Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - IMMAGE BIOTHERAPEUTICS CORP. | Financial_Report.xls |

| EX-31.1 - CERTIFICATION - IMMAGE BIOTHERAPEUTICS CORP. | epic_ex311.htm |

| EX-32.1 - CERTIFICATION - IMMAGE BIOTHERAPEUTICS CORP. | epic_ex321.htm |

,

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2014

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

333-185368

Commission file number

EPICURE CHARCOAL, INC.

(Exact name of registrant as specified in its charter)

|

NEVADA |

|

45-5538945 |

|

State or other jurisdiction of incorporation or organization |

|

(I.R.S. Employer Identification No.) |

|

6910 Salashan Parkway Ferndale, Washington 98248 |

|

98248 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(775)-321-8228

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

Common Stock

Title of each class

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

¨ |

Large accelerated filer |

|

¨ |

Accelerated filer |

|

¨ |

Non-accelerated filer |

|

x |

Smaller reporting company |

|

|

(Do not check if a smaller reporting company) |

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). x Yes ¨ No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. As of March 31, 2014 the aggregate value of voting and No-voting equity held by non-affiliates was $0.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ¨ Yes ¨ No

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of January 9, 2015 the Company has 367,039 shares of common stock issued and outstanding.

Table of Contents

|

Item 1. |

Business |

3 |

|||

|

|

|||||

|

Item 1A. |

Risk Factors |

7 |

|||

|

|

|||||

|

Item 1B. |

Unresolved Staff Comments |

7 |

|||

|

|

|||||

|

Item 2. |

Properties |

7 |

|||

|

|

|||||

|

Item 3. |

Legal Proceedings |

7 |

|||

|

|

|||||

|

Item 4. |

Mine Safety Disclosures |

7 |

|||

|

|

|||||

|

PART II |

|

||||

|

|

|||||

|

Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

8 |

|||

|

|

|||||

|

Item 6. |

Selected Financial Data |

8 |

|||

|

|

|||||

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

8 |

|||

|

|

|||||

|

Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk |

9 |

|||

|

|

|||||

|

Item 8. |

Financial Statements and Supplementary Data |

10 |

|||

|

|

|||||

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

19 |

|||

|

|

|||||

|

Item 9A. |

Controls and Procedures |

19 |

|||

|

|

|||||

|

Item 9B. |

Other Information |

20 |

|||

|

|

|||||

|

PART III |

|

||||

|

|

|||||

|

Item 10. |

Directors, Executive Officers and Corporate Governance |

21 |

|||

|

|

|||||

|

Item 11. |

Executive Compensation |

22 |

|||

|

|

|||||

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

24 |

|||

|

|

|||||

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

24 |

|||

|

|

|||||

|

Item 14. |

Principal Accountant Fees and Services |

25 |

|||

|

|

|||||

|

Item 15. |

Exhibits, Financial Statement Schedules |

26 |

|||

|

|

|||||

|

SIGNATURES |

27 |

||||

|

2

|

PART I

Item 1. Business.

Overview

The Company was incorporated in the state of Nevada as a for-profit company on June 21, 2012. We are a development-stage company that intends to sell our own brand of Charcoal products for BBQ and restaurant grilling purposes. The Company’s auditors have issued an opinion that the ability of the Company to continue as a going concern is dependent on raising capital to fund its business plan and ultimately to attain profitable operations. Accordingly, these factors raise substantial doubt as to the Company’s ability to continue as a going concern. Our auditors have issued a “going concern” opinion, meaning that there is substantial doubt if we can continue as an on-going business for the next twelve months unless we obtain additional capital..

The Company has not yet implemented its business model and to date has generated no revenues. Neither the Company’s management nor any affiliates of the Company or its management have previously been involved in the management or ownership of a development stage company.

The Company has registered 4,500 000 shares to offer at $0.04 per share. Since becoming incorporated, EPICURE CHARCOAL, INC. has not made any significant purchase or sale of assets, nor has it been involved in any mergers, acquisitions or consolidations nor has the Company any plans nor does any of its stockholders have any plans to merge into an operating company, to enter into a change of control or similar transaction or to change our management. Neither management nor the Company’s shareholders have plans or intentions to be acquired. EPICURE CHARCOAL, INC. is not a blank check registrant as that term is defined in Rule 419(a)(2) of Regulation C of the Securities Act of 1933, since it has a specific business plan or purpose.

We are an ‘‘emerging growth company’’ within the meaning of the federal securities laws. For as long as we are an emerging growth company, we will not be required to comply with the requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, the reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and the exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an emerging growth company. For a description of the qualifications and other requirements applicable to emerging growth companies and certain elections that we have made due to our status as an emerging growth company, see “Risk Factors—Risks Related to this Offering and our Common Stock – We are an ‘emerging growth company’ and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors”.

In their audit report dated January 09, 2015, our auditors have expressed an opinion that substantial doubt exists as to whether we can continue as an ongoing business.

Our business office is located at 112 North Curry Street Carson City Nevada 89703, our telephone number is (775) 321-8228 and our fax number is (775) 306-8587.

Business Development

On June 21, 2012, Mr. Alex Robertson, president and sole officer and director incorporated the Company in the State of Nevada and established a fiscal year end of September 30. The Company does not own or lease any property. The only employee of the Company is its sole officer and director. We intend to contract with consultants to develop our logo and packaging. EPICURE CHARCOAL, INC. is a development-stage company that intends to market its planned products online and sell its planed charcoal products, at Trade shows and market to Retailers. We do not have any developed products at this time; we plan to develop 1 product under the brand name EPICURE CHARCOAL, INC. The Company is currently a shell company as we have no operations and assets consisting solely of cash.

EPICURE CHARCOAL, INC. has not generated any revenues. We have not implemented our business model as of yet. Our auditors have expressed an opinion expressing their exists substantial doubt as to our ability to continue as an ongoing business.

We intend to provide our own brand of Charcoal to potential customers whose interests are in BBQ products and restaurant food grilling.

|

3

|

It is the Company’s intention to develop 1 product for recreational use BBQ, Catering and restaurant uses in different bag sizes (8lb, 16lb and 35lb)

The Company’s relationship with Jodwa Trading is limited to verbal communications. Jodwa Trading is a company incorporated in Namibia that manufactures lump charcoal and briquettes and exports to various countries around the world. Through our initial discussions with JODWA Trading we understand that they have all the necessary equipment to manufacture the charcoal and bag it with our logo in place. We intend to enter into a trade agreement with JODWA Trading for the supply of our planned product. We do not currently have any intellectual property

During the next 12 months EPICURE CHARCOAL, INC. intends to develop the EPICURE CHARCOAL, INC. range for BBQ, Catering and restaurant uses. Once our product is developed the Company will begin its marketing and sales initiative. Management intends to market its product to the states of Washington, Oregon, Idaho, California Nevada, Arizona and Montana in order to minimize the shipping cost, as we intend to store the first containers of charcoal in Blaine, Washington. The President has verbally agreed to provide storage facility to the Company at no charge for the charcoal containers; there is no written contract in place for this.

Plan of Operations

EPICURE CHARCOAL, INC. is a development stage Company that intends to sell lump charcoal under the product name Black Gold. We intend to introduce the product to the market place by, selling to individual hearth and Patio stores and specialty BBQ stores and local distributors. The Company intends to attend trade shows and have sales agents working on a commission basis to increase its potential sales.

It is our intention over the next 12 months to introduce Black Gold to the charcoal market. Management believes we will be able to distinguish our planned product as a premium priced charcoal because we believe its quality is superior. Black Gold charcoal is made from the Black Thorn tree (Acacia mellifera). Black Thorn, a very dense wood, weighs approximately 1100kg per cubic meter as compared to American white oak weighing approximately 770kg per cubic meter or Hickory weighing approximately 830kg per cubic meter. According to Wikipedia, “there is a correlation between density and calories/volume” and “denser hardwoods … tend to burn hotter and cleaner then charcoal briquettes”.

We intend to have three different size packages: 1) a smaller compact bag of charcoal at 8lb that is ideal for putting in the vehicle and going for a BBQ at a park or with friends, 2) a 16lb bag ideal for home environment where it can be used and stored again conveniently and 3) a 35lb bag intended for use by restaurants and caterers doing an extensive amount of BBQ and/or grilling of food.

The company intends to sell the 8lb, 16lb bag and the 35lb bag directly through its website to restaurants and caterers with minimum order quantities to mediate any shipping costs.

Our plan of operations over the next 12 months is the following. The Company has 3 anticipated phases for its plan of operations.

|

Significant step 1 30 days |

Travel to Namibia and Negotiations |

25% shares sold $5,000 |

50% $5,000 |

75% $7,500 |

100% $7,500 |

|

Significant step 2 90 Days |

Logo development, Market target research |

$6,000 |

$19,800 |

$29,000 |

$30,500 |

|

Significant Step 3 120 days |

Sales and marketing efforts |

$24,200 |

$52,500 |

$81,500 |

$125,000 |

|

4

|

Our first phase will start with the company’s sole officer and director flying to Namibia, and start negotiations for the Company to secure contracts, and business relations with JODWA TRADING of Tsumeb. Our anticipated costs for this phase is $7,500, this phase is expected to last up to 30 days.

The second phase of the company’s plan is obtaining contracts with researchers to determine which areas and what population demographic to target to start our sales and marketing campaign so that we can use our sales and marketing effort to the maximum capability. We intend to have our logos designed as well as the packaging of our bags The Company anticipates this phase to be completed 90 days after this registration statement becomes effective. The cost for this phase is estimated at $30,500. We intend to simultaneously do our Market research estimated at $7000.

The anticipated third phase of this operational plan of the Company will start 120 days after the registration statement becomes effective. In this phase we intend to have our first products shipped to us in Blaine Washington. The Company intends to have eight 40 feet containers in a storage facility in Blaine. We intend to launch our website contract sales agents to sell our product on commission basis, attend trade shows to generate sales and make the public aware of our brand and our social economic values. This phase is expected to cost $125,000. The Company intends to not have more than $3,000 office expenses.

The Market Opportunity

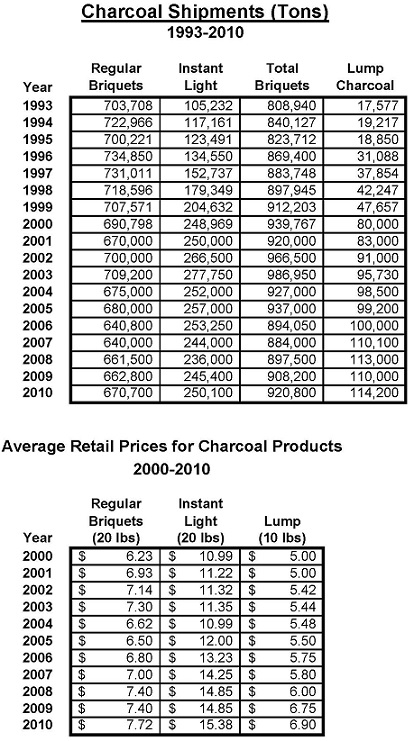

The HPBA (Hearth, Patio & Barbecue Association) State in there Report of the Barbecue Industry that Charcoal Shipment Statistics from 1993-2010 has seen a increase in shipping of Lump Charcoal and an increase in the price of Lump Charcoal, compared to regular briquettes. The tables below sourced from the HPBA, forms the basis of management’s belief that the trend will continue with more people realizing the advantages of using Natural lump charcoal, if the statistics are to be projected into the future the market for natural lump charcoal seems very lucrative.

|

5

|

The tables above represent the statistical data upon which management bases its belief that the trend of increased shipping and increased pricing of Lump Charcoal will continue.

Competitive Advantages

The charcoal market has many competitors. Some of our competitors may have greater access to capital than we do and may use these resources to engage in aggressive advertising and marketing campaigns. The prevalence of aggressive advertising and promotion may generate pricing pressures to which we must respond. We expect that competition will continue to increase. We might not be able to compete with large company’s if they where to drive prices down for BBQ charcoal.

Because our product will be supplied through Jodwa Trading, a low cost suppler from Namibia, our product costs will be relatively low and it will allow us to offer our planned product at a premium yet competitive price.

|

6

|

Item 1A. Risk Factors.

The Company is a smaller reporting company as defined by rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

Item 1B. Unresolved Staff Comments.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item

Item 2. Properties.

The Company does not own or lease any property, the office space is provided by the president at no charge. Our current principal executive offices is located at 6910 Salashan Parkway, Ferndale, Washington 98248, telephone 775-321-8228 and fax 775-306-8587.

Item 3. Legal Proceedings.

The Company is not party to any legal proceedings, nor is there any known legal proceedings contemplated against the Company.

No director, officer or affiliate of the Company and no owner of record or beneficial owner of more than 5.0% of the securities of the Company, or any associate of any such director, officer or security holder is a party adverse to the Company or has a material interest adverse to the Company in reference to pending litigation.

Item 4. Mine Safety Disclosures.

None.

|

7

|

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The Company’s common stock is available for quotation on the OTCBB. There are no current or historical price quotes available.

Item 6. Selected Financial Data

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide information required under this item

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis of our financial condition and results of operation should be read in conjunction with the Company financial statements and related notes included elsewhere in this report.

This form 10-K contains certain forward-looking statements. Management discusses and analyzes forward looking statements that reflect the views of management in respect to the Company’s future financial performance. Words used in these forward-looking statements are words that refer to future rustic events and are not based on substantial evidence. These words could be words like believe, expect, estimate, anticipate and project these are the words management believes project to forward looking financial performance and statements but are not limited to these words only. A potential investor cannot be completely certain that these statements will be accurate.

Liquidity and Capital Resources

Our auditor’s report on our September 30, 2014 financial statements expresses an opinion that substantial doubt exists as to whether we can continue as an ongoing business. Since our sole director may be unwilling or unable to loan or advance us additional capital, we believe that if we do not raise additional capital over the next 12 months, we may be required to suspend or cease the implementation of our business plans. See “September 30, 2014 Audited Financial Statements - Auditors Report.”

As the company has been issued an opinion by its auditors that substantial doubt exists as to whether the company can continue as a going concern, it may be difficult for the company to attract investors.

At the present time, we have been able to raise additional cash by selling of common stock, it will likely not be sufficient to support our planned operations. If we are unable to raise the cash needed to support our operations, we will either suspend product development and marketing activities until we do raise the cash, or cease operations entirely. Other than as described in this paragraph, we have no other financing plans.

|

8

|

We anticipate that our current cash and cash equivalents and cash generated from operations, if any, will be insufficient to satisfy our liquidity requirements for at least the next 12 months. We will require additional funds prior to such time and the Company will seek to obtain theses funds by selling additional capital through private equity placements, debt or other sources of financing. If we are unable to obtain sufficient additional financing, we may be required to reduce the scope of our planned operations, which could harm our business, financial condition and operating results. Additional funding to meet our requirements may not be available on favourable terms, if at all.

Over the next twelve months the Company intends to introduce it’s one product to the charcoal market in three different sizes: 1) a smaller compact bag of charcoal at 8lb that is ideal for putting in the vehicle and going for a BBQ at a park or with friends, 2) a 16lb bag ideal for home environment where it can be used and stored again conveniently and 3) a 35lb bag intended for use by restaurants and caterers doing an extensive amount of BBQ and/or grilling of food.

As of September 30, 2014, the Company had cash of $2,342 and liabilities of $23,937 as compared to cash of $7,215 and liabilities of $16,147 as of September 30, 2013.

Limited Operating History

The Company was incorporated in the state of Nevada as a for-profit company on June 21, 2012. We are a development-stage company. There is no historical financial information about us upon which to base an evaluation of our performance. We are a development stage company and have not generated any revenues from activities. We cannot guarantee that we will be successful in our planned business activities. Our business is subject to risks inherent to a new business enterprise including limited capital resources, possible delays in the development of our products and possible cost overruns due to cost increases.

Results of Operations

We did not earn any revenues during the fiscal year ending September 30, 2014. During the fiscal year ending September 30, 2014 we incurred operating expenses of $18,555 comprised of Office and administrative expenses of $3,728 and Professional fees in the amount of $14,827 resulting in a Net Loss of $18,555 as compared to operating expenses of $12,011 comprised of Office and administrative expenses of $3,116 and Professional fees of $8,895 resulting in a Net Loss of $12,011 for the fiscal year ending September 30, 2013.

Since inception the Company has incurred operating expenses of $32,487 resulting in a Net Loss of $32,487.

Off-Balance sheet arrangements

The Company is not aware of any off-balance sheet arrangements other than set forth in the Company’s Liquidity and Capital resources that have or are reasonably likely to have a current or future effect on the registrant's financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

|

9

|

Item 8. Financial Statements and Supplementary Data.

|

EPICURE CHARCOAL, INC. |

|

(A Development Stage Company) |

|

FINANCIAL STATEMENTS |

|

September 30, 2014 |

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

11 |

|||

|

|

|

|||

|

BALANCE SHEETS |

12 |

|||

|

STATEMENTS OF OPERATIONS |

13 |

|||

|

STATEMENTS OF STOCKHOLDERS' EQUITY (DEFICIT) |

14 |

|||

|

STATEMENTS OF CASH FLOWS |

15 |

|||

|

NOTES TO FINANCIAL STATEMENTS |

16 |

|

10

|

PLS CPA, A PROFESSIONAL CORPORATION

t 4725 MERCURY STREET #210 t SAN DIEGO t CALIFORNIA 92111 t

t TELEPHONE (858)722-5953 t FAX (858) 761-0341 t FAX (858) 764-5480

t E-MAIL changgpark@gmail.com t

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders

Epicure Charcoal, Inc.

(A Development Stage Company)

We have audited the accompanying balance sheet of Epicure Charcoal, Inc. (A Development Stage “Company”) as of September 30, 2014 and the related financial statements of operations, changes in shareholder’s equity (deficit) and cash flows for the year ended September 30, 2014, and for the period July 21, 2012 (inception) to September 30, 2014. These financial statements are the responsibility of the Company’s management.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Epicure Charcoal, Inc. as of September 30, 2014, and the results of its operation and its cash flows for the year ended September 30, 2014, and for the period from July 21, 2012 (inception) to September 30, 2014 in conformity with U.S. generally accepted accounting principles.

The financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company’s losses from operations raise substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ PLS CPA

PLS CPA, A Professional Corp.

January 09, 2015

San Diego, CA. 92111

Registered with the Public Company Accounting Oversight Board

|

11

|

|

EPICURE CHARCOAL, INC. |

|||||||||

|

(A Development Stage Company) |

|||||||||

|

BALANCE SHEETS |

| September 30, 2014 |

September 30, 2013 |

|||||||

|

ASSETS |

||||||||

|

CURRENT ASSETS |

||||||||

|

Cash |

$ |

2,342 |

$ |

7,215 |

||||

|

TOTAL ASSETS |

$ |

2,342 |

$ |

7,215 |

||||

|

LIABILITIES AND STOCKHOLDERS' DEFICIT |

||||||||

|

CURRENT LIABILITIES |

||||||||

|

Accounts payable and accrued liabilities |

$ |

1,841 |

$ |

900 |

||||

|

Loans from Related Party |

22,116 |

15,247 |

||||||

|

TOTAL CURRENT LIABILITIES |

$ |

23,957 |

$ |

16,147 |

||||

|

STOCKHOLDERS' DEFICIT |

||||||||

|

Capital stock |

||||||||

|

Authorized |

||||||||

|

200,000,000 shares of common stock, $0.001 par value |

||||||||

|

Issued and outstanding |

||||||||

|

367,039 shares of common stock (5,000,000 September 30, 2013) |

$ |

367 |

$ |

5,000 |

||||

|

Additional Paid in Capital |

10,505 |

- |

||||||

|

Deficit accumulated during the development stage |

(32,487 |

) |

(13,932 |

) |

||||

|

TOTAL STOCKHOLDERS' DEFICIT |

$ |

(21,615 |

) |

$ |

(8,932 |

) |

||

|

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT |

$ |

2,342 |

$ |

7,215 |

||||

The accompanying notes are an integral part of these financial statements

|

12

|

|

EPICURE CHARCOAL, INC. |

||||||

|

(A Development Stage Company) |

||||||

|

STATEMENTS OF OPERATIONS |

| Inception date | ||||||||||||

| Year | Year | (June 21, 2012) | ||||||||||

| ended | ended | to | ||||||||||

| September 30, 2014 |

September 30, 2013 |

September 30, 2014 |

||||||||||

|

EXPENSES |

||||||||||||

|

Office and general |

$ |

3,728 |

$ |

3,116 |

$ |

8,015 |

||||||

|

Professional Fees |

14,827 |

8,895 |

24,472 |

|||||||||

|

Total Expenses |

$ |

18,555 |

$ |

12,011 |

$ |

32,487 |

||||||

|

Operating Loss |

(18,555 |

) |

(12,011 |

) |

(32,487 |

) |

||||||

|

NET LOSS |

$ |

(18,555 |

) |

$ |

(12,011 |

) |

$ |

(32,487 |

) |

|||

|

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING |

2,056,006 |

5,000,000 |

- |

|||||||||

The accompanying notes are an integral part of these financial statements

|

13

|

|

EPICURE CHARCOAL, INC. |

|||||||||||

|

(A Development Stage Company) |

|||||||||||

|

STATEMENTS OF STOCKHOLDERS' EQUITY (DEFICIT) |

|||||||||||

|

From inception (June 21, 2012) to September 30, 2014 |

| Deficit | ||||||||||||||||||||||||

| accumulated | ||||||||||||||||||||||||

| Common Stock | Additional | Share | during the | |||||||||||||||||||||

| Number of | Paid-in | Subscriptions | development | |||||||||||||||||||||

| shares | Amount | Capital | Receivable | stage | Total | |||||||||||||||||||

|

Founder's Shares issued for cash at $0.001 |

||||||||||||||||||||||||

|

per share on September 30, 2012 |

5,000,000 |

$ |

5,000 |

$ |

- |

$ |

(5,000 |

) |

$ |

- |

$ |

- |

||||||||||||

|

Net Loss, September 30, 2012 |

(1,921 |

) |

(1,921 |

) |

||||||||||||||||||||

|

Balance, September 30, 2012 |

5,000,000 |

$ |

5,000 |

$ |

- |

$ |

(5,000 |

) |

$ |

(1,921 |

) |

$ |

(1,921 |

) |

||||||||||

|

Subscription Received, April 22, 2013 |

5,000 |

- |

5,000 |

|||||||||||||||||||||

|

Net Loss, September 30, 2013 |

(12,011 |

) |

(12,011 |

) |

||||||||||||||||||||

|

Balance, September 30, 2013 |

5,000,000 |

$ |

5,000 |

$ |

- |

$ |

- |

$ |

(13,932 |

) |

$ |

(8,932 |

) |

|||||||||||

|

Common shares issued for cash at $0.04 |

||||||||||||||||||||||||

|

per share on October 1, 2013 |

147,039 |

147 |

5,735 |

- |

- |

5,882 |

||||||||||||||||||

|

Common Shares retired on February 6, 2014 |

||||||||||||||||||||||||

|

for cash of $10 |

(4,780,000 |

) |

(4,780 |

) |

4,770 |

- |

- |

(10 |

) |

|||||||||||||||

|

Net Loss, September 30, 2014 |

(18,555 |

) |

(18,555 |

) |

||||||||||||||||||||

|

Balance, September 30, 2014 |

367,039 |

$ |

367 |

$ |

10,505 |

$ |

- |

$ |

(32,487 |

) |

$ |

(21,615 |

) |

|||||||||||

The accompanying notes are an integral part of these financial statements

|

14

|

|

EPICURE CHARCOAL, INC. |

|||||||

|

(A Development Stage Company) |

|||||||

|

STATEMENTS OF CASH FLOWS |

| June 21, 2012 | ||||||||||||

|

Year |

Year ended |

(date of inception) to | ||||||||||

| September 30, 2014 |

September 30, 2013 |

September 30, 2014 |

||||||||||

|

OPERATING ACTIVITIES |

||||||||||||

|

Net loss |

$ |

(18,555 |

) |

$ |

(12,011 |

) |

$ |

(32,487 |

) |

|||

|

Adjustment to reconcile net loss to net cash |

||||||||||||

|

Increase (decrease) in payables |

941 |

150 |

1,841 |

|||||||||

|

NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES |

$ |

(17,614 |

) |

$ |

(11,861 |

) |

$ |

(30,646 |

) |

|||

|

FINANCING ACTIVITIES |

||||||||||||

|

Proceeds from sale of common stock |

5,882 |

- |

10,882 |

|||||||||

|

Subscription Receivable |

- |

5,000 |

- |

|||||||||

|

Payment to retired common stock |

(10 |

) |

(10 |

) |

||||||||

|

Proceeds from related party loan |

12,053 |

9,062 |

27,300 |

|||||||||

|

Payment to related party loan |

(5,184 |

) |

- |

(5,184 |

) |

|||||||

|

NET CASH PROVIDED BY FINANCING ACTIVITIES |

$ |

12,741 |

$ |

14,062 |

$ |

32,988 |

||||||

|

NET INCREASE (DECREASE) IN CASH |

$ |

(4,873 |

) |

$ |

2,201 |

$ |

2,342 |

|||||

|

CASH, BEGINNING OF PERIOD |

$ |

7,215 |

$ |

5,014 |

$ |

- |

||||||

|

CASH, END OF PERIOD |

$ |

2,342 |

$ |

7,215 |

$ |

2,342 |

||||||

|

Supplemental cash flow information and noncash financing activities: |

|

|

||||||||||

|

Cash paid for: |

||||||||||||

|

Interest |

$ |

- |

$ |

- |

$ |

- |

||||||

|

Income taxes |

$ |

- |

$ |

- |

$ |

- |

||||||

The accompanying notes are an integral part of these financial statements

|

15

|

EPICURE CHARCOAL, INC.

(A Development Stage Enterprise)

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2014

NOTE 1 – NATURE OF OPERATIONS AND BASIS OF PRESENTATION

The Company was incorporated in the State of Nevada as a for-profit Company on June 21, 2012 and established a fiscal year end of September 30. We are a development-stage Company which intends to sell charcoal made from hard wood for BBQs and restaurants.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The financial statements present the balance sheet, statements of operations, stockholders' equity (deficit) and cash flows of the Company. These financial statements are presented in United States dollars and have been prepared in accordance with accounting principles generally accepted in the United States.

Advertising

Advertising costs will be expensed as incurred. As of September 30, 2014, no advertising costs have been incurred.

Property

The Company does not own or rent any property. The office space is provided by the president at no charge.

Use of Estimates and Assumptions

Preparation of the financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

Income Taxes

The Company follows the liability method of accounting for income taxes. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax balances. Deferred tax assets and liabilities are measured using enacted or substantially enacted tax rates expected to apply to the taxable income in the years in which those differences are expected to be recovered or settled. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the date of enactment or substantive enactment.

Net Loss per Share

Basic loss per share includes no dilution and is computed by dividing loss available to common stockholders by the weighted average number of common shares outstanding for the period. Dilutive loss per share reflects the potential dilution of securities that could share in the losses of the Company. Because the Company does not have any potentially dilutive securities, the accompanying presentation is only of basic loss per share.

Recent Accounting Pronouncements

The company has evaluated all the recent accounting pronouncements and believes that none of them will have a material effect on the company’s financial statement.

|

16

|

NOTE 3 – GOING CONCERN

The Company’s financial statements are prepared in accordance with generally accepted accounting principles applicable to a going concern. This contemplates the realization of assets and the liquidation of liabilities in the normal course of business. Currently, the Company has a working capital deficit of $21,595, an accumulated deficit of $32,487 and net loss from operations since inception of $32,487. The Company does not have a source of revenue sufficient to cover its operation costs giving substantial doubt for it to continue as a going concern. The Company will be dependent upon the raising of additional capital through placement of our common stock in order to implement its business plan, or merge with an operating company. There can be no assurance that the Company will be successful in either situation in order to continue as a going concern. The Company is funding its initial operations by way of issuing Founder’s shares.

These financial statements do not include any adjustments relating to the recoverability and classification of recorded assets or the amounts of and classification of liabilities that might be necessary in the event the company cannot continue in existence.

The officers and directors have committed to advancing certain operating costs of the Company, including Legal, Audit, Transfer Agency and Edgarizing costs.

NOTE 4 – FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company has determined the estimated fair value of financial instruments using available market information and appropriate valuation methodologies. The fair value of financial instruments classified as current assets or liabilities approximate their carrying value due to the short-term maturity of the instruments.

NOTE 5 – CAPITAL STOCK

The Company’s capitalization is 200,000,000 common shares with a par value of $0.001 per share. No preferred or common shares have been authorized or issued.

As of September 30, 2014, the Company had 367,039 shares of common shares issued and outstanding.

On September 30, 2012, the Company issued 5,000,000 common shares for cash $5,000.

On October 1, 2013 the company issued 147,039 common shares at $0.04 each for cash of $5,882.

On February 6, 2014, 4,780,000 founder's shares were retired for cash of $10.

As of September 30, 2014, the Company has not granted any stock options and has not recorded any stock-based compensation.

NOTE 6 – LOAN PAYABLE – RELATED PARTY LOANS

The Company has received $22,116 as a loan from a related party. The loan is payable on demand and without interest.

|

17

|

NOTE 7 – INCOME TAXES

We did not provide any current or deferred U.S. federal income tax provision or benefit for any of the periods presented because we have experienced operating losses since inception. Accounting for Uncertainty in Income Taxes when it is more likely than not that a tax asset cannot be realized through future income the Company must allow for this future tax benefit. We provided a full valuation allowance on the net deferred tax asset, consisting of net operating loss carry forwards, because management has determined that it is more likely than not that we will not earn income sufficient to realize the deferred tax assets during the carry forward period.

The components of the Company’s deferred tax asset and reconciliation of income taxes computed at the statutory rate to the income tax amount recorded as of September 30, 2014 are as follows:

| September 30, 2014 | September 30, 2013 | |||||||

|

Net operating loss carried forward |

32,487 |

13,932 |

||||||

|

Effective tax rate |

35 |

% |

35 |

% |

||||

|

Deferred tax assets |

11,370 |

4,876 |

||||||

|

Less: Valuation Allowance |

(11,370 |

) |

(4,876 |

) |

||||

|

Net deferred tax asset |

$ |

0 |

$ |

0 |

||||

The net federal operating loss carry forward will expire between 2027 and 2028. This carry forward may be limited upon the consummation of a business combination under IRC Section 381.

NOTE 8 – SUBSEQUENT EVENTS

On February 25, 2014 the Board of Directors and the consenting stockholder adopted and approved a resolution to effect an amendment to our Articles of Incorporation to effect a forward split of all issued and outstanding shares of common stock, at a ratio of 273:1 (the "Forward Stock Split"). The Forward Stock Split shall be effective twenty (20) days after this Information Statement is mailed to stockholders of Epicure. This event is still dependent on approval by FINRA.

|

18

|

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure.

There have not been any disagreements with our accountants on accounting, financial disclosure or any other matter. On November 5, 2014, Kenne Ruan, CPA, P.C (“Kenne Ruan”), notified Epicure Charcoal, Inc., a Nevada corporation (the “Company”), that Kenne Ruan had resigned as the independent registered public accounting firm of the Company effective November 5, 2014.

The reports of Kenne Ruan regarding the Company’s balance sheet as of September 30, 2013 and the statements of operations, stockholders’ deficit and cash flows for the years then ended and for the period from June 21, 2012 (inception) through September 30, 2013, contained no adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope, or accounting principle. The reports of Kenne Ruan, however, stated that there is substantial doubt about the Company’s ability to continue as a going concern. Kenne Ruan’s report on the financial statements for either of the past two years did not contain an adverse opinion or a disclaimer of opinion or was qualified or modified as to uncertainty, audit scope, or accounting principles and also describe the nature of each such adverse opinion, disclaimer of opinion, modification, or qualification.

From the period as of, and from, June 21, 2012 (inception) through September 30, 2013, and during the subsequent interim period through the date of resignation, the Company had no disagreement with Kenne Ruan on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreement, if not resolved to the satisfaction of Kenne Ruan, would have caused them to make reference thereto in their report on the Company’s financial statements for such period from June 21, 2012 (inception) through September 30, 2013. There were no reportable events, as listed in Item 304(a)(1)(v) of Regulation S-K.

The Company’s new independent registered public accounting firm is PLS CPAs.

Item 9A. Controls and Procedures.

The management of the Company is responsible for establishing and maintaining adequate internal control over financial reporting, as required by Sarbanes-Oxley (SOX) Section 404 A. The Company’s internal control over financial reporting is a process designed under the supervision of the Company’s Chief Executive Officer and Chief Financial Officer to provide reasonable assurance regarding the reliability of financial reporting and the preparation of the Company’s financial statements for external purposes in accordance with U.S. generally accepted accounting principles.

As of September 30, 2014 management assessed the effectiveness of the Company’s internal control over financial reporting based on the criteria for effective internal control over financial reporting established in SEC guidance on conducting such assessments. Based on that evaluation, they concluded that, during the period covered by this report, such internal controls and procedures were not effective to detect the inappropriate application of US GAAP rules as more fully described below. This was due to deficiencies that existed in the design or operation of our internal control over financial reporting that adversely affected our internal controls and that may be considered to be material weaknesses.

The matters involving internal controls and procedures that the Company’s management considered to be material weaknesses under the standards of the Public Company Accounting Oversight Board were: (1) lack of a functioning audit committee and lack of a majority of outside directors on the Company's board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; (2) inadequate segregation of duties consistent with control objectives; (3) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements; and (4) ineffective controls over period end financial disclosure and reporting processes. The aforementioned material weaknesses were identified by the Company's Chief Financial Officer in connection with the audit of our financial statements as of September 30, 2014 and communicated the matters to our management.

Management believes that the material weaknesses set forth in items (2), (3) and (4) above did not have an affect on the Company's financial results. However, management believes that the lack of a functioning audit committee and lack of a majority of outside directors on the Company's board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures can result in the Company's determination to its financial statements for the future years.

|

19

|

We are committed to improving our financial organization. As part of this commitment, we will create a position to segregate duties consistent with control objectives and will increase our personnel resources and technical accounting expertise within the accounting function when funds are available to the Company: i) Appointing one or more outside directors to our board of directors who shall be appointed to the audit committee of the Company resulting in a fully functioning audit committee who will undertake the oversight in the establishment and monitoring of required internal controls and procedures; and ii) Preparing and implementing sufficient written policies and checklists which will set forth procedures for accounting and financial reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements.

Management believes that the appointment of one or more outside directors, who shall be appointed to a fully functioning audit committee, will remedy the lack of a functioning audit committee and a lack of a majority of outside directors on the Company's Board. In addition, management believes that preparing and implementing sufficient written policies and checklists will remedy the following material weaknesses (i) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements; and (ii) ineffective controls over period end financial close and reporting processes. Further, management believes that the hiring of additional personnel who have the technical expertise and knowledge will result proper segregation of duties and provide more checks and balances within the department. Additional personnel will also provide the cross training needed to support the Company if personnel turn over issues within the department occur. This coupled with the appointment of additional outside directors will greatly decrease any control and procedure issues the company may encounter in the future.

We will continue to monitor and evaluate the effectiveness of our internal controls and procedures and our internal controls over financial reporting on an ongoing basis and are committed to taking further action and implementing additional enhancements or improvements, as necessary and as funds allow.

This annual report does not include an attestation report of the company’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this annual report.

There have been no changes in our internal control over financial reporting identified in connection with the evaluation required by paragraph (d) of Rules 13a-15 or 15d-15 under the Exchange Act that occurred during the small business issuer's last fiscal quarter that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

Item 9B. Other Information.

The Company appointed Vian Ulrich Crafford as Secretary of the Corporation on August 08, 2013

|

20

|

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

Identification of directors and executive officers

Alex Robertson, 58 years, is our President, renewable at every general stockholders meeting

Our Chief Financial Officer and Director named and Identified above is expected to hold his office/position until at lest the end of the first fiscal year after this offering or until the next annual meeting of the Company stockholders.

Business Experience

From January 1985 until December 2001 Alex Robertson joined Taiga Forest Products, a small wholesale forest products company that had 32 employees. He left Taiga after helping build it to a company with over $700 million in sales and trading publically on the Toronto Stock exchange. From January 2002 until August 2010 he joined Cypress Pacific Marketing a small value added forest products company. He left, after the company had successfully gone public on Toronto Venture Exchange. From September 2010 until November 2011, he researched the BBQ market in the USA. He joined Skana Forest Products in Nov. 2011 up to date.

Identification of Company Secretary

Vian Ulrich Crafford, 19, is the Company Secretary.

Business Experience

Mr. Crawford was a Full time student at High School Hartswater from 2008 till 2012. During his time at school he participated in numerous projects which involved the marketing of the school to both the district of the “Vaalharts Besproeiings” area and the Northern Cape. Marketing resposibilities include marketing of the school to prospective students. During school holidays he assisted in the marketing of the raw cotton product after harvesting.

From January 2013 until present, Mr. Crawford is studying B.com Marketing at the University of the Free State.

|

21

|

Significant Employees

The Company does not, at present, have any employees other than the current officers and director. We have not entered into any employment agreements, as we currently do not have any employees other than the current officers and director.

Family Relations

There are no family relationships among the Directors and Officers of Epicure Charcoal, Inc.

Involvement in Legal Proceedings

No executive Officer or Director of the Company has been convicted in any criminal proceeding (excluding traffic violations) or is the subject of a criminal proceeding that is currently pending.

No executive Officer or Director of the Company is the subject of any pending legal proceedings.

No Executive Officer or Director of the Company is involved in any bankruptcy petition by or against any business in which they are a general partner or executive officer at this time or within two years of any involvement as a general partner, executive officer, or Director of any business.

Item 11. Executive Compensation

EPICURE CHARCOAL, INC. has made no provisions for paying cash or non-cash compensation to its sole officer and director. No salaries are being paid at the present time, and none will be paid unless and until our operations generate sufficient cash flows.

The table below summarizes all compensation awarded to, earned by, or paid to our named executive officer for all services rendered in all capacities to us for the period from inception through September 30, 2014.

SUMMARY COMPENSATION TABLE

|

Name and principal position |

Year | Salary ($) |

Bonus ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) | Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($) | Total ($) |

||||||||||||||||||||||||||

|

Alex Robertson |

2012 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

||||||||||||||||||||||||||

|

President |

2013 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

||||||||||||||||||||||||||

|

2014 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

Vian Ulrich Crafford |

2013 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

||||||||||||||||||||||||||

|

2014 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|||||||||||||||||||||||||||

We did not pay any salaries in 2014. We do not anticipate beginning to pay salaries until we have adequate funds to do so. There are no other stock option plans, retirement, pension, or profit sharing plans for the benefit of our officer and director other than as described herein.

|

22

|

Out standing Equity awards at fiscal year end table.

The table below summarizes all unexercised options, stock that has not vested, and equity incentive plan awards for each named executive officer as of September 30, 2014.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-ENDOPTION AWARDS STOCK AWARDS

|

Name (a) |

Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($) (e) | Option Expiration Date (f) | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested (#) | |||||||||||||||||||||||||||

|

Alex Robertson |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|||||||||||||||||||||||||||

|

Vian Ulrich Crafford |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|||||||||||||||||||||||||||

There were no grants of stock options since inception though the year end September 30, 2014

We do not have any long-term incentive plans that provide compensation intended to serve as incentive for performance.

The Board of Directors of the Company has not adopted a stock option plan. The company has no plans to adopt it but may choose to do so in the future. If such a plan is adopted, this may be administered by the board or a committee appointed by the board (the “Committee”). The committee would have the power to modify, extend or renew outstanding options and to authorize the grant of new options in substitution therefore, provided that any such action may not impair any rights under any option previously granted. EPICURE CHARCOAL, INC. may develop an incentive based stock option plan for its officers and directors and may reserve up to 10% of its outstanding shares of common stock for that purpose.

Stock Awards Plan

The company has not adopted a Stock Awards Plan, but may do so in the future. The terms of any such plan have not been determined.

Director Compensation

The table below summarizes all compensation awarded to, earned by, or paid to our directors for all services rendered in all capacities to us for the period from inception (June 21, 2012) through September 30, 2014.

DIRECTORS COMPENSATION

|

Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($) | Total ($) |

|||||||||||||||||||||

|

Alex Robertson |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|||||||||||||||||||||

At this time, EPICURE CHARCOAL, Inc. has not entered into any employment agreements with its sole officer and director. If there is sufficient cash flow available from our future operations, the company may enter into employment agreements with our sole officer and director or future key staff members.

|

23

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

The following table sets forth, as of the date of this prospectus, the total number of shares owned beneficially by our President and director, and key employees, individually and as a group, and the present owners of 5% or more of our total outstanding shares. The table also reflects what this ownership will be assuming completion of the sale of all shares in this offering. The stockholder listed below has direct ownership of her shares and possesses sole voting and dispositive power with respect to the shares.

|

Title of class |

|

Name and Address Beneficial Owner [1] |

Amount and nature of beneficial ownership | Percent of Class | Percentage of Ownership Assuming all of the Shares are Sold | Percentage of Ownership Assuming 75% of the Shares are Sold | Percentage of Ownership Assuming 50% of the Shares are Sold | Percentage of Ownership Assuming 25% of the Shares are Sold | ||||||||||||||||||

|

Common Stock |

|

Alex Robertson 4332 Saltsspring Road, Ferndale, Washington 98248 [2] |

5,000,000 |

100 |

% |

52.63 |

% |

60 |

% |

68.97 |

% |

81.63 |

% |

|||||||||||||

|

All Officers and Directors as a Group (1 person) |

5,000,000 |

100 |

% |

52.63 |

% |

60 |

% |

68.97 |

% |

81.63 |

% |

|||||||||||||||

________________

|

[1] |

The person named above may be deemed to be a “parent” and “promoter” of our company, within the meaning of such terms under the Securities Act of 1933, as amended, by virtue of his direct and indirect stock holdings. Mr. Robertson is the only “promoter” of our company. |

|

[2] |

Beneficial ownership is determined in accordance with the Rule 13d-3(d)(1) of the Exchange Act, as amended and generally includes voting or investment power with respect to securities. Pursuant to the rules and regulations of the Securities and Exchange Commission, shares of common stock that an individual or group has a right to acquire within 60 days pursuant to the exercise of options or warrants are deemed to be outstanding for the purposes of computing the percentage ownership of such individual or group and includes shares that could be obtained by the named individual within the next 60 days |

Our President and director will continue to own the majority of our common stock after the offering, regardless of the number of shares sold. Since he will continue to control the Company after the offering, investors will be unable to change the course of the operations. Thus, the shares we are offering lack the value normally attributable to voting rights. This could result in a reduction in value of the shares you own because of their ineffective voting power. None of our common stock is subject to outstanding options, warrants, or securities convertible into common stock.

Item 13. Certain Relationships and Related Transactions, and Director Independence.

On September 30, 2012, we issued a total of 5,000,000 shares of common stock to Mr. Alex Robertson, our sole officer and director, for total cash consideration of $5,000. The Company considered these securities as “Founders” shares. Mr. Alex Robertson purchased his shares at par value being $0.001 per share. This offer and sale was made pursuant to the exemption from registration afforded by Section 4(2)-Exempted Transactions of the Securities Act of 1933 transactions by an issuer not involving any public offering. On February 6, 2014, 4,780,000 founder's shares were retired for cash of $10

Our sole officer and director provides office space at no charge to the Company. As of September 30, 2014, Mr. Alex Robertson has paid expenses on behalf of the Company in the amount of $22,116. The amount due to Mr. Robertson is unsecured, non-interest bearing, payable on demand with no written terms of repayment.

|

24

|

Director Independence

The Company’s board of directors is currently composed of one member Mr. Alex Robertson, who does not qualify as an independent director in accordance with the published listing requirements of the NASDAQ Global Market. The NASDAQ independence definition includes a series of objective tests, such as that the director is not, and has not been for at least three years, one of our employees and that neither the director, nor any of his family members has engaged in various types of business dealings with us. In addition, our board of directors has not made a subjective determination as to each director that no relationships exist which, in the opinion of our board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, though such subjective determination is required by the NASDAQ rules. Had our board of directors made these determinations, our board of directors would have reviewed and discussed information provided by the directors and us with regard to each director’s business and personal activities and relationships as they may relate to our management and us.

Item 14. Principal Accountant Fees and Services

For the fiscal year ended September 30, 2014 we incurred $7,500 in fees to our principal independent accountants for professional services. Audit fees that where incurred in connection with the audit of financial statements for the fiscal year ended September 30, 2013, were $2,800 and September 30, 2014 were $3,800. For review of our financial statements for the quarters ended December 31, 2013, March 31, 2014, and June 30, 2014, we incurred $3,700 in fees to our principal independent accountants for professional services.

During the fiscal year ended September 30, 2014, we did not incur any other fees for professional services rendered by our principal independent accountants for all other non-audit services which may include, but not limited to, tax related services, actuarial services or valuation services.

|

25

|

PART IV

Item 15. Exhibits, Financial Statement Schedules.

|

Exhibit No. |

|

|

|

3(i) |

|

Articles of incorporation Epicure Charcoal, Inc. [1] |

|

3(ii) |

|

By-Laws Epicure Charcoal, Inc. [2] |

|

31.1 |

|

Certification of Chief Executive Officer Pursuant to Rule 13a–14(a) or 15d-14(a) of the Securities Exchange Act of 1934* |

|

31.2 |

|

Certification of Chief Financial Officer Pursuant to Rule 13a-14(a) or 15d-14(a) of the Securities Exchange Act of 1934* |

|

32.1 |

|

Certification of Chief Executive Officer under Section 1350 as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

|

32.1 |

|

Certification of Chief Financial Officer under Section 1350 as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002** |

|

101 |

|

Interactive data files pursuant to Rule 405 of Regulation S-T |

________________

[1] Incorporated by reference from the Company’s S-1 filled with the Commission on December 10, 2012

[2] Incorporated by reference from the Company’s S-1 filled with the Commission on December 10, 2012

* Included in Exhibit 31.1

** Included in Exhibit 32.1

|

26

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

Epicure Charcoal, Inc. |

|||

|

Dated: January 9, 2015 |

By: | /s/ Alex Robertson | |

|

Alex Robertson |

|||

|

President and Director |

|||

| Principal Executive Officer

Principal Financial Officer Principal Accounting Officer |

|||

27