Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - 180 DEGREE CAPITAL CORP. /NY/ | v393864_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - 180 DEGREE CAPITAL CORP. /NY/ | v393864_ex99-2.htm |

Exhibit 99.1

Fellow Shareholders:

We will begin this third quarter 2014 Shareholder Letter by sharing a few updates on our business. We will then step back and provide a higher-level picture of both the challenge and the opportunity that presents itself to Harris & Harris Group. We are passionate about our business and the innovations we help bring to market.

We finished the third quarter of 2014 with $35,667,921 of primary and secondary liquidity, up from $33,620,478 at year-end 2013. Our primary liquidity consisted of $22,450,225 in cash and $2,119,570 in certain receivables, the vast majority of which relates to the first milestone payment from Amgen’s acquisition of BioVex Group, Inc., totaling $2,070,955. This milestone payment became due following acceptance by the FDA of a Biologics License Application (“BLA”) by Amgen after successful completion of its Phase III clinical trials. We are excited to potentially see this important malignant melanoma treatment reaching the market for cancer treatment in the near future.

Our secondary liquidity increased primarily as a result of the reverse merger of Enumeral Biomedical Corp. into a publicly traded shell company, Enumeral Biomedical Holdings, Inc., during the third quarter of 2014. Enumeral accounts for $8,857,444 of the total amount of secondary liquidity, and our shares are restricted until January 31, 2016. We were excited to see Enumeral successfully raise approximately $21.5 million in financing, and we look forward to continuing to build Enumeral in the years to come, now as a public company. Going forward, shareholders may see some volatility in the value of our securities of Enumeral resulting from volatility in the trading price of Enumeral’s stock as is often the case with small publicly traded companies. Shareholders may wish to read our recently posted blog on Enumeral by Daniel Wolfe. It can be accessed at http://www.hhvc.com/blog/harnessing-the-human-immune-system-on-a-single-cell-level/.

Our net asset value per share (“NAV”) decreased slightly to $3.85 during the third quarter of 2014 after increasing in the second quarter to $3.87. One reason for the decrease in NAV was owing to the inclusion of option pricing modeling into our valuation methodologies during the third quarter of 2014. As you can see from the Consolidated Schedule of Investments beginning on page 7 of the Quarterly report on Form 10-Q, the total values of our securities of D-Wave Systems, HZO and PWA all moved substantially, with D-Wave Systems decreasing by $2,110,030, HZO decreasing by $1,603,311 and PWA increasing by $1,654,040.

These changes do not reflect fundamental changes in the businesses of each of these companies. All three companies raised capital during the second quarter of 2014 at increased valuations, and continue to execute on their business plans. The negative net change in value of these three companies of approximately $2 million, or $0.06 per share, was primarily owing to the use of option pricing models in our valuation methodologies. All three companies are important to the future of Harris & Harris Group. We are very excited about each company’s potential to create value for Harris & Harris Group.

| 1 |

We made two new investments in the third quarter of 2014, TARA Biosystems, Inc., and Accelerator IV-New York Corporation (“Accelerator”). We discussed the uniqueness of the Accelerator investment in the second quarter Letter to Shareholders that can be found on our website at http://files.shareholder.com/downloads/TINY/3552273743x0x777414/02FB8222-6661-406A-8C60-02224E8D836F/Q2_2014_Shareholder_Letter.pdf.

TARA Biosystems is based on research from the Vunjak-Novakovic Laboratory at Columbia University, the Radisic Laboratory at University of Toronto and the Langer Laboratory at MIT. It aims to capitalize on the need for more effective processes for evaluating the safety and efficacy of new therapies and new drug compounds. TARA Biosystems will initially use its “organ-on-a-chip” platform to provide physiologically-relevant “heart-on-a-chip” human tissue models for both toxicology and drug discovery applications.

Today, many promising new therapies for a variety of diseases -- most strikingly, cardiovascular disease, which kills more people than all forms of cancer combined -- must endure a painstaking, long and expensive process of testing prior to being implemented in human trials. Even then, owing to the complexity of cardiac tissue, therapies that make it through the process continue to pose serious health hazards in the patient in early testing.

TARA Biosystems has created a unique, advanced, stem cell-derived system based on its proprietary, patent-pending 'biowire' technology. This system enables testing on physiologically-relevant, 3-D heart tissue to get a more accurate, dependable reading on the safety and efficacy of the therapy under investigation. The ‘biowire’ technology significantly reduces risk and uncertainty, thus reducing the cost of development and accelerating to market only those therapies with real therapeutic value.

Our Managing Director, Misti Ushio, was quoted in the press release announcing the investment saying, "Through this investment, we are taking a leading 3-D tissue engineering and drug discovery platform from the laboratory into commercial development…. Harris & Harris Group has a history of being the first to identify exciting innovations from laboratory research and move these new technologies out of the lab and into the commercial environment.”

We believe we are leaders in the areas we invest. We believe we are investing in the right markets and opportunities. Our view of innovation is not incremental. We are involved in the science that has the capability to truly transform and improve human lives into the future. Areas we are involved in include the Internet of Things (Adesto and HZO), quantum computing (D-Wave), the microbiome (AgBiome and ProMuc), immuno-oncology (Enumeral), machine learning/healthcare information technology (EchoPixel), 3-D biology and stem cells (TARA Biosystems) and personalized medicine (Metabolon). We believe that as these companies continue to execute on their businesses, our shareholders will benefit from our early investment in these emerging areas.

Our investment thesis and Harris & Harris Group require patience that is certainly not abundant in today’s market. We realize that. We would like to close this letter by explaining why we believe the type of investing we are involved in is important to Harris & Harris Group and to future generations.

| 2 |

The economic literature is conclusive that economic growth requires long-term increases in productivity that are primarily driven by innovation. If a country is to be economically robust, it must focus resources on innovation. We think many countries, including our own, have forgotten this important economic reality.

Currently, business dynamism is on the wane. Business dynamism is the process by which firms are born, fail, expand and contract. Economic research has firmly established that this dynamic process is vital to productivity and sustained economic growth. Entrepreneurs and company builders play a crucial role in this process and in net job creation.

Recent research reveals a disturbing trend -- business dynamism is slowing down. New business formation has been on a persistent decline in the U.S. during the last few decades. Concomitant with this trend is a subdued pace of net job creation. This decline has been documented across a broad range of sectors in the U.S. economy, even in the high-tech sector. It has also coincided with a decline in U.S. competitiveness. |

|

An important finding in the literature is that the amount of capital invested in R&D is less important than the pay-off to that R&D in driving innovation, productivity and growth. Historically that pay-off came from the translation of academically-derived ideas into new businesses by company builders and corporations. However, over the past decade, we have seen a disturbing trend, a “diversity breakdown,” in the type of R&D that is being translated into economic growth. Currently, entrepreneurial financing is significantly focused in information technology and creative and commerce technologies (media, entertainment and financial services). Thus an incredibly important source of innovation has been left behind -- the hard sciences.

You can see this trend in the data. From 1985 through 1999, much of venture capital was focused on the translation of academic research. Beginning in 1998, the venture capital community primarily focused on internet opportunities, and most recently on the digital technologies of information technology and creative and commerce technologies (media, entertainment and financial services). According to a report by SUNY and New York State in 2012, 40 percent of all venture capital deals flowed to information technology and 16 percent to creative and commerce deals. This trend left only approximately 40 percent of all deals for life science and physical science deals.

Total academic research exceeds over $100 billion annually, representing a significant portion of total U.S. R&D. Approximately $65 billion of this research is performed in academic research centers. Academic R&D has increased steadily each year as well, growing approximately 30 percent over the period from 2008 through 2011.

As compared with venture capital trends in the digital technologies, information technology, and creative and commerce technologies, academic R&D shows a very different pattern of investment -- a pattern of continued investment in the hard sciences. Over the past 20 years, the distribution of academic R&D has favored the hard sciences -- life science and physical science. Currently, life sciences represent approximately 57 percent of academic R&D. The physical sciences represent 30 percent of academic R&D (down from the postwar years). Information technology and the soft sciences together represent only 13 percent of academic research, according to this SUNY research report.

| 3 |

Historically, venture capital has been important to hard science-related innovation, but there are now growing concerns in Silicon Valley and elsewhere about the diminishing focus of venture capital-backed big ideas in science and technology.

Gary Pisano and Willy Shih of Harvard University authored a recent book titled, “Producing Prosperity.” The core thesis of this book is that a combination of bad decisions by both business and government is leading to an erosion of America’s industrial commons, the set of manufacturing and technical capabilities that support innovation across a broad range of industries.

The vision that led to policies after World War II that support basic scientific research and laid the institutional foundation for innovations in semiconductors, high-speed computers, computer graphics, broadband, mobile telephony, the internet and modern genomic-based methods of drug discovery has diminished. While R&D is still occurring, the investment to generate the pay-off to that R&D is not occurring as robustly as it once did.

With these trends as background, we at Harris & Harris Group believe there is a real opportunity to claim leadership in building companies focused on commercializing big ideas in the hard sciences. There are few venture capital firms remaining that have the operational talent and skills necessary to do this type of company building. Very few have the patience as well.

Additionally, a different type of company building is required than internet and media company building. In our experience, hard science companies have three very important requirements: high-quality operational leadership, time (more than you forecast) and large amounts of capital (more than you originally envision).

We believe high-quality operational leadership exists today. However, we believe time has become a real problem for financing and building hard science companies. The competition for funds among different asset classes is driving the need for shorter investment return time frames in the current market. In the structure of the initial public offering ("IPO") market that has developed since 2000, hard science companies are requiring, and sometime exceeding, 10 years of development before there is an exit opportunity. The result is that the 10-year fund time frame for traditional venture capital is creating issues for building hard science companies.

Furthermore, few private venture capital firms have the ability or economic incentive to build companies after an IPO because they are often required to distribute ownership in these companies to their investors (i.e., limited partners) shortly after the IPO. We believe a public structure, such as Harris & Harris Group, for building these companies is the most viable alternative. Future investment opportunities can be assessed at each time-frame in a company’s development and without a mandated exit strategy after a given amount of time or, potentially, at all. Thus a public vehicle may be the best structure for building these companies into the future.

| 4 |

Additionally, we believe capital has also become a problem for building these types of companies. As venture capital companies have turned to internet and media deals, there has been a dearth of funding available to hard science companies. Hard science companies may have the same long-term investment return potential, or even better, but internet and media deals can move towards that end point faster, and investors not interested in the long term results can enter and exit with better returns over this shorter time frame for these types of deals. This presents many opportunities for investors in hard science companies, but the underlying requirement is continued access to capital. Properly financed public companies, have the flexibility and the control of their balance sheets to more effectively manage the capital needs required to build these companies. Additionally, they can continue to build these companies after the companies have gone public.

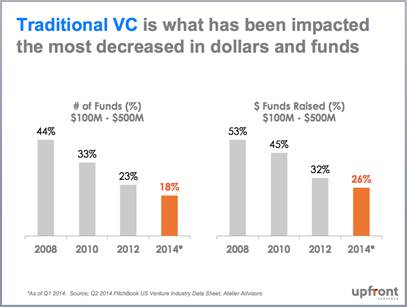

In synch with the diversity breakdown has been a reduction of venture funds with the capital to build these types of companies. We have seen a large decrease in the $100-$500 million fund size, the historical size for building life sciences and physical sciences companies. This fund size has now decreased to 18 percent of all funds down from 44 percent in 2008.

We believe there is a real opportunity to aggregate capital in a public vehicle to lead the return of hard science company building. We believe the economy is providing an ideal environment to invest in entrepreneurial companies for high-quality returns over the coming two decades, and we believe the company that does this effectively will become the leader in generating high-quality job growth and help return American innovation to a leadership position.

There is clearly an opportunity for becoming the leading company to translate hard science R&D into innovations that help economic growth more broadly than what we have been witnessing over the past five-to-ten years with the digital revolution. We believe it will take greater scale than we currently have in addition to our singular focus on execution. As we look to the future, achieving this scale is critical for Harris & Harris Group.

| 5 |

We understand that ours is not a business for the faint of heart. We understand that many of our shareholders have been waiting far longer than they ever envisioned to realize value in Harris & Harris Group. But it is a business that we believe will provide a better world for you, your children and your children’s children. And the reason the doors are still open is because we believe the value from this portfolio will be realized within the coming years.

In closing, we want to continue to remind our shareholders and others of the blog posts and previous shareholder letters on our website. These blog posts highlight some of our thoughts on areas of interest that are relevant to our business currently and into the future. We have also published a series of blogs under the concept of H&H at the Cutting Edge. These posts can be found on our website by clicking the BLOG menu option on our homepage or at http://www.hhvc.com/blog/.

We would like to thank you for your support of Harris & Harris Group. We believe that the Harris & Harris Group of the future is going to look different than it has in the past decade. Some of these changes have been put in place over the past couple of years, and more are coming. We will continue to focus on executing on our business. Thank you.

/s/ Douglas W. Jamison

Douglas W. Jamison

| Chairman, Chief Executive Officer |

| and Managing Director |

November 10, 2014

This letter may contain statements of a forward-looking nature relating to future events. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. These statements reflect the Company's current beliefs, and a number of important factors could cause actual results to differ materially from those expressed in this letter. Please see the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2013, as well as subsequent filings, filed with the Securities and Exchange Commission for a more detailed discussion of the risks and uncertainties associated with the Company's business, including but not limited to, the risks and uncertainties associated with venture capital investing and other significant factors that could affect the Company's actual results. Except as otherwise required by Federal securities laws, the Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties. The reference to the website www.HHVC.com has been provided as a convenience, and the information contained on such website is not incorporated by reference into this letter.

| 6 |