Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DOVER Corp | d819094d8k.htm |

Robert W. Baird & Co. Industrial Conference

November 11, 2014

Bob Livingston

President & CEO

Exhibit 99.1 |

2

Forward looking statements

We want to remind everyone that our comments may contain forward-looking

statements that are inherently subject to uncertainties and risks. We caution

everyone to be guided in their analysis of Dover by referring to

the documents

we file from time to time with the SEC, including our Form 10-K for 2013 and

our Form 10-Q for the third quarter of 2014, for a list of factors that

could cause our results to differ from those anticipated in any such

forward-looking statements. We would also direct your attention to our

website, www.dovercorporation.com, where considerably more information can

be found. |

3

Strategy

Our track record of success is based on:

–

Core technological advantages

–

Leading brands in the markets we serve

–

Commitment to industry leadership through innovation and scale

–

Strong focus on the customer

Our deep understanding of the customer and our exceptional capabilities in

providing solutions enable us to win

Our technologies and innovative products are enablers for our customers to

win Our focus on people drives our performance

–

Develop deep bench

–

Move talent through organization |

4

Recent activities support our underlying strategy & strengths

Building our industrial businesses

–

Continued to invest and acquire in

our growth areas

Recent acquisitions expand

product breadth and geographic

reach

–

Our business profile is more

consistent and focused with

sustainable higher margins

Increased investment in productivity

initiatives

–

Global supply chain

–

Rooftop consolidations

–

Common infrastructure for shared

services

–

Lean activities

Customer intimacy

–

Innovate for the customer

Recurring theme of delivering

efficiency and sustainability

–

Superior customer service

On-time delivery, quality, support

Leverage our scale

Generate cash

Market share leadership

–

Focus on technology and innovation

drive share gains and customer loyalty

Recent Activities

Underlying Strengths |

5

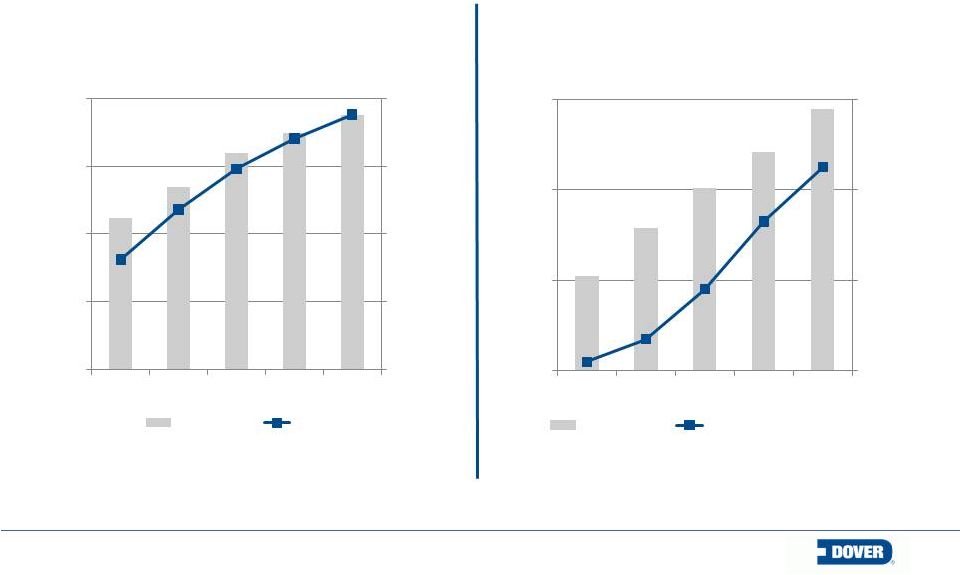

Our track record of success

Note: Revenue and EBIT is in millions; adjusted EPS represents Dover’s

earnings from continuing operations per common share adjusted for gains from discrete and other tax items

of $0.17, $0.16, $0.23, $0.09 and $0.46 respectively, for 2009, 2010, 2011, 2012

and 2013, and other one-time gains of $0.02 in 2013. Revenue

EBIT

$0

$325

$650

$975

$1,300

$0

$2,000

$4,000

$6,000

$8,000

2009

2010

2011

2012

2013

Revenue & EBIT

Revenue

EBIT

EPS

Dividends

$1.00

$1.20

$1.40

$1.60

$0.00

$1.50

$3.00

$4.50

2009

2010

2011

2012

2013

Adj. EPS & Dividends Paid

Adj. EPS

Dividend per share |

6

Energy

–

Core US artificial lift business is performing well, especially in key basins:

Permian, Eagle Ford, Bakken

Solid shale activity

–

Drilling remains stable

–

Middle East activity remains strong

–

Canada/Australia activity lower than last year

–

Compression markets improving

Engineered Systems

–

Generally solid market conditions in Industrial

Auto-related businesses continue to lead performance

–

Printing & Identification market continues to support solid organic

growth Strong US activity

Recent acquisitions performing well

Market commentary |

7

Fluids

–

Business remains solid across pumps and fluid transfer

Fluid transfer benefiting from active global retail fueling markets and regulation

related to fuel transportation safety concerns

Pumps driven by project activity in plastics and petrochemicals markets

Refrigeration & Food Equipment

–

Expect to outgrow a soft market

–

Modest organic growth

Shipments resume on small format store format push-outs from Q3

Delayed capital spending in dollar store market segment

Latin America (Mexico, Caribbean) refrigeration market remains weak

–

Completed transition to new Atlanta refrigeration system manufacturing

facility Market commentary |

8

Raised

annual

dividend

for

59

th

consecutive

year

Acquisition pipeline rebuilding

–

Closed $800 million in deals in 2014

Accelerated, Wellmark (Energy)

Liquip (Fluids)

MS Printing (Engineered Systems)

–

Focus on small bolt-on opportunities

Repurchased 5.7 million shares for $467 million YTD

Solid business trends through October; Q4 expectations:

–

Energy

growth driven by North American well activity (key basins)

–

Global growth in Printing & Identification and strong dynamics in Industrial

drive growth

in

Engineered

Systems

–

Strong

results

in

Fluids

on

continued

regulatory

tailwinds

in

fluid

transfer

–

Slightly

stronger

seasonal

pattern

in

Refrigeration

&

Food

Equipment

Capital allocation & Summary |

|