Attached files

| file | filename |

|---|---|

| 8-K - CUSTOMERS BANCORP,INC. FORM 8-K - Customers Bancorp, Inc. | customers8k.htm |

Highly Focused, Low Risk, Above Average Growth

Bank Holding Company

Analyst Day Presentation

January 7, 2015

NYSE: CUBI

2

Forward-Looking Statements

This presentation as well as other written or oral communications made from time to time by us, may contain certain forward-looking information

within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. These statements relate to future

events or future predictions, including events or predictions relating to our future financial performance, and are generally identifiable by the use of

forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “plan,” “intend,” “target,” or “anticipates” or the negative thereof

or comparable terminology, or by discussion of strategy or goals that involve risks and uncertainties. These forward-looking statements are only

predictions and estimates regarding future events and circumstances and involve known and unknown risks, uncertainties and other factors that may

cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity,

performance or achievements expressed or implied by such forward-looking statements. This information is based on various assumptions by us that

may not prove to be correct. Important factors to consider and evaluate in such forward-looking statements include:

within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. These statements relate to future

events or future predictions, including events or predictions relating to our future financial performance, and are generally identifiable by the use of

forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “plan,” “intend,” “target,” or “anticipates” or the negative thereof

or comparable terminology, or by discussion of strategy or goals that involve risks and uncertainties. These forward-looking statements are only

predictions and estimates regarding future events and circumstances and involve known and unknown risks, uncertainties and other factors that may

cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity,

performance or achievements expressed or implied by such forward-looking statements. This information is based on various assumptions by us that

may not prove to be correct. Important factors to consider and evaluate in such forward-looking statements include:

•changes in the external competitive market factors that might impact our results of operations;

•changes in laws and regulations, including without limitation changes in capital requirements under the federal prompt corrective action regulations;

•changes in our business strategy or an inability to execute our strategy due to the occurrence of unanticipated events;

•our ability to identify potential candidates for, and consummate, acquisition or investment transactions;

•the timing of acquisition or investment transactions;

•constraints on our ability to consummate an attractive acquisition or investment transaction because of significant competition for these

opportunities;

opportunities;

•the failure of the Bank to complete any or all of the transactions described herein on the terms currently contemplated;

•local, regional and national economic conditions and events and the impact they may have on us and our customers;

•ability to attract deposits and other sources of liquidity;

•changes in the financial performance and/or condition of our borrowers;

•changes in the level of non-performing and classified assets and charge-offs;

•changes in estimates of future loan loss reserve requirements based upon the periodic review thereof under relevant regulatory and accounting

requirements;

requirements;

•the integration of the Bank’s recent FDIC-assisted acquisitions may present unforeseen challenges;

•inflation, interest rate, securities market and monetary fluctuations;

•the timely development and acceptance of new banking products and services and perceived overall value of these products and services by users;

•changes in consumer spending, borrowing and saving habits;

•technological changes;

•the ability to increase market share and control expenses;

3

Forward-Looking Statements

• continued volatility in the credit and equity markets and its effect on the general economy;

• the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company

Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters;

Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters;

• the businesses of the Bank and any acquisition targets or merger partners and subsidiaries not integrating successfully or such integration being

more difficult, time-consuming or costly than expected;

more difficult, time-consuming or costly than expected;

• material differences in the actual financial results of merger and acquisition activities compared with expectations, such as with respect to the full

realization of anticipated cost savings and revenue enhancements within the expected time frame;

realization of anticipated cost savings and revenue enhancements within the expected time frame;

• revenues following any merger being lower than expected;

• deposit attrition, operating costs, customer loss and business disruption following the merger, including, without limitation, difficulties in

maintaining relationships with employees being greater than expected.

maintaining relationships with employees being greater than expected.

These forward-looking statements are subject to significant uncertainties and contingencies, many of which are beyond our control. Although we

believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity,

performance or achievements. Accordingly, there can be no assurance that actual results will meet expectations or will not be materially lower

than the results contemplated in this presentation. You are cautioned not to place undue reliance on these forward-looking statements, which

speak only as of the date of this document or, in the case of documents referred to or incorporated by reference, the dates of those documents.

We do not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after

the date of this document or to reflect the occurrence of unanticipated events, except as may be required under applicable law.

believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity,

performance or achievements. Accordingly, there can be no assurance that actual results will meet expectations or will not be materially lower

than the results contemplated in this presentation. You are cautioned not to place undue reliance on these forward-looking statements, which

speak only as of the date of this document or, in the case of documents referred to or incorporated by reference, the dates of those documents.

We do not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after

the date of this document or to reflect the occurrence of unanticipated events, except as may be required under applicable law.

This presentation is for discussion purposes only, and shall not constitute any offer to sell or the solicitation of an offer to buy any security, nor is it

intended to give rise to any legal relationship between Customers Bancorp, Inc. (the “Company”) and you or any other person, nor is it a

recommendation to buy any securities or enter into any transaction with the Company. The information contained herein is preliminary and

material changes to such information may be made at any time. If any offer of securities is made, it shall be made pursuant to a definitive offering

memorandum or prospectus (“Offering Memorandum”) prepared by or on behalf of the Company, which would contain material information not

contained herein and which shall supersede, amend and supplement this information in its entirety.

intended to give rise to any legal relationship between Customers Bancorp, Inc. (the “Company”) and you or any other person, nor is it a

recommendation to buy any securities or enter into any transaction with the Company. The information contained herein is preliminary and

material changes to such information may be made at any time. If any offer of securities is made, it shall be made pursuant to a definitive offering

memorandum or prospectus (“Offering Memorandum”) prepared by or on behalf of the Company, which would contain material information not

contained herein and which shall supersede, amend and supplement this information in its entirety.

Any decision to invest in the Company’s securities should be made after reviewing an Offering Memorandum, conducting such investigations as the

investor deems necessary or appropriate, and consulting the investor’s own legal, accounting, tax, and other advisors in order to make an

independent determination of the suitability and consequences of an investment in such securities. No offer to purchase securities of the

Company will be made or accepted prior to receipt by an investor of an Offering Memorandum and relevant subscription documentation, all of

which must be reviewed together with the Company’s then-current financial statements and, with respect to the subscription documentation,

completed and returned to the Company in its entirety. Unless purchasing in an offering of securities registered pursuant to the Securities Act of

1933, as amended, all investors must be “accredited investors” as defined in the securities laws of the United States before they can invest in the

Company.

investor deems necessary or appropriate, and consulting the investor’s own legal, accounting, tax, and other advisors in order to make an

independent determination of the suitability and consequences of an investment in such securities. No offer to purchase securities of the

Company will be made or accepted prior to receipt by an investor of an Offering Memorandum and relevant subscription documentation, all of

which must be reviewed together with the Company’s then-current financial statements and, with respect to the subscription documentation,

completed and returned to the Company in its entirety. Unless purchasing in an offering of securities registered pursuant to the Securities Act of

1933, as amended, all investors must be “accredited investors” as defined in the securities laws of the United States before they can invest in the

Company.

4

Forward-Looking Statements

This presentation also includes estimated guidance regarding our fully diluted earnings per share for the years 2014 and 2015, which

we have previously disclosed and is subject to the assumptions and qualifications included in that previous disclosure. The guidance

consists solely of estimates prepared by management based on currently available information and assumptions of future performance

of the company and the general economy. Our independent registered public accounting firm has not audited, reviewed or performed

any procedures with respect to the guidance and, accordingly, does not express an opinion or any other form of assurance with respect

to this data. Our actual results may differ from the guidance, and any such differences could be material. Accordingly, undue reliance

should not be placed on this information. The factors discussed above should be considered and evaluated with respect to our

guidance.

we have previously disclosed and is subject to the assumptions and qualifications included in that previous disclosure. The guidance

consists solely of estimates prepared by management based on currently available information and assumptions of future performance

of the company and the general economy. Our independent registered public accounting firm has not audited, reviewed or performed

any procedures with respect to the guidance and, accordingly, does not express an opinion or any other form of assurance with respect

to this data. Our actual results may differ from the guidance, and any such differences could be material. Accordingly, undue reliance

should not be placed on this information. The factors discussed above should be considered and evaluated with respect to our

guidance.

5

Agenda

1. Business Strategy

• Banking Industry Overview

• Customers Bancorp, Inc. - It’s Strategy

• Customers Bank - High Touch Supported with High Tech for

Businesses

Businesses

• BankMobile - High Tech with High Touch like features for

Consumers

Consumers

2. Shareholder Value Creation Model

3. Our Performance over the Past Five Years

4. Risk Management

• Credit Risk Management Process and Results

• CRA, Fair and Responsible Banking Risk Management Update

5. Financial Performance Model

• Strong revenue generation, strong credit, low efficiency ratio and

sustainable profitability in all interest rate environments

sustainable profitability in all interest rate environments

• Our financial targets for Q4 2014, 2015 & beyond

6. Bank Mobile

7. Questions & Answers

6

Current Banking Environment and

How We are Positioned

How We are Positioned

7

What We See as The Role of CEO and Board …

Especially in this Environment

Especially in this Environment

1. Absolute clarity of your vision, strategy, goals and tactics;

there must be absolute alignment between board and

management

there must be absolute alignment between board and

management

2. Become a master of your internal environment

§ Our authentic internal assessment of strengths,

weaknesses and opportunities

weaknesses and opportunities

3. Be a master of your external environment

§ What is happening with customer trends, technology,

competition, economy, regulatory environment, etc. -

How does this impact us?

competition, economy, regulatory environment, etc. -

How does this impact us?

4. Highest level of integrity and fairness in all we do

5. Passion for continuous improvement

8

Banking Industry Trends……

How Do We Deal with These Issues

Impediments to Growth

External Forces

• Role of traditional bank branches

changing very rapidly

changing very rapidly

• Mobile banking fastest growing channel

• Banks of all sizes revisiting their

business strategies, revenue generation

models and cost structures

business strategies, revenue generation

models and cost structures

• Technology & customer needs, desires

and style changing rapidly

and style changing rapidly

• Traditional CRE lending very difficult to do

• Very little consumer loan growth;

headwinds for consumer credit quality

headwinds for consumer credit quality

• Growth exists only at niche players

• Mortgage banking revenues are

extremely volatile

extremely volatile

• Pressure to reduce or eliminate Overdraft

and other nuisance fees by CFPB

and other nuisance fees by CFPB

• Regulators have no appreciation or

incentive to see banks grow profitability

incentive to see banks grow profitability

Business Issues

Shareholder Expectations

• Start bank and sell at 2 to 3x book no

longer an option - what do shareholders of

small privately held banks do?

longer an option - what do shareholders of

small privately held banks do?

• Equity markets not available to small

banks

banks

• Banks need to earn 10% or more ROE if

they want to remain independent

they want to remain independent

• Consistent ROE of 12% or greater and

ROA of 1% or greater being rewarded well

by market

ROA of 1% or greater being rewarded well

by market

• Slow economic growth

• Low good quality consumer and business

loan demand

loan demand

• Pressure continues on margin. Days of

3.5%-4.0% margin are gone. Banks need

to reduce efficiency ratios

3.5%-4.0% margin are gone. Banks need

to reduce efficiency ratios

• Difficult to attract good talent

• Very difficult and inconsistent regulatory

environment

environment

• Shareholders want 10%+ ROE, consistent

quality growth and strong risk

management infrastructure

quality growth and strong risk

management infrastructure

Issues facing

Boards &

CEO’s

Boards &

CEO’s

What is our unique strategy

for revenue and profitable

growth

for revenue and profitable

growth

How do we attract and retain

best talent?

best talent?

How do we take advantage of

technology?

technology?

How do we deal with growing

compliance burden?

compliance burden?

How do we manage our risks

better than peers?

better than peers?

How do we lower our

efficiency ratios?

efficiency ratios?

9

Our Approach to Developing a Winning Business Model

1. Must focus on both “Relationship” or “High Touch” banking combined with

“Highly Efficient” or “High Tech”. Strategy should be unique as to not be

copied easily

“Highly Efficient” or “High Tech”. Strategy should be unique as to not be

copied easily

2. Attract and retain best high quality talent. Business Bankers / Relationship

Bankers with approximately 15 years+ experience who bring a book of

business with them

Bankers with approximately 15 years+ experience who bring a book of

business with them

3. Compensate leaders based upon profitability with both cash and equity

4. Never deviate from following critical success factors

• Only focus on very strong credit quality niches

• Have very strong risk management culture

• Have significantly lower efficiency ratio than peers to deliver sustainable

strong profitability and growth with lower margin and lower risk profile

strong profitability and growth with lower margin and lower risk profile

• Always attract and retain top quality talent

• Culture of innovation and continuous improvement

10

Our Model

• A business bank with a unique strategy

• Attraction and retention of top quality talent

• Unique Model

• “Very Branch Lite” business model with “High Touch Supported

with High Tech”

with High Tech”

• Highly Efficient

• Focuses only on high quality, growth oriented, although somewhat

lower margin business

lower margin business

• Strong risk management with low efficiency ratio, driving higher

profitability, ROE and growth

profitability, ROE and growth

11

§ Innovator / disruptor / not

branch dependent

branch dependent

§ Differentiated / Unique model

§ Technology savvy

Our Thesis on Current

U.S. Banking Environment

Credit Improving - Though Banks Face a Number of Operational Headwinds

§ Credit Improving

§ Quality Asset Generation Remains A Challenge

4 Banks are starved for interest-earning assets and exploring new asset classes, competing on price and looking into specialty finance business / lending

§ NIM Compression

4 Low rate environment for the foreseeable future will continue to compress NIM

4 Many institutions wither betting on rates or otherwise taking excessive interest rate risk

4 Industry NIM continues to decline

4 Down about 100 bps since 1995

4 Low interest rate environment, competitive pressures likely to prevent return to historical levels

§ Operational leverage

4 Expense management is top of mind as banks try to improve efficiency in light of revenue pressure and increased regulatory / compliance costs

4 Regulatory pressure expected to stay robust

§ New Strategies

4 Yesterdays strategies may not be appropriate tomorrow

Critical to Have a Winning Business Model

§ Heavy branch based delivery

system

system

§ Strong credit quality

§ Core deposits

§ Dependent on OD fees

§ Expense management

Traditional Banks

§ Diversified revenue sources

§ Cross sell strength

§ Capital efficiency

Fee Income Leaders

Relationship & Innovative

Banks

Banks

Source: SNL Financial.

1Includes data for top 50 U.S. banks by assets.

12

Customers Bank

Executing On Our Unique High Performing

Banking Model

Top Line Growth in 2013 & 2012

13

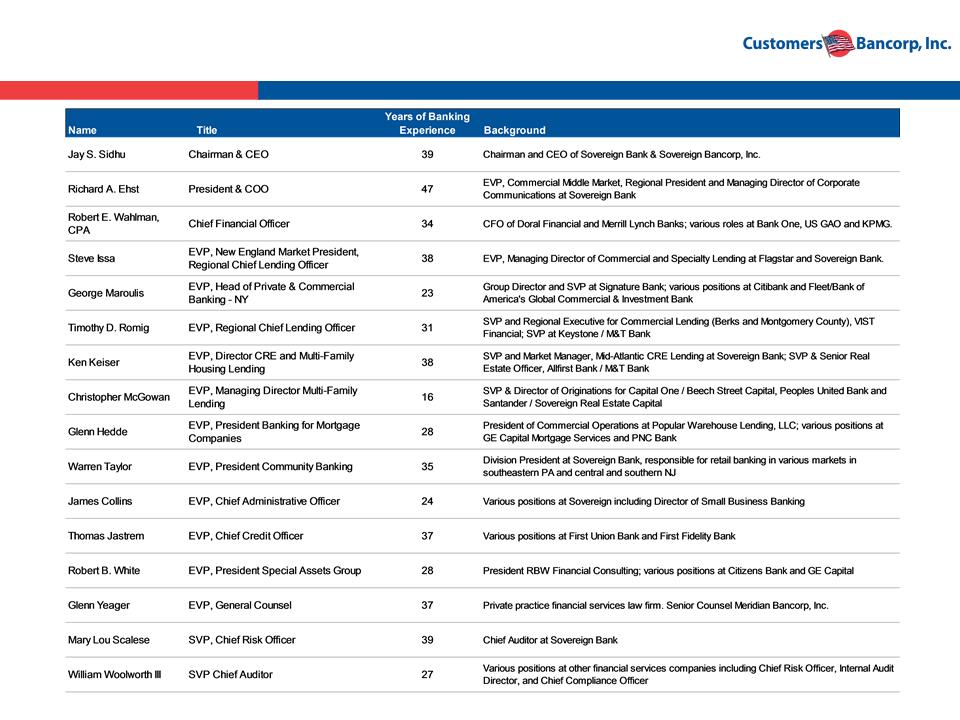

Our Competitive Advantage: A Highly Experienced Management Team

14

Disciplined Model for Increasing Shareholder Value

§ Strong organic revenue growth + scalable infrastructure =

sustainable double digit EPS growth and increased shareholder

value

sustainable double digit EPS growth and increased shareholder

value

§ A very robust risk management driven business strategy

§ Build tangible book value per share each quarter via earnings

§ Any book value dilution from any acquisitions must be overcome

within 1-2 years; otherwise stick with organic growth strategy

within 1-2 years; otherwise stick with organic growth strategy

§ Superior execution through proven management team

Disciplined Model for Superior Shareholder Value Creation

15

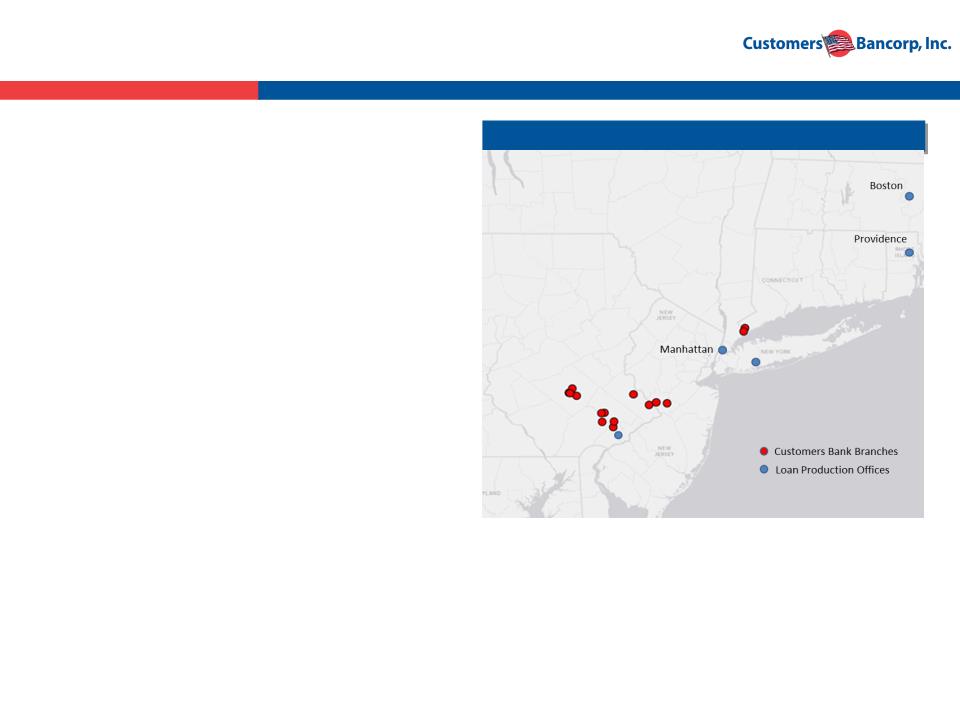

Current Company Overview

Source: SNL Financial and Company data.

Note: Branch proposed in northeastern Philadelphia

~$6.5 bn Business Bank with 19 sales offices with

target market from Boston to Philadelphia

target market from Boston to Philadelphia

Operating in key Mid-Atlantic and Northeast

markets

markets

§ Greater New York City area (Westchester County

Manhattan & Long Island)

Manhattan & Long Island)

§ Philadelphia area (Bucks, Berks, Chester, Delaware

and Philadelphia Counties in southeastern

Pennsylvania and Greater Princeton area in New

Jersey)

and Philadelphia Counties in southeastern

Pennsylvania and Greater Princeton area in New

Jersey)

§ Greater Boston area (Boston and Providence)

“High-touch, supported with high-tech” value

proposition

proposition

§ Very experienced teams using “Single Point of

Contact” model

Contact” model

§ Provides exceptional customer service supported by

state-of-the-art technology support

state-of-the-art technology support

§ Incentive compensation plans based upon P&L by

teams

teams

Branches and Loan Production Offices

16

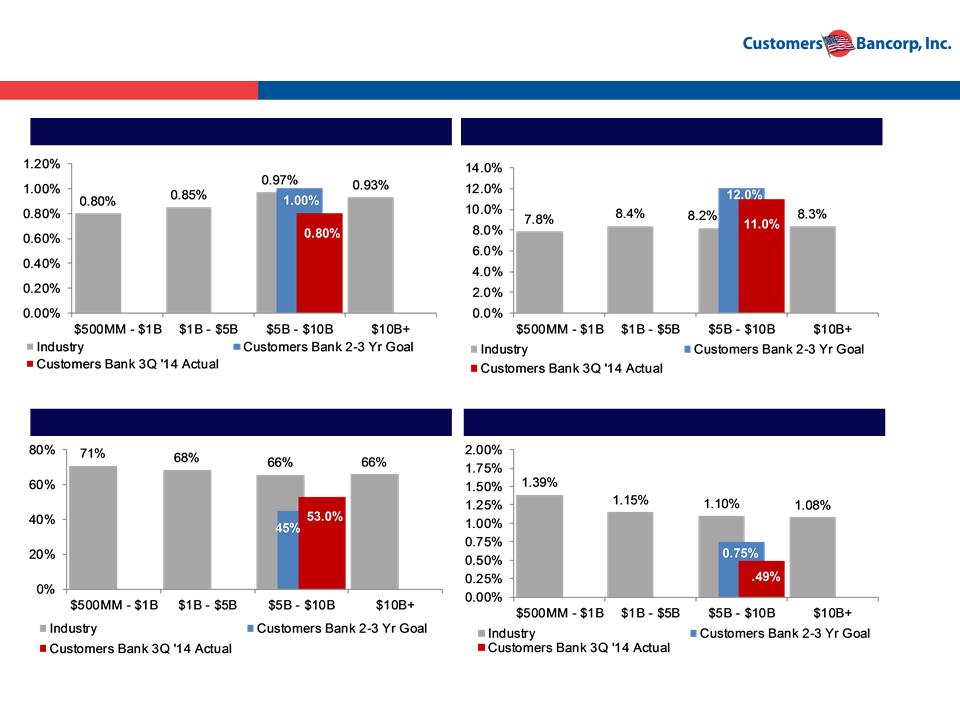

Investment Proposition

Strong Organic Growth, Well Capitalized, Branch Lite Bank in Attractive Markets

§ $6.5 billion asset bank with only 14 branches and 5 sales offices

§ Well capitalized at 11.2% total risk based capital, 7.1% tier 1 leverage, and 6.5% tangible equity to tangible assets

§ Target market from Boston to Philadelphia along Interstate 95

Strong Profitability & Growth

§ Q3 2014 earnings up 41% over 3Q 2013 with an ROA of .80% and an ROE of 11%

§ YTD through September 2014 net income of $30.0 million up 26.8% over same period last year

§ ROA goal of 1% + and ROE of 12% + within 2-3 years

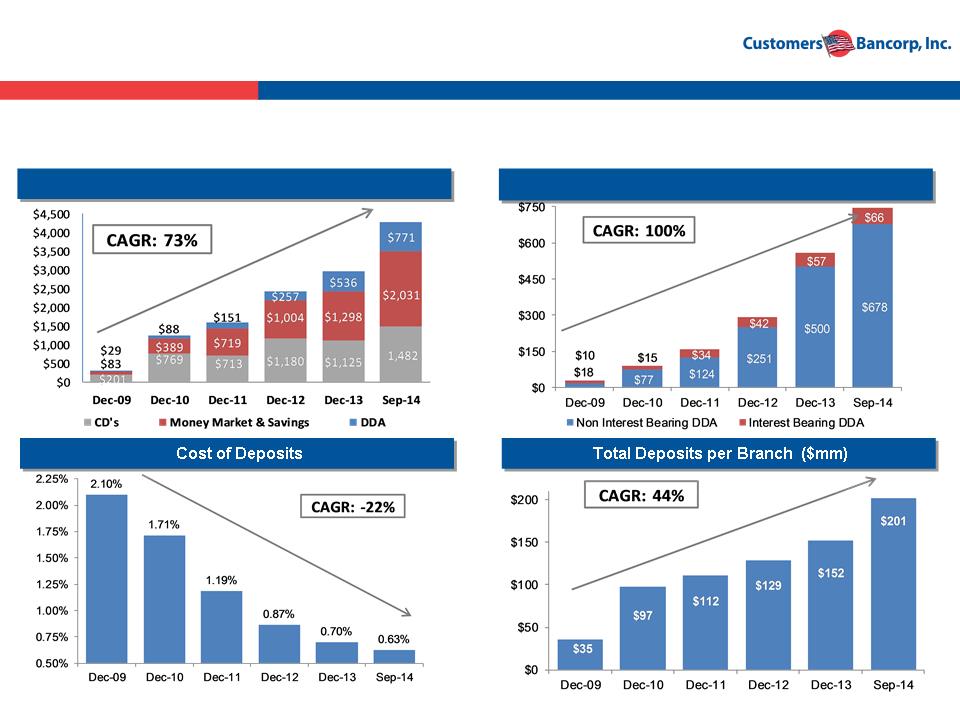

§ DDA and total deposits compounded annual growth of 100% and 73% respectively since 2009

§ Customers operating efficiencies offset tighter margins and generate sustainable profitability

Strong Credit Quality With Better Than Industry Efficiency Ratio

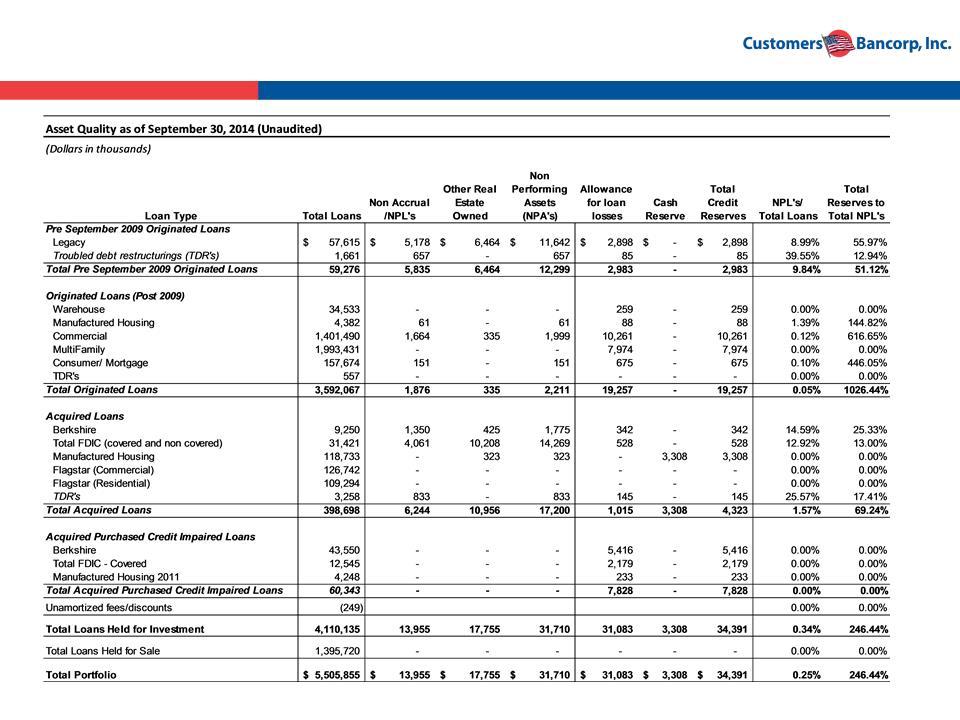

§ 0.25% non-performing loans (0.05% NPLs on $3.6 billion of loans originated after 2009)

§ No charge-offs on loans originated after 2009

§ Total reserves to non-performing loans of 246.4%

§ Q3 2014 margin was 2.79% and efficiency ratio was 54% - Efficiency ratio will be in the 40’s within 36 months

Attractive Valuation

§ Current share price (18.86)(1) is 12.3x estimated 2014 earnings, and 9.6x estimated 2015 earnings

§ Price/tangible book only 1.0x estimated for 2015 tangible book value

§ Peers, by size, trading at 14x LTM earnings and 1.7x price/tangible book; Peers with unique models trading at much

higher multiples

higher multiples

(1) Share price as of January 5, 2015

17

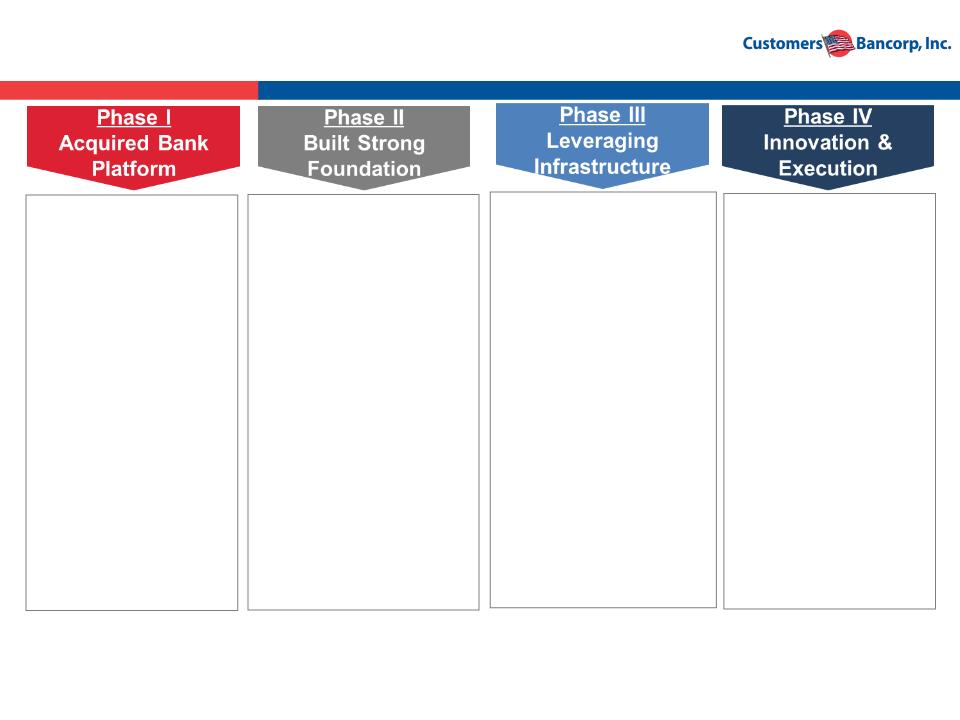

Execution Timeline

§ We invested in and

took control of a $270

million asset

Customers Bank (FKA

New Century Bank)

took control of a $270

million asset

Customers Bank (FKA

New Century Bank)

§ Identified existing

credit problems,

adequately reserved

and recapitalized the

bank

credit problems,

adequately reserved

and recapitalized the

bank

§ Actively worked out

very extensive loan

problems

very extensive loan

problems

§ Recruited experienced

management team

management team

§ Enhanced credit and risk

management

management

§ Developed infrastructure

for organic growth

for organic growth

§ Built out warehouse

lending platform and

doubled deposit and loan

portfolio

lending platform and

doubled deposit and loan

portfolio

§ Completed 3 small

acquisitions:

acquisitions:

– ISN Bank (FDIC-

assisted) ~ $70 mm

assisted) ~ $70 mm

– USA Bank (FDIC-

assisted) ~ $170 mm

assisted) ~ $170 mm

– Berkshire Bancorp

(Whole bank) ~ $85

mm

(Whole bank) ~ $85

mm

§ Recruited proven lending

teams

teams

§ Built out Commercial and

Multi-family lending

platforms

Multi-family lending

platforms

§ De Novo expansion;4-6

sales offices or teams

added each year

sales offices or teams

added each year

§ Continue to show strong

loan and deposit growth

loan and deposit growth

§ Built a “branch lite” high

growth Community Bank

and model for future

growth

growth Community Bank

and model for future

growth

§ Goals to ~12%+ ROE;

~1% ROA

~1% ROA

2009

Assets: $350M

Equity: $22M

2010-2011

Assets: $2.1B

Equity: $148M

2012-2013

Assets: $4.2B

Equity: $400M

3Q 2014

Assets: $6.5B

Equity: $426M

§ Single Point of Contact

Private Banking model

executed - commercial

focus

Private Banking model

executed - commercial

focus

§ Introduce bankmobile -

banking of the future

for consumers

banking of the future

for consumers

§ Continue to show

strong loan and

deposit growth

strong loan and

deposit growth

§ ~12%+ ROE; ~1%

ROA expected within

36 months

ROA expected within

36 months

§ ~$6.5+ billion asset

bank by end of 2014

bank by end of 2014

§ ~$9 billion asset bank

by end of 2019

by end of 2019

18

Banking Strategy

Business Banking Focus - ~95% of revenues come from business

• Loan and deposit business through these segments:

• Banking Privately Held Businesses

• Banking High Net Worth Families

• Banking Mortgage Companies

All Consumer

Products

Products

All Business

Products

Products

All Non-Credit

Products

Products

Client

Makes

One Call

Makes

One Call

Client

Private /

Personal

Bankers

Personal

Bankers

Concierge

Bankers

Bankers

Single Point of Contact

High Touch / High Tech

19

Deposit Strategy - High Touch, High Tech

§ Implementation of

technology suite

allows for unique

product offerings:

technology suite

allows for unique

product offerings:

§ Remote account

opening &

deposit capture

opening &

deposit capture

§ Internet/mobile

banking

banking

§ Free ATM

deployment in

U.S.

deployment in

U.S.

Cost of Funds + Branch Operating Expense - Fees = ALL-IN-Cost < Competitors

CUBI All-in cost of 1.75% is less than competitors all-in cost over the long-term

Technology

§ Low cost banking

model allows for

more pricing

flexibility

model allows for

more pricing

flexibility

§ Significantly lower

overhead costs vs. a

traditional branch

overhead costs vs. a

traditional branch

§ Pricing/profitability

measured across

relationship

measured across

relationship

Pricing

§ Experienced

bankers who own a

portfolio of

customers

bankers who own a

portfolio of

customers

§ Customer

acquisition &

retention strongly

incentivized

acquisition &

retention strongly

incentivized

§ Takes banker to the

customer’s home or

office, 12 hours a

day, 7 days a week

customer’s home or

office, 12 hours a

day, 7 days a week

§ Appointment

banking approach

banking approach

§ Customer access to

private bankers

private bankers

§ “Virtual Branches”

out of sales offices

out of sales offices

Sales Force

Concierge Banking

20

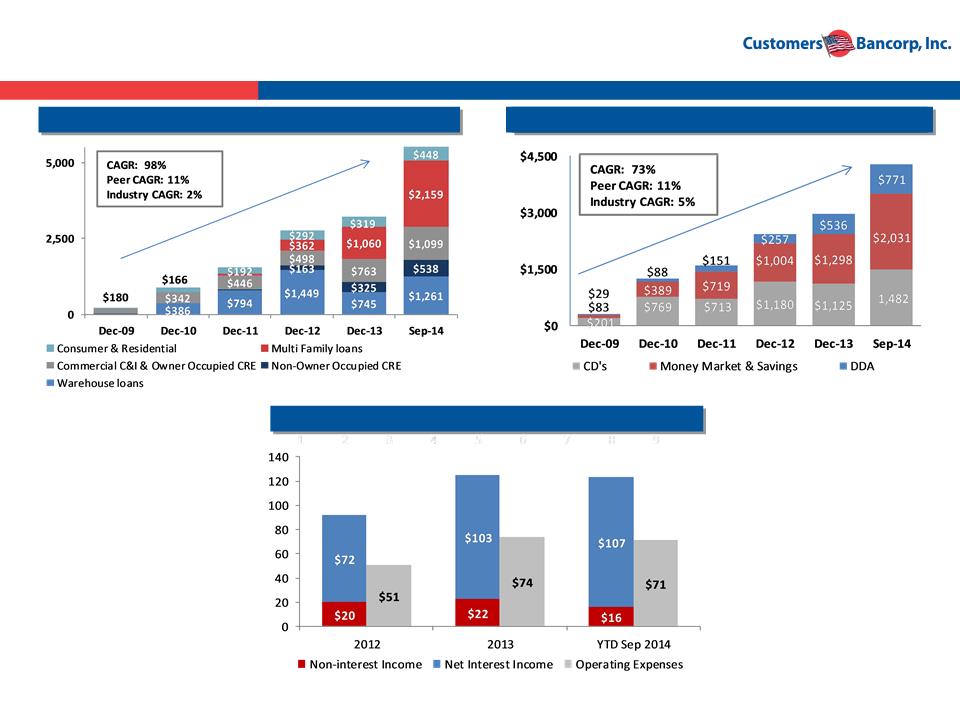

Results of Deposit Growth: Organic Growth with Controlled Costs

Source: Company data.

Total Deposit Growth ($mm)

Average DDA Growth ($mm)

Customers strategies of single point of contact and recruiting known teams in target markets produce

rapid deposit growth with low total cost

rapid deposit growth with low total cost

21

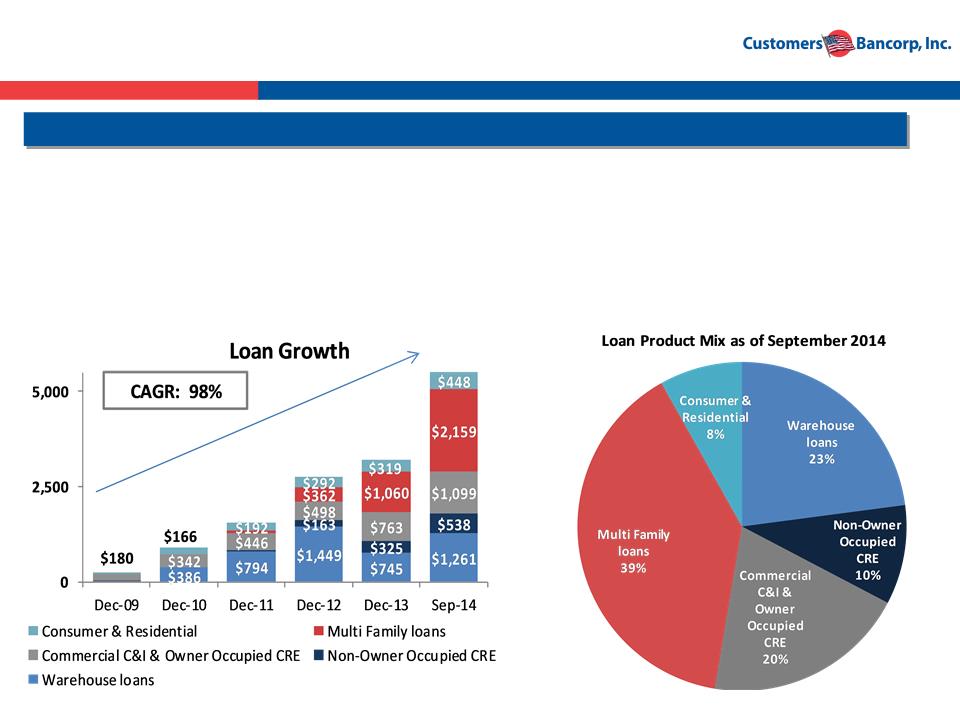

Customers Bank Advantage

Loan Portfolio Mix ($mm)

High Growth with Strong Credit Quality

§Continuous recruitment of high quality teams

§Centralized credit committee approval for all loans

§Loans are stress tested for higher rates and a slower economy

§No losses on loans originated since new management team took over

§Creation of solid foundation for future earnings

Source: Company documents.

22

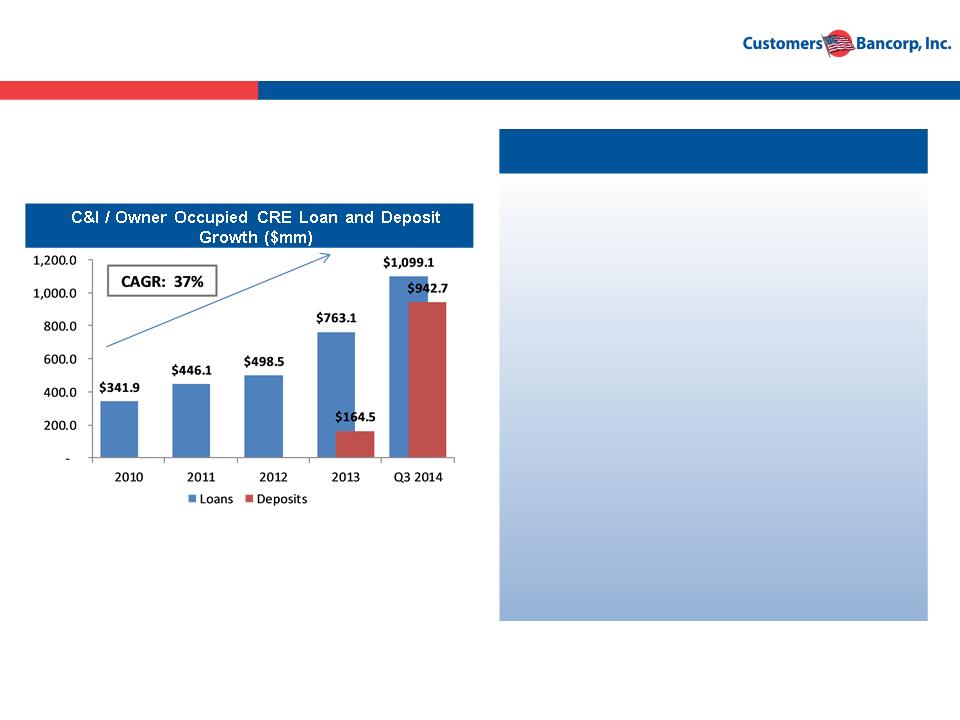

C&I & Owner Occupied CRE Banking Strategy

Private & Commercial Banking

§Target companies with up to $100 million

annual revenues

annual revenues

§Very experienced teams

§Single point of contact

§NE, NY, PA & NJ markets

Small Business

§Target companies with less than $5.0 million

annual revenue

annual revenue

§Principally SBA loans originated by small

business relationship managers or branch

network

business relationship managers or branch

network

§Current focus PA & NJ markets. Expanding

to National Markets

to National Markets

Banking Privately Held Business

Source: Company documents.

23

Multi-Family Banking Strategy

Banking High Net Worth Families

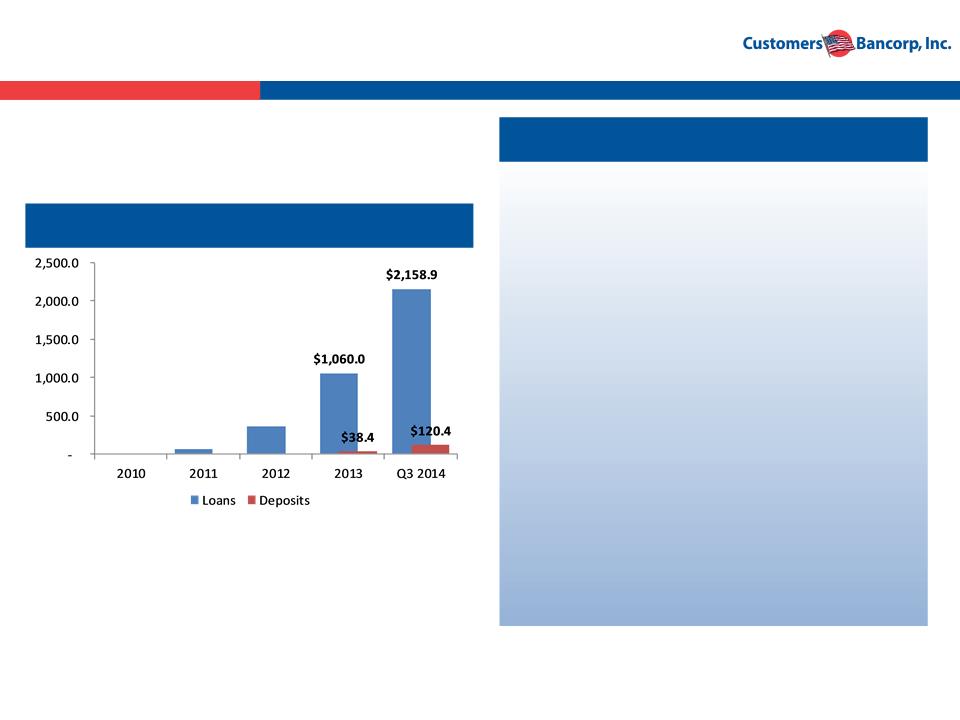

Multi-Family Loan and Deposit Growth ($mm)

§ Focus on families that have income

producing real estate in their portfolios

producing real estate in their portfolios

§ Private banking approach

§ Focus Markets: New York & Philadelphia

MSAs

MSAs

§ Average Loan Size: $4.0 - $7.0 million

§ Remote banking for deposits and other

relationship based loans

relationship based loans

§ Portfolio grown organically from a start up

with very experienced teams hired in the

past 3 years

with very experienced teams hired in the

past 3 years

§ Strong credit quality niche

§ Interest rate risk managed actively

Source: Company documents.

24

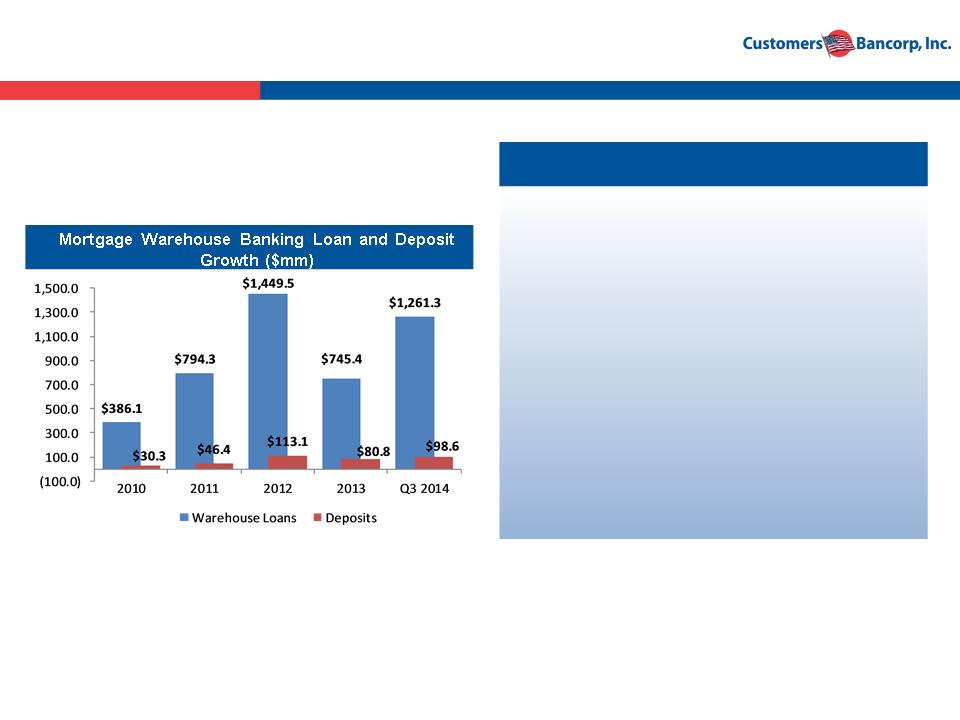

Mortgage Warehouse Banking Strategy

§Private banking focused on mortgage

companies with $5 to $10 million equity

companies with $5 to $10 million equity

§Very strong credit quality relationship

business with good fee income and deposits

business with good fee income and deposits

§~75 strong warehouse clients

§All outstanding loans are variable rate and

classified as held for sale

classified as held for sale

§All deposits are non-interest bearing DDA’s

§Balances rebounding from 2013 low and

expected to stay at this level

expected to stay at this level

Banking Mortgage Companies

Source: Company documents.

25

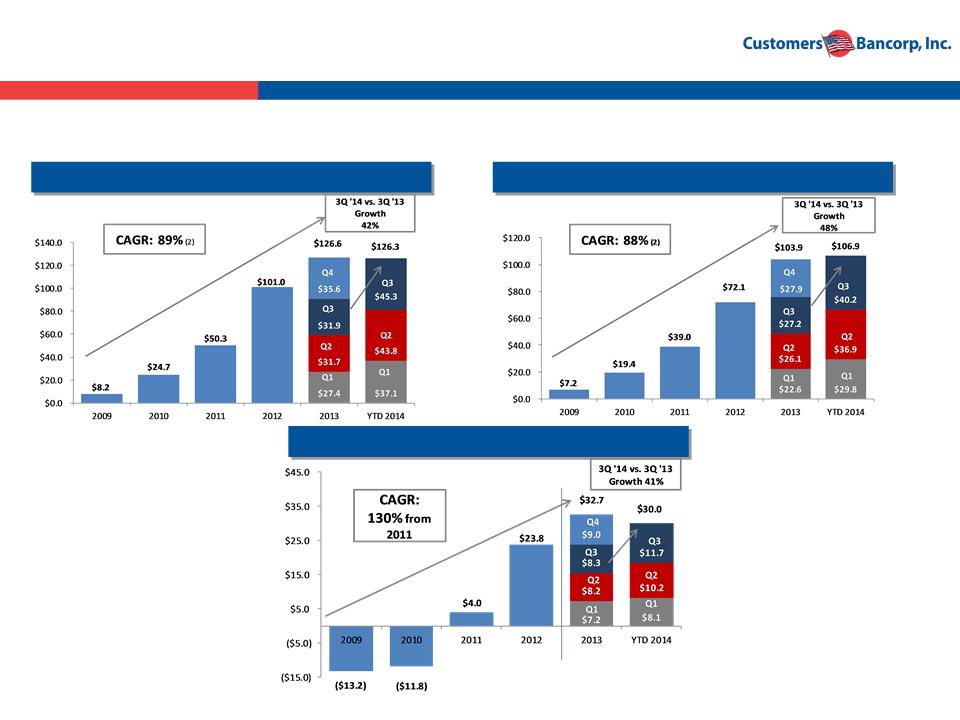

These Deposit and Lending Strategies Results in Disciplined & Profitable Growth

Core Revenue ($mm)

Core Net Income ($mm) (1)

Source: SNL Financial and Company data.

(1)Core income is net income before extraordinary items.

(2)CAGR calculated from Dec-09 to Sep-14 (annualized).

Net Interest Income ($mm)

• Strategy execution has produced superior growth in revenues and earnings

26

Return on Average Equity

Efficiency Ratio

NPAs / Total Assets

Return on Average Assets

Source: SNL Financial on an LTM basis as of 4Q2013

Note: NPA’s include FDIC covered loans

Customers Bancorp; A Stronger Performer

27

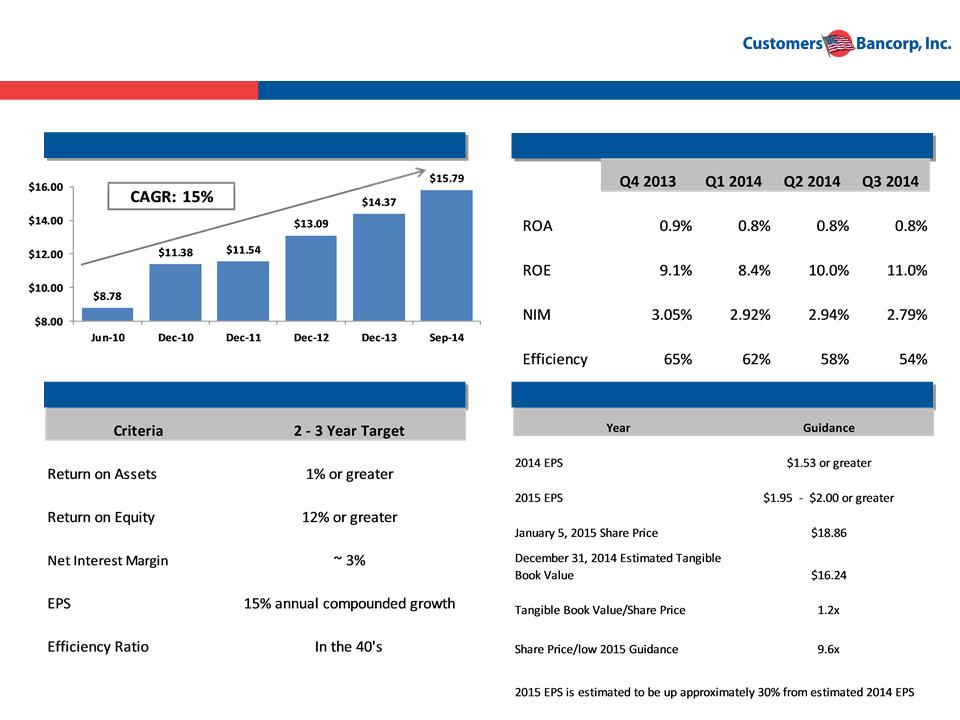

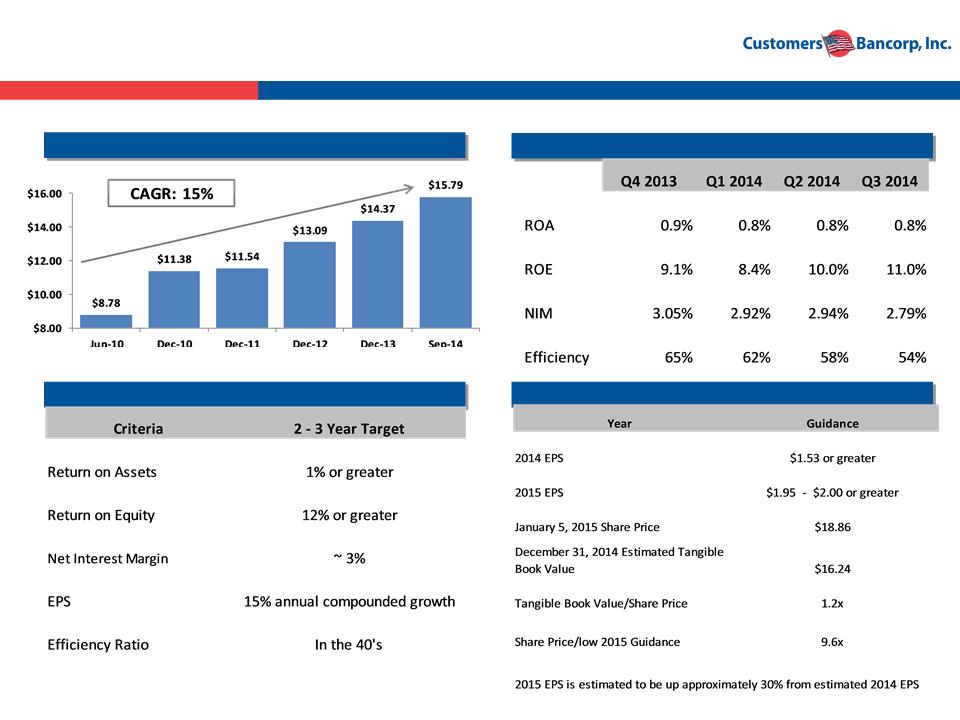

Tangible BV per Share

Source:

We are Building Customers Bank, to Provide Superior Returns to

Investors.

Investors.

Recent Performance Results

Financial Performance Targets

Earnings per Share Guidance

Source: Company documents.

28

Customers Bank

Risk Management

29

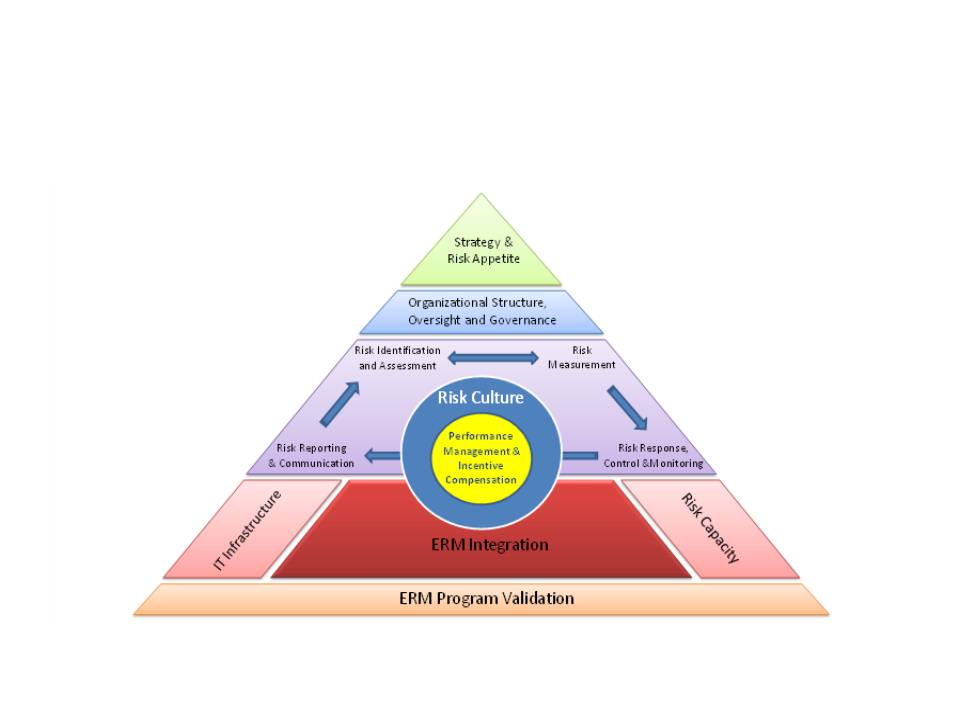

Elements of an Effective Risk

Management Program

Management Program

30

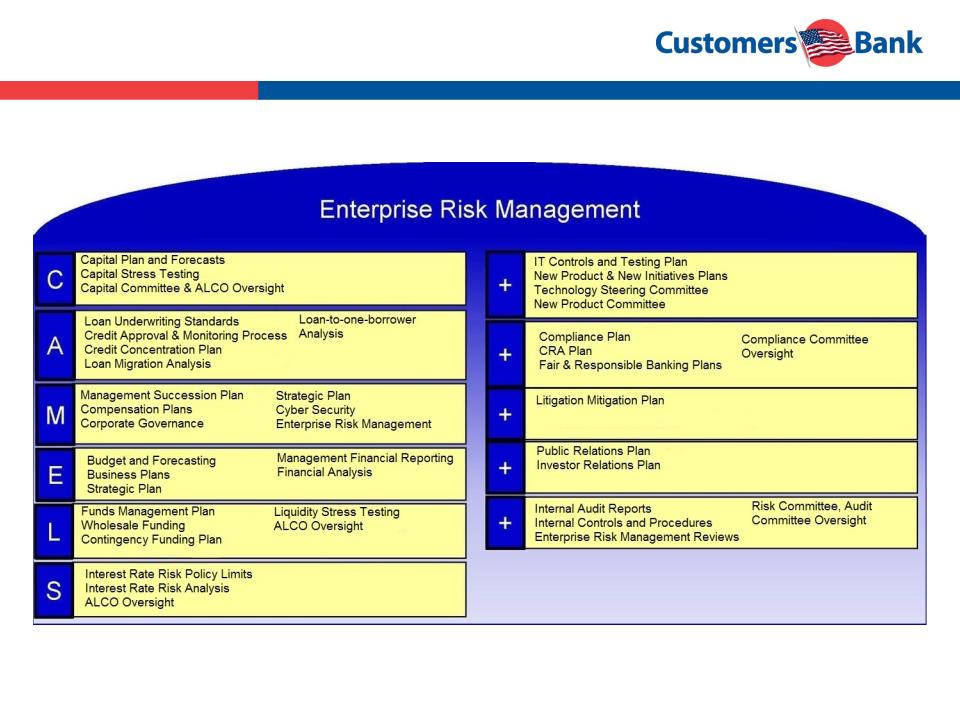

ERM Framework at Customers Bancorp, Inc.

Well Defined ERM Plan - ERM Integration into CAMELS +++++

31

Elements of Risk Management

• Active Board & Senior Management oversight

– Monthly Board, Risk, Audit, Compliance, Risk Management, ALCO, BUR meetings &

special meetings when needed—to Identify, Measure, Monitor and Control All Risks

special meetings when needed—to Identify, Measure, Monitor and Control All Risks

• Adequate and appropriate policies, procedures and limits

– Reviewed at appropriate management committees, significant policies reviewed at

Risk Management Committee, Risk Committee and Board

Risk Management Committee, Risk Committee and Board

• Adequate and appropriate risk-measurement, risk monitoring and

management information systems

management information systems

– Risk & Risk Management Committees - monthly scorecard and standard monthly

reports

reports

– Quarterly Risk Assessment based on a CAMELS+ methodology and Fed’s stress

tests scenarios

tests scenarios

– Management Reports and Board Reports - built a data warehouse and MIS system

that is continuously upgraded

that is continuously upgraded

• Comprehensive and effective internal controls

– Audit Committee, SOX Committee, COSO narratives & control matrices, Sox testing

– Internal Audit performs audits based on a risk focused plan

– Audit Committee reviews the internal audits and other control-review activities such

as SOX

as SOX

32

Credit Risk Management

Customers Bank manages “Credit Risk” through the following fundamental

principles:

principles:

Ø Ongoing maintenance of a comprehensive Loan Policy, that is fully assessed annually

Ø Dual approval authority required on any relationship with > $5.0MM in aggregate exposure

Ø Intra-Function Meetings (i.e. “Line” and “Credit”) and the (CCO and CLO) are held on an

ongoing basis to: 1) Ensure common goals/objectives exist; 2) Potential areas of conflict are

pro-actively addressed; and 3) That all functionally areas with the organization share a

common credit culture

ongoing basis to: 1) Ensure common goals/objectives exist; 2) Potential areas of conflict are

pro-actively addressed; and 3) That all functionally areas with the organization share a

common credit culture

Ø Proven and tested underwriting standards that are consistently applied across the entire

organization regardless of geographic region, credit type, etc…

organization regardless of geographic region, credit type, etc…

Ø Every loan is “Interest Rate Stress Tested” based on a 150 basis point and 300 basis point

scale in order to fully assess the potential ramifications of an escalating rate environment

scale in order to fully assess the potential ramifications of an escalating rate environment

Ø Every CRE Loan is “CAP Rate Stress Tested” based on a 100 basis point and 200 basis point

scale in order to fully assess potential ramifications of declining market values

scale in order to fully assess potential ramifications of declining market values

Ø Reports are provided to each Commercial Business Line Leader and Relationship Manager

denoting current and/or past due financial reporting requirements, covenant tests, annual

reviews, etc…

denoting current and/or past due financial reporting requirements, covenant tests, annual

reviews, etc…

Ø All relationship > $1.0MM are reviewed at least annually

Ø Loan Concentration Monitoring/Reporting to Total Risk Based Capital is performed monthly

with special focus placed on areas of concentration > 75.0% of Total Risk Based Capital (i.e.

Mortgage Warehouse and CRE)

with special focus placed on areas of concentration > 75.0% of Total Risk Based Capital (i.e.

Mortgage Warehouse and CRE)

Ø The Bank’s Chief Credit Officer reports to the Board Risk Committee

Ø Whitepapers are prepared, and updated on an ongoing basis, for any new lines of business

Ø Quarterly Watch List Meetings are held to discuss each and every credit assessed as

“Criticized” or “Classified”

“Criticized” or “Classified”

33

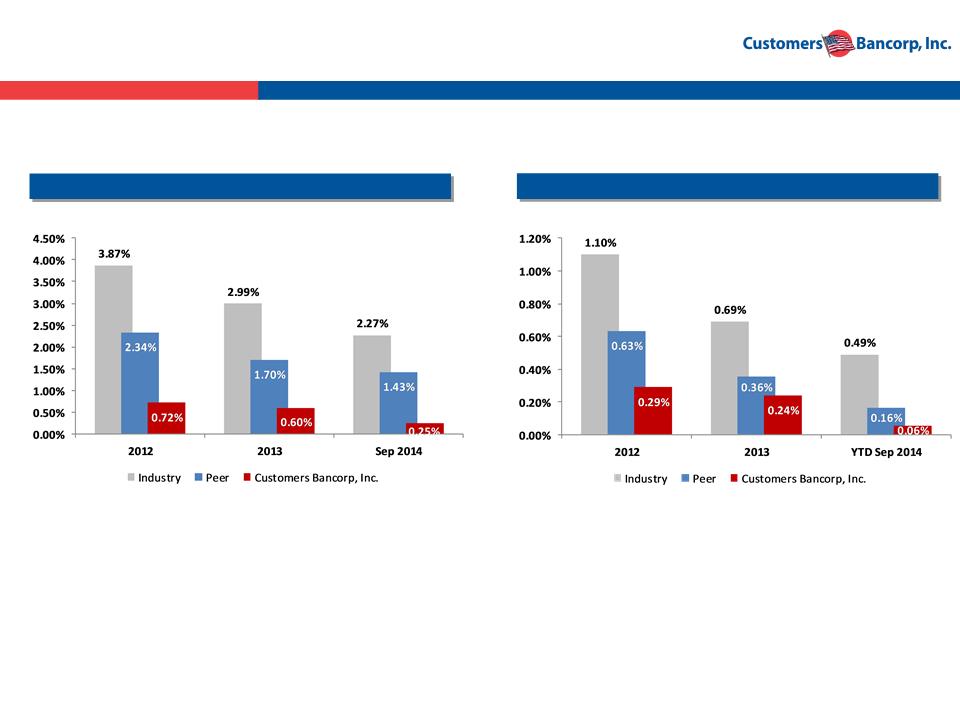

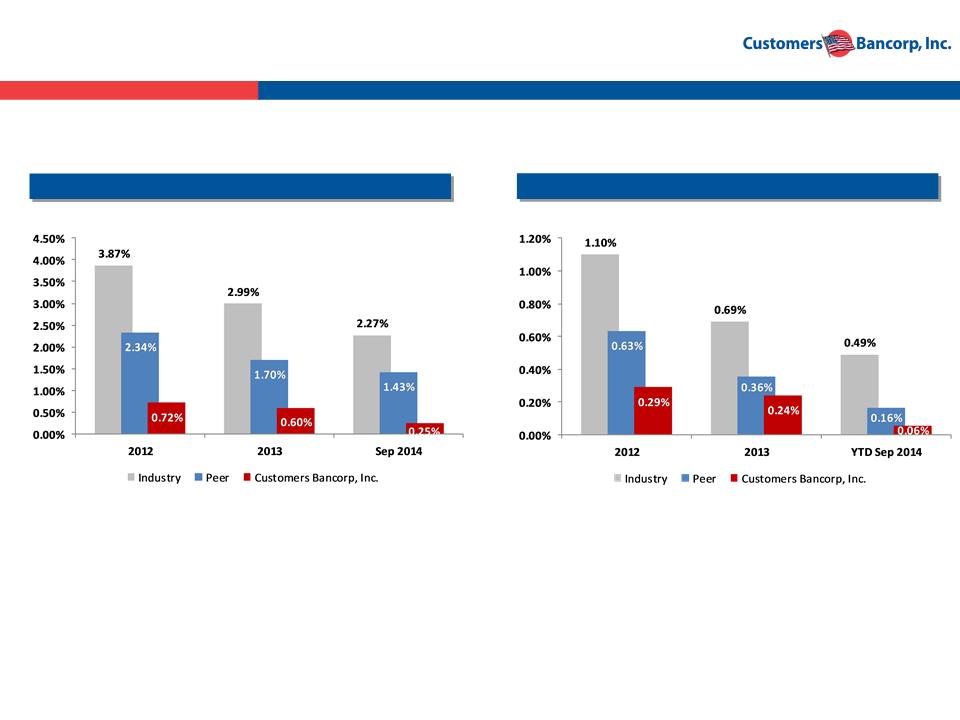

NPL

Source: SNL Financial, Company documents. Peer data consists of Northeast, Southeast, and Mid-Atlantic banks and thrifts with assets between $3.0 billion and $8.0 billion. Industry data includes all FDIC

insured banks.

insured banks.

Customers Credit Risk Management Results

Charge Offs

Customers non-performing loans at September 2014

excluding loans guaranteed by the FDIC were 0.18% of

total loans.

excluding loans guaranteed by the FDIC were 0.18% of

total loans.

Charge-offs excluding FDIC guaranteed loans at

September 2014 were .02% of total loans.

September 2014 were .02% of total loans.

34

CRA and Fair and Responsible Lending

Ø Customers’ spring 2013 CRA examination resulted in an overall “needs to

improve” rating principally due to Federal Reserve referral to Department of

Justice

improve” rating principally due to Federal Reserve referral to Department of

Justice

Ø In August 2014 Department of Justice returned the referral to the Federal

Reserve for their disposition

Reserve for their disposition

– Customers took proactive steps to remediate potential issues identified by the Federal Reserve

and management

and management

Ø Customers’ fall CRA examination results are not final, but Customers’

anticipates a “satisfactory” rating

anticipates a “satisfactory” rating

Ø Customers has a robust compliance and fair and responsible banking group

Ø Customers notes significant improvement in key CRA elements

– Affordable mortgages increased from $4.3 million to $41.1 million

– Community development loans excluding NY increased from $17 million to $133 million

– NY Community Development loans increased from $46 million to $241 million

– Opening of Philadelphia loan origination office in LMI minority geography

– Launching of outreach programs to attract a diversity of customers

35

Customers Bank

Financial Performance Model For Creating

Shareholder Value

Shareholder Value

36

Creating Shareholder Value

Customers’ objective is to create value for our shareholders

§ YTD through September 2014 Net Income up 26.8% and EPS up 12% over the same period

last year

last year

§ Book value has increased 80% to $15.93 since July 2009, a CAGR of 15%

§ Since going public in May 2013, the per share market value has increased from $15.08 (May

16, 2013) to $19.46 (December 31, 2014), a 29% increase

16, 2013) to $19.46 (December 31, 2014), a 29% increase

§ 2014 Shareholder value up 6 % over year end 2013

Our future shareholder value creation strategy optimizes book value and

earnings

earnings

§ Execute our Single Point of Contact model that combines excellent service delivered by very

experienced bankers

experienced bankers

§ Build a high credit quality loan portfolio by marketing to high quality borrowers and

charging them a little less interest rate

charging them a little less interest rate

§ Build a stable core deposit platform by paying a little more to attract DDA and other core

depositors and then WOWing them with service

depositors and then WOWing them with service

§ Operate our businesses at a significantly lower cost with a “branch lite,” high touch strategy

supported by high technology

supported by high technology

§ Use new technologies and products to both disrupt the market and improve our operating

efficiencies

efficiencies

§ Control our risks

§ Resulting in sustainable above average ROE and growth rate in earnings in rising or stable

interest rate environments

interest rate environments

37

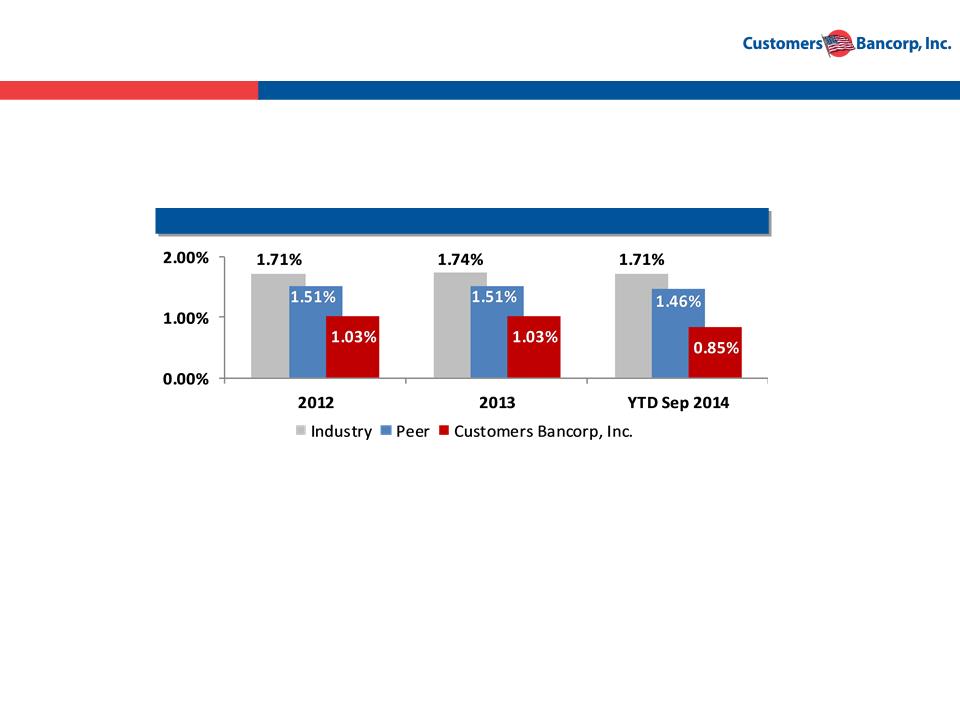

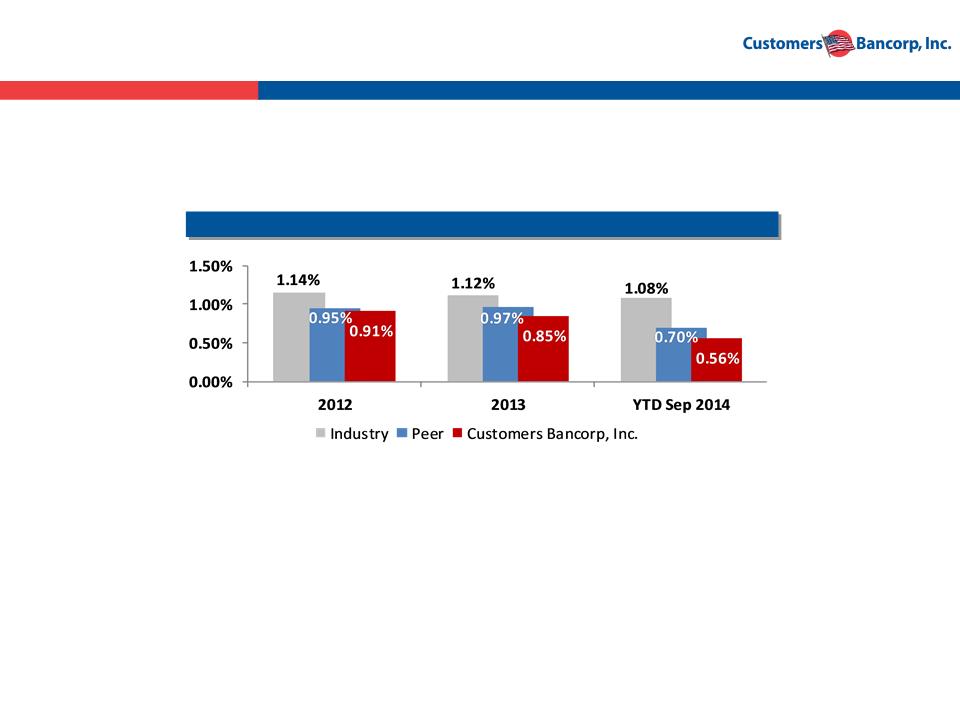

NPL

Source: SNL Financial, Company documents. Peer data consists of Northeast, Southeast, and Mid-Atlantic banks and thrifts with assets between $3.0 billion and $8.0 billion. Industry data includes all FDIC

insured banks.

insured banks.

Build a Strong Asset Quality Loan Portfolio

Charge Offs

Customers non-performing loans at September 2014

excluding loans guaranteed by the FDIC were 0.18% of

total loans.

excluding loans guaranteed by the FDIC were 0.18% of

total loans.

Charge-offs excluding FDIC guaranteed loans at

September 2014 were .02% of total loans.

September 2014 were .02% of total loans.

38

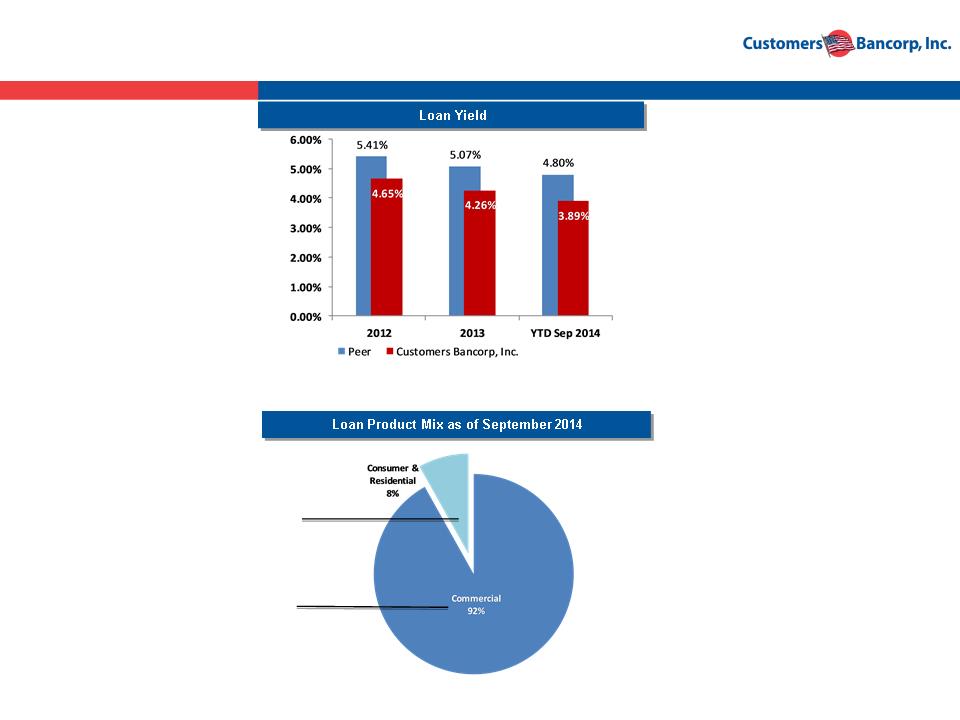

Accept a Little Less Yield from Strong Credit Quality Customers

Loan Product Mix, Duration and Collateral Influences Yield

Source: SNL Financial, Company documents. Peer data consists of Northeast, Southeast, and Mid-Atlantic banks and thrifts with assets between $3.0 billion and $8.0 billion.

Peer: 39%

Peer: 61%

39

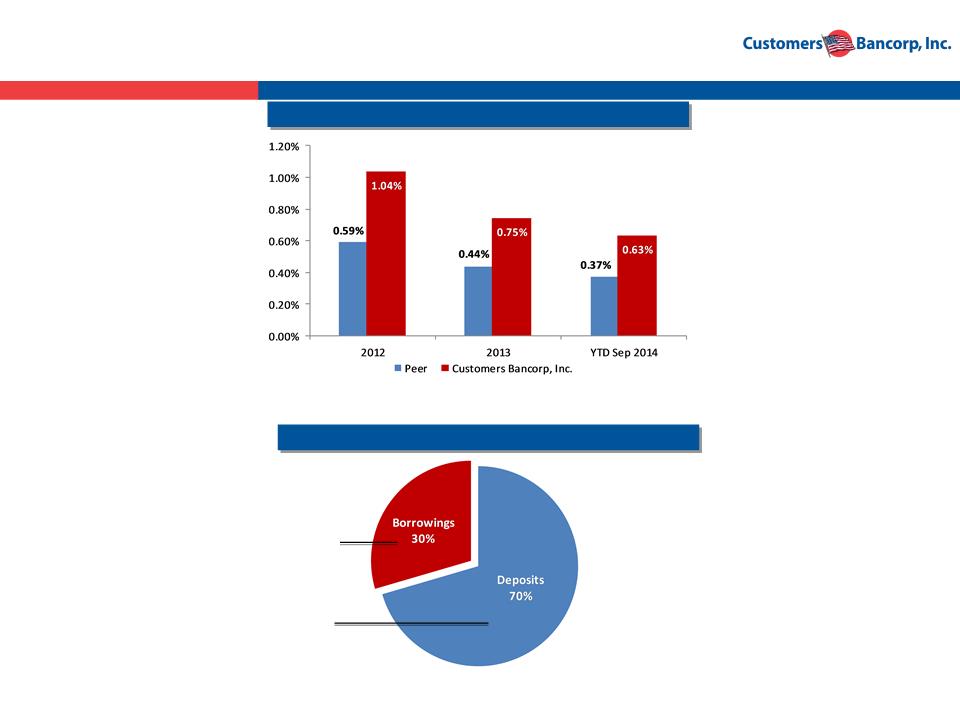

Deposit Rates

Pay a Little More for Core Deposits, Requiring DDA’s from

All Customers

Liability Mix and Duration Influences Interest Expense

Deposit and Borrowing Mix as of September 2014

Source: SNL Financial, Company documents. Peer data consists of Northeast, Southeast, and Mid-Atlantic banks and thrifts with assets between $3.0 billion and $8.0 billion.

Peer: 11%

Peer: 89%

•Borrowings principally fund our Mortgage

Warehouse business and assist in interest rate

risk management

Warehouse business and assist in interest rate

risk management

40

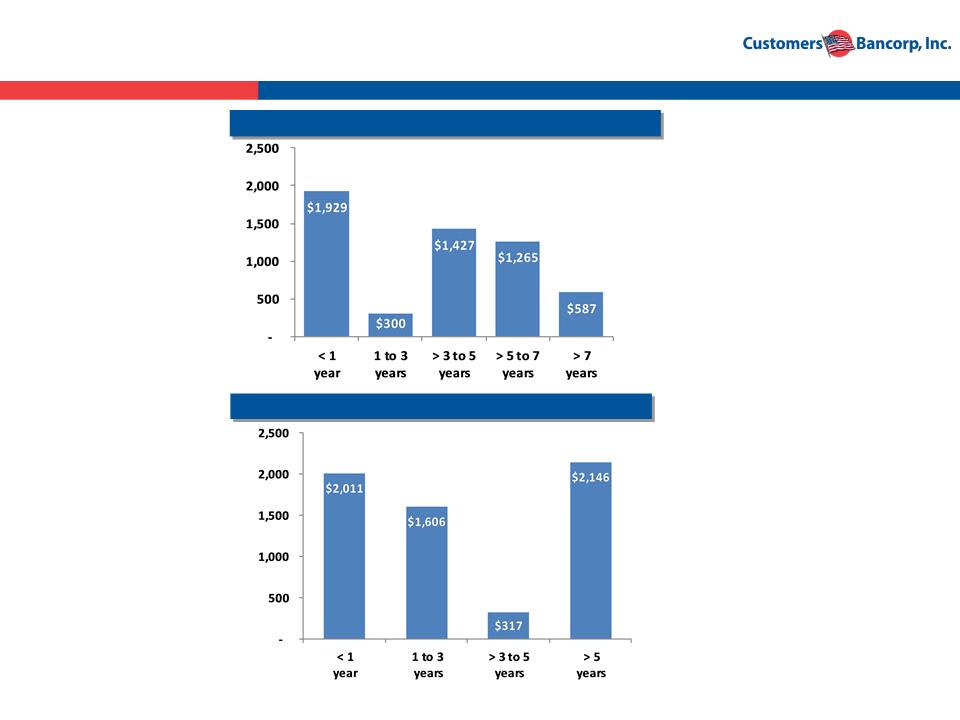

Interest Rate Risk - Balance Sheet Re-pricing

Source: SNL Financial, Company documents. Peer data consists of Northeast, Southeast, and Mid-Atlantic banks and thrifts with assets between $3.0 billion and $8.0 billion.

Deposit and Borrowing Maturities/Avg Lives ($mm)

Loan Maturity/Repricing ($mm)

41

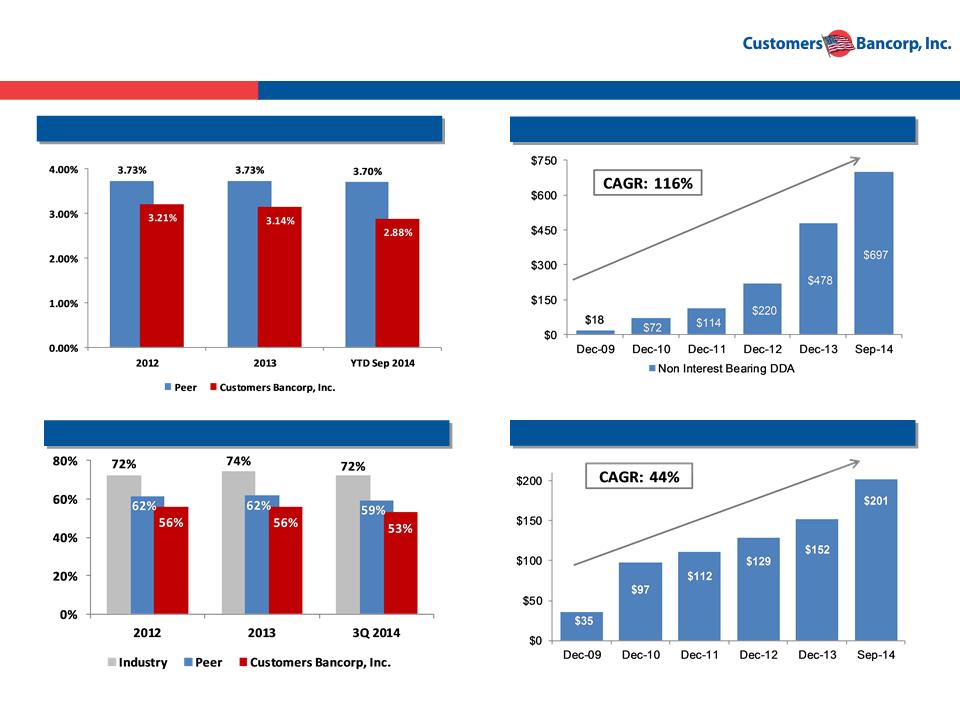

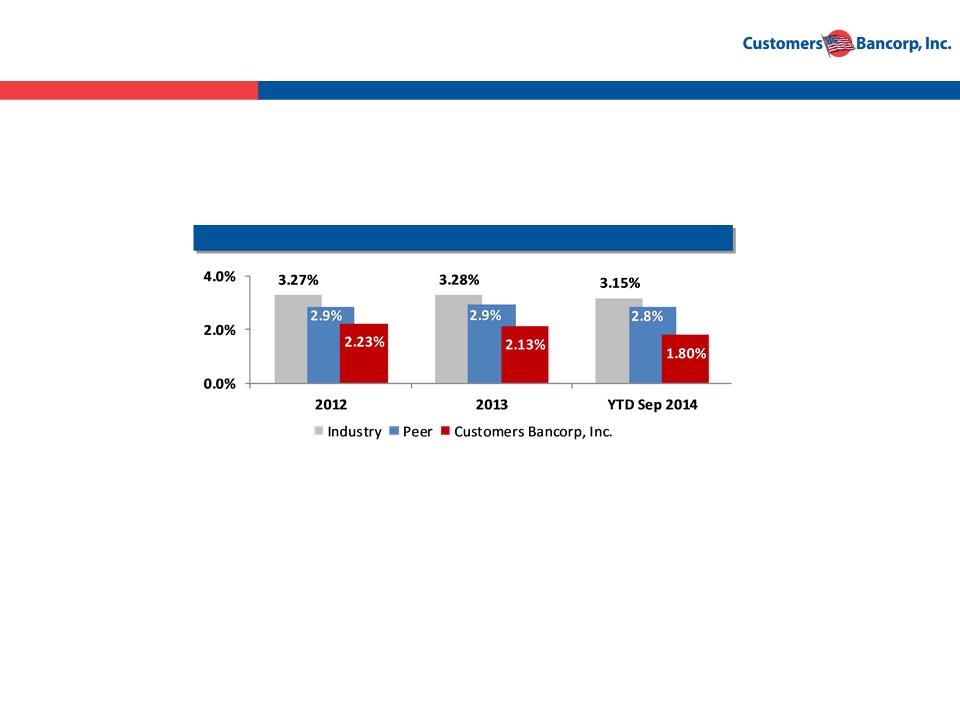

NIM

Lower NIM from Superior Credit Quality Niches is Offset by

Operating Efficiencies

Efficiency Ratio

Deposits Per Branch

Source: SNL Financial, Company documents. Peer data consists of Northeast, Southeast, and Mid-Atlantic banks and thrifts with assets between $3.0 billion and $8.0 billion. Industry data includes all FDIC

insured banks.

insured banks.

Non-Interest DDA Growth

42

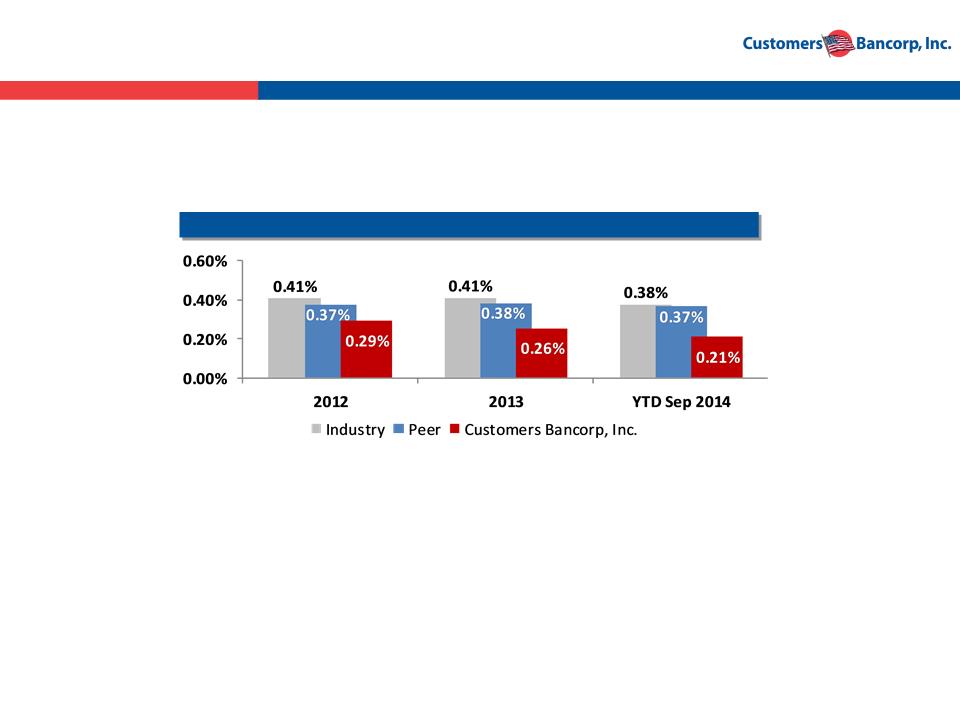

Staff Expense Ratio

Building Efficient Operations Will Achieve a 40’s Efficiency Ratio

Source: SNL Financial, Company documents. Peer data consists of Northeast, Southeast, and Mid-Atlantic banks and thrifts with assets between $3.0 billion and $8.0 billion. Industry data includes all FDIC

insured banks.

insured banks.

43

Building Efficient Operations Will Achieve a 40’s Efficiency Ratio

Occupancy Expense Ratio

Source: SNL Financial, Company documents. Peer data consists of Northeast, Southeast, and Mid-Atlantic banks and thrifts with assets between $3.0 billion and $8.0 billion. Industry data includes all FDIC

insured banks.

insured banks.

44

Building Efficient Operations Will Achieve a 40’s Efficiency Ratio

All-Other Expense Ratio

Source: SNL Financial, Company documents. Peer data consists of Northeast, Southeast, and Mid-Atlantic banks and thrifts with assets between $3.0 billion and $8.0 billion. Industry data includes all FDIC

insured banks.

insured banks.

45

Building Efficient Operations Will Achieve a 40’s Efficiency Ratio

Total Costs as a % of Assets

Source: SNL Financial, Company documents. Peer data consists of Northeast, Southeast, and Mid-Atlantic banks and thrifts with assets between $3.0 billion and $8.0 billion. Industry data includes all FDIC

insured banks.

insured banks.

46

Building Efficient Operations Will Achieve a 40’s Efficiency Ratio

Total Revenue per Employee ($000s)

Source: SNL Financial, Company documents. Peer data consists of Northeast, Southeast, and Mid-Atlantic banks and thrifts with assets between $3.0 billion and $8.0 billion. Industry data includes all FDIC

insured banks.

insured banks.

47

Building Efficient Operations Will Achieve a 40’s Efficiency Ratio

Assets per Employee ($mm)

Source: SNL Financial, Company documents. Peer data consists of Northeast, Southeast, and Mid-Atlantic banks and thrifts with assets between $3.0 billion and $8.0 billion. Industry data includes all FDIC

insured banks.

insured banks.

48

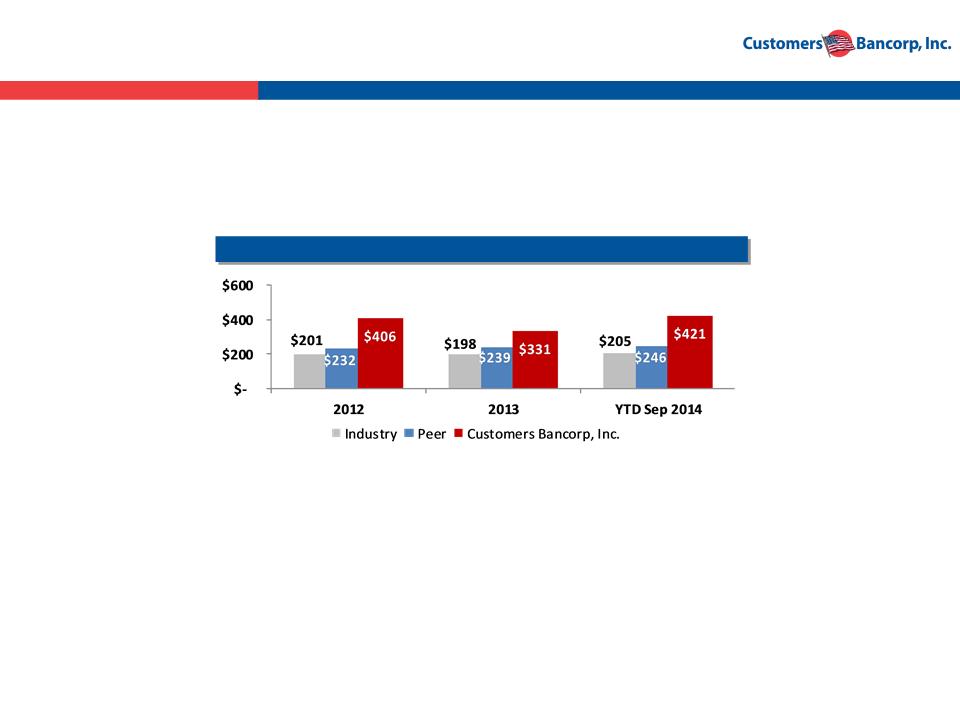

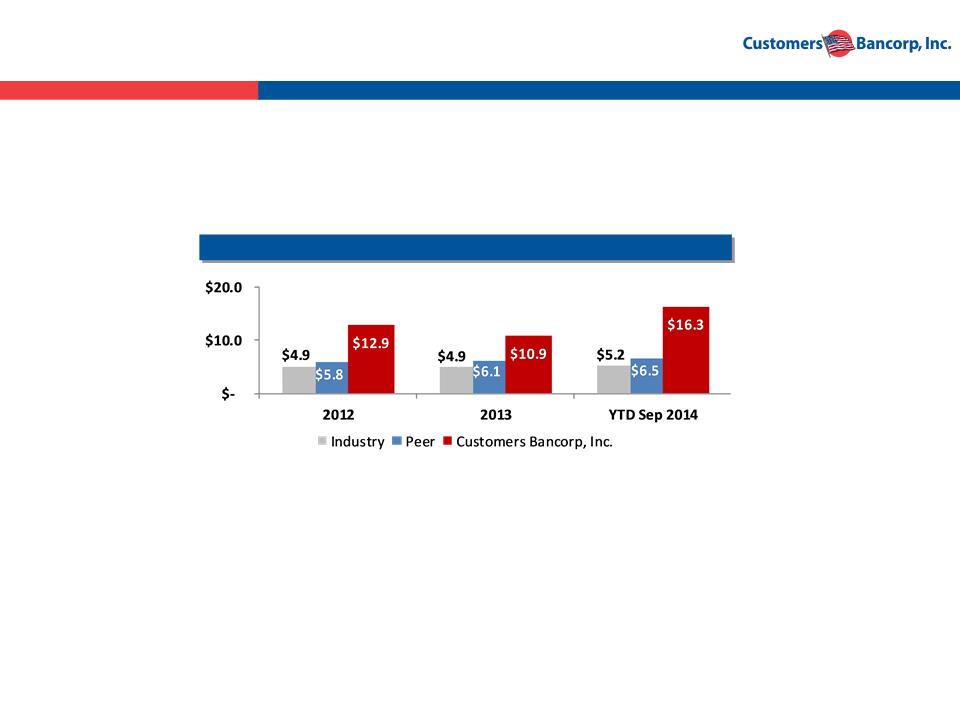

Loan Growth ($mm)

Operating Strategy has Resulted in Remarkable Loan, Deposit and

Profitability Growth

Profitability Growth

Income Growth ($mm)

Deposit Growth ($mm)

Source: SNL Financial, Company documents. Peer data consists of Northeast, Southeast, and Mid-Atlantic banks and thrifts with assets between $3.0 billion and $8.0 billion. Industry data includes all FDIC

insured banks.

insured banks.

49

Source:

Capital Strategy Enables the Organic Growth

Elements of Customers’ Capital Allocation & Management Strategy

§Protection and growth of shareholder value

– Disciplined capital raises

– Strong earnings

§Targeted capital levels sufficient to absorb unexpected losses but leverage

enough to optimize shareholder investment:

enough to optimize shareholder investment:

– Tangible common to tangible assets of 6.5% - 7.0%

– CET1 RBC of 7.0% - 7.5%

– Tier 1 leverage ratio of 7.0% - 7.5%

– Tier 1 RBC of 8.5% - 9.0%

– Total RBC of 10.5% - 11%

Source: Company documents.

50

2015 Guidance vs. 2014 Results

|

Business Driver

|

2015 Guidance vs. 2014 Guidance -

EPS Up about 30%

|

|

Investments

|

Unchanged

|

|

Average Loans (including Loans Held for Sale

and Loans Held for Investment) |

Growth slowed to 10 - 15% over year end 2014

|

|

Deposits

|

Steady growth at 20 - 25% over year end 2014

|

|

Net Interest Income

|

Growth in the mid-20’s %, largely built on 2014

asset growth |

|

Net Interest Margin

|

Largely flat with end of 2014 core (excluding

pre-payment penalties) run rate |

|

Net Charge-offs

|

Under 0.05%, with accelerated resolution of

FDIC guaranteed loans a possible exception |

|

Operating Expenses

|

Growth of 15 - 20% over 2014

|

|

Efficiency Ratio

|

Low - mid 50’s % for year, declining during the

year |

Source: Company documents.

51

Tangible BV per Share

Source:

Combined, We have Built Customers Bank, a Bank We Believe will

Provide Superior Returns to Investors.

Provide Superior Returns to Investors.

Recent Performance Results

Financial Performance Targets

Earnings per Share Guidance

Source: Company documents.

52

Summary

§ Strong high performing $6.5 billion bank with significant growth opportunities

§ Very experienced management team delivers strong results

§ Ranked #1 overall by Bank Director Magazine in the 2012 and 2013 Growth

Leader Rankings

Leader Rankings

§ “High touch, high tech” processes and technologies result in superior growth,

returns and efficiencies

returns and efficiencies

§ Shareholder value results from the combination of increasing tangible book

value with strong and consistent earnings growth

value with strong and consistent earnings growth

§ Attractive risk-reward: growing several times faster than industry average but

yet trading at a significant discount to peers

yet trading at a significant discount to peers

§ Introducing the first mobile banking application for account opening in the U.S.

and first full service consumer bank in the palm of your hand in the U.S.

and first full service consumer bank in the palm of your hand in the U.S.

53

54

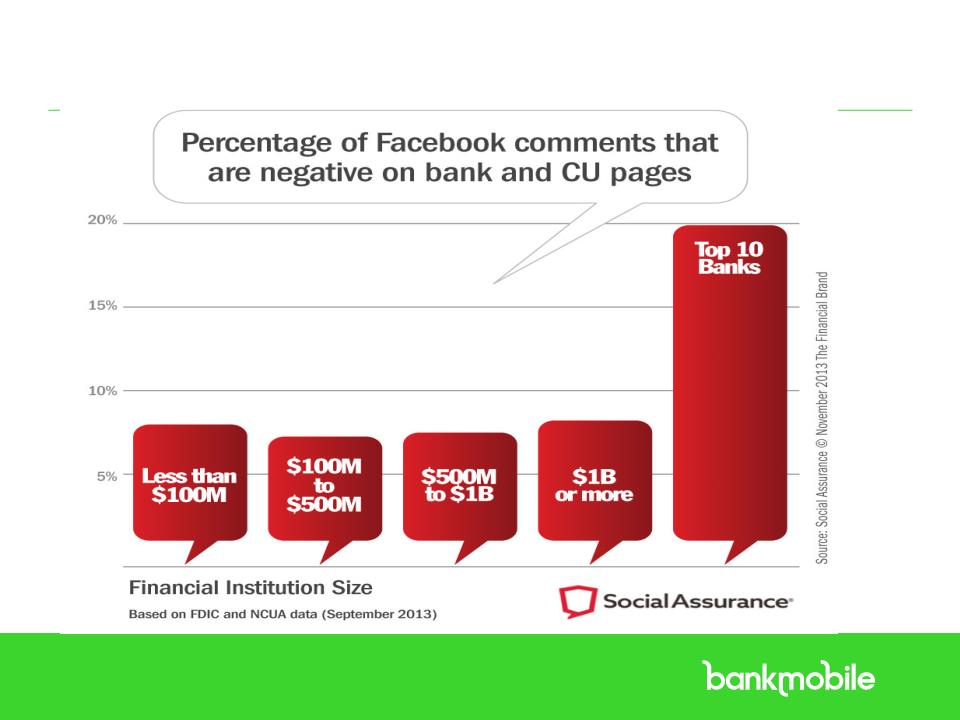

Startling Facts about Banks

§ Banks each year charge $32 billion in overdraft fees - that’s

allowing or creating over 1 billion overdrafts each year….Why??

allowing or creating over 1 billion overdrafts each year….Why??

§ Payday lenders charge consumers another $7 billion in fees

§ That’s more than 3x what America spends on Breast Cancer and

Lung Cancer combined

Lung Cancer combined

§ This is about 50% of all America spends on Food Stamps

§ Some of banking industries most profitable consumer customers

hate banks

hate banks

§ Another estimated 25% consumers are unbanked or under banked

This should not be happening in America

We hope to start, in a small way, a new revolution

to profitably address this problem

to profitably address this problem

55

§ New no fee banking, 25 bps higher interest savings, line of credit, 55,000 ATM’s, Personal

Banker and more, all in the palm of your hand

Banker and more, all in the palm of your hand

§ Marketing Strategy

§ Target technology dependent younger customers; including

underserved/underbanked now and later larger depositors generally >50 years old

segments

underserved/underbanked now and later larger depositors generally >50 years old

segments

§ Capitalize on retaining at least 25% of our ~ one million student customers over a 5

year period

year period

§ Reach markets also through Affinity Banking Groups

§ Revenue generation from debit card interchange and margin from low cost core

deposits

deposits

§ Durbin Amendment a unique opportunity for Bank Mobile

§ Total investment not to exceed about $5.0 million by end of 2015

§ Expected to achieve above average, franchise value, ROA and ROE within 5 years

Creating a Virtual Bank for the Future

56

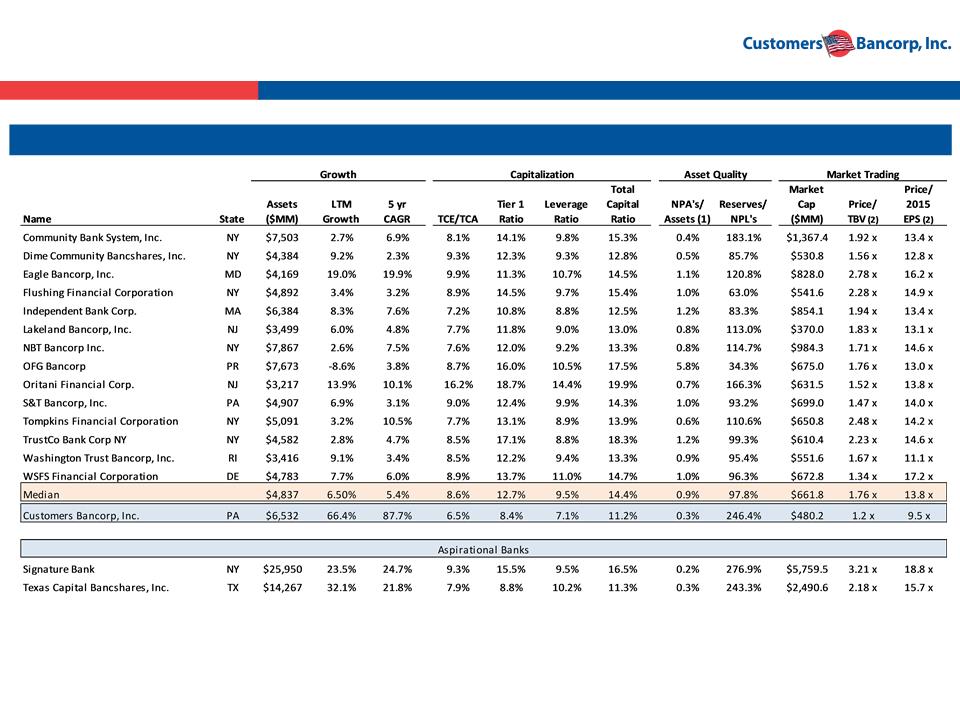

Regional Bank Comparison

High Performance Regional Banks

Source: SNL Financial, Company documents. Market data as of 9/30/2014. Consists of Northeast and Mid-Atlantic banks and thrifts with assets between $3.0 billion and $8.0 billion and most recent quarter core ROAA greater

than 90 bps. Excludes merger targets and MHCs.

than 90 bps. Excludes merger targets and MHCs.

(1)Customers Bancorp NPAs excludes accruing TDRs and loans 90+ days past due and still accruing.

(2)Customers Bancorp Price/TBV and Price/2015 EPS based on share price as of Dec 9, 2014.

57

Contacts

Company:

Robert Wahlman, CFO

Tel: 610-743-8074

rwahlman@customersbank.com

rwahlman@customersbank.com

www.customersbank.com

Jay Sidhu

Chairman & CEO

Tel: 610-301-6476

jsidhu@customersbank.com

jsidhu@customersbank.com

www.customersbank.com

Investor Relations:

Ted Haberfield

President, MZ North America

Tel: 760-755-2716

thaberfield@mzgroup.us

www.mzgroup.us

Appendix

59

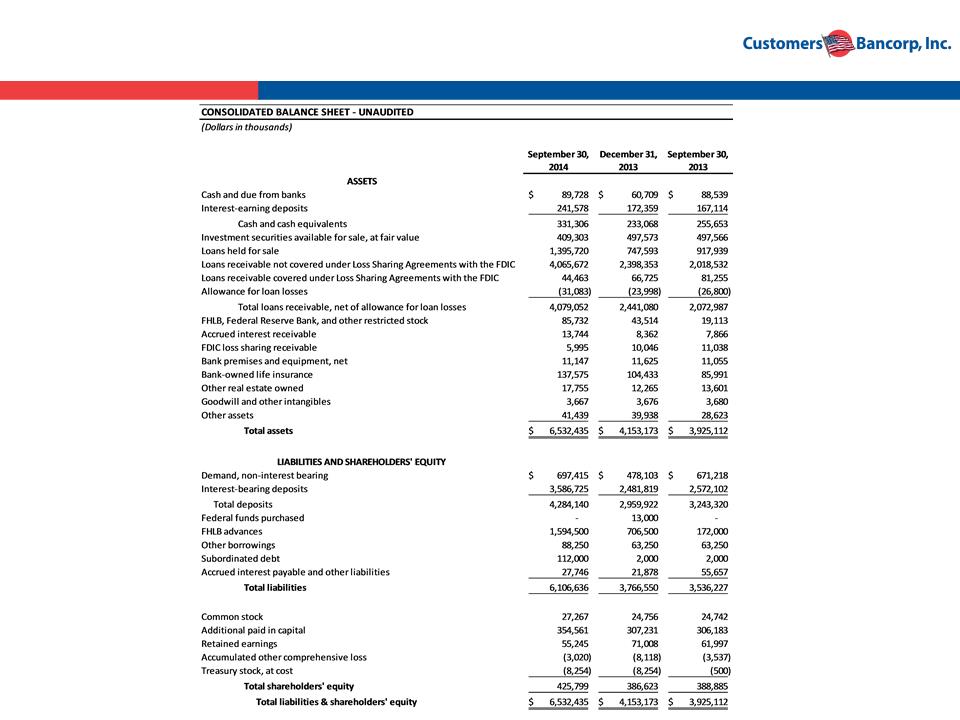

Balance Sheet

60

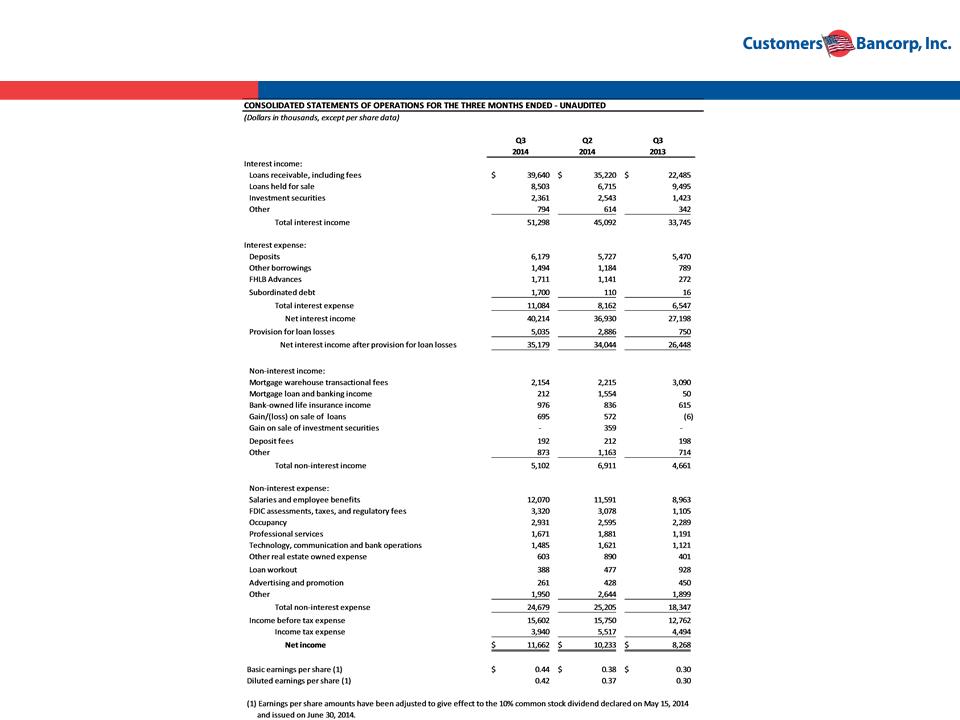

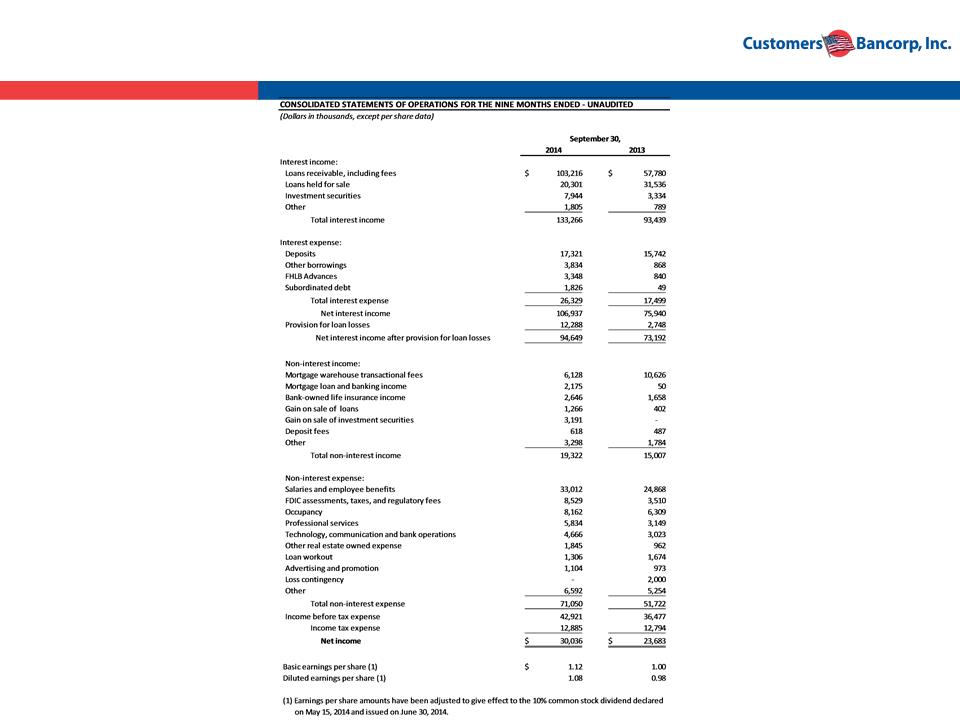

Income Statement

61

Income Statement

62

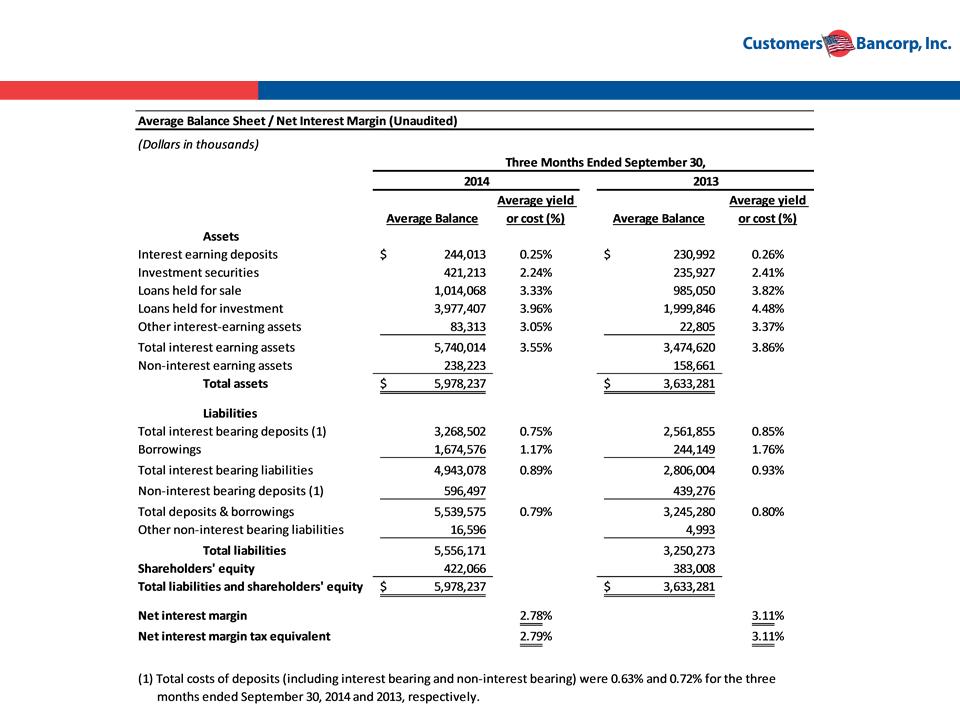

Net Interest Margin

63

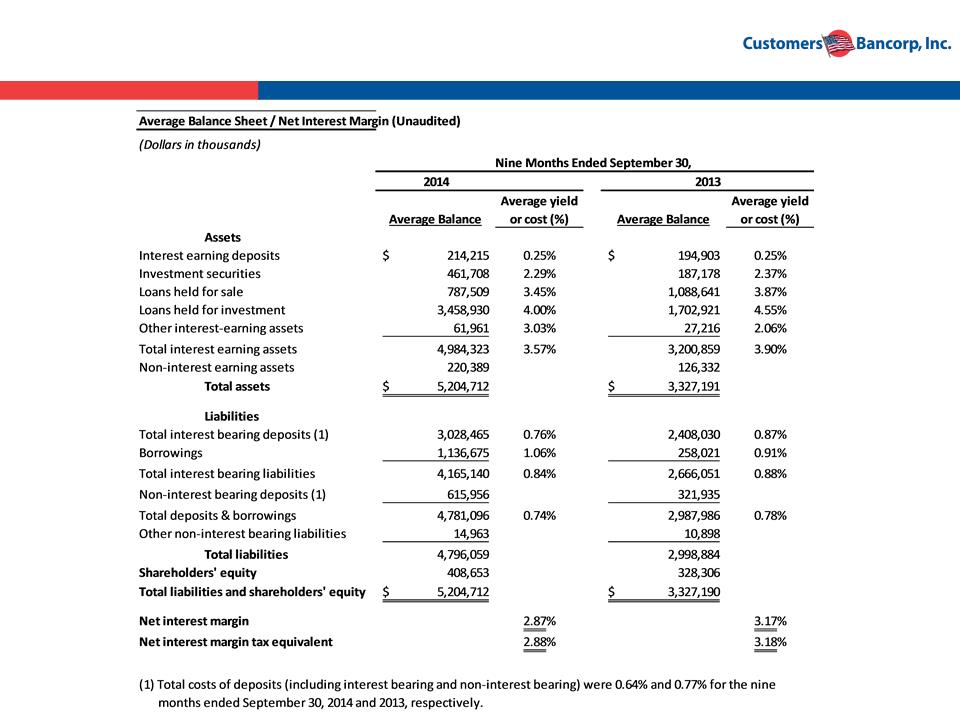

Net Interest Margin

64

Asset Quality

>> >> >>

WHY BANKMOBILE?

JANUARY 7, 2015

WARREN TAYLOR

PRESIDENT - BANKMOBILE

>>

AGENDA

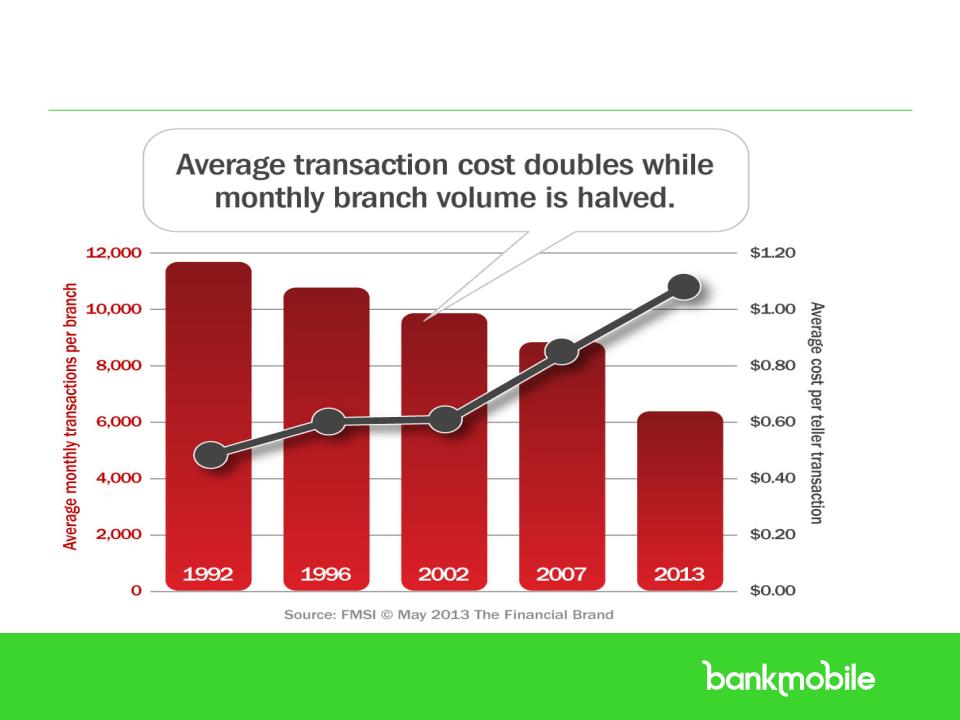

1. Retail Branch Banking - A Broken

Model?

Model?

1. BRANCH OVERHEAD IMPLICATIONS

2. BRANCH EFFICIENCY

2. Our Solution - BankMobile

.

>>

A NEW BRANCH MODEL

• Overhead + COD - Fees = All-In Cost

• $1 million OH / $55.7 M deposits* = 1.79%

• $1 million OH / $170 M deposits = 0.59%

• OD fees in 2013 were $32 billion

– A $35 FEE ON A $100 OVERDRAFT FOR 1 WEEK = 1820% APR

– WILL THE CFPB ALLOW THIS “USURY” TO CONTINUE?

* The 2014 Cornerstone Performance Report

ALL-IN COST MODEL

>>

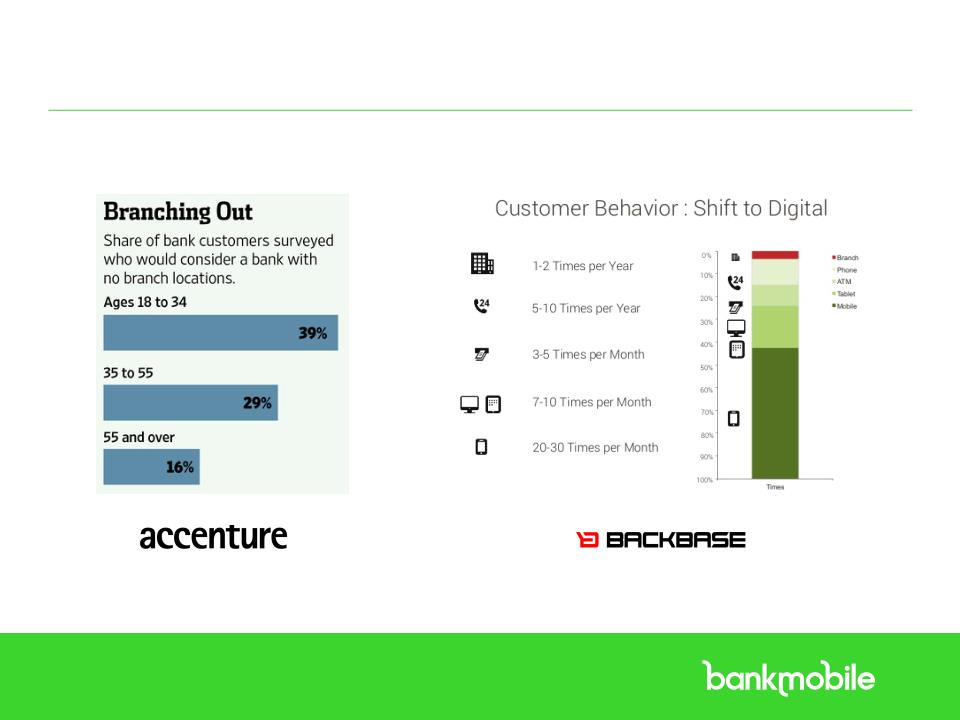

IS THE BRANCH DEAD?

• # of branches in 1970 = 45,337*

• # of branches in 2014 = 94,725*

• Peak in 2009 # of branches = 99,550*

• Consumers preferred delivery channel:**

1. INTERNET BANKING 31%

2. BRANCH BANKING 21%

3. ATMS 14%

4. MOBILE BANKING 10%

* Richard Brown, Chief Economist, FDIC

** American Bankers Assoc. report 2014

.

>>

OVERHEAD COSTS

>>

EFFICIENCY*

• Deposits open/close ratio = 1.07

• Total retail checking accounts per branch = 1,488

• Monthly new checking accounts opened per branch =

17

17

• Deposit accounts serviced per platform FTE = 2,627

– ACTIVE INTERNET BANKING USERS PER INTERNET BANKING

FTE = 15,235

FTE = 15,235

• The old retail branch model is broken!

* The 2014 Cornerstone Performance Report

.

>>

MAIN PRODUCTS

>>

CUSTOMER SERVICE

>>

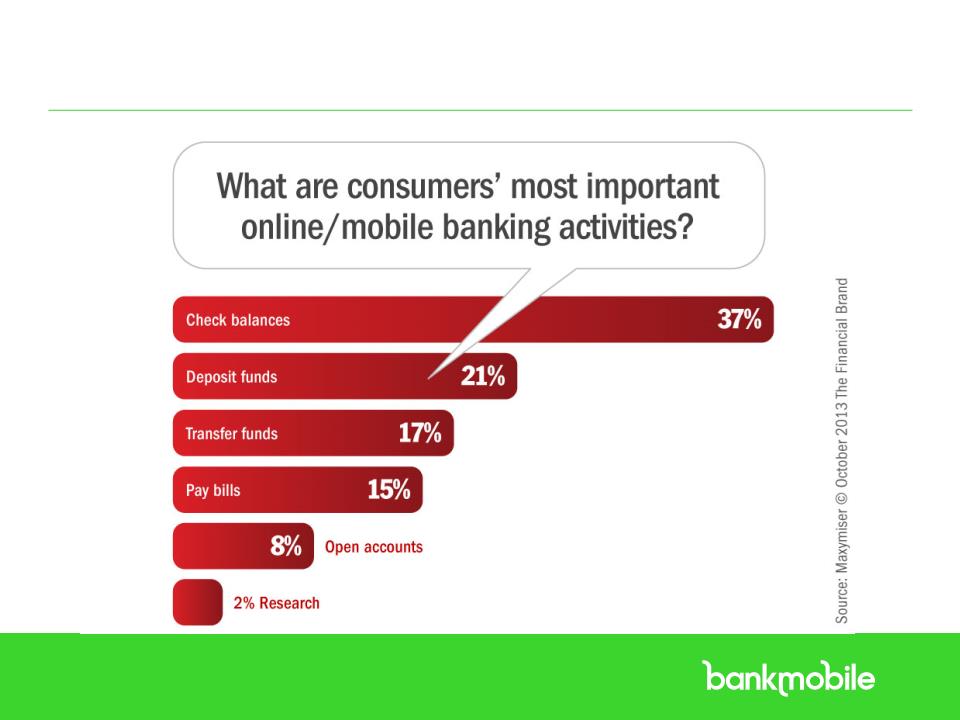

MOBILE BANKING BASICS

.

>>

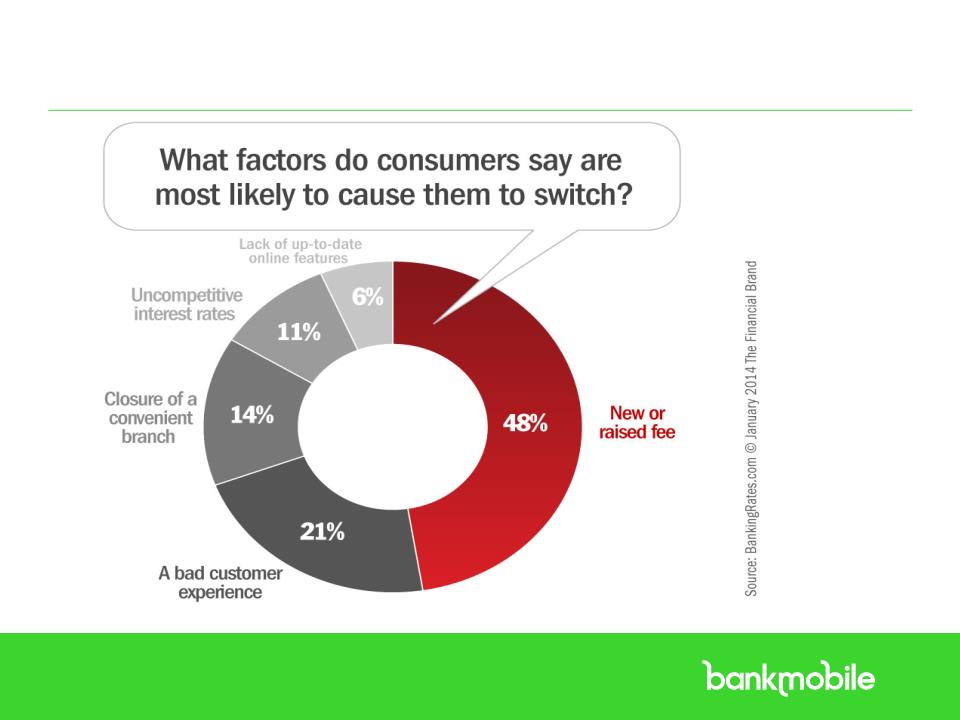

CUSTOMER HOT POINTS

>>

FINANCIALS

• Revenue

– INTERCHANGE INCOME

– INTEREST ON LOANS (MINUS RESERVES)

• Expenses

– PHOTO ACCOUNT OPENING

– SECURITY DATABASES

– PHOTO BILL PAY

– PHOTO CHECK DEPOSIT

– PLASTICS

– ATM NETWORK

– FRAUD LOSSES

– MARKETING

– APP DESIGN / MAINTENANCE

– SALARIES / OPS

– VENDOR COSTS

• $5 million allotted to BankMobile

• Profitability in 2-3 years

.

>>

BANKMOBILE OVERVIEW

.

We are creating a banking revolution - on a path to becoming

a disruptive player.

a disruptive player.

Why BankMobile?

1.Leverage our Higher One relationship

2.Improve efficiency, growth and profitability

3.Create a customer base for our future

Bankmobile Pillars

• NO Fees; Guaranteed ¼% Higher Rates

• Effortless banking offering 55,000 free ATMs

combined with exceptional customer service

combined with exceptional customer service

• Financial literacy / empowerment / advisor

BankMobile

Warren Taylor

>> >> >>

A REVOLUTIONARY BANK

JANUARY 7, 2015

LUVLEEN SIDHU

CHIEF STRATEGY & MARKETING OFFICER

>>

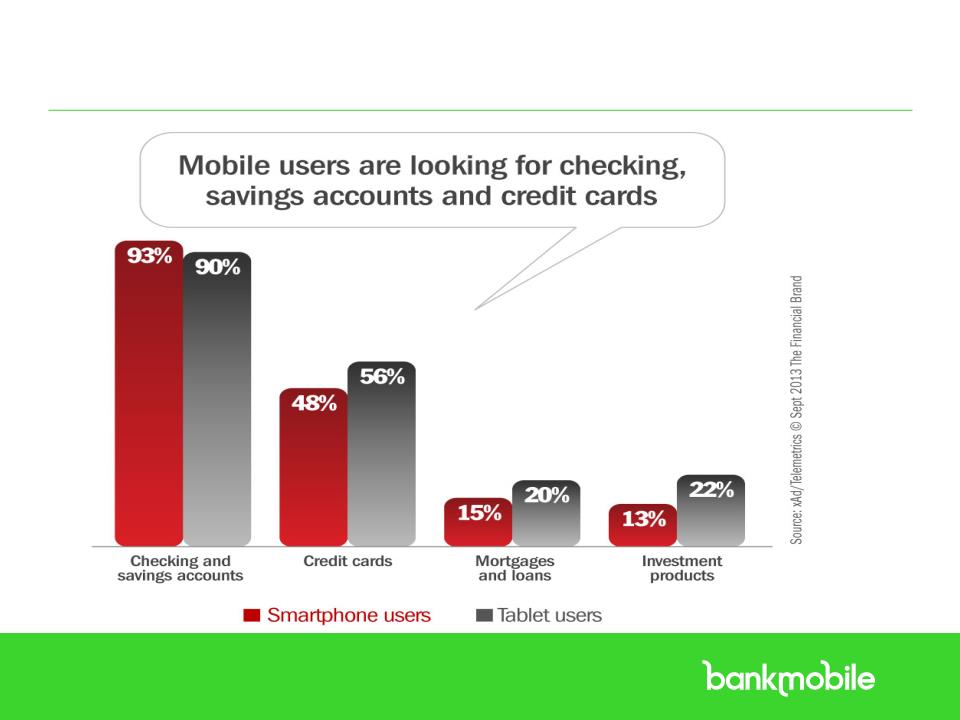

THE TIME FOR DISRUPTION IS NOW

Mobile banking increased 40 percent in 2013, Bankrate

says — that’s 40,000 new customers a day.

says — that’s 40,000 new customers a day.

Handling a transaction at a branch can cost 50 times

the same transaction on a mobile phone, or 20 times its

cost on an online platform

the same transaction on a mobile phone, or 20 times its

cost on an online platform

This year, for the first time, U.S. customers interacted

with their banks more through mobile devices than any

other means…Mobile interactions are now 35% of the

total, more than any other type, including traditional

online channels, automated-teller machines and branch

visits

with their banks more through mobile devices than any

other means…Mobile interactions are now 35% of the

total, more than any other type, including traditional

online channels, automated-teller machines and branch

visits

>>

THE TIME FOR DISRUPTION IS NOW

>>

HOW ARE WE DIFFERENT

COMPETITIVE LANDSCAPE

TRADITIONAL BANKS

INTERNET BANKS

NEO BANKS

• Defensive: Mobile apps are not

used to attract new customers;

Only to respond to demand for

mobile with a costly & large

branch network still there

used to attract new customers;

Only to respond to demand for

mobile with a costly & large

branch network still there

• Mobile banking is only an add on

service adding costs

service adding costs

• Low rates & High fees

• Product offering/pricing the same

whether you open an account in a

branch or on mobile device

whether you open an account in a

branch or on mobile device

• Attract age 55+, higher balance,

rate sensitive customer

rate sensitive customer

• Not focused on creating simplistic

mobile experience with innovative

banking features

mobile experience with innovative

banking features

• Do not provide a full suite of

banking products & services. Little

cross-sell capabilities

banking products & services. Little

cross-sell capabilities

• Revenue model built entirely

around interchange fee from debit

or prepaid cards

around interchange fee from debit

or prepaid cards

• Fees (although they say they

have none)

have none)

• Minimal focus on personalization

>>

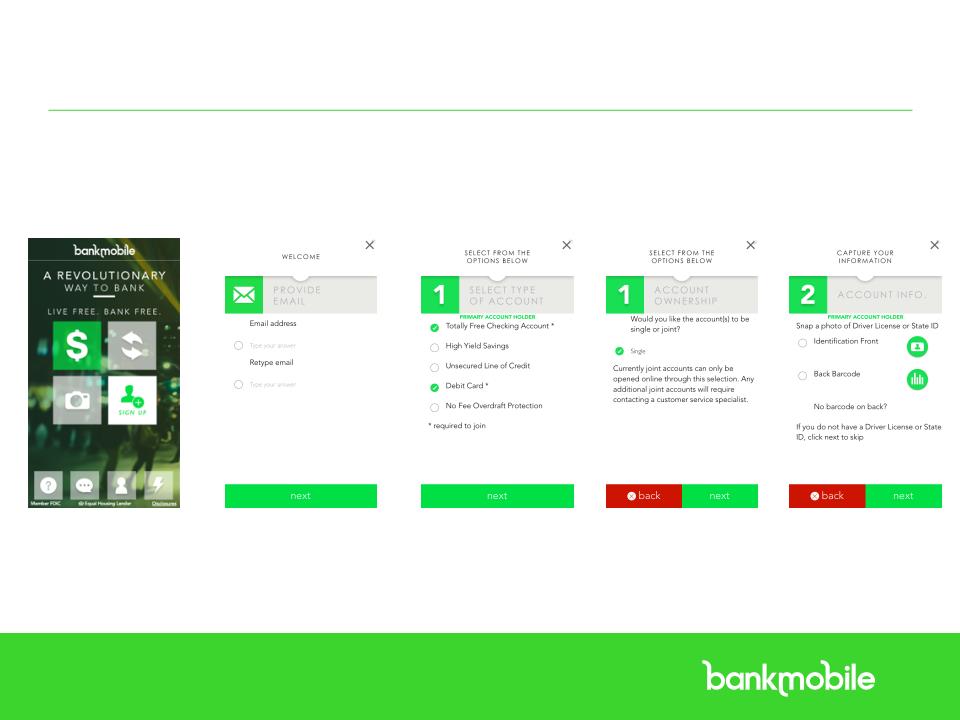

WHO ARE WE?

A Revolutionary New Way to Bank

– NO FEES

– BRANCH IN THE PALM OF YOUR HAND - MOBILE 1ST STRATEGY

– CHECKING, SAVINGS, LINE OF CREDIT, JOINT ACCOUNTS

– HIGHER SAVINGS RATES THAN THE LARGEST 4 BANKS (AT

LEAST 0.25% APY HIGHER RATE GUARANTEED)

LEAST 0.25% APY HIGHER RATE GUARANTEED)

– 55,000 FEE FREE ATMS (3X MORE THAN BOFA)

– PERSONAL BANKER

– FINANCIAL EDUCATION

LIVE FREE. BANK FREE.

>>

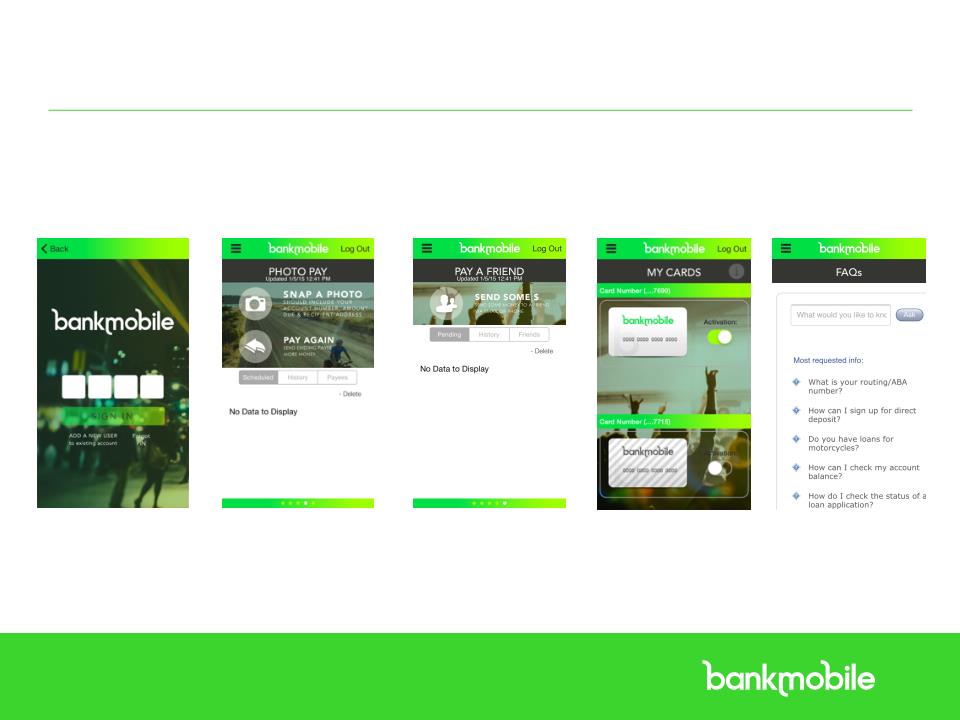

APP FEATURES AT LAUNCH

• Photo bill pay

• P2P payments

• Remote check deposit

• Debit card on/off

• Account balance quick access

• 4 digit password

• ATM Locator

• Part of Apple Pay

PHASE 1

>>

APP SCREENSHOTS

WELCOME SCREEN & ONBOARDING

>>

APP SCREENSHOTS

SOME FEATURES/FUNCTIONALITIES

>>

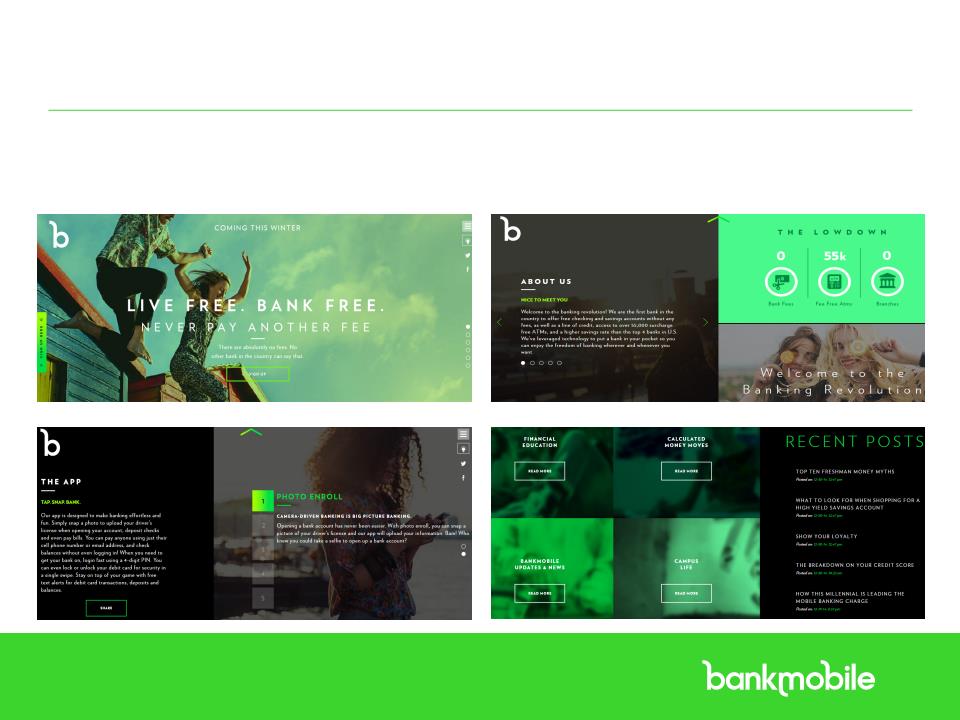

WEBSITE

YOUNG, FUN FEEL!

>>

WHAT IS PHASE 1?

– FOCUS GROUPS

– SOCIAL MEDIA

– EMAIL

– CONTESTS

• Gradually grow customer base at first

– ENSURE OPERATIONS, CALL CENTER, AND

TECHNOLOGY ARE WELL INTEGRATED AND

PREPARED FOR GROWTH

TECHNOLOGY ARE WELL INTEGRATED AND

PREPARED FOR GROWTH

BUILDING A STRONG FOUNDATION

>>

MILLENNIAL STRATEGY

HIGHER ONE

Who are they?

Why are they

attractive?

attractive?

How will we

do it?

do it?

§ Ages 18-35; Largest generation at around 84 million

§ Not just future customers, but influencers

§ Millennials rank the four largest banks among the 10 least loved brands in

America

America

§ Tech savvy, tech dependent, largest group of mobile users

§ 33% say they are switching banks in the next 90 days

§ 40% of millennials would consider switching to a branchless bank

§ Receiving the largest transfer of wealth in history from baby boomer parents

§ 33% of millennials say main reason to switch banks is excessive fees

§ Partnership with Higher One; access to ~250K graduates each year

§ Create hype and engagement through multiple social media platforms

§ Utilize college students as brand ambassadors

§ Develop & distribute content on financial topics to build loyalty & trust

§ Digital ad campaign

>>

WHAT DO MILLENNIALS WANT FROM THEIR BANK?

VIDEO

>>

AFFINITY STRATEGY

Objective

Partnership

Structure

Structure

Examples

§ Create affinity relationships with not for profits as well as profit generating

organizations

organizations

§ Members, followers, or customers must feel passionate about the

organizations we partner with

organizations we partner with

§ Develop a win/win partnership - Enter into a marketing fee agreement

§ Customers receive a branded banking experience

§ We financially compensate the organization our customers are passionate

about

about

§ We receive loyal banking customers

§ Credit card companies targeting affinity groups in the 80’s

§ USAA & Veterans

§ Bancorp Bank & T Mobile

§ We plan to target alumni associations, foundations, charities, advocacy groups

religious groups etc

religious groups etc

>> >> >>

AFFINITY MARKETING

JONATHAN LEWIS

CHIEF DEVELOPMENT OFFICER

>>

AFFINITY MARKET

• Unions, Associations and Employees of

Businesses with over 1000 employees

Businesses with over 1000 employees

– 17.7 MILLION MEMBERS OF UNIONS

– 100 MILLION MEMBERS OF ASSOCIATIONS

– 54 MILLION EMPLOYEES OF BUSINESSES WITH

OVER 1000 EMPLOYEES

OVER 1000 EMPLOYEES

WHO ARE OUR CUSTOMERS?

HOW BIG IS THE MARKET?

>>

OUR PROGRESS

September of 2014 we set out to contact and build

relations with groups that met our Market Criteria:

relations with groups that met our Market Criteria:

• To date we have spoken with organizations having over 3

million members.

million members.

• We have agreements from 7 organizations with over 400,000

combined members, and are going to begin the on-boarding

process during the next 12 months.

combined members, and are going to begin the on-boarding

process during the next 12 months.

Hired an experienced team in August

We expect to add 2-4 more team members in 2015

>>

GOAL

To Have 1% of All members of our

Affinity groups use Bank Mobile as its

Primary Bank in the first 12 months.

Affinity groups use Bank Mobile as its

Primary Bank in the first 12 months.

• Active Targeted Marketing

• Attending Meetings

• Education of Members

• Participation in Sponsored Events

• Provide financial benefit for the members

SUPPORT OUR MEMBERS,

CREATE VALUE

>>

MARKETING STRATEGY

CUSTOMER ACQUISITION

|

Channel

|

Strategy Detail

|

|

Email Campaign

|

Target 1M+ Higher One students through emails. Conduct

“experiments” to determine most effective messaging/campaigns |

|

Affinity Marketing

|

Reaching out to affinity groups, market to members using emails,

direct mail and newsletters, attending conferences |

|

Social Media

|

FB, Twitter, Instagram, Pinterest, Youtube, Vimeo, Vine presence

|

|

Blog

|

Create unique content on various financial topics

|

|

Gorilla Marketing

|

Street Teams, Bankmobile RV, Green range checking, videos, etc

|

|

PR

|

Target key blogs & publications

|

|

Crowdsourcing

|

Focus groups, social media engagement, email, contests

|

|

Digital Marketing

|

Entire website is optimized (SEO), paid search, social media

advertising, remarketing (cookies) |

>>

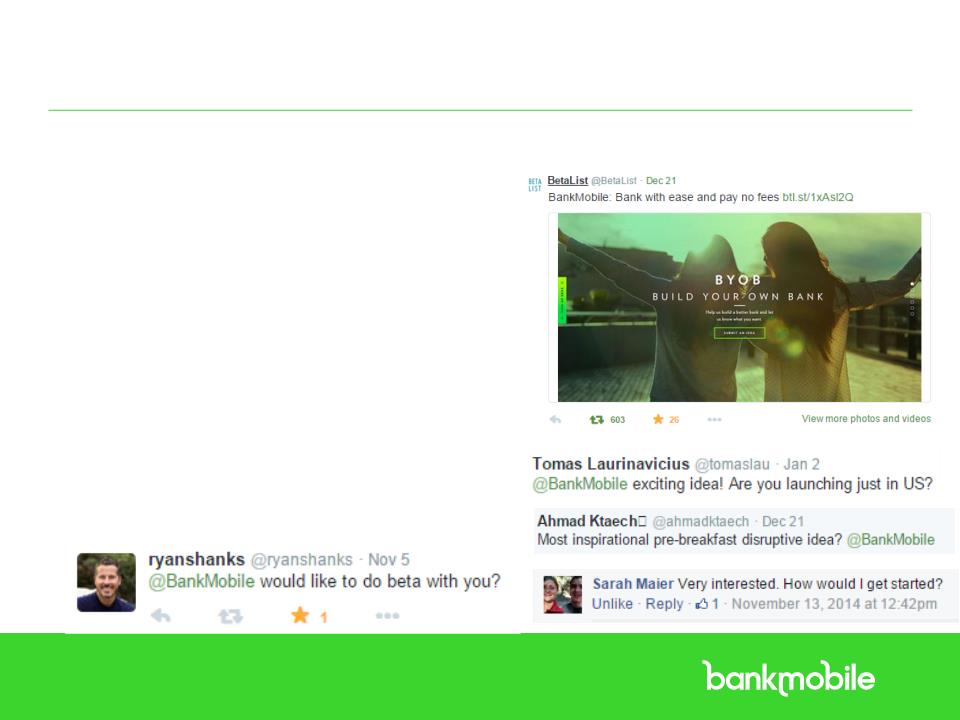

EXAMPLES OF MARKETING

EMAIL CAMPAIGNS AND PR

BankMobile in the News

>>

SOCIAL MEDIA @BANKMOBILE

MILLENNIALS & SOCIAL MEDIA

• 56% more likely to find brand content on social networks than on search engines or other

online news feeds

online news feeds

• 91% would consider a product if a friend recommended it to them

• 60% of Millennials are engaged in rating products and services

• Millennials are 2.5x more likely than Boomers to share a social-media link that references a brand

Millennials are fed up with traditional banks & use social media to find solutions

BankMobile’s Social Media Goals

•Build brand awareness & trust

•Increase consideration

•Drive traffic to website, app and blog

•Build following on social media & blog

•Increase brand loyalty and advocacy

•Amplify media coverage & word of mouth referrals

>>

BANKMOBILE’S BLOG

FINANCIAL EDUCATION, NEWS & UPDATES

Purpose: To educate and inform prospects and customers while increasing awareness, consideration,

loyalty and advocacy

loyalty and advocacy

Blog Pillars & Topics

•Research conducted to identify financial problems during target market’s life stages

•Topics showcase brand pillars and mission with transparency & authenticity

•Content developed to address needs of Millennial consumer in a relevant way

>>

SOCIAL MEDIA @BANKMOBILE

SOCIAL MEDIA STRATEGY

• Provide Superior Customer Service

• Answer questions quickly using our FAQ

database, video tutorials & blog

database, video tutorials & blog

• Listen & Engage to Build Community

• Find & engage those looking for a new bank

• Amplify engagement from press and users

• Create contests, campaigns & incentives

• Create and Publish Shareable Content

• Publish 2-3 blog posts per week

• Participate in Twitter chats to extend reach

• Post mix of helpful/informative posts

frequently

frequently

• Advertise Efficiently to Target Market

• Advertise to Higher One database on

Facebook & Twitter with custom audiences

Facebook & Twitter with custom audiences

• Pixel website visitors to remarket to online

• Advertise to target market to download app

>>

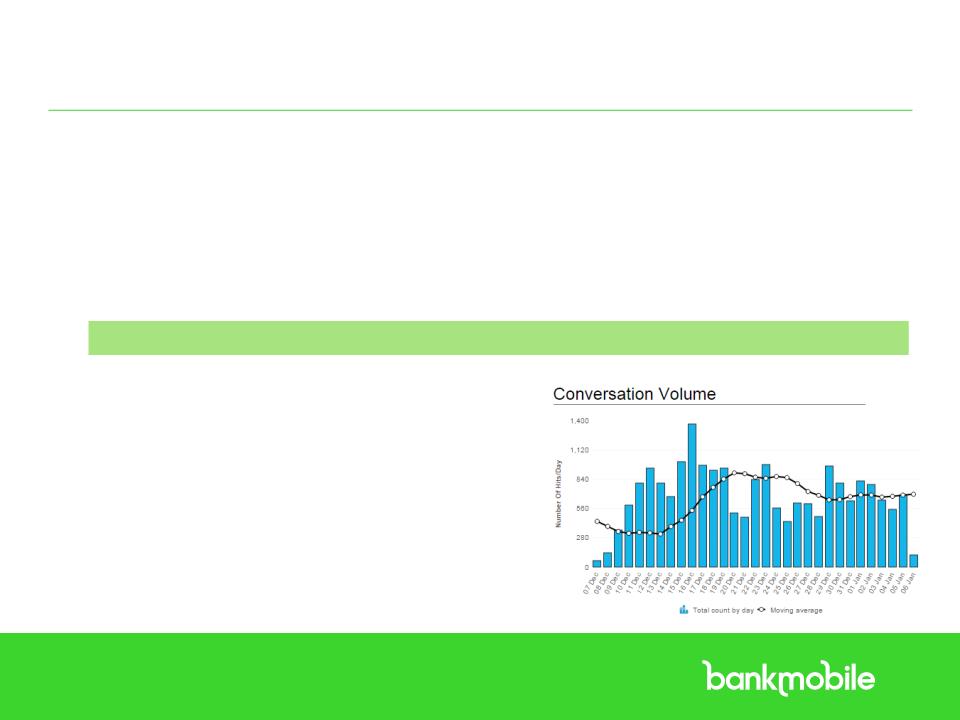

SOCIAL MEDIA @BANKMOBILE

PRE-LAUNCH EARNED MEDIA METRICS

Press Reach

•1.25 billion impressions from digital media

•2.54 billion potential impressions from digital

media

media

Website & Blog (Launched 12/18/14)

•10,012 pageviews on website

•534 visits to blog

Social Media (Launched on 10/28/14)

•200 Facebook fans, 12,844 impressions

•180 Twitter followers

•236 views of pins on Pinterest

•116 visits to website from social media

•Of those visits, 4% signed up for email

>>

PHASE 2 INNOVATIONS

SECOND HALF OF 2015 OR BEFORE

FEATURES

SERVICES

(NEXT 60-90 DAYS)

• Text Chat

• PFM (transaction categorization,

account aggregation, budgeting,

goals)

account aggregation, budgeting,

goals)

• Utilize data analytics for more

personalized banking experience

personalized banking experience

• Ability to search for and purchase

cars in your area. We provide a pre

approved auto loan

cars in your area. We provide a pre

approved auto loan

• Becoming a marketplace where

customers can purchase goods. We

provide financing and insurance

customers can purchase goods. We

provide financing and insurance

• Biometric authentication

• Auto loans

• Credit cards

• Mortgages

• CDs

• Customers who enroll in direct

deposit will become VIP customers

deposit will become VIP customers

• VIP customers will have free access

to a financial advisor

to a financial advisor

• VIP customers will also have access

to fee free ATMs nationwide

to fee free ATMs nationwide

PRODUCTS

>>

SECURITY RISK MITIGANTS

• Retained security experts to provide advice and

implement multi layer security

implement multi layer security

• Experience in security due to HO relationship (1M+

students using HO mobile banking with no security

breaches)

students using HO mobile banking with no security

breaches)

• Educating the customer

WE TAKE SECURITY VERY SERIOUSLY

>>

5 YEAR GOALS

Over a 1 year period, acquire ~25,000 customers

Over a 5 year period, acquire ~250,000

customers

customers

Make 20% plus ROE

>>

ANY QUESTIONS?