Patients in US

IMPROVING QUALITY OF LIFE from Surgery to Office Care

| 2 |

|

|

|

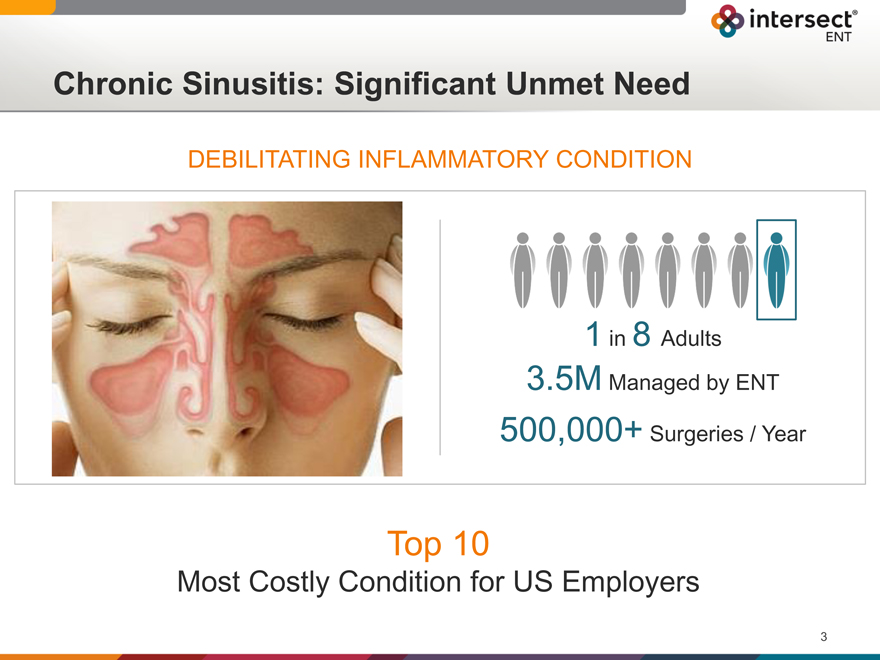

Chronic Sinusitis: Significant Unmet Need

DEBILITATING INFLAMMATORY CONDITION

| 1 |

|

in 8 Adults |

3.5M Managed by ENT

500,000+ Surgeries / Year

Top 10

Most Costly Condition for US Employers

| 3 |

|

|

|

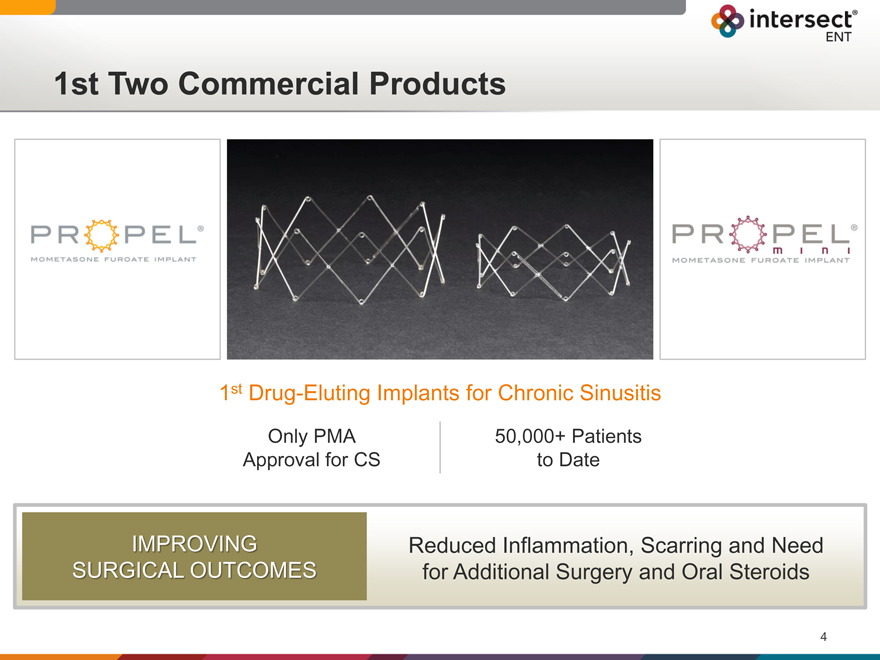

1st Two Commercial Products

1st Drug-Eluting Implants for Chronic Sinusitis

Only PMA 50,000+ Patients

Approval for CS to Date

IMPROVING

SURGICAL OUTCOMES

Reduced Inflammation, Scarring and Need for Additional Surgery and Oral Steroids

| 4 |

|

|

|

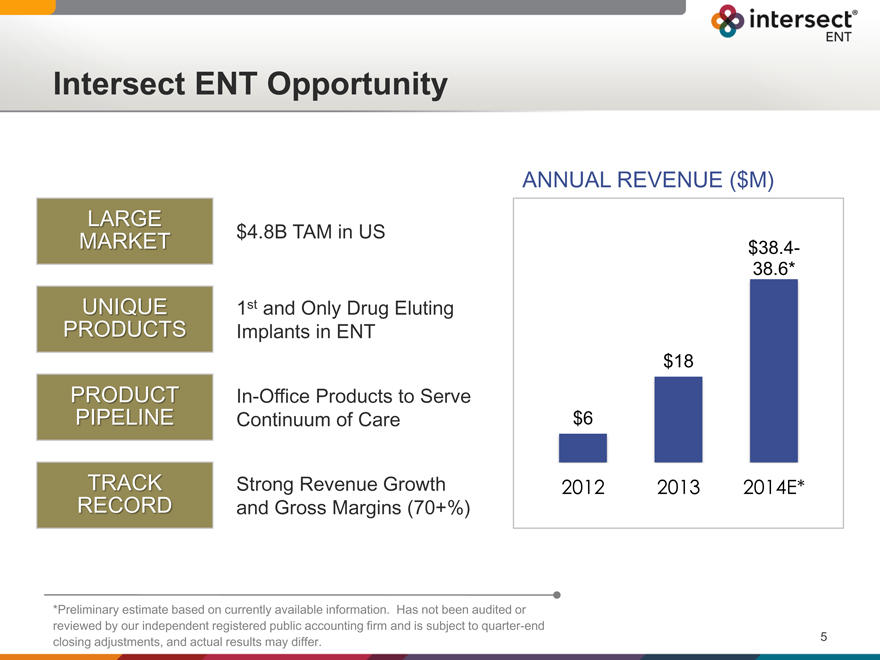

Intersect ENT Opportunity

LARGE

MARKET $4.8B TAM in US

UNIQUE 1st and Only Drug Eluting

PRODUCTS Implants in ENT

PRODUCT In-Office Products to Serve

PIPELINE Continuum of Care

TRACK Strong Revenue Growth

RECORD and Gross Margins (70+%)

ANNUAL REVENUE ($M)

$38.4-

38.6*

$18

$6

2012 2013 2014E*

*Preliminary estimate based on currently available information. Has not been audited or reviewed by our independent registered public accounting firm and is subject to quarter-end closing adjustments, and actual results may differ.

| 5 |

|

|

|

CS Treatment Pathway

MEDICATION TO TREAT

Oral Steroids Reduce Inflammation but Cause Side Effects

SURGERY TO OPEN (FESS)

Surgery Opens Pathways but Can Result in Post-Operative Scarring and Inflammation

MANAGEMENT TO MAINTAIN

Within One Year, 64% Symptom Recurrence and 10% Revision Surgery

Challenges Across the Continuum of Care to Treat Inflammation and Deliver Steroid Safely and Effectively

| 6 |

|

|

|

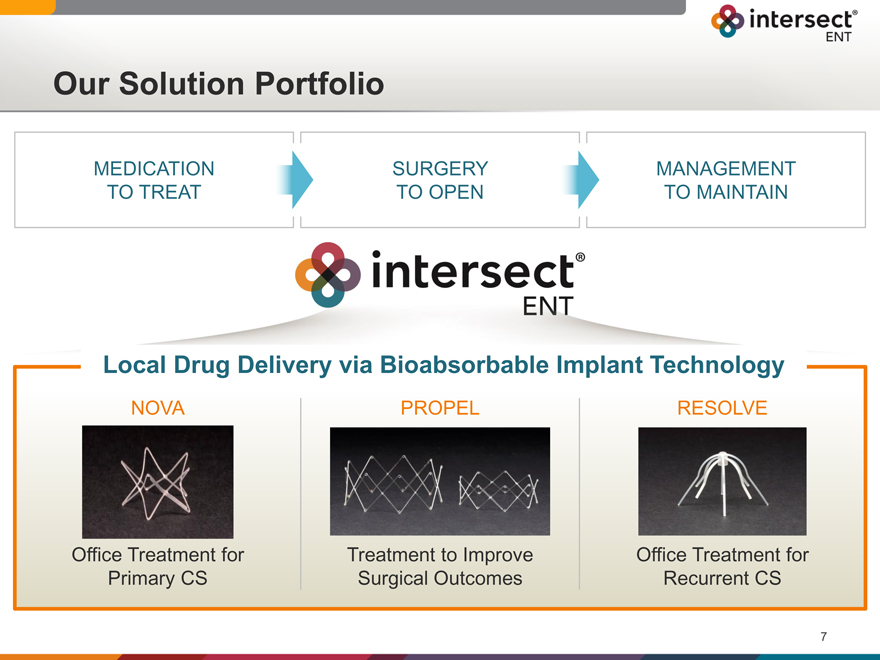

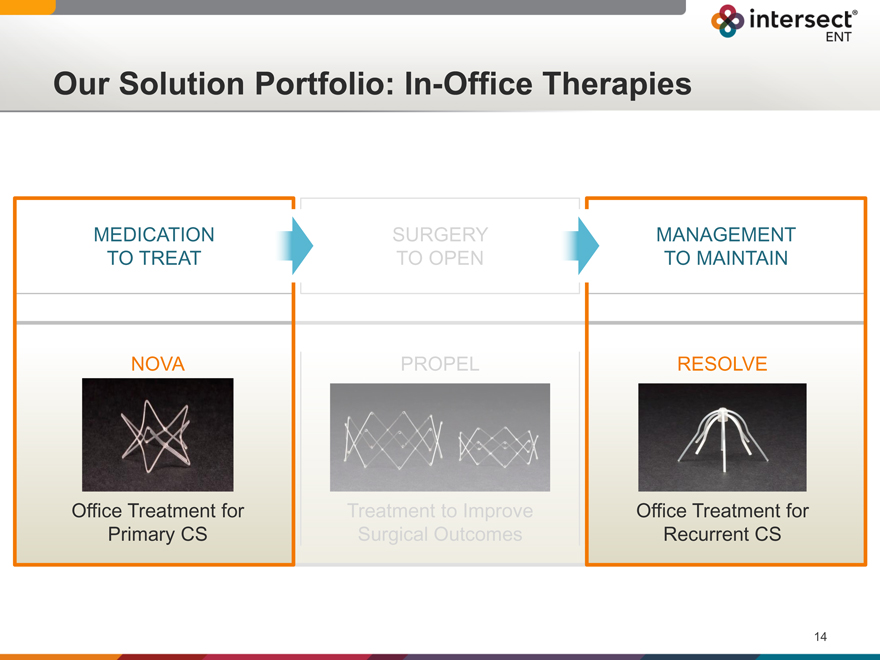

Our Solution Portfolio

MEDICATION SURGERY MANAGEMENT

TO TREAT TO OPEN TO MAINTAIN

Local Drug Delivery via Bioabsorbable Implant Technology

NOVA PROPEL RESOLVE

Office Treatment for Treatment to Improve Office Treatment for

Primary CS Surgical Outcomes Recurrent CS

| 7 |

|

|

|

Our Solution Portfolio: Commercial Therapies

SURGERY

TO OPEN

PROPEL

Treatment to Improve

Surgical Outcomes

| 8 |

|

|

|

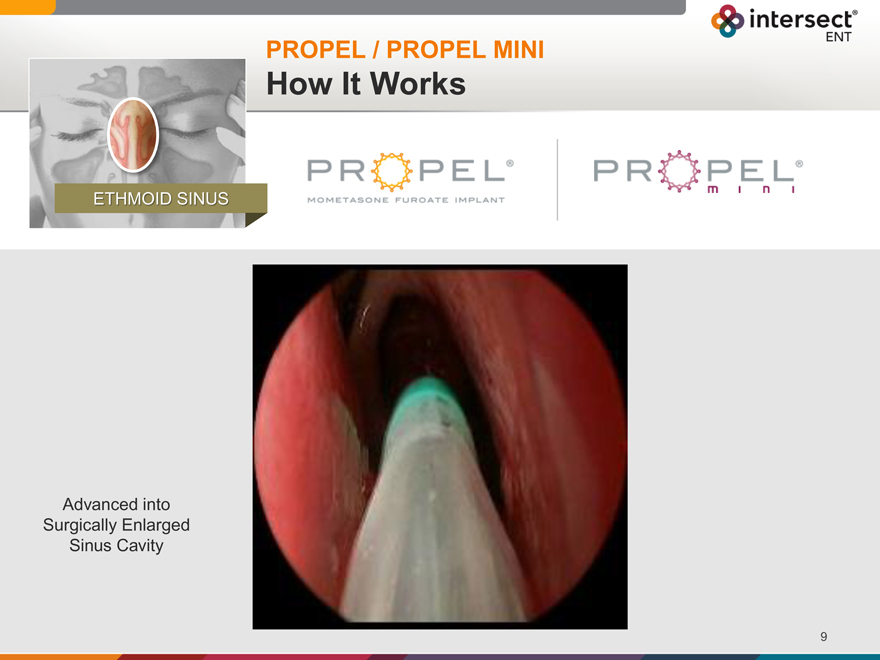

PROPEL / PROPEL MINI

How It Works

ETHMOID SINUS

Advanced into Surgically Enlarged Sinus Cavity

9

|

|

PROPEL / PROPEL MINI

How It Works

ETHMOID SINUS

Advanced into Surgically Enlarged Sinus Cavity

OPENS

Self-expanding Implant Conforms to and Holds Open Sinus

DELIVERS

Sustained, Targeted Delivery of Steroid Over 30 Days

MAINTAINS

Opening by Reducing Post-operative Inflammation and Scarring

10

|

|

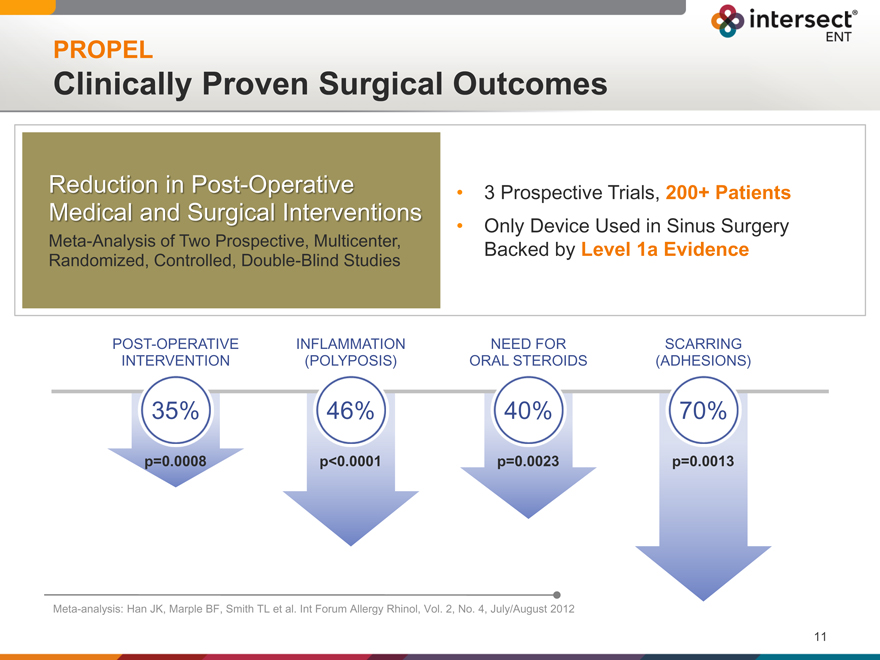

PROPEL

Clinically Proven Surgical Outcomes

Reduction in Post-Operative

Medical and Surgical Interventions

Meta-Analysis of Two Prospective, Multicenter, Randomized, Controlled, Double-Blind Studies

| 3 |

|

Prospective Trials, 200+ Patients Only Device Used in Sinus Surgery |

Backed by Level 1a Evidence

POST-OPERATIVE INFLAMMATION NEED FOR SCARRING

INTERVENTION (POLYPOSIS) ORAL STEROIDS (ADHESIONS)

35% 46% 40% 70%

p=0.0008 p<0.0001 p=0.0023 p=0.0013

Meta-analysis: Han JK, Marple BF, Smith TL et al. Int Forum Allergy Rhinol, Vol. 2, No. 4, July/August 2012

11

|

|

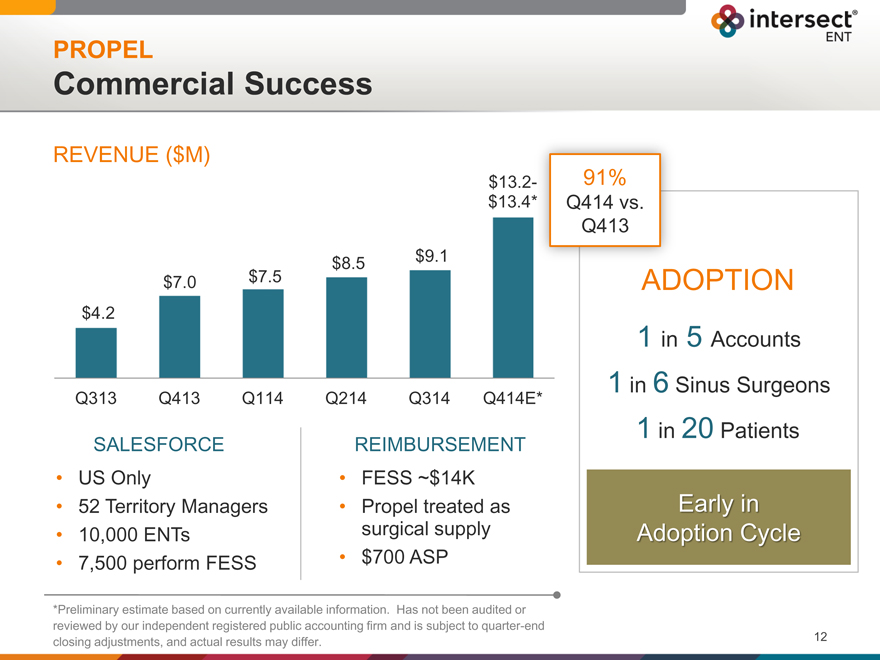

PROPEL

Commercial Success

REVENUE ($M)

$ 13.2

$ 13.4

$8.5 $ 9.1

$7.0 $7.5

$4.2

Q313 Q413 Q114 Q214 Q314 Q414E*

91%

Q414 vs.

Q413

ADOPTION

| 1 |

|

in 5 Accounts |

| 1 |

|

in 6 Sinus Surgeons |

| 1 |

|

in 20 Patients |

Early in

Adoption Cycle

SALESFORCE REIMBURSEMENT

US Only FESS ~$14K

52 Territory Managers Propel treated as

10,000 ENTs surgical supply

7,500 perform FESS $700 ASP

*Preliminary estimate based on currently available information. Has not been audited or reviewed by our independent registered public accounting firm and is subject to quarter-end closing adjustments, and actual results may differ.

12

|

|

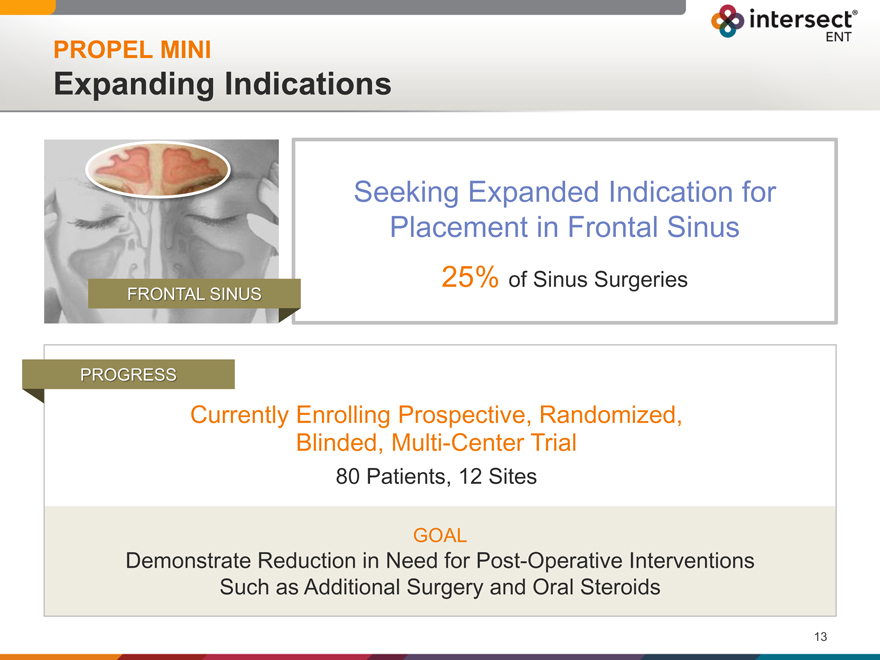

PROPEL MINI

Expanding Indications

Seeking Expanded Indication for Placement in Frontal Sinus

25% of Sinus Surgeries

FRONTAL SINUS

PROGRESS

Currently Enrolling Prospective, Randomized,

Blinded, Multi-Center Trial

80 Patients, 12 Sites

GOAL

Demonstrate Reduction in Need for Post-Operative Interventions Such as Additional Surgery and Oral Steroids

13

|

|

Our Solution Portfolio: In-Office Therapies

MEDICATION TO TREAT

NOVA

Office Treatment for Primary CS

MANAGEMENT

TO MAINTAIN

RESOLVE

Office Treatment for

Recurrent CS

14

|

|

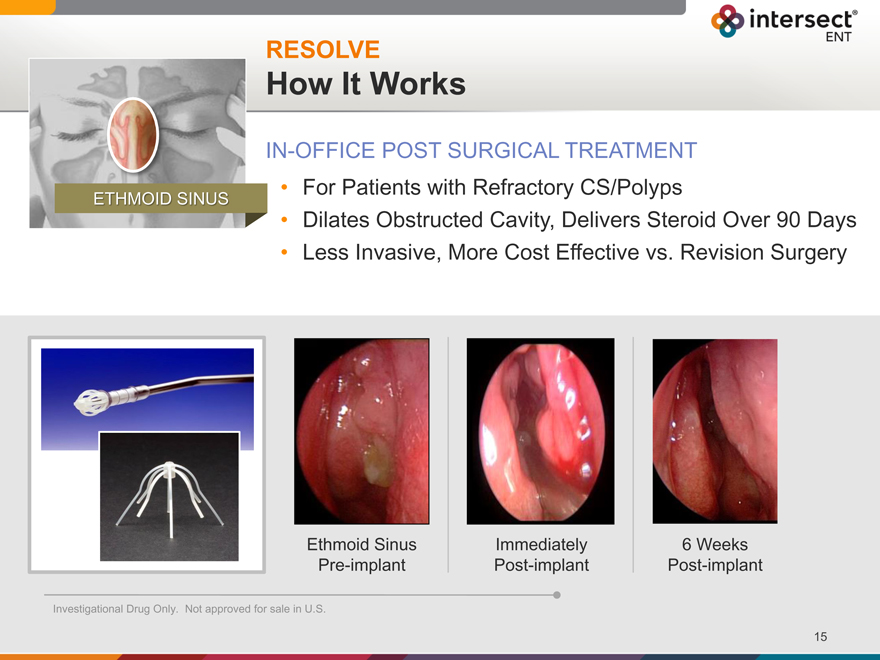

RESOLVE

How It Works

IN-OFFICE POST SURGICAL TREATMENT

For Patients with Refractory CS/Polyps

Dilates Obstructed Cavity, Delivers Steroid Over 90 Days

Less Invasive, More Cost Effective vs. Revision Surgery

ETHMOID SINUS

Ethmoid Sinus Immediately 6 Weeks

Pre-implant Post-implant Post-implant

Investigational Drug Only. Not approved for sale in U.S.

15

|

|

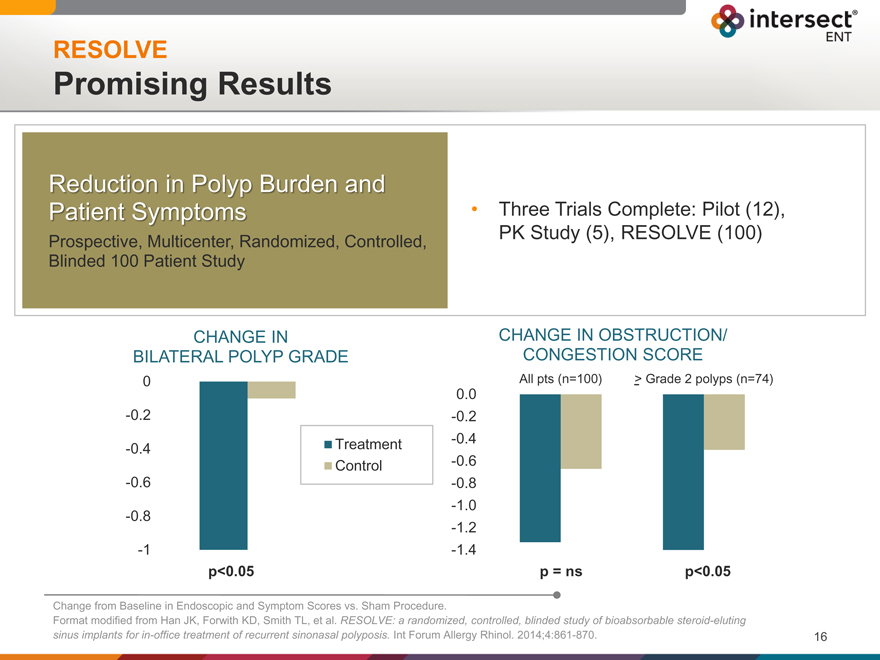

RESOLVE

Promising Results

Reduction in Polyp Burden and

Patient Symptoms

Prospective, Multicenter, Randomized, Controlled, Blinded 100 Patient Study

Three Trials Complete: Pilot (12), PK Study (5), RESOLVE (100)

CHANGE IN

BILATERAL POLYP GRADE

0

-0.2

-0.4 Treatment

Control

-0.6

-0.8

-1

p<0.05

CHANGE IN OBSTRUCTION/

CONGESTION SCORE

All pts (n=100) > Grade 2 polyps (n=74)

0.0

-0.2

-0.4

-0.6

-0.8

-1.0

-1.2

-1.4

p = ns p<0.05

Change from Baseline in Endoscopic and Symptom Scores vs. Sham Procedure.

Format modified from Han JK, Forwith KD, Smith TL, et al. RESOLVE: a randomized, controlled, blinded study of bioabsorbable steroid-eluting sinus implants for in-office treatment of recurrent sinonasal polyposis. Int Forum Allergy Rhinol. 2014;4:861-870.

16

|

|

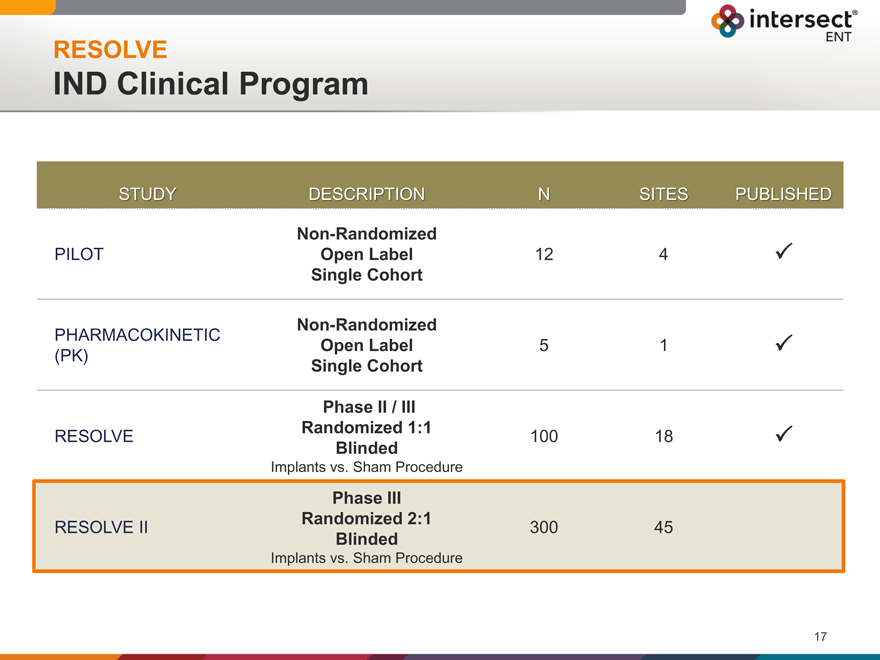

RESOLVE

IND Clinical Program

STUDY DESCRIPTION N SITES PUBLISHED

Non-Randomized

PILOT Open Label 12 4

Single Cohort

Non-Randomized

PHARMACOKINETIC Open Label 5 1

(PK) Single Cohort

Phase II / III

RESOLVE Randomized 1:1 100 18

Blinded

Implants vs. Sham Procedure

Phase III

Randomized 2:1

RESOLVE II 300 45

Blinded

Implants vs. Sham Procedure

17

|

|

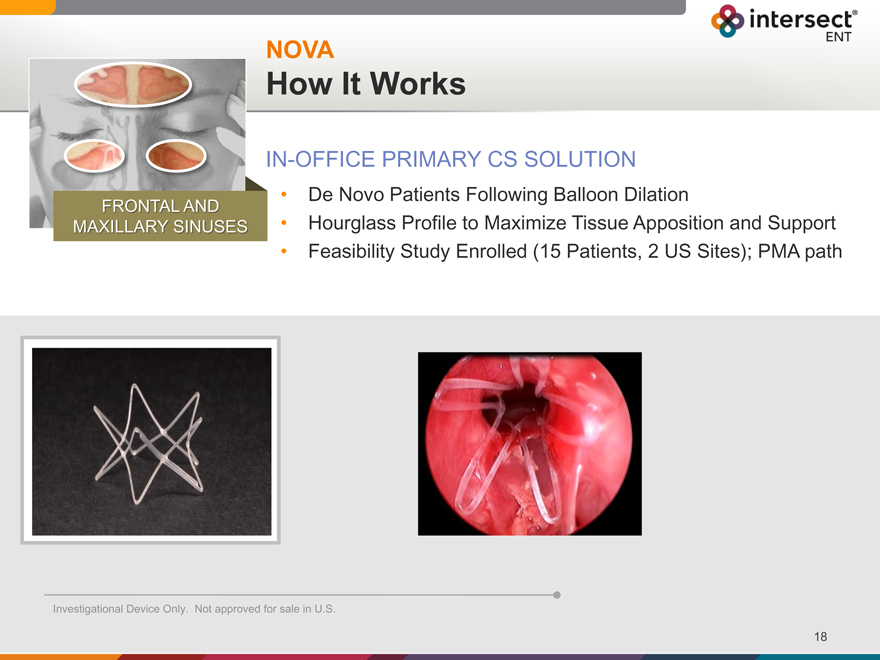

NOVA

How It Works

IN-OFFICE PRIMARY CS SOLUTION

De Novo Patients Following Balloon Dilation

Hourglass Profile to Maximize Tissue Apposition and Support

Feasibility Study Enrolled (15 Patients, 2 US Sites); PMA path

FRONTAL AND

MAXILLARY SINUSES

Investigational Device Only. Not approved for sale in U.S.

18

|

|

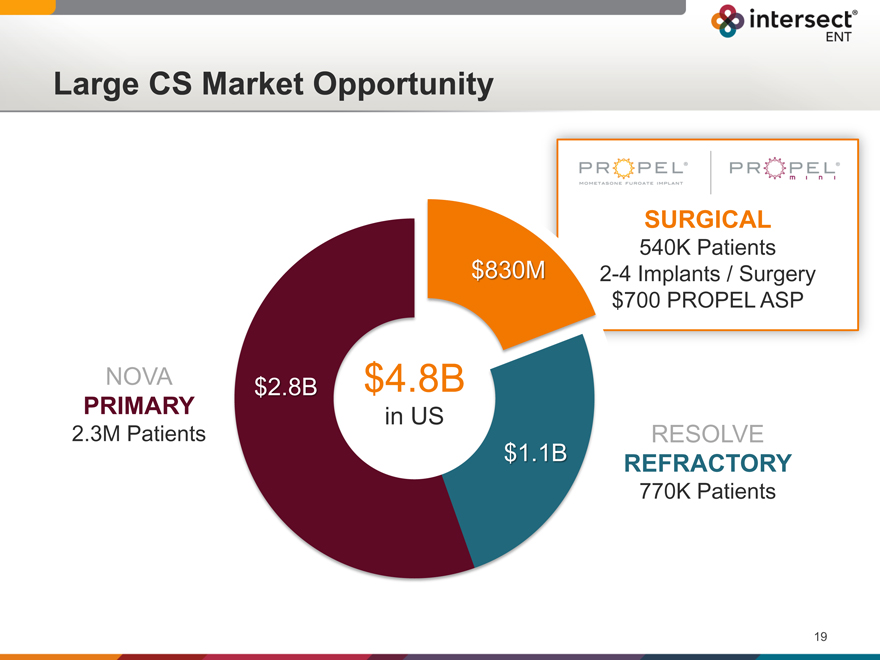

Large CS Market Opportunity

SURGICAL

540K Patients 2-4 Implants / Surgery $700 PROPEL ASP

$830M

NOVA $2.8B $4.8B

PRIMARY in US

2.3M Patients

$1.1B

RESOLVE

REFRACTORY

770K Patients

19

|

|

Industry Landscape

MEDICATION SURGERY MANAGEMENT

TO TREAT TO OPEN TO MAINTAIN

STEROIDS

SURGICAL TOOLS / SUPPLIES

We Are a Unique Solution – Complementary to Other Technologies

20

|

|

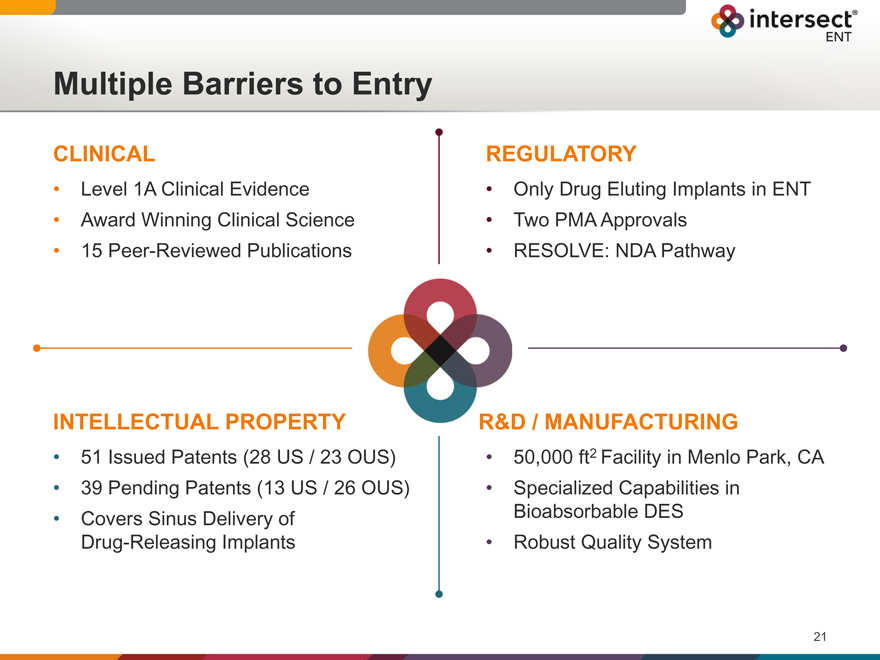

Multiple Barriers to Entry

CLINICAL

Level 1A Clinical Evidence

Award Winning Clinical Science

15 Peer-Reviewed Publications

REGULATORY

Only Drug Eluting Implants in ENT

Two PMA Approvals

RESOLVE: NDA Pathway

INTELLECTUAL PROPERTY

51 Issued Patents (28 US / 23 OUS)

39 Pending Patents (13 US / 26 OUS)

Covers Sinus Delivery of Drug-Releasing Implants

R&D / MANUFACTURING

50,000 ft2 Facility in Menlo Park, CA

Specialized Capabilities in Bioabsorbable DES

Robust Quality System

21

|

|

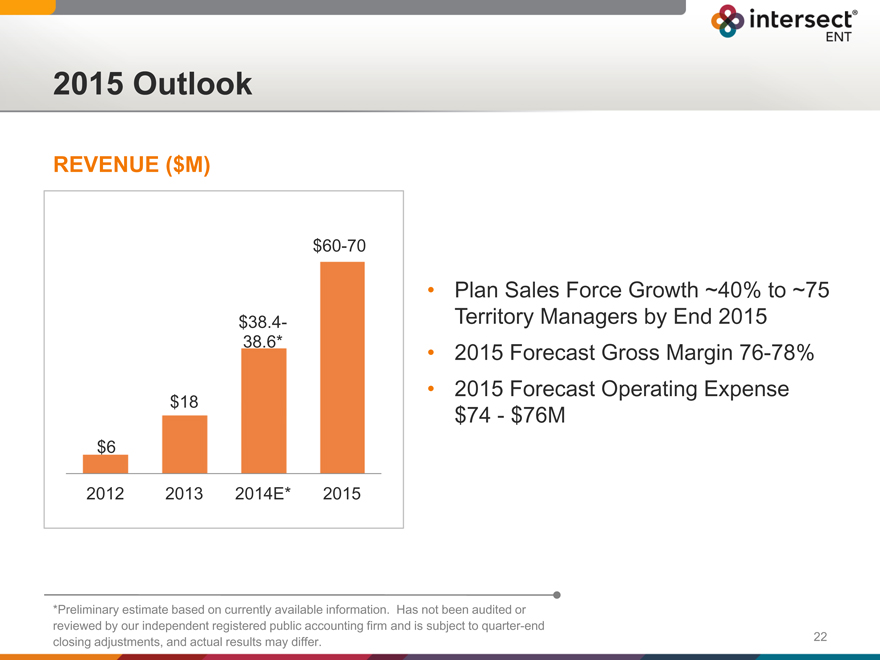

2015 Outlook

REVENUE ($M)

$60-70

$38.4-3

8.6*

$18

$6

2012 2013 2014E* 2015

Plan Sales Force Growth ~40% to ~75 Territory Managers by End 2015 2015 Forecast Gross Margin 76-78% 2015 Forecast Operating Expense

$74—$76M

*Preliminary estimate based on currently available information. Has not been audited or reviewed by our independent registered public accounting firm and is subject to quarter-end closing adjustments, and actual results may differ.

22

|

|

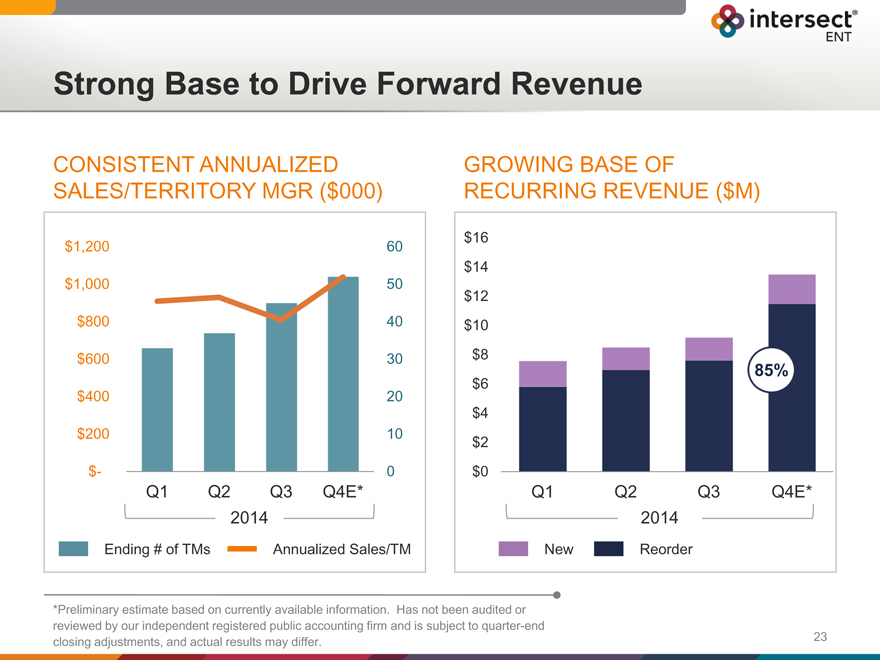

Strong Base to Drive Forward Revenue

CONSISTENT ANNUALIZED

SALES/TERRITORY MGR ($000)

$1,200 60

$1,000 50

$800 40

$600 30

$400 20

$200 10

$- 0

Q1 Q2 Q3 Q4E*

2014

Ending # of TMs Annualized Sales/TM

GROWING BASE OF

RECURRING REVENUE ($M)

$16

$14

$12

$10

$8

85%

$6

$4

$2

$0

Q1 Q2 Q3 Q4E*

2014

New Reorder

*Preliminary estimate based on currently available information. Has not been audited or reviewed by our independent registered public accounting firm and is subject to quarter-end closing adjustments, and actual results may differ.

23

|

|

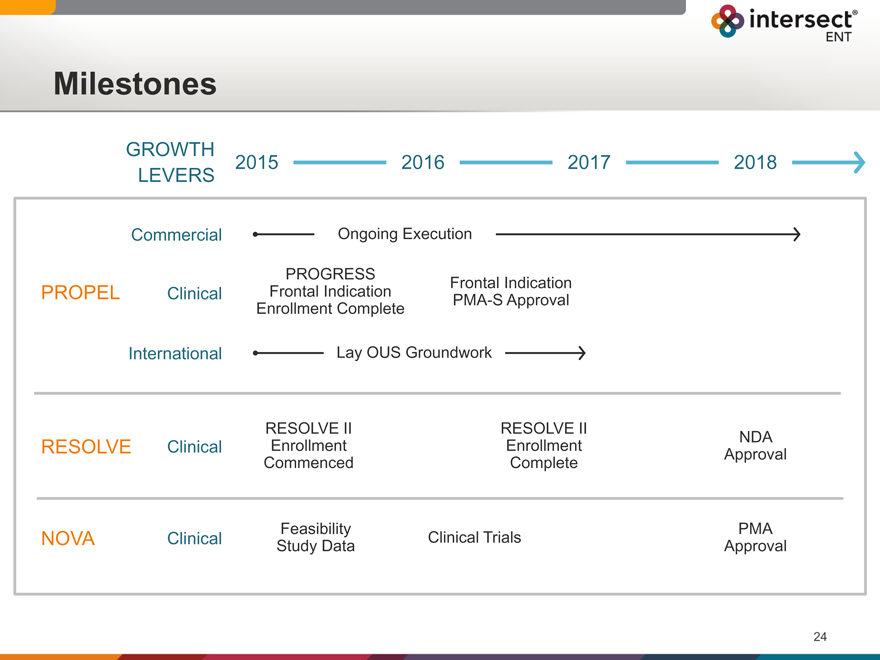

Milestones

GROWTH

2015 2016 2017 2018

LEVERS

Commercial Ongoing Execution

PROGRESS

PROPEL Clinical Frontal Indication Frontal PMA-S Indication Approval

Enrollment Complete

International Lay OUS Groundwork

RESOLVE II RESOLVE II

RESOLVE Clinical Enrollment Enrollment Approval NDA

Commenced Complete

Feasibility PMA

NOVA Clinical Study Data Clinical Trials Approval

24

|

|

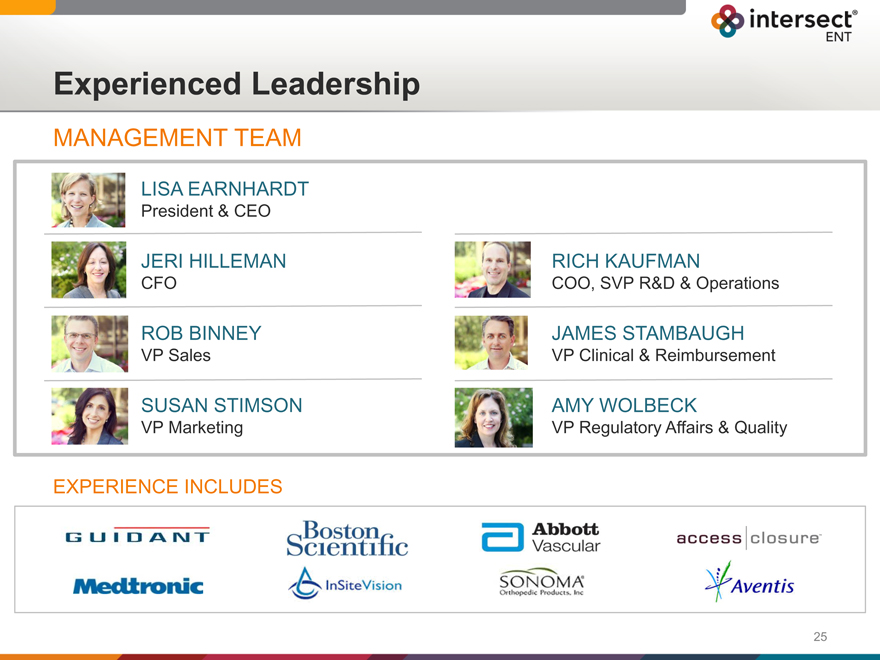

Experienced Leadership

MANAGEMENT TEAM

LISA EARNHARDT

President & CEO

JERI HILLEMAN RICH KAUFMAN

CFO COO, SVP R&D & Operations

ROB BINNEY JAMES STAMBAUGH

VP Sales VP Clinical & Reimbursement

SUSAN STIMSON AMY WOLBECK

VP Marketing VP Regulatory Affairs & Quality

EXPERIENCE INCLUDES

25

|

|

$4.8B US Market

1st and ONLY Drug Eluting Implants in ENT

EMERGING In-Office Portfolio

TRACK RECORD Strong Revenue Growth & GMs

26

|

|

NASDAQ: XENT

28