Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ENCORE CAPITAL GROUP INC | encoreform8-kxearningsslid.htm |

Encore Capital Group, Inc. Q3 2014 EARNINGS CALL Exhibit 99.1

PROPRIETARY 2 CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS The statements in this presentation that are not historical facts, including, most importantly, those statements preceded by, or that include, the words “will,” “may,” “believe,” “projects,” “expects,” “anticipates” or the negation thereof, or similar expressions, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). These statements may include, but are not limited to, statements regarding our future operating results, earnings per share, and growth. For all “forward-looking statements,” the Company claims the protection of the safe harbor for forward-looking statements contained in the Reform Act. Such forward-looking statements involve risks, uncertainties and other factors which may cause actual results, performance or achievements of the Company and its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These risks, uncertainties and other factors are discussed in the reports filed by the Company with the Securities and Exchange Commission, including its most recent report on Form 10-K, and its subsequent reports on Form 10-Q, each as it may be amended from time to time. The Company disclaims any intent or obligation to update these forward-looking statements.

PROPRIETARY 3 ENCORE DELIVERED RECORD QUARTERLY EARNINGS PER SHARE Economic EPS** $1.17 GAAP EPS* $1.11 GAAP Net Income* $30 million Adjusted Income** $31 million Estimated Remaining Collections of $5.1 billion * Attributable to Encore ** Please refer to Appendix for reconciliation of Economic EPS, Adjusted EBITDA, and Adjusted Income to GAAP *** Cost to Collect is Adjusted Operating Expenses / Dollars collected. See Appendix for reconciliation of Adjusted Operating Expenses to GAAP Note: All figures include Cabot Credit Management UK results unless otherwise indicated Adjusted EBITDA** $252 million Collections $407 million Cost to Collect*** 38.9%

PROPRIETARY 4 Q3 DEPLOYMENTS REFLECT A DIVERSE GLOBAL BUSINESS Q3-2014 Deployments $M Core US Purchasing $69 Core US (Atlantic) $105 Propel $36 Cabot $93 Refinancia $16 Grove $16 Total $336

PROPRIETARY OUR DIVERSIFICATION ALLOWS US TO OPERATE IN SEVERAL DISTINCT MARKETS 5 Current Market Conditions US Core Market • Pricing remains steady, even moderating in some instances • Supply moderate in Q4 • Two large issuers remain on the sidelines UK IVA* Market and Spain • IVA supply traditionally lumpy in the back half of the year • Some supply pushed into 2015 • Strong opportunity pipeline in Spain UK Core Market • Pricing remains competitive, but rational • Supply seasonally stronger in back half of the year • Buyer consolidation continues Colombia & Peru Market • Healthy pricing environment • Supply remains consistent • New sellers entering market • Interesting expansion opportunities in Latin America * Individual Voluntary Arrangements

PROPRIETARY OUR GROWTH STRATEGY IS TAILORED TO ADDRESS THE EVOLVING DYNAMICS OF OUR MARKETS 6 Encore Growth Strategy • Existing – Cabot/Marlin – Grove – Refinancia • New – India – Europe – Latin America – Australia – Others Expand Into New Geographies 2 • M&A opportunities in related spaces – Tax Liens – Debt Servicing – Others • New debt verticals – Government – Medical – Others • Funding and incubation of lending businesses Explore Business Model Adjacencies and Expansion 3 • Core Business – Core cards direct – Atlantic – Resale – Bankruptcy • Tax Lien Business – Propel Continue to Invest In Core Businesses 1

PROPRIETARY Investment Rationale Attractive Consolidation Partner Additional ERC Expanded Market for Future Capital Deployment • ACF specializes in high balance, recently charged-off (“fresh”) paper • Strong liquidation rates result from specialized approach and experienced staff • Long-standing relationship provides familiarity with successful strategy and operation • Encore has historically specialized in collecting on older paper • With ACF, Encore to place higher priority on fresh paper opportunities • Transaction includes ACF portfolio with ERC of approximately $275 million WE HAVE CONTINUED TO LEAD THE CONSOLIDATION OF OUR INDUSTRY IN THE U.S. 7 Attractive consolidation target Satisfies a significant portion of our purchasing target for 2014 Expands market for future capital deployment

PROPRIETARY Cabot’s Economic EPS Impact CABOT REMAINS A SOLID CONTRIBUTOR TO OVERALL EARNINGS - MARLIN INTEGRATION REMAINS ON TRACK 8 Cabot Update 0.17 0.18 0.21 0.19 0.21 0.00 0.05 0.10 0.15 0.20 0.25 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 $ Cabot deployed $503 million in new portfolio purchases, including Marlin, in the first three quarters of 2014 Cabot’s ERC has grown 54% in the last 12 months from $1.5B to $2.3B Cabot expects to leverage Marlin’s platform across more accounts than originally expected India continues to deliver on collection and quality expectations

PROPRIETARY PROPEL CONTINUES TO GROW AND CONTRIBUTE TO ENCORE Tax Note Receivables Total Revenue 0 2 4 6 8 10 Q1 '13 Q2 '13 Q3 '13 Q4 '13 Q1 '14 Q2 '14 Q3 '14 Operating Income 0 1 2 3 4 Q1 '13 Q2 '13 Q3 '13 Q4 '13 Q1 '14 Q2 '14 Q3 '14 9 $276 million in property tax lien receivables Now operating in 22 states, up from 11 states 6 months ago Operating income continues to grow $M $M $M 0 50 100 150 200 250 300 Q1 '13 Q2 '13 Q3 '13 Q4 '13 Q1 '14 Q2 '14 Q3 '14

10 Detailed Financial Discussion

PROPRIETARY 11 Q3 COLLECTIONS REFLECT STEADY EXECUTION AND GROWTH Collections by Geography 0 100 200 300 400 500 2 0 1 2 2 0 1 3 2 0 1 3 2 0 1 4 2 0 1 3 2 0 1 4 2 0 1 3 2 0 1 4 Q4 Q1 Q2 Q3 Collection Sites Legal Collections Collection Agencies $M 0 100 200 300 400 500 2 0 1 2 2 0 1 3 2 0 1 3 2 0 1 4 2 0 1 3 2 0 1 4 2 0 1 3 2 0 1 4 Q4 Q1 Q2 Q3 USA UK Latin America 230 270 278 380 351 397 409 407 $M 230 270 278 380 351 397 409 407 Collections by Channel

PROPRIETARY STRONG COLLECTIONS AND OUR GEOGRAPHIC DIVERSIFICATION STRATEGY LED TO SOLID REVENUE GROWTH Revenue From Business Lines 12 0 50 100 150 200 250 300 2 0 1 2 2 0 1 3 2 0 1 3 2 0 1 4 2 0 1 3 2 0 1 4 2 0 1 3 2 0 1 4 Q4 Q1 Q2 Q3 Core US Cabot Propel Refinancia Grove $M 144 145 156 236 237 254 269 273 Channel Q3 2014 Rev Rec Q3 2013 Rev Rec Europe 67.6% 61.1% United States 58.0% 58.0% Encore 60.4% 58.6% Revenue Recognition* * Revenue as a percentage of collections excludes the effects of net portfolio allowances or net portfolio allowance reversals

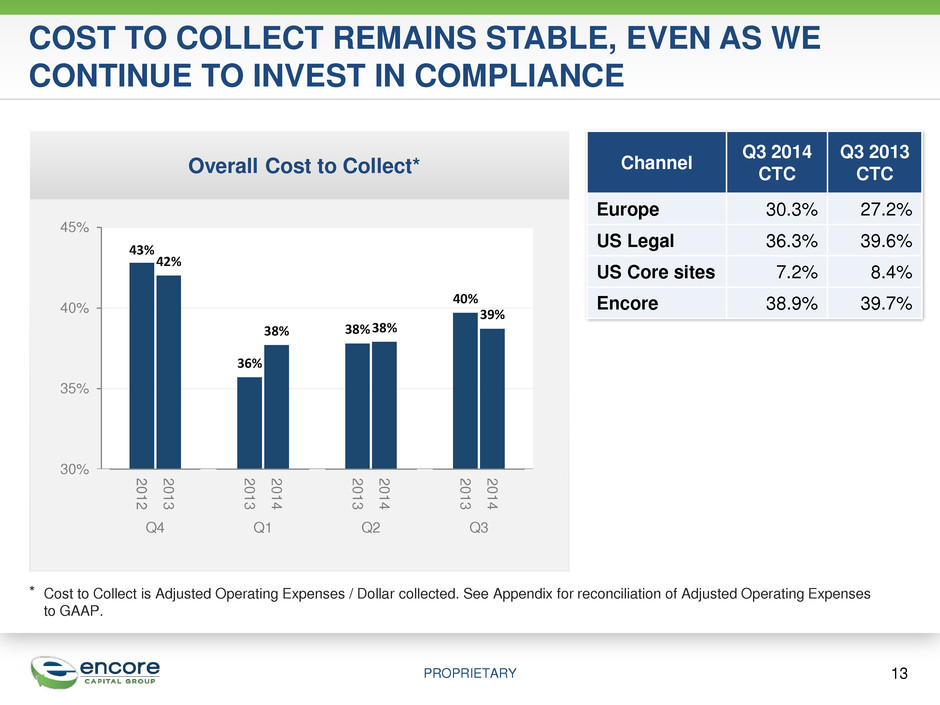

PROPRIETARY COST TO COLLECT REMAINS STABLE, EVEN AS WE CONTINUE TO INVEST IN COMPLIANCE 13 Overall Cost to Collect* 43% 42% 36% 38% 38% 38% 40% 39% 30% 35% 40% 45% 2 0 1 2 2 0 1 3 2 0 1 3 2 0 1 4 2 0 1 3 2 0 1 4 2 0 1 3 2 0 1 4 Q4 Q1 Q2 Q3 ⃰ Cost to Collect is Adjusted Operating Expenses / Dollar collected. See Appendix for reconciliation of Adjusted Operating Expenses to GAAP. Channel Q3 2014 CTC Q3 2013 CTC Europe 30.3% 27.2% US Legal 36.3% 39.6% US Core sites 7.2% 8.4% Encore 38.9% 39.7%

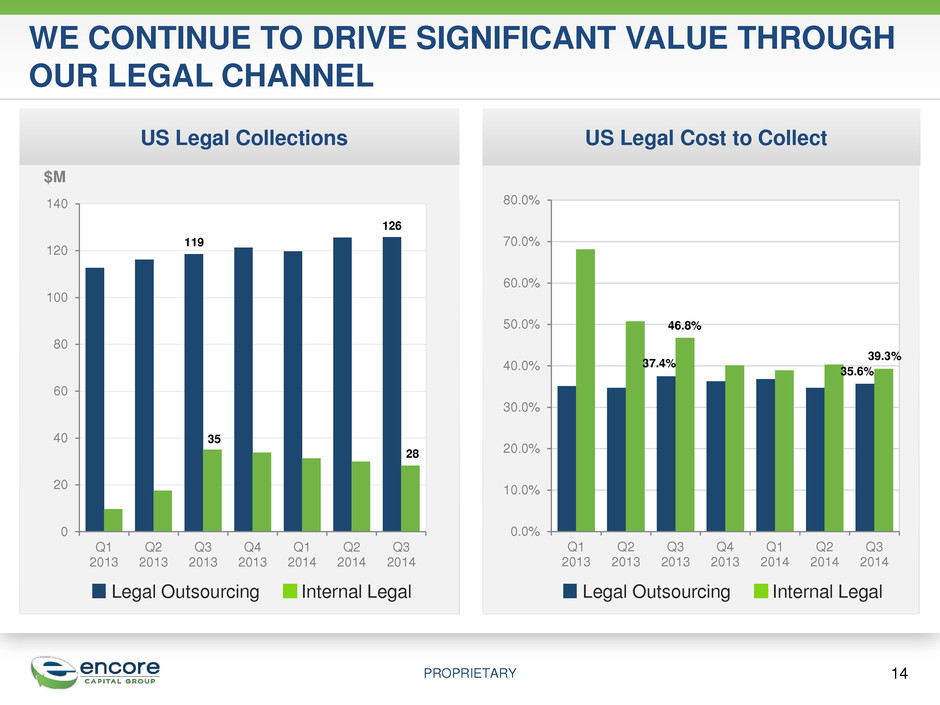

PROPRIETARY WE CONTINUE TO DRIVE SIGNIFICANT VALUE THROUGH OUR LEGAL CHANNEL US Legal Collections 0 20 40 60 80 100 120 140 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 $M US Legal Cost to Collect 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 14 Legal Outsourcing Internal Legal Legal Outsourcing Internal Legal 46.8% 37.4% 39.3% 35.6% 28 126 35 119

PROPRIETARY COLLECTIONS GROWTH LED TO IMPROVED CASH FLOWS 15 * Please refer to Appendix for reconciliation of Adjusted EBITDA to GAAP $M Adjusted Quarterly EBITDA* Adjusted EBITDA Trailing Twelve Months 135 206 174 250 172 256 231 252 0 50 100 150 200 250 300 2 0 1 2 2 0 1 3 2 0 1 3 2 0 1 4 2 0 1 3 2 0 1 4 2 0 1 3 2 0 1 4 Q4 Q1 Q2 Q3 577 608 633 713 784 859 943 963 0 200 400 600 800 1,000 1,200 Q 4 2 0 1 2 Q 1 2 0 1 3 Q 2 2 0 1 3 Q 3 2 0 1 3 Q 4 2 0 1 3 Q 1 2 0 1 4 Q 2 2 0 1 4 Q 3 2 0 1 4 $M $M

PROPRIETARY Estimated Remaining Collections $M 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 16 OUR ERC CONTINUES TO GROW * ERC at time of acquisition Acquired AACC* $952 Acquired Cabot* $1,445 Acquired Marlin* $607 Acquired Atlantic* $275 $5,128 $4,022

PROPRIETARY ENCORE DELIVERED RECORD ECONOMIC EPS IN Q3 OF $1.17 $1.11 ($0.08) $1.13 $1.17 $0.06 $0.04 Net income per diluted share attributable to Encore Net non-cash interest and issuance cost amortization, net of tax Acquisition and integration related fees, net of tax Effect of net tax credits applicable to prior periods Adjusted income per diluted share attributable to Encore - (Accounting)* Adjusted Income Attributable to Encore - (Economic)* 17 * Please refer to Appendix for reconciliation of Adjusted EPS / Economic EPS measurements to GAAP Less ~1.0M shares which are reflected in GAAP EPS, but will not be issued

PROPRIETARY 18 ENCORE’S LONG-TERM PROSPECTS REMAIN FAVORABLE Operating Results & Deployment A culture of constant improvement drives improved results Liquidity & Capital Access Strong liquidity and access to capital enhance our ability to take advantage of consolidating markets and new opportunities Solid Cash Flows Additional asset classes and geographies continue to enhance ERC and collections Geographic & Asset Class Diversification We are an international company in several asset classes, positioned for strong earnings growth going forward

19 Appendix

PROPRIETARY 20 NON-GAAP FINANCIAL MEASURES This presentation includes certain financial measures that exclude the impact of certain items and therefore have not been calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). The Company has included information concerning Adjusted EBITDA because management utilizes this information, which is materially similar to a financial measure contained in covenants used in the Company's revolving credit facility, in the evaluation of its operations and believes that this measure is a useful indicator of the Company’s ability to generate cash collections in excess of operating expenses through the liquidation of its receivable portfolios. The Company has included information concerning Adjusted Operating Expenses in order to facilitate a comparison of approximate cash costs to cash collections for the portfolio purchasing and recovery business in the periods presented. The Company has included Adjusted Income Attributable to Encore and Adjusted Income Attributable to Encore per Share (also referred to as Economic EPS when adjusted for certain shares associated with our convertible notes that will not be issued but are reflected in the fully diluted share count for accounting purposes) because management uses these measures to assess operating performance, in order highlight trends in the Company’s business that may not otherwise be apparent when relying on financial measures calculated in accordance with GAAP. Adjusted EBITDA, Adjusted Operating Expenses, Adjusted Income Attributable to Encore and Adjusted Income Attributable to Encore per Share/Economic EPS have not been prepared in accordance with GAAP. These non-GAAP financial measures should not be considered as alternatives to, or more meaningful than, net income, net income per share, and total operating expenses as indicators of the Company’s operating performance. Further, these non-GAAP financial measures, as presented by the Company, may not be comparable to similarly titled measures reported by other companies. The Company has attached to this presentation a reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures.

PROPRIETARY 21 RECONCILIATION OF ADJUSTED INCOME AND ECONOMIC / ADJUSTED EPS Reconciliation of Adjusted Income and Economic / Adjusted EPS to GAAP EPS (Unaudited, In Thousands, except per share amounts), Three Months Ended September 30, 2014 2013 $ Per Diluted Share – Accounting Per Diluted Share – Economic* $ Per Diluted Share – Accounting Per Diluted Share – Economic GAAP net income attributable to Encore, as reported $ 30,335 $ 1.11 $ 1.15 $ 22,194 $ 0.82 $ 0.84 Adjustments: Convertible notes non-cash interest and issuance cost amortization, net of tax 1,773 0.06 0.07 1,103 0.04 0.05 Acquisition and integration related expenses, net of tax 1,001 0.04 0.04 4,775 0.18 0.18 Effect of net tax credits applicable to prior periods (2,291) (0.08) (0.09) (1,236) (0.05) (0.05) Adjusted Income Attributable to Encore $ 30,818 $ 1.13 $ 1.17 $ 26,836 $ 0.99 $ 1.02 * Excludes approximately 1.0 million shares issuable upon the conversion of the company’s convertible senior notes that are included for accounting purposes but will not be issued due to certain hedge and warrant transactions

PROPRIETARY Reconciliation of Adjusted EBITDA to GAAP Net Income (Unaudited, In $ Thousands) Three Months Ended 9/30/12 12/31/12 3/31/13 6/30/13 9/30/13 12/31/13 3/31/14 6/30/14 9/30/14 GAAP net income, as reported 21,308 20,167 19,448 11,012 21,064 22,216 18,830 21,353 30,138 (Gain) loss from discontinued operations, net of tax - - - - 308 1,432 - - - Interest expense 7,012 6,540 6,854 7,482 29,186 29,747 37,962 43,218 43,498 Provision for income taxes 13,887 13,361 12,571 7,267 10,272 15,278 11,742 14,010 10,154 Depreciation and amortization 1,533 1,647 1,846 2,158 4,523 5,020 6,117 6,829 6,933 Amount applied to principal on receivable portfolios 105,283 90,895 129,487 126,364 154,283 124,520 159,106 161,048 155,435 Stock-based compensation expense 1,905 2,084 3,001 2,179 3,983 3,486 4,836 4,715 4,009 Acquisition and integration related expenses - - 1,276 16,033 7,752 4,260 11,081 4,645 1,622 Adjusted EBITDA 150,928 134,694 174,483 172,495 231,371 205,959 249,674 255,818 251,789 RECONCILIATION OF ADJUSTED EBITDA 22

PROPRIETARY Reconciliation of Adjusted Operating Expenses to GAAP Operating Expenses (Unaudited, In $ Thousands) Three Months Ended RECONCILIATION OF ADJUSTED OPERATING EXPENSES 12/31/12 3/31/13 6/30/13 9/30/13 12/31/13 3/31/14 6/30/14 9/30/14 GAAP total operating expenses, as reported 103,872 105,872 126,238 174,429 168,466 185,472 190,689 188,960 Adjustments: Stock-based compensation expense (2,084) (3,001) (2,179) (3,983) (3,486) (4,836) (4,715) (4,009) Operating expense related to other operating segments (3,092) (5,274) (6,367) (12,115) (12,755) (19,833) (26,409) (25,058) Acquisition and integration related expenses - (1,276) (12,403) (7,752) (4,260) (11,081) (4,645) (1,622) Adjusted Operating Expenses 98,696 96,321 105,289 150,579 147,965 149,722 154,920 158,271 23

Encore Capital Group, Inc. Q3 2014 EARNINGS CALL