Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Mattersight Corp | d817552d8k.htm |

| EX-99.1 - EX-99.1 - Mattersight Corp | d817552dex991.htm |

Mattersight

Q3 2014 November 5, 2014

Earnings Webinar

Exhibit 99.2 |

Confidential

& Restricted © 2014 Mattersight Corporation

Safe Harbor Language

During today’s call we will be making both historical and forward-

looking statements in order to help you better understand our

business. These forward-looking statements include references

to our plans, intentions, expectations, beliefs, strategies and

objectives. Any forward-looking statements speak only as of

today’s date. In addition, these forward-looking statements are

subject to risks and uncertainties that could cause actual results

to differ materially from those stated or implied by the forward-

looking statements. The risks and uncertainties associated with

our business are highlighted in our filings with the SEC, including

our Annual Report filed on Form 10-K for the year ended

December 31, 2013, our quarterly reports on Form 10-Q, as well

as our press release issued earlier today.

Mattersight Corporation undertakes no obligation to publicly

update or revise any forward-looking statements in this call.

Also, be advised that this call is being recorded and is

copyrighted by Mattersight Corporation.

2 |

Confidential

& Restricted © 2014 Mattersight Corporation

Mattersight Summary

•

Strong Core Analytics Business

Robust analytics platform with a premier set of large customers

Existing customers are expanding seats of core analytics and routing customers

are rapidly adding on these applications

•

Exciting Routing Opportunity

Creating a new software category

Positive initial data points

Explosive growth in sold seat count and a strong pipeline

•

Improving Business Metrics

Rapidly expanding Book of Business

Revenue growth beginning to catch up with Book of Business growth

Nearing best in class SaaS metrics

Much of this story is obscured by the loss of a government contract which was

~25% of our business in Q4 of 2013

•

Strong Balance Sheet

Ended the quarter with $18.3M in cash and no debt

3 |

Confidential

& Restricted © 2014 Mattersight Corporation

Q3 Highlights

•

Pilot Conversions and Routing

Record 8 pilot conversions, including a record 6 routing conversions

Grew routing seats sold by ~45% sequentially

Increased routing seats in Appliance Pilot to ~14,000, up ~3.4x yr/yr

•

Book of Business and Revenues

Grew quarterly Book of Business 7% sequentially to $9.5M

Book of Business is up ~40% annualized YTD

Grew revenues 5% sequentially

Revenues in deployment grew to a record $1.8M

•

Cash and Balance Sheet

Ended Q3 with $18.3M in cash, no debt

$10M available on line of credit with SVB (cancelled PfG Line)

•

Other Notable Recent Milestones

Closed add-on orders for additional 3,500+ routing seats in October

Announced esurance as a new routing customer

Received

significant

recognition

for

routing:

Chicago

Innovation

Award

and

CUSTOMER Magazine Innovation Award

Announced ERB relationship to OEM our algorithms to score student essay

content

Granted

two

important

Patents:

one

for

analyzing

personality

and

one

for

Predictive Behavioral Routing

4 |

Confidential

& Restricted © 2014 Mattersight Corporation

Q3 Commentary

•

Overall

Solid quarter

Strong bookings from new accounts and pilot conversions

Pipeline activity remains strong for both core analytics and routing

Another step towards building a best in class SaaS metrics company

Q4 is off to a strong start

•

Routing

7/7 converting routing appliances which have completed their trials

7 successful routing conversions have led to 12 total routing contracts

Expect routing seats sold will grow 75%-100% sequentially in Q4

•

Book of Business

Book of Business continues to grow strongly

Included in Book of Business is $1.8M of quarterly revenues in deployment (2 quarters

of bookings)

•

Income Statement

Getting the $1.8M of revenues in deployment deployed is a significant focus…if all these

contracts had deployed in Q3, we would be ~ AEBITDA breakeven

Gross Margins remain strong

Carefully adding operating expenses

5 |

Confidential

& Restricted © 2014 Mattersight Corporation

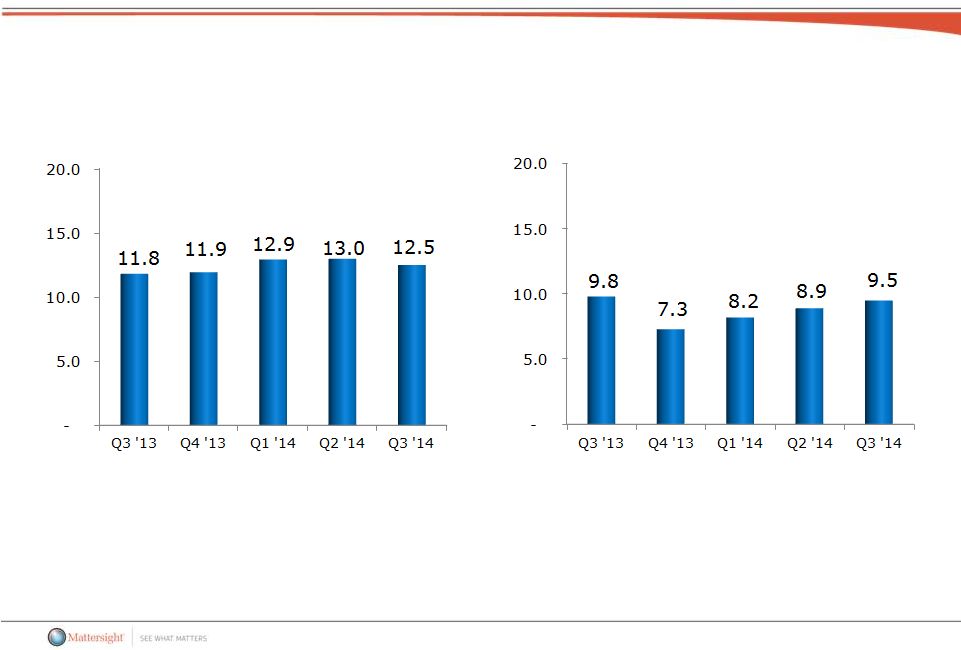

Rolling 4Q Bookings / Quarterly Book of Business Trends

6

Rolling 4 Quarter ACV ($M)

Quarterly Book of Business ($M) |

Confidential

& Restricted © 2014 Mattersight Corporation

Rolling 4Q Bookings Composition Trend

7

Rolling 4 Quarter Add-On ACV ($M)

Rolling 4 Quarter Pilot Conversion ACV ($M) |

Confidential

& Restricted © 2014 Mattersight Corporation

Revenue / Revenue in Deployment Trends

8

Quarterly Revenues ($M)

Revenues in Deployment ($M) |

Confidential

& Restricted © 2014 Mattersight Corporation

Gross Margin and Operating Expenses

9

Gross Margin %

Sales / Mktg / Dev Cash Expense ($M)

G&A Cash Expense ($M) |

Confidential

& Restricted © 2014 Mattersight Corporation

Revenue Composition Trends

Subscription Revenue Retention

Rate

(Ex GDIT)

10

Subscription as a Percentage of

Total Revenue

(Ex GDIT) |

Confidential

& Restricted © 2014 Mattersight Corporation

Pilot Composition Trends

11

Appliance

Pilots in

Progress

PM/

Analytics

IA’s

$39M Pilot Follow On ACV

-

Routing

Appliances

-

$10M

ACV

-

PM / Analytics -

$13M ACV

-

IA’s -

$16M ACV

Appliance

Backlog

PM/

Analytics

IA’s

Appliance

Backlog

Q3

2013

(33 Ending Pilots)

Q3

2014

(79 Ending Pilots)

$21M Pilot Follow On

ACV

-

Routing

Appliances

-

$5M

ACV

-

PM / Analytics -

$5M ACV

-

IA’s -

$11M ACV |

Confidential

& Restricted © 2014 Mattersight Corporation

Routing Seat Trends

12

Seats Sold

Follow-On Seats in Appliance Pilot |

Confidential

& Restricted © 2014 Mattersight Corporation

Metrics Dashboard

Measurement

Best in Class

Threshold

Q1

2014

Q2

2014

Q3

2014

Annualized Book of Business

$50.0M

$32.7M

$35.6M

$37.9M

Yr/Yr Book of Business Growth

30%

7%

(Ex GDIT)

16%

(Ex GDIT)

19%

(Ex GDIT)

Yr/Yr Revenue Growth

30%

(2%)

(Ex GDIT)

14%

(Ex GDIT)

11%

(Ex GDIT)

% Recurring Revs

90%

87%

86%

85%

Subscription Revenue Retention

%

90%

97%

97%

98%

% of Revs from New Accounts*

15%

2%

2%

8%

Yr/Yr Net Account Growth

$1.10

$1.03

$1.15

$1.07

Gross Margin

70%

68%

69%

69%

13

*New Accounts are defined as new logo accounts in the first 12 months of

subscription |

Confidential

& Restricted © 2014 Mattersight Corporation

Q4 Business Outlook

•

Revenue Drivers

Expect to deploy ~$1,000k of new revenue in Q4

Expect ~$400k of revenue roll off in Q4 (primarily due to run

off of non subscription revenues)

•

Expense Drivers

Incremental gross margins are expected to be 70%-75% for

Q4

Cash SG&A expenses are expected to be approximately flat

sequentially

14 |

Confidential

& Restricted © 2014 Mattersight Corporation

Thank You

•

Kelly Conway

847.582.7200

kelly.conway@mattersight.com

•

Mark Iserloth

312.454.3613

mark.iserloth@mattersight.com

15 |