Attached files

| file | filename |

|---|---|

| 8-K - 8-K - INTERPACE BIOSCIENCES, INC. | a14-24721_18k.htm |

Exhibit 99.1

|

|

November 2014 Investor Presentation |

|

|

This presentation and accompanying narrative contain forward-looking statements regarding future events and financial performance. These statements involve a number of risks and uncertainties and are based on numerous assumptions involving judgments with respect to future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond PDI’s control. Some of the important factors that could cause actual results to differ materially from those indicated by the forward-looking statements are changes in outsourcing trends or a reduction in promotional, marketing or sales expenditures in the pharmaceutical, biotechnology and life sciences industries, the early termination of a significant services contract or the loss of one or more of our significant customers or a material reduction in service revenues from these customers. Other factors that could cause actual results to differ materially from those indicated by the forward-looking statements include payers not providing reimbursement and/or our inability to negotiate reasonable reimbursement rates, gaining market acceptance of our tests, establishment of acceptable billing procedures, our ability to successfully implement our business model and manage the size of our operations, competition in the molecular diagnostics industry, changes in the regulatory oversight of laboratory tests as well as changes in laws and healthcare regulations applicable to us or our industry and the other risk factors detailed from time to time in PDI’s periodic filings with the Securities and Exchange Commission including without limitation, PDI's Annual Report on Form 10-K for the year ended December 31, 2013, and PDI's subsequently filed quarterly reports on Form 10-Q and current reports on Form 8-K. Because of these and other risks, uncertainties and assumptions, undue reliance should not be placed on these forward-looking statements. In addition, these statements speak only as of the date of this presentation and, except as may be required by law, PDI undertakes no obligation to revise or update publicly any forward-looking statements for any reason. FORWARD-LOOKING STATEMENTS 2 |

|

|

PDI Overview • Strong core commercialization business – Top 3 leader in US over twenty five years in business – Current $120 million in revenue – 1,000 Sales Reps in the field • New Molecular Diagnostics Business – Solid foundation with recent acquisitions (Asuragen assets and RedPath) – Current $12 million in revenue – By 4Q 2015: 4-5 tests expected to be commercialized in GI and endocrine with combined market potential of >$2.5 billion 3 |

|

|

PDI’s Commercialization Services Effective Live Sales Calls and Multi-Channel Integration Software Platform for Reps and Physicians to communicate Active Panel of Physicians Personal CSO Physician Panel of 466,000 Rep to HCP Communication Flexible and efficient solutions Unparalleled Infrastructure to Reach Physicians 4 |

|

|

PDI’s Commercialization Services Multi-Channel Platform Voice Print Reach 100% of your targets Efficient Personal Contact eMail 54% of all eMails were opened on Mobile Devices Mobile Average 6 minutes of messaging eDetail 466,000 HCP emails 5 Source: Group DCA Access |

|

|

Our Mission Leading Commercialization Company of Molecular Diagnostics Tests for Optimal Patient Care 6 |

|

|

Interpace Diagnostics Advantage Diagnostic Commercialization Experience Tapping into the power of PDI’s Commercial expertise and infrastructure • Broad commercial capabilities to physicians (Highly Trained Sales Reps, Expansive Digital Communications, Optimized Mobile Access) • Extensive back office infrastructure (Recruiting & Hiring, Training, Compliance, Territory Alignment, Analytics, CRM/SFA, Sales Operations) 7 |

|

|

Our Philosophy Targeting products that are nearing or ready commercialization Genomic Signature Discovery Proof of Concept Optimization/Cl inical Validation Commercial US Future International Expansion Acquisitions In-license 8 |

|

|

Key Milestones Accomplished AUGUST 2013: Exclusive Option to Acquire Thyroid cancer diagnostic AUGUST 2014: Acquired Asuragen Thyroid and Pancreas Assets AUGUST 2014: Announced molecular diagnostics leader to the board of directors (Heiner Dreisman former CEO of Roche Diagnostics) AUGUST 2014: Acquired turn-key CLIA certified and CAP accredited commercial laboratory New Haven CT OCTOBER 2014: Announced acquisition of RedPath Integrated Pathology and GI assets 9 |

|

|

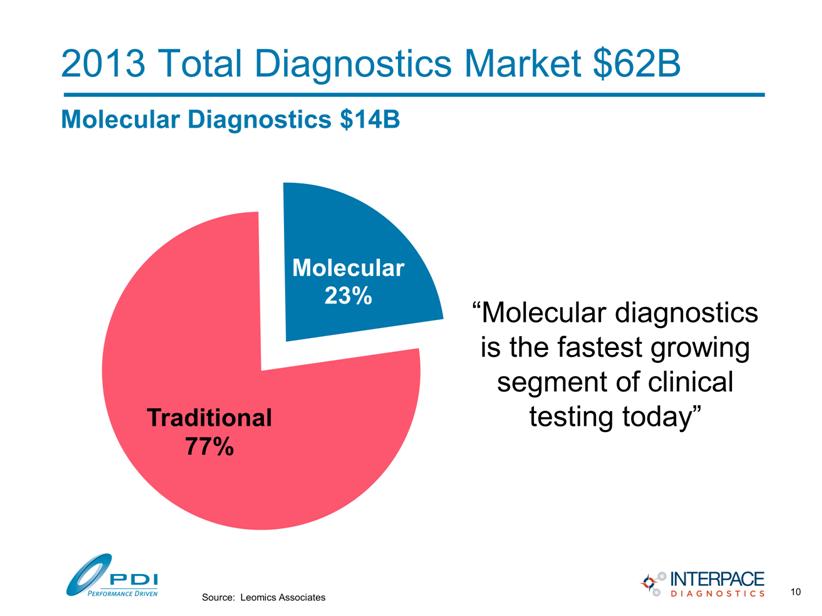

2013 Total Diagnostics Market $62B Molecular Diagnostics $14B “Molecular diagnostics is the fastest growing segment of clinical testing today” Source: Leomics Associates Molec ular 23% Tradit ional 77% 10 |

|

|

Specialty Molecular Test Developers A Growing Field 1. Most Developers of Lab Developed Tests (LTDs) are science driven with limited commercial capabilities 2. Fast-growing diagnostics field is in early stages of rapid growth 3. The future of personalized medicine is quickly gaining momentum PDI Commercial Expertise Aligned with Specialty Molecular Diagnostics Market Dynamics 11 |

|

|

Our Market Focus PathFinderTG® Integrated pancreatic oncology assay 12 currently Current In-Market Test Opportunity Pancreatic Cysts $350M Thyroid Cysts $350M GI Endocrine Source: Company estimates |

|

|

Two State-of-the-Art CLIA Labs New Haven • Located near Yale University • Medical Director Henry Rinder, MD • Access to top scientific talent • miRNA and endocrine focus • NextGen Sequencing Pittsburgh • Located near University of Pittsburgh • Chief Scientific Officer Syd Finckelstein, MD • Access to top scientific talent • Complex molecular testing capabilities GI focused Endocrine Center of Excellence Gastrointestinal Center of Excellence 13 |

|

|

14 The GI Oncology Diagnostics Market PathFinderTG® |

|

|

PathFinderTG® is Clinically Validated • Over 20,000 clinical cases analyzed • Over 200 peer-reviewed articles – Over 20 distinct clinical applications 15 |

|

|

Pancreatic Cancer: The Fourth Leading U.S. Cancer Killer 45,000 new U.S. cases 39,590 U.S. deaths 4,020 14,270 29,480 39,590 40,430 50,310 159,260 2 Source: ACS Cancer Facts & Figures 2014; all figures annual 16 |

|

|

120,000 Pancreatic Cysts Annually • The clinical dilemma: – GE manage patients using endoscopic ultrasonography (EUS) and perform fine needle aspiration of cyst. – Cyst fluid tested for CEA, amylase, and cytology (1st line tests) – These measures can’t accurately riskstratify patients. • The result: – 80% of all surgeries are for benign disease . wasted healthcare resources. – Pancreatic cancers go undetected. Pancreatic cysts: only 2-5% chance of cancer Pancreatic cysts: 80% surgeries are benign 17 |

|

|

First-Line Tests & Current Guidelines Sendai guidelines 2012 and ACG guidelines 2007 strongly favor surgical resection because of the inability of first-line tests to predict biological behavior and aggressiveness. PathFinderTG® technology helps physicians reduce unnecessary surgeries and more accurately detect cancer risk 18 |

|

|

PathFinderTG® 1. 147 DNA mutation markers 2. CEA & Amylase biomarkers 3. DNA quantification 4. Loss of heterozygosity 5. Cytology results Multi-faceted robust platform 19 Highly Accurate Test Results |

|

|

PathFinderTG® An established track record 1. The first and only molecular test for the diagnosis and prognosis of Pancreatic cancer from cysts 2. Better than first-line testing for cancer risk stratification 3. Robust clinical database 4. Recent peer review publication in Endoscopy (492 sample size) 20 |

|

|

Substantial improvement over current guidelines Sensitivity 83.3% 90.9% 0.17 Specificity 90.6% 46.2% <0.0001 NPV 97.2% 97.0% 0.88 PathfinderTG® Pancreas Sendai Guidelines P Value PPV 57.9% 20.8% <0.0001 21 Source: Integrated molecular pathology accurately determines the malignant potential of pancreatic cysts, Endoscopy, 10/2014 Performance of all patients (n=492) |

|

|

PathFinderTG® Pancreatic Cysts 22 Clinical Validity and Utility Source: Integrated molecular pathology accurately determines the malignant potential of pancreatic cysts, Endoscopy, 10/2014 97% probability of benign outcome at a median 3 years follow up 79% of patients who met Sendai guidelines for surgery actually had benign outcomes and surgery could have been avoided. PFTG provides an effective strategy of risk stratification of malignancy for optimal patient care |

|

|

PathFinderTG® Clinically Meaningful and Actionable Results • PFTG Diagnosis • Patient management recommendations • Based on patient outcome data • Provided by board certified pathologists Example Report: PFTG Pancreas 23 |

|

|

PathFinderTG® Market Accelerators • Publication of pivotal registry trial in Endoscopy • Double sales force by early 2015 • Deploy established PDI commercial infrastructure – Managed Care Access/Reimbursement – Multi-channel marketing – Medical education – Patient advocacy 24 |

|

|

What is Barrett’s Esophagus? • Gastroesophageal reflux very common (10-20% US adults) • 6% progress to Barrett's Esophagus (~3.3 million adults) • Barrett's Esophagus precedes esophageal cancer infrequently (1-3%) • Ablation (Barrx) has emerged as a treatment and prevention strategy • A high unmet medical need exists for a molecular diagnostic test to aid in cancer risk assessment 25 |

|

|

Barrett’s Esophagus ~650,000 Screened Annually $2B Potential Same platform as PathfinderTG® Pancreas Launch in 4Q2015 ~3.3M Adults 26 Source: Company estimates For Investigational Use Only. The performance characteristics of this product have not been established. |

|

|

2015 2016 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Barrett’s Esophageal Biliary Cancer GI Pipeline and Market Potential $125M $2B 27 $80M $350M Pancramir (Pancreatic Masses) on market PathFinderTG (Pancreatic Cysts) |

|

|

The Endocrine Oncology Market ThyGenX 28 |

|

|

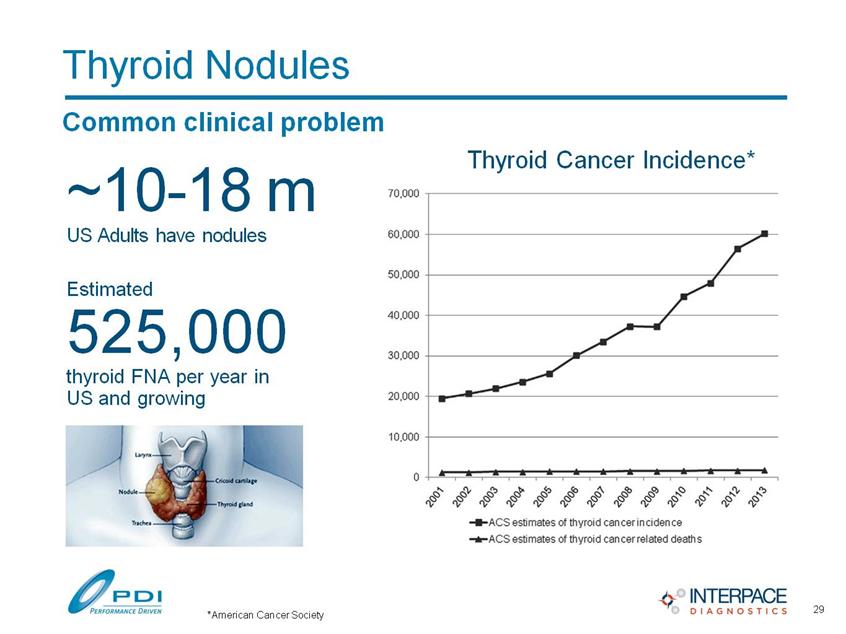

Thyroid Nodules Common clinical problem ~10-18 m US Adults have nodules Estimated 525,000 thyroid FNA per year in US and growing Thyroid Cancer Incidence* 29 *American Cancer Society |

|

|

Thyroid Surgery Is Not Inconsequential; Significant Surgical Risks • Large incision in sensitive area and potential for significant scarring • Risk of vocal cord damage, hoarseness, paralysis, and at the extreme, tracheotomy 30 |

|

|

Guideline Recommendations Molecular Markers/Diagnostic Testing 2013 NCCN Guidelines Molecular Diagnostics recommended testing on some indeterminate cytologies to minimize unnecessary surgeries 31 Source: Cooper DS et al. Thyroid. 2009;19(11):1167-1214; National Comprehensive Cancer Network. NCCN Clinical Practice Guidelines in Oncology: Thyroid Carcinoma. V.1.2014; ATA Guidelines on Thyroid Nodules and Differentiated Thyroid Cancer – Highlights, Consensus, and Controversies. ICE/ENDO conference; June 21-24, 2014; Chicago, Illinois. 2014 American Thyroid Association Revised Guidelines MDx Tests should be considered for suspicion of malignancy or indeterminate. The best markers are (BRAF, RAS, RET/PTC, PAX8/PPARG), a gene expression classifier, and Galectin-2 immunohistochemistry |

|

|

525,000 FNA Biopsies Annually miRInform® Pathway for Thyroid Cancer Diagnosis Community cytopathology 60-75% Benign Avg. ROM*: 6%1 15-30% Indeterminate Avg. ROM*: 34%1 5-8% Non-Diagnostic Avg. ROM*: 12%1 3-6% Malignant Avg. ROM*: 97%1 *ROM: Risk of Malignancy Mutation Negative Follow with watchful waiting Mutation Positive Inform thyroid surgery 32 1Wang CC, Friedman L, Kennedy GC, et al. Thyroid. 2011;21:243-251; 2Nikiforov et al. JCEM 2001; |

|

|

Molecular diagnostic tests helps the diagnosis of thyroid cancer when cytology is indeterminate Improving Thyroid Cancer Diagnosis Use of Molecular Markers CURRENTLY 2 MAIN PLATFORMS: 1. Mutation/Genetic Testing “Rules-In” Cancer – Highly specific (BRAF, KRAS, HRAS, NRAS, RET/PTC1, RET/PTC3, PAX8/PPAR-., etc.) – ThyGenX (Currently miRInform®) 2. Gene Expression “Rules-Out” Cancer – Highly sensitive – Veracyte Afirma GEC 33 |

|

|

Interpace Diagnostic Tests Meet or Exceed Thyroid Clinical Guidelines KRAS, BRAF*, HRAS*, NRAS*, RET/PTC1*, RET/PTC3, PAX8/PPARy* (17 reportable markers) KRAS, BRAF*, HRAS*, NRAS*, RET/PTC1*, RET/PTC3, PAX8/PPARy*, PIK3CA (47 reportable markers) NextGen Sequencing 34 Currently Sanger Sequencing 4Q 2014 |

|

|

Interpace Diagnostic Tests Thyroid Tests Performance 35 Highly specific “Rules-In” Cancer NextGen Sequencing 4Q 2014 (Mutation Assay) Highly sensitive “Rules-Out” Cancer— In clinic miRNA Markers 2H 2015 (miRNA Markers) miRNA Classifier Blinded multi-faceted validation underway |

|

|

miRInform + miRNA Classifier (2H2015) miRInform with miRNA Classifier substantially improves performance over competition Veracyte Afirma miRInform® miRInform® With Classifier Characterize Malignancy No Yes Yes Pathology Veracyte Performs Any Pathologist Any Pathologist Prominent Results Likely Benign Likely Malignant Benign/Malignant FNA Samples 2 1 1 PPV 56% 81% in progress NPV 95% 64% in progress 36 |

|

|

Thyroid Franchise 37 Market Accelerators • Launch ThyGenX 4Q 2014 (Improved NextGen sequencing platform from miRInform®) and launch miRNA Classifier by 2H 2015 • More than double field force by 1Q 2015 and scale with growth • Deploy established PDI commercial infrastructure – Managed Care Access/Reimbursement – Multi-channel marketing – Medical education – Patient advocacy |

|

|

Endocrine Pipeline and Market Potential 201 4 2015 2016 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 | on market—relaunch ThyGenX (Enhanced NGS Assay) miRNA Classifier Expanded ThyGenX miRInform future $350M 38 |

|

|

Current PDI Commercial Services • Strong 2014 momentum leading into 2015 • $140M new awards in Q4 • Multiple top pharma, mid-size, and small clients across numerous therapeutic categories • PD One Rep to Physician Software Platform set to grow to 700 Rep subscriptions by 1Q2015 Core business update 39 |

|

|

Financial Update 2014 Expectations Revenue: Operating Loss: (GAAP) Cash (Year End): $(15M) - $(17M) $121M - $123M $21M - $23M 40 |

|

|

PDI Value 1. Molecular Diagnostics commercialization strategy has significant upside potential — substantially higher gross margins and recurring revenue base 2. Core CSO and multi-channel offerings set for positive growth in 2015 and provide solid base for future success 3. PD One Software Platform is poised to differentiate sales rep to physician communication 41 |