Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Commercial Vehicle Group, Inc. | d819248d8k.htm |

Baird

Industrial Conference 2014 Richard Lavin –

President and CEO

Tim Trenary –

Chief Financial Officer

Patrick Miller –

President of Global Truck and Bus

Ulf Lindqwister –

Chief Administrative Officer

Exhibit 99.1 |

FORWARD LOOKING STATEMENT

This presentation contains forward-looking statements that are subject to risks and

uncertainties. These statements often include words such as "believe,"

"expect," "anticipate," "intend," "plan," "estimate," or similar expressions. In

particular, this press release may contain forward-looking statements about Company expectations

for future periods with respect to its plans to improve financial results and enhance the

Company, the future of the Company’s end markets, Class 8 North America build rates,

performance of the global construction equipment business, expected cost savings, enhanced

shareholder value and other economic benefits of the consulting services, the Company’s initiatives

to address customer needs, organic growth, the Company’s economic growth plans to focus on

certain segments and markets and the Company’s financial position or other financial

information. These statements are based on certain assumptions that the Company has made

in light of its experience in the industry as well as its perspective on historical trends,

current conditions, expected future developments and other factors it believes are appropriate under the

circumstances. Actual results may differ materially from the anticipated results because of

certain risks and uncertainties, including but not limited to: (i) general economic or business

conditions affecting the markets in which the Company serves; (ii) the Company's ability to

develop or successfully introduce new products; (iii) risks associated with conducting business

in foreign countries and currencies; (iv) increased competition in the medium and heavy-duty truck,

construction, aftermarket, military, bus, agriculture and other markets; (v) the Company’s

failure to complete or successfully integrate strategic acquisitions; (vi) the impact of

changes in governmental regulations on the Company's customers or on its business; (vii) the

loss of business from a major customer or the discontinuation of particular commercial vehicle

platforms; (viii) the Company’s ability to obtain future financing due to changes in the lending

markets or its financial position; (ix) the Company’s ability to comply with the financial

covenants in its revolving credit facility; (x) the Company’s ability to realize the

benefits of its cost reduction and strategic initiatives; (xi) a material weakness in our

internal control over financial reporting which could, if not remediated, result in material misstatements

in our financial statements; (xii) volatility and cyclicality in the commercial vehicle market

adversely affecting us; and (xiii) various other risks as outlined under the heading "Risk

Factors" in the Company's Annual Report on Form 10-K for fiscal year ending December

31, 2013. There can be no assurance that statements made in this presentation relating to

future events will be achieved. The Company undertakes no obligation to update or revise forward-looking

statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future

operating results over time. All subsequent written and oral forward-looking

statements attributable to the Company or persons acting on behalf of the Company are expressly

qualified in their entirety by such cautionary statements. |

Our

Focus is to Drive Profitable Organic Growth •

We will invest in products and capabilities that will

strengthen our right-to-win with our core products in our

end markets

•

We will consider opportunistic acquisitions to address

gaps in our product portfolio and to enhance serving our

end markets & customers

•

We intend to achieve sales and earnings targets

commensurate with companies delivering top-quartile

total shareholder returns

pg | 3

STRATEGY |

REGIONS

END-

MARKETS

CORE PRODUCTS

COMPLEMENTARY

PRODUCTS

NA

Seats

Trim

Wire

Harnesses

Mirrors

Office Seats

Structures

Wipers

Truck

X

X

Construction

X

X

X

Agriculture

X

X

X

Bus

X

X

Aftermarket

X

X

EMEA

Truck

X

Construction

X

X

Agriculture

X

X

Bus

X

Aftermarket

X

APAC

Truck

X

X

Construction

X

X

Agriculture

X

X

Bus

X

X

Aftermarket

X

•

Focus on core, value accretive

businesses

•

Prioritize investment in core products

•

Hire and develop difference-making

talent across the product lines

–

Product line management

–

Engineers

–

Sales

–

Manufacturing management

•

Build / enhance our right to win

–

Design and engineer innovative products

–

Next generation product plans

–

Global supply chain management

–

Operational excellence / Lean Six Sigma

•

CVG Sales Playbook

–

OEM coverage / participation / closure plans

at customer product family, product, and

program level

–

“Sell the House”

Prioritized Opportunities | Focused on Core

Products | Driving Disciplined Execution

CVG Business Portfolio

Regions, End-Markets and Products

Action Plan for Core Products

STRATEGY

pg | 4

•

Better support our customers globally |

CVG

has about 5% share of the addressable market – significant opportunity

to drive profitable organic growth across our end markets and penetrate our

addressable market with current products

•

Available Market

1

| $27B

•

Addressable Market

2

| $13B

pg | 5

$5M

$3.5B

$3.2B

$5.6B

Truck

$5.0B

$416M

Construction

$176M

$2.6B

$2.8B

Bus

$1.2B

$2.9B

Agriculture

2013 Sales

Addressable Market

White Space

$32M

Source:

Company data, LMC + Millmark research reports

1

Available market = Universe of applications / platforms available for product

portfolio 2

Addressable market = Subset of available market for which products are currently

available or product plans are in place 3

Does not include approximately $118M in sales of complementary products

$10.6B

$6.7B

$4.1B

$5.4B

MARKET SHARE

Our Opportunity is Significant

3 |

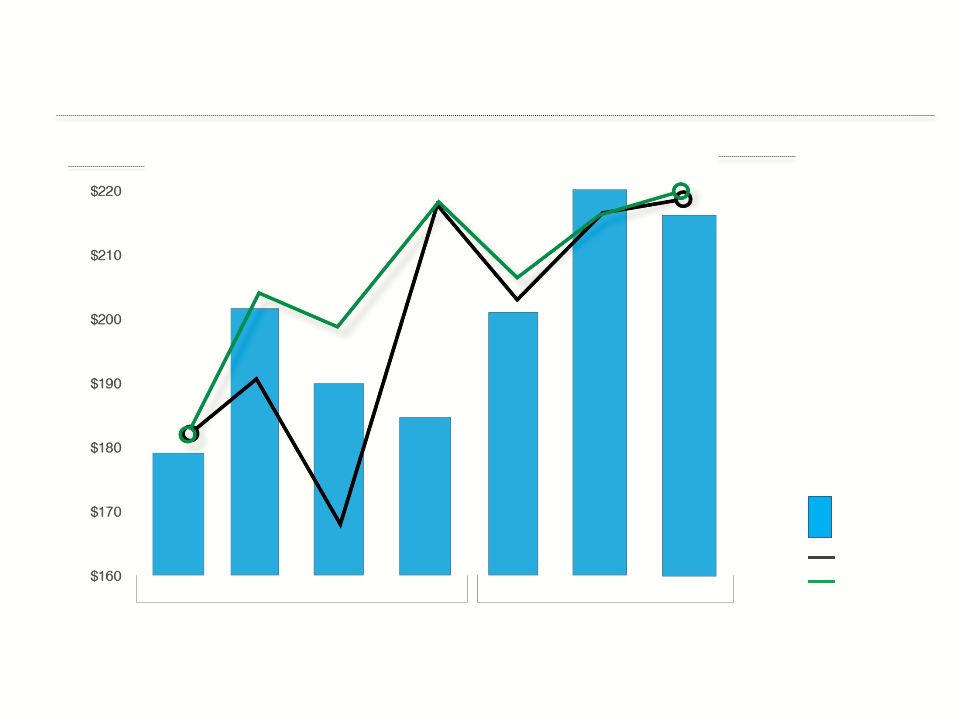

Sales

and Operating Income Margin SELECTED FINANCIAL RESULTS

Q1

Q2

Q3

Q4

Q1

Q2

Sales

(millions)

OIM

Adjusted

OIM

Sales

2014

2013

(0.2)%

1.1%

2.3%

(1.8)%

2.1%

4.4%

4.2%

2.8%

3.4%

See

appendix

for

reconciliation

of

GAAP

to

non-GAAP

financial

measures

–

adjusted

OIM

OI Margin

5%

4%

3%

1%

2%

0%

(1)%

(2)%

(3)%

Q3

4.6%

4.5% |

QUESTIONS AND

DISCUSSION |

APPENDIX |

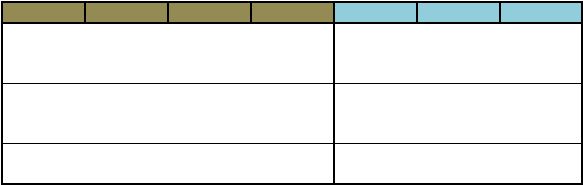

RECONCILIATION OF GAAP TO NON-

GAAP FINANCIAL MEASURES

Adjusted Operating Income Reconciliation

pg | 9

TOT_CVG_LOB

Q1 2013

Q2 2013

Q3 2013

Q4 2013

Q1 2014

Q2 2014

Q3 2014

$ (000's)

Net Sales

177,822

198,909

187,942

183,045

198,071

215,996

213,802

Cost of Sales

159,737

176,035

169,852

162,364

173,767

187,811

185,376

Gross Profit

18,085

22,874

18,090

20,681

24,304

28,185

28,426

SGA

17,949

20,339

21,135

12,288

18,472

18,748

18,333

Amortization

409

404

383

384

384

390

388

Operating Income

(273)

2,131

(3,428)

8,009

5,448

9,047

9,705

Operating Income Margin

(0.2)%

1.1%

(1.8)%

4.4%

2.8%

4.2%

4.5%

2013 Special Items

RIF

(1,800)

Third-Party Consulting Services

(2,800)

Asset Impairment

(2,700)

CEO Change

(2,500)

2014 Special Items

Tigard / Dublin Closure

(500)

(100)

(200)

Loss on Sale of Building

(800)

Adjusted Operating Income

(273)

4,631

3,872

8,009

6,748

9,147

9,905

Adjusted Operating Income Margin

(0.2)%

2.3%

2.1%

4.4%

3.4%

4.2%

4.6% |