Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT - CTPARTNERS EXECUTIVE SEARCH INC. | a09301410qexhibit321.htm |

| EX-32.2 - EXHIBIT - CTPARTNERS EXECUTIVE SEARCH INC. | a09301410qexhibit322.htm |

| EX-31.2 - EXHIBIT - CTPARTNERS EXECUTIVE SEARCH INC. | a09301410qexhibit312.htm |

| EX-31.1 - EXHIBIT - CTPARTNERS EXECUTIVE SEARCH INC. | a09301410qexhibit311.htm |

| EXCEL - IDEA: XBRL DOCUMENT - CTPARTNERS EXECUTIVE SEARCH INC. | Financial_Report.xls |

| 10-Q - 10-Q - CTPARTNERS EXECUTIVE SEARCH INC. | ctp-093014x10q.htm |

CTPartners Executive Search Inc. NLH KG Share Sale and Purchase Agreement

page 1 Contents 1 Definitions 5 2 Conditions to Completion 14 2.1 Conditions 14 2.2 Reasonable endeavours 15 2.3 Waiver 15 2.4 Notice 16 2.5 Termination 16 2.6 Remedies 16 3 Sale and purchase of the Share 16 3.1 Sale and purchase of the Share 16 3.2 Transfer of rights 16 4 Purchase Price 16 4.1 Purchase Price 16 4.2 Payment of the Purchase Price 16 4.3 Debt Redemption Amount 17 4.4 Completion Payment Amount 17 4.5 Net Working Capital Adjustment Amount 17 4.6 First Period Payment Amount 18 4.7 Second Period Payment Amount 18 4.8 Third Period Payment Amount 18 4.9 Payment AWS 18 4.10 Interest 18 4.11 Set-off 18 5 Conduct of Business until Completion 18 5.1 Ordinary course of Business 18 5.2 Integration Process 19 5.3 Seller to notify of potential Material Adverse Effect or breach of Seller’s Warranty 20 6 Completion 20 6.1 Date, time and place 20 6.2 Execution of a Share Transfer Agreement 20 6.3 Seller’s obligations 20 6.4 Delivery at Business premises 21 6.5 Actions by the managing directors 21 6.6 Buyer’s obligations 21 6.7 Interdependence of obligations 21 6.8 Title and risk 21 7 Completion Accounts 22 7.1 Preparation of Completion Accounts 22 7.2 Co-operation 22

page 2 7.3 Timing 22 7.4 Seller’s accounting 22 7.5 Dispute Notice 22 7.6 Content of Dispute Notice 22 7.7 Independent Accountant 23 7.8 Deemed acceptance 23 8 Trade Receivables and Trade Credits 24 9 Third party consents 24 10 Non-competition 24 10.1 Non-compete 24 10.2 Interpretation 25 10.3 Duration of prohibition 25 10.4 Geographic application of prohibition 25 10.5 Severability 25 10.6 Acknowledgement 26 10.7 Injunction 26 11 Seller’s Warranties 26 11.1 Seller’s Warranties 26 11.2 Reliance 26 11.3 Remedies 26 11.4 Ability to claim 27 11.5 Limitation on claims 27 11.6 Disclosures 28 11.7 Disclaimer 28 11.8 Payment of Claims 28 11.9 Tax effect 28 12 Indemnities 29 12.1 Seller’s indemnity 29 13 Buyer’s Warranties 30 13.1 Buyer’s Warranties 30 13.2 Reliance 31 13.3 LRS GmbH 31 14 Action after Completion 31 14.1 Business Records 31 14.2 Continuing co-operation 31 15 Tax Indemnity 31 16 Tax Claims 32 17 Tax Records 35 17.1 Retention of Tax Records 35 17.2 Access to Tax Records 35 18 Tax Returns 36 18.1 Co-operation regarding Tax Returns 36

page 3 19 Costs 36 19.1 Legal costs 36 19.2 Redemption or acquisition of the Company's debt 36 20 Notices 36 20.1 General 36 20.2 How to give a communication 36 20.3 Particulars for delivery of notices 37 20.4 Communications by post 37 20.5 Communications by fax 38 20.6 Communications by email 38 20.7 After hours communications 38 20.8 Process service 38 20.9 Change of address 38 21 Confidentiality 38 21.1 Definitions 38 21.2 Confidentiality obligation 39 21.3 Permitted disclosures 39 21.4 Disclosure to other persons 40 21.5 Destruction or return of Confidential Information 40 21.6 Survival 40 22 General 40 22.1 Error, frustration of contract or shortfall exceeding fifty percent 40 22.2 Amendment 40 22.3 Waiver and exercise of rights 40 22.4 Assignment 40 22.5 Consents 41 22.6 Further assurances 41 22.7 Rights cumulative 41 22.8 Continuing obligations 41 22.9 Counterparts 41 22.10 Governing law and jurisdiction 41 22.11 Entire agreement 42 22.12 Construction 42 22.13 Headings 43

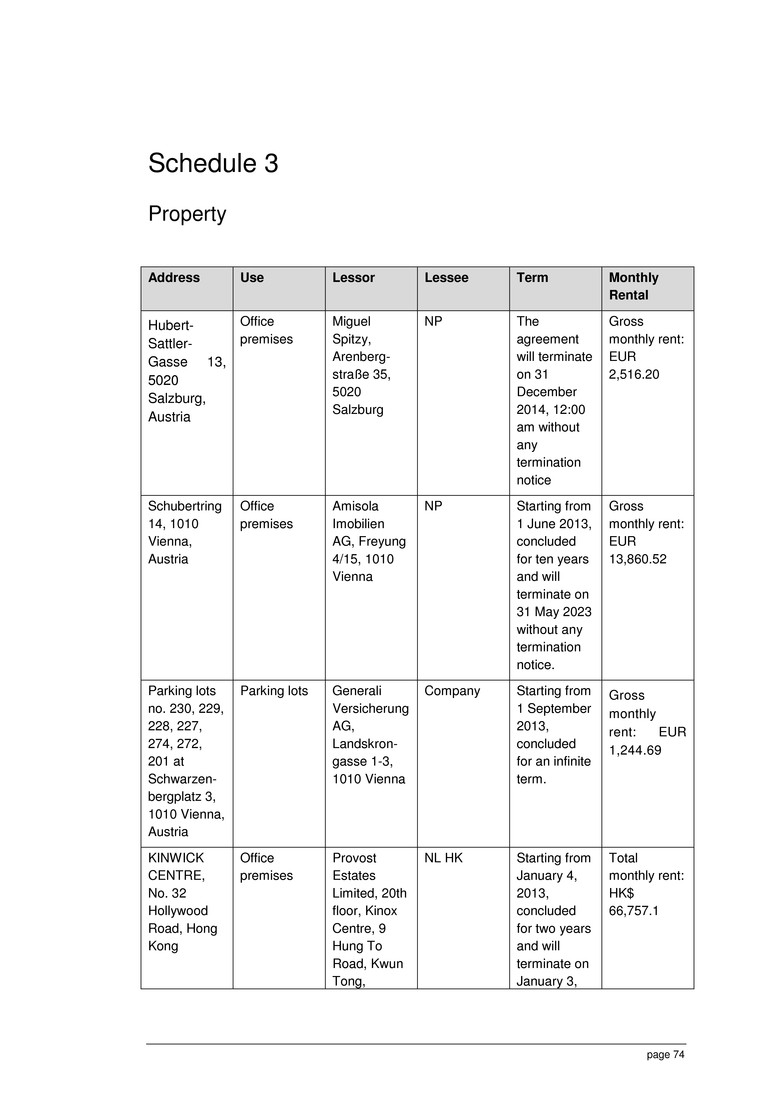

page 4 Schedules and Annexes: Schedule 1 - Sellers’ Warranties Schedule 2 - Company’s IP Schedule 3 - Property Schedule 4 - Employees Schedule 5 - Statement of Working Capital Schedule 6 - Business Authorisations Schedule 7 - Trade Receivables Annexure A - Accounts Annexure B - Data Room Documentation Annexure C - Permitted Encumbrances Annexure D - Disclosure Letter Annexure E - Net Working Capital Amount - Worked Example Annexure F - Employment Agreement Annexure G - Payment Annexure H - Austrian Share Transfer Agreement Annexure I - Non-solicitation declaration

page 5 Date 7 November 2014 Parties CTPartners Executive Search Inc., 28601 Chagrin Blvd, Suite 600, Cleveland, OH 44122 (Buyer) NLH KG, Schubertring 14, 1010 Vienna (Seller) Background A The Seller is the legal and beneficial owner of the Share which comprises all of the issued share capital of the Company. B The Seller has agreed to sell, and the Buyer has agreed to buy, the Share in accordance with the terms of this document. Agreed terms 1 Definitions In this document these terms have the following meanings: Accounting Policies The Accounting Standards and any accounting policies of the Business applied by the Company in its financial statements as of 31 December 2013. Accounting Standards The applicable accounting standards under the Austrian Commercial Code (Unternehmensgesetzbuch) and, generally accepted accounting principles and practices in Austria consistently applied by the Company. Accounts (a) The unaudited statement of financial position (Bilanz) as at the Accounts Date; (b) the unaudited statement of financial performance (Gewinn- und Verlustrechnung) for the 12 month period ending on the

page 6 Accounts Date; and any notes, statements and reports attached to and forming part of those financial statements, of the Company and the Company's Affiliates as set out in annexure Error! Reference source not found.. Accounts Date 30 June 2014. Affiliates With respect to any person, any other person directly or indirectly controlling, controlled by, or under common control with, that person. Assets All right, title and interest of the Company or the Company's Affiliates in: (a) Contracts; (b) Property; (c) Business Authorisations; (d) Goodwill; (e) Business Records; (f) Company’s IP; (g) Plant and Equipment; and (h) all other assets owned by the Company or the Company's Affiliates and used in the Business. Business The business carried on by the Company and the Company's Affiliates, being the business of executive search services. Business Authorisation Includes any authorisation, approval, registration, consent, permit, licence, certification or exemption from, by or with a Governmental Agency that is necessary for the operation of the Business. Business Day A day which is not a Saturday, Sunday or bank or public holiday in Vienna, Austria. Business Records All books, files, reports, records, correspondence, documents, data, programmes, software and other material (in whatever form stored) owned by the Company [or the Company's Affiliates] and used for the purposes of the Business including information contained in: (a) books of account, sales literature, market research reports, brochures and other promotional material (including printing blocks, negatives, sound tracks and any associated material); (b) all sales and purchasing records; (c) all trading and financial records; (d) lists of all regular customers and suppliers; (e) all business plans and sales forecasts; and (f) minute books and statutory company registers, but excluding Tax Records.

page 7 Buyer’s Warranties The warranties and representations in clause 13.1. Claim Includes any claim, demand, proceeding, suit, litigation, investigation, audit, action or cause of action in contract, tort, under statute or otherwise. Company Neumann Leadership Holding GmbH, a limited liability company (Gesellschaft mit beschränkter Haftung) under Austrian law with its seat in Vienna, Austria, and its business address at Schubertring 14, 1010 Vienna, Austria, registered with the Austrian companies register under registration number FN 227392 a. Company's Affiliates means NL D, NL HK, NP, NP doo, NP kft, NP sro, NP Spzoo and the Company's Offices. Company’s IP Means: (a) all rights subsisting in business names used by the Company and/or the Company's Affiliates in the Business and the reputation and goodwill associated with such, including those business names set out in Part A of schedule 2 (Business Names); (b) all rights subsisting in domain names used by the Company and/or the Company's Affiliates in the Business and the reputation and goodwill associated with such, including those domain names set out in Part B of schedule 2 (Domain Names); (c) all logos, symbols, get up, trademarks, trade names, service marks, brand names and similar rights (whether or not registered or registrable) used by the Company and/or the Company's Affiliates in the Business and the reputation and goodwill associated with such, including those trademarks set out in Part C of schedule 2 (Trademarks); (d) all rights subsisting in trade secrets and all rights subsisting in financial, marketing and technical information, ideas, concepts, know-how, technology, processes and knowledge which is confidential or of a sensitive nature (but excluding that which is in the public domain) including customer lists and contact details, used by the Company and/or the Company's Affiliates in the Business; (e) the copyright (if any) in labelling or printing or other subject matters used by the Company and/or the Company's Affiliates in connection with the Business; (f) the copyright and other rights in respect to any computer programs, software and circuit layouts used by the Company and/or the Company's Affiliates in the Business; (g) the goodwill of the Company and/or the Company's Affiliates in

page 8 and attaching to the Business; and (h) all other Intellectual Property Rights (excluding moral rights) used by the Company and/or the Company's Affiliates in the Business. Company's Offices means NP BG and NP RO. Company Tax Records Tax Records wholly or predominantly relating to the Company and/or the Company's Affiliates or used (whether before, on or after Completion) in connection with the Business, or otherwise relating to the Business. Completion The completion of the sale and purchase of the Share in accordance with clause 6. Completion Accounts The accounts prepared in accordance with this document to determine the amount of the Net Working Capital Amount (if any) an example of which is set out in schedule 5. Completion Date The date (which must not be before [31 October 2014]) that is the last day of the month in which all of the conditions precedent in clause 2.1 have been satisfied or waived, or such other date as may be agreed by the parties in writing. Completion Payment Amount The amount specified in annexure G. Contract Any contract, agreement, arrangement or commitment entered into by the Company and/or the Company's Affiliates in relation to the Business under which any obligation is not fully performed as at the Completion Date. Controlling Party The party that has control of all discussions and communications in relation to, and control of the conduct, defence and settlement of, a Tax Claim, Joint Tax Claim or Tax Proceedings (as the case may be) as contemplated by clause 16. Credit Agreements The credits listed in schedule 8 granted by Erste Bank der oesterreichischen Sparkassen AG to the Company. CZK Czech Crown, the lawful currency of the Czech Republic. Data Room Documentation Those documents listed in annexure Error! Reference source not found., as contained on two identical CDs tabled at Completion, with one being retained by each party. Debt Redemption Amount EUR 800,000 as agreed by the Seller with Erste Bank der oesterreichischen Sparkassen AG as consideration for the assignment of the receivables and relevant rights under the Credit Agreements and the amount (if any) to be paid under the final version of the agreement with Erste Bank der oesterreichischen Sparkassen AG in accordance with clause 2.1(e) plus expenses as

page 9 security deposit for the Guarantee Loan. Default Rate 5% per annum. Disclosures All information contained in the Data Room Documentation. Employees The employees employed by the Company or the Company's Affiliates who are engaged in the Business as at Completion, with the names and Employment Entitlements of such employees listed in schedule 4. Encumbrance Any charge, lien, mortgage, pledge, assignment by way of security, secured interest, title retention arrangement, preferential right or trust arrangement or any arrangement having the same or equivalent effect. Fees of the Business Gross fees, billings, related charges and indirect expenses, but excluding disbursements and reimbursable expenses, rendered for services provided or products supplied in the conduct of the Business by the Company and the Company's Affiliates. First Period The period commencing on the Completion Date and ending on the first anniversary of the Completion Date. First Period Payment Amount The amount specified in annexure G. Goodwill The goodwill of the Seller in and attaching to the Business. Governmental Agency Any government, whether Federal, State or Territory, municipal or local, and any agency, authority, commission, department, instrumentality, regulator or tribunal thereof, including the tax authorities of Austria or any of the jurisdictions where the Company [or any of the Company's Affiliates] operates. Guarantee Loan The guarantee loan listed in schedule 8 granted by Erste Bank der oesterreichischen Sparkassen AG to the Company. HR$ Hong Kong Dollar, the lawful currency of Hong Kong. HRK Croatian kuna, the lawful currency of the Republic of Croatia. HUF Hungarian forint, the lawful currency of Hungary. Immediately Available Funds Bank cheque, telegraphic transfer or other means of transfer of cleared funds into a bank account nominated in advance by the payee. Indemnified Entity The Buyer and the Company and the Company's Affiliates. Independent Accountant One of the following accountants (i) Mag. Georg Bauthen (Böcklinstraße 49, 1020 Vienna, Austria) or (ii) Dr. Erich Kandler (Blattgasse 4-6/3/12, 1030 Vienna, Austria) or (iii) Dr. Bernhard Vanas (Teinfaltstraße 9/7, 1010 Vienna, Austria) as elected by the Buyer. Intellectual Any patent, trade mark, service mark, design right, design registration, trade name, business name, copyright, semiconductor

page 10 Property Right and circuit layout right and any right or form of protection of a similar nature to any of these that may subsist anywhere in Austria or any jurisdiction in which the Company or any of the Company's Affiliates operates whether registered or unregistered. Joint Tax Claim A Tax Claim that relates: (a) to a period that occurs partly before the Completion Date and partly after the Completion Date; (b) to two or more periods at least one of which occurs partly before the Completion Date and partly after the Completion Date; or (c) to two or more periods one or more of which occurs before the Completion Date and one or more of which occurs after the Completion Date, but does not include a Tax Claim that relates to, or occurs in, a period after Completion only because interest accrues or penalties are incurred after Completion in respect of a Tax obligation relating to a period prior to Completion. Jorda Dr. Hans Jorda, born 17.04.1957. juR quest GmbH juR-quest GmbH, a limited liability company (Gesellschaft mit beschränkter Haftung) under German law with its seat in Hamburg, Germany, and its business address at Forstenrieder Allee 61, c/o ACTIO Revision & Treuhand GmbH, 81476 München, registered with the commercial register of Hamburg under registration number HRB 101511. Law Includes any law or legal requirement under any statute, regulation or by-law, any condition of any authorisation, and any decision, directive, guidance, guideline or requirements of any Governmental Agency. Liability Any liability (whether actual, contingent or prospective), loss, damage, cost and expense of whatsoever description and howsoever arising. Limited Partners Each of Thomas Hölzchen, born 17.09.1956, Prof.Dr. Robert Büchelhofer, born 23.07.1942, Reinhard Kolvenbach, born 21.01.1950, Andreas Venzke, born 23.11.1965, Helene Krieff, born 14.05.1958, Rudolf Müller, born 28.03.1957, Hedvig Vecsei-Zalka, born 12.07.1952, Mag.Dr. Gottfried Gröbl, born 04.12.1951, Mag. Günther Hassler, born 18.01.1959, Dr. Gerlinde Berger, born 29.10.1969, Dr. Hartmut Müller, born 31.03.1964, Patrick Haberland, born 05.10.1971, Kirsten Werner-Schäfer, born 26.03.1966, Alin Catalin Popescu, born 02.07.1971, Dr. Andreas Arthur Georgi, born 17.05.1957. Loss or Losses The losses and damages, costs and expenses as specified in clause 11.3.

page 11 Malanik Dr. Peter Malanik, geb. 29.08.1961. Material Adverse Effect The meaning given to it in clause 2.1(c)(i). NL D Neumann Leadership Deutschland GmbH, a limited liability company (Gesellschaft mit beschränkter Haftung) under German law with its seat in Munich, Germany, and its business address at Herzog- Heinrich-Str. 13, 80336 Munich, registered with the commercial register of Munich under registration number HRB 157090. NL HK Neumann Leadership Asia Pacific Limited, a private company limited by shares under Hong Kong law with its seat in Hong Kong, and its business address at 1205-06, Kinwick Centre, 32 Hollywood Road, Central, Hong Kong, registered with the companies register in Hong Kong, under registration number 1051597. NP NP Neumann & Partners GmbH, a limited liability company (Gesellschaft mit beschränkter Haftung) under Austrian law with its seat in Vienna, Austria, and its business address at Schubertring 14, 1010 Vienna, Austria, registered with the companies register under registration number FN 220412 k. NP BG NEUMANN & PARTNERS BRANCH BULGARIA / НОЙМАН ЕНД ПАРТНЪРС КЛОН БЪЛГАРИЯ" КЧТ, a registered branch office of the Company with its office at Bulgaria, 1000 Sofia, Sredetz region, r. a. 11 Slavyanska, office 5, registered under Unified Identification Code 202899808. NP doo Neumann & Partners d.o.o. za posredovanje pri zapošljavanju (in English: Neumann & Partners Ltd. for mediation in employment), a limited liability company under Croatian law with its seat in Zagreb, Croatia, and its business address at Gajeva 2a, Zagreb, Croatia, registered under no. 080743887. NP kft Neumann & Partners Vezetői Tanácsadó Korlátolt Felelősségű Társaság, abbreviated name: Neumann & Partners Kft, a limited liability company under Hungarian law with its seat in Budapest, Hungary, and its business address at Ali utca 8, 1025 Budapest, Hungary, registered under registration number 01-09-714998. NP RO NP Neumann &Partners GmbH, representative office (Romanian: reprezentanţă), a representative office of NP under Romanian law with its registered office at 1-3 Remus St., 4th floor, room E4.10, Bucharest, sector 3, Romania, registered with the Ministry of Economy under no. 1744/24.12.2013, VAT number 32624185. NP sro Neumann & Partners s .r.o., a limited liability company under Czech law with its seat in Prague, Czech Republic, and its business address at Národní 10/138, 110 00 Prague 1, Czech Republic, registered with the Commercial Register maintained by the Municipal Court in Prague under registration number 267 55 017.

page 12 NP Spzoo Neumann Leadership Poland Sp.z.o.o., a limited liability company under Polish law, with its seat in Warszawa and its business address in ul. Bonifraterska 17, 00-203 WarONIFRATERSKA 17, 00-203 Warszawa, Poland, registered under registration number KRS 244781. Net Working Capital Adjustment Amount The meaning given to it in clause 4.5. Net Working Capital Amount The net working capital amount set out in accordance with the statement of working capital in schedule 5. General Partners Each of Dr. Hans Jorda, born 17.04.1957 and Dr. Peter Malanik, born 29.08.1961. Permitted Encumbrance An Encumbrance which is listed in annexure Error! Reference source not found.. Plant and Equipment The plant, equipment, furniture, fixtures and fittings owned and used by the Company and/or the Company's Affiliates in the Business as at the Completion Date. PLN means polish zloty, the lawful currency of the Republic of Poland. Property The leasehold property detailed in schedule 3. Purchase Price The sum of the: (a) Debt Redemption Amount; (b) Completion Payment Amount; (c) Net Working Capital Adjustment Amount; (d) First Period Payment Amount; (e) Second Period Payment Amount; (f) Third Period Payment Amount. Related Party Liabilities All liabilities (including accrued interest) owing by or to the Company or any of the Company's Affiliates to or by any one or more of the General Partners and/or the Limited Partners. Second Period The period commencing on the day immediately following the end of the First Period and ending on the second anniversary of the Completion Date. Second Period Payment Amount The amount specified in annexure G. Seller NLH KG, a limited partnership (Kommanditgesellschaft) under Austrian law with its seat in Vienna, Austria, and its business address at Schubertring 14, 1010 Vienna, Austria, registered with the Austrian companies register under registration number FN 304926 x.

page 13 Seller’s Tax Records Tax Records relating to the Company or the Company's Affiliates and within the possession or control of the Seller or any of the General Partners or Limited Partners of the Seller that might reasonably be expected to support the Tax position of the Company or the Company's Affiliates. Seller’s Warranties The warranties of the Seller set out in schedule 1. Share The fully paid share in the Company in the amount of EUR 503,000 (registered capital). Stamp Duty Any stamp, transaction or registration duty or similar charge imposed by any Governmental Agency, including any interest, fine, penalty, charge or other amount in respect of the above. Tax (a) Any tax, levy, impost, deduction, charge, rate, compulsory loan, withholding or duty by whatever name called levied, imposed or assessed under Austrian tax law or any other Law in Austria or elsewhere (including, without limitation, profits tax, property tax, interest tax, income tax, capital gains tax, tax relating to the franking of dividends, fringe benefits tax, payroll tax, group tax, land tax, VAT, water and municipal rates, customs duties and transaction duties and social security contributions and any claims derived from such social security contributions); (b) unless the context otherwise requires, Stamp Duty; and (c) any interest, penalty, charge, fine or fee or other amount of any kind assessed, charge or imposed on or in respect of anything listed in paragraph (a) or (b). Tax Act The Austrian Income Tax Act 1988 (Einkommensteuergesetz 1988) as amended, the Austrian Corporate Tax Act 1988 (Körperschaftsteuergesetz 1988) as amended, as the case may be. Tax Claim The same meaning given in clause 16(a). Tax Indemnity The indemnity provided in clause 15. Tax Law Any Law under which Tax is imposed, assessed, charged or administered and including, without limitation, the Tax Act and the tax laws in the countries where the Company's Affiliates operate. Tax Proceedings The same meaning given in clause 16. Tax Records All originals and copies of books, files, reports, records, correspondence, documents, data and other material (whether in electronic or physical form and on whatever media stored) wholly or predominantly related to Tax matters, including Tax Returns and Tax assessments. Tax Relief Any refund, credit, offset, relief, allowance, deduction, rebate recoupment, compensation, penalty, damages, restitution, right to

page 14 repayment or other benefit or saving in relation to Tax. Tax Return Any return relating to Tax including any document which must be lodged with a Governmental Agency administering a Tax or which a taxpayer must prepare and retain under a Tax Law (such as an activity statement, amended return, schedule or election and any attachment). Tax Reviewer An independent Tax expert that the Seller and the Buyer agree to appoint. If such agreement cannot be reached within a reasonable time, the independent Tax expert will be nominated by the President for the time being of the Austrian Chamber of Public Accountants and Tax Advisors (Kammer der Wirtschaftstreuhänder) (or any successor institution). Tax Warranties The representations and warranties of the Seller contained in warranty 17 of schedule 1. Third Period The period commencing on the day immediately following the end of the Second Period and ending on the third anniversary of the Completion Date. Third Period Payment Amount The amount specified in annexure G. Trade Credit Money due from the Company or any of the Company's Affiliates under a invoice issued by a third party to the Company or any of the Company's Affiliates after the Completion Date that covers a period that begins prior to the Completion Date and ends after the Completion Date. Trade Receivables The receivables set out in schedule 7, being money owed to the Company or any of the Company's Affiliates under invoices issued by the Company or any of the Company's Affiliates prior to the Completion Date that are fully or partly unpaid. Upfront Payment The meaning given to it in clause 4.5. 2 Conditions to Completion 2.1 Conditions The obligation of the parties to complete is conditional on the following conditions having been satisfied or waived: (a) the Buyer having received in writing from the lessor of the Property located in Austria unconditional consent to the change of control of the Company to the Buyer and the confirmation that the lease will not be increased as a consequence of the change of control; (b) the Buyer having received in writing from the individuals mentioned in annexure I non-solicitation declarations in accordance with annexure I;

page 15 (c) the Buyer (acting reasonably) being satisfied that: (i) there has been no change in the Business, the financial or trading position of the Business or the operation of the Business since the date of this document that has, or is reasonably likely to have, a material and adverse effect on the turnover, profitability, financial condition or operation of the Business taken as a whole (a Material Adverse Effect); and (ii) no Seller’s Warranty is or has become materially false, misleading or incorrect or would be reasonably likely to result in a Claim being made, or allowed to be made, by the Buyer; and (d) Jorda and Malanik giving notice of their resignation under their existing agreements with the Company and entering into new agreements with the Buyer in a form set out in annexure Error! Reference source not found. with regard to the contract of Malanik; the form of the contract of Jorda to be agreed upon until Completion ; (e) the Company having entered into an agreement with Erste Bank der oesterreichischen Sparkassen AG whereby Erste Bank der oesterreichischen Sparkassen AG agrees to the full release and assignment of the receivables and relevant rights under the Credit Agreements (including the release of all collateral of the Company) against the payment of the Debt Redemption Amount by the Company or a third party as set out in the draft "Vereinbarung" attached hereto as schedule 6; (f) application for the renewal of the authorisation of NP RO according to the procedure provided by law (Decree no. 122/1990) by the Romanian Ministry of Economy; (g) written confirmation of the termination of the loan agreement entered into between Mr. Gottfried Gröbl, born December 4, 1951, and the Company, dated September 8, 2010, as amended by amendment agreement entered between Mr. Gottfried Gröbl and the Company under accession of the Seller, and of the termination of the option granted under the amendment agreement; (h) written confirmation of the termination of the loan agreement entered into between BON Consulting GmbH, registered under FN 302646 v, and the Company, dated September 8, 2010, as amended by amendment agreement entered between BON Consulting GmbH and the Company under accession of the Seller, and of the termination of the option granted under the amendment agreement. 2.2 Reasonable endeavours Each of the parties must use all reasonable endeavours to procure the satisfaction of the conditions referred to in clause 2.1. 2.3 Waiver The conditions in clause 2.1 may only be waived by the Buyer in writing.

page 16 2.4 Notice The Seller and the Buyer must promptly notify the other in writing as soon as it becomes aware that a condition to Completion is satisfied or becomes (or is likely to become) incapable of being satisfied. 2.5 Termination If Completion has not occurred on or before 1 December 2014 (or such other date as the parties may have agreed in writing) then the Seller or the Buyer may, if not in breach of this document, give written notice to the other terminating this document. 2.6 Remedies If this document is terminated under clause 2.5 then: (a) each party is released from its continuing obligations under this document, except those imposing obligations of confidentiality; (b) each party retains the rights it has against any other party in respect of any prior breach without affecting any rights at Law or in equity; and (c) the Buyer must return to the Seller all documents and other materials in any medium in its possession, power or control which contain information relating to the Company [or the Company's Affiliates] including its working papers and any information obtained from the Disclosures. 3 Sale and purchase of the Share 3.1 Sale and purchase of the Share Conditional upon Completion, the Seller agrees to sell to the Buyer and the Buyer agrees to purchase from the Seller, the Share free of all Encumbrances, for the Purchase Price and otherwise on the terms of this document. 3.2 Transfer of rights The Share will be transferred to the Buyer with all rights, including dividend rights, attached or accruing to them on and from the Completion Date. 4 Purchase Price 4.1 Purchase Price The amount payable by the Buyer to the Seller for the Share is the Purchase Price. The Purchase Price shall include the Debt Redemption Amount (but not any costs resulting from Stamp Duties for the redemption or acquisition of the Company's bank debt (see section 4.3)). 4.2 Payment of the Purchase Price The Purchase Price will be paid as follows:

page 17 (a) the Debt Redemption Amount will be paid in accordance with clause 4.3 (b) the Completion Payment Amount will be paid in accordance with clause 4.4; (c) the Net Working Capital Adjustment Amount will be paid in accordance with clause 4.5; (d) the First Period Payment Amount will be paid in accordance with clause 4.6; (e) the Second Period Payment Amount will be paid in accordance with clause 4.7; (f) the Third Period Payment Amount will be paid in accordance with clause 4.8; 4.3 Debt Redemption Amount On or before 31 December 2014 the Buyer must pay Erste Bank der oesterreichischen Sparkassen to the account named "VK Kreditmanagment II", IBAN AT532011140004522900, BIC GIBAATWWXX, in Immediately Available Funds the Debt Redemption Amount (which will be a non-refundable payment). 4.4 Completion Payment Amount On Completion the Buyer must pay the Seller, or as the Seller directs, in Immediately Available Funds the Completion Payment Amount (which will be a non-refundable payment). 4.5 Net Working Capital Adjustment Amount The Seller will provide the Buyer until December 15, 2014 with a calculation of the Net Working Capital Amount as of November 30, 2014. On or before December 22, 2014 the Buyer must pay the Seller (or as the Seller directs) in Immediately Available Funds an upfront payment in the amount of 50% of the Net Working Capital Amount ("Upfront Payment") according to the calculation of the Seller. Within 5 Business Days of acceptance (or deemed acceptance) of the Completion Accounts by the Seller, and subject to clause 8(a): (a) if the positive Net Working Capital Amount minus the Upfront Payment is positive the Buyer must pay the Seller (or as the Seller directs) in Immediately Available Funds the Net Working Capital Adjustment Amount (which is the Net Working Capital Amount minus the upfront payment); or (b) if the positive or negative Net Working Capital Amount minus the Upfront Payment is negative the Net Working Capital Adjustment Amount (which is the Net Working Capital Amount minus the Upfront Payment) shall be deducted from the First Period Payment Amount and, if the First Period Payment Amount is less than the Net Working Capital Adjustment Amount, from the Second Period Payment Amount and the Third Period Payment Amount (as applicable).

page 18 4.6 First Period Payment Amount 12 months after Completion the Buyer must pay the Seller (or as the Seller directs) in Immediately Available Funds the First Period Payment Amount. 4.7 Second Period Payment Amount 24 months after Completion the Buyer must pay the Seller (or as the Seller directs) in Immediately Available Funds the Second Period Payment Amount. 4.8 Third Period Payment Amount 36 months after Completion the Buyer must pay the Seller (or as the Seller directs) in Immediately Available Funds the Third Period Payment Amount. 4.9 Payment AWS The Buyer must within five business days after receipt pay the Seller (or as the Seller directs) in Immediately Available Funds of any payments received by the Company from Erste Bank der oesterreichischen Sparkassen AG (or Austria Wirtschaftsservice Gesellschaft mbH) related to the guarantee issued by Austria Wirtschaftsservice Gesellschaft mbH less any adverse tax effects for the Company and/or the Buyer. 4.10 Interest If either party does not pay any sum payable by it under this document at the time and otherwise in the manner provided in this document, that party must pay interest on such sum from the due date of payment until such sum is paid in full at the Default Rate. Interest accrues and compounds daily and is payable on demand. 4.11 Set-off Despite any other provision of this document, the Buyer shall set off (aufrechnen) any amount payable by the Buyer under this document against any amount payable by the Seller under this document, including any amount payable in connection with: (a) the Net Working Capital Adjustment Amount; (b) an overpayment in respect of any component of the Purchase Price; (c) a Claim for a breach of a Seller’s Warranty by the Seller; (d) a breach of this document by the Seller; or (e) a Claim under any indemnity in this document. 5 Conduct of Business until Completion 5.1 Ordinary course of Business (a) Subject to the agreement of the Buyer otherwise, until Completion the Seller must:

page 19 (i) ensure that the Company and the Company's Affiliates carry on the Business in the ordinary and normal course; (ii) use reasonable endeavours to preserve the goodwill of the Business; and (iii) promptly notify the Buyer of any Material Adverse Effect in the Business or the Company. (b) Except as contemplated by this document or as consented to by the Buyer in writing, the Seller must not and must procure that the Company does not, before Completion: (i) increase, reduce or otherwise alter its share capital (including by creating, allotting and issuing new share capital) or grant any options for the issue of shares or other securities; (ii) declare, make or pay any dividend; (iii) make a distribution or revaluation of assets; (iv) alter its articles of association; (v) cause or permit any Encumbrance (other than a Permitted Encumbrance) to be given or created over any of the Assets or undertaking or any material part thereof; (vi) enter into any commitment (other than a costumer contract): (A) for more than EUR 10,000; (B) with a particular person where the aggregate value of those commitments is more than EUR 20,000; or (C) for longer than 2 years; (vii) dispose of, or agree to dispose of or grant an option to purchase, any Asset (or any interest in an Asset); (viii) acquire or agree to acquire any share, shares or other interest in any company, partnership or other venture; (ix) engage any new employee, (at the Seller’s initiative) terminate the employment of any Employee, or (except in the ordinary course of business) change the terms of employment (including remuneration) of any of the Employees, or pay or provide any bonus to any Employee; or (x) institute, settle or compromise (or agree to do so) any legal proceedings (other than in relation to trade debts in the ordinary course). 5.2 Integration Process The Parties have initiated the integration process on 21 October 2014. The Seller shall use its best efforts and provide reasonable support to continue the integration process prior to the Completion Date.

page 20 5.3 Seller to notify of potential Material Adverse Effect or breach of Seller’s Warranty (a) If the Seller becomes aware of any fact, matter or circumstance which results in, or is reasonably likely to result in: (i) a Material Adverse Effect; or (ii) a breach of a Seller’s Warranty, the Seller must give notice to the Buyer as soon as reasonably practicable after becoming aware of the fact, matter or circumstance, and the notice must set out full details of those facts, matters or circumstances and the potential Material Adverse Effect or breach of the Seller’s Warranty (as applicable). (b) The Seller’s obligations in clause 5.3(a) apply until Completion. 6 Completion 6.1 Date, time and place Completion must take place on the Completion Date at 11am at the offices of Wolf Theiss Rechtsanwälte GmbH & Co KG, Vienna, or such other time and place as the parties may agree in writing. 6.2 Execution of a Share Transfer Agreement In order to effectuate the transfer of the Share to the Buyer, the Buyer and the Seller shall execute a separate share transfer agreement as a notarial deed substantially in the form of annexure H. 6.3 Seller’s obligations At Completion, the Seller must deliver to the Buyer: (a) written declaration of Jorda and Malanik, such declaration to acknowledge that the signatory or the companies which provide the services of Jorda or Malanik to the Company have no Claim or basis for a Claim against the Company or any Company's Affiliate in respect of fees, entitlements, salary, or otherwise as of Completion (except as expressly specified in the written declaration); (b) the Business Records, complete and up to date; (c) written non-solicitation declarations of all the individuals mentioned in and in the form specified in annexure I; (d) consents to change in control of the Company (in form and substance satisfactory to the Buyer) from each of the lessors of the Property required under clause 2.1(a); (e) copy of the application for the renewal of the authorisation of NP RO as contemplated by clause 2.1(f); (f) copies of the written confirmations as mentioned above under clause 2.1(g) and 2.1(h)

page 21 (g) the Company Tax Records; and (h) keys to the Business premises. 6.4 Delivery at Business premises The parties acknowledge and agree that delivery of the items referred to in clauses 6.3(b), 6.3(g) and 6.3(h) will be deemed to have occurred by those items being left at the Business premises under the control of the Company. 6.5 Actions by the managing directors On or prior to Completion, the Seller must cause the managing directors of the Company to: (a) execute in notarized form an application for registration of the transfer of the Share and the registration of the new managing directors of the Company in the Austrian companies register and have such application filed with the Austrian companies register; and (b) subject to Completion occurring revoke all existing authorities to operate the bank accounts of the Company and the Company's Affiliates and the persons nominated by the Buyer in writing be appointed as signatories of the bank accounts of the Company and the Company's Affiliates; 6.6 Buyer’s obligations At Completion, the Buyer must: (a) deliver to the Company: (i) written consents to act as directors, secretary and public officer of the Company or the Company's Affiliates signed by the persons nominated by the Buyer; and (ii) a CD Rom containing the Data Room Documentation; and (b) pay to the Seller the Completion Payment Amount (as directed by the Seller). 6.7 Interdependence of obligations (a) The obligations of the parties in respect of Completion are interdependent and if all such obligations have not been performed, then no Completion may take place. (b) Performance of the obligations of each party in respect of Completion is treated as taking place simultaneously and no delivery or payment will be taken to have been made until all deliveries and payments have been made. Once all such obligations have been performed, they must be treated as having been performed simultaneously on the date on which the final obligation is performed. 6.8 Title and risk Legal and beneficial title to the Share (and property and risk in it) will pass to the Buyer upon Completion.

page 22 7 Completion Accounts 7.1 Preparation of Completion Accounts The Buyer must prepare (or procure the preparation by its accountants of) the unaudited Completion Accounts as at the Completion Date in a form materially similar to the previous Accounts and in accordance with the Accounting Standards and Accounting Policies. 7.2 Co-operation The Seller and the Buyer must co-operate fully with each other and provide reasonable assistance in the preparation of the Completion Accounts. 7.3 Timing The Buyer must use its reasonable endeavours to prepare (or procure the preparation by its accountants of) the Completion Accounts as soon as possible but not later than 2 months after the Completion Date. The Buyer must deliver the Completion Accounts to the Seller as soon as the Completion Accounts have been finalised. 7.4 Seller’s accounting The Seller and its accountants will be entitled to examine and review the Completion Accounts and all working papers of the Buyer and its accountants. 7.5 Dispute Notice If the Seller disputes: (a) the inclusion, omission or calculation of any item in the Completion Accounts; or (b) that the Completion Accounts have been drawn up in accordance with the Accounting Standards and Accounting Policies, then it must give notice of such dispute (Dispute Notice) to the Buyer within 15 Business Days after receipt of the Completion Accounts. 7.6 Content of Dispute Notice (a) A Dispute Notice must identify: (i) the item in the Completion Accounts in respect of which the dispute exists (by category and location to the extent that the party has that information); (ii) insofar as possible, the amount in dispute; and (iii) the adjustments to the Completion Accounts and Net Working Capital Amount and Purchase Price if the Dispute Notice were to be accepted. (b) The Buyer and the Seller must use their respective best endeavours to resolve the dispute the subject of a Dispute Notice within 10 Business Days of receipt of the Dispute Notice by the Buyer, failing which the dispute must

page 23 be resolved in accordance with the dispute resolution mechanism set out in clause 7.7. (c) The resolution of the dispute, and the Completion Accounts (and the Purchase Price derived from the resolution of the dispute), will be taken to be accepted by the Buyer and the Seller. 7.7 Independent Accountant (a) If the Buyer and the Seller fail to resolve any dispute within 10 Business Days under clause 7.6(b) the dispute must be submitted as soon as reasonably practicable for determination by the Independent Accountant. (b) The Independent Accountant must be appointed to act on the following basis: (i) the Independent Accountant must act as experts and not as arbitrators; (ii) the Independent Accountant must determine the matter in dispute as soon as possible; (iii) the Buyer and the Seller: (A) must provide the Independent Accountant with all information the Independent Accountant reasonably requires; (B) are entitled to make written submissions to the Independent Accountant; and (C) must provide the other with a copy of all information provided and submissions made to the Independent Accountant. (c) The Independent Accountant is entitled (to the extent they consider it appropriate) to base their opinion on the information provided and submissions made by the Buyer and the Seller and on the Business Records. The Independent Accountant may seek the advice of another accountant at its discretion. (d) The determination of the Independent Accountant is (in the absence of manifest error) conclusive and binding on the Buyer and Seller and will be taken to be accepted by the Buyer and the Seller. (e) The costs of the Independent Accountant must be borne by the Buyer and Seller equally. 7.8 Deemed acceptance If the Seller does not give a Dispute Notice within the 15 Business Day period required by clause 7.5 it will be taken to have accepted the Completion Accounts and the amount of the Net Working Capital Amount, fees invoiced and Purchase Price included in the Completion Accounts.

page 24 8 Trade Receivables and Trade Credits (a) Any portion of any Trade Receivable that is overdue 120 days (or such other period as the parties acting reasonably agreed) at the Completion Date will: (i) reduce the Net Working Capital Adjustment Amount to be paid by the Buyer in accordance with clause 4.5(a); or (ii) be added to the Net Working Capital Adjustment Amount to be deducted from the First Period Payment Amount (or from the Second Period Payment Amount and the Third Period Payment Amount as applicable) in accordance with clause 4.5(b). (b) The Seller shall be in charge of collecting any Trade Receivable that is overdue 120 days at the Completion Date. Any collected Trade Receivable that is overdue 120 days at the Completion Date shall belong to the Seller. (c) If the Buyer or the Company pays a Trade Credit and there is no provision for such Trade Credit in the Completion Accounts, then: (i) following such payment the Buyer will provide to the Seller the Trade Credit and proof of payment; and (ii) the percentage of that total payment made by the Buyer that relates to the period from the commencement of the Trade Credit until the Completion Date shall be added to the Net Working Capital Adjustment Amount to be deducted from the First Period Payment Amount (or from the Second Period Payment Amount and the Third Period Payment Amount as applicable) in accordance with clause 4.5(b). 9 Third party consents If any Contract requires the consent of a third party to the continuation of that Contract as a result of the Buyer acquiring the Share, and such consent has not been obtained on or prior to Completion: (a) the Seller will, following Completion and upon request from the Buyer, use all reasonable endeavours to obtain the consent of that third party on terms reasonably acceptable to the Buyer; and (b) the Buyer must provide all assistance and information reasonably required by the Seller to secure such consents. 10 Non-competition 10.1 Non-compete The Seller (in consideration for the Buyer entering into this document) undertakes to the Buyer that it will not: (i) engage in a business or activity that is the same as or substantially similar to, or in competition with, the Business or the Buyer;

page 25 (ii) solicit, canvass, approach, or accept an approach from a person (including for the purpose of recruiting that person or otherwise inducing that person to leave their employment) about engaging in a business or activity that is the same as or substantially similar to, or in competition with, the Business or the Buyer if that person who was, at any time during the 12 months ending on the Completion Date: (A) an agent or employee of the Business or the Buyer; (B) a person occupying a senior management position and is (or is likely to be) in possession of confidential information relating to the Business or the Buyer; (C) a person able to materially influence customer or client relationships of the Business or the Buyer; or (D) a client or a customer of the Business or the Buyer; (iii) interfere with the relationship between either the Company and the Company's Affiliates or the Buyer and their clients, customers, employees or suppliers; or (iv) disclose confidential information known about the Company and the Company's Affiliates or the Buyer, except that nothing in this clause will restrict the Seller from holding or acquiring (either directly or indirectly) the issued ordinary shares in the capital of any body corporate listed on a regulated stock exchange. 10.2 Interpretation For the purposes of clause 10.1, engage in means to carry on, participate in, provide finance or services, or otherwise be directly or indirectly involved in, whether as a shareholder, unit holder, director, consultant, adviser, contractor, principal, agent, manager, employee, beneficiary, partner, associate, trustee or financier. 10.3 Duration of prohibition The undertakings in clause 10.1 begin on the Completion Date and end on the date that is three years after the Completion Date. 10.4 Geographic application of prohibition The undertakings in clause 10.1 apply if, and only to the extent that the activity prohibited occurs within: (a) Austria; (b) Germany; and (c) any other jurisdiction in which the Company or the Company's Affiliates are operating at the Completion Date. 10.5 Severability The Seller acknowledges that each of the prohibitions and restrictions contained in this clause:

page 26 (a) is to be read and construed and is to have effect as a separate severable and independent prohibition or restriction and will be enforceable accordingly; and (b) confers a benefit on the Buyer which is no more than that which is reasonably and necessarily required by the Buyer for the maintenance and protection of the Business. 10.6 Acknowledgement The Seller acknowledges that all the prohibitions and restrictions contained in this clause 10 are reasonable in the circumstances and necessary to protect the goodwill of the Business as at the Completion Date. 10.7 Injunction The Seller acknowledges that monetary damages alone will not be adequate compensation to the Buyer from breach of this clause 10 and that the Buyer is entitled to seek (in addition to any other remedies it may be able to seek but subject to the discretion of the court) an injunction from a court of competent jurisdiction if: (a) the Seller fails to comply with or threatens to fail to comply with any of the provisions of clause 10.1; or (b) the Buyer has reason to believe that the Seller will not comply with clause 10.1. 11 Seller’s Warranties 11.1 Seller’s Warranties Subject to the limitations set out in this document the Seller represents and warrants to the Buyer that each of the Seller’s Warranties set out in schedule 1 are true and accurate as at the date of this document and as at the Completion Date, if not otherwise explicitly stated in this document. 11.2 Reliance Each of the Seller’s Warranties is to be treated as a separate representation and warranty and the interpretation of any statement made must not be restricted by reference to, or inference from any other statement or provision of this document. 11.3 Remedies (a) Subject to Completion having occured, in the event of breach of any of the Seller's Warranties, the Buyer shall be entitled, subject to further provisions of this clause 11, at its sole discretion, to claim from the Seller monetary compensation for all actual losses and damages, costs and expenses (including reasonable attorneys' and accountants' fees) incurred by the Buyer and/or the Company and/or the Company's Affiliates (Losses) by reason of such Seller's Warranties not being true and accurate (and thus compared to such Seller's Warranties being true and accurate). Any liability

page 27 for lost profit (entgangener Gewinn) is hereby expressly excluded to the extent permitted by law. (b) Except for the Seller's Warranties, the Seller will not except any warranty or other liability with respect to the Share, the Company or the Company's Affiliates, the Business and the Assets. Any guarantee and liability for a certain income from the Share shall specifically be excluded. (c) The remedies for breaches of the Seller's Warranties provided in clause 11.3(a) shall be in lieu of any other remedy (Rechtsbehelf) (including, without limitation, in lieu of any warranty remedy [Gewährleistungsbehelf] and/or damage claims of whatever kind [Schadenersatzansprüche]) and any other liability claim (Haftungsanspruch) the Buyer may have by law or otherwise in connection with any breach of the Seller's Warranties. (d) If an event, a fact, a circumstance or a situation simultaneously constitutes a breach of several Seller's Warranties, the Buyer shall not be entitled to multiple compensation for the same Loss. 11.4 Ability to claim (a) The Buyer may not bring a Claim for any breach of a Seller’s Warranty to the extent that: (i) the relevant fact, matter or circumstance was fully and fairly disclosed in the Disclosures so that based on such disclosure the Buyer was – applying the standard of care and diligence of a prudent buyer – in a position to identify, assess and evaluate the material facts, matters and circumstances forming the basis for its Claim and the adverse impact (financially or otherwise) of such facts, matters and circumstances on the Business or was within the actual knowledge of the Buyer (this clause 11.4(a)(i) does not apply to Claims for any breach of a Tax Warranty); or (ii) provision or respective liability has been made for that fact, matter or circumstance in the Accounts. (b) The Seller shall not be liable towards the Buyer to the extent the Loss suffered in connection with the breach of a Seller's Warranty is compensated by a third party or an insurance company. 11.5 Limitation on claims (a) Any Claim made by the Buyer in respect of a Seller’s Warranty is subject to and limited as follows: (i) the Buyer must give written notice to the Seller of the Claim within 18 months after the Completion Date; (ii) in the case of a single Claim, or a series of related Claims, where the amount claimed exceeds EUR 15,000; (iii) the Seller will only be liable for any Claim if its liability for all Claims not excluded by the limitation in clause 11.5(ii) would exceed in aggregate EUR 35,000; and

page 28 (iv) the maximum aggregate amount which the Buyer may recover from the Seller in respect of all claims amounts to EUR 1,7 million, except that the Seller's maximum liability to the Buyer for all Claims under the Tax Indemnity under clause 15 and for breaches of a Tax Warranty are unlimited. 11.6 Disclosures (a) In the period from the date of this document until Completion: (i) the Seller must, as soon as reasonably practicable, disclose to the Buyer; and (ii) the Buyer must as soon as reasonably practicable disclose to the Seller, in writing any fact, matter or circumstance of which the Seller or the Buyer become aware and which in its opinion would result or would be likely to result in any Seller’s Warranty not being true, complete or accurate. The Seller must use all reasonable endeavours to remedy (if capable of remedy) the relevant fact, matter or circumstance before Completion. If remedied, the Buyer has no claim in respect of the fact, matter or circumstance. (b) If any fact, matter or circumstance is disclosed under clause 11.6(a) and is not remedied before Completion, then, if Completion occurs, the Buyer will be entitled to claim damages in accordance with this clause 11 but no right to damages will arise if Completion does not occur. 11.7 Disclaimer Nothing in this clause 11 applies in relation to any fraudulent misrepresentation made by the Seller before the date of this document. 11.8 Payment of Claims All sums payable by the Seller to the Buyer under this document in respect of a Claim for breach of a Tax Warranty, under the Tax Indemnity or in relation to any Tax Claim or Tax Proceedings referred to in clause 16 must be paid by the later of: (a) 20 Business Days preceding the due date (or any extended date for payment permitted by the relevant Governmental Agency) for payment of the Tax Liability to which the Claim relates; or (b) the day that is 20 Business Days after notice of the Claim is provided to the Seller. 11.9 Tax effect If any payment by the Seller to the Buyer under the Tax Indemnity or otherwise under this document, including the payment of an additional amount under this clause 11.9, would require the Buyer to pay Tax on, or as a result of, the amount received by the Buyer, the Seller must pay on demand to the Buyer an additional amount (which amount will not be subject to the limitations in clause 11.5) calculated as follows:

page 29 AA = T)(1 P - P where: AA means the additional amount to be paid; P means the amount payable by the Seller disregarding this clause; and T means the general corporate tax rate (as defined in the Austrian Corporate Tax Act), expressed as a decimal. The Buyer will provide proof to the Seller that any tax gross-up due under this clause is in fact additional tax to be borne by the Buyer caused by the Seller's payments, if any, net of any (current and future) tax benefits available to the Buyer. The Buyer will take all reasonable actions to avoid or mitigate such tax impact and will grant the Seller and his designees the unrestricted opportunity to appeal such assessments on his behalf and fully cooperate in this matter with the Seller and his designees. 12 Indemnities 12.1 Seller’s indemnity (a) Subject to Completion having occurred, the Seller shall indemnify the Buyer against any Loss suffered or incurred by the Buyer as a result of (i) any breach of any warranty of the Seller given in Schedule 1 under Clause 2(a), 2(b), 2(c), 2(d)(i), 2(e) , 2(f) and 2(k); and/or (ii) any claims that might be issued to the Company under the license agreement entered into between the Company, the Seller, Mr. Gary Mackney, Mr. Petrus Gerbaulet and Legal Neumann GmbH; and/or (iii) any claims from any employee or contractor, freelancer or consultant of the Company and/or any of the Company's Affiliates (e.g. salary claims, overtime, compensation for unused vacation) as well as related claims from tax or social insurance agencies (e.g. payroll tax payments and social insurance contributions) and/or; (iv) any non-compliance of the Company and/or any of the Company's Affiliates with provisions under the respective national trade law. (b) Clauses 11.4(a)(ii) and (b) as well as clauses 11.5(a)(i) – (iii) apply to Claims under this clause 12. However, such indemnification is not excluded or limited due to the fact that any claim is based on a fact, matter, event or circumstance which was fully and fairly disclosed in the Disclosures or was within the actual knowledge of the Buyer. (c) If an event, a fact, a circumstance or a situation constitutes a breach of a Seller's Warranty and simultaneously entitles the Buyer to be indemnified pursuant to this clause 12, the Buyer shall not be entitled to multiple compensation for the same Loss.

page 30 13 Buyer’s Warranties 13.1 Buyer’s Warranties The Buyer represents and warrants to the Seller as at the date of this document and as at Completion that: (a) it has full power and authority to enter into this document and has taken all necessary action to authorise the execution, delivery and performance of this document in accordance with its terms; (b) this document constitutes a legally valid and binding obligation of the Buyer enforceable in accordance with its terms; (c) the execution, delivery and performance of this document by the Buyer will not violate any provision of: (i) any law or regulation or any order or decree of any Governmental Agency of Austria or any state or territory or relevant jurisdiction in which it is incorporated; (ii) the constitution of the Buyer or equivalent constituent documents; or (iii) any Encumbrance or other document which is binding on the Buyer; (d) no order has been made, or application filed, or resolution passed or a notice of intention given to pass a resolution for the winding up of the Buyer and there are no circumstances justifying commencement of any such action; (e) no petition or other process for winding-up or dissolution has been presented or threatened in writing against the Buyer and, so far as the Buyer is aware, there are no circumstances justifying such a petition or other process; (f) no receiver, receiver and manager, liquidator, administrator, controller, trustee or similar official has been appointed over all or any part of the assets or undertaking of the Buyer and, so far as the Buyer is aware, there are no circumstances justifying such an appointment; (g) the Buyer has not entered into or taken steps or proposed to enter into any arrangement or composition or compromise with all or a class of its creditors; (h) the Buyer has not: (i) gone, and is not proposed to go, into liquidation; (ii) passed a winding-up resolution or commenced steps for winding-up or dissolution; or (i) no writ of execution has issued against the Buyer or any of its assets and, so far as the Buyer is aware, there are no circumstances justifying such a writ; and (j) the Buyer is able to pay its debts as and when they fall due. The Buyer is not taken under applicable laws to be unable to pay its debts

page 31 and has not stopped or suspended, or threatened to stop or suspend, payment of all or a class of its debts. 13.2 Reliance Each of the statements in clause 13.1 is to be treated as a separate representation and warranty and the interpretation of any statement made must not be restricted by reference to or inference from any other statement. 13.3 LRS GmbH The Buyer represents and warrants to the Seller the payment of the amount provided for in the Accounts (and considered in the Net Working Capital Amount) for the dissolution of the agreement between the Company and LRS GmbH (FN 194030p) by the Company. 14 Action after Completion 14.1 Business Records The Buyer must ensure that the Company does not dispose of or destroy any of the Business Records within the period of 7 years following the Completion Date, unless it has given the Seller not less than one month’s written notice of its intention to do so, and the Seller has not notified the Buyer within one month of receipt of that notice that it wishes to retain the Business Records the subject of the notice. 14.2 Continuing co-operation (a) The Seller and the Buyer acknowledge and agree that both parties must co- operate with each other in good faith following Completion to facilitate an orderly and thorough transition from the Seller to the Buyer carrying on the Business; (b) Other than to identify personally the credentials and/or career history of the Seller and each of the General Partners and the Limited Partners of the Seller, after Completion the Seller may not use, or authorise the use of: (i) any company or entity name, business name or trade name incorporating or resembling the “Neumann” name or likely to be mistaken for the “Neumann” name or confused with it; or (ii) any logo, symbol or trade mark which is substantially identical with or deceptively similar to the Trade Marks. 15 Tax Indemnity (a) The Seller shall indemnify and keep indemnified the Indemnified Entities against: (i) all Liabilities for Tax which an Indemnified Entity may suffer, incur or be liable for as a result of or arising out of (and whether directly or indirectly) any Tax matter which is not provided for (to like manner and

page 32 extent) in the Accounts and which has arisen before the Completion Date or arises after the Completion Date in respect of any period (or part thereof) before the Completion Date; (ii) all Liabilities for Tax which an Indemnified Entity suffers, incurs or is liable for, by reason of any matter or thing being other than as represented or warranted in the Warranties; and (iii) all costs and expenses incurred or payable by an Indemnified Entity in connection with any Liability for Tax referred to in this clause 15, including all legal proceedings relating thereto, any audit or investigation made by a Governmental Agency in relation to Tax, and the settlement of, and steps taken to mitigate or resolve any process which could lead to, a Liability for Tax, whether or not it transpires that it does. (b) Subject to clause 16(b), the Seller is not liable for any Claim under the Tax Indemnity to the extent that the Claim is made after the expiry of three months after the expiration of the statutory period within which the relevant Governmental Agency may seek to recover the Tax to which the Claim relates. (c) Obligations to pay Taxes resulting from determinations during tax audits conducted at the Company or the Company's Affiliates in respect of periods prior to the Completion Date shall be set off against effective Tax reductions relating to those determinations, which will be effective in periods after the Completion Date. (d) Claims under the Tax Indemnity are time-barred and shall forfeit, if the Buyer has not notified the Seller in writing of any such claim within three months after the date on which the obligation to pay Taxes was finally determined (materiell rechtskräftig) by the competent authority (i.e. the competent authority's decision is no longer contestable, neither by virtue of an ordinary or extraordinary appeal or otherwise). clauses 11.5(a)(ii) and (iii) apply to Claims under this clause 15 as well. (e) The Seller will pay any amount to the Buyer under this clause 15 in accordance with clause 11.8. 16 Tax Claims (a) If the Buyer or the Company or any of the Company's Affiliates receive any written communication or notice from any Governmental Agency, including a communication or notification of any enquiry (including any request for information, notice to produce documents, audit, review or request for a meeting) (Tax Claim) in relation to the Company or any of the Company's Affiliates which may directly or indirectly lead to a circumstance as a result of which the Buyer would, or would be likely, to bring a Claim for a breach of a Tax Warranty or under the Tax Indemnity, then the Buyer must promptly notify the Seller in writing and provide the Seller with all information relevant to the Tax Claim.

page 33 (b) If the Tax Claim referred to in clause 16(a) is received by the Buyer or the Company or any of the Company's Affiliates within the time period referred to in clause 15(b), then the limitation in that clause 15(b) will not apply to the Tax Claim and the Tax Claim will be governed by this clause 16. (c) Subject to the Tax Claim not being a Joint Tax Claim, the Seller will be the Controlling Party in relation to the relevant Tax Claim and, to the extent the Seller considers appropriate, will conduct, defend and settle any Tax Claim against the Company and the Buyer (Tax Proceedings) and the Buyer will, or will procure that the Company, provides all reasonable co-operation in relation to the conduct, defence or settlement of any such Tax Claim or Tax Proceedings. As Controlling Party the Seller must in relation to the Tax Claim or Tax Proceedings: (i) act in good faith at all times; (ii) liaise with the Buyer in relation to the Tax Claim or Tax Proceedings; (iii) make available to the Buyer as soon as possible, but in any event within 5 Business Days of receipt by the Seller, a copy of any notice, correspondence or other document relating to the Tax Claim or Tax Proceedings; (iv) not take any action which it is objectively unreasonable to take in all the circumstances; (v) bear all costs in relation to the conduct, defence or settlement of the Tax Claim or Tax Proceedings (including the costs of the Buyer in providing any co-operation); (vi) pay to the Buyer or the Company or the respective Affiliate of the Company so much of any Tax as is required by the relevant Governmental Agency to be paid in relation to the conduct, defence or settlement of any such Tax Claim or Tax Proceedings (such payment being made in accordance with clause 11.8); and (vii) provide the Buyer with an indemnity in a form agreed to by the Buyer (such agreement not being unreasonably withheld or delayed) against all Loss which may result from any action taken at the request of the Seller by the Buyer or the Company or in connection with the conduct of the Tax Claim or Tax Proceedings. (d) If a Tax Claim is a Joint Tax Claim, then the following principles will apply: (i) The Seller and the Buyer acting reasonably must agree that either the Seller and the Buyer will jointly control the conduct, defence or settlement of the Joint Tax Claim, or that one party will be the Controlling Party. (ii) Where the Seller and the Buyer are in joint control of the conduct, defence or settlement of the Joint Tax Claim then the Seller and the Buyer must agree to the appropriate manner in which to conduct, defend or settle the Joint Tax Claim and no other action may be taken

page 34 without such agreement. The agreement of the Seller and the Buyer must not be unreasonably withheld or delayed. (iii) Where one party is the Controlling Party in respect of the Joint Tax Claim, the other party must provide all reasonable co-operation in relation to the conduct, defence or settlement of the Joint Tax Claim. (iv) If: (A) the agreement required by clause 16(d)(i) cannot be reached between the Seller and the Buyer within a reasonable time, the Seller and the Buyer will jointly control the conduct, defence or settlement of the Joint Tax Claim; (B) the agreement required by clause 16(d)(ii) cannot be reached between the Seller and the Buyer within a reasonable time, the matter in dispute is to be determined by a Tax Reviewer. In so acting, the Tax Reviewer will act as an expert and not as an arbitrator, and his or her decision will be final and binding on the parties with the relevant conduct, defence or settlement of the Joint Tax Claim being conducted accordingly. The Seller and the Buyer will each pay one half of the Tax Reviewer’s costs and expenses in respect of any such reference. (v) The Controlling Party must, in relation to the conduct, defence or settlement of the Joint Tax Claim: (A) act in good faith at all times; (B) liaise with the other party (being the Seller or the Buyer as the case may be) in relation to the conduct, defence or settlement of the Joint Tax Claim; (C) make available to the other party as soon as possible, but in any event within 5 Business Days of receipt by the Controlling Party, a copy of any notice, correspondence or other document relating to the conduct, defence or settlement of the Joint Tax Claim; (D) not take any action which it is objectively unreasonable to take in all the circumstances; and (E) commence, pursue and conduct the defence or settlement of the Joint Tax Claim with all due skill, care and attention and without regard to the quantum of liability (if any) that each party would bear if the Joint Tax Claim was ultimately not successful. (vi) The Seller must pay to the Buyer or the Company so much of any Tax as is required by the relevant Governmental Agency to be paid in relation to the conduct, defence or settlement of any such Joint Tax Claim (such payment being made in accordance with clause 11.8); and (vii) Where the Seller is the Controlling Party in relation to the Joint Tax Claim, it must provide the Buyer with an indemnity in a form agreed to

page 35 by the Buyer (such agreement not being unreasonably withheld or delayed) against all Loss which may result from any action taken at the request of the Seller by the Buyer or the Company or any of the Company's Affiliates or in connection with the conduct of the Joint Tax Claim. 17 Tax Records 17.1 Retention of Tax Records (a) The Buyer agrees that after Completion it will hold for safe keeping and store any Company Tax Records that relate to a period before Completion (or part thereof): (i) for the period required under Tax Law; and (ii) otherwise in conformity with the Buyer’s usual records retention policy. (b) The Seller agrees that after Completion it will hold for safe keeping and store any Seller’s Tax Records: (i) for the period required under the Tax Law; and (ii) otherwise in conformity with the Seller’s usual records retention policy. 17.2 Access to Tax Records From Completion: (a) the Buyer will be entitled at the Buyer’s cost to have access at all reasonable times to the Seller’s Tax Records to the extent that such access is reasonably necessary to: (i) support the Tax position of the Company; or (ii) in respect of a Joint Tax Claim in respect of which the Buyer is the Controlling Party or is in joint control with the Seller as contemplated in clause 16. The Seller will provide such access to the Seller’s Tax Records within a reasonable time of the Buyer making its request for access and will otherwise provide such reasonable assistance as the Buyer requires in respect of such access. However, the Buyer is not entitled to access to any such records that the Seller believes (acting reasonably) may prejudice or adversely affect any Claim the Seller may have against the Buyer or which are the subject of client legal privilege or similar administrative concession and in circumstances where the granting of access may waive that privilege or concession; and (b) the Seller will be entitled at the Seller’s cost to have access at all reasonable times to the pre-Completion Company Tax Records to the extent that they relate to: (i) any Tax Return to be prepared by the Seller or any of its general partners or limited partners; or

page 36 (ii) the conduct of any Tax Claim or Joint Tax Claim in respect of which the Seller is the Controlling Party or the Seller is in joint control with the Buyer as contemplated in clause 16. The Buyer will provide such access to the Company Tax Records within a reasonable time of the Seller making a request for access and will otherwise provide such reasonable assistance as the Seller requires in respect of such access. However, the Seller is not entitled to access to any records which the Buyer believes (acting reasonably) are the subject of client legal privilege or similar administrative concession and in circumstances where the granting of access may waive that privilege or concession. 18 Tax Returns 18.1 Co-operation regarding Tax Returns The Seller must provide all reasonable co-operation and assistance requested by the Buyer in relation to the preparation of any income Tax Return for the Company or the Company's Affiliates that relates to a Tax period (or part thereof) before the Completion Date (including, for the avoidance of doubt, any income Tax Return that relates to a Tax period commencing before the Completion Date and ending after the Completion Date). 19 Costs 19.1 Legal costs Each party must bear its own legal and other costs and expenses in connection with the preparation, execution and completion of this document and of other related documentation. The Buyer shall pay the cost of the notary and all other expenses in connection with the execution of this agreement and all documents under this agreement. 19.2 Redemption or acquisition of the Company's debt Notwithstanding clause 19.1, the Buyer shall bear any costs resulting from Stamp Duties for the redemption or acquisition of the Company's bank debt. 20 Notices 20.1 General A notice, demand, certification, process or other communication relating to this document must be in writing in English and may be given by an agent of the sender. 20.2 How to give a communication In addition to any other lawful means, a communication may be given by being: (a) personally delivered;

page 37 (b) left at the party’s current delivery address for notices; (c) sent to the party’s current postal address for notices by pre-paid ordinary mail or, if the address is outside of Austria, by pre-paid airmail; (d) sent by fax to the party’s current fax number for notices; or (e) emailed to the email address last notified by the addressee. 20.3 Particulars for delivery of notices (a) The particulars for delivery of notices are initially: Buyer: Delivery address: CTPartners Executive Search Inc., 28601 Chagrin Blvd, Suite 600, Cleveland, OH 44122, United States of America Postal address: Same as delivery address Fax: 216-682-3202 Email: wkeneally@ctnet.com Attention: William J. Keneally with a copy to: Delivery address: Wolf Theiss Rechtsanwälte GmbH & Co KG, 1010 Vienna, Schubertring 6, Austria Postal address: Same as delivery address Fax: +43 1 51510 665100 Email: horst.ebhardt@wolftheiss.com Attention: Dr. Horst Ebhardt Seller: Delivery address: c/o Frotz Riedl Rechtsanwälte, Schottengasse 10/12, 1010 Vienna, Austria Postal address: Same as delivery address Fax: +43 1 8908590 88 Email: s.frotz@frra.at Attention: Dr. Stephan Frotz (b) Each party may change its particulars for delivery of notices by notice to each other party. 20.4 Communications by post Subject to clause 20.7, a communication is given if posted:

page 38 (a) within Austria to an Austrian postal address, 3 Business Days after posting; or (b) outside of Austria to an Austrian postal address or within Austria to an address outside of Austria,10 Business Days after posting. 20.5 Communications by fax Subject to clause 20.7, a communication is given if sent by fax, when the sender’s fax machine produces a report that the fax was sent in full to the addressee. That report is conclusive evidence that the addressee received the fax in full at the time indicated on that report. 20.6 Communications by email Subject to clause 20.7, if a communication is emailed, a delivery confirmation report received by the sender, which records the time that the email was delivered to the addressee’s last notified email address is prima facie evidence of its receipt by the addressee, unless the sender receives a delivery failure notification, indicating that the electronic mail has not been delivered to the addressee. 20.7 After hours communications If a communication is given: (a) after 5.00 pm in the place of receipt; or (b) on a day which is a Saturday, Sunday or bank or public holiday in the place of receipt, it is taken as having been given at 9.00 am on the next day which is not a Saturday, Sunday or bank or public holiday in that place. 20.8 Process service Any process or other document relating to litigation, administrative or arbitral proceedings relating to this document may be served by any method contemplated by this clause 20 or in accordance with any applicable law. 20.9 Change of address Any party may change its address for receipt of Notices at any time by giving written notice of such change to each other party. 21 Confidentiality 21.1 Definitions In this clause 21: Confidential Information means all information, in whatever form, relating to: (a) this document; (b) the negotiations relating to this document; and (c) any expert determination initiated under this document,