Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TELEFLEX INC | a10-29x20148kreq32014confc.htm |

1 TELEFLEX INCORPORATED THIRD QUARTER 2014 EARNINGS CONFERENCE CALL 1 Exhibit 99.1

Conference Call Logistics The release, accompanying slides, and replay webcast are available online at www.teleflex.com (click on “Investors”) Telephone replay available by dialing 888-286-8010 or for international calls, 617- 801-6888, pass code number 14097601 2

Introductions Benson Smith Chairman, President and CEO Thomas Powell Executive Vice President and CFO Jake Elguicze Treasurer and Vice President of Investor Relations 3

Forward-Looking Statements/Non-GAAP Financial Measures This presentation and our discussion contain forward-looking information and statements including, but not limited to, estimates with respect to the amount and timing of pre-tax charges, capital expenditures and annualized savings with respect to our 2014 manufacturing footprint realignment plan; forecasted 2014 constant currency revenue growth, adjusted gross margins, adjusted operating margins excluding intangible amortization expense and adjusted earnings per share; and other matters which inherently involve risks and uncertainties which could cause actual results to differ from those projected or implied in the forward–looking statements. These risks and uncertainties are addressed in our SEC filings, including our most recent Form 10-K. This presentation includes the following non-GAAP financial measures: • Adjusted diluted earnings per share. This measure excludes, depending on the period presented (i) the effect of charges associated with our restructuring programs, as well as goodwill and other asset impairment charges; (ii) losses, other charges and charge reversals, including acquisition and integration costs, charges related to facility consolidations, reversal of liabilities related to certain contingent consideration arrangements, the establishment of a litigation reserve and a litigation verdict against the Company with respect to a non-operating joint venture and reversal of a reserve related to a previously announced stock keeping unit benefit program; (iii) amortization of the debt discount on the Company’s convertible notes; (iv) intangible amortization expense; (v) loss on extinguishment of debt; and (vi) tax benefits resulting from the resolution of, or expiration of the statute of limitations with respect to, prior years’ tax matters. In addition, the calculation of diluted shares within adjusted earnings per share gives effect to the anti-dilutive impact of the Company’s convertible note hedge agreements, which reduce the potential economic dilution that otherwise would occur upon conversion of the Company’s senior subordinated convertible notes (under GAAP, the anti-dilutive impact of the convertible note hedge agreements is not reflected in diluted shares). • Constant currency revenue growth. This measure excludes the impact of translating the results of international subsidiaries at different currency exchange rates from period to period. • Adjusted gross margin. This measure excludes, depending on the period presented, certain losses and other charges, primarily related to facility consolidation costs and acquisition and integration costs. • Adjusted operating margin excluding intangible amortization expense. This measure excludes, depending on the period presented, (i) the impact of restructuring and other impairment charges; (ii) losses and other charges primarily related to the reversal of contingent consideration liabilities, acquisition and integration costs and facility consolidation charges; and (iii) the impact of intangible amortization expense. • Adjusted tax rate. This measure is the percentage of the Company’s adjusted taxes on income from continuing operations to its adjusted income from continuing operations before taxes. Adjusted taxes on income from continuing operations excludes, depending on the period presented, the impact of tax benefits or costs associated with (i) restructuring and impairment charges, (ii) amortization of the debt discount on the Company’s convertible notes, (iii) intangible amortization expense, (iv) the resolution of, or expiration of statutes of limitations with respect to, various prior years’ tax matters and (v) losses and other charges primarily related to related to acquisition and integration costs, the reversal of contingent consideration liabilities and facility consolidation charges. Reconciliation of these non-GAAP financial measures to the most comparable GAAP measures is contained within this presentation. Unless otherwise noted, the following slides reflect continuing operations. 4

5 THIRD QUARTER 2014 HIGHLIGHTS 5

Third Quarter Highlights Third quarter constant currency revenue growth and adjusted earnings per share achievement exceeded our expectations Revenue of $457.2 million, up 10.5% vs. prior year period on an as- reported basis; up 10.2% vs. prior year period on a constant currency basis Adjusted EPS of $1.57, up 18.0% vs. prior year 6

Third Quarter Highlights 190 bps improvement in sales of existing products in Q3’14 compared to Q3’13 resulting from modest improvement in end-market utilization Improvement in the average selling prices of products contributes 111 bps of top-line growth in Q3’14 compared to Q3’13 New product introductions contribute 78 bps of top-line growth in Q3’14 compared to Q3’13 Continue to expand GPO & IDN relationships • 8 new agreements (2 GPO; 6 IDN) • 4 renewed agreements (2 GPO; 2 IDN) 7

Third Quarter Highlights Vidacare contributes 5.3% to Teleflex’s constant currency revenue growth • Q3’14 revenue of $22.0 million, ahead of initial internal expectations • Q3’14 revenue up ~ 24% versus Q3’13 on an as-reported basis • Integration activities on schedule • Continue to invest in additional clinical training and cadaver lab workshops to drive future sustainable revenue growth 8

EZ-IO® provides the medical professional immediate vascular access to the central circulation within seconds, delivering medications, intravenous fluids and blood products to adult and pediatric patients alike. PRODUCT DESCRIPTION PRODUCT UPDATE 9 510(k) clearance received for restated Indications for Use of the ARROW ® EZ-IO® Vascular Access System. EZ-IO® is now indicated to include the distal femur for pediatric patients. Third Quarter Highlights ARROW® EZ-IO® Vascular Access System

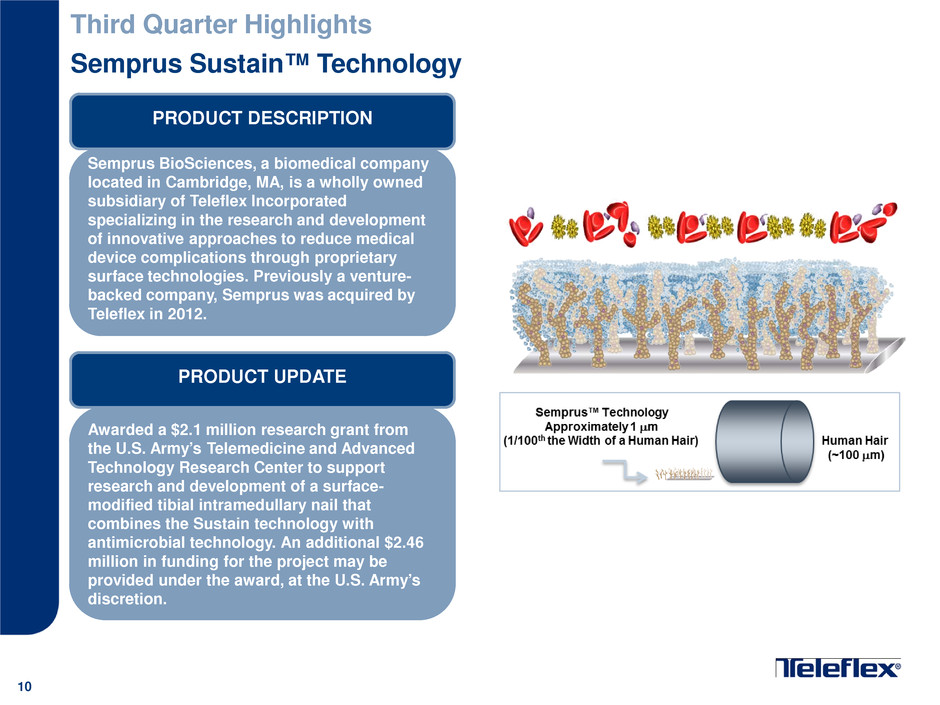

Semprus Sustain™ Technology Third Quarter Highlights 10 Awarded a $2.1 million research grant from the U.S. Army’s Telemedicine and Advanced Technology Research Center to support research and development of a surface- modified tibial intramedullary nail that combines the Sustain technology with antimicrobial technology. An additional $2.46 million in funding for the project may be provided under the award, at the U.S. Army’s discretion. PRODUCT UPDATE Semprus BioSciences, a biomedical company located in Cambridge, MA, is a wholly owned subsidiary of Teleflex Incorporated specializing in the research and development of innovative approaches to reduce medical device complications through proprietary surface technologies. Previously a venture- backed company, Semprus was acquired by Teleflex in 2012. PRODUCT DESCRIPTION

Mayo Healthcare Pty Ltd. • Contributed 1.6% to Teleflex’s constant currency revenue growth in Q3; mixture of additional volume and improved pricing • Integration activities on schedule Third Quarter Highlights 11

12 THIRD QUARTER 2014 FINANCIAL REVIEW 12

Financial Results Revenue of $457.2 million • Up 10.5% vs. prior year period on an as-reported basis • Up 10.2% vs. prior year period on a constant currency basis Adjusted gross margin of 52.1%, up 234 bps vs. prior year period Adjusted operating margin of 21.7%, up 133 bps vs. prior year period Adjusted tax rate of 18.8%, down 495 bps vs. prior year period Adjusted EPS of $1.57, up 18.0% vs. prior year period Cash flow from operations for first nine months of 2014 of $208.8 million, up 54% vs. the first nine months of 2013 13

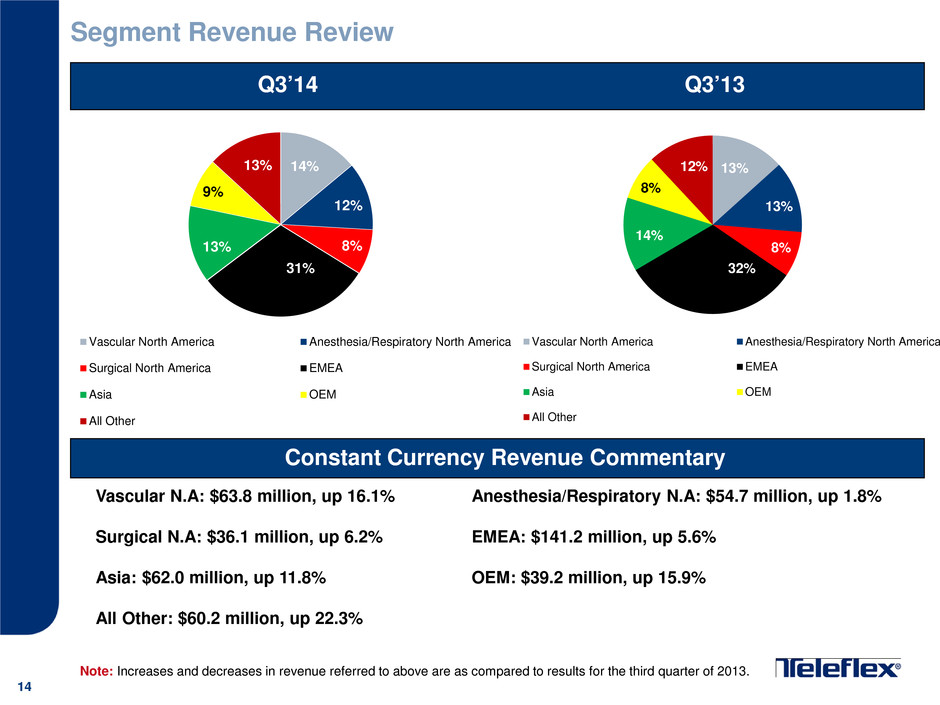

Segment Revenue Review Q3’14 Vascular N.A: $63.8 million, up 16.1% Anesthesia/Respiratory N.A: $54.7 million, up 1.8% Surgical N.A: $36.1 million, up 6.2% EMEA: $141.2 million, up 5.6% Asia: $62.0 million, up 11.8% OEM: $39.2 million, up 15.9% All Other: $60.2 million, up 22.3% Note: Increases and decreases in revenue referred to above are as compared to results for the third quarter of 2013. 14 14% 12% 8% 31% 13% 9% 13% Vascular North America Anesthesia/Respiratory North America Surgical North America EMEA Asia OEM All Other 13% 13% 8% 32% 14% 8% 12% Vascular North America Anesthesia/Respiratory North America Surgical North America EMEA Asia OEM All Other Constant Currency Revenue Commentary Q3’13

These estimates reflect a shift in the timing of certain costs from 2014 to 2015 as compared to the original plan, which did not impact the overall plan estimates Aggregate pre-tax charges of approximately $42 to $53 million1 , of which approximately $32 to $40 million will result in future cash outlays • 2014 pre-tax charges of approximately $15 to $17 million1 , of which approximately $5 to $7 million will result in cash outlays Aggregate capital expenditures of approximately $24 to $30 million • 2014 capital expenditures of approximately $8 to $10 million Expect to achieve annualized savings of approximately $28 to $35 million once the plan is fully implemented, and currently expects to realize plan-related savings beginning in 2015 Other Additional 2014 pre-tax operating expenses in the range of $4 to $5 million that will not be added-back when calculating adjusted earnings per share 1 = will be added-back when calculating adjusted earnings per share 2014 Manufacturing Footprint Realignment Plan 15

16 2014 FINANCIAL OUTLOOK 16

2014 Financial Outlook 17 2014 guidance ranges reaffirmed: • Adjusted gross margin of 52.0% to 52.5% • Adjusted operating margin excluding intangible amortization expense of 20% to 21% 2014 guidance ranges increased: • Constant currency revenue growth increased from 7% to 9% to 7.5% to 9% • Adjusted diluted earnings per share increased from $5.45 to $5.60 to $5.60 to $5.70

18 QUESTION & ANSWER 18

19 APPENDICES 19

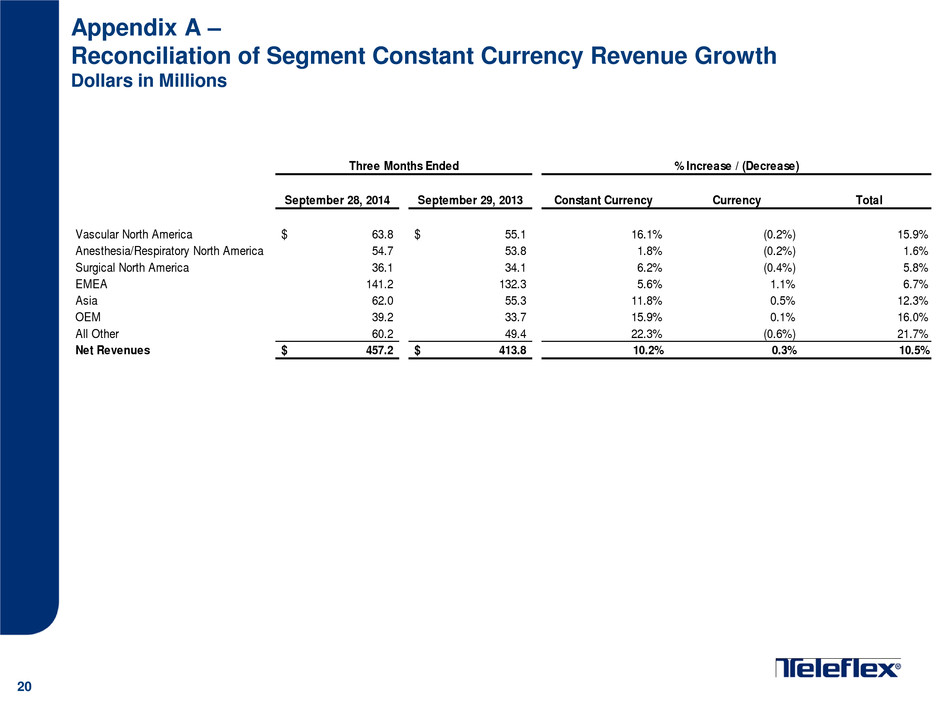

Appendix A – Reconciliation of Segment Constant Currency Revenue Growth Dollars in Millions 20 September 28, 2014 September 29, 2013 Constant Currency Currency Total Vascular North America 63.8$ 55.1$ 16.1% (0.2%) 15.9% Anesthesia/Respiratory North America 54.7 53.8 1.8% (0.2%) 1.6% Surgical North America 36.1 34.1 6.2% (0.4%) 5.8% EMEA 141.2 132.3 5.6% 1.1% 6.7% Asia 62.0 55.3 11.8% 0.5% 12.3% OEM 39.2 33.7 15.9% 0.1% 16.0% All Other 60.2 49.4 22.3% (0.6%) 21.7% Net Revenues 457.2$ 413.8$ 10.2% 0.3% 10.5% Three Months Ended % Increase / (Decrease)

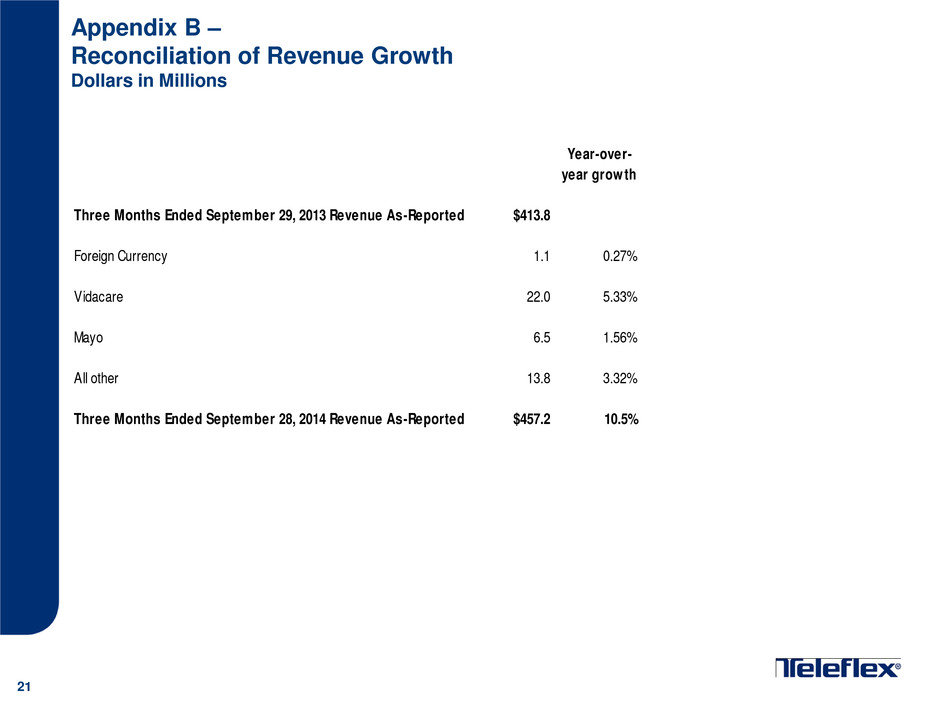

Appendix B – Reconciliation of Revenue Growth Dollars in Millions 21 Year-over- year growth Three Months Ended September 29, 2013 Revenue As-Reported $413.8 Foreign Currency 1.1 0.27% Vidacare 22.0 5.33% Mayo 6.5 1.56% All other 13.8 3.32% Three Months Ended September 28, 2014 Revenue As-Reported $457.2 10.5%

22 Appendix C – Reconciliation of Teleflex Gross Profit and Margin September 28, 2014 September 29, 2013 Teleflex gross profit as-reported 236,166$ 203,992$ Teleflex gross margin as-reported 51.7% 49.3% Losses, other charges and charge reversals (A) 1,897 1,797 Adjusted Teleflex gross profit 238,063$ 205,789$ Adjusted Teleflex gross margin 52.1% 49.7% Teleflex revenue as-reported 457,173$ 413,796$ $ thousands Three Months Ended A: In 2014 losses, other charges and charge reversals primarily relate to facility consolidation costs. In 2013, losses, other charges and charge reversals primarily relate to acquisition and integration costs.

23 Appendix D – Reconciliation of Teleflex Operating Profit and Margin September 28, 2014 September 29, 2013 Teleflex income from continuing operations before interest and taxes 81,935$ 66,042$ Teleflex income from continuing operations before interest and taxes margin 17.9% 16.0% Restructuring and other impairment charges 1,108 7,084 Losses, other charges and charge reversals (A) 1,076 (1,460) Adjusted Teleflex income from continuing operations before interest and taxes 84,119$ 71,666$ Adjusted Teleflex income from continuing operations before interest and taxes margin 18.4% 17.3% Intangible amortization expense 14,951 12,521 Adjusted Teleflex income from continuing operations before interest, taxes and intangible amortization expense 99,070$ 84,187$ Adjusted Teleflex income from continuing operations before interest, taxes and intangible amortization expense margin 21.7% 20.3% Teleflex revenue as-reported 457,173$ 413,796$ $ thousands Three Months Ended A: In 2014, losses, other charges and charge reversals primarily relate to the reversal of contingent consideration liabilities; acquisition and integration costs; and charges related to facility consolidations. In 2013, losses, other charges and charge reversals primarily relate to the reversal of contingent consideration liabilities; and acquisition and integration costs.

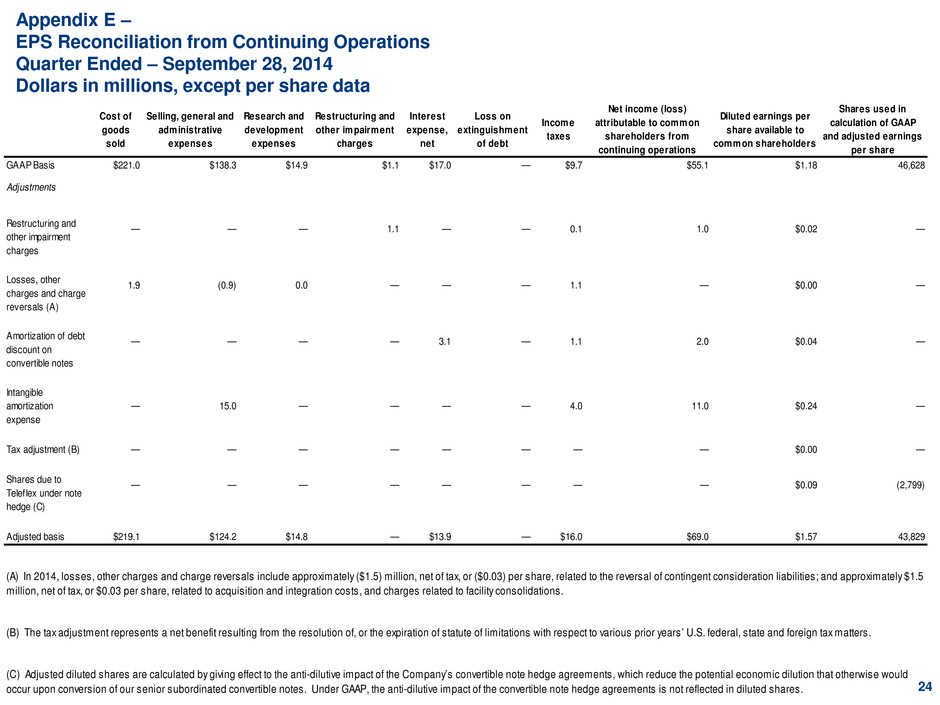

Appendix E – EPS Reconciliation from Continuing Operations Quarter Ended – September 28, 2014 Dollars in millions, except per share data 24 Cost of goods sold Selling, general and administrative expenses Research and development expenses Restructuring and other impairment charges Interest expense, net Loss on extinguishment of debt Income taxes Net income (loss) attributable to common shareholders from continuing operations Diluted earnings per share available to common shareholders Shares used in calculation of GAAP and adjusted earnings per share GAAP Basis $221.0 $138.3 $14.9 $1.1 $17.0 — $9.7 $55.1 $1.18 46,628 Adjustments Restructuring and other impairment charges Losses, other charges and charge reversals (A) Amortization of debt discount on convertible notes Intangible amortization expense — 15.0 — — — — 4.0 11.0 $0.24 — Tax adjustment (B) — — — — — — — — $0.00 — Shares due to Teleflex under note hedge (C) Adjusted basis $219.1 $124.2 $14.8 — $13.9 — $16.0 $69.0 $1.57 43,829 0.1 1.0 — — — 1.1 — — $0.02 — 1.9 (0.9) 0.0 — — — 1.1 — — — — — — 3.1 — 1.1 2.0 — — — — — $0.00 (A) In 2014, losses, other charges and charge reversals include approximately ($1.5) million, net of tax, or ($0.03) per share, related to the reversal of contingent consideration liabilities; and approximately $1.5 million, net of tax, or $0.03 per share, related to acquisition and integration costs, and charges related to facility consolidations. (B) The tax adjustment represents a net benefit resulting from the resolution of, or the expiration of statute of limitations with respect to various prior years’ U.S. federal, state and foreign tax matters. (C) Adjusted diluted shares are calculated by giving effect to the anti-dilutive impact of the Company’s convertible note hedge agreements, which reduce the potential economic dilution that otherwise would occur upon conversion of our senior subordinated convertible notes. Under GAAP, the anti-dilutive impact of the convertible note hedge agreements is not reflected in diluted shares. $0.09 (2,799) $0.04 — — — —

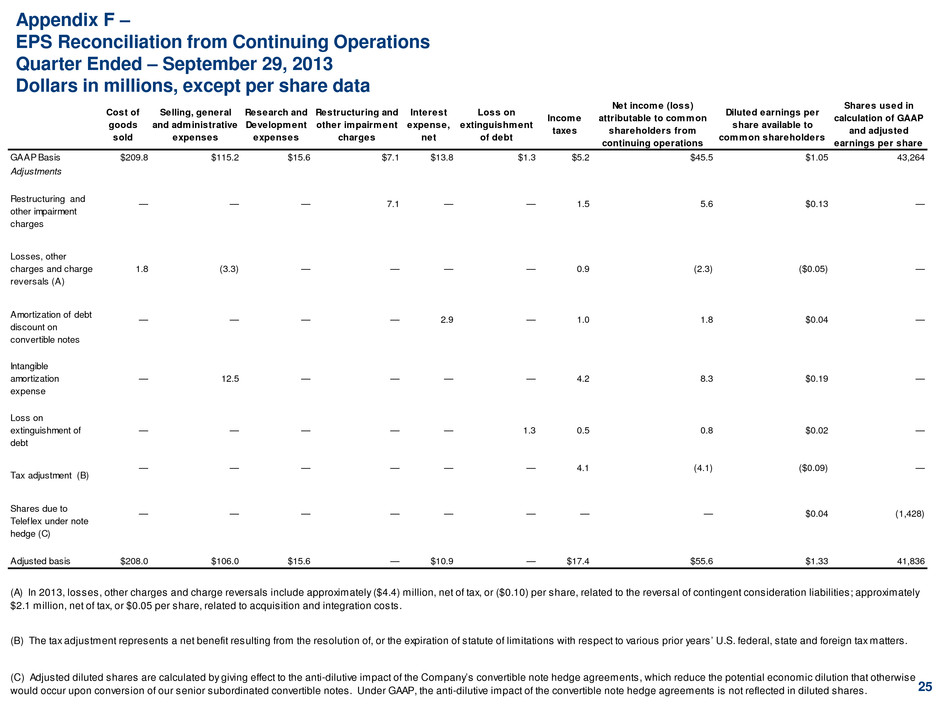

Appendix F – EPS Reconciliation from Continuing Operations Quarter Ended – September 29, 2013 Dollars in millions, except per share data 25 Cost of goods sold Selling, general and administrative expenses Research and Development expenses Restructuring and other impairment charges Interest expense, net Loss on extinguishment of debt Income taxes Net income (loss) attributable to common shareholders from continuing operations Diluted earnings per share available to common shareholders Shares used in calculation of GAAP and adjusted earnings per share GAAP Basis $209.8 $115.2 $15.6 $7.1 $13.8 $1.3 $5.2 $45.5 $1.05 43,264 Adjustments Restructuring and other impairment charges Losses, other charges and charge reversals (A) 1.8 (3.3) — — — — 0.9 (2.3) ($0.05) — Amortization of debt discount on convertible notes Intangible amortization expense — 12.5 — — — — 4.2 8.3 $0.19 — Loss on extinguishment of debt — — — — — 1.3 0.5 0.8 $0.02 — Tax adjustment (B) Shares due to Teleflex under note hedge (C) Adjusted basis $208.0 $106.0 $15.6 — $10.9 — $17.4 $55.6 $1.33 41,836 (C) Adjusted diluted shares are calculated by giving effect to the anti-dilutive impact of the Company’s convertible note hedge agreements, which reduce the potential economic dilution that otherwise would occur upon conversion of our senior subordinated convertible notes. Under GAAP, the anti-dilutive impact of the convertible note hedge agreements is not reflected in diluted shares. — — — 7.1 — — 1.5 5.6 $0.13 — — — — — 2.9 — 1.0 1.8 $0.04 — — — — — — — 4.1 (4.1) ($0.09) — — — — — — — — — $0.04 (1,428) (A) In 2013, losses, other charges and charge reversals include approximately ($4.4) million, net of tax, or ($0.10) per share, related to the reversal of contingent consideration liabilities; approximately $2.1 million, net of tax, or $0.05 per share, related to acquisition and integration costs. (B) The tax adjustment represents a net benefit resulting from the resolution of, or the expiration of statute of limitations with respect to various prior years’ U.S. federal, state and foreign tax matters.

26 Appendix G – Reconciliation of Teleflex Tax Rate Dollars in Thousands Three Months Ended September 28, 2014 Income from continuing operations before taxes Taxes on income from continuing operations Tax rate GAAP basis $64,912 $9,684 14.9% Restructuring and impairment charges 1,108 140 Losses, other charges and charge reversals (A) 1,076 1,092 Amortization of debt discount on convertible notes 3,092 1,130 Intangible amortization expense 14,951 3,980 Tax adjustment (B) 0 0 Adjusted basis $85,139 $16,026 18.8% Three Months Ended September 29, 2013 GAAP basis $50,988 $5,209 10.2% Restructuring and impairment charges 7,084 1,525 Losses, other charges and charge reversals (A) (1,460) 858 Amortization of debt discount on convertible notes 2,863 1,046 Intangible amortization expense 12,521 4,233 Loss on extinguishment of debt 1,250 457 Tax adjustment (B) 0 4,075 Adjusted basis $73,246 $17,403 23.8% (A) In 2014, losses, other charges and charge reversals primarily relate to the reversal of contingent consideration liabilities, acquisition and integration costs, and charges related to facility consolidations. In 2013, losses, other charges and charge reversals primarily relate to the reversal of contingent consideration liabilities and acquisition and integration costs. (B) The tax adjustment represents a net benefit resulting from the resolution of, or the expiration of statute of limitations w ith respect to various prior years’ U.S. federal, state and foreign tax matters.

Appendix H – Reconciliation of 2014 Constant Currency Revenue Growth Guidance 27 Low High Forecasted GAAP Revenue Growth 7.5% 9.0% Estimated impact of foreign currency fluctuations Forecasted Constant Currency Revenue Growth 7.5% 9.0%

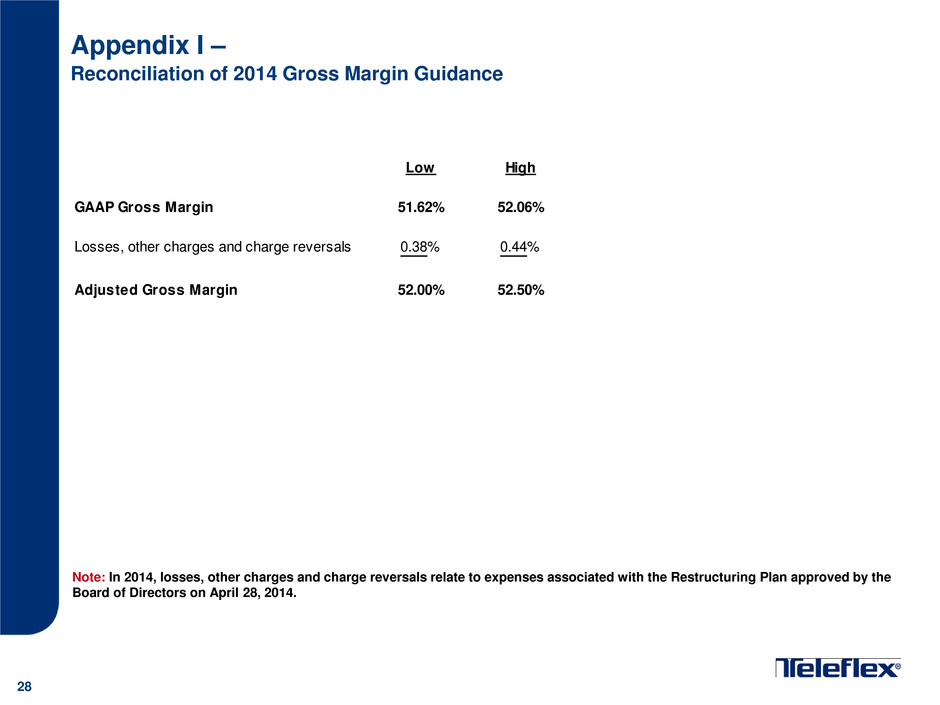

Appendix I – Reconciliation of 2014 Gross Margin Guidance 28 Note: In 2014, losses, other charges and charge reversals relate to expenses associated with the Restructuring Plan approved by the Board of Directors on April 28, 2014. Low High GAAP Gross Margin 51.62% 52.06% Losses, other charges and charge reversals 0.38% 0.44% Adjusted Gross Margin 52.00% 52.50%

Appendix J – Reconciliation of 2014 Operating Margin Guidance 29 Note: In 2014, losses, other charges and charge reversals include expenses associated with the Restructuring Plan approved by the Board of Directors on April 28, 2014, acquisition costs and the reversal of contingent consideration liabilities. Low High GAAP Operating Margin 16.3% 17.2% Losses, other charges and charge reversals 0.3% 0.4% Adjusted Operating Margin 16.6% 17.6% Intangible amortization expense 3.4% 3.4% Adjusted Operating Margin Excluding Intangible Amortization Expense 20.0% 21.0%

Appendix K – Reconciliation of 2014 Adjusted Earnings per Share Guidance 30 Low High Forecasted diluted earnings per share attributable to common shareholders $3.83 $3.88 Restructuring, impairment charges, and special items, net of tax $0.65 $0.70 Intangible amortization expense, net of tax $0.95 $0.95 Amortization of debt discount on convertible notes, net of tax $0.17 $0.17 Forecasted adjusted diluted earnings per share $5.60 $5.70