Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FreightCar America, Inc. | d819509d8k.htm |

November

2014 Exhibit 99.1 |

Forward-Looking Statements

2

This presentation contains statements relating to our expected financial performance

and/or future business prospects, events and plans that are “forward-looking

statements” as defined under the Private Securities Litigation Reform Act of

1995. Forward-looking statements represent our estimates and assumptions only

as of the date of this presentation. Our actual results may differ materially from the

results described in or anticipated by our forward-looking statements due to certain

risks and uncertainties. These potential risks and uncertainties include, among other

things: the cyclical nature of our business; adverse economic and market conditions;

fluctuating costs of raw materials, including steel and aluminum, and delays in the

delivery of raw materials; our ability to maintain relationships with our suppliers of

railcar components; our reliance upon a small number of customers that represent a large

percentage of our sales; the variable purchase patterns of our customers and the timing

of completion, delivery and customer acceptance of orders; the highly competitive nature

of our industry; the risk of lack of acceptance of our new railcar offerings by our

customers; and the additional risk factors described in our filings with the Securities

and Exchange Commission. We expressly disclaim any duty to provide updates to any

forward-looking statements made in this presentation, whether as a result of new

information, future events or otherwise. |

About Us

Diverse business model —

manufacturing, leasing, services

Full range of railcar types, excluding tank cars

Industry leader in coal cars

Manufacturing facilities in Cherokee, Alabama (Shoals);

Roanoke, Virginia; and Danville, Illinois

Scalable and flexible operations

3 |

Investment

Highlights New and redesigned products have provided growth

opportunities and expanded access to a $2.7 billion annual

railcar delivery market (excluding tank cars)*

Robust environment for broad range of freight cars

Coal car market leader

International growth opportunities

Q3 2014 backlog (railcar units) up 90% over prior year

YTD 2014 revenues and EPS up significantly over 2013

Strong balance sheet with no debt

* Based on Company estimates using 2014 industry data

4 |

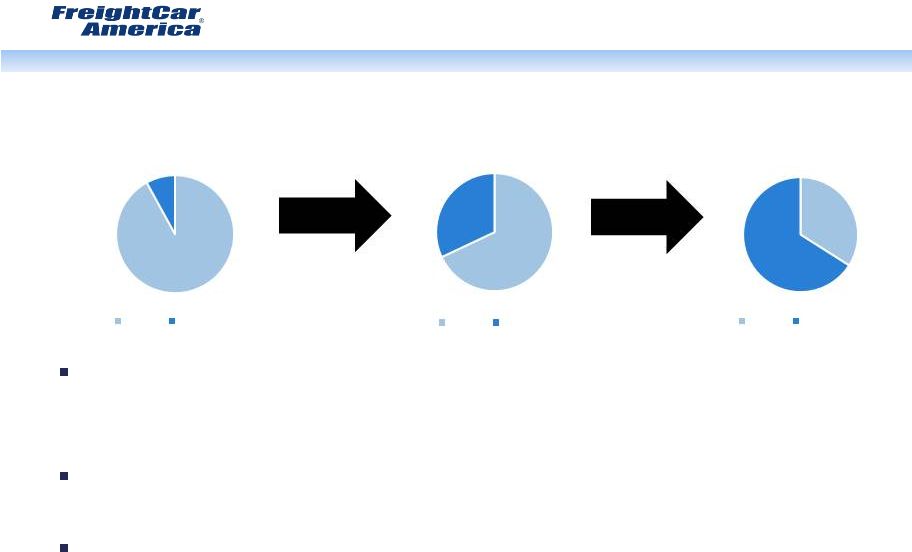

Diversified

Business Model 5

Coal Cars

Other Open

Top Hoppers

and

Gondolas

Covered

Hoppers

Boxcars

Intermodal

Cars

Non-

Intermodal

Flat Cars

Manufacturing

Parts Sales

Maintenance

and Repair

Services

Leasing |

Diverse Customer

Base Railroads

Shippers

6

Financial Institutions |

Freight

Cars Intermodal

Covered Hoppers

7

Cement

Frac sand

Grain and DDG

Potash and soda ash

Food-grade service

Plastic pellets

Trucking industry issues drive

modal shifts

o

Driver shortages

o

Highway congestion

Expansion of Panama Canal

Cost savings opportunities for

shippers |

Select Other

Freight Cars Bulkhead Flat

8

World Class Engineering Capabilities

Hybrid Aggregate Hopper

66-Foot Mill Gondola

Steel Aggregate Hopper |

Leader in Coal

Cars Aluminum Coal Car

Stainless Steel/Hybrid Coal Car

Aluminum

58% of total North American coal cars

Primarily Western service

Demand driven by electricity

generation and industrial production

Relatively young fleet; not expected to

see meaningful demand for some time

Steel

42% of total North American coal cars

Primarily Eastern service

Demand driven by replacement of

aging fleet

Replacement cycle will continue over

long term

9 |

Diversification

Strategy - Manufacturing

Investment in Shoals facility and new product development led to

successful transition from reliance on coal cars to near-full range of

freight car types

Provides growth opportunities in strong covered hopper, intermodal

and other freight car markets

Diversification can reduce revenue and earnings volatility while

maintaining position as premier coal car manufacturer

10

92%

8%

2008-2012 Avg.

(Units Delivered)

Coal

Non-Coal

68%

32%

2013

(Units Delivered)

34%

66%

Q3 2014 Backlog

(Units)

Coal

Non-Coal

Coal

Non-Coal |

Footprint

– Shoals Facility

State-of-the-art facility subleased

February 2013

On line July 2013

Initial build-out completed June

2014

New line to be added in Q2 2015

Proximity to key suppliers

Flexible manufacturing capacity for

a wide variety of freight cars

Primary facility for non-coal cars

11 |

Footprint

– Roanoke and

Danville Facilities

Primary facilities for coal

car manufacturing

Scalable and flexible

work force

Low fixed costs

12 |

Footprint

– Services

2 railcar maintenance and

repair facilities

•

Strategically located on high-

volume corridors

•

Servicing coal and other car types

•

Routine maintenance, regulatory

programs, car modifications and

rebuilds

Parts sales for variety of car

types

•

2 warehouses serving high-volume

Powder River Basin and East Coast

corridors

Grand Island, NE

Hastings, NE

Johnstown,

PA

13 |

Freight Car

Market Overview Growing freight car market

•

Greater demand to support growing

North American energy market

•

Intermodal is the second largest

category for loadings and revenues

for railroads

•

Increasing North American

consumption and expansion of

Panama Canal

•

Higher demand for environmental

compliance and construction

aggregates

•

Strengthening covered hopper

market

•

Slower railroad speeds

14 |

Coal Car Market

Overview Currently, coal constitutes 20% of

loadings and gross revenues and 40% of

tonnage for U.S. Class I railroads

Near term, coal car demand is challenged

Long-term opportunities

15

•

Coal projected to account for at least 32%

of the US’s electricity generation through 2040

•

U.S. coal production forecasted to

grow modestly through 2040

•

Approximately 1/4 of the estimated 240,000 coal

cars in service are 30+ years in age |

Railcar

Industry Delivery Forecast

†

Strong market demand has

tightened industry capacity

Strong 3-year CAGR

projections (2013-2016)

•

Open-Top Hoppers +79%

•

Intermodal +53%

•

Gondolas +39%

•

Covered Hoppers +25%

16

†

September 2014 (Q3) FTR Rail Equipment Outlook

*Units, North America

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

2011

2012

2013

2014F

2015F

2016F

2017F

2018F

Box Cars

Covered Hopper

Gondolas

Flat

Cars

(Including

Intermodal)

Tank Cars

Other Cars

Open-Top Hoppers |

Complementary

Services Diversify Revenue Mix

Increasing demand for repair

services

•

New technologies increasing frequency

of railcar repairs

•

Aging national coal car fleet will

require increasing maintenance

•

New tank car regulations could tighten

industry capacity

Less cyclical than freight car

manufacturing

Large, fragmented market*

•

Total replacement parts: $3.5B

•

Total freight car maintenance and

repair: $1.8B

•

Coal car maintenance and repair:

$500M

17

Drop Table -

Grand Island, Nebraska

* Based on Company estimates |

International

Growth Opportunities

Global middle-class population growth, coupled with

an increasing trend toward urbanization, should

drive demand for all railcar types

Significant portion of world’s electricity needs will be

met by coal, driving rapidly expanding coal

production in countries with large reserves

•

Significant growth in global electricity demand will drive 44%

increase in coal production through 2040*

•

Railcar export potential from the U.S.

•

International railcar manufacturing opportunities

18

*USEIA International Energy Outlook 2013 |

Growth Drivers

- Summary

Transportation industry dynamics favor rail

Long term, coal will continue to play an important role

for U.S. electricity generation

Growing freight car market due to increasing North

American consumption and higher demand for support

of energy market

Maintenance and repair is large, fragmented market

Demand for repair services increasing due to increased

frequency of railcar repairs and aging national coal car

fleet

International growth opportunities

19 |

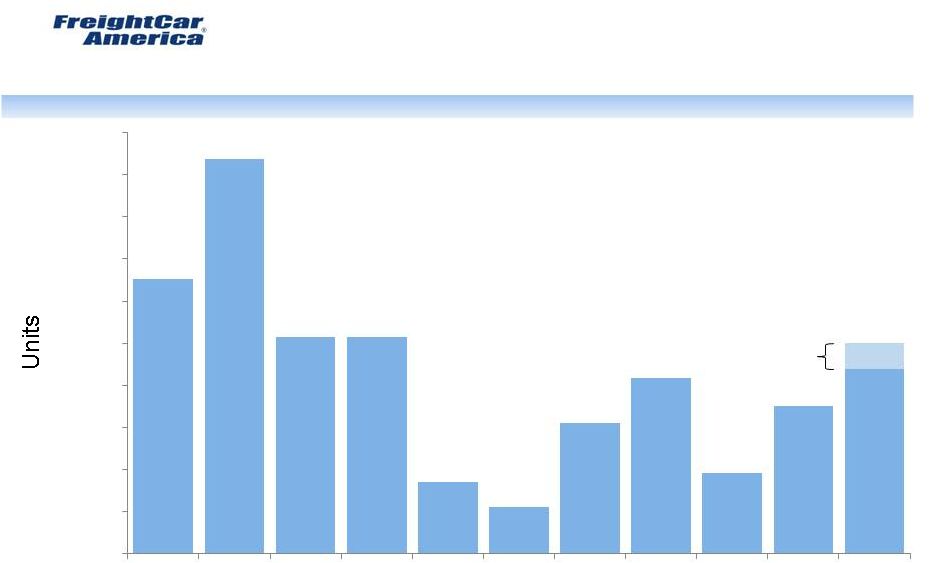

Company

Deliveries *Reflects Company estimates of full-year deliveries

20

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

20,000

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014*

2015*

13,031

18,764

10,282

10,276

3,377

2,229

6,188

8,325

3,821

7,000

9,000

2015

Projected

Range

10,000 |

Growing Company

Backlog 21

Growth reflects

diversification strategy

into non-coal cars

20,729

9,315

5,399

2,424

265

2,054

8,303

2,881

6,826

7,727

8,493

13,514

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

20,000

22,000

24,000

2005

2006

2007

2008

2009

2010

2011

2012

2013

Q1

2014

Q2

2014

Q3

2014

Units

Dollar Value

Valued at $1.1 billion;

non-coal cars comprise

66% of units |

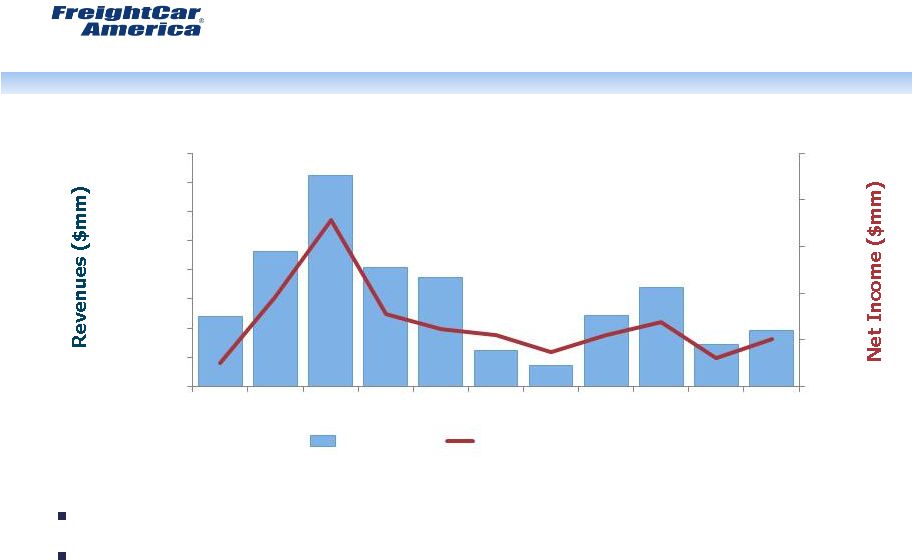

Revenue and

Earnings History Diversification strategy targets growth while mitigating

cyclicality YTD 2014 revenues and earnings up significantly over 2013

22

$482

$927

$817

$746

$249

$143

$487

$677

$290

$386

($50)

$0

$50

$100

$150

$200

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Q3

YTD

2014

Revenues

Net Income

$1,445 |

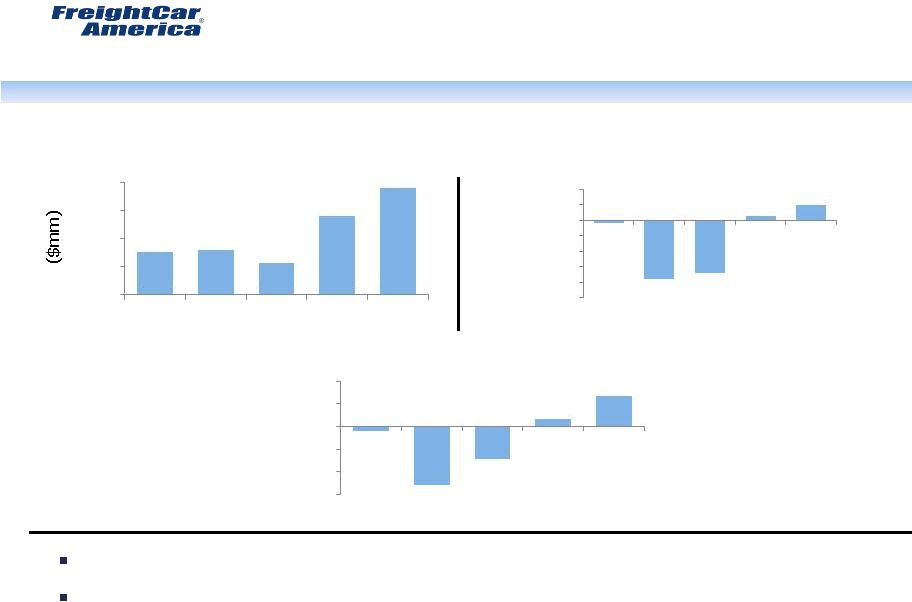

Recent Financial

History Q3 2014 Y/Y revenue growth of 151% driven by unit growth

Q3 2014 Y/Y operating income margin improvement a result of higher unit

volume and operating leverage

23

$75.9

$79.7

$56.1

$139.7

$190.3

$0

$50

$100

$150

$200

Q3 13

Q4 13

Q1 14

Q2 14

Q3 14

Revenues

-30%

-24%

-18%

-12%

-

6%

0%

6%

12%

Q3 13

Q4 13

Q1 14

Q2 14

Q3 14

Operating Income Margin

$(0.08)

$(1.03)

$(0.58)

$0.13

$0.53

-$1.20

-$0.80

-$0.40

$0.00

$0.40

$0.80

Q3 13

Q4 13

Q1 14

Q2 14

Q3 14

EPS

-22.7%

-20.6%

1.7%

5.9%

-1.2% |

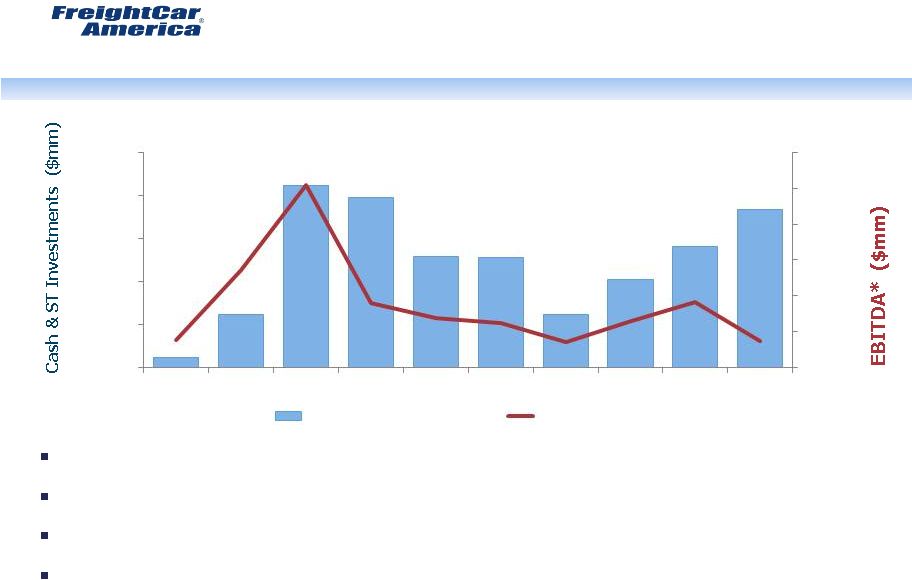

Strong Balance

Sheet Cash & short-term investments of $74 million and no debt at September 30,

2014 Strong cash position maintained to manage through industry cycles

Strict working capital management

Pension and OPEB liabilities of $64 million at end of 2013

24

*See page 27 for additional information

$11

$62

$212

$197

$129

$128

$62

$102

$140

$184

($50)

$0

$50

$100

$150

$200

$250

$0

$50

$100

$150

$200

$250

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Cash & ST Investments

EBITDA* |

FreightCar

America Outlook Unit delivery projections of 7,000 for 2014

Unit delivery projections between 9,000 and 10,000 for 2015

Revenue levels are dependent on manufacturing mix (new vs.

rebuild and car type)

25 |

Growing

Shareholder Value 26

Capitalize

on

Diversified

Product

Portfolio

Maintain

Coal Car

Market

Leadership

Grow

Services

Contribution

International

Market

Opportunities

Manage

Business for

the Long

Term

Capitalize

on |

Non-GAAP

Reconciliation EBITDA

27

($ in thousands)

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2013

2014

Net income (loss)

($24,860)

$45,693

$128,733

$27,459

$11,420

$4,784

($12,862)

$4,939

$19,095

($19,295)

($7,008)

$1,098

Interest income

(282)

(1,225)

(5,860)

(8,349)

(3,827)

(124)

(89)

(6)

(11)

(64)

(59)

(48)

Interest expense and deferred

financing costs

14,315

11,858

658

652

677

793

965

226

384

809

481

854

Income tax provision (benefit)

(7,962)

21,762

75,530

15,389

6,769

248

(9,511)

354

13,771

(5,537)

633

252

Depreciation and amortization

7,350

7,810

5,442

3,910

4,380

5,658

7,015

8,821

8,398

10,077

7,289

7,481

EBITDA

($11,439)

$85,898

$204,503

$39,061

$19,419

$11,359

($14,482)

$14,334

$41,637

($14,010)

$1,336

$9,637

Nine months ended

September 30,

EBITDA is defined as net income (loss) before interest income, interest expense and deferred

financing costs, income tax provision (benefit) and depreciation and amortization. We

believe that EBITDA is useful to investors in evaluating our operating performance compared to that of other companies in our industry. In

addition, our management uses EBITDA to evaluate our operating performance. The calculation of

EBITDA eliminates the effects of financing, income taxes and the accounting effects of

capital spending. These items may vary for different companies for reasons unrelated to the overall operating performance of a

company’s business. EBITDA is not a financial measure presented in accordance with

GAAP. Accordingly, when analyzing our operating performance, investors should not

consider EBITDA in isolation or as a substitute for net income (loss), cash flows from operating activities or other statements of operations or cash flow

data prepared in accordance with GAAP. Our calculation of EBITDA is not necessarily comparable

to that of other similarly titled measures provided by other companies.

We recognize that the usefulness of EBITDA has certain limitations. EBITDA does not

include the provision for income taxes and, because the payment of income taxes is a

necessary element of our costs, any measure that excludes income tax expense may have material limitations. EBITDA does not include depreciation

and amortization and, because we use capital assets, depreciation and amortization expense is a

necessary element of our costs and ability to generate profits and any measure that

excludes depreciation and amortization expense may have material limitations. EBITDA does not reflect cash expenditures or future

requirements for capital expenditures or contractual commitments and does not reflect changes

in, or cash requirements for, working capital needs. We compensate for the

foregoing limitations by using EBITDA as a comparative tool, together with GAAP measures, to assist in the evaluation of our operating

performance.

|