Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TIVO INC | fy2015-q38xk.htm |

| EX-99.1 - PRESS RELEASE DATE NOVEMBER 25,2014 - TIVO INC | a99-01xpressreleasedatedno.htm |

Q3’15 Financial Highlights & Capital Deployment Update Exhibit 99.2

2 TiVo Inc. - Q3’15 Investor Call - November 25, 2014 Disclaimer Caution Regarding Forward Looking Statements. This presentation contains forward looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, which are based on current expectations and assumptions that are subject to risks and uncertainties and actual results could materially differ. These statements relate to, among other things, TiVo's future business and growth strategies, including future distribution agreements and revenue and subscription growth from MSO customers (both domestically and internationally), future growth in TiVo’s overall subscription base, future service, technology and audience research revenues, future growth in TiVo’s Adjusted EBITDA, future products and features, future value in TiVo’s intellectual property portfolio, and future changes in TiVo’s operating expenses. Forward-looking statements generally can be identified by the use of forward-looking terminology such as, "believe," "expect," "may," "will," "intend," "estimate," "continue" or similar expressions or the negative of those terms or expressions. Such statements involve risks and uncertainties, which could cause actual results to vary materially from those expressed in or indicated by the forward-looking statements. Factors that may cause actual results to differ materially include delays in development, the growth of competing service offerings and lack of market acceptance, as well as the other potential factors described under "Risk Factors“ in TiVo’s public reports filed with the Securities and Exchange Commission, including TiVo’s Annual Report on Form 10-K for the fiscal year ended January 31, 2014; Quarterly Reports on Form 10-Q for the quarterly periods ended April 30, 2014 and July 31, 2014 and Current Reports on Form 8-K. TiVo cautions you not to place undue reliance on forward-looking statements, which reflect an analysis only and speak only as of the date hereof. TiVo disclaims any obligation to update these forward-looking statements. Non-GAAP Measures. This presentation also references non-GAAP financial measures. Additional information on these non-GAAP financial measures can be accessed through TiVo’s Investor Relations website at www.tivo.com/ir. For a reconciliation of these non-GAAP financial measures to the most comparable GAAP equivalent, please see Appendix. Industry Information. Information regarding market and industry statistics contained in this presentation is based on information available to us that we believe is accurate. It is generally based on publications that are not produced for purposes of economic analysis.

3 TiVo Inc. - Q3’15 Investor Call - November 25, 2014 Significant revenue and subscription growth YoY sub growth +32% S&T revenues growing +8% Continued Year-over-Year Growth 1.5 2.5 3.5 4.5 5.5 Q 3 1 0 Q 3 1 1 Q 3 1 2 Q 3 1 3 Q 3 1 4 Q 3 1 5 Total Subs (MM) $30 $50 $70 $90 Q 3 1 0 Q 3 1 1 Q 3 1 2 Q 3 1 3 Q 3 1 4 Q 3 1 5 Service and Technology Revenue (MM)

4 TiVo Inc. - Q3’15 Investor Call - November 25, 2014 $0 $2 $4 $6 $8 $10 $12 Q310 Q311 Q312 Q313 Q314 Q315 MSO Service Revenue (MM) 0 1 2 3 4 5 Q310 Q311 Q312 Q313 Q314 Q315 Total MSO Subs (MM) MSO Service revenue growth +37% YoY Doesn’t yet include ComHem and ONO service revenue ONO expected to help drive 20% plus growth in MSO service revenue next quarter MSO subscription growth +43% YoY Driven by Virgin Media, ONO, RCN, Suddenlink, and US Tier 2 operators US sub adds represented about 35% of MSO net adds in the quarter Key Driver: MSO Subscription Growth

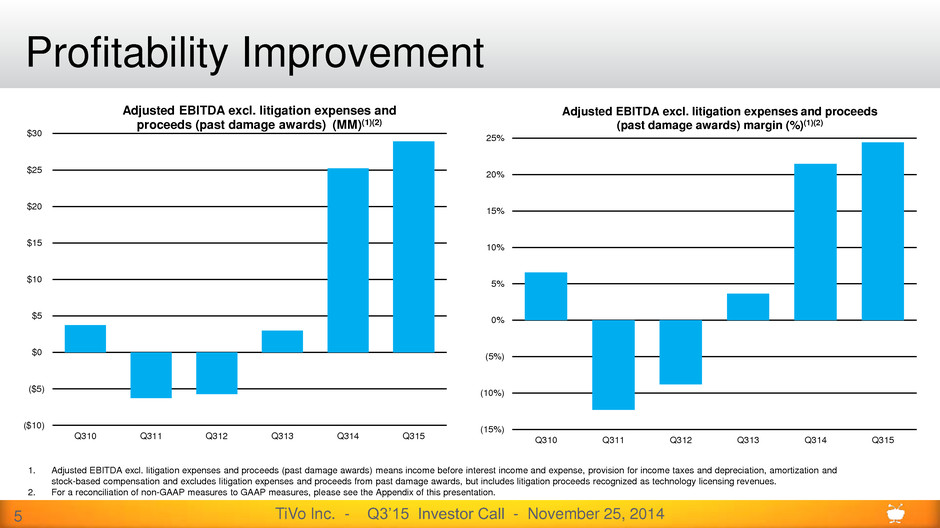

5 TiVo Inc. - Q3’15 Investor Call - November 25, 2014 ($10) ($5) $0 $5 $10 $15 $20 $25 $30 Q310 Q311 Q312 Q313 Q314 Q315 Adjusted EBITDA excl. litigation expenses and proceeds (past damage awards) (MM)(1)(2) (15%) (10%) (5%) 0% 5% 10% 15% 20% 25% Q310 Q311 Q312 Q313 Q314 Q315 Adjusted EBITDA excl. litigation expenses and proceeds (past damage awards) margin (%)(1)(2) Profitability Improvement 1. Adjusted EBITDA excl. litigation expenses and proceeds (past damage awards) means income before interest income and expense, provision for income taxes and depreciation, amortization and stock-based compensation and excludes litigation expenses and proceeds from past damage awards, but includes litigation proceeds recognized as technology licensing revenues. 2. For a reconciliation of non-GAAP measures to GAAP measures, please see the Appendix of this presentation.

6 TiVo Inc. - Q3’15 Investor Call - November 25, 2014 $350 million repurchase program over next 2.5 years (~20% of fully diluted shares outstanding)* Repurchases using proceeds of new convertible note to offset expected conversion of shares underlying the March 2016 convert - 9.6 million shares underlying new convert will effectively offset the expected conversion of the15.5 million shares underlying the old convert. Combination of repurchase program and convert repurchases will yield up to $550M in share repurchases which began in September 2014 Still leaves TiVo in strong cash position for potential M&A, further internal investment and/or additional capital returns in the future Capital Deployment Highlights *Used stock price of $13.00 to calculate potential share reduction; which equates to 26.9 million shares based on Q2’15 average weighted diluted shares of 129.1 million

7 TiVo Inc. - Q3’15 Investor Call - November 25, 2014 Details of new convertible debt offering: - Deal Size: $230 million - Conversion price: Up 30% @ $17.82 - Strike price on warrant transaction related to notes: Up 75% @ $24 - Coupon: 2% - Term: 7 years Impact on Financials: - Increased annual GAAP interest expense of $11.6 million and cash interest expense of $4.6 million - No impact of diluted shares outstanding until stock reaches $24 (non-GAAP) Call Spread Overlay - Upfront cost of ~$24 million (net of cost of hedge offset by warrant transaction) - Most of the expense expected to be recouped over term of the debt due to tax benefit associated with the hedge transaction Convertible Debt Impact on Financials:

8 TiVo Inc. - Q3’15 Investor Call - November 25, 2014 100 105 110 115 120 125 $0 $20 $40 $60 $80 $100 $120 $140 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 Increasing Share Repurchases ($MM) vs. Declining Basic Shares Outstanding (M) Significant Capital Returns $343M of open market repurchases over past 10 quarters $228M repurchased YTD $100M in 1H’15 $42M in conjunction with convertible debt offering $86M in Q3 through 10B5-1 plan $422M remaining under new authorization

9 TiVo Inc. - Q3’15 Investor Call - November 25, 2014 Significant potential for share count reduction Notes: Does not include future vesting of stock options, restricted shares & ESPP Above $24 share price, 9.6M shares from new convertible would be added to share count using treasury stock method (Non-GAAP) Q2’15 diluted shares outstanding include ~15.4M shares that underlie the March 2016 convertible notes Does not reflect possible non-routine equity issuance Reduced diluted shares outstanding by ~6% from Q2’13 to Q2’15 Pro-Forma Impact of Planned Repurchases (Based on $13 Stock Price) Combination of $350mm repurchase plan and convert-funded buyback yields up to ~$550 million of share repurchases and could reduce diluted share count by approximately 33% (based on current share price and count) by end of FY17. Q2'15 Diluted Sharecount 129,100,175 $350M Repurchase Plan (26,923,077) Convert Funded Repurchases (15,384,615) Reduction in Shares (42,307,692) Pecentage Reduction 33%

Appendix

11 TiVo Inc. - Q3’15 Investor Call - November 25, 2014 GAAP to Non-GAAP Reconciliations FY2010 FY2011 FY2012 FY2013 FY2014 Q3 Q3 Q3 Q3 Q3 Q3 Net Income ($6.4) ($20.6) ($24.5) $59.0 $12.5 $6.3 Add back: Depreciation and Amortization 2.2 2.3 2.2 2.5 2.5 3.5 Interest income & expense, other (0.3) (0.3) 1.3 0.6 1.0 2.1 Benefit (Provision) for income tax (0.0) 0.0 (0.3) 0.8 (2.0) 7.1 EBITDA ($4.5) ($18.7) ($21.3) $62.9 $14.0 $19.1 Stock-based compensation 6.1 6.4 7.4 9.0 9.8 8.5 Adjusted EBITDA $1.6 ($12.2) ($13.9) $71.9 $23.8 $27.7 Litigation expenses 2.1 6.0 8.2 9.5 1.4 1.2 Litigation proceeds (past damage awards) 0.0 0.0 0.0 (78.4) 0.0 0.0 Adjusted EBITDA ex. litigation expenses $3.8 ($6.3) ($5.7) $3.0 $25.2 $28.9 and proceeds (past damage awards) Margin % 6.6% (12.3%) (8.8%) 3.6% 21.5% 24.4% FY2015