Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CU Bancorp | d823071d8k.htm |

Exhibit 99.1

CU Bancorp

a better banking experience

Forward-Looking Statements

This press release contains certain forward-looking information about CU Bancorp (the “Company”), 1st Enterprise Bank and the combined company after the close of the transaction that is intended to be covered by the safe harbor for “forward looking statements” provided by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of the Company. Forward-looking statements speak only as of the date they are made and we assume no duty to update such statements. We caution readers that a number of important factors could cause actual results to differ materially from those expressed in, implied or projected by, such forward-looking statements. Risks and uncertainties include, but are not limited to: lower than expected revenues; credit quality deterioration or a reduction in real estate values could cause an increase in the allowance for credit losses and a reduction in net earnings; increased competitive pressure among depository institutions; the Company’s ability to complete future acquisitions, successfully integrate such acquired entities, or achieve expected beneficial synergies and/or operating efficiencies within expected time-frames or at all; the possibility that personnel changes will not proceed as planned; the cost of additional capital is more than expected; a change in the interest rate environment reduces net interest margins; asset/liability repricing risks and liquidity risks; legal matters could be filed against the Company and could take longer or cost more than expected to resolve or may be resolved adversely to the Company; general economic conditions, either nationally or in the market areas in which the Company does or anticipates doing business, are less favorable than expected; environmental conditions, including natural disasters and drought, may disrupt our business, impede our operations, negatively impact the values of collateral securing the Company’s loans and leases or impair the ability of our borrowers to support their debt obligations; the economic and regulatory effects of the continuing war on terrorism and other events of war, including the conflicts in the Middle East; legislative or regulatory requirements or changes adversely affecting the Company’s business; changes in the securities markets; regulatory approvals for any capital activities cannot be obtained on the terms expected or on the anticipated schedule; and, other risks that are described in CU Bancorp’s public filings with the U.S. Securities and Exchange Commission (the “SEC”). Additional risks and uncertainties relating to the proposed transaction with 1st Enterprise Bank include, but are not limited to: the ability to complete the proposed transaction, including obtaining regulatory approvals and approvals by the shareholders of CU Bancorp and 1st Enterprise Bank; the length of time necessary to consummate the proposed transaction; the ability to successfully integrate the two institutions and achieve expected synergies and operating efficiencies on the expected timeframe; unexpected costs relating to the proposed transaction; and the potential impact on the institutions’ respective businesses as a result of uncertainty surrounding the proposed transaction. If any of these risks or uncertainties materializes or if any of the assumptions underlying such forward-looking statements proves to be incorrect, CU Bancorp’s results could differ materially from those expressed in, implied or projected by such forward-looking statements. CU Bancorp assumes no obligation to update such forward-looking statements. For a more complete discussion of risks and uncertainties, investors and security holders are urged to read CU Bancorp’s annual report on Form 10-K, quarterly reports on Form 10-Q and other reports filed by CU Bancorp with the SEC. The documents filed by CU Bancorp with the SEC may be obtained at CU Bancorp’s website at www.cubancorp.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from CU Bancorp by directing a request to: CU Bancorp c/o California United Bank, 15821 Ventura Boulevard, Suite 100, Encino, CA 91436. Attention: Investor Relations. Telephone 818-257-7700.

CU BANCORP, CALIFORNIA UNITED BANK AND 1ST ENTERPRISE BANK MERGER ANNOUNCEMENT On June 3, 2014, CU Bancorp announced that it had entered into an Agreement and Plan of Merger (the “Merger Agreement”) among CU Bancorp, California United and 1st Enterprise Bank, a California state-chartered commercial bank (“1st Enterprise”) pursuant to which CU Bancorp will acquire 1st Enterprise Bank by merging 1st Enterprise Bank with and into California United Bank (the “Merger”). California United Bank will survive the Merger and will continue the commercial banking operations of the combined bank following the Merger. Under the terms of the Merger Agreement, holders of 1st Enterprise Bank common stock will receive shares of CU Bancorp common stock based upon a fixed exchange ratio of 1.3450 shares of CU Bancorp common stock for each share of 1st Enterprise Bank common stock. The U.S. Treasury, as the holder of all outstanding shares of 1st Enterprise Bank preferred stock granted in connection with 1st Enterprise’s participation in the Treasury’s Small Business Lending Fund program, will receive, in exchange for these shares, a new series of CU Bancorp preferred stock having the same rights (including with respect to dividends), preferences, privileges, voting powers, limitations and restrictions as the 1st Enterprise preferred stock. The Merger is subject to customary closing conditions, including regulatory and shareholder approvals. ADDITIONAL INFORMATION ABOUT THE PROPOSED TRANSACTION WITH 1ST ENTERPRISE BANK AND WHERE TO FIND IT Investors and security holders are urged to carefully review and consider each of CU Bancorp’s public filings with the SEC, including but not limited to its annual reports on Form 10-K, proxy statements, current reports on Form 8-K and quarterly reports on Form 10-Q. The documents filed by CU Bancorp with the SEC may be obtained free of charge at CU Bancorp’s website at www.cubancorp.com or at the SEC website at www.sec.gov. These documents may also be obtained free of charge from CU Bancorp by directing a request to: CU Bancorp c/o California United Bank, 15821 Ventura Boulevard, Suite 100, Encino, CA 91436. Attention: Investor Relations. Telephone 818-257-7700. The information on CU Bancorp’s website is not, and shall not be deemed to be, a part of this filing or incorporated into other filings CU Bancorp makes with the SEC. In connection with the proposed merger of California United Bank with 1st Enterprise Bank, CU Bancorp intends to file a registration statement on Form S-4 with the SEC to register the shares of CU Bancorp common stock to be issued to shareholders of 1st Enterprise Bank. The registration statement will include a joint proxy statement of CU Bancorp and 1st Enterprise and a prospectus of CU Bancorp, and each party will file other documents regarding the proposed transaction with the SEC. Before making any voting or investment decision, investors and security holders of CU Bancorp and 1st Enterprise Bank are urged to carefully read the entire registration statement and joint proxy statement/prospectus, when they become available, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. A definitive joint proxy statement/prospectus will be sent to the shareholders of each institution seeking any required stockholder approvals. Investors and security holders will be able to obtain the registration statement and the joint proxy statement/prospectus free of charge from the SEC’s website or from CU Bancorp by writing to the address provided in the paragraph above. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. 2

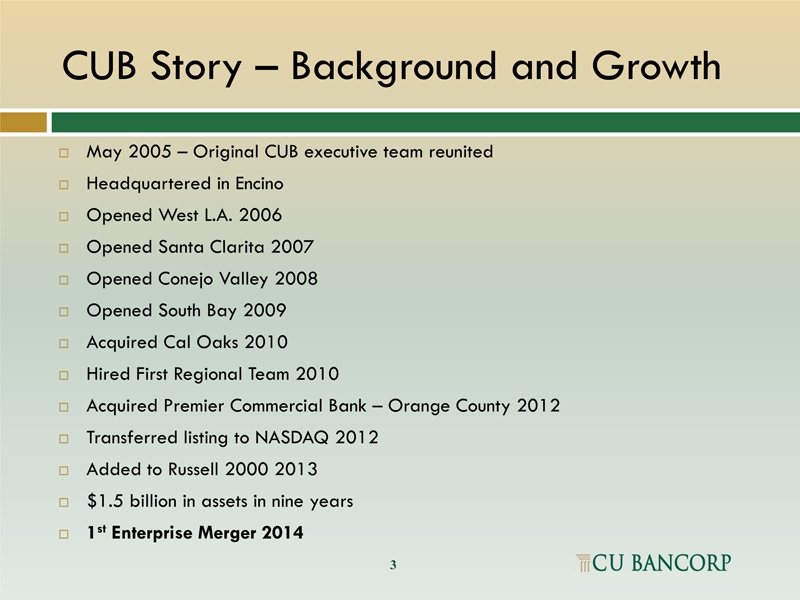

CUB Story – Background and Growth

May 2005 – Original CUB executive team reunited

Headquartered in Encino

Opened West L.A. 2006

Opened Santa Clarita 2007

Opened Conejo Valley 2008

Opened South Bay 2009

Acquired Cal Oaks 2010

Hired First Regional Team 2010

Acquired Premier Commercial Bank – Orange County 2012

Transferred listing to NASDAQ 2012

Added to Russell 2000 2013

$1.5 billion in assets in nine years

1st Enterprise Merger 2014

3

Merger is a Great Fit of People and Culture

Blending the best of two high performing organizations

Complementary branch locations and customer-centric cultures fit like a glove

Brings together some of the top bankers and banking support staff in Southern California

Larger organization provides increased opportunities for continued professional growth

4

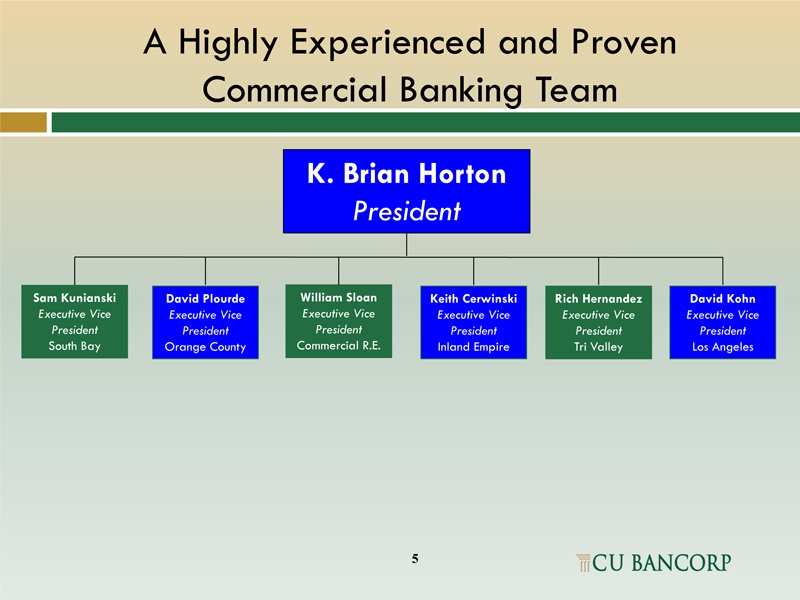

A Highly Experienced and Proven Commercial Banking Team

K. Brian Horton

President

Sam Kunianski

Executive Vice President

South Bay

David Plourde

Executive Vice President

Orange County

William Sloan

Executive Vice President

Commercial R.E.

Keith Cerwinski

Executive Vice President

Inland Empire

Rich Hernandez

Executive Vice President

Tri Valley

David Kohn

Executive Vice President

Los Angeles

5

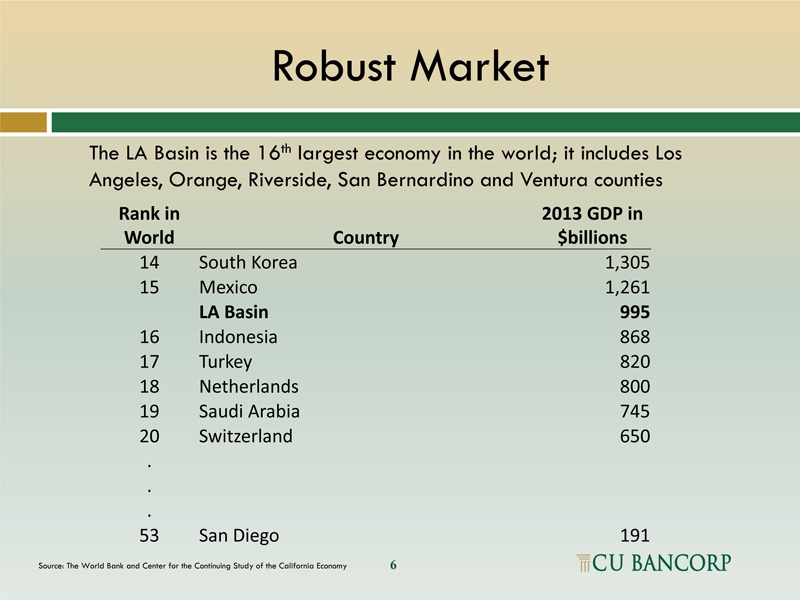

Robust Market

The LA Basin is the 16th largest economy in the world; it includes Los Angeles, Orange, Riverside, San Bernardino and Ventura counties

Rank in 2013 GDP in World Country $billions

14 South Korea 1,305

15 Mexico 1,261

LA Basin 995

16 Indonesia 868

17 Turkey 820

18 Netherlands 800

19 Saudi Arabia 745

20 Switzerland 650 . . .

53 San Diego 191

Source: The World Bank and Center for the Continuing Study of the California Economy

6

10 Branch Footprint Covers Five-County Area– The 16th Largest Economy in the World

Branch consolidation in Irvine

FENB Woodland Hills LPO to be consolidated into a CUNB branch

7

Strategic Locations

CUNB (8 branches) Santa Clarita Valley:

CUNB: $77 million

FENB (3 branches; 1 LPO)

Simi Valley: $100 Million+ Branches CUNB: $12 million

Downtown LA: Inland Empire:

FENB: $312 million FENB: $76 million

Conejo Valley:

CUNB: $219 million

Anaheim:

San Fernando Valley: CUNB: $199 million CUNB: $235 million

Irvine/Newport Beach:

CUNB: $147 million West LA: FENB: $290 million CUNB: $279 million Pro Forma: $437 million

South Bay:

CUNB: $69 million

Source: CUNB and FENB; branch deposits data as of Sept. 30, 2014

8

How We Compete

Approximately 80% of our new business comes from large banks

CUB’s relationship managers are more accessible and offer more personalized service than larger banks

Dedicated to the communities we serve

CUB employees volunteer at more than 75 nonprofit organizations

Annual golf tournament has raised more than $1.2 million to date

Six local Advisory Boards provide referrals and serve as CUB’s “eyes and ears” in the community

9

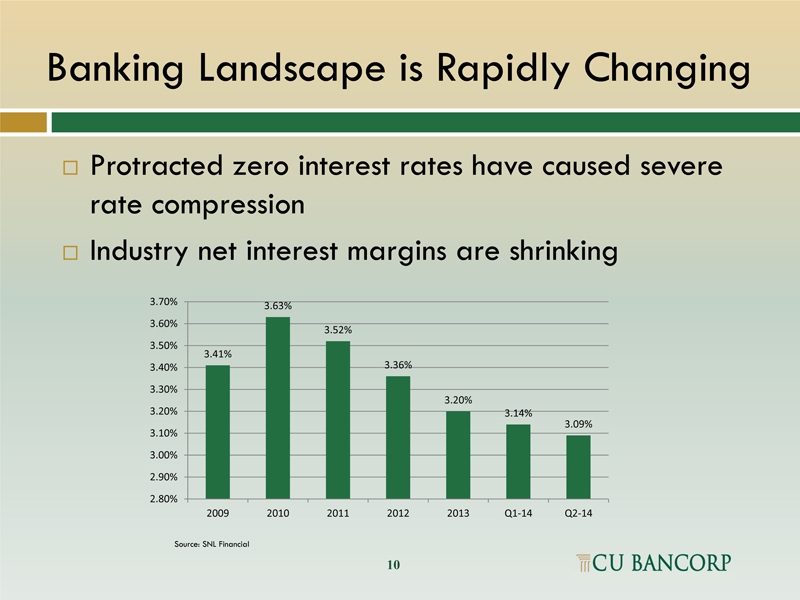

Banking Landscape is Rapidly Changing

Protracted zero interest rates have caused severe rate compression

Industry net interest margins are shrinking

3.70%

3.70%

3.63%

3.60%

3.52%

3.50%

3.41%

3.40%

3.36%

3.30%

3.20%

3.20%

3.14%

3.09%

3.10%

3.00%

2.90%

2.80%

2009

2010

2011

2012

2013

Q1-14

Q2-14

Source: SNL Financial

10

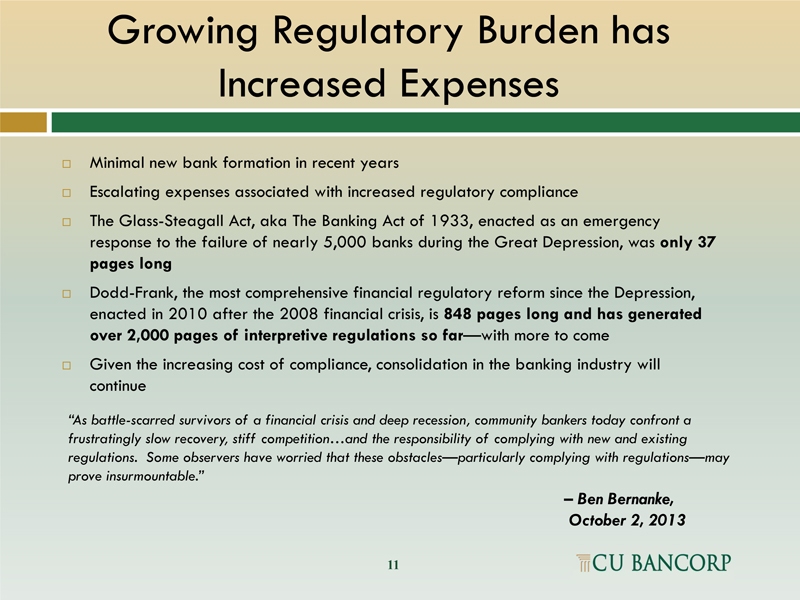

Growing Regulatory Burden has Increased Expenses

Minimal new bank formation in recent years

Escalating expenses associated with increased regulatory compliance

The Glass-Steagall Act, aka The Banking Act of 1933, enacted as an emergency response to the failure of nearly 5,000 banks during the Great Depression, was only 37 pages long

Dodd-Frank, the most comprehensive financial regulatory reform since the Depression, enacted in 2010 after the 2008 financial crisis, is 848 pages long and has generated over 2,000 pages of interpretive regulations so far—with more to come

Given the increasing cost of compliance, consolidation in the banking industry will continue

“As battle-scarred survivors of a financial crisis and deep recession, community bankers today confront a frustratingly slow recovery, stiff competition…and the responsibility of complying with new and existing regulations. Some observers have worried that these obstacles—particularly complying with regulations—may prove insurmountable.”

– Ben Bernanke, October 2, 2013

11

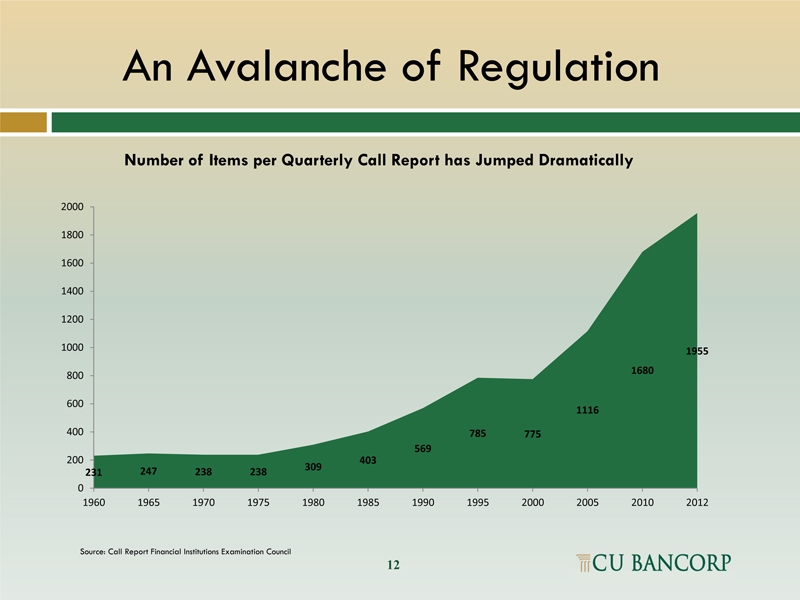

An Avalanche of Regulation

Number of Items per Quarterly Call Report has Jumped Dramatically

2000 1800 1600 1400 1200

1000 1955 1680

800

600

1116

400 785 775 569

200 403 309 231 247 238 238

0

1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 2012

Source: Call Report Financial Institutions Examination Council

12

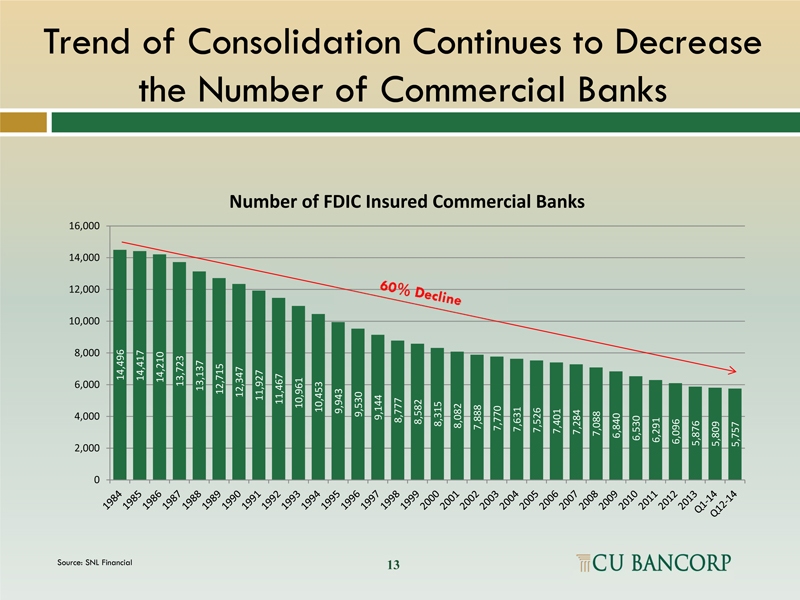

Trend of Consolidation Continues to Decrease the Number of Commercial Banks

Number of FDIC Insured Commercial Banks

0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000

14,496

14,417

14,210

13,723

13,137

12,715

12,347

11,927

11,467

10,961

10,453

9,943

9,530

9,144

8,777

8,582

8,315

8,082

7,888

7,770

7,631

7,526

7,401

7,284

7,088

6,840 6,530 6,291 6,096 5,876 5,809 5,757

1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

2005 2006 2007 2008 2009 2010 2011 2012 2013 Q1-14 Q12-14

Source: SNL Financial 13

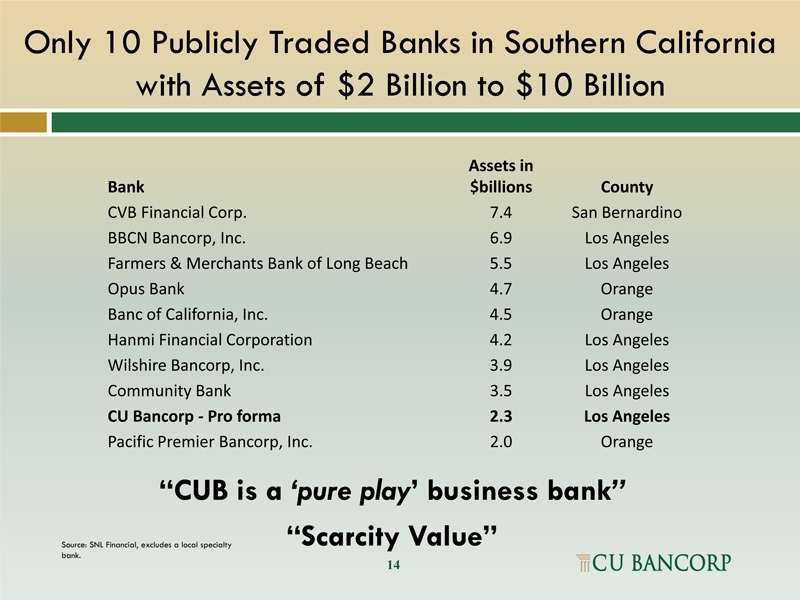

Only 10 Publicly Traded Banks in Southern California with Assets of $2 Billion to $10 Billion

Assets in

Bank $billions County

CVB Financial Corp. 7.4 San Bernardino

BBCN Bancorp, Inc. 6.9 Los Angeles

Farmers & Merchants Bank of Long Beach 5.5 Los Angeles

Opus Bank 4.7 Orange

Banc of California, Inc. 4.5 Orange

Hanmi Financial Corporation 4.2 Los Angeles

Wilshire Bancorp, Inc. 3.9 Los Angeles

Community Bank 3.5 Los Angeles

CU Bancorp—Pro forma 2.3 Los Angeles

Pacific Premier Bancorp, Inc. 2.0 Orange

“CUB is a ‘pure play’ business bank”

Source: SNL Financial, excludes a local specialty “Scarcity Value” bank.

14

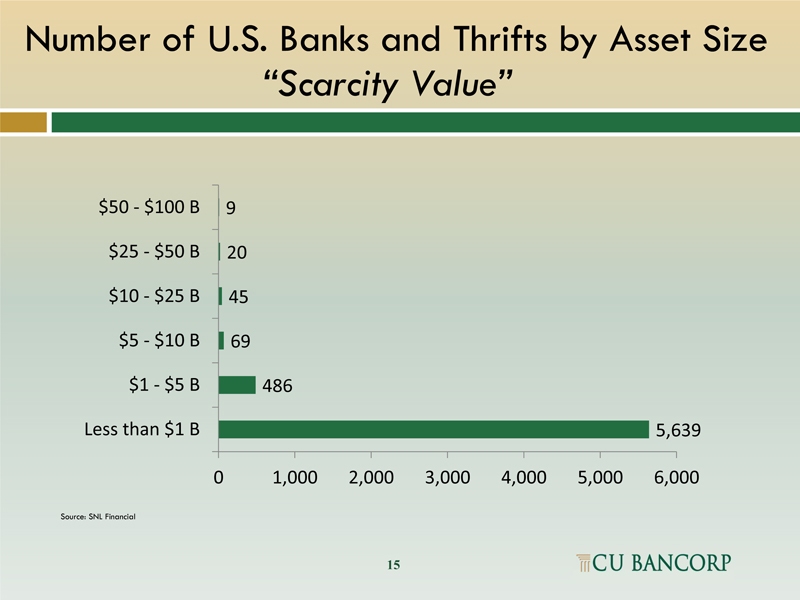

Number of U.S. Banks and Thrifts by Asset Size

“Scarcity Value”

$50—$100 B 9

$25—$50 B 20

$10—$25 B 45

$5—$10 B 69

$1—$5 B 486

Less than $1 B 5,639

0 1,000 2,000 3,000 4,000 5,000 6,000

Source: SNL Financial

15

CUNB & FENB Share the Same Corporate Values

Deliver “old fashioned banking relationship” that business owners want

Service, Service, Service

Value our employees

Disciplined credit culture

“Passionate” – committed to being the very best!

Build shareholder value

16

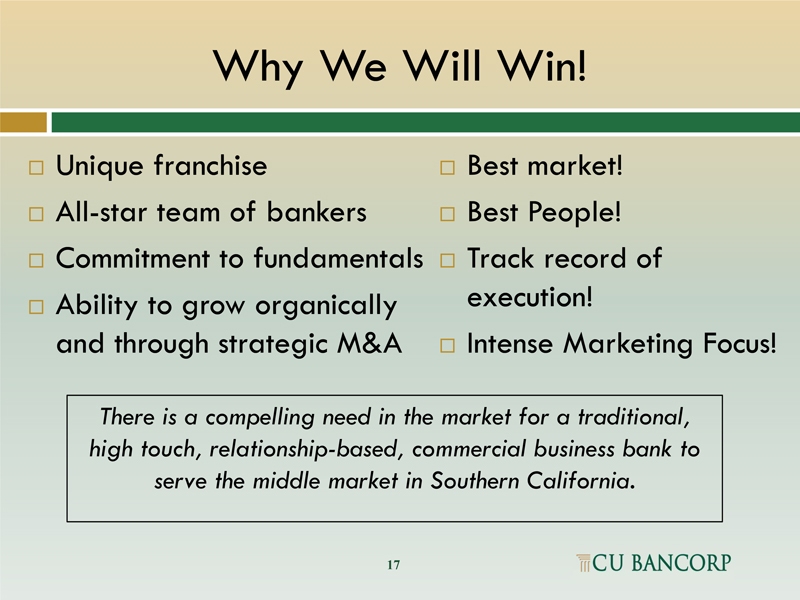

Why We Will Win!

Unique franchise

Best market!

All-star team of bankers

Best People!

Commitment to fundamentals

Track record of

Ability to grow organically execution! and through strategic M&A

Intense Marketing Focus!

There is a compelling need in the market for a traditional, high touch, relationship-based, commercial business bank to serve the middle market in Southern California.

17

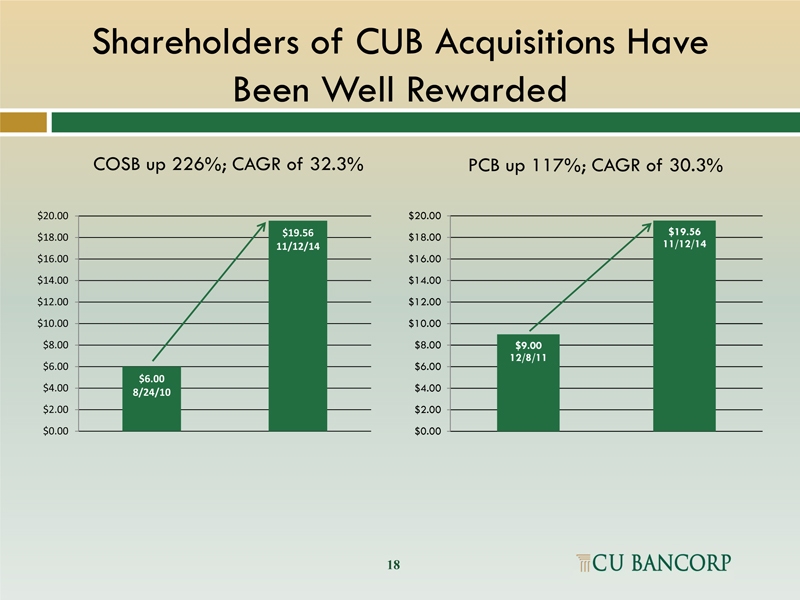

Shareholders of CUB Acquisitions Have Been Well Rewarded

COSB up 226%; CAGR of 32.3%

PCB up 117%; CAGR of

30.3%

$20.00

$20.00

$18.00

$19.56

$18.00

$19.56

11/12/14

11/12/14

$16.00

$16.00

$14.00

$14.00

$12.00

$12.00

$10.00

$10.00

$8.00

$8.00

$9.00

12/8/11

$6.00

$6.00

$6.00

$4.00

$4.00

8/24/10

$2.00

$2.00

$0.00

$0.00

18

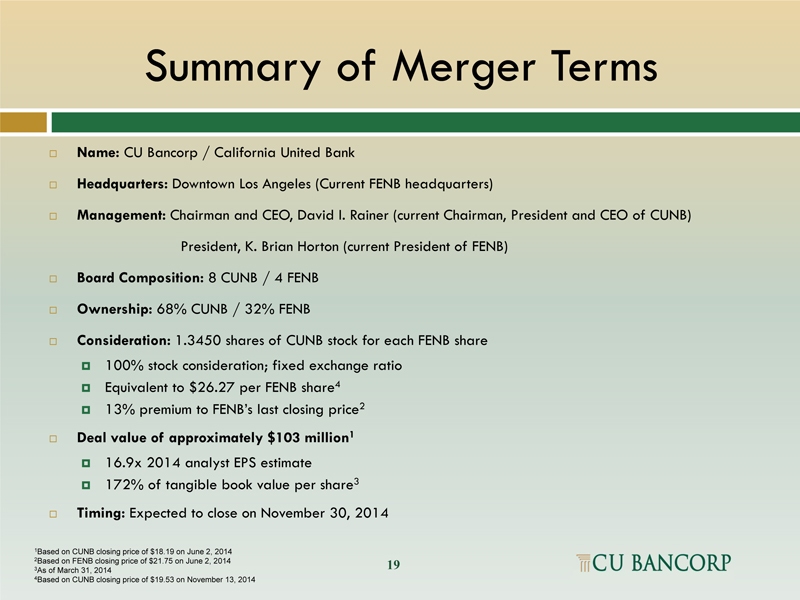

Summary of Merger Terms

Name: CU Bancorp / California United Bank

Headquarters: Downtown Los Angeles (Current FENB headquarters)

Management: Chairman and CEO, David I. Rainer (current Chairman, President and CEO of CUNB)

President, K. Brian Horton (current President of FENB)

Board Composition: 8 CUNB / 4 FENB

Ownership: 68% CUNB / 32% FENB

Consideration: 1.3450 shares of CUNB stock for each FENB share

100% stock consideration; fixed exchange ratio

Equivalent to $26.27 per FENB share4

13% premium to FENB’s last closing price2

Deal value of approximately $103 million1

16.9x 2014 analyst EPS estimate

172% of tangible book value per share3

Timing: Expected to close on November 30, 2014

1Based on CUNB closing price of $18.19 on June 2, 2014 2Based on FENB closing price of $21.75 on June 2, 2014 3As of March 31, 2014 4Based on CUNB closing price of $19.53 on November 13, 2014

19

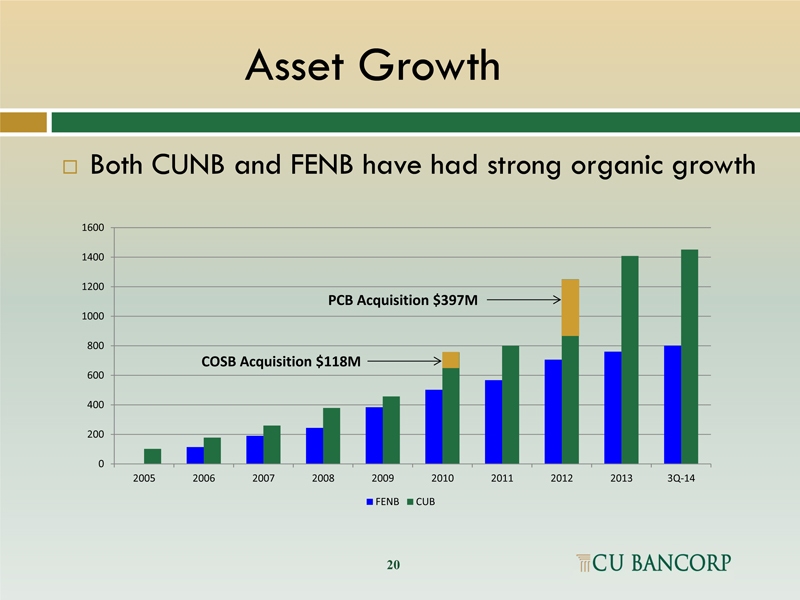

Asset Growth

Both CUNB and FENB have had strong organic growth

1600

1400

1200

PCB Acquisition $397M

1000

800

COSB Acquisition $118M

600 400 200

0

2005 2006 2007 2008 2009 2010 2011 2012 2013 3Q-14

FENB CUB

20

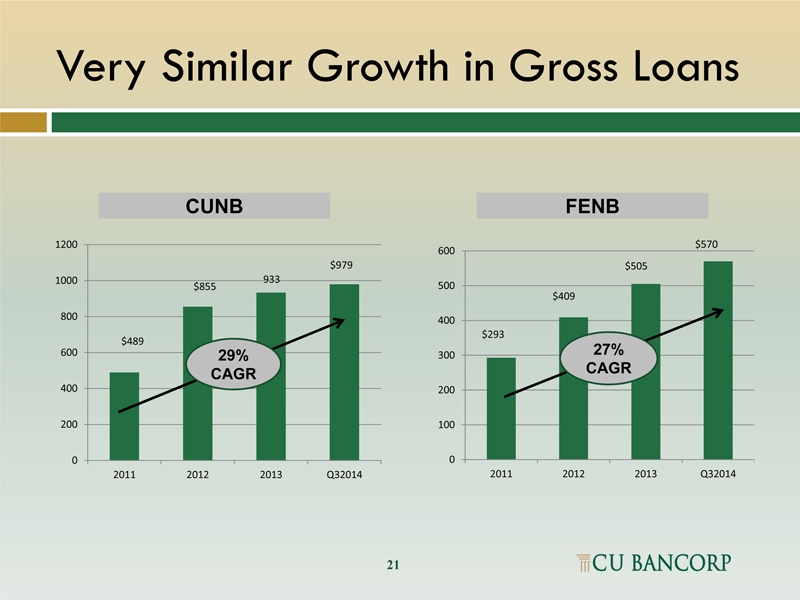

Very Similar Growth in Gross Loans

CUNB FENB

0

200

400

600

800

1000

1200

$489

$855

933

$979

2011 2012 2013 Q32014

29% CAGR

0

100

200

300

400

500

600

$293

$409

$505

$570

2011 2012 2013 Q32014

27% CAGR

21

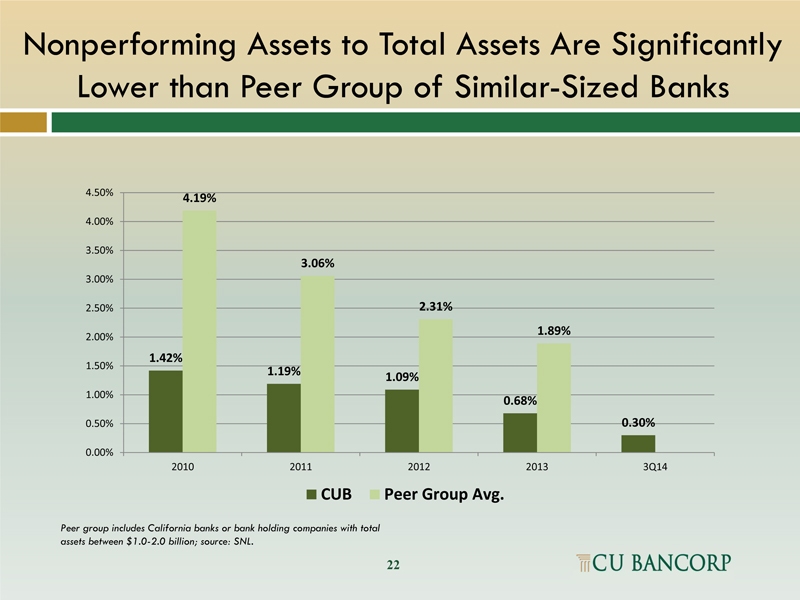

Nonperforming Assets to Total Assets Are Significantly

Lower than Peer Group of Similar-Sized Banks

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

1.42%

1.19%

1.09%

0.68%

0.30%

4.19%

3.06%

2.31%

1.89%

2010 2011 2012 2013 3Q14

CUB Peer Group Avg.

Peer group includes California banks or bank holding companies with total assets between $1.0-2.0 billion; source: SNL. 22

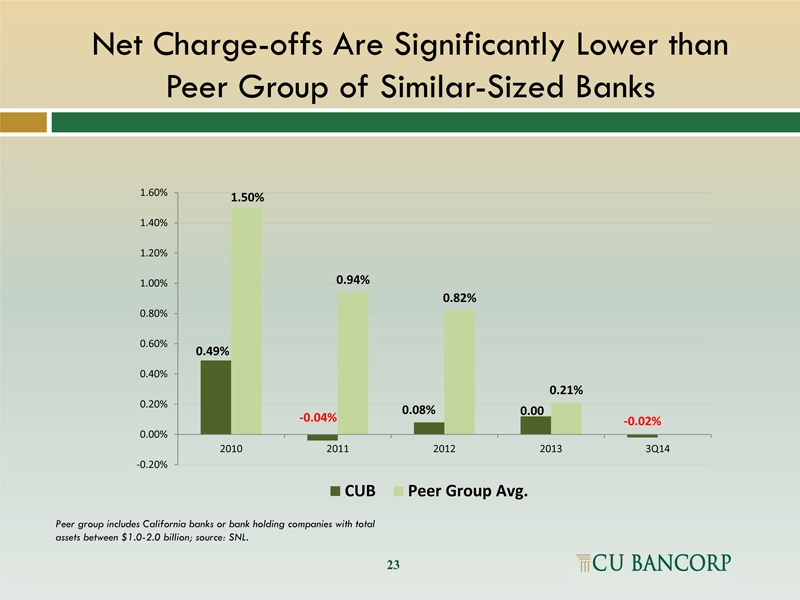

Net Charge-offs Are Significantly Lower than

Peer Group of Similar-Sized Banks

-2.20%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

1.60%

0.49% 1.50% -0.04% 0.94% 0.08% 0.82% 0.00 0.21% -0.02%

2010 2011 2012 2013 3Q14

CUB Peer Group Avg.

Peer group includes California banks or bank holding companies with total assets between $1.0-2.0 billion; source: SNL.

23

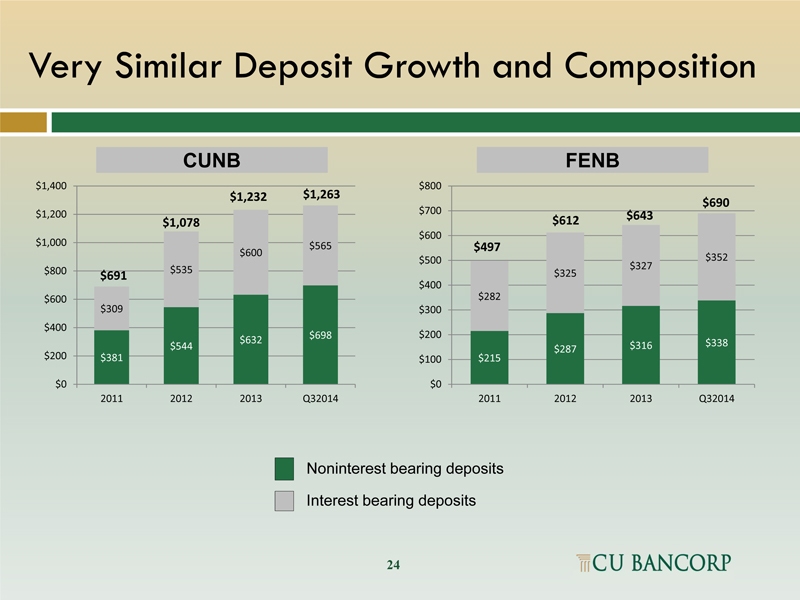

Very Similar Deposit Growth and Composition

CUNB

$1,400 $1,232 $1,263 $1,200 $1,078 $1,000 $565 $600 $800 $535 $691

$600 $309 $400 $698 $632 $544 $200 $381

$0

2011 2012 2013 Q32014

FENB

$800 $690 $700 $612 $643 $600 $497 $500 $327 $352 $325 $400 $282 $300

$200 $338 $287 $316 $100 $215

$0

2011 2012 2013 Q32014

Noninterest bearing deposits

Interest bearing deposits

24

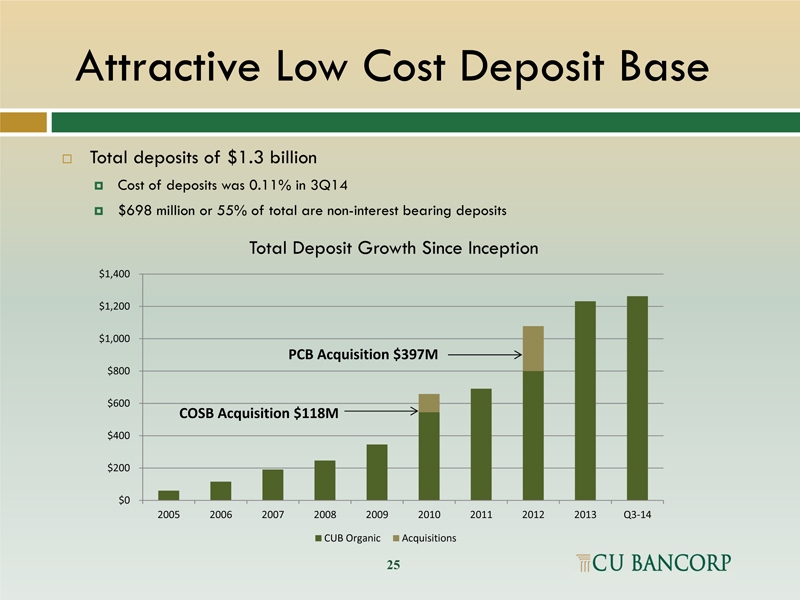

Attractive Low Cost Deposit Base

Total deposits of $1.3 billion

Cost of deposits was 0.11% in 3Q14

$698 million or 55% of total are non-interest bearing deposits

Total Deposit Growth Since Inception

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

PCB Acquisition $397M

COSB Acquisition $118M

2005 2006 2007 2008 2009 2010 2011 2012 2013 Q3-14

CUB Organic Acquisitions

25

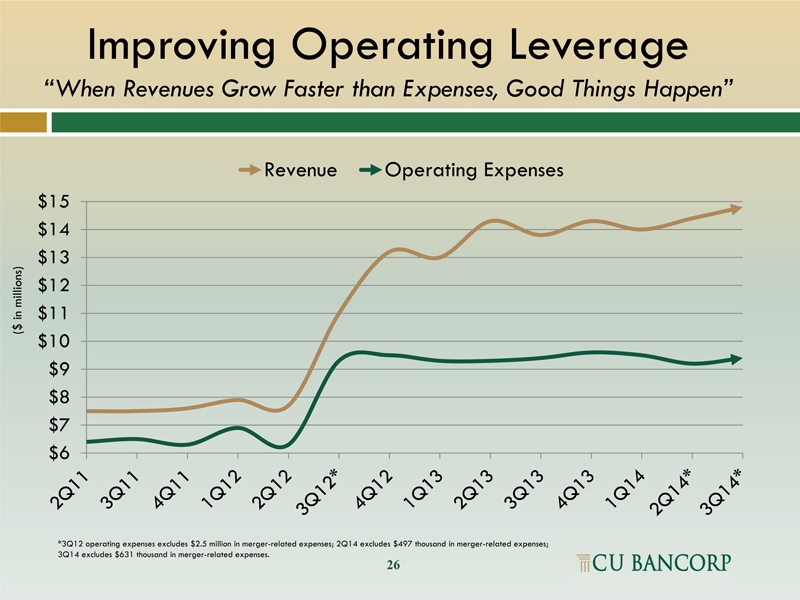

Improving Operating Leverage

“When Revenues Grow Faster than Expenses, Good Things Happen”

Revenue Operating Expenses

$15 $14 $13

millions) $12 in $11 $

( $10 $9 $8 $7 $6

*3Q12 operating expenses excludes $2.5 million in merger-related expenses; 2Q14 excludes $497 thousand in merger-related expenses; 3Q14 excludes $631 thousand in merger-related expenses.

26

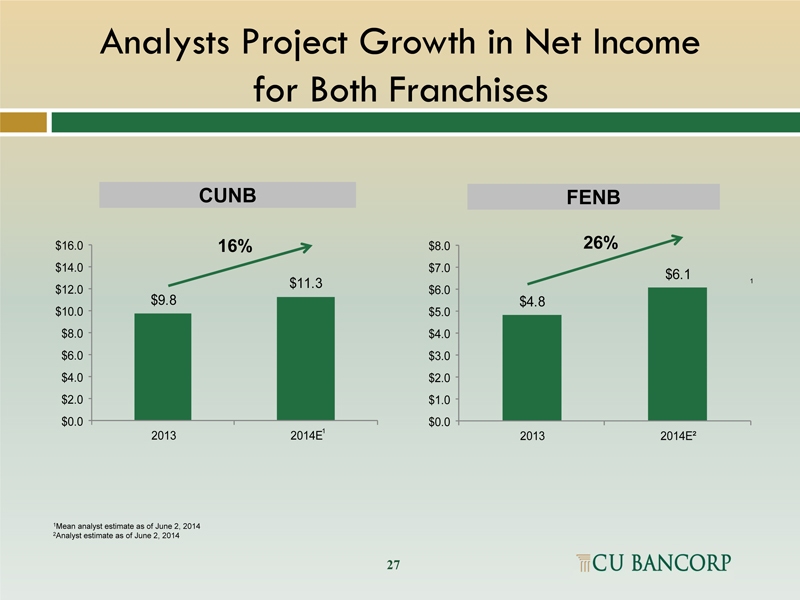

Analysts Project Growth in Net Income for Both Franchises

CUNB

$16.0 16%

$14.0

$11.3

$12.0

$10.0 $9.8

$8.0

$6.0

$4.0

$2.0

$0.0

2013 2014E1

FENB

$8.0 26%

$7.0 $6.1

$6.0 1

$4.8

$5.0

$4.0

$3.0

$2.0

$1.0

$0.0

2013 2014E²

1Mean analyst estimate as of June 2, 2014 2Analyst estimate as of June 2, 2014

27

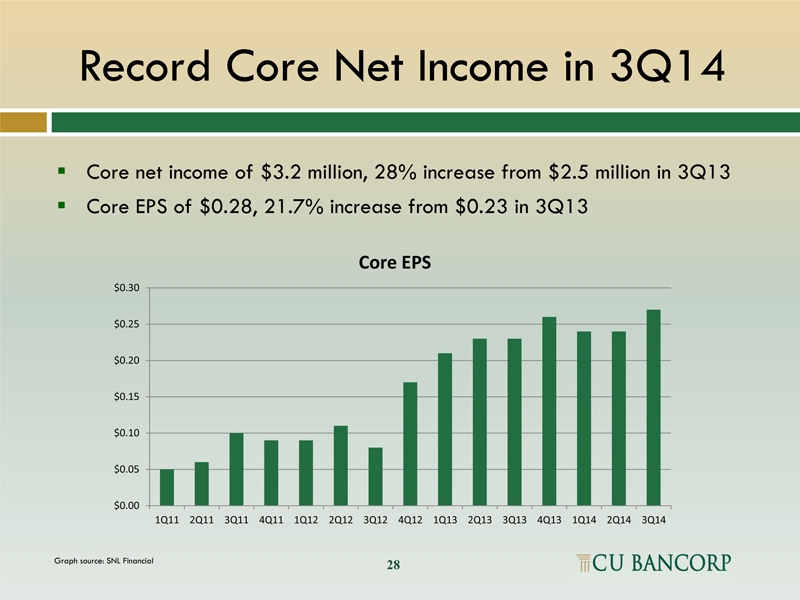

Record Core Net Income in 3Q14

Core net income of $3.2 million, 28% increase from $2.5 million in 3Q13 Core EPS of $0.28, 21.7% increase from $0.23 in 3Q13

Core EPS

$0.30 $0.25 $0.20 $0.15 $0.10 $0.05

$0.00

1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14

Graph source: SNL Financial

28

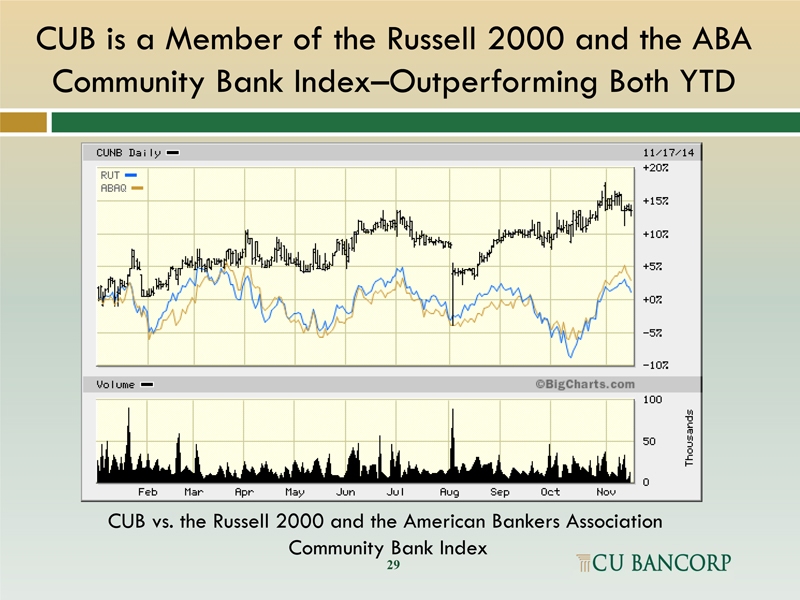

CUB is a Member of the Russell 2000 and the ABA Community Bank Index–Outperforming Both YTD

CUB vs. the Russell 2000 and the American Bankers Association Community Bank Index

29