Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - PUBLIC SERVICE ENTERPRISE GROUP INC | d811037dex991.htm |

| 8-K - FORM 8-K - PUBLIC SERVICE ENTERPRISE GROUP INC | d811037d8k.htm |

EXHIBIT 99

PSEG ANNOUNCES 2014 THIRD QUARTER RESULTS

$0.87 PER SHARE NET INCOME

Operating Earnings of $0.77 Per Share

Operating Earnings Guidance Narrowed to $2.60 - $2.75 Per Share

Full Year Operating Earnings Expected to be at Upper End of Range

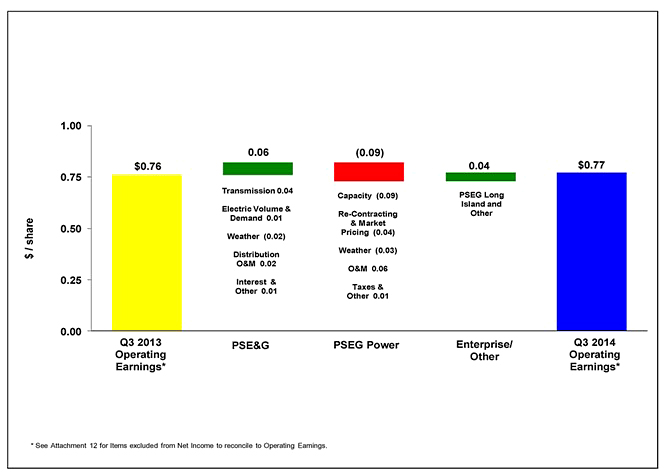

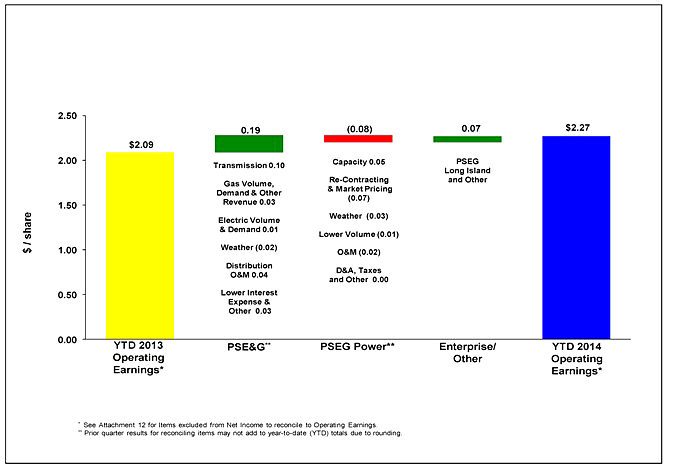

October 30, 2014 (Newark, NJ) (NYSE – PEG) Public Service Enterprise Group (PSEG) today reported third quarter 2014 Net Income of $444 million or $0.87 per share as compared to Net Income of $390 million or $0.77 per share for the third quarter of 2013. Operating earnings for the third quarter of 2014 were $393 million or $0.77 per share compared to the third quarter of 2013 operating earnings of $385 million or $0.76 per share.

“PSEG performed well in the third quarter despite the impact on demand for electricity due to less favorable weather conditions”, said Ralph Izzo, chairman, president and chief executive officer. “Our earnings continue to benefit from the expansion of our regulated utility capital programs as we execute on our business objectives to deliver safe, reliable energy to our customers and meet the needs of our shareholders even while we lowered customer gas rates another 9% on October 1. The strength of our results allows us to raise the low end of our full year operating earnings guidance. We remain on track to achieve results at the upper end of our revised operating earnings guidance of $2.60 - $2.75 per share.”

PSEG believes that the non-GAAP financial measure of “Operating Earnings” provides a consistent and comparable measure of performance of its businesses to help shareholders understand performance trends. Operating Earnings exclude the impact of gains/(losses) associated with Nuclear Decommissioning Trust (NDT), certain Mark-to-Market (MTM) accounting and other material one-time items. The table below provides a reconciliation of PSEG’s Net Income to Operating Earnings (a non-GAAP measure) for the third quarter. See Attachment 12 for a complete list of items excluded from Net Income in the determination of Operating Earnings.

1

PSEG CONSOLIDATED EARNINGS (unaudited)

Third Quarter Comparative Results

2014 and 2013

| Income | Diluted Earnings | |||||||||||||||

| ($ millions) | Per Share | |||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Operating Earnings |

$ | 393 | $ | 385 | $ | 0.77 | $ | 0.76 | ||||||||

| Reconciling Items |

51 | 5 | 0.10 | 0.01 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Income |

$ | 444 | $ | 390 | $ | 0.87 | $ | 0.77 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Average Shares |

507.4M | 507.7M | ||||||||||||||

Ralph Izzo went on to say “PSEG’s earnings demonstrate the benefits of our diversified business model. Our strong financial position has supported double-digit growth in our regulated company’s earnings. We continue to pursue investment opportunities across our business platform. Recently announced plans for PSEG Power to participate as an equity investor in the Penn East Pipeline; PSE&G’s filing to expand Energy Efficiency programs in New Jersey; the potential expansion of our Utility 2.0 investment program on Long Island; and, Power’s consideration of construction and permitting for a potential new generation unit at the Bridgeport Harbor Station will enhance our growth. These investments will also provide our customers with access to low-cost gas and cost effective technologies that reduce emissions as they also improve system reliability.”

Our revised Operating Earnings guidance by company for the full year is as follows:

Operating Earnings

($ millions, except EPS)

| 2014E | 2013A | |||||||

| PSE&G |

$ | 710 - $745 | $ | 612 | ||||

| PSEG Power |

$ | 575 - $610 | $ | 710 | ||||

| PSEG Enterprise/Other |

$ | 35 - $40 | $ | (13 | ) | |||

|

|

|

|

|

|||||

| Total |

$ | 1,320 - $1,395 | $ | 1,309 | ||||

|

|

|

|

|

|||||

| Earnings Per Share |

$ | 2.60 - $2.75 | $ | 2.58 | ||||

|

|

|

|

|

|||||

2

Operating Earnings Review and Outlook by Operating Subsidiary

See Attachment 6 for detail regarding the quarter-over-quarter reconciliations for each of PSEG’s businesses.

PSE&G

PSE&G reported operating earnings of $200 million ($0.39 per share) for the third quarter of 2014 compared with operating earnings of $168 million ($0.33 per share) for the third quarter of 2013.

PSE&G’s earnings reflect the impact of an increase in revenue associated with an expanded capital program and a decline in operating costs including pension expense.

PSE&G’s third quarter results reflect the contribution to earnings from higher transmission revenues associated with an increase in capital investment. An approved increase in PSE&G’s transmission revenue under its formula rate, effective on January 1, 2014, supported a quarter-over-quarter increase in the net earnings contribution from transmission of $0.04 per share.

Revenue from recognition of increased levels of capital investment under PSE&G’s Capital Infrastructure II investment program improved earnings comparisons by $0.01 per share. A decline in operating expenses – particularly pension expense – led to an improvement in quarter-over-quarter earnings of $0.02 per share. Weather conditions in the third quarter were cooler than normal and unfavorable relative to the year-ago quarter. The weather-related impact on sales reduced quarter-over-quarter earnings by $0.02 per share. PSE&G continues to benefit from a decline in financing costs which more than offsets an increase in the level of debt on its balance sheet associated with higher levels of capital spending. The reduction in interest expense and a lower tax rate more than offset an increase in depreciation expense and improved quarter-over-quarter earnings comparisons by $0.01 per share.

3

Economic conditions, as evidenced by employment in the service area, continue to show signs of improvement. During the quarter, weather-normalized electric sales — led by an improvement in demand from the residential sector – grew by 0.4%. On a year-to-date basis, weather-normalized electric sales grew by 1.1%. Weather-normalized sales of gas, while less impactful to results during the third quarter, advanced 1.9% in the quarter and 4.0% for the nine months ended September. Demand for gas continues to benefit from a decline in commodity prices and economic conditions.

The NJ Board of Public Utilities (BPU) approved, on a provisional basis, a reduction in gas rates effective on October 1, 2014. The reduction would reduce customer rates by 9%, or approximately $112 million on an annual basis. Given the continued availability of low-cost gas under the company’s long-term supply arrangements, PSE&G subsequently filed at the BPU a self-implementing three-month bill credit which would return approximately $160 million to residential customers over the last two months of 2014 and during January 2015.

In August 2014, PSE&G filed an Energy Efficiency Economic Extension II Program for approval from the BPU. The filing requests approval to invest $96 million (plus administrative costs) in programs that would extend existing energy efficiency offerings in the residential multi-family, self-install and hospital markets. A decision is expected in early 2015.

PSE&G filed an update of its Formula Rate for transmission at the Federal Energy Regulatory Commission. The update, which reflects an increase in the level of PSE&G’s capital investment in the transmission system, would increase 2015’s annual transmission revenues by an estimated $182 million effective on January 1, 2015.

The forecast of PSE&G’s operating earnings for 2014 has been modified slightly to $710 - $745 million from the prior forecast of $705 - $745 million. Results for the remainder of the year will continue to reflect an increase in transmission and distribution revenue and a reduction in operating and maintenance expense including pension costs.

4

PSEG Power

PSEG Power reported operating earnings of $171 million ($0.34 per share) for the third quarter of 2014 compared with operating earnings of $221 million ($0.43 per share) for the third quarter of 2013.

Power’s results for the third quarter reflect the impact of the scheduled reset in the average price received on PJM capacity and lower market prices for energy.

Earnings in the quarter were affected by a decline in capacity prices. PJM capacity prices were reset to an average level of $166/MW-day on June 1, 2014 from $242/MW-day. The decline in capacity revenues reduced quarter-over-quarter earnings by $0.09 per share. A decline in spark spreads due to lower gas prices and mild weather conditions compared to last year reduced quarter-over-quarter earnings by $0.03 per share. A decline in Power’s average hedged price for energy and lower market prices combined to further reduce quarter-over-quarter earnings by $0.04 per share.

Operation and maintenance expense (O&M) was lower than the level experienced in the year-ago quarter. The absence of major maintenance expense at the Bethlehem NY facility in 2014 compared to the year-ago quarter and a decline in nuclear outage related costs combined with lower pension expense to improve quarter-over-quarter earnings by $0.06 per share. A reduction in the tax rate and other miscellaneous items more than offset an increase in depreciation and interest expense to improve quarter-over-quarter earnings by $0.01 per share.

5

Output from Power’s fleet improved 4% in the third quarter compared to year-ago levels. The improvement reflects the availability of the Bethlehem NY combined cycle facility which was undergoing major maintenance in the year-ago period. Output from the nuclear fleet increased slightly from year ago levels to 7.6 TWh (52% of generation) as the fleet operated at a capacity factor of 92% in the third quarter. On a year-to-date basis, the nuclear fleet operated at a 91% capacity factor. Production from the gas-fired combined cycle fleet increased 16% in the quarter to 5 TWh given the availability of Bethlehem. Production from the coal-fired and peaking units declined 8% relative to year-ago levels as the result of planned outages at the Keystone/Conemaugh coal-fired station and lower weather-related demand.

Power expects output for the full year to approximate 53 – 55 TWh. The forecast, which represents a slight increase in output for the year, takes into account year-to-date performance and the scheduled fourth quarter outages at the Salem 1 and Peach Bottom 2 nuclear facilities. Approximately 80% - 85% of generation in the fourth quarter is hedged at an average price of $49 per MWh. Power is maintaining its forecast of economic generation for 2015 and 2016 at 55 – 57 TWh per year. For 2015, Power has maintained its average hedge position at 65% - 70% of forecast generation at an average price of $50 per MWh; for 2016, Power has hedged approximately 35% - 40% of its generation at an average price of $49 per MWh. The hedge data for 2015 continues to assume BGS volumes represent 11 TWh of demand – in line with the 2014 forecast of volumes.

PSEG Power plans to invest $100 - $120 million for an equity interest in the to-be constructed PennEast Pipeline, a 105.5 mile pipeline that would bring gas from eastern Pennsylvania to New Jersey. The targeted in-service date is November 2017.

PSEG Power is considering construction of and proceeding with permitting for a new, highly efficient combined-cycle power plant at its existing Bridgeport Harbor Station site based on the strength of the ISO NE capacity market. The proposed project would add approximately 450 megawatts (MWs) of gas-fired generating capacity in Connecticut’s southwestern region to support electric system reliability. A final decision on this investment will be made in early 2015.

PSEG Power has been verbally notified by the FERC staff that they have initiated a preliminary, non-public staff investigation into the matters surrounding the errors discovered by Power in its cost-based bids for its New Jersey fossil generating units in the PJM energy market as well as additional pricing errors and differences between the quantity of energy that Power offered into the energy market and the amounts for which Power was compensated in the capacity market. The investigation could result in the FERC seeking disgorgement of any over-collected amounts, civil penalties and non-financial remedies. Power has implemented and remains in the process of implementing additional measures to mitigate the risk of similar issues occurring in the future. It is not possible at this time to reasonably estimate the ultimate impact or predict any resulting penalties, other costs or the applicability of mitigating factors.

6

The forecast range of Power’s operating earnings for 2014 has been narrowed to $575 - $610 million from $550 - $610 million with full year operating results expected to be at the upper end of the range. Results for the remainder of the year will continue to be influenced by the reset in the average price received on PJM capacity and a decline in the average price of energy. O&M expense for the fourth quarter is expected to compare favorably with year-ago levels given a reduction in pension expense and the absence of major outage-related work. The estimate assumes normal operations and weather.

PSEG Enterprise/Other

PSEG Enterprise/Other reported operating earnings of $22 million ($0.04 per share) for the third quarter of 2014 versus an operating loss of $4 million, or a loss of less than $0.01 per share during the third quarter of 2013. The results reflect the inclusion of earnings from PSEG-Long Island’s (PSEG-LI) operating contract and a reduction in tax expense. The conclusion of an Internal Revenue Service audit for the tax years 2007 – 2010 resulted in a cash refund and a reduction in tax expense. The reduction in taxes improved quarter-over-quarter earnings comparisons by $0.02 per share.

PSEG-LI, on October 6, 2014, filed an update of its Utility 2.0 proposal. The revised proposal calls for an increase in the size of the program to $345 million, reaffirms PSEG-LI’s original proposal to fund programs that would expand investment in energy efficiency, demand resources and distributed generation and offered an alternate economic structure to support the expanded program which includes a performance incentive mechanism rather than utilizing PSEG LI’s capital. A decision is expected by year-end.

The forecast of PSEG Enterprise/Other full year operating earnings for 2014 remains unchanged at $35 - $40 million.

7

FORWARD-LOOKING STATEMENT

Certain of the matters discussed in this report about our and our subsidiaries’ future performance, including, without limitation, future revenues, earnings, strategies, prospects, consequences and all other statements that are not purely historical constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ materially from those anticipated. Such statements are based on management’s beliefs as well as assumptions made by and information currently available to management. When used herein, the words “anticipate,” “intend,” “estimate,” “believe,” “expect,” “plan,” “should,” “hypothetical,” “potential,” “forecast,” “project,” variations of such words and similar expressions are intended to identify forward-looking statements. Factors that may cause actual results to differ are often presented with the forward-looking statements themselves. Other factors that could cause actual results to differ materially from those contemplated in any forward-looking statements made by us herein are discussed in filings we make with the United States Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K and subsequent reports on Form 10-Q and Form 8-K and available on our website: http://www.pseg.com. These factors include, but are not limited to:

| • | adverse changes in the demand for or the price of the capacity and energy that we sell into wholesale electricity markets, |

| • | adverse changes in energy industry law, policies and regulation, including market structures and a potential shift away from competitive markets toward subsidized market mechanisms, capacity market design, transmission planning and cost allocation rules, including how transmission projects are planned and who is permitted to build transmission in the future, and reliability standards, |

| • | any inability of our transmission and distribution businesses to obtain adequate and timely rate relief and regulatory approvals from federal and state regulators, |

| • | changes in federal and state environmental regulations and enforcement that could increase our costs or limit our operations, |

| • | changes in nuclear regulation and/or general developments in the nuclear power industry, including various impacts from any accidents or incidents experienced at our facilities or by others in the industry, that could limit operations of our nuclear generating units, |

| • | actions or activities at one of our nuclear units located on a multi-unit site that might adversely affect our ability to continue to operate that unit or other units located at the same site, |

| • | any inability to manage our energy obligations, available supply and risks, |

| • | adverse outcomes of any legal, regulatory or other proceeding, settlement, investigation or claim applicable to us and/or the energy industry, |

| • | any deterioration in our credit quality or the credit quality of our counterparties, |

| • | availability of capital and credit at commercially reasonable terms and conditions and our ability to meet cash needs, |

| • | changes in the cost of, or interruption in the supply of, fuel and other commodities necessary to the operation of our generating units, |

| • | delays in receipt of necessary permits and approvals for our construction and development activities, |

| • | delays or unforeseen cost escalations in our construction and development activities, |

| • | any inability to achieve, or continue to sustain, our expected levels of operating performance, |

| • | any equipment failures, accidents, severe weather events or other incidents that impact our ability to provide safe and reliable service to our customers, and any inability to obtain sufficient insurance coverage or recover proceeds of insurance with respect to such events, |

| • | acts of terrorism, cybersecurity attacks or intrusions that could adversely impact our businesses, |

| • | increases in competition in energy supply markets as well as competition for certain transmission projects, |

| • | any inability to realize anticipated tax benefits or retain tax credits, |

| • | challenges associated with recruitment and/or retention of a qualified workforce, |

| • | adverse performance of our decommissioning and defined benefit plan trust fund investments and changes in funding requirements, |

| • | changes in technology, such as distributed generation and micro grids, and greater reliance on these technologies, and |

| • | changes in customer behaviors, including increases in energy efficiency, net-metering and demand response. |

All of the forward-looking statements made in this report are qualified by these cautionary statements and we cannot assure you that the results or developments anticipated by management will be realized or even if realized, will have the expected consequences to, or effects on, us or our business prospects, financial condition or results of operations. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this report apply only as of the date of this report. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even if internal estimates change, unless otherwise required by applicable securities laws.

The forward-looking statements contained in this report are intended to qualify for the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

8

Attachment 1

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Operating Earnings and Per Share Results by Subsidiary

(Unaudited)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Earnings Results ($ Millions) | ||||||||||||||||

| PSE&G |

$ | 200 | $ | 168 | $ | 565 | $ | 468 | ||||||||

| PSEG Power |

171 | 221 | 551 | 595 | ||||||||||||

| PSEG Enterprise/Other |

22 | (4 | ) | 37 | (2 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating Earnings |

$ | 393 | $ | 385 | $ | 1,153 | $ | 1,061 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reconciling Items(a) |

51 | 5 | (111 | ) | (18 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Income |

$ | 444 | $ | 390 | $ | 1,042 | $ | 1,043 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Fully Diluted Average Shares Outstanding (in Millions) |

507 | 508 | 507 | 507 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Per Share Results (Diluted) | ||||||||||||||||

| PSE&G |

$ | 0.39 | $ | 0.33 | $ | 1.11 | $ | 0.92 | ||||||||

| PSEG Power |

0.34 | 0.43 | 1.09 | 1.17 | ||||||||||||

| PSEG Enterprise/Other |

0.04 | — | 0.07 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating Earnings |

$ | 0.77 | $ | 0.76 | $ | 2.27 | $ | 2.09 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reconciling Items(a) |

0.10 | 0.01 | (0.22 | ) | (0.03 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Income |

$ | 0.87 | $ | 0.77 | $ | 2.05 | $ | 2.06 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | See Attachment 12 for details of items excluded from Net Income to compute Operating Earnings. |

Attachment 2

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Consolidating Statements of Operations

(Unaudited, $ Millions)

| Three Months Ended September 30, 2014 | ||||||||||||||||

| PSEG | PSEG Enterprise/ Other (a) |

PSEG Power |

PSE&G | |||||||||||||

| OPERATING REVENUES |

$ | 2,641 | $ | (152 | ) | $ | 1,138 | $ | 1,655 | |||||||

| OPERATING EXPENSES |

||||||||||||||||

| Energy Costs |

863 | (277 | ) | 472 | 668 | |||||||||||

| Operation and Maintenance |

714 | 106 | 242 | 366 | ||||||||||||

| Depreciation and Amortization |

318 | 9 | 71 | 238 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Operating Expenses |

1,895 | (162 | ) | 785 | 1,272 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING INCOME |

746 | 10 | 353 | 383 | ||||||||||||

| Income from Equity Method Investments |

3 | (1 | ) | 4 | — | |||||||||||

| Other Income and (Deductions) |

66 | 2 | 50 | 14 | ||||||||||||

| Other Than Temporary Impairments |

(10 | ) | — | (10 | ) | — | ||||||||||

| Interest Expense |

(100 | ) | 2 | (31 | ) | (71 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| INCOME BEFORE INCOME TAXES |

705 | 13 | 366 | 326 | ||||||||||||

| Income Tax Benefit (Expense) |

(261 | ) | 9 | (144 | ) | (126 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET INCOME |

$ | 444 | $ | 22 | $ | 222 | $ | 200 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EARNINGS |

$ | 393 | $ | 22 | $ | 171 | $ | 200 | ||||||||

| Reconciling Items Excluded from Net Income (b) |

51 | — | 51 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET INCOME |

$ | 444 | $ | 22 | $ | 222 | $ | 200 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Three Months Ended September 30, 2013 | ||||||||||||||||

| PSEG | PSEG Enterprise/ Other (a) |

PSEG Power |

PSE&G | |||||||||||||

| OPERATING REVENUES |

$ | 2,554 | $ | (286 | ) | $ | 1,174 | $ | 1,666 | |||||||

| OPERATING EXPENSES |

||||||||||||||||

| Energy Costs |

801 | (290 | ) | 430 | 661 | |||||||||||

| Operation and Maintenance |

713 | — | 305 | 408 | ||||||||||||

| Depreciation and Amortization |

313 | 8 | 69 | 236 | ||||||||||||

| Taxes Other Than Income Taxes |

15 | — | — | 15 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Operating Expenses |

1,842 | (282 | ) | 804 | 1,320 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING INCOME |

712 | (4 | ) | 370 | 346 | |||||||||||

| Income from Equity Method Investments |

4 | — | 4 | — | ||||||||||||

| Other Income and (Deductions) |

47 | 1 | 34 | 12 | ||||||||||||

| Other Than Temporary Impairments |

(3 | ) | — | (3 | ) | — | ||||||||||

| Interest Expense |

(100 | ) | 1 | (26 | ) | (75 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| INCOME BEFORE INCOME TAXES |

660 | (2 | ) | 379 | 283 | |||||||||||

| Income Tax Benefit (Expense) |

(270 | ) | (2 | ) | (153 | ) | (115 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET INCOME |

$ | 390 | $ | (4 | ) | $ | 226 | $ | 168 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EARNINGS |

$ | 385 | $ | (4 | ) | $ | 221 | $ | 168 | |||||||

| Reconciling Items Excluded from Net Income (b) |

5 | — | 5 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET INCOME |

$ | 390 | $ | (4 | ) | $ | 226 | $ | 168 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | Includes activities at Energy Holdings, PSEG Long Island and the Parent as well as intercompany eliminations. |

| (b) | See Attachment 12 for details of items excluded from Net Income to compute Operating Earnings. |

Attachment 3

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Consolidating Statements of Operations

(Unaudited, $ Millions)

| Nine Months Ended September 30, 2014 | ||||||||||||||||

| PSEG | PSEG Enterprise/ Other (a) |

PSEG Power |

PSE&G | |||||||||||||

| OPERATING REVENUES |

$ | 8,113 | $ | (946 | ) | $ | 3,824 | $ | 5,235 | |||||||

| OPERATING EXPENSES |

||||||||||||||||

| Energy Costs |

3,008 | (1,306 | ) | 2,036 | 2,278 | |||||||||||

| Operation and Maintenance |

2,370 | 309 | 871 | 1,190 | ||||||||||||

| Depreciation and Amortization |

919 | 22 | 215 | 682 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Operating Expenses |

6,297 | (975 | ) | 3,122 | 4,150 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING INCOME |

1,816 | 29 | 702 | 1,085 | ||||||||||||

| Income from Equity Method Investments |

10 | (1 | ) | 11 | — | |||||||||||

| Other Income and (Deductions) |

154 | 3 | 110 | 41 | ||||||||||||

| Other Than Temporary Impairments |

(14 | ) | — | (14 | ) | — | ||||||||||

| Interest Expense |

(291 | ) | 7 | (92 | ) | (206 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| INCOME BEFORE INCOME TAXES |

1,675 | 38 | 717 | 920 | ||||||||||||

| Income Tax Benefit (Expense) |

(633 | ) | (1 | ) | (277 | ) | (355 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET INCOME |

$ | 1,042 | $ | 37 | $ | 440 | $ | 565 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EARNINGS |

$ | 1,153 | $ | 37 | $ | 551 | $ | 565 | ||||||||

| Reconciling Items Excluded from Net Income (b) |

(111 | ) | — | (111 | ) | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET INCOME |

$ | 1,042 | $ | 37 | $ | 440 | $ | 565 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Nine Months Ended September 30, 2013 | ||||||||||||||||

| PSEG | PSEG Enterprise/ Other (a) |

PSEG Power |

PSE&G | |||||||||||||

| OPERATING REVENUES |

$ | 7,650 | $ | (1,252 | ) | $ | 3,818 | $ | 5,084 | |||||||

| OPERATING EXPENSES |

||||||||||||||||

| Energy Costs |

2,711 | (1,282 | ) | 1,785 | 2,208 | |||||||||||

| Operation and Maintenance |

2,069 | (3 | ) | 868 | 1,204 | |||||||||||

| Depreciation and Amortization |

886 | 26 | 202 | 658 | ||||||||||||

| Taxes Other Than Income Taxes |

50 | — | — | 50 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Operating Expenses |

5,716 | (1,259 | ) | 2,855 | 4,120 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING INCOME |

1,934 | 7 | 963 | 964 | ||||||||||||

| Income from Equity Method Investments |

9 | (3 | ) | 12 | — | |||||||||||

| Other Income and (Deductions) |

118 | 2 | 78 | 38 | ||||||||||||

| Other Than Temporary Impairments |

(7 | ) | — | (7 | ) | — | ||||||||||

| Interest Expense |

(303 | ) | 5 | (85 | ) | (223 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| INCOME BEFORE INCOME TAXES |

1,751 | 11 | 961 | 779 | ||||||||||||

| Income Tax Benefit (Expense) |

(708 | ) | (13 | ) | (384 | ) | (311 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET INCOME |

$ | 1,043 | $ | (2 | ) | $ | 577 | $ | 468 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| OPERATING EARNINGS |

$ | 1,061 | $ | (2 | ) | $ | 595 | $ | 468 | |||||||

| Reconciling Items Excluded from Net Income (b) |

(18 | ) | — | (18 | ) | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NET INCOME |

$ | 1,043 | $ | (2 | ) | $ | 577 | $ | 468 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | Includes activities at Energy Holdings, PSEG Long Island and the Parent as well as intercompany eliminations. |

| (b) | See Attachment 12 for details of items excluded from Net Income to compute Operating Earnings. |

Attachment 4

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Capitalization Schedule

(Unaudited, $ Millions)

| September 30, 2014 |

December 31, 2013 |

|||||||

| DEBT |

||||||||

| Long-Term Debt |

$ | 8,621 | $ | 8,131 | ||||

| Securitization Debt |

326 | 496 | ||||||

| Project Level, Non-Recourse Debt |

16 | 16 | ||||||

|

|

|

|

|

|||||

| Total Debt |

8,963 | 8,643 | ||||||

| STOCKHOLDERS’ EQUITY |

||||||||

| Common Stock |

4,873 | 4,861 | ||||||

| Treasury Stock |

(629 | ) | (615 | ) | ||||

| Retained Earnings |

7,938 | 7,457 | ||||||

| Accumulated Other Comprehensive Loss |

(99 | ) | (95 | ) | ||||

|

|

|

|

|

|||||

| Total Common Stockholders’ Equity |

12,083 | 11,608 | ||||||

| Noncontrolling Interests - Equity Investments |

1 | 1 | ||||||

|

|

|

|

|

|||||

| Total Equity |

12,084 | 11,609 | ||||||

|

|

|

|

|

|||||

| Total Capitalization |

$ | 21,047 | $ | 20,252 | ||||

|

|

|

|

|

|||||

Attachment 5

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, $ Millions)

| Nine Months Ended September 30, | ||||||||

| 2014 | 2013 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES |

||||||||

| Net Income |

$ | 1,042 | $ | 1,043 | ||||

| Adjustments to Reconcile Net Income to Net Cash Flows From Operating Activities |

1,494 | 1,392 | ||||||

|

|

|

|

|

|||||

| NET CASH PROVIDED BY OPERATING ACTIVITIES |

2,536 | 2,435 | ||||||

|

|

|

|

|

|||||

| NET CASH USED IN INVESTING ACTIVITIES |

(1,988 | ) | (2,088 | ) | ||||

|

|

|

|

|

|||||

| NET CASH USED IN FINANCING ACTIVITIES |

(338 | ) | (278 | ) | ||||

|

|

|

|

|

|||||

| Net Change in Cash and Cash Equivalents |

210 | 69 | ||||||

| Cash and Cash Equivalents at Beginning of Period |

493 | 379 | ||||||

|

|

|

|

|

|||||

| Cash and Cash Equivalents at End of Period |

$ | 703 | $ | 448 | ||||

|

|

|

|

|

|||||

Attachment 6

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Quarter-over-Quarter EPS Reconciliation

September 30, 2014 vs. September 30, 2013

(Unaudited)

Attachment 7

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Year-over-Year EPS Reconciliation

September 30, 2014 vs. September 30, 2013

(Unaudited)

Attachment 8

PSEG POWER LLC

Generation Measures*

(Unaudited)

| GWhr Breakdown | GWhr Breakdown | |||||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Nuclear - NJ |

5,113 | 5,408 | 14,653 | 15,635 | ||||||||||||

| Nuclear - PA |

2,452 | 2,090 | 7,499 | 7,148 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Nuclear |

7,565 | 7,498 | 22,152 | 22,783 | ||||||||||||

| Fossil - Coal/Natural Gas - NJ** |

563 | 420 | 1,441 | 1,086 | ||||||||||||

| Fossil - Coal - PA |

1,221 | 1,413 | 3,945 | 4,006 | ||||||||||||

| Fossil - Coal - CT |

47 | 103 | 710 | 434 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Coal |

1,831 | 1,936 | 6,096 | 5,526 | ||||||||||||

| Fossil - Oil & Natural Gas - NJ |

3,767 | 3,691 | 9,419 | 9,579 | ||||||||||||

| Fossil - Oil & Natural Gas - NY |

1,523 | 952 | 3,398 | 3,020 | ||||||||||||

| Fossil - Oil & Natural Gas - CT |

4 | 34 | 241 | 78 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Oil & Natural Gas |

5,294 | 4,677 | 13,058 | 12,677 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 14,690 | 14,111 | 41,306 | 40,986 | |||||||||||||

| % Generation by Fuel Type | % Generation by Fuel Type | |||||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Nuclear - NJ |

35 | % | 38 | % | 35 | % | 38 | % | ||||||||

| Nuclear - PA |

16 | % | 15 | % | 18 | % | 17 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Nuclear |

51 | % | 53 | % | 53 | % | 55 | % | ||||||||

| Fossil - Coal/Natural Gas - NJ** |

4 | % | 3 | % | 3 | % | 3 | % | ||||||||

| Fossil - Coal - PA |

9 | % | 10 | % | 10 | % | 10 | % | ||||||||

| Fossil - Coal - CT |

0 | % | 1 | % | 2 | % | 1 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Coal |

13 | % | 14 | % | 15 | % | 14 | % | ||||||||

| Fossil - Oil & Natural Gas - NJ |

26 | % | 26 | % | 23 | % | 24 | % | ||||||||

| Fossil - Oil & Natural Gas - NY |

10 | % | 7 | % | 8 | % | 7 | % | ||||||||

| Fossil - Oil & Natural Gas - CT |

0 | % | 0 | % | 1 | % | 0 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Oil & Natural Gas |

36 | % | 33 | % | 32 | % | 31 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 100 | % | 100 | % | 100 | % | 100 | % | |||||||||

| * | Excludes Solar and Kalaeloa |

| ** | Includes Pumped Storage. Pumped Storage accounted for <1% of total generation for the three months and nine ended September 30, 2014 and 2013. Also includes natural gas fuel switching intervals. |

Attachment 9

PUBLIC SERVICE ELECTRIC & GAS COMPANY

Retail Sales and Revenues

(Unaudited)

September 30, 2014

Electric Sales and Revenues

| Three Months Ended |

Change vs. 2013 |

Nine Months Ended |

Change vs. 2013 |

|||||||||||||

| Sales (millions kWh) |

||||||||||||||||

| Residential |

4,078 | -5.6 | % | 10,276 | -2.4 | % | ||||||||||

| Commercial & Industrial |

7,380 | -2.9 | % | 20,925 | 0.2 | % | ||||||||||

| Street Lighting |

71 | -2.7 | % | 232 | 0.2 | % | ||||||||||

| Interdepartmental |

2 | -5.8 | % | 7 | 3.3 | % | ||||||||||

|

|

|

|

|

|||||||||||||

| Total |

11,531 | -3.9 | % | 31,440 | -0.6 | % | ||||||||||

|

|

|

|

|

|||||||||||||

| Revenue (in millions) |

||||||||||||||||

| Residential |

$ | 659 | -2.8 | % | $ | 1,620 | -0.4 | % | ||||||||

| Commercial & Industrial |

629 | -3.1 | % | 1,633 | 2.4 | % | ||||||||||

| Street Lighting |

17 | -1.4 | % | 51 | -1.0 | % | ||||||||||

| Other Operating Revenues* |

135 | 24.2 | % | 384 | 19.6 | % | ||||||||||

|

|

|

|

|

|||||||||||||

| Total |

$ | 1,440 | -0.9 | % | $ | 3,688 | 2.6 | % | ||||||||

|

|

|

|

|

|||||||||||||

| Three Months Ended |

Change vs. 2013 |

Nine Months Ended |

Change vs. 2013 |

|||||||||||||

| Weather Data |

||||||||||||||||

| THI Hours - Actual |

10,086 | -18.4 | % | 13,520 | -20.5 | % | ||||||||||

| THI Hours - Normal |

11,725 | 15,772 | ||||||||||||||

| * | Primarily sales of Non-Utility Generator energy to PJM and Transmission related revenues. |

Attachment 10

PUBLIC SERVICE ELECTRIC & GAS COMPANY

Retail Sales and Revenues

(Unaudited)

September 30, 2014

Gas Sold and Transported

| Three Months Ended |

Change vs. 2013 |

Nine Months Ended |

Change vs. 2013 |

|||||||||||||

| Sales (millions therms)* |

||||||||||||||||

| Firm Sales |

||||||||||||||||

| Residential Sales |

102 | 3.5 | % | 1,128 | 14.6 | % | ||||||||||

| Commercial & Industrial |

98 | 0.2 | % | 771 | 12.6 | % | ||||||||||

|

|

|

|

|

|||||||||||||

| Total Firm Sales |

200 | 1.9 | % | 1,899 | 13.8 | % | ||||||||||

|

|

|

|

|

|||||||||||||

| Non-Firm Sales |

||||||||||||||||

| Commercial & Industrial |

712 | 110.5 | % | 1,829 | 110.1 | % | ||||||||||

|

|

|

|

|

|||||||||||||

| Total Non-Firm Sales |

712 | 1,829 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Total Sales |

912 | 70.6 | % | 3,728 | 46.8 | % | ||||||||||

|

|

|

|

|

|||||||||||||

| Revenue ($ millions) |

||||||||||||||||

| Residential Sales - Firm |

$ | 48 | 6.7 | % | $ | 408 | -7.5 | % | ||||||||

| Commercial & Industrial - Firm Sales |

20 | 10.4 | % | 235 | 35.8 | % | ||||||||||

| Non-Firm Sales |

7 | -14.7 | % | 32 | 4.6 | % | ||||||||||

| Other Operating Revenues** |

41 | 0.0 | % | 128 | 3.0 | % | ||||||||||

|

|

|

|

|

|||||||||||||

| Total |

$ | 116 | 3.2 | % | $ | 803 | 4.2 | % | ||||||||

|

|

|

|

|

|||||||||||||

| Gas Transported |

$ | 99 | -2.3 | % | $ | 744 | 3.1 | % | ||||||||

| Three Months Ended |

Change vs. 2013 |

Nine Months Ended |

Change vs. 2013 |

|||||||||||||

| Weather Data |

||||||||||||||||

| Degree Days - Actual |

21 | -56.1 | % | 3,471 | 11.4 | % | ||||||||||

| Degree Days - Normal |

29 | 3,035 | ||||||||||||||

| * CSG rate included in non-firm sales |

** Primarily Appliance Service |

Attachment 11

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Statistical Measures

(Unaudited)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Weighted Average Common Shares Outstanding (000’s) |

||||||||||||||||

| Basic |

505,862 | 505,858 | 505,937 | 505,900 | ||||||||||||

| Diluted |

507,422 | 507,694 | 507,402 | 507,433 | ||||||||||||

| Stock Price at End of Period |

$ | 37.24 | $ | 32.93 | ||||||||||||

| Dividends Paid per Share of Common Stock |

$ | 0.37 | $ | 0.36 | $ | 1.11 | $ | 1.08 | ||||||||

| Dividend Payout Ratio* |

53.6 | % | 57.6 | % | ||||||||||||

| Dividend Yield |

4.0 | % | 4.4 | % | ||||||||||||

| Price/Earnings Ratio* |

13.5 | 13.2 | ||||||||||||||

| Rate of Return on Average Common Equity* |

12.0 | % | 11.6 | % | ||||||||||||

| Book Value per Common Share |

$ | 23.89 | $ | 22.41 | ||||||||||||

| Market Price as a Percent of Book Value |

156 | % | 147 | % | ||||||||||||

| Total Shareholder Return |

-7.8 | % | 2.0 | % | 19.8 | % | 11.2 | % | ||||||||

| . | ||||||||||||||||

| * | Calculation based on Operating Earnings for the 12 month period ended. |

Attachment 12

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

| Reconciling Items, net of tax | Three Months Ended | Nine Months Ended | Year Ended | |||||||||||||||||||||

| September 30, | September 30, | December 31, | ||||||||||||||||||||||

| 2014 | 2013 | 2014 | 2013 | 2013 | 2012 | |||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||

| Earnings Impact ($ Millions) | ||||||||||||||||||||||||

| Operating Earnings |

$ | 393 | $ | 385 | $ | 1,153 | $ | 1,061 | $ | 1,309 | $ | 1,236 | ||||||||||||

| Gain (Loss) on Nuclear Decommissioning Trust (NDT) Fund Related Activity (PSEG Power) |

17 | 12 | 40 | 29 | 40 | 52 | ||||||||||||||||||

| Gain (Loss) on Mark-to-Market (MTM)(a) (PSEG Power) |

36 | 3 | (138 | ) | (22 | ) | (74 | ) | (10 | ) | ||||||||||||||

| Lease Related Activity (PSEG Enterprise/Other) |

— | — | — | — | — | 36 | ||||||||||||||||||

| Storm O&M, net of insurance recoveries (PSEG Power) |

(2 | ) | (10 | ) | (13 | ) | (25 | ) | (32 | ) | (39 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net Income |

$ | 444 | $ | 390 | $ | 1,042 | $ | 1,043 | $ | 1,243 | $ | 1,275 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Fully Diluted Average Shares Outstanding (in Millions) |

507 | 508 | 507 | 507 | 508 | 507 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Per Share Impact (Diluted) | ||||||||||||||||||||||||

| Operating Earnings |

$ | 0.77 | $ | 0.76 | $ | 2.27 | $ | 2.09 | $ | 2.58 | $ | 2.44 | ||||||||||||

| Gain (Loss) on NDT Fund Related Activity (PSEG Power) |

0.04 | 0.02 | 0.08 | 0.06 | 0.08 | 0.10 | ||||||||||||||||||

| Gain (Loss) on MTM(a) (PSEG Power) |

0.07 | 0.01 | (0.27 | ) | (0.04 | ) | (0.14 | ) | (0.02 | ) | ||||||||||||||

| Lease Related Activity (PSEG Enterprise/Other) |

— | — | — | — | — | 0.07 | ||||||||||||||||||

| Storm O&M, net of insurance recoveries (PSEG Power) |

(0.01 | ) | (0.02 | ) | (0.03 | ) | (0.05 | ) | (0.07 | ) | (0.08 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net Income |

$ | 0.87 | $ | 0.77 | $ | 2.05 | $ | 2.06 | $ | 2.45 | $ | 2.51 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) | Includes the financial impact from positions with forward delivery months. |