Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STAAR SURGICAL CO | v394772_8k.htm |

Exhibit 99.1

1 NASDAQ: STAA November 20, 2014

Forward - Looking Statements All statements in this press release that are not statements of historical fact are forward - looking statements, including statements about any of the following: any projections of earnings, revenue, sales, profit margins, cash, effective tax rate or any other financial items; the plans, st rat egies, and objectives of management for future operations or prospects for achieving such plans; metrics for 2014; statements regarding new or improved products, inc lud ing but not limited to, expectations for success of new or improved products in the U.S. or international markets or government approval of new or improved produc ts (including the Toric ICL in the U.S.); the nature, timing and likelihood of resolving issues cited in the FDA’s Warning Letter; future economic conditions or size of market opportunities; expected costs of quality system remediation; statements of belief, including as to achieving 2014 growth plans or metrics; expected regulatory activities and approvals, product launches, and any statements of assumptions underlying any of the foregoing. Important additional factors that could ca use actual results to differ materially from those indicated by such forward - looking statements are set forth in the company’s Annual Report on Form 10 - K for the year ended January 3, 2014, under the caption “Risk Factors,” and also in the company’s Quarterly Report on Form 10 - Q for the quarter ended July 4, 2014, un der the caption “Risk Factors,” both of which are on file with the Securities and Exchange Commission and available in the “Investor Information” section of the c omp any’s website under the heading “SEC Filings . These statements are based on expectations and assumptions as of the date of this press release and are subject to numerous r isk s and uncertainties, which could cause actual results to differ materially from those described in the forward - looking statements. The risks and uncertainties in clude the following : our limited capital resources and limited access to financing; the negative effect of unstable global economic conditions on sales of products, e spe cially products such as the ICL used in non - reimbursed elective procedures; the challenge of managing our foreign subsidiaries; backlog or supply delays as we fully int egrate our manufacturing facility consolidation; the risk of unfavorable changes in currency exchange rate; the discretion of regulatory agencies to approve or re ject new or improved products, or to require additional actions before approval (including but not limited to FDA requirements regarding the TICL and/or actions r ela ted to the FDA Warning Letter); unexpected costs or delays that could reduce or eliminate the expected benefits of our consolidation plans; the risk that res ear ch and development efforts will not be successful or may be delayed in delivering for launch; the purchasing patterns of our distributors carrying inventory in t he market; the willingness of surgeons and patients to adopt a new or improved product and procedure; patterns of Visian ICL use that have typically limited our penetra tio n of the refractive procedure market, negative media coverage in different regions regarding refractive procedures, and a general decline in the demand for refractive surgery particularly in the U.S. and the Asia Pacific region, which STAAR believes has resulted from both concerns about the safety and effectiveness of laser pro ced ures and current economic conditions. The Visian Toric ICL and the Visian ICL with CentraFLOW are not yet approved for sale in the United States . In addition, to supplement the GAAP numbers, this presentation includes supplemental non - GAAP financial information, which STAAR believes investors will find helpful in understanding its operating performance. “Adjusted Net Income” excludes the following items that are included in “Ne t Income (Loss)” as calculated in accordance with U.S. generally accepted accounting principles (“GAAP”): manufacturing consolidation expenses, gain or loss on foreign currency transactions, Spain distribution transition cost, the fair value adjustment of outstanding warrants issued in 2007, stock - based compensation expense s and FDA Panel/Remediation expenses. A table reconciling the GAAP information to the non - GAAP information is included in our financial release which can b e found in our Form 8 - K filed on October 30, 2014 and also available on our website. 2

3 Generating Strong Current and Future Growth Q3 YTD 2014 +10%/+12% in CC; FY 2013 +13 %/+19% in CC • Two large m arket o pportunities • Sustainable competitive a dvantages • Rapid cadence of new p roducts • Increasing IP position with new t echnologies • Strong B alance Sheet while i nvesting for future • 2015 operating l everage should show

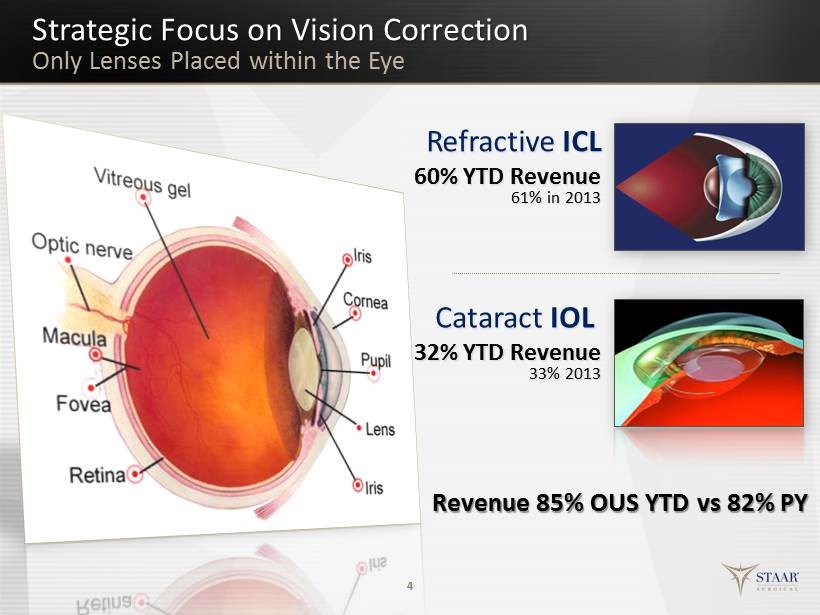

Strategic Focus on Vision Correction Only Lenses Placed within the Eye 4 Cataract IOL Refractive ICL 60% YTD Revenue 61% in 2013 32% YTD Revenue 33% 2013 Revenue 85% OUS YTD vs 82% PY

• Continued Visian ICL m arket p enetrations – Expect double digit r evenue growth (YTD +8%) – 85 % gross m argin – New products (CentraFLOW, Preloaded, and V6) • Targeted IOL p rofitable g rowth – Expect single digit r evenue growth (YTD +7% & Other +46%) – 60 %+ gross m argin t arget – New products (nanoFLEX Toric and KS - IOLs) • Manufacturing consolidation benefits – Expect to see gross m argin expansion – Tax benefits through approximately 2020 - 2022 – Full year impacts should be seen in 2015 5 Annual Drivers to Top Line & Bottom Line Growth STAAR’s Pathway to Future Growth!

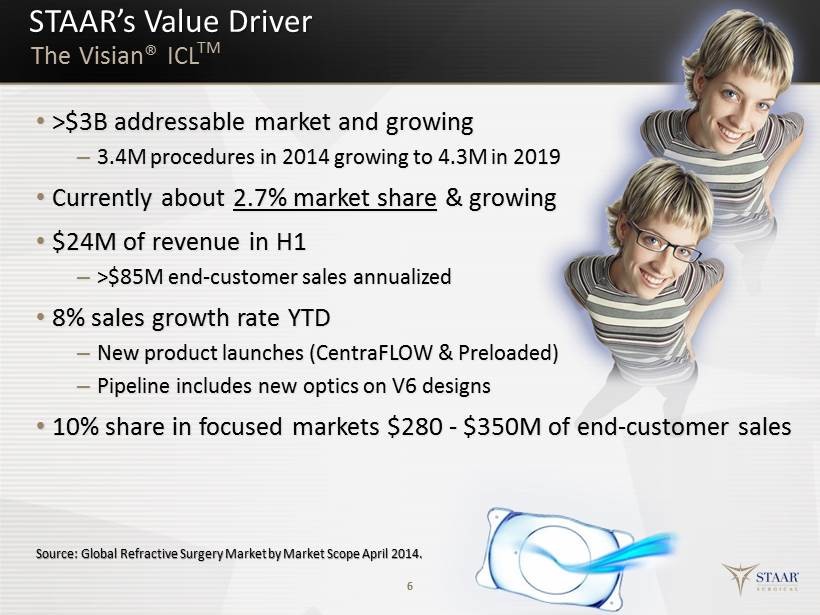

STAAR’s Value Driver 6 The Visian® ICL TM Source: Global Refractive Surgery Market by Market Scope April 2014. • >$ 3B addressable m arket and growing – 3.4M procedures in 2014 growing to 4.3M in 2019 • Currently about 2.7% m arket s hare & growing • $24M of revenue in H1 – >$85M end - customer s ales a nnualized • 8 % sales growth r ate YTD – New product launches (CentraFLOW & Preloaded) – Pipeline includes n ew o ptics on V6 designs • 10% share in focused m arkets $280 - $350M of end - customer s ales

• Implantable Collamer® Lens Better Known as the “Implantable Contact Lens” or ICL • Proprietary material c alled “Collamer” m ade from scratch • Corrects Myopia (Nearsightedness/Inability to see f ar) • Toric ICL (TICL TM ) Version corrects Both Myopia and Astigmatism (Blurred vision d ue to inability to focus)* 7 Visian ICL and TICL Premium Material & Product with Premium Visual Results

Competitive Landscape Changing Lens Based Segment • STAAR Is the Market Leader – ≈65% Unit & Dollar Market Share – Posterior Lens Approach • Other Players – Abbott - AMO (Not Competitive) – Novartis - Alcon ( Removed from Market 9/14 ) – Ophtec (Lower Tier Pricing) – IOC (India Lower Tier Pricing) • LASIK is the Real Competition! 8 Source: Data based upon internal estimates and The Global IOL Market Report by Market Scope May 2013.

9 ICL • Small micro i ncision • Adds lens into the eye • Permanent but removable • No induced Dry Eye • Future o ptions p reserved LASIK • O ver 1 inch - long incision • Burns material a way • Can NOT be r eversed • Potential Dry Eye • May reduce f uture o ptions Real Competition is LASIK Advantages of ICL over LASIK

Why LASIK Under Pressure Globally? Good Procedure for Some, 8 - 12% Not Candidates • Limitations of LASIK – Contraindications: • Dry Eye • Thin Cornea • Large Pupils • Cornea Disease • High Level of Myopia and/or Astigmatism • When LASIK Patients Reach Cataract Age – “ Patients who’ve had LASIK present increased risks and level of difficulty in achieving a good result at time of cataract surgery . These include significant challenges in calculating the correct IOL power to achieve a good visual result.” Dr. Mark Packer, Clinical Associate Professor of Ophthalmology at Oregon Health & Science University * 10 *Testimony at FDA Ophthalmic Device Panel Meeting, April 8, 2013.

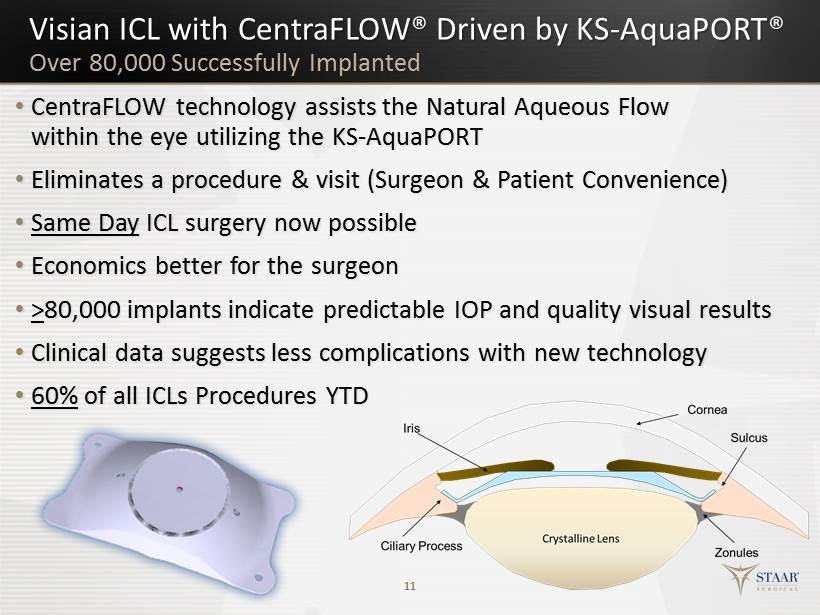

Visian ICL with CentraFLOW ® Driven by KS - AquaPORT® • CentraFLOW technology a ssists the Natural Aqueous Flow within the e ye u tilizing the KS - AquaPORT • Eliminates a procedure & visit ( S urgeon & P atient Convenience) • Same Day ICL surgery now possible • Economics better for t he surgeon • > 80,000 implants indicate predictable IOP and quality v isual results • Clinical data suggests less complications with new technology • 60% of all ICLs P rocedures YTD 11 Over 80,000 Successfully Implanted

Regulatory Process CentraFLOW ICL in China 12 • Process Included: – Successful May 15 th Expert Panel Meeting in China – September 24 th Technical Recommendation of Approval from CMDE – Marketing Approval from CFDA on October 29 th • Approval Certification on November 3 rd – Began shipping product on November 4 th – Both ICL and TICL • Additional Surgeon Training in China during November/December • China is the Largest Refractive market in the world – Today ICL only about 2% of refractive surgeries

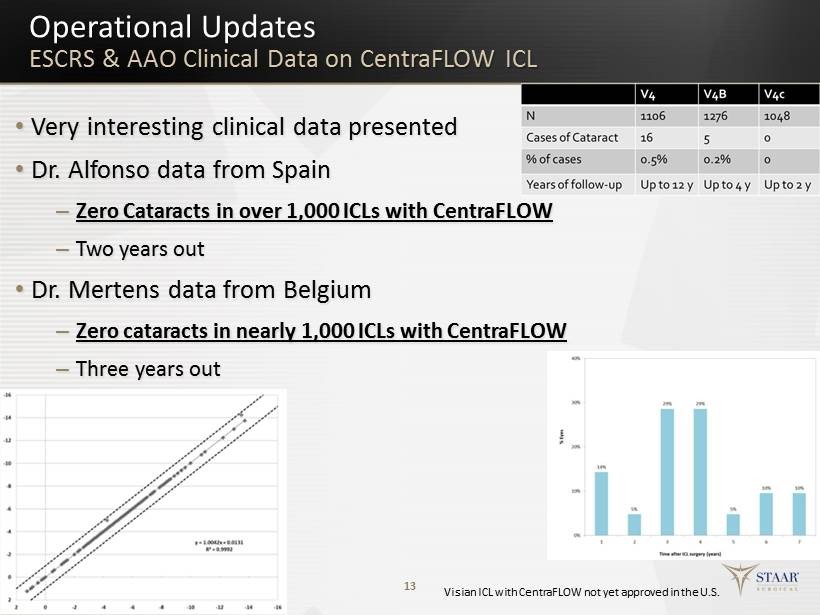

13 Operational Updates ESCRS & AAO Clinical Data on CentraFLOW ICL • Very interesting clinical data presented • Dr. Alfonso data from Spain – Zero Cataracts in over 1,000 ICLs with CentraFLOW – Two years out • Dr. Mertens data from Belgium – Zero cataracts in nearly 1,000 ICLs with CentraFLOW – Three years out Visian ICL with CentraFLOW not yet approved in the U.S.

Visian ICL Gains Market Share in All Target Markets 2013 Total Refractive Proc. ↓4.6% & ICL Proc .↑25.5 % 14 Market 2013 Total Ref. Proc.* 2013 Ref. Proc. ∆ 2013 ICL Proc. ∆ ICL Share Ref. Proc. 2013 ICL Gain China 875,000 +5% +41% 1.6% x U.S. 602,000 (3%) +19% 1.2% x Latin Am*** 226,380 (0.4%) +43% 1.7% x India*** 156,430 +5% +12% 4.5% x S. Korea*** 139,280 +0.7% +12% 12.4% x Germany** 135,000 +8% +25% 1.8% x Japan 125,000 (51%) +4% 2.1% x Italy** 105,240 (5%) +38% 0.8% x Spain** 105,000 (21%) +34% 4.6% x U.K.** 97,540 (5%) +16% .3% x France** 66,250 (5%) +54% 2.5% x Middle East 61,375 (0.2%) +16% 9.3% x *Global Refractive Surgery Market by Market Scope April 2014. **ICL with CentraFLOW available all of 2013. ***ICL with CentraFLOW available during H2 2013

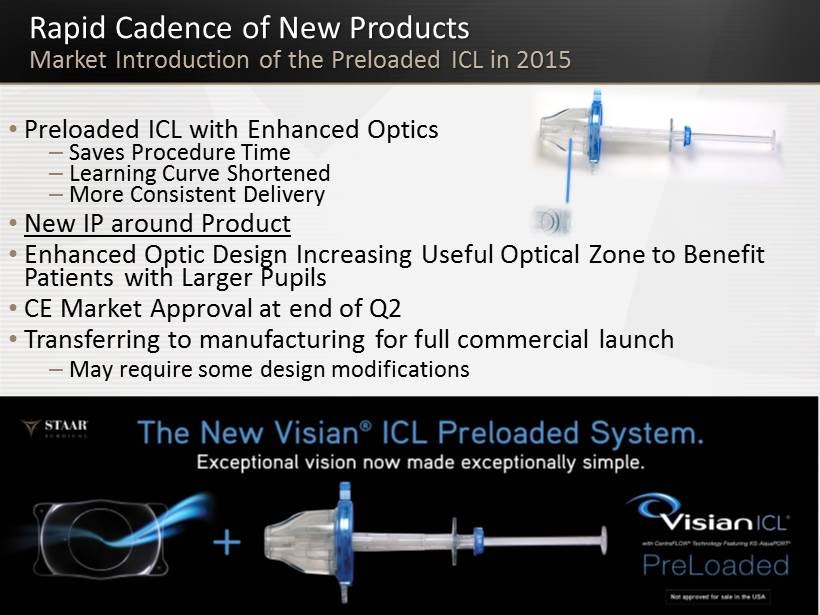

Rapid Cadence of New Products Market Introduction of the Preloaded ICL in 2015 15 • Preloaded ICL with Enhanced Optics – Saves Procedure Time – Learning Curve Shortened – More Consistent Delivery • New IP around Product • Enhanced Optic Design Increasing U seful O ptical Z one to Benefit P atients with Larger Pupils • CE Market Approval at end of Q2 • Transferring to manufacturing for full commercial launch – May require some design modifications

Rapid Cadence of New Products (2015) V6a ICL Next in Line • Differentiates ICL for Myopic patients n earing age 40 who w ill n eed near & intermediate A dds • Goal to a dd Near - Vision Enhancement Capability – Treats the early onset and progression of Presbyopia – Adds ≈2.0 Diopters of Near while providing Good Intermediate • New Clinical Data on CentraFLOW positive for this patient base • V6a ICLs being tested for Initial Confirmatory Study • Patients currently being recruited for Q1 initiation • Target Approval and Launch in CE Markets during 2015 16 Source: The Global Presbyopia Surgery Market by Market Scope October 2013.

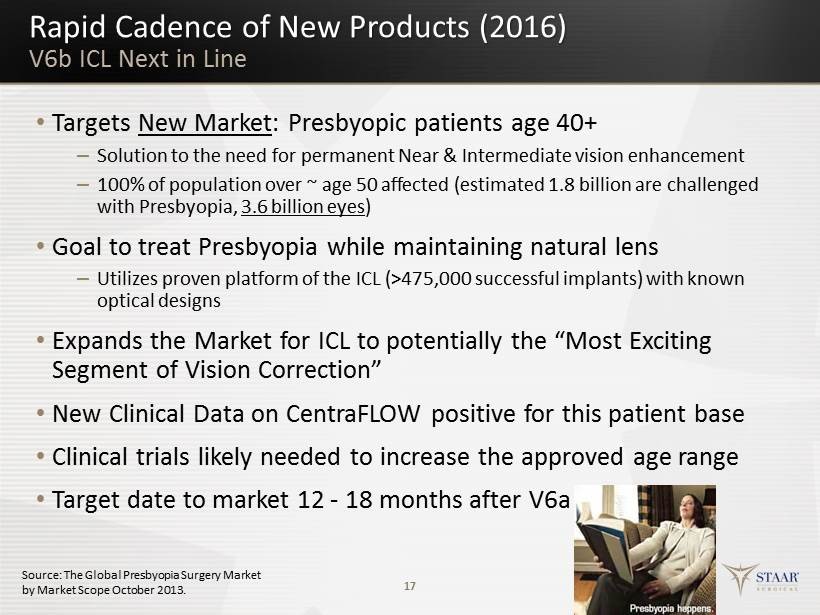

Rapid Cadence of New Products (2016 ) V6b ICL Next in Line • Targets New Market : Presbyopic p atients age 40+ – Solution to the need for permanent N ear & Intermediate v ision enhancement – 100% of population over ~ age 50 affected (estimated 1.8 billion a re challenged with Presbyopia, 3.6 billion eyes ) • Goal to t reat Presbyopia w hile maintaining natural lens – Utilizes proven p latform of the ICL (>475,000 successful implants) with known optical designs • Expands the Market for ICL to potentially the “Most E xciting S egment of Vision C orrection” • New Clinical Data on CentraFLOW positive for this patient base • Clinical trials l ikely needed to increase the approved a ge r ange • Target date to market 12 - 18 months after V6a 17 Source: The Global Presbyopia Surgery Market by Market Scope October 2013.

• 21.9M IOLs i mplanted in 2013 ( 26.1M 2018) • The Big Three hold ≈70% market share – Novartis (Alcon), Abbott (AMO), Valeant (B&L) • STAAR strategy – Focused on ONLY the higher - margin Premium IOLs – Focused ONLY in markets that g enerate a f air p rofit Large & Growing Market Tough Competitive Landscape 18 Source : The Global IOL Market by Market Scope May 2013 Cataract IOL

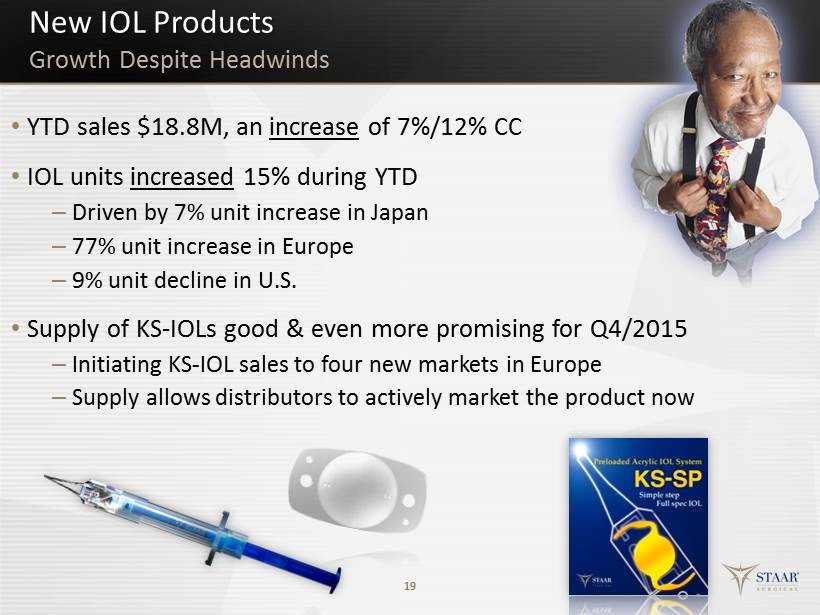

• YTD sales $18.8M, an increase of 7%/12% CC • IOL units increased 15% during YTD – Driven by 7 % unit increase in Japan – 77% unit increase in Europe – 9% unit decline in U.S. • Supply of KS - IOLs good & even more promising for Q4/2015 – Initiating KS - IOL sales to four new markets in Europe – Supply allows distributors to actively market the product now 19 Growth Despite Headwinds New IOL Products

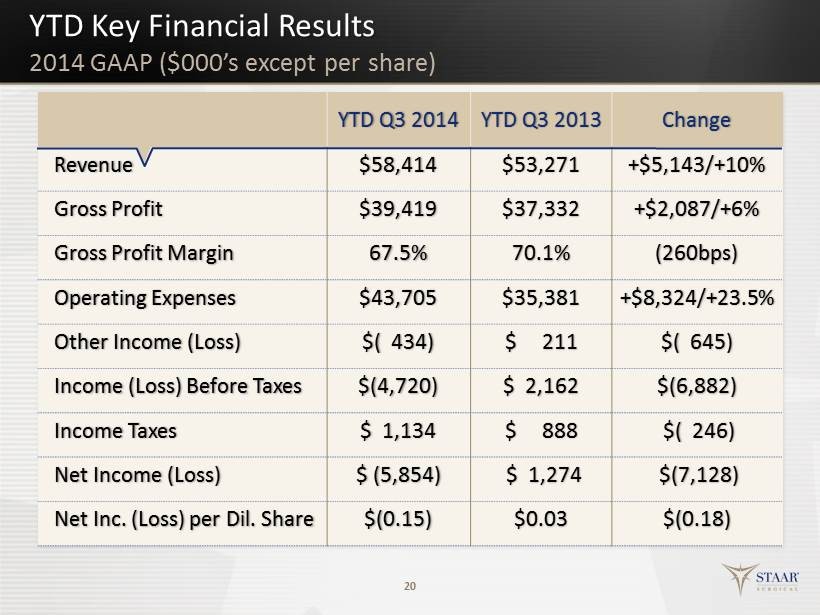

YTD Key Financial Results 20 YTD Q3 2014 YTD Q3 2013 Change Revenue $58,414 $53,271 +$5,143/+10% Gross Profit $39,419 $37,332 +$2,087/+6% Gross Profit Margin 67.5% 70.1% (260bps) Operating Expenses $43,705 $35,381 +$8,324/+23.5% Other Income (Loss) $( 434) $ 211 $( 645) Income (Loss) Before Taxes $(4,720) $ 2,162 $(6,882) Income Taxes $ 1,134 $ 888 $( 246) Net Income (Loss) $ ( 5,854) $ 1,274 $(7,128) Net Inc. (Loss) per Dil. Share $(0.15) $0.03 $(0.18) 2014 GAAP ($ 000’s except per share)

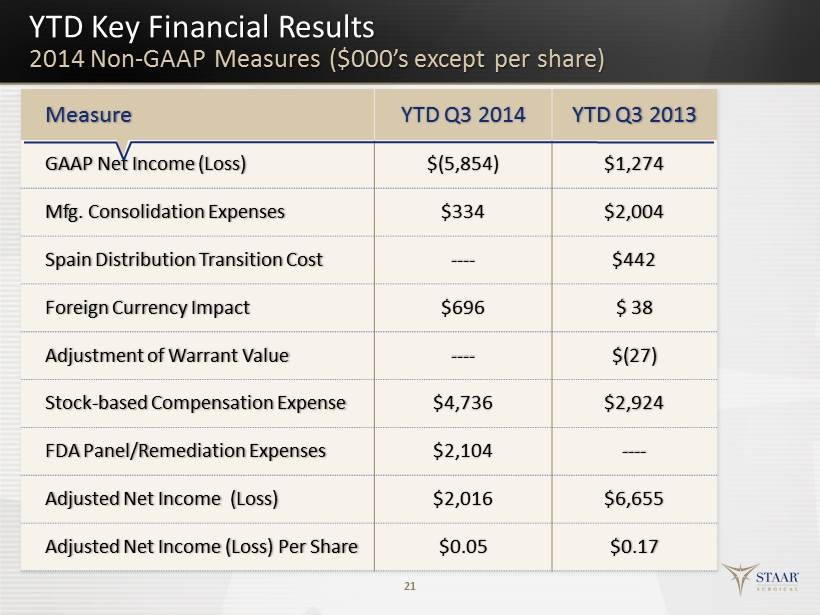

YTD Key Financial Results 2014 Non - GAAP Measures ($000’s except per share) 21 Measure YTD Q3 2014 YTD Q3 2013 GAAP Net Income (Loss) $(5,854) $1,274 Mfg. Consolidation Expenses $334 $2,004 Spain Distribution Transition Cost ---- $442 Foreign Currency Impact $696 $ 38 Adjustment of Warrant Value ---- $ (27) Stock - based Compensation Expense $4,736 $2,924 FDA Panel/Remediation Expenses $2,104 ---- Adjusted Net Income (Loss) $2,016 $6,655 Adjusted Net Income (Loss) Per Share $0.05 $0.17

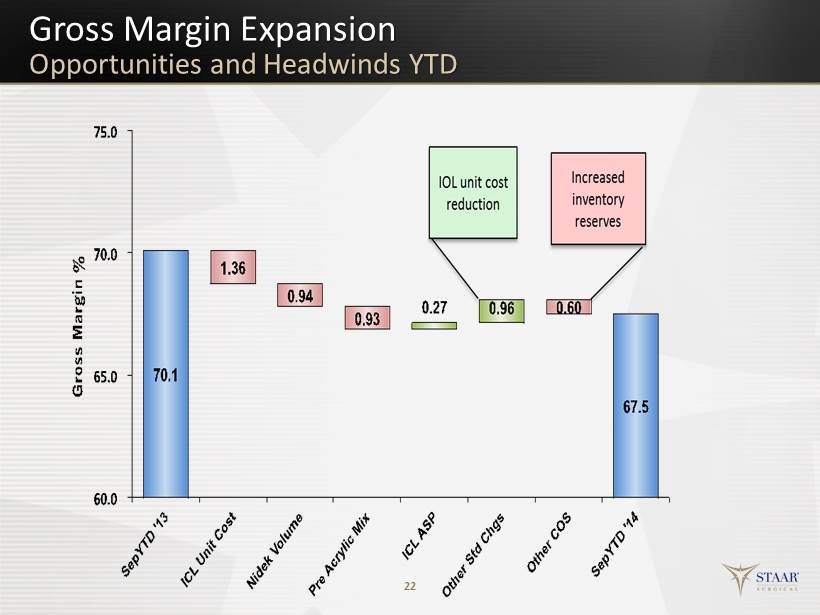

Gross Margin Expansion Opportunities and Headwinds YTD 22

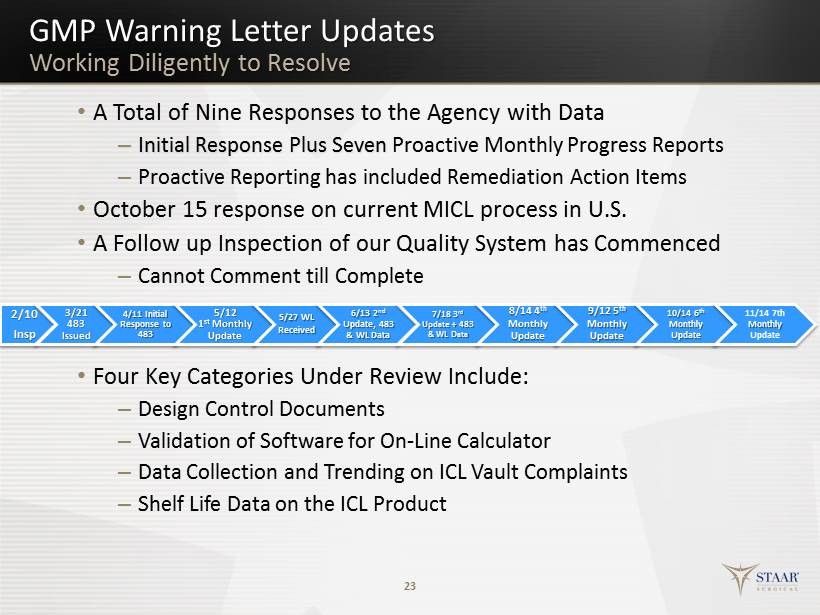

2/10 Insp 3/21 483 Issued 4/11 Initial Response to 483 5/12 1 st Monthly Update 5/27 WL Received 6/13 2 nd Update, 483 & WL Data 7/18 3 rd Update + 483 & WL Data 8/14 4 th Monthly Update 9/12 5 th Monthly Update 10/14 6 th Monthly Update 11/14 7th Monthly Update GMP Warning Letter Updates Working Diligently to Resolve • A Total of Nine Responses to the Agency with Data – Initial Response Plus Seven Proactive Monthly Progress Reports – Proactive Reporting has included Remediation Action Items • October 15 response on current MICL process in U.S. • A Follow up Inspection of our Quality System has Commenced – Cannot Comment till Complete • Four Key Categories Under Review Include: – Design Control Documents – Validation of Software for On - Line Calculator – Data Collection and Trending on ICL Vault Complaints – Shelf Life Data on the ICL Product 23

• Continued Adoption of ICL CentraFLOW technology – Began shipping product to China in November – Interesting Clinical results seen in First Three Years • We are committed to enhancement of our Quality System and investing significant resources to improve • Continue to Dialogue with the Agency on TICL in the U.S. • Preloaded ICL System to full commercialization in 2015 • On - going progress of V6a ICL including the Confirmatory Study • Increased Supply of Preloaded Acrylic IOLs should enhance growth • Gross margin & tax benefits from consolidation in 2015 24 Upcoming STAAR Catalysts Q4 and 2015 Growth Roadmap

25 NASDAQ: STAA November 20, 2014