Attached files

| file | filename |

|---|---|

| EX-99.2 - PRINT VERSION OF QUARTERLY INVESTOR UPDATE - SPRINT Corp | fiscal2q14sprintquarterlyinv.pdf |

| 8-K - FORM 8-K - SPRINT Corp | d8k.htm |

| EX-99.1 - PRESS RELEASE ANNOUNCING SECOND FISCAL QUARTER OF 2014 - SPRINT Corp | sprint2qfy14earningsrelease.htm |

SPRINT REPORTS RESULTS FOR SECOND FISCAL QUARTER OF 2014

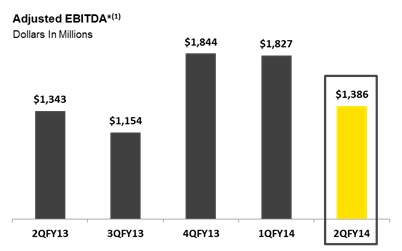

● | Net Operating Revenue of $8.5 billion; Operating Loss of $192 million and Adjusted EBITDA* of nearly $1.4 billion |  | |

● | Total Sprint platform net additions of 590,000 | ||

○ | Postpaid net losses of 272,000 | ||

○ | Prepaid net additions of 35,000 | ||

○ | Wholesale net additions of 827,000 | ||

● | Brand repositioned as the Best Value in Wireless | ||

○ | Postpaid phone gross additions grew 37 percent month-over-month in September and increased year-over-year for the first time in 2014 | ||

● | Continued improvement in network performance and 4G LTE expansion | ||

○ | Recent studies by RootMetrics® see improvement in data network reliability and speeds from a year ago | ||

○ | Sprint received 94 first-place or shared first-place RootScore® Awards for reliability, call and/or text performance in cities across the countryi | ||

○ | 4G LTE coverage expands to 260 million people | ||

Financial results in the enclosed tables include a predecessor period for the quarter ending September 30, 2013 related to the results of operations of Sprint Communications, Inc. (formerly Sprint Nextel) prior to the closing of the SoftBank transaction on July 10, 2013, and the applicable successor periods. In order to present financial results in a way that offers investors a more meaningful comparison of the year-over-year quarterly results, we have combined the calendar third quarter 2013 results of operations for the predecessor and successor periods. The enclosed remarks relating to calendar third quarter of 2013 are in reference to an unaudited combined period, unless otherwise noted. For additional information, please reference the section titled Financial Measures.

| TABLE OF CONTENTS | ||

Consolidated Results | 5 | ||

Wireless Results | 6 | ||

Wireline Results | 9 | ||

SPRINT'S FISCAL 2Q14 EARNINGS CONFERENCE CALL - 4:30 P.M. ET TODAY | Financial and Operational Results | 10 | |

U.S. or Canada: 866-360-1063 | Notes to the Financial Information | 18 | |

Internationally: 706-634-7849 | Financial Measures | 19 | |

Conference ID: 96625910 | Safe Harbor | 20 | |

To listen via the Internet: sprint.com/investors | |||

Sprint Corporation (NYSE: S) today reported operating results for the second fiscal quarter of 2014, including consolidated net operating revenues of $8.5 billion, an operating loss of $192 million, and Adjusted EBITDA* of nearly $1.4 billion. These results occurred during a transitional quarter for the company, as Marcelo Claure was appointed the new president and chief executive officer in mid-August.

“We have started a transformational journey,” said Claure. “While the company continues to face headwinds, we have begun the first phase of our plan and are encouraged with the early results. Every day we are focused on improving our standing with consumers, improving our network and controlling our costs.”

Taking Actions to Improve the Business

Entering the quarter, the company faced challenges related to competitive positioning and adverse impacts to the customer experience resulting from its comprehensive network upgrade efforts over the last several quarters. As a result, the company has incurred losses of postpaid phone customers that are pressuring revenue trends. To address these challenges and begin to improve the performance trajectory, the company has initiated its transformation plan with a focus on four key areas.

● | Competitive Value Proposition |  | |

During the quarter, the Sprint brand was repositioned with the launch of compelling new price plans and promotions designed to deliver the Best Value in Wireless. | |||

○ | Sprint Unlimited Plans offer the best value for individuals and couples at $50-$60/month per line. | ||

○ | Sprint Family Share Pack offers the best value for families and doubles the data of national competitors. | ||

○ | Sprint Business Share Plans offer lower rates and more data than national competitors’ smartphone plans. | ||

○ | Industry-first iPhone for Life leasing plan offers the lowest total cost of iPhone ownership for consumers starting at only $20/month. | ||

● | Network | ||

○ | The company is focused on delivering a consistent, reliable network experience with competitive voice performance, data capacity to meet growing customer demand and improved coverage. | ||

○ | Deployment of Sprint’s multi-band 4G LTE service offering continues, with emphasis on completing the build out of the 800 MHz spectrum and expanding the 2.5 GHz spectrum coverage. | ||

● | Cost Optimization | ||

○ | Sprint is undertaking a comprehensive review of all expenses to optimize its cost structure and is targeting $1.5 billion of annualized cost reductions compared to 2014 spending levels. | ||

○ | As part of the cost reduction efforts, the company is announcing additional headcount reductions of approximately 2,000 positions. Inclusive of recent work force actions, total labor cost is expected to decline $400 million on an annualized basis which will include internal and external labor costs. | ||

● | People | ||

○ | The company has launched a management review and will seek to grow its leadership talent with a combination of internal candidates, new outside talent and SoftBank resources. | ||

Early Market Results

Early reaction to Sprint’s new positioning and offers is encouraging.

• | Postpaid phone gross additions grew 37 percent month-over-month in September and increased year-over-year for the first time in 2014. |

• | Sprint platform postpaid phone net losses slowed by nearly 60 percent in September. |

• | Sprint achieved its most successful iPhone launch in company history with record sales volumes. |

THE SPRINT QUARTERLY INVESTOR UPDATE - FISCAL 2Q14 | 3 |

“While we are pleased to see customers respond to our new value proposition, we must continue to take bold actions to reach our goal of returning to growth in postpaid phone customers,” added Claure. “By improving our competitive position and driving costs out of the business, we plan to deliver long-term value creation.”

Network Deployment Continues and Performance Improves

• | 4G LTE coverage expanded to 260 million people. |

• | 2.5 GHz LTE deployment now covers 92 million people and remains on track to hit 100 million by the end of the year. |

• | Sprint’s network recently received 94 first-place or shared first-place RootScore® Awards for reliability, call and/or text performance in cities across the country, according to recent reports by RootMetrics®. |

“In RootMetrics recent studies of many top population metro areas we’ve seen improvements in Sprint’s data network reliability and speeds from a year ago,” says Bill Moore, CEO of RootMetrics, an independent mobile analytics company. “This is good news for Sprint’s customers in these areas, who are benefiting from investments that Sprint has made in these markets.”

Quarterly Financial Results

• | Operating loss was $192 million compared to an operating loss of $398 million in the year-ago quarter primarily driven by lower depreciation and amortization as the year-ago period included accelerated depreciation related to CDMA assets. |

• | Consolidated Adjusted EBITDA* of nearly $1.4 billion grew 3 percent over the prior year period, driven by double-digit growth within the Wireless segment. Wireless Adjusted EBITDA* of $1.37 billion increased 14 percent from the prior year period, as cost reductions across the business offset lower service revenues driven primarily by continued postpaid phone customer losses. Lower cost of service expenses related to the completion of the 3G and voice network replacement, lower net subsidy costs from the introduction of installment billing plans, and lower customer care and selling costs all contributed to the year-over-year growth. |

• | Sprint platform net additions were 590,000, mostly driven by strong wholesale net additions. |

• | Postpaid tablet net additions were 261,000 in the quarter, while phone losses were 500,000 and other device losses were 33,000. |

• | Sprint had 55 million connections at the end of the quarter. |

Updated Outlook

• | Given the success of the new offers, the company expects increased selling costs associated with significantly higher gross additions and upgrade volumes in the fiscal third quarter of 2014. In addition, the significant loss of postpaid phone customers over the last few quarters has pressured wireless service revenue, and this trend is expected to continue into the next quarter. Therefore, Consolidated Adjusted EBITDA* is expected to be $5.8 billion to $5.9 billion for calendar year 2014. |

• | The company still expects to meet its 800 MHz and 2.5 GHz deployment targets for the year, and now expects capital expenditures to be under $6 billion for calendar year 2014. |

THE SPRINT QUARTERLY INVESTOR UPDATE - FISCAL 2Q14 | 4 |

CONSOLIDATED RESULTS

• | Net operating revenues of $8.5 billion for the quarter were down 2 percent when compared to the year-ago quarter and 3 percent when compared to the prior quarter. The year-over-year decline was driven by declines in both wireless and wireline service revenues, partially mitigated by higher equipment revenues primarily due to the introduction of installment billing for devices. Revenues for the quarter declined sequentially primarily due to lower wireless service revenues. |

• | Operating loss was $192 million compared to an operating loss of $398 million in the year-ago quarter and operating income of $519 million in the prior quarter. The year-over-year change in operating loss was primarily driven by lower depreciation and amortization as the year-ago period included accelerated depreciation related to CDMA assets. The sequential decline of $711 million was primarily driven by items identified below in Adjusted EBITDA* and severance costs primarily associated with work force reductions in the quarter. |

• | Adjusted EBITDA* was $1.39 billion for the quarter, compared to $1.34 billion in the year-ago quarter and $1.83 billion in the prior quarter. Adjusted EBITDA* increased 3 percent year-over-year as growth in Wireless more than offset Wireline declines. Wireless Adjusted EBITDA* increased $164 million when compared to the year-ago quarter as expense reductions in several areas of the business offset lower service revenues driven by continued postpaid phone customer losses. Year-over-year expense reductions included lower cost of services, lower net subsidy with the introduction of installment billing for devices, and lower customer care and selling costs. Adjusted EBITDA* declined 24 percent sequentially mostly due to higher net subsidy expenses primarily driven by a higher mix of iPhone sales coupled with a lower mix of installment billing sales, higher sales volumes and lower wireless service revenues. |

• | Capital expenditures were $1.5 billion in the quarter, compared to $1.8 billion in the year-ago quarter and $1.4 billion in the prior quarter. The year-over-year decline was primarily related to the legacy network upgrade approaching completion, partially offset by increased spending associated with the build out of our 2.5 GHz spectrum. The sequential increase in capital expenditures was related to the build out of the 2.5 GHz spectrum. |

THE SPRINT QUARTERLY INVESTOR UPDATE - FISCAL 2Q14 | 5 |

• | Net cash provided by operating activities was $1.0 billion for the quarter, compared to $1.2 billion in the year-ago quarter and $679 million in the prior quarter. The decrease in cash provided by operating activities compared to the year-ago quarter was primarily due to increased interest payments associated with $6.5 billion of Sprint Corporation debt issued September 2013. Sequentially, cash provided by operating activities increased primarily due to a decrease in cash payments resulting from favorable changes in working capital. |

• | Free Cash Flow* was negative $75 million for the quarter, compared to negative $909 million in the year-ago quarter and negative $496 million in the prior quarter. |

• | The company’s total cash, cash equivalents, and short-term investments at the end of this quarter were $5.3 billion and its total liquidity position was $8.8 billion. |

WIRELESS RESULTS

• | The company had 55 million connections at the end of the quarter, including 29.9 million postpaid, 15.2 million prepaid, and 9.9 million wholesale and affiliate connections. |

• | The Sprint platform lost 272,000 net postpaid connections during the quarter. Sprint platform postpaid net connection losses included 261,000 tablet net additions offset by net losses of 500,000 phones and 33,000 other devices. This compares to net losses of 360,000 in the year-ago quarter and connection losses of 181,000 in the prior quarter which included 535,000 tablet net additions offset by net losses of 620,000 phones and 96,000 other devices. Phone losses were 120,000 fewer sequentially primarily driven by improving gross addition trends in the latter part of the quarter. |

• | The Sprint platform added 35,000 net prepaid connections during the quarter primarily driven by growth in the Boost brand offset by declines in the Virgin Mobile brand. |

• | Wholesale and affiliate net connection additions on the Sprint platform were 827,000 in the quarter. Connected devices, largely related to connected vehicles, accounted for the majority of the growth. |

• | Sprint platform postpaid churn was 2.18 percent, compared to 1.99 percent for the year-ago period and 2.05 percent for the prior quarter. Sprint platform quarterly postpaid churn increased year-over-year and sequentially primarily due to an increase in involuntary churn. |

THE SPRINT QUARTERLY INVESTOR UPDATE - FISCAL 2Q14 | 6 |

• | Approximately 8 percent of Sprint platform postpaid customers upgraded their devices during the quarter, compared to 7 percent for the year-ago and prior quarter. The majority of both the year-over-year and sequential increase in the upgrade rate was driven by targeted device promotions associated with customer retention efforts and the launch of the iPhone 6 late in the quarter. |

• | Sprint platform prepaid churn for the quarter was 3.76 percent, compared to 3.57 percent for the year-ago period and 4.44 percent for the prior quarter. The year-over-year increase was partially driven by changes in the mix of our customer base among our prepaid brands. Sequentially, the decrease was primarily a result of lower Assurance churn due to the prior quarter impact of annual re-certification. |

• | Wireless retail service revenue of $6.7 billion for the quarter declined approximately 7 percent year-over-year and 3 percent sequentially. The year-over-year and sequential decline was primarily attributable to postpaid revenue driven by a declining phone customer base. |

• | Sprint platform postpaid ARPU of $60.58 for the quarter declined $3.70 year-over-year and $1.49 sequentially. The year-over-year decline was primarily related to a higher mix of tablets, which have a lower ARPU than phones, and a shift to rate plans offered in conjunction with device financing programs, partially offset by lower customer discounts and higher phone insurance revenue. While at different magnitudes, these factors all impacted the sequential change in Sprint platform postpaid ARPU as well. |

• | Sprint platform prepaid ARPU of $27.19 for the quarter increased $1.86 year-over-year primarily due to the purchase price accounting dilution included in the year-ago period. Sequentially, the $0.19 decline was primarily driven by new pricing and promotional activity within our Boost brand, partially offset by changes in the mix of our customer base among our prepaid brands. |

• | Wholesale, affiliate and other revenues of $197 million for the quarter increased by $58 million compared to the year-ago period and $18 million sequentially. The year-over-year and sequential increases were both driven by interest revenue associated with the equipment installment billings and wholesale customer growth. |

THE SPRINT QUARTERLY INVESTOR UPDATE - FISCAL 2Q14 | 7 |

• | Wireless equipment net subsidy in the quarter was $1.3 billion (equipment revenue of $1.0 billion, less cost of products of $2.3 billion). Net subsidy declined $110 million year-over-year as equipment revenue rose $329 million primarily due to the introduction of installment billing for devices, and cost of products rose $219 million driven by both device sales mix and higher postpaid sales volumes. Sequentially, net subsidy was up $281 million primarily driven by increased iPhone sales mix in addition to higher overall sales volumes. |

• | Wireless cost of services of $2 billion decreased $339 million year-over-year, as the year-ago quarter included higher backhaul spend related to the legacy network upgrade and higher 3G roaming expenses. Wireless cost of services improved $61 million sequentially mostly due to lower backhaul spend primarily driven by disconnecting T-1’s as migration to Ethernet continues and lower service and repair expense. |

• | Wireless SG&A expenses of $2.2 billion decreased $157 million year-over-year and increased $6 million sequentially. The year-over-year decline was primarily driven by work force reductions, a shift in sales to more cost effective channels, and fewer calls to customer care, partially offset by higher bad debt expenses. The higher bad debt expenses were mostly driven by the introduction of installment billing for equipment which was not present in the year-ago period. Sequentially, wireless SG&A was relatively flat. |

• | Wireless depreciation and amortization expense of $1.2 billion decreased $216 million year-over-year and increased $20 million sequentially. The year-over-year decrease was primarily related to accelerated depreciation associated with CDMA assets included in the year-ago period. |

THE SPRINT QUARTERLY INVESTOR UPDATE - FISCAL 2Q14 | 8 |

WIRELINE RESULTS

• | Wireline revenue of $708 million for the quarter declined 19 percent year-over-year and 5 percent sequentially. The year-over-year decline was primarily a result of the migration of wholesale cable VoIP customers off of Sprint’s IP platform, lower voice volumes, and an intercompany rate reduction based on current market prices for voice and IP services sold to the wireless segment. The sequential decrease was primarily associated with lower international voice rates and lower domestic volumes. |

• | Wireline Adjusted EBITDA* of $27 million for the quarter was down $105 million from the year-ago quarter and $8 million sequentially. The year-over-year decline was primarily associated with the loss of high margin cable VoIP customers, lower usage volumes, and lower intercompany rates. |

THE SPRINT QUARTERLY INVESTOR UPDATE - FISCAL 2Q14 | 9 |

Wireless Operating Statistics (Unaudited)

Quarter To Date | Year To Date | ||||||||||

9/30/14 | 6/30/14 | 9/30/13 | 9/30/14 | 9/30/13 | |||||||

Net Additions (Losses) (in thousands) | |||||||||||

Sprint platform: | |||||||||||

Postpaid (2) | (272 | ) | (181 | ) | (360 | ) | (453 | ) | (166 | ) | |

Prepaid (3) | 35 | (542 | ) | 84 | (507 | ) | (402 | ) | |||

Wholesale and affiliate | 827 | 503 | 181 | 1,330 | (47 | ) | |||||

Total Sprint platform | 590 | (220 | ) | (95 | ) | 370 | (615 | ) | |||

Nextel platform: | |||||||||||

Postpaid (2) | — | — | — | — | (1,060 | ) | |||||

Prepaid (3) | — | — | — | — | (255 | ) | |||||

Total Nextel platform | — | — | — | — | (1,315 | ) | |||||

Transactions: | |||||||||||

Postpaid (2) | (64 | ) | (64 | ) | (175 | ) | (128 | ) | (354 | ) | |

Prepaid (3) | (55 | ) | (77 | ) | (56 | ) | (132 | ) | (76 | ) | |

Wholesale | 13 | 27 | 13 | 40 | 13 | ||||||

Total transactions | (106 | ) | (114 | ) | (218 | ) | (220 | ) | (417 | ) | |

Total retail postpaid net losses | (336 | ) | (245 | ) | (535 | ) | (581 | ) | (1,580 | ) | |

Total retail prepaid net (losses) additions | (20 | ) | (619 | ) | 28 | (639 | ) | (733 | ) | ||

Total wholesale and affiliate net additions (losses) | 840 | 530 | 194 | 1,370 | (34 | ) | |||||

Total Wireless Net Additions (Losses) | 484 | (334 | ) | (313 | ) | 150 | (2,347 | ) | |||

End of Period Connections (in thousands) | |||||||||||

Sprint platform: | |||||||||||

Postpaid (2) | 29,465 | 29,737 | 30,091 | 29,465 | 30,091 | ||||||

Prepaid (3) | 14,750 | 14,715 | 15,299 | 14,750 | 15,299 | ||||||

Wholesale and affiliate | 9,706 | 8,879 | 7,862 | 9,706 | 7,862 | ||||||

Total Sprint platform | 53,921 | 53,331 | 53,252 | 53,921 | 53,252 | ||||||

Nextel platform: | |||||||||||

Postpaid (2) | — | — | — | — | — | ||||||

Prepaid (3) | — | — | — | — | — | ||||||

Total Nextel platform | — | — | — | — | — | ||||||

Transactions: (a) | |||||||||||

Postpaid (2) | 458 | 522 | 815 | 458 | 815 | ||||||

Prepaid (3) | 418 | 473 | 704 | 418 | 704 | ||||||

Wholesale | 240 | 227 | 106 | 240 | 106 | ||||||

Total transactions | 1,116 | 1,222 | 1,625 | 1,116 | 1,625 | ||||||

Total retail postpaid end of period connections | 29,923 | 30,259 | 30,906 | 29,923 | 30,906 | ||||||

Total retail prepaid end of period connections | 15,168 | 15,188 | 16,003 | 15,168 | 16,003 | ||||||

Total wholesale and affiliate end of period connections | 9,946 | 9,106 | 7,968 | 9,946 | 7,968 | ||||||

Total End of Period Connections | 55,037 | 54,553 | 54,877 | 55,037 | 54,877 | ||||||

Supplemental Data - Connected Devices | |||||||||||

End of Period Connections (in thousands) | |||||||||||

Retail postpaid | 1,039 | 988 | 834 | 1,039 | 834 | ||||||

Wholesale and affiliate | 4,635 | 4,192 | 3,298 | 4,635 | 3,298 | ||||||

Total | 5,674 | 5,180 | 4,132 | 5,674 | 4,132 | ||||||

Churn | |||||||||||

Sprint platform: | |||||||||||

Postpaid | 2.18 | % | 2.05 | % | 1.99 | % | 2.12 | % | 1.91 | % | |

Prepaid | 3.76 | % | 4.44 | % | 3.57 | % | 4.10 | % | 4.41 | % | |

Nextel platform: | |||||||||||

Postpaid | — | — | — | — | 33.90 | % | |||||

Prepaid | — | — | — | — | 32.13 | % | |||||

Transactions: (a) | |||||||||||

Postpaid | 4.66 | % | 4.15 | % | 6.38 | % | 4.39 | % | 9.47 | % | |

Prepaid | 5.70 | % | 6.28 | % | 8.84 | % | 6.01 | % | 9.15 | % | |

Total retail postpaid churn | 2.22 | % | 2.09 | % | 2.09 | % | 2.16 | % | 2.36 | % | |

Total retail prepaid churn | 3.81 | % | 4.50 | % | 3.78 | % | 4.16 | % | 4.64 | % | |

Nextel Platform Connection Recaptures | |||||||||||

Connections (in thousands) (4): | |||||||||||

Postpaid | — | — | — | — | 364 | ||||||

Prepaid | — | — | — | — | 101 | ||||||

Rate (5): | |||||||||||

Postpaid | — | — | — | — | 34 | % | |||||

Prepaid | — | — | — | — | 39 | % | |||||

(a) We acquired approximately 352,000 postpaid connections and 59,000 prepaid connections through the acquisition of assets from U.S. Cellular when the transaction closed on May 17, 2013. We acquired approximately 788,000 postpaid connections, 721,000 prepaid connections, 93,000 wholesale connections and transferred 29,000 Sprint wholesale connections that were originally recognized through our Clearwire MVNO arrangement to Transactions postpaid connections as a result of the Clearwire acquisition when the transaction closed on July 9, 2013.

THE SPRINT QUARTERLY INVESTOR UPDATE - FISCAL 2Q14 | 10 |

Wireless Operating Statistics (Unaudited) (continued)

Successor | Predecessor | Combined (1) | |||||||||||||||||||||||||||||||

Quarter to Date | Quarter to Date | Quarter to Date | Year to Date | Year to Date | 10 Days Ended | 101 Days Ended | Quarter to Date | Year to Date | |||||||||||||||||||||||||

9/30/14 | 6/30/14 | 9/30/13 | 9/30/14 | 9/30/13 | 7/10/13 | 7/10/13 | 9/30/13 | 9/30/13 | |||||||||||||||||||||||||

ARPU (b) | |||||||||||||||||||||||||||||||||

Sprint platform: | |||||||||||||||||||||||||||||||||

Postpaid | $ | 60.58 | $ | 62.07 | $ | 64.24 | $ | 61.33 | $ | 64.24 | $ | 64.71 | $ | 64.25 | $ | 64.28 | $ | 64.24 | |||||||||||||||

Prepaid | $ | 27.19 | $ | 27.38 | $ | 25.14 | $ | 27.28 | $ | 25.14 | $ | 26.99 | $ | 26.96 | $ | 25.33 | $ | 26.16 | |||||||||||||||

Nextel platform: | |||||||||||||||||||||||||||||||||

Postpaid | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 36.66 | $ | — | $ | 36.66 | |||||||||||||||

Prepaid | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 34.48 | $ | — | $ | 34.48 | |||||||||||||||

Transactions: (a) | |||||||||||||||||||||||||||||||||

Postpaid | $ | 39.69 | $ | 39.16 | $ | 37.44 | $ | 39.41 | $ | 37.44 | $ | 35.75 | $ | 56.98 | $ | 40.00 | $ | 43.03 | |||||||||||||||

Prepaid | $ | 45.52 | $ | 45.15 | $ | 40.62 | $ | 45.32 | $ | 40.62 | $ | 12.78 | $ | 18.26 | $ | 43.20 | $ | 42.28 | |||||||||||||||

Total retail postpaid ARPU | $ | 60.24 | $ | 61.65 | $ | 63.48 | $ | 60.95 | $ | 63.48 | $ | 64.55 | $ | 63.68 | $ | 63.69 | $ | 63.64 | |||||||||||||||

Total retail prepaid ARPU | $ | 27.73 | $ | 27.97 | $ | 25.86 | $ | 27.85 | $ | 25.86 | $ | 26.96 | $ | 27.01 | $ | 26.04 | $ | 26.53 | |||||||||||||||

(a) We acquired approximately 352,000 postpaid connections and 59,000 prepaid connections through the acquisition of assets from U.S. Cellular when the transaction closed on May 17, 2013. We acquired approximately 788,000 postpaid connections, 721,000 prepaid connections, 93,000 wholesale connections and transferred 29,000 Sprint wholesale connections that were originally recognized through our Clearwire MVNO arrangement to Transactions postpaid connections as a result of the Clearwire acquisition when the transaction closed on July 9, 2013.

(b)ARPU is calculated by dividing service revenue by the sum of the average number of connections in the applicable service category. Changes in average monthly service revenue reflect connections for either the postpaid or prepaid service category who change rate plans, the level of voice and data usage, the amount of service credits which are offered to connections, plus the net effect of average monthly revenue generated by new connections and deactivating connections. Combined ARPU for the quarter-to-date September 30, 2013 period aggregate service revenue of ten days ended July 10, 2013 predecessor period and the quarter-to-date September 30, 2013 successor period divided by the sum of the average connections during the quarter. Combined ARPU for the year-to-date September 30, 2013 period aggregate service revenue of the 101 days ended July 10, 2013 predecessor period and the year-to-date September 30, 2013 successor period divided by the sum of the average connections during the year-to-date period.

THE SPRINT QUARTERLY INVESTOR UPDATE - FISCAL 2Q14 | 11 |

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(Millions, except per Share Data)

Successor | Predecessor | Combined (1) | |||||||||||||||||||||||||||||||

Quarter to Date | Quarter to Date | Quarter to Date | Year to Date | Year to Date | 10 Days Ended | 101 Days Ended | Quarter to Date | Year to Date | |||||||||||||||||||||||||

9/30/14 | 6/30/14 | 9/30/13 | 9/30/14 | 9/30/13 | 7/10/13 | 7/10/13 | 9/30/13 | 9/30/13 | |||||||||||||||||||||||||

Net Operating Revenues | $ | 8,488 | $ | 8,789 | $ | 7,749 | $ | 17,277 | $ | 7,749 | $ | 932 | $ | 9,809 | $ | 8,681 | $ | 17,558 | |||||||||||||||

Net Operating Expenses | |||||||||||||||||||||||||||||||||

Cost of services | 2,429 | 2,520 | 2,470 | 4,949 | 2,470 | 286 | 3,033 | 2,756 | 5,503 | ||||||||||||||||||||||||

Cost of products | 2,372 | 2,158 | 1,872 | 4,530 | 1,872 | 281 | 2,579 | 2,153 | 4,451 | ||||||||||||||||||||||||

Selling, general and administrative | 2,301 | 2,284 | 2,259 | 4,585 | 2,281 | 289 | 2,731 | 2,548 | 5,012 | ||||||||||||||||||||||||

Depreciation and amortization | 1,294 | 1,281 | 1,403 | 2,575 | 1,403 | 121 | 1,753 | 1,524 | 3,156 | ||||||||||||||||||||||||

Other, net | 284 | 27 | 103 | 311 | 103 | (5 | ) | 627 | 98 | 730 | |||||||||||||||||||||||

Total net operating expenses | 8,680 | 8,270 | 8,107 | 16,950 | 8,129 | 972 | 10,723 | 9,079 | 18,852 | ||||||||||||||||||||||||

Operating (Loss) Income | (192 | ) | 519 | (358 | ) | 327 | (380 | ) | (40 | ) | (914 | ) | (398 | ) | (1,294 | ) | |||||||||||||||||

Interest expense | (510 | ) | (512 | ) | (416 | ) | (1,022 | ) | (416 | ) | (275 | ) | (703 | ) | (691 | ) | (1,119 | ) | |||||||||||||||

Equity in earnings of unconsolidated investments and other, net | 8 | 1 | 165 | 9 | 12 | 2,905 | 2,665 | 3,070 | 2,677 | ||||||||||||||||||||||||

(Loss) Income before Income Taxes | (694 | ) | 8 | (609 | ) | (686 | ) | (784 | ) | 2,590 | 1,048 | 1,981 | 264 | ||||||||||||||||||||

Income tax (expense) benefit | (71 | ) | 15 | (90 | ) | (56 | ) | (29 | ) | (1,508 | ) | (1,563 | ) | (1,598 | ) | (1,592 | ) | ||||||||||||||||

Net (Loss) Income | $ | (765 | ) | $ | 23 | $ | (699 | ) | $ | (742 | ) | $ | (813 | ) | $ | 1,082 | $ | (515 | ) | $ | 383 | $ | (1,328 | ) | |||||||||

Basic Net (Loss) Income Per Common Share | $ | (0.19 | ) | $ | 0.01 | $ | (0.18 | ) | $ | (0.19 | ) | $ | (0.24 | ) | $ | 0.35 | $ | (0.17 | ) | NM | NM | ||||||||||||

Diluted Net (Loss) Income Per Common Share | $ | (0.19 | ) | $ | 0.01 | $ | (0.18 | ) | $ | (0.19 | ) | $ | (0.24 | ) | $ | 0.30 | $ | (0.17 | ) | NM | NM | ||||||||||||

Basic Weighted Average Common Shares outstanding | 3,949 | 3,945 | 3,802 | 3,947 | 3,439 | 3,086 | 3,038 | NM | NM | ||||||||||||||||||||||||

Diluted Weighted Average Common Shares outstanding | 3,949 | 4,002 | 3,802 | 3,947 | 3,439 | 3,640 | 3,038 | NM | NM | ||||||||||||||||||||||||

Effective Tax Rate | -10.2 | % | -187.5 | % | -14.8 | % | -8.2 | % | -3.7 | % | 58.2 | % | 149.1 | % | NM | NM | |||||||||||||||||

NON-GAAP RECONCILIATION - NET INCOME (LOSS) TO ADJUSTED EBITDA* (Unaudited)

(Millions)

Successor | Predecessor | Combined (1) | |||||||||||||||||||||||||||||||

Quarter to Date | Quarter to Date | Quarter to Date | Year to Date | Year to Date | 10 Days Ended | 101 Days Ended | Quarter to Date | Year to Date | |||||||||||||||||||||||||

9/30/14 | 6/30/14 | 9/30/13 | 9/30/14 | 9/30/13 | 7/10/13 | 7/10/13 | 9/30/13 | 9/30/13 | |||||||||||||||||||||||||

Net (Loss) Income | $ | (765 | ) | $ | 23 | $ | (699 | ) | $ | (742 | ) | $ | (813 | ) | $ | 1,082 | $ | (515 | ) | $ | 383 | $ | (1,328 | ) | |||||||||

Income tax expense (benefit) | 71 | (15 | ) | 90 | 56 | 29 | 1,508 | 1,563 | 1,598 | 1,592 | |||||||||||||||||||||||

(Loss) Income before Income Taxes | (694 | ) | 8 | (609 | ) | (686 | ) | (784 | ) | 2,590 | 1,048 | 1,981 | 264 | ||||||||||||||||||||

Equity in earnings of unconsolidated investments and other, net | (8 | ) | (1 | ) | (165 | ) | (9 | ) | (12 | ) | (2,905 | ) | (2,665 | ) | (3,070 | ) | (2,677 | ) | |||||||||||||||

Interest expense | 510 | 512 | 416 | 1,022 | 416 | 275 | 703 | 691 | 1,119 | ||||||||||||||||||||||||

Operating (Loss) Income | (192 | ) | 519 | (358 | ) | 327 | (380 | ) | (40 | ) | (914 | ) | (398 | ) | (1,294 | ) | |||||||||||||||||

Depreciation and amortization | 1,294 | 1,281 | 1,403 | 2,575 | 1,403 | 121 | 1,753 | 1,524 | 3,156 | ||||||||||||||||||||||||

EBITDA* | 1,102 | 1,800 | 1,045 | 2,902 | 1,023 | 81 | 839 | 1,126 | 1,862 | ||||||||||||||||||||||||

Severance and exit costs (6) | 284 | 27 | 103 | 311 | 103 | (5 | ) | 627 | 98 | 730 | |||||||||||||||||||||||

Business combinations (7) | — | — | 100 | — | 100 | 19 | 53 | 119 | 153 | ||||||||||||||||||||||||

Adjusted EBITDA* | $ | 1,386 | $ | 1,827 | $ | 1,248 | $ | 3,213 | $ | 1,226 | $ | 95 | $ | 1,519 | $ | 1,343 | $ | 2,745 | |||||||||||||||

Adjusted EBITDA Margin* | 18.6 | % | 23.8 | % | 17.5 | % | 21.2 | % | 17.2 | % | 11.1 | % | 17.0 | % | 16.8 | % | 17.1 | % | |||||||||||||||

Selected items: | |||||||||||||||||||||||||||||||||

Increase (Decrease) in deferred tax asset valuation allowance | $ | 324 | $ | (27 | ) | $ | 327 | $ | 297 | $ | 327 | $ | 524 | $ | 1,145 | $ | 851 | $ | 1,472 | ||||||||||||||

Accrued capital expenditures | $ | 1,517 | $ | 1,416 | $ | 1,666 | $ | 2,933 | $ | 1,666 | $ | 175 | $ | 2,072 | $ | 1,841 | $ | 3,738 | |||||||||||||||

Cash paid for capital expenditures | $ | 1,143 | $ | 1,246 | $ | 1,878 | $ | 2,389 | $ | 1,878 | $ | 188 | $ | 1,759 | $ | 2,066 | $ | 3,637 | |||||||||||||||

THE SPRINT QUARTERLY INVESTOR UPDATE - FISCAL 2Q14 | 12 |

WIRELESS STATEMENTS OF OPERATIONS (Unaudited)

(Millions)

Successor | Predecessor | Combined (1) | |||||||||||||||||||||||||||||||

Quarter to Date | Quarter to Date | Quarter to Date | Year to Date | Year to Date | 10 Days Ended | 101 Days Ended | Quarter to Date | Year to Date | |||||||||||||||||||||||||

9/30/14 | 6/30/14 | 9/30/13 | 9/30/14 | 9/30/13 | 7/10/13 | 7/10/13 | 9/30/13 | 9/30/13 | |||||||||||||||||||||||||

Net Operating Revenues | |||||||||||||||||||||||||||||||||

Service revenue | |||||||||||||||||||||||||||||||||

Sprint platform: | |||||||||||||||||||||||||||||||||

Postpaid (2) | $ | 5,377 | $ | 5,553 | $ | 5,201 | $ | 10,930 | $ | 5,201 | $ | 634 | $ | 6,469 | $ | 5,835 | $ | 11,670 | |||||||||||||||

Prepaid (3) | 1,197 | 1,221 | 1,028 | 2,418 | 1,028 | 132 | 1,408 | 1,160 | 2,436 | ||||||||||||||||||||||||

Wholesale, affiliate and other | 181 | 163 | 116 | 344 | 116 | 15 | 146 | 131 | 262 | ||||||||||||||||||||||||

Total Sprint platform | 6,755 | 6,937 | 6,345 | 13,692 | 6,345 | 781 | 8,023 | 7,126 | 14,368 | ||||||||||||||||||||||||

Nextel platform: | |||||||||||||||||||||||||||||||||

Postpaid (2) | — | — | — | — | — | — | 74 | — | 74 | ||||||||||||||||||||||||

Prepaid (3) | — | — | — | — | — | — | 17 | — | 17 | ||||||||||||||||||||||||

Total Nextel platform | — | — | — | — | — | — | 91 | — | 91 | ||||||||||||||||||||||||

Transactions: | |||||||||||||||||||||||||||||||||

Postpaid (2) | 58 | 65 | 89 | 123 | 89 | 2 | 26 | 91 | 115 | ||||||||||||||||||||||||

Prepaid (3) | 61 | 69 | 81 | 130 | 81 | 1 | 2 | 82 | 83 | ||||||||||||||||||||||||

Wholesale | 16 | 16 | 8 | 32 | 8 | — | — | 8 | 8 | ||||||||||||||||||||||||

Total transactions | 135 | 150 | 178 | 285 | 178 | 3 | 28 | 181 | 206 | ||||||||||||||||||||||||

Equipment revenue | 1,039 | 1,106 | 636 | 2,145 | 636 | 74 | 894 | 710 | 1,530 | ||||||||||||||||||||||||

Total net operating revenues | 7,929 | 8,193 | 7,159 | 16,122 | 7,159 | 858 | 9,036 | 8,017 | 16,195 | ||||||||||||||||||||||||

Net Operating Expenses | |||||||||||||||||||||||||||||||||

Cost of services | 1,988 | 2,049 | 2,087 | 4,037 | 2,087 | 240 | 2,532 | 2,327 | 4,619 | ||||||||||||||||||||||||

Cost of products | 2,372 | 2,158 | 1,872 | 4,530 | 1,872 | 281 | 2,579 | 2,153 | 4,451 | ||||||||||||||||||||||||

Selling, general and administrative | 2,199 | 2,193 | 2,100 | 4,392 | 2,100 | 256 | 2,550 | 2,356 | 4,650 | ||||||||||||||||||||||||

Depreciation and amortization | 1,232 | 1,212 | 1,338 | 2,444 | 1,338 | 110 | 1,636 | 1,448 | 2,974 | ||||||||||||||||||||||||

Other, net | 248 | 23 | 93 | 271 | 93 | (5 | ) | 627 | 88 | 720 | |||||||||||||||||||||||

Total net operating expenses | 8,039 | 7,635 | 7,490 | 15,674 | 7,490 | 882 | 9,924 | 8,372 | 17,414 | ||||||||||||||||||||||||

Operating (Loss) Income | $ | (110 | ) | $ | 558 | $ | (331 | ) | $ | 448 | $ | (331 | ) | $ | (24 | ) | $ | (888 | ) | $ | (355 | ) | $ | (1,219 | ) | ||||||||

Supplemental Revenue Data | |||||||||||||||||||||||||||||||||

Total retail service revenue | $ | 6,693 | $ | 6,908 | $ | 6,399 | $ | 13,601 | $ | 6,399 | $ | 769 | $ | 7,996 | $ | 7,168 | $ | 14,395 | |||||||||||||||

Total service revenue | $ | 6,890 | $ | 7,087 | $ | 6,523 | $ | 13,977 | $ | 6,523 | $ | 784 | $ | 8,142 | $ | 7,307 | $ | 14,665 | |||||||||||||||

WIRELESS NON-GAAP RECONCILIATION (Unaudited)

(Millions)

Successor | Predecessor | Combined (1) | |||||||||||||||||||||||||||||||

Quarter to Date | Quarter to Date | Quarter to Date | Year to Date | Year to Date | 10 Days Ended | 101 Days Ended | Quarter to Date | Year to Date | |||||||||||||||||||||||||

9/30/14 | 6/30/14 | 9/30/13 | 9/30/14 | 9/30/13 | 7/10/13 | 7/10/13 | 9/30/13 | 9/30/13 | |||||||||||||||||||||||||

Operating (Loss) Income | $ | (110 | ) | $ | 558 | $ | (331 | ) | $ | 448 | $ | (331 | ) | $ | (24 | ) | $ | (888 | ) | $ | (355 | ) | $ | (1,219 | ) | ||||||||

Severance and exit costs (6) | 248 | 23 | 93 | 271 | 93 | (5 | ) | 627 | 88 | 720 | |||||||||||||||||||||||

Business combinations (7) | — | — | 25 | — | 25 | — | — | 25 | 25 | ||||||||||||||||||||||||

Depreciation and amortization | 1,232 | 1,212 | 1,338 | 2,444 | 1,338 | 110 | 1,636 | 1,448 | 2,974 | ||||||||||||||||||||||||

Adjusted EBITDA* | $ | 1,370 | $ | 1,793 | $ | 1,125 | $ | 3,163 | $ | 1,125 | $ | 81 | $ | 1,375 | $ | 1,206 | $ | 2,500 | |||||||||||||||

Adjusted EBITDA Margin* | 19.9 | % | 25.3 | % | 17.2 | % | 22.6 | % | 17.2 | % | 10.3 | % | 16.9 | % | 16.5 | % | 17.0 | % | |||||||||||||||

Selected items: | |||||||||||||||||||||||||||||||||

Accrued capital expenditures | $ | 1,354 | $ | 1,276 | $ | 1,527 | $ | 2,630 | $ | 1,527 | $ | 156 | $ | 1,884 | $ | 1,683 | $ | 3,411 | |||||||||||||||

Cash paid for capital expenditures | $ | 989 | $ | 1,120 | $ | 1,743 | $ | 2,109 | $ | 1,743 | $ | 167 | $ | 1,570 | $ | 1,910 | $ | 3,313 | |||||||||||||||

THE SPRINT QUARTERLY INVESTOR UPDATE - FISCAL 2Q14 | 13 |

WIRELINE STATEMENTS OF OPERATIONS (Unaudited)

(Millions)

Successor | Predecessor | Combined (1) | |||||||||||||||||||||||||||||||

Quarter to Date | Quarter to Date | Quarter to Date | Year to Date | Year to Date | 10 Days Ended | 101 Days Ended | Quarter to Date | Year to Date | |||||||||||||||||||||||||

9/30/14 | 6/30/14 | 9/30/13 | 9/30/14 | 9/30/13 | 7/10/13 | 7/10/13 | 9/30/13 | 9/30/13 | |||||||||||||||||||||||||

Net Operating Revenues | |||||||||||||||||||||||||||||||||

Voice | $ | 294 | $ | 327 | $ | 333 | $ | 621 | $ | 333 | $ | 42 | $ | 419 | $ | 375 | $ | 752 | |||||||||||||||

Data | 53 | 56 | 57 | 109 | 57 | 7 | 94 | 64 | 151 | ||||||||||||||||||||||||

Internet | 340 | 345 | 373 | 685 | 373 | 47 | 479 | 420 | 852 | ||||||||||||||||||||||||

Other | 21 | 18 | 14 | 39 | 14 | 2 | 16 | 16 | 30 | ||||||||||||||||||||||||

Total net operating revenues | 708 | 746 | 777 | 1,454 | 777 | 98 | 1,008 | 875 | 1,785 | ||||||||||||||||||||||||

Net Operating Expenses | |||||||||||||||||||||||||||||||||

Cost of services and products | 593 | 626 | 576 | 1,219 | 576 | 72 | 741 | 648 | 1,317 | ||||||||||||||||||||||||

Selling, general and administrative | 88 | 85 | 84 | 173 | 84 | 11 | 123 | 95 | 207 | ||||||||||||||||||||||||

Depreciation and amortization | 60 | 67 | 61 | 127 | 61 | 10 | 115 | 71 | 176 | ||||||||||||||||||||||||

Other, net | 35 | 4 | 10 | 39 | 10 | — | — | 10 | 10 | ||||||||||||||||||||||||

Total net operating expenses | 776 | 782 | 731 | 1,558 | 731 | 93 | 979 | 824 | 1,710 | ||||||||||||||||||||||||

Operating (Loss) Income | $ | (68 | ) | $ | (36 | ) | $ | 46 | $ | (104 | ) | $ | 46 | $ | 5 | $ | 29 | $ | 51 | $ | 75 | ||||||||||||

WIRELINE NON-GAAP RECONCILIATION (Unaudited)

(Millions)

Successor | Predecessor | Combined (1) | |||||||||||||||||||||||||||||||

Quarter to Date | Quarter to Date | Quarter to Date | Year to Date | Year to Date | 10 Days Ended | 101 Days Ended | Quarter to Date | Year to Date | |||||||||||||||||||||||||

9/30/14 | 6/30/14 | 9/30/13 | 9/30/14 | 9/30/13 | 7/10/13 | 7/10/13 | 9/30/13 | 9/30/13 | |||||||||||||||||||||||||

Operating (Loss) Income | $ | (68 | ) | $ | (36 | ) | $ | 46 | $ | (104 | ) | $ | 46 | $ | 5 | $ | 29 | $ | 51 | $ | 75 | ||||||||||||

Severance and exit costs (6) | 35 | 4 | 10 | 39 | 10 | — | — | 10 | 10 | ||||||||||||||||||||||||

Depreciation and amortization | 60 | 67 | 61 | 127 | 61 | 10 | 115 | 71 | 176 | ||||||||||||||||||||||||

Adjusted EBITDA* | $ | 27 | $ | 35 | $ | 117 | $ | 62 | $ | 117 | $ | 15 | $ | 144 | $ | 132 | $ | 261 | |||||||||||||||

Adjusted EBITDA Margin* | 3.8 | % | 4.7 | % | 15.1 | % | 4.3 | % | 15.1 | % | 15.3 | % | 14.3 | % | 15.1 | % | 14.6 | % | |||||||||||||||

Selected items: | |||||||||||||||||||||||||||||||||

Accrued capital expenditures | $ | 74 | $ | 66 | $ | 73 | $ | 140 | $ | 73 | $ | 11 | $ | 104 | $ | 84 | $ | 177 | |||||||||||||||

Cash paid for capital expenditures | $ | 65 | $ | 59 | $ | 73 | $ | 124 | $ | 73 | $ | 10 | $ | 110 | $ | 83 | $ | 183 | |||||||||||||||

THE SPRINT QUARTERLY INVESTOR UPDATE - FISCAL 2Q14 | 14 |

CONDENSED CONSOLIDATED CASH FLOW INFORMATION (Unaudited)

(Millions)

Successor | Predecessor | Combined (1) | ||||||||||||||||

Year to Date | Year to Date | 101 Days Ended | Year to Date | |||||||||||||||

9/30/14 | 9/30/13 | 7/10/13 | 9/30/13 | |||||||||||||||

Operating Activities | ||||||||||||||||||

Net loss | $ | (742 | ) | $ | (813 | ) | $ | (515 | ) | $ | (1,328 | ) | ||||||

Depreciation and amortization | 2,575 | 1,403 | 1,753 | 3,156 | ||||||||||||||

Provision for losses on accounts receivable | 493 | 119 | 111 | 230 | ||||||||||||||

Share-based and long-term incentive compensation expense | 65 | 58 | 20 | 78 | ||||||||||||||

Deferred income tax expense | 28 | 23 | 1,562 | 1,585 | ||||||||||||||

Gain on previously-held equity interests | — | — | (2,926 | ) | (2,926 | ) | ||||||||||||

Equity in losses of unconsolidated investments, net | — | — | 280 | 280 | ||||||||||||||

Interest expense related to beneficial conversion feature on convertible bond | — | — | 247 | 247 | ||||||||||||||

Contribution to pension plan | (22 | ) | — | — | — | |||||||||||||

Amortization and accretion of long-term debt premiums and discounts | (149 | ) | (86 | ) | (5 | ) | (91 | ) | ||||||||||

Other working capital changes, net | (480 | ) | 33 | 1,004 | 1,037 | |||||||||||||

Other, net | (61 | ) | (35 | ) | 200 | 165 | ||||||||||||

Net cash provided by operating activities | 1,707 | 702 | 1,731 | 2,433 | ||||||||||||||

Investing Activities | ||||||||||||||||||

Capital expenditures | (2,389 | ) | (1,878 | ) | (1,759 | ) | (3,637 | ) | ||||||||||

Expenditures relating to FCC licenses | (79 | ) | (31 | ) | (70 | ) | (101 | ) | ||||||||||

Reimbursements relating to FCC licenses | 95 | — | — | — | ||||||||||||||

Change in short-term investments, net | 53 | (336 | ) | 869 | 533 | |||||||||||||

Acquisitions, net of cash acquired | — | (14,112 | ) | (4,039 | ) | (18,151 | ) | |||||||||||

Increase in restricted cash | — | (3,050 | ) | — | (3,050 | ) | ||||||||||||

Investment in Clearwire (including debt securities) | — | — | (228 | ) | (228 | ) | ||||||||||||

Proceeds from sales of assets and FCC licenses | 101 | 3 | 4 | 7 | ||||||||||||||

Other, net | (6 | ) | (3 | ) | (4 | ) | (7 | ) | ||||||||||

Net cash used in investing activities | (2,225 | ) | (19,407 | ) | (5,227 | ) | (24,634 | ) | ||||||||||

Financing Activities | ||||||||||||||||||

Proceeds from debt and financings | — | 6,826 | — | 6,826 | ||||||||||||||

Debt financing costs | — | (107 | ) | (1 | ) | (108 | ) | |||||||||||

Repayments of debt, financing and capital lease obligations | (363 | ) | (497 | ) | (303 | ) | (800 | ) | ||||||||||

Proceeds from issuance of common stock and warrants, net | 46 | 18,552 | 53 | 18,605 | ||||||||||||||

Other, net | — | (14 | ) | — | (14 | ) | ||||||||||||

Net cash (used in) provided by financing activities | (317 | ) | 24,760 | (251 | ) | 24,509 | ||||||||||||

Net (Decrease) Increase in Cash and Cash Equivalents | (835 | ) | 6,055 | (3,747 | ) | 2,308 | ||||||||||||

Cash and Cash Equivalents, beginning of period | 4,970 | 3 | 6,275 | 3,750 | ||||||||||||||

Cash and Cash Equivalents, end of period | $ | 4,135 | $ | 6,058 | $ | 2,528 | $ | 6,058 | ||||||||||

RECONCILIATION TO CONSOLIDATED FREE CASH FLOW* (NON-GAAP) (Unaudited)

(Millions)

Successor | Predecessor | Combined (1) | |||||||||||||||||||||||||||||||

Quarter to Date | Quarter to Date | Quarter to Date | Year to Date | Year to Date | 10 Days Ended | 101 Days Ended | Quarter to Date | Year to Date | |||||||||||||||||||||||||

9/30/14 | 6/30/14 | 9/30/13 | 9/30/14 | 9/30/13 | 7/10/13 | 7/10/13 | 9/30/13 | 9/30/13 | |||||||||||||||||||||||||

Net Cash Provided by Operating Activities | $ | 1,028 | $ | 679 | $ | 694 | $ | 1,707 | $ | 702 | $ | 496 | $ | 1,731 | $ | 1,190 | $ | 2,433 | |||||||||||||||

Capital expenditures | (1,143 | ) | (1,246 | ) | (1,878 | ) | (2,389 | ) | (1,878 | ) | (188 | ) | (1,759 | ) | (2,066 | ) | (3,637 | ) | |||||||||||||||

(Expenditures) Reimbursements relating to FCC licenses, net | (38 | ) | 54 | (31 | ) | 16 | (31 | ) | (2 | ) | (70 | ) | (33 | ) | (101 | ) | |||||||||||||||||

Proceeds from sales of assets and FCC licenses | 81 | 20 | 3 | 101 | 3 | — | 4 | 3 | 7 | ||||||||||||||||||||||||

Other investing activities, net | (3 | ) | (3 | ) | (3 | ) | (6 | ) | (3 | ) | — | (4 | ) | (3 | ) | (7 | ) | ||||||||||||||||

Free Cash Flow* | (75 | ) | (496 | ) | (1,215 | ) | (571 | ) | (1,207 | ) | 306 | (98 | ) | (909 | ) | (1,305 | ) | ||||||||||||||||

Debt financing costs | — | — | (107 | ) | — | (107 | ) | — | (1 | ) | (107 | ) | (108 | ) | |||||||||||||||||||

(Decrease) increase in debt and other, net | (153 | ) | (210 | ) | 6,329 | (363 | ) | 6,329 | — | (303 | ) | 6,329 | 6,026 | ||||||||||||||||||||

Acquisitions, net of cash acquired | — | — | (14,112 | ) | — | (14,112 | ) | (3,530 | ) | (4,039 | ) | (17,642 | ) | (18,151 | ) | ||||||||||||||||||

Proceeds from issuance of common stock and warrants, net | 37 | 9 | 18,552 | 46 | 18,552 | 9 | 53 | 18,561 | 18,605 | ||||||||||||||||||||||||

Increase in restricted cash | — | — | (3,050 | ) | — | (3,050 | ) | — | — | (3,050 | ) | (3,050 | ) | ||||||||||||||||||||

Investment in Clearwire (including debt securities) | — | — | — | — | — | (68 | ) | (228 | ) | (68 | ) | (228 | ) | ||||||||||||||||||||

Other financing activities, net | — | — | (14 | ) | — | (14 | ) | — | — | (14 | ) | (14 | ) | ||||||||||||||||||||

Net (Decrease) Increase in Cash, Cash | |||||||||||||||||||||||||||||||||

Equivalents and Short-Term Investments | $ | (191 | ) | $ | (697 | ) | $ | 6,383 | $ | (888 | ) | $ | 6,391 | $ | (3,283 | ) | $ | (4,616 | ) | $ | 3,100 | $ | 1,775 | ||||||||||

THE SPRINT QUARTERLY INVESTOR UPDATE - FISCAL 2Q14 | 15 |

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

(Millions)

Successor | ||||||

9/30/14 | 3/31/14 | |||||

Assets | ||||||

Current assets | ||||||

Cash and cash equivalents | $ | 4,135 | $ | 4,970 | ||

Short-term investments | 1,167 | 1,220 | ||||

Accounts and notes receivable, net | 3,942 | 3,607 | ||||

Device and accessory inventory | 1,124 | 982 | ||||

Deferred tax assets | 90 | 128 | ||||

Prepaid expenses and other current assets | 812 | 672 | ||||

Total current assets | 11,270 | 11,579 | ||||

Investments and other assets | 1,044 | 892 | ||||

Property, plant and equipment, net | 17,557 | 16,299 | ||||

Goodwill | 6,343 | 6,383 | ||||

FCC licenses and other | 41,800 | 41,978 | ||||

Definite-lived intangible assets, net | 6,696 | 7,558 | ||||

Total | $ | 84,710 | $ | 84,689 | ||

Liabilities and Shareholders' Equity | ||||||

Current liabilities | ||||||

Accounts payable | $ | 4,351 | $ | 3,163 | ||

Accrued expenses and other current liabilities | 5,439 | 5,544 | ||||

Current portion of long-term debt, financing and capital lease obligations | 808 | 991 | ||||

Total current liabilities | 10,598 | 9,698 | ||||

Long-term debt, financing and capital lease obligations | 31,458 | 31,787 | ||||

Deferred tax liabilities | 14,331 | 14,207 | ||||

Other liabilities | 3,660 | 3,685 | ||||

Total liabilities | 60,047 | 59,377 | ||||

Shareholders' equity | ||||||

Common shares | 40 | 39 | ||||

Paid-in capital | 27,453 | 27,354 | ||||

Accumulated deficit | (2,780 | ) | (2,038 | ) | ||

Accumulated other comprehensive loss | (50 | ) | (43 | ) | ||

Total shareholders' equity | 24,663 | 25,312 | ||||

Total | $ | 84,710 | $ | 84,689 | ||

NET DEBT* (NON-GAAP) (Unaudited)

(Millions)

Successor | ||||||

9/30/14 | 3/31/14 | |||||

Total Debt | $ | 32,266 | $ | 32,778 | ||

Less: Cash and cash equivalents | (4,135 | ) | (4,970 | ) | ||

Less: Short-term investments | (1,167 | ) | (1,220 | ) | ||

Net Debt* | $ | 26,964 | $ | 26,588 | ||

THE SPRINT QUARTERLY INVESTOR UPDATE - FISCAL 2Q14 | 16 |

SCHEDULE OF DEBT (Unaudited)

(Millions)

9/30/14 | |||||

ISSUER | COUPON | MATURITY | PRINCIPAL | ||

Sprint Corporation | |||||

7.25% Notes due 2021 | 7.250% | 09/15/2021 | $ | 2,250 | |

7.875% Notes due 2023 | 7.875% | 09/15/2023 | 4,250 | ||

7.125% Notes due 2024 | 7.125% | 06/15/2024 | 2,500 | ||

Sprint Corporation | 9,000 | ||||

Sprint Communications, Inc. | |||||

Export Development Canada Facility (Tranche 2) | 3.580% | 12/15/2015 | 500 | ||

6% Senior Notes due 2016 | 6.000% | 12/01/2016 | 2,000 | ||

9.125% Senior Notes due 2017 | 9.125% | 03/01/2017 | 1,000 | ||

8.375% Senior Notes due 2017 | 8.375% | 08/15/2017 | 1,300 | ||

9% Guaranteed Notes due 2018 | 9.000% | 11/15/2018 | 3,000 | ||

7% Guaranteed Notes due 2020 | 7.000% | 03/01/2020 | 1,000 | ||

7% Senior Notes due 2020 | 7.000% | 08/15/2020 | 1,500 | ||

11.5% Senior Notes due 2021 | 11.500% | 11/15/2021 | 1,000 | ||

9.25% Debentures due 2022 | 9.250% | 04/15/2022 | 200 | ||

6% Senior Notes due 2022 | 6.000% | 11/15/2022 | 2,280 | ||

Sprint Communications, Inc. | 13,780 | ||||

Sprint Capital Corporation | |||||

6.9% Senior Notes due 2019 | 6.900% | 05/01/2019 | 1,729 | ||

6.875% Senior Notes due 2028 | 6.875% | 11/15/2028 | 2,475 | ||

8.75% Senior Notes due 2032 | 8.750% | 03/15/2032 | 2,000 | ||

Sprint Capital Corporation | 6,204 | ||||

Clearwire Communications LLC | |||||

14.75% First-Priority Senior Secured Notes due 2016 | 14.750% | 12/01/2016 | 300 | ||

8.25% Exchangeable Notes due 2040 | 8.250% | 12/01/2040 | 629 | ||

Clearwire Communications LLC | 929 | ||||

EKN Secured Equipment Facility ($1 Billion) | 2.030% | 03/30/2017 | 635 | ||

Tower financing obligation | 6.092% | 09/30/2021 | 301 | ||

Capital lease obligations and other | 2015 - 2023 | 158 | |||

TOTAL PRINCIPAL | 31,007 | ||||

Net premiums | 1,259 | ||||

TOTAL DEBT | $ | 32,266 | |||

Supplemental information:

The Company had $2.4 billion of borrowing capacity available under our unsecured revolving bank credit facility as of September 30, 2014. Our unsecured revolving bank credit facility expires in February 2018.

In May 2012, certain of our subsidiaries entered into a $1.0 billion secured equipment credit facility to finance equipment-related purchases from Ericsson for Network Vision. The facility was fully drawn at the end of 2013, and a balance of $635 million principal amount was outstanding as of September 30, 2014. Repayments of remaining principal are due semi-annually in equal installments, along with corresponding payments of interest and fees, each March and September, with the final payment due upon maturity in March of 2017.

*This table excludes (i) our unsecured revolving bank credit facility, which will expire in 2018 and has no outstanding balance, (ii) $918 million in letters of credit outstanding under the unsecured revolving bank credit facility, (iii) vendor financing notes assumed in the Clearwire Acquisition, and (iv) all capital leases and other financing obligations.

THE SPRINT QUARTERLY INVESTOR UPDATE - FISCAL 2Q14 | 17 |

NOTES TO THE FINANCIAL INFORMATION (Unaudited)

(1) Financial results include a Predecessor period from January 1, 2012, through the closing of the SoftBank transaction on July 10, 2013, and a Successor period from October 5, 2012 through December 31, 2013. In order to present financial results in a way that offers investors a more meaningful calendar period-to-period comparison, we have combined results of operations and cash flows for the Predecessor and Successor periods for the three and six-month periods ended September 30, 2013. (See Financial Measures for further information).

(2) | Postpaid connections on the Sprint platform are defined as retail postpaid devices with an active line of service on the CDMA network, including connections utilizing WiMax and LTE technology. Postpaid connections previously on the Nextel platform are defined as retail postpaid connections on the iDEN network, which was shut-down on June 30, 2013. Postpaid connections from transactions are defined as retail postpaid connections acquired from U.S. Cellular in May 2013 and Clearwire in July 2013 who had not deactivated or been recaptured on the Sprint platform. The Sprint platform connections results included approximately 261,000, 535,000 and 54,000 tablet net adds during the September 30, 2014, June 30, 2014, and September 30, 2013 quarter-to-date periods, respectively, which generally generate a significantly lower ARPU than other postpaid connections. |

(3) | Prepaid connections on the Sprint platform are defined as retail prepaid connections and session-based tablet users who utilize the CDMA network and WiMax and LTE technology via our multi-brand offerings. Prepaid connections previously on the Nextel platform are defined as retail prepaid connections who utilized the iDEN network, which was shut-down on June 30, 2013. Prepaid connections from transactions are defined as retail prepaid connections acquired from U.S. Cellular in May 2013 and Clearwire in July 2013 who had not deactivated or been recaptured on the Sprint platform. |

(4) | Nextel Connection Recaptures are defined as the number of connections that deactivated service from the postpaid or prepaid Nextel platform, as applicable, during each period but remained with the Company as connections on the postpaid or prepaid Sprint platform, respectively. Connections that deactivated service from the Nextel platform and activated service on the Sprint platform are included in the Sprint platform net additions for the applicable period. |

(5) | The Postpaid and Prepaid Nextel Recapture Rates are defined as the portion of total connections that left the postpaid or prepaid Nextel platform, as applicable, during the period and were retained on the postpaid or prepaid Sprint platform, respectively. |

(6) | Severance and exit costs are primarily associated with work force reductions and exit costs associated with the Nextel platform and those related to exiting certain operations of Clearwire. |

(7) | For the second and first quarters of fiscal year 2013, included in selling, general and administrative expenses are fees paid to unrelated parties necessary for the transactions with SoftBank and our acquisition of Clearwire. |

THE SPRINT QUARTERLY INVESTOR UPDATE - FISCAL 2Q14 | 18 |

*FINANCIAL MEASURES

On July 9, 2013, Sprint Communications, Inc. (formerly Sprint Nextel Corporation) completed its acquisition of Clearwire. On July 10, 2013 we consummated the SoftBank Merger with Starburst II, which immediately changed its name to Sprint Corporation (now referred to as the Company or Sprint). As a result of these transactions, the assets and liabilities of Sprint Communications, Inc. and Clearwire were adjusted to fair value on the respective closing dates. The Company's financial statement presentations herein distinguish between a predecessor period relating to Sprint Communications, Inc. for periods prior to the SoftBank Merger (Predecessor) and a successor period (Successor). The Successor information represents Sprint Corporation, which includes the activity and accounts of Sprint Communications, Inc. as of and for the three and six month periods ended September 30, 2014 and September 30, 2013 and the three month period ended June 30, 2014. The accounts and activity for the successor periods from October 5, 2012 (date of inception) to December 31, 2012 and from January 1, 2013 to July 10, 2013 consist of the activity of Starburst II prior to the close of the SoftBank Merger. The Predecessor information contained herein represents the historical basis of presentation for Sprint Communications, Inc. for all periods prior to the SoftBank Merger date on July 10, 2013. As a result of the valuation of assets acquired and liabilities assumed at fair value at the time of the SoftBank Merger and Clearwire Acquisition, the financial statements for the successor period are presented on a measurement basis different than the predecessor period, which was Sprint Communication Inc.’s historical cost, and are, therefore, not comparable.

In order to present financial results in a way that offers investors a more meaningful calendar period-to-period comparison, we have combined the current and prior year results of operations for the predecessor with successor results of operations on an unaudited combined basis. The combined information for the three and six-month periods ended September 30, 2013 does not purport to represent what our consolidated results of operations would have been if the acquisition had occurred as of the beginning of 2013.

Sprint provides financial measures determined in accordance with GAAP and adjusted GAAP (non-GAAP). The non-GAAP financial measures reflect industry conventions, or standard measures of liquidity, profitability or performance commonly used by the investment community for comparability purposes. These measurements should be considered in addition to, but not as a substitute for, financial information prepared in accordance with GAAP. Other than the use of non-GAAP combined results as described above, we have defined below each of the non-GAAP measures we use, but these measures may not be synonymous to similar measurement terms used by other companies.

Sprint provides reconciliations of these non-GAAP measures in its financial reporting. Because Sprint does not predict special items that might occur in the future, and our forecasts are developed at a level of detail different than that used to prepare GAAP-based financial measures, Sprint does not provide reconciliations to GAAP of its forward-looking financial measures.

The measures used in this release include the following:

EBITDA is operating income/(loss) before depreciation and amortization. Adjusted EBITDA is EBITDA excluding severance, exit costs, and other special items. Adjusted EBITDA Margin represents Adjusted EBITDA divided by non-equipment net operating revenues for Wireless and Adjusted EBITDA divided by net operating revenues for Wireline. We believe that Adjusted EBITDA and Adjusted EBITDA Margin provide useful information to investors because they are an indicator of the strength and performance of our ongoing business operations, including our ability to fund discretionary spending such as capital expenditures, spectrum acquisitions and other investments and our ability to incur and service debt. While depreciation and amortization are considered operating costs under GAAP, these expenses primarily represent non-cash current period costs associated with the use of long-lived tangible and definite-lived intangible assets. Adjusted EBITDA and Adjusted EBITDA Margin are calculations commonly used as a basis for investors, analysts and credit rating agencies to evaluate and compare the periodic and future operating performance and value of companies within the telecommunications industry.

Free Cash Flow is the cash provided by operating activities less the cash used in investing activities other than short-term investments, including changes in restricted cash, if any, and amounts included as investments in Clearwire and Sprint Communications, Inc. during the period, if applicable. We believe that Free Cash Flow provides useful information to investors, analysts and our management about the cash generated by our core operations after interest and dividends, if any, and our ability to fund scheduled debt maturities and other financing activities, including discretionary refinancing and retirement of debt and purchase or sale of investments.

Net Debt is consolidated debt, including current maturities, less cash and cash equivalents, short-term investments and, if any, restricted cash. We believe that Net Debt provides useful information to investors, analysts and credit rating agencies about the capacity of the company to reduce the debt load and improve its capital structure.

THE SPRINT QUARTERLY INVESTOR UPDATE - FISCAL 2Q14 | 19 |

SAFE HARBOR

This release includes “forward-looking statements” within the meaning of the securities laws. The words “may,” “could,” “should,” “estimate,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “target,” “plan,” “providing guidance,” and similar expressions are intended to identify information that is not historical in nature. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future - including statements relating to our network, connections growth, and liquidity; and statements expressing general views about future operating results - are forward-looking statements. Forward-looking statements are estimates and projections reflecting management’s judgment based on currently available information and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. With respect to these forward-looking statements, management has made assumptions regarding, among other things, the ability to operationalize the anticipated benefits from the SoftBank and Clearwire transactions, the development and deployment of new technologies; efficiencies and cost savings of new technologies and services; customer and network usage; connection growth and retention; service, speed, coverage and quality; availability of devices; the timing of various events and the economic environment. Sprint believes these forward-looking statements are reasonable; however, you should not place undue reliance on forward-looking statements, which are based on current expectations and speak only as of the date when made. Sprint undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our company's historical experience and our present expectations or projections. Factors that might cause such differences include, but are not limited to, those discussed in Sprint Corporation’s Transition Report on Form 10-K for the period ended March 31, 2014. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

About Sprint:

Sprint (NYSE: S) is a communications services company that creates more and better ways to connect its customers to the things they care about most. Sprint served 55 million connections as of September 30, 2014 and is widely recognized for developing, engineering and deploying innovative technologies, including the first wireless 4G service from a national carrier in the United States; leading no-contract brands including Virgin Mobile USA, Boost Mobile, and Assurance Wireless; instant national and international push-to-talk capabilities; and a global Tier 1 Internet backbone. Sprint has been named to the Dow Jones Sustainability Index (DJSI) North America for the past four years. You can learn more and visit Sprint at www.sprint.com or www.facebook.com/sprint and www.twitter.com/sprint.

###

i Rankings based on applicable RootMetrics Metro RootScore® Reports for mobile performance as tested on best available plans and devices on 4 mobile networks across all available network types (January 2014 - October 2014). The RootMetrics award is not an endorsement of Sprint. Your results may vary. See www.rootmetrics.com for details.

THE SPRINT QUARTERLY INVESTOR UPDATE - FISCAL 2Q14 | 20 |