Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Prestige Consumer Healthcare Inc. | a8-kglobalconsumerconferen.htm |

| EX-99.2 - RECONCILIATIONTABLES - Prestige Consumer Healthcare Inc. | reconciliationtables.htm |

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 1 Morgan Stanley Global Consumer Conference Matt Mannelly, CEO & President Ron Lombardi, CFO November 18, 2014 Exhibit 99.1

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 2 This presentation contains certain “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements about the Company’s product introductions, investments in brand building, debt reduction, integration of the Insight acquisition, consumption growth and market position of the Company’s brands, M&A market activity, and the Company’s future financial performance. Words such as “continue,” “will,” “expect,” “project,” “anticipate,” “likely,” “estimate,” “may,” “should,” “could,” “would,” and similar expressions identify forward-looking statements. Such forward-looking statements represent the Company’s expectations and beliefs and involve a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. These factors include, among others, the failure to successfully integrate the Insight or Hydralyte businesses or future acquisitions, the failure to successfully commercialize new products, the severity of the cold and flu season, general economic and business conditions, competitive pressures, the effectiveness of the Company’s brand building investments, fluctuating foreign exchange rates, and other risks set forth in Part I, Item 1A. Risk Factors in the Company’s Annual Report on Form 10-K for the year ended March 31, 2014 and in Part II, Item 1A. Risk Factors in the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2014. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this presentation. Except to the extent required by applicable law, the Company undertakes no obligation to update any forward-looking statement contained in this presentation, whether as a result of new information, future events, or otherwise. Safe Harbor Disclosure

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 3 Agenda for Today’s Discussion I. Our Company: The Leading Independent Publicly Traded OTC Company in the U.S. II. Our Strategy: Three Core Pillars III. FY2015 Performance Outlook and the Road Ahead

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 4 I. Our Company: The Leading Independent Publicly Traded OTC Company in the U.S.

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 5 Prestige Today: Investment Highlights Diversified consumer healthcare company competing in attractive OTC market Portfolio of trusted brands with durable consumer franchises across multiple strategic platforms – Strong positions in key OTC categories (eye/ear, cough/cold, women's health, analgesics and G.I.) Proven track record of strong financial performance – Proven brand building initiatives – Industry leading margin and cash flow generation – Consistent M&A execution Proven management team supported by deep bench has delivered meaningful shareholder value creation FY2010 $0.67 FY2012 $0.99 FY2015 Outlook $1.75 – $1.85 Adj. EPS(1): (1) Adjusted EPS may be found in the Financial Highlights section of our Annual Report for the year ended March 31, 2014.

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 6 Analgesics GI Women’s Health Cough & Cold Oral Care Sleep Aids Skin Care Household Cleaning Eye & Ear Care Care Pharmaceuticals New Brand New Brand New Brand New Brand New Brand New Brand New Brand New Brand New Brand New Brand Building A Strong Portfolio Over Time…

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 7 …And Increased Scale Across Multiple Category Platforms $175 0% 20% 40% 60% 80% 100% $175 $200 $100 $140 $90 $70 ~$10 Women’s Health Cough Cold Analgesics Derm. Eye & Ear Oral Care Sleep Aids Other Insight Other Insight ~$75(1) Other Prestige PL Other Prestige GI Other Other Prestige Recent Acquisitions North America Australasia Oral Hydration Cough Cold ~$1BN Dollar values in millions Source: North America – IRI MULO + C-Store, L52-week period ending October 5, 2014. Note: Data reflects retail dollar sales. (1) Based on company estimate for retail dollar sales.

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 8 The Power of Prestige’s Portfolio Create a Diversified OTC Portfolio Leverage Our Financial Model to Build the Portfolio Build and add to our strategic category platforms and geographies Invest behind brand building efforts to drive growth in Core OTC and international Manage balance of portfolio for cash flow generation Continue our efficient operating model Maintain our strong margin profile and consistent cash flow conversion Provide capacity for additional, accretive acquisitions Maintain Our Disciplined and Aggressive M&A Plans Adhere to our well established M&A criteria Maintain active presence in M&A marketplace Ensure organization able to capitalize on new market opportunities

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 9 Leading, Independent Publicly Traded OTC Company in the U.S. Dollar values in billions Source: Euromonitor (~$26BN North American OTC Retail Sales; 2013) Note: Adjusted for announced and pending M&A activity. $3.1 $2.7 $1.7 $1.6 $1.3 $1.0 $0.9 $0.9 $0.4 $0.3 North American OTC Retail Sales #6

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 1 0 II. Our Strategy: Three Core Pillars

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 1 1 Drivers of Our Long-Term Value Creation Strategy + + FY10 PF FY15 Free Cash Flow(1) +3x $59(2) ~$175(3) Dollar values in millions (1) Free Cash Flow is a Non-GAAP financial measure and is defined as Net Cash Provided by Operating Activities less Capital Expenditures. (2) Free Cash Flow may be found in the Financial Highlights section of our Annual Report for the Fiscal Year ended March 31, 2014. (3) Pro forma is based as if Insight and Hydralyte were acquired on April 1, 2014. Pro Forma Cash Flow from Operations of approximately $182 million less Capital Expenditures of approximately $7 million. Core OTC Int’l ~75% of Our Portfolio

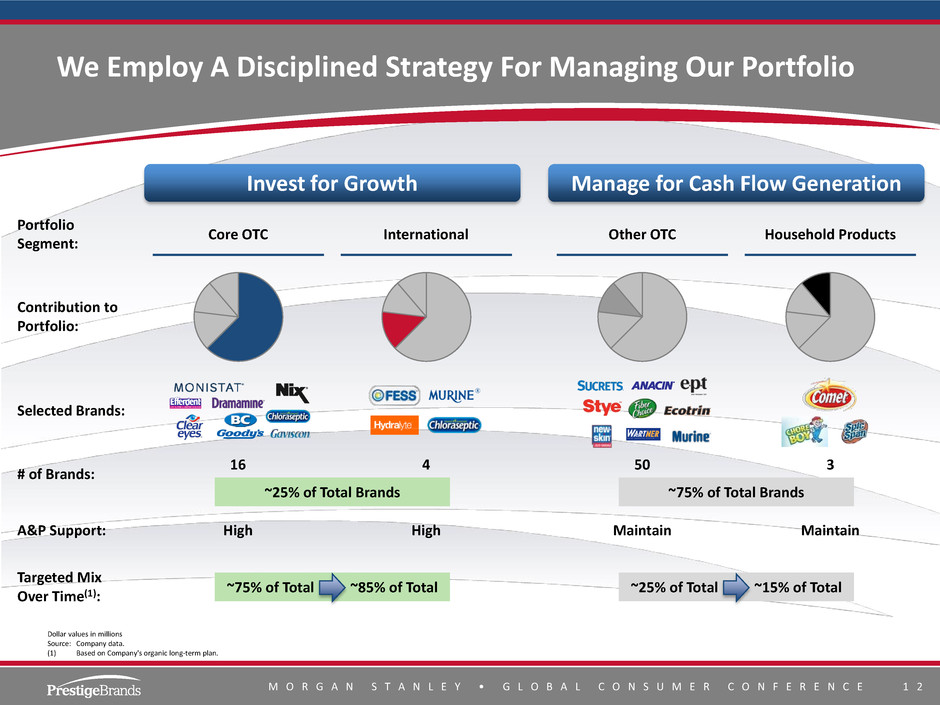

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 1 2 We Employ A Disciplined Strategy For Managing Our Portfolio Dollar values in millions Source: Company data. (1) Based on Company's organic long-term plan. Invest for Growth Manage for Cash Flow Generation Portfolio Segment: Core OTC International Other OTC Household Products Contribution to Portfolio: Selected Brands: # of Brands: 16 4 50 3 A&P Support: High High Maintain Maintain Targeted Mix Over Time(1): ~75% of Total ~85% of Total ~25% of Total ~15% of Total ~25% of Total Brands ~75% of Total Brands

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 1 3 Source: IRI multi-outlet retail dollar sales growth for relevant period. Excludes Insight Pharmaceuticals. Data reflects retail dollar sales percentage growth versus prior period. (1) Excludes PediaCare, Little Remedies, Beano and Insight Pharmaceuticals. (2) Core OTC organic revenue growth rates are calculated using the Core Brands of (Chloraseptic, Clear Eyes, Compound W, Little Remedies, The Doctors, Efferdent, Pediacare, Luden’s, Dramamine, BC, Goody’s, Beano, Debrox and Gaviscon) and exclude the effect of acquisitions, if such brand is not included in each of the respective periods. Excluding Pediatric Competitive Returns / GI Category Dynamics(1) Invest in Brand Building Efforts to Drive Core OTC Growth Core OTC Consumption Growth Core OTC Organic Revenue Growth(2) Consumption Growth Accelerating Following Transition Year Shipment Growth Accelerating But Still Trailing Consumption Growth 7.7% 4.8% (6.9%) (3.7%) (2.4%) 3.4% 2.7% (0.8%) (3.1%) 1.8% FY'12 FY'13 FY'14 Q1 Q2 FY’15 8.7% 8.3% (4.9%) (1.8%) 1.0% 4.5% 6.5% 0.1% 2.5% 4.9% FY'12 FY'13 FY'14 Q1 Q2 FY’15 Impacted by Retailer Inventory Reductions

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 1 4 Expanded Focus on Attractive, Growing International Markets 2011 2014 U.S. International Distributor model Predominantly established markets Local operations in Australia and New Zealand Beachhead for attractive region Attractive growth profile International Business Has Grown from $35MM to $110MM in Last Three Years U.S. International

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 1 5 ~37% 33.8% 27.6% 27.4% 23.1% 22.8% 22.0% 20.2% 19.9% 16.8% 15.6% 13.7% 11.5% Industry Leading EBITDA Margins Median: 22.0% Source: Company filings and Capital IQ Notes: For the latest twelve month period as of November 14, 2014 (1) Pro Forma Adjusted EBITDA is a Non-GAAP financial measure and is arrived at by taking Pro Forma Net Income of $89 million and adding back depreciation and amortization of $31 million, interest expense of $103 million, income taxes of $52 million and transition, integration and purchase accounting items of $25 million to arrive at $300 million. Pro Forma Adjusted EBITDA margin is arrived at by taking Pro Forma Adjusted EBITDA of $300 million divided by Pro Forma Net Sales of $800 million. (1)

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 1 6 Prestige’s Operating Model Generates Superior Free Cash Flow and Free Cash Flow Conversion Dollar values in millions (1) Free Cash Flow is a Non-GAAP financial measure and is defined as Net Cash Provided by Operating Activities less Capital Expenditures. (2) Free Cash Flow Conversion is a Non-GAAP financial measure and is defined as Free Cash Flow over Adjusted Net Income. (3) Free Cash Flow may be found in the Financial Highlights section of our Annual Report for the Fiscal Year ended March 31, 2014. (4) Free Cash Flow Conversion utilizes the Adjusted Net Income found in the Financial Highlights section of our Annual Report for the Fiscal Year ended March 31, 2014. (5) Cash Flow from Operations of approximately $132 million less Capital Expenditures of approximately $3 million. (6) Projected Cash Flow from Operations of $136 million plus $20 million of projected integration costs less $6 million of projected capital spending. (7) Pro Forma Cash Flow from Operations of approximately $182 million less Capital Expenditures of approximately $7 million. $59 $86 $67 $127 $125 $150 $175 FY10 FY11 FY12 FY13 FY14 FY15 Outlook PF FY15 Free Cash Flow(1) (Free Cash Flow Conversion(2)) North American Brands 176%(4) 216%(4) 133%(4) 165%(4) ~165% Disciplined acquisition strategy with proven integration synergies Structure acquisitions in a long-term highly tax-efficient manner Outsourced manufacturing with minimal capital outlays ~165% +40% $129(5) ~$175(7) (3) (3) (3) (3) ~165% (6)

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 1 7 Prestige Continues to Have Leading Free Cash Flow Conversion With Attractive Yields 175% 152% 135% 126% 118% 115% 113% 111% 110% 108% 96% 94% 84% Median: 113% Source: Company filings and Capital IQ Notes: For the latest twelve month period as of November 14, 2014. (1) Adjusted Free Cash Flow Conversion is a Non-GAAP financial measure and is defined as Non-GAAP Operating Cash Flow less Capital Expenditures over Non-GAAP Adjusted Net Income and is reconciled in exhibit 99.2 accompanying Form 8-K filed November 18, 2014. Operating Cash Flow and Adjusted Net Income are reconciled to their reported GAAP amounts in our earnings release in the “About Non-GAAP Financial Measures” section. (2) Adjusted Free Cash Flow Conversion is calculated as Non-GAAP Adjusted Free Cash Flow over Non-GAAP Adjusted Net Income. These Non-GAAP financial measures are reconciled to their respective GAAP measures in exhibit 99.2 accompanying Form 8-K filed November 18, 2014. (3) Adjusted Free Cash Flow yield is calculated as Non-GAAP Adjusted Free Cash Flow over the Company’s market capitalization as of November 14, 2014. Adjusted Free Cash Flow Conversion(1) (2) 9%(3) 8% 5% 6% 4% 5% 6% 5% 5% 6% 7% 5% 5% Yield: Median: 5%

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 1 8 Strong Cash Flow Conversion Drives Rapid De-Leveraging While Building Acquisition Capacity FY'15E FY'16E FY'17E ~$1.3 BN ~$2.1 BN (1) Leverage ratio reflects net debt / covenant defined EBITDA. (2) Assumes max leverage of 5.75x and average EBITDA acquisition multiple consistent with previous acquisitions. High cash flow conversion is expected to lead to continued rapid de-leveraging One full EBITDA multiple turn reduction by end of next fiscal year Existing financing arrangements and rapid deleveraging ability create expanded acquisition capacity Over time leverage not a constraint for continued M&A Maintain flexibility to employ alternative forms of financing ~$0.4 BN Leverage Ratio(1) Illustrative Financing Capacity(2) ~5.6x ~5.3x ~4.5x <4.0x Q2 FY'15 FY'15E FY'16E FY'17E

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 1 9 Acquisitions Continue the Transformation of Prestige by Expanding into Attractive OTC Segments and Geographies Six Acquisitions Completed in Past Five Years Have More Than Tripled Prestige’s OTC Business North American Brands 2010 2012 2013 2014 2011 April 2014 July 2013 April 2014 December 2011 December 2010 September 2010 Platform Expansion Geographic Expansion

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 2 0 Prestige Continues to be an Aggressive and Disciplined Acquirer Key Brands # of Key Brands: 3 1 5 1 1 3 Source: Private Equity Large U.S. Pharma Large U.K. Pharma Private Private Private Equity Type of Transaction: Going Concern Brand Sale Carve-Out Going Concern Brand Sale Going Concern Process: Exclusive Semi- Exclusive Competitive Exclusive Competitive Exclusive Different Types of Transactions Different Deal Dynamics Different Types of Counterparties Different Challenges

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 2 1 Acquisitions Have Strengthened Our OTC Platform Category Breadth(1) International Expansion(1) Brand Scale (Top 4 OTC Brands)(2) Channel Diversity FY2010 FY2015 Food, Drug, Mass Food, Drug, Mass, Convenience, Club and Dollar ~$35MM / ~10% ~$110MM / ~15% Cough & Cold Eye & Ear Derm. Oral Care Women’s Health Cough & Cold Analgesics Eye & Ear GI Derm. Oral Care +3.5x +3.1x +3.0x Expanded Avg.: $38MM Avg.: $113MM Dollar values in millions (1) Based on company estimates. (2) IRI MULO + C-Store data, reflects retail dollar sales.

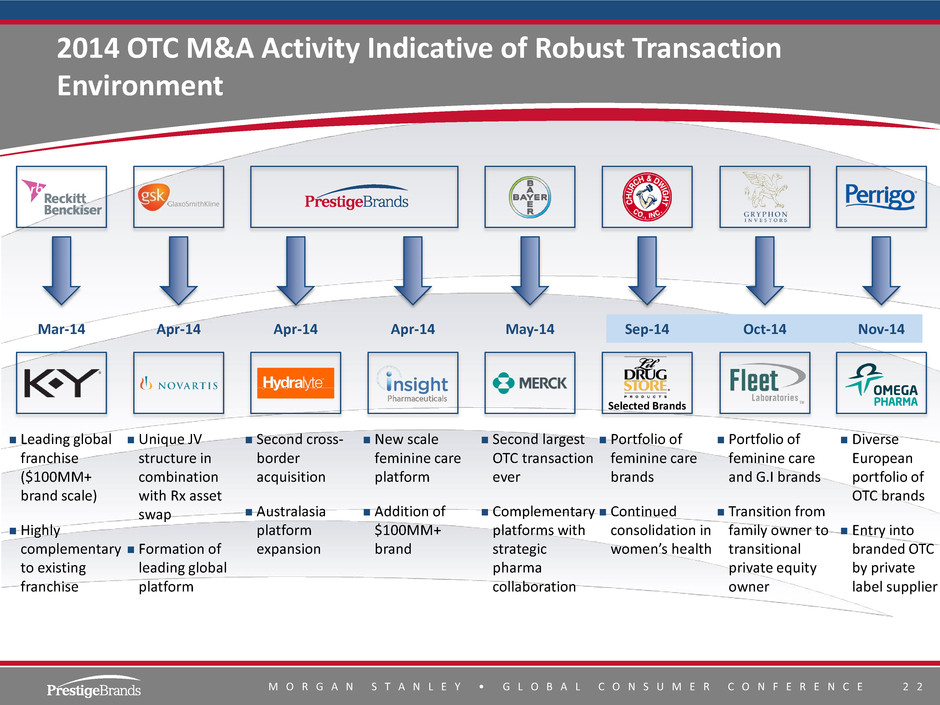

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 2 2 2014 OTC M&A Activity Indicative of Robust Transaction Environment Leading global franchise ($100MM+ brand scale) Highly complementary to existing franchise Unique JV structure in combination with Rx asset swap Formation of leading global platform Second cross- border acquisition Australasia platform expansion New scale feminine care platform Addition of $100MM+ brand Second largest OTC transaction ever Complementary platforms with strategic pharma collaboration Portfolio of feminine care brands Continued consolidation in women’s health Portfolio of feminine care and G.I brands Transition from family owner to transitional private equity owner Diverse European portfolio of OTC brands Entry into branded OTC by private label supplier Mar-14 Apr-14 Apr-14 Apr-14 May-14 Sep-14 Oct-14 Nov-14 Selected Brands

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 2 3 Drivers of Our Long-Term Value Creation Strategy + + FY10 PF FY15 Free Cash Flow(1) +3x $59(2) ~$175(3) Dollar values in millions (1) Free Cash Flow is a Non-GAAP financial measure and is defined as Net Cash Provided by Operating Activities less Capital Expenditures. (2) Free Cash Flow may be found in the Financial Highlights section of our Annual Report for the Fiscal Year ended March 31, 2014. (3) Pro forma is based as if Insight and Hydralyte were acquired on April 1, 2014. Pro Forma Cash Flow from Operations of approximately $182 million less Capital Expenditures of approximately $7 million. Core OTC Int’l ~75% of Our Portfolio

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 2 4 $0.67 $0.99 $1.53 $1.90 - $2.00 FY10A FY12A FY14A FY15PF Prestige’s Proven Track Record of Growth $88 $135 $204 $300 $293 $441 $602 $800 Dollar values in millions (1) Adjusted EBITDA may be found in our earnings releases for each respective year ended March 31. (2) Free Cash Flow and Adjusted EPS may be found in the Financial Highlights section of our Annual Report for the year ended March 31, 2014. (3) Pro Forma Adjusted EBITDA is a Non-GAAP financial measure and is arrived at by taking Pro Forma Net Income of $89 million and adding back depreciation and amortization of $31 million, interest expense of $103 million, income taxes of $52 million and transition, integration and purchase accounting items of $25 million to arrive at $300 million. (4) Pro forma Cash Flow from Operations of approximately $182 million less Capital Expenditures of approximately $7 million (5) Pro forma EPS of $1.60 to $1.70 plus $0.30 of acquisition related items totaling $1.90 to $2.00. (6) Pro forma is based as if Insight and Hydralyte were acquired on April 1, 2014. $59 $67 $129 $175 (1) (1) (2) (2) (2) (2) Net Sales Adjusted EBITDA Free Cash Flow Adjusted EPS 22.3% CAGR 27.7% CAGR 24.3% CAGR 23.8% CAGR (6) (1) (2) (2) (3) (4) (5)

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 2 5 III. FY2015 Performance Outlook and the Road Ahead

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 2 6 Q2 Performance Highlights: Strong Performance in A Challenging Retail Environment Q2 consolidated Total Revenue of $181.3 million, up 8.6% versus the prior year corresponding quarter Adjusted E.P.S. of $0.50(1), up 6.4% versus the prior year corresponding quarter Strong Adjusted Free Cash Flow of $36.5(1) million, up 14.7% versus the prior year corresponding quarter Core OTC consumption growth of 4.9% (excluding products impacted by pediatric and GI category dynamics) Continued investment in brand building efforts − New advertising campaigns − Goody’s sports marketing partnerships − New products, digital marketing and promotions across brands Closed acquisition of Insight Pharmaceuticals in September. Integration well underway On track to continue to deliver strong financial performance in FY2015 − Full year sales growth +15% – 18% − Adjusted E.P.S $1.75 – $1.85(1) − Adjusted Free Cash Flow of approximately $150 million(1) Notes: (1) These Non-GAAP financial measures are reconciled to their most closely related GAAP financial measures in our earnings release in the “About Non-GAAP Financial Measures” section for Q2 FY’15.

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 2 7 Consumption Continues to Outpace Shipments as Retailers Reduce Inventory Notes: (1) Core OTC Brands; Excludes PediaCare, Little Remedies, Beano and Insight Pharmaceuticals. (2) Company estimate. 6.8% 3.4% 6.2% 3.2% Q3 Q4 Q1 Q2 Core OTC Consump. vs. Rev. Growth(1) G rowt h D if fe ren ce FY’14 (1.7%) (0.7%) 2.5% 4.9% (8.5%) (4.1%) (3.1%) 1.8% FY’15 Total Revenue Growth Consumption Growth Consumption Consistently Outpacing Shipments 39 39 35 32 34 Inventory at Trade (MM of Units)(1)(2) Retailers Maintaining Low Inventory Level FY’14 FY’15 +6.8% +3.4% +5.6% +3.1% Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q2 (12%) Y/Y

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 2 8 Integration of Insight Pharmaceuticals on Track Regulatory / Quality Assurance Systems / Back-Office Supply Chain Sales & Distribution IT systems and processes transferred Personnel and offices transitioned Brand Building Expect to Complete by End of Q3 On-Going 12-24 Months Regulatory and quality functions integrated Go-to-market strategy in-place and selling organization integrated Optimizing common supplier network Identifying and capturing cost savings potential Marketing strategy formation underway Brand plans and new product / innovation pipeline being developed

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 2 9 Strategic Approach Continues to Create Shareholder Value − Improved Core OTC consumption trends leading to market share gains − Challenging retail environment continues to impact retailer inventory − Power of the portfolio provides favorable long term outlook − Continued new product introductions − Investment in brand building communication vehicles ● Typical 2nd half A&P increase ● Promotional spending − Ongoing evolution of marketing vehicles (sports marketing, digital) − Seasoned Integration Team and core competency ● Infrastructure largely in place by Q3 ● Brand building in progress–consumer learning, advertising, health care professionals − Stabilizing the business underway (supply and demand) − Marketing learning and foundation in FY’15 leads to investment in FY’16 − Remain aggressive and disciplined − Effectively integrate and acquisitions − Capitalize on OTC consolidation and major company announcements − Full year revenue growth +15% – 18% − Adjusted E.P.S $1.75 – $1.85(1) − Adjusted Free Cash Flow of approximately $150 million(1) Second Half of Year Brand Building in Focus Prolific M&A Outlook Confident in Full FY2015 Year Outlook Notes: (1) These Non-GAAP financial measures are reconciled to their most closely related GAAP financial measures in our earnings release in the “About Non-GAAP Financial Measures” section for Q2 FY’15. Insight Integration

M O R G A N S T A N L E Y • G L O B A L C O N S U M E R C O N F E R E N C E 3 0