Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K DATED DECEMBER 12, 2014 - DAKOTA PLAINS HOLDINGS, INC. | dakota144549_8k.htm |

| EX-99.2 - PRESS RELEASE DATED DECEMBER 12, 2014 - DAKOTA PLAINS HOLDINGS, INC. | dakota144549_ex99-2.htm |

Exhibit 99.1

WWW . DAKOTAPLAINS . COM NYSE MKT: DAKP C ORPORATE P RESENTATION D ECEMBER 12, 2014

F ORWARD L OOKING S TATEMENTS Statements made by representatives of Dakota Plains Holdings, Inc . (“Dakota Plains” or the “Company”) during the course of this presentation that are not historical facts, are forward - looking statements . These statements are based on certain assumptions and expectations made by the Company which reflect management’s experience, estimates and perception of historical trends, current conditions, anticipated future developments and other factors believed to be appropriate . Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company, which may cause actual results to differ materially from those implied or anticipated in the forward - looking statements . These include risks relating to global economics or politics, our ability to obtain additional capital needed to implement our business plan, minimal operating history, loss of key personnel, lack of business diversification, reliance on strategic, third - party relationships, financial performance and results, prices and demand for oil, our ability to make acquisitions on economically acceptable terms, and other factors described from time to time in the Company’s periodic reports filed with the SEC that could cause actual results to differ materially from those anticipated or implied in the forward - looking statements . Dakota Plains undertakes no obligation to publicly update any forward - looking statements, whether as a result of new information or future events . 2

S UMMARY » Well positioned to c reate value in 2015 and beyond » The buyout of the JVs: □ Creates value in earnings per share, EBITDA and operating c ash f low per share □ Fully financed with low cost debt and cash on hand □ Simplifies our capital structure and simplifies our financial reporting □ Expedites potential value - adding expansions underpinned by the strong level of interest in shippers to move oil through the Pioneer Terminal □ Mitigates exposure to the Lac Megantic legal claims » Operations are strong (despite downturn in oil prices): □ Demand for transloading services at Pioneer is increasing Dec. 2014 volumes are highest to date at 52k bopd □ With increased Canadian Pacific service, secured 55k bpd for January 2015 and were over - subscribed □ Have line of sight on 80k bopd by summer 2015; guidance assumes only 60k bopd in 2h15 □ Sand operation volumes are steady at an average of 25k tons per month in 2014 » Growth projects are compelling: □ Developing phased expansions toward goal of 160k bpd □ Tank #3 expansion is fully funded and on schedule for summer 2015 □ Considering a third loop track, an integral step toward 160k bpd » Providing FY 2015 adjusted EBITDA guidance of $ 23.4M □ Predictable revenues underpinned by contracted volumes and pricing with no direct commodity pricing risk 3

T RANSACTION R EVIEW

JV T RANSACTION Acquired partner’s 50% share of oil transloading, sand transloading, and oil marketing business Secured indemnity to mitigate contingent liability related to Lac Megantic Refinanced existing debt Divested 50% share of trucking JV Own 100% of the business, Pioneer Terminal and land Terminates under - performing JVs Removes direct commodity risk Mitigates Lac Megantic exposure Reduces cost of debt Refocuses business on fee - based, term contracts Frac Sand Logistics Crude Oil Storage & Logistics Our current Fee - based Services: 5 Inbound Outbound

S IMPLIFIED C ORPORATE S TRUCTURE 6 Dakota Plains Holdings, Inc . 100% Dakota Plains Marketing, LLC 100% DPTS Marketing LLC Dakota Plains Transloading , LLC 100% 100% Dakota Petroleum Transport Solutions, LLC Dakota Plains Sand, LLC 100% 100% DPTS Sand, LLC Sand Transloading operations Crude oil transloading operations Host of rail cars with no trading operations

T RANSACTION D ETAILS » Signed definitive agreement and closed on December 5, 2014 » Total consideration: □ Payment of $43m cash □ Future contingent payments at $0.225 per barrel actually transloaded , capped at 80k bopd , through 2026 (remainder of former JV term) » Indemnification mitigates DAKP’s contingent liability for Lac Megantic incident » Former JV partner becomes tenant at Pioneer with 15k bopd contract » Retained rail car fleet as a potential enabler to secure new volumes » Results in DAKP exiting from commodity trading business 7

F INANCING THE T RANSACTION » The new $ 57.5M credit facility provided by SunTrust Bank consists of □ T wo fully drawn tranches of term loan for a total of $37.5M □ One revolver of $20.0M which is $11.0M drawn » The former terminal note and the former promissory notes have been refinanced in the transaction 8 Sources Uses ($M) Cash $2.0 Cash consideration paid to WFS $43.0 New $20.0 Million DAKP Revolving Credit Facility 11.0 Refinance Terminal Note 6.4 New $15.0 Million Term Loan A 15.0 Refinance Promissory Note 7.7 New $22.5 Million Term Loan B 22.5 Fees & Other 2.3 Net Proceeds From JV Dissolution 8.9 Total Sources $59.4 Total Uses $59.4

F INANCIAL I MPACT OF THE T RANSACTION

Before After Difference EBITDA Consolidated $23.4 $23.4 Non-DAKP ($15.2) $0.0 Net $8.2 $23.4 186% Net income EBITDA $23.4 $23.4 Adjustments ($9.2) ($14.9) Net income $14.1 $8.5 Non-DAKP NI ($13.1) $0.0 Net income (DAKP) $1.1 $8.5 FD shares (million) 56.7 56.6 EPS $0.02 $0.15 n.m. Operating cash flow Consolidated $19.2 $13.5 Non-DAKP OCF ($14.2) $0.0 Tax savings (1) $0.0 1.6 Contingent payments $0.0 ($4.7) Adjusted $5.0 $10.4 FD shares (million) 56.7 56.6 CFPS $0.09 $0.18 108% A CCRETIVE IN 2015 TO DAKP S HAREHOLDERS 10 » Offers Scale – Leveraging DAKP Overhead □ More than doubles EBITDA with no increase in corporate G&A » Significantly Accretive □ Accretive to both earnings per share (“EPS”) and operating cash flow per share (“OCFPS ”) □ New debt financing significantly reduces weighted average cost of debt □ Contingent payments limited to actual throughput, capped at 80k bopd □ Cash tax benefit as a result of fair value write - up of tax basis » Simplifies the Financials □ Debt consolidated □ Eliminates non - controlling interest and equity method accounting ( $ in millions, expect per share figures or if otherwise notes) Note : The above analysis is provided for illustrative purposes and represents the hypothetical impact of the transaction . The analysis excludes any one - time transaction expenses ( 1 ) Based on preliminary estimates of purchase price allocation and incremental tax deductible amortization and depreciation

O PERATIONS U PDATE

O PERATIONS U PDATE – 4Q2014 T O D ATE » Crude Oil Operations □ October = 1.45M bbls • 47k bpd • 6k bpd via Pelican • 18 trains launched □ November = 1.01M bbls • 36k bpd • 8k bpd via Pelican & Hiland pipelines • 17 trains launched □ December through 10 th December = 519k bbls • 52k bopd average • 11k bopd via Pelican & Hiland pipelines • 7 trains launched » Sand Operations □ October = 281 cars = 32k tons □ November = 201 cars = 23k tons 12 Pictures?

2015 O PERATIONS O UTLOOK » Canadian Pacific expands crude oil train allocations to 22 per month starting 1Q2015 » Contracted crude oil transloading volumes now 55k bpd starting January 2015 » Canadian Pacific has also pledged incremental unit train allocations to support train commitments throughout 2015 » Third 90k barrel tank under construction safely achieved its winter shut - down goal □ Expected to be fully operational by August 2015 □ Construction to date is on budget (fully funded). » Urging Canadian Pacific to increase sand trains to meet strong demand. 13

Guidance

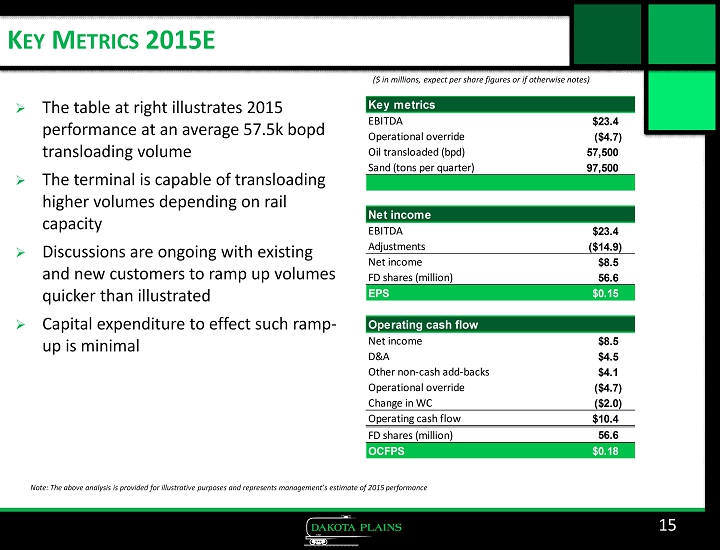

K EY M ETRICS 2015E » The table at right illustrates 2015 performance at an average 57.5k bopd transloading volume » The terminal is capable of transloading higher volumes depending on rail capacity » Discussions are ongoing with existing and new customers to ramp up volumes quicker than illustrated » Capital expenditure to effect such ramp - up is minimal 15 ( $ in millions, expect per share figures or if otherwise notes) Note : The above analysis is provided for illustrative purposes and represents management’s estimate of 2015 performance Key metrics EBITDA $23.4 Operational override ($4.7) Oil transloaded (bpd) 57,500 Sand (tons per quarter) 97,500 Net income EBITDA $23.4 Adjustments ($14.9) Net income $8.5 FD shares (million) 56.6 EPS $0.15 Operating cash flow Net income $8.5 D&A $4.5 Other non-cash add-backs $4.1 Operational override ($4.7) Change in WC ($2.0) Operating cash flow $10.4 FD shares (million) 56.6 OCFPS $0.18

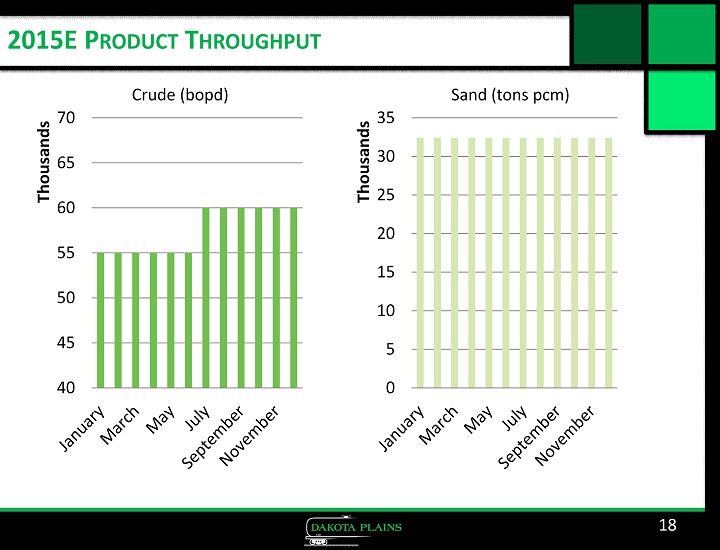

2015 G UIDANCE » C rude oil throughput volumes: □ 55k bopd effective Jan 2015 □ Increasing to 60k bopd effective 2H2015 □ 2015 expected average throughput volumes 57.5k bopd , opportunity to further increase volumes 2H2015 » Sand throughput volumes at 97.5k tons per quarter on average » 2015 expected EBITDA of $23.4M, excludes cash impact of anticipated contingent volume payments of $4.7M 16

EBITDA 1Q2015E – 4Q2015E -5,000 0 5,000 10,000 15,000 20,000 25,000 1Q2015 2Q2015 3Q2015 4Q2015 USD (Thousands) EBITDA Contingent payment LTM EBITDA 17

2015E P RODUCT T HROUGHPUT 40 45 50 55 60 65 70 Thousands 18 0 5 10 15 20 25 30 35 Thousands Crude ( bopd ) Sand (tons pcm)

C APITAL P LAN 2015E – 2017E » Objective is to build out the Pioneer Terminal to 160k bopd in phases based on level of rail service and demand for throughput: □ Phase 4 - A third 8,400 ft loop track: • Project still subject to approval • Estimated Cost : $5M • Targeting to be operational by Summer 2015 • Funding would be provided by cash from operations and the recently announced revolving credit facility □ Phase 5 – Addition of fourth and fifth tank and loading expansion: • Project still subject to approval • Estimated Cost: $25M • Targeting to be operational by end 1Q2016 □ Phase 6 – Addition of sixth tank and additional rail infrastructure: • Project still subject to approval • Estimated Cost: $6M • Targeting to be operational by 2H2016 19

A PPENDIX

P IONEER T ERMINAL 21 » Merchant transloading facility in New Town, ND » Currently transloading 80k bpd, but not every day » Capable of expansion up to 160k bopd 10 STATION RAIL LOADING 70 ACRE INDUSTRIAL YARD SPACE D OUBLE LOOP TRACK FOR TWO 120 - UNIT TRAINS F OUR LADDER TRACKS FOR FUTURE INBOUND UNIMIN FRAC SAND T ERMINAL I NBOUND PIPELINES 10 TRUCK OFFLOAD STATIONS 180 K BBLS STORAGE , E XPANSION TO 270 K UNDERWAY

C ONSOLIDATED B ALANCE S HEET 3Q 2014 22 millions Before After Current Assets $ 10.4 $ 32.0 Property and Equipment 54.8 54.8 Investment in DPTS Marketing, LLC 10.6 - Deferred Tax Asset 3.4 23.7 Other 1.5 0.8 Total Assets $ 80.7 $ 111.3 Current Liabilities $ 3.0 $ 13.4 Long - Term Liabilities Promissory Notes 13.7 48.5 Contingent Payment Payable - 47.1 Total Liabilities 16.7 109.0 Total Stockholders' Equity 64.0 2.3 Total Liabilities and Stockholder's Equity $ 80.7 $ 111.3

A DJUSTED EBITDA 23 (expressed in USD millions, unless otherwise indicated) Twelve Months Ended December 31, 2015 Net Income 8.5$ Add back: Interest Expense 7.6$ o/w Contingent payment interest 4.2$ Term loan and revolver interest 3.1$ Fees / amortization associated with loans 0.4$ Tax Provision 1.6$ Depreciation and Amortization 4.5$ Share Based Compensation 1.2$ Adjusted EBITDA 23.4$