Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - II-VI INC | d824501d8k.htm |

A Global Leader

in Engineered Materials & Opto-Electronic Components

Exhibit 99.1

Furey Research Partners

Hidden Gems Conference

November 20, 2014

New York City

Our Technologies for Tomorrow’s Innovations

www.ii-vi.com

NASDAQ: IIVI |

www.ii-vi.com I NASDAQ:

IIVI 2

Matters discussed in this presentation may contain forward-looking

statements that are subject to risks and uncertainties. These risks and

uncertainties could cause the forward-looking statements and II-VI

Incorporated’s (the Company’s) actual results to differ materially.

In evaluating these forward-looking statements, you should specifically

consider the “Risk Factors”

in the Company’s most recent Form 10-K and

Form 10-Q. Forward-looking statements are only estimates and actual

events or results may differ materially.

II-VI Incorporated disclaims any obligation to update information contained

in any forward-looking statement.

This presentation contains certain non-GAAP financial measures.

Reconciliations of non-GAAP financial measures to their most comparable

GAAP financial measures are presented at the end of this presentation.

Safe Harbor Statement |

3

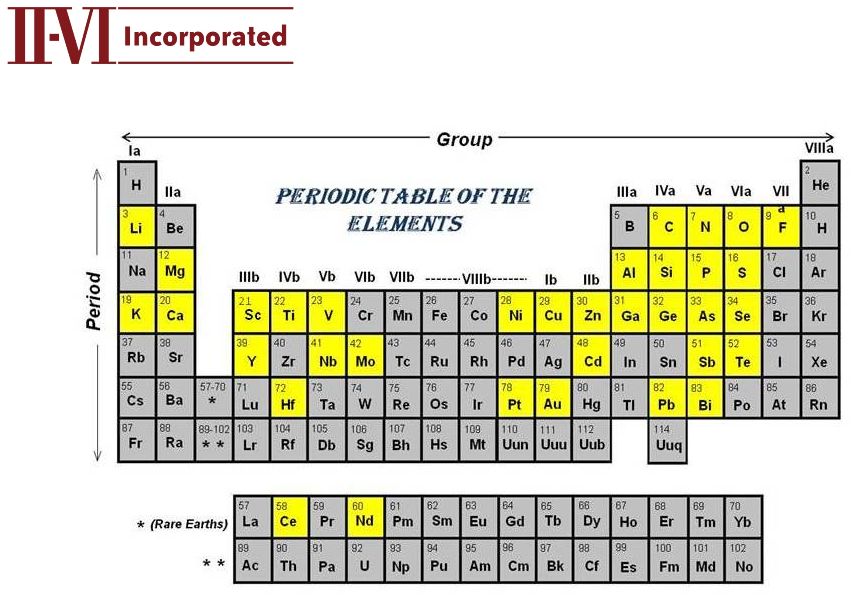

Our Core –

Material Excellence |

Global Leader in

Engineered Materials Headquartered in Saxonburg, PA

~ 7,000 Employees in 14 Countries

FY14: $683M Revenue, 5.6% ROS

4

4 consecutive decades of profitability and counting

Fiscal Year Revenues

56%

44%

46%

22%

20%

4%

4%

4%

About II-VI

31%

32%

37% |

5

Organization

Photonics

Performance Products

Laser Solutions

M&A / Integration

Tech Management

Trade Compliance

Operation Metrics

Quality

SCM

Legal

Strategic

Resources

Corporate

G&A

R&D

NPI |

6

Revenue

TAM

Share

FY14

FY13

$254M $218M

$885M

29%

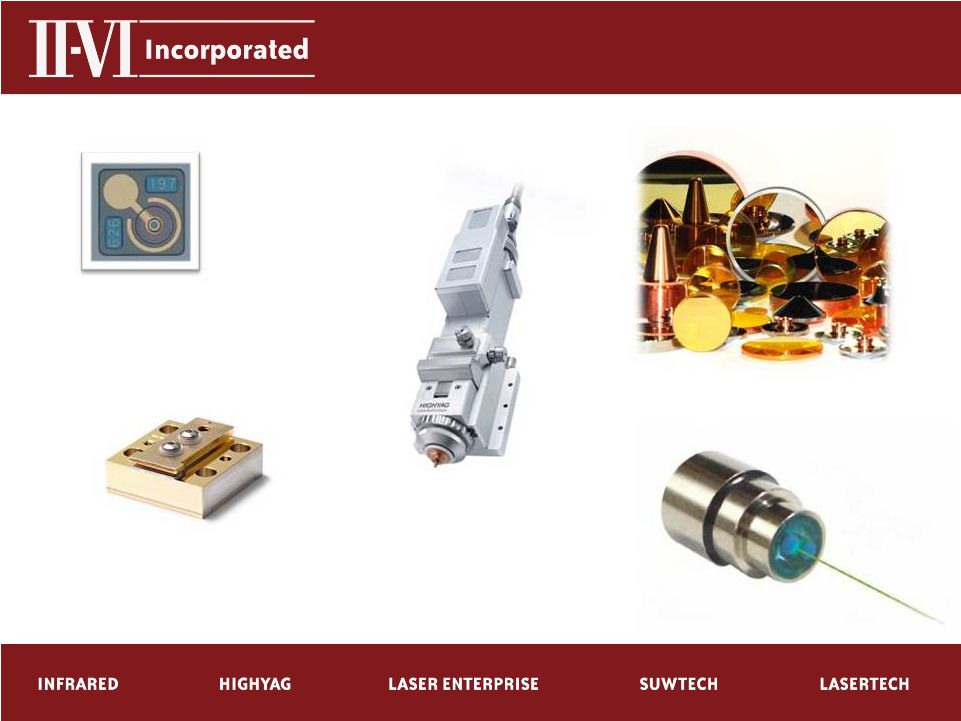

Laser Solutions Segment

Leading merchant supplier of CO

2

, Fiber, and

Direct Diode industrial laser components

Leading supplier of CO

2

optics for an install

base of >70,000 high power lasers

First to service EUV Lithography CVD

Diamond optics demand

—

Laser Optics

—

Cutting Heads

—

Semiconductor Laser Chips

—

Ultra-hard Material Processing

—

Laser Source Solutions

Focused on expanding our fiber and direct

diode laser footprint as markets grow |

7

Laser Solutions Segment

Vertical Cavity

Surface Emitting

Laser (VCSEL)

CO

2

Laser Optics

Laser Cutting

Heads

Laser Diode Bar

Green Laser Diode Module |

8

Revenue

TAM

Share

FY14

FY13

$217M $141M

$2.0B

11%

Photonics Segment

Worldwide supplier of cutting edge amplification,

pump, and transmission products for optical

communication networks

Service both intercontinental (undersea) and

transcontinental (terrestrial) applications

Leverage vertical integration synergies

to enable a cost structure for market

penetration and growth

—

Precision Optics

—

980nm Pumps

—

Erbium Doped Fiber Amplifiers

—

Optical Switches

—

Optical Coatings and Filters |

9

Source: Worldbank.org -

Based on data from the World Telecommunication/ICT Indicators database

Worldwide Fiber Optic Penetration |

10

Arrayed Amplifiers

Dual Laser Chip

980nm Pumps

40G & 100G Quad Small Form-factor

Pluggable (QSFP) Transceivers

High Performance

Optical Coatings and Filters

Optical Switches

Photonics Segment |

11

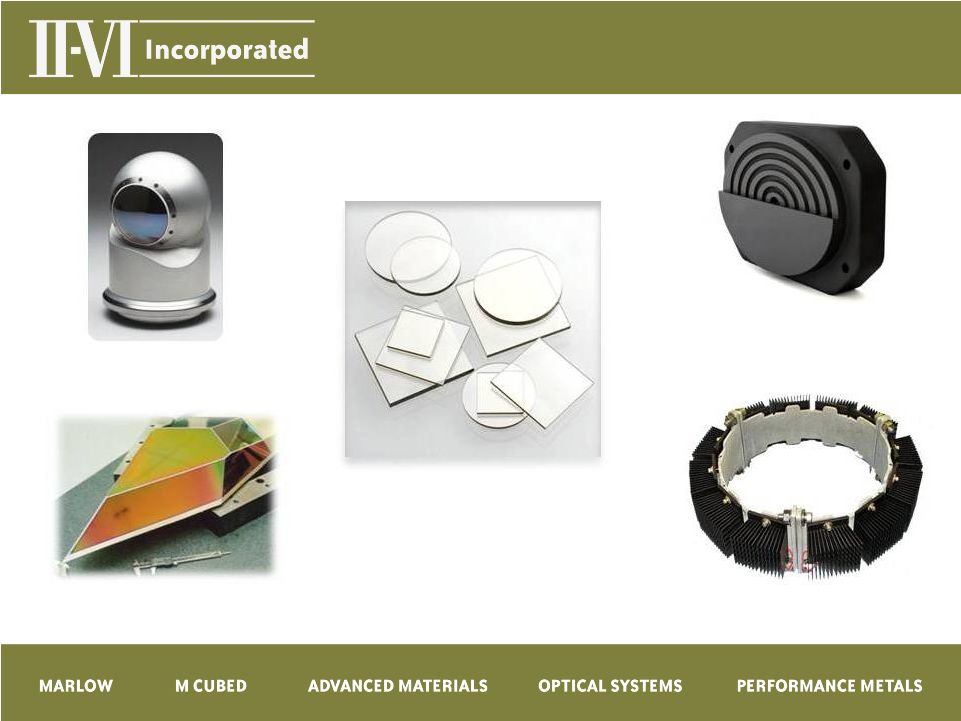

Revenue

TAM

Share

FY14

FY13

$213M $192M

$2.1B

10%

Focus on strategic markets where II-VI material

expertise and technology enables growth and new

functionality

—

Free Standing Diamond

—

Precision Optical Systems

—

High Value Material Reclamation

—

Reaction Bonded SiC Tools

—

Thermal Management

Target military platforms and applications

with growth potential

Identify emerging markets early and

enable the underpinning materials and

technology

Performance Products Segment |

12

Water Cooled Silicon

Carbide Optics

Energy Harvesting

Pipe Strap

CVD Polycrystalline

Diamond

Large Panel Sapphire

Windows

Opto-mechanical

Assemblies

Performance Products Segment |

13

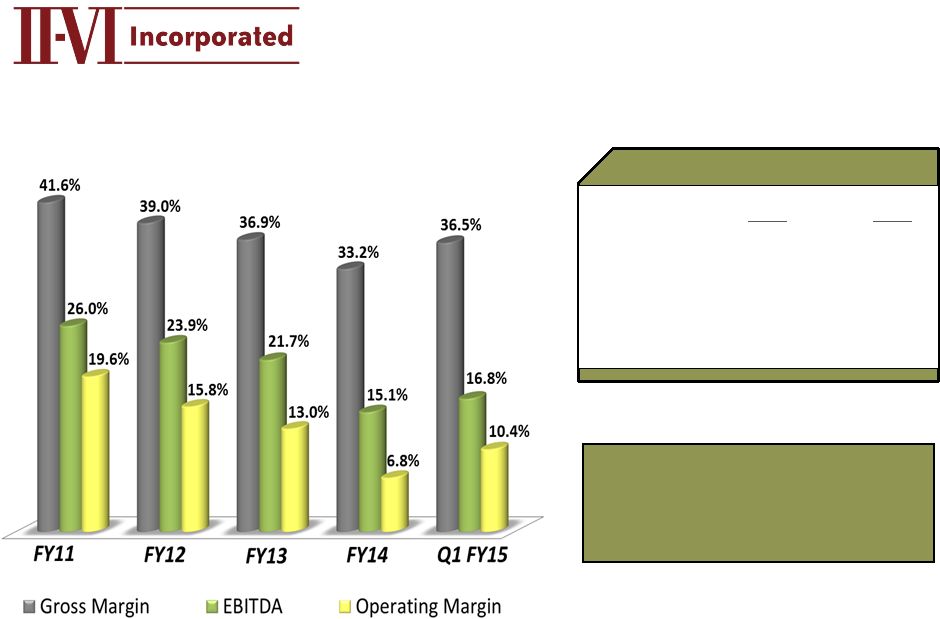

Gross Margin

EBITDA

Operating Margin

FY15

FY16

35%

-

38%

37%

-

40%

15%

-

18%

19%

-

21%

7%

-

10%

9%

-

12%

Expectations

Margin Performance

Profitability and Expectations

Exiting FY15

200 BPS > Q3 FY14 |

14

Cash and Liquidity

Cash and Equivalents

Cash Flow from Operations

Long-Term Debt

(Including current portion)

Shareholders' Equity

FY13

$185M

$108M

$114M

$636M

FY14

$175M

$95M

$241M

$675M

Cash and Liquidity |

15

Company Position

Strong Cash Position

Positive Profit Outlook

Leading Market Positions

Diverse End Markets

Global Manufacturing Footprint

Growth via Organic and Acquisitions

Ongoing $50M Stock Buyback Program |

www.ii-vi.com I NASDAQ:

IIVI 16

************************* |