Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CyrusOne Inc. | exhibit991-earningsrelease.htm |

| 8-K - 8-K - CyrusOne Inc. | a3rdqtr8k.htm |

Third Quarter 2014 Earnings Presentation November 4, 2014

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 2 Forward-looking statements Safe Harbor This presentation contains forward-looking statements regarding future events and our future results that are subject to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, are statements that could be deemed forward-looking statements. These statements are based on current expectations, estimates, forecasts, and projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,” “predicts,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “endeavors,” “strives,” “may,” variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of our future financial performance, our anticipated growth and trends in our businesses, and other characterizations of future events or circumstances are forward-looking statements. Readers are cautioned these forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially and adversely from those reflected in the forward- looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this release and those discussed in other documents we file with the Securities and Exchange Commission (SEC). More information on potential risks and uncertainties is available in our recent filings with the SEC, including CyrusOne’s Form 10-K and Form 8-Ks. Actual results may differ materially and adversely from those expressed in any forward-looking statements. We undertake no obligation to revise or update any forward-looking statements for any reason.

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 3 Third Quarter 2014 Highlights Third quarter Normalized FFO of $28.9 million and AFFO of $29.1 million increased 32% and 51%, respectively, over the third quarter of 2013 Third quarter revenue of $84.8 million increased 26% over the third quarter of 2013 Third quarter Adjusted EBITDA of $42.2 million increased 16% over the third quarter of 2013 Leased 33,000 colocation square feet(1) in the third quarter, with utilization remaining high at 88%, and subsequent to the end of the quarter signed lease in Northern Virginia for more than 12,000 colocation square feet Completed initial phase of Phoenix 2 facility in record time of 107 days, in what is believed to be the fastest data center construction project built from the ground up in the United States Note: 1. Colocation square feet (CSF) represents NRSF currently leased or available for lease as colocation space, where customers locate their servers and other IT equipment. Net rentable square feet (NRSF) represents the total square feet of a building currently leased or available for lease, based on engineers’ drawings and estimates but does not include space held for development or space used by CyrusOne.

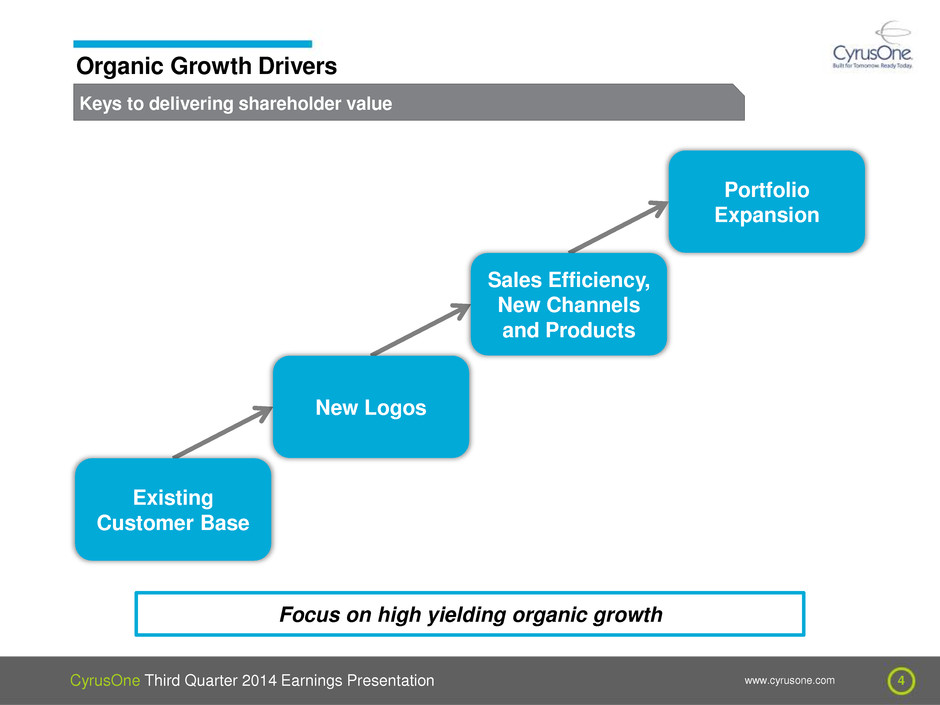

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 4 Keys to delivering shareholder value Organic Growth Drivers Portfolio Expansion Existing Customer Base New Logos Sales Efficiency, New Channels and Products Focus on high yielding organic growth

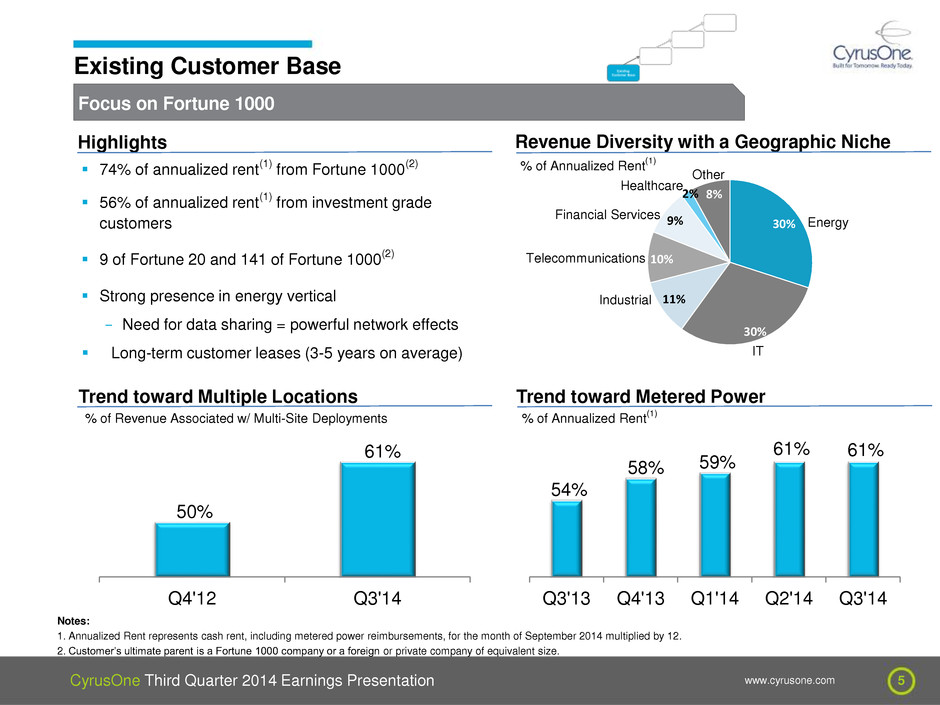

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 5 Focus on Fortune 1000 Existing Customer Base 74% of annualized rent(1) from Fortune 1000(2) 56% of annualized rent(1) from investment grade customers 9 of Fortune 20 and 141 of Fortune 1000(2) Strong presence in energy vertical - Need for data sharing = powerful network effects Long-term customer leases (3-5 years on average) Highlights Notes: 1. Annualized Rent represents cash rent, including metered power reimbursements, for the month of September 2014 multiplied by 12. 2. Customer’s ultimate parent is a Fortune 1000 company or a foreign or private company of equivalent size. 30% 30% 11% 10% 9% 2% 8% Revenue Diversity with a Geographic Niche Energy Other Telecommunications Financial Services Healthcare IT % of Annualized Rent (1) Industrial Trend toward Metered Power % of Annualized Rent (1) 54% 58% 59% 61% 61% Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 50% 61% Q4'12 Q3'14 Trend toward Multiple Locations % of Revenue Associated w/ Multi-Site Deployments

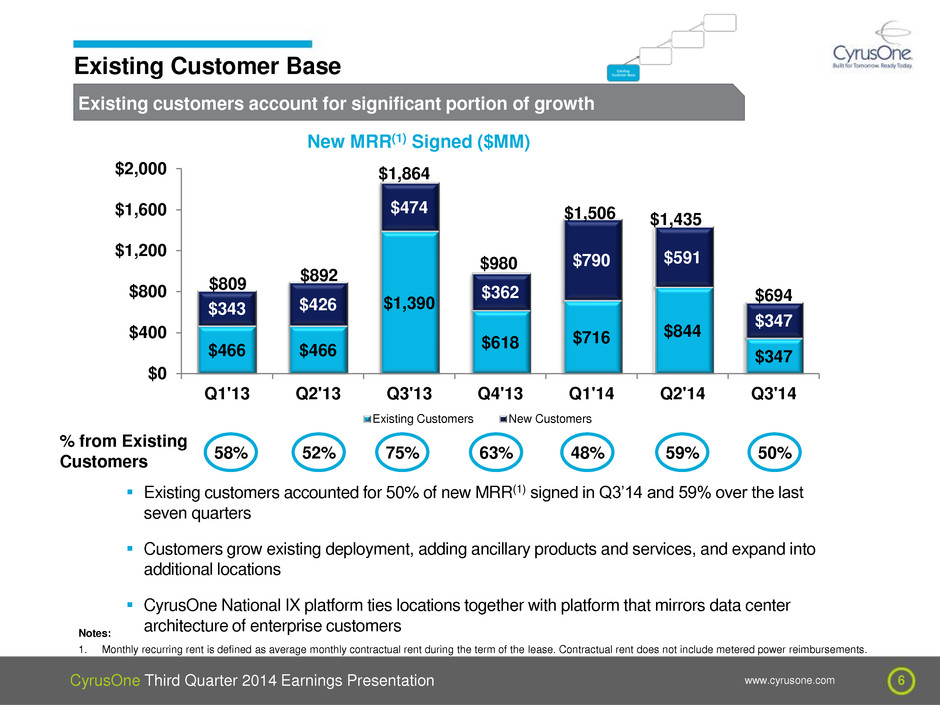

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 6 Existing customers account for significant portion of growth Existing Customer Base $466 $466 $1,390 $618 $716 $844 $347 $343 $426 $474 $362 $790 $591 $347 $809 $892 $1,864 $980 $1,506 $1,435 $694 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 $0 $400 $800 $1,200 $1,600 $2,000 Existing Customers New Customers New MRR(1) Signed ($MM) Existing customers accounted for 50% of new MRR(1) signed in Q3’14 and 59% over the last seven quarters Customers grow existing deployment, adding ancillary products and services, and expand into additional locations CyrusOne National IX platform ties locations together with platform that mirrors data center architecture of enterprise customers Notes: % from Existing Customers 63% 48% 59% 50% 1. Monthly recurring rent is defined as average monthly contractual rent during the term of the lease. Contractual rent does not include metered power reimbursements. 75% 52% 58%

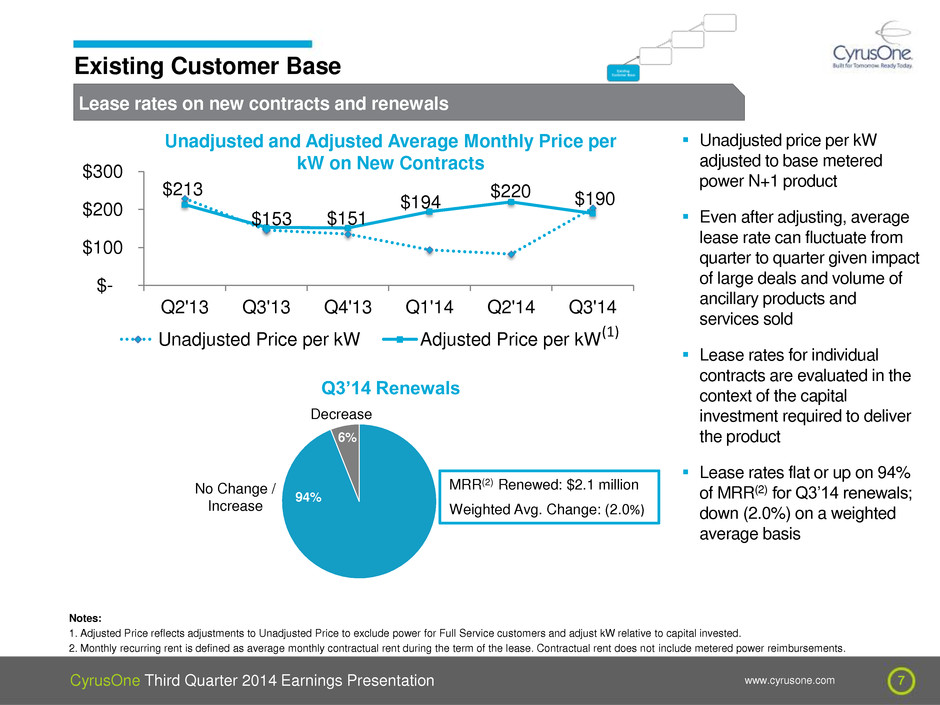

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 7 Lease rates on new contracts and renewals Existing Customer Base $213 $153 $151 $194 $220 $190 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 $- $100 $200 $300 Unadjusted Price per kW Adjusted Price per kW Unadjusted price per kW adjusted to base metered power N+1 product Even after adjusting, average lease rate can fluctuate from quarter to quarter given impact of large deals and volume of ancillary products and services sold Lease rates for individual contracts are evaluated in the context of the capital investment required to deliver the product Lease rates flat or up on 94% of MRR(2) for Q3’14 renewals; down (2.0%) on a weighted average basis Unadjusted and Adjusted Average Monthly Price per kW on New Contracts Q3’14 Renewals Decrease No Change / Increase 6% 94% Notes: 1. Adjusted Price reflects adjustments to Unadjusted Price to exclude power for Full Service customers and adjust kW relative to capital invested. 2. Monthly recurring rent is defined as average monthly contractual rent during the term of the lease. Contractual rent does not include metered power reimbursements. MRR(2) Renewed: $2.1 million Weighted Avg. Change: (2.0%) (1)

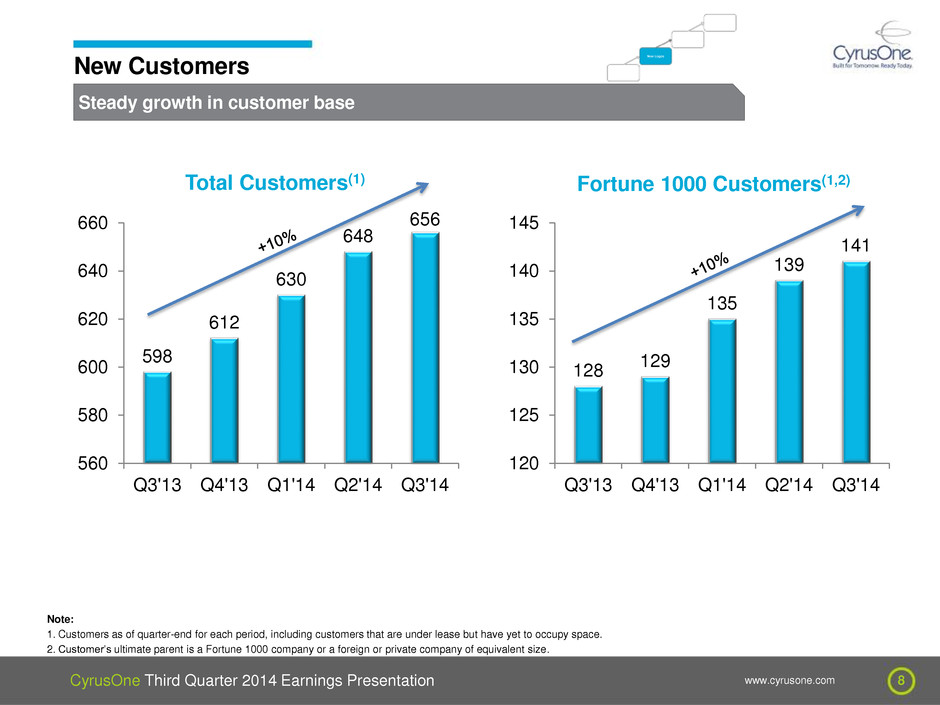

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 8 Steady growth in customer base New Customers 598 612 630 648 656 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 560 580 600 620 640 660 128 129 135 139 141 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 120 125 130 135 140 145 Total Customers(1) Note: 1. Customers as of quarter-end for each period, including customers that are under lease but have yet to occupy space. 2. Customer’s ultimate parent is a Fortune 1000 company or a foreign or private company of equivalent size. Fortune 1000 Customers(1,2)

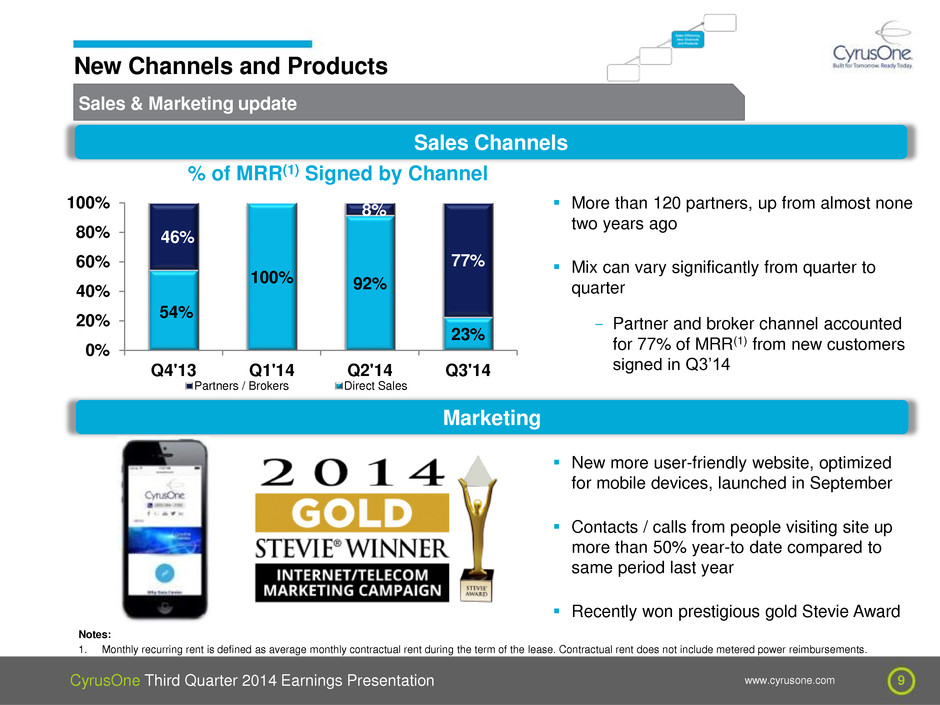

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 9 Sales & Marketing update New Channels and Products New more user-friendly website, optimized for mobile devices, launched in September Contacts / calls from people visiting site up more than 50% year-to date compared to same period last year Recently won prestigious gold Stevie Award Sales Channels Marketing 54% 100% 92% 23% 46% 8% 77% Q4'13 Q1'14 Q2'14 Q3'14 0% 20% 40% 60% 80% 100% % of MRR(1) Signed by Channel Partners / Brokers Direct Sales More than 120 partners, up from almost none two years ago Mix can vary significantly from quarter to quarter - Partner and broker channel accounted for 77% of MRR(1) from new customers signed in Q3’14 Notes: 1. Monthly recurring rent is defined as average monthly contractual rent during the term of the lease. Contractual rent does not include metered power reimbursements.

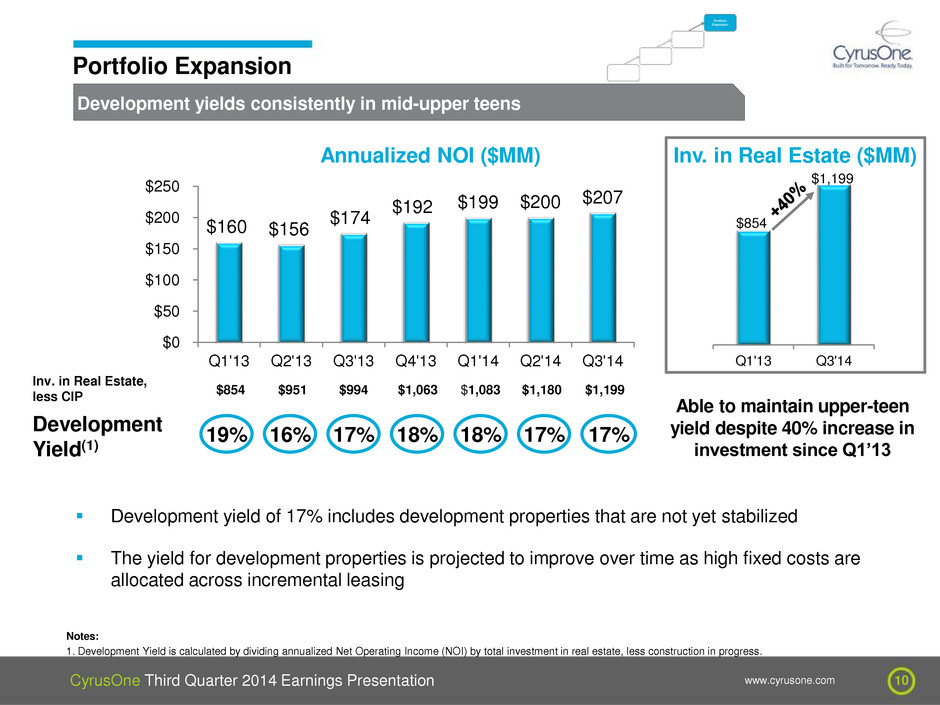

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 10 Development yields consistently in mid-upper teens Portfolio Expansion $160 $156 $174 $192 $199 $200 $207 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 $0 $50 $100 $150 $200 $250 Annualized NOI ($MM) Development Yield(1) Inv. in Real Estate, less CIP $994 $1,063 $1,083 17% $1,180 Development yield of 17% includes development properties that are not yet stabilized The yield for development properties is projected to improve over time as high fixed costs are allocated across incremental leasing Notes: 1. Development Yield is calculated by dividing annualized Net Operating Income (NOI) by total investment in real estate, less construction in progress. $951 Q1'13 Q3'14 $1,199 $854 Able to maintain upper-teen yield despite 40% increase in investment since Q1’13 Inv. in Real Estate ($MM) $1,199 $854 17% 18% 18% 17% 16% 19%

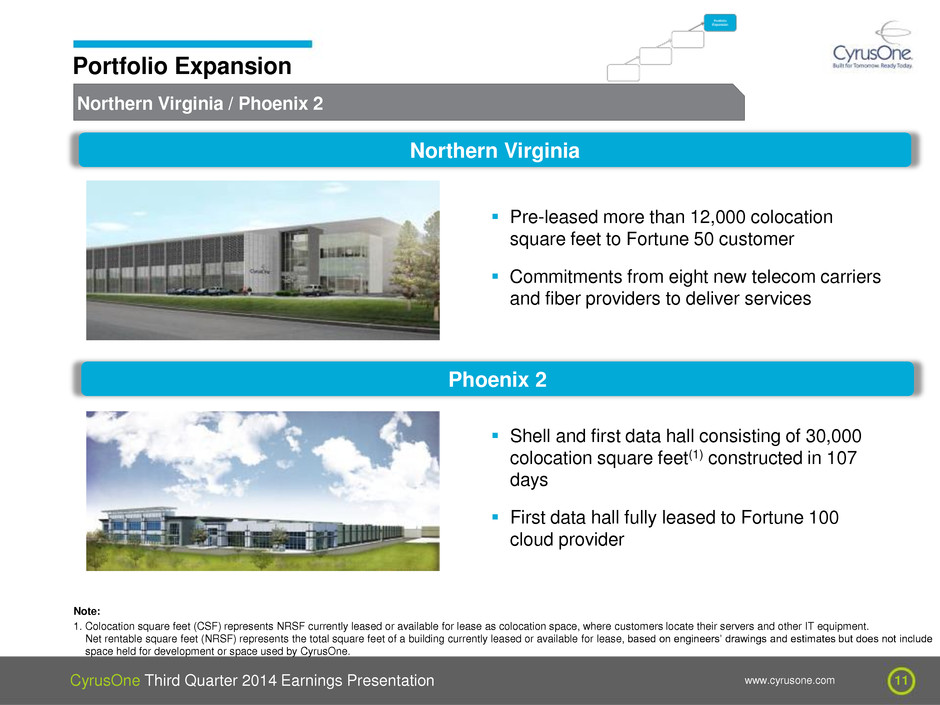

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 11 Northern Virginia / Phoenix 2 Portfolio Expansion Note: 1. Colocation square feet (CSF) represents NRSF currently leased or available for lease as colocation space, where customers locate their servers and other IT equipment. Net rentable square feet (NRSF) represents the total square feet of a building currently leased or available for lease, based on engineers’ drawings and estimates but does not include space held for development or space used by CyrusOne. Northern Virginia Pre-leased more than 12,000 colocation square feet to Fortune 50 customer Commitments from eight new telecom carriers and fiber providers to deliver services Phoenix 2 Shell and first data hall consisting of 30,000 colocation square feet(1) constructed in 107 days First data hall fully leased to Fortune 100 cloud provider

Third Quarter 2014 Financial Review

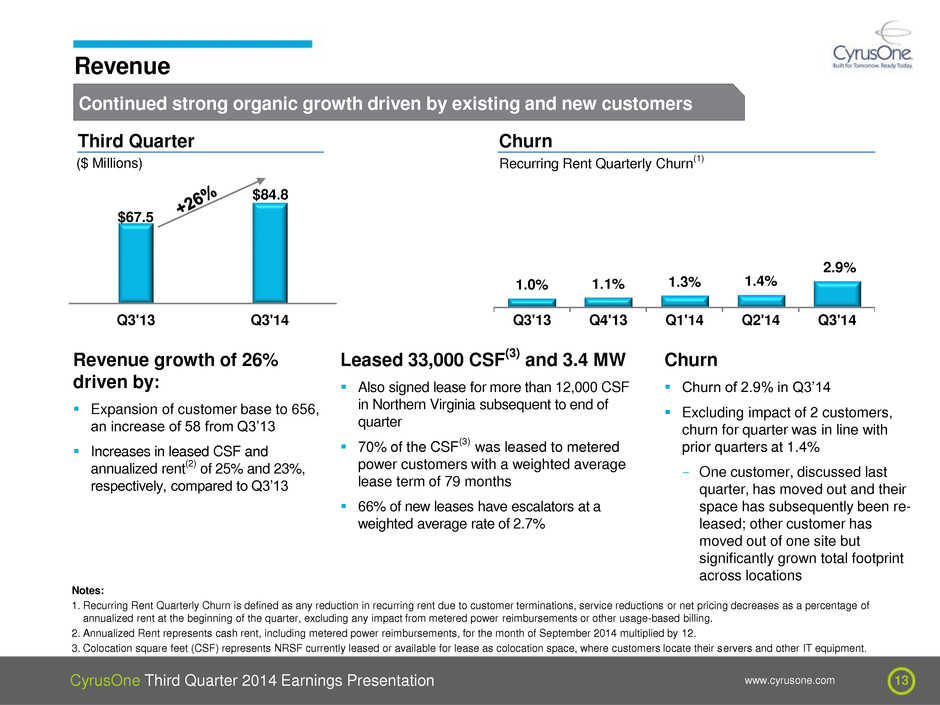

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 13 $67.5 $84.8 Q3'13 Q3'14 1.0% 1.1% 1.3% 1.4% 2.9% Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 Continued strong organic growth driven by existing and new customers Revenue Third Quarter ($ Millions) Churn Recurring Rent Quarterly Churn (1) Revenue growth of 26% driven by: Expansion of customer base to 656, an increase of 58 from Q3’13 Increases in leased CSF and annualized rent (2) of 25% and 23%, respectively, compared to Q3’13 Leased 33,000 CSF (3) and 3.4 MW Also signed lease for more than 12,000 CSF in Northern Virginia subsequent to end of quarter 70% of the CSF(3) was leased to metered power customers with a weighted average lease term of 79 months 66% of new leases have escalators at a weighted average rate of 2.7% Notes: 1. Recurring Rent Quarterly Churn is defined as any reduction in recurring rent due to customer terminations, service reductions or net pricing decreases as a percentage of annualized rent at the beginning of the quarter, excluding any impact from metered power reimbursements or other usage-based billing. 2. Annualized Rent represents cash rent, including metered power reimbursements, for the month of September 2014 multiplied by 12. 3. Colocation square feet (CSF) represents NRSF currently leased or available for lease as colocation space, where customers locate their servers and other IT equipment. Churn Churn of 2.9% in Q3’14 Excluding impact of 2 customers, churn for quarter was in line with prior quarters at 1.4% - One customer, discussed last quarter, has moved out and their space has subsequently been re- leased; other customer has moved out of one site but significantly grown total footprint across locations

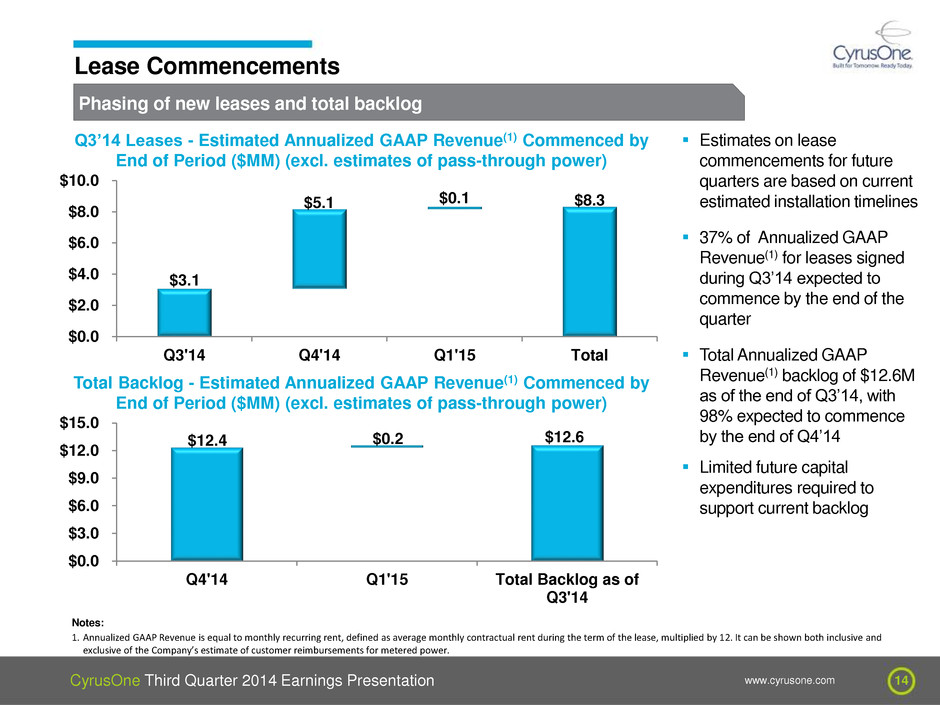

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 14 Phasing of new leases and total backlog Lease Commencements Notes: 1. Annualized GAAP Revenue is equal to monthly recurring rent, defined as average monthly contractual rent during the term of the lease, multiplied by 12. It can be shown both inclusive and exclusive of the Company’s estimate of customer reimbursements for metered power. $3.1 $8.3 $5.1 $0.1 Q3'14 Q4'14 Q1'15 Total $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 Q3’14 Leases - Estimated Annualized GAAP Revenue(1) Commenced by End of Period ($MM) (excl. estimates of pass-through power) $12.4 $12.6 $0.2 Q4'14 Q1'15 Total Backlog as of Q3'14 $0.0 $3.0 $6.0 $9.0 $12.0 $15.0 Total Backlog - Estimated Annualized GAAP Revenue(1) Commenced by End of Period ($MM) (excl. estimates of pass-through power) Estimates on lease commencements for future quarters are based on current estimated installation timelines 37% of Annualized GAAP Revenue(1) for leases signed during Q3’14 expected to commence by the end of the quarter Total Annualized GAAP Revenue(1) backlog of $12.6M as of the end of Q3’14, with 98% expected to commence by the end of Q4’14 Limited future capital expenditures required to support current backlog

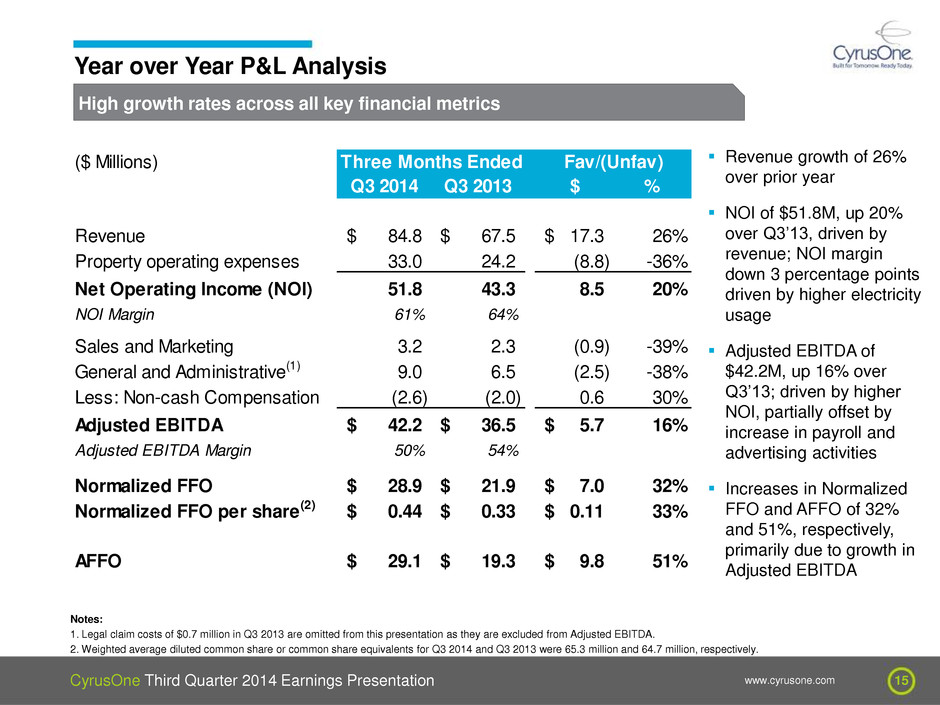

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 15 High growth rates across all key financial metrics Year over Year P&L Analysis Notes: 1. Legal claim costs of $0.7 million in Q3 2013 are omitted from this presentation as they are excluded from Adjusted EBITDA. 2. Weighted average diluted common share or common share equivalents for Q3 2014 and Q3 2013 were 65.3 million and 64.7 million, respectively. Revenue growth of 26% over prior year NOI of $51.8M, up 20% over Q3’13, driven by revenue; NOI margin down 3 percentage points driven by higher electricity usage Adjusted EBITDA of $42.2M, up 16% over Q3’13; driven by higher NOI, partially offset by increase in payroll and advertising activities Increases in Normalized FFO and AFFO of 32% and 51%, respectively, primarily due to growth in Adjusted EBITDA ($ Millions) Q3 2014 Q3 2013 $ % Revenue 84.8$ 67.5$ 17.3$ 26% Property operating expenses 33.0 24.2 (8.8) -36% Net Operating Income (NOI) 51.8 43.3 8.5 20% NOI Margin 61% 64% Sales and Marketing 3.2 2.3 (0.9) -39% General and Administrative(1) 9.0 6.5 (2.5) -38% Less: Non-cash Compensation (2.6) (2.0) 0.6 30% Adjusted EBITDA 42.2$ 36.5$ 5.7$ 16% Adjusted EBITDA Margin 50% 54% Normalized FFO 28.9$ 21.9$ 7.0$ 32% Normalized FFO per share(2) 0.44$ 0.33$ 0.11$ 33% AFFO 29.1$ 19.3$ 9.8$ 51% Three Months Ended Fav/(Unfav)

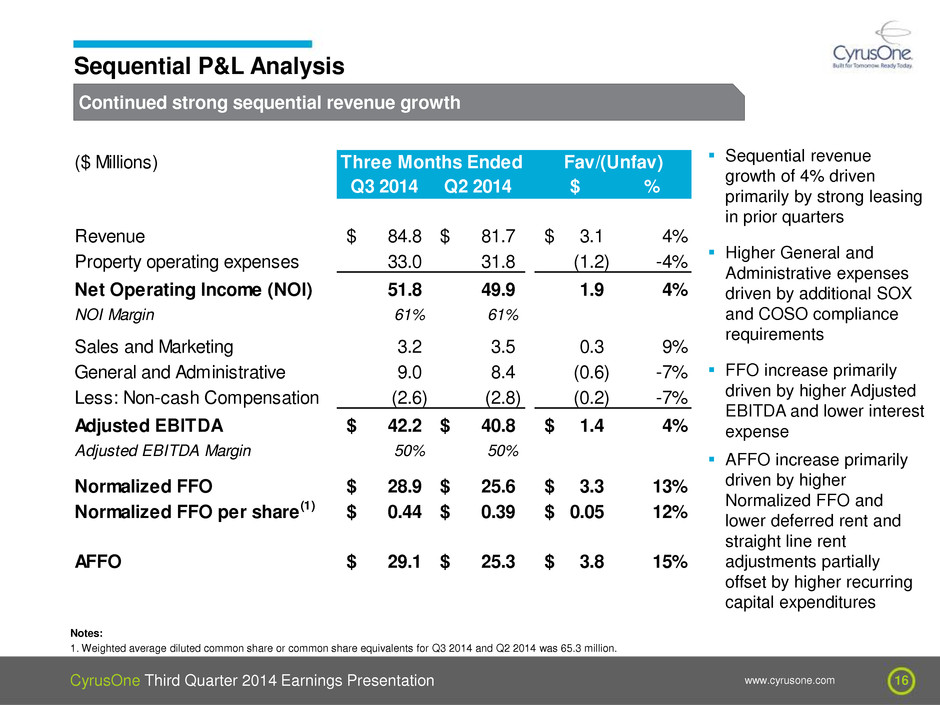

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 16 Continued strong sequential revenue growth Sequential P&L Analysis Notes: 1. Weighted average diluted common share or common share equivalents for Q3 2014 and Q2 2014 was 65.3 million. Sequential revenue growth of 4% driven primarily by strong leasing in prior quarters Higher General and Administrative expenses driven by additional SOX and COSO compliance requirements FFO increase primarily driven by higher Adjusted EBITDA and lower interest expense AFFO increase primarily driven by higher Normalized FFO and lower deferred rent and straight line rent adjustments partially offset by higher recurring capital expenditures ($ Millions) Q3 2014 Q2 2014 $ % Revenue 84.8$ 81.7$ 3.1$ 4% Property operating expenses 33.0 31.8 (1.2) -4% Net Operating Income (NOI) 51.8 49.9 1.9 4% NOI Margin 61% 61% Sales and Marketing 3.2 3.5 0.3 9% General and Administrative 9.0 8.4 (0.6) -7% Less: Non-cash Compensation (2.6) (2.8) (0.2) -7% Adjusted EBITDA 42.2$ 40.8$ 1.4$ 4% Adjusted EBITDA Margin 50% 50% Normalized FFO 28.9$ 25.6$ 3.3$ 13% Normalized FFO per share(1) 0.44$ 0.39$ 0.05$ 12% AFFO 29.1$ 25.3$ 3.8$ 15% Three Months Ended Fav/(Unfav)

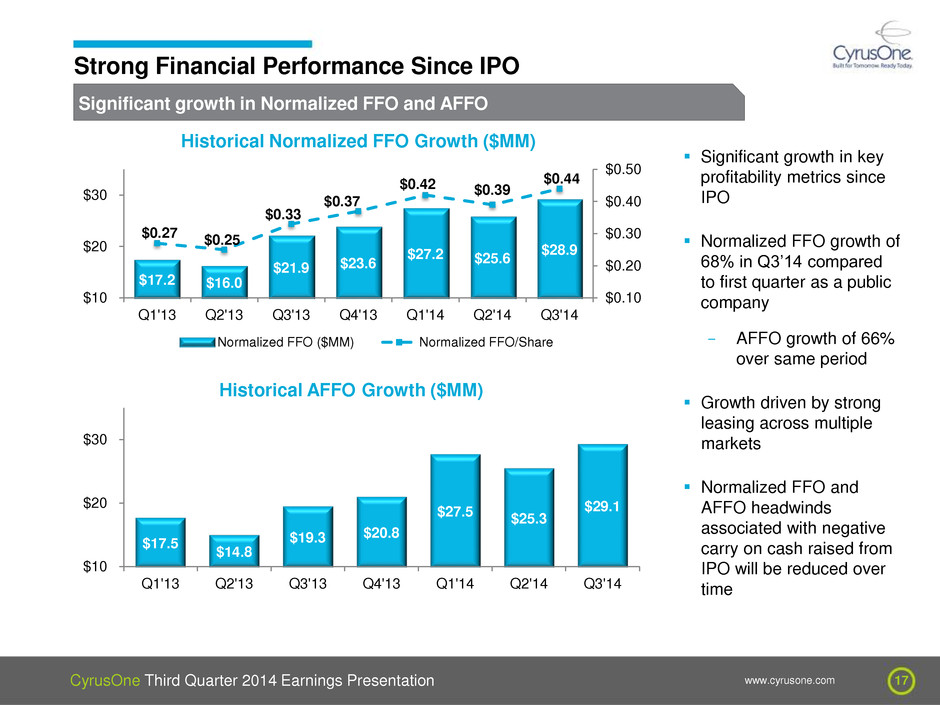

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 17 Significant growth in Normalized FFO and AFFO Strong Financial Performance Since IPO $17.2 $16.0 $21.9 $23.6 $27.2 $25.6 $28.9 $0.27 $0.25 $0.33 $0.37 $0.42 $0.39 $0.44 $0.10 $0.20 $0.30 $0.40 $0.50 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 $10 $20 $30 Normalized FFO ($MM) Normalized FFO/Share Historical Normalized FFO Growth ($MM) 6% 94% Historical AFFO Growth ($MM) $17.5 $14.8 $19.3 $20.8 $27.5 $25.3 $29.1 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 $10 $20 $30 Significant growth in key profitability metrics since IPO Normalized FFO growth of 68% in Q3’14 compared to first quarter as a public company - AFFO growth of 66% over same period Growth driven by strong leasing across multiple markets Normalized FFO and AFFO headwinds associated with negative carry on cash raised from IPO will be reduced over time

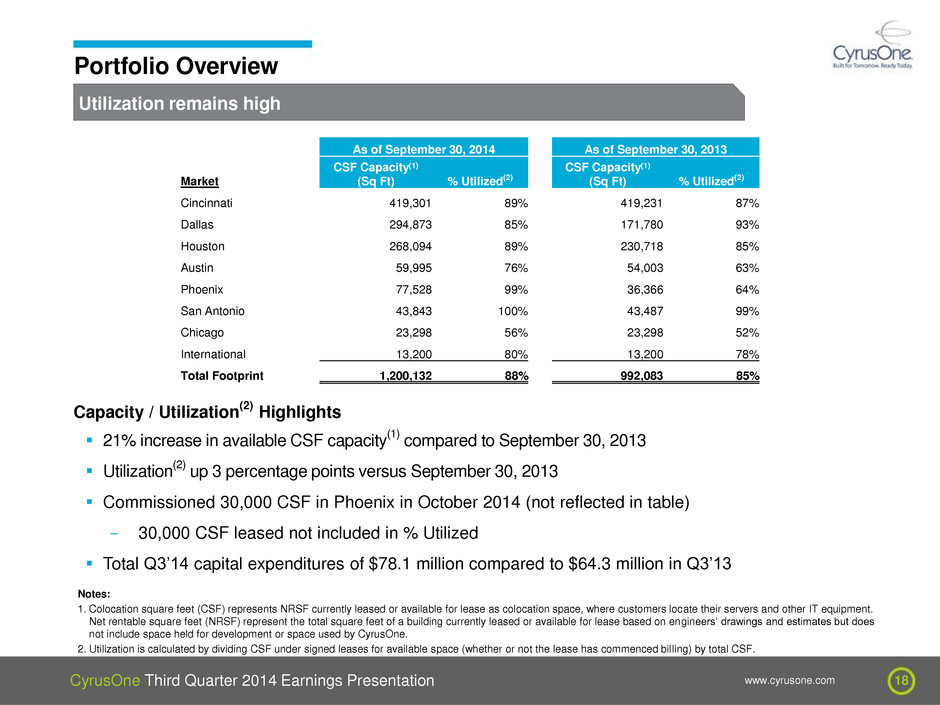

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 18 Utilization remains high Portfolio Overview As of September 30, 2014 As of September 30, 2013 Market CSF Capacity(1) (Sq Ft) % Utilized(2) CSF Capacity(1) (Sq Ft) % Utilized(2) Cincinnati 419,301 89% 419,231 87% Dallas 294,873 85% 171,780 93% Houston 268,094 89% 230,718 85% Austin 59,995 76% 54,003 63% Phoenix 77,528 99% 36,366 64% San Antonio 43,843 100% 43,487 99% Chicago 23,298 56% 23,298 52% International 13,200 80% 13,200 78% Total Footprint 1,200,132 88% 992,083 85% Capacity / Utilization (2) Highlights 21% increase in available CSF capacity(1) compared to September 30, 2013 Utilization(2) up 3 percentage points versus September 30, 2013 Commissioned 30,000 CSF in Phoenix in October 2014 (not reflected in table) - 30,000 CSF leased not included in % Utilized Total Q3’14 capital expenditures of $78.1 million compared to $64.3 million in Q3’13 Notes: 1. Colocation square feet (CSF) represents NRSF currently leased or available for lease as colocation space, where customers locate their servers and other IT equipment. Net rentable square feet (NRSF) represent the total square feet of a building currently leased or available for lease based on engineers’ drawings and estimates but does not include space held for development or space used by CyrusOne. 2. Utilization is calculated by dividing CSF under signed leases for available space (whether or not the lease has commenced billing) by total CSF.

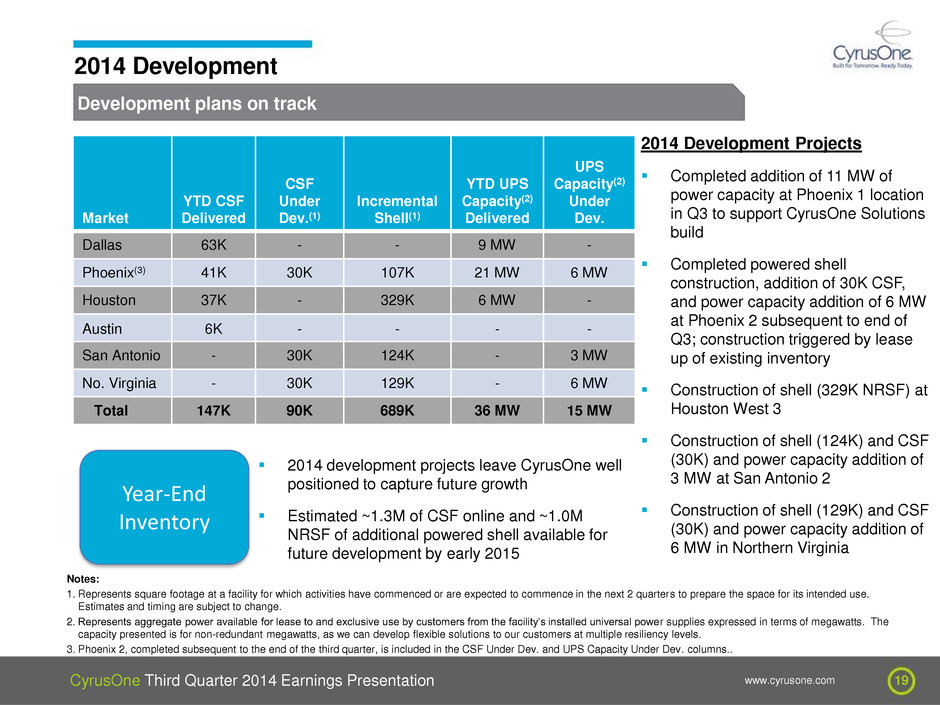

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 19 Development plans on track 2014 Development Market YTD CSF Delivered CSF Under Dev.(1) Incremental Shell(1) YTD UPS Capacity(2) Delivered UPS Capacity(2) Under Dev. Dallas 63K - - 9 MW - Phoenix(3) 41K 30K 107K 21 MW 6 MW Houston 37K - 329K 6 MW - Austin 6K - - - - San Antonio - 30K 124K - 3 MW No. Virginia - 30K 129K - 6 MW Total 147K 90K 689K 36 MW 15 MW Notes: 1. Represents square footage at a facility for which activities have commenced or are expected to commence in the next 2 quarters to prepare the space for its intended use. Estimates and timing are subject to change. 2. Represents aggregate power available for lease to and exclusive use by customers from the facility’s installed universal power supplies expressed in terms of megawatts. The capacity presented is for non-redundant megawatts, as we can develop flexible solutions to our customers at multiple resiliency levels. 3. Phoenix 2, completed subsequent to the end of the third quarter, is included in the CSF Under Dev. and UPS Capacity Under Dev. columns.. 2014 Development Projects Completed addition of 11 MW of power capacity at Phoenix 1 location in Q3 to support CyrusOne Solutions build Completed powered shell construction, addition of 30K CSF, and power capacity addition of 6 MW at Phoenix 2 subsequent to end of Q3; construction triggered by lease up of existing inventory Construction of shell (329K NRSF) at Houston West 3 Construction of shell (124K) and CSF (30K) and power capacity addition of 3 MW at San Antonio 2 Construction of shell (129K) and CSF (30K) and power capacity addition of 6 MW in Northern Virginia Year-End Inventory 2014 development projects leave CyrusOne well positioned to capture future growth Estimated ~1.3M of CSF online and ~1.0M NRSF of additional powered shell available for future development by early 2015

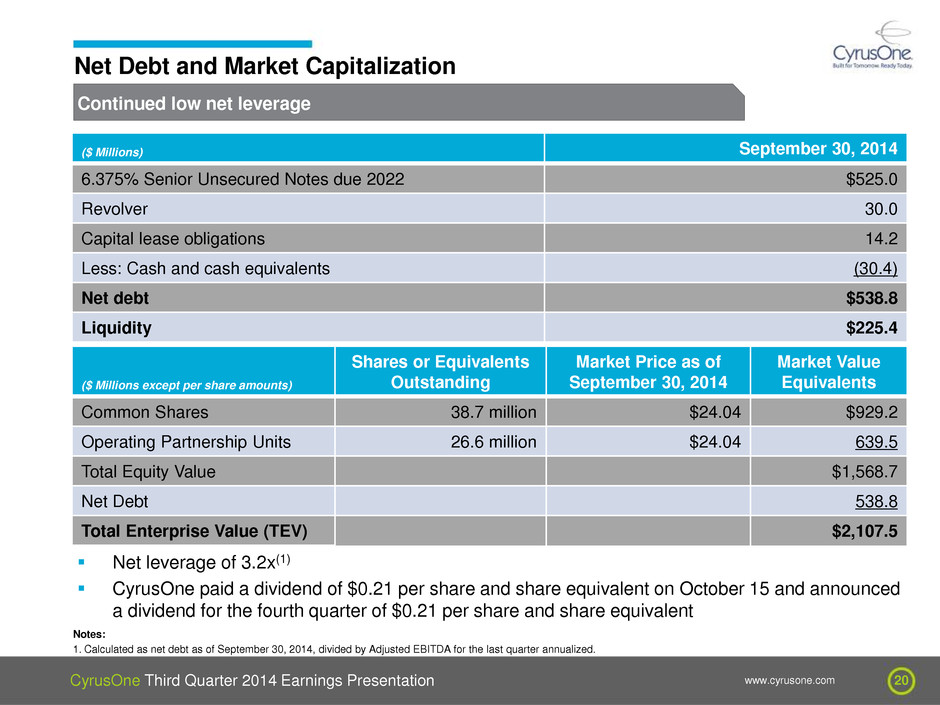

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 20 Continued low net leverage Net Debt and Market Capitalization ($ Millions except per share amounts) Shares or Equivalents Outstanding Market Price as of September 30, 2014 Market Value Equivalents Common Shares 38.7 million $24.04 $929.2 Operating Partnership Units 26.6 million $24.04 639.5 Total Equity Value $1,568.7 Net Debt 538.8 Total Enterprise Value (TEV) $2,107.5 ($ Millions) September 30, 2014 6.375% Senior Unsecured Notes due 2022 $525.0 Revolver 30.0 Capital lease obligations 14.2 Less: Cash and cash equivalents (30.4) Net debt $538.8 Liquidity $225.4 Net leverage of 3.2x(1) CyrusOne paid a dividend of $0.21 per share and share equivalent on October 15 and announced a dividend for the fourth quarter of $0.21 per share and share equivalent Notes: 1. Calculated as net debt as of September 30, 2014, divided by Adjusted EBITDA for the last quarter annualized.

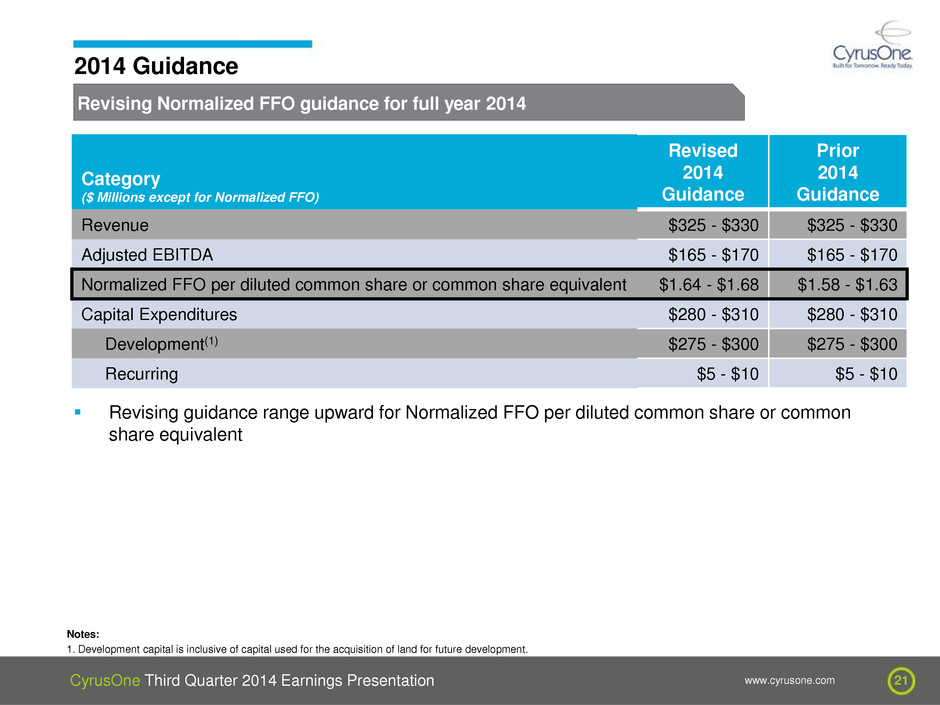

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 21 Revising Normalized FFO guidance for full year 2014 2014 Guidance Category ($ Millions except for Normalized FFO) Revised 2014 Guidance Prior 2014 Guidance Revenue $325 - $330 $325 - $330 Adjusted EBITDA $165 - $170 $165 - $170 Normalized FFO per diluted common share or common share equivalent $1.64 - $1.68 $1.58 - $1.63 Capital Expenditures $280 - $310 $280 - $310 Development(1) $275 - $300 $275 - $300 Recurring $5 - $10 $5 - $10 Notes: 1. Development capital is inclusive of capital used for the acquisition of land for future development. Revising guidance range upward for Normalized FFO per diluted common share or common share equivalent

Appendix Non-GAAP Reconciliations

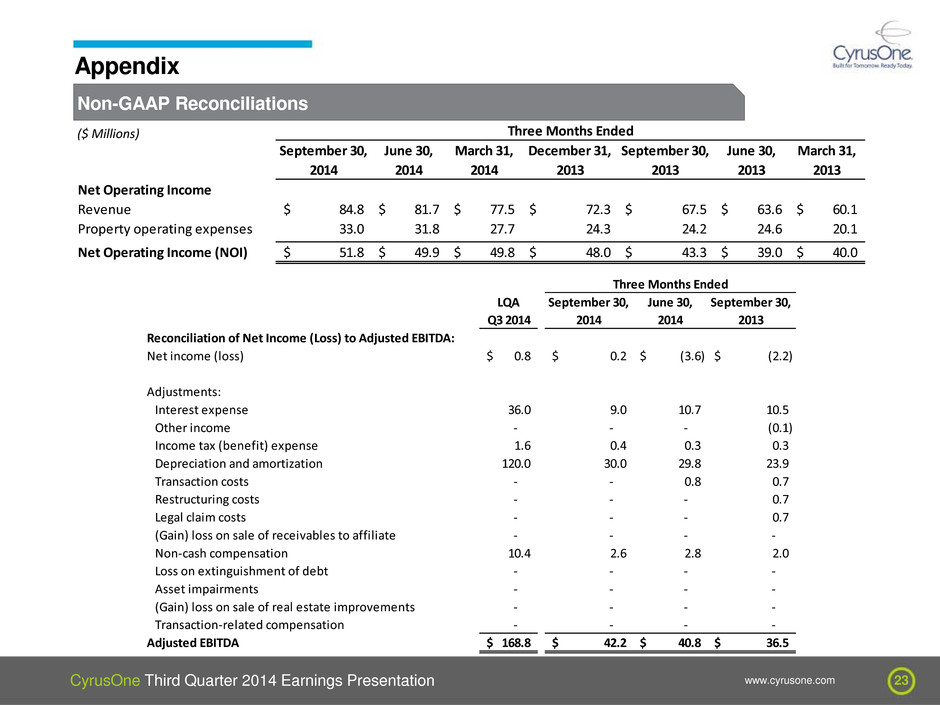

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 23 Non-GAAP Reconciliations Appendix ($ Millions) Net Operating Income Revenue 84.8$ 81.7$ 77.5$ 72.3$ 67.5$ 63.6$ 60.1$ Property operating expenses 33.0 31.8 27.7 24.3 24.2 24.6 20.1 Net Operating Income (NOI) 51.8$ 49.9$ 49.8$ 48.0$ 43.3$ 39.0$ 40.0$ September 30, 2014 Three Months Ended June 30, 2014 March 31, 2014 June 30, 2013 March 31, 2013 September 30, 2013 December 31, 2013 LQA Q3 2014 Reconciliation of Net Income (Loss) to Adjusted EBITDA: Net income (loss) 0.8$ 0.2$ (3.6)$ (2.2)$ Adjustments: Interest expense 36.0 9.0 10.7 10.5 Other income - - - (0.1) Income tax (benefit) expense 1.6 0.4 0.3 0.3 Depreciation and amortization 120.0 30.0 29.8 23.9 Transaction costs - - 0.8 0.7 Restructuring costs - - - 0.7 Legal claim costs - - - 0.7 (Gain) loss on sale of receivables to affiliate - - - - Non-cash compe sation 10.4 2.6 2.8 2.0 Loss on extinguishment of debt - - - - Asset impairments - - - - (Gain) loss on sale of real estate improvements - - - - Transaction-related compensation - - - - Adjusted EBITDA 168.8$ 42.2$ 40.8$ 36.5$ Three Months Ended June 30, 2014 September 30, 2014 September 30, 2013

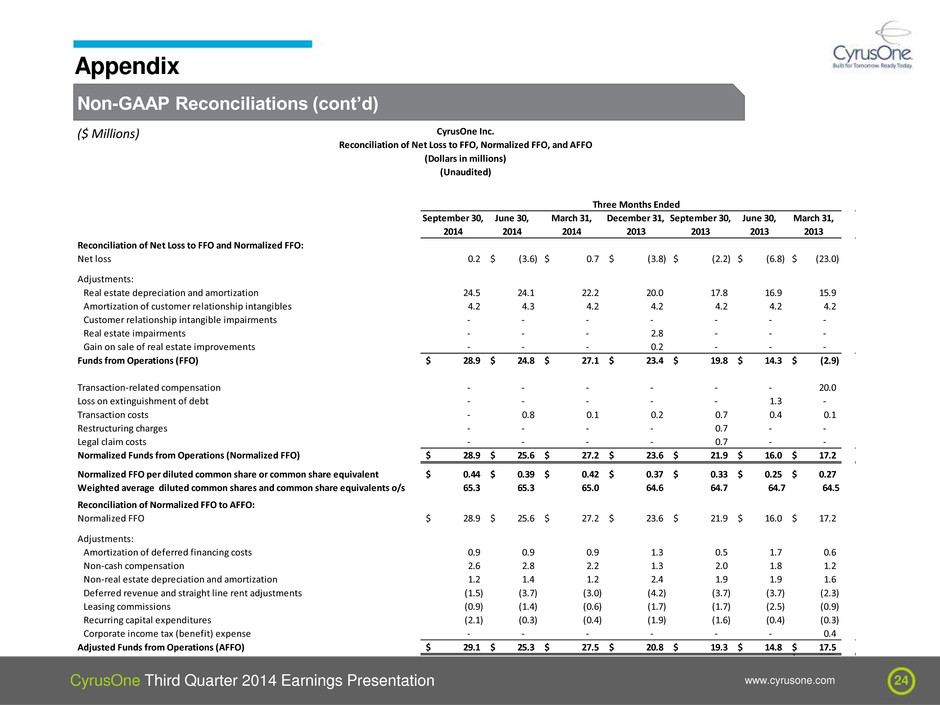

CyrusOne Third Quarter 2014 Earnings Presentation www.cyrusone.com 24 Non-GAAP Reconciliations (cont’d) Appendix ($ Millions) Reconciliation of Net Loss to FFO and Normalized FFO: Net loss 0.2 (3.6)$ 0.7$ (3.8)$ (2.2)$ (6.8)$ (23.0)$ Adjustments: Real estate depreciation and amortization 24.5 24.1 22.2 20.0 17.8 16.9 15.9 Amortization of customer relationship intangibles 4.2 4.3 4.2 4.2 4.2 4.2 4.2 Customer relationship intangible impairments - - - - - - - Real estate impairments - - - 2.8 - - - Gain on sale of real estate improvements - - - 0.2 - - - Funds from Operations (FFO) 28.9$ 24.8$ 27.1$ 23.4$ 19.8$ 14.3$ (2.9)$ Transaction-related compensation - - - - - - 20.0 Loss on extinguishment of debt - - - - - 1.3 - Transaction costs - 0.8 0.1 0.2 0.7 0.4 0.1 Restructuring charges - - - - 0.7 - - Legal claim costs - - - - 0.7 - - Normalized Funds from Operations (Normalized FFO) 28.9$ 25.6$ 27.2$ 23.6$ 21.9$ 16.0$ 17.2$ Normalized FFO per diluted common share or common share equivalent 0.44$ 0.39$ 0.42$ 0.37$ 0.33$ 0.25$ 0.27$ Weighted average diluted common shares and common share equivalents o/s 65.3 65.3 65.0 64.6 64.7 64.7 64.5 Reconciliation of Normalized FFO to AFFO: Normalized FFO 28.9$ 25.6$ 27.2$ 23.6$ 21.9$ 16.0$ 17.2$ Adjustments: Amortization of deferred financing costs 0.9 0.9 0.9 1.3 0.5 1.7 0.6 Non-cash compensation 2.6 2.8 2.2 1.3 2.0 1.8 1.2 Non-real estate depreciation and amortization 1.2 1.4 1.2 2.4 1.9 1.9 1.6 Deferred revenue and straight line rent adjustments (1.5) (3.7) (3.0) (4.2) (3.7) (3.7) (2.3) Leasing commissions (0.9) (1.4) (0.6) (1.7) (1.7) (2.5) (0.9) Recurring capital expenditures (2.1) (0.3) (0.4) (1.9) (1.6) (0.4) (0.3) Corporate income tax (benefit) expense - - - - - - 0.4 Adjusted Funds from Operations (AFFO) 29.1$ 25.3$ 27.5$ 20.8$ 19.3$ 14.8$ 17.5$ 0.27$ September 30, 2014 March 31, 2013 June 30, 2014 June 30, 2013 March 31, 2014 December 31, 2013 September 30, 2013 CyrusOne Inc. Reconciliation of Net Loss to FFO, Normalized FFO, and AFFO (Dollars in millions) (Unaudited) Three Months Ended