Attached files

| file | filename |

|---|---|

| 8-K - 8-K - APARTMENT INVESTMENT & MANAGEMENT CO | a11514nareit8-k.htm |

1 NAREIT ANNUAL CONVENTION NOVEMBER 2014

2 STRATEGIC AREAS OF FOCUS • Peer-leading operating cost control • Above-average resident retention • Above-average property operating results over cycle • Diversified across markets and price points to reduce volatility in revenue • Disciplined capital recycling to upgrade portfolio • Peer-leading growth in average revenue per apartment home • Redevelopment is a core business activity • Robust pipeline of redevelopment opportunities within existing portfolio • Occasional development when warranted by risk-adjusted returns • Quantity of leverage in line with peers and declining • Quality of leverage is superior to peers • Growing unencumbered pool adds flexibility •Working toward investment grade rating • Focus on ownership and operation of apartment communities • Add value through operational excellence and redevelopment • High level of transparency, high quality of earnings, limited non-recurring income •We live our values, foster a culture of success and work collaboratively every day to achieve our goals PROPERTY OPERATIONS PORTFOLIO MANAGEMENT REDEVELOPMENT & DEVELOPMENT BALANCE SHEET BUSINESS & CULTURE

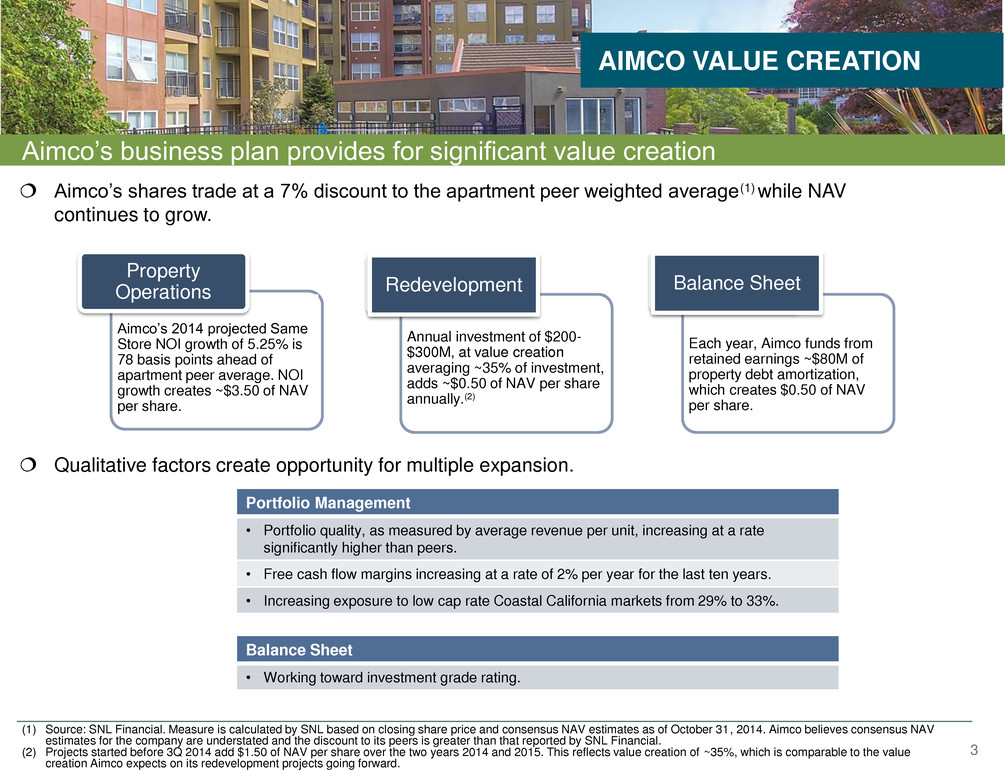

3 Aimco’s business plan provides for significant value creation AIMCO VALUE CREATION Portfolio Management • Portfolio quality, as measured by average revenue per unit, increasing at a rate significantly higher than peers. • Free cash flow margins increasing at a rate of 2% per year for the last ten years. • Increasing exposure to low cap rate Coastal California markets from 29% to 33%. Balance Sheet • Working toward investment grade rating. (1) Source: SNL Financial. Measure is calculated by SNL based on closing share price and consensus NAV estimates as of October 31, 2014. Aimco believes consensus NAV estimates for the company are understated and the discount to its peers is greater than that reported by SNL Financial. (2) Projects started before 3Q 2014 add $1.50 of NAV per share over the two years 2014 and 2015. This reflects value creation of ~35%, which is comparable to the value creation Aimco expects on its redevelopment projects going forward. Aimco’s shares trade at a 7% discount to the apartment peer weighted average(1) while NAV continues to grow. Qualitative factors create opportunity for multiple expansion. Each year, Aimco funds from retained earnings ~$80M of property debt amortization, which creates $0.50 of NAV per share. Annual investment of $200- $300M, at value creation averaging ~35% of investment, adds ~$0.50 of NAV per share annually.(2) Aimco’s 2014 projected Same Store NOI growth of 5.25% is 78 basis points ahead of apartment peer average. NOI growth creates ~$3.50 of NAV per share. Property Operations Redevelopment Balance Sheet

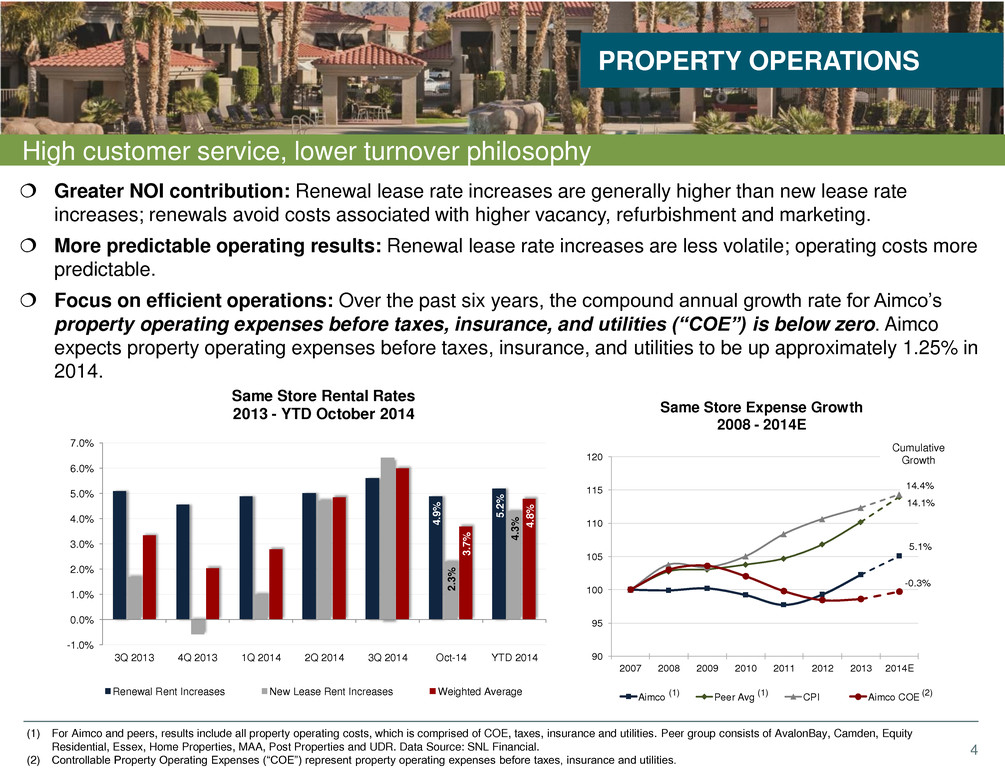

4 5.1% 14.1% 14.4% -0.3% 90 95 100 105 110 115 120 2007 2008 2009 2010 2011 2012 2013 2014E Same Store Expense Growth 2008 - 2014E Aimco Peer Avg CPI Aimco COE High customer service, lower turnover philosophy Greater NOI contribution: Renewal lease rate increases are generally higher than new lease rate increases; renewals avoid costs associated with higher vacancy, refurbishment and marketing. More predictable operating results: Renewal lease rate increases are less volatile; operating costs more predictable. Focus on efficient operations: Over the past six years, the compound annual growth rate for Aimco’s property operating expenses before taxes, insurance, and utilities (“COE”) is below zero. Aimco expects property operating expenses before taxes, insurance, and utilities to be up approximately 1.25% in 2014. PROPERTY OPERATIONS (1) For Aimco and peers, results include all property operating costs, which is comprised of COE, taxes, insurance and utilities. Peer group consists of AvalonBay, Camden, Equity Residential, Essex, Home Properties, MAA, Post Properties and UDR. Data Source: SNL Financial. (2) Controllable Property Operating Expenses (“COE”) represent property operating expenses before taxes, insurance and utilities. Cumulative Growth (2) (1) (1) 4. 9% 5. 2% 2. 3% 4. 3% 3. 7% 4. 8% 3Q 2013 4Q 2013 1Q 2014 2Q 2014 3Q 2014 Oct-14 YTD 2014 -1.0% 0 0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% Same Store Rental Rates 2013 - YTD October 2014 Renewal Rent Increases New Lease Rent Increases Weighted Average

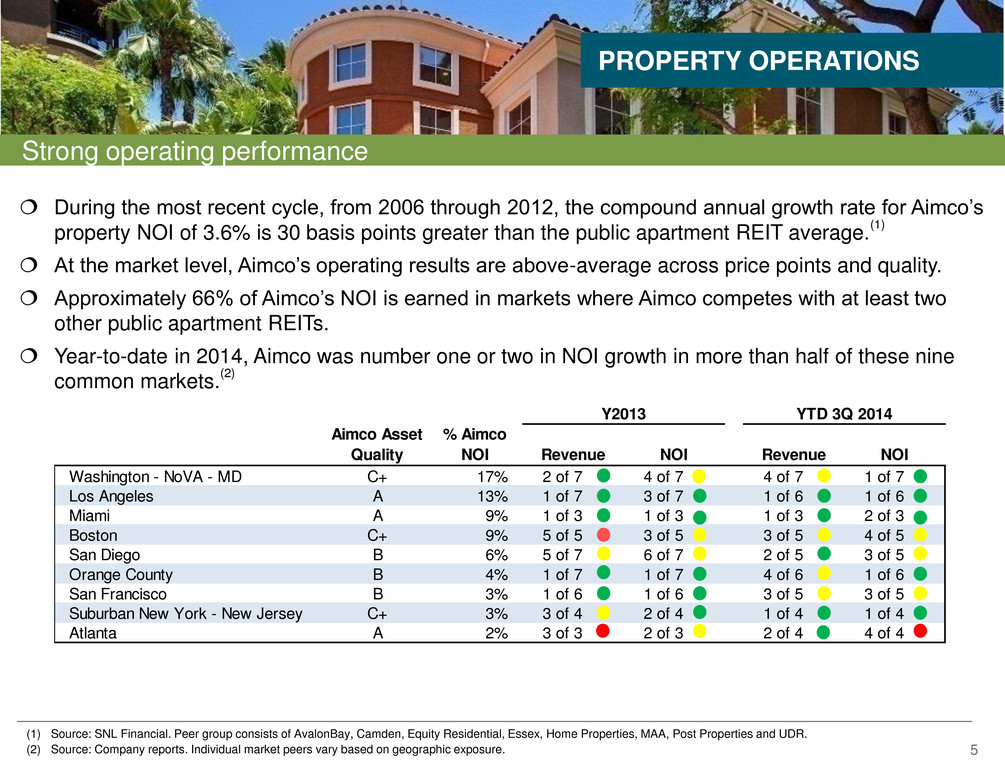

5 Strong operating performance PROPERTY OPERATIONS (1) Source: SNL Financial. Peer group consists of AvalonBay, Camden, Equity Residential, Essex, Home Properties, MAA, Post Properties and UDR. (2) Source: Company reports. Individual market peers vary based on geographic exposure. During the most recent cycle, from 2006 through 2012, the compound annual growth rate for Aimco’s property NOI of 3.6% is 30 basis points greater than the public apartment REIT average. (1) At the market level, Aimco’s operating results are above-average across price points and quality. Approximately 66% of Aimco’s NOI is earned in markets where Aimco competes with at least two other public apartment REITs. Year-to-date in 2014, Aimco was number one or two in NOI growth in more than half of these nine common markets. (2) Aimco Asset Quality % Aimco NOI Revenue NOI Revenue NOI Wa hington - NoVA - MD C+ 17% 2 of 7 4 of 7 4 of 7 1 of 7 Los Angeles A 13% 1 of 7 3 of 7 1 of 6 1 of 6 Miami A 9% 1 of 3 1 of 3 1 of 3 2 of 3 B ston C+ 9% 5 of 5 3 of 5 3 of 5 4 of 5 San Diego B 6% 5 of 7 6 of 7 2 of 5 3 of 5 Orange County B 4% 1 of 7 1 of 7 4 of 6 1 of 6 San Francisco B 3% 1 of 6 1 of 6 3 of 5 3 of 5 Suburban New York - New Jersey C+ 3% 3 of 4 2 of 4 1 of 4 1 of 4 Atlanta A 2% 3 of 3 2 of 3 2 of 4 4 of 4 YTD 3Q 2014Y2013

6 Maintaining diversification while moving to higher average price point Los Angeles expected to outperform in 2014, helping to offset slower Mid Atlantic. Allocation to Coastal California increasing to ~33% in coming years as redevelopments come online. Avoid concentration risk by maintaining allocation to Midwest, Sunbelt and Southeast Florida. PORTFOLIO MANAGEMENT Aimco defines asset quality as follows: "A" quality assets are those with rents greater than 125% of local market average; "B" quality assets are those with rents 90% to 125% of local market average; “C+” quality assets are those with rents less than 90% of local market average, but with rents greater than $1,100 per month; and "C" quality assets are those with rents less than 90% of local market average and with rents less than $1,100 per month. The chart above illustrates Aimco’s Conventional Property portfolio quality based on 2Q 2014 data the most recent period for which third-party data is available. Target allocation: ~40% A; ~40% B; ~20% high-rent C. Capital recycling combined with market rent growth increase average revenue per apartment home > $100/year for the next several years Revenue per apartment home expected to average ~$1,670 at the end of 2014. Geographic Diversification (% Conv NOI) Mid Atlantic (27%) Coastal California (29%) Northeast (15%) Midwest (11%, 70% Chicago) Sunbelt (9%) Southeast Florida (9%) Price Point Diversification (% Conv GAV) A Quality (43%) B/B+ Quality (36%) C+ Quality (18%) Avg Rents ~$1,330 C Quality (3%)

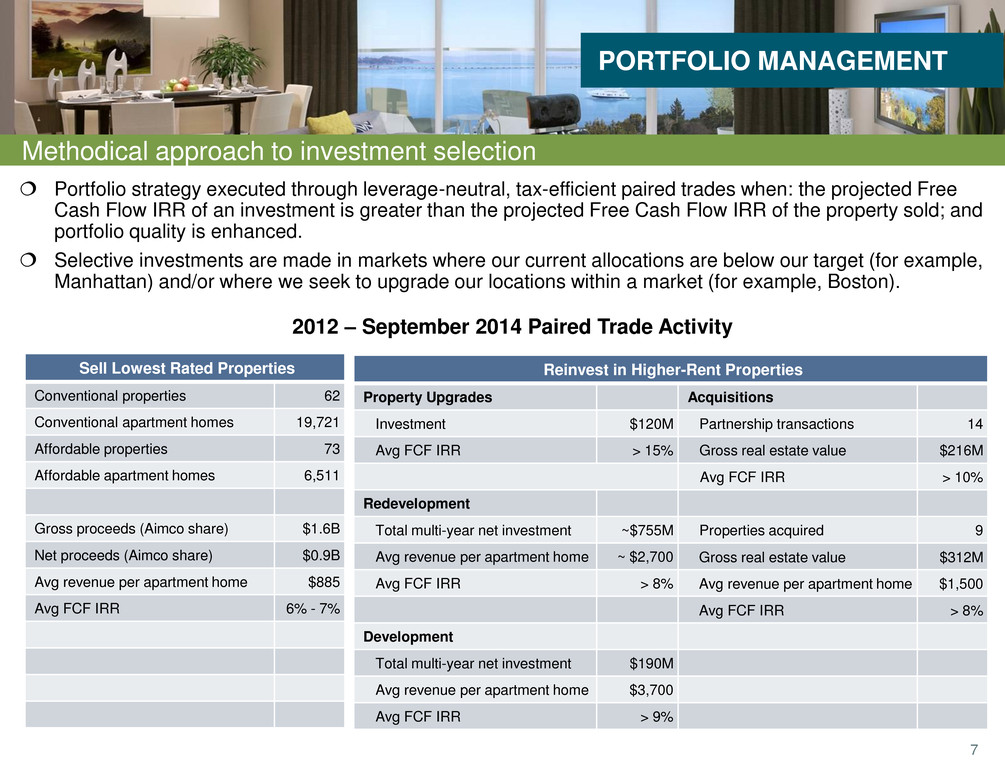

7 Methodical approach to investment selection Portfolio strategy executed through leverage-neutral, tax-efficient paired trades when: the projected Free Cash Flow IRR of an investment is greater than the projected Free Cash Flow IRR of the property sold; and portfolio quality is enhanced. Selective investments are made in markets where our current allocations are below our target (for example, Manhattan) and/or where we seek to upgrade our locations within a market (for example, Boston). 2012 – September 2014 Paired Trade Activity PORTFOLIO MANAGEMENT Sell Lowest Rated Properties Conventional properties 62 Conventional apartment homes 19,721 Affordable properties 73 Affordable apartment homes 6,511 Gross proceeds (Aimco share) $1.6B Net proceeds (Aimco share) $0.9B Avg revenue per apartment home $885 Avg FCF IRR 6% - 7% Reinvest in Higher-Rent Properties Property Upgrades Acquisitions Investment $120M Partnership transactions 14 Avg FCF IRR > 15% Gross real estate value $216M Avg FCF IRR > 10% Redevelopment Total multi-year net investment ~$755M Properties acquired 9 Avg revenue per apartment home ~ $2,700 Gross real estate value $312M Avg FCF IRR > 8% Avg revenue per apartment home $1,500 Avg FCF IRR > 8% Development Total multi-year net investment $190M Avg revenue per apartment home $3,700 Avg FCF IRR > 9%

8 Capital recycling contributes to high rate of Free Cash Flow/AFFO growth Sell Affordable properties and lowest rated Conventional properties: Lower average revenues per apartment home; lower NOI margins; located in submarkets with lower projected revenue growth. Invest in redevelopment, property upgrades and acquisitions: Higher average revenues per apartment home; higher NOI margins; higher projected revenue growth. Capital Replacement and property management expense: Relatively consistent across price points on a per apartment home basis; lower rent properties have significantly lower FCF margins. PORTFOLIO MANAGEMENT Example Sell Reinvest NOI cap rate 6.5% 5.0% Average revenue per apartment home $800 $1,600 Apartment homes 200 100 NOI margin 55% 65% Capital Replacements per apartment home $1,200 $1,200 Property management & other expenses per apartment home $400 $400 Free Cash Flow margin 38% 56% FCF cap rate 4.4% 4.4%

9 Peer-leading rate of increase in average revenues per apartment home PORTFOLIO MANAGEMENT * Peer group consists of AvalonBay, Camden, Equity Residential, Essex, Home Properties, MAA, Post Properties and UDR. Results based on average revenue per Same Store apartment home for the fourth quarter of each year presented and for the third quarter 2014, except for REIS US-Top 50, which is as of second quarter 2014, the most recent data available. Data Sources: SNL Financial, REIS. Over the last ten years, the compound annual growth rate for Aimco’s Same Store average revenue per apartment home is 27% higher than the peer average and nearly three times that of market rent growth. 7.1% 5.6% 2.5% 100 120 140 160 180 200 220 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 3Q 2014 Same Store Revenue per Apartment Home Growth 2004 - 3Q 2014 Aimco Peer Avg* REIS US-Top 50 MSAs

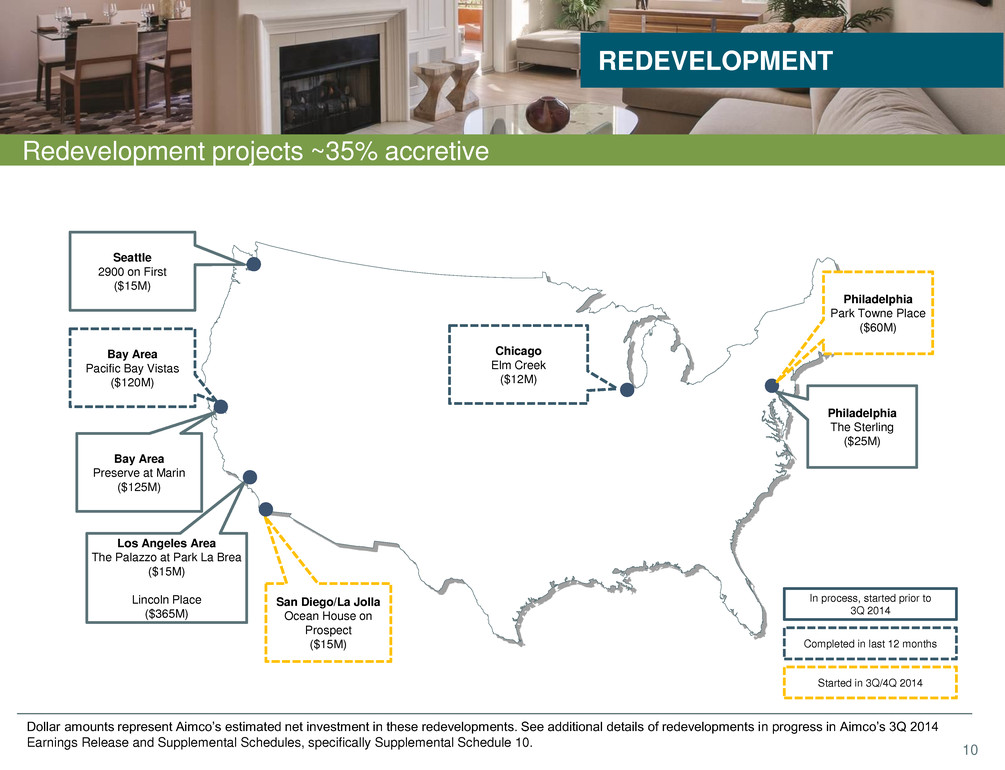

10 REDEVELOPMENT Redevelopment projects ~35% accretive Chicago Elm Creek ($12M) Philadelphia The Sterling ($25M) Seattle 2900 on First ($15M) Los Angeles Area The Palazzo at Park La Brea ($15M) Lincoln Place ($365M) Bay Area Pacific Bay Vistas ($120M) Dollar amounts represent Aimco’s estimated net investment in these redevelopments. See additional details of redevelopments in progress in Aimco’s 3Q 2014 Earnings Release and Supplemental Schedules, specifically Supplemental Schedule 10. Bay Area Preserve at Marin ($125M) San Diego/La Jolla Ocean House on Prospect ($15M) Completed in last 12 months Started in 3Q/4Q 2014 Philadelphia Park Towne Place ($60M) In process, started prior to 3Q 2014

11 REDEVELOPMENT Opportunities within existing portfolio support $200-$250M investment annually Chicago Yorktown Apartments (Expansion Approx. 100 Apartments) Manhattan Tempo (200 Apartments) Philadelphia The Sterling (Expanded Scope) Park Towne Place (Expanded Scope) Washington Merrill House (159 Apartments) Riverside Apartments (Expansion) Miami Yacht Club at Brickell (357 Apartments) Los Angeles Palazzo East (611 Apartments) Villas at Park La Brea (250 Apartments) The Palazzo at Park La Brea (Expanded Scope) Bay Area 707 Leahy (110 Apartments) Scotchollow (418 Apartments) Pipeline projects included in the above have not yet been approved by Aimco’s Investment Committee. Approved redevelopment projects, scope and timing may differ materially from the above. 2015 - 2017 Redevelopment Opportunities

12 6.7x 7.1x 4.9x Peer Wt Avg AIV AIV Adj for Refunding Risk Quantity of leverage is in line with peers, and declining We achieved our target for lower leverage two years ahead of plan. Aimco’s Debt and Preferred Equity to EBITDA of 7.1x reflects outstanding balances at 9/30/2014, but overstates the refunding risk of our leverage. With a lower AFFO payout ratio, Aimco’s level of retained earnings is among the highest of the apartment REITs. This high level of retained earnings funds the required amortization of our property debt. Our property debt balances at maturity are almost $1 billion lower than current balances as scheduled amortization is paid from retained earnings. BALANCE SHEET (1) Peer group consists of AvalonBay, Camden, Equity Residential, Essex, Home Properties, MAA, Post Properties and UDR. Peer weighted average computed by Aimco based on 9/30/2014 debt and preferred equity balances, less cash, cash equivalents and restricted cash, divided by last twelve months recurring EBITDA (annualized 3Q 2014 for Essex due to the impact of the BRE transaction), all as reported by SNL Financial. Balances are adjusted to reflect company share of unconsolidated debt and NOI. For Aimco, leverage represents Aimco’s share of property debt, preferred equity and any balance on the revolving credit facility, reduced by Aimco’s share of cash, cash equivalents, restricted cash and investments in a securitization trust that holds Aimco property loans. (2) Refunding Risk is lower than Total Leverage because property debt balances are reduced by scheduled amortization funded from retained earnings and because perpetual preferred equity is not subject to mandatory refunding. Property debt amortization, Perpetual Preferred Equity Total Leverage / LTM EBITDA (1) Refunding Risk (2)

13 Aimco’s balance sheet is the safest in the sector Limit entity risk by avoiding recourse debt, of which Aimco has very little. Reduce re-pricing risk by using fixed-rate loans. Reduce refunding risk by laddering maturities of long-term, non-recourse, amortizing property loans with little or no near-term maturities and using perpetual preferred stock. Hedge against inflation and cap rate expansion by using long-dated, fixed-rate leverage. BALANCE SHEET (1) Peer group consists of AvalonBay, Camden, Equity Residential, Essex, Home Properties, MAA, Post Properties and UDR. Data as of 9/30/2014. (2) Represents the sum of (a) variable rate debt outstanding and (b) fixed rate debt maturing within one year and within three years as a percentage of total debt outstanding. (3) Data sources: SNL Financial, company reports. May 2014 preferred equity issued at 6.875%, 50 bps below Digital Realty Trust and 50 bps above Public Storage offerings in March, both investment-grade companies. Aimco’s Class A and Class Z Preferred Stocks consistently trade at a premium to par, equating to yields between 6.7% and 6.8%. Pricing reflects market confidence in the Aimco balance sheet and business plan. Debt Maturities as a % of LTM EBITDA % Debt Subject to Near Term Re-Pricing Non-Recourse vs Recourse Debt (1) (1) (1) (2) 20% 40% 60% 80% 100% Aimco Peer Wt Avg % Non-Recourse % Recourse 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 2014 - 2015 2014 - 2018 Aimco Peer Wt Avg 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2014 2015 2016 2017 2018 Aimco Peer Wt Avg

14 8% 6% 14% 100 120 140 160 180 2010 2011 2012 2013 2014E Earnings and Dividend Growth 2010 - 2014E AFFO per share FFO per share NOI Execution of strategy produces high rate of AFFO growth Strong operating results produce above-peer NOI growth. Decreasing leverage contributes to strong FFO growth. Improving portfolio quality and focus on efficient operations result in higher margins and higher projected revenue growth, which increase Free Cash Flow and AFFO at a faster rate than NOI and FFO. AFFO growth drives dividend growth. PORTFOLIO MANAGEMENT CAGR 27% Dividend CAGR

15 We live our values, foster a culture of success and work collaboratively BUSINESS & CULTURE Our Vision To be the best owner and operator of apartment communities, inspired by a talented team committed to exceptional customer service, strong financial performance, and outstanding corporate citizenship. Aimco Cares This year, we celebrate 10 years of Aimco Cares. Over the last decade: Aimco team members have contributed tens of 2013 2014 Top Work Place In 2014, Aimco was again recognized by the Denver Post as a Top Work Place based on nearly 300 independent team member surveys. thousands of volunteer hours to hundreds of non-profit organizations; the annual Aimco Cares Charity Golf Classic has raised more than $3 million for military and educational causes; and Aimco has awarded nearly 500 college scholarships to help team members with the cost of their child’s higher education.

16 This presentation contains forward-looking statements within the meaning of the federal securities laws, including, without limitation, statements regarding projected results and specifically: forecasts of 2014 financial and operating results; Aimco's development and redevelopment project investments, timelines and stabilized rents; projected returns on property upgrades, acquisitions, redevelopment and development projects; estimated value of 2014 unencumbered asset pool. These forward- looking statements reflect management’s judgment as of this date, and Aimco assumes no obligation to revise or update them to reflect future events or circumstances. These forward-looking statements include certain risks and uncertainties. Readers should carefully review Aimco’s financial statements and notes thereto, as well as the risk factors described in Aimco’s Annual Report on Form 10-K for the year ended December 31, 2013, and the other documents Aimco files from time to time with the Securities and Exchange Commission. This presentation does not constitute an offer of securities for sale. Future quarterly dividend payments are subject to determinations by Aimco's board of directors based on the circumstances at the time of authorization, and the actual dividends paid may vary from the currently expected amounts. FORWARD LOOKING STATEMENTS & OTHER INFORMATION