Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Approach Resources Inc | d817367d8k.htm |

| EX-99.2 - EX-99.2 - Approach Resources Inc | d817367dex992.htm |

| EX-99.1 - EX-99.1 - Approach Resources Inc | d817367dex991.htm |

| EX-10.1 - EX-10.1 - Approach Resources Inc | d817367dex101.htm |

Third Quarter 2014 Results

NOVEMBER 5, 2014

Exhibit 99.3 |

Forward-looking statements

2

Cautionary statements regarding oil & gas quantities

Third

Quarter

2014

Results

–

November

2014 |

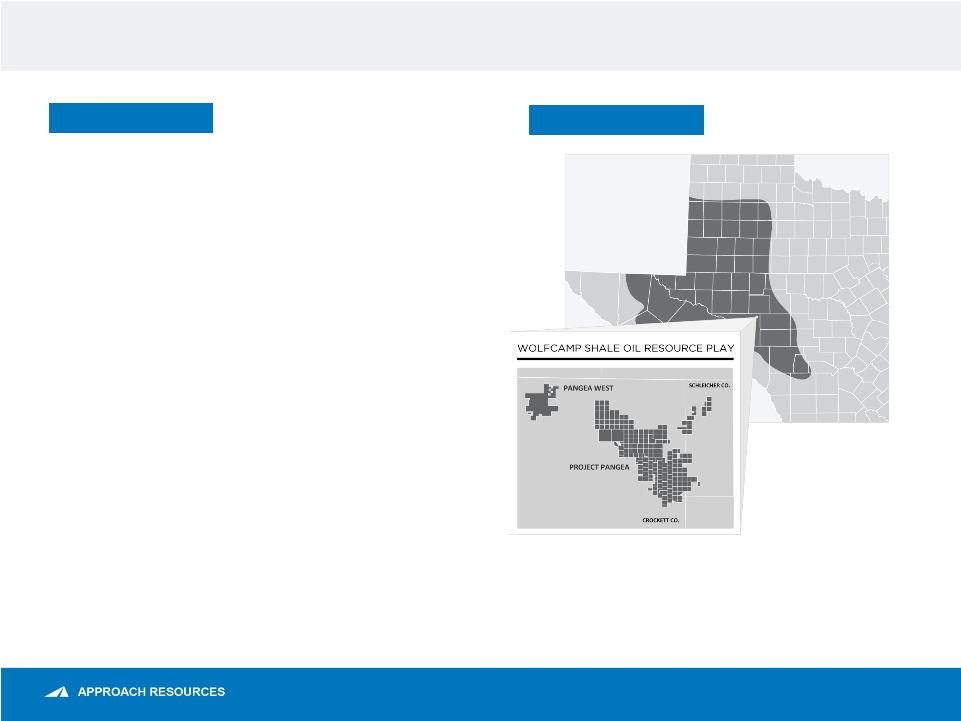

Company overview

AREX OVERVIEW

ASSET OVERVIEW

Enterprise value $710 MM

High-quality reserve base

Permian core operating area

2014 Capital program of $400 MM

Notes:

Proved

reserves

and

acreage

as

of

12/31/2013

and

9/30/2014,

respectively.

All

Boe

and

Mcfe

calculations

are

based

on

a

6

to

1

conversion

ratio.

Enterprise

value

is

equal

to

market

capitalization

using

the

closing

share

price

of

$9.44

per

share

on

11/3/2014,

plus

net

debt

as

of

9/30/2014.

See

“PV-10

(unaudited)”

slide.

3

Third

Quarter

2014

Results

–

November

2014

115 MMBoe proved reserves

$1.1 BN proved PV-10

99% Permian Basin

155,000 gross (136,500 net) acres

Running 3 HZ rigs in the Wolfcamp shale play to drill

70 wells during 2014

~1+ BnBoe gross, unrisked resource potential

~2,000+ Identified HZ drilling locations targeting

Wolfcamp A/B/C |

3Q14 Key highlights

4

3Q14 HIGHLIGHTS

•

Drilled 18 and completed 16 HZ wells

•

Maintained best-in-class HZ well costs

•

New Elliott well expands Wolfcamp

development eastward

•

Increased 3Q14 production 61% YoY to

14.2 MBoe/d

•

Delivered seventh consecutive record

quarterly EBITDAX

•

Solid financial position further

strengthened by borrowing base increase

3Q14 SUMMARY RESULTS

Production (MBoe/d)

14.2

% Oil

39%

% Total liquids

69%

Average realized price ($/Boe)

Average realized price, excluding commodity derivatives impact

$

52.17

Average realized price, including commodity derivatives impact

51.59

Costs and expenses ($/Boe)

LOE

$

5.87

Production and ad valorem taxes

2.55

Exploration

0.68

General and administrative

5.88

G&A –

cash component

4.37

G&A –

noncash component

1.51

DD&A

19.88

Third

Quarter

2014

Results

–

November

2014 |

Outperformance in gas/NGL volumes achieves higher reserve

recovery and drives production growth

Horizontal Wolfcamp Production by Commodity

83% oil growth since 3Q13

135% growth in HZ Wolfcamp

production since 3Q13

216% NGL growth since 3Q13

218% gas growth since 3Q13

Mboe

85

135

166

247

270

82

128

153

230

259

260

424

396

481

475

0

200

400

600

800

1,000

3Q13

4Q13

1Q14

2Q14

3Q14

Gas

NGLs

Oil

5

427

687

715

957

1,004

Third

Quarter

2014

Results

–

November

2014 |

AREX HZ Wolfcamp Well Performance

6

AREX HZ WOLFCAMP (BOE/D)

Note: Daily production normalized for operational downtime.

Third

Quarter

2014

Results

–

November

2014

Production Data from

AREX A Bench Wells (11)

450 MBoe Type Curve

Wolfcamp Shale Oil

Production Data from

AREX B Bench Wells (74)

Production Data from

AREX C Bench Wells (13)

0

200

300

400

600

700

800

0

90

180

270

360

450

540

630

720

810

900

990

1080

1170

Time (Days)

100

500 |

3Q14 Operating highlights

OPERATING HIGHLIGHTS

Maximizing

Returns

•

Oil differential of $(4.17)/Bbl

•

HZ well costs continue to track $5.5 MM per well

•

LOE of $5.87/Boe, improved 5% QoQ

Tracking

Development

Plan

•

Drilled

18

HZ

wells

and

completed

16

HZ

wells

•

Wolfcamp

A

–

2

wells,

Wolfcamp

B

–

7

wells

and

Wolfcamp

C

–

7

wells

•

HZ Wolfcamp B/C average IP 746 Boe/d (67% oil, 85% liquids)

•

Overall HZ well results continue to track at or above type curve

•

Impressive initial results from recent Elliott C bench well (IP of 806 Boe/d, 63%

oil and 83% liquids) expand Wolfcamp development eastward

Delivering

Production

Growth

•

Total production 14.2 MBoe/d (up 61% YoY)

•

Oil production 5.5 Mbbl/d (up 61% YoY)

7

Third

Quarter

2014

Results

–

November

2014 |

3Q14 Financial highlights

FINANCIAL HIGHLIGHTS

Significant Cash

Flow

•

Record quarterly EBITDAX (non-GAAP) of $50.7 MM (up 60% YoY), or $1.29 per

diluted share (up 59% YoY)

•

Capital expenditures of $104.9 MM ($94 million for D&C)

Strong Financial

Position

•

Liquidity of $362MM at September 30

•

Increased borrowing base to $600 MM in November 2014

Increasing

Revenues

•

Revenues of $68.1 MM (up 54% YoY)

•

Net income of $22.4 MM, or $0.57 per diluted share

•

Adjusted net income (non-GAAP) of $10.5 MM, or $0.27 per diluted share

Strong Balance Sheet and Liquidity to Develop

HZ Wolfcamp Shale

Note:

See

“Adjusted

Net

Income,”

“EBITDAX”

and

“Strong,

Simple

Balance

Sheet”

slides.

8

Third

Quarter

2014

Results

–

November

2014

th |

Current hedge position

9

Commodity & Period

Contract Type

Volume

Contract Price

Crude Oil

October 2014 –

December 2014

Collar

550 Bbls/d

$90.00/Bbl -

$105.50/Bbl

October 2014 –

December 2014

Collar

950 Bbls/d

$85.05/Bbl -

$95.05/Bbl

October 2014 –

December 2014

Collar

2,000 Bbls/d

$89.00/Bbl -

$98.85/Bbl

October 2014 –

March 2015

Collar

1,500 Bbls/d

$85.00/Bbl -

$95.30/Bbl

January 2015 –

December 2015

Collar

1,600 Bbls/d

$84.00/Bbl -

$91.00/Bbl

January 2015 –

December 2015

Collar

1,000 Bbls/d

$90.00/Bbl -

$102.50/Bbl

January 2015 –

December 2015

3-way Collar

500 Bbls/d

$75.00/Bbl -

$84.00/Bbl -

$94.00/Bbl

January 2015 –

December 2015

3-way Collar

500 Bbls/d

$75.00/Bbl -

$84.00/Bbl -

$95.00/Bbl

Natural Gas Liquids

Propane

October 2014 –

December 2014

Swap

500 Bbls/d

$41.16/Bbl

Natural Gasoline

October 2014 –

December 2014

Swap

175 Bbls/d

$83.37/Bbl

Natural Gas

October 2014 –

December 2014

Swap

360,000 MMBtu/month

$4.18/MMBtu

October 2014 –

December 2014

Swap

35,000 MMBtu/month

$4.29/MMBtu

October 2014 –

December 2014

Swap

160,000 MMBtu/month

$4.40/MMBtu

October 2014 –

June 2015

Collar

80,000 MMBtu/month

$4.00/MMBtu -

$4.74/MMBtu

January 2015 –

December 2015

Swap

200,000 MMBtu/month

$4.10/MMBtu

January 2015 –

December 2015

Collar

130,000 MMBtu/month

$4.00/MMBtu -

$4.25/MMBtu

Third

Quarter

2014

Results

–

November

2014 |

Production and expense guidance

10

2014 Guidance

Production

Total (MBoe)

4,950

Oil (MBbls)

2,050 –

2,200

Percent total liquids

70%

Operating costs and expenses (per Boe)

Lease operating

$6.00 -

$6.75

Production and ad valorem taxes

6.5% of oil & gas revenues

Cash general and administrative

$4.50 -

$5.00

Exploration

$0.50 -

$1.00

Depletion, depreciation and amortization

$21.00 -

$23.00

Capital expenditures (in millions)

Approx. $400

Horizontal wells

70

Third

Quarter

2014

Results

–

November

2014 |

Strong, simple balance sheet

11

FINANCIAL RESULTS ($MM)

As of

September 30, 2014

Summary Balance Sheet

Cash and Cash Equivalents

$1.6

Credit Facility

89.5

Senior Notes

250.0

Total Long-Term Debt

$339.5

Shareholders’

Equity

745.1

Total Book Capitalization

$1,084.6

Liquidity

Borrowing Base

$450.0

Cash and Cash Equivalents

1.6

Long-term Debt under Credit Facility

(89.5)

Undrawn Letters of Credit

(0.3)

Liquidity

$361.8

Key Metrics

LTM EBITDAX (non-GAAP)

$185.1

Total Reserves (MMBoe)

114.7

Proved Developed Reserves (MMBoe)

45.2

% Proved Developed

39%

% Liquids

69%

Credit Statistics

Debt / Book Capital

31%

Debt / LTM EBITDAX

1.8x

LTM EBITDAX / LTM Interest

8.7x

Debt / Proved Reserves ($/Boe)

$2.96

Third

Quarter

2014

Results

–

November

2014

Note: See “EBITDAX”

slide for reconciliation. |

Appendix |

Adjusted net income (unaudited)

13

(in thousands, except per-share amounts)

Three Months Ended

September 30,

2014

2013

Net income

$

22,447

$

495

Adjustments for certain items:

Unrealized (gain) loss on commodity derivatives

(18,810)

3,438

Related income tax effect

6,816

(1,169)

Adjusted net income

$

10,453

$

2,764

Adjusted net income per diluted share

$

0.27

$

0.07

The

amounts

included

in

the

calculation

of

adjusted

net

income

and

adjusted

net

income

per

diluted

share

below

were

computed

in

accordance

with

GAAP.

We

believe

adjusted

net

income

and

adjusted

net

income

per

diluted

share

are

useful

to

investors

because

they

provide

readers

with

a

more

meaningful

measure

of

our

profitability

before

recording

certain

items

whose

timing

or

amount

cannot

be

reasonably

determined.

However,

these

measures

are

provided

in

addition

to,

and

not

as

an

alternative

for,

and

should

be

read

in

conjunction

with,

the

information

contained

in

our

financial

statements

prepared

in

accordance

with

GAAP

(including

the

notes),

included

in

our

SEC

filings

and

posted

on

our

website.

The

following

table

provides

a

reconciliation

of

adjusted

net

income

to

net

income

for

the

three

months

ended

September

30,

2014

and

2013.

ADJUSTED NET INCOME (UNAUDITED)

Third

Quarter

2014

Results

–

November

2014 |

EBITDAX (unaudited)

14

EBITDAX (UNAUDITED)

The

amounts

included

in

the

calculation

of

EBITDAX

were

computed

in

accordance

with

GAAP.

EBITDAX

is

not

a

measure

of

net

income

or

cash

flow

as

determined

by

GAAP.

EBITDAX

is

presented

herein

and

reconciled

to

the

GAAP

measure

of

net

income

because

of

its

wide

acceptance

by

the

investment

community

as

a

financial

indicator

of

a

company's

ability

to

internally

fund

development

and

exploration

activities.

This

measure

is

provided

in

addition

to,

and

not

as

an

alternative

for,

and

should

be

read

in

conjunction

with,

the

information

contained

in

our

financial

statements

prepared

in

accordance

with

GAAP

(including

the

notes),

included

in

our

SEC

filings

and

posted

on

our

website.

The

following

table

provides

a

reconciliation

of

EBITDAX

to

net

income

for

the

three

months

ended

September

30,

2014

and

2013.

(in thousands, except per-share amounts)

Three Months Ended

September 30,

2014

2013

Net income

$

22,447

$

495

Exploration

891

1,193

Depletion, depreciation and amortization

25,959

19,413

Share-based compensation

1,965

1,599

Unrealized (gain) loss on commodity derivatives

(18,810)

3,438

Interest expense, net

5,442

5,179

Income tax provision

12,756

270

EBITDAX

$

50,650

$

31,587

EBITDAX per diluted share

$

1.29

$

0.81

Third

Quarter

2014

Results

–

November

2014 |

PV-10 (unaudited)

15

PV-10 (UNAUDITED)

(in millions)

December 31,

2013

PV-10

$

1,132

Less income taxes:

Undiscounted future income taxes

(919)

10% discount factor

463

Future discounted income taxes

(456)

Standardized measure of discounted future net cash flows

$

676

The

present

value

of

our

proved

reserves,

discounted

at

10%

(“PV-10”),

was

estimated

at

$1.1

billion

at

December

31,

2013,

and

was

calculated

based

on

the

first-of-the-month,

twelve-month

average

prices

for

oil,

NGLs

and

gas,

of

$97.28

per

Bbl

of

oil,

$30.16

per

Bbl

of

NGLs

and

$3.66

per

MMBtu

of

natural

gas.

PV-10

is

our

estimate

of

the

present

value

of

future

net

revenues

from

proved

oil

and

gas

reserves

after

deducting

estimated

production

and

ad

valorem

taxes,

future

capital

costs

and

operating

expenses,

but

before

deducting

any

estimates

of

future

income

taxes.

The

estimated

future

net

revenues

are

discounted

at

an

annual

rate

of

10%

to

determine

their

“present

value.”

We

believe

PV-10

to

be

an

important

measure

for

evaluating

the

relative

significance

of

our

oil

and

gas

properties

and

that

the

presentation

of

the

non-GAAP

financial

measure

of

PV-10

provides

useful

information

to

investors

because

it

is

widely

used

by

professional

analysts

and

investors

in

evaluating

oil

and

gas

companies.

Because

there

are

many

unique

factors

that

can

impact

an

individual

company

when

estimating

the

amount

of

future

income

taxes

to

be

paid,

we

believe

the

use

of

a

pre-tax

measure

is

valuable

for

evaluating

the

Company.

We

believe

that

PV-10

is

a

financial

measure

routinely

used

and

calculated

similarly

by

other

companies

in

the

oil

and

gas

industry.

The

following

table

reconciles

PV-10

to

our

standardized

measure

of

discounted

future

net

cash

flows,

the

most

directly

comparable

measure

calculated

and

presented

in

accordance

with

GAAP.

PV-10

should

not

be

considered

as

an

alternative

to

the

standardized

measure

as

computed

under

GAAP.

Third

Quarter

2014

Results

–

November

2014 |

Contact information

SERGEI KRYLOV

Executive Vice President & Chief Financial Officer

817.989.9000

ir@approachresources.com

www.approachresources.com |