Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DARDEN RESTAURANTS INC | q2fy15earningsrelease8-k.htm |

| EX-99.1 - NEWS RELEASE - DARDEN RESTAURANTS INC | q2fy15exhibit991-earnings.htm |

FY2015 Q2 Review | FY2015 Outlook DECEMBER 16, 2014

Forward-Looking Statement Forward-looking statements in this communication regarding our expected earnings performance and all other statements that are not historical facts, including without limitation statements concerning our future economic performance, are made under the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. Any forward-looking statements speak only as of the date on which such statements are first made, and we undertake no obligation to update such statements to reflect events or circumstances arising after such date. We wish to caution investors not to place undue reliance on any such forward-looking statements. By their nature, forward-looking statements involve risks and uncertainties that could cause actual results to materially differ from those anticipated in the statements. The most significant of these uncertainties are described in Darden's Form 10-K, Form 10-Q and Form 8-K reports. These risks and uncertainties include the ability to achieve Darden's strategic plan to enhance shareholder value including realizing the expected benefits from the sale of Red Lobster, food safety and food-borne illness concerns, litigation, unfavorable publicity, risks relating to public policy changes and federal, state and local regulation of our business, labor and insurance costs, technology failures, failure to execute a business continuity plan following a disaster, health concerns including virus outbreaks, intense competition, failure to drive sales growth, our plans to expand our smaller brands Bahama Breeze, Seasons 52 and Eddie V's, higher-than-anticipated costs to open, close, relocate or remodel restaurants, a failure to execute innovative marketing tactics, a failure to develop and recruit effective leaders, a failure to address cost pressures, shortages or interruptions in the delivery of food and other products and services, adverse weather conditions and natural disasters, volatility in the market value of derivatives, economic factors specific to the restaurant industry and general macroeconomic factors including interest rates, disruptions in the financial markets, risks of doing business with franchisees and vendors in foreign markets, failure to protect our intellectual property, impairment in the carrying value of our goodwill or other intangible assets, an inability or failure to manage the accelerated impact of social media and other factors and uncertainties discussed from time to time in reports filed by Darden with the Securities and Exchange Commission. 2

Non-GAAP Information The information in this communication includes financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”), such as adjusted diluted net earnings per share from continuing operations. The Company’s management uses these non-GAAP measures in its analysis of the Company’s performance. The Company believes that the presentation of certain non-GAAP measures provides useful supplemental information that is essential to a proper understanding of the operating results of the Company’s businesses. These non- GAAP disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. 3

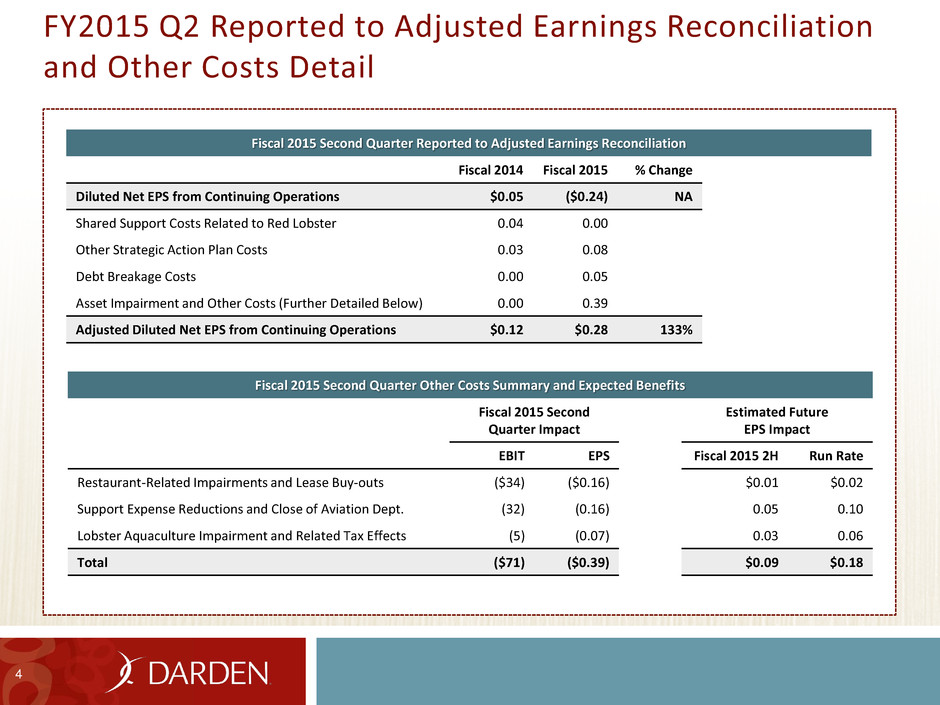

FY2015 Q2 Reported to Adjusted Earnings Reconciliation and Other Costs Detail 4 Fiscal 2015 Second Quarter Reported to Adjusted Earnings Reconciliation Fiscal 2014 Fiscal 2015 % Change Diluted Net EPS from Continuing Operations $0.05 ($0.24) NA Shared Support Costs Related to Red Lobster 0.04 0.00 Other Strategic Action Plan Costs 0.03 0.08 Debt Breakage Costs 0.00 0.05 Asset Impairment and Other Costs (Further Detailed Below) 0.00 0.39 Adjusted Diluted Net EPS from Continuing Operations $0.12 $0.28 133% Fiscal 2015 Second Quarter Other Costs Summary and Expected Benefits Fiscal 2015 Second Quarter Impact Estimated Future EPS Impact EBIT EPS Fiscal 2015 2H Run Rate Restaurant-Related Impairments and Lease Buy-outs ($34) ($0.16) $0.01 $0.02 Support Expense Reductions and Close of Aviation Dept. (32) (0.16) 0.05 0.10 Lobster Aquaculture Impairment and Related Tax Effects (5) (0.07) 0.03 0.06 Total ($71) ($0.39) $0.09 $0.18

FY2015 Q2 Margin Impacts of Adjustments As Reported As Adjusted Q2 2015 Q2 2015 vs. Q2 2014 (Bps) Favorable/(Unfavorable) Food & Beverage 31.1% 31.1% (100) Restaurant Labor 32.5% 32.5% 60 Restaurant Expenses 17.8% 17.8% (20) Restaurant Margin 18.5% 18.5% (60) SG&A 11.7% 9.5% 140 Impairments 3.1% 0.0% 0 Depreciation & Amortization 5.1% 5.1% 0 EBIT -1.3% 4.0% 80 Interest Expense 2.2% 1.5% 70 EBT -3.5% 2.5% 150 5

FY2015 Outlook 6 Fiscal 2015 Same-Restaurant Sales Q1 Q2 Annual Projected Darden Blended +0.2% +1.5% +1 to +2% Olive Garden -1.3% +0.5% Even to +1% LongHorn Steakhouse +2.8% +2.6% +2% to +3% Specialty Restaurants +2.1% +3.2% +2% to +3% Fiscal 2015 Continuing Operations Diluted Net EPS Q1 Q2 Annual Projected1 Diluted Net EPS from Continuing Operations ($0.14) ($0.24) $1.30 - $1.35 Shared Support Costs Related to Red Lobster 0.02 0.00 0.02 Other Strategic Action Plan Costs 0.03 0.08 0.11 Debt Breakage Costs 0.37 0.05 0.42 Asset Impairment and Other Costs 0.04 0.39 0.43 Adjusted Diluted Net EPS from Continuing Operations $0.32 $0.28 $2.25 - $2.30 Adjusted EPS Growth vs FY14 ($0.04) $0.16 $0.54 - $0.59 Fiscal 2015 Growth Sources Adjusted EPS % Growth Business Improvement $0.22 - $0.27 14% - 16% Reduced Interest Expense 0.18 11% Dilutive Share Count 0.09 5% 53rd Week 0.05 3% Total Growth vs FY14 $0.54 - $0.59 32% - 35% 1 Reflects the additional operating week vs Fiscal 2014