Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Tecnoglass Inc. | v395082_8k.htm |

Exhibit 99.1

November 2014 A Leading Manufacturer of Architectural Glass and Windows Serving the Global Residential and Commercial Construction Industries (Nasdaq: TGLS; OTCBB: TGLSW)

2 Safe Harbor FORWARD LOOKING STATEMENTS This presentation includes certain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 , including statements regarding future financial performance, future growth and future acquisitions . These statements are based on Tecnoglass’s current expectations or beliefs and are subject to uncertainty and changes in circumstances . Actual results may vary materially from those expressed or implied by the statements herein due to changes in economic, business, competitive and/or regulatory factors, and other risks and uncertainties affecting the operation of Tecnoglass’ business . These risks, uncertainties and contingencies are indicated from time to time in Tecnoglass’ filings with the Securities and Exchange Commission . The information set forth herein should be read in light of such risks . Further, investors should keep in mind that Tecnoglass’ financial results in any particular period may not be indicative of future results . Tecnoglass is under no obligation to, and expressly disclaims any obligation to, update or alter its forward - looking statements, whether as a result of new information, future events, changes in assumptions or otherwise . FINANCIAL PRESENTATION Certain of the financial information contained herein is unaudited and does not conform to SEC Regulation S - X . Furthermore, it includes EBITDA (earnings before interest, taxes depreciation and amortization) which is a non - GAAP financial measure as defined by Regulation G promulgated by the SEC under the Securities Act of 1933 , as amended . Accordingly, such information may be materially different when presented in Tecnoglass’s filings with the Securities and Exchange Commission . Tecnoglass believes that the presentation of this non - GAAP financial measure provides information that is useful to investors as it indicates more clearly the ability of Tecnoglass to meet capital expenditures and working capital requirements and otherwise meet its obligations as they become due . EBITDA was derived by taking earnings before interest, taxes, depreciation and amortization as adjusted for certain one - time non - recurring items and exclusions .

3 Investment Highlights • #1 architectural glass transformation company in Latin America • 800+ customers in North, Central and South America • United States accounted for 49% of total 9 Mo. 2014 sales • Significant growth in revenue and Adjusted EBITDA, with record forecasts for 2014 and 2015 • Invested / committed ~$80 M to expand manufacturing capacity, reduce costs, and improve efficiencies • Strategic, cost - effective location in Barranquilla, Colombia: o a ccess to the Americas, Caribbean, and the Pacific o meaningful manufacturing cost advantages • Bonding capacity increased to $500 M+ on combined projects • High barriers to entry

4 30 - year History of Quality, Innovation, and Service • Leveraged market - leading position in Colombia with intent to expand into Argentina, Aruba, Costa Rica, Panama, and Puerto Rico. • Glass Magazine ranked Tecnoglass as the second largest glass fabricator serving the U.S. market in 2013. • Focused on U.S. expansion, supported by strong South Florida presence. • Meets strict regulation and product standardization requirements, notably in hurricane - prone markets in the U.S., Latin America, and Caribbean • Authorized to sell hurricane windows in Miami - Dade County, FL, one of the most demanding certifications in the world. • Only PPG certified glass fabricator in South America

5 Global Customer Base : Hi - Spec Products for Premier Properties South Dade Miami Cultural Arts Center (Miami, FL) 50 UN Plaza (New York City) Lincoln Center (Miami, FL) 4 Waterway Square (The Woodlands, TX) Fordham University (New York City) The Edge (West Palm Beach, FL)

6 Global Customer Base : Hi - Spec Products for Premier Properties Forum II (Costa Rica) Trump Tower (Panama) OPM (Argentina) Hotel Marriott (Aruba) Aeropuerto El Dorado (Bogota) Hotel La Concha (Puerto Rico)

7 2.3 M Square Foot, State - of - the Art Manufacturing Facility Glass & Window Production • Five lamination machines with independent assembly rooms • Six specialized tempering furnaces and state - of - the - art glass molding furnaces • CNC - controlled profile bending machine • Five silk - screening machines Aluminum Window Façade & Assembly • Capacity of 1,200 tons/month • Creates wide variety of shapes and forms for the door and window industries • Smelter furnace provides 90% of raw materials used in aluminum production 2013 $29 Million Capital Investment Plan Completed May 2014 Acquired 700,000 sq. feet of adjacent land. Constructing new facility to expand manufacturing capabilities.

8 State - of - the - Art Assets, Talented Workforce Manufactures various glass + aluminum products Products are customized into finished goods Tecnoglass purchases prime raw materials Quick, on - time delivery to global customers

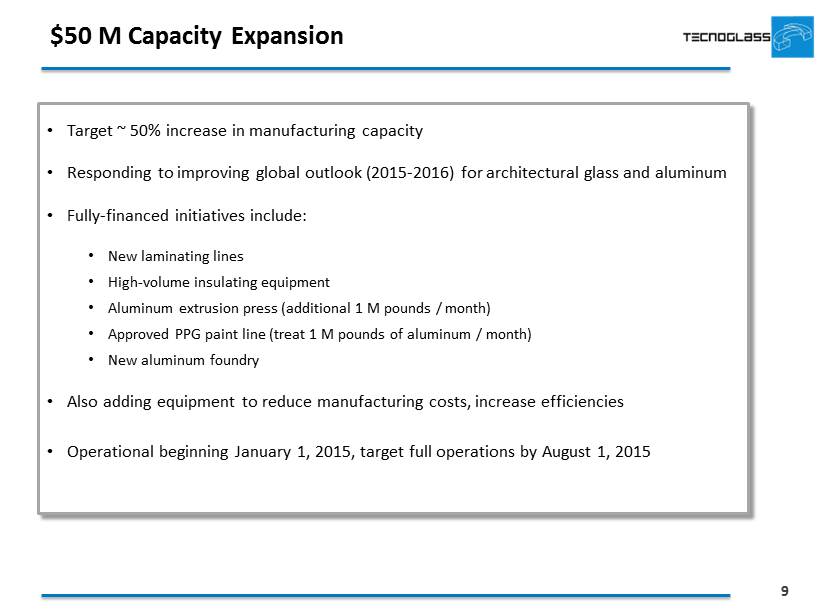

9 $50 M Capacity Expansion • Target ~ 50% increase in manufacturing capacity • Responding to improving global outlook (2015 - 2016) for architectural glass and aluminum • Fully - financed initiatives include: • New laminating lines • High - volume insulating equipment • Aluminum extrusion press (additional 1 M pounds / month) • Approved PPG paint line (treat 1 M pounds of aluminum / month) • New aluminum foundry • Also adding equipment to reduce manufacturing costs, increase efficiencies • Operational beginning January 1, 2015, target full operations by August 1, 2015

10 Strong Growth Profile: Rising Revenues, Income, Adjusted EBITDA (1) Excludes gains / losses related to change in fair value of warrant liability $130 $183 $206 $240 $- $50 $100 $150 $200 $250 $300 2012 2013 2014E 2015E Revenues $6 $15 $16.9 $20.3 $- $5 $10 $15 $20 $25 2012 2013 2014E 2015E Consolidated Net Income $22 $39 $46 $56 $- $10 $20 $30 $40 $50 $60 2012 2013 2014E 2015E Consolidated Adjusted EBITDA (1) (1) 23% 50% 37% C A G R C A G R C A G R ($ in MMs)

11 Revenue Breakdown $ 101.8 $ 66.7 $10.2 $4.6 Other Panama U.S. Colombia Expanding U.S. sales driven by : • Rising demand in South Florida. • Penetrating newer markets, including Baltimore - Washington, California, New York, New Jersey and Texas. • Increased bonding capacity. • Quality, service, manufacturing efficiencies. • Acquisition of Selected Assets of RC Aluminum Industries: o Designs, manufactures, and installs glass products for architects, designers, developers, and general contractors o $70 M of South Florida backlog o Miami - Dade Notice of Acceptance for 50+ products o Industry veteran now leading South Florida sales effort $65.1 $74.7 $10.5 $2.9 2013 Revenues $183 M 9 Mo. 2014 Revenues $153.2 M

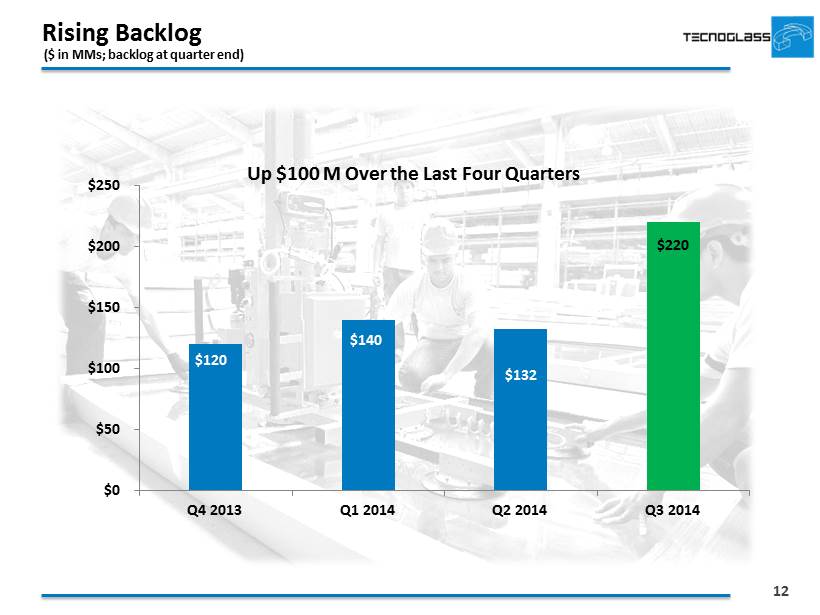

12 Rising Backlog ($ in MMs; backlog at quarter end) $120 $140 $132 $220 $0 $50 $100 $150 $200 $250 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Up $100 M Over the Last Four Quarters

13 Barranquilla: Strategic Location Supports Geographic Diversity • Tecnoglass’s operations are located near three major ports in Colombia: Barranquilla , Cartagena , and Santa Marta • Location favors: - Exports to the Americas, the Caribbean, and the Pacific - Imports of raw materials • 4 - day transportation to Southeast U.S. Tecnoglass ships its products from Barranquilla to Miami less expensively than its competitors ship from Minneapolis to Miami

14 Growth Strategy • Utilize increased bonding capacity to participate in larger projects. • Increase market share in U.S. and South America. • Penetrate Europe and Asia, leveraging labor and transportation advantages. • Establish and maintain alliances. • Continued investments in product innovation and state - of - the - art manufacturing technology.

15 APPENDIX SLIDES

16 Tecnoglass: The Power of Quality Sales and Marketing • No customer accounts for greater than 10% of revenues (excl. intercompany) • 80 - 85% of glass and aluminum sales to architectural market; 15 - 20% to industrial • Sell architectural products primarily through window contractors Manufacturing • Captive aluminum extrusions production requires high level of vertical integration • Lower cost of labor, shipping in Colombia vs. U.S. • Rigorous QA program • Recycle ~ 30% of manufacturing - related residues • Self - supplied power generation • Operating leverage should drive strong incremental EBITDA above current sales level Customer Service • Jose M. Daes (CEO) and Christian Daes (COO) have 50 years of combined industry experience • Established ES Windows University R&D • Annual investment in new product development • Thermal Break and ES powdered paint line

17 High Quality, Innovative Products Finished Products Windows Floating facades Commercial display windows Hurricane - proof windows Automatic doors Bathroom dividers Aluminum Products Bars Plates Profiles Rods Tubes

18 High Quality, Innovative Products Glass Products Description Laminated / Thermo - Laminated Produced by bonding two glass sheets with an intermediate film between. Safety product – fractures into small pieces if it breaks. Thermo - Acoustic Manufactured with two or more glass sheets separated by an aluminum or micro - perforated steel profile. Has a double - seal system that ensures the unit’s tightness, buffering noise and improving thermal control. Serves as an excellent noise barrier, which is used especially in zones close to airports, traffic or wherever there are unpleasant sounds. Tempered Glass subject to a tempering process through elevated temperatures. Greater superficial elasticity and resistance than conventional glass. Silk - Screened Special paint is applied to glass using automated CNC machinery which ensures paint homogeneity and an excellent finish. Curved Produced by bending a flat glass sheet over a mold, using an automated heat process, which maintains the glass’ physical properties. Digital Print Digital print glass offers architects structured and artistic design. Digital printing allows assuming any kind of appearance required by the client, offering versatility to projects.

19 Market Opportunity U.S . Market Rebounding, Especially Southeast / Florida 0 50 100 150 200 250 2006 2007 2008 2009 2010 2011 2012 2013E 2014E 2015E 2016E Florida Total Housing Starts (000s) (2) Florida Impact Resistant Window & Door Market (1) (1) State of Florida.; Florida Building Commission ; building codes require structures to withstand wind speeds shown on map in these ranges (2) Historical and forecasts from University of Central Florida, 2013 ...aided by niche Southeastern U.S. / Florida impact - resistant window and door market

20 U.S. demand for windows is expected to grow significantly over the next several years... 66.7 59.1 48.4 38.9 41.6 37.9 40.5 45.8 54.2 58.9 0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 80.0 90.0 100.0 2006 2007 2008 2009 2010 2011 2012E 2013E 2014E 2015E U.S. Window Demand by Shipments (mm units) (1) (1) Ducker Worldwide / Bank of America as of 1/10/2013 Improving U.S. Market

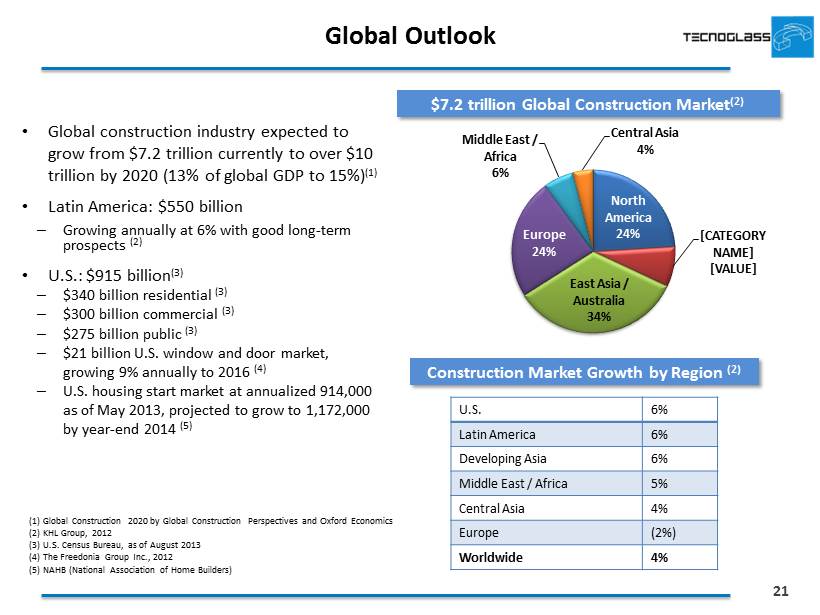

21 Global Outlook • Global construction industry expected to grow from $7.2 trillion currently to over $10 trillion by 2020 (13% of global GDP to 15%) (1) • Latin America: $550 billion – Growing annually at 6% with good long - term prospects (2) • U.S.: $915 billion (3) – $340 billion residential (3) – $300 billion commercial (3) – $275 billion public (3) – $21 billion U.S. window and door market, growing 9% annually to 2016 (4) – U.S. housing start market at annualized 914,000 as of May 2013, projected to grow to 1,172,000 by year - end 2014 (5 ) $ 7.2 trillion Global Construction Market (2) Construction Market Growth by Region (2) U.S. 6% Latin America 6% Developing Asia 6% Middle East / Africa 5% Central Asia 4% Europe (2%) Worldwide 4% (1) Global Construction 2020 by Global Construction Perspectives and Oxford Economics (2) KHL Group, 2012 (3) U.S. Census Bureau, as of August 2013 (4 ) The Freedonia Group Inc ., 2012 (5) NAHB (National Association of Home Builders) North America 24% [CATEGORY NAME] [VALUE] East Asia / Australia 34% Europe 24% Middle East / Africa 6% Central Asia 4%

22 Colombia Economic Outlook • The U.S. is Colombia's leading trade partner (1) , and the two countries entered into the U.S. - Colombia Trade Promotion Agreement , a free trade agreement, in May 2012. • Colombia GDP grew 4.3% in 2013 and is forecast to grow 4.9% in 2014 (2) • Growth in Colombia is expected to remain solid, led by strong construction activity. (3) • Colombia holds an investment grade rating from Moody's , Fitch and S&P. • 2014 Index of Economic Freedom – The Heritage Foundation – Colombia advanced to 3 rd out of 29 countries in the South and Central America / Caribbean region – Colombia achieved its highest economic freedom score ever in 2014, becoming a “mostly free” economy for the first time in the 20 - year history of the Index (1) Congressional Research Service, Nov. 2012 (2) World Bank, October 2014 (3) IMF World Economic Outlook, October 2014

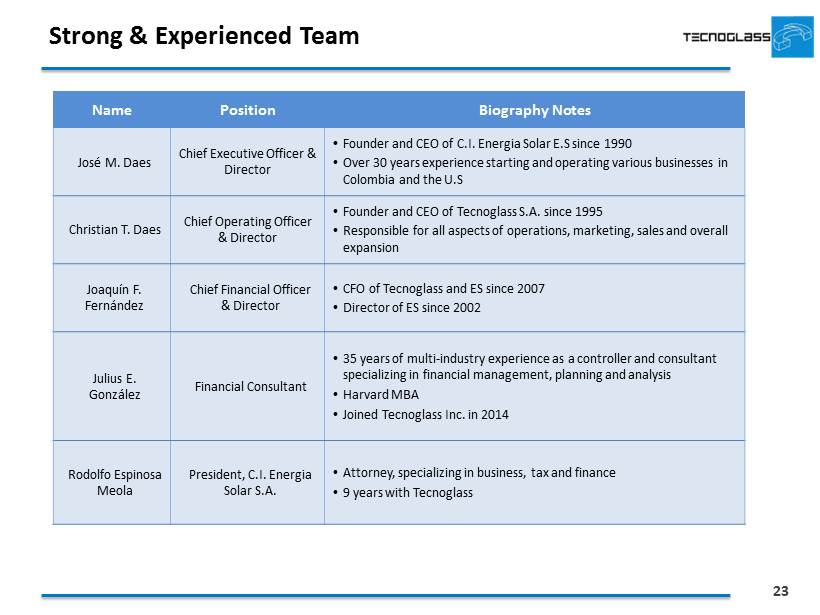

23 Strong & Experienced Team Name Position Biography Notes José M. Daes Chief Executive Officer & Director • Founder and CEO of C.I. Energia Solar E.S since 1990 • Over 30 years experience starting and operating various businesses in Colombia and the U.S Christian T. Daes Chief Operating Officer & Director • Founder and CEO of Tecnoglass S.A. since 1995 • Responsible for all aspects of operations, marketing, sales and overall expansion Joaquín F. Fernández Chief Financial Officer & Director • CFO of Tecnoglass and ES since 2007 • Director of ES since 2002 Julius E. Gonz á lez Financial Consultant • 35 years of multi - industry experience as a controller and consultant specializing in financial management, planning and analysis • Harvard MBA • Joined Tecnoglass Inc. in 2014 Rodolfo Espinosa Meola President, C.I. Energia Solar S.A. • Attorney, specializing in business, tax and finance • 9 years with Tecnoglass

24 Strong & Experienced Team Name Position Biography Notes Omar Dominguez National Sales Manager, SA Tecnoglass • 32 years of industry experience, 19 with Tecnoglass Jean Paolo Chemello Technical Manager, C.I. Energia Solar S.A • 41 years of industry experience • 23 years with Tecnoglass Karla Rodriguez Chain Chief Operating Officer C.I. Energia Solar S.A • 15 years industry experience, all with Tecnoglass Carlos Amin Cargo Sales USA • 10 years of industry experience, all with Tecnoglass Raul Casares Sales Director for South Florida • Founder and President of RC Aluminum • 50 years of industry experience

25 Board of Directors Name Position Age Biography Notes A. Lorne Weil Non - Executive Chairman of the Board 66 • Chairman of the Board of Scientific Games Corporation (Oct. 1991 – Nov. 2013); CEO for all but ~24 months of that time • During his tenure, Scientific Games grew from under $50 million in annualized revenue to ~ $2 billion Samuel R. Azout Director 54 • Investment Manager, Abacus Real Estate • Served as Senior Presidential Advisor for Social Prosperity • Served as CEO of National Agency for Overcoming Extreme Poverty in Colombia Juan Carlos Vilariño Director 51 • GM of various business consortiums in Colombia, including the Malla Vial del Atlántico Consortium and the Barranquilla - Ciénaga c onsortium Martha (Stormy) L. Byorum Director 59 • Founder and CEO, Cori Investmet Advisors • Former EVP, Stephens, Inc. & co - founder, VB&P • Former Chief of Staff and CFO for Citibank’s Latin American Banking Group, and former head of Citibank’s U.S. Corporate Banking Business Julio A. Torres Director 46 • Managing Director, Nexus Capital Partners • Former Director General of Public Credit and Treasury, Colombia Ministry of Finance • Former Vice President, JPMorgan Chase Bank

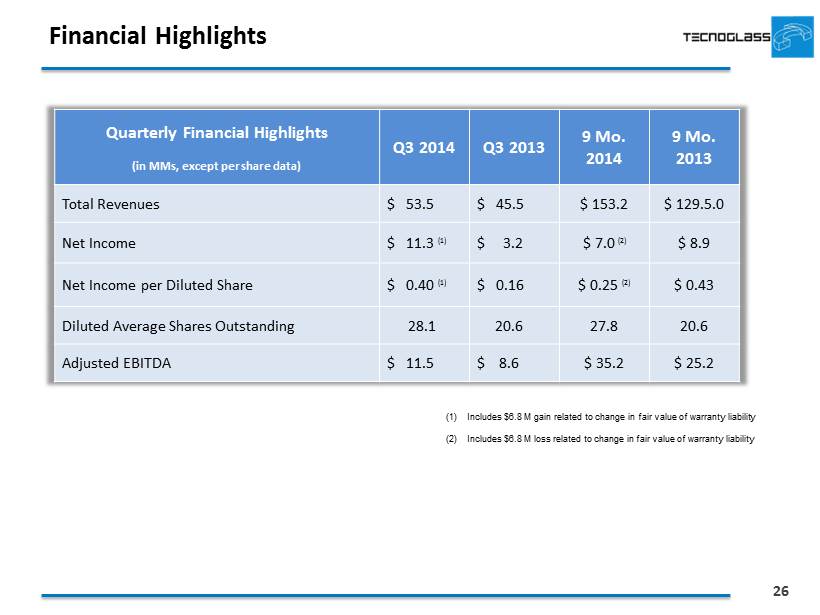

26 Financial Highlights Quarterly Financial Highlights (in MMs, except per share data) Q3 2014 Q3 2013 9 Mo. 2014 9 Mo. 2013 Total Revenues $ 53.5 $ 45.5 $ 153.2 $ 129.5.0 Net Income $ 11.3 (1) $ 3.2 $ 7.0 (2) $ 8.9 Net Income per Diluted Share $ 0.40 (1) $ 0.16 $ 0.25 (2) $ 0.43 Diluted Average Shares Outstanding 28.1 20.6 27.8 20.6 Adjusted EBITDA $ 11.5 $ 8.6 $ 35.2 $ 25.2 (1) Includes $6.8 M gain related to change in fair value of warranty liability (2) Includes $6.8 M loss related to change in fair value of warranty liability

27 Adjusted EBITDA Reconciliation ($ in 000s) Year Adjusted EBITDA Depreciation Adjusted EBIT Warrants Liability Interest Expense Tax Provision Net Income Net Income w/o Warrants Q3 2013 8,616 1,982 6,634 - 1,888 1,552 3,194 3,194 Q3 2014 11,458 2,805 8,653 (6,756) 2,380 1,770 11,259 4,503 9 Mo. 2013 25,153 5,977 19,176 - 5,375 4,902 8,899 8,899 9 Mo. 2014 35,183 7,777 27,406 6,769 6,647 7,004 6,986 13,755 2014 E 46,000 10,400 35,600 13,500 9,000 9,700 3,400 16,900 2015 E 56,000 12,400 43,600 - 12,600 10,700 20,300 20,300 2012 22,296 7,668 14,628 - 5,513 3,223 5,892 5,892 2013 38,506 7,238 31,268 (7,626) 7,886 8,696 22,312 14,686

28 Contacts Devin Sullivan Senior Vice President (212) 836 - 9608 dsullivan@equityny.com Kalle Ahl Senior Associate (212) 836 - 9614 kahl@equityny.com José M. Daes Chief Executive Officer jdaes@energiasolarsa.com Christian Daes Chief Operating Officer chris@tecnoglass.com A . Lorne Weil Non - Executive Chairman lorne.weil@tecnoglass.com