Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Engility Holdings, Inc. | d810058d8k.htm |

| EX-10.1 - EX-10.1 - Engility Holdings, Inc. | d810058dex101.htm |

| EX-99.5 - EX-99.5 - Engility Holdings, Inc. | d810058dex995.htm |

| EX-99.2 - EX-99.2 - Engility Holdings, Inc. | d810058dex992.htm |

| EX-2.1 - EX-2.1 - Engility Holdings, Inc. | d810058dex21.htm |

| EX-99.4 - EX-99.4 - Engility Holdings, Inc. | d810058dex994.htm |

| EX-99.3 - EX-99.3 - Engility Holdings, Inc. | d810058dex993.htm |

Exhibit 99.1

BUILT FOR

TODAY.

DESIGNED FOR

TOMORROW.

Third Quarter Financial Results and Acquisition of TASC

October 28, 2014

ENGILITY

Your Mission. Our Commitment.

Management Presenters

ENGILITY

Your Mission. Our Commitment.

Tony Smeraglinolo

President and CEO

Engility

John Hynes

President and CEO

TASC

Michael Alber

Senior Vice President and CFO

Engility

Craig Reed

Senior VP, Strategy & Corporate

Development

Engility

2

Forward Looking Statements

ENGILITY

Your Mission. Our Commitment.

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements

regarding Engility’s future prospects, projected financial results, estimated integration costs and acquisition related amortization expenses, business plans and the benefits of the business combination transaction involving Engility and TASC,

including future financial and operating results, the combined company’s plans, objectives, expectations and intentions and other statements that are not historical facts. Words such as “may,” “will,” “should,”

“likely,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates” and similar expressions are also used to identify these forward-looking

statements. These statements are based on the current beliefs and expectations of Engility’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements.

Forward-looking statements are made only as of the date hereof, and we undertake no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In

addition, historical information should not be considered as an indicator of future performance. In addition to factors previously disclosed in Engility’s reports filed with the Securities and Exchange Commission (“SEC”), the

following factors among others, could cause actual results to differ materially from forward-looking statements: ability to obtain regulatory approvals and meet other closing conditions to the merger, including approval by Engility and TASC

stockholders and obtaining the requisite financing, on the expected terms and schedule; other delay in closing the merger; difficulties and delays in integrating the Engility and TASC businesses or fully realizing cost savings and other benefits;

business disruption following the proposed transaction; credit and financing risk; the inability to sustain revenue and earnings growth; the increased leverage and interest expense of the combined company, changes in interest rates and capital

markets; inflation; customer borrowing, repayment, investment and deposit practices; customer disintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions; the inability to realize cost savings

or revenues or to implement integration plans and other consequences associated with mergers, acquisitions and divestitures; economic conditions; changes in Engility’s stock price before closing, including as a result of the financial

performance of TASC prior to closing; the reaction to the transaction of the companies’ customers, employees and counterparties; and the impact, extent and timing of technological changes, capital management activities, and legislative and

regulatory actions and reforms.

3

Additional Information For

Stockholders

ENGILITY

Your Mission. Our Commitment.

In connection with the proposed merger, Engility Holdings will

file with the SEC a Registration Statement on Form S-4 that will include a joint proxy/consent solicitation statement of Engility and TASC and a prospectus of Engility Holdings, as well as other relevant documents concerning the proposed

transaction. Engility will mail the joint proxy/consent solicitation statement/prospectus to the Engility and TASC stockholders. STOCKHOLDERS OF ENGILITY AND TASC ARE URGED TO READ THE REGISTRATION STATEMENT AND JOINT PROXY/CONSENT SOLICITATION

STATEMENT/PROSPECTUS

REGARDING THE PROPOSED MERGERS WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR

SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and stockholders may obtain a free copy of the joint proxy/consent solicitation statement/prospectus (when available) and other filings containing information

about Engility and TASC at the SEC’s website at www.sec.gov. The joint proxy/consent solicitation statement/prospectus (when available) and the other filings may also be obtained free of charge at Engility’s website at www.Engilitycorp.com

under the tab “Investor Relations,” and then under the heading “SEC Filings.”

Engility, TASC and certain of their respective directors and

executive officers, under the SEC’s rules, may be deemed to be participants in the solicitation of proxies of Engility stockholders in connection with the proposed merger. Information about the directors and executive officers of Engility and

their ownership of Engility common stock is set forth in the proxy statement for Engility’s 2014 annual meeting of stockholders, as filed with the SEC on Schedule 14A on April 11, 2014. Additional information regarding the interests of

those participants and other persons who may be deemed participants in the transaction may be obtained by reading the joint proxy/consent solicitation statement/prospectus regarding the proposed merger when it becomes available. Free copies of this

presentation may be obtained as described above.

This presentation is for informational purposes only and is neither an offer to purchase, nor a solicitation of an

offer to sell, subscribe for or buy any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in

contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

4

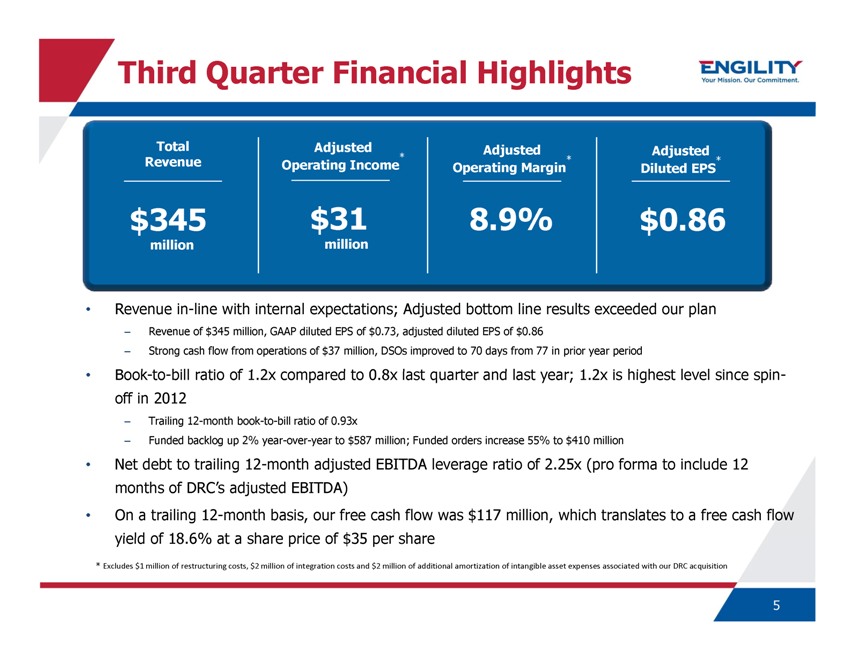

Third Quarter Financial Highlights

ENGILITY

Your Mission. Our Commitment.

Total Revenue

$345 million

Adjusted Operating Income*

$31 million

Adjusted Operating Margin*

8.9%

Adjusted Diluted EPS*

$0.86

Revenue in-line with internal expectations; Adjusted bottom line results exceeded our plan

– Revenue of $345 million, GAAP diluted EPS of $0.73, adjusted diluted EPS of $0.86

– Strong cash flow from operations of $37 million, DSOs improved to 70 days from 77 in prior year period

Book-to-bill ratio of 1.2x compared to 0.8x last quarter and last year; 1.2x is highest level since spinoff in 2012

– Trailing 12-month book-to-bill ratio of 0.93x

– Funded backlog up 2%

year-over-year to $587 million; Funded orders increase 55% to $410 million

Net debt to trailing 12-month adjusted EBITDA leverage ratio of 2.25x (pro forma to

include 12 months of DRC’s adjusted EBITDA)

On a trailing 12-month basis, our free cash flow was $117 million, which translates to a free cash flow yield of

18.6% at a share price of $35 per share

* Excludes $1 million of restructuring costs, $2 million of integration costs and $2 million of additional amortization of

intangible asset expenses associated with our DRC acquisition

5

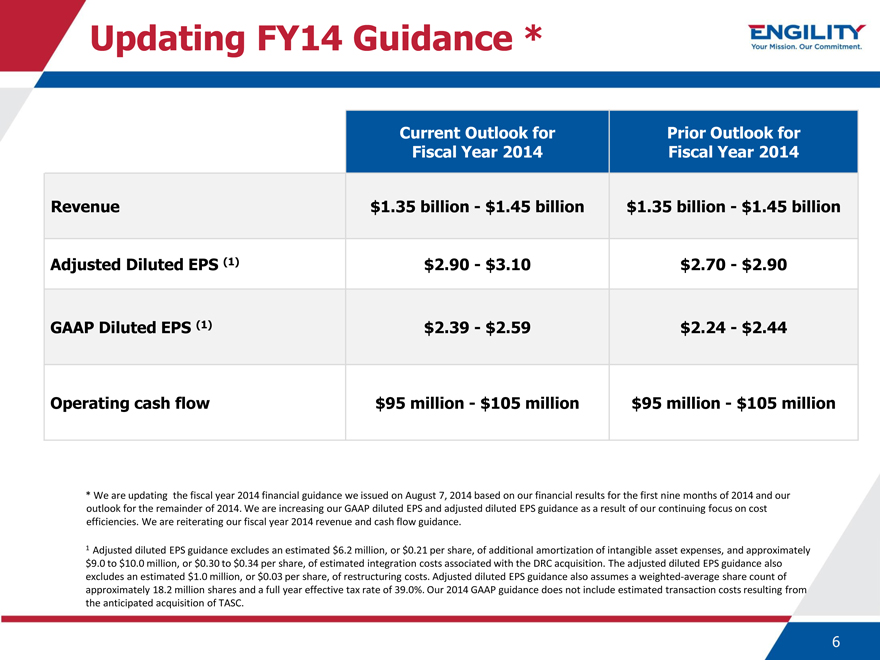

Updating FY14 Guidance *

ENGILITY

Your Mission. Our Commitment.

Current Outlook for Fiscal Year 2014 Prior Outlook for Fiscal Year 2014

Revenue $1.35 billion

- $ 1.45 billion $1.35 billion - $ 1.45 billion

Adjusted Diluted EPS (1) $2.90 - $ 3.10 $2.70 - $ 2.90

GAAP Diluted EPS (1) $2.39 - $ 2.59 $2.24 - $ 2.44

Operating cash flow $95 million - $105

million $95 million - $105 million

* We are updating the fiscal year 2014 financial guidance we issued on August 7, 2014 based on our financial results for the

first nine months of 2014 and our outlook for the remainder of 2014. We are increasing our GAAP diluted EPS and adjusted diluted EPS guidance as a result of our continuing focus on cost efficiencies. We are reiterating our fiscal year 2014 revenue

and cash flow guidance.

1 Adjusted diluted EPS guidance excludes an estimated $6.2 million, or $0.21 per share, of additional amortization of intangible asset

expenses, and approximately $9.0 to $10.0 million, or $0.30 to $0.34 per share, of estimated integration costs associated with the DRC acquisition. The adjusted diluted EPS guidance also excludes an estimated $1.0 million, or $0.03 per share, of

restructuring costs. Adjusted diluted EPS guidance also assumes a weighted-average share count of approximately 18.2 million shares and a full year effective tax rate of 39.0%. Our 2014 GAAP guidance does not include estimated transaction costs

resulting from the anticipated acquisition of TASC.

| 6 |

ENGILITY

Your Mission.

Our Commitment.

Acquisition of TASC

Engility Transformation

ENGILITY

Your Mission. Our Commitment.

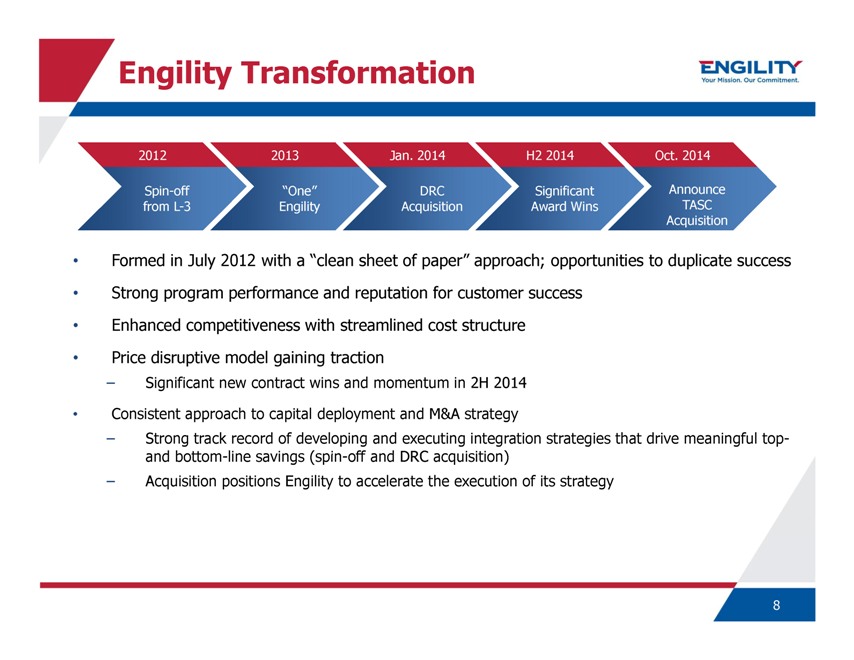

2012 2013 Jan. 2014 H2 2014 Oct. 2014

Spin-off from L-3

“One” Engility

DRC Acquisition

Significant Award Wins

Announce TASC Acquisition

Formed in July 2012 with a “clean sheet of paper” approach; opportunities to duplicate success

Strong program performance and reputation for customer success

Enhanced competitiveness with

streamlined cost structure

Price disruptive model gaining traction

–

Significant new contract wins and momentum in 2H 2014

Consistent approach to capital deployment and M&A strategy

– Strong track record of developing and executing integration strategies that drive meaningful top- and bottom-line savings (spin-off

and DRC acquisition)

– Acquisition positions Engility to accelerate the execution of its strategy

8

TASC Overview

ENGILITY

Your Mission. Our Commitment.

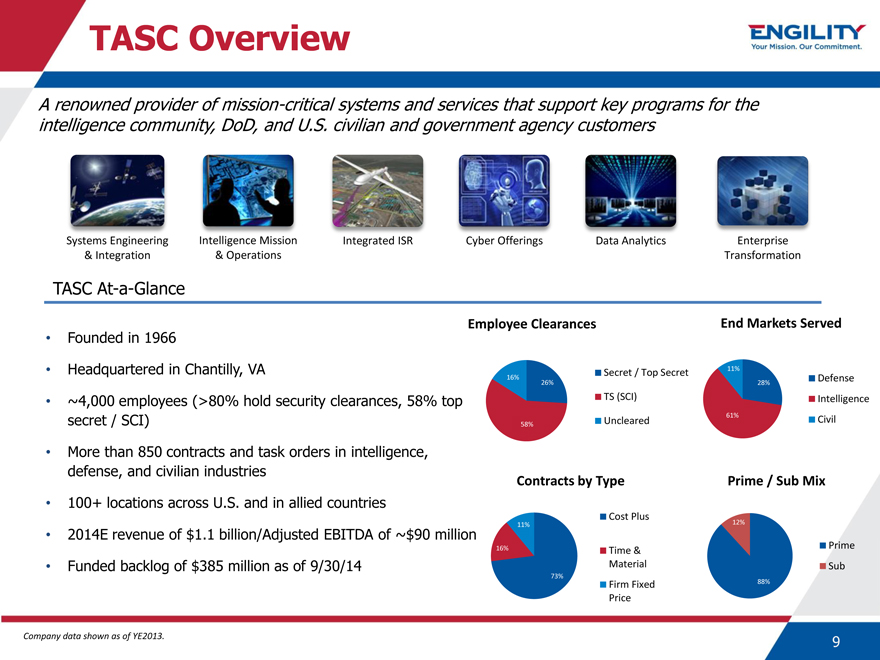

A renowned provider of mission-critical systems

and services that support key programs for the intelligence community, DoD, and U.S. civilian and government agency customers

Systems Engineering & Integration

Intelligence Mission & Operations

Integrated ISR

Cyber Offerings

Data Analytics

Enterprise Transformation

TASC At-a-Glance

Founded in 1966

Headquartered in Chantilly, VA

~4,000 employees (>80% hold security clearances, 58% top secret / SCI)

More than 850

contracts and task orders in intelligence, defense, and civilian industries

100+ locations across U.S. and in allied countries

2014E revenue of $1.1 billion/Adjusted EBITDA of ~$90 million

Employee Clearances

16% 26%

58%

Secret / Top Secret

TS (SCI)

Uncleared

End Markets Served

11%

28%

61%

Defense

Intelligence

Civil

Contracts by Type

11%

16%

73%

Cost Plus

Time & Material

Firm Fixed Price

Prime / Sub Mix

12%

88%

Prime

Sub

9

Company data shown as of YE2013.

Funded backlog of $385 million as of 9/30/14

Compelling Strategic Rationale

ENGILITY

Your Mission. Our Commitment.

Transformational acquisition is consistent with our growth strategy to further balance and diversify our customer base and capabilities, add substantial scale to our business, and

increase our addressable market

– Overall Defense concentration will be reduced from 64% to 48%; remaining 52% roughly split between Intelligence and Federal

Civilian agency customers

Highly complementary business with market leading position in Intelligence Community and meaningful presence with Air Force, NASA and

DISA

– TASC is recognized as a “national asset” by its Intelligence Community customers

Enhances Engility’s existing position with the DHS, Defense Threat Reduction Agency, FAA, Missile Defense Agency and NAVSEA

Adds more than 850 contracts and task orders that have minimal overlap with Engility’s current contract vehicles and customers

Significant revenue opportunities by bringing Engility’s cost effective model to TASC’s served markets

– Potential to improve recompete win rates and competitiveness on new bids

Creates $2.5B premier government service provider with 11,000 employees

10

Enhanced Capabilities with TASC

ENGILITY

Your Mission. Our Commitment.

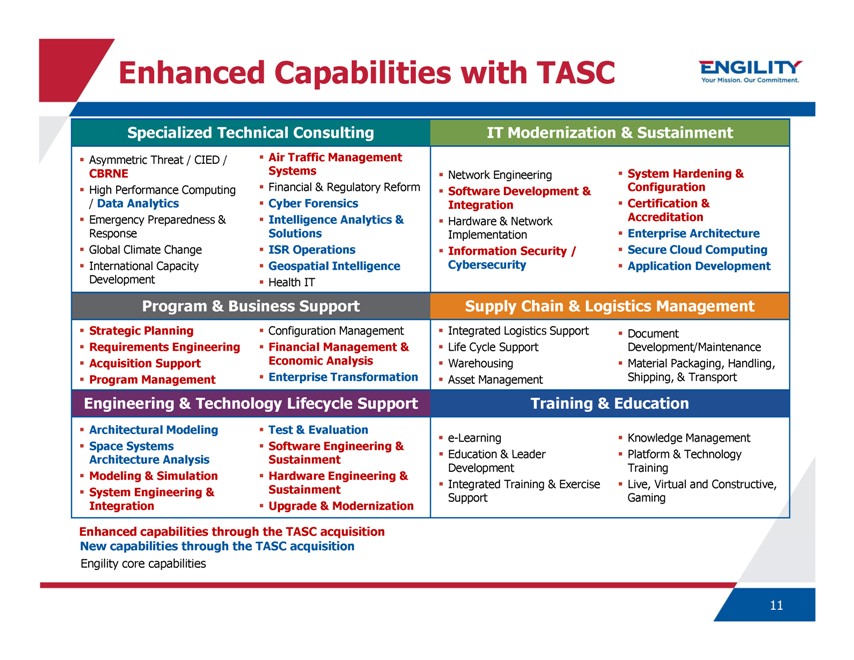

Specialized Technical Consulting

Asymmetric Threat / CIED / CBRNE

High Performance Computing / Data Analytics

Emergency Preparedness & Response

Global Climate Change

International Capacity Development

Air Traffic Management Systems

Financial & Regulatory Reform

Cyber Forensics

Intelligence Analytics & Solutions

ISR Operations

Geospatial Intelligence

Health IT

Program & Business Support

Strategic Planning

Requirements Engineering

Acquisition Support

Program Management

Configuration Management

Financial Management & Economic Analysis

Enterprise Transformation

Engineering & Technology Lifecycle Support

Architectural Modeling

Space Systems Architecture Analysis

Modeling & Simulation

System Engineering & Integration

Test & Evaluation

Software Engineering & Sustainment

Hardware Engineering & Sustainment

Upgrade & Modernization

IT Modernization & Sustainment

Network Engineering

Software Development & Integration

Hardware & Network Implementation

Information Security / Cybersecurity

System Hardening &

Configuration

Certification & Accreditation

Enterprise Architecture

Secure Cloud Computing

Application Development

Supply Chain & Logistics Management

Integrated Logistics Support

Life Cycle Support

Warehousing

Asset Management

Document Development/Maintenance

Material Packaging, Handling, Shipping, & Transport

Training & Education

e-Learning

Education & Leader Development

Integrated Training & Exercise Support

Knowledge Management

Platform & Technology Training

Live, Virtual and Constructive, Gaming

Enhanced capabilities through the TASC acquisition

New capabilities through the TASC

acquisition

Engility core capabilities

11

Customer Diversification

ENGILITY

Your Mission. Our Commitment.

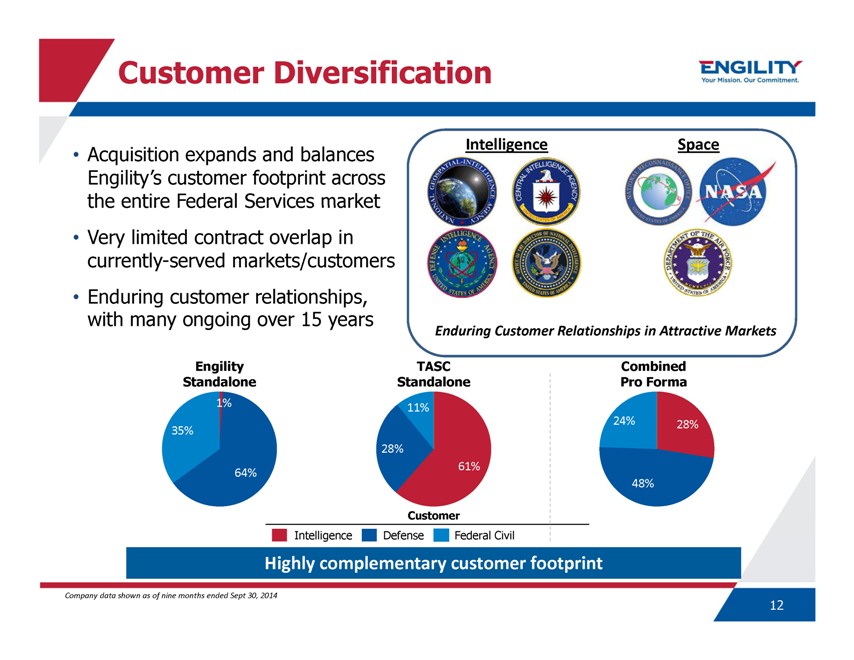

Acquisition expands and balances Engility’s customer footprint across the entire Federal Services market

Very limited contract overlap in currently-served markets/customers

Enduring customer

relationships, with many ongoing over 15 years

Intelligence

Space

Enduring Customer Relationships in Attractive Markets

Engility

Standalone

35%

1%

64%

TASC Standalone

11%

61%

28%

Combined Pro Forma

24% 28%

48%

Customer

Intelligence Defense Federal Civil

Highly complementary customer footprint

Company data shown as of nine months ended Sept 30, 2014

12

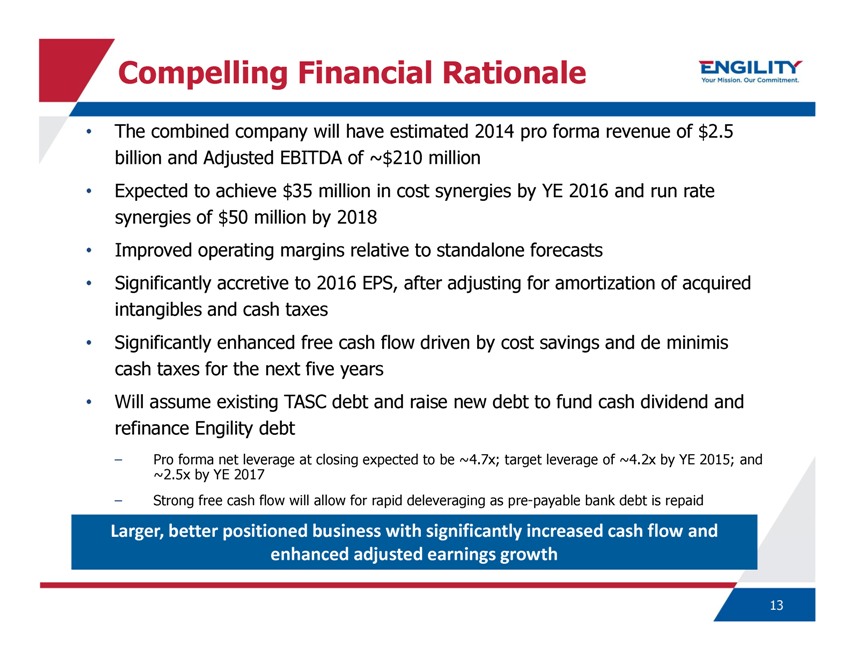

Compelling Financial Rationale

ENGILITY

Your Mission. Our Commitment.

The combined company will have estimated 2014 pro forma revenue of $2.5 billion and Adjusted EBITDA of ~$210 million

Expected to achieve $35 million in cost synergies by YE 2016 and run rate synergies of $50 million by 2018

Improved operating margins relative to standalone forecasts

Significantly accretive to 2016

EPS, after adjusting for amortization of acquired intangibles and cash taxes

Significantly enhanced free cash flow driven by cost savings and de minimis cash taxes

for the next five years

Will assume existing TASC debt and raise new debt to fund cash dividend and refinance Engility debt

– Pro forma net leverage at closing expected to be ~4.7x; target leverage of ~4.2x by YE 2015; and ~2.5x by YE 2017

– Strong free cash flow will allow for rapid deleveraging as pre-payable bank debt is repaid

Larger, better positioned business with significantly increased cash flow and enhanced adjusted earnings growth

13

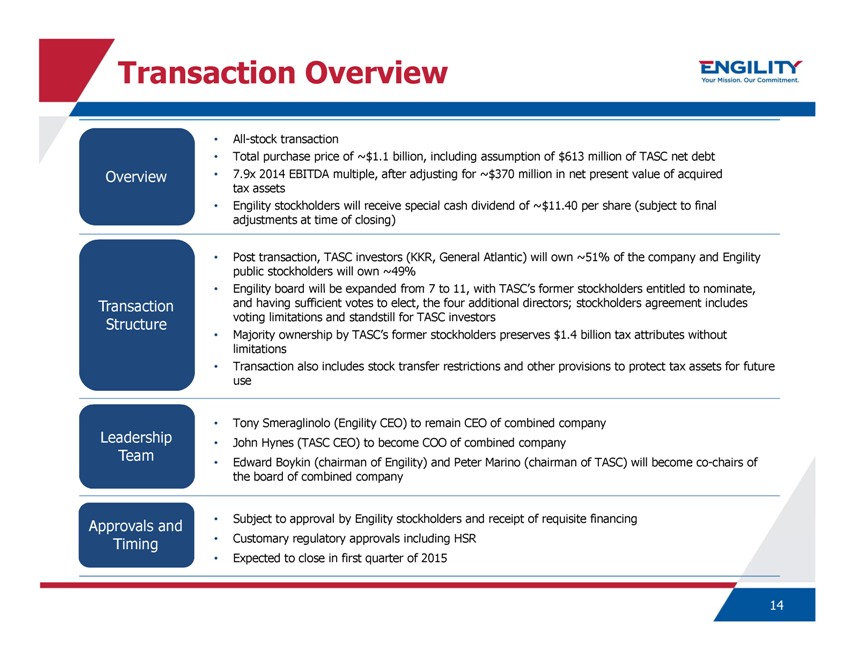

Transaction Overview

ENGILITY

Your Mission. Our Commitment.

Overview

All-stock transaction

Total purchase price of ~$1.1 billion, including assumption of $613 million of TASC net debt

7.9x 2014 EBITDA multiple, after adjusting for ~$370 million in net present value of acquired tax assets

Engility stockholders will receive special cash dividend of ~$11.40 per share (subject to final adjustments at time of closing)

Transaction Structure

Post transaction, TASC investors (KKR, General Atlantic) will own ~51%

of the company and Engility public stockholders will own ~49%

Engility board will be expanded from 7 to 11, with TASC’s former stockholders entitled to

nominate, and having sufficient votes to elect, the four additional directors; stockholders agreement includes voting limitations and standstill for TASC investors

Majority ownership by TASC’s former stockholders preserves $1.4 billion tax attributes without limitations

Transaction also includes stock transfer restrictions and other provisions to protect tax assets for future use

Leadership Team

Tony Smeraglinolo (Engility CEO) to remain CEO of combined company

John Hynes (TASC CEO) to become COO of combined company

Edward Boykin (chairman of Engility)

and Peter Marino (chairman of TASC) will become co-chairs of the board of combined company

Approvals and Timing

Subject to approval by Engility stockholders and receipt of requisite financing

Customary

regulatory approvals including HSR

Expected to close in first quarter of 2015

14

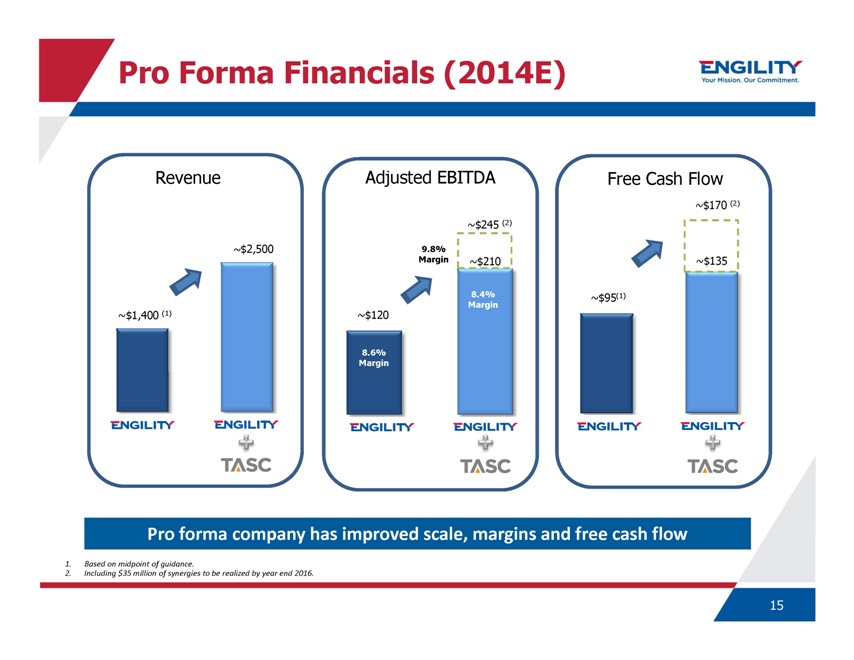

Pro Forma Financials (2014E)

ENGILITY

Your Mission. Our Commitment.

Revenue

~$1,400 (1)

ENGILITY

~$2,500

ENGILITY

+

TASC

Adjusted EBITDA

~$120

8.6%

Margin

ENGILITY

9.8%

Margin

~$245 (2)

~$210

8.4%

Margin

ENGILITY

+

TASC

Free Cash Flow

~$95(1)

ENGILITY

~$170 (2)

~$135

ENGILITY

+

TASC

Pro forma company has improved scale, margins and free cash flow

1. Based on midpoint of guidance.

2. Including $35 million of synergies to be

realized by year end 2016.

15

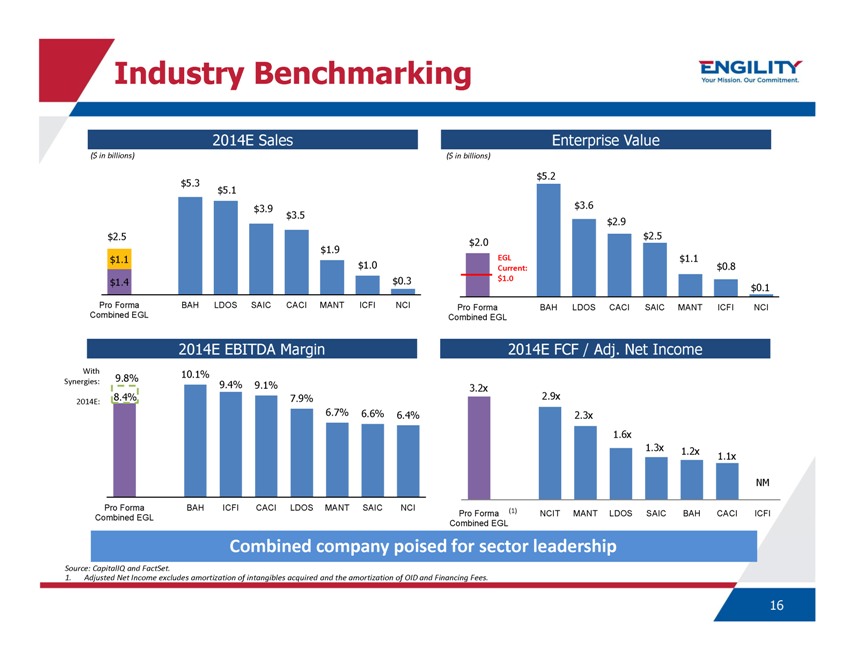

Industry Benchmarking

ENGILITY

Your Mission. Our Commitment.

2014E Sales

($ in billions)

$2.5

$1.1

$1.4

$5.3

$5.1

$3.9

$3.5

$1.9

$1.0

$0.3

Pro Forma

Combined EGL

BAH

LDOS

SAIC

CACI

MANT

ICFI

NCI

2014E EBITDA Margin

With

Synergies:

2014E:

9.8%

8.4%

10.1%

9.4%

9.1%

7.9%

6.7%

6.6%

6.4%

Pro Forma

Combined EGL

BAH

ICFI

CACI

LDOS

MANT

SAIC

NCI

Enterprise Value

($ in billions)

$2.0

EGL

Current:

$1.0

$5.2

$3.6

$2.9

$2.5

$1.1

$0.8

$0.1

Pro Forma

Combined EGL

BAH

LDOS

CACI

SAIC

MANT

ICFI

NCI

2014E FCF / Adj. Net Income

3.2x

2.9x

2.3x

1.6x

1.3x

1.2x

1.1x

NM

Pro Forma (1)

Combined EGL

NCIT

MANT

LDOS

SAIC

BAH

CACI

ICFI

Combined company poised for sector leadership

Source: CapitalIQ and FactSet.

1. Adjusted Net Income excludes amortization of intangibles

acquired and the amortization of OID and Financing Fees.

16

Income Tax Attributes

ENGILITY

Your Mission. Our Commitment.

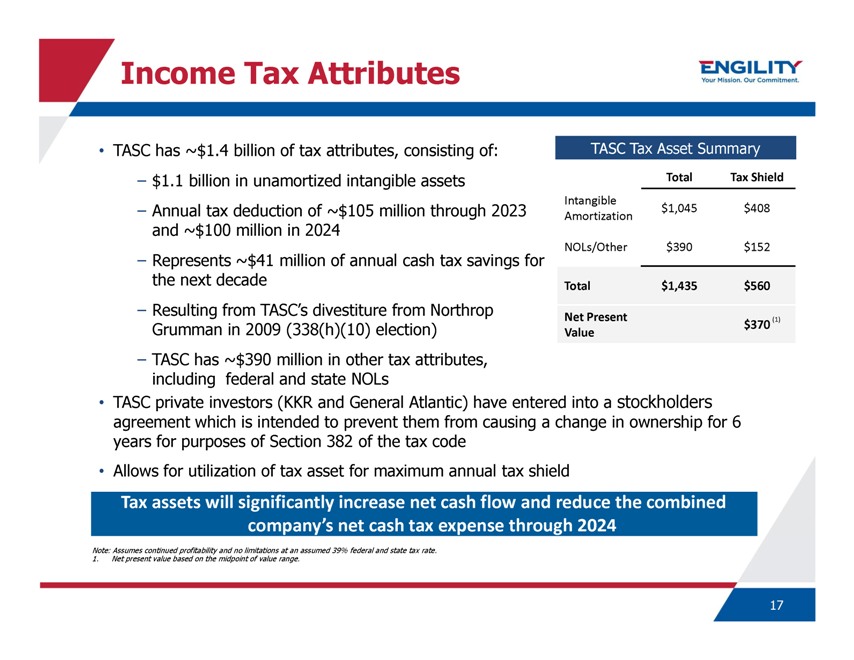

TASC has ~$1.4 billion of tax attributes, consisting of:

– $1.1 billion in unamortized

intangible assets

– Annual tax deduction of ~$105 million through 2023 and ~$100 million in 2024

– Represents ~$41 million of annual cash tax savings for the next decade

– Resulting

from TASC’s divestiture from Northrop Grumman in 2009 (338(h)(10) election)

– TASC has ~$390 million in other tax attributes, including federal and state

NOLs

TASC Tax Asset Summary

Total

Tax Shield

Intangible Amortization

$1,045

$408

NOLs/Other

$390

$152

Total

$1,435

$560

Net Present Value

$370 (1)

TASC private investors (KKR and General Atlantic) have entered into a stockholders agreement which is intended to prevent them from causing a change in ownership for 6 years for

purposes of Section 382 of the tax code

Allows for utilization of tax asset for maximum annual tax shield

Tax assets will significantly increase net cash flow and reduce the combined company’s net cash tax expense through 2024

Note: Assumes continued profitability and no limitations at an assumed 39% federal and state tax rate.

1. Net present value based on the midpoint of value range.

17

Pro Forma Capitalization and Deleveraging Profile

ENGILITY

Your Mission. Our Commitment.

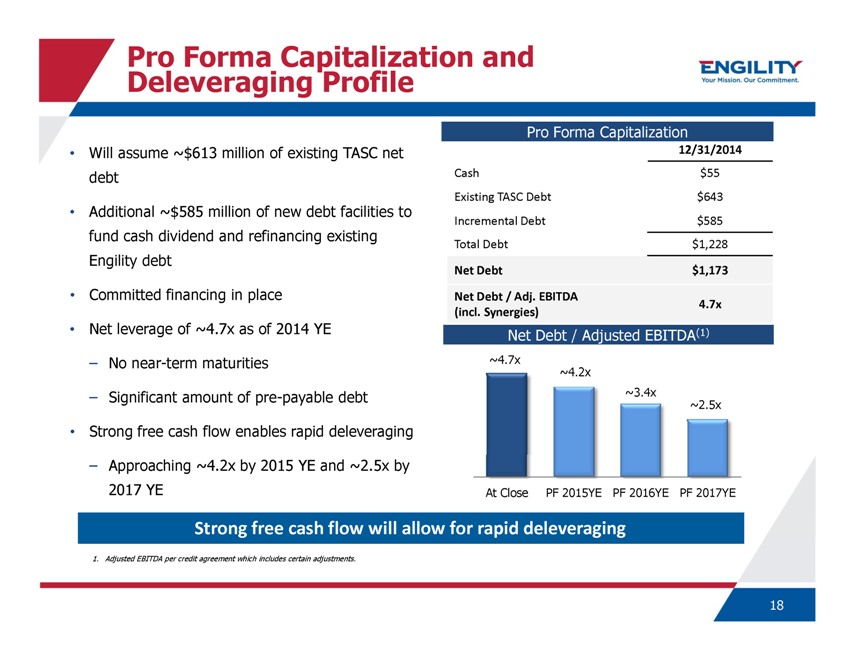

Will assume ~$613 million of existing TASC net debt

Additional ~$585 million of new debt

facilities to fund cash dividend and refinancing existing Engility debt

Committed financing in place

Net leverage of ~4.7x as of 2014 YE

– No near-term maturities

– Significant amount of pre-payable debt

Strong free cash flow enables rapid deleveraging

– Approaching ~4.2x by 2015 YE and ~2.5x by 2017 YE

Pro Forma

Capitalization

12/31/2014

Cash

Existing TASC Debt

Incremental Debt

Total Debt

Net Debt

Net Debt / Adj. EBITDA

(incl. Synergies)

$55

$643

$585

$1,228

$1,173

4.7x

Net Debt / Adjusted EBITDA(1)

~4.7x

~4.2x

~3.4x

~2.5x

At Close

PF 2015YE

PF 2016YE

PF 2017YE

Strong free cash flow will allow for rapid deleveraging

1. Adjusted EBITDA per credit agreement which includes certain adjustments.

18

Stockholders Agreement with TASC Investors

ENGILITY

Your Mission. Our Commitment.

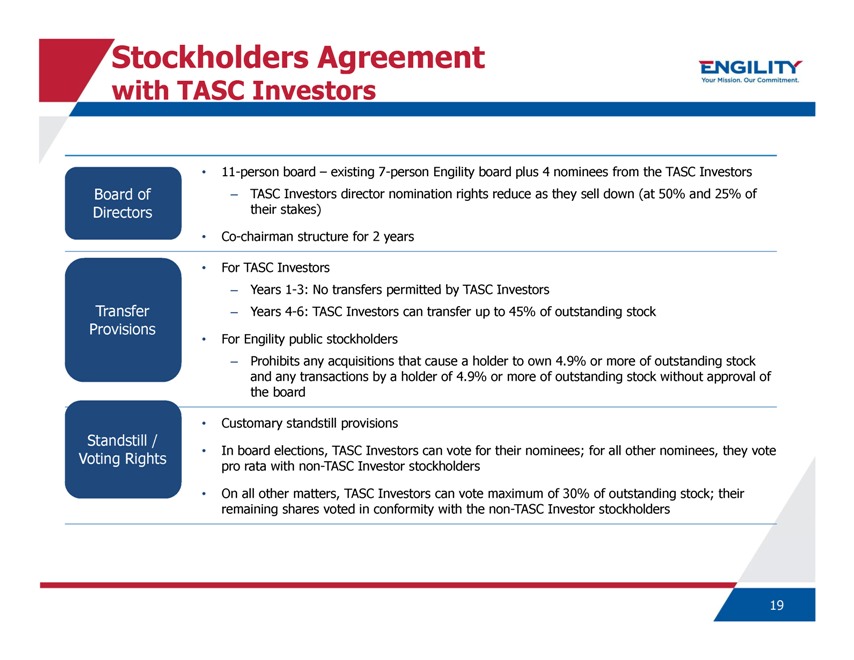

Board of Directors

11-person board – existing 7-person Engility board plus 4 nominees

from the TASC Investors

– TASC Investors director nomination rights reduce as they sell down (at 50% and 25% of their stakes)

Co-chairman structure for 2 years

Transfer Provisions

For TASC Investors

– Years 1-3: No transfers permitted by TASC Investors

– Years 4-6: TASC Investors can transfer up to 45% of outstanding stock

For Engility

public stockholders

– Prohibits any acquisitions that cause a holder to own 4.9% or more of outstanding stock and any transactions by a holder of 4.9% or more

of outstanding stock without approval of the board

Standstill / Voting Rights

Customary standstill provisions

In board elections, TASC Investors can vote

for their nominees; for all other nominees, they vote pro rata with non-TASC Investor stockholders

On all other matters, TASC Investors can vote maximum of 30% of

outstanding stock; their remaining shares voted in conformity with the non-TASC Investor stockholders

19

Summary

ENGILITY

Your Mission. Our Commitment.

Creates a $2.5 billion top-tier government

services provider

Balances and diversifies our customer base and capabilities, adds substantial scale to our business, and increases our addressable market

Engility’s low cost differentiation complements TASC’s technical differentiators

Provides significant revenue and cost synergies with benefits for years to come

Generates

significant free cash flow and pro forma earnings

Positions us for leadership in today’s budget environment

20

ENGILITY

Your Mission.

Our Commitment.

Appendix

21

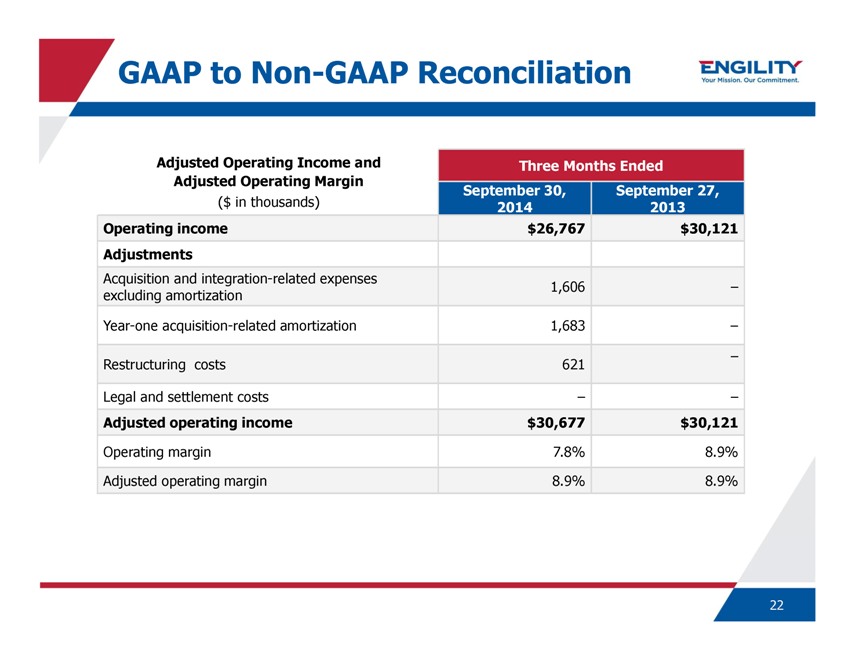

GAAP to Non-GAAP Reconciliation

ENGILITY

Your Mission. Our Commitment.

Adjusted Operating Income and Adjusted Operating Margin

($ in thousands)

Three Months Ended

September 30, September 27,

2014 2013

Operating income $26,767 $30,121

Adjustments

Acquisition and integration-related expenses 1,606 –

excluding amortization

Year-one acquisition-related amortization 1,683 –

Restructuring costs 621 –

Legal and settlement costs – –

Adjusted operating income $30,677 $30,121

Operating margin 7.8% 8.9%

Adjusted operating margin 8.9% 8.9%

22

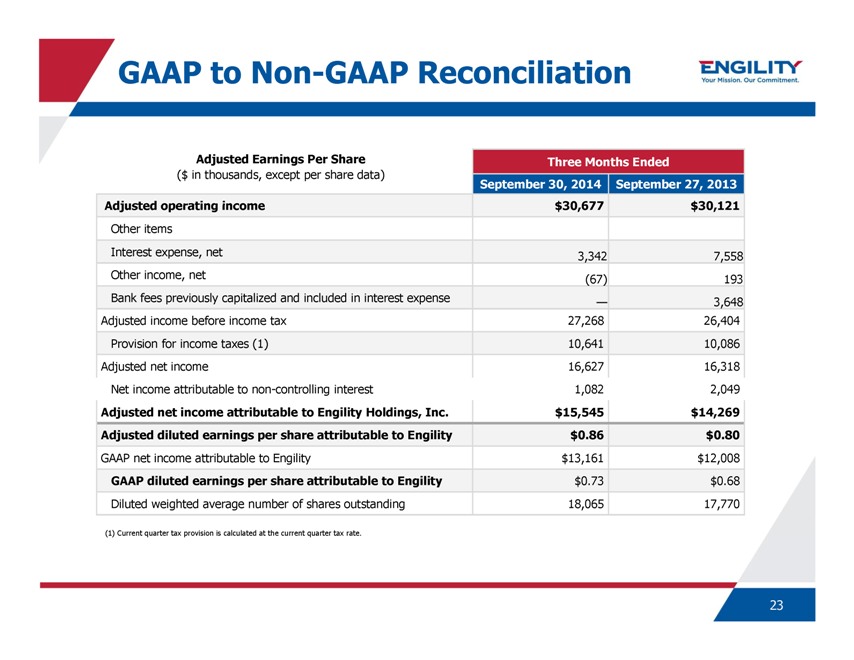

GAAP to Non-GAAP Reconciliation

ENGILITY

Your Mission. Our Commitment.

Adjusted Earnings Per Share

($ in thousands, except per share data)

Three Months Ended

September 30, 2014 September 27, 2013

Adjusted operating income $30,677 $30,121

Other items

Interest expense, net 3,342 7,558

Other income, net (67) 193

Bank fees previously capitalized and included in interest expense — 3,648

Adjusted income

before income tax 27,268 26,404

Provision for income taxes (1) 10,641 10,086

Adjusted net income 16,627 16,318

Net income attributable to non-controlling

interest 1,082 2,049

Adjusted net income attributable to Engility Holdings, Inc. $15,545 $14,269

Adjusted diluted earnings per share attributable to Engility $0.86 $0.80

GAAP net income

attributable to Engility $13,161 $12,008

GAAP diluted earnings per share attributable to Engility $0.73 $0.68

Diluted weighted average number of shares outstanding 18,065 17,770

(1) Current quarter tax

provision is calculated at the current quarter tax rate.

23

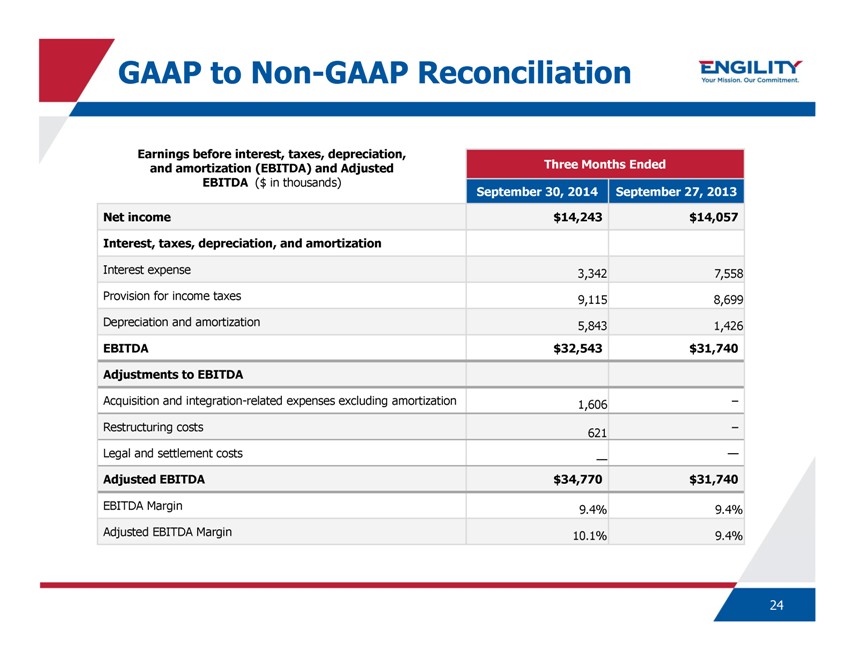

GAAP to Non-GAAP Reconciliation

ENGILITY

Your Mission. Our Commitment.

Earnings before interest, taxes, depreciation,

and amortization (EBITDA) and Adjusted

EBITDA ($ in thousands)

Three Months Ended

September 30, 2014 September 27, 2013

Net income $14,243 $14,057

Interest, taxes, depreciation, and amortization

Interest expense 3,342 7,558

Provision for income taxes 9,115 8,699

Depreciation and amortization 5,843 1,426

EBITDA $32,543 $31,740

Adjustments to EBITDA

Acquisition and integration-related expenses excluding amortization 1,606 –

Restructuring

costs –

621

Legal and settlement costs —

—

Adjusted EBITDA $34,770 $31,740

EBITDA Margin 9.4% 9.4%

Adjusted EBITDA Margin 10.1% 9.4%

24