Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MERCADOLIBRE INC | d825420d8k.htm |

| EX-99.1 - EX-99.1 - MERCADOLIBRE INC | d825420dex991.htm |

| EX-99.2 - EX-99.2 - MERCADOLIBRE INC | d825420dex992.htm |

August

2014

Investor Relations

Second Quarter 2014 Results

Exhibit 99.3 |

This

presentation may make forward-looking statements relating to such matters as continued growth

prospects for the company, industry trends and product and technology initiatives.

These statements are based on currently available information and our current

assumptions, expectations and projections about future events. While we believe that

our assumptions, expectations and projections are reasonable in view of currently

available information, you are cautioned not to place undue reliance on these

forward-looking statements. Our actual results may differ materially from those included in this

presentation, for a variety of reasons, including those described in the forward-looking

statements and risk factor sections of our 10-K and other filings with the

Securities and Exchange Commission, which are available on our investor relations

website. (http://investor.mercadolibre.com) A reconciliation of Non-GAAP measures

to the nearest comparable GAAP measures can be found in our second quarter 2014

earnings press release available on our investor relations website All of the

information included in this presentation is updated as of August 7th, 2014. Except as may be

required by applicable law, we assume no obligation to publicly update or revise our

statements. |

Q2 2014

Highlights •

Payments outpaced solid Marketplace performance in MELI’s second quarter

•

Total Revenues accelerated to +66% YoY in local currencies (+47%

ex Venezuela), despite

World Cup and Easter headwinds

•

Local currency revenues accelerated in our largest market, Brazil: +34% YoY

•

Total payments volume accelerated both On & Off Platform in the second quarter, growing

82% and 61% YoY in local currencies in the second quarter

Key Trends

Continued progress on

strategic initiatives

•

Total payments reached 44% of gross merchandise volume, with strong on-platform

penetration in Brazil and Argentina.

•

Our shipping solution, MercadoEnvios, shipped over 25% of Brazil’s sold items in

June •

In June, 31% of our new registered users were mobile, and mobile

penetration of our gross

merchandise volume reached 16%

•

Official Stores for large brands gained ground in Argentina, Brazil and Mexico, totaling 226

by end of quarter

•

Closed the acquisition of 2 real estate portals, operating in Chile and Mexico: Portal

Inmobiliario and Guia de Inmuebles

•

Issued $330 million convertible notes due 2019, at a rate of 2.25% per year

In Other News… |

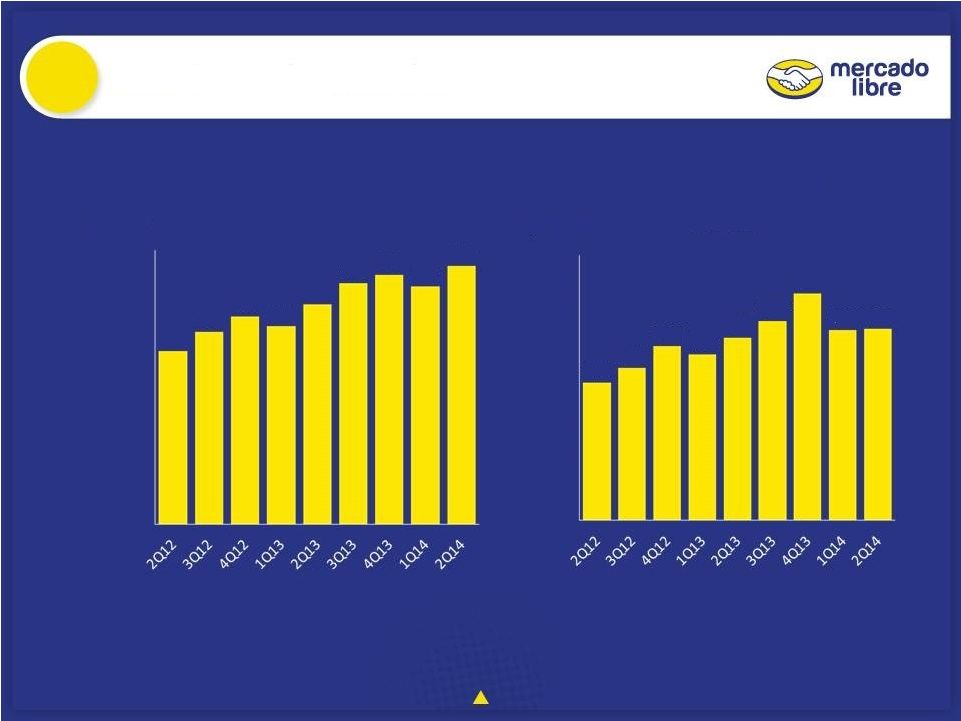

Core Operating

Metrics 20%

18%

36%

22%

19%

20%

27%

25%

20%

YoY

Growth

15%

5%

22%

7%

14%

18%

33%

31%

30%

YoY Reported

USD growth

58%

67%

37%

20%

21%

30%

45%

49%

49%

YoY Constant

USD growth

15.8

17.6

19.0

18.1

20.1

22.0

22.8

21.7

23.6

0

5

10

15

20

25

Millions

Items Sold

1,299

1,436

1,647

1,563

1,725

1,878

2,139

1,797

1,805

0

500

1,000

1,500

2,000

2,500

U$ Millions

Gross Merchandise

Volume |

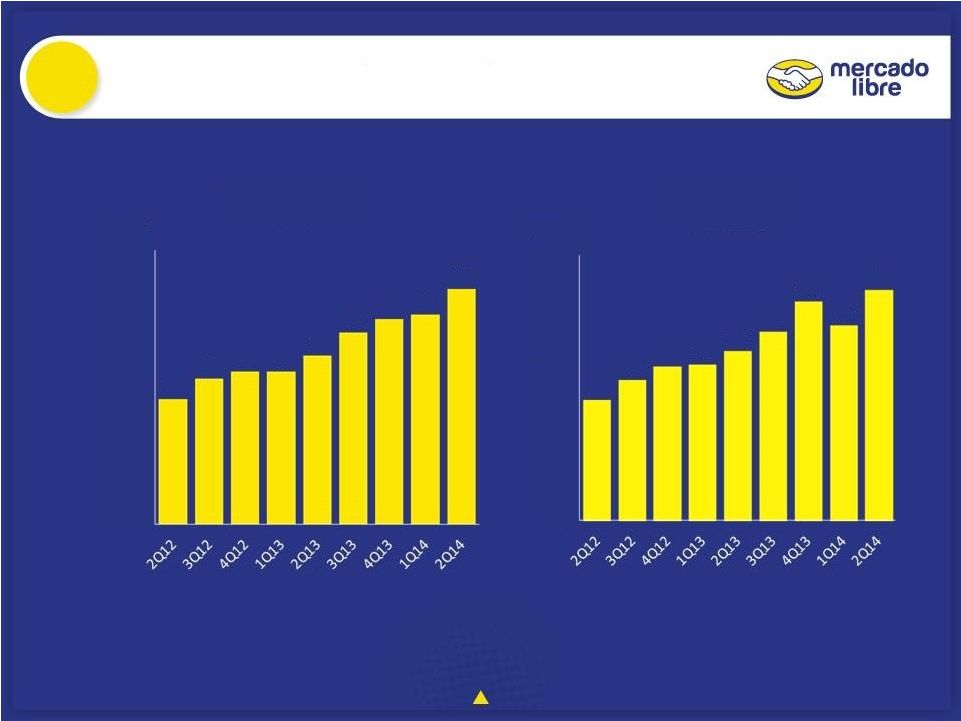

Payments

Operating Metrics 36%

40%

78%

65%

43%

38%

35%

32%

34%

YoY

Growth

25%

36%

39%

30%

30%

44%

40%

34%

42%

YoY Reported

USD growth

64%

77%

64%

55%

47%

62%

54%

55%

66%

YoY Constant

USD growth

5.5

6.4

6.7

6.7

7.4

8.4

9.0

9.2

10.3

0

2

4

6

8

10

12

Millions

Total Payment

Transactions

412

480

525

532

578

642

746

664

785

0

100

200

300

400

500

600

700

800

900

U$ Millions

Total Payment

Volume |

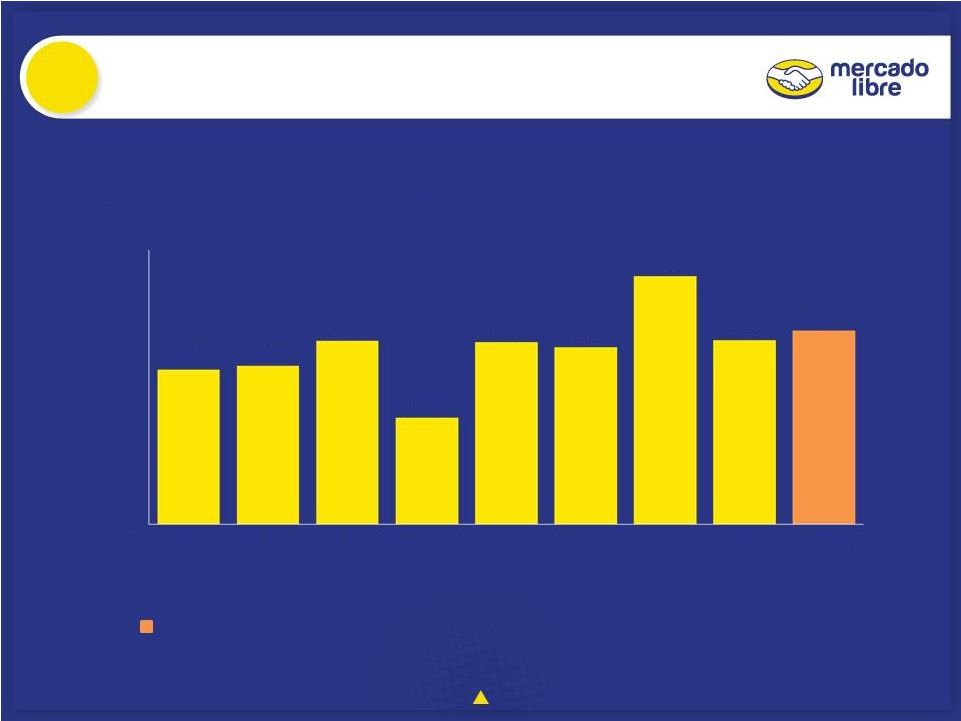

Net

Revenues 12%

18%

28%

19%

20%

23%

26%

27%

30%

YoY Reported

USD Growth

50%

66%

47%

37%

31%

36%

38%

45%

50%

YoY Constant

USD Growth

88.8

97.3

103.8

102.7

112.2

123.1

134.6

115.4

131.8

0

20

40

60

80

100

120

140

160

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

U$ Millions

Net Revenues |

Gross Profit

& EBIT 73%

72%

73%

74%

74%

72%

72%

72%

73%

Gross

Margin

29%

36%

35%

38%

28%

32%

30%

39%

EBIT

Margin

* Adjusted measures, excluding one time effects of Venezuela

devaluation in 2Q14. A reconciliation of these Non-GAAP

measures can be found at the end of this presentation

33%*

65.0

71.6

76.4

74.1

81.1

88.9

98.4

83.8

95.5

0

20

40

60

80

100

120

U$ Millions

Gross Profit

31.9

33.7

39.1

28.6

35.4

37.4

52.1

34.0

43.6*

0

10

20

30

40

50

60

U$ Millions

EBIT |

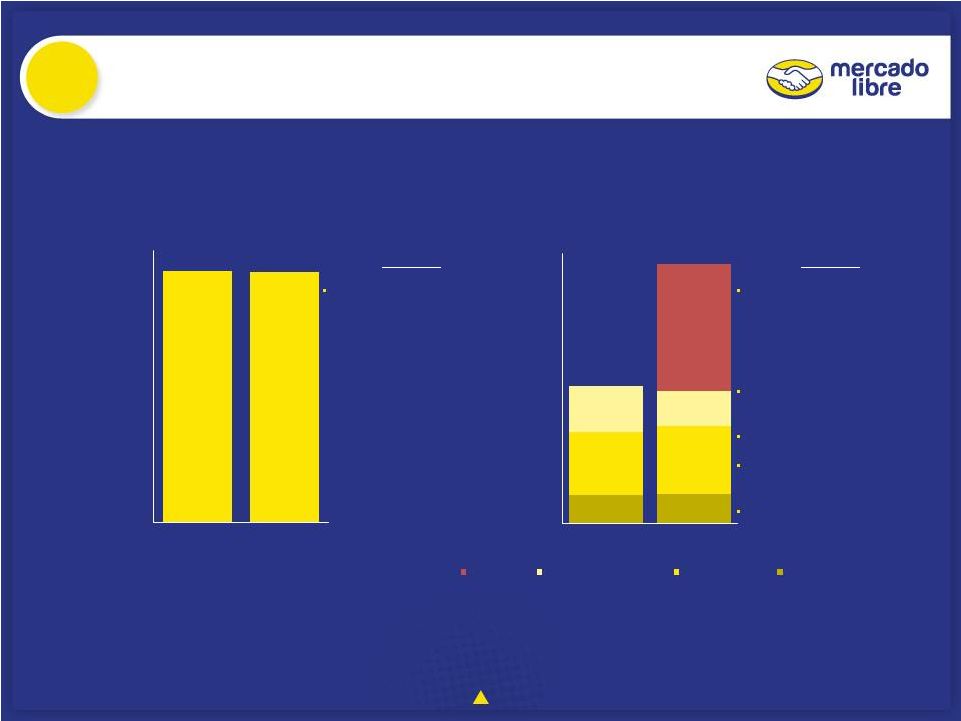

COGS &

OPEX YoY change:

+139 bps of margin

contraction due to growth in

MP, offset by scale in Sales

Taxes, Customer Experience

and Fraud Prevention

YoY change:

$49.5 M one-time Impairment

charge on Venezuela long-

lived assets, following the

adoption of SICAD 2 FX rate in

that country

-279 bps of scale in salaries

-351 bps of scale in offline

marketing (TV campaign last year)

+222 bps as chargebacks grow in

line with payments

Scale in salaries offset by

hardware maintenance

40.7

76.9

27.7

27.6

0

10

20

30

2Q13

2Q14

% of

Revenues

COGS

8.7

8.9

18.6

20.1

13.4

10.4

37.5

0

10

20

30

40

50

60

70

80

2Q13

2Q14

% of

Revenues

OPEX

Impairment

General & Administrative

Sales & Marketing

Product Development |

Net Income &

EPS 26%

24%*

29%

27%

29%

17%

27%

24%

30%

Net Income

Margin

0.69

0.72*

0.45

0.57

0.59

0.69

0.40

0.67

0.66

EPS

* Adjusted measures, excluding one time effects of Venezuela devaluation in 2Q14. A

reconciliation of these Non-GAAP measures can be found at the end of this

presentation 25.4

26.1

30.2

17.5

30.0

29.1

40.8

30.3

31.8*

0

5

10

15

20

25

30

35

40

45

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

U$ Millions

Net Income |

Non -

GAAP Financial Measures

Three-months periods ended (**)

June 30, 2014

June 30, 2013

Operating expenses (OPEX)

(101.4)

(45.7)

Impairment of long-lived assets

49.5

-

Adjusted Operating expenses (OPEX)

(51.9)

(45.7)

Income from operations (EBIT)

$

(5.9)

$

35.4

Impairment of long-lived assets

49.5

-

Adjusted Income from operations

$

43.6

$

35.4

Net Income

$

(25.6)

$

30.0

Devaluation loss in Venezuela

16.5

-

Impairment of long-lived assets

49.5

-

Income tax effect on devaluation loss in Venezuela

(8.6)

-

(1)

Adjusted Net Income

$

31.8

$

30.0

(**) Stated in millions of U.S. dollars

(1) Income tax charge related to the Venezuela devaluation under local tax norms.

|