Attached files

| file | filename |

|---|---|

| EX-99.1 - EARNINGS PRESS RELEASE - WCI Communities, Inc. | d811815dex991.htm |

| 8-K - FORM 8-K - WCI Communities, Inc. | d811815d8k.htm |

WCI

Communities Third

Quarter

2014

-

Earnings

Conference

Call

November 4, 2014

Exhibit 99.2 |

2

2

Disclosure Statement

This

presentation

contains

forward-looking

statements.

All

statements

that

are

not

statements

of

historical

fact,

including

statements

about

the

Company’s

beliefs

and

expectations,

are

forward-looking

statements

within

the

meaning

of

the

federal

securities

laws,

and

should

be

evaluated

as

such.

Forward-looking

statements

include

information

concerning

the

Company’s

future

goals,

expected

growth,

market

conditions

and

outlook

(including

the

estimates,

forecasts,

statements

and

projections

relating

to

Florida

or

national

markets

prepared

by

John

Burns

Real

Estate

Consulting),

expected

liquidity

and

possible

or

assumed

future

results

of

operations,

including

descriptions

of

its

business

plan

and

strategies.

These

forward-looking

statements

may

be

identified

by

the

use

of

such forward-

looking

terminology,

including

the

terms

“believe,”

“estimate,”

“project,”

“anticipate,”

“expect,”

“seek,”

“predict,”

“contemplate,”

“continue,”

“possible,”

“intend,”

“may,”

“might,”

“will,”

“could,”

“would,”

“should,”

“forecast,”

or

“assume”

or,

in

each

case,

their

negative,

or

other

variations

or

comparable

terminology.

For

more

information

concerning

factors

that

could

cause

actual

results

to

differ

materially

from

those

contained

in

the

forward-looking

statements,

please

refer

to

“Risk

Factors”

in

Item

1A

of

Part

I

of

our

Annual

Report

on

Form

10-K

filed

by

the

Company

with

the

Securities

and

Exchange

Commission

on

February

27,

2014

and

subsequent

filings

by

the

Company.

The

Company

bases

these forward-

looking

statements

or

projections

on

its

current

expectations,

plans

and

assumptions

that

it

has

made

in

light

of

its

experience

in

the

industry,

as

well

as

its

perceptions

of

historical

trends,

current

conditions,

expected

future

developments

and

other

factors

it

believes

are

appropriate

under

the

circumstances

and

at

such

time.

As

you

read

and

consider

this

presentation,

you

should

understand

that

these

statements

are

not

guarantees

of

performance

or

results.

The

forward-looking

statements

and

projections

are

subject

to

and

involve

risks,

uncertainties

and

assumptions

and

you

should

not

place

undue

reliance

on

these

forward-looking

statements

or

projections.

Although

the

Company

believes

that

these

forward-looking

statements

and

projections

are

based

on

reasonable

assumptions

at

the

time

they

are

made,

you

should

be

aware

that

many

factors

could

affect

the

Company’s

actual

financial

results

or

results

of

operations

and

could

cause

actual

results

to

differ

materially

from

those

expressed

in

the

forward-looking

statements

and

projections.

The

Company

undertakes

no

obligation

to

update

or

revise

any

forward-looking

statements,

whether

as

a

result

of

new

information,

future

events

or

otherwise.

If

the

Company

does

update

one

or

more

forward-looking

statements,

there

should

be

no

inference

that

it

will

make

additional

updates

with

respect

to

those

or

other

forward-looking

statements.

In

addition

to

the

financial

measures

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“GAAP”),

this

presentation

contains

the

non-GAAP

financial

measures

EBITDA,

Adjusted

EBITDA

and

Adjusted

gross

margin

from

homes

delivered.

The

reasons

for

the

use

of

these

measures,

a

reconciliation

of

these

measures

to

the

most

directly

comparable

GAAP

measures

and

other

information

relating

to

these

measures

are

included

below

in

the

appendix

to

this

presentation. |

3

3

Cash

58%

LTV 1-64%

12%

LTV 65-80%

23%

LTV >80%

7%

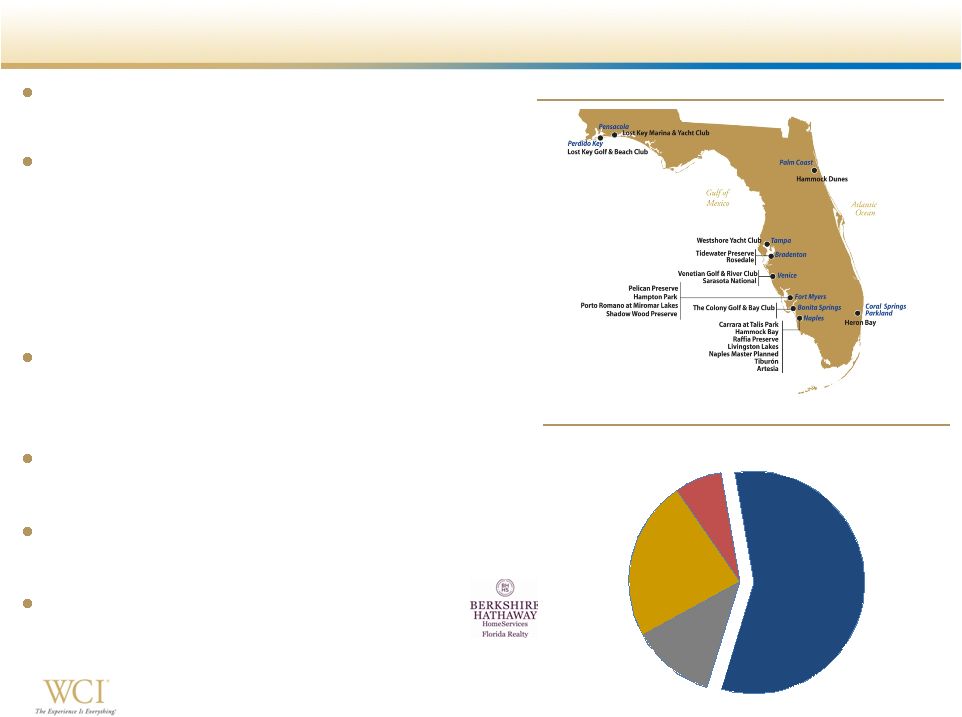

Buyer Profile with Low Reliance on Financing

WCI Communities at a Glance

Lifestyle community developer and

luxury homebuilder throughout Florida

Target move-up, second-home and

active adult customers

–

High average selling prices -

$427k on

3Q14 deliveries

–

High proportion of all cash buyers -

58% in

3Q14; 59% year to date

–

Low cancellation rate –

6.5% in 3Q14

Approximately 10,400 home sites

owned and controlled as of

September 30, 2014

Conservative balance sheet with $170

million of cash

Continued Homebuilding new order and

neighborhood count growth

Complementary and value-add Real

Estate Services & Amenities

businesses

Geographic Footprint

Loan to Value Percentage –

3Q14 Deliveries |

4

4

Note: Florida as referenced to John Burns Real Estate Consulting and in the

charts represents a compilation of the major FL markets

(1)

US Census Bureau

(2)

John Burns Real Estate Consulting, October 2014

(3)

Florida Realtors’

®

Florida Housing Market statewide data reports

(4)

Metrostudy

Compelling Florida Real Estate Market Opportunity

Florida building permits year to date 2014 –

2

nd

highest in the nation

(1)

–

LTM permits still ~70% off peak

–

LTM single family permit growth of 6.5%,

compared to (0.8%) nationally

(2)

Florida is a leading growth state

–

Population growth –

3

rd

highest growth state

(1)

–

Household growth rate three times the national

rate

(2)

–

Job growth rate 20% higher than the national

rate

(2)

–

Sarasota/Bradenton and Naples/Ft.Myers

ranked among the top 10 national markets for

year-over-year starts growth

(4)

Southern Florida ranked as the #1 market in the

U.S. in October 2014

(2)

(includes Naples, Ft. Myers,

Sarasota, West Palm Beach, Miami and Ft. Lauderdale)

Strong resale market

–

September 2014 was the 34th consecutive

month of year over year increase in median

sale prices for both single and multi-family

homes

(3)

Household Growth –

YOY Percent Change

0.0%

0.2%

0.4%

0.6%

0.8%

1.0%

1.2%

1.4%

2010

2011

2012

2013

Aug-14 TTM

Florida

National

Source: Moody's Analytics, John Burns R.E. Consulting, Pub: Oct-14

Months Supply of Resale Inventory -

Single Family

(3)

5.4

5.4

5.1

4.7

4.7

4.1

Florida

Naples

Ft.Lauderdale*

Ft.Myers

Tampa

Bradenton/Sarasota

Note:

Ft.Lauderdale represents Broward County only; other locations represent MSA

|

5

5

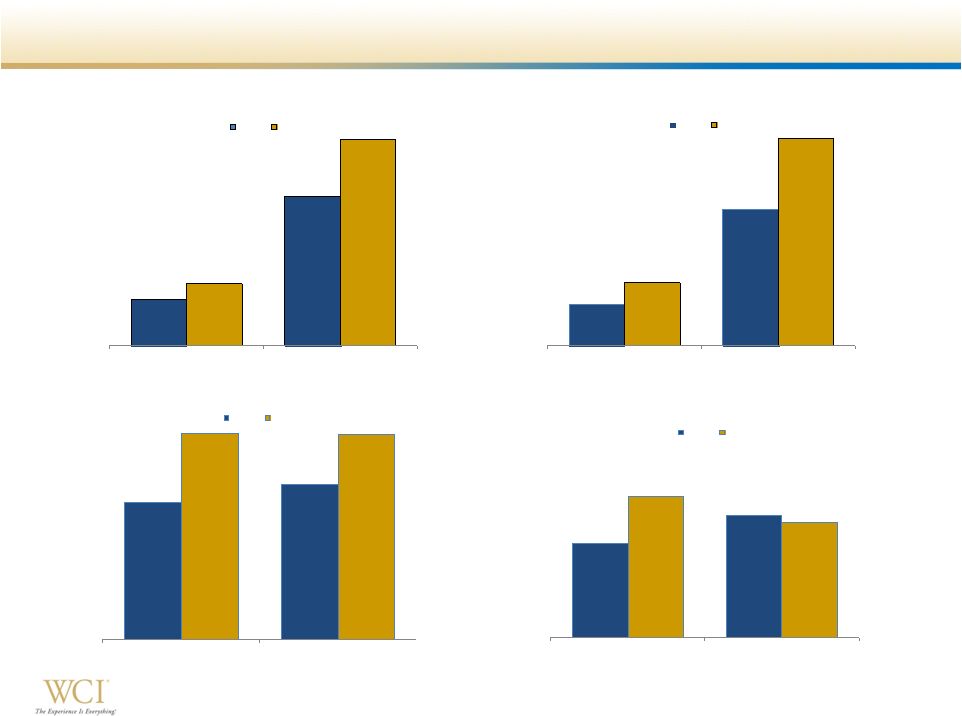

Continued New Order Growth ($ in thousands)

128

415

172

572

3Q

YTD

New Orders

2013

2014

+34%

+38%

$54,411

$183,347

$84,001

$278,750

3Q

YTD

Contract Value of New Orders

2013

2014

+54%

+52%

$425

$442

$488

$487

3Q

YTD

New Orders ASP

2013

2014

+15%

+10%

2.6%

3.4%

3.9%

3.2%

3Q

YTD

New Orders

Incentives % of Base Price

2013

2014

-20 bps

+130 bps |

6

6

Continued Deliveries and Backlog Growth ($ in

thousands) 141

342

146

406

3Q

YTD

Deliveries

2013

2014

+4%

+19%

328

459

3Q13

3Q14

Backlog Units

3Q13

3Q14

+40%

$154,239

$252,308

3Q13

3Q14

Contract Value of Backlog

3Q13

3Q14

+64%

ASP -

$470

ASP -

$550

$429

$423

$427

$422

3Q

YTD

ASP per Home Delivered

2013

2014 |

7

7

Executing on the Long Term Growth Strategy

(1)

Measured as a percentage of total homebuilding revenues

(2)

Percentage measured as a percentage of total revenues

17.0%

17.2%

3.0%

1.5%

20.0%

18.7%

YTD 2013

YTD 2014

SG&A %

(1)

Non-Cash Incentive Comp

$25.7

$23.7

YTD 2013

YTD 2014

Adjusted EBITDA

(2)

($ in

millions)

11.6%

9.3%

HB

$145.1

HB

$171.3

RES

$60.9

RES

$67.8

AM $16.6

AM $17.3

$222.6

$256.4

YTD 2013

YTD 2014

Revenues

($ in millions)

HB

$44.4

HB

$46.9

RES $3.2

RES $1.8

AM $(1.7)

AM $(1.2)

$45.9

$47.5

YTD 2013

YTD 2014

Gross Margin

($ in millions) |

8

8

6,483

5,872

5,390

379

2,635

4,977

6,862

8,507

10,367

4Q12

4Q13

3Q14

Legacy

New Acquisitions

Strong Land Portfolio Positions WCI for Future Growth

Land portfolio totals approximately

10,400 owned and controlled home

sites

High quality land in constrained

markets

21% increase from the

approximately 8,600 owned and

controlled home sites in September

2013

84% Owned / 16% Optioned

Low basis legacy land marked to fair

value in 2009 represents 52% of the

total portfolio

Experienced team with extensive

land development expertise

Actively pursuing additional land

acquisition opportunities throughout

Florida

Owned and Controlled Home Sites |

9

9

Selected Third Quarter and YTD Operating Results

Note: Some variance percentages have been rounded to tie to third quarter

2014 Form 10-Q. $ in thousands, except per share amounts

2014

2013

Variance %

2014

2013

Variance %

Homebuilding revenues

62,381

$

60,802

$

2.6%

171,294

$

145,054

$

18.1%

Real estate services revenues

22,886

20,524

11.7%

67,848

60,915

11.3%

Amenities revenues

4,393

4,192

4.8%

17,257

16,620

4.2%

Total revenues

89,660

85,518

4.9%

256,399

222,589

15.2%

Total gross margin

15,698

17,157

-8.5%

47,539

45,863

3.7%

Income tax (expense) benefit

(1,703)

-

NM

(6,337)

85

NM

Net income (loss) attributable to common shareholders

3,140

$

(17,022)

$

NM

8,958

$

(8,230)

$

NM

Earnings (loss) per share - diluted

0.12

$

(0.71)

$

NM

0.34

$

(0.41)

$

NM

Weighted average number of shares outstanding - diluted

26,307

24,138

9.0%

26,272

20,099

30.7%

SG&A expenses as a percent of Homebuilding revenues

17.7%

16.9%

+80 bps

18.7%

20.0%

-130 bps

Adjusted gross margin percentage

28.6%

31.3%

-270 bps

29.5%

32.6%

-310 bps

Adjusted EBITDA

7,847

$

11,320

$

-30.7%

23,740

$

25,724

$

-7.7%

Homes delivered

146

141

3.5%

406

342

18.7%

Average selling price per home delivered

427

$

429

$

-0.5%

422

$

423

$

-0.2%

New orders

172

128

34.4%

572

415

37.8%

Average selling price per new order

488

$

425

$

14.8%

487

$

442

$

10.2%

Backlog units

459

328

39.9%

Average selling price per backlog unit

550

$

470

$

17.0%

Three Months Ended September 30,

Nine Months Ended September 30, |

10

10

Strong Balance Sheet with Ample Liquidity

Conservative balance sheet

positioned to execute growth

strategy

Year to date investment in

land and land development

of approximately $111

million

Undrawn $75 million

revolving credit facility

(1)

Available liquidity includes the $75 million of borrowing capacity under a

four-year revolving credit facility and $8 million of borrowing capacity

available under a revolving credit facility with Stonegate Bank.

(2)

Net Debt represents total debt excluding premium less cash and cash equivalents;

capital represents net debt plus total equity.

$ in thousands

Cash & cash equivalents

169,541

$

213,352

$

Real estate inventories

420,045

280,293

Senior notes due 2021

250,000

200,000

Total equity

421,022

409,864

Total capitalization

671,022

609,864

Availabile liquidity

(1)

252,541

296,352

Debt to capitalization

37.3%

32.8%

Net debt to capital

(2)

16.0%

NM

(Cash + inventory) / debt

2.36

2.47

September 30,

2014 December 31, 2013 |

11

11

Key Takeaways

Fully integrated Florida luxury homebuilder and

community developer

Focus on move-up, second-home and active

adult customer segments

Complementary and strategic Amenities and

Real Estate Services businesses

Florida real estate market remains strong

Continued growth

Actively pursuing land acquisition opportunities

Leverage the scalable operating platform

Experienced and talented team

–

Orders & deliveries

–

Neighborhood counts |

12

12

Appendix |

13

13

2014

2013

2014

2013

($ in thousands)

Homebuilding gross margin

16,444

$

17,810

$

46,940

$

44,433

$

Less: gross margin from land and home sites

-

166

-

201

Gross margin from homes delivered

16,444

17,644

46,940

44,232

Add: capitalized interest in cost of sales

1,386

1,317

3,653

2,880

Adjusted gross margin from homes delivered

17,830

$

18,961

$

50,593

$

47,112

$

Gross margin from homes delivered as a percentage

of revenues from homes delivered

26.4%

29.2%

27.4%

30.6%

Adjusted gross margin from homes delivered as a

percentage of revenues from homes delivered

28.6%

31.3%

29.5%

32.6%

Three Months Ended

September 30,

September 30,

Nine Months Ended

Reconciliation of Non-GAAP Financial Measures

Adjusted Gross Margin from Homes Delivered

Reconciliation of Non-GAAP Financial Measures

In addition to the results reported in accordance with U.S. generally accepted

accounting principles (“GAAP”), we have provided information in this

presentation relating to adjusted gross margin from homes delivered, EBITDA and

Adjusted EBITDA (as defined below). Adjusted Gross Margin from Homes

Delivered We

calculate

adjusted

gross

margin

from

homes

delivered

by

subtracting

the

gross

margin

from

land

and

home

sites,

if

any,

from

Homebuilding

gross

margin

to

arrive

at

gross

margin

from

homes

delivered.

Adjusted

gross

margin

from

homes

delivered

is

calculated

by

adding

asset

impairments,

if

any,

and

capitalized

interest

in

cost

of

sales

to

gross

margin

from

homes

delivered.

Management

uses

adjusted

gross

margin

from

homes

delivered

to

evaluate

operating

performance

in

our

Homebuilding

segment

and

make

strategic

decisions

regarding

sales

price,

construction

and

development

pace,

product

mix

and

other

operating

decisions.

We

believe

that

adjusted

gross

margin

from

homes

delivered

is

relevant

and

useful

to

investors

and

other

interested

parties

for

evaluating

our

comparative

operating

performance

from

period

to

period

and

among

companies

within

the

homebuilding

industry

as

it

is

reflective

of

overall

profitability

during

any

given

reporting

period.

This

measure

is

considered

a

non-GAAP

financial

measure

and

should

be

considered

in

addition

to,

rather

than

as

a

substitute

for,

the

comparable

GAAP

financial

measures

when

evaluating

our

operating

performance.

Although

other

companies

in

the

homebuilding

industry

report

similar

information,

the

methods

used

by

such

companies

may

differ

from

our

methodology

and,

therefore,

may

not

be

comparable.

We

urge

investors

and

other

interested

parties

to

understand

the

methods

used

by

other

companies

in

the

homebuilding

industry

to

calculate

gross

margins

and

any

adjustments

to

such

amounts

before

comparing

our

measures

to

those

of

such

other

companies.

The table below reconciles adjusted gross margin from homes delivered to the most

directly comparable GAAP financial measure, Homebuilding gross margin, for

the periods presented herein. |

14

14

Reconciliation of Non-GAAP Financial Measures

(continued) EBITDA and Adjusted EBITDA

EBITDA and Adjusted EBITDA

Adjusted

EBITDA

measures

performance

by

adjusting

net

income

(loss)

attributable

to

common

shareholders

of

WCI

Communities,

Inc.

to

exclude,

if

any,

interest

expense,

capitalized

interest

in

cost

of

sales,

income

taxes,

depreciation

(‘‘EBITDA’’),

preferred

stock

dividends,

income

(loss)

from

discontinued

operations,

other

income,

stock-based

and

other

non-cash

long-term

incentive

compensation

expense,

asset

impairments

and

expenses

related

to

early

repayment

of

debt.

We

believe

that

the

presentation

of

Adjusted

EBITDA

provides

useful

information

to

investors

and

other

interested

parties

regarding

our

results

of

operations

because

it

assists

those

parties

and

us

when

analyzing

and

benchmarking

the

performance

and

value

of

our

business.

We

also

believe

that

Adjusted

EBITDA

is

useful

as

a

measure

of

comparative

operating

performance

from

period

to

period

and

among

companies

in

the

homebuilding

industry

as

it

is

reflective

of

changes

in

pricing

decisions,

cost

controls

and

other

factors

that

affect

operating

performance,

and

it

removes

the

effects

of

our

capital

structure

(such

as

preferred

stock

dividends

and

interest

expense),

asset

base

(primarily

depreciation),

items

outside

of

our

control

(primarily

income

taxes)

and

the

volatility

related

to

the

timing

and

extent

of

non-operating

activities

(such

as

discontinued

operations

and

asset

impairments).

Accordingly,

we

believe

that

this

measure

is

useful

for

comparing

general

operating

performance

from

period

to

period.

Other

companies

may

define

Adjusted

EBITDA

differently

and,

as

a

result,

our

measure

of

Adjusted

EBITDA

may

not

be

directly

comparable

to

Adjusted

EBITDA

of

other

companies.

Although

we

use

Adjusted

EBITDA

as

a

financial

measure

to

assess

the

performance

of

our

business,

the

use

of

Adjusted

EBITDA

is

limited

because

it

does

not

include

certain

material

costs,

such

as

interest

and

income

taxes,

necessary

to

operate

our

business.

Adjusted

EBITDA

and

EBITDA

should

be

considered

in

addition

to,

and

not

as

substitutes

for,

net

income

(loss)

in

accordance

with

GAAP

as

a

measure

of

performance.

Our

presentation

of

EBITDA

and

Adjusted

EBITDA

should

not

be

construed

as

an

indication

that

our

future

results

will

be

unaffected

by

unusual

or

nonrecurring

items.

Our

EBITDA-based

measures

have

limitations

as

analytical

tools

and,

therefore,

investors

and

other

interested

parties

should

not

consider

them

in

isolation

or

as

substitutes

for

analyses

of

our

results

as

reported

under

GAAP.

Some

such

limitations

are:

Because

of

these

limitations,

our

EBITDA-based

measures

are

not

intended

to

be

alternatives

to

net

income

(loss),

indicators

of

our

operating

performance,

alternatives

to

any

other

measure

of

performance

in

conformity

with

GAAP

or

alternatives

to

cash

flow

provided

by

(used

in)

operating

activities

as

measures

of

liquidity.

Investors

and

other

interested

parties

should

therefore

not

place

undue

reliance

on

our

EBITDA-

based

measures

or

ratios

calculated

using

those

measures.

Our

GAAP-based

measures

can

be

found

in

our

unaudited

consolidated

financial

statements

in

Item

1

of

the

Quarterly

Report

on

Form

10-Q

that

we

plan

to

file

with

the

Securities

and

Exchange

Commission

on

or

before

November

7,

2014.

they do not reflect the impact of earnings or charges resulting from matters that

we consider not to be indicative of our ongoing operations; they are not

adjusted for all non-cash income or expense items that are reflected in our consolidated statements of cash flows;

they do not reflect the interest expense necessary to service our debt; and

other companies in our industry may calculate these measures differently than we

do, thereby limiting their usefulness as comparative measures.

|

15

15

Reconciliation of Non-GAAP Financial Measures

(continued) EBITDA and Adjusted EBITDA (continued) (1)

Represents

capitalized

interest

expensed

in

cost

of

sales

on

home

deliveries

and

land

and

home

site

sales.

(2)

Represents

the

Company’s

income

taxes

as

reported

in

its

unaudited

consolidated

statements

of

operations.

(3)

Represents

a

reduction

in

net

income

attributable

to

WCI

Communities,

Inc.

pertaining

to

its

preferred

stock

wherein

we

(i)

exchanged

903,825

shares

of

our

common

stock

(valued

at

$19.0

million)

for

10,000

outstanding

shares

of

our

Series

A

preferred

stock

during

July

2013

and

(ii)

paid

$0.7

million

in

cash

to

purchase

the

one

outstanding

share

of

our

Series

B

preferred

stock

during

April

2013.

All

such

shares

of

preferred

stock,

which

were

carried

at

a

nominal

value

on

our

consolidated

balance

sheets,

have

been

cancelled

and

retired.

In

accordance

with

Accounting

Standards

Codification

260,

Earnings

Per

Share,

paragraph

10-S99-2,

any

difference

between

the

consideration

transferred

to

our

preferred

stock

shareholders

and

the

corresponding

book

value

has

been

(i)

characterized

as

a

preferred

stock

dividend

in

the

Company’s

unaudited

consolidated

statements

of

operations

during

the

period

that

the

related

transaction

was

completed

and

(ii)

deducted

from

net

income

attributable

to

WCI

Communities,

Inc.

to

arrive

at

net

income

(loss)

attributable

to

common

shareholders

of

WCI

Communities,

Inc.

(4)

Represents

the

Company’s

other

income,

net

as

reported

in

its

unaudited

consolidated

statements

of

operations.

(5)

Represents

expenses

recorded

in

the

Company’s

unaudited

consolidated

statements

of

operations

related

to

its

stock-based

and

other

non-cash

long-term

incentive compensation

plans.

(6)

Represents

expenses

related

to

early

repayment

of

debt

as

reported

in

the

Company’s

unaudited

consolidated

statements

of

operations

during

the

three

and

nine

months

ended

September

30,

2013,

including

write-offs

of

unamortized

debt

discount

and

debt

issuance

costs

and

a

prepayment

premium

related

to

our

voluntary

prepayment

during

August

2013

of

the

entire

outstanding

principal

amount

of

the

Company’s

Senior

Secured

Term

Notes

due

2017.

The table below reconciles EBITDA and Adjusted EBITDA to the most directly

comparable GAAP financial measure, net income (loss) attributable to common

shareholders of WCI Communities, Inc., for the periods presented herein. 2014

2013

2014

2013

($ in thousands)

Net income (loss) attributable to common

shareholders of WCI Communities, Inc.

3,140

$

(17,022)

$

8,958

$

(8,230)

$

Interest expense

191

184

876

1,798

Capitalized interest in cost of sales (1)

1,386

1,317

3,653

2,880

Income taxes (2)

1,703

-

6,337

(85)

Depreciation

678

505

1,910

1,513

EBITDA

7,098

(15,016)

21,734

(2,124)

Preferred stock dividends (3)

-

18,980

-

19,680

Other income, net (4)

(107)

(29)

(535)

(1,249)

Stock-based and other non-cash long-term

incentive compensation expense (5)

856

2,280

2,541

4,312

Expenses related to early repayment of debt (6)

-

5,105

-

5,105

Adjusted EBITDA

7,847

$

11,320

$

23,740

$

25,724

$

Adjusted EBITDA margin

8.8%

13.2%

9.3%

11.6%

Three Months Ended

September 30,

September 30,

Nine Months Ended |